|

市場調査レポート

商品コード

1687046

非破壊検査(NDT)装置-市場シェア分析、産業動向と統計、成長予測(2025年~2030年)Non-Destructive Testing (NDT) Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 非破壊検査(NDT)装置-市場シェア分析、産業動向と統計、成長予測(2025年~2030年) |

|

出版日: 2025年03月18日

発行: Mordor Intelligence

ページ情報: 英文 180 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

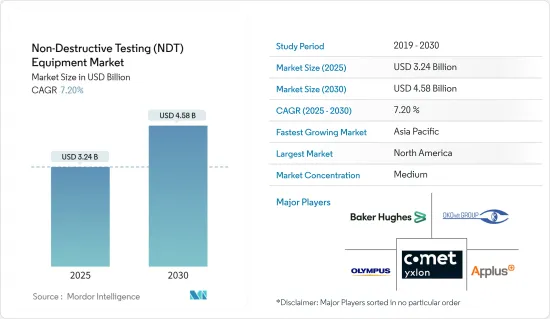

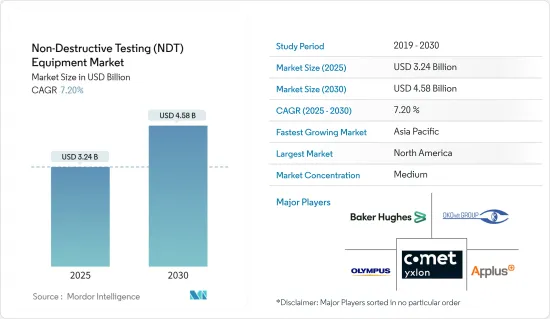

非破壊検査装置の市場規模は2025年に32億4,000万米ドルと推定され、予測期間(2025年~2030年)のCAGRは7.2%で、2030年には45億8,000万米ドルに達すると予測されます。

主なハイライト

- 非破壊検査(NDT)には、部品、材料、アセンブリの検査、試験、評価が含まれます。製品の保守性や部品に支障をきたすことなく、特性の不一致や不連続性を検査します。

- NDT装置は、分解や解体の必要性をなくすことで、時間を大幅に節約することができます。例えば、航空機のメンテナンスや、外皮を剥がして(交換して)行う内部構造部品(翼のリブなど)の検査は、X線透視検査装置で行うことができます。

- 世界中のいくつかの政府機関や地域機関が、主に建築物の安全性を保証するための厳しい措置を策定しました。これらの措置は、適性検査を実施するためにNDTやその他の評価技術の使用を義務付けています。これは、関係当局からインフラ・プロジェクトの建築許可を得るために重要です。これらのチェックには、構造強度評価、防火安全性、緊急プロトコル準拠テストなどが含まれます。

- 2024年4月、Marri Lakshman Reddy Institute of Technology(MLRIT)は、航空宇宙、防衛、産業分野のスキルを学生に習得させるため、NDTと溶接の研究室を新設すると発表しました。この研究室は、Synergem社と共同で設立されたもので、X線透視検査、超音波検査、液体浸透探傷検査、磁粉探傷検査などの高度な検査手法を備え、学生に欠陥の検出や材料の完全性評価の実地体験を提供します。

- 非破壊検査は、従来の方法に代わって、構造物の経年劣化を定期的に監視するための最も実現可能な方法として登場しました。新しいインフラを建設するための制限されたコストと課題の結果、既存の構造物の老朽化が顕著になり、企業は既存の資産の寿命を延ばす方法を模索するようになりました。

- 熟練した非破壊検査技術者の需要は世界的に増加しています。現在、需要が供給を上回っているのには多くの理由があります。非破壊検査は、データ分析に関わる様々な技術や技能に関する専門知識を得るために、専門家の立会いの下で詳細な訓練を受けた認定専門家によってのみ実施されます。

- さらに、自動車業界では、エンジン部品やシャーシなどの複雑な部品を迅速かつ正確に検査する必要性から、品質管理と規制基準への準拠を強化するために非破壊検査装置の導入が進んでいます。同様に、製造および建設分野では、非侵襲的な方法で欠陥、亀裂、材料の不規則性を検出し、それによって建設された構造物や加工部品の安全性と耐久性を確保することが急務となっていることが市場の需要を牽引しています。

非破壊検査(NDT)機器市場の動向

石油・ガスが最高市場シェアを占める

- 石油・ガス産業は、非破壊検査が機器の完全性と石油精製・採掘作業の安全性の両方において重要な役割を果たしているため、最大の市場シェアを占めています。超音波および渦電流非破壊検査ソリューションは、溶接部や金属の欠陥や腐食を注意深く検査するために業界でよく使用され、潜在的に危険な化学物質や流体をパイプや圧力容器内に安全に封じ込めるのに役立っています。

- さらに、石油・ガスには炭素、水素、硫化物が存在し、鋼鉄を予想外の速度で腐食させる可能性があります。NDTは、これらの材料を検査し、より大規模な問題が発生する前に腐食を検出するための効果的な方法を提供します。

- 非破壊検査技術の導入が増加している主な要因の1つは、石油・ガスパイプラインの数が世界的に増加していることと、今後予定されているプロジェクトです。Global Gas &Oil Network(GGON)によると、2023年10月現在、世界で稼働中のガス・パイプラインは1,869本で、世界で最も多くのガス・パイプラインが稼働している国は中国です。

- 石油・ガス産業における非破壊検査は、機器の完全性と石油精製・生産作業の安全性に不可欠です。潜在的に危険な化学物質や流体をパイプや圧力容器に安全に保管するには、非破壊の超音波検査や渦電流検査ソリューションを使用して、溶接部や金属の欠陥や腐食を注意深く検査する必要があります。

- 石油・ガス業界では配管の漏れが増加しており、NDTソフトウェアの必要性が高まっています。例えば、米国沿岸警備隊によると、2023年11月、ルイジアナ州沖のパイプライン付近で約110万ガロンの原油がメキシコ湾に流出しました。

- 近年、米国非破壊検査協会(ASNT)は石油・ガス分野の産業分野資格(ISQ)を発表しました。このプログラムは、石油・ガス業界にNDT要員を提供するもので、実演資格試験の実地実施を通じて特定の技術に対する能力を証明します。

北米が大きな市場シェアを占める

- 米国の製造、輸送、航空、石油・ガス、海洋、発電などのエンドユーザー産業は、検査のためにNDT試験を義務付けているさまざまな連邦機関や州機関によって管理されています。非破壊検査(NDT)は、米国全土のインフラと設備の継続的な運用と安全性を保証します。非破壊検査機器の使用は、米国ではしばしば法律として義務付けられています。

- 例えば、米連邦航空局(FAA)によると、米国では20万機以上の航空機がNDTによる定期的な安全検査を受けなければならないです。軍用機器には国防総省のNDT基準が適用されます。これらの基準は、多くの場合、米国非破壊検査協会(ASNT)などの独立した検査協会が提供する情報を利用して作られています。

- 米国は、製造業におけるNDT機器にとって最も重要な市場の一つです。全米製造業協会(NAM)によると、米国には25万社以上の製造業があり、全産業で14,000社以上が加盟しています。米国の製造業は、経済総生産の11.39%を占めています。

- 米国エネルギー情報局によると、テキサスは米国最大の産油州です。2023年、テキサスは合計20億バレル以上を生産しました。ニューメキシコ州はダントツの2位で、今年は6億6,750万バレルを生産します。パイプライン輸送能力増強の必要性と原油生産量の増加が、石油パイプライン・インフラの拡張を刺激しています。この石油・ガス・インフラ需要の増加は、市場における非破壊検査装置の需要を押し上げると予想されます。

- カナダのGDPは、設備投資と輸出を伴う石油・ガス部門が大部分を占めています。掘削を奨励する魅力的な州の優遇措置、長い水平井戸の導入増加、シェール資源における多段フラクチャリングは、カナダの石油・ガス産業の成長における主要な促進要因です。

- 非破壊検査は、元のシステムの可用性を損なわずに石油・ガスパイプラインの特性を評価する最も一般的な方法の1つであり、石油・ガス生産の増加は市場の需要増につながります。

- カナダの航空宇宙産業は引き続き経済に大きく貢献しており、同地域のNDT機器の総需要のかなりの部分を占めています。カナダ航空宇宙産業協会(AIAC)がカナダ革新・科学・経済開発省(ISED)と共同で発表した「カナダ航空宇宙産業の現状報告書」によると、カナダの航空宇宙産業は連邦戦略革新基金の一環として、7年間で13億6,000万米ドルを投資する予定です。

非破壊検査(NDT)装置産業の概要

非破壊検査(NDT)装置市場は、オリンパス・コーポレーション、ベーカー・ヒューズ、エクスロン・インターナショナルGmbH(COMETホールディングAG)、OkoNDTグループ、アプラスプラス・ラボラトリーズなどの主要企業が存在し、市場の集中度は中程度に高いです。同市場のプレーヤーは、製品提供を強化し、持続可能な競争優位性を獲得するために、提携や買収などの戦略を採用しています。例えば

- 2024年2月、Pinnacle X-Ray Solutions LLCは、NDT X線装置のサプライヤーであり、医療機器、軍事、航空宇宙分野に関連サービスを提供するWillick Engineering Co.この買収により、同社は現在および将来の顧客に対する製品とサービスを拡大します。

- 2024年1月、米国非破壊検査協会(ASNT)は、ローワ州立大学(LSU)の非破壊検査センター(CNDE)をスポンサーとする戦略的提携を発表しました。この提携は、検査とセンサー技術の分野における研究開発の進展における重要なマイルストーンとなります。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリスト・サポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 業界の魅力度-ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

- 業界バリューチェーン分析

- COVID-19の副作用とその他のマクロ経済要因が市場に与える影響

第5章 市場力学

- 市場促進要因

- 安全性を義務付ける厳しい規制

- インフラの老朽化とメンテナンスニーズの増加

- 市場抑制要因

- 熟練した人材とトレーニング施設の不足

第6章 市場セグメンテーション

- 技術別

- ラジオグラフィー検査機器

- 超音波検査装置

- 磁粉探傷試験機

- 液体浸透探傷検査装置

- 外観検査装置

- 渦流探傷装置

- その他の技術装置

- エンドユーザー産業別

- 石油・ガス

- 電力・エネルギー

- 航空宇宙・防衛

- 自動車・運輸

- 建設

- その他のエンドユーザー産業

- 地域別

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- フランス

- ロシア

- イタリア

- アジア

- 中国

- インド

- 韓国

- オーストラリア・ニュージーランド

- ラテンアメリカ

- メキシコ

- ブラジル

- アルゼンチン

- 中東・アフリカ

- サウジアラビア

- アラブ首長国連邦

- カタール

- 北米

第7章 競合情勢

- 企業プロファイル

- Olympus Corporation

- Baker Hughes

- YXLON International GmbH(COMET Holding AG)

- OkoNDT Group

- Applus+Laboratories

- Mistras Group Inc.

- Controle Mesure Systemes SA

- Fujifilm Corporation

- Bureau Veritas SA

- Nikon Metrology NV

- Intertek Group PLC

- Innospection Limited

- Magnaflux Corp.

第8章 投資分析

第9章 市場の将来

The Non-Destructive Testing Equipment Market size is estimated at USD 3.24 billion in 2025, and is expected to reach USD 4.58 billion by 2030, at a CAGR of 7.2% during the forecast period (2025-2030).

Key Highlights

- Non-destructive testing (NDT) involves inspecting, testing, or evaluating components, materials, or assemblies. It involves examining disparities in characteristics or discontinuities without hampering the product's serviceability or part.

- NDT devices can save substantial time by eliminating the need for disassembly or dismantling. For instance, the maintenance of aircraft and the examination of internal structural components (like wing ribs), carried out by removing (and replacing) the outer skin, may be accomplished by radiographic inspection equipment.

- Several governmental agencies and regional bodies across the world formulated stringent measures, primarily for assuring the safety of buildings. These measures have mandated the use of NDT and other evaluation techniques for conducting fitness checks. This is important for gaining building clearances from concerned authorities for infrastructural projects. These checks include structural strength evaluation, fire safety, and emergency protocol compliance tests.

- In April 2024, The Marri Lakshman Reddy Institute of Technology (MLRIT) announced the set up of a new NDT and welding laboratory that will equip students with skills in the aerospace, defense, and industrial sectors. The lab was established in collaboration with Synergem and is equipped with advanced testing methodologies such as radiographic testing, ultrasonic testing, liquid penetrant testing, and magnetic particle testing to provide students with hands-on experience in detecting flaws and assessing material integrity.

- NDT emerged as the most feasible method for monitoring the aging of structures periodically in place of traditional methods. The restrictive cost and challenge of constructing new infrastructure resulted in the notable aging of existing structures and prompted companies to explore ways to extend the life of existing assets.

- There has been an incremental rise in the demand for skilled NDT technicians worldwide. The demand currently outweighs the supply due to many reasons. Non-destructive testing can only be performed by certified professionals who undergo detailed training in the presence of subject-matter experts to gain expertise on the various techniques and skills involved in analyzing the data.

- Moreover, in the automotive industry, the need for rapid and accurate inspection of complex components, such as engine parts and chassis, has propelled the adoption of NDT equipment to enhance quality control and compliance with regulatory standards. Likewise, in the manufacturing and construction sectors, the demand for the market is driven by the imperative to detect flaws, cracks, and material irregularities in a non-invasive manner, thereby ensuring the safety and durability of built structures and fabricated components.

Non-Destructive Testing (NDT) Equipment Market Trends

Oil and Gas Holds Highest Market Share

- The oil and gas industry accounts for the largest market share as non-destructive testing plays a critical role in the industry for both the integrity of equipment and the safety of petroleum refining and extraction operations. Ultrasonic and eddy current NDT testing solutions are often used in the industry to carefully inspect welds and metals for flaws and corrosion, which helps keep potentially hazardous chemicals and fluids safely contained within pipes and pressure vessels.

- Moreover, oil and gas have carbon, hydrogen, and sulfides that can corrode steel unpredictably and at an unexpected speed. NDT provides an effective method for inspecting these materials and detecting corrosion before it creates a larger-scale issue.

- One of the primary drivers of the increased deployment of NDT technologies is the rising number of oil and gas pipelines and upcoming projects globally. As per the Global Gas & Oil Network (GGON), as of October 2023, there were 1,869 operational gas pipelines in the world, with China being the country with the most significant number of operational gas pipelines worldwide.

- NDT in the oil and gas industry is critical to the integrity of equipment and the safety of oil refining and production operations. Safely storing potentially hazardous chemicals and fluids in pipes and pressure vessels requires careful inspection of welds and metals for defects and corrosion using non-destructive ultrasonic and eddy current testing solutions.

- The increasing cases of pipe leaks in the oil and gas industry demand the need for NDT software. For instance, in November 2023, about 1.1 million gallons of crude oil spilled into the Gulf of Mexico near a pipeline off the coast of Louisiana, according to the US Coast Guard.

- In recent years, the American Society for Non-destructive Testing (ASNT) announced the Industry Sector Qualification (ISQ) for oil and gas, which is a new non-destructive testing (NDT) qualification program for the oil and gas sector. This program provides NDT personnel to the oil and gas industry, demonstrating competency for specific techniques through the hands-on performance of demonstration qualification examinations.

North America to Hold Significant Market Share

- The end-user industries in the United States, such as manufacturing, transportation, aviation, oil and gas, marine, and power generation, are governed by many different federal and state agencies that require mandatory NDT testing for inspection. Non-destructive testing (NDT) ensures the continued operation and safety of infrastructure and equipment across the United States. The use of non-destructive testing equipment is often required in the United States as a law.

- For instance, according to the Federal Aviation Administration (FAA), the 200,000+ aircraft in the United States must undergo periodic safety inspections using NDT. The military equipment is subjected to Department of Defense NDT standards. These standards are often made using the information provided by independent testing associations, such as the American Society for Non-destructive Testing (ASNT).

- The United States is one of the most important markets for NDT equipment in manufacturing. According to the National Association of Manufacturers (NAM), there are more than 250,000 manufacturing companies in the United States and more than 14,000 member companies in all industries across the country. Manufacturers in the United States account for 11.39% of the economy's total output.

- According to the US Energy Information Administration, Texas is the largest oil-producing state in the United States. In 2023, Texas produced a total of more than two billion barrels. New Mexico is a distant second, producing 667.5 million barrels this year. The need for increased pipeline transportation capacity and increased crude oil production have stimulated the expansion of oil pipeline infrastructure. This increase in demand for oil and gas infrastructure is expected to boost the demand for non-destructive testing equipment in the market.

- The Canadian GDP is majorly dominated by the oil and gas sector, with capital investments and exports. Attractive provincial incentives to encourage drilling, increased implementation of long horizontal wells, and multistage fracturing in shale resources are the major drivers in the growth of the Canadian oil and gas industry.

- With NDT being one of the most common methods to evaluate the properties of oil and gas pipelines without destroying the serviceability of the original system, the increase in oil and gas production translates to a higher demand for the market.

- The aerospace industry in Canada continues to be a significant contributor to the economy and accounts for a substantial portion of the total demand for NDT equipment in the region. As per the State of Canada's Aerospace Industry Report released by the Aerospace Industries Association of Canada (AIAC), in partnership with Innovation, Science, and Economic Development Canada (ISED), the Canadian aerospace industry will invest USD 1.36 billion over seven years as a part of Federal Strategic Innovation Fund.

Non-Destructive Testing (NDT) Equipment Industry Overview

The non-destructive testing (NDT) equipment market concentration is moderately high with the presence of key players like Olympus Corporation, Baker Hughes, YXLON International GmbH (COMET Holding AG), OkoNDT group, and Applus+ Laboratories, among others. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage. For instance,

- In February 2024, Pinnacle X-Ray Solutions LLC announced the acquisition of Willick Engineering Co. Inc., a supplier of NDT X-ray equipment and provider of related services to the medical device, military, and aerospace sectors. Through this acquisition, the company will expand its products and services for current and prospective customers.

- In January 2024, The American Society for Non-Destructive Testing (ASNT) announced a strategic collaboration with the Center for Non-Destructive Testing (CNDE) at Lowa State University (LSU) as a sponsor. This partnership marks an important milestone in the advancement of research and development in the area of inspection and sensor technologies.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Stringent Regulations Mandating Safety

- 5.1.2 Aging Infrastructure and Increasing Need for Maintenance

- 5.2 Market Restraints

- 5.2.1 Lack of Skilled Personnel and Training Facilities

6 MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 Radiography Testing Equipment

- 6.1.2 Ultrasonic Testing Equipment

- 6.1.3 Magnetic Particle Testing Equipment

- 6.1.4 Liquid Penetrant Testing Equipment

- 6.1.5 Visual Inspection Equipment

- 6.1.6 Eddy Current Equipment

- 6.1.7 Other Technologies Equipment

- 6.2 By End-user Industry

- 6.2.1 Oil and Gas

- 6.2.2 Power and Energy

- 6.2.3 Aerospace and Defense

- 6.2.4 Automotive and Transportation

- 6.2.5 Construction

- 6.2.6 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Russia

- 6.3.2.5 Italy

- 6.3.3 Asia

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 South Korea

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.5.1 Mexico

- 6.3.5.2 Brazil

- 6.3.5.3 Argentina

- 6.3.6 Middle East and Africa

- 6.3.6.1 Saudi Arabia

- 6.3.6.2 United Arab Emirates

- 6.3.6.3 Qatar

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Olympus Corporation

- 7.1.2 Baker Hughes

- 7.1.3 YXLON International GmbH (COMET Holding AG)

- 7.1.4 OkoNDT Group

- 7.1.5 Applus+ Laboratories

- 7.1.6 Mistras Group Inc.

- 7.1.7 Controle Mesure Systemes SA

- 7.1.8 Fujifilm Corporation

- 7.1.9 Bureau Veritas SA

- 7.1.10 Nikon Metrology NV

- 7.1.11 Intertek Group PLC

- 7.1.12 Innospection Limited

- 7.1.13 Magnaflux Corp.