|

|

市場調査レポート

商品コード

1660127

EV用バッテリーの世界市場:バッテリータイプ別、材料タイプ別、バッテリー形態別、推進力別、車両タイプ別、バッテリー容量別、方式別、リチウムイオンバッテリーコンポーネント別、地域別 - 2035年までの予測EV Battery Market by Battery Type (Li-ion, NiMH, SSB), Vehicle Type (PC, Vans/Light Truck, MHCV, Bus & OHV), Propulsion, Battery Form, Material Type, Battery Capacity, Method, Li-ion Battery Component, and Region - Global Forecast to 2035 |

||||||

カスタマイズ可能

|

|||||||

| EV用バッテリーの世界市場:バッテリータイプ別、材料タイプ別、バッテリー形態別、推進力別、車両タイプ別、バッテリー容量別、方式別、リチウムイオンバッテリーコンポーネント別、地域別 - 2035年までの予測 |

|

出版日: 2025年02月05日

発行: MarketsandMarkets

ページ情報: 英文 371 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のEV用バッテリーの市場規模は、2024年に919億3,000万米ドル、2035年に2,513億3,000万米ドルに達すると予測され、2024年から2035年までのCAGRは9.6%とみられています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2019年~2035 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2035年 |

| 対象台数 | 数量(台)および金額(100万米ドル) |

| セグメント | バッテリータイプ別、材料タイプ別、バッテリー形態別、推進力別、車両タイプ別、電池容量別、方式別、リチウムイオンバッテリーコンポーネント別、地域別 |

| 対象地域 | アジア太平洋、欧州、北米 |

EV用バッテリー市場は、電気自動車の普及拡大、電池技術の進歩、政府の支援政策によって急速な成長を遂げています。航続距離が長く、充電速度の速いバッテリーに対する需要の高まりは、Hondaが2024年までに1回の充電で最大620マイル(約820km)を走行できる固体バッテリーを生産する計画などの技術革新に拍車をかけています。さらに、2024年12月に発表されたStellantisとCATLによるスペインでのリン酸鉄リチウム電池工場の42億米ドルのベンチャーのように、パートナーシップと投資が事業拡大に拍車をかけています。OEMがEVの新モデルを発売し、電池メーカーが生産規模を拡大していることから、EV用バッテリー市場は大幅な拡大が見込まれています。

ソリッドステートバッテリーは、エネルギー密度、安全性、充電効率に革命をもたらす可能性があるため、EV用バッテリー市場で大きな成長を示すと予想されています。これらの電池は、従来のリチウムイオン電池に見られる液体電解質を固体電解質に置き換えることで、熱安定性を高め、火災のリスクを低減し、より長い寿命を実現します。エネルギー密度が高いため、EVの航続距離を大幅に伸ばすと同時に、充電時間の短縮も可能になり、EVの普及を大きく変えます。最近の動向は、その勢いの高まりを裏付けています。2024年12月、Hondaは1回の充電で最大620マイル(1,000キロメートル)の走行が可能なEV用固体電池の生産計画を発表しました。同様に2024年9月、ファクトリアルはMercedes-Benzと共同で、斬新な設計の乾式正極を採用した全固体電池「ソルスティス」を開発しました。この技術革新は、最大450Wh/kgのエネルギー密度と、より効率的で持続可能な生産工程を約束し、固体電池技術の大きな飛躍を示すものです。主要自動車企業や電池企業が研究開発努力を強化し、政府が電池技術の進歩にインセンティブを与えていることから、固体電池は、航続距離不安、安全性への懸念、充電インフラの制限といった主要課題に対処し、EV市場の将来を形作る上で極めて重要な役割を果たす態勢が整っています。

乗用車は、消費者需要の急増、政府の支援政策、多様なEVモデルの増加により、調査期間中、EV用バッテリー市場で最大の市場シェアを獲得し、EV用バッテリー市場を独占すると予想されます。世界各国の政府は、自動車の排出ガスに関する厳しい規制を実施し、EVの導入を促進するための補助金を提供しており、乗用車の販売を促進しています。さらに、エネルギー密度の向上、充電の高速化、低コスト化といったEV用バッテリー技術の進歩により、電気乗用車は大衆市場にとってより身近な存在となっています。大手自動車メーカー各社は、この移行に向けて準備を進めており、今後数年間に複数の乗用車用EVモデルの発売が予定されています。例えば、Renaultが2026年に発売を予定している待望のRenault5 E-Techには、AESCから調達した先進的なリチウムイオン電池が搭載されます。同様に、Mercedes-Benzは2025年に、SKイノベーションの子会社であるSK ONが提供する高性能NMCバッテリーを搭載したEQA 300 4MATICの導入を計画しています。これらの車両は、先進的なEV用バッテリーに対する需要の高まりを浮き彫りにし、バッテリー業界の技術革新と生産成長を促進しています。LFPからNMCやNCAへの移行など、電池化学の進歩がエネルギー密度と航続距離を高め、市場拡大に拍車をかけています。OEMメーカーと電池メーカーのコラボレーションは、高性能電池の開発を加速させています。例えば、LG Energy Solutionは2024年11月、RivianのR2向けに4695個の円筒形リチウムイオン電池を供給する5年契約を発表しました。

当レポートでは、世界のEV用バッテリー市場について調査し、バッテリータイプ別、材料タイプ別、バッテリー形態別、推進力別、車両タイプ別、電池容量別、方式別、リチウムイオンバッテリーコンポーネント別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客ビジネスに影響を与える動向と混乱

- NEVSの急速な開発がEV用バッテリー市場の成長を牽引

- リチウムイオン電池の価格とコストの分析

- 価格分析

- EV用バッテリー市場へのAIの影響

- エコシステム分析

- バリューチェーン分析

- ケーススタディ分析

- 投資と資金調達のシナリオ

- 特許分析

- 技術分析

- HSコード:リチウムセルおよびバッテリー

- 規制状況

- 2025年~2026年の主な会議とイベント

- 主な利害関係者と購入基準

- OEM分析

- サプライヤー分析

第6章 EV用バッテリー市場(バッテリータイプ別)

- イントロダクション

- リチウムイオン

- ニッケル水素

- ソリッドステート

- その他

- 主な洞察

第7章 EV用バッテリー市場(材料タイプ別)

- イントロダクション

- コバルト

- リチウム

- 天然グラファイト

- マンガン

- 鉄

- リン酸

- ニッケル

- その他

- 主な洞察

第8章 EV用バッテリー市場(バッテリー形態別)

- イントロダクション

- プリズマティック

- ポーチ

- 円筒形

- 主な洞察

第9章 EV用バッテリー市場(推進力別)

- イントロダクション

- 電気自動車

- PHEV

- 燃料電池車

- ハイブリッド

- 主な洞察

第10章 EV用バッテリー市場(車両タイプ別)

- イントロダクション

- 乗用車

- バン・小型トラック

- 中型・大型トラック

- バス

- オフロード車両

- 主な洞察

第11章 EV用バッテリー市場(バッテリー容量別)

- イントロダクション

- 50KWH未満

- 50~110KWH

- 111~200KWH

- 201~300KWH

- 301KWH超

- 主な洞察

第12章 EV用バッテリー市場(方式別)

- イントロダクション

- ワイヤーボンディング

- レーザー接合

- 超音波金属溶接

第13章 EV用バッテリー市場(リチウムイオンバッテリーコンポーネント別)

- イントロダクション

- 正極

- 負極

- 電解質

- セパレーター

第14章 EV用バッテリー市場(地域別)

- イントロダクション

- アジア太平洋

- マクロ経済見通し

- 中国

- インド

- 日本

- 韓国

- 欧州

- マクロ経済見通し

- ドイツ

- フランス

- イタリア

- 英国

- スペイン

- ノルウェー

- スウェーデン

- デンマーク

- 北米

- マクロ経済見通し

- 米国

- カナダ

第15章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み、2022年~2024年

- 収益分析

- 市場シェア分析、2024年

- EV用バッテリー市場シェア動向分析

- 企業価値評価と財務指標

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業の、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

第16章 企業プロファイル

- 主要参入企業

- CONTEMPORARY AMPEREX TECHNOLOGY CO., LIMITED

- BYD COMPANY LTD.

- LG ENERGY SOLUTION

- CALB

- SK INNOVATION CO. LTD.

- PANASONIC HOLDINGS CORPORATION

- SAMSUNG SDI

- GOTION

- SUNWODA ELECTRONIC CO., LTD.

- FARASIS ENERGY(GANZHOU)CO., LTD.

- TOSHIBA CORPORATION

- MITSUBISHI CORPORATION

- ENERSYS

- その他の企業

- EXIDE INDUSTRIES LIMITED

- E-ONE MOLI ENERGY CORP.

- TARGRAY TECHNOLOGY INTERNATIONAL INC.

- ALTAIR NANOTECHNOLOGIES INC.

- CLARIOS

- NORTHVOLT AB

- LECLANCHE SA

- ENVISION GROUP

- A123 SYSTEMS(SUBSIDIARY OF WANXIANG GROUP)

- GS YUASA INTERNATIONAL LTD.

- AUTOMOTIVE ENERGY SUPPLY CORPORATION

- REPT BATTERO ENERGY CO LTD.

- AUTOMOTIVE CELLS COMPANY

- BLUEOVAL SK

- CELLFORCE GROUP GMBH

- ULTIUM CELLS

- ONE BATTERY

- SILA NANOTECHNOLOGIES INC.

- MORROW BATTERIES

第17章 市場における提言

第18章 付録

List of Tables

- TABLE 1 EV BATTERY MARKET DEFINITION, BY BATTERY TYPE

- TABLE 2 EV BATTERY MARKET DEFINITION, BY LITHIUM-ION BATTERY COMPONENT

- TABLE 3 EV BATTERY MARKET DEFINITION, BY PROPULSION

- TABLE 4 EV BATTERY MARKET DEFINITION, BY VEHICLE TYPE

- TABLE 5 EV BATTERY MARKET DEFINITION, BY MATERIAL TYPE

- TABLE 6 EV BATTERY MARKET DEFINITION, BY METHOD

- TABLE 7 EV BATTERY MARKET DEFINITION, BY BATTERY FORM

- TABLE 8 INCLUSIONS & EXCLUSIONS

- TABLE 9 USD EXCHANGE RATES, 2019-2024

- TABLE 10 ADVANCEMENTS IN BATTERY TECHNOLOGIES, 2023-2024

- TABLE 11 REGULATIONS AND POLICIES FOR EVS, BY KEY COUNTRY

- TABLE 12 CHARGING TIME OF EVS OPERATING IN US, BY CHARGER TYPE

- TABLE 13 TOTAL EV CHARGING POINTS IN EMERGING COUNTRIES, 2024

- TABLE 14 IMPACT OF MARKET DYNAMICS ON EV BATTERY MARKET

- TABLE 15 AVERAGE SELLING PRICE OF KEY PLAYERS FOR PASSENGER CARS, 2024 (USD/KWH)

- TABLE 16 AVERAGE SELLING PRICE, BY REGION, 2022-2024 (USD/KWH)

- TABLE 17 ROLE OF PLAYERS IN ECOSYSTEM

- TABLE 18 FUNDING, BY USE CASE, 2022-2024

- TABLE 19 PATENTS GRANTED, 2022-2024

- TABLE 20 IMPORT DATA FOR HS CODE 850650-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 21 EXPORT DATA FOR HS CODE 850650-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 22 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 24 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 25 REGULATORY CHANGES, BY COUNTRY/REGION

- TABLE 26 REGULATIONS/VOLUNTARY PROCEDURES FOR PERFORMANCE MEASUREMENT OF EV BATTERIES, BY KEY COUNTRY/REGION

- TABLE 27 REGULATIONS/VOLUNTARY PROCEDURES FOR DURABILITY MEASUREMENT OF EV BATTERIES, BY KEY COUNTRY/REGION

- TABLE 28 REGULATIONS/VOLUNTARY PROCEDURES TO ENSURE SAFETY OF EV BATTERIES, BY COUNTRY

- TABLE 29 REGULATIONS/VOLUNTARY PROCEDURES FOR RECYCLING EV BATTERIES, BY KEY COUNTRY/REGION

- TABLE 30 KEY CONFERENCES & EVENTS, 2025-2026

- TABLE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY VEHICLE TYPE (%)

- TABLE 32 KEY BUYING CRITERIA, BY VEHICLE TYPE

- TABLE 33 LITHIUM-ION BATTERY CELLS (CATHODE TYPE): OEMS AND KEY SUPPLIERS

- TABLE 34 EV BATTERY SUPPLIERS, 2024-2026

- TABLE 35 EV BATTERY MARKET, BY BATTERY TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 36 EV BATTERY MARKET, BY BATTERY TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 37 EV BATTERY MARKET, BY BATTERY TYPE, 2031-2035 (THOUSAND UNITS)

- TABLE 38 TYPES OF BATTERIES USED IN CURRENT AND UPCOMING EV MODELS, 2025-2026

- TABLE 39 LITHIUM-ION: EV BATTERY MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 40 LITHIUM-ION: EV BATTERY MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 41 LITHIUM-ION: EV BATTERY MARKET, BY REGION, 2031-2035 (THOUSAND UNITS)

- TABLE 42 COMPARISON BETWEEN LITHIUM-ION BATTERY CHEMISTRIES

- TABLE 43 LITHIUM IRON PHOSPHATE: EV BATTERY MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 44 LITHIUM IRON PHOSPHATE: EV BATTERY MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 45 LITHIUM IRON PHOSPHATE: EV BATTERY MARKET, BY REGION, 2031-2035 (THOUSAND UNITS)

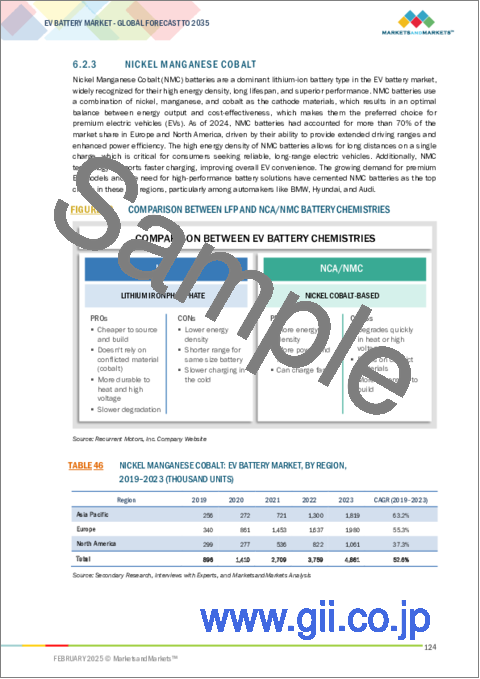

- TABLE 46 NICKEL MANGANESE COBALT: EV BATTERY MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 47 NICKEL MANGANESE COBALT: EV BATTERY MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 48 NICKEL MANGANESE COBALT: EV BATTERY MARKET, BY REGION, 2031-2035 (THOUSAND UNITS)

- TABLE 49 LITHIUM IRON MANGANESE PHOSPHATE: EV BATTERY MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 50 LITHIUM IRON MANGANESE PHOSPHATE: EV BATTERY MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 51 LITHIUM IRON MANGANESE PHOSPHATE: EV BATTERY MARKET, BY REGION, 2031-2035 (THOUSAND UNITS)

- TABLE 52 OTHERS: EV BATTERY MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 53 OTHERS: EV BATTERY MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 54 OTHERS: EV BATTERY MARKET, BY REGION, 2031-2035 (THOUSAND UNITS)

- TABLE 55 NICKEL-METAL HYDRIDE: EV BATTERY MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 56 NICKEL-METAL HYDRIDE: EV BATTERY MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 57 NICKEL-METAL HYDRIDE: EV BATTERY MARKET, BY REGION, 2031-2035 (THOUSAND UNITS)

- TABLE 58 SOLID-STATE: EV BATTERY MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 59 SOLID-STATE: EV BATTERY MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 60 SOLID-STATE: EV BATTERY MARKET, BY REGION, 2031-2035 (THOUSAND UNITS)

- TABLE 61 OTHER BATTERY TYPES: EV BATTERY MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 62 OTHER BATTERY TYPES: EV BATTERY MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 63 OTHER BATTERY TYPES: EV BATTERY MARKET, BY REGION, 2031-2035 (THOUSAND UNITS)

- TABLE 64 EV BATTERY MARKET, BY MATERIAL TYPE, 2019-2023 (USD MILLION)

- TABLE 65 EV BATTERY MARKET, BY MATERIAL TYPE, 2024-2030 (USD MILLION)

- TABLE 66 EV BATTERY MARKET, BY MATERIAL TYPE, 2031-2035 (USD MILLION)

- TABLE 67 COBALT: EV BATTERY MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 68 COBALT: EV BATTERY MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 69 COBALT: EV BATTERY MARKET, BY REGION, 2031-2035 (USD MILLION)

- TABLE 70 LITHIUM: EV BATTERY MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 71 LITHIUM: EV BATTERY MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 72 LITHIUM: EV BATTERY MARKET, BY REGION, 2031-2035 (USD MILLION)

- TABLE 73 NATURAL GRAPHITE: EV BATTERY MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 74 NATURAL GRAPHITE: EV BATTERY MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 75 NATURAL GRAPHITE: EV BATTERY MARKET, BY REGION, 2031-2035 (USD MILLION)

- TABLE 76 MANGANESE: EV BATTERY MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 77 MANGANESE: EV BATTERY MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 78 MANGANESE: EV BATTERY MARKET, BY REGION, 2031-2035 (USD MILLION)

- TABLE 79 IRON: EV BATTERY MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 80 IRON: EV BATTERY MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 81 IRON: EV BATTERY MARKET, BY REGION, 2031-2035 (USD MILLION)

- TABLE 82 PHOSPHATE: EV BATTERY MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 83 PHOSPHATE: EV BATTERY MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 84 PHOSPHATE: EV BATTERY MARKET, BY REGION, 2031-2035 (USD MILLION)

- TABLE 85 NICKEL: EV BATTERY MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 86 NICKEL: EV BATTERY MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 87 NICKEL: EV BATTERY MARKET, BY REGION, 2031-2035 (USD MILLION)

- TABLE 88 OTHER MATERIAL TYPES: EV BATTERY MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 89 OTHER MATERIAL TYPES: EV BATTERY MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 90 OTHER MATERIAL TYPES: EV BATTERY MARKET, BY REGION, 2031-2035 (USD MILLION)

- TABLE 91 EV BATTERY MARKET, BY BATTERY FORM, 2019-2023 (THOUSAND UNITS)

- TABLE 92 EV BATTERY MARKET, BY BATTERY FORM, 2024-2030 (THOUSAND UNITS)

- TABLE 93 EV BATTERY MARKET, BY BATTERY FORM, 2031-2035 (THOUSAND UNITS)

- TABLE 94 BATTERY FORMS USED IN EV MODELS, 2024-2026

- TABLE 95 BATTERY FORMS: ADVANTAGES AND DISADVANTAGES

- TABLE 96 PRISMATIC: EV BATTERY MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 97 PRISMATIC: EV BATTERY MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 98 PRISMATIC: EV BATTERY MARKET, BY REGION, 2031-2035 (THOUSAND UNITS)

- TABLE 99 POUCH: EV BATTERY MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 100 POUCH: EV BATTERY MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 101 POUCH: EV BATTERY MARKET, BY REGION, 2031-2035 (THOUSAND UNITS)

- TABLE 102 CYLINDRICAL: EV BATTERY MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 103 CYLINDRICAL: EV BATTERY MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 104 CYLINDRICAL: EV BATTERY MARKET, BY REGION, 2031-2035 (THOUSAND UNITS)

- TABLE 105 EV BATTERY MARKET, BY PROPULSION, 2019-2023 (MWH)

- TABLE 106 EV BATTERY MARKET, BY PROPULSION, 2024-2030 (MWH)

- TABLE 107 EV BATTERY MARKET, BY PROPULSION, 2031-2035 (MWH)

- TABLE 108 BEST-SELLING BEVS IN US, 2024

- TABLE 109 BEV: EV BATTERY MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 110 BEV: EV BATTERY MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 111 BEV: EV BATTERY MARKET, BY REGION, 2031-2035 (THOUSAND UNITS)

- TABLE 112 PHEV: EV BATTERY MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 113 PHEV: EV BATTERY MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 114 PHEV: EV BATTERY MARKET, BY REGION, 2031-2035 (THOUSAND UNITS)

- TABLE 115 FCEV: EV BATTERY MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 116 FCEV: EV BATTERY MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 117 FCEV: EV BATTERY MARKET, BY REGION, 2031-2035 (THOUSAND UNITS)

- TABLE 118 EV BATTERY MARKET, BY VEHICLE TYPE, 2019-2023 (MWH)

- TABLE 119 EV BATTERY MARKET, BY VEHICLE TYPE, 2024-2030 (MWH)

- TABLE 120 EV BATTERY MARKET, BY VEHICLE TYPE, 2031-2035 (MWH)

- TABLE 121 EV BATTERY MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 122 EV BATTERY MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 123 EV BATTERY MARKET, BY VEHICLE TYPE, 2031-2035 (USD MILLION)

- TABLE 124 UPCOMING EV MODELS, 2025-2026

- TABLE 125 CURRENT AND UPCOMING EV MODELS, 2024-2025

- TABLE 126 CURRENT AND UPCOMING ELECTRIC COMMERCIAL VEHICLES, 2023-2026

- TABLE 127 PASSENGER CAR: EV BATTERY MARKET, BY REGION, 2019-2023 (MWH)

- TABLE 128 PASSENGER CAR: EV BATTERY MARKET, BY REGION, 2024-2030 (MWH)

- TABLE 129 PASSENGER CAR: EV BATTERY MARKET, BY REGION, 2031-2035 (MWH)

- TABLE 130 PASSENGER CAR: EV BATTERY MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 131 PASSENGER CAR: EV BATTERY MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 132 PASSENGER CAR: EV BATTERY MARKET, BY REGION, 2031-2035 (USD MILLION)

- TABLE 133 VAN/LIGHT TRUCK: EV BATTERY MARKET, BY REGION, 2019-2023 (MWH)

- TABLE 134 VAN/LIGHT TRUCK: EV BATTERY MARKET, BY REGION, 2024-2030 (MWH)

- TABLE 135 VAN/LIGHT TRUCK: EV BATTERY MARKET, BY REGION, 2031-2035 (MWH)

- TABLE 136 VAN/LIGHT TRUCK: EV BATTERY MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 137 VAN/LIGHT TRUCK: EV BATTERY MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 138 VAN/LIGHT TRUCK: EV BATTERY MARKET, BY REGION, 2031-2035 (USD MILLION)

- TABLE 139 MEDIUM & HEAVY TRUCK: EV BATTERY MARKET, BY REGION, 2019-2023 (MWH)

- TABLE 140 MEDIUM & HEAVY TRUCK: EV BATTERY MARKET, BY REGION, 2024-2030 (MWH)

- TABLE 141 MEDIUM & HEAVY TRUCK: EV BATTERY MARKET, BY REGION, 2031-2035 (MWH)

- TABLE 142 MEDIUM & HEAVY TRUCK: EV BATTERY MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 143 MEDIUM & HEAVY TRUCK: EV BATTERY MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 144 MEDIUM & HEAVY TRUCK: EV BATTERY MARKET, BY REGION, 2031-2035 (USD MILLION)

- TABLE 145 POPULAR ELECTRIC BUS MODELS

- TABLE 146 BUS: EV BATTERY MARKET, BY REGION, 2019-2023 (MWH)

- TABLE 147 BUS: EV BATTERY MARKET, BY REGION, 2024-2030 (MWH)

- TABLE 148 BUS: EV BATTERY MARKET, BY REGION, 2031-2035 (MWH)

- TABLE 149 BUS: EV BATTERY MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 150 BUS: EV BATTERY MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 151 BUS: EV BATTERY MARKET, BY REGION, 2031-2035 (USD MILLION)

- TABLE 152 MAJOR ELECTRIC OFF-HIGHWAY VEHICLE MODELS

- TABLE 153 OFF-HIGHWAY VEHICLE: EV BATTERY MARKET, BY REGION, 2019-2023 (MWH)

- TABLE 154 OFF-HIGHWAY VEHICLE: EV BATTERY MARKET, BY REGION, 2024-2030 (MWH)

- TABLE 155 OFF-HIGHWAY VEHICLE: EV BATTERY MARKET, BY REGION, 2031-2035 (MWH)

- TABLE 156 OFF-HIGHWAY VEHICLE: EV BATTERY MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 157 OFF-HIGHWAY VEHICLE: EV BATTERY MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 158 OFF-HIGHWAY VEHICLE: EV BATTERY MARKET, BY REGION, 2031-2035 (USD MILLION)

- TABLE 159 BATTERY CAPACITY OF POPULAR EV MODELS

- TABLE 160 EV BATTERY MARKET, BY BATTERY CAPACITY, 2019-2023 (THOUSAND UNITS)

- TABLE 161 EV BATTERY MARKET, BY BATTERY CAPACITY, 2024-2030 (THOUSAND UNITS)

- TABLE 162 EV BATTERY MARKET, BY BATTERY CAPACITY, 2031-2035 (THOUSAND UNITS)

- TABLE 163 < 50 KWH: EV BATTERY MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 164 < 50 KWH: EV BATTERY MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 165 < 50 KWH: EV BATTERY MARKET, BY REGION, 2031-2035 (THOUSAND UNITS)

- TABLE 166 50-110 KWH: EV BATTERY MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 167 50-110 KWH: EV BATTERY MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 168 50-110 KWH: EV BATTERY MARKET, BY REGION, 2031-2035 (THOUSAND UNITS)

- TABLE 169 111-200 KWH: EV BATTERY MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 170 111-200 KWH: EV BATTERY MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 171 111-200 KWH: EV BATTERY MARKET, BY REGION, 2031-2035 (THOUSAND UNITS)

- TABLE 172 201-300 KWH: EV BATTERY MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 173 201-300 KWH: EV BATTERY MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 174 201-300 KWH: EV BATTERY MARKET, BY REGION, 2031-2035 (THOUSAND UNITS)

- TABLE 175 > 301 KWH: EV BATTERY MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 176 > 301 KWH: EV BATTERY MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 177 > 301 KWH: EV BATTERY MARKET, BY REGION, 2031-2035 (THOUSAND UNITS)

- TABLE 178 ELECTROLYTE SOLVENTS IN LITHIUM-ION BATTERIES

- TABLE 179 COMMONLY USED LITHIUM-ION BATTERIES AND THEIR SPECIFICATIONS

- TABLE 180 CATHODE MATERIAL SUPPLIERS FOR EV MODELS, 2023-2024

- TABLE 181 ANODE MATERIAL SUPPLIERS FOR EV MODELS, 2023-2024

- TABLE 182 EV BATTERY MARKET, BY REGION, 2019-2023 (MWH)

- TABLE 183 EV BATTERY MARKET, BY REGION, 2024-2030 (MWH)

- TABLE 184 EV BATTERY MARKET, BY REGION, 2031-2035 (MWH)

- TABLE 185 EV BATTERY MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 186 EV BATTERY MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 187 EV BATTERY MARKET, BY REGION, 2031-2035 (USD MILLION)

- TABLE 188 ASIA PACIFIC: EV BATTERY MARKET, BY COUNTRY, 2019-2023 (MWH)

- TABLE 189 ASIA PACIFIC: EV BATTERY MARKET, BY COUNTRY, 2024-2030 (MWH)

- TABLE 190 ASIA PACIFIC: EV BATTERY MARKET, BY COUNTRY, 2031-2035 (MWH)

- TABLE 191 ASIA PACIFIC: EV BATTERY MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 192 ASIA PACIFIC: EV BATTERY MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 193 ASIA PACIFIC: EV BATTERY MARKET, BY COUNTRY, 2031-2035 (USD MILLION)

- TABLE 194 CHINA: EV BATTERY MARKET, BY VEHICLE TYPE, 2019-2023 (MWH)

- TABLE 195 CHINA: EV BATTERY MARKET, BY VEHICLE TYPE, 2024-2030 (MWH)

- TABLE 196 CHINA: EV BATTERY MARKET, BY VEHICLE TYPE, 2031-2035 (MWH)

- TABLE 197 CHINA: EV BATTERY MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 198 CHINA: EV BATTERY MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 199 CHINA: EV BATTERY MARKET, BY VEHICLE TYPE, 2031-2035 (USD MILLION)

- TABLE 200 INDIA: EV BATTERY MARKET, BY VEHICLE TYPE, 2019-2023 (MWH)

- TABLE 201 INDIA: EV BATTERY MARKET, BY VEHICLE TYPE, 2024-2030 (MWH)

- TABLE 202 INDIA: EV BATTERY MARKET, BY VEHICLE TYPE, 2031-2035 (MWH)

- TABLE 203 INDIA: EV BATTERY MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 204 INDIA: EV BATTERY MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 205 INDIA: EV BATTERY MARKET, BY VEHICLE TYPE, 2031-2035 (USD MILLION)

- TABLE 206 JAPAN: EV BATTERY MARKET, BY VEHICLE TYPE, 2019-2023 (MWH)

- TABLE 207 JAPAN: EV BATTERY MARKET, BY VEHICLE TYPE, 2024-2030 (MWH)

- TABLE 208 JAPAN: EV BATTERY MARKET, BY VEHICLE TYPE, 2031-2035 (MWH)

- TABLE 209 JAPAN: EV BATTERY MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 210 JAPAN: EV BATTERY MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 211 JAPAN: EV BATTERY MARKET, BY VEHICLE TYPE, 2031-2035 (USD MILLION)

- TABLE 212 SOUTH KOREA: EV BATTERY MARKET, BY VEHICLE TYPE, 2019-2023 (MWH)

- TABLE 213 SOUTH KOREA: EV BATTERY MARKET, BY VEHICLE TYPE, 2024-2030 (MWH)

- TABLE 214 SOUTH KOREA: EV BATTERY MARKET, BY VEHICLE TYPE, 2031-2035 (MWH)

- TABLE 215 SOUTH KOREA: EV BATTERY MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 216 SOUTH KOREA: EV BATTERY MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 217 SOUTH KOREA: EV BATTERY MARKET, BY VEHICLE TYPE, 2031-2035 (USD MILLION)

- TABLE 218 EUROPE: EV BATTERY MARKET, BY COUNTRY, 2019-2023 (MWH)

- TABLE 219 EUROPE: EV BATTERY MARKET, BY COUNTRY, 2024-2030 (MWH)

- TABLE 220 EUROPE: EV BATTERY MARKET, BY COUNTRY, 2031-2035 (MWH)

- TABLE 221 EUROPE: EV BATTERY MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 222 EUROPE: EV BATTERY MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 223 EUROPE: EV BATTERY MARKET, BY COUNTRY, 2031-2035 (USD MILLION)

- TABLE 224 GERMANY: EV BATTERY MARKET, BY VEHICLE TYPE, 2019-2023 (MWH)

- TABLE 225 GERMANY: EV BATTERY MARKET, BY VEHICLE TYPE, 2024-2030 (MWH)

- TABLE 226 GERMANY: EV BATTERY MARKET, BY VEHICLE TYPE, 2031-2035 (MWH)

- TABLE 227 GERMANY: EV BATTERY MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 228 GERMANY: EV BATTERY MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 229 GERMANY: EV BATTERY MARKET, BY VEHICLE TYPE, 2031-2035 (USD MILLION)

- TABLE 230 FRANCE: EV BATTERY MARKET, BY VEHICLE TYPE, 2019-2023 (MWH)

- TABLE 231 FRANCE: EV BATTERY MARKET, BY VEHICLE TYPE, 2024-2030 (MWH)

- TABLE 232 FRANCE: EV BATTERY MARKET, BY VEHICLE TYPE, 2031-2035 (MWH)

- TABLE 233 FRANCE: EV BATTERY MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 234 FRANCE: EV BATTERY MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 235 FRANCE: EV BATTERY MARKET, BY VEHICLE TYPE, 2031-2035 (USD MILLION)

- TABLE 236 ITALY: EV BATTERY MARKET, BY VEHICLE TYPE, 2019-2023 (KWH)

- TABLE 237 ITALY: EV BATTERY MARKET, BY VEHICLE TYPE, 2024-2030 (MWH)

- TABLE 238 ITALY: EV BATTERY MARKET, BY VEHICLE TYPE, 2031-2035 (MWH)

- TABLE 239 ITALY: EV BATTERY MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 240 ITALY: EV BATTERY MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 241 ITALY: EV BATTERY MARKET, BY VEHICLE TYPE, 2031-2035 (USD MILLION)

- TABLE 242 UK: EV BATTERY MARKET, BY VEHICLE TYPE, 2019-2023 (MWH)

- TABLE 243 UK: EV BATTERY MARKET, BY VEHICLE TYPE, 2024-2030 (MWH)

- TABLE 244 UK: EV BATTERY MARKET, BY VEHICLE TYPE, 2031-2035 (MWH)

- TABLE 245 UK: EV BATTERY MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 246 UK: EV BATTERY MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 247 UK: EV BATTERY MARKET, BY VEHICLE TYPE, 2031-2035 (USD MILLION)

- TABLE 248 SPAIN: EV BATTERY MARKET, BY VEHICLE TYPE, 2019-2023 (KWH)

- TABLE 249 SPAIN: EV BATTERY MARKET, BY VEHICLE TYPE, 2024-2030 (KWH)

- TABLE 250 SPAIN: EV BATTERY MARKET, BY VEHICLE TYPE, 2031-2035 (MWH)

- TABLE 251 SPAIN: EV BATTERY MARKET, BY VEHICLE TYPE, 2019-2023 (USD THOUSAND)

- TABLE 252 SPAIN: EV BATTERY MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 253 SPAIN: EV BATTERY MARKET, BY VEHICLE TYPE, 2031-2035 (USD MILLION)

- TABLE 254 NORWAY: EV BATTERY MARKET, BY VEHICLE TYPE, 2019-2023 (MWH)

- TABLE 255 NORWAY: EV BATTERY MARKET, BY VEHICLE TYPE, 2024-2030 (MWH)

- TABLE 256 NORWAY: EV BATTERY MARKET, BY VEHICLE TYPE, 2031-2035 (MWH)

- TABLE 257 NORWAY: EV BATTERY MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 258 NORWAY: EV BATTERY MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 259 NORWAY: EV BATTERY MARKET, BY VEHICLE TYPE, 2031-2035 (USD MILLION)

- TABLE 260 SWEDEN: EV BATTERY MARKET, BY VEHICLE TYPE, 2019-2023 (KWH)

- TABLE 261 SWEDEN: EV BATTERY MARKET, BY VEHICLE TYPE, 2024-2030 (MWH)

- TABLE 262 SWEDEN: EV BATTERY MARKET, BY VEHICLE TYPE, 2031-2035 (MWH)

- TABLE 263 SWEDEN: EV BATTERY MARKET, BY VEHICLE TYPE, 2019-2023 (USD THOUSAND)

- TABLE 264 SWEDEN: EV BATTERY MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 265 SWEDEN: EV BATTERY MARKET, BY VEHICLE TYPE, 2031-2035 (USD MILLION)

- TABLE 266 DENMARK: EV BATTERY MARKET, BY VEHICLE TYPE, 2019-2023 (KWH)

- TABLE 267 DENMARK: EV BATTERY MARKET, BY VEHICLE TYPE, 2024-2030 (MWH)

- TABLE 268 DENMARK: EV BATTERY MARKET, BY VEHICLE TYPE, 2031-2035 (MWH)

- TABLE 269 DENMARK: EV BATTERY MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 270 DENMARK: EV BATTERY MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 271 DENMARK: EV BATTERY MARKET, BY VEHICLE TYPE, 2031-2035 (USD MILLION)

- TABLE 272 NORTH AMERICA: EV BATTERY MARKET, BY COUNTRY, 2019-2023 (MWH)

- TABLE 273 NORTH AMERICA: EV BATTERY MARKET, BY COUNTRY, 2024-2030 (MWH)

- TABLE 274 NORTH AMERICA: EV BATTERY MARKET, BY COUNTRY, 2031-2035 (MWH)

- TABLE 275 NORTH AMERICA: EV BATTERY MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 276 NORTH AMERICA: EV BATTERY MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 277 NORTH AMERICA: EV BATTERY MARKET, BY COUNTRY, 2031-2035 (USD MILLION)

- TABLE 278 US: EV BATTERY MARKET, BY VEHICLE TYPE, 2019-2023 (MWH)

- TABLE 279 US: EV BATTERY MARKET, BY VEHICLE TYPE, 2024-2030 (MWH)

- TABLE 280 US: EV BATTERY MARKET, BY VEHICLE TYPE, 2031-2035 (MWH)

- TABLE 281 US: EV BATTERY MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 282 US: EV BATTERY MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 283 US: EV BATTERY MARKET, BY VEHICLE TYPE, 2031-2035 (USD MILLION)

- TABLE 284 CANADA: EV BATTERY MARKET, BY VEHICLE TYPE, 2019-2023 (MWH)

- TABLE 285 CANADA: EV BATTERY MARKET, BY VEHICLE TYPE, 2024-2030 (MWH)

- TABLE 286 CANADA: EV BATTERY MARKET, BY VEHICLE TYPE, 2031-2035 (MWH)

- TABLE 287 CANADA: EV BATTERY MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 288 CANADA: EV BATTERY MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 289 CANADA: EV BATTERY MARKET, BY VEHICLE TYPE, 2031-2035 (USD MILLION)

- TABLE 290 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022-2024

- TABLE 291 EV BATTERY MARKET SHARE ANALYSIS, 2024

- TABLE 292 EV BATTERY MARKET SHARE TREND ANALYSIS, 2022-2024

- TABLE 293 EV BATTERY MARKET: REGION FOOTPRINT

- TABLE 294 EV BATTERY MARKET: BATTERY FORM FOOTPRINT

- TABLE 295 EV BATTERY MARKET: BATTERY TYPE FOOTPRINT

- TABLE 296 EV BATTERY MARKET: PROPULSION FOOTPRINT

- TABLE 297 EV BATTERY MARKET: LIST OF STARTUPS/SMES

- TABLE 298 EV BATTERY MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES (1/2)

- TABLE 299 EV BATTERY MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES (2/2)

- TABLE 300 EV BATTERY MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, MARCH 2020-DECEMBER 2024

- TABLE 301 EV BATTERY MARKET: DEALS, MARCH 2020-DECEMBER 2024

- TABLE 302 EV BATTERY MARKET: EXPANSION, MARCH 2020-DECEMBER 2024

- TABLE 303 EV BATTERY MARKET: OTHER DEVELOPMENTS, MARCH 2020-DECEMBER 2024

- TABLE 304 CONTEMPORARY AMPEREX TECHNOLOGY CO., LIMITED: COMPANY OVERVIEW

- TABLE 305 CONTEMPORARY AMPEREX TECHNOLOGY CO., LIMITED: PRODUCTS OFFERED

- TABLE 306 CONTEMPORARY AMPEREX TECHNOLOGY CO., LIMITED: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 307 CONTEMPORARY AMPEREX TECHNOLOGY CO., LIMITED: DEALS

- TABLE 308 CONTEMPORARY AMPEREX TECHNOLOGY CO., LIMITED: OTHER DEVELOPMENTS

- TABLE 309 BYD COMPANY LTD.: COMPANY OVERVIEW

- TABLE 310 BYD COMPANY LTD.: PRODUCTS OFFERED

- TABLE 311 BYD COMPANY LTD.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 312 BYD COMPANY LTD.: DEALS

- TABLE 313 BYD COMPANY LTD.: EXPANSION

- TABLE 314 BYD COMPANY LTD.: OTHER DEVELOPMENTS

- TABLE 315 LG ENERGY SOLUTION: COMPANY OVERVIEW

- TABLE 316 LG ENERGY SOLUTION: R&D OVERVIEW

- TABLE 317 LG ENERGY SOLUTION: PRODUCTS OFFERED

- TABLE 318 LG ENERGY SOLUTION: DEALS

- TABLE 319 LG ENERGY SOLUTION: EXPANSION

- TABLE 320 LG ENERGY SOLUTION: OTHER DEVELOPMENTS

- TABLE 321 CALB: COMPANY OVERVIEW

- TABLE 322 CALB: PRODUCTS OFFERED

- TABLE 323 CALB: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 324 CALB: DEALS

- TABLE 325 CALB: OTHER DEVELOPMENTS

- TABLE 326 SK INNOVATION CO. LTD.: COMPANY OVERVIEW

- TABLE 327 SK INNOVATION CO. LTD.: PRODUCTS OFFERED

- TABLE 328 SK INNOVATION CO. LTD.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 329 SK INNOVATION CO. LTD.: DEALS

- TABLE 330 SK INNOVATION CO. LTD.: OTHER DEVELOPMENTS

- TABLE 331 PANASONIC HOLDINGS CORPORATION: COMPANY OVERVIEW

- TABLE 332 PANASONIC HOLDINGS CORPORATION: PRODUCTS OFFERED

- TABLE 333 PANASONIC HOLDINGS CORPORATION: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 334 PANASONIC HOLDINGS CORPORATION: DEALS

- TABLE 335 PANASONIC HOLDINGS CORPORATION: EXPANSION

- TABLE 336 PANASONIC HOLDINGS CORPORATION: OTHER DEVELOPMENTS

- TABLE 337 SAMSUNG SDI: COMPANY OVERVIEW

- TABLE 338 SAMSUNG SDI: PRODUCTS OFFERED

- TABLE 339 SAMSUNG SDI: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 340 SAMSUNG SDI: DEALS

- TABLE 341 SAMSUNG SDI: EXPANSION

- TABLE 342 SAMSUNG SDI: OTHER DEVELOPMENTS

- TABLE 343 GOTION: COMPANY OVERVIEW

- TABLE 344 GOTION: PRODUCTS OFFERED

- TABLE 345 GOTION: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 346 GOTION: DEALS

- TABLE 347 GOTION: EXPANSION

- TABLE 348 SUNWODA ELECTRONIC CO., LTD.: COMPANY OVERVIEW

- TABLE 349 SUNWODA ELECTRONIC CO., LTD.: PRODUCTS OFFERED

- TABLE 350 SUNWODA ELECTRONIC CO., LTD.: DEALS

- TABLE 351 SUNWODA ELECTRONIC CO., LTD.: EXPANSION

- TABLE 352 SUNWODA ELECTRONIC CO., LTD.: OTHER DEVELOPMENTS

- TABLE 353 FARASIS ENERGY (GANZHOU) CO., LTD.: COMPANY OVERVIEW

- TABLE 354 FARASIS ENERGY (GANZHOU) CO., LTD.: PRODUCTS OFFERED

- TABLE 355 FARASIS ENERGY (GANZHOU) CO., LTD.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 356 FARASIS ENERGY (GANZHOU) CO., LTD.: DEALS

- TABLE 357 FARASIS ENERGY (GANZHOU) CO., LTD.: EXPANSION

- TABLE 358 TOSHIBA CORPORATION: COMPANY OVERVIEW

- TABLE 359 TOSHIBA CORPORATION: PRODUCTS OFFERED

- TABLE 360 TOSHIBA CORPORATION: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 361 TOSHIBA CORPORATION: DEALS

- TABLE 362 MITSUBISHI CORPORATION: COMPANY OVERVIEW

- TABLE 363 MITSUBISHI CORPORATION: PRODUCTS OFFERED

- TABLE 364 MITSUBISHI CORPORATION: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 365 MITSUBISHI CORPORATION: DEALS

- TABLE 366 MITSUBISHI CORPORATION: EXPANSION

- TABLE 367 MITSUBISHI CORPORATION: OTHER DEVELOPMENTS

- TABLE 368 ENERSYS: COMPANY OVERVIEW

- TABLE 369 ENERSYS: PRODUCTS OFFERED

- TABLE 370 ENERSYS: DEALS

- TABLE 371 ENERSYS: EXPANSION

- TABLE 372 ENERSYS: OTHER DEVELOPMENTS

- TABLE 373 EXIDE INDUSTRIES LIMITED: COMPANY OVERVIEW

- TABLE 374 E-ONE MOLI ENERGY CORP: COMPANY OVERVIEW

- TABLE 375 TARGRAY TECHNOLOGY INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 376 ALTAIR NANOTECHNOLOGIES INC.: COMPANY OVERVIEW

- TABLE 377 CLARIOS: COMPANY OVERVIEW

- TABLE 378 NORTHVOLT AB: COMPANY OVERVIEW

- TABLE 379 LECLANCHE SA: COMPANY OVERVIEW

- TABLE 380 ENVISION GROUP: COMPANY OVERVIEW

- TABLE 381 A123 SYSTEMS: COMPANY OVERVIEW

- TABLE 382 GS YUASA INTERNATIONAL LTD.: COMPANY OVERVIEW

- TABLE 383 AUTOMOTIVE ENERGY SUPPLY CORPORATION: COMPANY OVERVIEW

- TABLE 384 REPT BATTERO ENERGY CO LTD.: COMPANY OVERVIEW

- TABLE 385 AUTOMOTIVE CELLS COMPANY: COMPANY OVERVIEW

- TABLE 386 BLUEOVAL SK: COMPANY OVERVIEW

- TABLE 387 CELLFORCE GROUP GMBH: COMPANY OVERVIEW

- TABLE 388 ULTIUM CELLS: COMPANY OVERVIEW

- TABLE 389 ONE BATTERY: COMPANY OVERVIEW

- TABLE 390 SILA NANOTECHNOLOGIES INC.: COMPANY OVERVIEW

- TABLE 391 MORROW BATTERIES: COMPANY OVERVIEW

List of Figures

- FIGURE 1 RESEARCH DESIGN

- FIGURE 2 RESEARCH DESIGN MODEL

- FIGURE 3 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 4 BOTTOM-UP APPROACH

- FIGURE 5 TOP-DOWN APPROACH

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 GROWTH PROJECTIONS FROM DEMAND-SIDE DRIVERS

- FIGURE 8 DEMAND- AND SUPPLY-SIDE FACTORS IMPACTING OVERALL MARKET

- FIGURE 9 EV BATTERY MARKET OVERVIEW

- FIGURE 10 ASIA PACIFIC TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 11 LITHIUM-ION SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 12 ADVANCEMENTS IN LITHIUM-ION AND SOLID-STATE BATTERY TECHNOLOGIES TO DRIVE MARKET

- FIGURE 13 ASIA PACIFIC TO BE LARGEST MARKET IN 2024

- FIGURE 14 50-110 KWH SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 15 PRISMATIC SEGMENT TO ACCOUNT FOR LARGEST SHARE BY 2035

- FIGURE 16 LITHIUM-ION SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 17 IRON SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 18 BEV SEGMENT TO ACCOUNT FOR LARGEST SHARE BY 2035

- FIGURE 19 PASSENGER CAR SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 20 EV BATTERY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 21 EV SALES, BY KEY COUNTRY, 2021-2023 (USD MILLION)

- FIGURE 22 PRICE TREND OF EV BATTERIES, 2020-2030 (USD/KWH)

- FIGURE 23 CHINA'S CONTRIBUTION IN PRODUCTION AND PROCESSING OF CRITICAL MINERALS, 2023

- FIGURE 24 GLOBAL COBALT RESERVES, 2024

- FIGURE 25 GLOBAL LITHIUM RESERVES, 2024

- FIGURE 26 BATTERY AS A SERVICE (BAAS) BUSINESS MODEL

- FIGURE 27 ADVANTAGES OF SOLID-STATE BATTERIES

- FIGURE 28 SPARKION'S ENERGY STORAGE SYSTEM (ESS) WORKFLOW

- FIGURE 29 LITHIUM-ION: DEMAND AND SUPPLY ANALYSIS, 2022-2030 (KILOTONS)

- FIGURE 30 PRICE AND RANGE COMPARISON BETWEEN BMW I5 (EV) AND BMW 5 SERIES (ICE)

- FIGURE 31 TRENDS & DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 32 COST STRUCTURE OF LITHIUM-ION BATTERIES, 2024

- FIGURE 33 AVERAGE SELLING PRICE OF KEY PLAYERS FOR PASSENGER CARS, 2024 (USD/KWH)

- FIGURE 34 AVERAGE SELLING PRICE TREND, BY REGION, 2022-2024 (USD/KWH)

- FIGURE 35 ECOSYSTEM ANALYSIS

- FIGURE 36 EV BATTERY MARKET: VALUE CHAIN ANALYSIS

- FIGURE 37 INVESTMENT AND FUNDING SCENARIO, 2022-2024 (USD BILLION)

- FIGURE 38 PATENT ANALYSIS, 2015-2024

- FIGURE 39 CATL'S THIRD-GENERATION CTP TECHNOLOGY

- FIGURE 40 ILLUSTRATION OF CELL-TO-CHASSIS APPROACH BY RWTH AACHEN UNIVERSITY

- FIGURE 41 IMPORT DATA FOR HS CODE 850650-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- FIGURE 42 EXPORT DATA FOR HS CODE 850650-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- FIGURE 43 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY VEHICLE TYPE

- FIGURE 44 KEY BUYING CRITERIA, BY VEHICLE TYPE

- FIGURE 45 INVESTMENT ANNOUNCEMENTS BY BATTERY MANUFACTURERS/OEMS

- FIGURE 46 LITHIUM-ION SEGMENT TO ACCOUNT FOR LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 47 EVS EQUIPPED WITH LITHIUM-ION BATTERIES

- FIGURE 48 LITHIUM-ION BATTERY CELL SPECIFICATIONS

- FIGURE 49 COMPARISON BETWEEN LFP AND LITHIUM-ION BATTERIES

- FIGURE 50 COMPARISON BETWEEN LFP AND NCA/NMC BATTERY CHEMISTRIES

- FIGURE 51 LITHIUM-ION: COMPARISON BETWEEN WH/KG AND WH/L

- FIGURE 52 FEATURES AND ADVANTAGES OF SODIUM-ION BATTERIES

- FIGURE 53 IRON SEGMENT TO ACCOUNT FOR LARGEST MARKET BY 2035

- FIGURE 54 PRISMATIC SEGMENT TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 55 EV BATTERY FORMS: SPECIFICATIONS

- FIGURE 56 PRISMATIC BATTERY CELL SPECIFICATIONS

- FIGURE 57 POUCH BATTERY CELL SPECIFICATIONS

- FIGURE 58 CYLINDRICAL BATTERY CELL SPECIFICATIONS

- FIGURE 59 BEV SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 60 PASSENGER CAR SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 61 > 300 KWH SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 62 WORKING PRINCIPLE OF BONDING METHODS IN BATTERY CELL

- FIGURE 63 LITHIUM-ION BATTERY SPECIFICATIONS

- FIGURE 64 EV BATTERY MARKET, BY REGION, 2024 VS. 2035 (MWH)

- FIGURE 65 ASIA PACIFIC: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 66 ASIA PACIFIC: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 67 ASIA PACIFIC: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 68 ASIA PACIFIC: MANUFACTURING INDUSTRY'S CONTRIBUTION TO GDP, 2024

- FIGURE 69 ASIA PACIFIC: EV BATTERY MARKET SNAPSHOT

- FIGURE 70 EUROPE: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 71 EUROPE: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 72 EUROPE: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 73 EUROPE: MANUFACTURING INDUSTRY'S CONTRIBUTION TO GDP, 2024

- FIGURE 74 EUROPE: EV BATTERY MARKET, BY COUNTRY, 2024 VS. 2035 (USD MILLION)

- FIGURE 75 NORTH AMERICA: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 76 NORTH AMERICA: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 77 NORTH AMERICA: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 78 NORTH AMERICA: MANUFACTURING INDUSTRY'S CONTRIBUTION TO GDP, 2024

- FIGURE 79 NORTH AMERICA: EV BATTERY MARKET SNAPSHOT

- FIGURE 80 REVENUE ANALYSIS, 2019-2023 (USD BILLION)

- FIGURE 81 EV BATTERY MARKET SHARE ANALYSIS, 2024

- FIGURE 82 COMPANY VALUATION OF KEY PLAYERS

- FIGURE 83 FINANCIAL METRICS OF KEY PLAYERS

- FIGURE 84 BRAND/PRODUCT COMPARISON

- FIGURE 85 EV BATTERY MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 86 EV BATTERY MARKET: COMPANY FOOTPRINT

- FIGURE 87 EV BATTERY MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 88 CONTEMPORARY AMPEREX TECHNOLOGY CO., LIMITED: COMPANY SNAPSHOT

- FIGURE 89 BYD COMPANY LTD.: COMPANY SNAPSHOT

- FIGURE 90 LG ENERGY SOLUTION: COMPANY SNAPSHOT

- FIGURE 91 CALB: COMPANY SNAPSHOT

- FIGURE 92 SK INNOVATION CO. LTD.: COMPANY SNAPSHOT

- FIGURE 93 PANASONIC HOLDINGS CORPORATION: COMPANY SNAPSHOT

- FIGURE 94 SAMSUNG SDI: COMPANY SNAPSHOT

- FIGURE 95 GOTION: COMPANY SNAPSHOT

- FIGURE 96 SUNWODA ELECTRONIC CO., LTD.: COMPANY SNAPSHOT

- FIGURE 97 FARASIS ENERGY (GANZHOU) CO., LTD.: COMPANY SNAPSHOT

- FIGURE 98 TOSHIBA CORPORATION: COMPANY SNAPSHOT

- FIGURE 99 MITSUBISHI CORPORATION: COMPANY SNAPSHOT

- FIGURE 100 ENERSYS: COMPANY SNAPSHOT

The global EV Battery market is projected to reach USD 91.93 billion in 2024 to USD 251.33 billion in 2035, at a CAGR of 9.6% from 2024-2035.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2035 |

| Base Year | 2024 |

| Forecast Period | 2025-2035 |

| Units Considered | Volume (Units) and Value (USD Million) |

| Segments | Battery Capacity, Battery Form, Battery Type, Lithium-ion Battery Component, Material Type, Method, Propulsion, Vehicle Type, and Region |

| Regions covered | Asia Pacific, Europe, and North America |

The EV battery market is experiencing rapid growth driven by increasing electric vehicle adoption, advancements in battery technology, and supportive government policies. Growing demand for longer-range, faster-charging batteries has spurred innovations such as Honda's plan to produce solid-state batteries offering up to 620 miles on a single charge by 2024. Additionally, partnerships and investments are fueling expansion, such as Stellantis and CATL's USD 4.2 billion venture for a lithium iron phosphate battery plant in Spain, announced in December 2024. With OEMs launching new EV models and battery manufacturers scaling production, the EV battery market is poised for significant expansion.

"Solid-state battery is expected to show a significant growth rate in the EV battery market during the forecast period."

Solid-state batteries are anticipated to witness significant growth in the EV battery market due to their potential to revolutionize energy density, safety, and charging efficiency. These batteries replace the liquid electrolyte found in conventional lithium-ion batteries with a solid electrolyte, offering enhanced thermal stability, reduced risk of fires, and longer lifespans. Their higher energy density can substantially increase EV range while enabling faster charging times, making them a game-changer for EV adoption. Recent developments underscore their growing momentum. In December 2024, Honda announced plans to produce solid-state batteries for EVs capable of delivering up to 620 miles (1,000 kilometers) on a single charge-more than double the range of many existing electric vehicles. Similarly, in September 2024, Factorial collaborated with Mercedes-Benz to develop the Solstice battery, an all-solid-state battery featuring a novel dry cathode design. This innovation promises an energy density of up to 450Wh/kg and more efficient, sustainable production processes, marking a significant leap in solid-state battery technology. With leading automotive and battery companies intensifying their R&D efforts and governments incentivizing advancements in battery technology, solid-state batteries are poised to play a pivotal role in shaping the future of the EV market, addressing key challenges like range anxiety, safety concerns, and charging infrastructure limitations.

"Passenger Car is expected to hold the largest share in the EV Battery market during the forecast period."

Passenger cars are expected to dominate the EV battery market over the study period, capturing the largest market share due to surge in consumer demand, supportive government policies, and the increasing availability of diverse EV models. Governments worldwide are implementing stringent regulations on vehicle emissions and offering subsidies to promote EV adoption, driving passenger car sales. Additionally, advancements in EV battery technology, such as enhanced energy density, faster charging, and lower costs, have made electric passenger cars more accessible to the mass market. Major automotive OEMs are gearing up for this transition, with several passenger car EV models slated for release in the coming years. For instance, Renault's highly anticipated Renault 5 E-Tech, set for a 2026 launch, will feature advanced lithium-ion batteries sourced from AESC. Similarly, Mercedes-Benz plans to introduce the EQA 300 4MATIC in 2025, equipped with a high-performance NMC battery provided by SK ON, a subsidiary of SK Innovation. These vehicles highlight the rising demand for advanced EV batteries, driving innovation and production growth in the battery industry. Advances in battery chemistry, such as the shift from LFP to NMC and NCA, are boosting energy density and driving ranges, fueling market expansion. Collaborations between OEMs and battery manufacturers are accelerating high-performance battery development. For instance, in November 2024, LG Energy Solution announced a five-year agreement to supply 4695 cylindrical lithium-ion batteries for Rivian's R2.

Investments in new technologies like solid-state batteries and silicon anode chemistries, along with scaling production through gigafactories, are further enhancing market growth. These trends underscore the synergy between OEMs and battery makers, positioning the passenger car segment as the largest driver of the EV battery market and advancing the global shift to sustainable transportation.

"Europe set to witness a notable growth in EV battery market during the forecast period."

Europe is poised to experience remarkable growth in the EV battery market over the forecast period, fueled by stringent emission reduction targets, rising EV demand, and increasing investments in battery infrastructure. The EU's March 2023 law mandates zero CO2 emissions for all new cars sold by 2035, alongside a 55% reduction in CO2 emissions by 2030 compared to 2021 levels. These ambitious targets are driving the rapid decarbonization of new car fleets, significantly boosting EV adoption and, consequently, the EV battery market. While the EU has pledged a legal pathway for e-fuels vehicles beyond 2035, the focus remains on zero-emission solutions for cars and vans. European OEMs are heavily investing in EV and battery developments. For instance, in December 2024, Stellantis NV and CATL announced an estimated USD 4.3 billion joint venture to build a large-scale lithium iron phosphate (LFP) battery plant in Zaragoza, Spain. Similarly, BMW Group plans to open five battery factories near auto manufacturing hubs, including facilities in Lower Bavaria and Debrecen, Hungary, to support its Neue Klasse electric vehicles.

Key battery manufacturers are also expanding their presence in Europe. Major players like Northvolt, LG Energy Solution, and CATL are establishing battery gigafactories to meet the growing demand. These developments underscore Europe's commitment to becoming a global leader in EV batteries, supported by progressive policies, a robust automotive ecosystem, and increasing investments from OEMs and suppliers.

In-depth interviews were conducted with CEOs, marketing directors, other innovation and technology directors, and executives from various key organizations operating in this market.

- By Company Type: Tier I - 37%, Tier II - 41%, and Tier III - 22%

- By Designation: Directors - 31%, Managers - 45%, and Others - 24%

- By Region: Asia Pacific - 33%, North America - 39%, and Europe - 28%

The EV Battery market is dominated by major players, including Contemporary Amperex Technology Co., Limited (China), BYD Company Ltd. (China), LG Energy Solution Ltd. (South Korea), CALB (China), SK Innovation Co., Ltd. (South Korea) and more. These companies are expanding their portfolios to strengthen their EV battery market position.

Research Coverage:

The report covers the EV Battery market in terms of Battery Capacity (<50 kWh, 51-110 kWh, 111-201 kWh, 201-300 kWh, > 301 kWh), Battery Form (Prismatic, Pouch, Cylindrical), Battery Type (Lithium-ion, Nickel-metal Hydride, Solid-state, Sodium-ion), Lithium-ion Battery Component (Negative Electrode, Positive Electrode, Electrolyte, Separator), Material Type (Cobalt, Lithium, Natural Graphite, Manganese, Iron, Phosphate, Nickel), Method (Wire Bonding, Laser Bonding, Ultrasonic Metal Welding), Propulsion (Battery Electric Vehicle, Plug-in Hybrid Electric Vehicle, Fuel Cell Electric Vehicle, Hybrid Electric Vehicle), Vehicle Type (Passenger Cars, Vans/Light Trucks, Medium & Heavy Trucks, Buses, Off-highway Vehicles), and Region. It covers the competitive landscape and company profiles of the significant EV Battery market players.

The study also includes an in-depth competitive analysis of the key market players, their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report:

- The report will help market leaders/new entrants with information on the closest approximations of revenue numbers for the EV Battery market and its subsegments.

- This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies.

- The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

- The report also helps stakeholders understand the current and future pricing trends of the EV Battery market.

- The report will help market leaders/new entrants with information on various trends in EV Battery market based on component, battery form, region, and other parameters.

The report provides insight on the following pointers:

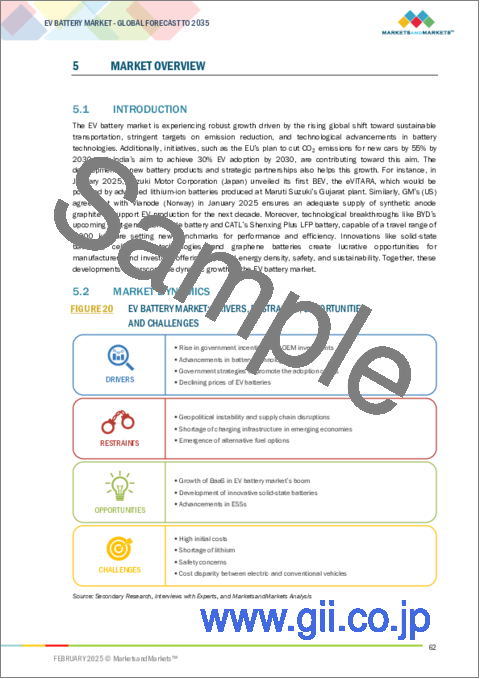

- Analysis of key drivers (Government incentives and OEM investments accelerate EV battery demand, Advancements in battery technologies leading the charge for EV battery market, Government strategies for EV adoption driving battery market boom, Declining EV battery prices boost market accessibility and growth), restraints (Geopolitical instabilities and supply chain disruptions pose risks to EV battery expansion, Charging infrastructure deficit hinders EV adoption in emerging economies, Emergence of alternative fuels to create a potential restraint for the EV batteries), opportunities (The growing role of Battery-as-a-Service in EV battery market boom, Innovative solid-state batteries creating new growth prospects for the EV battery, ESS advancements creating new paths for EV battery market growth), and challenges (High initial costs hindering the proliferation of the EV battery market, Lithium shortages jeopardizing the growth of the EV battery, Safety concerns hindering the expansion of the EV battery market, Cost disparity Between EVs and conventional vehicles to create a hurdle for EV battery expansion)

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the EV Battery market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the EV Battery market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the EV Battery market.

- Competitive Assessment: In-depth assessment of market share, growth strategies, and service offerings of leading players like Contemporary Amperex Technology Co., Limited (China), BYD Company Ltd. (China), LG Energy Solution Ltd. (South Korea), CALB (China), and SK Innovation Co., Ltd. (South Korea) among others in EV Battery market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 UNIT CONSIDERED

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews from demand and supply sides

- 2.1.2.2 Breakdown of primary interviews

- 2.1.2.3 Primary participants

- 2.1.2.4 Objectives of primary research

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 FACTOR ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS & CONSIDERATIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN EV BATTERY MARKET

- 4.2 EV BATTERY MARKET, BY REGION

- 4.3 EV BATTERY MARKET, BY BATTERY CAPACITY

- 4.4 EV BATTERY MARKET, BY BATTERY FORM

- 4.5 EV BATTERY MARKET, BY BATTERY TYPE

- 4.6 EV BATTERY MARKET, BY MATERIAL TYPE

- 4.7 EV BATTERY MARKET, BY PROPULSION

- 4.8 EV BATTERY MARKET, BY VEHICLE TYPE

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rise in government incentives and OEM investments

- 5.2.1.2 Advancements in battery technologies

- 5.2.1.3 Government strategies to promote adoption of EVs

- 5.2.1.4 Declining prices of EV batteries

- 5.2.2 RESTRAINTS

- 5.2.2.1 Geopolitical instability and supply chain disruptions

- 5.2.2.2 Shortage of charging infrastructure in emerging economies

- 5.2.2.3 Emergence of alternative fuel options

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growth of BaaS in EV battery market's boom

- 5.2.3.2 Development of innovative solid-state batteries

- 5.2.3.3 Advancements in ESSs

- 5.2.4 CHALLENGES

- 5.2.4.1 High initial cost

- 5.2.4.2 Shortage of lithium

- 5.2.4.3 Safety concerns

- 5.2.4.4 Cost disparity between electric and conventional vehicles

- 5.2.1 DRIVERS

- 5.3 TRENDS & DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 RAPID DEVELOPMENT OF NEVS TO DRIVE GROWTH OF EV BATTERY MARKET

- 5.5 ANALYSIS OF PRICE AND COST OF LITHIUM-ION BATTERIES

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE OF KEY PLAYERS FOR PASSENGER CARS

- 5.6.2 AVERAGE SELLING PRICE, BY REGION

- 5.7 IMPACT OF AI ON EV BATTERY MARKET

- 5.8 ECOSYSTEM ANALYSIS

- 5.9 VALUE CHAIN ANALYSIS

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 BYD DEVELOPED BLADE BATTERY TO PRIORITIZE SAFETY AND DURABILITY WITHOUT COMPROMISING PERFORMANCE

- 5.10.2 WIPRO PARI LEVERAGED COGNEX'S ADVANCED MACHINE VISION SYSTEM TO ADDRESS COMPLEXITIES OF EV BATTERY MANUFACTURING

- 5.10.3 NORTHVOLT ADOPTED AUTODESK'S INTEGRATED SOFTWARE SOLUTION TO IMPLEMENT DIGITAL FACTORY APPROACH THAT CONNECTS BATTERY DESIGN AND MANUFACTURING

- 5.10.4 MAXWELL ENERGY OFFERED CUTTING-EDGE ULTRACAPACITOR TECHNOLOGY TO ENHANCE ENERGY RECOVERY AND POWER DELIVERY

- 5.11 INVESTMENT AND FUNDING SCENARIO

- 5.12 PATENT ANALYSIS

- 5.13 TECHNOLOGY ANALYSIS

- 5.13.1 KEY TECHNOLOGIES

- 5.13.1.1 Lithium-ion and other battery chemistries

- 5.13.2 COMPLEMENTARY TECHNOLOGIES

- 5.13.2.1 Cell-to-pack (CTP) technology

- 5.13.3 ADJACENT TECHNOLOGIES

- 5.13.3.1 Cell-to-chassis battery technology

- 5.13.1 KEY TECHNOLOGIES

- 5.14 HS CODE: LITHIUM CELLS AND BATTERIES (850650)

- 5.14.1 IMPORT DATA

- 5.14.2 EXPORT DATA

- 5.15 REGULATORY LANDSCAPE

- 5.15.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.15.2 REGULATIONS/VOLUNTARY PROCEDURES FOR EV BATTERIES

- 5.16 KEY CONFERENCES & EVENTS, 2025-2026

- 5.17 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.17.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.17.2 BUYING CRITERIA

- 5.18 OEM ANALYSIS

- 5.18.1 INITIATIVES UNDERTAKEN AND INVESTMENTS IN LITHIUM BY BATTERY MANUFACTURERS/OEMS

- 5.18.1.1 Lithium-ion battery cells (cathode type): OEMs and key suppliers

- 5.18.1 INITIATIVES UNDERTAKEN AND INVESTMENTS IN LITHIUM BY BATTERY MANUFACTURERS/OEMS

- 5.19 SUPPLIER ANALYSIS

6 EV BATTERY MARKET, BY BATTERY TYPE

- 6.1 INTRODUCTION

- 6.2 LITHIUM-ION

- 6.2.1 CONTINUOUS IMPROVEMENTS IN BATTERY CHEMISTRY TO DRIVE MARKET

- 6.2.2 LITHIUM IRON PHOSPHATE

- 6.2.3 NICKEL MANGANESE COBALT

- 6.2.4 LITHIUM IRON MANGANESE PHOSPHATE

- 6.2.5 OTHERS

- 6.3 NICKEL-METAL HYDRIDE

- 6.3.1 LARGE-SCALE ADOPTION OF NIMH BATTERIES IN HEVS TO DRIVE GROWTH

- 6.4 SOLID-STATE

- 6.4.1 ADVANCEMENTS IN SOLID-STATE TECHNOLOGY TO DRIVE DEMAND

- 6.5 OTHER BATTERY TYPES

- 6.6 KEY PRIMARY INSIGHTS

7 EV BATTERY MARKET, BY MATERIAL TYPE

- 7.1 INTRODUCTION

- 7.2 COBALT

- 7.2.1 SUPPORT FOR HIGH-PERFORMANCE BATTERY CHEMISTRIES TO DRIVE MARKET

- 7.3 LITHIUM

- 7.3.1 HIGH ENERGY DENSITY OF LITHIUM TO BOOST ITS DEMAND IN EV BATTERIES

- 7.4 NATURAL GRAPHITE

- 7.4.1 USE OF NATURAL GRAPHITE AS ANODE MATERIAL TO BOOST ITS GROWTH

- 7.5 MANGANESE

- 7.5.1 VERSATILITY IN CATHODE CHEMISTRIES TO DRIVE MARKET

- 7.6 IRON

- 7.6.1 WIDESPREAD AVAILABILITY OF IRON TO BOOST ITS USAGE AS KEY BATTERY COMPONENT

- 7.7 PHOSPHATE

- 7.7.1 ABUNDANCE AND AVAILABILITY OF PHOSPHATE TO DRIVE MARKET

- 7.8 NICKEL

- 7.8.1 FOCUS ON ACHIEVING HIGH ENERGY DENSITY TO DRIVE MARKET

- 7.9 OTHER MATERIAL TYPES

- 7.10 KEY PRIMARY INSIGHTS

8 EV BATTERY MARKET, BY BATTERY FORM

- 8.1 INTRODUCTION

- 8.2 PRISMATIC

- 8.2.1 HIGH ENERGY DENSITY AND BETTER DURABILITY OF PRISMATIC BATTERIES TO DRIVE DEMAND

- 8.3 POUCH

- 8.3.1 SPACE EFFICIENCY OF POUCH CELLS TO DRIVE MARKET

- 8.4 CYLINDRICAL

- 8.4.1 MECHANICAL STABILITY OF CYLINDRICAL CELLS TO DRIVE MARKET

- 8.5 KEY PRIMARY INSIGHTS

9 EV BATTERY MARKET, BY PROPULSION

- 9.1 INTRODUCTION

- 9.2 BEV

- 9.2.1 ADVANCEMENTS IN BATTERY TECHNOLOGY TO DRIVE MARKET

- 9.3 PHEV

- 9.3.1 REDUCED FUEL CONSUMPTION OF PHEVS TO DRIVE DEMAND FOR ADVANCED EV BATTERIES

- 9.4 FCEV

- 9.4.1 HEAVY-DUTY, COMMERCIAL APPLICATIONS OF FCEVS TO DRIVE MARKET FOR BATTERIES

- 9.5 HEV

- 9.6 KEY PRIMARY INSIGHTS

10 EV BATTERY MARKET, BY VEHICLE TYPE

- 10.1 INTRODUCTION

- 10.2 PASSENGER CAR

- 10.2.1 GOVERNMENT POLICIES AND ADVANCEMENTS IN BATTERY TECHNOLOGY TO DRIVE MARKET

- 10.3 VAN/LIGHT TRUCK

- 10.3.1 GROWTH OF LAST-MILE DELIVERY SERVICE AND E-COMMERCE TO DRIVE MARKET

- 10.4 MEDIUM & HEAVY TRUCK

- 10.4.1 CORPORATE SUSTAINABILITY GOALS AND ADVANCEMENTS IN BATTERY AND CHARGING INFRASTRUCTURE TO DRIVE MARKET

- 10.5 BUS

- 10.5.1 GROWING FOCUS ON SUSTAINABLE URBAN TRANSPORTATION TO DRIVE MARKET

- 10.6 OFF-HIGHWAY VEHICLES

- 10.6.1 NEED FOR HEAVY-DUTY VEHICLES TO DRIVE DEMAND FOR ROBUST BATTERIES

- 10.7 KEY PRIMARY INSIGHTS

11 EV BATTERY MARKET, BY BATTERY CAPACITY

- 11.1 INTRODUCTION

- 11.2 < 50 KWH

- 11.2.1 NEED FOR URBAN-FRIENDLY, AFFORDABLE BATTERY PACKS TO DRIVE MARKET

- 11.3 50-110 KWH

- 11.3.1 RISING DEMAND FOR ELECTRIC VANS/LIGHT TRUCKS TO DRIVE MARKET

- 11.4 111-200 KWH

- 11.4.1 INCREASING DEMAND FOR COMMERCIAL EVS TO DRIVE MARKET

- 11.5 201-300 KWH

- 11.5.1 NEED FOR ELECTRIC PICKUP TRUCKS TO DRIVE DEMAND FOR BATTERIES

- 11.6 > 301 KWH

- 11.6.1 RISING ADOPTION OF HEAVY-DUTY ELECTRIC VEHICLES TO DRIVE MARKET

- 11.7 KEY PRIMARY INSIGHTS

12 EV BATTERY MARKET, BY METHOD

- 12.1 INTRODUCTION

- 12.2 WIRE BONDING

- 12.3 LASER BONDING

- 12.4 ULTRASONIC METAL WELDING

13 EV BATTERY MARKET, BY LITHIUM-ION BATTERY COMPONENT

- 13.1 INTRODUCTION

- 13.2 POSITIVE ELECTRODE

- 13.3 NEGATIVE ELECTRODE

- 13.4 ELECTROLYTE

- 13.5 SEPARATOR

14 EV BATTERY MARKET, BY REGION

- 14.1 INTRODUCTION

- 14.2 ASIA PACIFIC

- 14.2.1 MACROECONOMIC OUTLOOK

- 14.2.2 CHINA

- 14.2.2.1 Advancements in battery technologies to drive market

- 14.2.3 INDIA

- 14.2.3.1 Focus on reducing harmful emissions and expansion of domestic battery production to drive market

- 14.2.4 JAPAN

- 14.2.4.1 Emphasis on greenhouse gas reduction to fuel market growth

- 14.2.5 SOUTH KOREA

- 14.2.5.1 Rising technological advancements and support from local manufacturers to boost market

- 14.3 EUROPE

- 14.3.1 MACROECONOMIC OUTLOOK

- 14.3.2 GERMANY

- 14.3.2.1 Presence of leading OEMs like BMW, Mercedes-Benz, and Volkswagen to drive market

- 14.3.3 FRANCE

- 14.3.3.1 Push for clean mobility through policies to drive market

- 14.3.4 ITALY

- 14.3.4.1 Rising focus on electrifying public transport to drive market

- 14.3.5 UK

- 14.3.5.1 Stringent emission reduction targets and government-backed policies to drive growth

- 14.3.6 SPAIN

- 14.3.6.1 Large-scale investments in battery plants and consumer demand for sustainable vehicles to drive market

- 14.3.7 NORWAY

- 14.3.7.1 Adoption of EVs by consumers and ambitious electrification goals by government to drive market

- 14.3.8 SWEDEN

- 14.3.8.1 Commitment to decarbonization to fuel demand for EV batteries

- 14.3.9 DENMARK

- 14.3.9.1 Rapid innovations and increase in sustainability policies to propel market

- 14.4 NORTH AMERICA

- 14.4.1 MACROECONOMIC OUTLOOK

- 14.4.2 US

- 14.4.2.1 Government investments and initiatives to boost EV sales

- 14.4.3 CANADA

- 14.4.3.1 Expansion of OEMs and development of new manufacturing facilities to boost market

15 COMPETITIVE LANDSCAPE

- 15.1 INTRODUCTION

- 15.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022-2024

- 15.3 REVENUE ANALYSIS

- 15.4 MARKET SHARE ANALYSIS, 2024

- 15.5 EV BATTERY MARKET SHARE TREND ANALYSIS

- 15.6 COMPANY VALUATION AND FINANCIAL METRICS

- 15.7 BRAND/PRODUCT COMPARISON

- 15.8 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 15.8.1 STARS

- 15.8.2 EMERGING LEADERS

- 15.8.3 PERVASIVE PLAYERS

- 15.8.4 PARTICIPANTS

- 15.8.5 COMPANY FOOTPRINT

- 15.8.5.1 Company footprint

- 15.8.5.2 Region footprint

- 15.8.5.3 Battery form footprint

- 15.8.5.4 Battery type footprint

- 15.8.5.5 Propulsion footprint

- 15.9 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 15.9.1 PROGRESSIVE COMPANIES

- 15.9.2 RESPONSIVE COMPANIES

- 15.9.3 DYNAMIC COMPANIES

- 15.9.4 STARTING BLOCKS

- 15.9.5 COMPETITIVE BENCHMARKING

- 15.9.5.1 List of startups/SMEs

- 15.9.5.2 Competitive benchmarking of startups/SMEs

- 15.10 COMPETITIVE SCENARIO

- 15.10.1 PRODUCT LAUNCHES/DEVELOPMENTS

- 15.10.2 DEALS

- 15.10.3 EXPANSION

- 15.10.4 OTHER DEVELOPMENTS

16 COMPANY PROFILES

- 16.1 KEY PLAYERS

- 16.1.1 CONTEMPORARY AMPEREX TECHNOLOGY CO., LIMITED

- 16.1.1.1 Business overview

- 16.1.1.2 Products offered

- 16.1.1.3 Recent developments

- 16.1.1.3.1 Product launches/developments

- 16.1.1.3.2 Deals

- 16.1.1.3.3 Other developments

- 16.1.1.4 MnM view

- 16.1.1.4.1 Key strengths

- 16.1.1.4.2 Strategic choices

- 16.1.1.4.3 Weaknesses and competitive threats

- 16.1.2 BYD COMPANY LTD.

- 16.1.2.1 Business overview

- 16.1.2.2 Products offered

- 16.1.2.3 Recent developments

- 16.1.2.3.1 Product launches/developments

- 16.1.2.3.2 Deals

- 16.1.2.3.3 Expansion

- 16.1.2.3.4 Other developments

- 16.1.2.4 MnM view

- 16.1.2.4.1 Key strengths

- 16.1.2.4.2 Strategic choices

- 16.1.2.4.3 Weaknesses and competitive threats

- 16.1.3 LG ENERGY SOLUTION

- 16.1.3.1 Business overview

- 16.1.3.2 Products offered

- 16.1.3.3 Recent developments

- 16.1.3.3.1 Deals

- 16.1.3.3.2 Expansion

- 16.1.3.3.3 Other developments

- 16.1.3.4 MnM view

- 16.1.3.4.1 Key strengths

- 16.1.3.4.2 Strategic choices

- 16.1.3.4.3 Weaknesses and competitive threats

- 16.1.4 CALB

- 16.1.4.1 Business overview

- 16.1.4.2 Products offered

- 16.1.4.3 Recent developments

- 16.1.4.3.1 Product launches/developments

- 16.1.4.3.2 Deals

- 16.1.4.3.3 Other developments

- 16.1.4.4 MnM view

- 16.1.4.4.1 Key strengths

- 16.1.4.4.2 Strategic choices

- 16.1.4.4.3 Weaknesses and competitive threats

- 16.1.5 SK INNOVATION CO. LTD.

- 16.1.5.1 Business overview

- 16.1.5.2 Products offered

- 16.1.5.3 Recent developments

- 16.1.5.3.1 Product launches/developments

- 16.1.5.3.2 Deals

- 16.1.5.3.3 Other developments

- 16.1.5.4 MnM view

- 16.1.5.4.1 Key strengths

- 16.1.5.4.2 Strategic choices

- 16.1.5.4.3 Weaknesses and competitive threats

- 16.1.6 PANASONIC HOLDINGS CORPORATION

- 16.1.6.1 Business overview

- 16.1.6.2 Products offered

- 16.1.6.3 Recent developments

- 16.1.6.3.1 Product launches/developments

- 16.1.6.3.2 Deals

- 16.1.6.3.3 Expansion

- 16.1.6.3.4 Other developments

- 16.1.7 SAMSUNG SDI

- 16.1.7.1 Business overview

- 16.1.7.2 Products offered

- 16.1.7.3 Recent developments

- 16.1.7.3.1 Product launches/developments

- 16.1.7.3.2 Deals

- 16.1.7.3.3 Expansion

- 16.1.7.3.4 Other developments

- 16.1.8 GOTION

- 16.1.8.1 Business overview

- 16.1.8.2 Products offered

- 16.1.8.3 Recent developments

- 16.1.8.3.1 Product launches/developments

- 16.1.8.3.2 Deals

- 16.1.8.3.3 Expansion

- 16.1.9 SUNWODA ELECTRONIC CO., LTD.

- 16.1.9.1 Business overview

- 16.1.9.2 Products/Solutions offered

- 16.1.9.2.1 Deals

- 16.1.9.2.2 Expansion

- 16.1.9.2.3 Other developments

- 16.1.10 FARASIS ENERGY (GANZHOU) CO., LTD.

- 16.1.10.1 Business overview

- 16.1.10.2 Products offered

- 16.1.10.3 Recent developments

- 16.1.10.3.1 Product launches/developments

- 16.1.10.3.2 Deals

- 16.1.10.3.3 Expansion

- 16.1.11 TOSHIBA CORPORATION

- 16.1.11.1 Business overview

- 16.1.11.2 Products offered

- 16.1.11.3 Recent developments

- 16.1.11.3.1 Product launches/developments

- 16.1.11.3.2 Deals

- 16.1.12 MITSUBISHI CORPORATION

- 16.1.12.1 Business overview

- 16.1.12.2 Products offered

- 16.1.12.3 Recent developments

- 16.1.12.3.1 Product launches/developments

- 16.1.12.3.2 Deals

- 16.1.12.3.3 Expansion

- 16.1.12.3.4 Other developments

- 16.1.13 ENERSYS

- 16.1.13.1 Business overview

- 16.1.13.2 Products offered

- 16.1.13.3 Recent developments

- 16.1.13.3.1 Deals

- 16.1.13.3.2 Expansion

- 16.1.13.3.3 Other developments

- 16.1.1 CONTEMPORARY AMPEREX TECHNOLOGY CO., LIMITED

- 16.2 OTHER PLAYERS

- 16.2.1 EXIDE INDUSTRIES LIMITED

- 16.2.2 E-ONE MOLI ENERGY CORP.

- 16.2.3 TARGRAY TECHNOLOGY INTERNATIONAL INC.

- 16.2.4 ALTAIR NANOTECHNOLOGIES INC.

- 16.2.5 CLARIOS

- 16.2.6 NORTHVOLT AB

- 16.2.7 LECLANCHE SA

- 16.2.8 ENVISION GROUP

- 16.2.9 A123 SYSTEMS (SUBSIDIARY OF WANXIANG GROUP)

- 16.2.10 GS YUASA INTERNATIONAL LTD.

- 16.2.11 AUTOMOTIVE ENERGY SUPPLY CORPORATION

- 16.2.12 REPT BATTERO ENERGY CO LTD.

- 16.2.13 AUTOMOTIVE CELLS COMPANY

- 16.2.14 BLUEOVAL SK

- 16.2.15 CELLFORCE GROUP GMBH

- 16.2.16 ULTIUM CELLS

- 16.2.17 ONE BATTERY

- 16.2.18 SILA NANOTECHNOLOGIES INC.

- 16.2.19 MORROW BATTERIES

17 RECOMMENDATIONS BY MARKETSANDMARKETS

- 17.1 ASIA PACIFIC TO LEAD MARKET FOR EV BATTERIES DURING FORECAST PERIOD

- 17.2 LITHIUM-ION BATTERIES SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- 17.3 PASSENGER CAR SEGMENT TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- 17.4 SOLID-STATE BATTERIES SEGMENT TO CREATE OPPORTUNITIES FOR BATTERY MANUFACTURERS

- 17.5 CONCLUSION

18 APPENDIX

- 18.1 INSIGHTS FROM INDUSTRY EXPERTS

- 18.2 DISCUSSION GUIDE

- 18.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 18.4 CUSTOMIZATION OPTIONS

- 18.4.1 EV BATTERY MARKET, BY PROPULSION TYPE (COUNTRY LEVEL)

- 18.4.2 EV BATTERY MARKET, BY BATTERY CAPACITY (VEHICLE TYPE LEVEL)

- 18.4.3 COMPANY INFORMATION

- 18.4.3.1 Profiling of additional market players (up to five)

- 18.5 RELATED REPORTS

- 18.6 AUTHOR DETAILS