|

|

市場調査レポート

商品コード

1358289

ハイブリッドトレインの世界市場:電池タイプ別、用途別、運転速度別、常用出力別、推進力別、バッテリータイプ別、地域別-2030年までの予測Hybrid Train Market by Battery Type (Lead Acid, Lithium-Ion, Sodium-Ion, Nickel Cadmium), Application (Passenger and Freight), Operating Speed (Below 100 KM/H, 100-200 KM/H, And Above 200 KM/H), Service Power, Propulsion Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| ハイブリッドトレインの世界市場:電池タイプ別、用途別、運転速度別、常用出力別、推進力別、バッテリータイプ別、地域別-2030年までの予測 |

|

出版日: 2023年10月03日

発行: MarketsandMarkets

ページ情報: 英文 258 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のハイブリッドトレインの市場規模は、2023年の412台から2030年には446台に成長し、CAGRは1.1%になると予測されています。

環境の持続可能性、エネルギー効率、二酸化炭素排出量削減の必要性が重視される中、ハイブリッドトレインは現代の鉄道輸送の課題を解決する有力なソリューションとして浮上してきました。これらの先進的な機関車は、複数の動力源をシームレスに統合し、従来のディーゼル推進の利点と電気およびバッテリー技術を組み合わせています。都市化が加速し、環境への関心が高まるなか、ハイブリッドトレイン市場は目覚ましい成長を遂げており、移動手段に革命をもたらすだけでなく、鉄道輸送におけるよりクリーンで環境に優しく、持続可能な未来への道を開いています。

| 調査範囲 | |

|---|---|

| 対象期間 | 2019-2030年 |

| 基準年 | 2022年 |

| 予測期間 | 2023-2030年 |

| 単位 | 数量 (単位) |

| セグメント | 電池タイプ, 用途, 運転速度, 常用出力, 推進力, 地域 |

| 対象地域 | アジア・アセアニア, 欧州, 北米, 中東&アフリカ, その他の地域 |

世界の都市化の動向は、都市における人口密度の増加をもたらしています。都市交通列車は、こうした都市部内で多くの人々を移動させ、交通渋滞や大気汚染を軽減する効率的な手段です。都市部はしばしば交通渋滞に悩まされ、大幅な遅延と経済的コストにつながります。都市交通列車は、道路交通の影響を受けない代替交通手段を提供することで、解決策を提供します。

ハイブリッドトレインは、都市部では電化された線路で、郊外や農村部では電化されていない線路の両方で運行することができます。このような柔軟性により、交通システムは電化区間を超えても、可能な限り電気運転の恩恵を受けながら、その範囲を拡大することができます。2022年11月、Iarnrod Eireann(IE)はアイルランド政府から、アルストムからバッテリー式電車車両90両を新たに調達する承認を受けました。政府は1億8,500万米ドルの契約で新型車両調達の枠組みを承認しました。運輸省は、国家運輸局(NTA)を通じて、5両編成の最新型バッテリー式多連装車両(BEMUS)18両を含む列車の発注に資金を提供します。この開発により、予測期間中に都市交通用列車の需要が増加します。

予測期間中、時速100km以下のハイブリッドトレインが最も速い速度で成長すると予想されます。ハイブリッドトレインには、旅客列車と貨物機関車が含まれます。通常、短距離を走行するハイブリッドトレインの運転速度は100km/h未満です。一部の貨物機関車と旅客列車は、100km/h未満の運転速度で走行します。都市交通列車などのハイブリッドトレインのほとんどは、この運転速度範囲に含まれます。この運転速度域の列車は、必要な電力が少ないため、一般に効率が高くなります。

予測期間中、欧州が最大のハイブリッドトレイン市場になると予測されます。インフラの整備が進み、数カ国でハイブリッドトレインの導入が進んでいることから、世界のハイブリッドトレイン市場は今後数年間で飛躍的な成長が見込まれます。欧州では、ハイブリッドトレインや電気列車をサポートするため、架線や充電ステーションを含む電化鉄道インフラへの投資が進んでいます。このインフラ整備により、より長い路線でハイブリッドトレインを運行することがより現実的になっています。さらに、欧州では安全規制と環境規制が厳しくなっており、ハイブリッドトレイン市場にとって大きな成長機会となっています。

当レポートでは、世界のハイブリッドトレイン市場について調査し、電池タイプ別、用途別、運転速度別、常用出力別、推進力別、バッテリータイプ別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 価格分析

- エコシステム分析

- マクロ経済指標

- バリューチェーン分析

- ケーススタディ分析

- 特許分析

- 技術分析

- 代替燃料(推進/補助)の主な動向

- 関税と規制状況

- 貿易分析

- 2023年~2024年の主な会議とイベント

- 市場に影響を与える動向と混乱

- 主要な利害関係者と購入基準

- ハイブリッドトレイン市場シナリオ分析

- 世界中のハイブリッドトレイン鉄道プロジェクトの詳細

第6章 ハイブリッドトレイン市場、用途別

- イントロダクション

- 乗客

- 貨物

- 主要な洞察

第7章 ハイブリッドトレイン市場、常用出力別

- イントロダクション

- 2000KW未満

- 2000~4000KWの間

- 4000KW以上

- 主要な洞察

第8章 ハイブリッドトレイン市場、運転速度別

- イントロダクション

- 時速100km未満

- 時速100~200km

- 時速200km以上

- 主要な洞察

第9章 ハイブリッドトレイン市場、推進力別

- イントロダクション

- エレクトロディーゼル

- バッテリー電気

- 水素電池

- 主要な洞察

第10章 ハイブリッドトレイン市場、バッテリータイプ別

- イントロダクション

- 鉛酸

- リチウムイオン

- ナトリウムイオン

- ニッケルカドミウム

- その他

第11章 ハイブリッドトレイン市場、地域別

- イントロダクション

- アジアオセアニア

- 欧州

- 北米

- 中東・アフリカ

- その他の地域

第12章 競合情勢

- 概要

- 主要参入企業の戦略/有力企業

- 主要企業の市場シェア分析、2022年

- CRRC

- ALSTOM

- SIEMENS

- WABTEC CORPORATION

- STADLER RAIL AG

- 主要企業の収益分析、2018~2022年

- 競合シナリオ

- 企業評価マトリックス

- スタートアップ/中小企業の評価マトリックス

第13章 企業プロファイル

- 主要参入企業

- CRRC CORPORATION LIMITED(CRRC)

- ALSTOM

- SIEMENS

- WABTEC CORPORATION

- STADLER RAIL AG

- HYUNDAI ROTEM COMPANY

- HITACHI, LTD.

- CONSTRUCCIONES Y AUXILIAR DE FERROCARRILES(CAF)

- TOSHIBA

- CUMMINS INC.

- ABB

- MITSUBISHI ELECTRIC CORPORATION

- TALGO

- その他の企業

- BNSF

- BALLARD POWER SYSTEMS

- CHART INDUSTRIES

- RENFE OPERADORA

- SKODA TRANSPORTATION

- DB CARGO

- SNCF

- ROLLS-ROYCE

- THE KINKI SHARYO CO., LTD.

- KAWASAKI HEAVY INDUSTRIES

- ETIHAD RAIL

- SINARA TRANSPORT MACHINES

- TRANSMASHHOLDING

- INTAMIN BAHNTECHNIK UND BETRIEBS-MBH & CO. KG

第14章 市場別提言

第15章 付録

The global hybrid train market is projected to grow from 412 units in 2023 to 446 units by 2030, registering a CAGR of 1.1%. With a growing emphasis on environmental sustainability, energy efficiency, and the need to reduce carbon footprints, hybrid trains have emerged as a compelling solution to meet the challenges of modern rail transport. These advanced locomotives seamlessly integrate multiple power sources, combining the benefits of traditional diesel propulsion with electric and battery technologies. As urbanization accelerates and environmental concerns intensify, the hybrid train market is witnessing remarkable growth, not only revolutionizing the way we travel but also paving the way for a cleaner, greener, and more sustainable future in rail transportation.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Units Considered | Volume (Units) |

| Segments | Battery Type, Application, Operating Speed, Service Power, Propulsion Type, Region |

| Regions covered | Asia Oceania, Europe, North America, MEA, RoW |

"Urban Transit Passenger Trains to be the largest market during the forecast period."

The global trend of urbanization has led to increased population density in cities. Urban transit trains are an efficient way to move many people within these urban areas, reducing traffic congestion and air pollution. Urban areas often suffer from traffic congestion, leading to significant delays and economic costs. Urban transit trains offer a solution by providing an alternative mode of transportation unaffected by road traffic.

Hybrid trains can operate both on electrified tracks within urban areas and on non-electrified tracks in suburban or rural areas. This flexibility allows transit systems to extend their reach beyond electrified zones while still benefiting from electric operation where possible. In November 2022, Iarnrod Eireann (IE) received approval from the Government of Ireland to procure 90 new battery-electric train carriages from Alstom. The government has authorized a procurement framework for new train carriages in a USD 185 million contract. The Department of Transport will fund the train order, which will include 18 modern five-carriage battery-electric multiple units (BEMUS) through the National Transport Authority (NTA). This development will increase the demand for urban transit trains during the forecast period.

"Hybrid trains with speed below 100 KM/H are expected to grow at the fastest rate during the forecast period."

Hybrid trains with speeds below 100 KM/H are expected to grow at the fastest rate during the forecast period. Hybrid trains include passenger trains and freight locomotives. Hybrid trains that usually travel short distances have an operating speed of less than 100 km/h. Some freight locomotives and passenger trains run at an operating speed of less than 100 km/h. Most of the hybrid trains such as urban transit trains are included in this operating speed range. Trains in this operating speed range are generally more efficient, as less power is required.

"Europe holds the largest market share during the forecast period."

Europe is estimated to be the largest hybrid train market in the forecast period. With the development of infrastructure and the increasing adoption of hybrid trains in several countries, the global hybrid train market is anticipated to witness exponential growth in the coming years. Europe has been investing in electrified rail infrastructure, including overhead lines and charging stations, to support hybrid and electric trains. This infrastructure development makes it more feasible to operate hybrid trains across longer routes. Further, Europe presents a big growth opportunity for the hybrid train market as the safety and environment regulations have become stringent. These changes propel the market for testing and development of hybrid trains, which would further increase their demand. Germany is estimated to be the largest hybrid train market in the region. A vibrant R&D landscape and technological excellence justify its dominance in the field of connectivity, hybrid technology, and innovative railway applications. The country was the first to witness a hydrogen-powered passenger train. These factors collectively contribute to the growth and adoption of hybrid trains in the region.

In-depth interviews were conducted with CEOs, marketing directors, other innovation and technology directors, and executives from various key organizations operating in this market.

- By Company Type: OEMs - 40%, Tier I - 42%, Tier II- 18%,

- By Designation: CXOs - 23%, Directors- 43%, Others- 34%

- By Region: Asia Oceania- 35%, Europe - 25%, North America- 20%, MEA-15%, ROW-5%

The hybrid train market is dominated by established players such as CRRC (China), Alstom (France), Siemens (Germany), Wabtec Corporation (US), and Stadler Rail AG (Switzerland), among others. These companies manufacture trains and develop new technologies. These companies have set up R&D facilities and offer best-in-class products to their customers.

Research Coverage:

The market study covers the Hybrid Train Market by Hybrid Train Market by Battery Type (Lead Acid, Lithium-Ion, Sodium-Ion, Nickel Cadmium And Others), Application (Passenger And Freight), Operating Speed (Below 100 KM/H, 100-200 KM/H, And Above 200 KM/H), Service Power (Less than 2000 KW, Between 2000 To 4000 KW And Above 4000 KW), Propulsion (Electro Diesel, Battery Electric, And Hydrogen Battery) and Region (Asia Oceania, Europe, North America, Middle East & Africa, Rest of the World). It also covers the competitive landscape and company profiles of the major players in the hybrid train market ecosystem.

Key Benefits of the Report

The study also includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall hybrid train market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Increasing stringency in emission norms, Rising demand for less polluting train operations and energy-efficient transport, Benefits of hybrid trains over conventional diesel trains, Increasing preference for railway-based public transport to reduce traffic congestion), restraints (High development costs and complexities in technologies and related infrastructure, Refurbishment of existing trains), opportunities (Development of hydrogen fuel cell locomotives, Development of battery operated trains, Retrofitting of diesel-electric trains), and challenges (Technical challenges related to lead-acid and lithium-ion batteries, High cost of charging infrastructure and replacement) influencing the growth of the hybrid train market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the hybrid train market

- Market Development: Comprehensive information about lucrative markets - the report analyses the hybrid train market across varied regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the hybrid train market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like CRRC (China), Alstom (France), Siemens (Germany), Wabtec Corporation (US), and Stadler Rail AG (Switzerland) among others in the hybrid train market Page 25 of 34 strategies. The report also helps stakeholders understand the pulse of the rolling stock market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- TABLE 1 HYBRID TRAIN MARKET DEFINITION, BY BATTERY TYPE

- TABLE 2 HYBRID TRAIN MARKET DEFINITION, BY APPLICATION

- TABLE 3 HYBRID TRAIN MARKET DEFINITION, BY PROPULSION

- TABLE 4 HYBRID TRAIN MARKET DEFINITION, BY OPERATING SPEED

- TABLE 5 HYBRID TRAIN MARKET DEFINITION, BY SERVICE POWER

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- TABLE 6 HYBRID TRAIN MARKET: INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 HYBRID TRAIN MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- TABLE 7 CURRENCY EXCHANGE RATES

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 HYBRID TRAIN MARKET: RESEARCH DESIGN

- FIGURE 3 RESEARCH DESIGN MODEL

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary source

- 2.1.2.2 List of participating companies for primary research

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY, DESIGNATION, AND REGION

- 2.1.2.3 Major objectives of primary research

- 2.1.2.4 Primary participants

- 2.2 MARKET ESTIMATION METHODOLOGY

- FIGURE 5 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- 2.3 MARKET SIZE ESTIMATION

- FIGURE 6 HYBRID TRAIN MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 9 HYBRID TRAIN MARKET: RESEARCH DESIGN AND METHODOLOGY

- 2.4 DATA TRIANGULATION

- FIGURE 10 HYBRID TRAIN MARKET: DATA TRIANGULATION

- 2.5 FACTOR ANALYSIS

- FIGURE 11 FACTORS IMPACTING HYBRID TRAIN MARKET

- 2.5.1 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND AND SUPPLY SIDES

- 2.6 RECESSION IMPACT ANALYSIS

- 2.7 RESEARCH ASSUMPTIONS

- 2.8 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

- FIGURE 12 HYBRID TRAIN MARKET OVERVIEW

- FIGURE 13 HYBRID TRAIN MARKET, BY REGION, 2023-2030

- FIGURE 14 HYBRID TRAIN MARKET PERFORMANCE IN 2023

- FIGURE 15 PASSENGER SEGMENT TO LEAD HYBRID TRAIN MARKET IN 2023

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN HYBRID TRAIN MARKET

- FIGURE 16 ADVANCEMENTS IN BATTERY TECHNOLOGY AND HYBRID PROPULSION SYSTEMS TO DRIVE MARKET

- 4.2 HYBRID TRAIN MARKET, BY APPLICATION

- FIGURE 17 PASSENGER SEGMENT TO HOLD LARGER MARKET SHARE IN 2023

- 4.3 HYBRID TRAIN MARKET, BY OPERATING SPEED

- FIGURE 18 HYBRID TRAINS WITH 100-200 KM/H OPERATING SPEED TO CAPTURE LARGEST MARKET SHARE DURING FORECAST PERIOD

- 4.4 HYBRID TRAIN MARKET, BY SERVICE POWER

- FIGURE 19 ABOVE 4000 KW SEGMENT TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

- 4.5 HYBRID TRAIN MARKET, BY REGION

- FIGURE 20 EUROPE TO LEAD HYBRID TRAIN MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 21 HYBRID TRAIN MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing stringency in emission norms

- 5.2.1.1.1 Emissions standards issued by UIC

- 5.2.1.1.1.1 UIC 624-1

- 5.2.1.1.1 Emissions standards issued by UIC

- 5.2.1.1 Increasing stringency in emission norms

- TABLE 8 EMISSIONS STANDARD, UIC 624-1

- 5.2.1.1.1.2 UIC 624-2

- TABLE 9 EMISSIONS STANDARD, UIC 624-2

- 5.2.1.1.1.3 UIC 624-3

- 5.2.1.1.1.4 UIC 624-4

- 5.2.1.2 Rising demand for less polluting train operations and energy-efficient transport

- FIGURE 22 RAIL OPERATORS TO ADDRESS EMISSIONS WITH 5 LEVELS

- FIGURE 23 GLOBAL CO2 EMISSIONS FROM DIFFERENT TRANSPORT SEGMENTS, 2000-2030

- 5.2.1.3 Benefits of hybrid trains over conventional diesel trains

- FIGURE 24 CURRENT AND FUTURE EMISSION TECHNOLOGIES

- 5.2.1.4 Increasing preference for railway-based public transport to reduce traffic congestion

- FIGURE 25 DRIVING TIME SPENT IN TRAFFIC CONGESTION IN US, 2022

- 5.2.2 RESTRAINTS

- 5.2.2.1 High development costs and complexities in technologies and related infrastructure

- 5.2.2.2 Refurbishment of existing trains

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Development of hydrogen fuel cell locomotives

- FIGURE 26 PROTOTYPE OF HYDROGEN TRAIN

- 5.2.3.2 Development of battery-operated trains

- FIGURE 27 BENEFITS OF USING BATTERIES IN RAIL FOR MAXIMUM OPERATIONAL FLEXIBILITY

- 5.2.3.3 Retrofitting of diesel-electric trains

- 5.2.4 CHALLENGES

- 5.2.4.1 Technical challenges related to lead-acid and lithium-ion batteries

- FIGURE 28 COMPARISON OF BATTERY RECYCLING: LEAD-ACID VS. LITHIUM-ION

- 5.2.4.2 High cost of charging infrastructure development

- TABLE 10 HYBRID TRAIN MARKET: IMPACT OF MARKET DYNAMICS

- 5.3 PRICING ANALYSIS

- 5.3.1 AVERAGE SELLING PRICE TRENDS OF KEY PLAYERS, BY PROPULSION, 2023

- 5.3.2 AVERAGE SELLING PRICE TRENDS, BY ELECTRO-DIESEL PROPULSION, BY REGION

- FIGURE 29 AVERAGE SELLING PRICE TRENDS, BY ELECTRO-DIESEL PROPULSION, BY REGION, 2018-2023

- 5.4 ECOSYSTEM ANALYSIS

- FIGURE 30 HYBRID TRAIN MARKET: ECOSYSTEM ANALYSIS

- TABLE 11 HYBRID TRAIN MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- 5.5 MACROECONOMIC INDICATORS

- 5.5.1 GDP TRENDS AND FORECASTS FOR MAJOR ECONOMIES

- TABLE 12 GDP TRENDS AND FORECASTS, BY MAJOR ECONOMIES, 2018-2026 (USD BILLION)

- TABLE 13 REAL GDP GROWTH RATE (ANNUAL PERCENTAGE CHANGE AND FORECAST), BY MAJOR ECONOMIES, 2022-2026

- TABLE 14 GDP PER CAPITA TRENDS AND FORECASTS, BY MAJOR ECONOMIES, 2022-2026 (USD BILLION)

- 5.6 VALUE CHAIN ANALYSIS

- FIGURE 31 HYBRID TRAIN MARKET: VALUE CHAIN ANALYSIS

- 5.6.1 RESEARCH & DEVELOPMENT

- 5.6.2 PROCUREMENT OF RAW MATERIALS

- 5.6.3 PRODUCTION DEPARTMENT

- 5.6.4 FINAL ASSEMBLY AND TESTING

- 5.6.5 MAINTENANCE AND OVERHAUL

- 5.7 CASE STUDY ANALYSIS

- 5.7.1 DEVELOPMENT OF CLIMATE-NEUTRAL DRIVE SYSTEM FOR BRIDGING NON-ELECTRIFIED SUBSECTIONS OF LINE

- 5.7.2 GOLINC-M MODULES

- 5.7.3 ENVIRONMENTALLY FRIENDLY MONORAIL SYSTEM USED BY 70,000 RIDERS/DAY IN KOREAN METROPOLIS

- 5.7.4 SCOTTISH HYDROGEN TRAIN ON TRACK TO DELIVER CLIMATE TARGETS

- 5.7.5 FREIGHTLINER TO PROGRESS TOWARD LOW-EMISSION FUEL

- 5.8 PATENT ANALYSIS

- TABLE 15 IMPORTANT PATENT REGISTRATIONS RELATED TO HYBRID TRAIN MARKET

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 INTRODUCTION

- 5.9.2 REGENERATIVE BRAKING IN TRAINS

- FIGURE 32 REGENERATIVE BRAKING SYSTEM IN TRAINS

- 5.9.3 AUTONOMOUS TRAINS

- TABLE 16 LEVEL OF AUTONOMY FOR AUTONOMOUS TRAINS

- 5.9.4 USE OF FUEL CELLS FOR HEAVY-LOAD TRANSPORTATION

- FIGURE 33 TIMELINE OF FUEL CELL MASS MARKET ACCEPTABILITY IN TRANSPORTATION SECTOR, 2016-2050

- 5.9.5 RAPID CHARGING TRAIN OPERATIONAL CONCEPTS FOR HYBRID HEAVY HAUL LOCOMOTIVES

- 5.9.6 DEVELOPMENT OF TRI-MODE HYBRID TRAINS

- FIGURE 34 SPECIFICATIONS OF TRI-MODE BATTERY TRAIN

- 5.9.7 MITRAC PULSE TRACTION BATTERY

- 5.9.8 MRX NICKEL TECHNOLOGY BATTERY

- 5.10 KEY TRENDS IN ALTERNATE FUELS (PROPULSION/AUXILIARY)

- 5.10.1 CNG

- 5.10.2 LNG

- 5.10.3 HYDROGEN

- 5.10.4 SOLAR

- 5.11 TARIFF AND REGULATORY LANDSCAPE

- 5.11.1 US

- 5.11.2 EUROPE

- TABLE 17 STANDARDS: RAIL TRACTION ENGINES (STAGE III A)

- TABLE 18 STANDARDS: RAIL TRACTION ENGINES (STAGE III B)

- 5.11.3 INDIA

- TABLE 19 DESIGN OF EQUIPMENT, SYSTEM, AND SUB-SYSTEMS TO COMPLY WITH FOLLOWING STANDARDS

- 5.11.4 SOUTH KOREA

- 5.11.5 CHINA

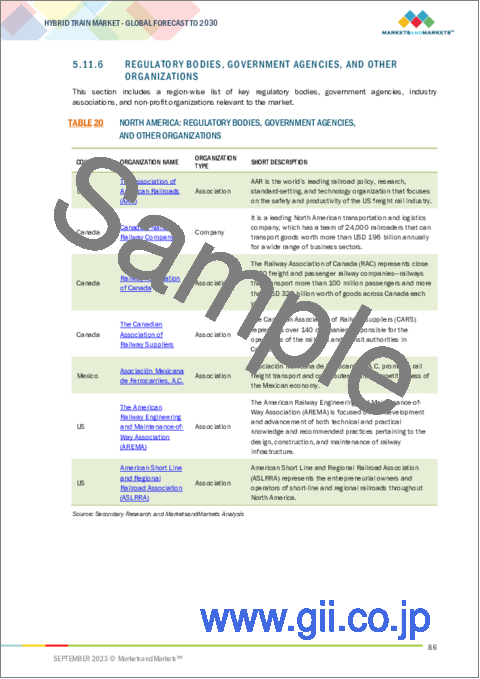

- 5.11.6 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 ASIA OCEANIA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12 TRADE ANALYSIS

- 5.12.1 US

- FIGURE 35 US: IMPORT AND EXPORT DATA FOR RAILWAYS AND TRAMWAYS, LOCOMOTIVES, ROLLING STOCK, AND PARTS, 2018-2022 (USD MILLION)

- 5.12.2 CHINA

- FIGURE 36 CHINA: IMPORT AND EXPORT DATA FOR RAILWAYS AND TRAMWAYS, LOCOMOTIVES, ROLLING STOCK, AND PARTS, 2018-2022 (USD MILLION)

- 5.12.3 GERMANY

- FIGURE 37 GERMANY: IMPORT AND EXPORT DATA FOR RAILWAYS AND TRAMWAYS, LOCOMOTIVES, ROLLING STOCK, AND PARTS, 2018-2022 (USD MILLION)

- 5.12.4 UK

- FIGURE 38 UK: IMPORT AND EXPORT DATA FOR RAILWAYS AND TRAMWAYS, LOCOMOTIVES, ROLLING STOCK, AND PARTS, 2018-2022 (USD MILLION)

- 5.12.5 FRANCE

- FIGURE 39 FRANCE: IMPORT AND EXPORT DATA FOR RAILWAYS AND TRAMWAYS, LOCOMOTIVES, ROLLING STOCK, AND PARTS, 2018-2022 (USD MILLION)

- 5.12.6 INDIA

- FIGURE 40 INDIA: IMPORT AND EXPORT DATA FOR RAILWAYS AND TRAMWAYS, LOCOMOTIVES, ROLLING STOCK, AND PARTS, 2018-2022 (USD MILLION)

- 5.12.7 ITALY

- FIGURE 41 ITALY: IMPORT AND EXPORT DATA FOR RAILWAYS AND TRAMWAYS, LOCOMOTIVES, ROLLING STOCK, AND PARTS, 2018-2022 (USD MILLION)

- 5.12.8 AUSTRIA

- FIGURE 42 AUSTRIA: IMPORT AND EXPORT DATA FOR RAILWAYS AND TRAMWAYS, LOCOMOTIVES, ROLLING STOCK, AND PARTS, 2018-2022 (USD MILLION)

- 5.12.9 SWITZERLAND

- FIGURE 43 SWITZERLAND: IMPORT AND EXPORT DATA FOR RAILWAYS AND TRAMWAYS, LOCOMOTIVES, ROLLING STOCK, AND PARTS, 2018-2022 (USD MILLION)

- 5.12.10 JAPAN

- FIGURE 44 JAPAN: IMPORT AND EXPORT DATA FOR RAILWAYS AND TRAMWAYS, LOCOMOTIVES, ROLLING STOCK, AND PARTS, 2018-2022 (USD MILLION)

- 5.13 KEY CONFERENCES AND EVENTS IN 2023-2024

- TABLE 24 HYBRID TRAIN MARKET: KEY CONFERENCES AND EVENTS

- 5.14 TRENDS AND DISRUPTIONS IMPACTING MARKET

- FIGURE 45 REVENUE SOURCES FOR HYBRID TRAIN MARKET

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 46 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR HYBRID TRAINS, BY PROPULSION

- TABLE 25 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR HYBRID TRAINS, BY PROPULSION (%)

- 5.15.2 BUYING CRITERIA

- FIGURE 47 KEY BUYING CRITERIA

- TABLE 26 KEY BUYING CRITERIA

- 5.16 HYBRID TRAIN MARKET SCENARIO ANALYSIS

- 5.16.1 MOST LIKELY SCENARIO

- TABLE 27 MOST LIKELY SCENARIO, BY REGION, 2023-2030 (UNITS)

- 5.16.2 OPTIMISTIC SCENARIO

- TABLE 28 OPTIMISTIC SCENARIO, BY REGION, 2023-2030 (UNITS)

- 5.16.3 PESSIMISTIC SCENARIO

- TABLE 29 PESSIMISTIC SCENARIO, BY REGION, 2023-2030 (UNITS)

- 5.17 DETAILS OF HYBRID TRAIN RAILWAY PROJECTS WORLDWIDE

- TABLE 30 EUROPE: RAILWAY PROJECTS

- TABLE 31 NORTH AMERICA: RAILWAY PROJECTS

- TABLE 32 ASIA OCEANIA: RAILWAY PROJECTS

- TABLE 33 REST OF THE WORLD: RAILWAY PROJECTS

6 HYBRID TRAIN MARKET, BY APPLICATION

- 6.1 INTRODUCTION

- FIGURE 48 FREIGHT SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- TABLE 34 HYBRID TRAIN MARKET, BY APPLICATION, 2018-2022 (UNITS)

- TABLE 35 HYBRID TRAIN MARKET, BY APPLICATION, 2023-2030 (UNITS)

- TABLE 36 OEMS IN HYBRID TRAIN MARKET, BY APPLICATION

- 6.2 PASSENGER

- TABLE 37 PASSENGER: HYBRID TRAIN MARKET, BY TRAIN TYPE, 2018-2022 (UNITS)

- TABLE 38 PASSENGER: HYBRID TRAIN MARKET, BY TRAIN TYPE, 2023-2030 (UNITS)

- 6.2.1 LONG DISTANCE TRAIN

- 6.2.1.1 Increasing investment in high-speed rail infrastructure to drive growth

- TABLE 39 LONG DISTANCE HYBRID TRAIN MARKET, BY REGION, 2018-2022 (UNITS)

- TABLE 40 LONG DISTANCE HYBRID TRAIN MARKET, BY REGION, 2023-2030 (UNITS)

- 6.2.2 URBAN TRANSIT TRAIN

- 6.2.2.1 Rising urbanization and traffic congestion to drive growth

- TABLE 41 URBAN TRANSIT HYBRID TRAIN MARKET, BY REGION, 2018-2022 (UNITS)

- TABLE 42 URBAN TRANSIT HYBRID TRAIN MARKET, BY REGION, 2023-2030 (UNITS)

- 6.3 FREIGHT

- 6.3.1 DEVELOPMENT OF HYBRID TECHNOLOGIES TO DRIVE GROWTH

- TABLE 43 FREIGHT: HYBRID TRAIN MARKET, BY REGION, 2018-2022 (UNITS)

- TABLE 44 FREIGHT: HYBRID TRAIN MARKET, BY REGION, 2023-2030 (UNITS)

- 6.4 KEY PRIMARY INSIGHTS

7 HYBRID TRAIN MARKET, BY SERVICE POWER

- 7.1 INTRODUCTION

- FIGURE 49 BETWEEN 2000 TO 4000 KW SEGMENT TO HAVE LARGEST MARKET SHARE DURING FORECAST PERIOD

- TABLE 45 HYBRID TRAIN MARKET, BY SERVICE POWER, 2018-2022 (UNITS)

- TABLE 46 HYBRID TRAIN MARKET, BY SERVICE POWER, 2023-2030 (UNITS)

- 7.2 LESS THAN 2000 KW

- 7.2.1 RISE IN DEMAND FOR URBAN TRANSIT TO DRIVE GROWTH

- TABLE 47 LESS THAN 2000 KW: HYBRID TRAIN MARKET, BY REGION, 2018-2022 (UNITS)

- TABLE 48 LESS THAN 2000 KW: HYBRID TRAIN MARKET, BY REGION, 2023-2030 (UNITS)

- 7.3 BETWEEN 2000 TO 4000 KW

- 7.3.1 INCREASING DEMAND FOR HIGH-SPEED RAIL TO DRIVE GROWTH

- TABLE 49 BETWEEN 2000 TO 4000 KW: HYBRID TRAIN MARKET, BY REGION, 2018-2022 (UNITS)

- TABLE 50 BETWEEN 2000 TO 4000 KW: HYBRID TRAIN MARKET, BY REGION, 2023-2030 (UNITS)

- 7.4 ABOVE 4000 KW

- 7.4.1 ADVANCEMENT IN PROPULSION TECHNOLOGY TO DRIVE GROWTH

- TABLE 51 ABOVE 4000 KW: HYBRID TRAIN MARKET, BY REGION, 2018-2022 (UNITS)

- TABLE 52 ABOVE 4000 KW: HYBRID TRAIN MARKET, BY REGION, 2023-2030 (UNITS)

- 7.5 KEY PRIMARY INSIGHTS

8 HYBRID TRAIN MARKET, BY OPERATING SPEED

- 8.1 INTRODUCTION

- FIGURE 50 100-200 KM/H SEGMENT TO HAVE LARGEST MARKET SHARE DURING FORECAST PERIOD

- TABLE 53 HYBRID TRAIN MARKET, BY OPERATING SPEED, 2018-2022 (UNITS)

- TABLE 54 HYBRID TRAIN MARKET, BY OPERATING SPEED, 2023-2030 (UNITS)

- 8.2 BELOW 100 KM/H

- 8.2.1 DEVELOPMENT IN PROPULSION TECHNOLOGIES TO DRIVE GROWTH

- TABLE 55 BELOW 100 KM/H HYBRID TRAIN MARKET, BY REGION, 2018-2022 (UNITS)

- TABLE 56 BELOW 100 KM/H HYBRID TRAIN MARKET, BY REGION, 2023-2030 (UNITS)

- 8.3 100-200 KM/H

- 8.3.1 ADVANCEMENTS IN HYDROGEN FUEL CELL AND BATTERY-OPERATED TRAINS TO DRIVE GROWTH

- TABLE 57 100-200 KM/H HYBRID TRAIN MARKET, BY REGION, 2018-2022 (UNITS)

- TABLE 58 100-200 KM/H HYBRID TRAIN MARKET, BY REGION, 2023-2030 (UNITS)

- 8.4 ABOVE 200 KM/H

- 8.4.1 INCREASE IN INVESTMENT FOR HIGH-SPEED RAIL TO DRIVE GROWTH

- TABLE 59 ABOVE 200 KM/H HYBRID TRAIN MARKET, BY REGION, 2018-2022 (UNITS)

- TABLE 60 ABOVE 200 KM/H HYBRID TRAIN MARKET, BY REGION, 2023-2030 (UNITS)

- 8.5 KEY PRIMARY INSIGHTS

9 HYBRID TRAIN MARKET, BY PROPULSION

- 9.1 INTRODUCTION

- TABLE 61 DIFFERENCE BETWEEN ELECTRO-DIESEL, BATTERY-ELECTRIC, AND HYDROGEN-BATTERY HYBRID TRAINS

- TABLE 62 HYBRID TRAIN MARKET, BY PROPULSION, 2018-2022 (UNITS)

- TABLE 63 HYBRID TRAIN MARKET, BY PROPULSION, 2023-2030 (UNITS)

- TABLE 64 HYBRID TRAIN MODELS, BY PROPULSION

- 9.2 ELECTRO DIESEL

- 9.2.1 RISING DEMAND FOR ENERGY-EFFICIENT LOCOMOTIVES TO DRIVE GROWTH

- TABLE 65 ELECTRO DIESEL-PROPELLED HYBRID TRAIN MARKET, BY REGION, 2018-2022 (UNITS)

- TABLE 66 ELECTRO DIESEL-PROPELLED HYBRID TRAIN MARKET, BY REGION, 2023-2030 (UNITS)

- 9.3 BATTERY ELECTRIC

- 9.3.1 CONTINUOUS DEVELOPMENTS IN BATTERY TECHNOLOGIES TO DRIVE GROWTH

- 9.4 HYDROGEN BATTERY

- 9.4.1 DEMAND FOR CLEAN TRANSPORTATION TO DRIVE GROWTH

- 9.5 KEY PRIMARY INSIGHTS

10 HYBRID TRAIN MARKET, BY BATTERY TYPE

- 10.1 INTRODUCTION

- FIGURE 51 TYPES OF LITHIUM-ION BATTERIES

- 10.2 LEAD-ACID

- 10.3 LITHIUM-ION

- FIGURE 52 LITHIUM-ION BATTERY USED IN REGIONAL BATTERY TRAIN

- 10.3.1 LITHIUM-TITANATE OXIDE (LTO)

- 10.3.2 LITHIUM IRON PHOSPHATE (LFP)

- 10.3.3 LITHIUM-NICKEL-MANGANESE-COBALT-OXIDE (NMC)

- 10.4 SODIUM-ION

- 10.5 NICKEL-CADMIUM

- 10.6 OTHERS

11 HYBRID TRAIN MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 53 EUROPE TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- TABLE 67 HYBRID TRAIN MARKET, BY REGION, 2018-2022 (UNITS)

- TABLE 68 HYBRID TRAIN MARKET, BY REGION, 2023-2030 (UNITS)

- 11.2 ASIA OCEANIA

- 11.2.1 RECESSION IMPACT ANALYSIS

- FIGURE 54 ASIA OCEANIA: HYBRID TRAIN MARKET SNAPSHOT

- TABLE 69 ASIA OCEANIA: HYBRID TRAIN MARKET, BY COUNTRY, 2018-2022 (UNITS)

- TABLE 70 ASIA OCEANIA: HYBRID TRAIN MARKET, BY COUNTRY, 2023-2030 (UNITS)

- 11.2.2 CHINA

- 11.2.2.1 Increase in demand for high-speed hybrid trains to drive growth

- TABLE 71 CHINA: HYBRID TRAIN MARKET, BY PROPULSION, 2018-2022 (UNITS)

- TABLE 72 CHINA: HYBRID TRAIN MARKET, BY PROPULSION, 2023-2030 (UNITS)

- 11.2.3 JAPAN

- 11.2.3.1 Presence of leading hybrid train manufacturers to drive growth

- TABLE 73 JAPAN: HYBRID TRAIN MARKET, BY PROPULSION, 2018-2022 (UNITS)

- TABLE 74 JAPAN: HYBRID TRAIN MARKET, BY PROPULSION, 2023-2030 (UNITS)

- 11.2.4 INDIA

- 11.2.4.1 Increasing railway electrification to drive growth

- TABLE 75 INDIA: HYBRID TRAIN MARKET, BY PROPULSION, 2018-2022 (UNITS)

- TABLE 76 INDIA: HYBRID TRAIN MARKET, BY PROPULSION, 2023-2030 (UNITS)

- 11.2.5 SOUTH KOREA

- 11.2.5.1 Increase in infrastructure investments for hybrid trains to drive growth

- TABLE 77 SOUTH KOREA: HYBRID TRAIN MARKET, BY PROPULSION, 2018-2022 (UNITS)

- TABLE 78 SOUTH KOREA: HYBRID TRAIN MARKET, BY PROPULSION, 2023-2030 (UNITS)

- 11.2.6 NEW ZEALAND

- 11.2.6.1 Rising number of railway projects to drive growth

- TABLE 79 NEW ZEALAND: HYBRID TRAIN MARKET, BY PROPULSION, 2018-2022 (UNITS)

- TABLE 80 NEW ZEALAND: HYBRID TRAIN MARKET, BY PROPULSION, 2023-2030 (UNITS)

- 11.2.7 AUSTRALIA

- 11.2.7.1 Rise in government investment in railways sector to drive growth

- TABLE 81 AUSTRALIA: HYBRID TRAIN MARKET, BY PROPULSION, 2018-2022 (UNITS)

- TABLE 82 AUSTRALIA: HYBRID TRAIN MARKET, BY PROPULSION, 2023-2030 (UNITS)

- 11.3 EUROPE

- 11.3.1 RECESSION IMPACT ANALYSIS

- FIGURE 55 GERMANY TO HOLD LARGEST MARKET SHARE IN EUROPE DURING FORECAST PERIOD

- TABLE 83 EUROPE: HYBRID TRAIN MARKET, BY COUNTRY, 2018-2022 (UNITS)

- TABLE 84 EUROPE: HYBRID TRAIN MARKET, BY COUNTRY, 2023-2030 (UNITS)

- 11.3.2 FRANCE

- 11.3.2.1 Rising demand for less polluting trains to drive growth

- TABLE 85 FRANCE: HYBRID TRAIN MARKET, BY PROPULSION, 2018-2022 (UNITS)

- TABLE 86 FRANCE: HYBRID TRAIN MARKET, BY PROPULSION, 2023-2030 (UNITS)

- 11.3.3 GERMANY

- 11.3.3.1 Increase in investment for upgrading railway infrastructure to drive growth

- TABLE 87 GERMANY: HYBRID TRAIN MARKET, BY PROPULSION, 2018-2022 (UNITS)

- TABLE 88 GERMANY: HYBRID TRAIN MARKET, BY PROPULSION, 2023-2030 (UNITS)

- 11.3.4 ITALY

- 11.3.4.1 Increasing modernization and expansion of existing railway network to drive growth

- TABLE 89 ITALY: HYBRID TRAIN MARKET, BY PROPULSION, 2018-2022 (UNITS)

- TABLE 90 ITALY: HYBRID TRAIN MARKET, BY PROPULSION, 2023-2030 (UNITS)

- 11.3.5 SPAIN

- 11.3.5.1 Increasing high-speed railway network and presence of reputed hybrid train manufacturers to drive growth

- TABLE 91 SPAIN: HYBRID TRAIN MARKET, BY PROPULSION, 2018-2022 (UNITS)

- TABLE 92 SPAIN: HYBRID TRAIN MARKET, BY PROPULSION, 2023-2030 (UNITS)

- 11.3.6 AUSTRIA

- 11.3.6.1 Replacement of current diesel trains with electro-diesel trains to drive growth

- TABLE 93 AUSTRIA: HYBRID TRAIN MARKET, BY PROPULSION, 2018-2022 (UNITS)

- TABLE 94 AUSTRIA: HYBRID TRAIN MARKET, BY PROPULSION, 2023-2030 (UNITS)

- 11.3.7 UK

- 11.3.7.1 Rise in government investment in emission-free transportation to drive growth

- TABLE 95 UK: HYBRID TRAIN MARKET, BY PROPULSION, 2018-2022 (UNITS)

- TABLE 96 UK: HYBRID TRAIN MARKET, BY PROPULSION, 2023-2030 (UNITS)

- 11.4 NORTH AMERICA

- 11.4.1 RECESSION IMPACT ANALYSIS

- FIGURE 56 NORTH AMERICA: HYBRID TRAIN MARKET SNAPSHOT

- TABLE 97 NORTH AMERICA: HYBRID TRAIN MARKET, BY COUNTRY, 2018-2022 (UNITS)

- TABLE 98 NORTH AMERICA: HYBRID TRAIN MARKET, BY COUNTRY, 2023-2030 (UNITS)

- 11.4.2 US

- 11.4.2.1 Rising demand for hybrid freight trains to drive growth

- TABLE 99 US: HYBRID TRAIN MARKET, BY PROPULSION, 2018-2022 (UNITS)

- TABLE 100 US: HYBRID TRAIN MARKET, BY PROPULSION, 2023-2030 (UNITS)

- 11.4.3 CANADA

- 11.4.3.1 Increasing passenger and freight transportation to drive growth

- TABLE 101 CANADA: HYBRID TRAIN MARKET, BY PROPULSION, 2018-2022 (UNITS)

- TABLE 102 CANADA: HYBRID TRAIN MARKET, BY PROPULSION, 2023-2030 (UNITS)

- 11.4.4 MEXICO

- 11.4.4.1 Rising concerns about reduction in carbon emissions to drive growth

- TABLE 103 MEXICO: HYBRID TRAIN MARKET, BY PROPULSION, 2018-2022 (UNITS)

- TABLE 104 MEXICO: HYBRID TRAIN MARKET, BY PROPULSION, 2023-2030 (UNITS)

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 RECESSION IMPACT ANALYSIS

- FIGURE 57 EGYPT TO HOLD LARGEST MARKET SHARE IN MIDDLE EAST & AFRICA DURING FORECAST PERIOD

- TABLE 105 MIDDLE EAST & AFRICA: HYBRID TRAIN MARKET, BY COUNTRY, 2018-2022 (UNITS)

- TABLE 106 MIDDLE EAST & AFRICA: HYBRID TRAIN MARKET, BY COUNTRY, 2023-2030 (UNITS)

- 11.5.2 SOUTH AFRICA

- 11.5.2.1 Rise in government spending on greener trains to drive growth

- TABLE 107 SOUTH AFRICA: HYBRID TRAIN MARKET, BY PROPULSION, 2018-2022 (UNITS)

- TABLE 108 SOUTH AFRICA: HYBRID TRAIN MARKET, BY PROPULSION, 2023-2030 (UNITS)

- 11.5.3 UAE

- 11.5.3.1 Development in railway technologies to drive growth

- TABLE 109 UAE: HYBRID TRAIN MARKET, BY PROPULSION, 2018-2022 (UNITS)

- TABLE 110 UAE: HYBRID TRAIN MARKET, BY PROPULSION, 2023-2030 (UNITS)

- 11.5.4 EGYPT

- 11.5.4.1 Government plans to invest in hybrid train lines for tourism to drive growth

- TABLE 111 EGYPT: HYBRID TRAIN MARKET, BY PROPULSION, 2018-2022 (UNITS)

- TABLE 112 EGYPT: HYBRID TRAIN MARKET, BY PROPULSION, 2023-2030 (UNITS)

- 11.6 REST OF THE WORLD

- FIGURE 58 RUSSIA TO HOLD LARGEST MARKET SHARE IN REST OF THE WORLD DURING FORECAST PERIOD

- TABLE 113 REST OF THE WORLD: HYBRID TRAIN MARKET, BY COUNTRY, 2018-2022 (UNITS)

- TABLE 114 REST OF THE WORLD: HYBRID TRAIN MARKET, BY COUNTRY, 2023-2030 (UNITS)

- 11.6.1 BRAZIL

- 11.6.1.1 Rising electrification of existing networks to drive growth

- TABLE 115 BRAZIL: HYBRID TRAIN MARKET, BY PROPULSION, 2018-2022 (UNITS)

- TABLE 116 BRAZIL: HYBRID TRAIN MARKET, BY PROPULSION, 2023-2030 (UNITS)

- 11.6.2 RUSSIA

- 11.6.2.1 Increasing demand for electro-diesel trains to drive growth

- TABLE 117 RUSSIA: HYBRID TRAIN MARKET, BY PROPULSION, 2018-2022 (UNITS)

- TABLE 118 RUSSIA: HYBRID TRAIN MARKET, BY PROPULSION, 2023-2030 (UNITS)

- 11.6.3 ARGENTINA

- 11.6.3.1 Modernization of railway network to drive growth

- TABLE 119 ARGENTINA: HYBRID TRAIN MARKET, BY PROPULSION, 2018-2022 (UNITS)

- TABLE 120 ARGENTINA: HYBRID TRAIN MARKET, BY PROPULSION, 2023-2030 (UNITS)

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYERS' STRATEGIES/RIGHT TO WIN

- TABLE 121 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN HYBRID TRAIN MARKET

- 12.3 MARKET SHARE ANALYSIS FOR KEY PLAYERS, 2022

- TABLE 122 MARKET SHARE ANALYSIS, 2022

- FIGURE 59 HYBRID TRAIN MARKET SHARE ANALYSIS, 2022

- 12.3.1 CRRC

- 12.3.2 ALSTOM

- 12.3.3 SIEMENS

- 12.3.4 WABTEC CORPORATION

- 12.3.5 STADLER RAIL AG

- 12.4 REVENUE ANALYSIS OF KEY PLAYERS, 2018-2022

- FIGURE 60 TOP PUBLIC/LISTED PLAYERS IN HYBRID TRAIN MARKET IN LAST 5 YEARS

- 12.5 COMPETITIVE SCENARIO

- 12.5.1 PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 123 PRODUCT LAUNCHES/DEVELOPMENTS, 2021-2023

- 12.5.2 DEALS

- TABLE 124 DEALS, 2021-2023

- 12.5.3 OTHERS

- TABLE 125 OTHERS, 2021-2023

- 12.6 COMPANY EVALUATION MATRIX

- 12.6.1 STARS

- 12.6.2 PERVASIVE PLAYERS

- 12.6.3 EMERGING LEADERS

- 12.6.4 PARTICIPANTS

- FIGURE 61 HYBRID TRAIN MARKET: COMPANY EVALUATION MATRIX, 2022

- TABLE 126 HYBRID TRAIN MARKET: COMPANY REGION FOOTPRINT, 2022

- TABLE 127 HYBRID TRAIN MARKET: COMPANY APPLICATION FOOTPRINT, 2022

- TABLE 128 HYBRID TRAIN MARKET: COMPANY BATTERY TYPE FOOTPRINT, 2022

- TABLE 129 HYBRID TRAIN MARKET: COMPANY PRODUCT, APPLICATION, AND REGION FOOTPRINT, 2022

- 12.7 STARTUP/SME EVALUATION MATRIX

- 12.7.1 PROGRESSIVE COMPANIES

- 12.7.2 RESPONSIVE COMPANIES

- 12.7.3 DYNAMIC COMPANIES

- 12.7.4 STARTING BLOCKS

- FIGURE 62 HYBRID TRAIN MARKET: STARTUP/SME EVALUATION MATRIX, 2022

- TABLE 130 HYBRID TRAIN MARKET: STARTUP/SME REGION FOOTPRINT, 2022

- TABLE 131 HYBRID TRAIN MARKET: STARTUP/SME APPLICATION FOOTPRINT, 2022

- TABLE 132 HYBRID TRAIN MARKET: STARTUP/SME APPLICATION AND REGION FOOTPRINT, 2022

13 COMPANY PROFILES

- (Business overview, Products offered, Recent developments & MnM View)**

- 13.1 KEY PLAYERS

- 13.1.1 CRRC CORPORATION LIMITED (CRRC)

- TABLE 133 CRRC: COMPANY OVERVIEW

- FIGURE 63 CRRC: COMPANY SNAPSHOT

- TABLE 134 CRRC: PRODUCTS OFFERED

- TABLE 135 CRRC: PRODUCT DEVELOPMENTS

- TABLE 136 CRRC: DEALS

- 13.1.2 ALSTOM

- TABLE 137 ALSTOM: COMPANY OVERVIEW

- FIGURE 64 ALSTOM: COMPANY SNAPSHOT

- FIGURE 65 ALSTOM: NEW BUSINESS OPPORTUNITY SPACES

- TABLE 138 ALSTOM: PRODUCTS OFFERED

- TABLE 139 ALSTOM: PRODUCT DEVELOPMENTS

- TABLE 140 ALSTOM: DEALS

- TABLE 141 ALSTOM: OTHERS

- 13.1.3 SIEMENS

- TABLE 142 SIEMENS: COMPANY OVERVIEW

- FIGURE 66 SIEMENS: COMPANY SNAPSHOT

- TABLE 143 SIEMENS: PRODUCTS OFFERED

- TABLE 144 SIEMENS: PRODUCT DEVELOPMENTS

- TABLE 145 SIEMENS: DEALS

- TABLE 146 SIEMENS: OTHERS

- 13.1.4 WABTEC CORPORATION

- TABLE 147 WABTEC CORPORATION: COMPANY OVERVIEW

- FIGURE 67 WABTEC CORPORATION: COMPANY SNAPSHOT

- TABLE 148 WABTEC CORPORATION: PRODUCTS OFFERED

- TABLE 149 WABTEC CORPORATION: DEALS

- TABLE 150 WABTEC CORPORATION: OTHERS

- 13.1.5 STADLER RAIL AG

- TABLE 151 STADLER RAIL AG: COMPANY OVERVIEW

- FIGURE 68 STADLER RAIL AG: COMPANY SNAPSHOT

- TABLE 152 STADLER RAIL AG: PRODUCTS OFFERED

- TABLE 153 STADLER RAIL AG: PRODUCT DEVELOPMENTS

- TABLE 154 STADLER RAIL AG: DEALS

- TABLE 155 STADLER RAIL AG: OTHERS

- 13.1.6 HYUNDAI ROTEM COMPANY

- TABLE 156 HYUNDAI ROTEM COMPANY: COMPANY OVERVIEW

- FIGURE 69 HYUNDAI ROTEM COMPANY: COMPANY SNAPSHOT

- TABLE 157 HYUNDAI ROTEM COMPANY: PRODUCTS OFFERED

- TABLE 158 HYUNDAI ROTEM COMPANY: PRODUCT DEVELOPMENTS

- TABLE 159 HYUNDAI ROTEM COMPANY: DEALS

- 13.1.7 HITACHI, LTD.

- TABLE 160 HITACHI, LTD.: COMPANY OVERVIEW

- FIGURE 70 HITACHI, LTD.: COMPANY SNAPSHOT

- TABLE 161 HITACHI, LTD.: PRODUCTS OFFERED

- TABLE 162 HITACHI, LTD.: PRODUCT DEVELOPMENTS

- TABLE 163 HITACHI, LTD.: DEALS

- 13.1.8 CONSTRUCCIONES Y AUXILIAR DE FERROCARRILES (CAF)

- TABLE 164 CAF: COMPANY OVERVIEW

- FIGURE 71 CAF: COMPANY SNAPSHOT

- TABLE 165 CAF: PRODUCTS OFFERED

- TABLE 166 CAF: DEALS

- 13.1.9 TOSHIBA

- TABLE 167 TOSHIBA: COMPANY OVERVIEW

- FIGURE 72 TOSHIBA: COMPANY SNAPSHOT

- TABLE 168 TOSHIBA: PRODUCTS OFFERED

- TABLE 169 TOSHIBA: PRODUCT DEVELOPMENTS

- TABLE 170 TOSHIBA: DEALS

- 13.1.10 CUMMINS INC.

- TABLE 171 CUMMINS INC.: COMPANY OVERVIEW

- FIGURE 73 CUMMINS INC.: COMPANY SNAPSHOT

- TABLE 172 CUMMINS INC.: PRODUCTS OFFERED

- TABLE 173 CUMMINS INC.: DEALS

- 13.1.11 ABB

- TABLE 174 ABB: COMPANY OVERVIEW

- FIGURE 74 ABB: COMPANY SNAPSHOT

- TABLE 175 ABB: PRODUCTS OFFERED

- TABLE 176 ABB: DEALS

- TABLE 177 ABB: OTHERS

- 13.1.12 MITSUBISHI ELECTRIC CORPORATION

- TABLE 178 MITSUBISHI ELECTRIC CORPORATION: COMPANY OVERVIEW

- FIGURE 75 MITSUBISHI ELECTRIC CORPORATION: COMPANY SNAPSHOT

- TABLE 179 MITSUBISHI ELECTRIC CORPORATION: PRODUCTS OFFERED

- TABLE 180 MITSUBISHI ELECTRIC CORPORATION: DEALS

- 13.1.13 TALGO

- TABLE 181 TALGO: COMPANY OVERVIEW

- FIGURE 76 TALGO: COMPANY SNAPSHOT

- TABLE 182 TALGO: PRODUCTS OFFERED

- TABLE 183 TALGO: DEALS

- *Details on Business overview, Products offered, Recent developments & MnM View might not be captured in case of unlisted companies.

- 13.2 OTHER KEY PLAYERS

- 13.2.1 BNSF

- TABLE 184 BNSF: COMPANY OVERVIEW

- 13.2.2 BALLARD POWER SYSTEMS

- TABLE 185 BALLARD POWER SYSTEMS: COMPANY OVERVIEW

- 13.2.3 CHART INDUSTRIES

- TABLE 186 CHART INDUSTRIES: COMPANY OVERVIEW

- 13.2.4 RENFE OPERADORA

- TABLE 187 RENFE OPERADORA: COMPANY OVERVIEW

- 13.2.5 SKODA TRANSPORTATION

- TABLE 188 SKODA TRANSPORTATION: COMPANY OVERVIEW

- 13.2.6 DB CARGO

- TABLE 189 DB CARGO: COMPANY OVERVIEW

- 13.2.7 SNCF

- TABLE 190 SNCF: COMPANY OVERVIEW

- 13.2.8 ROLLS-ROYCE

- TABLE 191 ROLLS-ROYCE: COMPANY OVERVIEW

- 13.2.9 THE KINKI SHARYO CO., LTD.

- TABLE 192 THE KINKI SHARYO CO., LTD.: COMPANY OVERVIEW

- 13.2.10 KAWASAKI HEAVY INDUSTRIES

- TABLE 193 KAWASAKI HEAVY INDUSTRIES: COMPANY OVERVIEW

- 13.2.11 ETIHAD RAIL

- TABLE 194 ETIHAD RAIL: COMPANY OVERVIEW

- 13.2.12 SINARA TRANSPORT MACHINES

- TABLE 195 SINARA TRANSPORT MACHINES: COMPANY OVERVIEW

- 13.2.13 TRANSMASHHOLDING

- TABLE 196 TRANSMASHHOLDING: COMPANY OVERVIEW

- 13.2.14 INTAMIN BAHNTECHNIK UND BETRIEBS-MBH & CO. KG

- TABLE 197 INTAMIN BAHNTECHNIK UND BETRIEBS-MBH & CO. KG: COMPANY OVERVIEW

14 RECOMMENDATIONS BY MARKETSANDMARKETS

- 14.1 NORTH AMERICA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- 14.2 INCREASING RAILWAY ELECTRIFICATION NETWORK TO DRIVE DEMAND FOR ELECTRO-DIESEL TRAINS

- 14.3 UPCOMING TRI-MODE TRAIN TECHNOLOGY TO OFFER MARKET GROWTH OPPORTUNITIES

- 14.4 CONCLUSION

15 APPENDIX

- 15.1 KEY INSIGHTS FROM INDUSTRY EXPERTS

- 15.2 DISCUSSION GUIDE

- 15.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.4 CUSTOMIZATION OPTIONS

- 15.5 RELATED REPORTS

- 15.6 AUTHOR DETAILS