|

|

市場調査レポート

商品コード

1493851

低速車両の世界市場:車両タイプ別、出力別、モータータイプ&構成別、推進区分別、電池タイプ別、用途別、カテゴリー別、電圧別 - 予測(~2030年)Low-Speed Vehicle Market by Vehicle Type (Commercial Turf Utility, Industrial Utility, Golf Cart, Personal), Power Output (<=5, 6-15, >15 kW), Motor Type & Configuration, Propulsion, Battery Type, Application, Category, Voltage - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 低速車両の世界市場:車両タイプ別、出力別、モータータイプ&構成別、推進区分別、電池タイプ別、用途別、カテゴリー別、電圧別 - 予測(~2030年) |

|

出版日: 2024年06月10日

発行: MarketsandMarkets

ページ情報: 英文 279 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

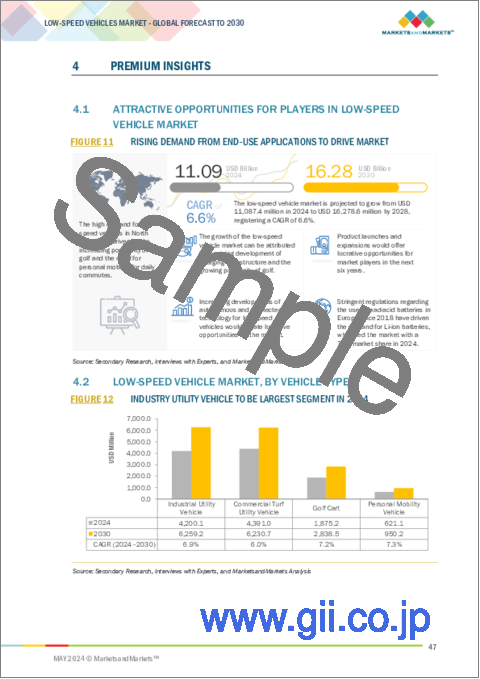

低速車両の市場規模は、2024年の111億米ドルから、CAGR 6.6%で推移し、2030年には163億米ドルに成長すると予測されています。

世界銀行の統計によると、世界人口は毎年1%ずつ増加しており、2020年には世界人口の35%近くが40~79歳の年齢層になるとされています。

米国では人口のほぼ25%が60歳以上であり、欧州諸国では60歳以上の人口が平均21.5%を占めています。さらに日本は現在、60歳以上の人口が全体の28%を占めています。高齢者人口の増加に伴い、高齢者向けモビリティソリューションの需要も伸びています。また、北米、欧州、アジア諸国ではゴルフの人気が高まっており、それに伴い、低速車両の成長も見込まれています。これらの要因から、低速車両はゴルフ場や観光地での移動手段、また、高齢者の日々の近距離移動の手段として好まれており、予測期間中の需要を牽引する見通しです。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2024-2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2024-2030年 |

| 単位 | 金額 (米ドル) |

| セグメント | 車両タイプ・出力・電池タイプ・推進区分・用途・モータータイプ・モーター構成タイプ・電圧・カテゴリ・地域 |

| 対象地域 | アジア太平洋・北米・欧州・その他の地域 |

ゴルフコースが低速車両の主要用途となる見通し:

ゴルフはこれまでエリートスポーツとみなされてきましたが、年齢層を問わず幅広い観客を魅了するようになり、近年大きな盛り上がりを見せています。National Golf Foundationによると、米国では2023年に約2,660万人がゴルフをプレーし、2022年に比べて約100万人増加しました。世界中のゴルフコースのほとんどが西半球にあり、米国は最前線にあり、16,000以上のコースを誇っています。さらに、ゴルフ人気の高まりは、報奨金や賞金の増加にも起因しています。PGTI (Professional Golf Tour of India) によると、アジア太平洋で開催されるプロゴルフトーナメントの賞金は、3万米ドルから20万米ドルの範囲に拡大しています。ゴルフ需要は日本が突出していますが、中国、インド、タイも可処分所得と観光客の増加によりゴルフクラブ事業が有望です。増加するゴルフクラブは、家族向け環境、豪華な客室、フィットネス施設、新規会員獲得のための先進アメニティなど、家族会員カード保持者に数多くの特典を提供しています。この動向は、2~8人乗りのゴルフカートの需要を促進すると予想され、これらの国のゴルフカート市場の今後数年間の有望な成長見通しを示しています。

60-100Vの電圧区分がもっとも成長する見通し:

電気低速車両の60-100V電池の部門は、パワー、効率、航続距離が向上しており、工業施設、製造工場、オフィス輸送、ゴルフ場、丘陵地帯のリゾート地などで使用されています。これらの高電圧電池は、主に商用ユーティリティ車両で好まれています。北米地域では、ゴルフコースやスポーツ施設の拡大、インフラ部門の発展により、芝用の商用ユーティリティ車両の普及が進んでいます。また、技術革新と開発により、多くの企業が車両の航続距離を延ばすために回生ブレーキ技術を提供し始めています。さらに、多くの企業がオンラインオペレーションに移行したことで、需要に応えるため、遠隔地や高地のメガ物流センターや倉庫が世界的に急増しています。

当レポートでは、世界の低速車両の市場を調査し、市場概要、市場影響因子および市場機会の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客のビジネスに影響を与える動向とディスラプション

- OEM分析

- ケーススタディ分析

- 特許分析

- 貿易分析

- 投資と資金調達のシナリオ

- サプライチェーン分析

- エコシステムマッピング

- 価格分析

- 規制状況

- 技術分析

- 主なステークホルダーと購入基準

- 主な会議とイベント

第6章 低速車両市場:車両タイプ別

- ゴルフカート

- 商用芝用ユーティリティ車両

- 産業用ユーティリティ車両

- パーソナルモビリティ車両

- 業界考察

第7章 低速車両市場:出力別

- 5 kW以下

- 6-15kW

- 15kW超

- 業界考察

第8章 低速車両市場:電池タイプ別

- リチウムイオン電池

- 鉛蓄電池

- 業界考察

第9章 低速車両市場:用途別

- ゴルフ場

- ホテルリゾート

- 空港

- 産業施設

- その他

- 業界考察

第10章 低速車両市場:推進方式別

- 電気

- ガソリン

- ディーゼル

- 業界考察

第11章 低速車両市場:カテゴリー別

- L7車両

- L6車両

- 業界考察

第12章 低速車両市場:電圧別

- 60V以下

- 61-100V

- 100V超

- 業界考察

第13章 低速車両市場:モーター構成別

- ハブマウント

- ミッドマウント

- その他

- 業界考察

第14章 低速車両市場:モータータイプ別

- ACモーター

- DCモーター

- 業界考察

第15章 低速車両市場:地域別

- アジア太平洋

- 北米

- 欧州

- その他の地域

第16章 競合情勢

- 概要

- 主要企業の戦略/有力企業

- 市場シェア分析

- 収益分析

- 企業評価マトリックス

- 企業評価マトリックス:ゴルフカートメーカー

- 企業価値評価と財務指標

- ブランド/製品比較

- 競合シナリオと動向

第17章 企業プロファイル

- 主要企業

- TEXTRON INC.

- DEERE & COMPANY

- YAMAHA MOTOR CO., LTD.

- THE TORO COMPANY

- KUBOTA CORPORATION

- CLUB CAR

- AMERICAN LANDMASTER

- COLUMBIA VEHICLE GROUP INC.

- WAEV INC.

- SUZHOU EAGLE ELECTRIC VEHICLE MANUFACTURING CO., LTD.

- その他の企業

- AGT ELECTRIC CARS

- BINTELLI ELECTRIC VEHICLES

- MARSHELL GREEN POWER

- ICON ELECTRIC VEHICLES

- STAR EV CORPORATION, USA

- HDK ELECTRIC VEHICLE

- TROPOS MOTORS, INC.

- PILOTCAR

- MOTO ELECTRIC VEHICLES

- ACG INC.

- CITECAR ELECTRIC VEHICLES

- CRUISE CAR INC.

- LIGIER GROUP

- KAWASAKI MOTOR CORPORATION US

- SPEEDWAYS ELECTRIC

- DINIS

- AUTOPOWER

第18章 MARKETSANDMARKETSによる推奨事項

- 北米が低速車両市場を独占

- 安全機能と電動化が主な焦点領域となる

- 結論

第19章 付録

The low-speed vehicle market is projected to grow from USD 11.1 billion in 2024 to USD 16.3 billion by 2030, at a CAGR of 6.6%. The World Bank statistics say the global population is increasing at ~1% annually, where nearly 35% of the worldwide population came under the 40-79 age group in 2020. Almost 25% of the population in the US was 60 years and above, and European nations had an average of 21.5% of the population above 60 years and above. Further, Japan presently has ~28% of its population in the 60 and above age group. The demand for senior mobility solutions is also growing with the growing aged population. Additionally, the anticipated growth of low-speed vehicles (LSVs) has risen as golf gains popularity across North America, Europe, and Asian countries. Given these factors, LSVs are the preferred choice for transportation at golf courses, tourist spots, and daily short-distance commutes for the retired community, driving market demand during the review period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD Billion) |

| Segments | Vehicle type, power output, battery type, propulsion type, application type, motor type, motor configuration type, voltage type, category type, and region |

| Regions covered | Asia Pacific, North America, Europe, and the Rest of the World [RoW] |

"Golf courses are expected to be the dominant low-speed vehicle application."

Golf has been considered an elite sport for leisure pastime, and a significant surge has been noticed recently as it has attracted a wider audience of any age group. According to the National Golf Foundation, around 26.6 million people in the US played golf in 2023, an increase of approximately 1 million golf enthusiasts compared to 2022. Most golf courses worldwide are in the western hemisphere, so the US is at the forefront, boasting over 16,000 courses. Additionally, the growing popularity of golf can be attributed to an increase in rewards and prize money. Per the Professional Golf Tour of India (PGTI), prize money for events organized in Asia Pacific has scaled up to a range from USD 30,000 to USD 0.2 million in professional golf tournaments. Though Japan has prominent golf demand, China, India, and Thailand are promising golf club businesses owing to increased disposable income and tourist visitors. The rising number of golf clubs offers numerous benefits to packaged family membership card holders, including family-friendly environments, luxury rooms, fitness facilities, and advanced amenities designed to attract new members. This trend is expected to drive demand for golf carts with 2 to 8-seater capacities, presenting a promising growth outlook for the golf cart market in these countries in the coming years.

"The LSVs within 60-100V batteries are projected to grow fastest by 2030."

The 60-100V battery segment of electric low-speed vehicles is installed with six or eight batteries, and the Voltage could be 72V. LSVs with 72V provide better power, efficiency, and improved range and hence are used for industrial facilities, manufacturing plants, office transport, golf courses, and resorts in hilly areas. According to MnM analysis, the estimated range of a 72V LSV is above 35 to 40 miles on a single charge and can be recharged faster when plugged in with a higher capacity 1500w charger. These high-voltage batteries are mainly preferred in commercial utility vehicles. Commercial turf utility vehicles have more penetration in the North American region due to the expansion of golf courses and sports facilities and development in the infrastructure sector. Further, with innovation and development, many companies have started offering regenerative braking technology to extend the vehicle's range. Additionally, the shift of many businesses to online operations has led to a surge in mega distribution centers and warehouses worldwide located at remote or higher altitudes to meet public demand. This growth has driven up sales of electric commercial turf and industrial utility vehicles to provide sufficient power delivery to pull large packages. For instance, In June 2021, Club Car (US) launched its new electric truck in partnership with AYRO Inc. (US), equipped with a 72 V battery. As the demand for commercial turf utility vehicles will grow, the demand for 60-100 V batteries is expected to increase during the forecast period.

"Europe is another prominent market for low-speed vehicles."

The European region is one of the lucrative markets for low-speed vehicle manufacturers during the forecast period. The rising market demand in Europe can be attributed to the strong demand for golf sports and the rapid growth of the hospitality and tourism sectors. Many EU countries host professional tournaments, such as the BMW International Open, German Championship, European Open, and Pro Golf Tour, inviting several international players and visitors to participate in these events. The UK accounts for the region's largest market for low-speed vehicles, holding the maximum share of the total European low-speed vehicle market, followed by France and Germany. Low-speed cars with up to 5 kW power output are preferred in resorts and golf courses. Commercial turf utility and industrial utility vehicles are widely chosen across the region owing to the higher growth rate of the travel and tourism industry and industrial sector. With a strong regional distribution network, north American OEMs significantly influence the European market. In addition, the regional LSV manufacturers are also emphasizing the development of pure electric low-speed vehicles due to stringent emission laws, regional body commitment towards carbon-neutral regions, and growing developments in the charging infrastructures across the EU. With higher demand for these low-power electric LSVs, Chinese players are exporting golf carts, commercial turf, and industry utility vehicles to European countries at relatively lower costs. With growing tourism activities, hotels and resorts are keen to offer the best possible services, and customers also prefer convenient, safe, and clean mobility solutions, leading to the regional growth of low-speed electric vehicles.

The break-up of the profile of primary participants in the low-speed vehicle market:

- By Stakeholder Type: LSV Manufacturers- 60% and Component Manufacturers -40%

- By Designation: C Level Executives- 30%, Director Level - 30%, Others-40%

- By Region: North America - 30%, Europe - 25%, and Asia Pacific - 45%

Prominent companies include Textron Inc. (US), Deere & Company (US), Yamaha Motor Co. Ltd. (Japan), The Toro Company (US), Waev Inc. (US), and Club Car (US).

Research Coverage:

This research report categorizes the LSV market By Application (Golf courses, hotels and restaurants, airports, industrial facilities, and others), by Vehicle Type (Golf cart, industrial turf utility vehicle, commercial utility vehicle, and personal mobility vehicle), by Power Output (<=5kW, 6-15 kW, and >15 kW), by propulsion type (Electric, gasoline, and diesel), by Voltage (<60V, 60-100 V, and >100 V), by Motor Type (AC Motor and DC Motor), by Motor Configuration (Mid-Mounted and hub-Mounted), by Battery Type (Lithium-ion, and Lead acid), by category type (L6 Vehicle and L7 Vehicle) and by region (North America, Europe, Asia Pacific, and Rest of the World). The report's scope covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the LSV market. A thorough analysis of the key industry players has provided insights into their business overview, solutions, and services; key strategies; contracts, partnerships, agreements, new product & service launches; mergers and acquisitions, recession impact; and recent developments associated with the LSV market. This report covers a competitive analysis of upcoming startups in the LSV market ecosystem.

Reasons to buy this report:

The report will help market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall LSV market and the subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Need of golf carts and street legal vehicle with autonomous technology for the geriatric population for their daily commute, increasing popularity of golf sports with increase in number of golf courses in US and Asia Pacific region, and increase in charging infrastructure), restraints (High cost of LSVs has lower sales of the vehicles in developing and underdeveloped countries), opportunities (Increase in infrastructure development in real estate, hotel and resort, and rehabilitation in other European countries for the families of Ukraine after Russia war, increase in autonomous vehicle and connected car technology for better experience of the LSV riders, and increase in global tourism sector which has reached to pre pandemic situation), and challenges (Adoption of lithium ion batteries with high density has increased the battery cost compared to lead acid battery, and lack of safety standards followed by the OEMs with LSV body structure design) are influencing the growth of the LSV market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the LSV market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the LSV market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the LSV market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Textron Inc. (US), Deere & Company (US), Club Car (US), The Toro Company (US), and Yamaha Motor Co Ltd (Japan) among others in the LSV market

The report also helps stakeholders understand the pulse of the automotive micro-mobility market & electric vehicle market by providing them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- TABLE 1 INCLUSION AND EXCLUSIONS

- 1.3 STUDY SCOPE

- FIGURE 1 LOW-SPEED VEHICLE MARKET SEGMENTATION

- 1.3.1 REGIONS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- TABLE 2 CURRENCY EXCHANGE RATES

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 RESEARCH DESIGN MODEL

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primary interviews

- 2.1.3 SAMPLING TECHNIQUES AND DATA COLLECTION METHODS

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 4 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 5 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 6 TOP-DOWN APPROACH

- FIGURE 7 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND AND SUPPLY SIDES

- 2.3 FACTOR ANALYSIS

- 2.4 DATA TRIANGULATION

- FIGURE 8 DATA TRIANGULATION

- 2.5 RECESSION IMPACT ANALYSIS

- 2.6 RESEARCH ASSUMPTIONS

- TABLE 3 RESEARCH ASSUMPTIONS

- 2.7 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

- FIGURE 9 LOW-SPEED VEHICLE MARKET OVERVIEW

- FIGURE 10 LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2024-2030

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN LOW-SPEED VEHICLE MARKET

- FIGURE 11 RISING DEMAND FROM END-USE APPLICATIONS TO DRIVE MARKET

- 4.2 LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE

- FIGURE 12 INDUSTRY UTILITY VEHICLE TO BE LARGEST SEGMENT IN 2024

- 4.3 LOW-SPEED VEHICLE MARKET, BY PROPULSION

- FIGURE 13 ELECTRIC SEGMENT TO SECURE LEADING MARKET POSITION DURING FORECAST PERIOD

- 4.4 LOW-SPEED VEHICLE MARKET, BY BATTERY TYPE

- FIGURE 14 LITHIUM-ION BATTERY TO HOLD HIGHER MARKET SHARE DURING FORECAST PERIOD

- 4.5 LOW-SPEED VEHICLE MARKET, BY APPLICATION

- FIGURE 15 GOLF COURSE TO SURPASS OTHER SEGMENTS DURING FORECAST PERIOD

- 4.6 LOW-SPEED VEHICLE MARKET, BY POWER OUTPUT

- FIGURE 16 <=5 KW SEGMENT TO HOLD HIGHEST SHARE IN 2024

- 4.7 LOW-SPEED VEHICLE MARKET, BY VOLTAGE

- FIGURE 17 <=60 V SEGMENT TO BE DOMINANT DURING FORECAST PERIOD

- 4.8 LOW-SPEED VEHICLE MARKET, BY CATEGORY

- FIGURE 18 L6 VEHICLE TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- 4.9 LOW-SPEED VEHICLE MARKET, BY MOTOR TYPE

- FIGURE 19 AC MOTOR TO BE LARGER SEGMENT THAN DC MOTOR DURING FORECAST PERIOD

- 4.10 LOW-SPEED VEHICLE MARKET, BY MOTOR CONFIGURATION

- FIGURE 20 MID-MOUNTED SEGMENT TO ACQUIRE MAXIMUM SHARE IN 2024

- 4.11 LOW-SPEED VEHICLE MARKET, BY REGION

- FIGURE 21 NORTH AMERICA TO BE LARGEST MARKET FOR LOW-SPEED ELECTRIC VEHICLES DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 22 LOW-SPEED VEHICLE MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising geriatric population

- FIGURE 23 US: SHARE OF GERIATRIC POPULATION (65 AND ABOVE), 1990-2030

- 5.2.1.2 Growing popularity of golf

- TABLE 4 TOTAL GOLF COURSES, BY COUNTRY, 2023

- TABLE 5 MAJOR GOLF EVENTS

- 5.2.1.3 Adequate EV charging infrastructure

- FIGURE 24 EUROPE: EV CHARGING STATIONS, 2022

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of low-speed vehicles in emerging markets

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Booming real estate and other commercial sectors

- 5.2.3.2 Development of autonomous and connected technologies

- TABLE 6 OEMS WITH CONNECTED TECHNOLOGY FEATURES

- 5.2.3.3 Expanding global tourism

- FIGURE 25 TRAVEL AND TOURISM GDP, 2022

- 5.2.4 CHALLENGES

- 5.2.4.1 Substantial cost of batteries

- 5.2.4.2 Lack of safety standards and equipment

- 5.3 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 26 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.4 OEM ANALYSIS

- FIGURE 27 VOLTAGE VS. SEATING OCCUPANCY, BY OEM

- 5.5 CASE STUDY ANALYSIS

- 5.5.1 ENHANCED NVH PERFORMANCE OF ICE GOLF CARS

- 5.5.2 PALM DESERT GOLF CART TRANSPORTATION PILOT PROGRAM

- 5.5.3 SOLAR-POWERED ELECTRIC GOLF CARTS

- 5.5.4 IMPROVEMENTS IN EXISTING AUTONOMOUS GOLF CARTS

- 5.5.5 AUTONOMOUS GOLF CARTS BY CARTEAV

- 5.6 PATENT ANALYSIS

- FIGURE 28 PATENT ANALYSIS

- TABLE 7 PATENT ANALYSIS

- 5.7 TRADE ANALYSIS

- 5.7.1 EXPORT DATA

- TABLE 8 CHINA: EXPORT, BY COUNTRY (USD THOUSAND)

- TABLE 9 US: EXPORT, BY COUNTRY (USD THOUSAND)

- TABLE 10 CANADA: EXPORT, BY COUNTRY (USD THOUSAND)

- TABLE 11 FINLAND: EXPORT, BY COUNTRY (USD THOUSAND)

- TABLE 12 NETHERLANDS: EXPORT, BY COUNTRY (USD THOUSAND)

- TABLE 13 GERMANY: EXPORT, BY COUNTRY (USD THOUSAND)

- 5.7.2 IMPORT DATA

- TABLE 14 US: IMPORT, BY COUNTRY (USD THOUSAND)

- TABLE 15 CANADA: IMPORT, BY COUNTRY (USD THOUSAND)

- TABLE 16 SWEDEN: IMPORT, BY COUNTRY (USD THOUSAND)

- TABLE 17 RUSSIA: IMPORT, BY COUNTRY (USD THOUSAND)

- TABLE 18 UK: IMPORT, BY COUNTRY (USD THOUSAND)

- TABLE 19 NORWAY: IMPORT, BY COUNTRY (USD THOUSAND)

- 5.8 INVESTMENT AND FUNDING SCENARIO

- FIGURE 29 INVESTMENT AND FUNDING SCENARIO, 2021-2024

- TABLE 20 LIST OF FUNDINGS, 2023-2024

- 5.9 SUPPLY CHAIN ANALYSIS

- FIGURE 30 SUPPLY CHAIN ANALYSIS

- 5.10 ECOSYSTEM MAPPING

- FIGURE 31 ECOSYSTEM ANALYSIS

- FIGURE 32 ECOSYSTEM MAP

- TABLE 21 ROLE OF COMPANIES IN ECOSYSTEM

- 5.11 PRICING ANALYSIS

- 5.11.1 AVERAGE SELLING PRICE TREND, BY REGION

- TABLE 22 AVERAGE SELLING PRICE OF LOW-SPEED VEHICLES, BY REGION, 2020-2024

- FIGURE 33 AVERAGE SELLING PRICE OF LOW-SPEED VEHICLES, BY REGION, 2020-2024

- 5.11.2 AVERAGE SELLING PRICE TREND, BY VEHICLE TYPE

- TABLE 23 AVERAGE SELLING PRICE OF LOW-SPEED VEHICLES, BY VEHICLE TYPE, 2020-2024

- 5.12 REGULATORY LANDSCAPE

- 5.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12.1.1 North America

- TABLE 24 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12.1.2 Europe

- TABLE 25 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12.1.3 Asia Pacific

- TABLE 26 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12.1.4 Rest of the World

- TABLE 27 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12.2 REGULATIONS RELATED TO LOW-SPEED VEHICLES

- 5.12.2.1 US

- TABLE 28 US: REGULATIONS FOR LOW-SPEED VEHICLES

- 5.12.2.2 Canada

- TABLE 29 CANADA: REGULATIONS FOR LOW-SPEED VEHICLES

- 5.12.2.3 Europe/Asia

- TABLE 30 EUROPE/ASIA: REGULATIONS FOR LOW-SPEED VEHICLES

- 5.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13 TECHNOLOGY ANALYSIS

- 5.13.1 KEY TECHNOLOGY

- 5.13.1.1 Electrification

- 5.13.2 COMPLIMENTARY TECHNOLOGY

- 5.13.2.1 Improved luxury and safety features

- 5.13.2.2 Advanced GPS and sensors

- 5.13.1 KEY TECHNOLOGY

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 34 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION

- TABLE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION (%)

- 5.14.2 BUYING CRITERIA

- FIGURE 35 KEY BUYING CRITERIA, BY VEHICLE TYPE

- TABLE 32 KEY BUYING CRITERIA, BY VEHICLE TYPE

- 5.15 KEY CONFERENCES AND EVENTS, 2024-2025

- TABLE 33 KEY CONFERENCES AND EVENTS, 2024-2025

6 LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE

- 6.1 INTRODUCTION

- FIGURE 36 LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 34 LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2019-2023 (UNITS)

- TABLE 35 LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2024-2030 (UNITS)

- TABLE 36 LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 37 LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- 6.2 GOLF CART

- 6.2.1 SURGING INTEREST IN GOLF TO DRIVE MARKET

- TABLE 38 GOLF CART MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 39 GOLF CART MARKET, BY REGION, 2024-2030 (UNITS)

- TABLE 40 GOLF CART MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 41 GOLF CART MARKET, BY REGION, 2024-2030 (USD MILLION)

- 6.3 COMMERCIAL TURF UTILITY VEHICLE

- 6.3.1 BOOMING TOURISM AND HOSPITALITY INDUSTRIES TO DRIVE MARKET

- TABLE 42 COMMERCIAL TURF UTILITY VEHICLE MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 43 COMMERCIAL TURF UTILITY VEHICLE MARKET, BY REGION, 2024-2030 (UNITS)

- TABLE 44 COMMERCIAL TURF UTILITY VEHICLE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 45 COMMERCIAL TURF UTILITY VEHICLE MARKET, BY REGION, 2024-2030 (USD MILLION)

- 6.4 INDUSTRIAL UTILITY VEHICLE

- 6.4.1 RISING CONSTRUCTION ACTIVITIES TO DRIVE MARKET

- TABLE 46 INDUSTRIAL UTILITY VEHICLE MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 47 INDUSTRIAL UTILITY VEHICLE MARKET, BY REGION, 2024-2030 (UNITS)

- TABLE 48 INDUSTRIAL UTILITY VEHICLE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 49 INDUSTRIAL UTILITY VEHICLE MARKET, BY REGION, 2024-2030 (USD MILLION)

- 6.5 PERSONAL MOBILITY VEHICLE

- 6.5.1 GROWING ACCEPTANCE OF STREET-LEGAL VEHICLES TO DRIVE MARKET

- TABLE 50 PERSONAL MOBILITY VEHICLE MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 51 PERSONAL MOBILITY VEHICLE MARKET, BY REGION, 2024-2030 (UNITS)

- TABLE 52 PERSONAL MOBILITY VEHICLE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 53 PERSONAL MOBILITY VEHICLE MARKET, BY REGION, 2024-2030 (USD MILLION)

- 6.6 INDUSTRY INSIGHTS

7 LOW-SPEED VEHICLE MARKET, BY POWER OUTPUT

- 7.1 INTRODUCTION

- FIGURE 37 LOW-SPEED VEHICLE MARKET, BY POWER OUTPUT, 2024-2030 (USD MILLION)

- TABLE 54 LOW-SPEED VEHICLE MARKET, BY POWER OUTPUT, 2019-2023 (UNITS)

- TABLE 55 LOW-SPEED VEHICLE MARKET, BY POWER OUTPUT, 2024-2030 (UNITS)

- TABLE 56 LOW-SPEED VEHICLE MARKET, BY POWER OUTPUT, 2019-2023 (USD MILLION)

- TABLE 57 LOW-SPEED VEHICLE MARKET, BY POWER OUTPUT, 2024-2030 (USD MILLION)

- 7.2 <=5 KW

- 7.2.1 INCREASING DEMAND FOR LOW-POWER OUTPUT VEHICLES TO DRIVE MARKET

- TABLE 58 <=5 KW: LOW-SPEED VEHICLE MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 59 <=5 KW: LOW-SPEED VEHICLE MARKET, BY REGION, 2024-2030 (UNITS)

- TABLE 60 <=5 KW: LOW-SPEED VEHICLE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 61 <=5 KW: LOW-SPEED VEHICLE MARKET, BY REGION, 2024-2030 (USD MILLION)

- 7.3 6-15 KW

- 7.3.1 EXTENSIVE USE IN COMMERCIAL MOBILITY TO DRIVE MARKET

- TABLE 62 6-15 KW: LOW-SPEED VEHICLE MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 63 6-15 KW: LOW-SPEED VEHICLE MARKET, BY REGION, 2024-2030 (UNITS)

- TABLE 64 6-15 KW: LOW-SPEED VEHICLE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 65 6-15 KW: LOW-SPEED VEHICLE MARKET, BY REGION, 2024-2030 (USD MILLION)

- 7.4 >15 KW

- 7.4.1 HIGH DEMAND FROM INDUSTRIAL FACILITIES TO DRIVE MARKET

- TABLE 66 >15 KW: LOW-SPEED VEHICLE MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 67 >15 KW: LOW-SPEED VEHICLE MARKET, BY REGION, 2024-2030 (UNITS)

- TABLE 68 >15 KW: LOW-SPEED VEHICLE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 69 >15 KW: LOW-SPEED VEHICLE MARKET, BY REGION, 2024-2030 (USD MILLION)

- 7.5 INDUSTRY INSIGHTS

8 LOW-SPEED VEHICLE MARKET, BY BATTERY TYPE

- 8.1 INTRODUCTION

- FIGURE 38 LOW-SPEED VEHICLE MARKET, BY BATTERY TYPE, 2024-2030 (USD MILLION)

- TABLE 70 LOW-SPEED VEHICLE MARKET, BY BATTERY TYPE, 2019-2023 (UNITS)

- TABLE 71 LOW-SPEED VEHICLE MARKET, BY BATTERY TYPE, 2024-2030 (UNITS)

- TABLE 72 LOW-SPEED VEHICLE MARKET, BY BATTERY TYPE, 2019-2023 (USD MILLION)

- TABLE 73 LOW-SPEED VEHICLE MARKET, BY BATTERY TYPE, 2024-2030 (USD MILLION)

- 8.2 LITHIUM-ION BATTERY

- 8.2.1 HIGHER RANGE AND EFFICIENCY TO DRIVE MARKET

- TABLE 74 LITHIUM-ION BATTERY: LOW-SPEED VEHICLE MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 75 LITHIUM-ION BATTERY: LOW-SPEED VEHICLE MARKET, BY REGION, 2024-2030 (UNITS)

- TABLE 76 LITHIUM-ION BATTERY: LOW-SPEED VEHICLE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 77 LITHIUM-ION BATTERY: LOW-SPEED VEHICLE MARKET, BY REGION, 2024-2030 (USD MILLION)

- 8.3 LEAD-ACID BATTERY

- 8.3.1 PEUKERT EFFECT TO IMPEDE MARKET

- TABLE 78 LEAD-ACID BATTERY: LOW-SPEED VEHICLE MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 79 LEAD-ACID BATTERY: LOW-SPEED VEHICLE MARKET, BY REGION, 2024-2030 (UNITS)

- TABLE 80 LEAD-ACID BATTERY: LOW-SPEED VEHICLE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 81 LEAD-ACID BATTERY: LOW-SPEED VEHICLE MARKET, BY REGION, 2024-2030 (USD MILLION)

- 8.4 INDUSTRY INSIGHTS

9 LOW-SPEED VEHICLE MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- FIGURE 39 LOW-SPEED VEHICLE MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 82 LOW-SPEED VEHICLE MARKET, BY APPLICATION, 2019-2023 (UNITS)

- TABLE 83 LOW-SPEED VEHICLE MARKET, BY APPLICATION, 2024-2030 (UNITS)

- TABLE 84 LOW-SPEED VEHICLE MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 85 LOW-SPEED VEHICLE MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- 9.2 GOLF COURSE

- 9.2.1 INCREASING PARTICIPATION IN GOLF TO DRIVE MARKET

- TABLE 86 GOLF COURSE: LOW-SPEED VEHICLE MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 87 GOLF COURSE: LOW-SPEED VEHICLE MARKET, BY REGION, 2024-2030 (UNITS)

- TABLE 88 GOLF COURSE: LOW-SPEED VEHICLE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 89 GOLF COURSE: LOW-SPEED VEHICLE MARKET, BY REGION, 2024-2030 (USD MILLION)

- 9.3 HOTEL & RESORT

- 9.3.1 GROWING INVESTMENTS IN HOSPITALITY INDUSTRY TO DRIVE MARKET

- TABLE 90 HOTEL & RESORT: LOW-SPEED VEHICLE MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 91 HOTEL & RESORT: LOW-SPEED VEHICLE MARKET, BY REGION, 2024-2030 (UNITS)

- TABLE 92 HOTEL & RESORT: LOW-SPEED VEHICLE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 93 HOTEL & RESORT: LOW-SPEED VEHICLE MARKET, BY REGION, 2024-2030 (USD MILLION)

- 9.4 AIRPORT

- 9.4.1 RISING PASSENGER AND CARGO TRAFFIC TO DRIVE MARKET

- TABLE 94 AIRPORT: LOW-SPEED VEHICLE MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 95 AIRPORT: LOW-SPEED VEHICLE MARKET, BY REGION, 2024-2030 (UNITS)

- TABLE 96 AIRPORT: LOW-SPEED VEHICLE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 97 AIRPORT: LOW-SPEED VEHICLE MARKET, BY REGION, 2024-2030 (USD MILLION)

- 9.5 INDUSTRIAL FACILITY

- 9.5.1 LOW MAINTENANCE COSTS OF LOW-SPEED VEHICLES TO DRIVE MARKET

- TABLE 98 INDUSTRIAL FACILITY: LOW-SPEED VEHICLE MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 99 INDUSTRIAL FACILITY: LOW-SPEED VEHICLE MARKET, BY REGION, 2024-2030 (UNITS)

- TABLE 100 INDUSTRIAL FACILITY: LOW-SPEED VEHICLE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 101 INDUSTRIAL FACILITY: LOW-SPEED VEHICLE MARKET, BY REGION, 2024-2030 (USD MILLION)

- 9.6 OTHER APPLICATIONS

- TABLE 102 OTHER APPLICATIONS: LOW-SPEED VEHICLE MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 103 OTHER APPLICATIONS: LOW-SPEED VEHICLE MARKET, BY REGION, 2024-2030 (UNITS)

- TABLE 104 OTHER APPLICATIONS: LOW-SPEED VEHICLE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 105 OTHER APPLICATIONS: LOW-SPEED VEHICLE MARKET, BY REGION, 2024-2030 (USD MILLION)

- 9.7 INDUSTRY INSIGHTS

10 LOW-SPEED VEHICLE MARKET, BY PROPULSION

- 10.1 INTRODUCTION

- FIGURE 40 LOW-SPEED VEHICLE MARKET, BY PROPULSION, 2024-2030 (USD MILLION)

- TABLE 106 LOW-SPEED VEHICLE MARKET, BY PROPULSION, 2019-2023 (UNITS)

- TABLE 107 LOW-SPEED VEHICLE MARKET, BY PROPULSION, 2024-2030 (UNITS)

- TABLE 108 LOW-SPEED VEHICLE MARKET, BY PROPULSION, 2019-2023 (USD MILLION)

- TABLE 109 LOW-SPEED VEHICLE MARKET, BY PROPULSION, 2024-2030 (USD MILLION)

- 10.2 ELECTRIC

- 10.2.1 DEVELOPMENTS IN CHARGING INFRASTRUCTURE TO DRIVE MARKET

- TABLE 110 ELECTRIC: LOW-SPEED VEHICLE MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 111 ELECTRIC: LOW-SPEED VEHICLE MARKET, BY REGION, 2024-2030 (UNITS)

- TABLE 112 ELECTRIC: LOW-SPEED VEHICLE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 113 ELECTRIC: LOW-SPEED VEHICLE MARKET, BY REGION, 2024-2030 (USD MILLION)

- 10.3 GASOLINE

- 10.3.1 HIGH POWER OUTPUT AND LOAD-CARRYING CAPACITY TO DRIVE MARKET

- TABLE 114 GASOLINE: LOW-SPEED VEHICLE MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 115 GASOLINE: LOW-SPEED VEHICLE MARKET, BY REGION, 2024-2030 (UNITS)

- TABLE 116 GASOLINE: LOW-SPEED VEHICLE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 117 GASOLINE: LOW-SPEED VEHICLE MARKET, BY REGION, 2024-2030 (USD MILLION)

- 10.4 DIESEL

- 10.4.1 STRINGENT EMISSION NORMS TO STUNT GROWTH

- TABLE 118 DIESEL: LOW-SPEED VEHICLE MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 119 DIESEL: LOW-SPEED VEHICLE MARKET, BY REGION, 2024-2030 (UNITS)

- TABLE 120 DIESEL: LOW-SPEED VEHICLE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 121 DIESEL: LOW-SPEED VEHICLE MARKET, BY REGION, 2024-2030 (USD MILLION)

- 10.5 INDUSTRY INSIGHTS

11 LOW-SPEED VEHICLE MARKET, BY CATEGORY

- 11.1 INTRODUCTION

- FIGURE 41 LOW-SPEED VEHICLE MARKET, BY CATEGORY, 2024-2030 (UNITS)

- TABLE 122 LOW-SPEED VEHICLE MARKET, BY CATEGORY, 2019-2023 (UNITS)

- TABLE 123 LOW-SPEED VEHICLE MARKET, BY CATEGORY, 2024-2030 (UNITS)

- 11.2 L7 VEHICLE

- 11.2.1 GROWING PREFERENCE FOR MICROCARS TO DRIVE MARKET

- TABLE 124 L7 VEHICLES MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 125 L7 VEHICLES MARKET, BY REGION, 2024-2030 (UNITS)

- 11.3 L6 VEHICLE

- 11.3.1 EXPANDING TRAVEL AND TOURISM INDUSTRY TO DRIVE MARKET

- TABLE 126 L6 VEHICLES MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 127 L6 VEHICLES MARKET, BY REGION, 2024-2030 (UNITS)

- 11.4 INDUSTRY INSIGHTS

12 LOW-SPEED VEHICLE MARKET, BY VOLTAGE

- 12.1 INTRODUCTION

- FIGURE 42 LOW-SPEED VEHICLE MARKET, BY VOLTAGE, 2024-2030 (USD MILLION)

- TABLE 128 LOW-SPEED VEHICLE MARKET, BY VOLTAGE, 2019-2023 (UNITS)

- TABLE 129 LOW-SPEED VEHICLE MARKET, BY VOLTAGE, 2024-2030 (UNITS)

- TABLE 130 LOW-SPEED VEHICLE MARKET, BY VOLTAGE, 2019-2023 (USD MILLION)

- TABLE 131 LOW-SPEED VEHICLE MARKET, BY VOLTAGE, 2024-2030 (USD MILLION)

- 12.2 <=60 V

- 12.2.1 ADEQUATE POWER AND COST EFFICIENCY TO DRIVE MARKET

- TABLE 132 <=60 V: LOW-SPEED VEHICLE MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 133 <=60 V: LOW-SPEED VEHICLE MARKET, BY REGION, 2024-2030 (UNITS)

- TABLE 134 <=60 V: LOW-SPEED VEHICLE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 135 <=60 V: LOW-SPEED VEHICLE MARKET, BY REGION, 2024-2030 (USD MILLION)

- 12.3 61-100 V

- 12.3.1 IMPROVED RANGE AND EFFICIENCY TO DRIVE MARKET

- TABLE 136 61-100 V: LOW-SPEED VEHICLE MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 137 61-100 V: LOW-SPEED VEHICLE MARKET, BY REGION, 2024-2030 (UNITS)

- TABLE 138 61-100 V: LOW-SPEED VEHICLE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 139 61-100 V: LOW-SPEED VEHICLE MARKET, BY REGION, 2024-2030 (USD MILLION)

- 12.4 >100 V

- 12.4.1 UNTAPPED POTENTIAL FOR ROBUST PERFORMANCE IN RUGGED TERRAINS TO DRIVE MARKET

- TABLE 140 >100 V: LOW-SPEED VEHICLE MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 141 >100 V: LOW-SPEED VEHICLE MARKET, BY REGION, 2024-2030 (UNITS)

- TABLE 142 >100 V: LOW-SPEED VEHICLE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 143 >100 V: LOW-SPEED VEHICLE MARKET, BY REGION, 2024-2030 (USD MILLION)

- 12.5 INDUSTRY INSIGHTS

13 LOW-SPEED VEHICLE MARKET, BY MOTOR CONFIGURATION

- 13.1 INTRODUCTION

- FIGURE 43 LOW-SPEED VEHICLE MARKET, BY MOTOR CONFIGURATION, 2024-2030 (USD MILLION)

- TABLE 144 LOW-SPEED VEHICLE MARKET, BY MOTOR CONFIGURATION, 2019-2023 (UNITS)

- TABLE 145 LOW-SPEED VEHICLE MARKET, BY MOTOR CONFIGURATION, 2024-2030 (UNITS)

- TABLE 146 LOW-SPEED VEHICLE MARKET, BY MOTOR CONFIGURATION, 2019-2023 (USD MILLION)

- TABLE 147 LOW-SPEED VEHICLE MARKET, BY MOTOR CONFIGURATION, 2024-2030 (USD MILLION)

- 13.2 HUB-MOUNTED

- 13.2.1 RISING DEMAND FOR SUSTAINABLE TRANSPORTATION SOLUTIONS TO DRIVE MARKET

- TABLE 148 HUB-MOUNTED: LOW-SPEED VEHICLE MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 149 HUB-MOUNTED: LOW-SPEED VEHICLE MARKET, BY REGION, 2024-2030 (UNITS)

- TABLE 150 HUB-MOUNTED: LOW-SPEED VEHICLE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 151 HUB-MOUNTED: LOW-SPEED VEHICLE MARKET, BY REGION, 2024-2030 (USD MILLION)

- 13.3 MID-MOUNTED

- 13.3.1 ONGOING ELECTRIFICATION TREND TO DRIVE MARKET

- TABLE 152 MID-MOUNTED: LOW-SPEED VEHICLE MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 153 MID-MOUNTED: LOW-SPEED VEHICLE MARKET, BY REGION, 2024-2030 (UNITS)

- TABLE 154 MID-MOUNTED: LOW-SPEED VEHICLE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 155 MID-MOUNTED: LOW-SPEED VEHICLE MARKET, BY REGION, 2024-2030 (USD MILLION)

- 13.4 OTHER MOTOR CONFIGURATIONS

- 13.5 INDUSTRY INSIGHTS

14 LOW-SPEED VEHICLE MARKET, BY MOTOR TYPE

- 14.1 INTRODUCTION

- FIGURE 44 LOW-SPEED VEHICLE MARKET, BY MOTOR TYPE, 2024-2030 (USD MILLION)

- TABLE 156 LOW-SPEED VEHICLE MARKET, BY MOTOR TYPE, 2019-2023 (UNITS)

- TABLE 157 LOW-SPEED VEHICLE MARKET, BY MOTOR TYPE, 2024-2030 (UNITS)

- TABLE 158 LOW-SPEED VEHICLE MARKET, BY MOTOR TYPE, 2019-2023 (USD MILLION)

- TABLE 159 LOW-SPEED VEHICLE MARKET, BY MOTOR TYPE, 2024-2030 (USD MILLION)

- 14.2 AC MOTOR

- 14.2.1 EFFICIENCY AND SIMPLE DESIGN TO DRIVE MARKET

- TABLE 160 AC MOTOR: LOW-SPEED VEHICLE MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 161 AC MOTOR: LOW-SPEED VEHICLE MARKET, BY REGION, 2024-2030 (UNITS)

- TABLE 162 AC MOTOR: LOW-SPEED VEHICLE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 163 AC MOTOR: LOW-SPEED VEHICLE MARKET, BY REGION, 2024-2030 (USD MILLION)

- 14.3 DC MOTOR

- 14.3.1 EASE OF CONTROLLING SPEED AND TORQUE TO DRIVE MARKET

- TABLE 164 DC MOTOR: LOW-SPEED VEHICLE MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 165 DC MOTOR: LOW-SPEED VEHICLE MARKET, BY REGION, 2024-2030 (UNITS)

- TABLE 166 DC MOTOR: LOW-SPEED VEHICLE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 167 DC MOTOR: LOW-SPEED VEHICLE MARKET, BY REGION, 2024-2030 (USD MILLION)

- 14.4 INDUSTRY INSIGHTS

15 LOW-SPEED VEHICLE MARKET, BY REGION

- 15.1 INTRODUCTION

- FIGURE 45 LOW-SPEED VEHICLE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 168 LOW-SPEED VEHICLE MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 169 LOW-SPEED VEHICLE MARKET, BY REGION, 2024-2030 (UNITS)

- TABLE 170 LOW-SPEED VEHICLE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 171 LOW-SPEED VEHICLE MARKET, BY REGION, 2024-2030 (USD MILLION)

- 15.2 ASIA PACIFIC

- 15.2.1 RECESSION IMPACT ANALYSIS

- FIGURE 46 ASIA PACIFIC: LOW-SPEED VEHICLE MARKET SNAPSHOT

- TABLE 172 ASIA PACIFIC: LOW-SPEED VEHICLE MARKET, BY COUNTRY, 2019-2023 (UNITS)

- TABLE 173 ASIA PACIFIC: LOW-SPEED VEHICLE MARKET, BY COUNTRY, 2024-2030 (UNITS)

- TABLE 174 ASIA PACIFIC: LOW-SPEED VEHICLE MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 175 ASIA PACIFIC: LOW-SPEED VEHICLE MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- 15.2.2 CHINA

- 15.2.2.1 Ongoing development of low-speed vehicles to drive market

- TABLE 176 CHINA: LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2019-2023 (UNITS)

- TABLE 177 CHINA: LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2024-2030 (UNITS)

- TABLE 178 CHINA: LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 179 CHINA: LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- 15.2.3 INDIA

- 15.2.3.1 Predominant use of low-speed vehicles in industrial sector to drive market

- TABLE 180 INDIA: LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2019-2023 (UNITS)

- TABLE 181 INDIA: LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2024-2030 (UNITS)

- TABLE 182 INDIA: LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 183 INDIA: LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- 15.2.4 JAPAN

- 15.2.4.1 Increasing need for industrial utility vehicles to drive market

- TABLE 184 JAPAN: LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2019-2023 (UNITS)

- TABLE 185 JAPAN: LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2024-2030 (UNITS)

- TABLE 186 JAPAN: LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 187 JAPAN: LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- 15.2.5 SOUTH KOREA

- 15.2.5.1 Expanding tourism industry to drive market

- TABLE 188 SOUTH KOREA: LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2019-2023 (UNITS)

- TABLE 189 SOUTH KOREA: LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2024-2030 (UNITS)

- TABLE 190 SOUTH KOREA: LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 191 SOUTH KOREA: LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- 15.2.6 THAILAND

- 15.2.6.1 Affordable golfing options to drive market

- TABLE 192 THAILAND: LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2019-2023 (UNITS)

- TABLE 193 THAILAND: LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2024-2030 (UNITS)

- TABLE 194 THAILAND: LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 195 THAILAND: LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- 15.2.7 INDONESIA

- 15.2.7.1 Rising tourist activities to drive market

- TABLE 196 INDONESIA: LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2019-2023 (UNITS)

- TABLE 197 INDONESIA: LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2024-2030 (UNITS)

- TABLE 198 INDONESIA: LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 199 INDONESIA: LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- 15.2.8 VIETNAM

- 15.2.8.1 Upcoming golf events to drive market

- TABLE 200 VIETNAM: LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2019-2023 (UNITS)

- TABLE 201 VIETNAM: LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2024-2030 (UNITS)

- TABLE 202 VIETNAM: LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 203 VIETNAM: LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- 15.2.9 PHILIPPINES

- 15.2.9.1 Growing golfers community to drive market

- TABLE 204 PHILIPPINES: LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2019-2023 (UNITS)

- TABLE 205 PHILIPPINES: LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2024-2030 (UNITS)

- TABLE 206 PHILIPPINES: LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 207 PHILIPPINES: LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- 15.3 NORTH AMERICA

- 15.3.1 RECESSION IMPACT ANALYSIS

- FIGURE 47 NORTH AMERICA: LOW-SPEED VEHICLE MARKET SNAPSHOT

- TABLE 208 NORTH AMERICA: LOW-SPEED VEHICLE MARKET, BY COUNTRY, 2019-2023 (UNITS)

- TABLE 209 NORTH AMERICA: LOW-SPEED VEHICLE MARKET, BY COUNTRY, 2024-2030 (UNITS)

- TABLE 210 NORTH AMERICA: LOW-SPEED VEHICLE MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 211 NORTH AMERICA: LOW-SPEED VEHICLE MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- 15.3.2 US

- 15.3.2.1 Stringent vehicle emission standards to drive market

- TABLE 212 US: LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2019-2023 (UNITS)

- TABLE 213 US: LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2024-2030 (UNITS)

- TABLE 214 US: LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 215 US: LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- 15.3.3 MEXICO

- 15.3.3.1 Growing demand from hospitality industry to drive market

- TABLE 216 MEXICO: LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2019-2023 (UNITS)

- TABLE 217 MEXICO: LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2024-2030 (UNITS)

- TABLE 218 MEXICO: LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 219 MEXICO: LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- 15.3.4 CANADA

- 15.3.4.1 Rapid developments by key players to drive market

- TABLE 220 CANADA: LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2019-2023 (UNITS)

- TABLE 221 CANADA: LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2024-2030 (UNITS)

- TABLE 222 CANADA: LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 223 CANADA: LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- 15.4 EUROPE

- 15.4.1 RECESSION IMPACT ANALYSIS

- FIGURE 48 EUROPE: LOW-SPEED VEHICLE MARKET SNAPSHOT

- TABLE 224 EUROPE: LOW-SPEED VEHICLE MARKET, BY COUNTRY, 2019-2023 (UNITS)

- TABLE 225 EUROPE: LOW-SPEED VEHICLE MARKET, BY COUNTRY, 2024-2030 (UNITS)

- TABLE 226 EUROPE: LOW-SPEED VEHICLE MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 227 EUROPE: LOW-SPEED VEHICLE MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- 15.4.2 UK

- 15.4.2.1 Escalating tourism activities to drive market

- TABLE 228 UK: LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2019-2023 (UNITS)

- TABLE 229 UK: LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2024-2030 (UNITS)

- TABLE 230 UK: LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 231 UK: LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- 15.4.3 FRANCE

- 15.4.3.1 Rising popularity of golf to drive market

- TABLE 232 FRANCE: LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2019-2023 (UNITS)

- TABLE 233 FRANCE: LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2024-2030 (UNITS)

- TABLE 234 FRANCE: LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 235 FRANCE: LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- 15.4.4 GERMANY

- 15.4.4.1 Increasing golf activities to drive market

- TABLE 236 GERMANY: LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2019-2023 (UNITS)

- TABLE 237 GERMANY: LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2024-2030 (UNITS)

- TABLE 238 GERMANY: LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 239 GERMANY: LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- 15.4.5 NORDIC

- 15.4.5.1 Focus on green and zero-emission mobility to drive market

- TABLE 240 NORDIC: LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2019-2023 (UNITS)

- TABLE 241 NORDIC: LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2024-2030 (UNITS)

- TABLE 242 NORDIC: LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 243 NORDIC: LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- 15.4.6 ITALY

- 15.4.6.1 High demand for commercial utility vehicles at hotels and resorts to drive market

- TABLE 244 ITALY: LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2019-2023 (UNITS)

- TABLE 245 ITALY: LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2024-2030 (UNITS)

- TABLE 246 ITALY: LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 247 ITALY: LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- 15.4.7 SPAIN

- 15.4.7.1 Popularity of golf holidays to drive market

- TABLE 248 SPAIN: LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2019-2023 (UNITS)

- TABLE 249 SPAIN: LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2024-2030 (UNITS)

- TABLE 250 SPAIN: LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 251 SPAIN: LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- 15.5 REST OF THE WORLD

- 15.5.1 RECESSION IMPACT ANALYSIS

- FIGURE 49 REST OF THE WORLD: LOW-SPEED VEHICLE MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 252 REST OF THE WORLD: LOW-SPEED VEHICLE MARKET, BY COUNTRY, 2019-2023 (UNITS)

- TABLE 253 REST OF THE WORLD: LOW-SPEED VEHICLE MARKET, BY COUNTRY, 2024-2030 (UNITS)

- TABLE 254 REST OF THE WORLD: LOW-SPEED VEHICLE MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 255 REST OF THE WORLD: LOW-SPEED VEHICLE MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- 15.5.2 SOUTH AFRICA

- 15.5.2.1 Surge in demand for personal mobility vehicles to drive market

- TABLE 256 SOUTH AFRICA: LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2019-2023 (UNITS)

- TABLE 257 SOUTH AFRICA: LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2024-2030 (UNITS)

- TABLE 258 SOUTH AFRICA: LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 259 SOUTH AFRICA: LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- 15.5.3 BRAZIL

- 15.5.3.1 Presence of world-class golf courses to drive market

- TABLE 260 BRAZIL: LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2019-2023 (UNITS)

- TABLE 261 BRAZIL: LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2024-2030 (UNITS)

- TABLE 262 BRAZIL: LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 263 BRAZIL: LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- 15.5.4 IRAN

- 15.5.4.1 Significant demand from tourism industry to drive market

- TABLE 264 IRAN: LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2019-2023 (UNITS)

- TABLE 265 IRAN: LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2024-2030 (UNITS)

- TABLE 266 IRAN: LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 267 IRAN: LOW-SPEED VEHICLE MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

16 COMPETITIVE LANDSCAPE

- 16.1 OVERVIEW

- 16.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- TABLE 268 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- 16.3 MARKET SHARE ANALYSIS, 2023

- FIGURE 50 MARKET SHARE OF KEY PLAYERS, 2023

- TABLE 269 LOW-SPEED VEHICLE MARKET: DEGREE OF COMPETITION, 2023

- 16.4 REVENUE ANALYSIS, 2021-2023

- FIGURE 51 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2021-2023

- 16.5 COMPANY EVALUATION MATRIX: LOW-SPEED VEHICLE SUPPLIERS, 2024

- 16.5.1 STARS

- 16.5.2 EMERGING LEADERS

- 16.5.3 PERVASIVE PLAYERS

- 16.5.4 PARTICIPANTS

- FIGURE 52 COMPANY EVALUATION MATRIX (LOW-SPEED VEHICLE SUPPLIERS), 2024

- 16.5.5 COMPANY FOOTPRINT: LOW-SPEED VEHICLE SUPPLIERS

- FIGURE 53 LOW-SPEED VEHICLE SUPPLIERS: COMPANY FOOTPRINT

- TABLE 270 LOW-SPEED VEHICLE SUPPLIERS: APPLICATION FOOTPRINT

- TABLE 271 LOW-SPEED VEHICLE SUPPLIERS: PROPULSION FOOTPRINT

- TABLE 272 LOW-SPEED VEHICLE SUPPLIERS: REGION FOOTPRINT

- 16.6 COMPANY EVALUATION MATRIX: GOLF CART MANUFACTURERS, 2024

- 16.6.1 STARS

- 16.6.2 EMERGING LEADERS

- 16.6.3 PERVASIVE PLAYERS

- 16.6.4 PARTICIPANTS

- FIGURE 54 COMPANY EVALUATION MATRIX (GOLF CART MANUFACTURERS), 2024

- 16.6.5 COMPANY FOOTPRINT: GOLF CART MANUFACTURERS

- FIGURE 55 GOLF CART MANUFACTURERS: COMPANY FOOTPRINT

- TABLE 273 GOLF CART MANUFACTURERS: PROPULSION FOOTPRINT

- TABLE 274 GOLF CART MANUFACTURERS: APPLICATION FOOTPRINT

- TABLE 275 GOLF CART MANUFACTURERS: REGION FOOTPRINT

- 16.7 COMPANY VALUATION AND FINANCIAL METRICS

- FIGURE 56 COMPANY VALUATION, 2023

- FIGURE 57 FINANCIAL METRICS, 2023

- 16.8 BRAND/PRODUCT COMPARISON

- FIGURE 58 BRAND/PRODUCT COMPARISON

- 16.9 COMPETITIVE SCENARIO AND TRENDS

- 16.9.1 PRODUCT LAUNCHES, 2020-2024

- TABLE 276 LOW-SPEED VEHICLE MARKET: PRODUCT LAUNCHES, 2020-2024

- 16.9.2 DEALS, 2020-2024

- TABLE 277 LOW-SPEED VEHICLE MARKET: DEALS, 2020-2024

- 16.9.3 EXPANSIONS, 2020-2024

- TABLE 278 LOW-SPEED VEHICLE MARKET: EXPANSIONS, 2020-2024

- 16.9.4 OTHERS, 2020-2024

- TABLE 279 LOW-SPEED VEHICLE MARKET: OTHERS, 2020-2024

17 COMPANY PROFILES

- 17.1 KEY PLAYERS

- (Business overview, Products offered, Recent developments, MnM view, Key strengths, Strategic choices, and Weaknesses and Competitive threats)**

- 17.1.1 TEXTRON INC.

- TABLE 280 TEXTRON INC.: COMPANY OVERVIEW

- FIGURE 59 TEXTRON INC.: COMPANY SNAPSHOT

- TABLE 281 TEXTRON INC: PRODUCTS OFFERED

- TABLE 282 TEXTRON INC.: PRODUCT LAUNCHES

- TABLE 283 TEXTRON INC.: DEALS

- TABLE 284 TEXTRON INC.: OTHERS

- 17.1.2 DEERE & COMPANY

- TABLE 285 DEERE & COMPANY: COMPANY OVERVIEW

- FIGURE 60 DEERE & COMPANY: COMPANY SNAPSHOT

- TABLE 286 DEERE & COMPANY: PRODUCTS OFFERED

- TABLE 287 DEERE & COMPANY: PRODUCT LAUNCHES

- TABLE 288 DEERE & COMPANY: DEALS

- TABLE 289 DEERE & COMPANY: OTHERS

- 17.1.3 YAMAHA MOTOR CO., LTD.

- TABLE 290 YAMAHA MOTOR CO., LTD.: COMPANY OVERVIEW

- FIGURE 61 YAMAHA MOTOR CO., LTD.: COMPANY SNAPSHOT

- TABLE 291 YAMAHA MOTOR CO., LTD.: PRODUCTS OFFERED

- TABLE 292 YAMAHA MOTOR CO., LTD.: PRODUCT LAUNCHES

- TABLE 293 YAMAHA MOTOR CO., LTD.: DEALS

- TABLE 294 YAMAHA MOTOR CO., LTD.: EXPANSIONS

- TABLE 295 YAMAHA MOTOR CO., LTD.: OTHERS

- 17.1.4 THE TORO COMPANY

- TABLE 296 THE TORO COMPANY: COMPANY OVERVIEW

- FIGURE 62 THE TORO COMPANY: COMPANY SNAPSHOT

- TABLE 297 THE TORO COMPANY: PRODUCTS OFFERED

- TABLE 298 THE TORO COMPANY: PRODUCT LAUNCHES

- TABLE 299 THE TORO COMPANY: DEALS

- TABLE 300 THE TORO COMPANY: EXPANSIONS

- 17.1.5 KUBOTA CORPORATION

- TABLE 301 KUBOTA CORPORATION: COMPANY OVERVIEW

- FIGURE 63 KUBOTA CORPORATION: COMPANY SNAPSHOT

- TABLE 302 KUBOTA CORPORATION: PRODUCTS OFFERED

- TABLE 303 KUBOTA CORPORATION: PRODUCT LAUNCHES

- TABLE 304 KUBOTA CORPORATION: DEALS

- TABLE 305 KUBOTA CORPORATION: EXPANSIONS

- 17.1.6 CLUB CAR

- TABLE 306 CLUB CAR: COMPANY OVERVIEW

- TABLE 307 CLUB CAR: PRODUCTS OFFERED

- TABLE 308 CLUB CAR: PRODUCT LAUNCHES

- TABLE 309 CLUB CAR: DEALS

- TABLE 310 CLUB CAR: EXPANSIONS

- TABLE 311 CLUB CAR: OTHERS

- 17.1.7 AMERICAN LANDMASTER

- TABLE 312 AMERICAN LANDMASTER: COMPANY OVERVIEW

- TABLE 313 AMERICAN LANDMASTER: PRODUCTS OFFERED

- TABLE 314 AMERICAN LANDMASTER: PRODUCT LAUNCHES

- TABLE 315 AMERICAN LANDMASTER: DEALS

- 17.1.8 COLUMBIA VEHICLE GROUP INC.

- TABLE 316 COLUMBIA VEHICLE GROUP INC.: COMPANY OVERVIEW

- TABLE 317 COLUMBIA VEHICLE GROUP INC.: PRODUCTS OFFERED

- TABLE 318 COLUMBIA VEHICLE GROUP INC.: PRODUCT LAUNCHES

- TABLE 319 COLUMBIA VEHICLE GROUP INC.: DEALS

- 17.1.9 WAEV INC.

- TABLE 320 WAEV INC.: COMPANY OVERVIEW

- TABLE 321 WAEV INC.: PRODUCTS OFFERED

- TABLE 322 WAEV INC.: PRODUCT LAUNCHES

- TABLE 323 WAEV INC.: DEALS

- TABLE 324 WAEV INC.: OTHERS

- 17.1.10 SUZHOU EAGLE ELECTRIC VEHICLE MANUFACTURING CO., LTD.

- TABLE 325 SUZHOU EAGLE ELECTRIC VEHICLE MANUFACTURING CO., LTD.: COMPANY OVERVIEW

- TABLE 326 SUZHOU EAGLE ELECTRIC VEHICLE MANUFACTURING CO., LTD.: PRODUCTS OFFERED

- 17.2 OTHER PLAYERS

- 17.2.1 AGT ELECTRIC CARS

- TABLE 327 AGT ELECTRIC CARS: COMPANY OVERVIEW

- 17.2.2 BINTELLI ELECTRIC VEHICLES

- TABLE 328 BINTELLI ELECTRIC VEHICLE: COMPANY OVERVIEW

- 17.2.3 MARSHELL GREEN POWER

- TABLE 329 MARSHELL GREEN POWER: COMPANY OVERVIEW

- 17.2.4 ICON ELECTRIC VEHICLES

- TABLE 330 ICON ELECTRIC VEHICLES: COMPANY OVERVIEW

- 17.2.5 STAR EV CORPORATION, USA

- TABLE 331 STAR EV CORPORATION, USA: COMPANY OVERVIEW

- 17.2.6 HDK ELECTRIC VEHICLE

- TABLE 332 HDK ELECTRIC VEHICLE: COMPANY OVERVIEW

- 17.2.7 TROPOS MOTORS, INC.

- TABLE 333 TROPOS MOTORS, INC.: COMPANY OVERVIEW

- 17.2.8 PILOTCAR

- TABLE 334 PILOTCAR: COMPANY OVERVIEW

- 17.2.9 MOTO ELECTRIC VEHICLES

- TABLE 335 MOTO ELECTRIC VEHICLES: COMPANY OVERVIEW

- 17.2.10 ACG INC.

- TABLE 336 ACG INC.: COMPANY OVERVIEW

- 17.2.11 CITECAR ELECTRIC VEHICLES

- TABLE 337 CITECAR ELECTRIC VEHICLES: COMPANY OVERVIEW

- 17.2.12 CRUISE CAR INC.

- TABLE 338 CRUISE CAR INC.: COMPANY OVERVIEW

- 17.2.13 LIGIER GROUP

- TABLE 339 LIGIER GROUP: COMPANY OVERVIEW

- 17.2.14 KAWASAKI MOTOR CORPORATION US

- TABLE 340 KAWASAKI MOTOR CORPORATION US: COMPANY OVERVIEW

- 17.2.15 SPEEDWAYS ELECTRIC

- TABLE 341 SPEEDWAYS ELECTRIC: COMPANY OVERVIEW

- 17.2.16 DINIS

- TABLE 342 DINIS: COMPANY OVERVIEW

- 17.2.17 AUTOPOWER

- TABLE 343 AUTOPOWER: COMPANY OVERVIEW

- *Details on Business overview, Products offered, Recent developments, MnM view, Key strengths, Strategic choices, and Weaknesses and Competitive threats might not be captured in case of unlisted companies.

18 RECOMMENDATIONS BY MARKETSANDMARKETS

- 18.1 NORTH AMERICA TO DOMINATE LOW-SPEED VEHICLE MARKET

- 18.2 SAFETY FEATURES AND ELECTRIFICATION TO BE KEY FOCUS AREAS

- 18.3 CONCLUSION

19 APPENDIX

- 19.1 INSIGHTS FROM INDUSTRY EXPERTS

- 19.2 DISCUSSION GUIDE

- 19.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 19.4 CUSTOMIZATION OPTIONS

- 19.4.1 LOW-SPEED VEHICLE MARKET, BY PROPULSION, AT COUNTRY LEVEL

- 19.4.1.1 Gasoline

- 19.4.1.2 Diesel

- 19.4.1.3 Electric

- 19.4.2 LOW-SPEED VEHICLE MARKET, BY POWER OUTPUT, AT COUNTRY LEVEL

- 19.4.2.1 <=5 kW

- 19.4.2.2 6-15 kW

- 19.4.2.3 >15 kW

- 19.4.3 LOW-SPEED VEHICLE MARKET, BY SEATING CAPACITY

- 19.4.3.1 Small (2-4 Seater)

- 19.4.3.2 Medium (6-8 Seater)

- 19.4.3.3 Large (Above 8 Seater)

- 19.4.1 LOW-SPEED VEHICLE MARKET, BY PROPULSION, AT COUNTRY LEVEL

- 19.5 RELATED REPORTS

- 19.6 AUTHOR DETAILS