|

|

市場調査レポート

商品コード

1807085

LiDARの世界市場:技術別、設置場所別、タイプ別、距離別、サービス別、最終用途別、地域別 - 2030年までの予測LiDAR Market by Installation (Airborne, Ground-based), Type (Mechanical, Solid-state), Range (Short, Medium, Long), Service (Aerial Surveying, Asset Management, GIS Services, Ground-based Surveying), Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| LiDARの世界市場:技術別、設置場所別、タイプ別、距離別、サービス別、最終用途別、地域別 - 2030年までの予測 |

|

出版日: 2025年08月29日

発行: MarketsandMarkets

ページ情報: 英文 262 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

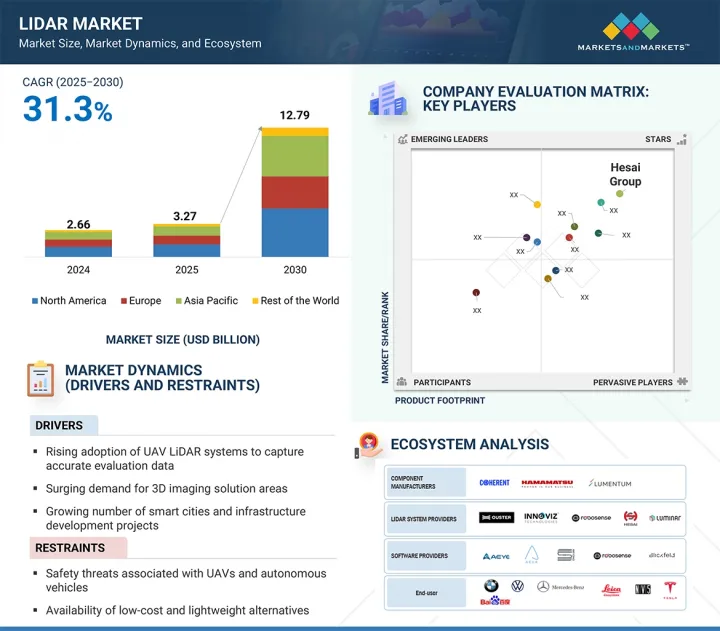

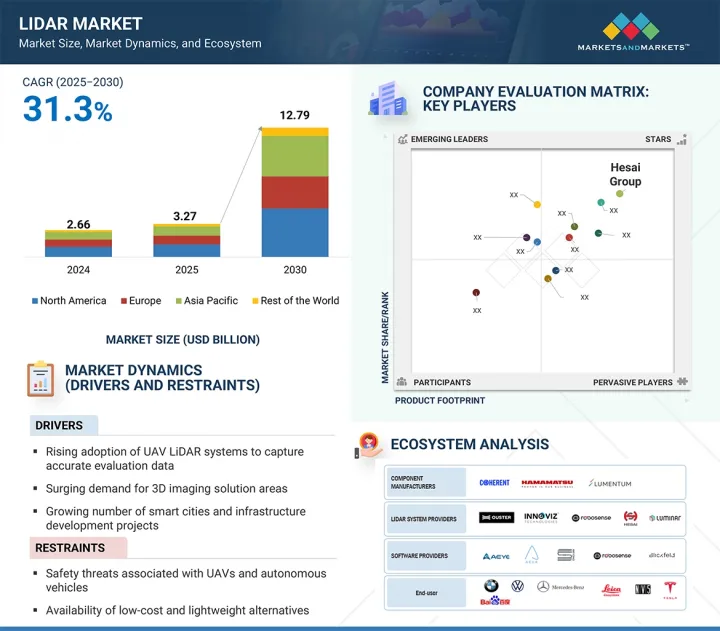

LiDARの市場規模は、予測期間中に31.3%のCAGRで拡大し、2025年の32億7,000万米ドルから2030年には127億9,000万米ドルに達すると予測されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント別 | 技術別、設置場所別、タイプ別、距離別、サービス別、最終用途別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

自律走行車の普及がLiDAR市場を牽引し、高精度3Dマッピングの需要が高まり、スマートシティやインフラ開発プロジェクトへの投資が増加しています。コスト効率と耐久性を提供するソリッドステートLiDAR技術の進歩は、自動車、環境、産業用途での採用をさらに加速しています。さらに、デジタルマッピングやインテリジェント交通システムを支援する政府の取り組みが、市場の成長を促進しています。しかし、LiDARシステムの初期コストが高く、カメラやレーダーベースのシステムなどの代替センシング技術が利用可能であることが、主な阻害要因となっています。また、自律航法における限られた標準化と規制上の課題も、大規模な展開の妨げとなっています。

LiDAR市場におけるGISサービスセグメントは、生のLiDARデータを実用的な地理空間的洞察に変換する上で重要な役割を果たすため、予測期間中に最も高いCAGRで成長すると予想されています。交通、都市開発、環境モニタリングなどの分野における正確なマッピング、空間分析、インフラ計画に対する需要の高まりが、採用を促進しています。先進的なGISプラットフォームとLiDARを統合することで、リアルタイムの意思決定が可能になり、災害管理、農業、公共施設の資産管理などの効率が向上します。政府や民間組織は、スマートシティプロジェクトやインフラ近代化のために、GISベースのLiDARソリューションへの投資を増やしています。さらに、クラウドベースのGISとAI主導の空間解析の進歩により、これらのサービスのアクセシビリティとスケーラビリティが拡大しています。このような技術革新と幅広い業界横断的な適用性の強力な組み合わせにより、GISサービスはLiDAR市場で最も急成長しているセグメントとして位置づけられています。

地上設置型LiDARは、通路マッピング、建設、鉱業、林業、環境モニタリングなどの用途で幅広く使用されているため、最大の市場シェアを占めると予想されています。高精度、高密度の点群データを取得可能、短・中距離スキャンに適していることから、詳細な地形や構造解析に最適です。この技術は、精度が重要な都市計画、考古学、インフラ検査における測量やマッピングに広く採用されています。さらに、地上型LiDARシステムは、小規模から中規模のプロジェクトでは、空中型と比較して費用対効果が高いです。ビルディング・インフォメーション・モデリング(BIM)や産業プラントのメンテナンスにおける地上レーザースキャニングの需要の高まりは、市場の優位性をさらに高めています。可搬性、自動化、GISプラットフォームとの統合における継続的な進歩が、複数の分野での採用を強化しています。

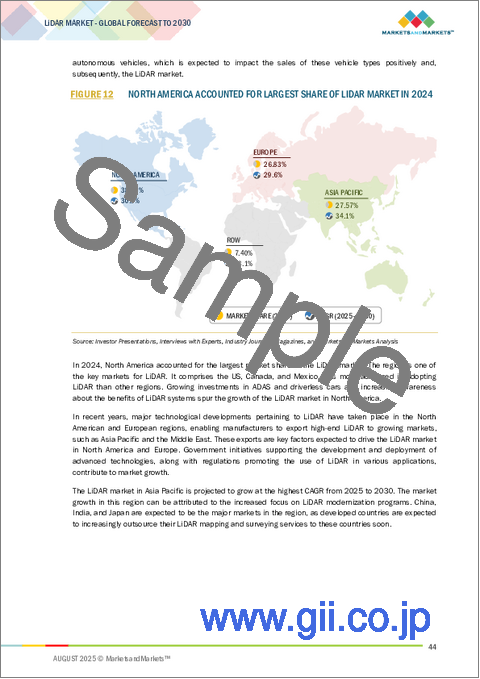

北米は、この地域の主要LiDARメーカー、技術プロバイダー、自律走行車開発者の強い存在感により、LiDAR市場で最大のシェアを占めると予想されています。自動運転車研究、スマートインフラプロジェクト、先進マッピングイニシアティブへの多額の投資が需要を牽引しています。この地域は、環境モニタリング、防衛アプリケーション、輸送安全プログラムに対する政府の強力な支援から恩恵を受けています。鉱業、林業、建設、石油・ガスなどの分野でのLiDARの高い採用が、市場の成長をさらに強化しています。さらに、LiDARとAI、IoT、クラウドベースのプラットフォームとの早期統合が、その応用可能性を高めています。技術的リーダーシップ、高い研究開発費、多様な最終用途の採用の組み合わせにより、北米は世界的に支配的なLiDAR市場に位置付けられています。

当レポートでは、世界のLiDAR市場について調査し、技術別、設置場所別、タイプ別、距離別、サービス別、最終用途別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- バリューチェーン分析

- エコシステム/市場マップ

- 価格分析

- 顧客ビジネスに影響を与える動向/混乱

- 技術分析

- ポーターのファイブフォース分析

- ケーススタディ分析

- 投資と資金調達のシナリオ

- 関税と規制状況

- 貿易分析

- 特許分析

- 2025年~2026年の主な会議とイベント

- 主要な利害関係者と購入プロセス

- AIがLiDAR市場に与える影響

- トランプ関税がライダー市場に与える影響

- 主要関税率

- 価格影響分析

- さまざまな地域への影響

- 最終用途産業レベルへの影響

第6章 LiDAR市場(技術別)

- イントロダクション

- 2D

- 3D

- 4D

第7章 ライダー市場(設置場所別)

- イントロダクション

- 空中

- 地上

第8章 LiDAR市場(タイプ別)

- イントロダクション

- 機械

- ソリッドステート

第9章 LiDAR市場(距離別)

- イントロダクション

- 短距離(0~200メートル)

- 中距離(200~500メートル)

- 長距離(500メートル以上)

第10章 ライダー市場(サービス別)

- イントロダクション

- 航空測量

- 資産運用管理

- 地理情報システム(GIS)サービス

- 地上測量

- その他

第11章 ライダー市場(最終用途)

- イントロダクション

- 廊下マッピング

- エンジニアリング

- 環境

- ADASと自動運転車

- 探検

- 都市計画

- 地図作成

- 気象学

- その他

第12章 LiDAR市場(地域別)

- イントロダクション

- 北米

- 北米のマクロ経済見通し

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州のマクロ経済見通し

- 英国

- ドイツ

- フランス

- イタリア

- スペイン

- ポーランド

- 北欧

- その他

- アジア太平洋

- アジア太平洋のマクロ経済見通し

- 中国

- 日本

- 韓国

- インド

- オーストラリア

- インドネシア

- マレーシア

- タイ

- ベトナム

- その他

- その他の地域

- マクロ経済見通しは連続

- 南米

- 中東

- アフリカ

第13章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 収益分析、2021年~2024年

- 市場シェア分析、2024年

- 企業評価と財務指標

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

第14章 企業プロファイル

- 主要参入企業

- ROBOSENSE

- HESAI GROUP

- LUMINAR TECHNOLOGIES, INC.

- OUSTER, INC.

- SICK AG

- LEICA GEOSYSTEMS AG

- TRIMBLE INC.

- TELEDYNE OPTECH

- FARO

- RIEGL LASER MEASUREMENT SYSTEMS GMBH

- NV5 GEOSPATIA

- SURESTAR

- YELLOWSCAN

- その他の企業

- PREACT TECHNOLOGIES

- OPSYS TECHNOLOGIES

- GEOKNO

- PHOENIX LiDAR SYSTEMS

- QUANERGY SYSTEMS, INC.

- INNOVIZ TECHNOLOGIES LTD

- LEOSPHERE

- WAYMO LLC

- VALEO

- NEPTEC TECHNOLOGIES CORP.

- ZX LiDARS

- LIVOX

- ROUTESCENE

- BLICKFELD GMBH

- SABRE ADVANCED 3D SURVEYING SYSTEMS LTD

- LEISHEN INTELLIGENT SYSTEM

第15章 付録

List of Tables

- TABLE 1 PARAMETERS INCLUDED AND EXCLUDED

- TABLE 2 LIST OF INDUSTRY EXPERTS

- TABLE 3 ASSUMPTIONS CONSIDERED DURING RESEARCH

- TABLE 4 COMPANIES AND THEIR ROLES IN LIDAR ECOSYSTEM

- TABLE 5 AVERAGE SELLING PRICE, BY KEY PLAYER, 2024 (USD)

- TABLE 6 AVERAGE SELLING PRICE TREND, BY REGION, 2021-2024 (USD)

- TABLE 7 PORTER'S FIVE FORCES: IMPACT ANALYSIS

- TABLE 8 MFN TARIFFS FOR LIDAR COMPONENTS EXPORTED BY US

- TABLE 9 MFN TARIFFS FOR LIDAR COMPONENTS EXPORTED BY CHINA

- TABLE 10 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 IMPORT DATA FOR HS CODE 901320-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 15 EXPORT DATA FOR HS CODE 901320-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 16 PATENTS RELATED TO LIDAR

- TABLE 17 LIDAR MARKET: LIST OF CONFERENCES AND EVENTS, 2025-2026

- TABLE 18 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE APPLICATIONS (%)

- TABLE 19 KEY BUYING CRITERIA FOR TOP THREE END-USE APPLICATIONS

- TABLE 20 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 21 LIDAR MARKET, BY INSTALLATION, 2021-2024 (USD MILLION)

- TABLE 22 LIDAR MARKET, BY INSTALLATION, 2025-2030 (USD MILLION)

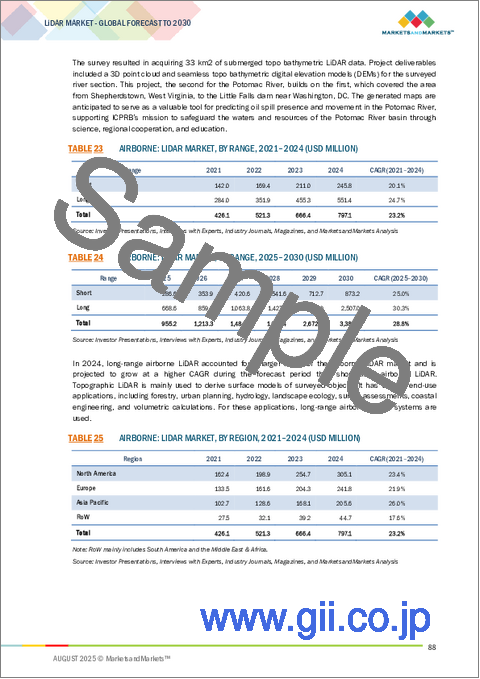

- TABLE 23 AIRBORNE: LIDAR MARKET, BY RANGE, 2021-2024 (USD MILLION)

- TABLE 24 AIRBORNE: LIDAR MARKET, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 25 AIRBORNE: LIDAR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 26 AIRBORNE: LIDAR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 27 NORTH AMERICA: AIRBORNE LIDAR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 28 NORTH AMERICA: AIRBORNE LIDAR MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 29 EUROPE: AIRBORNE LIDAR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 30 EUROPE: AIRBORNE LIDAR MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 31 ASIA PACIFIC: AIRBORNE LIDAR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 32 ASIA PACIFIC: AIRBORNE LIDAR MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 33 ROW: AIRBORNE LIDAR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 34 ROW: AIRBORNE LIDAR MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 35 AIRBORNE: LIDAR MARKET, BY AIRCRAFT TYPE, 2021-2024 (USD MILLION)

- TABLE 36 AIRBORNE: LIDAR MARKET, BY AIRCRAFT TYPE, 2025-2030 (USD MILLION)

- TABLE 37 AIRBORNE: LIDAR MARKET, BY INSTALLATION, 2021-2024 (USD MILLION)

- TABLE 38 AIRBORNE: LIDAR MARKET, BY INSTALLATION, 2025-2030 (USD MILLION)

- TABLE 39 GROUND-BASED: LIDAR MARKET, BY RANGE, 2021-2024 (USD MILLION)

- TABLE 40 GROUND-BASED: LIDAR MARKET, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 41 GROUND-BASED: LIDAR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 42 GROUND-BASED: LIDAR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 43 NORTH AMERICA: GROUND-BASED LIDAR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 44 NORTH AMERICA: GROUND-BASED LIDAR MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 45 EUROPE: GROUND-BASED LIDAR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 46 EUROPE: GROUND-BASED LIDAR MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 47 ASIA PACIFIC: GROUND-BASED LIDAR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 48 ASIA PACIFIC: GROUND-BASED LIDAR MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 49 ROW: GROUND-BASED LIDAR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 50 ROW: GROUND-BASED LIDAR MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 51 GROUND-BASED: LIDAR MARKET, BY INSTALLATION, 2021-2024 (USD MILLION)

- TABLE 52 GROUND-BASED: LIDAR MARKET, BY INSTALLATION, 2025-2030 (USD MILLION)

- TABLE 53 LIDAR MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 54 LIDAR MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 55 MECHANICAL LIDAR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 56 MECHANICAL LIDAR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 57 SOLID-STATE LIDAR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 58 SOLID-STATE LIDAR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 59 LIDAR MARKET, BY RANGE, 2021-2024 (USD MILLION)

- TABLE 60 LIDAR MARKET, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 61 LIDAR MARKET, BY SERVICE, 2021-2024 (USD MILLION)

- TABLE 62 LIDAR MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 63 LIDAR MARKET: BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 64 LIDAR MARKET: BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 65 CORRIDOR MAPPING: LIDAR MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 66 CORRIDOR MAPPING: LIDAR MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 67 CORRIDOR MAPPING: LIDAR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 68 CORRIDOR MAPPING: LIDAR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 69 ENGINEERING: LIDAR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 70 ENGINEERING: LIDAR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 71 ENVIRONMENT: LIDAR MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 72 ENVIRONMENT: LIDAR MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 73 ENVIRONMENT: LIDAR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 74 ENVIRONMENT: LIDAR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 75 LIDAR MARKET FOR ADAS & DRIVERLESS CARS APPLICATION, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 76 LIDAR MARKET FOR ADAS & DRIVERLESS CARS APPLICATION, BY TYPE, 2025-2030 (THOUSAND UNITS)

- TABLE 77 ADAS & DRIVERLESS CARS: LIDAR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 78 ADAS & DRIVERLESS CARS: LIDAR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 79 EXPLORATION: LIDAR MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 80 EXPLORATION: LIDAR MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 81 EXPLORATION: LIDAR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 82 EXPLORATION: LIDAR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 83 URBAN PLANNING: LIDAR MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 84 URBAN PLANNING: LIDAR MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 85 URBAN PLANNING: LIDAR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 86 URBAN PLANNING: LIDAR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 87 CARTOGRAPHY: LIDAR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 88 CARTOGRAPHY: LIDAR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 89 METEOROLOGY: LIDAR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 90 METEOROLOGY: LIDAR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 91 OTHER END-USE APPLICATIONS: LIDAR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 92 OTHER END-USE APPLICATIONS: LIDAR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 93 LIDAR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 94 LIDAR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 95 NORTH AMERICA: LIDAR MARKET, BY INSTALLATION, 2021-2024 (USD MILLION)

- TABLE 96 NORTH AMERICA: LIDAR MARKET, BY INSTALLATION, 2025-2030 (USD MILLION)

- TABLE 97 NORTH AMERICA: LIDAR MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 98 NORTH AMERICA: LIDAR MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 99 NORTH AMERICA: LIDAR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 100 NORTH AMERICA: LIDAR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 101 NORTH AMERICA: LIDAR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 102 NORTH AMERICA: LIDAR MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 103 US: LIDAR MARKET, BY INSTALLATION, 2021-2024 (USD MILLION)

- TABLE 104 US: LIDAR MARKET, BY INSTALLATION, 2025-2030 (USD MILLION)

- TABLE 105 CANADA: LIDAR MARKET, BY INSTALLATION, 2021-2024 (USD MILLION)

- TABLE 106 CANADA: LIDAR MARKET, BY INSTALLATION, 2025-2030 (USD MILLION)

- TABLE 107 MEXICO: LIDAR MARKET, BY INSTALLATION, 2021-2024 (USD MILLION)

- TABLE 108 MEXICO: LIDAR MARKET, BY INSTALLATION, 2025-2030 (USD MILLION)

- TABLE 109 EUROPE: LIDAR MARKET, BY INSTALLATION, 2021-2024 (USD MILLION)

- TABLE 110 EUROPE: LIDAR MARKET, BY INSTALLATION, 2025-2030 (USD MILLION)

- TABLE 111 EUROPE: LIDAR MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 112 EUROPE: LIDAR MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 113 EUROPE: LIDAR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 114 EUROPE: LIDAR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 115 EUROPE: LIDAR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 116 EUROPE: LIDAR MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 117 UK: LIDAR MARKET, BY INSTALLATION, 2021-2024 (USD MILLION)

- TABLE 118 UK: LIDAR MARKET, BY INSTALLATION, 2025-2030 (USD MILLION)

- TABLE 119 GERMANY: LIDAR MARKET, BY INSTALLATION, 2021-2024 (USD MILLION)

- TABLE 120 GERMANY: LIDAR MARKET, BY INSTALLATION, 2025-2030 (USD MILLION)

- TABLE 121 FRANCE: LIDAR MARKET, BY INSTALLATION, 2021-2024 (USD MILLION)

- TABLE 122 FRANCE: LIDAR MARKET, BY INSTALLATION, 2025-2030 (USD MILLION)

- TABLE 123 ITALY: LIDAR MARKET, BY INSTALLATION, 2021-2024 (USD MILLION)

- TABLE 124 ITALY: LIDAR MARKET, BY INSTALLATION, 2025-2030 (USD MILLION)

- TABLE 125 SPAIN: LIDAR MARKET, BY INSTALLATION, 2021-2024 (USD MILLION)

- TABLE 126 SPAIN: LIDAR MARKET, BY INSTALLATION, 2025-2030 (USD MILLION)

- TABLE 127 POLAND: LIDAR MARKET, BY INSTALLATION, 2021-2024 (USD MILLION)

- TABLE 128 POLAND: LIDAR MARKET, BY INSTALLATION, 2025-2030 (USD MILLION)

- TABLE 129 NORDICS: LIDAR MARKET, BY INSTALLATION, 2021-2024 (USD MILLION)

- TABLE 130 NORDICS: LIDAR MARKET, BY INSTALLATION, 2025-2030 (USD MILLION)

- TABLE 131 REST OF EUROPE: LIDAR MARKET, BY INSTALLATION, 2021-2024 (USD MILLION)

- TABLE 132 REST OF EUROPE: LIDAR MARKET, BY INSTALLATION, 2025-2030 (USD MILLION)

- TABLE 133 ASIA PACIFIC: LIDAR MARKET, BY INSTALLATION, 2021-2024 (USD MILLION)

- TABLE 134 ASIA PACIFIC: LIDAR MARKET, BY INSTALLATION, 2025-2030 (USD MILLION)

- TABLE 135 ASIA PACIFIC: LIDAR MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 136 ASIA PACIFIC: LIDAR MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 137 ASIA PACIFIC: LIDAR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 138 ASIA PACIFIC: LIDAR MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 139 ASIA PACIFIC: LIDAR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 140 ASIA PACIFIC: LIDAR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 141 CHINA: LIDAR MARKET, BY INSTALLATION, 2021-2024 (USD MILLION)

- TABLE 142 CHINA: LIDAR MARKET, BY INSTALLATION, 2025-2030 (USD MILLION)

- TABLE 143 JAPAN: LIDAR MARKET, BY INSTALLATION, 2021-2024 (USD MILLION)

- TABLE 144 JAPAN: LIDAR MARKET, BY INSTALLATION, 2025-2030 (USD MILLION)

- TABLE 145 SOUTH KOREA: LIDAR MARKET, BY INSTALLATION, 2021-2024 (USD MILLION)

- TABLE 146 SOUTH KOREA: LIDAR MARKET, BY INSTALLATION, 2025-2030 (USD MILLION)

- TABLE 147 INDIA: LIDAR MARKET, BY INSTALLATION, 2021-2024 (USD MILLION)

- TABLE 148 INDIA: LIDAR MARKET, BY INSTALLATION, 2025-2030 (USD MILLION)

- TABLE 149 AUSTRALIA: LIDAR MARKET, BY INSTALLATION, 2021-2024 (USD MILLION)

- TABLE 150 AUSTRALIA: LIDAR MARKET, BY INSTALLATION, 2025-2030 (USD MILLION)

- TABLE 151 INDONESIA: LIDAR MARKET, BY INSTALLATION, 2021-2024 (USD MILLION)

- TABLE 152 INDONESIA: LIDAR MARKET, BY INSTALLATION, 2025-2030 (USD MILLION)

- TABLE 153 MALAYSIA: LIDAR MARKET, BY INSTALLATION, 2021-2024 (USD MILLION)

- TABLE 154 MALAYSIA: LIDAR MARKET, BY INSTALLATION, 2025-2030 (USD MILLION)

- TABLE 155 THAILAND: LIDAR MARKET, BY INSTALLATION, 2021-2024 (USD MILLION)

- TABLE 156 THAILAND: LIDAR MARKET, BY INSTALLATION, 2025-2030 (USD MILLION)

- TABLE 157 VIETNAM: LIDAR MARKET, BY INSTALLATION, 2021-2024 (USD MILLION)

- TABLE 158 VIETNAM: LIDAR MARKET, BY INSTALLATION, 2025-2030 (USD MILLION)

- TABLE 159 REST OF ASIA PACIFIC: LIDAR MARKET, BY INSTALLATION, 2021-2024 (USD MILLION)

- TABLE 160 REST OF ASIA PACIFIC: LIDAR MARKET, BY INSTALLATION, 2025-2030 (USD MILLION)

- TABLE 161 ROW: LIDAR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 162 ROW: LIDAR MARKET, BY REGION 2025-2030 (USD MILLION)

- TABLE 163 ROW: LIDAR MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 164 ROW: LIDAR MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 165 SOUTH AMERICA: LIDAR MARKET, BY INSTALLATION, 2021-2024 (USD MILLION)

- TABLE 166 SOUTH AMERICA: LIDAR MARKET, BY INSTALLATION, 2025-2030 (USD MILLION)

- TABLE 167 MIDDLE EAST: LIDAR MARKET, BY INSTALLATION, 2021-2024 (USD MILLION)

- TABLE 168 MIDDLE EAST: LIDAR MARKET, BY INSTALLATION, 2025-2030 (USD MILLION)

- TABLE 169 AFRICA: LIDAR MARKET, BY INSTALLATION, 2021-2024 (USD MILLION)

- TABLE 170 AFRICA: LIDAR MARKET, BY INSTALLATION, 2025-2030 (USD MILLION)

- TABLE 171 ROW: LIDAR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 172 ROW: LIDAR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 173 KEY PLAYER STRATEGIES/RIGHT TO WIN, JANUARY 2021-JUNE 2025

- TABLE 174 LIDAR MARKET: DEGREE OF COMPETITION, 2024

- TABLE 175 OVERALL COMPANY FOOTPRINT

- TABLE 176 COMPANY REGION FOOTPRINT

- TABLE 177 COMPANY END-USE APPLICATION FOOTPRINT

- TABLE 178 COMPANY INSTALLATION FOOTPRINT

- TABLE 179 START-UP/SME MATRIX: LIST OF KEY START-UPS/SMES

- TABLE 180 LIDAR MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- TABLE 181 LIDAR MARKET: PRODUCT LAUNCHES, JUNE 2021-MARCH 2025

- TABLE 182 LIDAR MARKET: DEALS, APRIL 2022-JULY 2025

- TABLE 183 ROBOSENSE: COMPANY OVERVIEW

- TABLE 184 ROBOSENSE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 185 ROBOSENSE: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 186 ROBOSENSE: DEALS

- TABLE 187 ROBOSENSE: OTHER DEVELOPMENTS

- TABLE 188 HESAI GROUP: COMPANY OVERVIEW

- TABLE 189 HESAI GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 190 HESAI GROUP: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 191 HESAI GROUP: DEALS

- TABLE 192 HESAI GROUP: OTHER DEVELOPMENTS

- TABLE 193 LUMINAR TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 194 LUMINAR TECHNOLOGIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 195 LUMINAR TECHNOLOGIES, INC.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 196 LUMINAR TECHNOLOGIES, INC.: DEALS

- TABLE 197 LUMINAR TECHNOLOGIES, INC.: EXPANSIONS

- TABLE 198 OUSTER, INC.: COMPANY OVERVIEW

- TABLE 199 OUSTER, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 200 OUSTER, INC.: PRODUCT LAUNCHES

- TABLE 201 OUSTER, INC.: DEALS

- TABLE 202 SICK AG: COMPANY OVERVIEW

- TABLE 203 SICK AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 204 SICK AG: PRODUCT LAUNCHES

- TABLE 205 SICK AG: DEALS

- TABLE 206 LEICA GEOSYSTEMS AG: COMPANY OVERVIEW

- TABLE 207 LEICA GEOSYSTEMS AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 208 LEICA GEOSYSTEMS AG: PRODUCT LAUNCHES

- TABLE 209 LEICA GEOSYSTEMS AG: DEALS

- TABLE 210 TRIMBLE INC.: COMPANY OVERVIEW

- TABLE 211 TRIMBLE INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 212 TRIMBLE INC.: PRODUCT LAUNCHES

- TABLE 213 TRIMBLE INC.: DEALS

- TABLE 214 TELEDYNE OPTECH: COMPANY OVERVIEW

- TABLE 215 TELEDYNE OPTECH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 216 TELEDYNE OPTECH: PRODUCT LAUNCHES

- TABLE 217 FARO: COMPANY OVERVIEW

- TABLE 218 FARO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 219 FARO: PRODUCT LAUNCHES

- TABLE 220 FARO: DEALS

- TABLE 221 RIEGL LASER MEASUREMENT SYSTEM GMBH: COMPANY OVERVIEW

- TABLE 222 RIEGL LASER MEASUREMENT SYSTEM GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 223 RIEGL LASER MEASUREMENT SYSTEM GMBH: PRODUCT LAUNCHES

- TABLE 224 RIEGL LASER MEASUREMENT SYSTEM GMBH: DEALS

- TABLE 225 NV5 GEOSPATIAL: COMPANY OVERVIEW

- TABLE 226 NV5 GEOSPATIAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 227 NV5 GEOSPATIAL: DEALS

- TABLE 228 SURESTAR: COMPANY OVERVIEW

- TABLE 229 SURESTAR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 230 SURESTAR: PRODUCT LAUNCHES

- TABLE 231 YELLOWSCAN: COMPANY OVERVIEW

- TABLE 232 YELLOWSCAN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 233 YELLOWSCAN: PRODUCT LAUNCHES

- TABLE 234 YELLOWSCAN: DEALS

- TABLE 235 PREACT TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 236 OPSYS TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 237 GEOKNO: COMPANY OVERVIEW

- TABLE 238 PHOENIX LIDAR SYSTEMS: COMPANY OVERVIEW

- TABLE 239 QUANERGY SYSTEMS, INC.: COMPANY OVERVIEW

- TABLE 240 INNOVIZ TECHNOLOGIES LTD: COMPANY OVERVIEW

- TABLE 241 LEOSPHERE: COMPANY OVERVIEW

- TABLE 242 WAYMO LLC: COMPANY OVERVIEW

- TABLE 243 VALEO: COMPANY OVERVIEW

- TABLE 244 NEPTEC TECHNOLOGIES CORP.: COMPANY OVERVIEW

- TABLE 245 ZX LIDARS: COMPANY OVERVIEW

- TABLE 246 LIVOX: BUSINESS OVERVIEW

- TABLE 247 ROUTESCENE: COMPANY OVERVIEW

- TABLE 248 BLICKFELD GMBH: COMPANY OVERVIEW

- TABLE 249 SABRE ADVANCED 3D SURVEYING SYSTEMS: COMPANY OVERVIEW

- TABLE 250 LEISHEN INTELLIGENT SYSTEM: COMPANY OVERVIEW

List of Figures

- FIGURE 1 LIDAR MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 LIDAR MARKET: RESEARCH DESIGN

- FIGURE 3 DATA CAPTURED THROUGH SECONDARY SOURCES

- FIGURE 4 INSIGHTS DERIVED FROM PRIMARY RESEARCH SOURCES

- FIGURE 5 LIDAR MARKET SIZE ESTIMATION METHODOLOGY

- FIGURE 6 LIDAR MARKET: BOTTOM-UP APPROACH

- FIGURE 7 LIDAR MARKET: TOP-DOWN APPROACH

- FIGURE 8 DATA TRIANGULATION

- FIGURE 9 GROUND-BASED INSTALLATION TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 10 SOLID-STATE LIDAR TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 11 ADAS & DRIVERLESS CARS TO EXHIBIT HIGHEST CAGR BETWEEN 2025 AND 2030

- FIGURE 12 NORTH AMERICA ACCOUNTED FOR LARGEST SHARE OF LIDAR MARKET IN 2024

- FIGURE 13 INCREASE IN SMART CITY DEVELOPMENT AND INFRASTRUCTURE PROJECTS TO DRIVE LIDAR MARKET

- FIGURE 14 MECHANICAL LIDAR TO ACCOUNT FOR LARGER MARKET SHARE IN 2030

- FIGURE 15 ADAS & DRIVERLESS CARS APPLICATION TO HOLD LARGEST MARKET SHARE IN 2030

- FIGURE 16 GROUND-BASED INSTALLATION AND CHINA HELD LARGEST SHARES OF ASIA PACIFIC LIDAR MARKET IN 2024

- FIGURE 17 SOUTH KOREA TO REGISTER HIGHEST CAGR IN LIDAR MARKET DURING FORECAST PERIOD

- FIGURE 18 LIDAR MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 LIDAR MARKET: DRIVERS AND THEIR IMPACT

- FIGURE 20 LIDAR MARKET: RESTRAINTS AND THEIR IMPACT

- FIGURE 21 LIDAR MARKET: OPPORTUNITIES AND THEIR IMPACT

- FIGURE 22 LIDAR MARKET: CHALLENGES AND THEIR IMPACT

- FIGURE 23 LIDAR MARKET: VALUE CHAIN ANALYSIS

- FIGURE 24 LIDAR ECOSYSTEM

- FIGURE 25 AVERAGE SELLING PRICE, BY KEY PLAYER, 2024 (USD)

- FIGURE 26 AVERAGE SELLING PRICE TREND, BY REGION, 2021-2024 (USD)

- FIGURE 27 LIDAR MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 28 LIDAR MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 29 INVESTMENT AND FUNDING SCENARIO FOR START-UP COMPANIES

- FIGURE 30 IMPORT DATA FOR HS CODE 901320-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024

- FIGURE 31 EXPORT DATA FOR HS CODE 901320-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024

- FIGURE 32 PATENTS APPLIED AND GRANTED, 2014-2024

- FIGURE 33 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE APPLICATIONS

- FIGURE 34 KEY BUYING CRITERIA FOR TOP THREE END-USE APPLICATIONS

- FIGURE 35 LIDAR MARKET: IMPACT OF AI

- FIGURE 36 LIDAR MARKET, BY INSTALLATION

- FIGURE 37 GROUND-BASED LIDAR TO HAVE LARGER MARKET SIZE DURING FORECAST PERIOD

- FIGURE 38 LIDAR MARKET, BY TYPE

- FIGURE 39 MECHANICAL LIDAR TO ACCOUNT FOR LARGER MARKET SHARE IN 2030

- FIGURE 40 LIDAR MARKET, BY RANGE

- FIGURE 41 SHORT-RANGE (0-200 M) LIDAR TO BE LARGEST SEGMENT OF LIDAR MARKET DURING FORECAST PERIOD

- FIGURE 42 LIDAR MARKET, BY SERVICE

- FIGURE 43 GEOGRAPHIC INFORMATION SYSTEM (GIS) SERVICES TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 44 LIDAR MARKET, BY END-USE APPLICATION

- FIGURE 45 ADAS & DRIVERLESS CARS APPLICATION TO BE LARGEST SEGMENT OF LIDAR MARKET DURING FORECAST PERIOD

- FIGURE 46 LIDAR MARKET, BY REGION

- FIGURE 47 NORTH AMERICA: LIDAR MARKET SNAPSHOT

- FIGURE 48 EUROPE: LIDAR MARKET SNAPSHOT

- FIGURE 49 ASIA PACIFIC: LIDAR MARKET SNAPSHOT

- FIGURE 50 LIDRA MARKET: REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2021-2024

- FIGURE 51 LIDAR MARKET SHARE ANALYSIS, 2024

- FIGURE 52 VALUATION OF KEY PLAYERS IN LIDAR MARKET

- FIGURE 53 EV/EBITDA OF KEY PLAYERS

- FIGURE 54 BRAND/PRODUCT COMPARISON

- FIGURE 55 LIDAR MARKET: COMPANY EVALUATION MATRIX, 2024

- FIGURE 56 LIDAR MARKET: COMPANY FOOTPRINT

- FIGURE 57 LIDAR MARKET: START-UP/SME EVALUATION MATRIX, 2024

- FIGURE 58 ROBOSENSE: COMPANY SNAPSHOT

- FIGURE 59 HESAI GROUP: COMPANY SNAPSHOT

- FIGURE 60 LUMINAR TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- FIGURE 61 OUSTER, INC.: COMPANY SNAPSHOT

- FIGURE 62 SICK AG: COMPANY SNAPSHOT

- FIGURE 63 TRIMBLE INC.: COMPANY SNAPSHOT

The LiDAR market is projected to reach USD 12.79 billion by 2030 from USD 3.27 billion in 2025, at a CAGR of 31.3% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Installation, Type, Range, Service, End-Use Application, and Region |

| Regions covered | North America, Europe, APAC, RoW |

The rising adoption of autonomous vehicles drives the LiDAR market, growing demand for high-precision 3D mapping, and increasing investments in smart city and infrastructure development projects. Advancements in solid-state LiDAR technology, offering cost efficiency and durability, are further accelerating adoption across automotive, environmental, and industrial applications. Additionally, government initiatives that support digital mapping and intelligent transportation systems are driving market growth. However, the high initial cost of LiDAR systems and the availability of alternative sensing technologies, such as camera and radar-based systems, act as key restraints. Limited standardization and regulatory challenges in autonomous navigation also hinder large-scale deployment.

"GIS service to witness the highest growth during the forecast period."

The GIS services segment in the LiDAR market is expected to grow at the highest CAGR during the forecast period due to its critical role in transforming raw LiDAR data into actionable geospatial insights. Increasing demand for accurate mapping, spatial analysis, and infrastructure planning in sectors such as transportation, urban development, and environmental monitoring is driving adoption. The integration of LiDAR with advanced GIS platforms enables real-time decision-making, improving efficiency in disaster management, agriculture, and utility asset management. Governments and private organizations are increasingly investing in GIS-based LiDAR solutions for smart city projects and infrastructure modernization. Furthermore, advancements in cloud-based GIS and AI-driven spatial analytics are expanding the accessibility and scalability of these services. This strong combination of technological innovation and broad cross-industry applicability positions GIS services as the fastest-growing segment in the LiDAR market.

"Ground-based installation segment to dominate the market during the forecast period."

Ground-based LiDAR is expected to hold the largest market share due to its extensive use in applications such as corridor mapping, construction, mining, forestry, and environmental monitoring. Its high accuracy, ability to capture dense point clouds, and suitability for short- to medium-range scanning make it ideal for detailed terrain and structural analysis. The technology is widely adopted for surveying and mapping in urban planning, archaeology, and infrastructure inspection, where precision is critical. Additionally, ground-based LiDAR systems are cost-effective compared to airborne counterparts for small- to mid-scale projects. The growing demand for terrestrial laser scanning in building information modeling (BIM) and industrial plant maintenance further fuels market dominance. Continuous advancements in portability, automation, and integration with GIS platforms are strengthening its adoption across multiple sectors.

"North America to hold the largest share of the LiDAR market during the forecast period."

North America is expected to hold the largest share in the LiDAR market due to the strong presence of leading LiDAR manufacturers, technology providers, and autonomous vehicle developers in the region. Significant investments in self-driving car research, smart infrastructure projects, and advanced mapping initiatives are driving demand. The region benefits from robust government support for environmental monitoring, defense applications, and transportation safety programs. High adoption of LiDAR in sectors such as mining, forestry, construction, and oil & gas further strengthens market growth. Additionally, the early integration of LiDAR with AI, IoT, and cloud-based platforms enhances its application potential. The combination of technological leadership, high R&D spending, and diverse end-use adoption positions North America as the dominant LiDAR market globally.

The study contains insights from various industry experts, from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type: Tier 1 - 40%, Tier 2 - 40%, and Tier 3 - 20%

- By Designation: C-level Executives - 40%, Directors - 40%, and Others - 20%

- By Region: North America - 40%, Europe - 30%, Asia Pacific - 20%, and RoW - 10%

The report profiles key LiDAR market players and their respective market ranking analyses. Prominent players profiled in this report include Hesai Group (China), RoboSense Technology Co., Ltd. (China), Sick AG (Germany), Ouster, Inc. (US), Luminar Technologies (US), Leica Geosystems AG (Sweden), Trimble Inc. (US), Teledyne Optech (Canada), FARO Technologies, Inc. (US), RIEGL Laser Measurement Systems GmbH (Austria), NV5 Geospatial (US), Beijing SureStar Technology Co., Ltd. (China), YellowScan (France) SABRE Advanced 3D Surveying Systems (Scotland), Geokno (India), Phoenix LiDAR Systems (US), Quanergy Systems, Inc. (US), Innoviz Technologies Ltd (Israel), Leosphere (France), Waymo LLC (US), Valeo (France), ZX Lidars (UK), Livox (China), Routescene (Scotland), and Blickfeld GmbH (Germany).

Research Coverage

The report defines, describes, and forecasts the LiDAR market based on installation, type, range, services, end-use application, and region. It provides detailed information regarding drivers, restraints, opportunities, and challenges influencing the market's growth. It also analyzes competitive developments such as product launches, acquisitions, expansions, and actions carried out by the key players to grow in the market.

Reason to Buy This Report

The report will help the market leaders/new entrants with information on the closest approximations of the revenue for the overall LiDAR market and the subsegments. The report will help stakeholders understand the competitive landscape and gain more insight to position their business better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market's pulse and provides information on key drivers, restraints, opportunities, and challenges.

The report provides insights into the following pointers:

- Analysis of key drivers (Rising adoption of UAV LIDAR systems to capture accurate evaluation data), restraints (Availability of low-cost and lightweight alternatives), opportunities (Increasing development of quantum dot detectors), and challenges (High cost of post-processing LIDAR software) of the LiDAR market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the LiDAR market

- Market Development: Comprehensive information about lucrative markets by analyzing the LiDAR market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the LiDAR market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and offerings of leading players in the LiDAR market, such as Hesai Group (China), RoboSense Technology Co., Ltd. (China), Sick AG (Germany), Ouster, Inc. (US), and Luminar Technologies (US), among others.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 INCLUSIONS AND EXCLUSIONS

- 1.3.2 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Major secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of key interview participants

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of primary interviews

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION METHODOLOGY

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to estimate market size using bottom-up analysis (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to estimate market size using top-down analysis (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN LIDAR MARKET

- 4.2 LIDAR MARKET, BY TYPE

- 4.3 LIDAR MARKET, BY END-USE APPLICATION

- 4.4 LIDAR MARKET IN ASIA PACIFIC, BY INSTALLATION AND COUNTRY

- 4.5 LIDAR MARKET, BY GEOGRAPHY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising adoption of UAV LiDAR systems to capture accurate evaluation data

- 5.2.1.2 Surging demand for 3D imaging solutions

- 5.2.1.3 Growing number of smart cities and infrastructure development projects

- 5.2.1.4 Rising deployment of 4D LiDAR technology in autonomous vehicles

- 5.2.1.5 Increasing enforcement of regulations related to commercial drone adoption in highway construction applications

- 5.2.2 RESTRAINTS

- 5.2.2.1 Safety threats associated with UAVs and autonomous vehicles

- 5.2.2.2 Availability of low-cost and lightweight alternatives

- 5.2.2.3 High testing, engineering, and calibration costs

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing investments in ADAS systems by automotive giants

- 5.2.3.2 Increasing development of quantum dot detectors

- 5.2.3.3 Rising popularity of compact and cost-effective flash LiDAR

- 5.2.3.4 Developing advanced geospatial solutions

- 5.2.3.5 Increasing reliance on drones to gather key analytic data

- 5.2.4 CHALLENGES

- 5.2.4.1 High cost of post-processing LiDAR software

- 5.2.4.2 Complexities related to miniaturized LiDAR sensing

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.3.1 RESEARCH, DESIGN, AND DEVELOPMENT

- 5.3.2 RAW MATERIAL SUPPLY

- 5.3.3 LIDAR COMPONENT MANUFACTURING

- 5.3.4 SYSTEM INTEGRATION

- 5.3.5 SUPPLY AND DISTRIBUTION

- 5.3.6 END-USE APPLICATION

- 5.4 ECOSYSTEM/MARKET MAP

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE, BY KEY PLAYER, 2024

- 5.5.2 AVERAGE SELLING PRICE, BY REGION

- 5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGY

- 5.7.1.1 Frequency-modulated continuous-wave LiDAR

- 5.7.1.2 Photon-counting LiDAR

- 5.7.1.3 Multi-wavelength LiDAR

- 5.7.2 ADJACENT TECHNOLOGY

- 5.7.2.1 Metamaterials

- 5.7.2.2 In-car LiDAR

- 5.7.2.3 Artificial intelligence (AI) and machine learning (ML)

- 5.7.3 COMPLEMENTARY TECHNOLOGIES

- 5.7.3.1 Sensor suite

- 5.7.3.2 Flash LiDAR technology

- 5.7.1 KEY TECHNOLOGY

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- 5.8.1 THREAT OF NEW ENTRANTS

- 5.8.2 THREAT OF SUBSTITUTES

- 5.8.3 BARGAINING POWER OF SUPPLIERS

- 5.8.4 BARGAINING POWER OF BUYERS

- 5.8.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.9 CASE STUDY ANALYSIS

- 5.9.1 VISIMIND PARTNERS WITH VELODYNE LIDAR TO INCREASE SAFETY AND SECURE DATA RELATED TO ENERGY DISTRIBUTION

- 5.9.2 DRONE TECHNOLOGIES ADOPTS TRIMBLE INC.'S LIDAR SENSORS FOR TERRAIN MAPPING

- 5.9.3 TS ENGINEERING PERFORMS HIGHWAY AERIAL MAPPING WITH TRUEVIEW 535 AND LP360 PROCESSING SOFTWARE

- 5.9.4 CSX TRANSPORTATION UTILIZES PHOENIX LIDAR SCOUT SYSTEMS FOR RAILROAD SURVEYING

- 5.9.5 MEASUREMENT SCIENCES INC. IMPLEMENTS LIDAR IN PIPELINE SURVEYS TO MAP LARGE VEGETATED AREAS EFFICIENTLY

- 5.10 INVESTMENT AND FUNDING SCENARIO

- 5.11 TARIFF AND REGULATORY LANDSCAPE

- 5.11.1 REGULATIONS

- 5.11.1.1 Restriction of Hazardous Substances (RoHs) Directive

- 5.11.1.2 General Data Protection Regulation (GDPR)

- 5.11.1.3 Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH)

- 5.11.1.4 Import-export laws

- 5.11.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11.1 REGULATIONS

- 5.12 TRADE ANALYSIS

- 5.12.1 IMPORT SCENARIO (HS CODE 901320)

- 5.12.2 EXPORT SCENARIO (HS CODE 901320)

- 5.13 PATENT ANALYSIS

- 5.14 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.15 KEY STAKEHOLDERS AND BUYING PROCESS

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 IMPACT OF AI ON LIDAR MARKET

- 5.17 TRUMP TARIFF IMPACT ON LIDAR MARKET

- 5.17.1 INTRODUCTION

- 5.18 KEY TARIFF RATES

- 5.19 PRICE IMPACT ANALYSIS

- 5.20 IMPACT ON VARIOUS REGIONS

- 5.20.1 US

- 5.20.2 EUROPE

- 5.20.3 ASIA PACIFIC

- 5.21 END-USE INDUSTRY-LEVEL IMPACT

6 LIDAR MARKET, BY TECHNOLOGY

- 6.1 INTRODUCTION

- 6.2 2D

- 6.3 3D

- 6.4 4D

7 LIDAR MARKET, BY INSTALLATION

- 7.1 INTRODUCTION

- 7.2 AIRBORNE

- 7.2.1 TOPOGRAPHIC

- 7.2.1.1 Topographic LiDAR unlocks precision terrain intelligence, fueling market expansion

- 7.2.2 BATHYMETRIC LIDAR

- 7.2.2.1 Development of airborne bathymetric LiDAR systems to map coastal zones to contribute to market growth

- 7.2.1 TOPOGRAPHIC

- 7.3 GROUND-BASED

- 7.3.1 MOBILE

- 7.3.1.1 Deployment of mobile LiDAR technology in corridor mapping and meteorology applications to fuel segmental growth

- 7.3.2 STATIC

- 7.3.2.1 Utilization of static LiDAR in engineering and exploration to accelerate segmental growth

- 7.3.1 MOBILE

8 LIDAR MARKET, BY TYPE

- 8.1 INTRODUCTION

- 8.2 MECHANICAL

- 8.2.1 MECHANICAL LIDAR-ENABLED ENVIRONMENTAL MAPPING TO ACCELERATE MARKET EXPANSION

- 8.3 SOLID STATE

- 8.3.1 SOLID-STATE LIDAR GAINS TRACTION WITH SUPERIOR SHOCK AND VIBRATION RESISTANCE

9 LIDAR MARKET, BY RANGE

- 9.1 INTRODUCTION

- 9.2 SHORT (0-200 M)

- 9.2.1 ADOPTION OF SHORT-RANGE LIDAR TO AUTOMATE INDUSTRIAL OBJECT PROXIMITY SENSING TO BOOST SEGMENTAL GROWTH

- 9.3 MEDIUM (200-500 M)

- 9.3.1 IMPLEMENTATION OF MEDIUM-RANGE LIDAR TO NAVIGATE AUTOMATED GUIDED VEHICLES TO ACCELERATE SEGMENTAL GROWTH

- 9.4 LONG (ABOVE 500 M)

- 9.4.1 EMPLOYMENT OF LONG-RANGE LIDAR COMPONENTS FOR WIDE-AREA MAPPING TO FOSTER SEGMENTAL GROWTH

10 LIDAR MARKET, BY SERVICE

- 10.1 INTRODUCTION

- 10.2 AERIAL SURVEYING

- 10.2.1 RELIANCE ON AERIAL LIDAR SURVEYS TO PROVIDE ACCURATE 3D MAPPING OF TERRAINS AND LANDSCAPES TO PROPEL MARKET

- 10.3 ASSET MANAGEMENT

- 10.3.1 ADOPTION OF LIDAR IN TRANSMISSION LINE AND ROAD MAPPING PROJECTS TO FUEL SEGMENTAL GROWTH

- 10.4 GEOGRAPHIC INFORMATION SYSTEM (GIS) SERVICES

- 10.4.1 CAPABILITY TO INTEGRATE LIDAR WITH GEOSPATIAL DATA TO AUGMENT DEMAND

- 10.5 GROUND-BASED SURVEYING

- 10.5.1 USE OF GROUND-BASED MONITORING SYSTEMS IN HIGH-VOLUME TRAFFIC STUDIES TO DRIVE SEGMENTAL GROWTH

- 10.6 OTHER SERVICES

11 LIDAR MARKET, BY END-USE APPLICATION

- 11.1 INTRODUCTION

- 11.2 CORRIDOR MAPPING

- 11.2.1 ROADWAYS

- 11.2.1.1 Reliance on LiDAR technology to determine length of roads and terrain structure to foster segmental growth

- 11.2.2 RAILWAYS

- 11.2.2.1 Use of LiDAR systems as cost-effective solution to map complete railway networks to propel market

- 11.2.3 OTHER CORRIDOR MAPPING TYPES

- 11.2.1 ROADWAYS

- 11.3 ENGINEERING

- 11.3.1 RELIANCE ON LIDAR-BASED SURVEY TO EXTRACT DATA RELATED TO GROUND ELEVATION TO CONTRIBUTE TO SEGMENTAL GROWTH

- 11.4 ENVIRONMENT

- 11.4.1 FOREST MANAGEMENT

- 11.4.1.1 Adoption of LiDAR technology to detect deforestation and forest loss to fuel segmental growth

- 11.4.2 COASTLINE MANAGEMENT

- 11.4.2.1 Utilization of LiDAR systems to create accurate topographic maps of coastal areas to accelerate segmental growth

- 11.4.3 POLLUTION MODELING

- 11.4.3.1 Implementation of LiDAR systems to determine carbon absorption in forests to drive market

- 11.4.4 AGRICULTURE MAPPING

- 11.4.4.1 Use of LiDAR systems to increase crop viability and mapping to fuel segmental growth

- 11.4.5 WIND FARM

- 11.4.5.1 Deployment of LiDAR technology to detect wind direction to accelerate segmental growth

- 11.4.6 PRECISION FORESTRY

- 11.4.6.1 Utilization of LiDAR systems to make data-driven decisions related to forest dynamics to boost segmental growth

- 11.4.1 FOREST MANAGEMENT

- 11.5 ADAS & DRIVERLESS CARS

- 11.5.1 RELIANCE ON LIDAR TO ENSURE ACCURATE OBJECT DETECTION AND RECOGNITION BY ADAS & DRIVERLESS CARS TO PROPEL MARKET

- 11.6 EXPLORATION

- 11.6.1 OIL & GAS

- 11.6.1.1 Adoption of LiDAR photography solutions to identify threats along oil & gas pipelines to augment segmental growth

- 11.6.2 MINING

- 11.6.2.1 Utilization of LiDAR solutions to provide exact mining location to drive market

- 11.6.1 OIL & GAS

- 11.7 URBAN PLANNING

- 11.7.1 ADOPTION OF LIDAR TO OBTAIN DIGITAL MODELS OF CITIES AND DIGITAL SURFACE TO FUEL SEGMENTAL GROWTH

- 11.8 CARTOGRAPHY

- 11.8.1 UTILIZATION OF LIDAR COMPONENTS TO PRODUCE HIGH-RESOLUTION CONTOUR MAPS TO FOSTER SEGMENTAL GROWTH

- 11.9 METEOROLOGY

- 11.9.1 IMPLEMENTATION OF LIDAR TECHNOLOGY TO GAIN ACCURATE DATA ON ATMOSPHERIC GASES TO CONTRIBUTE TO SEGMENTAL GROWTH

- 11.10 OTHER END-USE APPLICATIONS

12 LIDAR MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 NORTH AMERICA

- 12.2.1 MACROECONOMIC OUTLOOK IN NORTH AMERICA

- 12.2.2 US

- 12.2.2.1 Surging demand for drones for corridor mapping applications to drive market

- 12.2.3 CANADA

- 12.2.3.1 Rising development of spatial data infrastructure to contribute to market growth

- 12.2.4 MEXICO

- 12.2.4.1 Increasing emphasis on examining ancient archeological sites to foster market growth

- 12.3 EUROPE

- 12.3.1 MACROECONOMIC OUTLOOK IN EUROPE

- 12.3.2 UK

- 12.3.2.1 Rising production of cost-effective terrain maps to assess flood risks to drive market

- 12.3.3 GERMANY

- 12.3.3.1 Increasing R&D of advanced automotive technologies to fuel market growth

- 12.3.4 FRANCE

- 12.3.4.1 Rising demand for innovative technologies for corridor mapping to boost market growth

- 12.3.5 ITALY

- 12.3.5.1 Growing need for infrastructure monitoring and coastline protection to augment demand for LiDAR components

- 12.3.6 SPAIN

- 12.3.6.1 Regulatory backing and cross-industry adoption to propel LiDAR market growth in Spain

- 12.3.7 POLAND

- 12.3.7.1 Government modernization initiatives and industrial automation to boost LiDAR market in Poland

- 12.3.8 NORDICS

- 12.3.8.1 Sustainability goals and advanced mobility projects fuel LiDAR growth in Nordic region

- 12.3.9 REST OF EUROPE

- 12.4 ASIA PACIFIC

- 12.4.1 MACROECONOMIC OUTLOOK IN ASIA PACIFIC

- 12.4.2 CHINA

- 12.4.2.1 Increasing development of advanced drone technologies to drive market

- 12.4.3 JAPAN

- 12.4.3.1 Growing demand for autonomous vehicles to fuel market

- 12.4.4 SOUTH KOREA

- 12.4.4.1 Rising emphasis on optimizing factory to accelerate market growth

- 12.4.5 INDIA

- 12.4.5.1 Increasing formulation of mandates on LiDAR adoption during highway construction to contribute to market growth

- 12.4.6 AUSTRALIA

- 12.4.6.1 Government-backed mapping and climate efforts to advance LiDAR adoption in Australia

- 12.4.7 INDONESIA

- 12.4.7.1 Infrastructure growth and urban planning to spur LiDAR demand in Indonesia

- 12.4.8 MALAYSIA

- 12.4.8.1 Smart nation ambitions and environmental policies to drive LiDAR growth in Malaysia

- 12.4.9 THAILAND

- 12.4.9.1 Tourism and urban expansion initiatives to encourage LiDAR usage in Thailand

- 12.4.10 VIETNAM

- 12.4.10.1 Disaster management and coastal planning to propel LiDAR market in Vietnam

- 12.4.11 REST OF ASIA PACIFIC

- 12.5 ROW

- 12.5.1 MACROECONOMIC OUTLOOK IN ROW

- 12.5.2 SOUTH AMERICA

- 12.5.2.1 Topographic mapping and environmental monitoring to accelerate LiDAR growth in South America

- 12.5.3 MIDDLE EAST

- 12.5.3.1 Smart infrastructure and sustainability goals to drive LiDAR demand in Middle East

- 12.5.3.2 Bahrain

- 12.5.3.2.1 Urban digitization and land management to boost LiDAR market in Bahrain

- 12.5.3.3 Kuwait

- 12.5.3.3.1 Geospatial intelligence and environmental security to drive demand

- 12.5.3.4 Oman

- 12.5.3.4.1 LiDAR adoption in Oman driven by geological and coastal applications

- 12.5.3.5 Qatar

- 12.5.3.5.1 Infrastructure vision and smart city push to fuel LiDAR in Qatar

- 12.5.3.6 Saudi Arabia

- 12.5.3.6.1 Desert terrain mapping and autonomous mobility to expand LiDAR market in Saudi Arabia

- 12.5.3.7 United Arab Emirates (UAE)

- 12.5.3.7.1 LiDAR deployment in UAE accelerated by megaprojects and automation demand

- 12.5.3.8 Rest of Middle East

- 12.5.4 AFRICA

- 12.5.4.1 South Africa

- 12.5.4.1.1 South Africa leads regional LiDAR market with advanced applications in mining and conservation

- 12.5.4.2 Other African countries

- 12.5.4.1 South Africa

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 13.3 REVENUE ANALYSIS, 2021-2024

- 13.4 MARKET SHARE ANALYSIS, 2024

- 13.5 COMPANY VALUATION AND FINANCIAL METRICS

- 13.6 BRAND/PRODUCT COMPARISON

- 13.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.7.1 STARS

- 13.7.2 EMERGING LEADERS

- 13.7.3 PERVASIVE PLAYERS

- 13.7.4 PARTICIPANTS

- 13.7.4.1 Company footprint

- 13.7.4.2 Company overall footprint

- 13.7.4.3 Company region footprint

- 13.7.4.4 Company end-use application footprint

- 13.7.4.5 Company installation footprint

- 13.8 START-UP/SME EVALUATION MATRIX, 2024

- 13.8.1 PROGRESSIVE COMPANIES

- 13.8.2 RESPONSIVE COMPANIES

- 13.8.3 DYNAMIC COMPANIES

- 13.8.4 STARTING BLOCKS

- 13.8.5 COMPETITIVE BENCHMARKING

- 13.8.5.1 Detailed list of key startups/SMEs

- 13.8.5.2 Competitive benchmarking of key startups/SMES

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 PRODUCT LAUNCHES

- 13.9.2 DEALS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 ROBOSENSE

- 14.1.1.1 Business overview

- 14.1.1.2 Products/Solutions/Services offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Product launches/developments

- 14.1.1.4 Deals

- 14.1.1.5 MnM view

- 14.1.1.5.1 Key strengths

- 14.1.1.5.2 Strategic choices

- 14.1.1.5.3 Weaknesses and competitive threats

- 14.1.2 HESAI GROUP

- 14.1.2.1 Business overview

- 14.1.2.2 Products/Solutions/Services offered

- 14.1.2.3 Recent developments

- 14.1.2.4 MnM view

- 14.1.2.4.1 Key strengths

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses and competitive threats

- 14.1.3 LUMINAR TECHNOLOGIES, INC.

- 14.1.3.1 Business overview

- 14.1.3.2 Products/Solutions/Services offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Product launches/developments

- 14.1.3.3.2 Deals

- 14.1.3.3.3 Expansions

- 14.1.3.4 MnM view

- 14.1.3.4.1 Key strengths

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses and competitive threats

- 14.1.4 OUSTER, INC.

- 14.1.4.1 Business overview

- 14.1.4.2 Products/Solutions/Services offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Product launches

- 14.1.4.3.2 Deals

- 14.1.4.4 MnM view

- 14.1.4.4.1 Key strengths

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses and competitive threats

- 14.1.5 SICK AG

- 14.1.5.1 Business overview

- 14.1.5.2 Products/Solutions/Services offered

- 14.1.5.3 Recent developments

- 14.1.5.3.1 Product launches

- 14.1.5.3.2 Deals

- 14.1.5.4 MnM view

- 14.1.5.4.1 Key strengths

- 14.1.5.4.2 Strategic choices

- 14.1.5.4.3 Weaknesses and competitive threats

- 14.1.6 LEICA GEOSYSTEMS AG

- 14.1.6.1 Business overview

- 14.1.6.2 Products/Solutions/Services offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Product launches

- 14.1.6.4 Recent developments

- 14.1.6.4.1 Deals

- 14.1.7 TRIMBLE INC.

- 14.1.7.1 Business overview

- 14.1.7.2 Products/Solutions/Services offered

- 14.1.7.3 Recent developments

- 14.1.7.3.1 Product launches

- 14.1.7.3.2 Deals

- 14.1.8 TELEDYNE OPTECH

- 14.1.8.1 Business overview

- 14.1.8.2 Products/Solutions/Services offered

- 14.1.8.3 Recent developments

- 14.1.8.3.1 Product launches

- 14.1.9 FARO

- 14.1.9.1 Business overview

- 14.1.9.2 Products/Solutions/Services offered

- 14.1.9.3 Recent developments

- 14.1.9.3.1 Product launches

- 14.1.9.3.2 Deals

- 14.1.10 RIEGL LASER MEASUREMENT SYSTEMS GMBH

- 14.1.10.1 Business overview

- 14.1.10.2 Products/Solutions/Services offered

- 14.1.10.3 Recent developments

- 14.1.10.3.1 Product launches

- 14.1.10.3.2 Deals

- 14.1.11 NV5 GEOSPATIA

- 14.1.11.1 Business overview

- 14.1.11.2 Products/Solutions/Services offered

- 14.1.11.3 Recent developments

- 14.1.11.3.1 Deals

- 14.1.12 SURESTAR

- 14.1.12.1 Business overview

- 14.1.12.2 Products/Solutions/Services offered

- 14.1.12.3 Recent developments

- 14.1.12.3.1 Product launches

- 14.1.13 YELLOWSCAN

- 14.1.13.1 Business overview

- 14.1.13.2 Products/Solutions/Services offered

- 14.1.13.3 Recent developments

- 14.1.13.3.1 Product launches

- 14.1.13.3.2 Deals

- 14.1.1 ROBOSENSE

- 14.2 OTHER PLAYERS

- 14.2.1 PREACT TECHNOLOGIES

- 14.2.2 OPSYS TECHNOLOGIES

- 14.2.3 GEOKNO

- 14.2.4 PHOENIX LIDAR SYSTEMS

- 14.2.5 QUANERGY SYSTEMS, INC.

- 14.2.6 INNOVIZ TECHNOLOGIES LTD

- 14.2.7 LEOSPHERE

- 14.2.8 WAYMO LLC

- 14.2.9 VALEO

- 14.2.10 NEPTEC TECHNOLOGIES CORP.

- 14.2.11 ZX LIDARS

- 14.2.12 LIVOX

- 14.2.13 ROUTESCENE

- 14.2.14 BLICKFELD GMBH

- 14.2.15 SABRE ADVANCED 3D SURVEYING SYSTEMS LTD

- 14.2.16 LEISHEN INTELLIGENT SYSTEM

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS