|

|

市場調査レポート

商品コード

1769077

植物性タンパク質市場:用途別、性質別、形態別、機能別、由来別、タイプ別、地域別 - 2030年までの予測Plant-based Protein Market by Source, Type, Application, Nature, Form, Function, and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 植物性タンパク質市場:用途別、性質別、形態別、機能別、由来別、タイプ別、地域別 - 2030年までの予測 |

|

出版日: 2025年06月25日

発行: MarketsandMarkets

ページ情報: 英文 318 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

植物性タンパク質の市場規模は、2025年に238億9,000万米ドルと推定され、7.9%のCAGRで拡大し、2030年には349億7,000万米ドルに達すると予測されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(100万米ドル)および数量(KT) |

| セグメント別 | 用途別、性質別、形態別、機能別、由来別、タイプ別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、南米、その他の地域 |

タンパク質源の多様化は、植物性タンパク質業界を再構築している主要動向の一つです。従来は、大豆と小麦が様々な代替タンパク質製品に使用される植物性タンパク質原料の主要供給源でした。最近になって、業界は急速に、そら豆、麻、緑豆、その他の豆や種子など、様々な作物による新たなタンパク質源を模索しています。これは主に、消費者の需要を満たす明確な味覚プロファイルを提供する、アレルゲンフリーで環境的に持続可能な製品に対する需要の変化によるものです。

先進諸国の消費者は、必須栄養素の供給、健康増進、体重管理のサポート、食品の全体的な魅力の向上などの能力により、植物性代替タンパク質を受け入れています。したがって、菜食主義者への消費者のシフトも、成長に影響を与える主要な促進要因です。しかし、植物性タンパク質源に関連するアレルギーや、菜食主義者の栄養・ビタミン欠乏が市場を抑制すると予想されます。

植物性タンパク質市場は、調達、加工、消費者動向、持続可能性への懸念の進歩に煽られた包括的な破壊に直面しています。最も重要な変化のひとつは、アレルゲン、持続可能性、風味の問題を克服しつつ、従来の大豆やエンドウ豆の代替タンパク質を提供する、ひよこ豆、空豆、麻、その他の豆や種子といった、未開発の新しいタンパク源の出現です。同時に、精密発酵、酵素加水分解、乾式分画などのハイテク抽出・加工技術は、植物性タンパク質の栄養成分、消化率、機能的挙動を向上させ、よりクリーンな表示と官能効果の改善を可能にします。クリーン・ラベルへの要求は製剤のニーズを変化させ、メーカーを人工添加物の除去や自然なニュートラルテイストまたは改良されたテイストのタンパク質の選択に駆り立てる。

植物由来の食肉は、従来の食肉製品と比較して様々な利点とトレードオフを提示します。資源投入量と消費量に関して、従来の食肉よりもエコロジカルな選択肢となります。大規模な肥育場と放牧地が必要なため、生態系に多大な影響を及ぼし、資源集約的でもあります。加えて、植物性食肉は農場から食卓までのバリュー・チェーン全体にわたってかなりの環境利益をもたらします。これらの要因は、代替肉セグメントの需要を促進すると予想されます。

エンドウ豆タンパク質は、その卓越した栄養プロファイルと持続可能性の利点により、植物性タンパク質分野における手ごわい代替品として台頭してきました。その豊富な必須アミノ酸組成は、動物性タンパク質に頼らずに栄養摂取量を改善したい人々にとって魅力的な選択肢となっています。さらに、エンドウ豆タンパク質は従来の畜産に比べて環境フットプリントが低いため、環境に優しい食品を優先する消費者の間でその魅力が高まっています。植物性タンパク質の市場が拡大を続ける中、エンドウ豆タンパク質の受け入れと需要の拡大は、タンパク質消費の未来を形作る可能性を強調しています。

米国市場は、植物性タンパク質産業にとって世界最大の市場の一つです。植物性食肉や乳製品代替製品の消費と依存の増加により、植物性タンパク質に大きなビジネスチャンスがもたらされています。さらに、企業のジムやウェルネス・センターでは、自然で植物性の代替品に対する需要が高まっています。このシフトは、持続可能で健康志向のライフスタイル・ソリューションを求める従業員の嗜好と一致し、植物性栄養製品の拡大を支えています。

当レポートでは、世界の植物性タンパク質市場について調査し、用途別、性質別、形態別、機能別、由来別、タイプ別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- マクロ経済指標

- 市場力学

- 生成AIが飲食品の原料・添加物に与える影響

第6章 業界動向

- イントロダクション

- 2025年の米国関税の影響:植物性タンパク質市場

- バリューチェーン分析

- 貿易分析

- 技術分析

- 価格分析

- エコシステム

- 顧客ビジネスに影響を与える動向/混乱

- 特許分析

- 2025年~2026年の主な会議とイベント

- 規制状況

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- ケーススタディ分析

- 投資と資金調達のシナリオ

- 新たなタンパク質源- ゴマタンパク質

第7章 植物性タンパク質市場(用途別)

- イントロダクション

- 食品・飲料

- 飼料

第8章 植物性タンパク質市場(性質別)

- イントロダクション

- 従来型

- オーガニック

第9章 植物性タンパク質市場(形態別)

- イントロダクション

- ドライ

- 液体

第10章 植物性タンパク質市場(機能別)

- イントロダクション

- 栄養強化

- 結合剤

- 増粘・粘度向上

- その他の機能

第11章 植物性タンパク質市場(由来別)

- イントロダクション

- 大豆

- 小麦

- エンドウ

- キャノーラ、米、オート麦、ジャガイモ

- ソラマメ

- その他

第12章 植物性タンパク質市場(タイプ別)

- イントロダクション

- 分離株

- 濃縮物

- テクスチャ加工

- 粉砕タンパク質粉

- デンプン質が豊富なタンパク質粉

第13章 植物性タンパク質市場(地域別)

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- オランダ

- その他

- アジア太平洋

- 中国

- 日本

- オーストラリアとニュージーランド

- インド

- その他

- 南米

- ブラジル

- アルゼンチン

- その他

- その他の地域

- アフリカ

- 中東

第14章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 収益分析

- 市場シェア分析

- 企業評価と財務指標

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオと動向

第15章 企業プロファイル

- 主要参入企業

- CARGILL, INCORPORATED

- ARCHER DANIELS MIDLAND(ADM)COMPANY

- KERRY GROUP PLC

- INTERNATIONAL FLAVORS & FRAGRANCES INC.

- INGREDION INCORPORATED

- WILMAR INTERNATIONAL LIMITED

- ROQUETTE FRERES

- GLANBIA PLC

- DSM-FIRMENICH

- AGT FOOD AND INGREDIENTS

- TATE & LYLE

- BURCON

- EMSLAND GROUP

- PURIS

- COSUCRA

- その他の企業

- BENEO

- SOTEXPRO

- SHANDONG JIANYUAN GROUP

- AMCO PROTEINS

- AMINOLA

- THE GREEN LABS LLC

- AXIOM FOODS, INC.

- NUTRI-PEA

- FENCHEM

- SUN NUTRAFOODS

第16章 隣接市場と関連市場

第17章 付録

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2020-2024

- TABLE 2 PLANT-BASED PROTEIN MARKET SNAPSHOT, 2025 VS. 2030 (USD MILLION)

- TABLE 3 PERCENTAGE OF LACTOSE-INTOLERANT PEOPLE, BY ETHNICITY

- TABLE 4 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 5 EXPECTED IMPACT LEVEL ON TARGET INGREDIENTS WITH RELEVANT HS CODES DUE TO TRUMP TARIFF IMPACT

- TABLE 6 EXPECTED TARIFF IMPACT ON END-USE INDUSTRIES: PLANT-BASED FOOD PRODUCTS

- TABLE 7 IMPORT SCENARIO FOR HS CODE: 1201, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 8 EXPORT SCENARIO FOR HS CODE: 1201, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 9 IMPORT SCENARIO FOR HS CODE: 071310, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 10 EXPORT SCENARIO FOR HS CODE: 071310, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 11 IMPORT SCENARIO FOR HS CODE: 1001, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 12 EXPORT SCENARIO FOR HS CODE: 1001, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 13 IMPORT SCENARIO FOR HS CODE: 1006, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 14 EXPORT SCENARIO FOR HS CODE: 1006, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 15 IMPORT SCENARIO FOR HS CODE: 1004, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 16 EXPORT SCENARIO FOR HS CODE: 1004, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 17 AVERAGE SELLING PRICE OF PLANT-BASED PROTEIN, BY KEY PLAYERS, 2024 (USD/KG)

- TABLE 18 AVERAGE SELLING PRICE OF PLANT-BASED PROTEIN, BY REGION, 2021-2024 (USD/TON)

- TABLE 19 PLANT-BASED PROTEIN MARKET: ECOSYSTEM

- TABLE 20 LIST OF MAJOR PATENTS PERTAINING TO PLANT-BASED PROTEIN MARKET, 2014-2024

- TABLE 21 PLANT-BASED PROTEIN MARKET: LIST OF KEY CONFERENCES & EVENTS, 2025-2026

- TABLE 22 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 24 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 25 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 26 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 27 PORTER'S FIVE FORCES ANALYSIS

- TABLE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE SOURCES

- TABLE 29 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

- TABLE 30 PLANT-BASED PROTEIN MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 31 PLANT-BASED PROTEIN MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 32 FOOD & BEVERAGE: PLANT-BASED PROTEIN MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 33 FOOD & BEVERAGE: PLANT-BASED PROTEIN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 34 FOOD & BEVERAGE: PLANT-BASED PROTEIN MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 35 FOOD & BEVERAGE: PLANT-BASED PROTEIN MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 36 MEAT ALTERNATIVES: PLANT-BASED PROTEIN MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 37 MEAT ALTERNATIVES: PLANT-BASED PROTEIN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 38 DAIRY ALTERNATIVES: PLANT-BASED PROTEIN MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 39 DAIRY ALTERNATIVES: PLANT-BASED PROTEIN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 40 BAKERY PRODUCTS: PLANT-BASED PROTEIN MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 41 BAKERY PRODUCTS: PLANT-BASED PROTEIN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 42 PERFORMANCE NUTRITION: PLANT-BASED PROTEIN MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 43 PERFORMANCE NUTRITION: PLANT-BASED PROTEIN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 44 CONVENIENCE FOOD: PLANT-BASED PROTEIN MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 45 CONVENIENCE FOOD: PLANT-BASED PROTEIN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 46 OTHER FOOD & BEVERAGE APPLICATIONS: PLANT-BASED PROTEIN MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 47 OTHER FOOD & BEVERAGE APPLICATIONS: PLANT-BASED PROTEIN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 48 FEED: PLANT-BASED PROTEIN MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 49 FEED: PLANT-BASED PROTEIN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 50 PLANT-BASED PROTEIN MARKET, BY NATURE, 2021-2024 (USD MILLION)

- TABLE 51 PLANT-BASED PROTEIN MARKET, BY NATURE, 2025-2030 (USD MILLION)

- TABLE 52 CONVENTIONAL: PLANT-BASED PROTEIN MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 53 CONVENTIONAL: PLANT-BASED PROTEIN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 54 ORGANIC: PLANT-BASED PROTEIN MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 55 ORGANIC: PLANT-BASED PROTEIN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 56 PLANT-BASED PROTEIN MARKET, BY FORM, 2021-2024 (USD MILLION)

- TABLE 57 PLANT-BASED PROTEIN MARKET, BY FORM, 2025-2030 (USD MILLION)

- TABLE 58 DRY: PLANT-BASED PROTEIN MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 59 DRY: PLANT-BASED PROTEIN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 60 LIQUID: PLANT-BASED PROTEIN MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 61 LIQUID: PLANT-BASED PROTEIN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 62 PLANT-BASED PROTEIN MARKET, BY SOURCE, 2021-2024 (USD MILLION)

- TABLE 63 PLANT-BASED PROTEIN MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 64 PLANT-BASED PROTEIN MARKET, BY SOURCE, 2021-2024 (KT)

- TABLE 65 PLANT-BASED PROTEIN MARKET, BY SOURCE, 2025-2030 (KT)

- TABLE 66 SOY: PLANT-BASED PROTEIN MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 67 SOY: PLANT-BASED PROTEIN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 68 SOY: PLANT-BASED PROTEIN MARKET, BY REGION, 2021-2024 (KT)

- TABLE 69 SOY: PLANT-BASED PROTEIN MARKET, BY REGION, 2025-2030 (KT)

- TABLE 70 WHEAT: PLANT-BASED PROTEIN MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 71 WHEAT: PLANT-BASED PROTEIN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 72 WHEAT: PLANT-BASED PROTEIN MARKET, BY REGION, 2021-2024 (KT)

- TABLE 73 WHEAT: PLANT-BASED PROTEIN MARKET, BY REGION, 2025-2030 (KT)

- TABLE 74 PEA: PLANT-BASED PROTEIN MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 75 PEA: PLANT-BASED PROTEIN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 76 PEA: PLANT-BASED PROTEIN MARKET, BY REGION, 2021-2024 (KT)

- TABLE 77 PEA: PLANT-BASED PROTEIN MARKET, BY REGION, 2025-2030 (KT)

- TABLE 78 CANOLA, RICE, OATS, AND POTATOES: PLANT-BASED PROTEIN MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 79 CANOLA, RICE, OATS, AND POTATOES: PLANT-BASED PROTEIN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 80 CANOLA, RICE, OATS, AND POTATOES: PLANT-BASED PROTEIN MARKET, BY REGION, 2021-2024 (KT)

- TABLE 81 CANOLA, RICE, OATS, AND POTATOES: PLANT-BASED PROTEIN MARKET, BY REGION, 2025-2030 (KT)

- TABLE 82 FABA BEANS: PLANT-BASED PROTEIN MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 83 FABA BEANS: PLANT-BASED PROTEIN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 84 FABA BEANS: PLANT-BASED PROTEIN MARKET, BY REGION, 2021-2024 (KT)

- TABLE 85 FABA BEANS: PLANT-BASED PROTEIN MARKET, BY REGION, 2025-2030 (KT)

- TABLE 86 OTHER SOURCES: PLANT-BASED PROTEIN MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 87 OTHER SOURCES: PLANT-BASED PROTEIN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 88 OTHER SOURCES: PLANT-BASED PROTEIN MARKET, BY REGION, 2021-2024 (KT)

- TABLE 89 OTHER SOURCES: PLANT-BASED PROTEIN MARKET, BY REGION, 2025-2030 (KT)

- TABLE 90 PLANT-BASED PROTEIN MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 91 PLANT-BASED PROTEIN MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 92 ISOLATES: PLANT-BASED PROTEIN MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 93 ISOLATES: PLANT-BASED PROTEIN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 94 CONCENTRATES: PLANT-BASED PROTEIN MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 95 CONCENTRATES: PLANT-BASED PROTEIN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 96 TEXTURED: PLANT-BASED PROTEIN MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 97 TEXTURED: PLANT-BASED PROTEIN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 98 MILLED PROTEIN FLOURS: PLANT-BASED PROTEIN MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 99 MILLED PROTEIN FLOURS: PLANT-BASED PROTEIN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 100 STARCH-RICH PROTEIN FLOURS: PLANT-BASED PROTEIN MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 101 STARCH-RICH PROTEIN FLOURS: PLANT-BASED PROTEIN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 102 PLANT-BASED PROTEIN MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 103 PLANT-BASED PROTEIN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 104 PLANT-BASED PROTEIN MARKET, BY REGION, 2021-2024 (KT)

- TABLE 105 PLANT-BASED PROTEIN MARKET, BY REGION, 2025-2030 (KT)

- TABLE 106 NORTH AMERICA: PLANT-BASED PROTEIN MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 107 NORTH AMERICA: PLANT-BASED PROTEIN MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 108 NORTH AMERICA: PLANT-BASED PROTEIN MARKET, BY SOURCE, 2021-2024 (USD MILLION)

- TABLE 109 NORTH AMERICA: PLANT-BASED PROTEIN MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 110 NORTH AMERICA: PLANT-BASED PROTEIN MARKET, BY SOURCE, 2021-2024 (KT)

- TABLE 111 NORTH AMERICA: PLANT-BASED PROTEIN MARKET, BY SOURCE, 2025-2030 (KT)

- TABLE 112 NORTH AMERICA: PLANT-BASED PROTEIN MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 113 NORTH AMERICA: PLANT-BASED PROTEIN MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 114 NORTH AMERICA: PLANT-BASED PROTEIN MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 115 NORTH AMERICA: PLANT-BASED PROTEIN MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 116 NORTH AMERICA: PLANT-BASED PROTEIN MARKET, BY FOOD & BEVERAGE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 117 NORTH AMERICA: PLANT-BASED PROTEIN MARKET, BY FOOD & BEVERAGE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 118 NORTH AMERICA: PLANT-BASED PROTEIN MARKET, BY NATURE, 2021-2024 (USD MILLION)

- TABLE 119 NORTH AMERICA: PLANT-BASED PROTEIN MARKET, BY NATURE, 2025-2030 (USD MILLION)

- TABLE 120 NORTH AMERICA: PLANT-BASED PROTEIN MARKET, BY FORM, 2021-2024 (USD MILLION)

- TABLE 121 NORTH AMERICA: PLANT-BASED PROTEIN MARKET, BY FORM, 2025-2030 (USD MILLION)

- TABLE 122 US: PLANT-BASED PROTEIN MARKET, BY SOURCE, 2021-2024 (USD MILLION)

- TABLE 123 US: PLANT-BASED PROTEIN MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 124 CANADA: PLANT-BASED PROTEIN MARKET, BY SOURCE, 2021-2024 (USD MILLION)

- TABLE 125 CANADA: PLANT-BASED PROTEIN MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 126 MEXICO: PLANT-BASED PROTEIN MARKET, BY SOURCE, 2021-2024 (USD MILLION)

- TABLE 127 MEXICO: PLANT-BASED PROTEIN MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 128 EUROPE: PLANT-BASED PROTEIN MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 129 EUROPE: PLANT-BASED PROTEIN MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 130 EUROPE: PLANT-BASED PROTEIN MARKET, BY SOURCE, 2021-2024 (USD MILLION)

- TABLE 131 EUROPE: PLANT-BASED PROTEIN MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 132 EUROPE: PLANT-BASED PROTEIN MARKET, BY SOURCE, 2021-2024 (KT)

- TABLE 133 EUROPE: PLANT-BASED PROTEIN MARKET, BY SOURCE, 2025-2030 (KT)

- TABLE 134 EUROPE: PLANT-BASED PROTEIN MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 135 EUROPE: PLANT-BASED PROTEIN MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 136 EUROPE: PLANT-BASED PROTEIN MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 137 EUROPE: PLANT-BASED PROTEIN MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 138 EUROPE: PLANT-BASED PROTEIN MARKET, BY FOOD & BEVERAGE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 139 EUROPE: PLANT-BASED PROTEIN MARKET, BY FOOD & BEVERAGE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 140 EUROPE: PLANT-BASED PROTEIN MARKET, BY NATURE, 2021-2024 (USD MILLION)

- TABLE 141 EUROPE: PLANT-BASED PROTEIN MARKET, BY NATURE, 2025-2030 (USD MILLION)

- TABLE 142 EUROPE: PLANT-BASED PROTEIN MARKET, BY FORM, 2021-2024 (USD MILLION)

- TABLE 143 EUROPE: PLANT-BASED PROTEIN MARKET, BY FORM, 2025-2030 (USD MILLION)

- TABLE 144 GERMANY: PLANT-BASED PROTEIN MARKET, BY SOURCE, 2021-2024 (USD MILLION)

- TABLE 145 GERMANY: PLANT-BASED PROTEIN MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 146 UK: PLANT-BASED PROTEIN MARKET, BY SOURCE, 2021-2024 (USD MILLION)

- TABLE 147 UK: PLANT-BASED PROTEIN MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 148 FRANCE: PLANT-BASED PROTEIN MARKET, BY SOURCE, 2021-2024 (USD MILLION)

- TABLE 149 FRANCE: PLANT-BASED PROTEIN MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 150 ITALY: PLANT-BASED PROTEIN MARKET, BY SOURCE, 2021-2024 (USD MILLION)

- TABLE 151 ITALY: PLANT-BASED PROTEIN MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 152 SPAIN: PLANT-BASED PROTEIN MARKET, BY SOURCE, 2021-2024 (USD MILLION)

- TABLE 153 SPAIN: PLANT-BASED PROTEIN MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 154 NETHERLANDS: PLANT-BASED PROTEIN MARKET, BY SOURCE, 2021-2024 (USD MILLION)

- TABLE 155 NETHERLANDS: PLANT-BASED PROTEIN MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 156 REST OF EUROPE: PLANT-BASED PROTEIN MARKET, BY SOURCE, 2021-2024 (USD MILLION)

- TABLE 157 REST OF EUROPE: PLANT-BASED PROTEIN MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 158 ASIA PACIFIC: PLANT-BASED PROTEIN MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 159 ASIA PACIFIC: PLANT-BASED PROTEIN MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 160 ASIA PACIFIC: PLANT-BASED PROTEIN MARKET, BY SOURCE, 2021-2024 (USD MILLION)

- TABLE 161 ASIA PACIFIC: PLANT-BASED PROTEIN MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 162 ASIA PACIFIC: PLANT-BASED PROTEIN MARKET, BY SOURCE, 2021-2024 (KT)

- TABLE 163 ASIA PACIFIC: PLANT-BASED PROTEIN MARKET, BY SOURCE, 2025-2030 (KT)

- TABLE 164 ASIA PACIFIC: PLANT-BASED PROTEIN MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 165 ASIA PACIFIC: PLANT-BASED PROTEIN MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 166 ASIA PACIFIC: PLANT-BASED PROTEIN MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 167 ASIA PACIFIC: PLANT-BASED PROTEIN MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 168 ASIA PACIFIC: PLANT-BASED PROTEIN MARKET, BY FOOD & BEVERAGE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 169 ASIA PACIFIC: PLANT-BASED PROTEIN MARKET, BY FOOD & BEVERAGE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 170 ASIA PACIFIC: PLANT-BASED PROTEIN MARKET, BY NATURE, 2021-2024 (USD MILLION)

- TABLE 171 ASIA PACIFIC: PLANT-BASED PROTEIN MARKET, BY NATURE, 2025-2030 (USD MILLION)

- TABLE 172 ASIA PACIFIC: PLANT-BASED PROTEIN MARKET, BY FORM, 2021-2024 (USD MILLION)

- TABLE 173 ASIA PACIFIC: PLANT-BASED PROTEIN MARKET, BY FORM, 2025-2030 (USD MILLION)

- TABLE 174 CHINA: PLANT-BASED PROTEIN MARKET, BY SOURCE, 2021-2024 (USD MILLION)

- TABLE 175 CHINA: PLANT-BASED PROTEIN MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 176 JAPAN: PLANT-BASED PROTEIN MARKET, BY SOURCE, 2021-2024 (USD MILLION)

- TABLE 177 JAPAN: PLANT-BASED PROTEIN MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 178 AUSTRALIA & NZ: PLANT-BASED PROTEIN MARKET, BY SOURCE, 2021-2024 (USD MILLION)

- TABLE 179 AUSTRALIA & NZ: PLANT-BASED PROTEIN MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 180 INDIA: PLANT-BASED PROTEIN MARKET, BY SOURCE, 2021-2024 (USD MILLION)

- TABLE 181 INDIA: PLANT-BASED PROTEIN MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 182 REST OF ASIA PACIFIC: PLANT-BASED PROTEIN MARKET, BY SOURCE, 2021-2024 (USD MILLION)

- TABLE 183 REST OF ASIA PACIFIC: PLANT-BASED PROTEIN MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 184 SOUTH AMERICA: PLANT-BASED PROTEIN MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 185 SOUTH AMERICA: PLANT-BASED PROTEIN MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 186 SOUTH AMERICA: PLANT-BASED PROTEIN MARKET, BY SOURCE, 2021-2024 (USD MILLION)

- TABLE 187 SOUTH AMERICA: PLANT-BASED PROTEIN MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 188 SOUTH AMERICA: PLANT-BASED PROTEIN MARKET, BY SOURCE, 2021-2024 (KT)

- TABLE 189 SOUTH AMERICA: PLANT-BASED PROTEIN MARKET, BY SOURCE, 2025-2030 (KT)

- TABLE 190 SOUTH AMERICA: PLANT-BASED PROTEIN MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 191 SOUTH AMERICA: PLANT-BASED PROTEIN MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 192 SOUTH AMERICA: PLANT-BASED PROTEIN MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 193 SOUTH AMERICA: PLANT-BASED PROTEIN MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 194 SOUTH AMERICA: PLANT-BASED PROTEIN MARKET, BY FOOD & BEVERAGE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 195 SOUTH AMERICA: PLANT-BASED PROTEIN MARKET, BY FOOD & BEVERAGE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 196 SOUTH AMERICA: PLANT-BASED PROTEIN MARKET, BY NATURE, 2021-2024 (USD MILLION)

- TABLE 197 SOUTH AMERICA: PLANT-BASED PROTEIN MARKET, BY NATURE, 2025-2030 (USD MILLION)

- TABLE 198 SOUTH AMERICA: PLANT-BASED PROTEIN MARKET, BY FORM, 2021-2024 (USD MILLION)

- TABLE 199 SOUTH AMERICA: PLANT-BASED PROTEIN MARKET, BY FORM, 2025-2030 (USD MILLION)

- TABLE 200 BRAZIL: PLANT-BASED PROTEIN MARKET, BY SOURCE, 2021-2024 (USD MILLION)

- TABLE 201 BRAZIL: PLANT-BASED PROTEIN MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 202 ARGENTINA: PLANT-BASED PROTEIN MARKET, BY SOURCE, 2021-2024 (USD MILLION)

- TABLE 203 ARGENTINA: PLANT-BASED PROTEIN MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 204 REST OF SOUTH AMERICA: PLANT-BASED PROTEIN MARKET, BY SOURCE, 2021-2024 (USD MILLION)

- TABLE 205 REST OF SOUTH AMERICA: PLANT-BASED PROTEIN MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 206 ROW: PLANT-BASED PROTEIN MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 207 ROW: PLANT-BASED PROTEIN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 208 ROW: PLANT-BASED PROTEIN MARKET, BY SOURCE, 2021-2024 (USD MILLION)

- TABLE 209 ROW: PLANT-BASED PROTEIN MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 210 ROW: PLANT-BASED PROTEIN MARKET, BY SOURCE, 2021-2024 (KT)

- TABLE 211 ROW: PLANT-BASED PROTEIN MARKET, BY SOURCE, 2025-2030 (KT)

- TABLE 212 ROW: PLANT-BASED PROTEIN MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 213 ROW: PLANT-BASED PROTEIN MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 214 ROW: PLANT-BASED PROTEIN MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 215 ROW: PLANT-BASED PROTEIN MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 216 ROW: PLANT-BASED PROTEIN MARKET, BY FOOD & BEVERAGE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 217 ROW: PLANT-BASED PROTEIN MARKET, BY FOOD & BEVERAGE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 218 ROW: PLANT-BASED PROTEIN MARKET, BY NATURE, 2021-2024 (USD MILLION)

- TABLE 219 ROW: PLANT-BASED PROTEIN MARKET, BY NATURE, 2025-2030 (USD MILLION)

- TABLE 220 ROW: PLANT-BASED PROTEIN MARKET, BY FORM, 2021-2024 (USD MILLION)

- TABLE 221 ROW: PLANT-BASED PROTEIN MARKET, BY FORM, 2025-2030 (USD MILLION)

- TABLE 222 AFRICA: PLANT-BASED PROTEIN MARKET, BY SOURCE, 2021-2024 (USD MILLION)

- TABLE 223 AFRICA: PLANT-BASED PROTEIN MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 224 MIDDLE EAST: PLANT-BASED PROTEIN MARKET, BY SOURCE, 2021-2024 (USD MILLION)

- TABLE 225 MIDDLE EAST: PLANT-BASED PROTEIN MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 226 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLANT-BASED PROTEIN MARKET PLAYERS

- TABLE 227 PLANT-BASED PROTEIN: MARKET SHARE ANALYSIS, 2024

- TABLE 228 REGIONAL FOOTPRINT

- TABLE 229 SOURCE FOOTPRINT

- TABLE 230 TYPE FOOTPRINT

- TABLE 231 PLANT-BASED PROTEIN MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 232 PLANT-BASED PROTEIN MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 233 PLANT-BASED PROTEIN MARKET: PRODUCT LAUNCHES, AUGUST 2020-JUNE 2025

- TABLE 234 PLANT-BASED PROTEIN MARKET: DEALS, JANUARY 2020-JUNE 2025

- TABLE 235 PLANT-BASED PROTEIN MARKET: EXPANSIONS, JUNE 2020-APRIL 2022

- TABLE 236 CARGILL, INCORPORATED: COMPANY OVERVIEW

- TABLE 237 CARGILL, INCORPORATED: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 238 CARGILL, INCORPORATED: DEALS

- TABLE 239 CARGILL, INCORPORATED: OTHERS

- TABLE 240 ADM: COMPANY OVERVIEW

- TABLE 241 ADM: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 242 ADM: PRODUCT LAUNCHES

- TABLE 243 ADM: DEALS

- TABLE 244 ADM: OTHERS

- TABLE 245 KERRY GROUP PLC: COMPANY OVERVIEW

- TABLE 246 KERRY GROUP PLC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 247 KERRY GROUP PLC: DEALS

- TABLE 248 KERRY GROUP PLC: OTHERS

- TABLE 249 INTERNATIONAL FLAVORS & FRAGRANCES INC.: COMPANY OVERVIEW

- TABLE 250 INTERNATIONAL FLAVORS & FRAGRANCES INC: PRODUCTS/SERVICES/ SOLUTIONS OFFERED

- TABLE 251 INTERNATIONAL FLAVORS & FRAGRANCES INC: DEALS

- TABLE 252 INGREDION INCORPORATED: COMPANY OVERVIEW

- TABLE 253 INGREDION INCORPORATED: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 254 INGREDION INCORPORATED: PRODUCT LAUNCHES

- TABLE 255 INGREDION INCORPORATED: DEALS

- TABLE 256 INGREDION INCORPORATED: OTHERS

- TABLE 257 WILMAR INTERNATIONAL LIMITED: COMPANY OVERVIEW

- TABLE 258 WILMAR INTERNATIONAL LIMITED: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 259 ROQUETTE FRERES: COMPANY OVERVIEW

- TABLE 260 ROQUETTE FRERES: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 261 ROQUETTE FRERES: PRODUCT LAUNCHES

- TABLE 262 ROQUETTE FRERES: DEALS

- TABLE 263 ROQUETTE FRERES: OTHERS

- TABLE 264 GLANBIA PLC: COMPANY OVERVIEW

- TABLE 265 GLANBIA PLC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 266 GLANBIA PLC: PRODUCT LAUNCHES

- TABLE 267 DSM-FIRMENICH: COMPANY OVERVIEW

- TABLE 268 DSM-FIRMENICH: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 269 DSM-FIRMENICH: DEALS

- TABLE 270 AGT FOOD AND INGREDIENTS: COMPANY OVERVIEW

- TABLE 271 AGT FOOD AND INGREDIENTS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 272 AGT FOOD AND INGREDIENTS: DEALS

- TABLE 273 TATE & LYLE: COMPANY OVERVIEW

- TABLE 274 TATE & LYLE: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 275 TATE & LYLE: DEALS

- TABLE 276 BURCON: COMPANY OVERVIEW

- TABLE 277 BURCON: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 278 BURCON: DEALS

- TABLE 279 BURCON: OTHERS

- TABLE 280 EMSLAND GROUP: COMPANY OVERVIEW

- TABLE 281 EMSLAND GROUP: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 282 EMSLAND GROUP: DEALS

- TABLE 283 PURIS: COMPANY OVERVIEW

- TABLE 284 PURIS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 285 PURIS: OTHERS

- TABLE 286 COSUCRA: COMPANY OVERVIEW

- TABLE 287 COSUCRA: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 288 COSUCRA: PRODUCT LAUNCHES

- TABLE 289 COSUCRA: OTHERS

- TABLE 290 BENEO: COMPANY OVERVIEW

- TABLE 291 BENEO: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 292 BENEO: DEALS

- TABLE 293 BENEO: OTHERS

- TABLE 294 SOTEXPRO: COMPANY OVERVIEW

- TABLE 295 SOTEXPRO: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 296 SHANDONG JIANYUAN GROUP: COMPANY OVERVIEW

- TABLE 297 SHANDONG JIANYUAN GROUP: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 298 AMCO PROTEINS: COMPANY OVERVIEW

- TABLE 299 AMCO PROTEINS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 300 AMCO PROTEINS: OTHERS

- TABLE 301 AMINOLA: COMPANY OVERVIEW

- TABLE 302 AMINOLA: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 303 MARKETS ADJACENT TO PLANT-BASED PROTEIN MARKET

- TABLE 304 PEA PROTEIN MARKET, BY FORM, 2020-2023 (USD MILLION)

- TABLE 305 PEA PROTEIN MARKET, BY FORM, 2024-2029 (USD MILLION)

- TABLE 306 SOY PROTEIN INGREDIENTS MARKET, BY NATURE, 2018-2021 (USD MILLION)

- TABLE 307 SOY PROTEIN INGREDIENTS MARKET, BY NATURE, 2022-2027 (USD MILLION)

- TABLE 308 PROTEIN INGREDIENTS MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 309 PROTEIN INGREDIENTS MARKET, BY FORM, 2023-2028 (USD MILLION)

List of Figures

- FIGURE 1 PLANT-BASED PROTEIN MARKET: RESEARCH DESIGN

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 4 SUPPLY-SIDE ANALYSIS: SOURCES OF INFORMATION AT EVERY STEP

- FIGURE 5 PLANT-BASED PROTEIN MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 PLANT-BASED PROTEIN MARKET, BY SOURCE, 2025 VS. 2030

- FIGURE 8 PLANT-BASED PROTEIN MARKET, BY TYPE, 2025 VS. 2030

- FIGURE 9 PLANT-BASED PROTEIN MARKET, BY NATURE, 2025 VS. 2030

- FIGURE 10 PLANT-BASED PROTEIN MARKET, BY APPLICATION, 2025 VS. 2030

- FIGURE 11 PLANT-BASED PROTEIN MARKET, BY FORM, 2025 VS. 2030

- FIGURE 12 PLANT-BASED PROTEIN MARKET SHARE AND GROWTH RATE, BY REGION, 2024 (BY VALUE)

- FIGURE 13 CONSUMER PREFERENCES FOR HEALTHY AND NUTRITIONAL PROTEIN SOURCES TO DRIVE PLANT-BASED PROTEIN MARKET

- FIGURE 14 US AND FOOD & BEVERAGE SEGMENT TO ACCOUNT FOR SIGNIFICANT SHARES IN 2025

- FIGURE 15 ISOLATES SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 16 SOY SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 17 DRY SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

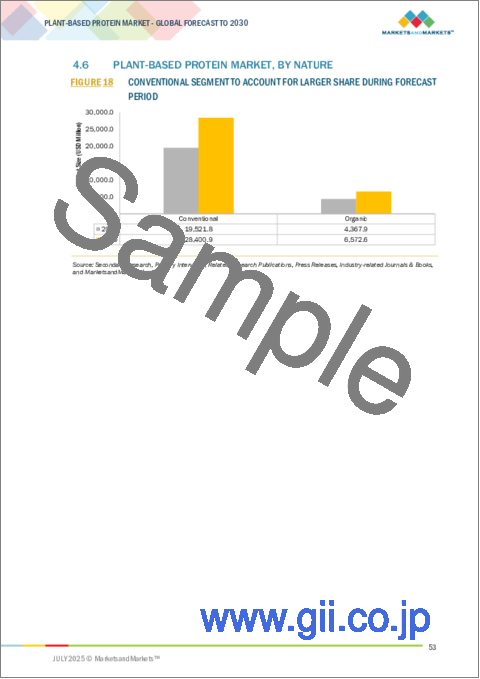

- FIGURE 18 CONVENTIONAL SEGMENT TO ACCOUNT FOR LARGER SHARE DURING FORECAST PERIOD

- FIGURE 19 FOOD & BEVERAGES SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 20 US TO RECORD HIGHEST MARKET SHARE IN PLANT-BASED PROTEIN MARKET IN 2025

- FIGURE 21 GLOBAL PRODUCTION OF CHICKPEAS AND GREEN PEAS, 2019-2023 (MILLION TONNES)

- FIGURE 22 GLOBAL PEA PRODUCTION, BY COUNTRY, 2023 (MILLION TONNES)

- FIGURE 23 SOYBEAN PRODUCTION, BY COUNTRY, 2021-2024 (MILLION METRIC TONS)

- FIGURE 24 PLANT-BASED PROTEIN MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 25 ADOPTION OF GEN AI IN FOOD & BEVERAGE PRODUCTION PROCESS

- FIGURE 26 PLANT-BASED PROTEIN MARKET: VALUE CHAIN ANALYSIS

- FIGURE 27 IMPORT OF SOYBEANS, BY KEY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 28 EXPORT OF SOYBEANS, BY KEY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 29 IMPORT OF PEAS, BY KEY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 30 EXPORT OF PEAS, BY KEY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 31 IMPORT OF WHEAT & MESLIN, BY KEY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 32 EXPORT OF WHEAT & MESLIN, BY KEY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 33 IMPORT OF RICE, BY KEY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 34 EXPORT OF RICE, BY KEY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 35 IMPORT OF OATS, BY KEY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 36 EXPORT OF OATS, BY KEY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 37 AVERAGE SELLING PRICE OF PLANT-BASED PROTEIN, BY KEY PLAYER, 2024 (USD/KG)

- FIGURE 38 AVERAGE SELLING PRICE OF PLANT-BASED PROTEIN, BY REGION, 2021-2024 (USD/TON)

- FIGURE 39 KEY PLAYERS IN PLANT-BASED PROTEIN MARKET

- FIGURE 40 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 41 NUMBER OF PATENTS GRANTED FOR PLANT-BASED PROTEIN, 2014-2024

- FIGURE 42 REGIONAL ANALYSIS OF PATENTS GRANTED FOR PLANT-BASED PROTEIN

- FIGURE 43 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 44 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE SOURCES

- FIGURE 45 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

- FIGURE 46 PLANT-BASED PROTEIN MARKET: INVESTMENT & FUNDING SCENARIO

- FIGURE 47 PLANT-BASED PROTEIN MARKET, BY APPLICATION, 2025 VS. 2030 (USD MILLION)

- FIGURE 48 PLANT-BASED PROTEIN MARKET, BY NATURE, 2025 VS. 2030 (USD MILLION)

- FIGURE 49 PLANT-BASED PROTEIN MARKET, BY FORM, 2025 VS. 2030 (USD MILLION)

- FIGURE 50 PLANT-BASED PROTEIN MARKET, BY SOURCE, 2025 VS. 2030 (USD MILLION)

- FIGURE 51 PLANT-BASED PROTEIN MARKET, BY TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 52 JAPAN TO RECORD HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 53 NORTH AMERICAN PLANT-BASED PROTEIN MARKET SNAPSHOT

- FIGURE 54 ASIA PACIFIC PLANT-BASED PROTEIN MARKET SNAPSHOT

- FIGURE 55 JAPAN: AGE GROUP DISTRIBUTION (2010-2060)

- FIGURE 56 INDIA: CONSUMER MOTIVATION FOR TURNING TO PLANT-BASED DIET

- FIGURE 57 REVENUE ANALYSIS OF KEY PLAYERS, 2022-2024 (USD BILLION)

- FIGURE 58 MARKET SHARE ANALYSIS, 2024

- FIGURE 59 COMPANY VALUATION FOR SEVEN MAJOR PLAYERS IN PLANT-BASED PROTEIN & FLOUR MARKET

- FIGURE 60 EV/EBITDA OF MAJOR PLAYERS

- FIGURE 61 PLANT-BASED PROTEIN MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 62 PLANT-BASED PROTEIN MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 63 PLANT-BASED PROTEIN MARKET: COMPANY FOOTPRINT

- FIGURE 64 PLANT-BASED PROTEIN MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 65 CARGILL, INCORPORATED: COMPANY SNAPSHOT

- FIGURE 66 ADM: COMPANY SNAPSHOT

- FIGURE 67 KERRY GROUP PLC: COMPANY SNAPSHOT

- FIGURE 68 INTERNATIONAL FLAVORS & FRAGRANCES INC.: COMPANY SNAPSHOT

- FIGURE 69 INGREDION INCORPORATED: COMPANY SNAPSHOT

- FIGURE 70 WILMAR INTERNATIONAL LIMITED: COMPANY SNAPSHOT

- FIGURE 71 GLANBIA PLC: COMPANY SNAPSHOT

- FIGURE 72 DSM-FIRMENICH: COMPANY SNAPSHOT

- FIGURE 73 TATE & LYLE: COMPANY SNAPSHOT

- FIGURE 74 BURCON: COMPANY SNAPSHOT

The plant-based protein market is estimated at USD 23.89 billion in 2025 and is projected to reach USD 34.97 billion by 2030, at a CAGR of 7.9%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) and Volume (KT) |

| Segments | By source, type, application, nature, form, function, and region |

| Regions covered | North America, Europe, Asia Pacific, South America, and Rest of the World (RoW) |

Diversification of protein sources is one of the major trends that is reshaping the plant-based protein industry. Traditionally, soy and wheat were the key sources of plant-based protein ingredients used in various alternative protein products. Recently, the industry has been rapidly exploring new protein sources with various crops such as faba beans, hemp, mung beans, and other beans & seeds. This is mainly due to a shift in demand for allergen-free and environmentally sustainable products that provide a clear taste profile to meet consumer demand.

Consumers in developed countries are embracing plant-based protein alternatives due to their ability to provide essential nutrients, promote better health, support weight management, and enhance the overall appeal of food. Thus, the consumer shift toward vegan diets is also a key driver impacting the growth. However, allergies associated with plant-based protein sources and nutritional and vitamin deficiencies among vegans are expected to restrain the market.

"Disruptions in the plant-based protein market may offer opportunities for players"

The plant-based protein market faces comprehensive disruption fueled by advances in sourcing, processing, consumer trends, and sustainability concerns. One of the most important changes is the emergence of new and underdeveloped protein sources such as chickpeas, fava beans, hemp, and other beans & seeds that provide alternatives to legacy soy and pea proteins while overcoming allergen, sustainability, and flavor issues. Concurrently, high-tech extraction and processing technologies such as precision fermentation, enzymatic hydrolysis, and dry fractionation enhance plant protein nutritional content, digestibility, and functional behavior to allow cleaner labels and improved sensory effects. Clean label demand alters formulation needs, driving makers to remove artificial additives and choose naturally neutral-tasting or improved-taste proteins.

Meat alternatives in the food & beverage sub-application segment is projected to be the fastest-growing segment

Plant-based meat presents a variety of advantages and trade-offs compared to traditional meat products. It represents an ecological choice over conventional meat regarding resource input and consumption. The requirement of large-scale feedlots and grazing areas results in a considerable ecological impact and is also resource-intensive. In addition, plant-based meat provides considerable environmental benefits across the value chain from farm to fork. These factors are expected to drive the demand for meat alternative segment.

"Pea segment will hold a significant market share among the sources in the plant-based protein market"

Pea protein has emerged as a formidable alternative in the plant-based protein sector due to its exceptional nutritional profile and sustainability benefits. Its rich essential amino acid composition makes it an attractive option for those looking to improve their nutritional intake without relying on animal-based proteins. Furthermore, pea protein's lower environmental footprint compared to traditional livestock farming enhances its appeal among consumers, who are increasingly prioritizing eco-friendly food sources. As the market for plant-based proteins continues to expand, the growing acceptance and demand for pea protein underscores its potential to shape the future of protein consumption.

"US is projected to dominate the North American plant-based protein market during forecast period"

The US market is one of the largest global markets for the plant-based protein industry. The increased consumption and dependency on plant-based meat and dairy-alternative products have paved the way for significant business opportunities for plant-based protein. Additionally, there is a growing demand for natural and plant-based alternatives within corporate gyms and wellness centers. This shift supports the expansion of plant-based nutritional products, aligning with employee preferences for sustainable, health-conscious lifestyle solutions.

In-depth interviews have been conducted with chief executive officers (CEOs), directors, and other executives from various key organizations operating in the plant-based protein market.

- By Company Type: Tier 1-25%, Tier 2-45%, and Tier 3-30%

- By Designation: CXOs-20%, Managers-50%, Executives-30%

- By Region: North America-25%, Europe-20%, Asia Pacific-30%, South America-15%, and Rest of the World-10%

Prominent companies in the market include Cargill, Incorporated (US), ADM (US), Kerry Group PLC (Ireland), International Flavors & Fragrances Inc. (US), Ingredion Incorporated (US), Wilmar International Ltd. (Singapore), Roquette Freres (France), Glanbia PLC (Ireland), DSM-Firmenich (Switzerland), AGT Food and Ingredients (Canada), Tate & Lyle (UK), Burcon (Canada), Emsland Group (Germany), PURIS (US), and COSUCRA (Belgium).

Research Coverage

This research report categorizes the plant-based protein market by source (soy, wheat, pea, canola, rice, & potato, faba beans, other sources), type (isolates, concentrates, textured, milled protein flours, starch-rich protein flours), application (food & beverages[meat alternatives, dairy alternatives, bakery products, performance nutrition, convenience food, other food & beverage applications] and feed), form (dry and liquid), nature (conventional and organic), function (nutrition enrichment, binders, thickening & viscosity enhancement, other functions), and region (North America, Europe, Asia Pacific, South America, and Rest of the World).

The report's scope covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of plant-based protein. A thorough analysis of the key industry players has provided insights into their business, services, key strategies, contracts, partnerships, agreements, product launches, mergers & acquisitions, and recent developments associated with the plant-based protein market. This report covers the competitive analysis of upcoming startups in the plant-based protein market ecosystem. Furthermore, industry-specific trends such as technology analysis, ecosystem & market mapping, and patent & regulatory landscape, among others, are also covered in the study.

Reasons to Buy This Report

The report will offer market leaders/new entrants information on the closest approximate revenue numbers for the overall plant-based protein and subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers.

- Analysis of key drivers (growing interest in health-centric food and beverages), restraints (allergies associated with plant-based protein sources), opportunities (effective marketing strategies and correct positioning of plant-based proteins), and challenges (concerns over the quality of food and beverages due to adulteration of GM ingredients) influencing the growth of the plant-based protein market

- Product Development/Innovation: Detailed insights on research & development activities and new product launches in the plant-based protein market

- Market Development: Comprehensive information about lucrative markets-analysis of plant-based protein across varied regions

- Market Diversification: Exhaustive information about new product sources, untapped geographies, recent developments, and investments in the plant-based protein market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, brand/product comparison, and product footprints of leading players such as Cargill, Incorporated (US), ADM (US), Kerry Group PLC (Ireland), International Flavors & Fragrances Inc. (US), Ingredion Incorporated (US), Wilmar International Ltd. (Singapore), Roquette Freres (France), Glanbia PLC (Ireland), DSM-Firmenich (Switzerland), and other players in the plant-based protein market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONS CONSIDERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primary profiles

- 2.1.2.3 Key insights from industry experts

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- 2.2.2 SUPPLY-SIDE ANALYSIS

- 2.2.3 BOTTOM-UP APPROACH (DEMAND SIDE)

- 2.3 DATA TRIANGULATION AND MARKET BREAKDOWN

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 LIMITATIONS & RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN PLANT-BASED PROTEIN MARKET

- 4.2 NORTH AMERICA: PLANT-BASED PROTEIN MARKET, BY APPLICATION AND COUNTRY

- 4.3 PLANT-BASED PROTEIN MARKET, BY TYPE

- 4.4 PLANT-BASED PROTEIN MARKET, BY SOURCE

- 4.5 PLANT-BASED PROTEIN MARKET, BY FORM

- 4.6 PLANT-BASED PROTEIN MARKET, BY NATURE

- 4.7 PLANT-BASED PROTEIN MARKET, BY APPLICATION AND REGION

- 4.8 PLANT-BASED PROTEIN MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC INDICATORS

- 5.2.1 GLOBAL PRODUCTION OF CHICKPEAS AND GREEN PEAS AND BOOST IN INNOVATION

- 5.2.2 INCREASE IN SOYBEAN PRODUCTION

- 5.2.3 CONSUMER SHIFT TOWARD PLANT-BASED NUTRITION

- 5.3 MARKET DYNAMICS

- 5.3.1 DRIVERS

- 5.3.1.1 Growing interest in health-centric food and beverages

- 5.3.1.2 Growth in consumer preferences toward veganism

- 5.3.1.3 Rise in cases of lactose intolerance

- 5.3.1.4 Increased preference for meat alternatives

- 5.3.1.5 Innovation and developments related to plant-based protein to augment vegan trend

- 5.3.2 RESTRAINTS

- 5.3.2.1 Allergies associated with plant-based protein sources

- 5.3.2.2 Nutritional and vitamin deficiencies among vegans

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Focus on aquatic plants as new and emerging sources of protein

- 5.3.3.2 Effective marketing strategies and correct positioning of plant-based proteins

- 5.3.3.3 Lifestyle changes

- 5.3.4 CHALLENGES

- 5.3.4.1 Concerns over quality of food and beverages due to adulteration of GM ingredients

- 5.3.4.2 Economic constraints

- 5.3.4.3 Concerns related to taste and texture offered by plant-based protein

- 5.3.1 DRIVERS

- 5.4 IMPACT OF GEN AI ON FOOD & BEVERAGE INGREDIENTS/ ADDITIVES

- 5.4.1 USE OF GEN AI IN FOOD & BEVERAGE INGREDIENTS/ADDITIVES

- 5.4.2 CASE STUDIES FOR GENERATIVE AI IN FOOD & BEVERAGE INGREDIENTS/ADDITIVES

- 5.4.2.1 Kerry Trendspotter leveraged AI and ML to analyze consumer-generated social media content, identifying and predicting food trends

- 5.4.2.2 IFF partners with Salus Optima to create personalized nutrition platform using AI to offer customized dietary recommendations based on metabolic health

- 5.4.2.3 Ingredion utilized cloud-based data analytics, AI, and cloud technology to address challenges in F&B industry

- 5.4.3 IMPACT OF GENERATIVE AI/AI ON PLANT-BASED PROTEIN MARKET

- 5.4.4 ADJACENT ECOSYSTEM WORKING ON GENERATIVE AI

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 IMPACT OF 2025 US TARIFF: PLANT-BASED PROTEIN MARKET

- 6.2.1 INTRODUCTION

- 6.2.2 KEY TARIFF RATES

- 6.2.3 DISRUPTION IN PLANT-BASED PROTEIN PRODUCTS

- 6.2.4 PRICE IMPACT ANALYSIS

- 6.2.5 IMPACT ON COUNTRY/REGION

- 6.2.5.1 US

- 6.2.5.2 Europe

- 6.2.5.3 China

- 6.2.6 IMPACT ON END-USE INDUSTRY

- 6.3 VALUE CHAIN ANALYSIS

- 6.3.1 RESEARCH & PRODUCT DEVELOPMENT

- 6.3.2 RAW MATERIAL SOURCING

- 6.3.3 PRODUCTION & PROCESSING

- 6.3.4 DISTRIBUTION

- 6.3.5 MARKETING & SALES

- 6.3.6 END USERS

- 6.4 TRADE ANALYSIS

- 6.4.1 IMPORT SCENARIO OF SOYBEANS

- 6.4.2 EXPORT SCENARIO OF SOYBEANS

- 6.4.3 IMPORT SCENARIO OF PEAS

- 6.4.4 EXPORT SCENARIO OF PEAS

- 6.4.5 IMPORT SCENARIO OF WHEAT & MESLIN

- 6.4.6 EXPORT SCENARIO OF WHEAT & MESLIN

- 6.4.7 IMPORT SCENARIO OF RICE

- 6.4.8 EXPORT SCENARIO OF RICE

- 6.4.9 IMPORT SCENARIO OF OATS

- 6.4.10 EXPORT SCENARIO OF OATS

- 6.5 TECHNOLOGY ANALYSIS

- 6.5.1 KEY TECHNOLOGY

- 6.5.1.1 Extrusion

- 6.5.2 COMPLIMENTARY TECHNOLOGY

- 6.5.2.1 High-Pressure Processing (HPP)

- 6.5.3 ADJACENT TECHNOLOGY

- 6.5.3.1 Wet processing method for producing dairy milk alternative

- 6.5.1 KEY TECHNOLOGY

- 6.6 PRICING ANALYSIS

- 6.6.1 AVERAGE SELLING PRICE, BY KEY PLAYER

- 6.6.2 AVERAGE SELLING PRICE TREND, BY REGION

- 6.7 ECOSYSTEM

- 6.7.1 DEMAND SIDE

- 6.7.2 SUPPLY SIDE

- 6.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.9 PATENT ANALYSIS

- 6.10 KEY CONFERENCES & EVENTS, 2025-2026

- 6.11 REGULATORY LANDSCAPE

- 6.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.11.2 REGULATORY FRAMEWORK

- 6.11.2.1 North America

- 6.11.2.2 Europe

- 6.11.2.3 Asia Pacific

- 6.12 PORTER'S FIVE FORCES ANALYSIS

- 6.12.1 THREAT OF NEW ENTRANTS

- 6.12.2 THREAT OF SUBSTITUTES

- 6.12.3 BARGAINING POWER OF SUPPLIERS

- 6.12.4 BARGAINING POWER OF BUYERS

- 6.12.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.13 KEY STAKEHOLDERS & BUYING CRITERIA

- 6.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.13.2 BUYING CRITERIA

- 6.14 CASE STUDY ANALYSIS

- 6.14.1 BLUE DIAMOND GROWERS PARTNERED WITH GROUP LALA TO ESTABLISH NETWORK IN MEXICO

- 6.14.2 KERRY GROUP PLC REVOLUTIONIZED PLANT-BASED PRODUCTS IN ASIA PACIFIC MARKET

- 6.14.3 ADM OFFERED NEW PLANT-BASED PROTEINS TO MEET GROWING CONSUMER DEMAND

- 6.14.4 GLANBIA LAUNCHED GRAIN PORTFOLIO TO ADDRESS CONSUMERS' RISING HEALTH CONCERNS

- 6.15 INVESTMENT & FUNDING SCENARIO

- 6.16 EMERGING PROTEIN SOURCE - SESAME PROTEIN

7 PLANT-BASED PROTEIN MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.2 FOOD & BEVERAGES

- 7.2.1 INCREASED CONSUMPTION OF PLANT-BASED MEAT AND DAIRY ALTERNATIVES TO DRIVE DEMAND

- 7.2.2 MEAT ALTERNATIVES

- 7.2.3 DAIRY ALTERNATIVES

- 7.2.4 BAKERY PRODUCTS

- 7.2.5 PERFORMANCE NUTRITION

- 7.2.6 CONVENIENCE FOOD

- 7.2.7 OTHER FOOD & BEVERAGE APPLICATIONS

- 7.3 FEED

- 7.3.1 GROWING DEMAND FOR CLEAN-LABEL AND SUSTAINABLE FEED PRODUCTS TO DRIVE MARKET

8 PLANT-BASED PROTEIN MARKET, BY NATURE

- 8.1 INTRODUCTION

- 8.2 CONVENTIONAL

- 8.2.1 GROWING UTILIZATION IN FOOD AND FEED INDUSTRIES TO STIMULATE MARKET EXPANSION

- 8.3 ORGANIC

- 8.3.1 CONSUMER INCLINATION TOWARD TRANSPARENCY AND PRODUCT CLAIMS TO DRIVE GROWTH

9 PLANT-BASED PROTEIN MARKET, BY FORM

- 9.1 INTRODUCTION

- 9.2 DRY

- 9.2.1 APPLICATION OF DRY PLANT-BASED PROTEIN IN FOOD & BEVERAGE PRODUCTS TO DRIVE MARKET

- 9.3 LIQUID

- 9.3.1 HIGH PROTEIN REQUIREMENTS IN NUTRITIONAL SUPPLEMENTS TO DRIVE DEMAND

10 PLANT-BASED PROTEIN MARKET, BY FUNCTION

- 10.1 INTRODUCTION

- 10.2 NUTRITION ENRICHMENT

- 10.3 BINDERS

- 10.4 THICKENING & VISCOSITY ENHANCEMENT

- 10.5 OTHER FUNCTIONS

11 PLANT-BASED PROTEIN MARKET, BY SOURCE

- 11.1 INTRODUCTION

- 11.2 SOY

- 11.2.1 SURGE IN DEMAND FOR PLANT-BASED PROTEIN ALTERNATIVES AND INCREASING SOY EXPORTS TO LEAD TO MARKET GROWTH

- 11.3 WHEAT

- 11.3.1 EXCELLENT BINDING CHARACTERISTICS, COUPLED WITH INCREASED USAGE IN ALTERNATIVE MEAT PRODUCTS, TO DRIVE GROWTH

- 11.4 PEA

- 11.4.1 RAPID SHIFT IN PREFERENCES OF CONSUMERS TO PLANT-BASED PROTEIN TO DRIVE DEMAND

- 11.5 CANOLA, RICE, OATS, AND POTATOES

- 11.5.1 GROWING CONSUMER INTEREST IN TRADITIONAL PLANT-BASED PROTEIN PRODUCTS TO DRIVE DEMAND

- 11.6 FABA BEANS

- 11.6.1 VEGAN POPULATION AND HEALTH-CONSCIOUS CONSUMERS SEEKING SUSTAINABLE PROTEIN SOURCES TO DRIVE DEMAND

- 11.7 OTHER SOURCES

12 PLANT-BASED PROTEIN MARKET, BY TYPE

- 12.1 INTRODUCTION

- 12.2 ISOLATES

- 12.2.1 APPLICATION OF PLANT-PROTEIN ISOLATES IN INFANT FOOD PRODUCTS TO DRIVE GROWTH

- 12.3 CONCENTRATES

- 12.3.1 APPLICATION OF CONCENTRATES ACROSS FOOD AND NUTRITION SUPPLEMENTS TO DRIVE DEMAND

- 12.4 TEXTURED

- 12.4.1 INCREASE IN CONSUMER PREFERENCE FOR PLANT-BASED MEAT PRODUCTS TO DRIVE DEMAND

- 12.5 MILLED PROTEIN FLOURS

- 12.5.1 ADAPTABILITY IN GLUTEN-FREE AND VEGAN PRODUCTS TO BOOST MARKET

- 12.6 STARCH-RICH PROTEIN FLOURS

- 12.6.1 VERSATILITY IN IMPROVING PRODUCT TEXTURE AND SHELF LIFE TO DRIVE MARKET GROWTH

13 PLANT-BASED PROTEIN MARKET, BY REGION

- 13.1 INTRODUCTION

- 13.2 NORTH AMERICA

- 13.2.1 US

- 13.2.1.1 Rise in awareness regarding environmental and personal health benefits to drive preference for plant-based ingredients

- 13.2.2 CANADA

- 13.2.2.1 Capitalization on large-scale shift toward flexitarian diets by prominent players to drive production

- 13.2.3 MEXICO

- 13.2.3.1 Evolving consumer preferences and increasing demand for nutritious pet food to stimulate market growth

- 13.2.1 US

- 13.3 EUROPE

- 13.3.1 GERMANY

- 13.3.1.1 Increasing dependence on plant-based foods and high adoption rate of flexitarian diets to drive growth

- 13.3.2 UK

- 13.3.2.1 Increasing vegan population to drive plant-based protein market

- 13.3.3 FRANCE

- 13.3.3.1 Government support to develop domestic plant-based protein production and reduce imports to drive growth

- 13.3.4 ITALY

- 13.3.4.1 Rapid shift in consumer preferences from conventional to plant-based protein to drive market

- 13.3.5 SPAIN

- 13.3.5.1 Product innovation and increased consumption of plant-based convenience food products to drive market

- 13.3.6 NETHERLANDS

- 13.3.6.1 Increasing popularity of plant-based food products due to their health and environmental benefits to drive demand

- 13.3.7 REST OF EUROPE

- 13.3.1 GERMANY

- 13.4 ASIA PACIFIC

- 13.4.1 CHINA

- 13.4.1.1 Demand for products with health benefits to drive market

- 13.4.2 JAPAN

- 13.4.2.1 Aging population and rising consumption of plant-based convenience foods to drive market

- 13.4.3 AUSTRALIA & NEW ZEALAND

- 13.4.3.1 Investments from key players and rising vegan population to drive growth

- 13.4.4 INDIA

- 13.4.4.1 Evolving dietary preferences and increasing cases of coronary heart disease to drive demand

- 13.4.5 REST OF ASIA PACIFIC

- 13.4.1 CHINA

- 13.5 SOUTH AMERICA

- 13.5.1 BRAZIL

- 13.5.1.1 Rise in demand for performance nutrition products to drive growth

- 13.5.2 ARGENTINA

- 13.5.2.1 Environmental, nutritional, and animal welfare concerns among youth to drive demand

- 13.5.3 REST OF SOUTH AMERICA

- 13.5.3.1 Increase in willingness to invest extra in nutritionally advantageous foods to drive demand

- 13.5.1 BRAZIL

- 13.6 REST OF THE WORLD (ROW)

- 13.6.1 AFRICA

- 13.6.1.1 Favorable processing conditions, coupled with rising consumer awareness regarding health issues, to drive growth

- 13.6.2 MIDDLE EAST

- 13.6.2.1 Demand for plant-based convenience food to drive growth

- 13.6.1 AFRICA

14 COMPETITIVE LANDSCAPE

- 14.1 OVERVIEW

- 14.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 14.3 REVENUE ANALYSIS

- 14.4 MARKET SHARE ANALYSIS

- 14.5 COMPANY VALUATION AND FINANCIAL METRICS

- 14.6 BRAND/PRODUCT COMPARISON

- 14.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 14.7.1 STARS

- 14.7.2 EMERGING LEADERS

- 14.7.3 PERVASIVE PLAYERS

- 14.7.4 PARTICIPANTS

- 14.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 14.7.5.1 Company footprint

- 14.7.5.2 Regional footprint

- 14.7.5.3 Source footprint

- 14.7.5.4 Type footprint

- 14.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 14.8.1 PROGRESSIVE COMPANIES

- 14.8.2 RESPONSIVE COMPANIES

- 14.8.3 DYNAMIC COMPANIES

- 14.8.4 STARTING BLOCKS

- 14.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 14.9 COMPETITIVE SCENARIO AND TRENDS

- 14.9.1 PRODUCT LAUNCHES

- 14.9.2 DEALS

- 14.9.3 EXPANSIONS

15 COMPANY PROFILES

- 15.1 KEY PLAYERS

- 15.1.1 CARGILL, INCORPORATED

- 15.1.1.1 Business overview

- 15.1.1.2 Products/Services/Solutions offered

- 15.1.1.3 Recent developments

- 15.1.1.3.1 Deals

- 15.1.1.3.2 Others

- 15.1.1.4 MnM view

- 15.1.1.4.1 Key strengths

- 15.1.1.4.2 Strategic choices

- 15.1.1.4.3 Weaknesses & competitive threats

- 15.1.2 ARCHER DANIELS MIDLAND (ADM)COMPANY

- 15.1.2.1 Business overview

- 15.1.2.2 Products/Services/Solutions offered

- 15.1.2.3 Recent developments

- 15.1.2.3.1 Product launches

- 15.1.2.3.2 Deals

- 15.1.2.3.3 Others

- 15.1.2.4 MnM view

- 15.1.2.4.1 Key strengths

- 15.1.2.4.2 Strategic choices

- 15.1.2.4.3 Weaknesses & competitive threats

- 15.1.3 KERRY GROUP PLC

- 15.1.3.1 Business overview

- 15.1.3.2 Products/Services/Solutions offered

- 15.1.3.3 Recent developments

- 15.1.3.3.1 Deals

- 15.1.3.3.2 Others

- 15.1.3.4 MnM view

- 15.1.3.4.1 Key strengths

- 15.1.3.4.2 Strategic choices

- 15.1.3.4.3 Weaknesses & competitive threats

- 15.1.4 INTERNATIONAL FLAVORS & FRAGRANCES INC.

- 15.1.4.1 Business overview

- 15.1.4.2 Products/Services/Solutions offered

- 15.1.4.3 Recent developments

- 15.1.4.3.1 Deals

- 15.1.4.4 MnM view

- 15.1.4.4.1 Key strengths

- 15.1.4.4.2 Strategic choices

- 15.1.4.4.3 Weaknesses & competitive threats

- 15.1.5 INGREDION INCORPORATED

- 15.1.5.1 Business overview

- 15.1.5.2 Products/Services/Solutions offered

- 15.1.5.3 Recent developments

- 15.1.5.3.1 Product launches

- 15.1.5.3.2 Deals

- 15.1.5.3.3 Others

- 15.1.5.4 MnM view

- 15.1.5.4.1 Key strengths

- 15.1.5.4.2 Strategic choices

- 15.1.5.4.3 Weaknesses & competitive threats

- 15.1.6 WILMAR INTERNATIONAL LIMITED

- 15.1.6.1 Business overview

- 15.1.6.2 Products/Services/Solutions offered

- 15.1.6.3 Recent developments

- 15.1.6.4 MnM view

- 15.1.7 ROQUETTE FRERES

- 15.1.7.1 Business overview

- 15.1.7.2 Products/Services/Solutions offered

- 15.1.7.3 Recent developments

- 15.1.7.3.1 Product launches

- 15.1.7.3.2 Deals

- 15.1.7.3.3 Others

- 15.1.7.4 MnM view

- 15.1.8 GLANBIA PLC

- 15.1.8.1 Business overview

- 15.1.8.2 Products/Services/Solutions offered

- 15.1.8.3 Recent developments

- 15.1.8.3.1 Product launches

- 15.1.8.4 MnM view

- 15.1.9 DSM-FIRMENICH

- 15.1.9.1 Business overview

- 15.1.9.2 Products/Services/Solutions offered

- 15.1.9.3 Recent developments

- 15.1.9.3.1 Deals

- 15.1.9.4 MnM view

- 15.1.10 AGT FOOD AND INGREDIENTS

- 15.1.10.1 Business overview

- 15.1.10.2 Products/Services/Solutions offered

- 15.1.10.3 Recent developments

- 15.1.10.3.1 Deals

- 15.1.10.4 MnM view

- 15.1.11 TATE & LYLE

- 15.1.11.1 Business overview

- 15.1.11.2 Products/Services/Solutions offered

- 15.1.11.3 Recent developments

- 15.1.11.3.1 Deals

- 15.1.11.4 MnM view

- 15.1.12 BURCON

- 15.1.12.1 Business overview

- 15.1.12.2 Products/Services/Solutions offered

- 15.1.12.3 Recent developments

- 15.1.12.3.1 Deals

- 15.1.12.3.2 Others

- 15.1.12.4 MnM view

- 15.1.13 EMSLAND GROUP

- 15.1.13.1 Business overview

- 15.1.13.2 Products/Services/Solutions offered

- 15.1.13.3 Recent developments

- 15.1.13.3.1 Deals

- 15.1.13.4 MnM view

- 15.1.14 PURIS

- 15.1.14.1 Business overview

- 15.1.14.2 Products/Services/Solutions offered

- 15.1.14.3 Recent developments

- 15.1.14.3.1 Others

- 15.1.14.4 MnM view

- 15.1.15 COSUCRA

- 15.1.15.1 Business overview

- 15.1.15.2 Products/Services/Solutions offered

- 15.1.15.3 Recent developments

- 15.1.15.3.1 Product launches

- 15.1.15.3.2 Others

- 15.1.15.4 MnM view

- 15.1.1 CARGILL, INCORPORATED

- 15.2 OTHER PLAYERS

- 15.2.1 BENEO

- 15.2.1.1 Business overview

- 15.2.1.2 Products/Services/Solutions offered

- 15.2.1.3 Recent developments

- 15.2.1.3.1 Deals

- 15.2.1.3.2 Others

- 15.2.1.4 MnM view

- 15.2.2 SOTEXPRO

- 15.2.2.1 Business overview

- 15.2.2.2 Products/Services/Solutions offered

- 15.2.2.3 Recent developments

- 15.2.2.4 MnM view

- 15.2.3 SHANDONG JIANYUAN GROUP

- 15.2.3.1 Business overview

- 15.2.3.2 Products/Services/Solutions offered

- 15.2.3.3 Recent developments

- 15.2.3.4 MnM view

- 15.2.4 AMCO PROTEINS

- 15.2.4.1 Business overview

- 15.2.4.2 Products/Services/Solutions offered

- 15.2.4.3 Recent developments

- 15.2.4.3.1 Others

- 15.2.4.4 MnM view

- 15.2.5 AMINOLA

- 15.2.5.1 Business overview

- 15.2.5.2 Products/Services/Solutions offered

- 15.2.5.3 Recent developments

- 15.2.5.4 MnM view

- 15.2.6 THE GREEN LABS LLC

- 15.2.7 AXIOM FOODS, INC.

- 15.2.8 NUTRI-PEA

- 15.2.9 FENCHEM

- 15.2.10 SUN NUTRAFOODS

- 15.2.1 BENEO

16 ADJACENT & RELATED MARKETS

- 16.1 INTRODUCTION

- 16.2 STUDY LIMITATIONS

- 16.3 PEA PROTEIN MARKET

- 16.3.1 MARKET DEFINITION

- 16.3.2 MARKET OVERVIEW

- 16.4 SOY PROTEIN INGREDIENTS MARKET

- 16.4.1 MARKET DEFINITION

- 16.4.2 MARKET OVERVIEW

- 16.5 PROTEIN INGREDIENTS MARKET

- 16.5.1 MARKET DEFINITION

- 16.5.2 MARKET OVERVIEW

17 APPENDIX

- 17.1 DISCUSSION GUIDE

- 17.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 17.3 CUSTOMIZATION OPTIONS

- 17.4 RELATED REPORTS

- 17.5 AUTHOR DETAILS