|

|

市場調査レポート

商品コード

1733567

LiDARの世界市場:2034年までの市場の機会と戦略LiDAR Global Market Opportunities And Strategies To 2034 |

||||||

カスタマイズ可能

|

|||||||

| LiDARの世界市場:2034年までの市場の機会と戦略 |

|

出版日: 2025年05月26日

発行: The Business Research Company

ページ情報: 英文 362 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

世界のLiDARの市場規模は、2019年に13億3,964万米ドルと評価され、2024年まで13.00%以上の複合年間成長率(CAGR)で成長しました。

無人航空機(UAV)の採用拡大

無人航空機(UAV)の採用拡大が、実績期間のLiDAR市場の成長を支えました。UAV搭載LiDARシステムは、広大なエリアを高精度で効率的にカバーします。これらは、地形マッピング、林業モニタリング、農業などの測量に特に有用です。衛星ベースのリモートセンシングとは異なり、UAV LiDARは高解像度のリアルタイムデータを優れたディテールで提供します。さらに、軍事・治安機関はUAV搭載LiDARを監視、国境警備、偵察に活用しています。敵の動きの検知、戦略的防衛のための地形マッピング、密集した環境での隠された物体の特定に役立ちます。例えば、米国を拠点とする運輸機関である連邦航空局が発表した報告書によると、2023年7月、米国で有効な商用無人航空機システムの登録数は41万2,342件となっています。さらに、2021年にはレクリエーション用ドローンのアクティブなフリート数は約60万7,177でした。従って、UAVの採用拡大がLiDAR市場の成長を牽引しました。

当レポートは、世界のLiDAR市場について調査し、市場の概要とともに、コンポーネント別、タイプ別、技術別、用途別、エンドユーザー別、地域・国別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

第1章 エグゼクティブサマリー

第2章 目次

第3章 テーブル一覧

第4章 図表一覧

第5章 レポートの構成

第6章 市場の特徴

- 一般的な市場定義

- サマリー

- LiDAR市場の定義とセグメンテーション

- 市場セグメンテーション、コンポーネント別

- レーザースキャナー

- ナビゲーションおよび測位システム

- その他

- 市場セグメンテーション、タイプ別

- 地上

- 航空

- 衛星

- 市場セグメンテーション、技術別

- 2D

- 3D

- 4D

- 市場セグメンテーション、用途別

- 地図作成と地図作成

- 先進運転支援システム(ADAS)

- 環境

- 探索と検出

- その他

- 市場セグメンテーション、エンドユーザー別

- 防衛・航空宇宙

- 土木工学

- 考古学

- 自動車

- 林業と農業

- 鉱業

- 交通機関

- その他

第7章 主要な市場動向

- スマート交通検知ソリューションの進歩

- 測量およびマッピング向けUAVベースLiDARの革新

- 鮮明さと精度を向上させる高解像度画像の進歩

- 空間認識力を向上させる4Dライダーセンサーの進歩

- LiDARの性能向上を実現する次世代センサー

- LiDAR業界のイノベーションと成長を推進する戦略的パートナーシップ

第8章 世界LiDAR成長分析と戦略分析フレームワーク

- 世界:PESTEL分析

- B2B市場におけるエンドユーザー分析

- 世界市場規模と成長

- 市場規模

- 市場成長実績、2019年~2024年

- 市場成長予測、2024年~2029年、2034年

- 成長予測の貢献要因

- 世界のLiDAR総獲得可能市場(TAM)

第9章 世界のLiDAR市場セグメンテーション

- 世界のLiDAR市場、コンポーネント別

- 世界のLiDAR市場:タイプ別

- 世界のLiDAR市場:技術別セ

- 世界のLiDAR市場、用途別

- 世界のLiDAR市場、エンドユーザー別

- 世界のLiDAR市場、レーザースキャナー

- 世界のLiDAR市場、ナビゲーションおよび測位システム

- 世界のLiDAR市場、その他

第10章 LiDAR市場、地域別・国別分析

- 世界のLiDAR市場、地域別、実績および予測、2019年~2024年、2029年予測、2034年予測

- 世界のLiDAR市場、国別、実績および予測、2019年~2024年、2029年予測、2034年予測

第11章 アジア太平洋市場

第12章 西欧市場

第13章 東欧市場

第14章 北米市場

第15章 南米市場

第16章 中東市場

第17章 アフリカ市場

第18章 競合情勢と企業プロファイル

- 企業プロファイル

- Hesai Technology Co. Ltd.

- Ouster Inc.

- Hexagon AB(Leica Geosystems)

- Faro Technologies Inc.

- Valeo SA

第19章 その他の大手企業と革新企業

- Sick AG

- Luminar Technologies Inc.

- Teledyne Technologies Inc.

- Innoviz Technologies Ltd.

- Aerometrex Ltd.

- Trimble Inc.

- Benewake(Beijing)Co. Ltd.

- Quanergy Systems Inc.

- Topcon Positioning Systems Inc.

- LeddarTech Inc.

- Microvision Inc.

- Waymo LLC

- RoboSense Technology Co. Ltd.

- Aeva Technologies Inc.

- AEye Inc.

第20章 競合ベンチマーキング

第21章 競合ダッシュボード

第22章 主要な合併と買収

- Koito Manufacturing Co., Ltd がCeptonを買収

- Sanborn Map CompanyがVeridaaS Corporationを買収

- FARO TechnologiesがSiteScapeを買収

- Velodyne Lidar Inc. がTopodroneを買収

第23章 LiDAR市場の最近の動向

第24章 機会と戦略

第25章 LiDAR市場、結論・提言

第26章 付録

LiDAR stands for Light Detection and Ranging. It is a remote sensing technology that uses laser pulses to measure distances between a sensor and objects or surfaces. LiDAR systems work by emitting laser beams, which reflect off objects and return to the sensor. LiDAR can determine precise distances and create detailed 3D maps by calculating the time the light returns. LiDAR is primarily used for mapping, object detection, and environmental monitoring. It provides high-resolution and accurate spatial data, making it useful in a variety of industries.

The LiDAR market consists of sales, by entities (organizations, sole traders, or partnerships), of LiDAR technology that is used to measure a large number of areas in a relatively small amount of time with more accuracy than manual labor. It is technology used to create three-dimensional images.

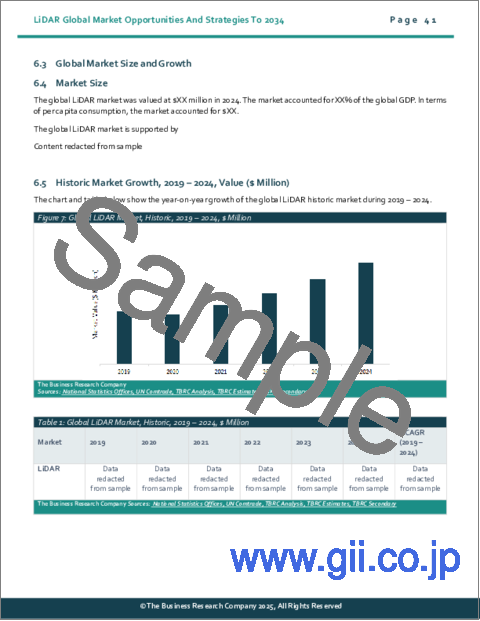

The global LiDAR market was valued at $1,339.64 million in 2019 which grew till 2024 at a compound annual growth rate (CAGR) of more than m 13.00%.

Growing Adoption Of Unmanned Aerial Vehicles (UAV)

The growing adoption of unmanned aerial vehicles (UAV) supported the growth of the LiDAR market during the historic period. UAV-mounted LiDAR systems efficiently cover vast areas with high precision. They are particularly valuable for surveying applications such as terrain mapping, forestry monitoring and agriculture. Unlike satellite-based remote sensing, UAV LiDAR provides high-resolution, real-time data with superior detail. Additionally, military and security agencies utilize UAV-mounted LiDAR for surveillance, border security and reconnaissance. It aids in detecting enemy movements, mapping terrain for strategic defense and identifying concealed objects in dense environments. For instance, in July 2023, according to the report published by the Federal Aviation Administration, a US-based transportation agency, the number of active commercial unmanned aerial systems registrations in the USA was 412,342 in 2023. Further, there were around 607,177 active fleets of recreational drones in 2021. Therefore, the growing adoption of UAV drove the growth of the LiDAR market.

Advancements In Smart Traffic Detection Solutions

Leading companies in the LiDAR market are prioritizing the development of smart traffic detection solutions to enhance road safety, optimize traffic flow, and support intelligent transportation systems. These solutions utilize real-time data processing, high-precision object detection, and adaptive signal control to improve urban mobility, minimize congestion, and facilitate autonomous vehicle integration. For instance, in October 2024, Seyond, a US-based developer and manufacturer of LiDAR solutions launched Seyond Intersection Management Platform (SIMPL), a smart traffic detection solution that utilizes LiDAR technology and artificial intelligence to optimize traffic signal controls at intersections. At the core of SIMPL is the Falcon K LiDAR, a high-resolution, long-range sensor that detects vehicles, pedestrians and cyclists in real time while meeting national electrical manufacturers association (NEMA) (TS2) traffic signal controller assembly standard version 2 standards. Using (AI) artificial intelligence-powered analysis, the system processes traffic patterns to dynamically adjust signals, reducing congestion and (CO2) carbon dioxide emissions. Additionally, SIMPL enhances safety at intersections by ensuring accurate detection and enabling timely hazard responses, improving overall traffic flow and urban mobility.

Hesai Technology Co. Ltd. was the largest competitor with an 11.46% share of the market, followed by Ouster Inc. and Hexagon AB (Leica Geosystems).

LiDAR Global Market Opportunities And Strategies To 2034 from The Business Research Company provides the strategists; marketers and senior management with the critical information they need to assess the global LiDAR market as it emerges from the COVID-19 shut down.

Reasons to Purchase

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Understand how the market is being affected by the coronavirus and how it is likely to emerge and grow as the impact of the virus abates.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market research findings.

- Benchmark performance against key competitors.

- Utilize the relationships between key data sets for superior strategizing.

- Suitable for supporting your internal and external presentations with reliable high-quality data and analysis.

Where is the largest and fastest-growing market for LiDAR? How does the market relate to the overall economy; demography and other similar markets? What forces will shape the market going forward? The LiDAR market global report from The Business Research Company answers all these questions and many more.

The report covers market characteristics; size and growth; segmentation; regional and country breakdowns; competitive landscape; market shares; trends and strategies for this market. It traces the market's history and forecasts market growth by geography. It places the market within the context of the wider LiDAR market; and compares it with other markets.

The report covers the following chapters

- Introduction and Market Characteristics: - Brief introduction to the segmentations covered in the market, definitions and explanations about the segment by component, by type, by technology, by applications and by end user.

- Key Trends: - Highlights the major trends shaping the global market. This section also highlights likely future developments in the market.

- Growth Analysis And Strategic Analysis Framework: - Analysis on PESTEL, end use industries, market growth rate, global historic (2019-2024) and forecast (2024-2029, 2034F) market values and drivers and restraints that support and control the growth of the market in the historic and forecast periods, forecast growth contributors and total addressable market (TAM).

- Regional And Country Analysis: - Historic (2019-2024) and forecast (2024-2029, 2034F) market values and growth and market share comparison by region and country.

- Market Segmentation: - Contains the market values (2019-2024) (2024-2029, 2034F) and analysis for each segment by component, by type, by technology, by applications and by end user in the market. Historic (2019-2024) and forecast (2024-2029) and (2029-2034) market values and growth and market share comparison by region market.

- Regional Market Size And Growth: - Regional market size (2024), historic (2019-2024) and forecast (2024-2029, 2034F) market values and growth and market share comparison of countries within the region. This report includes information on all the regions Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa and major countries within each region.

- Competitive Landscape: - Details on the competitive landscape of the market, estimated market shares and company profiles of the leading players.

- Other Major And Innovative: - Companies Details on the company profiles of other major and innovative companies in the market.

- Competitive Benchmarking- Briefs on the financials comparison between major players in the market.

- Competitive Dashboard: - Briefs on competitive dashboard of major players.

- Key Mergers and Acquisitions: - Information on recent mergers and acquisitions in the market covered in the report. This section gives key financial details of mergers and acquisitions, which have shaped the market in recent years.

- Recent Developments: - Information on recent developments in the market covered in the report.

- Market Opportunities And Strategies Describes market opportunities and strategies based on findings of the research, with information on growth opportunities across countries, segments and strategies to be followed in those markets.

- Conclusions And Recommendations This section includes recommendations for LiDAR providers in terms of product/service offerings geographic expansion, marketing strategies and target groups.

- Appendix- This section includes details on the NAICS codes covered, abbreviations and currencies codes used in this report.

Markets Covered:

- 1) By Component: Laser Scanner; Navigation And Positioning Systems; Other Components

- 2) By Type: Terrestrial; Aerial; Satellite

- 3) By Application: Mapping And Cartography; ADAS (Advanced Driver-Assistance System); Environment; Exploration And Detection; Other Applications

- 4) By Technology: 2D; 3D; 4D

- 5) By End User: Defense And Aerospace; Civil Engineering; Archaeology; Automotive; Forestry And Agriculture; Mining; Transportation; Other End User

- Companies Mentioned: Hesai Technology Co. Ltd.; Ouster Inc.; Hexagon AB (Leica Geosystems); Faro Technologies Inc.; Valeo SA.

- Countries: China; Australia; India; Indonesia; Japan; South Korea; USA; Canada; Brazil; France; Germany; UK; Italy; Spain; Russia

- Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

- Time-series: Five years historic and ten years forecast.

- Data: Ratios of market size and growth to related markets; GDP proportions; expenditure per capita; LiDAR indicators comparison.

- Data segmentations: country and regional historic and forecast data; market share of competitors; market segments.

- Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Table of Contents

1 Executive Summary

- 1.1 LiDAR - Market Attractiveness And Macro Economic Landscape

2 Table Of Contents

3 List Of Tables

4 List Of Figures

5 Report Structure

6 Market Characteristics

- 6.1 General Market Definition

- 6.2 Summary

- 6.3 LiDAR Market Definition And Segmentations

- 6.4 Market Segmentation By Component

- 6.4.1 Laser Scanner

- 6.4.2 Navigation And Positioning Systems

- 6.4.3 Other Components

- 6.5 Market Segmentation By Type

- 6.5.1 Terrestrial

- 6.5.2 Aerial

- 6.5.3 Satellite

- 6.6 Market Segmentation By Technology

- 6.6.1 2D

- 6.6.2 3D

- 6.6.3 4D

- 6.7 Market Segmentation By Applications

- 6.7.1 Mapping And Cartography

- 6.7.2 Advanced Driver-Assistance System (ADAS)

- 6.7.3 Environment

- 6.7.4 Exploration And Detection

- 6.7.5 Other Applications

- 6.8 Market Segmentation By End User

- 6.8.1 Defense And Aerospace

- 6.8.2 Civil Engineering

- 6.8.3 Archaeology

- 6.8.4 Automotive

- 6.8.5 Forestry And Agriculture

- 6.8.6 Mining

- 6.8.7 Transportation

- 6.8.8 Other End Users

7 Major Market Trends

- 7.1 Advancements In Smart Traffic Detection Solutions

- 7.2 Revolutionizing UAV-Based LiDAR for Surveying and Mapping Applications

- 7.3 Advancements in High-Resolution Imaging for Enhanced Clarity and Accuracy

- 7.4 Advancements In 4D Lidar Sensors For Enhanced Spatial Awareness

- 7.5 Next-Generation Sensors For Improved LiDAR Performance

- 7.6 Strategic Partnerships Driving Innovation And Growth In The LiDAR Industry

8 Global LiDAR Growth Analysis And Strategic Analysis Framework

- 8.1 Global: PESTEL Analysis

- 8.1.1 Political

- 8.1.2 Economic

- 8.1.3 Social

- 8.1.4 Technological

- 8.1.5 Environmental

- 8.1.6 Legal

- 8.2 Analysis Of End User For B2B Markets

- 8.2.1 Defense And Aerospace

- 8.2.2 Civil Engineering

- 8.2.3 Archaeology

- 8.2.4 Automotive

- 8.2.5 Forestry And Agriculture

- 8.2.6 Mining

- 8.2.7 Transportation

- 8.2.8 Other End Users

- 8.3 Global Market Size and Growth

- 8.4 Market Size

- 8.5 Historic Market Growth, 2019 - 2024, Value ($ Million)

- 8.5.1 Market Drivers 2019 - 2024

- 8.5.2 Market Restraints 2019 - 2024

- 8.6 Forecast Market Growth, 2024 - 2029, 2034F Value ($ Million)

- 8.6.1 Market Drivers 2024 - 2029

- 8.6.2 Market Restraints 2024 - 2029

- 8.7 Forecast Growth Contributors/Factors

- 8.7.1 Quantitative Growth Contributors

- 8.7.2 Drivers

- 8.7.3 Restraints

- 8.8 Global LiDAR Total Addressable Market (TAM)

9 Global LiDAR Market Segmentation

- 9.1 Global LiDAR Market, Segmentation By Component, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 9.2 Global LiDAR Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 9.3 Global LiDAR Market, Segmentation By Technology, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 9.4 Global LiDAR Market, Segmentation By Applications, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 9.5 Global LiDAR Market, Segmentation By End User, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 9.6 Global LiDAR Market, Sub-Segmentation Of Laser Scanner, By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 9.7 Global LiDAR Market, Sub-Segmentation By Navigation And Positioning Systems, By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 9.8 Global LiDAR Market, Sub-Segmentation By Other Components, By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

10 LiDAR Market, Regional and Country Analysis

- 10.1 Global LiDAR Market, By Region, Historic and Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 10.2 Global LiDAR Market, By Country, Historic and Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

11 Asia-Pacific Market

- 11.1 Summary

- 11.2 Market Overview

- 11.2.1 Region Information

- 11.2.2 Market Information

- 11.2.3 Background Information

- 11.2.4 Government Initiatives

- 11.2.5 Regulations

- 11.2.6 Regulatory Bodies

- 11.2.7 Major Associations

- 11.2.8 Taxes Levied

- 11.2.9 Corporate Tax Structure

- 11.2.10 Investments

- 11.2.11 Major Companies

- 11.3 Asia-Pacific LiDAR Market, Segmentation By Component, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.4 Asia-Pacific LiDAR Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.5 Asia-Pacific LiDAR Market, Segmentation By Technology, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.6 Asia-Pacific LiDAR Market: Country Analysis

- 11.7 China Market

- 11.8 Summary

- 11.9 Market Overview

- 11.9.1 Country Information

- 11.9.2 Market Information

- 11.9.3 Background Information

- 11.9.4 Government Initiatives

- 11.9.5 Regulations

- 11.9.6 Regulatory Bodies

- 11.9.7 Major Associations

- 11.9.8 Taxes Levied

- 11.9.9 Corporate Tax Structure

- 11.9.10 Investments

- 11.9.11 Major Companies

- 11.10 China LiDAR Market, Segmentation By Component, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.11 China LiDAR Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.12 China LiDAR Market, Segmentation By Technology, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.13 India Market

- 11.14 India LiDAR Market, Segmentation By Component, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.15 India LiDAR Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.16 India LiDAR Market, Segmentation By Technology, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.17 Japan Market

- 11.18 Summary

- 11.19 Market Overview

- 11.19.1 Country Information

- 11.19.2 Market Information

- 11.19.3 Background Information

- 11.19.4 Government Initiatives

- 11.19.5 Regulations

- 11.19.6 Regulatory Bodies

- 11.19.7 Major Associations

- 11.19.8 Taxes Levied

- 11.19.9 Corporate Tax Structure

- 11.19.10 Investments

- 11.19.11 Major Companies

- 11.20 Japan LiDAR Market, Segmentation By Component, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.21 Japan LiDAR Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.22 Japan LiDAR Market, Segmentation By Technology, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.23 Australia Market

- 11.24 Australia LiDAR Market, Segmentation By Component, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.25 Australia LiDAR Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.26 Australia LiDAR Market, Segmentation By Technology, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.27 Indonesia Market

- 11.28 Indonesia LiDAR Market, Segmentation By Component, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.29 Indonesia LiDAR Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.30 Indonesia LiDAR Market, Segmentation By Technology, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.31 South Korea Market

- 11.32 Summary

- 11.33 Market Overview

- 11.33.1 Country Information

- 11.33.2 Market Information

- 11.33.3 Background Information

- 11.33.4 Government Initiatives

- 11.33.5 Regulations

- 11.33.6 Regulatory Bodies

- 11.33.7 Major Associations

- 11.33.8 Taxes Levied

- 11.33.9 Corporate Tax Structure

- 11.33.10 Investments

- 11.33.11 Major Companies

- 11.34 South Korea LiDAR Market, Segmentation By Component, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.35 South Korea LiDAR Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.36 South Korea LiDAR Market, Segmentation By Technology, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

12 Western Europe Market

- 12.1 Summary

- 12.2 Market Overview

- 12.2.1 Region Information

- 12.2.2 Market Information

- 12.2.3 Background Information

- 12.2.4 Government Initiatives

- 12.2.5 Regulations

- 12.2.6 Regulatory Bodies

- 12.2.7 Major Associations

- 12.2.8 Taxes Levied

- 12.2.9 Corporate tax structure

- 12.2.10 Investments

- 12.2.11 Major Companies

- 12.3 Western Europe LiDAR Market, Segmentation By Component, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.4 Western Europe LiDAR Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.5 Western Europe LiDAR Market, Segmentation By Technology, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.6 Western Europe LiDAR Market: Country Analysis

- 12.7 UK Market

- 12.8 UK LiDAR Market, Segmentation By Component, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.9 UK LiDAR Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.10 UK LiDAR Market, Segmentation By Technology, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.11 Germany Market

- 12.12 Germany LiDAR Market, Segmentation By Component, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.13 Germany LiDAR Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.14 Germany LiDAR Market, Segmentation By Technology, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.15 France Market

- 12.16 France LiDAR Market, Segmentation By Component, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.17 France LiDAR Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.18 France LiDAR Market, Segmentation By Technology, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.19 Italy Market

- 12.20 Italy LiDAR Market, Segmentation By Component, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.21 Italy LiDAR Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.22 Italy LiDAR Market, Segmentation By Technology, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.23 Spain Market

- 12.24 Spain LiDAR Market, Segmentation By Component, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.25 Spain LiDAR Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.26 Spain LiDAR Market, Segmentation By Technology, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

13 Eastern Europe Market

- 13.1 Summary

- 13.2 Market Overview

- 13.2.1 Region Information

- 13.2.2 Market Information

- 13.2.3 Background Information

- 13.2.4 Government Initiatives

- 13.2.5 Regulations

- 13.2.6 Regulatory Bodies

- 13.2.7 Major Associations

- 13.2.8 Taxes Levied

- 13.2.9 Corporate Tax Structure

- 13.2.10 Investments

- 13.2.11 Major Companies

- 13.3 Eastern Europe LiDAR Market, Segmentation By Component, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 13.4 Eastern Europe LiDAR Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 13.5 Eastern Europe LiDAR Market, Segmentation By Technology, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 13.6 Eastern Europe LiDAR Market: Country Analysis

- 13.7 Russia Market

- 13.8 Russia LiDAR Market, Segmentation By Component, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 13.9 Russia LiDAR Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 13.10 Russia LiDAR Market, Segmentation By Technology, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

14 North America Market

- 14.1 Summary

- 14.2 Market Overview

- 14.2.1 Region Information

- 14.2.2 Market Information

- 14.2.3 Background Information

- 14.2.4 Government Initiatives

- 14.2.5 Regulations

- 14.2.6 Regulatory Bodies

- 14.2.7 Major Associations

- 14.2.8 Taxes Levied

- 14.2.9 Corporate Tax Structure

- 14.2.10 Investments

- 14.2.11 Major Companies

- 14.3 North America LiDAR Market, Segmentation By Component, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 14.4 North America LiDAR Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 14.5 North America LiDAR Market, Segmentation By Technology, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 14.6 North America LiDAR Market: Country Analysis

- 14.7 USA Market

- 14.8 Summary

- 14.9 Market Overview

- 14.9.1 Country Information

- 14.9.2 Market Information

- 14.9.3 Background Information

- 14.9.4 Government Initiatives

- 14.9.5 Regulations

- 14.9.6 Regulatory Bodies

- 14.9.7 Major Associations

- 14.9.8 Taxes Levied

- 14.9.9 Corporate Tax Structure

- 14.9.10 Investments

- 14.9.11 Major Companies

- 14.10 USA LiDAR Market, Segmentation By Component, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 14.11 USA LiDAR Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 14.12 USA LiDAR Market, Segmentation By Technology, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 14.13 Canada Market

- 14.14 Summary

- 14.15 Market Overview

- 14.15.1 Region Information

- 14.15.2 Market Information

- 14.15.3 Background Information

- 14.15.4 Government Initiatives

- 14.15.5 Regulations

- 14.15.6 Regulatory Bodies

- 14.15.7 Major Associations

- 14.15.8 Taxes Levied

- 14.15.9 Corporate Tax Structure

- 14.15.10 Investments

- 14.15.11 Major Companies

- 14.16 Canada LiDAR Market, Segmentation By Component, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 14.17 Canada LiDAR Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 14.18 Canada LiDAR Market, Segmentation By Technology, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

15 South America Market

- 15.1 Summary

- 15.2 Market Overview

- 15.2.1 Region Information

- 15.2.2 Market Information

- 15.2.3 Background Information

- 15.2.4 Government Initiatives

- 15.2.5 Regulations

- 15.2.6 Regulatory Bodies

- 15.2.7 Major Associations

- 15.2.8 Taxes Levied

- 15.2.9 Corporate Tax Structure

- 15.2.10 Investments

- 15.2.11 Major Companies

- 15.3 South America LiDAR Market, Segmentation By Component, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 15.4 South America LiDAR Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 15.5 South America LiDAR Market, Segmentation By Technology, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 15.6 South America LiDAR Market: Country Analysis

- 15.7 Brazil Market

- 15.8 Brazil LiDAR Market, Segmentation By Component, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 15.9 Brazil LiDAR Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 15.10 Brazil LiDAR Market, Segmentation By Technology, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

16 Middle East Market

- 16.1 Summary

- 16.2 Market Overview

- 16.2.1 Region Information

- 16.2.2 Market Information

- 16.2.3 Background Information

- 16.2.4 Government Initiatives

- 16.2.5 Regulations

- 16.2.6 Regulatory Bodies

- 16.2.7 Major Associations

- 16.2.8 Taxes Levied

- 16.2.9 Corporate Tax Structure

- 16.2.10 Investments

- 16.2.11 Major Companies

- 16.3 Middle East LiDAR Market, Segmentation By Component, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 16.4 Middle East LiDAR Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 16.5 Middle East LiDAR Market, Segmentation By Technology, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

17 Africa Market

- 17.1 Summary

- 17.2 Market Overview

- 17.2.1 Region Information

- 17.2.2 Market Information

- 17.2.3 Background Information

- 17.2.4 Government Initiatives

- 17.2.5 Regulations

- 17.2.6 Regulatory Bodies

- 17.2.7 Major Associations

- 17.2.8 Taxes Levied

- 17.2.9 Corporate Tax Structure

- 17.2.10 Investments

- 17.2.11 Major Companies

- 17.3 Africa LiDAR Market, Segmentation By Component, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 17.4 Africa LiDAR Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 17.5 Africa LiDAR Market, Segmentation By Technology, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

18 Competitive Landscape And Company Profiles

- 18.1 Company Profiles

- 18.2 Hesai Technology Co. Ltd.

- 18.2.1 Company Overview

- 18.2.2 Products And Services

- 18.2.3 Business Strategy

- 18.2.4 Financial Overview

- 18.3 Ouster Inc.

- 18.3.1 Company Overview

- 18.3.2 Products And Services

- 18.3.3 Business Strategy

- 18.3.4 Financial Overview

- 18.4 Hexagon AB (Leica Geosystems)

- 18.4.1 Company Overview

- 18.4.2 Products And Services

- 18.4.3 Business Strategy

- 18.4.4 Financial Overview

- 18.5 Faro Technologies Inc.

- 18.5.1 Company Overview

- 18.5.2 Products And Services

- 18.5.3 Financial Overview

- 18.6 Valeo SA

- 18.6.1 Company Overview

- 18.6.2 Products And Services

- 18.6.3 Business Strategy

- 18.6.4 Financial Overview

19 Other Major And Innovative Companies

- 19.1 Sick AG

- 19.1.1 Company Overview

- 19.1.2 Products And Services

- 19.2 Luminar Technologies Inc.

- 19.2.1 Company Overview

- 19.2.2 Products And Services

- 19.3 Teledyne Technologies Inc.

- 19.3.1 Company Overview

- 19.3.2 Products And Services

- 19.4 Innoviz Technologies Ltd.

- 19.4.1 Company Overview

- 19.4.2 Products And Services

- 19.5 Aerometrex Ltd.

- 19.5.1 Company Overview

- 19.5.2 Products And Services

- 19.6 Trimble Inc.

- 19.6.1 Company Overview

- 19.6.2 Products And Services

- 19.7 Benewake (Beijing) Co. Ltd.

- 19.7.1 Company Overview

- 19.8 Quanergy Systems Inc.

- 19.8.1 Company Overview

- 19.8.2 Products And Services

- 19.9 Topcon Positioning Systems Inc.

- 19.9.1 Company Overview

- 19.9.2 Products And Services

- 19.10 LeddarTech Inc.

- 19.10.1 Company Overview

- 19.10.2 Products And Services

- 19.11 Microvision Inc.

- 19.11.1 Company Overview

- 19.11.2 Products And Services

- 19.12 Waymo LLC

- 19.12.1 Company Overview

- 19.12.2 Products And Services

- 19.13 RoboSense Technology Co. Ltd.

- 19.13.1 Company Overview

- 19.13.2 Products And Services

- 19.14 Aeva Technologies Inc.

- 19.14.1 Company Overview

- 19.14.2 Products And Services

- 19.15 AEye Inc.

- 19.15.1 Company Overview

- 19.15.2 Products And Services

20 Competitive Benchmarking

21 Competitive Dashboard

22 Key Mergers And Acquisitions

- 22.1 Koito Manufacturing Co., Ltd Acquired Cepton

- 22.2 Sanborn Map Company Acquired VeridaaS Corporation

- 22.3 FARO Technologies Acquired SiteScape

- 22.4 Velodyne Lidar Inc. Acquired Topodrone

23 Recent Developments In The LiDAR Market

- 23.1 Strategic Partnership For LiDAR And 3D Sensing Innovation

- 23.2 Advanced Laser Line Scanner For Industrial Automation

- 23.3 Revolutionizing Real-Time Object Detection With FMCW Technology

- 23.4 Advancing L4 Autonomous Driving With High-Precision LiDAR

- 23.5 Next-Generation LiDAR Drone For High-Precision Mapping

24 Opportunities And Strategies

- 24.1 Global LiDAR Market In 2029 - Countries Offering Most New Opportunities

- 24.2 Global LiDAR Market In 2029 - Segments Offering Most New Opportunities

- 24.3 Global LiDAR Market In 2029 - Growth Strategies

- 24.3.1 Market Trend Based Strategies

- 24.3.2 Competitor Strategies

25 LiDAR Market, Conclusions And Recommendations

- 25.1 Conclusions

- 25.2 Recommendations

- 25.2.1 Product

- 25.2.2 Place

- 25.2.3 Price

- 25.2.4 Promotion

- 25.2.5 People

26 Appendix

- 26.1 Geographies Covered

- 26.2 Market Data Sources

- 26.3 Research Methodology

- 26.4 Currencies

- 26.5 The Business Research Company

- 26.6 Copyright and Disclaimer