|

|

市場調査レポート

商品コード

1152295

培養肉の世界市場:タイプ、流通チャネル、用途 - 市場予測(~2035年)Lab-grown Meat Market by Type (Beef, Poultry, Pork, Seafood), Distribution Channel (Business-to-Business, Business-to-Consumer), Application (Nuggets, Burger Patties, Meatballs, Steak, Hot Dogs & Sausages)-Global Forecast to 2035 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 培養肉の世界市場:タイプ、流通チャネル、用途 - 市場予測(~2035年) |

|

出版日: 2022年09月11日

発行: Meticulous Research

ページ情報: 英文 158 Pages

納期: 即納可能

|

- 全表示

- 概要

- 図表

- 目次

世界の培養肉の市場規模は、2035年までに19億9,000万米ドルに達し、2025年~2035年にCAGRで24.1%の成長が予測されています。市場の高成長は主に、培養肉の生産における技術の進歩、培養肉産業へのベンチャー投資の増加、動物福祉への注目の高まり、動物由来の加工食品とアレルゲンフリー食品に対する需要の向上に起因しています。

当レポートでは、世界の培養肉市場について調査分析し、市場の考察、セグメント分析、地域分析、競合情勢などを提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

- イントロダクション

- セグメント分析

- 培養肉市場:タイプ別

- 培養肉市場:流通チャネル別

- 培養肉市場:用途別

- 地域分析

- 競合情勢と市場の競合企業

第4章 市場の考察

- イントロダクション

- 促進要因

- 抑制要因

- 機会

- 課題

- 動向

- 規制分析

- シンガポール

- 欧州連合(EU)

- 英国

- ブラジル

- イスラエル

- 日本

- 中国

- 米国

- カナダ

- オーストラリア - ニュージーランド

- インド

- その他の地域

第5章 世界の培養肉市場:タイプ別

- イントロダクション

- 牛肉

- 鶏肉

- 豚肉

- シーフード

- その他の培養肉

第6章 世界の培養肉市場:流通チャネル別

- イントロダクション

- B2B

- B2C

第7章 世界の培養肉市場:用途別

- イントロダクション

- ナゲット

- バーガーパティ

- ミートボール

- ステーキ

- ホットドッグ・ソーセージ

- その他の用途

第8章 培養肉市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- 英国

- オランダ

- スペイン

- ドイツ

- その他の欧州

- アジア太平洋

- 中国

- シンガポール

- 日本

- インド

- その他のアジア太平洋

- ラテンアメリカ

- 中東・アフリカ

第9章 競合情勢

- イントロダクション

- 主な成長戦略

- 競合ベンチマーキング

第10章 企業プロファイル(事業の概要、製品ポートフォリオ、戦略的展開)

- Aleph Farms Ltd.

- Avant Meats Company Limited

- BlueNalu, Inc.

- Finless Foods, Inc.

- Future Meat Technologies Ltd.

- Higher Steaks

- Lab Farm Foods, Inc.

- Mosa Meat B.V.

- Shiok Meats Pte Ltd

- SUPERMEAT THE ESSENCE OF MEAT. LTD

- Upside Foods, Inc. (Formerly Memphis Meats)

- Meatable B.V.

- Clearmeat

- Ants Innovate Pte Ltd

- MIRAI FOODS AG

- Orbillion Bio, Inc.

第11章 付録

List of Tables

- Table 1 Global Lab-Grown Meat Market: Impact Analysis of Market Drivers (2022-2035)

- Table 2 Recent Investments & Funding in the Lab-Grown Meat Industry

- Table 3 Global Lab-Grown Meat Market: Impact Analysis of Market Restraints (2022-2035)

- Table 4 Consumer Acceptance Rates for Lab-Grown Meat As Per Various Surveys, by Country (2019-2020)

- Table 5 Lab-Grown Meat Market: Regulatory Approval Status,2022

- Table 6 Global Lab-Grown Meat Market Size, by Type, 2025-2035 (USD Million)

- Table 7 Lab-Grown Beef Market Size, by Country/Region, 2025-2035 (USD Million)

- Table 8 Lab-Grown Poultry Market Size, by Country/Region, 2025-2035 (USD Million)

- Table 9 Lab-Grown Pork Market Size, by Country/Region, 2025-2035 (USD Million)

- Table 10 Lab-Grown Seafood Market Size, by Country/Region, 2025-2035 (USD Million)

- Table 11 Other Lab-Grown Meat Market Size, by Country/Region, 2025-2035 (USD Million)

- Table 12 Global Lab-Grown Business-To-Business Meat Market Size, by Distribution Channel, 2025-2035 (USD Million)

- Table 13 Global Lab-Grown Meat B2B Market Size, by Country/Region, 2025-2035 (USD Million)

- Table 14 Global Lab-Grown Meat B2C Market Size, by Country/Region, 2025-2035 (USD Million)

- Table 15 Global Lab-Grown Meat Market Size, by Application, 2025-2035 (USD Million)

- Table 16 Global Lab-Grown Meat Market Size for Nuggets, by Country/Region, 2025-2035 (USD Million)

- Table 17 Global Lab-Grown Meat Market Size for Burger Patties, by Country/Region, 2025-2035 (USD Million)

- Table 18 Global Lab-Grown Meat Market Size for Meatballs, by Country/Region, 2025-2035 (USD Million)

- Table 19 Global Lab-Grown Meat Market Size for Steaks, by Country/Region, 2025-2035 (USD Million)

- Table 20 Global Lab-Grown Meat Market Size for Hot Dogs & Sausages, by Country/Region, 2025-2035 (USD Million)

- Table 21 Global Lab-Grown Meat Market Size for Other Applications, by Country/Region, 2025-2035 (USD Million)

- Table 22 Lab-Grown Meat Market Size, by Region, 2025-2035 (USD Million)

- Table 23 North America: Lab-Grown Meat Market Size, by Country/Region, 2025-2035 (USD Million)

- Table 24 North America: Lab-Grown Meat Market Size, by Type, 2025-2035 (USD Million)

- Table 25 North America: Lab-Grown Meat Market Size, by Distribution Channel, 2025-2035 (USD Million)

- Table 26 North America: Lab-Grown Meat Market Size, by Application, 2025-2035 (USD Million)

- Table 27 U.S: Most Active Investors in the Lab-Grown Meat Industry

- Table 28 U.S.: Lab-Grown Meat Market Size, by Type, 2025-2035 (USD Million)

- Table 29 U.S.: Lab-Grown Meat Market Size, by Distribution Channel, 2025-2035 (USD Million)

- Table 30 U.S.: Lab-Grown Meat Market Size, by Application, 2025-2035 (USD Million)

- Table 31 Canada: Lab-Grown Meat Market Size, by Type, 2025-2035 (USD Million)

- Table 32 Canada: Lab-Grown Meat Market Size, by Distribution Channel, 2025-2035 (USD Million)

- Table 33 Canada: Lab-Grown Meat Market Size, by Application, 2025-2035 (USD Million)

- Table 34 Europe: Lab-Grown Meat Market Size, by Country/Region, 2025-2035 (USD Million)

- Table 35 Europe: Lab-Grown Meat Market Size, by Type, 2025-2035 (USD Million)

- Table 36 Europe: Lab-Grown Meat Market Size, by Distribution Channel, 2025-2035 (USD Million)

- Table 37 Europe: Lab-Grown Meat Market Size, by Application, 2025-2035 (USD Million)

- Table 38 U.K.: Most Active Investors in Lab-Grown Industry

- Table 39 U.K.: Lab-Grown Meat Market Size, by Type, 2025-2035 (USD Million)

- Table 40 U.K.: Lab-Grown Meat Market Size, by Distribution Channel, 2025-2035 (USD Million)

- Table 41 U.K: Lab-Grown Meat Market Size, by Application, 2025-2035 (USD Million)

- Table 42 Netherlands: Lab-Grown Meat Market Size, by Type, 2025-2035 (USD Million)

- Table 43 Netherlands: Lab-Grown Meat Market Size, by Distribution Channel, 2025-2035 (USD Million)

- Table 44 Netherlands: Lab-Grown Meat Market Size, by Application, 2025-2035 (USD Million)

- Table 45 Spain: Lab-Grown Meat Market Size, by Type, 2025-2035 (USD Million)

- Table 46 Spain: Lab-Grown Meat Market Size, by Distribution Channel, 2025-2035 (USD Million)

- Table 47 Spain: Lab-Grown Meat Market Size, by Application, 2025-2035 (USD Million)

- Table 48 Germany: Lab-Grown Meat Market Size, by Type, 2025-2035 (USD Million)

- Table 49 Germany: Lab-Grown Meat Market Size, by Distribution Channel, 2025-2035 (USD Million)

- Table 50 Germany: Lab-Grown Meat Market Size, by Application, 2025-2035 (USD Million)

- Table 51 Rest of Europe: Lab-Grown Meat Market Size, by Type, 2025-2035 (USD Million)

- Table 52 Rest of Europe: Lab-Grown Meat Market Size, by Distribution Channel, 2025-2035 (USD Million)

- Table 53 Rest of Europe: Lab-Grown Meat Market Size, by Application, 2025-2035 (USD Million)

- Table 54 Asia-Pacific: Lab-Grown Meat Market Size, by Country/Region, 2025-2035 (USD Million)

- Table 55 Asia-Pacific: Lab-Grown Meat Market Size, by Type, 2025-2035 (USD Million)

- Table 56 Asia-Pacific: Lab-Grown Meat Market Size, by Distribution Channel, 2025-2035 (USD Million)

- Table 57 Asia-Pacific: Lab-Grown Meat Market Size, by Application, 2025-2035 (USD Million)

- Table 58 China: Lab-Grown Meat Market Size, by Type, 2025-2035 (USD Million)

- Table 59 China: Lab-Grown Meat Market Size, by Distribution Channel, 2025-2035 (USD Million)

- Table 60 China: Lab-Grown Meat Market Size, by Application, 2025-2035 (USD Million)

- Table 61 Singapore: Lab-Grown Meat Market Size, by Type, 2025-2035 (USD Million)

- Table 62 Singapore: Lab-Grown Meat Market Size, by Distribution Channel, 2025-2035 (USD Million)

- Table 63 Singapore: Lab-Grown Meat Market Size, by Application, 2025-2035 (USD Million)

- Table 64 Japan: Lab-Grown Meat Market Size, by Type, 2025-2035 (USD Million)

- Table 65 Japan: Lab-Grown Meat Market Size, by Distribution Channel, 2025-2035 (USD Million)

- Table 66 Japan: Lab-Grown Meat Market Size, by Application, 2025-2035 (USD Million)

- Table 67 India: Organizations Supporting the Lab-Grown Meat Industry

- Table 68 India: Lab-Grown Meat Market Size, by Type, 2025-2035 (USD Million)

- Table 69 India: Lab-Grown Meat Market Size, by Distribution Channel, 2025-2035 (USD Million)

- Table 70 India: Lab-Grown Meat Market Size, by Application, 2025-2035 (USD Million)

- Table 71 RoAPAC: Lab-Grown Meat Market Size, by Type, 2025-2035 (USD Million)

- Table 72 RoAPAC: Lab-Grown Meat Market Size, by Distribution Channel, 2025-2035 (USD Million)

- Table 73 RoAPAC: Lab-Grown Meat Market Size, by Application, 2025-2035 (USD Million)

- Table 74 Latin America: Lab-Grown Meat Market Size, by Type, 2025-2035 (USD Million)

- Table 75 Latin America: Lab-Grown Meat Market Size, by Distribution Channel, 2025-2035 (USD Million)

- Table 76 Latin America: Lab-Grown Meat Market Size, by Application, 2025-2035 (USD Million)

- Table 77 Middle East & Africa: Lab-Grown Meat Market Size, by Type, 2025-2035 (USD Million)

- Table 78 Middle East & Africa: Lab-Grown Meat Market Size, by Distribution Channel, 2025-2035 (USD Million)

- Table 79 Middle East & Africa: Lab-Grown Meat Market Size, by Application, 2025-2035 (USD Million)

- Table 80 Number of Developments by Major Players During 2019-2022

- Table 81 Funding Rounds of Future Meat Technologies Ltd.

List of Figures

- Figure 1 Market Ecosystem

- Figure 2 Research Process

- Figure 3 Key Secondary Sources

- Figure 4 Primary Research Techniques

- Figure 5 Key Executives Interviewed

- Figure 6 Breakdown of Primary Interviews (Lab-Grown Research Institute & Lab-Grown Developers)

- Figure 7 Market Size Estimation

- Figure 8 In 2025, the Beef Segment Is Expected to Dominate the Lab-Grown Meat Market

- Figure 9 In 2025, the Business-To-Business (B2B) Segment is Expected to Dominate the Lab-Grown Meat Market

- Figure 10 In 2025, the Nuggets Segment is Expected to Dominate the Lab-Grown Meat Market

- Figure 11 In 2025, North America is Expected to Dominate the Global Lab-Grown Meat Market

- Figure 12 Market Dynamics

- Figure 13 Lab-Grown Meat Market: Regulatory Approval Possibilities by 2025

- Figure 14 Global Lab-Grown Meat Market Size, by Type, 2025 Vs. 2035 (USD Million)

- Figure 15 Global Lab-Grown Meat Market Size, by Distribution Channel, 2025 Vs. 2035 (USD Million)

- Figure 16 Global Lab-Grown Meat Market Size, by Application, 2025 Vs. 2035 (USD Million)

- Figure 17 Lab-Grown Meat Market Share, by Region, 2025 (%)

- Figure 18 Lab-Grown Meat Market Size, by Region, 2025 Vs. 2035 (USD Million)

- Figure 19 North America: Lab-Grown Meat Market Snapshot (2025)

- Figure 20 Europe: Lab-Grown Meat Market Snapshot (2025)

- Figure 21 Asia-Pacific: Lab-Grown Meat Market Snapshot, 2025

- Figure 22 Latin America: Lab-Grown Meat Market Snapshot, 2025

- Figure 23 Middle East & Africa: Lab-Grown Meat Market Snapshot, 2025

- Figure 24 Key Growth Strategies Adopted by Leading Players, 2019-2022

- Figure 25 Lab-Grown Meat Market: Competitive Benchmarking of Key Players, by Application

The research report titled 'Lab-grown Meat Market by Type (Beef, Poultry, Pork, Seafood), Distribution Channel (Business-to-Business, Business-to-Consumer), Application (Nuggets, Burger Patties, Meatballs, Steak, Hot Dogs & Sausages) -Global Forecast to 2035,' provides an in-depth analysis of the lab-grown meat market across five major geographies emphasizing on the current market trends, market sizes, recent developments, and forecasts till 2035.

The lab-grown meat market is projected to reach $1.99 billion by 2035, at a CAGR of 24.1% from 2025-2035.

Succeeding extensive secondary and primary research and an in-depth analysis of the market scenario, the report conducts the impact analysis of the key industry drivers, restraints, opportunities, and challenges. This market is characterized by more diversified operations, which offer healthy products, mainly due to rising health consciousness and consumer preference for sustainable food.

The high growth of the lab-grown meat market is mainly attributed to the technological advancements in the production of lab-grown meat, increasing venture investments in the lab-grown meat industry, growing focus on animal welfare, and the increasing demand for animal-based processed food products and allergen-free foods. However, high demand for plant-based protein, a lack of a standardized regulatory framework for lab-grown meat, psychological barriers to consuming lab-grown meat as food, and the growing vegan population are expected to restrain the growth of this market to a certain extent in the near future.

Based on type, in 2025, the beef segment is expected to account for the largest share of the lab-grown meat market. The growing demand for beef as a major source of protein, increasing awareness of protein consumption through high-nutritional food, and the growing preference for beef over other types of meat owing to various diseases associated with poultry and pork are the key factors contributing to the dominant position of this segment.

Based on distribution channel, in 2025, the business-to-business segment is expected to register the largest share of the lab-grown meat market. The key factors attributed to the large market share of this segment are the growing demand for meat-based products from foodservice industries and the approvals received by restaurants to sell lab-grown meat meals in some countries. This segment is also projected to register the highest CAGR during the forecast period.

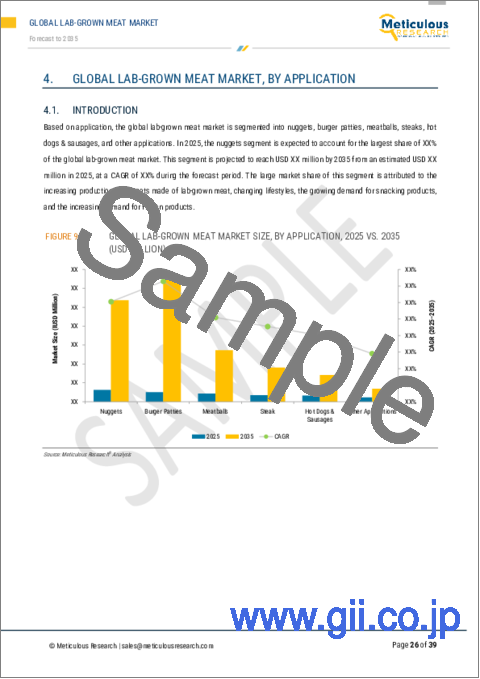

Based on application, in 2025, the nuggets segment is expected to account for the largest share of the lab-grown meat market. The large market share of this segment is attributed to the increasing adoption of on-the-go lifestyles, the growing demand for snacking products, and the increasing demand for frozen products. However, the burger patties segment is projected to register the highest CAGR during the forecast period.

An in-depth geographic analysis of the industry provides detailed qualitative and quantitative insights into the five major geographies (North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa) and the coverage of major countries in each region.

North America is projected to register the highest CAGR during the forecast period. The high growth rate of this regional market is mainly attributed to the rise in innovations, developments, and high spending for efficient R&D and the presence of a number of investors in the lab-grown market.

The key players profiled in the global lab-grown meat market study are Aleph Farms Ltd.(Israel), Avant Meats Company Limited (China), Ants Innovate Pte Ltd (Singapore), BlueNalu, Inc.(U.S.), ClearMeat (India), Finless Foods, Inc. (U.S.), Future Meat Technologies Ltd. (Israel), Higher Steaks (U.K), Lab Farm Foods, Inc.(U.S.), Meatable B.V.(Netherlands), Mosa Meat B.V. (Netherlands), MIRAI FOODS AG (Switzerland), Shiok Meats Pte Ltd (Singapore), SUPERMEAT THE ESSENCE OF MEAT LTD (Israel), Upside Foods, Inc. (U.S.), and Orbillion Bio, Inc (U.S).

Key Questions Answered in the Report:

- What is the current value of revenue generated by the lab-grown meat market?

- At what rate is the demand for lab-grown meat projected to grow for the next 7-10 years?

- What is the historical market size and growth rate for the lab-grown meat market?

- What are the major factors impacting the growth of this market at the global and regional levels? What are the major opportunities for existing players and new entrants in the market?

- Which segments in terms of type, distribution channel, and application create major traction for the manufacturers in this market?

- What are the key geographical trends in this market? Which regions/countries are expected to offer significant growth opportunities for the manufacturers operating in the lab-grown meat market?

- Who are the major players in the lab-grown meat market? What are their specific product offerings in this market?

What recent developments have taken place in the lab-grown meat market? What impacts have these strategic developments made on the market?

Scope of the Report:

Lab-grown Meat Market, by Type

- Beef

- Poultry

- Pork

- Seafood

- Other Lab-grown Meat Types

Lab-grown Meat Market, by Distribution Channel

- Business-to-Business

- Business-to-Consumer

Lab-grown Meat Market, by Application

- Nuggets

- Burger Patties

- Meatballs

- Steak

- Hot Dogs & Sausages

- Other Applications

Lab-grown Meat Market, by Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Netherlands

- Spain

- Germany

- Rest of Europe (RoE)

- Asia-Pacific (APAC)

- China

- Singapore

- Japan

- India

- Rest of Asia-Pacific (RoAPAC)

- Latin America

- Middle East & Africa

TABLE OF CONTENTS

1. Introduction

- 1.1. Market Definition

- 1.2. Market Ecosystem

- 1.3. Currency

- 1.4. Key Stakeholders

2. Research Methodology

- 2.1. Research Process

- 2.2. Data Collection & Validation

- 2.2.1. Secondary Research

- 2.2.2. Primary Research

- 2.3. Market Assessment

- 2.3.1. Market Size Estimation

- 2.3.1.1. Bottom-Up Approach

- 2.3.1.2. Top-Down Approach

- 2.3.1.3. Growth Forecast

- 2.3.1. Market Size Estimation

- 2.4. Assumptions for the Study

- 2.5. Limitations for the Study

3. Executive Summary

- 3.1. Introduction

- 3.2. Segmental Analysis

- 3.2.1. Lab-Grown Meat Market, by Type

- 3.2.2. Lab-Grown Meat Market, by Distribution Channel

- 3.2.3. Lab-Grown Meat Market, by Application

- 3.3. Regional Analysis

- 3.4. Competitive Landscape & Market Competitors

4. Market Insights

- 4.1. Introduction

- 4.2. Drivers

- 4.2.1. Technological Advancements in the Production of Lab-Grown Meat

- 4.2.2. Increasing Venture Investments in the Lab-Grown Meat Industry

- 4.2.3. Growing Focus on Animal Welfare

- 4.2.4. Rising Demand for Animal-Based Processed Food Products

- 4.2.5. Increasing Demand for Allergen-Free Foods

- 4.3. Restraints

- 4.3.1. High Demand for Plant-Based Protein

- 4.3.2. Lack of A Standardized Regulatory Framework for Lab-Grown Meat

- 4.3.3. Psychological Barriers to Consuming Lab-Grown Meat As Food

- 4.3.4. Growing Vegan Population

- 4.4. Opportunities

- 4.4.1. Rising Demand for Alternative Proteins

- 4.4.2. Growing Per Capita Meat Consumption

- 4.5. Challenges

- 4.5.1. High Production Costs

- 4.6. Trends

- 4.6.1. Clean Eating

- 4.6.2. Sustainable Foods

- 4.7. Regulatory Analysis

- 4.7.1. Singapore

- 4.7.2. European Union (EU)

- 4.7.3. U.K

- 4.7.4. Brazil

- 4.7.5. Israel

- 4.7.6. Japan

- 4.7.7. China

- 4.7.8. U.S.

- 4.7.9. Canada

- 4.7.10. Australia-New Zealand

- 4.7.11. India

- 4.7.12. Rest of the World

5. Global Lab-Grown Meat Market, by Type

- 5.1. Introduction

- 5.2. Beef

- 5.3. Poultry

- 5.4. Pork

- 5.5. Seafood

- 5.6. Other Lab-Grown Meat

6. Global Lab-Grown Meat Market, by Distribution Channel

- 6.1. Introduction

- 6.2. Business-To-Business (B2B)

- 6.3. Business-To-Consumer (B2C)

7. Global Lab-Grown Meat Market, by Application

- 7.1. Introduction

- 7.2. Nuggets

- 7.3. Burger Patties

- 7.4. Meatballs

- 7.5. Steaks

- 7.6. Hot Dogs & Sausages

- 7.7. Other Applications

8. Lab-Grown Meat Market, by Geography

- 8.1. Introduction

- 8.2. North America

- 8.2.1. U.S.

- 8.2.2. Canada

- 8.3. Europe

- 8.3.1. U.K.

- 8.3.2. Netherlands

- 8.3.3. Spain

- 8.3.4. Germany

- 8.3.5. Rest of Europe (RoE)

- 8.4. Asia-Pacific

- 8.4.1. China

- 8.4.2. Singapore

- 8.4.3. Japan

- 8.4.4. India

- 8.4.5. Rest of Asia-Pacific

- 8.5. Latin America

- 8.6. Middle East & Africa

9. Competitive Landscape

- 9.1. Introduction

- 9.2. Key Growth Strategies

- 9.3. Competitive Benchmarking

10. Company Profiles (Business Overview, Product Portfolio, and Strategic Developments)

- 10.1. Aleph Farms Ltd.

- 10.2. Avant Meats Company Limited

- 10.3. BlueNalu, Inc.

- 10.4. Finless Foods, Inc.

- 10.5. Future Meat Technologies Ltd.

- 10.6. Higher Steaks

- 10.7. Lab Farm Foods, Inc.

- 10.8. Mosa Meat B.V.

- 10.9. Shiok Meats Pte Ltd

- 10.10. SUPERMEAT THE ESSENCE OF MEAT. LTD

- 10.11. Upside Foods, Inc. (Formerly Memphis Meats)

- 10.12. Meatable B.V.

- 10.13. Clearmeat

- 10.14. Ants Innovate Pte Ltd

- 10.15. MIRAI FOODS AG

- 10.16. Orbillion Bio, Inc.

11. Appendix

- 11.1. Questionnaire

- 11.2. Available Customization