|

市場調査レポート

商品コード

1440320

オフィス不動産:市場シェア分析、業界動向と統計、成長予測(2024~2029年)Office Real Estate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| オフィス不動産:市場シェア分析、業界動向と統計、成長予測(2024~2029年) |

|

出版日: 2024年02月15日

発行: Mordor Intelligence

ページ情報: 英文 150 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

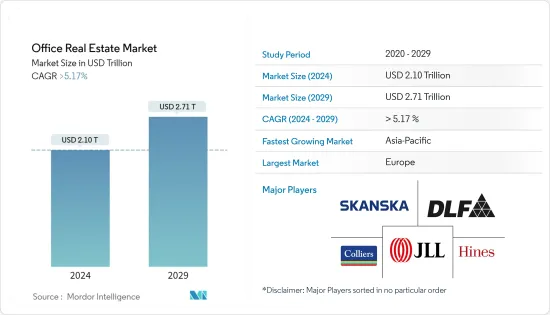

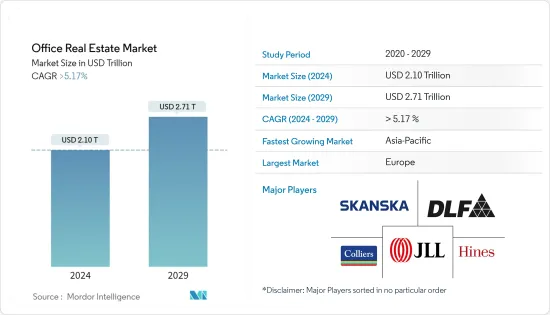

オフィス不動産市場規模は2024年に2兆1,000億米ドルと推定され、2029年までに2兆7,100億米ドルに達すると予測されており、予測期間(2024年から2029年)中に5.17%を超えるCAGRで成長します。

この市場は、新規参入企業によるオフィス需要の高まりによって牽引されています。さらに、市場は欧州およびGCC市場での需要の増加によって牽引されています。

主なハイライト

- 主要なオフィス不動産市場におけるオフィススペースの吸収率は、2022年第1四半期も引き続きマイナスでした。これは、賃貸したスペースよりも空いたスペースの方が多かったことを意味します。アメリカのテクノロジーの中心地であるカリフォルニア州サンフランシスコ、そしてアメリカの金融の中心地でありニューヨーク証券取引所の所在地であるニューヨーク州マンハッタンでも、こうした状況が蔓延していました。テキサス州ダラスとヒューストンの空室率は29%を超えました。新型コロナウイルス感染症(COVID-19)の発生によりオフィスが閉鎖され、従来のオフィススペースの需要が減少しました。多くの企業が規模を縮小し、ハイブリッドな働き方に切り替え、リースを更新しなかったり、オフィススペースの拡張計画を延期したりしました。その結果、賃貸活動が減少し、空室率が上昇しました。

- 投資活動はCOVID-19感染症のパンデミックが始まった当初は減少したが、2021年には急増し、パンデミック前の水準にほぼ戻った。変動はあるもの、賃料は近年徐々に上昇しており、今後も上昇し続ける可能性が高いです。オフィス賃料指数は、2021年 9月の時点で、2008年に指数の基準値を100として設定して以来、総賃料が24%以上増加していることを示しています。最も高価なオフィス市場はニューヨーク州マンハッタンとカリフォルニア州サンフランシスコでした。年間平方フィート賃料はそれぞれ129ドルと97ドル。

- 新型コロナウイルス感染症(COVID-19)のパンデミックにより、2020年と2021年の欧州オフィス不動産市場における賃貸活動は大幅に減少しました。両年とも入居率は標準の5年には及ばなかったもの、2021年下半期には顕著な増加が見られました。 2022年上半期の占有面積は431万平方メートルで、欧州のオフィス市場が回復に向けて急速に進んでいることを示しています。欧州で最も活気のあるオフィス不動産投資市場の一部は、ベルリン、ハンブルク、ミュンヘン、フランクフルトのドイツの4大都市とパリ、ロンドンで引き続き見られます。フィリピン、マニラ首都圏のオフィススペースの費用は、2022年第2四半期に1平方メートルあたり月額 1,037フィリピンペソ(19.01米ドル)でした。同四半期中に、約4万7,400平方メートルのグレード Aオフィススペースがマニラ首都圏のストックに追加されました。ただし、オフィス用不動産は通常、住宅不動産ほどの税制上の優遇措置を受けていないため、固定資産税、賃貸税、およびローン返済リベートの欠如が、潜在的な投資家にとって考慮すべき要素となる可能性があります。

オフィス不動産市場動向

コワーキングスペースの需要の高まり

- 企業は、これまで社会的距離の確保、在宅勤務、商業活動の閉鎖などの制限的な封じ込め策をもたらしていた新型コロナウイルス感染症(COVID-19)の影響から回復するにつれて、業務を再開し、新たな常態に適応しつつあります。COVID-19、フレキシブルワークスペースの成長が大幅に加速しました。 JLLの調査データによると、パンデミック直前の2019年末時点で、フレキシブルオフィススペース市場はインドの上位7市場に47万1,782席あり、約3,000万平方フィートに広がっていました。この数は、2020年末には約2,000万平方フィート、座席数312,990席まで急減しました。それ以来の回復は目覚ましいものでした。

- 2022年 6月までに、上位7都市のコワーキングスペースは117%増加して4,340万平方フィート近くになり、座席数は679,760以上になりました。 2022年末までに、その数は5,000万平方フィート、座席数75万席にまで増加します。インドはコワーキング革命の瀬戸際にあり、複数の大手企業が国中での優位性を競い合っています。インドの主要都市におけるエグゼクティブセンターの占有率と客数は、2020年の75%から2021年10月には90%に増加しました。

- 米国のコワーキングスペースの数は、今後5年間で2倍または3倍になると推定されています。 JLLは、2030年までに全オフィススペースの30%がフレキシブルに消費されると予測しています。 Global Coworking Growth Studyによると、2024年までに約500万人がコワーキングスペースで働くことになり、これは2020年比158%増加します。2022年 3月の時点で、欧州では約4,200のフレキシブルワークスペースに集中しています。それに加えて、アジアにはフレキシブルワーク専用のスペースが4,100以上ありました。 2020年には、世界中で約193万人がコワーキングスペースで働いていました。

- さらに、コワーキングスペースプロバイダーが採用する持続可能な実践は多大な利益をもたらし、経済的にも実現可能です。たとえば、香港のCoCoonの床は天然の竹でできており、毒性のない塗料とLEDライトが使用されています。これに加えて、乾燥に強い植物が内装と外装の一部になっています。デンバーのGreen Spacesでは、オフィスの屋根に約160枚のソーラーパネルを使用しています。これらにより、緑地スペースの大幅なコスト削減が可能になります。したがって、持続可能なコワーキングスペースも予測期間中に成長しています。

市場を牽引するデータセンターの需要の増加

- データセンターの容量に対する需要は史上最高にあり、世界のデータセンターインフラストラクチャに対するエンドユーザーの支出は、2021年には2020年比6%増の約2,000億米ドルに達します。さらに、Microsoftは最大100のデータセンターを構築する計画を発表しました。毎年新しいデータセンターが新設されることは、この傾向が今後も続くことを示唆しており、他の企業もすぐに追随する可能性があります。例えば、ヒューリック(不動産会社)は2022年5月、日本橋に新しいデータセンターを建設するために老朽化したオフィスビルを取り壊す建設プロジェクトに着手し、2025年に完成する予定です。

- データセンターに対する需要の増加は、2021年を通じてパンデミックによるライフスタイルの変化によって促進され、この成長は少なくとも2024年まで続くと予想されています。リモートワークがより一般的になり、より多くの活動がデジタル領域に移行するにつれて、インターネットの使用量は増加し、今後も続くでしょう。これは、より多くのユーザーがクラウドベースのサービスを求めるにつれて、データ作成が増加することを示唆しています。 2022年 1月の時点で、米国には2,701のデータセンターがあり、ドイツにはさらに487のデータセンターがあります。データセンターの数では英国が456か国で第3位にランクされ、中国は443を記録しました。

- さらに、モノのインターネット(IoT)デバイスの購入も増加しました。 IoTデバイスは2025年までに73.1ゼタバイトを生成すると予想されます。現在の容量で1ゼタバイトを保存するには、約1,000のデータセンターが必要になります。データストレージのニーズは高まると予測されており、データセンター運営者は、現在のデータニーズを満たし、将来のデータニーズに対応するために施設のあらゆる平方インチを最大限に活用する必要があります。

- データセンター業界では、需要の増加により、ますます大量のデータを保存するための設備が必要になります。より多くのデータセンターを建設することが解決策のように見えるかもしれません。しかし、2020年のロックダウンにより、新しいデータセンター建設の60%以上が延期されました。

- サーバーCPUはまだ豊富にありますが、業界が法外に高い建設資材価格に苦戦しているため、最近のサプライチェーン不足によりデータセンター建設の状況は悪化しています。その結果、データセンターの建設がパンデミック前のレベルに追いつくには何年もかかる可能性が高く、現在の需要に見合うのは依然として困難になると思われます。

オフィス不動産業界の概要

このレポートは、オフィス不動産市場で活動する主要企業をカバーしています。オフィス不動産市場は比較的細分化されています。オフィス不動産市場には、不動産取得件数の増加や新規不動産建設業者の増加に支えられ、多くの投資が集まっています。オフィス不動産市場の主要企業には、ハインズ、スカンスカ、三菱地所、デリー・ランド&ファイナンス、JLL、コリアーズ・インターナショナルなどが含まれます。オフィス不動産のリースは通常長期であり、3年ごとに賃貸料が15%ずつ上昇するため、開発業者にとっては利益が得られます。これにより、現在建設中で間もなくオープンするいくつかの新しいオフィススペースプロジェクトの創出が促進されました。たとえば、タタリアルティアンドインフラストラクチャリミテッド(TRIL)は、グルグラムセクター59に企業リース用にグレード A+のオフィススペースを建設中です。広さは550,000平方フィートで、2026年 12月までに利用可能になる予定です。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3か月のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 現在の市場シナリオ

- オフィス不動産市場における技術革新

- リモート勤務がスペース需要に及ぼす影響

- 政府の規制と業界の取り組み

- オフィス不動産セグメントの賃貸利回りに関する洞察

- 業界のバリューチェーン分析

- 主要なオフィス不動産業界の指標(供給、賃貸料、価格、占有率/空室率(%))に関する洞察

- オフィス不動産の建設コストに関する洞察

- オフィス不動産投資に関する洞察

- COVID-19の市場への影響

第5章 市場力学

- 市場促進要因

- オフィス賃貸量は大幅に増加

- オフィススペースの賃料値上げ

- 市場抑制要因/課題

- リモートワークとハイブリッドモデル

- オフィス市場では空室率の高さが大きな課題となる可能性がある

- 市場機会

- コワーキングスペースやサービスオフィスなど、フレキシブルなオフィススペースに対する需要が高まっています

- リモートワークの増加により、郊外のオフィススペースがより魅力的になっている

- 業界の魅力- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替製品の脅威

- 競争企業間の敵対関係の激しさ

第6章 市場セグメンテーション

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- 英国

- フランス

- ドイツ

- その他欧州

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- その他アジア太平洋地域

- 中東とアフリカ

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

- その他中東とアフリカ

- ラテンアメリカ

- ブラジル

- アルゼンチン

- その他ラテンアメリカ

- 世界のその他の地域

- 北米

第7章 競合情勢

- 企業プロファイル-不動産企業

- Colliers International

- Cushman &Wakefield

- JLL

- CBRE*

- 企業プロファイル-開発者

- Hines

- Skanska

- China Evergrande Group

- Delhi Land &Finance

- Buckingham Properties*

第8章 市場の将来

第9章 投資分析

第10章 付録

The Office Real Estate Market size is estimated at USD 2.10 trillion in 2024, and is expected to reach USD 2.71 trillion by 2029, growing at a CAGR of greater than 5.17% during the forecast period (2024-2029).

The market is driven by the growing demand for offices by the new companies entering the market. Furthermore, the market is driven by the increasing demand in the European and GCC markets.

Key Highlights

- Office space absorption in the leading office real estate markets remained negative in the first quarter of 2022, which means that more space was vacated than leased. In San Francisco, California, the hub of American technology, as well as Manhattan, New York, the center of American finance and location of the New York Stock Exchange, these circumstances prevailed. The vacancy rate in Dallas and Houston, Texas, was higher than 29%. The COVID-19 outbreak led to the closure of offices, resulting in a decrease in demand for traditional office spaces. Many companies downsized, switched to a hybrid working style, didn't renew their leases, or put off plans to expand their office space. As a result, leasing activity decreased, and vacancy rates increased.

- Investment activity decreased during the start of the COVID-19 pandemic but surged in 2021 and nearly returned to pre-pandemic levels. Despite the swings, rents have been growing gradually in recent years and are likely to keep doing so. The office rental index shows that as of September 2021, gross rents had increased by more than 24% since the index's base value of 100 was created in 2008. The most expensive office markets were in Manhattan, NY, and San Francisco, CA, with annual square footage rents of 129 and 97 dollars, respectively.

- The COVID-19 pandemic significantly reduced lease activity in the European office real estate market in 2020 and 2021. Although take-up in both years fell short of the five-year norm, there was a noticeable increase in the second half of 2021. The take-up of 4.31 million square meters in the first half of 2022 indicated that the European office market is on the fast track to recovery. Some of the busiest office real estate investment markets in Europe continue to be seen in the big four German cities of Berlin, Hamburg, Munich, and Frankfurt, as well as Paris and London. Office space in Metro Manila, Philippines, cost 1,037 Philippine pesos (19.01 USD) per square meter per month in the second quarter of 2022. About 47.4 thousand square meters of Grade A office space were added to the Metro Manila stock during the same quarter. However, office real estate properties typically do not receive the same tax incentives as residential properties do, so property taxes, rental taxes, and the lack of loan repayment rebates may be a factor for potential investors to consider.

Office Real Estate Market Trends

Rise in Demand for Coworking Spaces

- Companies are resuming operations and adapting to the new normal as they recover from the COVID-19 impact, which had previously resulted in restrictive containment measures such as social distancing, remote working, and the closure of commercial activities. COVID-19 accelerated the growth of flexible workspaces significantly. At the year 2019 end, just before the pandemic, the flexible office spaces market was spread over some 30 million sq. ft, with 471,782 seats across the top seven markets in India, per JLL research data. This number plummeted to some 20 million sq. ft and 312,990 seats in end-2020. The recovery since then has been impressive.

- By June 2022, co-working spaces in the top seven cities had grown 117 percent to nearly 43.4 million sq. ft, with over 679,760 seats. By the end-2022, the numbers have grown to 50 million sq. ft and 750,000 seats. India is on the verge of a co-working revolution, with several major players competing for dominance across the country. The Executive Centre's occupancy and foot traffic increased from 75% in 2020 to 90% in October 2021 in major cities in India.

- It is estimated that the number of coworking spaces in the United States will double or triple in the next five years. By 2030, JLL predicts that 30% of all office space will be consumed flexibly. According to the Global Coworking Growth Study, approximately 5 million people will be working from coworking spaces by 2024, up 158% from 2020. As of March 2022, Europe concentrated on approximately 4,200 flexible workspaces. In addition to that, Asia had over 4,100 spaces dedicated to flexible work. In 2020, around 1.93 million people were working in coworking spaces worldwide.

- Moreover, sustainable practices adopted by coworking space providers offer substantial benefits and are economically feasible. For instance, CoCoon in Hong Kong has a floor made of natural bamboo and uses non-toxic paints and LED lights. In addition to this, drought-resistant plants are part of the interior and exterior. Another such example is Green Spaces in Denver uses about 160 solar panels on the roofs of its offices. These allow significant cost savings at Green Spaces. Thus, sustainable coworking space is also growing over the forecast period.

Increasing Demand for Data Centres Driving the Market

- Demand for data center capacity is at an all-time high, with end-user spending on global data center infrastructure approximately hitting USD 200 billion in 2021, up by 6% from 2020. Furthermore, Microsoft's announcement of a plan to build up to 100 new data centers per year suggests that this trend will continue, and other companies may soon follow. For instance, in May 2022, HULIC (a real estate company) started a construction project that will involve the demolition of an outdated office building to make way for a new data center in Nihonbashi, and its completion is expected in 2025.

- Increased demand for data centers was fueled by lifestyle changes prompted by the pandemic throughout 2021, and this growth is expected to continue through at least 2024. As remote work becomes more common and more activities move to the digital realm, internet usage has risen and will continue to rise, implying that data creation will increase as more users seek cloud-based services. As of January 2022, 2,701 data centers were in the United States, with a further 487 data centers located in Germany. The United Kingdom ranked third among countries in terms of the number of data centers, with 456, while China recorded 443.

- In addition, the purchase of internet-of-things (IoT) devices increased. IoT devices will generate 73.1 zettabytes by 2025. About 1,000 data centers will be required to store one zettabyte at the current capacity. Predicted data storage needs are high, and data center operators must make sure they are maximizing every square inch of their facilities to meet current data needs and handle future ones.

- The data center industry will need to be equipped to store increasingly large amounts of data due to increased demand. Building more data centers may appear to be a solution. However, lockdowns in 2020 caused the postponement of more than 60% of new data center construction.

- Though server CPUs are still plentiful, recent supply chain shortages worsened the data center construction situation as the industry struggled with absurdly high construction material prices. As a result, data center construction will likely take years to catch up to pre-pandemic levels, which will still make it difficult to match current demand.

Office Real Estate Industry Overview

The report covers major players operating in the office real estate market. The office real estate market is relatively fragmented. The office real estate market is attracting a lot of investments supported by an increasing number of real estate acquisitions as well as an increase in new property builders. Some of the leading players in the office real estate market include Hines, Skanska, Mitsubishi Estate, Delhi Land & Finance, JLL, Colliers International, and many more. Office real estate leases are typically long-term, and every three years, the rental rate increases by 15%, making it profitable for developers. This has fueled the creation of several new office space projects that are currently under construction and will be open soon. For instance, Tata Realty and Infrastructure Limited (TRIL) is constructing grade A+ office space for corporate leasing in Gurugram sector 59, which is 550,000 sq. ft. and will likely be available by December 2026.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Technological Innovations in the Office Real Estate Market

- 4.3 Impact of Remote Working on Space Demand

- 4.4 Government Regulations and Initiatives in the Industry

- 4.5 Insights into Rental Yields in the Office Real Estate Segment

- 4.6 Industry Value Chain Analysis

- 4.7 Insights into the Key Office Real Estate Industry Metrics (Supply, Rentals, Prices, Occupancy/Vacancy (%))

- 4.8 Insights into Office Real Estate Construction Costs

- 4.9 Insights into Office Real Estate Investment

- 4.10 Impact of the COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Office Leasing Volume is Witnessing Significant Growth

- 5.1.2 Increasing Rental Prices of Office Spaces

- 5.2 Market Restraints/Challenges

- 5.2.1 Remote Work and Hybrid Models

- 5.2.2 High vacancy rates can be a significant challenge in the office market

- 5.3 Market Opportunities

- 5.3.1 The demand for flexible office spaces, including co-working spaces and serviced offices, has been growing

- 5.3.2 With the rise of remote work, suburban office spaces are becoming more attractive

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Bargaining Power of Suppliers

- 5.4.2 Bargaining Power of Buyers/Consumers

- 5.4.3 Threat of New Entrants

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Geography

- 6.1.1 North America

- 6.1.1.1 United States

- 6.1.1.2 Canada

- 6.1.1.3 Mexico

- 6.1.2 Europe

- 6.1.2.1 United Kingdom

- 6.1.2.2 France

- 6.1.2.3 Germany

- 6.1.2.4 Rest of Europe

- 6.1.3 Asia-Pacific

- 6.1.1 North America

- 6.1.3.1 China

- 6.1.3.2 India

- 6.1.3.3 Japan

- 6.1.3.4 South Korea

- 6.1.3.5 Rest of Asia-Pacific

- 6.1.4 Middle East & Africa

- 6.1.4.1 United Arab Emirates

- 6.1.4.2 Saudi Arabia

- 6.1.4.3 South Africa

- 6.1.4.4 Rest of Middle East & Africa

- 6.1.5 Latin America

- 6.1.5.1 Brazil

- 6.1.5.2 Argentina

- 6.1.5.3 Rest of Latin America

- 6.1.6 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Overview (Market Concentration and Major Players)

- 7.2 Company Profiles - Real estate Players

- 7.2.1 Colliers International

- 7.2.2 Cushman & Wakefield

- 7.2.3 JLL

- 7.2.4 CBRE*

- 7.3 Company Profiles - Developers

- 7.3.1 Hines

- 7.3.2 Skanska

- 7.3.3 China Evergrande Group

- 7.3.4 Delhi Land & Finance

- 7.3.5 Buckingham Properties*