|

|

市場調査レポート

商品コード

1419623

自動車用V2X市場:接続性別、通信別、車両タイプ別、推進力別、オファリング別、ユニット別、技術別、地域別 - 2030年までの予測Automotive V2X Market by Connectivity, Communication, Vehicle Type, Propulsion, Offering, Unit, Technology and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 自動車用V2X市場:接続性別、通信別、車両タイプ別、推進力別、オファリング別、ユニット別、技術別、地域別 - 2030年までの予測 |

|

出版日: 2024年01月25日

発行: MarketsandMarkets

ページ情報: 英文 321 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

| 調査範囲 | |

|---|---|

| 調査対象年 | 2023年~2030年 |

| 基準年 | 2022年 |

| 予測期間 | 2023年~2030年 |

| 検討単位 | 金額(100万米ドル/10億米ドル) |

| セグメント | 接続性別(DSRC、C-V2X)、通信別(V2V、V2I、V2P、V2G、V2C)、車両タイプ別(乗用車、商用車)、推進力別、オファリング別(ハードウェア、ソフトウェア)、ユニット別、技術別、地域別 |

| 対象地域 | アジア太平洋、欧州、北米、その他の地域 |

世界の自動車用V2Xの市場規模は、2023年の5億米ドルからCAGR 51.9%で拡大し、2030年までに95億米ドルに成長すると予測されています。

コネクテッドカー需要の増加や自律走行モビリティ需要の増加などのパラメータが市場を牽引します。さらに、5G技術の進歩とV2X技術に対する政府の支援が、この市場に新たな機会を生み出すと思われます。

乗用車セグメントは、世界の自動車セクターの中で最大のカテゴリーを占めており、自動車のV2X(Vehicle-to-Everything)技術にとって最も有望な市場として認識されています。自動車産業は、新興経済圏、特に中国とインドで急速な拡大を経験しています。新興経済圏では、利用可能な資源、熟練していながら費用対効果の高い労働力、確立された自動車関連事業、生産と貿易に対する政府の支援政策などの要因により、大手自動車メーカーの投資が増加しています。アジア太平洋地域は自動車セクターの重要な生産拠点として浮上しており、中でも中国は同地域最大の乗用車市場として際立っています。2022年、乗用車の世界販売台数は約5,740万台に達しました。さまざまな相手先商標製品メーカー(OEM)が、自社の車種にV2X技術を組み込んでいます。自動車用V2X市場の乗用車セグメントは、予測期間を通じて大幅な成長が見込まれています。乗用車の事故に起因する死亡事故をめぐる懸念は、国民と政府の双方にとって焦点となっており、自動車用V2X市場におけるこの特定セグメントの拡大を促進する可能性があります。

北米は、急速な成長を特徴とする世界的に急成長している自動車分野の一つとして際立っています。この地域は、Ford Motors、General Motors、Fiat Chrysler Automobilesのような業界の大手企業を抱え、特に高度な快適性と安全技術を備えた乗用車が好まれています。大手自動車メーカー3社を抱える米国は、北米最大の市場を形成しており、自動車市場全体の3分の2以上を占めています。北米自由貿易協定(NAFTA)は、この地域の自動車およびテクノロジー産業の繁栄に大きく貢献しています。

当レポートでは、世界の自動車用V2X市場について調査し、接続性別、通信別、車両タイプ別、推進力別、オファリング別、ユニット別、技術別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- サプライチェーン分析

- 主要な利害関係者と購入基準

- 技術分析

- エコシステム分析

- 自動車用V2XへのOEM投資

- 現在市場にある商用V2Xデバイス

- 顧客のビジネスに影響を与える動向/混乱

- 価格分析

- 特許分析

- ケーススタディ分析

- 関税と規制の概要

- 2024年~2025年の主要な会議とイベント

第6章 自動車用V2X市場、製品別

- イントロダクション

- ハードウェア

- ソフトウェア

- 主な洞察

第7章 自動車用V2X市場、通信別

- イントロダクション

- V2V

- V2I

- V2G

- V2P

- V2C

- V2D

- 主な洞察

第8章 自動車用V2X市場、推進力別

- イントロダクション

- エンジン車(ICE)

- 電気自動車(EV)

- 主な洞察

第9章 自動車用V2X市場、技術別

- イントロダクション

- V2V

- V2I

- V2P

- 主な洞察

第10章 自動車用V2X市場、車両タイプ別

- イントロダクション

- 乗用車

- 商用車

- 主な洞察

第11章 自動車用V2X市場、接続性別

- イントロダクション

- DSRC

- C-V2X

- 主な洞察

第12章 自動車用V2X市場、ユニット別

- イントロダクション

- 車載器(OBU)

- 路側ユニット(RSU)

第13章 自動車用V2X市場、オファリング別

- イントロダクション

- ハードウェア

- ソフトウェア

- サービス

第14章 自動車用V2X市場、地域別

- イントロダクション

- アジア太平洋

- 欧州

- 北米

- その他の地域

第15章 競合情勢

- 概要

- 市場ランキング分析

- 主要企業の戦略、2020~2023年

- 収益分析

- 企業(主要企業)の評価マトリックス

- 企業(その他の主要企業)の評価マトリックス

- 競合シナリオ

第16章 企業プロファイル

- 主要参入企業

- QUALCOMM INCORPORATED

- AUTOTALKS

- HARMAN INTERNATIONAL

- HUAWEI TECHNOLOGIES CO., LTD.

- NXP SEMICONDUCTORS

- CONTINENTAL AG

- ROBERT BOSCH GMBH

- COHDA WIRELESS

- INFINEON TECHNOLOGIES AG

- DENSO CORPORATION

- STMICROELECTRONICS

- HYUNDAI MOBIS

- その他の企業

- KAPSCH GROUP

- MARBEN PRODUCTS

- CAPGEMINI ENGINEERING

- NOKIA

- DSPACE GMBH

- FICOSA INTERNACIONAL SA

- ESCRYPT

- VECTOR INFORMATIK GMBH

- VOLKSWAGEN AG

- BMW AG

- MERCEDES-BENZ GROUP AG

- AUDI AG

- RENAULT GROUP

- MCLAREN GROUP

- UNEX TECHNOLOGY CORP.

- MITSUBISHI ELECTRIC CORPORATION

- FLEX LTD.

- TATA MOTORS

- HITACHI SOLUTIONS, LTD.

- NISSAN MOTOR CO., LTD.

- LEAR CORPORATION

- INTEL CORPORATION

- DANLAW, INC.

- COMMSIGNIA LTD.

- GENERAL MOTORS

- FORD MOTOR COMPANY

- SOAR ROBOTICS

第17章 市場における提言

第18章 付録

Report Description

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2023-2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Units Considered | Value (USD Million/Billion) |

| Segments | Connectivity (DSRC, and C-V2X), Communication (V2V, V2I, V2P, V2G, V2C), Vehicle Type (Passenger Cars & Commercial Vehicles), Propulsion, Offering (Hardware and Software), Unit, Technology and Region |

| Regions covered | Asia Pacific, Europe, North America, and RoW |

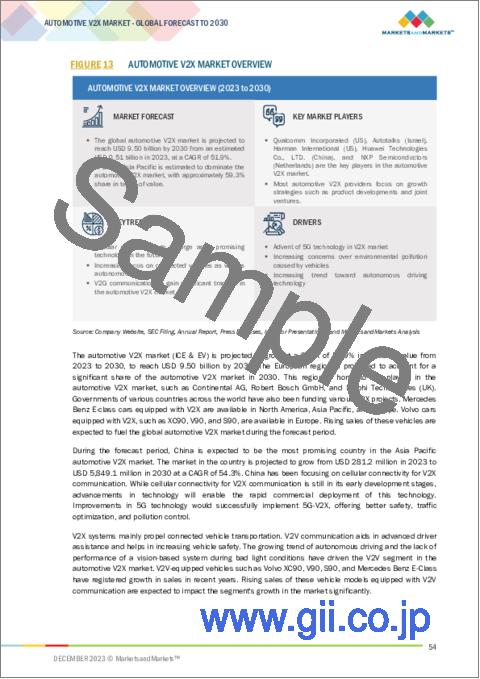

The global automotive V2X market is projected to grow from USD 0.5 billion in 2023 to USD 9.5 billion by 2030, at a CAGR of 51.9%. Parameters such as an increase in demand for connected vehicles and an increase in demand for autonomous mobility will drive the market. In addition, the advancements in 5G technology, paired with government support for V2X technology, will create new opportunities for this market.

"Passenger car segment is expected to be the largest market during the forecast period, by vehicle type."

The passenger car segment represents the largest category within the global automotive sector and is identified as the most promising market for automotive Vehicle-to-Everything (V2X) technology. The automotive industry has experienced rapid expansion in emerging economies, notably in China and India, where leading automobile manufacturers are increasingly investing due to factors such as available resources, a skilled yet cost-effective workforce, established auto-ancillary businesses, and supportive government policies for production and trade. The Asia Pacific region has emerged as a key production hub for the automotive sector, with China standing out as the region's largest market for passenger cars. In 2022, global sales of passenger cars reached approximately 57.4 million units. Various original equipment manufacturers (OEMs) have integrated V2X technology into their vehicle models. Notable examples include Ford's inclusion of V2X in the Mustang Mach E, Honda's implementation in models such as the Civic Tourer and CR-V, Mercedes Benz integrating the technology into the E-Class and S-Class, and NIO offering V2X in their ES7, ET7, and ET5 models. The passenger cars segment within the automotive V2X market is anticipated to experience substantial growth throughout the forecast period. Concerns surrounding fatalities resulting from accidents involving passenger cars have become a focal point for both the public and governments, potentially driving the expansion of this specific segment within the automotive V2X market.

"North America is expected to grow significantly during the forecast period."

North America stands out as one of the globally burgeoning automotive sectors, characterized by rapid growth. This region, housing major industry players like Ford Motors, General Motors, and Fiat Chrysler Automobiles, particularly favors passenger cars equipped with advanced comfort and safety technologies. The United States, hosting the big three automakers, constitutes the largest market in North America, commanding over two-thirds of the overall automotive market, with Mexico and Canada following suit. Domination in the market is evident among American OEMs, including Ford Motors, General Motors, and Fiat-Chrysler Automotive, alongside established European and Asian counterparts such as Toyota (Japan), Nissan (Japan), Honda (Japan), Hyundai/Kia (South Korea), BMW Group (Germany), and Volkswagen Group (Germany). The North American Free Trade Agreement (NAFTA) has significantly contributed to the region's flourishing automotive and technology industries. North America has a sizable customer base and high disposable income and an appealing market for the entire automobile ecosystem. Ongoing advancements in safety regulations within North American countries, such as discussions on mandatory rear-view camera installations in the United States and considerations for mandates related to Vehicle-to-Everything (V2X) communication, coupled with the presence of key automotive sector players like Qualcomm Incorporated and HARMAN International, are poised to propel the North American V2X market. In May 2023, in collaboration with PG&E, BMW initiated V2X testing in California, USA. Subsequently, in September 2023, the BMW Group formalized a 5G-connected vehicle license agreement with Avanci, granting a license to essential patented technologies for 5G, including critical components such as Cellular Vehicle-to-Everything (C-V2X). This strategic move underscores the commitment of major industry players to advance technological frontiers in the North American automotive landscape.

"Cellular Vehicle to Everything (C-V2X) segment is estimated to be the fastest growing segment in the automotive V2X market during the forecast period"

C-V2X stands out as a cutting-edge technology that has recently garnered global attention due to its exceptional efficiency and contributions to mobility safety. This advanced wireless technology empowers vehicles to maintain connectivity while in motion, facilitating communication with various entities in their vicinity, including other vehicles (V2V), pedestrians (V2P), roadside infrastructure (V2I), network (V2N), and cloud (V2C). Introduced by the 3rd Generation Partnership Project (3GPP) in June 2017 as LTE-V2X within its 3GPP release 14, C-V2X has become a focal point of innovation in wireless communication. The 3GPP, comprising seven telecommunication connectivity development organizations (ARIB, ATIS, CCSA, ETSI, TSDSI, TTC, and TTA), provides a stable environment for its members to generate reports and specifications defining 3GPP technologies. C-V2X operates in two transmission modes. The first, known as short-range direct transmission mode (<1 km), facilitates V2V, V2P, and V2I communication, utilizing the 5.9 GHz frequency band designated as the Intelligent Transport System (ITS) spectrum. This mode functions independently of the cellular network. The second mode, long-range network communication (>1 km), operates in the mobile operator spectrum band, leveraging conventional mobile networks. This enables vehicles to access information from the cloud regarding traffic and road conditions in a given area. Key advantages of C-V2X encompass enhanced security and real-time, low-latency communications. Anticipated advancements in 5G technology are poised to enhance transmission speed and quality further. Notably, C-V2X supports short- and long-range transmission among vehicles and other connected devices. Countries are already planning to develop V2X-enabled vehicle ecosystem. China, for instance, has focused on the burgeoning C-V2X technology, with an expectation that approximately 30-40% of new cars will come equipped with pre-installed C-V2X capabilities by 2025.

Prominent original equipment manufacturers (OEMs) have embarked on developing and providing C-V2X, albeit on select models. This includes BYD, which features C-V2X in the BYD Han EV; Ford, incorporating it into models such as the F-150, Mustang Mach E, and Bronco; Mercedes Benz, integrating the technology into the E-Class and S-Class; NIO, providing C-V2X in the ES7, ET5, and ET7 models; SAIC, equipping the Buick GL6 and GL8 with C-V2X connectivity; Stellantis, including it in the Jeep Wrangler; Volvo, incorporating C-V2X into the XC90; FAW, integrating it into the Hongqi H7 and E-HS9 models; and Great Wall, offering C-V2X connectivity in the Mocha. Furthermore, certain OEMs, such as Geely and Hyundai, plan to integrate C-V2X technology into their forthcoming vehicle models. This strategic move underscores the industry-wide recognition of the significance of C-V2X in advancing connectivity and communication capabilities within the automotive landscape.

In-depth interviews have been conducted with chief executive officers (CEOS), Directors, and other executives from various key organizations operating in the automotive V2X market.

- By Respondent Type: OEMs- 31%, Tier 1- 21%, and Tier 2- 48%

- By Designation: CXOs- 40%, Directors- 35%, and Others- 25%

- By Region: North America- 30%, Europe - 50%, Asia Pacific- 15% and RoW- 5%

Qualcomm Incorporated (US), Autotalks (Israel), Harman International (US), Huawei Technologies Co., LTD. (China), and NXP Semiconductors (Netherlands) are some of the key players in the automotive V2X market.

The study includes an in-depth competitive analysis of these key players in the automotive V2X market, with their company profiles, recent developments, and key market strategies.

Research Coverage:

The report covers the automotive V2X market, in terms of Connectivity (DSRC, and Cellular), Communication (V2V, V2I, V2P, and V2G), Vehicle Type (Passenger Cars, and Commercial Vehicles), Propulsion (ICE Vehicles, and Electric Vehicles), Unit (On-Board Units, and Roadside Units), Offering (Hardware, and Software), Technology (Automated Driver Assistance, Intelligent Traffic Systems, Emergency Vehicle Notification, Passenger Information System, Fleet & Asset Management, Parking Management System, Line of Sight, Non-line of Sight, Backing, and Others), Aftermarket Offering (Hardware, Software, and Service) and Region (Asia Pacific, Europe, North America, and Row). It covers the competitive landscape and company profiles of the major automotive V2X market ecosystem players.

The study also includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report:

- The report will help market leaders/new entrants with information on the closest approximations of revenue numbers for the overall automotive V2X market and its subsegments.

- This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies.

- The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

- The report also helps stakeholders understand the current and future pricing trends of different automotive V2X systems based on their capacity.

The report provides insight on the following pointers:

- Analysis of key drivers (Increasing demand for advanced technologies to address vehicle safety concerns, growing adoption of C-V2X connectivity, development in connected car technology, advancements in 5G technology), restraints (Lack of infrastructure for proper functioning), challenges (Government support for V2X technology, increasing adoption of V2V and V2I technology in connected vehicles, OEM and EVCS providers providing V2g services), and opportunities (Vulnerability to cyberattacks, prohibition on DSRC technology in US, latency/reliability challenges), influencing the growth of the authentication and brand protection market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the automotive V2X market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the automotive V2X market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the automotive V2X market.

- Competitive Assessment: In-depth assessment of market ranking, growth strategies, and service offerings of leading players like Qualcomm Incorporated (US), Autotalks (Israel), Harman International (US), Huawei Technologies Co., LTD. (China), and NXP Semiconductors (Netherlands) among others in automotive V2X market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- TABLE 1 AUTOMOTIVE V2X MARKET DEFINITION, BY COMMUNICATION

- TABLE 2 AUTOMOTIVE V2X MARKET DEFINITION, BY VEHICLE TYPE

- TABLE 3 AUTOMOTIVE V2X MARKET DEFINITION, BY CONNECTIVITY

- TABLE 4 AUTOMOTIVE V2X MARKET DEFINITION, BY UNIT

- TABLE 5 AUTOMOTIVE V2X MARKET DEFINITION, BY PROPULSION

- TABLE 6 AUTOMOTIVE V2X MARKET DEFINITION, BY OFFERING

- TABLE 7 AUTOMOTIVE V2X MARKET DEFINITION, BY TECHNOLOGY

- 1.3 INCLUSIONS AND EXCLUSIONS

- TABLE 8 AUTOMOTIVE V2X MARKET: INCLUSIONS AND EXCLUSIONS

- 1.4 MARKET SCOPE

- 1.4.1 MARKETS COVERED

- FIGURE 1 AUTOMOTIVE V2X MARKET SEGMENTATION

- 1.4.2 REGIONS COVERED

- 1.5 YEARS CONSIDERED

- 1.6 CURRENCY CONSIDERED

- TABLE 9 CURRENCY EXCHANGE RATES

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 AUTOMOTIVE V2X MARKET: RESEARCH DESIGN

- FIGURE 3 RESEARCH DESIGN MODEL

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key secondary sources for automotive V2X market

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews from demand and supply sides

- FIGURE 4 KEY INSIGHTS FROM INDUSTRY EXPERTS

- 2.1.2.2 Breakdown of primary interviews

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.1.2.3 List of primary interview participants

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 6 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 7 AUTOMOTIVE V2X MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 8 AUTOMOTIVE V2X MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 9 AUTOMOTIVE V2X MARKET ESTIMATION NOTES

- 2.3 RECESSION IMPACT ANALYSIS

- FIGURE 10 RESEARCH DESIGN AND METHODOLOGY FOR ICE VEHICLES (DEMAND SIDE)

- 2.4 DATA TRIANGULATION

- FIGURE 11 DATA TRIANGULATION

- 2.5 FACTOR ANALYSIS

- 2.5.1 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND AND SUPPLY SIDES

- FIGURE 12 FACTORS IMPACTING AUTOMOTIVE V2X MARKET

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

- TABLE 10 C-V2X-EQUIPPED VEHICLES

- FIGURE 13 AUTOMOTIVE V2X MARKET OVERVIEW

- FIGURE 14 AUTOMOTIVE V2X MARKET, BY REGION, 2023-2030

- FIGURE 15 KEY PLAYERS IN AUTOMOTIVE V2X MARKET

- FIGURE 16 AUTOMOTIVE V2X MARKET, BY CONNECTIVITY, 2023 VS. 2030

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AUTOMOTIVE V2X MARKET

- FIGURE 17 INCREASING FOCUS ON AUTONOMOUS MOBILITY AND CONNECTED CAR TECHNOLOGY TO DRIVE MARKET

- 4.2 AUTOMOTIVE V2X MARKET, BY REGION

- FIGURE 18 ASIA PACIFIC HOLDS LARGEST MARKET SHARE

- 4.3 AUTOMOTIVE V2X MARKET, BY COMMUNICATION

- FIGURE 19 V2V TO BE DOMINANT COMMUNICATION SEGMENT DURING FORECAST PERIOD

- 4.4 AUTOMOTIVE V2X MARKET, BY CONNECTIVITY

- FIGURE 20 DSRC TO BE LARGER CONNECTIVITY SEGMENT DURING FORECAST PERIOD

- 4.5 AUTOMOTIVE V2X MARKET, BY PROPULSION

- FIGURE 21 EV SEGMENT TO GROW RAPIDLY DURING FORECAST PERIOD

- 4.6 AUTOMOTIVE V2X MARKET, BY OFFERING

- FIGURE 22 SOFTWARE TO BE FASTER-GROWING OFFERING SEGMENT DURING FORECAST PERIOD

- 4.7 AUTOMOTIVE V2X MARKET, BY VEHICLE TYPE

- FIGURE 23 PASSENGER CARS TO BE LARGER VEHICLE TYPE SEGMENT DURING FORECAST PERIOD

- 4.8 AUTOMOTIVE V2X MARKET, BY TECHNOLOGY

- FIGURE 24 AUTOMATED DRIVER ASSISTANCE TO BE LARGEST TECHNOLOGY SEGMENT DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- FIGURE 25 KEY ELEMENTS OF V2X

- FIGURE 26 COMMUNICATION BETWEEN VEHICLES, USERS, AND INFRASTRUCTURE

- TABLE 11 COMPARISON OF V2X TECHNOLOGIES

- 5.2 MARKET DYNAMICS

- FIGURE 27 AUTOMOTIVE V2X MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing demand for advanced technologies to address vehicle safety concerns

- TABLE 12 SAFETY FACTS CONCERNING V2X COMMUNICATION

- FIGURE 28 ADVANCED SAFETY USE CASES OF V2X TECHNOLOGY

- 5.2.1.2 Growing adoption of C-V2X connectivity

- FIGURE 29 C-V2X INCREASES REACTION TIME OVER DSRC

- 5.2.1.3 Development of connected car technology

- FIGURE 30 EVOLUTION OF V2X USE CASES TOWARD CONNECTED COOPERATIVE DRIVING

- 5.2.1.4 Advancements in 5G technology

- FIGURE 31 HIGH-SPEED DATA AND PERFORMANCE LEVEL

- FIGURE 32 EVOLUTION OF C-V2X TOWARD 5G NR V2X

- TABLE 13 ADVANCEMENT IN 5G NR OVER 4G LTE

- TABLE 14 5G-V2X USE CASE PERFORMANCES

- 5.2.2 RESTRAINTS

- 5.2.2.1 Lack of infrastructure for proper functioning

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Government support for V2X technology

- FIGURE 33 USDOT'S ACTIONS RELATED TO V2X

- FIGURE 34 ACTIONS OF KEY STAKEHOLDERS REGARDING V2X DEVELOPMENTS

- 5.2.3.2 Increasing adoption of V2V/V2I technology in connected vehicles

- FIGURE 35 DIRECT AND NETWORK-BASED COMMUNICATION IN VEHICLES

- 5.2.3.3 OEMs and EVCS providers offering V2G services

- FIGURE 36 V2G INFRASTRUCTURE

- 5.2.3.4 Data monetization

- FIGURE 37 DATA GENERATED BY V2X SYSTEMS

- FIGURE 38 BENEFITS OF DATA MONETIZATION

- 5.2.4 CHALLENGES

- 5.2.4.1 Vulnerability to cyberattacks

- TABLE 15 PLAUSIBILITY OF ATTACKS CONDUCTED ON EACH GENERATION OF V2X

- FIGURE 39 EMERGING CYBER THREATS IN AUTOMOTIVE V2X

- TABLE 16 BASE STANDARDS FOR SECURITY AND PRIVACY DEVELOPED BY EUROPEAN TELECOMMUNICATIONS STANDARDS INSTITUTE (ETSI)

- 5.2.4.2 Prohibition of DSRC technology in US

- FIGURE 40 SPECTRUM METHODS FOR V2X

- FIGURE 41 V2X COMMUNICATION SPECTRUM

- 5.2.4.3 Latency/reliability issue

- TABLE 17 DSRC-BASED AND C-V2X COMMUNICATIONS

- TABLE 18 IMPACT OF MARKET DYNAMICS

- 5.3 SUPPLY CHAIN ANALYSIS

- FIGURE 42 SUPPLY CHAIN ANALYSIS OF AUTOMOTIVE V2X MARKET

- 5.4 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.4.1 V2V

- 5.4.2 V2I

- 5.4.3 V2G

- 5.4.4 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 43 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- TABLE 19 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS (%)

- 5.4.5 BUYING CRITERIA

- FIGURE 44 KEY BUYING CRITERIA FOR AUTOMOTIVE V2X SYSTEMS

- TABLE 20 KEY BUYING CRITERIA FOR AUTOMOTIVE V2X SYSTEMS

- 5.5 TECHNOLOGY ANALYSIS

- TABLE 21 C-V2X TECHNICAL ADVANTAGES OVER IEEE 802.11P (ITS-G5 OR DSRC)

- 5.5.1 DEDICATED SHORT-RANGE COMMUNICATIONS (DSRC)

- FIGURE 45 DSRC INFRASTRUCTURE

- FIGURE 46 DSRC SPECTRUM BAND AND CHANNELS

- 5.5.2 CELLULAR V2X (C-V2X)

- FIGURE 47 C-V2X NETWORK ARCHITECTURE

- FIGURE 48 C-V2X TIMELINE WITH FEATURES

- TABLE 22 CUMULATIVE GAIN IN TIME TO TRAVEL WHILE USING 5G NR (NEW RADIO) C-V2X

- 5.5.2.1 LTE-V2X

- FIGURE 49 VEHICLE COMMUNICATION MODES

- 5.5.2.2 5G-V2X

- FIGURE 50 5NR FLEXIBLE FRAMEWORK

- 5.5.3 BLOCKCHAIN TECHNOLOGY

- FIGURE 51 IMPLEMENTATION OF BLOCKCHAIN TECHNOLOGY IN NETWORKING STACK

- FIGURE 52 SERVICES PROVIDED BY BLOCKCHAIN TO V2X APPLICATIONS

- 5.5.4 EDGE COMPUTING

- FIGURE 53 IMPLEMENTATION OF EDGE COMPUTING IN V2V COMMUNICATION

- 5.6 ECOSYSTEM ANALYSIS

- FIGURE 54 ECOSYSTEM ANALYSIS

- 5.6.1 V2X HARDWARE PROVIDERS

- 5.6.2 V2X PROVIDERS

- 5.6.3 AUTOMOTIVE ENGINEERING SERVICE PROVIDERS

- 5.6.4 C-V2X MODULE SUPPLIERS

- 5.6.5 ANTENNA SUPPLIERS

- 5.6.6 OEMS

- TABLE 23 ROLE OF COMPANIES IN ECOSYSTEM

- 5.7 OEM INVESTMENTS IN AUTOMOTIVE V2X

- TABLE 24 OEM INVESTMENT IN V2X

- 5.8 COMMERCIAL V2X DEVICES CURRENTLY IN MARKET

- TABLE 25 COMMERCIAL V2X DEVICES CURRENTLY IN MARKET

- 5.9 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 55 REVENUE SHIFT FOR AUTOMOTIVE V2X MARKET

- 5.10 PRICING ANALYSIS

- 5.10.1 AVERAGE SELLING PRICE TREND, BY REGION

- TABLE 26 AUTOMOTIVE V2X HARDWARE: REGIONAL PRICE TREND, 2020 VS. 2022

- TABLE 27 AUTOMOTIVE V2X HARDWARE: AVERAGE SELLING PRICE ANALYSIS, BY CONNECTIVITY AND REGION (2022)

- TABLE 28 AUTOMOTIVE V2X HARDWARE: AVERAGE SELLING PRICE ANALYSIS, BY CONNECTIVITY AND REGION (2030)

- 5.11 PATENT ANALYSIS

- 5.11.1 INTRODUCTION

- FIGURE 56 NUMBER OF PATENTS GRANTED, 2014-2023

- FIGURE 57 PATENT PUBLICATION TREND

- TABLE 29 INNOVATIONS AND PATENT REGISTRATIONS, 2018-2023

- 5.12 CASE STUDY ANALYSIS

- 5.12.1 PILOT PROJECT ON VIRGINIA SMART ROAD

- 5.12.2 VEHICLE POSITIONING ACCURACY IN NEW YORK

- 5.12.3 TOWARDS ZERO ROAD SAFETY STRATEGY

- 5.12.4 PREPARING ROADS FOR AUTONOMOUS VEHICLES

- 5.12.5 PILOT PROJECT ON SAN DIEGO ROADWAYS

- 5.12.6 ECOCAR MOBILITY CHALLENGE

- 5.12.7 TRANSFORMING SNOW REMOVAL IN DENVER WITH V2X TECHNOLOGY

- 5.12.8 IMPLEMENTATION OF NISSAN LEAF IN DURHAM (US)

- 5.13 TARIFF AND REGULATORY OVERVIEW

- TABLE 30 REGULATIONS FOR AUTOMOTIVE V2X, BY REGION/COUNTRY

- TABLE 31 US AND EU SPECIFICATION STANDARDS

- 5.13.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 32 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 33 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 34 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14 KEY CONFERENCES AND EVENTS IN 2024-2025

- TABLE 35 LIST OF CONFERENCES AND EVENTS, 2024-2025

6 AUTOMOTIVE V2X MARKET, BY OFFERING

- 6.1 INTRODUCTION

- FIGURE 58 SOFTWARE SEGMENT TO HOLD LARGER MARKET SHARE THAN HARDWARE BY 2030

- TABLE 36 AUTOMOTIVE V2X MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 37 AUTOMOTIVE V2X MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- 6.1.1 OPERATIONAL DATA

- TABLE 38 HARDWARE AND SOFTWARE OFFERED BY KEY PLAYERS

- 6.2 HARDWARE

- 6.2.1 INCREASING FOCUS ON PRODUCT LAUNCHES BY MAJOR PLAYERS TO DRIVE MARKET

- TABLE 39 HARDWARE: AUTOMOTIVE V2X MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 40 HARDWARE: AUTOMOTIVE V2X MARKET, BY REGION, 2023-2030 (USD MILLION)

- 6.3 SOFTWARE

- 6.3.1 RAPID DEPLOYMENT OF 5G TO CREATE NEW USE CASES FOR V2X SOFTWARE TO DRIVE MARKET

- TABLE 41 SOFTWARE: AUTOMOTIVE V2X MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 42 SOFTWARE: AUTOMOTIVE V2X MARKET, BY REGION, 2023-2030 (USD MILLION)

- 6.4 KEY PRIMARY INSIGHTS

7 AUTOMOTIVE V2X MARKET, BY COMMUNICATION

- 7.1 INTRODUCTION

- FIGURE 59 V2V SEGMENT TO HOLD LARGEST MARKET SHARE BY 2030

- TABLE 43 AUTOMOTIVE V2X MARKET, BY COMMUNICATION, 2019-2022 (THOUSAND UNITS)

- TABLE 44 AUTOMOTIVE V2X MARKET, BY COMMUNICATION, 2023-2030 (THOUSAND UNITS)

- TABLE 45 AUTOMOTIVE V2X MARKET, BY COMMUNICATION, 2019-2022 (USD MILLION)

- TABLE 46 AUTOMOTIVE V2X MARKET, BY COMMUNICATION, 2023-2030 (USD MILLION)

- 7.1.1 OPERATIONAL DATA

- TABLE 47 VEHICLES EQUIPPED WITH VARIOUS V2X COMMUNICATIONS

- 7.2 VEHICLE-TO-VEHICLE (V2V)

- 7.2.1 ABILITY TO CREATE 360-DEGREE AWARENESS ABOUT NEARBY VEHICLES TO DRIVE MARKET

- TABLE 48 V2V: AUTOMOTIVE V2X MARKET, BY REGION, 2019-2022 (THOUSAND UNITS)

- TABLE 49 V2V: AUTOMOTIVE V2X MARKET, BY REGION, 2023-2030 (THOUSAND UNITS)

- TABLE 50 V2V: AUTOMOTIVE V2X MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 51 V2V: AUTOMOTIVE V2X MARKET, BY REGION, 2023-2030 (USD MILLION)

- 7.3 VEHICLE-TO-INFRASTRUCTURE (V2I)

- 7.3.1 IMPROVEMENT IN RSU INFRASTRUCTURE TO DRIVE MARKET

- TABLE 52 V2I: AUTOMOTIVE V2X MARKET, BY REGION, 2019-2022 (THOUSAND UNITS)

- TABLE 53 V2I: AUTOMOTIVE V2X MARKET, BY REGION, 2023-2030 (THOUSAND UNITS)

- TABLE 54 V2I: AUTOMOTIVE V2X MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 55 V2I: AUTOMOTIVE V2X MARKET, BY REGION, 2023-2030 (USD MILLION)

- 7.4 VEHICLE-TO-GRID (V2G)

- 7.4.1 USABILITY AS BACKUP POWER SOURCE TO DRIVE MARKET

- TABLE 56 V2G: AUTOMOTIVE V2X MARKET, BY REGION, 2019-2022 (THOUSAND UNITS)

- TABLE 57 V2G: AUTOMOTIVE V2X MARKET, BY REGION, 2023-2030 (THOUSAND UNITS)

- TABLE 58 V2G: AUTOMOTIVE V2X MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 59 V2G: AUTOMOTIVE V2X MARKET, BY REGION, 2023-2030 (USD MILLION)

- 7.5 VEHICLE-TO-PEDESTRIAN (V2P)

- 7.5.1 MOBILE-ACCESSIBLE PEDESTRIAN SIGNAL SYSTEM AS KEY APPLICATION TO DRIVE MARKET

- TABLE 60 V2P: AUTOMOTIVE V2X MARKET, BY REGION, 2019-2022 (THOUSAND UNITS)

- TABLE 61 V2P: AUTOMOTIVE V2X MARKET, BY REGION, 2023-2030 (THOUSAND UNITS)

- TABLE 62 V2P: AUTOMOTIVE V2X MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 63 V2P: AUTOMOTIVE V2X MARKET, BY REGION, 2023-2030 (USD MILLION)

- 7.6 VEHICLE-TO-CLOUD (V2C)

- 7.7 VEHICLE-TO-DEVICE (V2D)

- 7.8 KEY PRIMARY INSIGHTS

8 AUTOMOTIVE V2X MARKET, BY PROPULSION

- 8.1 INTRODUCTION

- FIGURE 60 AUTOMOTIVE V2X MARKET, BY PROPULSION, 2023 VS. 2030 (THOUSAND UNITS)

- TABLE 64 AUTOMOTIVE V2X MARKET, BY PROPULSION, 2019-2022 (THOUSAND UNITS)

- TABLE 65 AUTOMOTIVE V2X MARKET, BY PROPULSION, 2023-2030 (THOUSAND UNITS)

- 8.1.1 OPERATIONAL DATA

- TABLE 66 CARS EQUIPPED WITH V2X (BY PROPULSION)

- 8.2 INTERNAL COMBUSTION ENGINE (ICE)

- 8.2.1 INCREASING SAFETY AND FUEL EFFICIENCY IN ICE VEHICLES TO DRIVE MARKET

- TABLE 67 ICE: AUTOMOTIVE V2X MARKET, BY REGION, 2019-2022 (THOUSAND UNITS)

- TABLE 68 ICE: AUTOMOTIVE V2X MARKET, BY REGION, 2023-2030 (THOUSAND UNITS)

- 8.3 ELECTRIC VEHICLE (EV)

- 8.3.1 EASE OF V2X ADOPTION IN EV ARCHITECTURE TO DRIVE MARKET

- TABLE 69 EV: AUTOMOTIVE V2X MARKET, BY REGION, 2019-2022 (THOUSAND UNITS)

- TABLE 70 EV: AUTOMOTIVE V2X MARKET, BY REGION, 2023-2030 (THOUSAND UNITS)

- 8.4 KEY PRIMARY INSIGHTS

9 AUTOMOTIVE V2X MARKET, BY TECHNOLOGY

- 9.1 INTRODUCTION

- FIGURE 61 AUTOMOTIVE V2X MARKET, BY TECHNOLOGY, 2023 VS. 2030

- TABLE 71 AUTOMOTIVE V2X MARKET, BY TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 72 AUTOMOTIVE V2X MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- 9.1.1 OPERATIONAL DATA

- TABLE 73 VARIOUS V2X TECHNOLOGIES BY COMMUNICATION TYPE AND APPLICATION

- 9.2 V2V

- 9.2.1 AUTOMATED DRIVER ASSISTANCE

- 9.2.2 OTHERS

- 9.3 V2I

- 9.3.1 INTELLIGENT TRAFFIC SYSTEM (ITS)

- TABLE 74 ITS SERVICES

- 9.3.2 EMERGENCY VEHICLE NOTIFICATION

- 9.3.3 PASSENGER INFORMATION SYSTEM

- 9.3.4 FLEET & ASSET MANAGEMENT

- 9.3.5 PARKING MANAGEMENT SYSTEM

- 9.4 V2P

- 9.4.1 LINE OF SIGHT

- 9.4.2 NON-LINE OF SIGHT

- 9.4.3 BACKING

- 9.5 KEY PRIMARY INSIGHTS

10 AUTOMOTIVE V2X MARKET, BY VEHICLE TYPE

- 10.1 INTRODUCTION

- FIGURE 62 AUTOMOTIVE V2X MARKET, BY VEHICLE TYPE, 2023 VS. 2030

- TABLE 75 AUTOMOTIVE V2X MARKET, BY VEHICLE TYPE, 2019-2022 (THOUSAND UNITS)

- TABLE 76 AUTOMOTIVE V2X MARKET, BY VEHICLE TYPE, 2023-2030 (THOUSAND UNITS)

- 10.1.1 OPERATIONAL DATA

- TABLE 77 PASSENGER CARS EQUIPPED WITH V2X

- TABLE 78 COMMERCIAL VEHICLES EQUIPPED WITH V2X

- 10.2 PASSENGER CARS

- 10.2.1 RAPID ADOPTION OF V2X SYSTEMS IN PREMIUM CARS TO DRIVE MARKET

- TABLE 79 PASSENGER CAR V2X MARKET, BY REGION, 2019-2022 (THOUSAND UNITS)

- TABLE 80 PASSENGER CAR V2X MARKET, BY REGION, 2023-2030 (THOUSAND UNITS)

- 10.3 COMMERCIAL VEHICLES

- 10.3.1 PLATOONING FEATURE OFFERED BY V2X TO DRIVE MARKET

- TABLE 81 COMMERCIAL VEHICLE V2X MARKET, BY REGION, 2019-2022 (THOUSAND UNITS)

- TABLE 82 COMMERCIAL VEHICLE V2X MARKET, BY REGION, 2023-2030 (THOUSAND UNITS)

- 10.4 KEY PRIMARY INSIGHTS

11 AUTOMOTIVE V2X MARKET, BY CONNECTIVITY

- 11.1 INTRODUCTION

- TABLE 83 DSRC VS. C-V2X, PHYSICAL LAYER MAIN PARAMETERS

- TABLE 84 COMPARISON BETWEEN DSRC AND C-V2X

- FIGURE 63 AUTOMOTIVE V2X MARKET, BY CONNECTIVITY, 2023 VS. 2030

- TABLE 85 AUTOMOTIVE V2X MARKET, BY CONNECTIVITY, 2019-2022 (THOUSAND UNITS)

- TABLE 86 AUTOMOTIVE V2X MARKET, BY CONNECTIVITY, 2023-2030 (THOUSAND UNITS)

- 11.1.1 OPERATIONAL DATA

- TABLE 87 COMPANIES OFFERING V2X PRODUCTS, BY CONNECTIVITY

- TABLE 88 ADVANCED USE CASES AND QUALITY OF SERVICE REQUIREMENTS OF V2X APPLICATIONS

- 11.2 DEDICATED SHORT-RANGE COMMUNICATIONS (DSRC)

- 11.2.1 360-DEGREE NON-LINE OF SIGHT AWARENESS TO DRIVE MARKET

- TABLE 89 DSRC V2X MARKET, BY REGION, 2019-2022 (THOUSAND UNITS)

- TABLE 90 DSRC V2X MARKET, BY REGION, 2023-2030 (THOUSAND UNITS)

- 11.3 CELLULAR VEHICLE-TO-EVERYTHING (C-V2X)

- 11.3.1 REAL-TIME AND LOW-LATENCY COMMUNICATIONS TO DRIVE MARKET

- FIGURE 64 C-V2X IMPACT ON DRIVING EXPERIENCE AND SMART CITY DEVELOPMENT

- TABLE 91 PERFORMANCE OF DSRC VS. C-V2X

- TABLE 92 V2X STANDARDS FOR VARIOUS COMMUNICATION RANGES

- TABLE 93 C-V2X MARKET, BY REGION, 2019-2022 (THOUSAND UNITS)

- TABLE 94 C-V2X MARKET, BY REGION, 2023-2030 (THOUSAND UNITS)

- 11.4 KEY PRIMARY INSIGHTS

12 AUTOMOTIVE V2X MARKET, BY UNIT

- 12.1 INTRODUCTION

- 12.1.1 OPERATIONAL DATA

- TABLE 95 COMPANIES OFFERING RSU AND OBU

- 12.2 ON-BOARD UNIT (OBU)

- 12.3 ROADSIDE UNIT (RSU)

13 AUTOMOTIVE V2X MARKET, BY AFTERMARKET OFFERING

- 13.1 INTRODUCTION

- 13.1.1 OPERATIONAL DATA

- TABLE 96 TOP INDUSTRIES FOR V2X MARKET IN NORTH AMERICA

- 13.2 HARDWARE

- 13.3 SOFTWARE

- 13.4 SERVICES

- 13.4.1 FLEET MANAGEMENT

- 13.4.2 AUTOMOTIVE ADVANCED DRIVER-ASSISTANCE SYSTEMS (ADAS)

- 13.4.3 TELEMATICS

- 13.4.4 CYBERSECURITY

- 13.4.5 AUTONOMOUS DRIVING

14 AUTOMOTIVE V2X MARKET, BY REGION

- 14.1 INTRODUCTION

- FIGURE 65 FREQUENCY SPECTRUM BANDS FOR DSRC

- FIGURE 66 AUTOMOTIVE V2X MARKET, BY REGION, 2023 VS. 2030

- TABLE 97 AUTOMOTIVE V2X MARKET (ICE AND EV), BY REGION, 2019-2022 (THOUSAND UNITS)

- TABLE 98 AUTOMOTIVE V2X MARKET (ICE AND EV), BY REGION, 2023-2030 (THOUSAND UNITS)

- TABLE 99 AUTOMOTIVE V2X MARKET (ICE AND EV), BY REGION, 2019-2022 (USD MILLION)

- TABLE 100 AUTOMOTIVE V2X MARKET (ICE AND EV), BY REGION, 2023-2030 (USD MILLION)

- 14.2 ASIA PACIFIC

- FIGURE 67 ASIA PACIFIC: AUTOMOTIVE V2X MARKET SNAPSHOT

- TABLE 101 ASIA PACIFIC: AUTOMOTIVE V2X MARKET (ICE), BY COUNTRY, 2019-2022 (THOUSAND UNITS)

- TABLE 102 ASIA PACIFIC: AUTOMOTIVE V2X MARKET (ICE), BY COUNTRY, 2023-2030 (THOUSAND UNITS)

- TABLE 103 ASIA PACIFIC: AUTOMOTIVE V2X MARKET (ICE), BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 104 ASIA PACIFIC: AUTOMOTIVE V2X MARKET (ICE), BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 105 ASIA PACIFIC: AUTOMOTIVE V2X MARKET (EV), BY COUNTRY, 2019-2022 (THOUSAND UNITS)

- TABLE 106 ASIA PACIFIC: AUTOMOTIVE V2X MARKET (EV), BY COUNTRY, 2023-2030 (THOUSAND UNITS)

- TABLE 107 ASIA PACIFIC: AUTOMOTIVE V2X MARKET (EV), BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 108 ASIA PACIFIC: AUTOMOTIVE V2X MARKET (EV), BY COUNTRY, 2023-2030 (USD MILLION)

- 14.2.1 RECESSION IMPACT ANALYSIS

- 14.2.2 CHINA

- 14.2.2.1 OEMs shifting to C-V2X to drive market

- FIGURE 68 CHINA: C-V2X TIMELINES AND MILESTONES

- TABLE 109 CHINA: AUTOMOTIVE V2X MARKET (ICE), BY COMMUNICATION, 2019-2022 (THOUSAND UNITS)

- TABLE 110 CHINA: AUTOMOTIVE V2X MARKET (ICE), BY COMMUNICATION, 2023-2030 (THOUSAND UNITS)

- TABLE 111 CHINA: AUTOMOTIVE V2X MARKET (ICE), BY COMMUNICATION, 2019-2022 (USD MILLION)

- TABLE 112 CHINA: AUTOMOTIVE V2X MARKET (ICE), BY COMMUNICATION, 2023-2030 (USD MILLION)

- TABLE 113 CHINA: AUTOMOTIVE V2X MARKET (EV), BY COMMUNICATION, 2019-2022 (THOUSAND UNITS)

- TABLE 114 CHINA: AUTOMOTIVE V2X MARKET (EV), BY COMMUNICATION, 2023-2030 (THOUSAND UNITS)

- TABLE 115 CHINA: AUTOMOTIVE V2X MARKET (EV), BY COMMUNICATION, 2019-2022 (USD MILLION)

- TABLE 116 CHINA: AUTOMOTIVE V2X MARKET (EV), BY COMMUNICATION, 2023-2030 (USD MILLION)

- 14.2.3 JAPAN

- 14.2.3.1 Faster adoption of V2X technologies than other countries in the region to drive market

- TABLE 117 JAPAN: AUTOMOTIVE V2X MARKET (ICE), BY COMMUNICATION, 2019-2022 (THOUSAND UNITS)

- TABLE 118 JAPAN: AUTOMOTIVE V2X MARKET (ICE), BY COMMUNICATION, 2023-2030 (THOUSAND UNITS)

- TABLE 119 JAPAN: AUTOMOTIVE V2X MARKET (ICE), BY COMMUNICATION, 2019-2022 (USD MILLION)

- TABLE 120 JAPAN: AUTOMOTIVE V2X MARKET (ICE), BY COMMUNICATION, 2023-2030 (USD MILLION)

- TABLE 121 JAPAN: AUTOMOTIVE V2X MARKET (EV), BY COMMUNICATION, 2019-2022 (THOUSAND UNITS)

- TABLE 122 JAPAN: AUTOMOTIVE V2X MARKET (EV), BY COMMUNICATION, 2023-2030 (THOUSAND UNITS)

- TABLE 123 JAPAN: AUTOMOTIVE V2X MARKET (EV), BY COMMUNICATION, 2019-2022 (USD MILLION)

- TABLE 124 JAPAN: AUTOMOTIVE V2X MARKET (EV), BY COMMUNICATION, 2023-2030 (USD MILLION)

- 14.2.4 SOUTH KOREA

- 14.2.4.1 Government support and technological advancements to drive market

- TABLE 125 SOUTH KOREA: AUTOMOTIVE V2X MARKET (ICE), BY COMMUNICATION, 2019-2022 (THOUSAND UNITS)

- TABLE 126 SOUTH KOREA: AUTOMOTIVE V2X MARKET (ICE), BY COMMUNICATION, 2023-2030 (THOUSAND UNITS)

- TABLE 127 SOUTH KOREA: AUTOMOTIVE V2X MARKET (ICE), BY COMMUNICATION, 2019-2022 (USD MILLION)

- TABLE 128 SOUTH KOREA: AUTOMOTIVE V2X MARKET (ICE), BY COMMUNICATION, 2023-2030 (USD MILLION)

- TABLE 129 SOUTH KOREA: AUTOMOTIVE V2X MARKET (EV), BY COMMUNICATION, 2019-2022 (THOUSAND UNITS)

- TABLE 130 SOUTH KOREA: AUTOMOTIVE V2X MARKET (EV), BY COMMUNICATION, 2023-2030 (THOUSAND UNITS)

- TABLE 131 SOUTH KOREA: AUTOMOTIVE V2X MARKET (EV), BY COMMUNICATION, 2019-2022 (USD MILLION)

- TABLE 132 SOUTH KOREA: AUTOMOTIVE V2X MARKET (EV), BY COMMUNICATION, 2023-2030 (USD MILLION)

- 14.2.5 INDIA

- 14.2.5.1 Plans for V2X in new-generation vehicles to drive market

- TABLE 133 INDIA: AUTOMOTIVE V2X MARKET (ICE), BY COMMUNICATION, 2019-2022 (THOUSAND UNITS)

- TABLE 134 INDIA: AUTOMOTIVE V2X MARKET (ICE), BY COMMUNICATION, 2023-2030 (THOUSAND UNITS)

- TABLE 135 INDIA: AUTOMOTIVE V2X MARKET (ICE), BY COMMUNICATION, 2019-2022 (USD MILLION)

- TABLE 136 INDIA: AUTOMOTIVE V2X MARKET (ICE), BY COMMUNICATION, 2023-2030 (USD MILLION)

- TABLE 137 INDIA: AUTOMOTIVE V2X MARKET (EV), BY COMMUNICATION, 2019-2022 (THOUSAND UNITS)

- TABLE 138 INDIA: AUTOMOTIVE V2X MARKET (EV), BY COMMUNICATION, 2023-2030 (THOUSAND UNITS)

- TABLE 139 INDIA: AUTOMOTIVE V2X MARKET (EV), BY COMMUNICATION, 2019-2022 (USD MILLION)

- TABLE 140 INDIA: AUTOMOTIVE V2X MARKET (EV), BY COMMUNICATION, 2023-2030 (USD MILLION)

- 14.3 EUROPE

- FIGURE 69 EUROPE: AUTOMOTIVE V2X MARKET, 2023 VS. 2030

- TABLE 141 EUROPE: AUTOMOTIVE V2X MARKET (ICE), BY COUNTRY, 2019-2022 (THOUSAND UNITS)

- TABLE 142 EUROPE: AUTOMOTIVE V2X MARKET (ICE), BY COUNTRY, 2023-2030 (THOUSAND UNITS)

- TABLE 143 EUROPE: AUTOMOTIVE V2X MARKET (ICE), BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 144 EUROPE: AUTOMOTIVE V2X MARKET (ICE), BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 145 EUROPE: AUTOMOTIVE V2X MARKET (EV), BY COUNTRY, 2019-2022 (THOUSAND UNITS)

- TABLE 146 EUROPE: AUTOMOTIVE V2X MARKET (EV), BY COUNTRY, 2023-2030 (THOUSAND UNITS)

- TABLE 147 EUROPE: AUTOMOTIVE V2X MARKET (EV), BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 148 EUROPE: AUTOMOTIVE V2X MARKET (EV), BY COUNTRY, 2023-2030 (USD MILLION)

- 14.3.1 RECESSION IMPACT ANALYSIS

- 14.3.2 GERMANY

- 14.3.2.1 Growing presence of V2X-enabled vehicles and plans for making V2X mainstream to drive market

- TABLE 149 GERMANY: AUTOMOTIVE V2X MARKET (ICE), BY COMMUNICATION, 2019-2022 (THOUSAND UNITS)

- TABLE 150 GERMANY: AUTOMOTIVE V2X MARKET (ICE), BY COMMUNICATION, 2023-2030 (THOUSAND UNITS)

- TABLE 151 GERMANY: AUTOMOTIVE V2X MARKET (ICE), BY COMMUNICATION, 2019-2022 (USD MILLION)

- TABLE 152 GERMANY: AUTOMOTIVE V2X MARKET (ICE), BY COMMUNICATION, 2023-2030 (USD MILLION)

- TABLE 153 GERMANY: AUTOMOTIVE V2X MARKET (EV), BY COMMUNICATION, 2019-2022 (THOUSAND UNITS)

- TABLE 154 GERMANY: AUTOMOTIVE V2X MARKET (EV), BY COMMUNICATION, 2023-2030 (THOUSAND UNITS)

- TABLE 155 GERMANY: AUTOMOTIVE V2X MARKET (EV), BY COMMUNICATION, 2019-2022 (USD MILLION)

- TABLE 156 GERMANY: AUTOMOTIVE V2X MARKET (EV), BY COMMUNICATION, 2023-2030 (USD MILLION)

- 14.3.3 FRANCE

- 14.3.3.1 Government-funded projects for V2X development to drive market

- TABLE 157 FRANCE: AUTOMOTIVE V2X MARKET (ICE), BY COMMUNICATION, 2019-2022 (THOUSAND UNITS)

- TABLE 158 FRANCE: AUTOMOTIVE V2X MARKET (ICE), BY COMMUNICATION, 2023-2030 (THOUSAND UNITS)

- TABLE 159 FRANCE: AUTOMOTIVE V2X MARKET (ICE), BY COMMUNICATION, 2019-2022 (USD MILLION)

- TABLE 160 FRANCE: AUTOMOTIVE V2X MARKET (ICE), BY COMMUNICATION, 2023-2030 (USD MILLION)

- TABLE 161 FRANCE: AUTOMOTIVE V2X MARKET (EV), BY COMMUNICATION, 2019-2022 (THOUSAND UNITS)

- TABLE 162 FRANCE: AUTOMOTIVE V2X MARKET (EV), BY COMMUNICATION, 2023-2030 (THOUSAND UNITS)

- TABLE 163 FRANCE: AUTOMOTIVE V2X MARKET (EV), BY COMMUNICATION, 2019-2022 (USD MILLION)

- TABLE 164 FRANCE: AUTOMOTIVE V2X MARKET (EV), BY COMMUNICATION, 2023-2030 (USD MILLION)

- 14.3.4 SPAIN

- 14.3.4.1 Emphasis on 5G developments to drive market

- TABLE 165 SPAIN: AUTOMOTIVE V2X MARKET (ICE), BY COMMUNICATION, 2019-2022 (THOUSAND UNITS)

- TABLE 166 SPAIN: AUTOMOTIVE V2X MARKET (ICE), BY COMMUNICATION, 2023-2030 (THOUSAND UNITS)

- TABLE 167 SPAIN: AUTOMOTIVE V2X MARKET (ICE), BY COMMUNICATION, 2019-2022 (USD MILLION)

- TABLE 168 SPAIN: AUTOMOTIVE V2X MARKET (ICE), BY COMMUNICATION, 2023-2030 (USD MILLION)

- TABLE 169 SPAIN: AUTOMOTIVE V2X MARKET (EV), BY COMMUNICATION, 2019-2022 (THOUSAND UNITS)

- TABLE 170 SPAIN: AUTOMOTIVE V2X MARKET (EV), BY COMMUNICATION, 2023-2030 (THOUSAND UNITS)

- TABLE 171 SPAIN: AUTOMOTIVE V2X MARKET (EV), BY COMMUNICATION, 2019-2022 (USD MILLION)

- TABLE 172 SPAIN: AUTOMOTIVE V2X MARKET (EV), BY COMMUNICATION, 2023-2030 (USD MILLION)

- 14.3.5 ITALY

- 14.3.5.1 Testing of V2X technology for platooning to drive market

- TABLE 173 ITALY: AUTOMOTIVE V2X MARKET (ICE), BY COMMUNICATION, 2019-2022 (THOUSAND UNITS)

- TABLE 174 ITALY: AUTOMOTIVE V2X MARKET (ICE), BY COMMUNICATION, 2023-2030 (THOUSAND UNITS)

- TABLE 175 ITALY: AUTOMOTIVE V2X MARKET (ICE), BY COMMUNICATION, 2019-2022 (USD MILLION)

- TABLE 176 ITALY: AUTOMOTIVE V2X MARKET (ICE), BY COMMUNICATION, 2023-2030 (USD MILLION)

- 14.3.6 UK

- 14.3.6.1 Government projects for implementation of V2X to drive market

- TABLE 177 UK: AUTOMOTIVE V2X MARKET (ICE), BY COMMUNICATION, 2019-2022 (THOUSAND UNITS)

- TABLE 178 UK: AUTOMOTIVE V2X MARKET (ICE), BY COMMUNICATION, 2023-2030 (THOUSAND UNITS)

- TABLE 179 UK: AUTOMOTIVE V2X MARKET (ICE), BY COMMUNICATION, 2019-2022 (USD MILLION)

- TABLE 180 UK: AUTOMOTIVE V2X MARKET (ICE), BY COMMUNICATION, 2023-2030 (USD MILLION)

- TABLE 181 UK: AUTOMOTIVE V2X MARKET (EV), BY COMMUNICATION, 2019-2022 (THOUSAND UNITS)

- TABLE 182 UK: AUTOMOTIVE V2X MARKET (EV), BY COMMUNICATION, 2023-2030 (THOUSAND UNITS)

- TABLE 183 UK: AUTOMOTIVE V2X MARKET (EV), BY COMMUNICATION, 2019-2022 (USD MILLION)

- TABLE 184 UK: AUTOMOTIVE V2X MARKET (EV), BY COMMUNICATION, 2023-2030 (USD MILLION)

- 14.4 NORTH AMERICA

- FIGURE 70 NORTH AMERICA: AUTOMOTIVE V2X MARKET SNAPSHOT

- TABLE 185 NORTH AMERICA: AUTOMOTIVE V2X MARKET (ICE), BY COUNTRY, 2019-2022 (THOUSAND UNITS)

- TABLE 186 NORTH AMERICA: AUTOMOTIVE V2X MARKET (ICE), BY COUNTRY, 2023-2030 (THOUSAND UNITS)

- TABLE 187 NORTH AMERICA: AUTOMOTIVE V2X MARKET (ICE), BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 188 NORTH AMERICA: AUTOMOTIVE V2X MARKET (ICE), BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 189 NORTH AMERICA: AUTOMOTIVE V2X MARKET (EV), BY COUNTRY, 2019-2022 (THOUSAND UNITS)

- TABLE 190 NORTH AMERICA: AUTOMOTIVE V2X MARKET (EV), BY COUNTRY, 2023-2030 (THOUSAND UNITS)

- TABLE 191 NORTH AMERICA: AUTOMOTIVE V2X MARKET (EV), BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 192 NORTH AMERICA: AUTOMOTIVE V2X MARKET (EV), BY COUNTRY, 2023-2030 (USD MILLION)

- 14.4.1 RECESSION IMPACT ANALYSIS

- 14.4.2 US

- 14.4.2.1 Increasing V2X use cases by leading OEMs to drive market

- TABLE 193 US: AUTOMOTIVE V2X MARKET (ICE), BY COMMUNICATION, 2019-2022 (THOUSAND UNITS)

- TABLE 194 US: AUTOMOTIVE V2X MARKET (ICE), BY COMMUNICATION, 2023-2030 (THOUSAND UNITS)

- TABLE 195 US: AUTOMOTIVE V2X MARKET (ICE), BY COMMUNICATION, 2019-2022 (USD MILLION)

- TABLE 196 US: AUTOMOTIVE V2X MARKET (ICE), BY COMMUNICATION, 2023-2030 (USD MILLION)

- TABLE 197 US: AUTOMOTIVE V2X MARKET (EV), BY COMMUNICATION, 2019-2022 (THOUSAND UNITS)

- TABLE 198 US: AUTOMOTIVE V2X MARKET (EV), BY COMMUNICATION, 2023-2030 (THOUSAND UNITS)

- TABLE 199 US: AUTOMOTIVE V2X MARKET (EV), BY COMMUNICATION, 2019-2022 (USD MILLION)

- TABLE 200 US: AUTOMOTIVE V2X MARKET (EV), BY COMMUNICATION, 2023-2030 (USD MILLION)

- 14.4.3 CANADA

- 14.4.3.1 Incorporation of V2X by OEMs to drive market

- TABLE 201 CANADA: AUTOMOTIVE V2X MARKET (ICE), BY COMMUNICATION, 2019-2022 (THOUSAND UNITS)

- TABLE 202 CANADA: AUTOMOTIVE V2X MARKET (ICE), BY COMMUNICATION, 2023-2030 (THOUSAND UNITS)

- TABLE 203 CANADA: AUTOMOTIVE V2X MARKET (ICE), BY COMMUNICATION, 2019-2022 (USD MILLION)

- TABLE 204 CANADA: AUTOMOTIVE V2X MARKET (ICE), BY COMMUNICATION, 2023-2030 (USD MILLION)

- TABLE 205 CANADA: AUTOMOTIVE V2X MARKET (EV), BY COMMUNICATION, 2019-2022 (THOUSAND UNITS)

- TABLE 206 CANADA: AUTOMOTIVE V2X MARKET (EV), BY COMMUNICATION, 2023-2030 (THOUSAND UNITS)

- TABLE 207 CANADA: AUTOMOTIVE V2X MARKET (EV), BY COMMUNICATION, 2019-2022 (USD MILLION)

- TABLE 208 CANADA: AUTOMOTIVE V2X MARKET (EV), BY COMMUNICATION, 2023-2030 (USD MILLION)

- 14.4.4 MEXICO

- 14.4.4.1 Flourishing automotive sector to drive market

- TABLE 209 MEXICO: AUTOMOTIVE V2X MARKET (ICE), BY COMMUNICATION, 2019-2022 (THOUSAND UNITS)

- TABLE 210 MEXICO: AUTOMOTIVE V2X MARKET (ICE), BY COMMUNICATION, 2023-2030 (THOUSAND UNITS)

- TABLE 211 MEXICO: AUTOMOTIVE V2X MARKET (ICE), BY COMMUNICATION, 2019-2022 (USD MILLION)

- TABLE 212 MEXICO: AUTOMOTIVE V2X MARKET (ICE), BY COMMUNICATION, 2023-2030 (USD MILLION)

- 14.5 REST OF THE WORLD (ROW)

- FIGURE 71 ROW: AUTOMOTIVE V2X MARKET, BY COUNTRY, 2023 VS. 2030

- TABLE 213 ROW: AUTOMOTIVE V2X MARKET (ICE), BY COUNTRY, 2019-2022 (THOUSAND UNITS)

- TABLE 214 ROW: AUTOMOTIVE V2X MARKET (ICE), BY COUNTRY, 2023-2030 (THOUSAND UNITS)

- TABLE 215 ROW: AUTOMOTIVE V2X MARKET (ICE), BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 216 ROW: AUTOMOTIVE V2X MARKET (ICE), BY COUNTRY, 2023-2030 (USD MILLION)

- 14.5.1 RECESSION IMPACT ANALYSIS

- 14.5.2 BRAZIL

- 14.5.2.1 Government initiatives for vehicle safety to drive market

- TABLE 217 BRAZIL: AUTOMOTIVE V2X MARKET (ICE), BY COMMUNICATION, 2019-2022 (THOUSAND UNITS)

- TABLE 218 BRAZIL: AUTOMOTIVE V2X MARKET (ICE), BY COMMUNICATION, 2023-2030 (THOUSAND UNITS)

- TABLE 219 BRAZIL: AUTOMOTIVE V2X MARKET (ICE), BY COMMUNICATION, 2019-2022 (USD MILLION)

- TABLE 220 BRAZIL: AUTOMOTIVE V2X MARKET (ICE), BY COMMUNICATION, 2023-2030 (USD MILLION)

- 14.5.3 ARGENTINA

- 14.5.3.1 Presence of startups offering V2X technology to drive market

- TABLE 221 ARGENTINA: AUTOMOTIVE V2X MARKET (ICE), BY COMMUNICATION, 2019-2022 (THOUSAND UNITS)

- TABLE 222 ARGENTINA: AUTOMOTIVE V2X MARKET (ICE), BY COMMUNICATION, 2023-2030 (THOUSAND UNITS)

- TABLE 223 ARGENTINA: AUTOMOTIVE V2X MARKET (ICE), BY COMMUNICATION, 2019-2022 (USD MILLION)

- TABLE 224 ARGENTINA: AUTOMOTIVE V2X MARKET (ICE), BY COMMUNICATION, 2023-2030 (USD MILLION)

15 COMPETITIVE LANDSCAPE

- 15.1 OVERVIEW

- 15.2 MARKET RANKING ANALYSIS

- FIGURE 72 AUTOMOTIVE V2X MARKET RANKING ANALYSIS, 2022

- 15.3 KEY PLAYERS' STRATEGIES, 2020-2023

- TABLE 225 KEY PLAYERS' STRATEGIES, 2020-2023

- 15.4 REVENUE ANALYSIS

- FIGURE 73 REVENUE ANALYSIS OF TOP 3 PLAYERS, 2018-2022

- 15.5 COMPANY (KEY PLAYERS) EVALUATION MATRIX

- 15.5.1 STARS

- 15.5.2 EMERGING LEADERS

- 15.5.3 PERVASIVE PLAYERS

- 15.5.4 PARTICIPANTS

- FIGURE 74 COMPANY (KEY PLAYERS) EVALUATION MATRIX, 2023

- 15.5.5 COMPANY FOOTPRINT

- TABLE 226 COMPANY OVERALL FOOTPRINT, 2023

- TABLE 227 COMPANY FOOTPRINT, BY APPLICATION, 2023

- TABLE 228 COMPANY FOOTPRINT, BY REGION, 2023

- 15.6 COMPANY (OTHER KEY PLAYERS) EVALUATION MATRIX

- 15.6.1 PROGRESSIVE COMPANIES

- 15.6.2 RESPONSIVE COMPANIES

- 15.6.3 DYNAMIC COMPANIES

- 15.6.4 STARTING BLOCKS

- FIGURE 75 COMPANY (OTHER KEY PLAYERS) EVALUATION MATRIX, 2023

- 15.6.5 COMPETITIVE BENCHMARKING

- TABLE 229 LIST OF KEY STARTUPS/SMES

- TABLE 230 COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- 15.7 COMPETITIVE SCENARIO

- 15.7.1 PRODUCT LAUNCHES

- TABLE 231 PRODUCT LAUNCHES, 2020-2023

- 15.7.2 DEALS

- TABLE 232 DEALS, 2020-2023

- 15.7.3 EXPANSIONS

- TABLE 233 EXPANSIONS, 2020-2023

16 COMPANY PROFILES

- 16.1 KEY PLAYERS

(Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)**

- 16.1.1 QUALCOMM INCORPORATED

- TABLE 234 QUALCOMM INCORPORATED: COMPANY OVERVIEW

- FIGURE 76 QUALCOMM INCORPORATED: COMPANY SNAPSHOT

- FIGURE 77 QUALCOMM C-V2X FOR AUTOMOTIVE SAFETY

- FIGURE 78 V2X ADVANCED USE CASES

- TABLE 235 QUALCOMM INCORPORATED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 236 QUALCOMM INCORPORATED: PRODUCT LAUNCHES

- TABLE 237 QUALCOMM INCORPORATED: DEALS

- 16.1.2 AUTOTALKS

- TABLE 238 AUTOTALKS: COMPANY OVERVIEW

- TABLE 239 AUTOTALKS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 240 AUTOTALKS: PRODUCT LAUNCHES

- TABLE 241 AUTOTALKS: DEALS

- TABLE 242 AUTOTALKS: OTHERS

- 16.1.3 HARMAN INTERNATIONAL

- TABLE 243 HARMAN INTERNATIONAL: COMPANY OVERVIEW

- FIGURE 79 HARMAN INTERNATIONAL: DUAL-MODE V2X SYSTEM

- TABLE 244 HARMAN INTERNATIONAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 245 HARMAN INTERNATIONAL: PRODUCT LAUNCHES

- TABLE 246 HARMAN INTERNATIONAL: DEALS

- 16.1.4 HUAWEI TECHNOLOGIES CO., LTD.

- TABLE 247 HUAWEI TECHNOLOGIES CO., LTD.: COMPANY OVERVIEW

- FIGURE 80 HUAWEI TECHNOLOGIES CO., LTD.: COMPANY SNAPSHOT

- FIGURE 81 HUAWEI TECHNOLOGIES CO., LTD.: VISION FOR 5G EXPANSION

- TABLE 248 HUAWEI TECHNOLOGIES CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 249 HUAWEI TECHNOLOGIES CO., LTD.: PRODUCT LAUNCHES

- TABLE 250 HUAWEI TECHNOLOGIES CO., LTD.: DEALS

- 16.1.5 NXP SEMICONDUCTORS

- TABLE 251 NXP SEMICONDUCTORS: COMPANY OVERVIEW

- FIGURE 82 NXP SEMICONDUCTORS: COMPANY SNAPSHOT

- FIGURE 83 NXP SEMICONDUCTORS: V2X AUTOMATED DRIVING

- FIGURE 84 NXP SEMICONDUCTORS: V2X COMMUNICATIONS

- TABLE 252 NXP SEMICONDUCTORS: REVENUE FROM END MARKETS (USD MILLION)

- TABLE 253 NXP SEMICONDUCTORS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 254 NXP SEMICONDUCTORS: DEALS

- 16.1.6 CONTINENTAL AG

- TABLE 255 CONTINENTAL AG: COMPANY OVERVIEW

- FIGURE 85 CONTINENTAL AG: COMPANY SNAPSHOT

- FIGURE 86 CONTINENTAL AG: PRODUCT PORTFOLIO

- TABLE 256 CONTINENTAL AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 257 CONTINENTAL AG: DEALS

- 16.1.7 ROBERT BOSCH GMBH

- TABLE 258 ROBERT BOSCH GMBH: COMPANY OVERVIEW

- FIGURE 87 ROBERT BOSCH GMBH: COMPANY SNAPSHOT

- FIGURE 88 ROBERT BOSCH GMBH: FOCUS AREAS

- TABLE 259 ROBERT BOSCH GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 260 ROBERT BOSCH GMBH: KEY CUSTOMERS

- TABLE 261 ROBERT BOSCH GMBH: PRODUCT LAUNCHES

- TABLE 262 ROBERT BOSCH GMBH: DEALS

- 16.1.8 COHDA WIRELESS

- TABLE 263 COHDA WIRELESS: COMPANY OVERVIEW

- FIGURE 89 COHDA WIRELESS: NEW CELLULAR V2X EVALUATION UNIT

- TABLE 264 COHDA WIRELESS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 265 COHDA WIRELESS: PRODUCT LAUNCHES

- TABLE 266 COHDA WIRELESS: DEALS

- TABLE 267 COHDA WIRELESS: OTHERS

- 16.1.9 INFINEON TECHNOLOGIES AG

- TABLE 268 INFINEON TECHNOLOGIES AG: COMPANY OVERVIEW

- FIGURE 90 INFINEON TECHNOLOGIES AG: COMPANY SNAPSHOT

- FIGURE 91 INFINEON TECHNOLOGIES AG: REVENUE SPLIT BY APPLICATION

- FIGURE 92 INFINEON TECHNOLOGIES AG: V2X DEVICE INTERACTIONS

- FIGURE 93 INFINEON TECHNOLOGIES AG: AUTOMOTIVE V2X SETUP

- TABLE 269 INFINEON TECHNOLOGIES AG: KEY CUSTOMERS

- TABLE 270 INFINEON TECHNOLOGIES AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 271 INFINEON TECHNOLOGIES AG: PRODUCT LAUNCHES

- TABLE 272 INFINEON TECHNOLOGIES AG: DEALS

- 16.1.10 DENSO CORPORATION

- TABLE 273 DENSO CORPORATION: COMPANY OVERVIEW

- FIGURE 94 DENSO CORPORATION: COMPANY SNAPSHOT

- TABLE 274 DENSO CORPORATION: KEY CUSTOMERS

- TABLE 275 DENSO CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 276 DENSO CORPORATION: DEALS

- 16.1.11 STMICROELECTRONICS

- TABLE 277 STMICROELECTRONICS: COMPANY OVERVIEW

- FIGURE 95 STMICROELECTRONICS: COMPANY SNAPSHOT

- TABLE 278 STMICROELECTRONICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 16.1.12 HYUNDAI MOBIS

- TABLE 279 HYUNDAI MOBIS: COMPANY OVERVIEW

- FIGURE 96 HYUNDAI MOBIS: COMPANY SNAPSHOT

- TABLE 280 HYUNDAI MOBIS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 281 HYUNDAI MOBIS: PRODUCT LAUNCHES

- TABLE 282 HYUNDAI MOBIS: DEALS

- *Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments might not be captured in case of unlisted companies.

- 16.2 OTHER PLAYERS

- 16.2.1 KAPSCH GROUP

- TABLE 283 KAPSCH GROUP: COMPANY OVERVIEW

- 16.2.2 MARBEN PRODUCTS

- TABLE 284 MARBEN PRODUCTS: COMPANY OVERVIEW

- 16.2.3 CAPGEMINI ENGINEERING

- TABLE 285 CAPGEMINI ENGINEERING: COMPANY OVERVIEW

- 16.2.4 NOKIA

- TABLE 286 NOKIA: COMPANY OVERVIEW

- 16.2.5 DSPACE GMBH

- TABLE 287 DSPACE GMBH: COMPANY OVERVIEW

- 16.2.6 FICOSA INTERNACIONAL SA

- TABLE 288 FICOSA INTERNACIONAL SA: COMPANY OVERVIEW

- 16.2.7 ESCRYPT

- TABLE 289 ESCRYPT: COMPANY OVERVIEW

- 16.2.8 VECTOR INFORMATIK GMBH

- TABLE 290 VECTOR INFORMATIK GMBH: COMPANY OVERVIEW

- 16.2.9 VOLKSWAGEN AG

- TABLE 291 VOLKSWAGEN AG: COMPANY OVERVIEW

- 16.2.10 BMW AG

- TABLE 292 BMW AG: COMPANY OVERVIEW

- 16.2.11 MERCEDES-BENZ GROUP AG

- TABLE 293 MERCEDES-BENZ GROUP AG: COMPANY OVERVIEW

- 16.2.12 AUDI AG

- TABLE 294 AUDI AG: COMPANY OVERVIEW

- 16.2.13 RENAULT GROUP

- TABLE 295 RENAULT GROUP: COMPANY OVERVIEW

- 16.2.14 MCLAREN GROUP

- TABLE 296 MCLAREN GROUP: COMPANY OVERVIEW

- 16.2.15 UNEX TECHNOLOGY CORP.

- TABLE 297 UNEX TECHNOLOGY CORP.: COMPANY OVERVIEW

- 16.2.16 MITSUBISHI ELECTRIC CORPORATION

- TABLE 298 MITSUBISHI ELECTRIC CORPORATION: COMPANY OVERVIEW

- 16.2.17 FLEX LTD.

- TABLE 299 FLEX LTD.: COMPANY OVERVIEW

- 16.2.18 TATA MOTORS

- TABLE 300 TATA MOTORS: COMPANY OVERVIEW

- 16.2.19 HITACHI SOLUTIONS, LTD.

- TABLE 301 HITACHI SOLUTIONS, LTD.: COMPANY OVERVIEW

- 16.2.20 NISSAN MOTOR CO., LTD.

- TABLE 302 NISSAN MOTOR CO., LTD.: COMPANY OVERVIEW

- 16.2.21 LEAR CORPORATION

- TABLE 303 LEAR CORPORATION: COMPANY OVERVIEW

- 16.2.22 INTEL CORPORATION

- TABLE 304 INTEL CORPORATION: COMPANY OVERVIEW

- 16.2.23 DANLAW, INC.

- TABLE 305 DANLAW, INC.: COMPANY OVERVIEW

- 16.2.24 COMMSIGNIA LTD.

- TABLE 306 COMMSIGNIA LTD.: COMPANY OVERVIEW

- 16.2.25 GENERAL MOTORS

- TABLE 307 GENERAL MOTORS: COMPANY OVERVIEW

- 16.2.26 FORD MOTOR COMPANY

- TABLE 308 FORD MOTOR COMPANY: COMPANY OVERVIEW

- 16.2.27 SOAR ROBOTICS

- TABLE 309 SOAR ROBOTICS: COMPANY OVERVIEW

17 RECOMMENDATIONS BY MARKETSANDMARKETS

- 17.1 ASIA PACIFIC AND EUROPE TO BE SIGNIFICANT MARKETS FOR AUTOMOTIVE V2X

- 17.2 C-V2X TECHNOLOGY TRANSFORMING ROADS AND DRIVING FUTURE OF INTELLIGENT TRANSPORTATION

- 17.3 V2G COMMUNICATION TO EMERGE AS PROMISING TECHNOLOGY

- 17.4 CONCLUSION

18 APPENDIX

- 18.1 KEY INSIGHTS FROM INDUSTRY EXPERTS

- 18.2 DISCUSSION GUIDE

- 18.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 18.4 CUSTOMIZATION OPTIONS

- 18.4.1 FURTHER BREAKDOWN OF THE AUTOMOTIVE V2X MARKET BY EV TYPE

- 18.4.2 ADDITIONAL COUNTRIES (APART FROM THOSE ALREADY CONSIDERED IN THE REPORT) WITH SIGNIFICANT MARKET

- 18.4.3 COMPANY INFORMATION

- 18.4.4 PROFILES OF ADDITIONAL MARKET PLAYERS (UP TO FIVE)

- 18.5 RELATED REPORTS

- 18.6 AUTHOR DETAILS