|

|

市場調査レポート

商品コード

1376862

HMI (ヒューマンマシンインターフェース) の世界市場 (~2028年):提供区分 (ベーシック・先進パネルベース・先進PCベースHMI)・ソフトウェア (オンプレミス・クラウドベース)・画面サイズ (1~9インチ・9~17インチ・17インチ超)・構成 (スタンドアロン・埋め込み)・産業別Human Machine Interface Market by Offering (Basic, Advanced Panel-based, & Advanced PC-based HMI), Software (On-premises, Cloud-based), Screen Size (1"-9", 9"-17", More than 17"), Configuration (Standalone, Embedded), Industry - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| HMI (ヒューマンマシンインターフェース) の世界市場 (~2028年):提供区分 (ベーシック・先進パネルベース・先進PCベースHMI)・ソフトウェア (オンプレミス・クラウドベース)・画面サイズ (1~9インチ・9~17インチ・17インチ超)・構成 (スタンドアロン・埋め込み)・産業別 |

|

出版日: 2023年10月25日

発行: MarketsandMarkets

ページ情報: 英文 248 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のHMI (ヒューマンマシンインターフェース) の市場規模は、2023年の52億米ドルから、予測期間中は8.2%のCAGRで推移し、2028年には77億米ドルの規模に成長すると予測されています。

HMI市場は、主に製造業におけるインダストリー4.0の採用の急増と、運用技術の採用を促進する政府の取り組みによって、力強い成長を遂げています。インダストリー4.0は、スマートファクトリーと、機械や製造プロセスのリアルタイム監視、データアナリティクス、効率的な制御を促進する高度なHMIソリューションに依存する相互接続システムに重点を置いています。さらに、製造部門における運用技術の採用を促進することを目的とした政府の取り組みも、HMI市場の成長をさらに加速させています。こうした取り組みには、先進的なHMIシステムの導入を奨励する奨励金や資金援助が含まれることが多く、世界市場における生産性、製品品質、競争力を強化するための幅広い取り組みに同調しています。

「2022年、ディスクリート産業がHMI市場で最大シェアを占める」

自動車、半導体・エレクトロニクス、航空宇宙などのディスクリート産業は、正確な制御、迅速な切り替え、高度なカスタマイズを必要とするため、適応性が高く使いやすいHMIソリューションに特に依存しています。ハイペースで進むディスクリート製造には、リアルタイムのデータ可視化、直感的なインターフェース、他のオートメーションシステムとのシームレスな統合を提供する最先端のHMI技術が必要です。これらの機能により、業務効率が向上し、製品の品質が維持され、革新的で高品質な製品を求める消費者のダイナミックな需要に確実に応えることができます。ディスクリート製造業のユニークな要件と競合情勢から、市場での優位性を高めています。

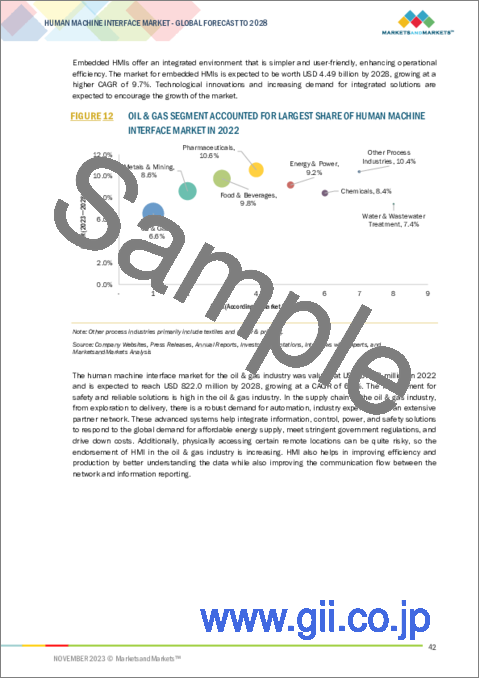

「2022年、石油・ガス産業がプロセス産業向けHMI市場で最大シェアを占める」

石油・ガス産業は、掘削、精製、流通などの複雑でリスクの高いプロセスを含み、そこでは正確な監視と制御が安全性、効率性、コンプライアンスのために不可欠です。HMIシステムは、このような課題環境におけるリアルタイムのデータ可視化、制御、意思決定を促進する上で不可欠です。さらに、この分野ではオペレーションの最適化とコスト削減のために自動化とデジタル化の統合が進んでおり、高度なHMIソリューションの需要が高まっています。IoT、データアナリティクス、遠隔監視の採用により、HMI技術は石油・ガス産業における卓越したオペレーションの実現に不可欠であり、HMIの有力なエンドユーザー産業となっています。

当レポートでは、世界のHMI (ヒューマンマシンインターフェース) の市場を調査し、市場概要、市場影響因子および市場機会の分析、技術・特許動向、ケーススタディ、法規制環境、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

報告書概要

| 調査範囲 | |

|---|---|

| 調査対象年 | 2019-2028年 |

| 基準年 | 2022年 |

| 予測期間 | 2023-2028年 |

| 検討単位 | 金額 (米ドル) |

| セグメント別 | 提供区分・ソフトウェア・画面サイズ・構成・産業別 |

| 対象地域 | 北米・欧州・アジア太平洋・その他の地域 |

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客の事業に影響を与える動向/ディスラプション

- 価格分析

- サプライチェーン分析

- 市場/エコシステムマップ

- 技術分析

- 空間コンピューティング

- 透明ディスプレイ

- 生体音響センシング

- 機械学習

- ジェスチャーコントロールデバイス

- フレキシブルディスプレイ

- 拡張現実

- センサーフュージョン

- バーチャルリアリティ

- デジタル化とIIOT

- インダストリー4.0

- AI

- IOT

- 特許分析

- 貿易分析

- 主要な会議とイベント

- ケーススタディ分析

- 関税と規制状況

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

第6章 HMIデバイスに導入された技術

- モーション

- バイオニック

- 触覚

- 音響

- 光学

第7章 HMI技術の動向と新たな用途

- HMI技術に関連する動向

- HMIとジェスチャーおよび音声認識技術の統合

- HMIとAR・VR技術の統合

- HMIとAI技術の統合

- HMIとエッジコンピューティング技術の統合

- HMI技術の新たな応用例

- 自動車

- ヘルスケア

- エンターテイメントとゲーム

- 小売・輸送

- 産業オートメーション

第8章 HMIソリューションのコンポーネント

- ディスプレイ端子

- 静電容量式タッチスクリーン

- 近接場イメージングタッチスクリーン

- 赤外線および分散信号タッチスクリーン

- 抵抗膜式タッチスクリーン

- ソフトウェア

- 産業用パーソナルコンピュータ (PCS)

- プロセッサー

- 入出力デバイス

- ストレージデバイス

- メンブレンスイッチ

- ゴム製キーパッド

- リモートパネル

第9章 HMIシステムの画面サイズに基づく分類

- 1~9インチ

- 9~17インチ

- 17インチ超

第10章 HMIソリューションの販売チャネル

- 直接

- 間接

第11章 HMI (ヒューマンマシンインターフェース) 市場:製品別

- ハードウェア

- ソフトウェア

第12章 HMI (ヒューマンマシンインターフェース) 市場:構成別

- 埋め込み

- スタンドアロン

第13章 HMI (ヒューマンマシンインターフェース) 市場:エンドユーザー産業別

- プロセス産業

- 石油・ガス

- 食品・飲料

- 医薬品

- 化学薬品

- エネルギー・電力

- 金属・鉱業

- 水・廃水処理

- その他

- ディスクリート産業

- 自動車

- 航空宇宙

- パッケージング

- 医療機器

- 半導体・エレクトロニクス

- その他

第14章 HMI (ヒューマンマシンインターフェース) 市場:地域別

- 北米

- 欧州

- アジア太平洋

- その他

第15章 競合情勢

- 概要

- 主要企業の採用戦略

- トップ5社の収益分析

- 市場シェア分析

- 企業評価マトリックス

- 新興企業/中小企業評価マトリックス

- 競争シナリオと動向

第16章 企業プロファイル

- 主要企業

- ABB

- ADVANTECH CO., LTD.

- EMERSON ELECTRIC CO.

- GENERAL ELECTRIC

- HONEYWELL INTERNATIONAL INC.

- MITSUBISHI ELECTRIC CORPORATION

- ROCKWELL AUTOMATION

- SCHNEIDER ELECTRIC

- SIEMENS

- YOKOGAWA ELECTRIC CORPORATION

- その他の企業

- AMERICAN INDUSTRIAL SYSTEMS INC.

- BARTEC TOP HOLDING GMBH

- BECKHOFF AUTOMATION

- EAO AG

- INDUCTIVE AUTOMATION, LLC

- MAKERSAN

- MAPLE SYSTEMS INC.

- MICON AUTOMATION SYSTEMS PVT. LTD.

- NOVAKON CO., LTD.

- PCI PRIVATE LIMITED

- RED LION

- RITTAL GMBH & CO. KG

- SENECA SRL

- WECON

- WEINTEK LABS., INC.

第17章 隣接市場

第18章 付録

Report Description

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | Value (USD Billion) |

| Segments | By Offering, Software, Screen Size, Configuration and Industry |

| Regions covered | North America, Europe, APAC, RoW |

The HMI market is estimated to be worth USD 5.2 billion in 2023 and is projected to reach USD 7.7 billion by 2028 at a CAGR of 8.2% during the forecast period. The HMI market is experiencing robust growth, primarily driven by surging adoption of industry 4.0 in manufacturing industries and government initiatives that are promoting adoption of operational technologies. Industry 4.0 emphasizes smart factories and interconnected systems that rely on advanced HMI solutions to facilitate real-time monitoring, data analysis, and efficient control of machinery and production processes. Additionally, government initiatives aimed at promoting the adoption of operational technologies in manufacturing sectors have further accelerated the HMI market's growth. These initiatives often include incentives and funding to encourage the implementation of advanced HMI systems, aligning with broader efforts to enhance productivity, product quality, and competitiveness in the global market.

"Discrete industries to hold the largest share of HMI market in 2022."

Discrete industries such as automobile, semiconductor & electronics, and aerospace require precise control, rapid changeovers, and advanced customization, making them particularly reliant on adaptable and user-friendly HMI solutions. The fast-paced nature of discrete manufacturing necessitates cutting-edge HMI technologies that offer real-time data visualization, intuitive interfaces, and seamless integration with other automation systems. These features enhance operational efficiency, maintain product quality, and ensure that these industries can meet the dynamic consumer demands for innovative and high-quality products. As a result, the unique requirements and the competitive landscape of discrete manufacturing sectors make them the largest and essential consumers of HMI solutions, ultimately driving their prominence in the market.

"Oil & Gas industry to hold the largest share of HMI market for process industries in 2022."

The oil and gas industry involves complex, high-risk processes, such as drilling, refining, and distribution, where precise monitoring and control are imperative for safety, efficiency, and compliance. HMI systems are essential in facilitating real-time data visualization, control, and decision-making in this challenging environment. Moreover, the sector is increasingly integrating automation and digitalization to optimize operations and reduce costs, driving the demand for advanced HMI solutions. With the adoption of IoT, data analytics, and remote monitoring, HMI technologies are crucial for achieving operational excellence in the oil and gas industry, making it a prominent player in the HMI market.

"North America to hold the largest market share of HMI market in 2022."

North America is a major hub for technological innovations, as well as an early adopter of new technologies. These sectors rely heavily on advanced HMI solutions to improve operational efficiency and maintain a competitive edge. Moreover, North America has a mature and well-established infrastructure that readily adopts emerging technologies, including HMI systems, which are integral to Industry 4.0 initiatives and smart manufacturing. Additionally, the presence of leading HMI solution providers and a strong emphasis on research and development further drives the market's growth. The region has witnessed a marginal shift toward automated production and continuous R&D investments by manufacturers to drive innovation in their manufacturing processes. Moreover, the industrial, automotive, power, oil & gas, pharmaceutical, and healthcare sectors are integrating HMI with data analytics to improve performance and reduce overall operational costs, which is likely to further lead to the growth of the HMI market in North America.

The break-up of the profiles of primary participants:

- By Company Type - Tier 1 - 65%, Tier 2 - 20%, and Tier 3 - 15%

- By Designation - C-level Executives - 57%, Directors - 27%, and Others - 16%

- By Region - North America - 24%, Europe - 24%, Asia Pacific - 46%, and Rest of the World - 6%

Major players in the HMI market are Rockwell Automation (US), Siemens (Germany), Schneider Electric (France), ABB (Switzerland), and Honeywell International Inc. (US).

Research Coverage

The report segments the HMI market by offering, configuration, end-user industry, and region. The report also comprehensively reviews drivers, restraints, opportunities, and challenges influencing market growth. The report also covers qualitative aspects in addition to the quantitative aspects of the market.

Reasons to buy the report:

The report will help the market leaders/new entrants with information on the closest approximate revenues for the overall HMI market and related segments. This report will help stakeholders understand the competitive landscape and gain more insights to strengthen their position in the market and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of key drivers (Rising adoption of industrial automation in process and discrete industries, Growing focus on real-time data analysis and predictive maintenance, Government initiatives to promote adoption of operational technologies, and Surging adoption of industry 4.0 in manufacturing industries is driving the market), restraints (High cost associated with installation and maintenance, Need for regular maintenance and frequent software updates, and Shortage of skilled and experienced workforce are hindering the growth of the market), opportunities (Surging demand for safety compliance automation systems in manufacturing industries, Increasing adoption of IIoT and cloud computing across industries, and Rapid growth and increasing investments in renewable energy sector), and challenges (Absence of standardization in industrial communication protocols and interfaces and Susceptibility of cloud-HMI systems to cyberattacks are resulting as a risk for HMI systems) influencing the growth of the HMI market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and new product launches in the HMI market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the HMI market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the HMI market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players like Rockwell Automation (US), Siemens (Germany), Schneider Electric (France), ABB (Switzerland), and Honeywell International Inc. (US).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS AND EXCLUSIONS

- 1.4 STUDY SCOPE

- 1.4.1 MARKETS COVERED

- FIGURE 1 HUMAN MACHINE INTERFACE MARKET SEGMENTATION

- 1.4.2 REGIONAL SCOPE

- 1.4.3 YEARS CONSIDERED

- 1.4.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

- 1.6.1 IMPACT OF RECESSION

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 HUMAN MACHINE INTERFACE MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakdown of primaries

- 2.1.2.2 Primary interviews with experts

- 2.1.2.3 Key data from primary sources

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.3.1 Key industry insights

- 2.2 MARKET SIZE ESTIMATION METHODOLOGY

- FIGURE 3 HUMAN MACHINE INTERFACE MARKET: REVENUE GENERATED THROUGH SALES OF HMI SOLUTIONS

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to arrive at market size using bottom-up analysis (demand side)

- FIGURE 4 HUMAN MACHINE INTERFACE MARKET: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to arrive at market size using top-down analysis (supply side)

- FIGURE 5 HUMAN MACHINE INTERFACE MARKET: TOP-DOWN APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 6 HUMAN MACHINE INTERFACE MARKET: DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- FIGURE 7 HUMAN MACHINE INTERFACE MARKET: RESEARCH ASSUMPTIONS

- 2.5 PARAMETERS CONSIDERED TO ANALYZE RECESSION IMPACT ON HUMAN MACHINE INTERFACE MARKET

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

- FIGURE 8 HUMAN MACHINE INTERFACE MARKET: RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- FIGURE 9 HUMAN MACHINE INTERFACE MARKET SIZE, 2019-2028 (USD MILLION)

- FIGURE 10 SOFTWARE SEGMENT ACCOUNTED FOR LARGER MARKET SHARE IN 2022

- FIGURE 11 EMBEDDED SEGMENT TO EXHIBIT HIGHER CAGR IN HUMAN MACHINE INTERFACE MARKET FROM 2023 TO 2028

- FIGURE 12 OIL & GAS SEGMENT ACCOUNTED FOR LARGEST SHARE OF HUMAN MACHINE INTERFACE MARKET IN 2022

- FIGURE 13 AUTOMOBILE SEGMENT TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 14 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR IN HUMAN MACHINE INTERFACE MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN HUMAN MACHINE INTERFACE MARKET

- FIGURE 15 RISING ADOPTION OF INDUSTRIAL AUTOMATION SYSTEMS IN MANUFACTURING FACILITIES TO CREATE LUCRATIVE OPPORTUNITIES FOR PLAYERS IN HUMAN MACHINE INTERFACE MARKET

- 4.2 HUMAN MACHINE INTERFACE MARKET, BY END-USER INDUSTRY

- FIGURE 16 PROCESS INDUSTRIES SEGMENT TO GROW AT HIGHER CAGR IN HUMAN MACHINE INTERFACE MARKET FROM 2023 TO 2028

- 4.3 HUMAN MACHINE INTERFACE MARKET, BY PROCESS INDUSTRY

- FIGURE 17 OIL & GAS SEGMENT TO DOMINATE HUMAN MACHINE INTERFACE MARKET DURING FORECAST PERIOD

- 4.4 HUMAN MACHINE INTERFACE MARKET, BY DISCRETE INDUSTRY

- FIGURE 18 AUTOMOBILE SEGMENT TO HOLD LARGEST MARKET SHARE IN 2023

- 4.5 HUMAN MACHINE INTERFACE MARKET, BY COUNTRY

- FIGURE 19 CHINA TO REGISTER HIGHEST CAGR IN HUMAN MACHINE INTERFACE MARKET FROM 2023 TO 2028

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 20 HUMAN MACHINE INTERFACE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing adoption of automation technologies to enhance productivity and efficiency in manufacturing

- 5.2.1.2 Rising focus on real-time data visualization and predictive maintenance of industrial machinery

- 5.2.1.3 Escalating investments in IIoT and 3D printing technologies to transform manufacturing chains

- 5.2.1.4 Surging demand for smart machines and rapid industrial revolution

- FIGURE 21 HUMAN MACHINE INTERFACE MARKET: DRIVERS AND THEIR IMPACT

- 5.2.2 RESTRAINTS

- 5.2.2.1 High costs associated with installation and maintenance of HMI systems

- 5.2.2.2 Need for periodic maintenance and frequent HMI software updates

- 5.2.2.3 Shortage of skilled and experienced workforce

- FIGURE 22 HUMAN MACHINE INTERFACE MARKET: RESTRAINTS AND THEIR IMPACT

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Heightened focus on workplace safety and regulatory compliance of automated systems

- 5.2.3.2 Increased adoption of IoT and cloud computing technologies

- 5.2.3.3 Need for advanced solutions to monitor ever-increasing renewable energy assets

- FIGURE 23 HUMAN MACHINE INTERFACE MARKET: OPPORTUNITIES AND THEIR IMPACT

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of standardization of industrial communication protocols

- 5.2.4.2 Susceptibility of cloud-based HMI systems to cyberattacks

- FIGURE 24 HUMAN MACHINE INTERFACE MARKET: CHALLENGES AND THEIR IMPACT

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 25 HUMAN MACHINE INTERFACE MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE TREND, BY SCREEN SIZE (USD THOUSAND)

- FIGURE 26 AVERAGE SELLING PRICE TREND, BY SCREEN SIZE (USD THOUSAND)

- TABLE 1 AVERAGE SELLING PRICE TREND, BY SCREEN SIZE (USD THOUSAND)

- 5.4.2 AVERAGE SELLING PRICE TREND, BY REGION (USD THOUSAND)

- TABLE 2 AVERAGE SELLING PRICE TREND, BY REGION (USD THOUSAND)

- FIGURE 27 HUMAN MACHINE INTERFACE MARKET: PRICING ANALYSIS OF BASIC HMI SOLUTIONS, 2019-2028

- 5.5 SUPPLY CHAIN ANALYSIS

- FIGURE 28 HUMAN MACHINE INTERFACE MARKET: SUPPLY CHAIN ANALYSIS

- 5.6 MARKET/ECOSYSTEM MAP

- FIGURE 29 HUMAN MACHINE INTERFACE MARKET: MARKET/ECOSYSTEM MAP

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 SPATIAL COMPUTING

- 5.7.2 TRANSPARENT DISPLAYS

- 5.7.3 BIOACOUSTIC SENSING

- 5.7.4 MACHINE LEARNING

- 5.7.5 GESTURE CONTROL DEVICES

- 5.7.6 FLEXIBLE DISPLAYS

- 5.7.7 AUGMENTED REALITY

- 5.7.8 SENSOR FUSION

- 5.7.9 VIRTUAL REALITY

- 5.7.10 DIGITALIZATION AND INDUSTRIAL INTERNET OF THINGS (IIOT)

- 5.7.11 INDUSTRY 4.0

- 5.7.12 ARTIFICIAL INTELLIGENCE (AI)

- 5.7.13 INTERNET OF THINGS (IOT)

- 5.8 PATENT ANALYSIS

- FIGURE 30 HUMAN MACHINE INTERFACE MARKET: TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS, 2013-2022

- FIGURE 31 HUMAN MACHINE INTERFACE MARKET: PATENTS GRANTED, 2013-2022

- TABLE 3 HUMAN MACHINE INTERFACE MARKET: TOP 20 PATENT OWNERS, 2013-2022

- TABLE 4 HUMAN MACHINE INTERFACE MARKET: LIST OF PATENTS RELATED TO HMI SOLUTIONS

- 5.9 TRADE ANALYSIS

- 5.9.1 IMPORT SCENARIO

- FIGURE 32 HUMAN MACHINE INTERFACE MARKET: IMPORT DATA FOR HS CODE 853710-COMPLIANT HMI SOLUTIONS, BY KEY COUNTRY, 2018-2022 (USD MILLION)

- 5.9.2 EXPORT SCENARIO

- FIGURE 33 HUMAN MACHINE INTERFACE MARKET: EXPORT DATA FOR HS CODE 853710-COMPLIANT HMI SOLUTIONS, BY KEY COUNTRY, 2018-2022 (USD MILLION)

- 5.10 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 5 HUMAN MACHINE INTERFACE MARKET: LIST OF CONFERENCES AND EVENTS, 2023-2024

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 IMPLEMENTATION OF EMERSON ELECTRIC CO.'S SCADA SYSTEMS TO MONITOR AND CONTROL SHOPPING MALLS AND HYPERMARKETS IN ITALY

- 5.11.2 DEVELOPMENT OF LEMATIC'S AUTO INET SAAS SOLUTIONS TO IMPROVE ACCESS TO CRITICAL INFRASTRUCTURE

- 5.11.3 ADOPTION OF SCADA SYSTEMS BY ARB MIDSTREAM TO CREATE OPERATION CONTROL CENTER

- 5.12 TARIFFS AND REGULATORY LANDSCAPE

- 5.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12.2 STANDARDS

- 5.12.2.1 IEC TS 62832-1:2020

- 5.12.2.2 ISO/IEC TR 63306-1:2020

- 5.12.2.3 ISO 55001:2014

- 5.12.2.4 Industrial safety standards

- 5.13 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 34 HUMAN MACHINE INTERFACE MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 10 SMART MANUFACTURING MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 35 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END-USER INDUSTRIES

- TABLE 11 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END-USER INDUSTRIES (%)

- 5.14.2 BUYING CRITERIA

- FIGURE 36 HUMAN MACHINE INTERFACE MARKET: KEY BUYING CRITERIA FOR TOP 3 END-USER INDUSTRIES

- TABLE 12 HUMAN MACHINE INTERFACE MARKET: KEY BUYING CRITERIA FOR TOP 3 END-USER INDUSTRIES

6 TECHNOLOGIES DEPLOYED IN HMI DEVICES

- 6.1 INTRODUCTION

- 6.2 MOTION

- 6.3 BIONIC

- 6.4 TACTILE

- 6.5 ACOUSTIC

- 6.6 OPTICAL

7 TRENDS AND EMERGING APPLICATIONS OF HMI TECHNOLOGY

- 7.1 INTRODUCTION

- 7.2 TRENDS RELATED TO HMI TECHNOLOGY

- 7.2.1 INTEGRATION OF HMI WITH GESTURE AND VOICE RECOGNITION TECHNOLOGY

- 7.2.2 INTEGRATION OF HMI WITH AUGMENTED REALITY (AR) AND VIRTUAL REALITY (VR) TECHNOLOGIES

- 7.2.3 INTEGRATION OF HMI WITH ARTIFICIAL INTELLIGENCE (AI) TECHNOLOGY

- 7.2.4 INTEGRATION OF HMI WITH EDGE COMPUTING TECHNOLOGY

- 7.3 EMERGING APPLICATIONS OF HMI TECHNOLOGY

- 7.3.1 AUTOMOTIVE

- 7.3.2 HEALTHCARE

- 7.3.3 ENTERTAINMENT AND GAMING

- 7.3.4 RETAIL AND TRANSPORTATION

- 7.3.5 INDUSTRIAL AUTOMATION

8 COMPONENTS OF HMI SOLUTIONS

- 8.1 INTRODUCTION

- 8.2 DISPLAY TERMINALS

- 8.2.1 CAPACITIVE TOUCHSCREENS

- 8.2.2 NEAR-FIELD IMAGING TOUCHSCREENS

- 8.2.3 INFRARED AND DISPERSIVE SIGNAL TOUCHSCREENS

- 8.2.4 RESISTIVE TOUCHSCREENS

- 8.3 SOFTWARE

- 8.4 INDUSTRIAL PERSONAL COMPUTERS (PCS)

- 8.4.1 PROCESSORS

- 8.4.2 INPUT/OUTPUT DEVICES

- 8.4.3 STORAGE DEVICES

- 8.5 MEMBRANE SWITCHES

- 8.6 RUBBER KEYPADS

- 8.7 REMOTE PANELS

9 SCREEN SIZE-BASED CLASSIFICATION OF HMI SYSTEMS

- 9.1 INTRODUCTION

- FIGURE 37 HUMAN MACHINE INTERFACE MARKET: SCREEN SIZE-BASED CLASSIFICATION OF HMI SOLUTIONS

- 9.2 BETWEEN 1 TO 9''

- 9.3 BETWEEN 9 TO 17''

- 9.4 MORE THAN 17''

10 SALES CHANNELS OF HMI SOLUTIONS

- 10.1 INTRODUCTION

- FIGURE 38 HUMAN MACHINE INTERFACE MARKET: SALES CHANNELS OF HMI SOLUTIONS

- 10.2 DIRECT

- 10.2.1 HIGH PREFERENCE FOR PERSONALIZATION OF HMI PRODUCT BUYING EXPERIENCES TO AUGMENT MARKET GROWTH

- 10.3 INDIRECT

- 10.3.1 INCREASED SALES OF HMI PRODUCTS THROUGH E-COMMERCE PLATFORMS TO BOOST SEGMENTAL GROWTH

11 HUMAN MACHINE INTERFACE MARKET, BY OFFERING

- 11.1 INTRODUCTION

- FIGURE 39 HUMAN MACHINE INTERFACE MARKET, BY OFFERING

- TABLE 13 HUMAN MACHINE INTERFACE MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 14 HUMAN MACHINE INTERFACE MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- FIGURE 40 SOFTWARE TO HOLD LARGER SHARE OF HUMAN MACHINE INTERFACE MARKET IN 2028

- 11.2 HARDWARE

- TABLE 15 HARDWARE: HUMAN MACHINE INTERFACE MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 16 HARDWARE: HUMAN MACHINE INTERFACE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.2.1 BY TYPE

- 11.2.1.1 Basic HMI

- 11.2.1.1.1 Increasing use of basic HMIs in small-scale machinery and home automation systems to foster segmental growth

- 11.2.1.1 Basic HMI

- TABLE 17 BASIC HMI: HUMAN MACHINE INTERFACE MARKET, 2019-2022 (THOUSAND UNITS)

- TABLE 18 BASIC HMI: HUMAN MACHINE INTERFACE MARKET, 2023-2028 (THOUSAND UNITS)

- 11.2.1.2 Advanced panel-based HMI

- 11.2.1.2.1 Shifting preference toward advanced panel-based HMIs with mobile functionalities to drive market

- 11.2.1.3 Advanced PC-based HMI

- 11.2.1.3.1 Growing need for advanced PC-based HMI systems equipped with high-performance processors to contribute to segmental growth

- 11.2.1.2 Advanced panel-based HMI

- 11.2.2 OTHER HARDWARE TYPES

- 11.3 SOFTWARE

- 11.3.1 BY DEPLOYMENT MODE

- 11.3.1.1 On-premises

- 11.3.1.1.1 Adoption of on-premise HMI software for enhancing data security and control to fuel segmental growth

- 11.3.1.2 Cloud-based

- 11.3.1.2.1 Reliance on cloud-based HMI software with multi-location access support to boost segmental growth

- 11.3.1.1 On-premises

- FIGURE 41 CLOUD-BASED SEGMENT TO EXHIBIT HIGHER CAGR IN HUMAN MACHINE INTERFACE MARKET DURING FORECAST PERIOD

- TABLE 19 SOFTWARE: HUMAN MACHINE INTERFACE MARKET, BY DEPLOYMENT MODE, 2019-2022 (USD MILLION)

- TABLE 20 SOFTWARE: HUMAN MACHINE INTERFACE MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- 11.3.1 BY DEPLOYMENT MODE

12 HUMAN MACHINE INTERFACE MARKET, BY CONFIGURATION

- 12.1 INTRODUCTION

- FIGURE 42 HUMAN MACHINE INTERFACE MARKET, BY CONFIGURATION

- TABLE 21 HUMAN MACHINE INTERFACE MARKET, BY CONFIGURATION, 2019-2022 (USD MILLION)

- TABLE 22 HUMAN MACHINE INTERFACE MARKET, BY CONFIGURATION, 2023-2028 (USD MILLION)

- FIGURE 43 EMBEDDED SEGMENT TO DOMINATE HUMAN MACHINE INTERFACE MARKET BETWEEN 2023 AND 2028

- 12.2 EMBEDDED

- 12.2.1 RAPID TECHNOLOGICAL ADVANCEMENTS TO ENCOURAGE ADOPTION OF USER-FRIENDLY EMBEDDED HMI SOLUTIONS

- TABLE 23 EMBEDDED: HUMAN MACHINE INTERFACE MARKET, BY PROCESS INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 24 EMBEDDED: HUMAN MACHINE INTERFACE MARKET, BY PROCESS INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 25 EMBEDDED: HUMAN MACHINE INTERFACE MARKET, BY DISCRETE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 26 EMBEDDED: HUMAN MACHINE INTERFACE MARKET, BY DISCRETE INDUSTRY, 2023-2028 (USD MILLION)

- 12.3 STANDALONE

- 12.3.1 DECLINE IN TOTAL OWNERSHIP COST AND EASE OF USE TO CONTRIBUTE TO SEGMENTAL GROWTH

- TABLE 27 STANDALONE: HUMAN MACHINE INTERFACE MARKET, BY PROCESS INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 28 STANDALONE: HUMAN MACHINE INTERFACE MARKET, BY PROCESS INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 29 STANDALONE: HUMAN MACHINE INTERFACE MARKET, BY DISCRETE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 30 STANDALONE: HUMAN MACHINE INTERFACE MARKET, BY DISCRETE INDUSTRY, 2023-2028 (USD MILLION)

13 HUMAN MACHINE INTERFACE MARKET, BY END-USER INDUSTRY

- 13.1 INTRODUCTION

- FIGURE 44 HUMAN MACHINE INTERFACE MARKET, BY END-USER INDUSTRY

- TABLE 31 HUMAN MACHINE INTERFACE MARKET, BY END-USER INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 32 HUMAN MACHINE INTERFACE MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 13.2 PROCESS INDUSTRIES

- FIGURE 45 HUMAN MACHINE INTERFACE MARKET, BY PROCESS INDUSTRY

- TABLE 33 HUMAN MACHINE INTERFACE MARKET, BY PROCESS INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 34 HUMAN MACHINE INTERFACE MARKET, BY PROCESS INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 35 PROCESS INDUSTRIES: HUMAN MACHINE INTERFACE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 36 PROCESS INDUSTRIES: HUMAN MACHINE INTERFACE MARKET, BY REGION, 2023-2028 (USD MILLION)

- FIGURE 46 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE OF MARKET FOR PROCESS INDUSTRIES IN 2028

- TABLE 37 PROCESS INDUSTRIES: HUMAN MACHINE INTERFACE MARKET, BY CONFIGURATION, 2019-2022 (USD MILLION)

- TABLE 38 PROCESS INDUSTRIES: HUMAN MACHINE INTERFACE MARKET, BY CONFIGURATION, 2023-2028 (USD MILLION)

- 13.2.1 OIL & GAS

- 13.2.1.1 Burgeoning investments in oil and gas exploration projects to accelerate segmental growth

- TABLE 39 OIL & GAS: HUMAN MACHINE INTERFACE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 40 OIL & GAS: HUMAN MACHINE INTERFACE MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 41 OIL & GAS: HUMAN MACHINE INTERFACE MARKET, BY CONFIGURATION, 2019-2022 (USD MILLION)

- TABLE 42 OIL & GAS: HUMAN MACHINE INTERFACE MARKET, BY CONFIGURATION, 2023-2028 (USD MILLION)

- 13.2.2 FOOD & BEVERAGES

- 13.2.2.1 Rising usage of HMI solutions to automate food and beverage manufacturing operations to fuel segmental growth

- TABLE 43 FOOD & BEVERAGES: HUMAN MACHINE INTERFACE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 44 FOOD & BEVERAGES: HUMAN MACHINE INTERFACE MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 45 FOOD & BEVERAGES: HUMAN MACHINE INTERFACE MARKET, BY CONFIGURATION, 2019-2022 (USD MILLION)

- TABLE 46 FOOD & BEVERAGES: HUMAN MACHINE INTERFACE MARKET, BY CONFIGURATION, 2023-2028 (USD MILLION)

- 13.2.3 PHARMACEUTICALS

- 13.2.3.1 Increasing adoption of HMI solutions to minimize downtime and cost of pharmaceutical operations to foster segmental growth

- TABLE 47 PHARMACEUTICALS: HUMAN MACHINE INTERFACE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 48 PHARMACEUTICALS: HUMAN MACHINE INTERFACE MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 49 PHARMACEUTICALS: HUMAN MACHINE INTERFACE MARKET, BY CONFIGURATION, 2019-2022 (USD MILLION)

- TABLE 50 PHARMACEUTICALS: HUMAN MACHINE INTERFACE MARKET, BY CONFIGURATION, 2023-2028 (USD MILLION)

- 13.2.4 CHEMICALS

- 13.2.4.1 Growing implementation of HMI technology to ensure high safety and quality of chemical products to propel market

- TABLE 51 CHEMICALS: HUMAN MACHINE INTERFACE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 52 CHEMICALS: HUMAN MACHINE INTERFACE MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 53 CHEMICALS: HUMAN MACHINE INTERFACE MARKET, BY CONFIGURATION, 2019-2022 (USD MILLION)

- TABLE 54 CHEMICALS: HUMAN MACHINE INTERFACE MARKET, BY CONFIGURATION, 2023-2028 (USD MILLION)

- 13.2.5 ENERGY & POWER

- 13.2.5.1 Rising adoption of HMI solutions to enhance production output in energy and power plants to accelerate segmental growth

- TABLE 55 ENERGY & POWER: HUMAN MACHINE INTERFACE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 56 ENERGY & POWER: HUMAN MACHINE INTERFACE MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 57 ENERGY & POWER: HUMAN MACHINE INTERFACE MARKET, BY CONFIGURATION, 2019-2022 (USD MILLION)

- TABLE 58 ENERGY & POWER: HUMAN MACHINE INTERFACE MARKET, BY CONFIGURATION, 2023-2028 (USD MILLION)

- 13.2.6 METALS & MINING

- 13.2.6.1 Increasing enforcement of stringent regulations to ensure safety at mine facilities to boost segmental growth

- TABLE 59 METALS & MINING: HUMAN MACHINE INTERFACE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 60 METALS & MINING: HUMAN MACHINE INTERFACE MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 61 METALS & MINING: HUMAN MACHINE INTERFACE MARKET, BY CONFIGURATION, 2019-2022 (USD MILLION)

- TABLE 62 METALS & MINING: HUMAN MACHINE INTERFACE MARKET, BY CONFIGURATION, 2023-2028 (USD MILLION)

- 13.2.7 WATER & WASTEWATER TREATMENT

- 13.2.7.1 Escalating adoption of HMI solutions to improve reliability of water treatment and distribution systems to fuel segmental growth

- TABLE 63 WATER & WASTEWATER TREATMENT: HUMAN MACHINE INTERFACE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 64 WATER & WASTEWATER TREATMENT: HUMAN MACHINE INTERFACE MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 65 WATER & WASTEWATER TREATMENT: HUMAN MACHINE INTERFACE MARKET, BY CONFIGURATION, 2019-2022 (USD MILLION)

- TABLE 66 WATER & WASTEWATER TREATMENT: HUMAN MACHINE INTERFACE MARKET, BY CONFIGURATION, 2023-2028 (USD MILLION)

- 13.2.8 OTHER PROCESS INDUSTRIES

- TABLE 67 OTHER PROCESS INDUSTRIES: HUMAN MACHINE INTERFACE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 68 OTHER PROCESS INDUSTRIES: HUMAN MACHINE INTERFACE MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 69 OTHER PROCESS INDUSTRIES: HUMAN MACHINE INTERFACE MARKET, BY CONFIGURATION, 2019-2022 (USD MILLION)

- TABLE 70 OTHER PROCESS INDUSTRIES: HUMAN MACHINE INTERFACE MARKET, BY CONFIGURATION, 2023-2028 (USD MILLION)

- 13.3 DISCRETE INDUSTRIES

- FIGURE 47 HUMAN MACHINE INTERFACE MARKET, BY DISCRETE INDUSTRY

- TABLE 71 HUMAN MACHINE INTERFACE MARKET, BY DISCRETE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 72 HUMAN MACHINE INTERFACE MARKET, BY DISCRETE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 73 DISCRETE INDUSTRIES: HUMAN MACHINE INTERFACE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 74 DISCRETE INDUSTRIES: HUMAN MACHINE INTERFACE MARKET, BY REGION, 2023-2028 (USD MILLION)

- FIGURE 48 HUMAN MACHINE INTERFACE MARKET IN ASIA PACIFIC FOR DISCRETE INDUSTRIES TO GROW AT HIGHEST CAGR BETWEEN 2023 AND 2028

- TABLE 75 DISCRETE INDUSTRIES: HUMAN MACHINE INTERFACE MARKET, BY CONFIGURATION, 2019-2022 (USD MILLION)

- TABLE 76 DISCRETE INDUSTRIES: HUMAN MACHINE INTERFACE MARKET, BY CONFIGURATION, 2023-2028 (USD MILLION)

- 13.3.1 AUTOMOBILE

- 13.3.1.1 Reliance on HMI solutions to analyze automobile manufacturing processes in real time to drive market

- TABLE 77 AUTOMOBILE: HUMAN MACHINE INTERFACE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 78 AUTOMOBILE: HUMAN MACHINE INTERFACE MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 79 AUTOMOBILE: HUMAN MACHINE INTERFACE MARKET, BY CONFIGURATION, 2019-2022 (USD MILLION)

- TABLE 80 AUTOMOBILE: HUMAN MACHINE INTERFACE MARKET, BY CONFIGURATION, 2023-2028 (USD MILLION)

- 13.3.2 AEROSPACE

- 13.3.2.1 Adoption of HMI technology to provide real-time weather information to pilots to accelerate market growth

- TABLE 81 AEROSPACE: HUMAN MACHINE INTERFACE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 82 AEROSPACE: HUMAN MACHINE INTERFACE MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 83 AEROSPACE: HUMAN MACHINE INTERFACE MARKET, BY CONFIGURATION, 2019-2022 (USD MILLION)

- TABLE 84 AEROSPACE: HUMAN MACHINE INTERFACE MARKET, BY CONFIGURATION, 2023-2028 (USD MILLION)

- 13.3.3 PACKAGING

- 13.3.3.1 Requirement to streamline packaging processes and minimize wastage to boost adoption of advanced HMI solutions

- TABLE 85 PACKAGING: HUMAN MACHINE INTERFACE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 86 PACKAGING: HUMAN MACHINE INTERFACE MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 87 PACKAGING: HUMAN MACHINE INTERFACE MARKET, BY CONFIGURATION, 2019-2022 (USD MILLION)

- TABLE 88 PACKAGING: HUMAN MACHINE INTERFACE MARKET, BY CONFIGURATION, 2023-2028 (USD MILLION)

- 13.3.4 MEDICAL DEVICES

- 13.3.4.1 Utilization of HMI software to improvise centralized medical device procurement processes to support market growth

- TABLE 89 MEDICAL DEVICES: HUMAN MACHINE INTERFACE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 90 MEDICAL DEVICES: HUMAN MACHINE INTERFACE MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 91 MEDICAL DEVICES: HUMAN MACHINE INTERFACE MARKET, BY CONFIGURATION, 2019-2022 (USD MILLION)

- TABLE 92 MEDICAL DEVICES: HUMAN MACHINE INTERFACE MARKET, BY CONFIGURATION, 2023-2028 (USD MILLION)

- 13.3.5 SEMICONDUCTOR & ELECTRONICS

- 13.3.5.1 Employment of HMI solutions in semiconductor & electronics manufacturing facilities to fuel segmental growth

- TABLE 93 SEMICONDUCTOR & ELECTRONICS: HUMAN MACHINE INTERFACE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 94 SEMICONDUCTOR & ELECTRONICS: HUMAN MACHINE INTERFACE MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 95 SEMICONDUCTOR & ELECTRONICS: HUMAN MACHINE INTERFACE MARKET, BY CONFIGURATION, 2019-2022 (USD MILLION)

- TABLE 96 SEMICONDUCTOR & ELECTRONICS: HUMAN MACHINE INTERFACE MARKET, BY CONFIGURATION, 2023-2028 (USD MILLION)

- 13.3.6 OTHER DISCRETE INDUSTRIES

- TABLE 97 OTHER DISCRETE INDUSTRIES: HUMAN MACHINE INTERFACE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 98 OTHER DISCRETE INDUSTRIES: HUMAN MACHINE INTERFACE MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 99 OTHER DISCRETE INDUSTRIES: HUMAN MACHINE INTERFACE MARKET, BY CONFIGURATION, 2019-2022 (USD MILLION)

- TABLE 100 OTHER DISCRETE INDUSTRIES: HUMAN MACHINE INTERFACE MARKET, BY CONFIGURATION, 2023-2028 (USD MILLION)

14 HUMAN MACHINE INTERFACE MARKET, BY REGION

- 14.1 INTRODUCTION

- FIGURE 49 HUMAN MACHINE INTERFACE MARKET IN CHINA TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 101 HUMAN MACHINE INTERFACE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 102 HUMAN MACHINE INTERFACE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 14.2 NORTH AMERICA

- 14.2.1 RECESSION IMPACT ON MARKET IN NORTH AMERICA

- TABLE 103 NORTH AMERICA: HUMAN MACHINE INTERFACE MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 104 NORTH AMERICA: HUMAN MACHINE INTERFACE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- FIGURE 50 NORTH AMERICA: HUMAN MACHINE INTERFACE MARKET SNAPSHOT

- TABLE 105 NORTH AMERICA: HUMAN MACHINE INTERFACE MARKET, BY PROCESS INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 106 NORTH AMERICA: HUMAN MACHINE INTERFACE MARKET, BY PROCESS INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 107 NORTH AMERICA: HUMAN MACHINE INTERFACE MARKET, BY DISCRETE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 108 NORTH AMERICA: HUMAN MACHINE INTERFACE MARKET, BY DISCRETE INDUSTRY, 2023-2028 (USD MILLION)

- 14.2.2 US

- 14.2.2.1 Deployment of HMI products in renewable energy projects to curb resource wastage to accelerate market growth

- 14.2.3 CANADA

- 14.2.3.1 Requirement for advanced manufacturing technologies in food & beverages and chemicals industries to boost adoption of HMI solutions

- 14.2.4 MEXICO

- 14.2.4.1 Reliance on advanced manufacturing technologies to contribute to market growth

- 14.3 EUROPE

- 14.3.1 RECESSION IMPACT ON MARKET IN EUROPE

- TABLE 109 EUROPE: HUMAN MACHINE INTERFACE MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 110 EUROPE: HUMAN MACHINE INTERFACE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- FIGURE 51 EUROPE: HUMAN MACHINE INTERFACE MARKET SNAPSHOT

- TABLE 111 EUROPE: HUMAN MACHINE INTERFACE MARKET, BY PROCESS INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 112 EUROPE: HUMAN MACHINE INTERFACE MARKET, BY PROCESS INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 113 EUROPE: HUMAN MACHINE INTERFACE MARKET, BY DISCRETE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 114 EUROPE: HUMAN MACHINE INTERFACE MARKET, BY DISCRETE INDUSTRY, 2023-2028 (USD MILLION)

- 14.3.2 UK

- 14.3.2.1 Adoption of automated systems in manufacturing facilities to foster market growth

- 14.3.3 GERMANY

- 14.3.3.1 Utilization of HMI solutions to automate vehicle production process to stimulate market growth

- 14.3.4 FRANCE

- 14.3.4.1 Enforcement of regulations to mitigate greenhouse gas emissions to propel market

- 14.3.5 REST OF EUROPE

- 14.4 ASIA PACIFIC

- 14.4.1 RECESSION IMPACT ON MARKET IN ASIA PACIFIC

- TABLE 115 ASIA PACIFIC: HUMAN MACHINE INTERFACE MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 116 ASIA PACIFIC: HUMAN MACHINE INTERFACE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- FIGURE 52 ASIA PACIFIC: HUMAN MACHINE INTERFACE MARKET SNAPSHOT

- TABLE 117 ASIA PACIFIC: HUMAN MACHINE INTERFACE MARKET, BY PROCESS INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 118 ASIA PACIFIC: HUMAN MACHINE INTERFACE MARKET, BY PROCESS INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 119 ASIA PACIFIC: HUMAN MACHINE INTERFACE MARKET, BY DISCRETE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 120 ASIA PACIFIC: HUMAN MACHINE INTERFACE MARKET, BY DISCRETE INDUSTRY, 2023-2028 (USD MILLION)

- 14.4.2 CHINA

- 14.4.2.1 Surging demand for advanced industrial automation technologies to contribute to market growth

- 14.4.3 JAPAN

- 14.4.3.1 Increasing need for automated systems for combating labor shortage to encourage adoption of HMI solutions

- 14.4.4 INDIA

- 14.4.4.1 Rapid industrialization and growth of manufacturing industries to create opportunities for HMI solution providers

- 14.4.5 REST OF ASIA PACIFIC

- 14.5 ROW

- 14.5.1 RECESSION IMPACT ON MARKET IN ROW

- TABLE 121 ROW: HUMAN MACHINE INTERFACE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 122 ROW: HUMAN MACHINE INTERFACE MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 123 ROW: HUMAN MACHINE INTERFACE MARKET, BY PROCESS INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 124 ROW: HUMAN MACHINE INTERFACE MARKET, BY PROCESS INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 125 ROW: HUMAN MACHINE INTERFACE MARKET, BY DISCRETE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 126 ROW: HUMAN MACHINE INTERFACE MARKET, BY DISCRETE INDUSTRY, 2023-2028 (USD MILLION)

- 14.5.2 SOUTH AMERICA

- 14.5.2.1 Deployment of HMI technologies to improve manufacturing process and ensure quality control to drive market

- 14.5.3 GCC

- 14.5.3.1 Adoption of HMI solutions in construction and infrastructure sectors to boost market growth

- 14.5.4 AFRICA & REST OF MIDDLE EAST

- 14.5.4.1 Government initiatives toward clean energy economy to accelerate market growth

15 COMPETITIVE LANDSCAPE

- 15.1 OVERVIEW

- 15.2 STRATEGIES ADOPTED BY KEY PLAYERS, 2020-2023

- TABLE 127 HUMAN MACHINE INTERFACE MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2020-2023

- 15.3 REVENUE ANALYSIS OF TOP 5 PLAYERS, 2018-2022

- FIGURE 53 HUMAN MACHINE INTERFACE MARKET: REVENUE ANALYSIS OF TOP 5 PLAYERS, 2018-2022

- 15.4 MARKET SHARE ANALYSIS, 2022

- TABLE 128 HUMAN MACHINE INTERFACE MARKET SHARE ANALYSIS, 2022

- FIGURE 54 HUMAN MACHINE INTERFACE MARKET SHARE ANALYSIS, 2022

- 15.5 COMPANY EVALUATION MATRIX, 2022

- 15.5.1 STARS

- 15.5.2 EMERGING LEADERS

- 15.5.3 PERVASIVE PLAYERS

- 15.5.4 PARTICIPANTS

- FIGURE 55 HUMAN MACHINE INTERFACE MARKET: COMPANY EVALUATION MATRIX, 2022

- 15.5.5 COMPANY FOOTPRINT

- TABLE 129 OVERALL COMPANY FOOTPRINT

- TABLE 130 COMPANY OFFERING FOOTPRINT

- TABLE 131 COMPANY END-USER INDUSTRY FOOTPRINT

- TABLE 132 COMPANY REGION FOOTPRINT

- 15.6 START-UP/SME EVALUATION MATRIX, 2022

- 15.6.1 PROGRESSIVE COMPANIES

- 15.6.2 RESPONSIVE COMPANIES

- 15.6.3 DYNAMIC COMPANIES

- 15.6.4 STARTING BLOCKS

- FIGURE 56 HUMAN MACHINE INTERFACE MARKET: START-UP/SME EVALUATION MATRIX, 2022

- 15.6.5 COMPETITIVE BENCHMARKING

- TABLE 133 HUMAN MACHINE INTERFACE MARKET: LIST OF KEY START-UPS/SMES

- TABLE 134 HUMAN MACHINE INTERFACE MARKET: COMPANY OFFERING FOOTPRINT

- TABLE 135 HUMAN MACHINE INTERFACE MARKET: COMPANY END-USER INDUSTRY FOOTPRINT

- TABLE 136 HUMAN MACHINE INTERFACE MARKET: COMPANY REGION FOOTPRINT

- 15.7 COMPETITIVE SCENARIOS AND TRENDS

- TABLE 137 HUMAN MACHINE INTERFACE MARKET: PRODUCT LAUNCHES, 2022

- TABLE 138 HUMAN MACHINE INTERFACE MARKET: DEALS, 2020-2021

16 COMPANY PROFILES

(Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 16.1 KEY PLAYERS

- 16.1.1 ABB

- TABLE 139 ABB: COMPANY OVERVIEW

- FIGURE 57 ABB: COMPANY SNAPSHOT

- TABLE 140 ABB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 16.1.2 ADVANTECH CO., LTD.

- TABLE 141 ADVANTECH CO., LTD.: COMPANY OVERVIEW

- FIGURE 58 ADVANTECH CO., LTD.: COMPANY SNAPSHOT

- TABLE 142 ADVANTECH CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 143 ADVANTECH CO., LTD.: PRODUCT LAUNCHES

- 16.1.3 EMERSON ELECTRIC CO.

- TABLE 144 EMERSON ELECTRIC CO.: COMPANY OVERVIEW

- FIGURE 59 EMERSON ELECTRIC CO.: COMPANY SNAPSHOT

- TABLE 145 EMERSON ELECTRIC CO.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 146 EMERSON ELECTRIC CO.: PRODUCT LAUNCHES

- TABLE 147 EMERSON ELECTRIC CO.: DEALS

- 16.1.4 GENERAL ELECTRIC

- TABLE 148 GENERAL ELECTRIC: COMPANY OVERVIEW

- FIGURE 60 GENERAL ELECTRIC: COMPANY SNAPSHOT

- TABLE 149 GENERAL ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 150 GENERAL ELECTRIC: PRODUCT LAUNCHES

- 16.1.5 HONEYWELL INTERNATIONAL INC.

- TABLE 151 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- FIGURE 61 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- TABLE 152 HONEYWELL INTERNATIONAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 16.1.5.3 Recent developments

- TABLE 153 HONEYWELL INTERNATIONAL INC.: DEALS

- 16.1.6 MITSUBISHI ELECTRIC CORPORATION

- TABLE 154 MITSUBISHI ELECTRIC CORPORATION: COMPANY OVERVIEW

- FIGURE 62 MITSUBISHI ELECTRIC CORPORATION: COMPANY SNAPSHOT

- TABLE 155 MITSUBISHI ELECTRIC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 156 MITSUBISHI ELECTRIC CORPORATION: PRODUCT LAUNCHES

- 16.1.7 ROCKWELL AUTOMATION

- TABLE 157 ROCKWELL AUTOMATION: COMPANY OVERVIEW

- FIGURE 63 ROCKWELL AUTOMATION: COMPANY SNAPSHOT

- TABLE 158 ROCKWELL AUTOMATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 159 ROCKWELL AUTOMATION: PRODUCT LAUNCHES

- TABLE 160 ROCKWELL AUTOMATION: DEALS

- 16.1.8 SCHNEIDER ELECTRIC

- TABLE 161 SCHNEIDER ELECTRIC: COMPANY OVERVIEW

- FIGURE 64 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

- TABLE 162 SCHNEIDER ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 16.1.9 SIEMENS

- TABLE 163 SIEMENS: COMPANY OVERVIEW

- FIGURE 65 SIEMENS: COMPANY SNAPSHOT

- TABLE 164 SIEMENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 16.1.10 YOKOGAWA ELECTRIC CORPORATION

- TABLE 165 YOKOGAWA ELECTRIC CORPORATION: COMPANY OVERVIEW

- FIGURE 66 YOKOGAWA ELECTRIC CORPORATION: COMPANY SNAPSHOT

- TABLE 166 YOKOGAWA ELECTRIC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 16.2 OTHER PLAYERS

- 16.2.1 AMERICAN INDUSTRIAL SYSTEMS INC.

- 16.2.2 BARTEC TOP HOLDING GMBH

- 16.2.3 BECKHOFF AUTOMATION

- 16.2.4 EAO AG

- 16.2.5 INDUCTIVE AUTOMATION, LLC

- 16.2.6 MAKERSAN

- 16.2.7 MAPLE SYSTEMS INC.

- 16.2.8 MICON AUTOMATION SYSTEMS PVT. LTD.

- 16.2.9 NOVAKON CO., LTD.

- 16.2.10 PCI PRIVATE LIMITED

- 16.2.11 RED LION

- 16.2.12 RITTAL GMBH & CO. KG

- 16.2.13 SENECA SRL

- 16.2.14 WECON

- 16.2.15 WEINTEK LABS., INC.

- *Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

17 ADJACENT MARKET

- 17.1 INDUSTRIAL PC MARKET

- 17.2 INTRODUCTION

- FIGURE 67 PANEL IPC SEGMENT TO DOMINATE INDUSTRIAL PC MARKET FROM 2023 TO 2028

- TABLE 167 INDUSTRIAL PC MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 168 INDUSTRIAL PC MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 17.3 PANEL IPC

- 17.3.1 GROWING ADOPTION OF AUTOMATED MANUFACTURING TECHNOLOGIES TO DRIVE SEGMENTAL GROWTH

- TABLE 169 PANEL IPC: INDUSTRIAL PC MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 170 PANEL IPC: INDUSTRIAL PC MARKET, BY REGION, 2023-2028 (USD MILLION)

- 17.4 RACK MOUNT IPC

- 17.4.1 RISING NEED FOR COMPACT DESIGNS IN SPACE-CONSTRAINED APPLICATIONS TO BOOST MARKET GROWTH

- TABLE 171 RACK MOUNT IPC: INDUSTRIAL PC MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 172 RACK MOUNT IPC: INDUSTRIAL PC MARKET, BY REGION, 2023-2028 (USD MILLION)

- 17.5 DIN RAIL IPC

- 17.5.1 INCREASING USE OF RUGGED AND SCALABLE DIN RAIL IPCS FOR MAINTENANCE-FREE AND CONTINUOUS OPERATIONS TO FUEL SEGMENTAL GROWTH

- TABLE 173 DIN RAIL IPC: INDUSTRIAL PC MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 174 DIN RAIL IPC: INDUSTRIAL PC MARKET, BY REGION, 2023-2028 (USD MILLION)

- 17.6 EMBEDDED IPC

- 17.6.1 ESCALATING USAGE OF EMBEDDED IPCS IN HIGH-BANDWIDTH PROJECTS TO FOSTER MARKET GROWTH

- TABLE 175 EMBEDDED IPC: INDUSTRIAL PC MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 176 EMBEDDED IPC: INDUSTRIAL PC MARKET, BY REGION, 2023-2028 (USD MILLION)

18 APPENDIX

- 18.1 INSIGHTS FROM INDUSTRY EXPERTS

- 18.2 DISCUSSION GUIDE

- 18.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 18.4 CUSTOMIZATION OPTIONS

- 18.5 RELATED REPORTS

- 18.6 AUTHOR DETAILS