|

|

市場調査レポート

商品コード

1427276

フリートマネジメントの世界市場:コンポーネント別、フリートタイプ別、業界別、地域別 - 予測(~2028年)Fleet Management Market by Component (Services, Solutions (Operation Management, Vehicle Maintenance & Diagnostics, Performance Management)), Fleet Type (Commercial Fleets, Passenger Vehicles), Vertical and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| フリートマネジメントの世界市場:コンポーネント別、フリートタイプ別、業界別、地域別 - 予測(~2028年) |

|

出版日: 2024年02月13日

発行: MarketsandMarkets

ページ情報: 英文 309 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

世界のフリートマネジメントの市場規模は、2023年に286億米ドル、2028年までに556億米ドルに達し、CAGRで14.2%の成長が予測されています。

テレマティクスデータを保険プロセスに組み込むことは、フリートマネジメント市場の拡大に対する根本的なカタリストとして機能します。車両の位置、ドライバーの行動、全体的なパフォーマンスに関するリアルタイムの情報を保険モデルにシームレスに組み込むことで、企業は利用ベース保険(UBI)モデルを開発することができます。この戦略的統合は、フリート運行企業が包括的なフリートマネジメントソリューションを採用する強力な促進要因となります。一般的な指標ではなく、実際の運転行動や特定の危険因子によって決定される保険料削減の可能性は、説得力のある動機付けとして機能します。企業がコストの最適化と業務効率の向上を目指す中、UBIモデルによる保険費用の削減が見込まれることから、先進のフリートマネジメントソリューションの普及が促進され、市場全体の成長に寄与しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2018年~2028年 |

| 基準年 | 2022年 |

| 予測期間 | 2023年~2028年 |

| 単位 | 10億米ドル |

| セグメント | ソリューション別、サービス別、フリートタイプ別、業界別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、中東・アフリカ、ラテンアメリカ |

「予測期間に商用フリートセグメントが最大の市場規模を維持する見込みです。」

リアルタイムの車両モニタリングとデータ転送の提供により、フリートマネジメントソリューションは大規模な商用フリートを管理する上で極めて重要であり、迅速な対応と定時配送を保証します。これらのシステムは、安全性の向上、効果的なナビゲーション、規制遵守のモニタリングに向け、ドライバー支援技術とGPS追跡を組み合わせています。フリートマネジメントシステムは、持続可能性目標に沿ったハイブリッド車や電気自動車の統合を可能にすることで、環境にやさしい輸送への移行をサポートします。

「予測期間にサービスセグメントがもっとも速い成長率を記録します。」

フリートマネジメントサービスは、導入、サポート、メンテナンスといった専門的な技術に加え、マネージドサービスを含む包括的な一連のソリューションを提供します。データセキュリティへの懸念の高まりを受け、サポート・メンテナンスサービスへの需要が急増しています。これらのサービスは、フリートマネジメントシステムの堅牢性を強化する上で極めて重要な役割を果たし、潜在的な脅威から機密情報を保護する差し迫ったニーズに対応しています。デジタル情勢が進化するにつれ、企業はフリートデータの完全性とセキュリティを維持することの重要性を認識しています。サポート・メンテナンスサービスは、これらのシステムの継続的な機能を確保し、リスクを軽減し、潜在的なサイバーセキュリティの課題から保護する予防的な防御メカニズムとして機能します。データセキュリティに対するこのような関心の高まりは、包括的なソリューションが効率性とサイバーセキュリティのレジリエンスという2つの目的を満たすように調整される、フリートマネジメントサービスの進化した性質を強調しています。

「予測期間にアジア太平洋がもっとも高い成長率となります。」

アジア太平洋では、オンラインショッピングやeコマースプラットフォームの急激な成長により、効率的な配送サービスへの需要が高まっており、ロジスティクスと輸送の最適化におけるフリートマネジメントソリューションの重要性が浮き彫りになっています。同地域では、道路網やスマート交通システムを含むインフラへの戦略的投資が行われており、フリートマネジメント技術の普及を後押ししています。この発展は、全体的な接続性を高めるだけでなく、綿密なロジスティクス計画にも寄与しています。さらに、中間層の急増と可処分所得の増加が、自動車所有の顕著な増加に拍車をかけています。企業も個人も同様に、ダイナミックなアジア太平洋市場で増大するフリートを管理し最適化するための合理的かつ効果的な手段を求めているためです。

当レポートでは、世界のフリートマネジメント市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- フリートマネジメント市場の企業にとっての機会

- フリートマネジメント市場:コンポーネント別

- フリートマネジメント市場:フリートタイプ別

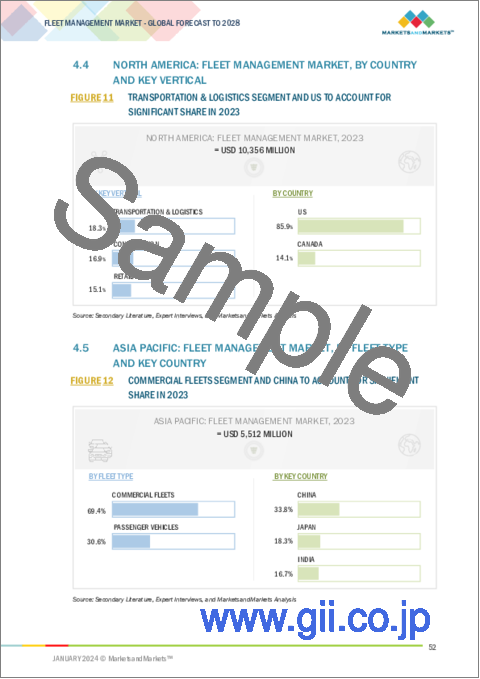

- 北米のフリートマネジメント市場:国別、主要業界別

- アジア太平洋のフリートマネジメント市場:フリートタイプ別、主要国別

第5章 市場の概要

- 市場の概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- フリートマネジメント市場の進化

- バリューチェーン分析

- エコシステム分析

- ケーススタディ分析

- フリートマネジメント市場の技術ロードマップ

- 短期(2023年~2025年)

- 中期(2026年~2028年)

- 長期(2029年~2030年)

- 技術分析

- 主な技術

- 補完技術

- 関連技術

- 特許分析

- 平均販売価格の動向

- 主要企業の平均販売価格の動向:ソリューション別

- 主要企業の平均販売価格の動向:サブスクリプションベースソフトウェア別

- 主な会議とイベント

- 関税と規制情勢

- フリートマネジメントデバイスに関連する関税

- 規制機関、政府機関、その他の組織

- 北米

- 欧州

- アジア太平洋

- HSコード:レーダー、航行用無線機器及び無線遠隔制御機器(8526)

- HSコード:8526の輸出シナリオ

- HSコード:8526の輸入シナリオ

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- 顧客のビジネスに影響を与える動向/混乱

- フリートマネジメントの問題点の分析

- コンプライアンスマネジメント

- ドライバーマネジメント

- エラーの削減

- 燃料コストの最適化

- メンテナンススケジュールマネジメント

第6章 フリートマネジメント市場:コンポーネント別

- イントロダクション

- ソリューション

- 成長を促進する、集中管理による業務効率化へのニーズの高まり

- 業務管理

- 車両のメンテナンス・診断

- パフォーマンスマネジメント

- フリートアナリティクス・レポート

- コンプライアンスマネジメント

- その他のソリューション

- サービス

- 市場拡大を促進する、運航の合理化に向けたフリートマネジメントサービスに対する需要の増大

- プロフェッショナルサービス

- マネージドサービス

第7章 フリートマネジメント市場:フリートタイプ別

- イントロダクション

- 商用フリート

- 商用フリートの需要を促進する、急速な都市化と道路インフラの改善、規制政策

- LCV

- M&HCV

- 乗用車

- 乗用車の需要を促進する、フリート運行の完全な制御の重視

- ICE

- EV

第8章 フリートマネジメント市場:業界別

- イントロダクション

- 小売

- 医療・医薬品

- 建設

- 輸送・ロジスティクス

- 公共事業

- 石油・ガス、鉱業

- 政府

- その他の業界

第9章 フリートマネジメント市場:地域別

- イントロダクション

- 北米

- 北米のフリートマネジメント市場の促進要因

- 北米の不況の影響

- 米国

- カナダ

- 欧州

- 欧州のフリートマネジメント市場の促進要因

- 欧州の不況の影響

- 英国

- ドイツ

- イタリア

- フランス

- スペイン

- その他の欧州

- アジア太平洋

- アジア太平洋のフリートマネジメント市場の促進要因

- アジア太平洋の不況の影響

- 中国

- インド

- 日本

- オーストラリア・ニュージーランド

- その他のアジア太平洋

- 中東・アフリカ

- 中東・アフリカのフリートマネジメント市場の促進要因

- 中東・アフリカの不況の影響

- GCC諸国

- 南アフリカ

- その他の中東・アフリカ

- ラテンアメリカ

- ラテンアメリカのフリートマネジメント市場の促進要因

- ラテンアメリカの不況の影響

- ブラジル

- メキシコ

- その他のラテンアメリカ

第10章 競合情勢

- イントロダクション

- 主要企業戦略/有力企業

- 収益分析

- 市場シェア分析

- 主要企業ランキング

- 企業の評価マトリクス

- スタートアップ/中小企業の評価マトリクス

- 競合シナリオと動向

- フリートマネジメント製品のベンチマーク

- 主なフリートマネジメントベンダーの評価と財務指標

第11章 企業プロファイル

- 主要企業

- VERIZON CONNECT

- TRIMBLE

- GEOTAB

- WHEELS

- SAMSARA

- BRIDGESTONE

- INSEEGO

- SOLERA

- TELETRAC NAVMAN

- HOLMAN

- ORBCOMM

- MIX TELEMATICS

- VERRA MOBILITY

- CHEVIN

- ZEBRA TECHNOLOGIES

- MOTIVE

- MICHELIN

- スタートアップ/中小企業

- GPS INSIGHT

- CLEARPATHGPS

- FLEET COMPLETE

- GURTAM

- AUTOMILE

- VIA TRANSPORTATION

- FLEETROOT

- RUPTELA

- FREEWAY FLEET SYSTEMS

第12章 隣接/関連市場

- イントロダクション

- スマート交通市場

- 市場の定義

- 市場の概要

- 交通管理システム市場

- 市場の定義

- 市場の概要

第13章 付録

The fleet management market is estimated at USD 28.6 billion in 2023 to USD 55.6 billion by 2028, at a Compound Annual Growth Rate (CAGR) of 14.2%. The incorporation of telematics data into insurance processes serves as a fundamental catalyst for the expansion of the fleet management market. By seamlessly incorporating real-time information on vehicle location, driver behavior, and overall performance into insurance models, companies can develop usage-based insurance (UBI) models. This strategic integration provides a strong incentive for fleet operators to embrace comprehensive fleet management solutions. The potential for reduced insurance premiums, determined by actual driving behavior and specific risk factors rather than generic metrics, serves as a compelling motivator. As businesses seek to optimize costs and improve operational efficiency, the promise of lower insurance expenses through UBI models encourages widespread adoption of advanced fleet management solutions, contributing to the market's overall growth.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2018-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | Value (USD Billion) |

| Segments | By Solution, Services, Fleet Type Verticals, and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

"The commercial fleet segment is expected to hold the largest market size during the forecast period." City buses, motor coaches, ambulances, and long-haul delivery trucks are all part of the diversified commercial vehicle sector landscape, which includes both Light Commercial Vehicles (LCVs) and Medium and Heavy Commercial Vehicles (M&HCVs). By offering real-time vehicle monitoring and data transfer, fleet management solutions are crucial in managing large commercial fleets, guaranteeing quicker response times and on-time deliveries. These systems combine driver assistance technology with GPS tracking for increased safety, effective navigation, and regulatory compliance monitoring. Fleet management systems support the transition to environmentally friendly transportation by enabling the integration of hybrid and electric cars in line with sustainability objectives.

"The services segment to register the fastest growth rate during the forecast period." Fleet management services offer a comprehensive suite of solutions, encompassing managed services alongside specialized expertise such as implementation, support, and maintenance. In response to the escalating data security concerns, the demand for support and maintenance services has surged. These services play a pivotal role in fortifying the robustness of fleet management systems, addressing the pressing need to shield sensitive information from potential threats. As the digital landscape evolves, businesses recognize the critical importance of maintaining the integrity and security of their fleet data. Support and maintenance services ensure these systems' continuous functionality and act as a proactive defense mechanism, mitigating risks and safeguarding against potential cybersecurity challenges. This heightened focus on data security underscores the evolving nature of fleet management services, where comprehensive solutions are tailored to meet the dual objectives of efficiency and cybersecurity resilience.

"Asia Pacific's highest growth rate during the forecast period."

In the Asia Pacific region, the exponential growth of online shopping and e-commerce platforms has generated a demand for efficient delivery services, underscoring the significance of fleet management solutions in optimizing logistics and transportation. The region's strategic investments in infrastructure, encompassing road networks and smart transportation systems, catalyze the widespread adoption of fleet management technologies. This development not only enhances overall connectivity but also contributes to meticulous logistics planning. Furthermore, the burgeoning middle class and escalating disposable income have fueled a notable increase in vehicle ownership. This surge, both in commercial and personal vehicles, presents a compelling opportunity for expanding fleet management solutions, as businesses and individuals alike seek streamlined and effective means to manage and optimize their growing fleets in the dynamic Asia Pacific market.

In-depth interviews have been conducted with chief executive officers (CEOs), Directors, and other executives from various key organizations operating in the fleet management market.

- By Company Type: Tier 1 - 35%, Tier 2 - 45%, and Tier 3 - 20%

- By Designation: C-level -35%, D-level - 25%, and Others - 40%

- By Region: North America - 30%, Europe - 30%, Asia Pacific - 25%, Latin America- 5%, and Middle East & Africa - 10%,

The major players in the fleet management market are Geotab (Canada), Verizon Connect (US), Bridgestone Group (Japan), Trimble (US), Samsara (US), Wheels (US), Inseego (US), Solera Group (US), Verra Mobility (US), Teletrac Navman (US), Holman (US), Orbcomm (US), Mix Telematics (South Africa), Zebra Technologies (US), Motive (US), Chevin (UK), GPS Insight (US), Michelin (France), ClearpathGPS (US), Fleetcomplete (Canada), Gurtam (Belarus), Automile (US), VIA (Israel), Fleetroot (UAE), Ruptela (Lithuania), Freeway Fleet (UK). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches, enhancements, and acquisitions to expand their fleet management market footprint.

Research Coverage

The market study covers the fleet management market size across different segments. It aims at estimating the market size and the growth potential across different segments, including solution (operations management, vehicle maintenance and diagnostics, performance management, fleet analytics and reporting, compliance management, other solutions), services (professional services, managed services), by fleet type (commercial fleets, passenger vehicles) verticals (retail, transportation & logistics, healthcare & pharmaceuticals, construction, utilities, oil, gas and mining, government, other verticals ) and Region (North America, Europe, Asia Pacific, Middle East & Africa, and Latin America). The study includes an in-depth competitive analysis of the leading market players, their company profiles, key observations related to product and business offerings, recent developments, and market strategies.

Key Benefits of Buying the Report

The report will help the market leaders/new entrants with information on the closest approximations of the global fleet management market's revenue numbers and subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. Moreover, the report will provide insights for stakeholders to understand the market's pulse and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

1. Analysis of key drivers (To enhance the safety and security of workers and monitor driver behavior will drive the market, increasing focus of fleet owners on operational efficiency, increasing adoption of cloud-based, analytical solutions to manage field vehicles, declining hardware and IoT connectivity costs, Strict government mandates creating new revenue streams

for vendors) restraints(Atmospheric interference causing problems for GPS connectivity), opportunities (Development of transportation in the logistics industry and growth in fleet size, development of communication networks through 5G, harnessing telematics data for making informed business decisions, introduction of autonomous fleets to provide multiple partnership opportunities, Mobility-as-a-service to provide new revenue streams, fleet integration with artificial intelligence extends profitable opportunities to market players), and challenges( Inaccurate geocoding, driver safety and productivity affecting vehicle uptime, lack of network connectivity in the non-terrestrial areas, rapidly growing data volumes and increasing cyber threats) influencing the growth of the fleet management market.

2. Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and new product and service launches in the fleet management market.

3. Market Development: Comprehensive information about lucrative markets - the report analyses the fleet management market across various regions.

4. Market Diversification: Exhaustive information about new products and services, untapped geographies, recent developments, and investments in the fleet management market.

5. Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading Geotab (Canada), Verizon Connect (US), Bridgestone Group (Japan), Trimble (US), Samsara (US), Wheels (US), Inseego (US), Solera Group (US), Verra Mobility (US), Teletrac Navman (US), Holman (US), Orbcomm (US), Mix Telematics (South Africa), Zebra Technologies (US), Motive (US), Chevin (UK), GPS Insight (US), Michelin (France), ClearpathGPS (US), Fleetcomplete (Canada), Gurtam (Belarus), Automile (US), VIA (Israel), Fleetroot (UAE), Ruptela (Lithuania), Freeway Fleet (UK).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS & EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES, 2020-2022

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

- 1.8 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 FLEET MANAGEMENT MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews with experts

- 2.1.2.2 Breakup of primary profiles

- 2.1.2.3 List of key primary interview participants

- 2.1.2.4 Key industry insights

- 2.2 MARKET BREAKUP AND DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- FIGURE 2 BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- FIGURE 3 TOP-DOWN APPROACH

- 2.4 MARKET SIZE ESTIMATION: SUPPLY-SIDE ANALYSIS

- FIGURE 4 FLEET MANAGEMENT MARKET SIZE ESTIMATION: SUPPLY-SIDE ANALYSIS (1/2)

- FIGURE 5 FLEET MANAGEMENT MARKET SIZE ESTIMATION: SUPPLY-SIDE ANALYSIS (2/2)

- 2.5 MARKET SIZE ESTIMATION: DEMAND-SIDE ANALYSIS

- FIGURE 6 FLEET MANAGEMENT MARKET SIZE ESTIMATION: DEMAND-SIDE ANALYSIS

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 RISK ASSESSMENT

- 2.8 LIMITATIONS

- 2.9 IMPACT OF RECESSION ON FLEET MANAGEMENT MARKET

3 EXECUTIVE SUMMARY

- FIGURE 7 LEADING SEGMENTS IN FLEET MANAGEMENT MARKET

4 PREMIUM INSIGHTS

- 4.1 OPPORTUNITIES FOR PLAYERS IN FLEET MANAGEMENT MARKET

- FIGURE 8 STRICT REGULATORY MANDATES IN NORTH AMERICA AND EUROPE TO DRIVE MARKET GROWTH

- 4.2 FLEET MANAGEMENT MARKET, BY COMPONENT

- FIGURE 9 SERVICES SEGMENT TO REGISTER HIGHER GROWTH RATE DURING FORECAST PERIOD

- 4.3 FLEET MANAGEMENT MARKET, BY FLEET TYPE

- FIGURE 10 COMMERCIAL FLEETS SEGMENT TO LEAD MARKET IN 2023

- 4.4 NORTH AMERICA: FLEET MANAGEMENT MARKET, BY COUNTRY AND KEY VERTICAL

- FIGURE 11 TRANSPORTATION & LOGISTICS SEGMENT AND US TO ACCOUNT FOR SIGNIFICANT SHARE IN 2023

- 4.5 ASIA PACIFIC: FLEET MANAGEMENT MARKET, BY FLEET TYPE AND KEY COUNTRY

- FIGURE 12 COMMERCIAL FLEETS SEGMENT AND CHINA TO ACCOUNT FOR SIGNIFICANT SHARE IN 2023

5 MARKET OVERVIEW

- 5.1 MARKET OVERVIEW

- 5.2 MARKET DYNAMICS

- FIGURE 13 FLEET MANAGEMENT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Need for enhancing safety and security of workers and monitoring driver behavior

- 5.2.1.2 Rising focus of fleet owners on operational efficiency

- 5.2.1.3 Increasing adoption of cloud-based, analytical solutions to manage field vehicles

- 5.2.1.4 Declining hardware and IoT connectivity costs

- 5.2.1.5 Emphasis on creating new revenue streams for vendors

- 5.2.2 RESTRAINTS

- 5.2.2.1 Atmospheric interference hampering GPS connectivity

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Development of transportation in logistics industry and growth in fleet size

- 5.2.3.2 Development of communication networks through 5G

- 5.2.3.3 Harnessing telematics data for making informed business decisions

- 5.2.3.4 Introduction of autonomous fleets to provide multiple partnership opportunities

- 5.2.3.5 Mobility-as-a-Service to provide new revenue streams

- 5.2.3.6 Fleet integration with artificial intelligence to extend profitable opportunities to market players

- 5.2.4 CHALLENGES

- 5.2.4.1 Inaccurate geocoding

- 5.2.4.2 Driver safety and productivity affecting vehicle uptime

- 5.2.4.3 Lack of network connectivity in non-terrestrial areas

- 5.2.4.4 Rapidly growing data volumes and increasing cyber threats

- 5.2.4.5 Lack of awareness regarding fleet management solutions and slow adaptability among developing countries

- 5.3 FLEET MANAGEMENT MARKET EVOLUTION

- FIGURE 14 EVOLUTION OF FLEET MANAGEMENT SOLUTIONS

- 5.4 VALUE CHAIN ANALYSIS

- FIGURE 15 VALUE CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- FIGURE 16 KEY PLAYERS IN FLEET MANAGEMENT MARKET ECOSYSTEM

- TABLE 2 ROLE OF PLAYERS IN MARKET ECOSYSTEM

- 5.6 CASE STUDY ANALYSIS

- 5.6.1 GEOTAB HELPED SOLARIS OILFIELD INFRASTRUCTURE PERFORM REAL-TIME VEHICLE TRACKING

- 5.6.2 FLEETIO HELPED UNIFIED GOVERNMENT OF WYANDOTTE COUNTY AND KANSAS CITY REDUCE OPERATIONAL COSTS AND INCREASE VEHICLE EFFICIENCY

- 5.6.3 DAYTON FREIGHT PARTNERED WITH OMNITRACS TO AUTOMATE CRITICAL MANUAL PROCEDURES

- 5.6.4 T.E. ROBERTS LEVERAGED FLEET VISIBILITY TO PREVENT UNNECESSARY DOWNTIME

- 5.6.5 FLEETIO HELPED SCOBEE POWERLINE CONSTRUCTION TO STREAMLINE DOCUMENTATION AND COMMUNICATIONS

- 5.6.6 INSEEGO HELPED NORTHUMBRIAN WATER LIMITED TO IMPROVE OPERATIONAL EFFICIENCY AND DRIVER BEHAVIOR

- 5.7 TECHNOLOGY ROADMAP FOR FLEET MANAGEMENT MARKET

- 5.7.1 SHORT-TERM (2023-2025):

- 5.7.2 MID-TERM (2026-2028):

- 5.7.3 LONG-TERM (2029-2030):

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Big data and analytics

- 5.8.1.2 Artificial intelligence

- 5.8.1.3 5G

- 5.8.1.4 Internet of things

- 5.8.1.5 Blockchain

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Robotics and automation

- 5.8.2.2 Cloud computing

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 Advanced Driver-Assistance Systems (ADASs)

- 5.8.3.2 Telematics and connectivity

- 5.8.1 KEY TECHNOLOGIES

- 5.9 PATENT ANALYSIS

- 5.9.1 METHODOLOGY

- FIGURE 17 LIST OF MAJOR PATENTS IN FLEET MANAGEMENT

- TABLE 3 LIST OF MAJOR PATENTS

- 5.10 AVERAGE SELLING PRICE TREND

- 5.10.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY SOLUTION

- FIGURE 18 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY SOLUTION (USD PER VEHICLE/MONTH)

- TABLE 4 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY SOLUTION (USD PER VEHICLE/MONTH)

- 5.10.2 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY SUBSCRIPTION-BASED SOFTWARE

- TABLE 5 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY SUBSCRIPTION-BASED FLEET MANAGEMENT SOFTWARE

- 5.11 KEY CONFERENCES & EVENTS

- TABLE 6 LIST OF KEY CONFERENCES & EVENTS, 2023-2024

- 5.12 TARIFFS AND REGULATORY LANDSCAPE

- 5.12.1 TARIFFS RELATED TO FLEET MANAGEMENT DEVICES

- TABLE 7 TARIFFS RELATED TO RADAR APPARATUS, RADIO NAVIGATIONAL AID APPARATUS, AND RADIO REMOTE CONTROL APPARATUS

- 5.12.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12.3 NORTH AMERICA

- 5.12.3.1 Federal Motor Carrier Safety Administration

- 5.12.3.2 Institute of Electrical and Electronics Engineers

- 5.12.3.3 Corporate Average Fuel Economy

- 5.12.3.4 Energy Policy Act

- 5.12.4 EUROPE

- 5.12.4.1 General Data Protection Regulation

- 5.12.4.2 CEN/ISO

- 5.12.4.3 CEN/CENELEC

- 5.12.4.4 European Telecommunications Standards Institute

- 5.12.5 ASIA PACIFIC

- 5.12.5.1 Department of Heavy Industry

- 5.13 HS CODES: RADAR APPARATUS, RADIO NAVIGATIONAL AID APPARATUS, AND RADIO REMOTE CONTROL APPARATUS (8526)

- 5.13.1 EXPORT SCENARIO FOR HS CODE: 8526

- FIGURE 19 EXPORT VALUE OF RADAR APPARATUS, RADIO NAVIGATIONAL AID APPARATUS, AND RADIO REMOTE CONTROL APPARATUS, BY KEY COUNTRY, 2015-2022 (USD MILLION)

- 5.13.2 IMPORT SCENARIO FOR HS CODE: 8526

- FIGURE 20 IMPORT VALUE OF RADAR APPARATUS, RADIO NAVIGATIONAL AID APPARATUS, AND RADIO REMOTE CONTROL APPARATUS, BY KEY COUNTRY, 2015-2022 (USD MILLION)

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- TABLE 13 IMPACT OF PORTER'S FIVE FORCES ON FLEET MANAGEMENT MARKET

- FIGURE 21 PORTER'S FIVE FORCES MODEL

- 5.14.1 THREAT OF NEW ENTRANTS

- 5.14.2 THREAT OF SUBSTITUTES

- 5.14.3 BARGAINING POWER OF BUYERS

- 5.14.4 BARGAINING POWER OF SUPPLIERS

- 5.14.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- TABLE 14 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- 5.15.2 BUYING CRITERIA

- FIGURE 23 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 15 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- 5.16 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 24 REVENUE SHIFT IN FLEET MANAGEMENT MARKET

- 5.17 ANALYSIS OF PAIN POINTS IN FLEET MANAGEMENT

- 5.17.1 COMPLIANCE MANAGEMENT

- 5.17.2 DRIVER MANAGEMENT

- 5.17.3 ERROR REDUCTION

- 5.17.4 FUEL COST OPTIMIZATION

- 5.17.5 MAINTENANCE SCHEDULE MANAGEMENT

6 FLEET MANAGEMENT MARKET, BY COMPONENT

- 6.1 INTRODUCTION

- 6.1.1 COMPONENTS: FLEET MANAGEMENT MARKET DRIVERS

- FIGURE 25 SOLUTIONS SEGMENT TO ACCOUNT FOR LARGER SHARE DURING FORECAST PERIOD

- TABLE 16 FLEET MANAGEMENT MARKET, BY COMPONENT, 2018-2022 (USD MILLION)

- TABLE 17 FLEET MANAGEMENT MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- 6.2 SOLUTIONS

- 6.2.1 GROWING NEED TO UNLEASH OPERATIONAL EFFICIENCY WITH CENTRALIZED CONTROL TO DRIVE GROWTH

- TABLE 18 SOLUTIONS: FLEET MANAGEMENT MARKET, BY REGION, 2018-2022 USD MILLION)

- TABLE 19 SOLUTIONS: FLEET MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- FIGURE 26 OPERATIONS MANAGEMENT SEGMENT TO ACCOUNT FOR LARGEST MARKET BY 2028

- TABLE 20 FLEET MANAGEMENT MARKET, BY SOLUTION, 2018-2022 (USD MILLION)

- TABLE 21 FLEET MANAGEMENT MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- 6.2.2 OPERATIONS MANAGEMENT

- TABLE 22 FLEET MANAGEMENT MARKET, BY OPERATIONS MANAGEMENT TYPE, 2018-2022 (USD MILLION)

- TABLE 23 FLEET MANAGEMENT MARKET, BY OPERATIONS MANAGEMENT TYPE, 2023-2028 (USD MILLION)

- TABLE 24 OPERATIONS MANAGEMENT: FLEET MANAGEMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 25 OPERATIONS MANAGEMENT: FLEET MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.2.1 Fleet tracking & geofencing

- 6.2.2.2 Routing & scheduling

- 6.2.3 VEHICLE MAINTENANCE & DIAGNOSTICS

- TABLE 26 VEHICLE MAINTENANCE & DIAGNOSTICS: FLEET MANAGEMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 27 VEHICLE MAINTENANCE & DIAGNOSTICS: FLEET MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.4 PERFORMANCE MANAGEMENT

- TABLE 28 FLEET MANAGEMENT MARKET, BY PERFORMANCE MANAGEMENT TYPE, 2018-2022 (USD MILLION)

- TABLE 29 FLEET MANAGEMENT MARKET, BY PERFORMANCE MANAGEMENT TYPE, 2023-2028 (USD MILLION)

- TABLE 30 PERFORMANCE MANAGEMENT: FLEET MANAGEMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 31 PERFORMANCE MANAGEMENT: FLEET MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.4.1 Driver management

- 6.2.4.2 Fuel management

- 6.2.5 FLEET ANALYTICS & REPORTING

- TABLE 32 FLEET ANALYTICS & REPORTING: FLEET MANAGEMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 33 FLEET ANALYTICS & REPORTING: FLEET MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.6 COMPLIANCE MANAGEMENT

- TABLE 34 COMPLIANCE MANAGEMENT: FLEET MANAGEMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 35 COMPLIANCE MANAGEMENT: FLEET MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

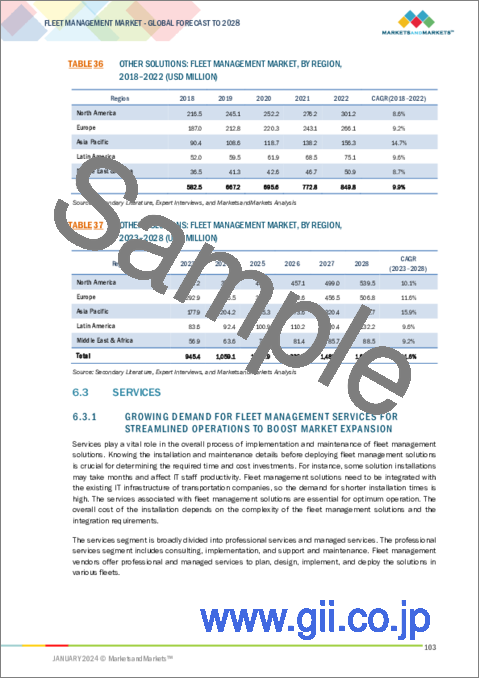

- 6.2.7 OTHER SOLUTIONS

- TABLE 36 OTHER SOLUTIONS: FLEET MANAGEMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 37 OTHER SOLUTIONS: FLEET MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3 SERVICES

- 6.3.1 GROWING DEMAND FOR FLEET MANAGEMENT SERVICES FOR STREAMLINED OPERATIONS TO BOOST MARKET EXPANSION

- TABLE 38 SERVICES: FLEET MANAGEMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 39 SERVICES: FLEET MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- FIGURE 27 PROFESSIONAL SERVICES SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- TABLE 40 FLEET MANAGEMENT MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 41 FLEET MANAGEMENT MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- 6.3.2 PROFESSIONAL SERVICES

- TABLE 42 FLEET MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2018-2022 (USD MILLION)

- TABLE 43 FLEET MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 44 PROFESSIONAL SERVICES: FLEET MANAGEMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 45 PROFESSIONAL SERVICES: FLEET MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.2.1 Consulting

- 6.3.2.2 Implementation

- 6.3.2.3 Support & maintenance

- 6.3.3 MANAGED SERVICES

- TABLE 46 MANAGED SERVICES: FLEET MANAGEMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 47 MANAGED SERVICES: FLEET MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

7 FLEET MANAGEMENT MARKET, BY FLEET TYPE

- 7.1 INTRODUCTION

- 7.1.1 FLEET TYPES: FLEET MANAGEMENT MARKET DRIVERS

- FIGURE 28 COMMERCIAL VEHICLES SEGMENT TO ACCOUNT FOR LARGER MARKET DURING FORECAST PERIOD

- TABLE 48 FLEET MANAGEMENT MARKET, BY FLEET TYPE, 2018-2022 (USD MILLION)

- TABLE 49 FLEET MANAGEMENT MARKET, BY FLEET TYPE, 2023-2028 (USD MILLION)

- 7.2 COMMERCIAL FLEETS

- 7.2.1 RAPID URBANIZATION AND IMPROVEMENT OF ROAD INFRASTRUCTURE AND REGULATORY POLICIES TO DRIVE DEMAND FOR COMMERCIAL FLEETS

- TABLE 50 FLEET MANAGEMENT MARKET, BY COMMERCIAL FLEET TYPE, 2018-2022 (USD MILLION)

- TABLE 51 FLEET MANAGEMENT MARKET, BY COMMERCIAL FLEET TYPE, 2023-2028 (USD MILLION)

- TABLE 52 COMMERCIAL FLEETS: FLEET MANAGEMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 53 COMMERCIAL FLEETS: FLEET MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.2.2 LCV

- 7.2.3 M&HCV

- 7.3 PASSENGER VEHICLES

- 7.3.1 FOCUS ON GAINING COMPLETE CONTROL OF FLEET OPERATIONS TO SPUR DEMAND FOR PASSENGER VEHICLES

- TABLE 54 FLEET MANAGEMENT MARKET, BY PASSENGER VEHICLE TYPE, 2018-2022 (USD MILLION)

- TABLE 55 FLEET MANAGEMENT MARKET, BY PASSENGER VEHICLE TYPE, 2023-2028 (USD MILLION)

- TABLE 56 PASSENGER VEHICLES: FLEET MANAGEMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 57 PASSENGER VEHICLES: FLEET MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3.2 ICE

- 7.3.3 EV

8 FLEET MANAGEMENT MARKET, BY VERTICAL

- 8.1 INTRODUCTION

- 8.1.1 VERTICALS: FLEET MANAGEMENT MARKET DRIVERS

- FIGURE 29 TRANSPORTATION & LOGISTICS SEGMENT TO LEAD MARKET BY 2028

- TABLE 58 FLEET MANAGEMENT MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 59 FLEET MANAGEMENT MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 8.2 RETAIL

- 8.2.1 INCREASED ECOMMERCE PENETRATION OF RETAIL SECTOR ACROSS GLOBE DRIVE DEMAND FOR FLEET MANAGEMENT SOLUTIONS

- 8.2.2 USE CASE

- 8.2.2.1 Streamlining operations for cost efficiency

- TABLE 60 RETAIL: FLEET MANAGEMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 61 RETAIL: FLEET MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3 HEALTHCARE & PHARMACEUTICALS

- 8.3.1 FLEET MANAGEMENT SOLUTIONS STREAMLINE HEALTHCARE INDUSTRY BY OFFERING COST-REDUCTION STRATEGIES

- 8.3.2 USE CASE

- 8.3.2.1 Optimizing fleets to save costs

- TABLE 62 HEALTHCARE & PHARMACEUTICALS: FLEET MANAGEMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 63 HEALTHCARE & PHARMACEUTICALS: FLEET MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.4 CONSTRUCTION

- 8.4.1 CONSTRUCTION FLEET MANAGEMENT INVOLVES EFFICIENTLY HANDLING COMMERCIAL VEHICLES TO ENSURE PROPER USE AND MAINTENANCE

- 8.4.2 USE CASE

- 8.4.2.1 Streamlining fleet management with telematics integration

- TABLE 64 CONSTRUCTION: FLEET MANAGEMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 65 CONSTRUCTION: FLEET MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.5 TRANSPORTATION & LOGISTICS

- 8.5.1 EMPHASIS ON EFFICIENT FUNCTIONING OF LOGISTICS OPERATIONS TO DRIVE NEED FOR TRANSPORTATION & LOGISTICS FLEET MANAGEMENT

- 8.5.2 USE CASE

- 8.5.2.1 Improving uptime and driver communication with integrated solutions

- TABLE 66 TRANSPORTATION & LOGISTICS: FLEET MANAGEMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 67 TRANSPORTATION & LOGISTICS: FLEET MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.6 UTILITIES

- 8.6.1 FOCUS ON ANALYZING AND REGULATING DRIVER BEHAVIOR, TRACKING FLEET MOVEMENTS, AND IMPROVING EFFICIENCIES TO DRIVE GROWTH

- 8.6.2 USE CASE

- 8.6.2.1 Revolutionizing fuel delivery operations with TMW suite

- TABLE 68 UTILITIES: FLEET MANAGEMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 69 UTILITIES: FLEET MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.7 OIL, GAS, AND MINING

- 8.7.1 OIL, GAS, AND MINING SECTOR UTILIZES GPS MONITORING TO MONITOR WORKERS AND TRACK THEIR MOVEMENT

- 8.7.2 USE CASE

- 8.7.2.1 Transforming logistics operations

- TABLE 70 OIL, GAS, AND MINING: FLEET MANAGEMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 71 OIL, GAS, AND MINING: FLEET MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.8 GOVERNMENT

- 8.8.1 USE OF FLEET MANAGEMENT ADDRESSES ISSUES SUCH AS LACK OF RESOURCES AND AGING ASSETS IN GOVERNMENT SECTOR

- 8.8.2 USE CASE

- 8.8.2.1 Overcoming telematics challenges for fleet excellence

- TABLE 72 GOVERNMENT: FLEET MANAGEMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 73 GOVERNMENT: FLEET MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.9 OTHER VERTICALS

- TABLE 74 OTHER VERTICALS: FLEET MANAGEMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 75 OTHER VERTICALS: FLEET MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

9 FLEET MANAGEMENT MARKET, BY REGION

- 9.1 INTRODUCTION

- TABLE 76 FLEET MANAGEMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 77 FLEET MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.2 NORTH AMERICA

- 9.2.1 NORTH AMERICA: FLEET MANAGEMENT MARKET DRIVERS

- 9.2.2 NORTH AMERICA: RECESSION IMPACT

- FIGURE 30 NORTH AMERICA: FLEET MANAGEMENT MARKET SNAPSHOT

- TABLE 78 NORTH AMERICA: FLEET MANAGEMENT MARKET, BY COMPONENT, 2018-2022 (USD MILLION)

- TABLE 79 NORTH AMERICA: FLEET MANAGEMENT MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 80 NORTH AMERICA: FLEET MANAGEMENT MARKET, BY SOLUTION, 2018-2022 (USD MILLION)

- TABLE 81 NORTH AMERICA: FLEET MANAGEMENT MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 82 NORTH AMERICA: FLEET MANAGEMENT MARKET, BY OPERATIONS MANAGEMENT TYPE, 2018-2022 (USD MILLION)

- TABLE 83 NORTH AMERICA: FLEET MANAGEMENT MARKET, BY OPERATIONS MANAGEMENT TYPE, 2023-2028 (USD MILLION)

- TABLE 84 NORTH AMERICA: FLEET MANAGEMENT MARKET, BY PERFORMANCE MANAGEMENT TYPE, 2018-2022 (USD MILLION)

- TABLE 85 NORTH AMERICA: FLEET MANAGEMENT MARKET, BY PERFORMANCE MANAGEMENT TYPE, 2023-2028 (USD MILLION)

- TABLE 86 NORTH AMERICA: FLEET MANAGEMENT MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 87 NORTH AMERICA: FLEET MANAGEMENT MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 88 NORTH AMERICA: FLEET MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2018-2022 (USD MILLION)

- TABLE 89 NORTH AMERICA: FLEET MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 90 NORTH AMERICA: FLEET MANAGEMENT MARKET, BY FLEET TYPE, 2018-2022 (USD MILLION)

- TABLE 91 NORTH AMERICA: FLEET MANAGEMENT MARKET, BY FLEET TYPE, 2023-2028 (USD MILLION)

- TABLE 92 NORTH AMERICA: FLEET MANAGEMENT MARKET, BY COMMERCIAL FLEET TYPE, 2018-2022 (USD MILLION)

- TABLE 93 NORTH AMERICA: FLEET MANAGEMENT MARKET, BY COMMERCIAL FLEET TYPE, 2023-2028 (USD MILLION)

- TABLE 94 NORTH AMERICA: FLEET MANAGEMENT MARKET, BY PASSENGER VEHICLE TYPE, 2018-2022 (USD MILLION)

- TABLE 95 NORTH AMERICA: FLEET MANAGEMENT MARKET, BY PASSENGER VEHICLE TYPE, 2023-2028 (USD MILLION)

- TABLE 96 NORTH AMERICA: FLEET MANAGEMENT MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 97 NORTH AMERICA: FLEET MANAGEMENT MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 98 NORTH AMERICA: FLEET MANAGEMENT MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 99 NORTH AMERICA: FLEET MANAGEMENT MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 9.2.3 US

- 9.2.3.1 Robust financial ecosystem and presence of major players to drive market

- TABLE 100 US: FLEET MANAGEMENT MARKET, BY COMPONENT, 2018-2022 (USD MILLION)

- TABLE 101 US: FLEET MANAGEMENT MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 102 US: FLEET MANAGEMENT MARKET, BY SOLUTION, 2018-2022 (USD MILLION)

- TABLE 103 US: FLEET MANAGEMENT MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 104 US: FLEET MANAGEMENT MARKET, BY OPERATIONS MANAGEMENT TYPE, 2018-2022 (USD MILLION)

- TABLE 105 US: FLEET MANAGEMENT MARKET, BY OPERATIONS MANAGEMENT TYPE, 2023-2028 (USD MILLION)

- TABLE 106 US: FLEET MANAGEMENT MARKET, BY PERFORMANCE MANAGEMENT TYPE, 2018-2022 (USD MILLION)

- TABLE 107 US: FLEET MANAGEMENT MARKET, BY PERFORMANCE MANAGEMENT TYPE, 2023-2028 (USD MILLION)

- TABLE 108 US: FLEET MANAGEMENT MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 109 US: FLEET MANAGEMENT MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 110 US: FLEET MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2018-2022 (USD MILLION)

- TABLE 111 US: FLEET MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 112 US: FLEET MANAGEMENT MARKET, BY FLEET TYPE, 2018-2022 (USD MILLION)

- TABLE 113 US: FLEET MANAGEMENT MARKET, BY FLEET TYPE, 2023-2028 (USD MILLION)

- TABLE 114 US: FLEET MANAGEMENT MARKET, BY COMMERCIAL FLEET TYPE, 2018-2022 (USD MILLION)

- TABLE 115 US: FLEET MANAGEMENT MARKET, BY COMMERCIAL FLEET TYPE 2023-2028 (USD MILLION)

- TABLE 116 US: FLEET MANAGEMENT MARKET, BY PASSENGER VEHICLE TYPE, 2018-2022 (USD MILLION)

- TABLE 117 US: FLEET MANAGEMENT MARKET, BY PASSENGER VEHICLE TYPE, 2023-2028 (USD MILLION)

- TABLE 118 US: FLEET MANAGEMENT MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 119 US: FLEET MANAGEMENT MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 9.2.4 CANADA

- 9.2.4.1 Government initiatives and strategic planning to spur growth

- TABLE 120 CANADA: FLEET MANAGEMENT MARKET, BY COMPONENT, 2018-2022 (USD MILLION)

- TABLE 121 CANADA: FLEET MANAGEMENT MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 122 CANADA: FLEET MANAGEMENT MARKET, BY SOLUTION, 2018-2022 (USD MILLION)

- TABLE 123 CANADA: FLEET MANAGEMENT MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 124 CANADA: FLEET MANAGEMENT MARKET, BY OPERATIONS MANAGEMENT TYPE, 2018-2022 (USD MILLION)

- TABLE 125 CANADA: FLEET MANAGEMENT MARKET, BY OPERATIONS MANAGEMENT TYPE, 2023-2028 (USD MILLION)

- TABLE 126 CANADA: FLEET MANAGEMENT MARKET, BY PERFORMANCE MANAGEMENT TYPE, 2018-2022 (USD MILLION)

- TABLE 127 CANADA: FLEET MANAGEMENT MARKET, BY PERFORMANCE MANAGEMENT TYPE, 2023-2028 (USD MILLION)

- TABLE 128 CANADA: FLEET MANAGEMENT MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 129 CANADA: FLEET MANAGEMENT MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 130 CANADA: FLEET MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2018-2022 (USD MILLION)

- TABLE 131 CANADA: FLEET MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 132 CANADA: FLEET MANAGEMENT MARKET, BY FLEET TYPE, 2018-2022 (USD MILLION)

- TABLE 133 CANADA: FLEET MANAGEMENT MARKET, BY FLEET TYPE, 2023-2028 (USD MILLION)

- TABLE 134 CANADA: FLEET MANAGEMENT MARKET, BY COMMERCIAL FLEET TYPE, 2018-2022 (USD MILLION)

- TABLE 135 CANADA: FLEET MANAGEMENT MARKET, BY COMMERCIAL FLEET TYPE, 2023-2028 (USD MILLION)

- TABLE 136 CANADA: FLEET MANAGEMENT MARKET, BY PASSENGER VEHICLE TYPE, 2018-2022 (USD MILLION)

- TABLE 137 CANADA: FLEET MANAGEMENT MARKET, BY PASSENGER VEHICLE TYPE, 2023-2028 (USD MILLION)

- TABLE 138 CANADA: FLEET MANAGEMENT MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 139 CANADA: FLEET MANAGEMENT MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 9.3 EUROPE

- 9.3.1 EUROPE: FLEET MANAGEMENT MARKET DRIVERS

- 9.3.2 EUROPE: RECESSION IMPACT

- TABLE 140 EUROPE: FLEET MANAGEMENT MARKET, BY COMPONENT, 2018-2022 (USD MILLION)

- TABLE 141 EUROPE: FLEET MANAGEMENT MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 142 EUROPE: FLEET MANAGEMENT MARKET, BY SOLUTION, 2018-2022 (USD MILLION)

- TABLE 143 EUROPE: FLEET MANAGEMENT MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 144 EUROPE: FLEET MANAGEMENT MARKET, BY OPERATIONS MANAGEMENT TYPE, 2018-2022 (USD MILLION)

- TABLE 145 EUROPE: FLEET MANAGEMENT MARKET, BY OPERATIONS MANAGEMENT TYPE, 2023-2028 (USD MILLION)

- TABLE 146 EUROPE: FLEET MANAGEMENT MARKET, BY PERFORMANCE MANAGEMENT TYPE, 2018-2022 (USD MILLION)

- TABLE 147 EUROPE: FLEET MANAGEMENT MARKET, BY PERFORMANCE MANAGEMENT TYPE, 2023-2028 (USD MILLION)

- TABLE 148 EUROPE: FLEET MANAGEMENT MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 149 EUROPE: FLEET MANAGEMENT MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 150 EUROPE: FLEET MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2018-2022 (USD MILLION)

- TABLE 151 EUROPE: FLEET MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 152 EUROPE: FLEET MANAGEMENT MARKET, BY FLEET TYPE, 2018-2022 (USD MILLION)

- TABLE 153 EUROPE: FLEET MANAGEMENT MARKET, BY FLEET TYPE, 2023-2028 (USD MILLION)

- TABLE 154 EUROPE: FLEET MANAGEMENT MARKET, BY COMMERCIAL FLEET TYPE, 2018-2022 (USD MILLION)

- TABLE 155 EUROPE: FLEET MANAGEMENT MARKET, BY COMMERCIAL FLEET TYPE, 2023-2028 (USD MILLION)

- TABLE 156 EUROPE: FLEET MANAGEMENT MARKET, BY PASSENGER VEHICLE TYPE, 2018-2022 (USD MILLION)

- TABLE 157 EUROPE: FLEET MANAGEMENT MARKET, BY PASSENGER VEHICLE TYPE, 2023-2028 (USD MILLION)

- TABLE 158 EUROPE: FLEET MANAGEMENT MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 159 EUROPE: FLEET MANAGEMENT MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 160 EUROPE: FLEET MANAGEMENT MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 161 EUROPE: FLEET MANAGEMENT MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 9.3.3 UK

- 9.3.3.1 Government initiatives and significant participation by private players to drive growth

- 9.3.4 GERMANY

- 9.3.4.1 Government funding and robust automobile industry to drive growth

- 9.3.5 ITALY

- 9.3.5.1 Focus on lowering carbon emissions to boost market growth

- TABLE 162 ITALY: FLEET MANAGEMENT MARKET, BY COMPONENT, 2018-2022 (USD MILLION)

- TABLE 163 ITALY: FLEET MANAGEMENT MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 164 ITALY: FLEET MANAGEMENT MARKET, BY SOLUTION, 2018-2022 (USD MILLION)

- TABLE 165 ITALY: FLEET MANAGEMENT MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 166 ITALY: FLEET MANAGEMENT MARKET, BY OPERATIONS MANAGEMENT TYPE, 2018-2022 (USD MILLION)

- TABLE 167 ITALY: FLEET MANAGEMENT MARKET, BY OPERATIONS MANAGEMENT TYPE, 2023-2028 (USD MILLION)

- TABLE 168 ITALY: FLEET MANAGEMENT MARKET, BY PERFORMANCE MANAGEMENT TYPE, 2018-2022 (USD MILLION)

- TABLE 169 ITALY: FLEET MANAGEMENT MARKET, BY PERFORMANCE MANAGEMENT TYPE, 2023-2028 (USD MILLION)

- TABLE 170 ITALY: FLEET MANAGEMENT MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 171 ITALY: FLEET MANAGEMENT MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 172 ITALY: FLEET MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2018-2022 (USD MILLION)

- TABLE 173 ITALY: FLEET MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 174 ITALY: FLEET MANAGEMENT MARKET, BY FLEET TYPE, 2018-2022 (USD MILLION)

- TABLE 175 ITALY: FLEET MANAGEMENT MARKET, BY FLEET TYPE, 2023-2028 (USD MILLION)

- TABLE 176 ITALY: FLEET MANAGEMENT MARKET, BY COMMERCIAL FLEET TYPE, 2018-2022 (USD MILLION)

- TABLE 177 ITALY: FLEET MANAGEMENT MARKET, BY COMMERCIAL FLEET TYPE, 2023-2028 (USD MILLION)

- TABLE 178 ITALY: FLEET MANAGEMENT MARKET, BY PASSENGER VEHICLE TYPE, 2018-2022 (USD MILLION)

- TABLE 179 ITALY: FLEET MANAGEMENT MARKET, BY PASSENGER VEHICLE TYPE, 2023-2028 (USD MILLION)

- TABLE 180 ITALY: FLEET MANAGEMENT MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 181 ITALY: FLEET MANAGEMENT MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 9.3.6 FRANCE

- 9.3.6.1 Strategic investments and increased popularity of hybrid and electric vehicles to fuel market growth

- 9.3.7 SPAIN

- 9.3.7.1 Spain's blooming corporate fleets to encourage market expansion

- 9.3.8 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 ASIA PACIFIC: FLEET MANAGEMENT MARKET DRIVERS

- 9.4.2 ASIA PACIFIC: RECESSION IMPACT

- FIGURE 31 ASIA PACIFIC: FLEET MANAGEMENT MARKET SNAPSHOT

- TABLE 182 ASIA PACIFIC: FLEET MANAGEMENT MARKET, BY COMPONENT, 2018-2022 (USD MILLION)

- TABLE 183 ASIA PACIFIC: FLEET MANAGEMENT MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 184 ASIA PACIFIC: FLEET MANAGEMENT MARKET, BY SOLUTION, 2018-2022 (USD MILLION)

- TABLE 185 ASIA PACIFIC: FLEET MANAGEMENT MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 186 ASIA PACIFIC: FLEET MANAGEMENT MARKET, BY OPERATIONS MANAGEMENT TYPE, 2018-2022 (USD MILLION)

- TABLE 187 ASIA PACIFIC: FLEET MANAGEMENT MARKET, BY OPERATIONS MANAGEMENT TYPE, 2023-2028 (USD MILLION)

- TABLE 188 ASIA PACIFIC: FLEET MANAGEMENT MARKET, BY PERFORMANCE MANAGEMENT TYPE, 2018-2022 (USD MILLION)

- TABLE 189 ASIA PACIFIC: FLEET MANAGEMENT MARKET, BY PERFORMANCE MANAGEMENT TYPE, 2023-2028 (USD MILLION)

- TABLE 190 ASIA PACIFIC: FLEET MANAGEMENT MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 191 ASIA PACIFIC: FLEET MANAGEMENT MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 192 ASIA PACIFIC: FLEET MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2018-2022 (USD MILLION)

- TABLE 193 ASIA PACIFIC: FLEET MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 194 ASIA PACIFIC: FLEET MANAGEMENT MARKET, BY FLEET TYPE, 2018-2022 (USD MILLION)

- TABLE 195 ASIA PACIFIC: FLEET MANAGEMENT MARKET, BY FLEET TYPE, 2023-2028 (USD MILLION)

- TABLE 196 ASIA PACIFIC: FLEET MANAGEMENT MARKET, BY COMMERCIAL FLEET TYPE, 2018-2022 (USD MILLION)

- TABLE 197 ASIA PACIFIC: FLEET MANAGEMENT MARKET, BY COMMERCIAL FLEET TYPE, 2023-2028 (USD MILLION)

- TABLE 198 ASIA PACIFIC: FLEET MANAGEMENT MARKET, BY PASSENGER VEHICLE TYPE, 2018-2022 (USD MILLION)

- TABLE 199 ASIA PACIFIC: FLEET MANAGEMENT MARKET, BY PASSENGER VEHICLE TYPE, 2023-2028 (USD MILLION)

- TABLE 200 ASIA PACIFIC: FLEET MANAGEMENT MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 201 ASIA PACIFIC: FLEET MANAGEMENT MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 202 ASIA PACIFIC: FLEET MANAGEMENT MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 203 ASIA PACIFIC: FLEET MANAGEMENT MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 9.4.3 CHINA

- 9.4.3.1 Substantial investments and supportive technological ecosystem to drive market growth

- TABLE 204 CHINA: FLEET MANAGEMENT MARKET, BY COMPONENT, 2018-2022 (USD MILLION)

- TABLE 205 CHINA: FLEET MANAGEMENT MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 206 CHINA: FLEET MANAGEMENT MARKET, BY SOLUTION, 2018-2022 (USD MILLION)

- TABLE 207 CHINA: FLEET MANAGEMENT MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 208 CHINA: FLEET MANAGEMENT MARKET, BY OPERATIONS MANAGEMENT TYPE, 2018-2022 (USD MILLION)

- TABLE 209 CHINA: FLEET MANAGEMENT MARKET, BY OPERATIONS MANAGEMENT TYPE, 2023-2028 (USD MILLION)

- TABLE 210 CHINA: FLEET MANAGEMENT MARKET, BY PERFORMANCE MANAGEMENT TYPE, 2018-2022 (USD MILLION)

- TABLE 211 CHINA: FLEET MANAGEMENT MARKET, BY PERFORMANCE MANAGEMENT TYPE, 2023-2028 (USD MILLION)

- TABLE 212 CHINA: FLEET MANAGEMENT MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 213 CHINA: FLEET MANAGEMENT MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 214 CHINA: FLEET MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2018-2022 (USD MILLION)

- TABLE 215 CHINA: FLEET MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 216 CHINA: FLEET MANAGEMENT MARKET, BY FLEET TYPE, 2018-2022 (USD MILLION)

- TABLE 217 CHINA: FLEET MANAGEMENT MARKET, BY FLEET TYPE, 2023-2028 (USD MILLION)

- TABLE 218 CHINA: FLEET MANAGEMENT MARKET, BY COMMERCIAL FLEET TYPE, 2018-2022 (USD MILLION)

- TABLE 219 CHINA: FLEET MANAGEMENT MARKET, BY COMMERCIAL FLEET TYPE, 2023-2028 (USD MILLION)

- TABLE 220 CHINA: FLEET MANAGEMENT MARKET, BY PASSENGER VEHICLE TYPE, 2018-2022 (USD MILLION)

- TABLE 221 CHINA: FLEET MANAGEMENT MARKET, BY PASSENGER VEHICLE TYPE, 2023-2028 (USD MILLION)

- TABLE 222 CHINA: FLEET MANAGEMENT MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 223 CHINA: FLEET MANAGEMENT MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 9.4.4 INDIA

- 9.4.4.1 Increasing emphasis on driver safety and ecommerce boom to drive growth

- 9.4.5 JAPAN

- 9.4.5.1 Robust technological ecosystem to drive market growth

- 9.4.6 AUSTRALIA & NEW ZEALAND

- 9.4.6.1 Government incentives and investments to boost market growth

- 9.4.7 REST OF ASIA PACIFIC

- 9.5 MIDDLE EAST & AFRICA

- 9.5.1 MIDDLE EAST & AFRICA: FLEET MANAGEMENT MARKET DRIVERS

- 9.5.2 MIDDLE EAST & AFRICA: RECESSION IMPACT

- TABLE 224 MIDDLE EAST & AFRICA: FLEET MANAGEMENT MARKET, BY COMPONENT, 2018-2022 (USD MILLION)

- TABLE 225 MIDDLE EAST & AFRICA: FLEET MANAGEMENT MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 226 MIDDLE EAST & AFRICA: FLEET MANAGEMENT MARKET, BY SOLUTION, 2018-2022 (USD MILLION)

- TABLE 227 MIDDLE EAST & AFRICA: FLEET MANAGEMENT MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 228 MIDDLE EAST & AFRICA: FLEET MANAGEMENT MARKET, BY OPERATIONS MANAGEMENT TYPE, 2018-2022 (USD MILLION)

- TABLE 229 MIDDLE EAST & AFRICA: FLEET MANAGEMENT MARKET, BY OPERATIONS MANAGEMENT TYPE, 2023-2028 (USD MILLION)

- TABLE 230 MIDDLE EAST & AFRICA: FLEET MANAGEMENT MARKET, BY PERFORMANCE MANAGEMENT TYPE, 2018-2022 (USD MILLION)

- TABLE 231 MIDDLE EAST & AFRICA: FLEET MANAGEMENT MARKET, BY PERFORMANCE MANAGEMENT TYPE, 2023-2028 (USD MILLION)

- TABLE 232 MIDDLE EAST & AFRICA: FLEET MANAGEMENT MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 233 MIDDLE EAST & AFRICA: FLEET MANAGEMENT MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 234 MIDDLE EAST & AFRICA: FLEET MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2018-2022 (USD MILLION)

- TABLE 235 MIDDLE EAST & AFRICA: FLEET MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 236 MIDDLE EAST & AFRICA: FLEET MANAGEMENT MARKET, BY FLEET TYPE, 2018-2022 (USD MILLION)

- TABLE 237 MIDDLE EAST & AFRICA: FLEET MANAGEMENT MARKET, BY FLEET TYPE, 2023-2028 (USD MILLION)

- TABLE 238 MIDDLE EAST & AFRICA: FLEET MANAGEMENT MARKET, BY COMMERCIAL FLEET TYPE, 2018-2022 (USD MILLION)

- TABLE 239 MIDDLE EAST & AFRICA: FLEET MANAGEMENT MARKET, BY COMMERCIAL FLEET TYPE, 2023-2028 (USD MILLION)

- TABLE 240 MIDDLE EAST & AFRICA: FLEET MANAGEMENT MARKET, BY PASSENGER VEHICLE TYPE, 2018-2022 (USD MILLION)

- TABLE 241 MIDDLE EAST & AFRICA: FLEET MANAGEMENT MARKET, BY PASSENGER VEHICLE TYPE, 2023-2028 (USD MILLION)

- TABLE 242 MIDDLE EAST & AFRICA: FLEET MANAGEMENT MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 243 MIDDLE EAST & AFRICA: FLEET MANAGEMENT MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 244 MIDDLE EAST & AFRICA: FLEET MANAGEMENT MARKET, BY COUNTRY/REGION, 2018-2022 (USD MILLION)

- TABLE 245 MIDDLE EAST & AFRICA: FLEET MANAGEMENT MARKET, BY COUNTRY/REGION, 2023-2028 (USD MILLION)

- 9.5.3 GCC COUNTRIES

- TABLE 246 GCC COUNTRIES: FLEET MANAGEMENT MARKET, BY COMPONENT, 2018-2022 (USD MILLION)

- TABLE 247 GCC COUNTRIES: FLEET MANAGEMENT MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 248 GCC COUNTRIES: FLEET MANAGEMENT MARKET, BY SOLUTION, 2018-2022 (USD MILLION)

- TABLE 249 GCC COUNTRIES: FLEET MANAGEMENT MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 250 GCC COUNTRIES: FLEET MANAGEMENT MARKET, BY OPERATIONS MANAGEMENT TYPE, 2018-2022 (USD MILLION)

- TABLE 251 GCC COUNTRIES: FLEET MANAGEMENT MARKET, BY OPERATIONS MANAGEMENT TYPE, 2023-2028 (USD MILLION)

- TABLE 252 GCC COUNTRIES: FLEET MANAGEMENT MARKET, BY PERFORMANCE MANAGEMENT TYPE, 2018-2022 (USD MILLION)

- TABLE 253 GCC COUNTRIES: FLEET MANAGEMENT MARKET, BY PERFORMANCE MANAGEMENT TYPE, 2023-2028 (USD MILLION)

- TABLE 254 GCC COUNTRIES: FLEET MANAGEMENT MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 255 GCC COUNTRIES: FLEET MANAGEMENT MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 256 GCC COUNTRIES: FLEET MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2018-2022 (USD MILLION)

- TABLE 257 GCC COUNTRIES: FLEET MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 258 GCC COUNTRIES: FLEET MANAGEMENT MARKET, BY FLEET TYPE, 2018-2022 (USD MILLION)

- TABLE 259 GCC COUNTRIES: FLEET MANAGEMENT MARKET, BY FLEET TYPE, 2023-2028 (USD MILLION)

- TABLE 260 GCC COUNTRIES: FLEET MANAGEMENT MARKET, BY COMMERCIAL FLEET TYPE, 2018-2022 (USD MILLION)

- TABLE 261 GCC COUNTRIES: FLEET MANAGEMENT MARKET, BY COMMERCIAL FLEET TYPE, 2023-2028 (USD MILLION)

- TABLE 262 GCC COUNTRIES: FLEET MANAGEMENT MARKET, BY PASSENGER VEHICLE TYPE, 2018-2022 (USD MILLION)

- TABLE 263 GCC COUNTRIES: FLEET MANAGEMENT MARKET, BY PASSENGER VEHICLE TYPE, 2023-2028 (USD MILLION)

- TABLE 264 GCC COUNTRIES: FLEET MANAGEMENT MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 265 GCC COUNTRIES: FLEET MANAGEMENT MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 266 FLEET MANAGEMENT MARKET, BY GCC COUNTRY, 2018-2022 (USD MILLION)

- TABLE 267 FLEET MANAGEMENT MARKET, BY GCC COUNTRY, 2023-2028 (USD MILLION)

- 9.5.3.1 UAE

- 9.5.3.1.1 Strategic investments and eco-friendly initiatives to drive growth

- 9.5.3.2 Kingdom of Saudi Arabia

- 9.5.3.2.1 Collaboration between government and private sector and suitable initiatives to drive market growth

- 9.5.3.3 Rest of GCC countries

- 9.5.3.1 UAE

- 9.5.4 SOUTH AFRICA

- 9.5.4.1 Rising government initiatives and focus on EVs to drive growth

- 9.5.5 REST OF MIDDLE EAST & AFRICA

- 9.6 LATIN AMERICA

- 9.6.1 LATIN AMERICA: FLEET MANAGEMENT MARKET DRIVERS

- 9.6.2 LATIN AMERICA: RECESSION IMPACT

- TABLE 268 LATIN AMERICA: FLEET MANAGEMENT MARKET, BY COMPONENT, 2018-2022 (USD MILLION)

- TABLE 269 LATIN AMERICA: FLEET MANAGEMENT MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 270 LATIN AMERICA FLEET MANAGEMENT MARKET, BY SOLUTION, 2018-2022 (USD MILLION)

- TABLE 271 LATIN AMERICA: FLEET MANAGEMENT MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 272 LATIN AMERICA: FLEET MANAGEMENT MARKET, BY OPERATIONS MANAGEMENT TYPE, 2018-2022 (USD MILLION)

- TABLE 273 LATIN AMERICA: FLEET MANAGEMENT MARKET, BY OPERATIONS MANAGEMENT TYPE, 2023-2028 (USD MILLION)

- TABLE 274 LATIN AMERICA: FLEET MANAGEMENT MARKET, BY PERFORMANCE MANAGEMENT TYPE, 2018-2022 (USD MILLION)

- TABLE 275 LATIN AMERICA: FLEET MANAGEMENT MARKET, BY PERFORMANCE MANAGEMENT TYPE, 2023-2028 (USD MILLION)

- TABLE 276 LATIN AMERICA: FLEET MANAGEMENT MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 277 LATIN AMERICA: FLEET MANAGEMENT MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 278 LATIN AMERICA: FLEET MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2018-2022 (USD MILLION)

- TABLE 279 LATIN AMERICA: FLEET MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 280 LATIN AMERICA: FLEET MANAGEMENT MARKET, BY FLEET TYPE, 2018-2022 (USD MILLION)

- TABLE 281 LATIN AMERICA: FLEET MANAGEMENT MARKET, BY FLEET TYPE, 2023-2028 (USD MILLION)

- TABLE 282 LATIN AMERICA: FLEET MANAGEMENT MARKET, BY COMMERCIAL FLEET TYPE, 2018-2022 (USD MILLION)

- TABLE 283 LATIN AMERICA: FLEET MANAGEMENT MARKET, BY COMMERCIAL FLEET TYPE, 2023-2028 (USD MILLION)

- TABLE 284 LATIN AMERICA: FLEET MANAGEMENT MARKET, BY PASSENGER VEHICLE TYPE, 2018-2022 (USD MILLION)

- TABLE 285 LATIN AMERICA: FLEET MANAGEMENT MARKET, BY PASSENGER VEHICLE TYPE, 2023-2028 (USD MILLION)

- TABLE 286 LATIN AMERICA: FLEET MANAGEMENT MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 287 LATIN AMERICA: FLEET MANAGEMENT MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 288 LATIN AMERICA: FLEET MANAGEMENT MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 289 LATIN AMERICA: FLEET MANAGEMENT MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 9.6.3 BRAZIL

- 9.6.3.1 Major players and government initiatives to drive growth

- TABLE 290 BRAZIL: FLEET MANAGEMENT MARKET, BY COMPONENT, 2018-2022 (USD MILLION)

- TABLE 291 BRAZIL: FLEET MANAGEMENT MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 292 BRAZIL: FLEET MANAGEMENT MARKET, BY SOLUTION, 2018-2022 (USD MILLION)

- TABLE 293 BRAZIL: FLEET MANAGEMENT MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 294 BRAZIL: FLEET MANAGEMENT MARKET, BY OPERATIONS MANAGEMENT TYPE, 2018-2022 (USD MILLION)

- TABLE 295 BRAZIL: FLEET MANAGEMENT MARKET, BY OPERATIONS MANAGEMENT TYPE, 2023-2028 (USD MILLION)

- TABLE 296 BRAZIL: FLEET MANAGEMENT MARKET, BY PERFORMANCE MANAGEMENT TYPE, 2018-2022 (USD MILLION)

- TABLE 297 BRAZIL: FLEET MANAGEMENT MARKET, BY PERFORMANCE MANAGEMENT TYPE, 2023-2028 (USD MILLION)

- TABLE 298 BRAZIL: FLEET MANAGEMENT MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 299 BRAZIL: FLEET MANAGEMENT MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 300 BRAZIL: FLEET MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2018-2022 (USD MILLION)

- TABLE 301 BRAZIL: FLEET MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 302 BRAZIL: FLEET MANAGEMENT MARKET, BY FLEET TYPE, 2018-2022 (USD MILLION)

- TABLE 303 BRAZIL: FLEET MANAGEMENT MARKET, BY FLEET TYPE, 2023-2028 (USD MILLION)

- TABLE 304 BRAZIL: FLEET MANAGEMENT MARKET, BY COMMERCIAL FLEET TYPE, 2018-2022 (USD MILLION)

- TABLE 305 BRAZIL: FLEET MANAGEMENT MARKET, BY COMMERCIAL FLEET TYPE, 2023-2028 (USD MILLION)

- TABLE 306 BRAZIL: FLEET MANAGEMENT MARKET, BY PASSENGER VEHICLE TYPE, 2018-2022 (USD MILLION)

- TABLE 307 BRAZIL: FLEET MANAGEMENT MARKET, BY PASSENGER VEHICLE TYPE, 2023-2028 (USD MILLION)

- TABLE 308 BRAZIL: FLEET MANAGEMENT MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 309 BRAZIL: FLEET MANAGEMENT MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 9.6.4 MEXICO

- 9.6.4.1 Strong emphasis on leasing and rentals to boost growth

- 9.6.5 REST OF LATIN AMERICA

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- TABLE 310 OVERVIEW OF STRATEGIES ADOPTED BY KEY FLEET MANAGEMENT TECHNOLOGY VENDORS

- 10.3 REVENUE ANALYSIS

- FIGURE 32 REVENUE ANALYSIS OF KEY PLAYERS, 2020-2023 (USD BILLION)

- 10.4 MARKET SHARE ANALYSIS

- FIGURE 33 SHARE OF LEADING COMPANIES IN FLEET MANAGEMENT MARKET

- TABLE 311 FLEET MANAGEMENT MARKET: INTENSITY OF COMPETITIVE RIVALRY

- 10.5 KEY PLAYER RANKING

- FIGURE 34 RANKING OF KEY PLAYERS IN FLEET MANAGEMENT MARKET, 2023

- 10.6 COMPANY EVALUATION MATRIX

- 10.6.1 STARS

- 10.6.2 EMERGING LEADERS

- 10.6.3 PERVASIVE PLAYERS

- 10.6.4 PARTICIPANTS

- FIGURE 35 FLEET MANAGEMENT MARKET: COMPANY EVALUATION MATRIX, 2023

- 10.6.5 COMPANY FOOTPRINT

- TABLE 312 OVERALL COMPANY FOOTPRINT

- TABLE 313 COMPANY COMPONENT FOOTPRINT

- TABLE 314 COMPANY VERTICAL FOOTPRINT

- TABLE 315 COMPANY REGIONAL FOOTPRINT

- 10.7 STARTUP/SME EVALUATION MATRIX

- 10.7.1 PROGRESSIVE COMPANIES

- 10.7.2 RESPONSIVE COMPANIES

- 10.7.3 DYNAMIC COMPANIES

- 10.7.4 STARTING BLOCKS

- FIGURE 36 FLEET MANAGEMENT MARKET: STARTUP/SME EVALUATION MATRIX, 2023

- 10.7.5 COMPETITIVE BENCHMARKING

- TABLE 316 DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 317 COMPETITIVE BENCHMARKING FOR STARTUPS/SMES

- 10.8 COMPETITIVE SCENARIO AND TRENDS

- 10.8.1 PRODUCT LAUNCHES

- TABLE 318 FLEET MANAGEMENT MARKET: PRODUCT LAUNCHES, JUNE 2021-NOVEMBER 2023

- 10.8.2 DEALS

- TABLE 319 FLEET MANAGEMENT MARKET: DEALS, OCTOBER 2020-JANUARY 2024

- 10.9 FLEET MANAGEMENT PRODUCT BENCHMARKING

- 10.9.1 PROMINENT FLEET MANAGEMENT SOLUTIONS

- TABLE 320 COMPARATIVE ANALYSIS OF PROMINENT FLEET MANAGEMENT SOLUTIONS

- 10.9.1.1 Geotab MyGeotab

- 10.9.1.2 Samsara Connected Operations Platform

- 10.9.1.3 Verizon Connect Reveal

- 10.9.1.4 GPS Insight FleetManager

- 10.10 VALUATION AND FINANCIAL METRICS OF KEY FLEET MANAGEMENT VENDORS

- FIGURE 37 VALUATION AND FINANCIAL METRICS OF KEY FLEET MANAGEMENT VENDORS

11 COMPANY PROFILES

- (Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 11.1 KEY PLAYERS

- 11.1.1 VERIZON CONNECT

- TABLE 321 VERIZON CONNECT: BUSINESS OVERVIEW

- FIGURE 38 VERIZON CONNECT: COMPANY SNAPSHOT

- TABLE 322 VERIZON CONNECT: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 323 VERIZON CONNECT: PRODUCT LAUNCHES

- TABLE 324 VERIZON CONNECT: DEALS

- 11.1.2 TRIMBLE

- TABLE 325 TRIMBLE: BUSINESS OVERVIEW

- FIGURE 39 TRIMBLE: COMPANY SNAPSHOT

- TABLE 326 TRIMBLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 327 TRIMBLE: PRODUCT LAUNCHES

- TABLE 328 TRIMBLE: DEALS

- 11.1.3 GEOTAB

- TABLE 329 GEOTAB: BUSINESS OVERVIEW

- TABLE 330 GEOTAB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 331 GEOTAB: PRODUCT LAUNCHES

- TABLE 332 GEOTAB: DEALS

- 11.1.4 WHEELS

- TABLE 333 WHEELS: BUSINESS OVERVIEW

- TABLE 334 WHEELS: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 335 WHEELS: PRODUCT LAUNCHES

- TABLE 336 WHEELS: DEALS

- 11.1.5 SAMSARA

- TABLE 337 SAMSARA: BUSINESS OVERVIEW

- FIGURE 40 SAMSARA: COMPANY SNAPSHOT

- TABLE 338 SAMSARA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 339 SAMSARA: PRODUCT LAUNCHES

- TABLE 340 SAMSARA: DEALS

- 11.1.6 BRIDGESTONE

- TABLE 341 BRIDGESTONE: BUSINESS OVERVIEW

- FIGURE 41 BRIDGESTONE: COMPANY SNAPSHOT

- TABLE 342 BRIDGESTONE: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 343 BRIDGESTONE: PRODUCT LAUNCHES

- TABLE 344 BRIDGESTONE: DEALS

- 11.1.7 INSEEGO

- TABLE 345 INSEEGO: BUSINESS OVERVIEW

- FIGURE 42 INSEEGO: COMPANY SNAPSHOT

- TABLE 346 INSEEGO: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 347 INSEEGO: PRODUCT LAUNCHES

- TABLE 348 INSEEGO: DEALS

- 11.1.8 SOLERA

- TABLE 349 SOLERA: BUSINESS OVERVIEW

- TABLE 350 SOLERA: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 351 SOLERA: PRODUCT LAUNCHES

- TABLE 352 SOLERA: DEALS

- 11.1.9 TELETRAC NAVMAN

- TABLE 353 TELETRAC NAVMAN: BUSINESS OVERVIEW

- TABLE 354 TELETRAC NAVMAN: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 355 TELETRAC NAVMAN: PRODUCT LAUNCHES

- TABLE 356 TELETRAC NAVMAN: DEALS

- 11.1.10 HOLMAN

- TABLE 357 HOLMAN: BUSINESS OVERVIEW

- TABLE 358 HOLMAN: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 359 HOLMAN: PRODUCT LAUNCHES

- TABLE 360 HOLMAN: DEALS

- 11.1.11 ORBCOMM

- TABLE 361 ORBCOMM: BUSINESS OVERVIEW

- TABLE 362 ORBCOMM: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 363 ORBCOMM: PRODUCT LAUNCHES

- TABLE 364 ORBCOMM: DEALS

- 11.1.12 MIX TELEMATICS

- 11.1.13 VERRA MOBILITY

- 11.1.14 CHEVIN

- 11.1.15 ZEBRA TECHNOLOGIES

- 11.1.16 MOTIVE

- 11.1.17 MICHELIN

- 11.2 STARTUPS/SMES

- 11.2.1 GPS INSIGHT

- 11.2.2 CLEARPATHGPS

- 11.2.3 FLEET COMPLETE

- 11.2.4 GURTAM

- 11.2.5 AUTOMILE

- 11.2.6 VIA TRANSPORTATION

- 11.2.7 FLEETROOT

- 11.2.8 RUPTELA

- 11.2.9 FREEWAY FLEET SYSTEMS

- *Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

12 ADJACENT/RELATED MARKETS

- 12.1 INTRODUCTION

- 12.1.1 LIMITATIONS

- 12.2 SMART TRANSPORTATION MARKET

- 12.2.1 MARKET DEFINITION

- 12.2.2 MARKET OVERVIEW

- 12.2.2.1 Smart transportation market, by transportation mode

- TABLE 365 SMART TRANSPORTATION MARKET, BY TRANSPORTATION MODE, 2018-2022 (USD MILLION)

- TABLE 366 SMART TRANSPORTATION MARKET, BY TRANSPORTATION MODE, 2023-2028 (USD MILLION)

- 12.2.2.2 Smart transportation market, by solution in roadway

- TABLE 367 SMART TRANSPORTATION MARKET, BY SOLUTION IN ROADWAY, 2018-2022 (USD MILLION)

- TABLE 368 SMART TRANSPORTATION MARKET, BY SOLUTION IN ROADWAY, 2023-2028 (USD MILLION)

- 12.2.2.3 Smart transportation market, by solution in railway

- TABLE 369 SMART TRANSPORTATION MARKET, BY SOLUTION IN RAILWAY, 2018-2022 (USD MILLION)

- TABLE 370 SMART TRANSPORTATION MARKET, BY SOLUTION IN RAILWAY, 2023-2028 (USD MILLION)

- 12.2.2.4 Smart transportation market, by solution in airway

- TABLE 371 SMART TRANSPORTATION MARKET, BY SOLUTION IN AIRWAY, 2018-2022 (USD MILLION)

- TABLE 372 SMART TRANSPORTATION MARKET, BY SOLUTION IN AIRWAY, 2023-2028 (USD MILLION)

- 12.2.2.5 Smart transportation market, by solution in maritime

- TABLE 373 SMART TRANSPORTATION MARKET, BY SOLUTION IN MARITIME, 2018-2022 (USD MILLION)

- TABLE 374 SMART TRANSPORTATION MARKET, BY SOLUTION IN MARITIME, 2023-2028 (USD MILLION)

- 12.2.2.6 Smart transportation market, by region

- TABLE 375 SMART TRANSPORTATION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 376 SMART TRANSPORTATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 12.3 TRANSPORTATION MANAGEMENT SYSTEM MARKET

- 12.3.1 MARKET DEFINITION

- 12.3.2 MARKET OVERVIEW

- 12.3.2.1 Transportation management system market, by offering

- TABLE 377 TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 378 TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 379 SOLUTIONS: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 380 SOLUTIONS: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 381 SERVICES: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 382 SERVICES: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 12.3.2.2 Transportation management system market, by solution

- TABLE 383 TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2018-2022 (USD MILLION)

- TABLE 384 TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- 12.3.2.3 Transportation management system market, by service

- TABLE 385 TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 386 TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- 12.3.2.4 Transportation management system market, by transportation mode

- TABLE 387 TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY TRANSPORTATION MODE, 2018-2022 (USD MILLION)

- TABLE 388 TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY TRANSPORTATION MODE, 2023-2028 (USD MILLION)

- 12.3.2.5 Transportation management system market, by vertical

- TABLE 389 TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 390 TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 12.3.2.6 Transportation management system market, by end user

- TABLE 391 TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY END USER, 2018-2022 (USD MILLION)

- TABLE 392 TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY END USER, 2023-2028 (USD MILLION)

- 12.3.2.7 Transportation management system market, by region

- TABLE 393 TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 394 TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY REGION, 2023-2028 (USD MILLION)

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS