|

|

市場調査レポート

商品コード

1681525

電気商用車の世界市場:車両タイプ別、推進別、航続距離別、バッテリータイプ別、出力別、バッテリー容量別、コンポーネント別、エンドユーザー別、車体構造別、地域別 - 予測(~2030年)Electric Commercial Vehicle Market by Vehicle Type (Pickups, Medium and Heavy-Duty Trucks, Vans, Buses), Propulsion, Range, Battery Type, Power Output, Battery Capacity, Component, End User, Body Construction and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 電気商用車の世界市場:車両タイプ別、推進別、航続距離別、バッテリータイプ別、出力別、バッテリー容量別、コンポーネント別、エンドユーザー別、車体構造別、地域別 - 予測(~2030年) |

|

出版日: 2025年03月01日

発行: MarketsandMarkets

ページ情報: 英文 375 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の電気商用車の市場規模は、2024年の709億米ドルから2030年までに2,556億米ドルに達すると予測され、CAGRで23.8%の成長が見込まれます。

世界のEV市場は、政府のインセンティブ、環境問題、バッテリー技術の進歩に後押しされて爆発的な成長を示しています。このようなEV生産の急増は、電気商用車の需要の増加につながります。また、電気商用車は内燃機関車よりも低コストで運用されています。EV用バッテリーとEV充電システムの研究の拡大が電気商用車市場を牽引します。電気商用車の需要の増加に対応するため、電気自動車充電ステーション、バッテリー交換ステーション、フリートステーションを世界中に設置する必要があります。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2019年~2030年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2030年 |

| 単位 | 10億米ドル |

| セグメント | 車両タイプ、出力、モータータイプ、設計、トランスミッション、車軸構造、地域 |

| 対象地域 | アジア太平洋、欧州、北米 |

「予測期間にBEVセグメントが最大の市場シェアを占める。」

予測期間にBEVセグメントが電気商用車市場で大きなシェアを占める見込みです。長期的に見れば、BEVは従来の内燃機関車と比較して低い運用コストを提供できます。燃料コストの低減、メンテナンス要件の低減(可動部品が少ない)、潜在的なインセンティブや補助金は、有利な総所有コスト(TCO)に寄与し、BEVを商業用途に経済的に実行可能なものにしています。エネルギー密度の向上、充電インフラの改善、バッテリー寿命の延長など、バッテリー技術の継続的な進歩は、電気自動車に関連する複数の懸念に対処します。これらの進歩は、商業用途におけるBEVの性能と競争力を高めています。世界中の自動車OEMも商用BEVを提供しています。例えば、BEV市場において、K5、K6、K7M、K8、K9はBYDが提供する電気商用バスシリーズの一部です。このように、前述の要因が予測期間に電気商用車市場におけるBEVの需要を促進するとみられます。

「NMC電池が予測期間に最大の市場になる見込みです。」

NMCバッテリーは、世界的に広く使用されているため、最大の市場シェアを占めています。CATL(中国)、LG Energy Solutions(韓国)、Panasonic Corporation(日本)、BYD(中国)など、多くの主要バッテリーメーカーがNMC電池を生産しています。NMC(ニッケルマンガンコバルト)電池は、電気商用車市場で広く採用されています。これらの電池はコストと性能のバランスが取れており、電気商用車のコスト効率を高めています。この費用対効果は、総所有コストが重要視される商業部門にとって極めて重要です。また、Mercedes-Benze-Actros、Volvo FL Electric、BYD Tシリーズ、Rivian R1Tなど、多くの主要OEMが電気トラックにNMCバッテリーを搭載しています。これらのバッテリーはLFPバッテリーよりもエネルギー密度が高く、NMCバッテリーのコスト低下がこのセグメントをさらに牽引しています。

「ラストマイル配送セグメントが予測期間に最終用途セグメント市場をリードする見込みです。」

最終用途別では、ラストマイル配送セグメントが予測期間に市場をリードすると予測されています。このセグメントの成長は、主にeコマースの進化と、効率的で持続可能なデリバリーソリューションに対する消費者需要の増加が要因となっています。特に都市部におけるラストワンマイル配送の運用コストを下げるため、電気バンへの移行が進んでいます。電気商用車はラストワンマイル配送に理想的なソリューションを提供し、従来のガソリン車に代わるコスト効率と環境にやさしい選択肢を提供します。さらに、政府と企業の双方による排出規制の強化や持続可能性目標の推進が、電気ラストワンマイル配送車の採用をさらに後押ししています。2023年9月、FedEx Express Europeは、英国で23台のMercedes-Benz eSprinterを追加すると発表しました。

当レポートでは、世界の電気商用車市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- 電気商用車市場の企業にとって魅力的な機会

- 電気商用車市場:車両タイプ別

- 電動商用車市場:推進別

- 電気商用車市場:バッテリータイプ別

- 電気商用車市場:車両タイプ別

- 電気商用車市場:バッテリー容量別

- 電気商用車市場:出力別

- 電気商用車市場:最終用途別

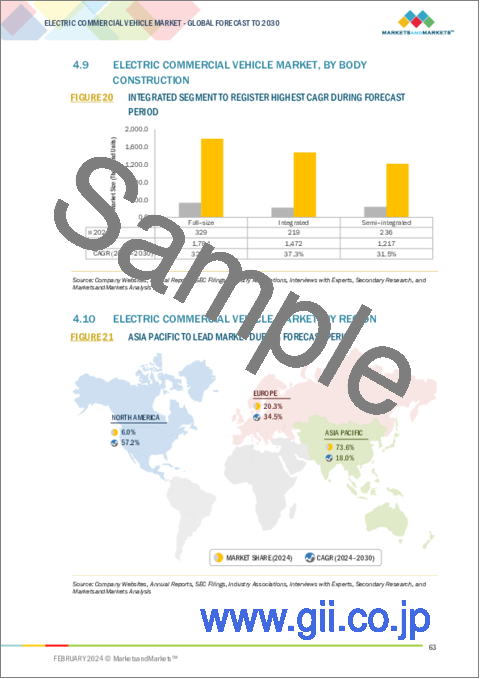

- 電気商用車市場:車体構造別

- 電気商用車市場:地域別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 価格分析

- 平均販売価格の推移:車両タイプ別

- 価格分析:地域別

- 見込まれる電気商用車の発売:OEM別

- 部品表

- OEM調達戦略

- 調達戦略:電気商用車OEM別

- OEMモーターの定格の分析:航続距離別

- 競合市場の評価:積載量別

- サプライチェーン分析

- エコシステムマッピング

- EV充電インフラプロバイダー

- 部品メーカー

- Tier 2サプライヤー

- Tier 1サプライヤー

- 原材料サプライヤー

- OEM

- 総所有コスト

- 電気商用車に関する考察

- 航続距離/バッテリー容量

- 航続距離/最終用途

- バッテリー容量/最終用途

- 電力/充電時間

- ケーススタディ分析

- 投資と資金調達のシナリオ

- 特許分析

- 技術分析

- 未来の技術の概要

- オフボードトップダウンパンタグラフ充電システム

- オンボードボトムアップパンタグラフ充電システム

- 地上静的/動的ワイヤレス充電システム

- パッケージ燃料電池システムモジュール

- メタン燃料電池

- スマート充電システム

- 電気自動車におけるIoT

- 固体電池

- 貿易分析

- 輸入シナリオ(HSコード8702)

- 輸出シナリオ(HSコード8702)

- 規制情勢

- 規制:国別

- 規制機関、政府機関、その他の組織

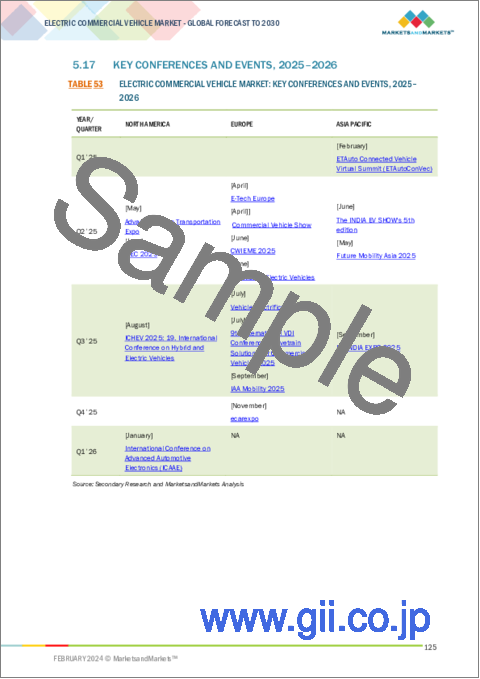

- 主な会議とイベント(2025年~2026年)

- 主なステークホルダーと購入基準

- 顧客ビジネスに影響を与える動向/混乱

第6章 電気商用車市場:車両タイプ別

- イントロダクション

- ピックアップトラック

- トラック

- バン

- バス

- 主な産業考察

第7章 電動商用車市場:推進別

- イントロダクション

- BEV

- FCEV

- 主な産業考察

第8章 電気商用車市場:バッテリータイプ別

- イントロダクション

- NMCバッテリー

- LFPバッテリー

- 固体電池

- その他

- 主な産業考察

第9章 電気商用車市場:バッテリー容量別

- イントロダクション

- 60kWh未満

- 60~120kWh

- 121~200kWh

- 201~300kWh

- 301~500kWh

- 501~1,000kWh

- 主な産業考察

第10章 電気商用車市場:出力別

- イントロダクション

- 100kW未満

- 100~250kW

- 250kW超

- 主な産業考察

第11章 電気商用車市場:航続距離別

- イントロダクション

- 150マイル未満

- 151~300マイル

- 300マイル超

- 主な産業考察

第12章 電気商用車市場:最終用途別

- イントロダクション

- ラストマイル配送

- フィールドサービス

- 流通サービス

- 長距離輸送

- ゴミ収集車

- 主な産業考察

第13章 電気商用車市場:車体構造別

- イントロダクション

- 統合型

- 半統合型

- フルサイズ

- 主な産業考察

第14章 電気商用車市場:部品別

- イントロダクション

- バッテリーパック

- オンボードチャージャー

- 電気モーター

- インバーター

- DC-DCコンバータ

- 燃料電池スタック

第15章 電気商用車市場:地域別

- イントロダクション

- アジア太平洋

- マクロ経済の見通し

- 中国

- 日本

- インド

- 韓国

- 欧州

- マクロ経済の見通し

- フランス

- ドイツ

- スペイン

- オーストリア

- ノルウェー

- スウェーデン

- オランダ

- 英国

- イタリア

- その他

- 北米

- マクロ経済の見通し

- 米国

- カナダ

第16章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 市場シェア分析(2024年)

- 収益分析(2019年~2023年)

- 企業の評価と財務指標

- 電気バスの比較:OEM別

- ブランド/製品の比較

- 企業の評価マトリクス:主要企業(2024年)

- 企業の評価マトリクス:スタートアップ/中小企業(2024年)

- 競合シナリオ

第17章 企業プロファイル

- 主要企業

- BYD

- MERCEDES-BENZ GROUP AG

- YUTONG BUS CO., LTD.

- AB VOLVO

- FORD MOTOR COMPANY

- TESLA, INC.

- RENAULT

- PACCAR INC.

- SCANIA AB

- DONGFENG MOTOR CORPORATION

- GENERAL MOTORS

- VDL GROEP

- RIVIAN

- その他の企業

- TATA MOTORS LIMITED

- WORKHORSE GROUP

- NIKOLA CORPORATION

- ASHOK LEYLAND

- ISUZU MOTORS LTD.

- IRIZAR GROUP

- IVECO

- BOLLINGER MOTORS

- XOS TRUCKS INC.

- MAN SE

- GOLDEN DRAGON

- ZENITH MOTORS

- ARRIVAL

- LORDSTOWN MOTORS

第18章 MARKETSANDMARKETSの提言

- アジア太平洋は電気商用車の重要な市場となる

- 150マイル未満が最大の市場セグメントとして浮上

- NMCバッテリーは有望な分野となる

- 結論

第19章 付録

List of Tables

- TABLE 1 MARKET DEFINITION, BY PROPULSION

- TABLE 2 MARKET DEFINITION, BY END USE

- TABLE 3 MARKET DEFINITION, BY BATTERY TYPE

- TABLE 4 MARKET DEFINITION, BY VEHICLE TYPE

- TABLE 5 MARKET DEFINITION, BY COMPONENT

- TABLE 6 INCLUSIONS AND EXCLUSIONS

- TABLE 7 USD EXCHANGE RATES

- TABLE 8 PURCHASE ORDER/SUPPLY CONTRACT FOR ELECTRIC COMMERCIAL VEHICLES

- TABLE 9 GOVERNMENT PROGRAMS FOR ELECTRIC COMMERCIAL VEHICLE SALES

- TABLE 10 ZERO-EMISSION LIGHT-DUTY VEHICLE POLICIES AND INCENTIVES IN SELECTED COUNTRIES

- TABLE 11 EV CHARGER DENSITY, 2024

- TABLE 12 ELECTRIC COMMERCIAL VEHICLE MODELS, BY COUNTRY, 2023-2024

- TABLE 13 BATTERY CAPACITIES OF POPULAR ELECTRIC BUSES

- TABLE 14 ELECTRIC VANS: AVERAGE PRICE (USD), 2024

- TABLE 15 ELECTRIC PICKUP TRUCKS: AVERAGE PRICE (USD), 2024

- TABLE 16 ELECTRIC TRUCKS: AVERAGE PRICE (USD), 2024

- TABLE 17 ELECTRIC BUSES: AVERAGE PRICE (USD), 2024

- TABLE 18 ELECTRIC TRUCKS: AVERAGE PRICE COMPARISON, BY CLASS

- TABLE 19 UPCOMING ELECTRIC COMMERCIAL VEHICLES, 2024-2026

- TABLE 20 ROLE OF COMPANIES IN ELECTRIC COMMERCIAL VEHICLE MARKET ECOSYSTEM

- TABLE 21 TOTAL COST OF OWNERSHIP, VEHICLE TYPE

- TABLE 22 ELECTRIC COMMERCIAL VEHICLES: RANGE VS. BATTERY CAPACITY

- TABLE 23 ELECTRIC COMMERCIAL VEHICLES: RANGE VS. END USE

- TABLE 24 ELECTRIC COMMERCIAL VEHICLES: BATTERY CAPACITY VS. END USE

- TABLE 25 ELECTRIC COMMERCIAL VEHICLES: POWER VS. CHARGING DURATION

- TABLE 26 PATENT REGISTRATIONS RELATED TO ELECTRIC COMMERCIAL VEHICLE MARKET, 2021-2024

- TABLE 27 GERMANY: IMPORT DATA FOR HS CODE 8702: ELECTRIC COMMERCIAL VEHICLE IMPORT SHARE, BY COUNTRY, 2019-2023 (000' USD)

- TABLE 28 ITALY: IMPORT DATA FOR HS CODE 8702: ELECTRIC COMMERCIAL VEHICLE IMPORT SHARE, BY COUNTRY, 2019-2023 (000' USD)

- TABLE 29 FRANCE IMPORT DATA FOR HS CODE 8702: ELECTRIC COMMERCIAL VEHICLE IMPORT SHARE, BY COUNTRY, 2019-2023 (000' USD)

- TABLE 30 US: IMPORT DATA FOR HS CODE 8702: ELECTRIC COMMERCIAL VEHICLE IMPORT SHARE, BY COUNTRY, 2019-2023 (000' USD)

- TABLE 31 SPAIN: IMPORT DATA FOR HS CODE 8702: ELECTRIC COMMERCIAL VEHICLE IMPORT SHARE, BY COUNTRY, 2019-2023 (000' USD)

- TABLE 32 CHINA: EXPORT DATA FOR HS CODE 8702: ELECTRIC COMMERCIAL VEHICLE EXPORT SHARE, BY COUNTRY, 2019-2023 (000' USD)

- TABLE 33 TURKIYE: EXPORT DATA FOR HS CODE 8702: ELECTRIC COMMERCIAL VEHICLE EXPORT SHARE, BY COUNTRY, 2019-2023 (000' USD)

- TABLE 34 JAPAN: EXPORT DATA FOR HS CODE 8702: ELECTRIC COMMERCIAL VEHICLE EXPORT SHARE, BY COUNTRY, 2019-2023 (000' USD)

- TABLE 35 POLAND: EXPORT DATA FOR HS CODE 8702: ELECTRIC COMMERCIAL VEHICLE EXPORT SHARE, BY COUNTRY, 2019-2023 (000' USD)

- TABLE 36 SPAIN: EXPORT DATA FOR HS CODE 8702: ELECTRIC COMMERCIAL VEHICLE EXPORT SHARE, BY COUNTRY, 2019-2023 (000' USD)

- TABLE 37 NETHERLANDS: ELECTRIC VEHICLE INCENTIVES

- TABLE 38 NETHERLANDS: EV CHARGING STATION INCENTIVES

- TABLE 39 GERMANY: ELECTRIC VEHICLE INCENTIVES

- TABLE 40 GERMANY: EV CHARGING STATION INCENTIVES

- TABLE 41 FRANCE: ELECTRIC VEHICLE INCENTIVES

- TABLE 42 FRANCE: EV CHARGING STATION INCENTIVES

- TABLE 43 UK: ELECTRIC VEHICLE INCENTIVES

- TABLE 44 UK: EV CHARGING STATION INCENTIVES

- TABLE 45 CHINA: ELECTRIC VEHICLE INCENTIVES

- TABLE 46 CHINA: EV CHARGING STATION INCENTIVES

- TABLE 47 US: ELECTRIC VEHICLE INCENTIVES

- TABLE 48 US: EV CHARGING STATION INCENTIVES

- TABLE 49 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 50 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 51 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 52 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 53 ELECTRIC COMMERCIAL VEHICLE MARKET: KEY CONFERENCES AND EVENTS, 2025- 2026

- TABLE 54 INFLUENCE OF INSTITUTIONAL BUYERS ON BUYING PROCESS FOR ELECTRIC COMMERCIAL VEHICLES

- TABLE 55 ELECTRIC COMMERCIAL VEHICLE MARKET, BY VEHICLE TYPE, 2019-2023 (UNITS)

- TABLE 56 ELECTRIC COMMERCIAL VEHICLE MARKET, BY VEHICLE TYPE, 2024-2030 (UNITS)

- TABLE 57 ELECTRIC COMMERCIAL VEHICLE MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 58 ELECTRIC COMMERCIAL VEHICLE MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 59 ELECTRIC COMMERCIAL VEHICLE, BY VEHICLE TYPE

- TABLE 60 PICKUP TRUCKS: ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 61 PICKUP TRUCKS: ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION, 2024-2030 (UNITS)

- TABLE 62 PICKUP TRUCKS: ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 63 PICKUP TRUCKS: ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 64 TRUCKS: ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 65 TRUCKS: ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION, 2024-2030 (UNITS)

- TABLE 66 TRUCKS: ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 67 TRUCKS: ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 68 MEDIUM-DUTY TRUCKS: ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 69 MEDIUM-DUTY TRUCKS: ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION, 2024-2030 (UNITS)

- TABLE 70 MEDIUM-DUTY TRUCKS: ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 71 MEDIUM-DUTY TRUCKS: ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 72 HEAVY-DUTY TRUCKS: ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 73 HEAVY-DUTY TRUCKS: ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION, 2024-2030 (UNITS)

- TABLE 74 HEAVY-DUTY TRUCKS: ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 75 HEAVY-DUTY TRUCKS: ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 76 VANS: ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 77 VANS: ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION, 2024-2030 (UNITS)

- TABLE 78 VANS: ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 79 VANS: ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 80 LIGHT VANS: ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 81 LIGHT VANS: ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION, 2024-2030 (UNITS)

- TABLE 82 LIGHT VANS: ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 83 LIGHT VANS: ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 84 FULL-SIZE VANS: ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 85 FULL-SIZE VANS: ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION, 2024-2030 (UNITS)

- TABLE 86 FULL-SIZE VANS: ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 87 FULL-SIZE VANS: ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 88 BUSES & COACHES: ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 89 BUSES & COACHES: ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION, 2024-2030 (UNITS)

- TABLE 90 BUSES & COACHES: ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 91 BUSES & COACHES: ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 92 ELECTRIC COMMERCIAL VEHICLE MARKET, BY PROPULSION, 2019-2023 (UNITS)

- TABLE 93 ELECTRIC COMMERCIAL VEHICLE MARKET, BY PROPULSION, 2024-2030 (UNITS)

- TABLE 94 ELECTRIC COMMERCIAL VEHICLE MODELS, BY PROPULSION TYPE

- TABLE 95 BEVS: ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 96 BEVS: ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION, 2024-2030 (UNITS)

- TABLE 97 FCEVS: ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 98 FCEVS: ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION, 2024-2030 (UNITS)

- TABLE 99 ELECTRIC COMMERCIAL VEHICLE MARKET, BY BATTERY TYPE, 2019-2023 (UNITS)

- TABLE 100 ELECTRIC COMMERCIAL VEHICLE MARKET, BY BATTERY TYPE, 2024-2030 (UNITS)

- TABLE 101 NMC BATTERIES: ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 102 NMC BATTERIES: ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION, 2024-2030 (UNITS)

- TABLE 103 ELECTRIC COMMERCIAL VEHICLE MODELS WITH LITHIUM-ION BATTERIES

- TABLE 104 LFP BATTERIES: ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 105 LFP BATTERIES: ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION, 2024-2030 (UNITS)

- TABLE 106 SOLID-STATE BATTERIES: ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 107 SOLID-STATE BATTERIES: ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION, 2024-2030 (UNITS)

- TABLE 108 OTHERS: ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 109 OTHERS: ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION, 2024-2030 (UNITS)

- TABLE 110 ELECTRIC COMMERCIAL VEHICLE MARKET, BY BATTERY CAPACITY, 2019-2023 (UNITS)

- TABLE 111 ELECTRIC COMMERCIAL VEHICLE MARKET, BY BATTERY CAPACITY, 2024-2030 (UNITS)

- TABLE 112 LESS THAN 60 KWH: ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 113 LESS THAN 60 KWH: ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION, 2024-2030 (UNITS)

- TABLE 114 60-120 KWH: ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 115 60-120 KWH: ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION, 2024-2030 (UNITS)

- TABLE 116 121-200 KWH: ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 117 121-200 KWH: ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION, 2024-2030 (UNITS)

- TABLE 118 201-300 KWH ELECTRIC COMMERCIAL VEHICLE MODELS, BY OEMS

- TABLE 119 201-300 KWH: ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 120 201-300 KWH: ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION, 2024-2030 (UNITS)

- TABLE 121 301-500 KWH: ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 122 301-500 KWH: ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION, 2024-2030 (UNITS)

- TABLE 123 501-1,000 KWH: ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 124 501-1,000 KWH: ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION, 2024-2030 (UNITS)

- TABLE 125 ELECTRIC COMMERCIAL VEHICLE MARKET, BY POWER OUTPUT, 2019-2023 (UNITS)

- TABLE 126 ELECTRIC COMMERCIAL VEHICLE MARKET, BY POWER OUTPUT, 2024-2030 (UNITS)

- TABLE 127 LESS THAN 100 KW: ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION 2019-2023 (UNITS)

- TABLE 128 LESS THAN 100 KW: ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION 2024-2030 (UNITS)

- TABLE 129 100-250 KW: ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 130 100-250 KW: ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION, 2024-2030 (UNITS)

- TABLE 131 ABOVE 250 KW: ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 132 ABOVE 250 KW: ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION, 2024-2030 (UNITS)

- TABLE 133 ELECTRIC COMMERCIAL VEHICLE MARKET, BY RANGE, 2019-2023 (UNITS)

- TABLE 134 ELECTRIC COMMERCIAL VEHICLE MARKET, BY RANGE, 2024-2030 (UNITS)

- TABLE 135 LESS THAN 150 MILES: ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 136 LESS THAN 150 MILES: ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION, 2024-2030 (UNITS)

- TABLE 137 151-300 MILES: ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 138 151-300 MILES: ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION, 2024-2030 (UNITS)

- TABLE 139 ABOVE 300 MILES: ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 140 ABOVE 300 MILES: ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION, 2024-2030 (UNITS)

- TABLE 141 ELECTRIC COMMERCIAL VEHICLE MARKET, BY END USE, 2019-2023 (UNITS)

- TABLE 142 ELECTRIC COMMERCIAL VEHICLE MARKET, BY END USE, 2024-2030 (UNITS)

- TABLE 143 ELECTRIC COMMERCIAL VEHICLE MARKET, BY BODY CONSTRUCTION, 2019-2023 (UNITS)

- TABLE 144 ELECTRIC COMMERCIAL VEHICLE MARKET, BY BODY CONSTRUCTION, 2024-2030 (UNITS)

- TABLE 145 PRODUCTS OFFERED BY BATTERY MANUFACTURERS

- TABLE 146 ONBOARD CHARGER MANUFACTURERS FOR ELECTRIC COMMERCIAL VEHICLES

- TABLE 147 ELECTRIC TRUCK MODELS, BY ELECTRIC MOTOR TYPE

- TABLE 148 INVERTER MANUFACTURERS FOR ELECTRIC COMMERCIAL VEHICLES

- TABLE 149 ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 150 ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION, 2024-2030 (UNITS)

- TABLE 151 ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 152 ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 153 ASIA PACIFIC: ELECTRIC COMMERCIAL VEHICLE MARKET, BY COUNTRY, 2019-2023 (UNITS)

- TABLE 154 ASIA PACIFIC: ELECTRIC COMMERCIAL VEHICLE MARKET, BY COUNTRY, 2024-2030 (UNITS)

- TABLE 155 ASIA PACIFIC: ELECTRIC COMMERCIAL VEHICLE MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 156 ASIA PACIFIC: ELECTRIC COMMERCIAL VEHICLE MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 157 CHINA: ELECTRIC COMMERCIAL VEHICLE MARKET, BY VEHICLE TYPE, 2019-2023 (UNITS)

- TABLE 158 CHINA: ELECTRIC COMMERCIAL VEHICLE MARKET, BY VEHICLE TYPE, 2024-2030 (UNITS)

- TABLE 159 CHINA: ELECTRIC COMMERCIAL VEHICLE MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 160 CHINA: ELECTRIC COMMERCIAL VEHICLE MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 161 JAPAN: ELECTRIC COMMERCIAL VEHICLE MARKET, BY VEHICLE TYPE, 2019-2023 (UNITS)

- TABLE 162 JAPAN ELECTRIC COMMERCIAL VEHICLE MARKET, BY VEHICLE TYPE, 2024-2030 (UNITS)

- TABLE 163 JAPAN: ELECTRIC COMMERCIAL VEHICLE MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 164 JAPAN ELECTRIC COMMERCIAL VEHICLE MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 165 INDIA: ELECTRIC COMMERCIAL VEHICLE MARKET, BY VEHICLE TYPE, 2019-2023 (UNITS)

- TABLE 166 INDIA: ELECTRIC COMMERCIAL VEHICLE MARKET, BY VEHICLE TYPE, 2024-2030 (UNITS)

- TABLE 167 INDIA: ELECTRIC COMMERCIAL VEHICLE MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 168 INDIA: ELECTRIC COMMERCIAL VEHICLE MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 169 SOUTH KOREA: ELECTRIC COMMERCIAL VEHICLE MARKET, BY VEHICLE TYPE, 2019-2023 (UNITS)

- TABLE 170 SOUTH KOREA: ELECTRIC COMMERCIAL VEHICLE MARKET, BY VEHICLE TYPE, 2024-2030 (UNITS)

- TABLE 171 SOUTH KOREA: ELECTRIC COMMERCIAL VEHICLE MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 172 SOUTH KOREA: ELECTRIC COMMERCIAL VEHICLE MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 173 EUROPE: ELECTRIC COMMERCIAL VEHICLE MARKET, BY COUNTRY, 2019-2023 (UNITS)

- TABLE 174 EUROPE: ELECTRIC COMMERCIAL VEHICLE MARKET, BY COUNTRY, 2024-2030 (UNITS)

- TABLE 175 EUROPE: ELECTRIC COMMERCIAL VEHICLE MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 176 EUROPE: ELECTRIC COMMERCIAL VEHICLE MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 177 FRANCE: ELECTRIC COMMERCIAL VEHICLE MARKET, BY VEHICLE TYPE, 2019-2023 (UNITS)

- TABLE 178 FRANCE: ELECTRIC COMMERCIAL VEHICLE MARKET, BY VEHICLE TYPE, 2024-2030 (UNITS)

- TABLE 179 FRANCE: ELECTRIC COMMERCIAL VEHICLE MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 180 FRANCE: ELECTRIC COMMERCIAL VEHICLE MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 181 GERMANY: ELECTRIC COMMERCIAL VEHICLE MARKET, BY VEHICLE TYPE, 2019-2023 (UNITS)

- TABLE 182 GERMANY: ELECTRIC COMMERCIAL VEHICLE MARKET, BY VEHICLE TYPE, 2024-2030 (UNITS)

- TABLE 183 GERMANY: ELECTRIC COMMERCIAL VEHICLE MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 184 GERMANY: ELECTRIC COMMERCIAL VEHICLE MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 185 SPAIN: ELECTRIC COMMERCIAL VEHICLE MARKET, BY VEHICLE TYPE, 2019-2023 (UNITS)

- TABLE 186 SPAIN: ELECTRIC COMMERCIAL VEHICLE MARKET, BY VEHICLE TYPE, 2024-2030 (UNITS)

- TABLE 187 SPAIN: ELECTRIC COMMERCIAL VEHICLE MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 188 SPAIN: ELECTRIC COMMERCIAL VEHICLE MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 189 AUSTRIA: ELECTRIC COMMERCIAL VEHICLE MARKET, BY VEHICLE TYPE, 2019-2023 (UNITS)

- TABLE 190 AUSTRIA: ELECTRIC COMMERCIAL VEHICLE MARKET, BY VEHICLE TYPE, 2024-2030 (UNITS)

- TABLE 191 AUSTRIA: ELECTRIC COMMERCIAL VEHICLE MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 192 AUSTRIA: ELECTRIC COMMERCIAL VEHICLE MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 193 NORWAY: ELECTRIC COMMERCIAL VEHICLE MARKET, BY VEHICLE TYPE, 2019-2023 (UNITS)

- TABLE 194 NORWAY: ELECTRIC COMMERCIAL VEHICLE MARKET, BY VEHICLE TYPE, 2024-2030 (UNITS)

- TABLE 195 NORWAY: ELECTRIC COMMERCIAL VEHICLE MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 196 NORWAY: ELECTRIC COMMERCIAL VEHICLE MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 197 SWEDEN: ELECTRIC COMMERCIAL VEHICLE MARKET, BY VEHICLE TYPE, 2019-2023 (UNITS)

- TABLE 198 SWEDEN: ELECTRIC COMMERCIAL VEHICLE MARKET, BY VEHICLE TYPE, 2024-2030 (UNITS)

- TABLE 199 SWEDEN: ELECTRIC COMMERCIAL VEHICLE MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 200 SWEDEN: ELECTRIC COMMERCIAL VEHICLE MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 201 NETHERLANDS: ELECTRIC COMMERCIAL VEHICLE MARKET, BY VEHICLE TYPE, 2019-2023 (UNITS)

- TABLE 202 NETHERLANDS: ELECTRIC COMMERCIAL VEHICLE MARKET, BY VEHICLE TYPE, 2024-2030 (UNITS)

- TABLE 203 NETHERLANDS: ELECTRIC COMMERCIAL VEHICLE MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 204 NETHERLANDS: ELECTRIC COMMERCIAL VEHICLE MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 205 UK: ELECTRIC COMMERCIAL VEHICLE MARKET, BY VEHICLE TYPE, 2019-2023 (UNITS)

- TABLE 206 UK: ELECTRIC COMMERCIAL VEHICLE MARKET, BY VEHICLE TYPE, 2024-2030 (UNITS)

- TABLE 207 UK: ELECTRIC COMMERCIAL VEHICLE MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 208 UK: ELECTRIC COMMERCIAL VEHICLE MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 209 ITALY: ELECTRIC COMMERCIAL VEHICLE MARKET, BY VEHICLE TYPE, 2019-2023 (UNITS)

- TABLE 210 ITALY: ELECTRIC COMMERCIAL VEHICLE MARKET, BY VEHICLE TYPE, 2024-2030 (UNITS)

- TABLE 211 ITALY: ELECTRIC COMMERCIAL VEHICLE MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 212 ITALY: ELECTRIC COMMERCIAL VEHICLE MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 213 OTHERS: ELECTRIC COMMERCIAL VEHICLE MARKET, BY VEHICLE TYPE, 2019-2023 (UNITS)

- TABLE 214 OTHERS: ELECTRIC COMMERCIAL VEHICLE MARKET, BY VEHICLE TYPE, 2024-2030 (UNITS)

- TABLE 215 OTHERS: ELECTRIC COMMERCIAL VEHICLE MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 216 OTHERS: ELECTRIC COMMERCIAL VEHICLE MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 217 NORTH AMERICA: ELECTRIC COMMERCIAL VEHICLE MARKET, BY COUNTRY, 2019-2023 (UNITS)

- TABLE 218 NORTH AMERICA: ELECTRIC COMMERCIAL VEHICLE MARKET, BY COUNTRY, 2024-2030 (UNITS)

- TABLE 219 NORTH AMERICA: ELECTRIC COMMERCIAL VEHICLE MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 220 NORTH AMERICA: ELECTRIC COMMERCIAL VEHICLE MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 221 US: ELECTRIC VEHICLE INCENTIVES

- TABLE 222 US: ELECTRIC COMMERCIAL VEHICLE MARKET, BY VEHICLE TYPE, 2019-2023 (UNITS)

- TABLE 223 US: ELECTRIC COMMERCIAL VEHICLE MARKET, BY VEHICLE TYPE, 2024-2030 (UNITS)

- TABLE 224 US: ELECTRIC COMMERCIAL VEHICLE MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 225 US: ELECTRIC COMMERCIAL VEHICLE MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 226 CANADA: ELECTRIC COMMERCIAL VEHICLE MARKET, BY VEHICLE TYPE, 2019-2023 (UNITS)

- TABLE 227 CANADA: ELECTRIC COMMERCIAL VEHICLE MARKET, BY VEHICLE TYPE, 2024-2030 (UNITS)

- TABLE 228 CANADA: ELECTRIC COMMERCIAL VEHICLE MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 229 CANADA: ELECTRIC COMMERCIAL VEHICLE MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 230 OVERVIEW OF STRATEGIES DEPLOYED BY KEY COMPANIES

- TABLE 231 ELECTRIC COMMERCIAL VEHICLE MARKET SHARE OF TOP FIVE PLAYERS, 2024

- TABLE 232 ELECTRIC COMMERCIAL VEHICLE MARKET: ELECTRIC BUS COMPARISON

- TABLE 233 ELECTRIC COMMERCIAL VEHICLE MARKET: ELECTRIC VANS COMPARISON

- TABLE 234 ELECTRIC COMMERCIAL VEHICLE MARKET: REGIONAL TYPE FOOTPRINT, 2024

- TABLE 235 ELECTRIC COMMERCIAL VEHICLE MARKET: VEHICLE TYPE FOOTPRINT, 2024

- TABLE 236 ELECTRIC COMMERCIAL VEHICLE MARKET: PROPULSION TYPE FOOTPRINT, 2024

- TABLE 237 ELECTRIC COMMERCIAL VEHICLE MARKET: BATTERY TYPE FOOTPRINT, 2024

- TABLE 238 ELECTRIC COMMERCIAL VEHICLE MARKET: KEY STARTUPS/SMES

- TABLE 239 ELECTRIC COMMERCIAL VEHICLE MARKET: PRODUCT LAUNCHES, JANUARY 2021-JANUARY 2025

- TABLE 240 ELECTRIC COMMERCIAL VEHICLE MARKET: DEALS, JANUARY 2021- JANUARY 2025

- TABLE 241 ELECTRIC COMMERCIAL VEHICLE MARKET: EXPANSIONS, JANUARY 2021-JANUARY 2025

- TABLE 242 ELECTRIC COMMERCIAL VEHICLE MARKET: OTHER DEVELOPMENTS, JANUARY 2021-JANUARY 2025

- TABLE 243 BYD: COMPANY OVERVIEW

- TABLE 244 BYD: PRODUCTS OFFERED

- TABLE 245 BYD: PRODUCT LAUNCHES, JANUARY 2021-JANUARY 2025

- TABLE 246 BYD: DEALS, JANUARY 2021-JANUARY 2025

- TABLE 247 BYD: EXPANSIONS, JANUARY 2021-JANUARY 2025

- TABLE 248 BYD: OTHER DEVELOPMENTS, JANUARY 2021-JANUARY 2025

- TABLE 249 MERCEDES-BENZ GROUP AG: COMPANY OVERVIEW

- TABLE 250 MERCEDES-BENZ GROUP AG: PRODUCTS OFFERED

- TABLE 251 MERCEDES-BENZ GROUP AG: PRODUCT LAUNCHES, JANUARY 2021- JANUARY 2025

- TABLE 252 MERCEDES-BENZ GROUP AG: DEALS, JANUARY 2021-JANUARY 2025

- TABLE 253 MERCEDES-BENZ GROUP AG: EXPANSIONS, JANUARY 2021-JANUARY 2025

- TABLE 254 MERCEDES-BENZ GROUP AG: OTHER DEVELOPMENTS, JANUARY 2021-J ANUARY 2025

- TABLE 255 YUTONG BUS CO., LTD.: COMPANY OVERVIEW

- TABLE 256 YUTONG BUS CO., LTD.: PRODUCTS OFFERED

- TABLE 257 YUTONG BUS CO., LTD.: PRODUCT LAUNCHES, JANUARY 2021-JANUARY 2025

- TABLE 258 YUTONG BUS CO., LTD.: DEALS, JANUARY 2021-JANUARY 2025

- TABLE 259 YUTONG BUS CO., LTD.: EXPANSIONS, JANUARY 2021-JANUARY 2025

- TABLE 260 YUTONG BUS CO., LTD.: OTHER DEVELOPMENTS, JANUARY 2021-JANUARY 2025

- TABLE 261 AB VOLVO: COMPANY OVERVIEW

- TABLE 262 AB VOLVO: PRODUCTS OFFERED

- TABLE 263 AB VOLVO: PRODUCT LAUNCHES, JANUARY 2021-JANUARY 2025

- TABLE 264 AB VOLVO: DEALS, JANUARY 2021-JANUARY 2025

- TABLE 265 AB VOLVO: EXPANSIONS, JANUARY 2021-JANUARY 2025

- TABLE 266 FORD MOTOR COMPANY: COMPANY OVERVIEW

- TABLE 267 FORD MOTOR COMPANY: PRODUCTS OFFERED

- TABLE 268 FORD MOTOR COMPANY: PRODUCT LAUNCHES, JANUARY 2021-JANUARY 2025

- TABLE 269 FORD MOTOR COMPANY: DEALS, JANUARY 2021-JANUARY 2025

- TABLE 270 FORD MOTOR COMPANY: EXPANSIONS, JANUARY 2021-JANUARY 2025

- TABLE 271 FORD MOTORS COMPANY: OTHER DEVELOPMENTS, JANUARY 2021- JANUARY 2025

- TABLE 272 TESLA, INC.: COMPANY OVERVIEW

- TABLE 273 TESLA, INC.: PRODUCTS OFFERED

- TABLE 274 TESLA, INC.: PRODUCT LAUNCHES, JANUARY 2021-JANUARY 2025

- TABLE 275 TESLA, INC.: DEALS, JANUARY 2021-JANUARY 2025

- TABLE 276 TESLA, INC.: EXPANSIONS, JANUARY 2021-JANUARY 2025

- TABLE 277 RENAULT: COMPANY OVERVIEW

- TABLE 278 RENAULT: PRODUCTS OFFERED

- TABLE 279 RENAULT: PRODUCT LAUNCHES, JANUARY 2021-JANUARY 2025

- TABLE 280 RENAULT: DEALS, JANUARY 2021-JANUARY 2025

- TABLE 281 RENAULT: EXPANSIONS, JANUARY 2021-JANUARY 2025

- TABLE 282 RENAULT: OTHER DEVELOPMENTS, JANUARY 2021-JANUARY 2025

- TABLE 283 PACCAR INC.: COMPANY OVERVIEW

- TABLE 284 PACCAR INC.: PRODUCTS OFFERED

- TABLE 285 PACCAR INC.: PRODUCT LAUNCHES, JANUARY 2021-JANUARY 2025

- TABLE 286 PACCAR INC.: DEALS, JANUARY 2021-JANUARY 2025

- TABLE 287 PACCAR INC.: EXPANSIONS, JANUARY 2021-JANUARY 2025

- TABLE 288 PACCAR INC.: OTHER DEVELOPMENTS, JANUARY 2021-JANUARY 2025

- TABLE 289 SCANIA AB: COMPANY OVERVIEW

- TABLE 290 SCANIA AB: PRODUCTS OFFERED

- TABLE 291 SCANIA AB: PRODUCT LAUNCHES, JANUARY 2021-JANUARY 2025

- TABLE 292 SCANIA AB: DEALS, JANUARY 2021-JANUARY 2025

- TABLE 293 SCANIA AB: EXPANSIONS, JANUARY 2021-JANUARY 2025

- TABLE 294 SCANIA AB: OTHER DEVELOPMENTS, JANUARY 2021-JANUARY 2025

- TABLE 295 DONGFENG MOTOR CORPORATION: COMPANY OVERVIEW

- TABLE 296 DONGFENG MOTOR CORPORATION: PRODUCTS OFFERED

- TABLE 297 DONGFENG MOTOR CORPORATION: PRODUCT LAUNCHES, JANUARY 2021-JANUARY 2025

- TABLE 298 DONGFENG MOTOR CORPORATION: DEALS, JANUARY 2021-JANUARY 2025

- TABLE 299 DONGFENG MOTOR CORPORATION: EXPANSIONS, JANUARY 2021-JANUARY 2025

- TABLE 300 DONGFENG MOTOR CORPORATION: OTHER DEVELOPMENTS, JANUARY 2021-JANUARY 2025

- TABLE 301 GENERAL MOTORS: COMPANY OVERVIEW

- TABLE 302 GENERAL MOTORS: PRODUCTS OFFERED

- TABLE 303 GENERAL MOTORS: PRODUCT LAUNCHES, JANUARY 2021-JANUARY 2025

- TABLE 304 GENERAL MOTORS: DEALS, JANUARY 2021-JANUARY 2025

- TABLE 305 GENERAL MOTORS: EXPANSIONS, JANUARY 2021-JANUARY 2025

- TABLE 306 GENERAL MOTORS: OTHER DEVELOPMENTS, JANUARY 2021-JANUARY 2025

- TABLE 307 VDL GROEP: COMPANY OVERVIEW

- TABLE 308 VDL GROEP: PRODUCTS OFFERED

- TABLE 309 VDL GROEP: PRODUCT LAUNCHES, JANUARY 2021-JANUARY 2025

- TABLE 310 VDL GROEP: DEALS, JANUARY 2021-JANUARY 2025

- TABLE 311 VDL GROEP: EXPANSIONS, JANUARY 2021-JANUARY 2025

- TABLE 312 VDL GROEP: OTHER DEVELOPMENTS, JANUARY 2021-JANUARY 2025

- TABLE 313 RIVIAN: COMPANY OVERVIEW

- TABLE 314 RIVIAN: PRODUCTS OFFERED

- TABLE 315 RIVIAN: PRODUCT LAUNCHES, JANUARY 2021-JANUARY 2025

- TABLE 316 RIVIAN: DEALS, JANUARY 2021-JANUARY 2025

- TABLE 317 RIVIAN: EXPANSIONS, JANUARY 2021-JANUARY 2025

List of Figures

- FIGURE 1 ELECTRIC COMMERCIAL VEHICLE MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 RESEARCH DESIGN MODEL

- FIGURE 4 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 5 APPROACH 1: BOTTOM-UP APPROACH: ELECTRIC COMMERCIAL VEHICLE MARKET

- FIGURE 6 APPROACH 2: BOTTOM-UP APPROACH: ELECTRIC COMMERCIAL VEHICLE MARKET

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 ELECTRIC COMMERCIAL VEHICLE MARKET OVERVIEW

- FIGURE 9 ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION, 2024 VS. 2030 (USD MILLION)

- FIGURE 10 ELECTRIC COMMERCIAL VEHICLE MARKET, BY VEHICLE TYPE, 2024 VS. 2030 (USD MILLION)

- FIGURE 11 KEY PLAYERS IN ELECTRIC COMMERCIAL VEHICLE MARKET

- FIGURE 12 INCREASING ADOPTION OF ZERO-EMISSION VEHICLES TO DRIVE MARKET

- FIGURE 13 LIGHT VANS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 14 BEVS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 15 NMC BATTERIES SEGMENT TO HAVE LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 16 LESS THAN 150 MILES SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 17 501-1,000 KWH SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 18 ABOVE 250 KW SEGMENT TO REGISTER HIGHEST RATE DURING FORECAST PERIOD

- FIGURE 19 LONG-HAUL TRANSPORTATION SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 20 INTEGRATED SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 21 ASIA PACIFIC TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 22 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN ELECTRIC COMMERCIAL VEHICLE MARKET

- FIGURE 23 EV BATTERY PRICING, 2019-2025

- FIGURE 24 AVERAGE GLOBAL PETROL PRICES 2001 VS. 2011 VS. 2024

- FIGURE 25 OPERATING COST COMPARISON OF EVS AND ICE VEHICLES

- FIGURE 26 LIFE-CYCLE GHG EMISSIONS FOR 40-TON TRACTOR TRAILERS, 2021 VS. 2030 SCENARIOS

- FIGURE 27 GLOBAL REGULATORY COMPARISON FOR ELECTRIC VEHICLES AND CHARGERS

- FIGURE 28 GLOBAL ELECTRIFICATION TARGETS, 2024

- FIGURE 29 BATTERY SAFETY ARCHITECTURE

- FIGURE 30 PRIVATE, SEMI-PUBLIC, AND PUBLIC CHARGING OWNERSHIP

- FIGURE 31 FUNCTIONING OF WIRELESSLY CHARGED ELECTRIC BUSES

- FIGURE 32 TIME REQUIRED FOR DIFFERENT CHARGING TYPES

- FIGURE 33 GROWING DEMAND FOR LITHIUM-ION BATTERIES, 2010-2030

- FIGURE 34 GRID REQUIREMENT FOR ELECTRIC VEHICLES IN GERMANY

- FIGURE 35 PRICING ANALYSIS, BY REGION

- FIGURE 36 BILL OF MATERIALS: ELECTRIC LIGHT COMMERCIAL VEHICLES (USD)

- FIGURE 37 BILL OF MATERIALS: BATTERY VS. NON-BATTERY COMPONENTS (USD)

- FIGURE 38 BILL OF MATERIALS: ELECTRIC BUS MARKET (USD)

- FIGURE 39 OEM SOURCING STRATEGIES

- FIGURE 40 ELECTRIC COMMERCIAL VEHICLE MARKET, BY POWER RANGE (KW)

- FIGURE 41 MARKET COMPETITIVE ASSESSMENT, BY PAYLOAD CAPACITY

- FIGURE 42 CARGO DELIVERY VS. PAYLOAD CAPACITY

- FIGURE 43 SUPPLY CHAIN ANALYSIS

- FIGURE 44 ELECTRIC COMMERCIAL VEHICLE MARKET ECOSYSTEM

- FIGURE 45 ELECTRIC COMMERCIAL VEHICLE MARKET ECOSYSTEM MAP

- FIGURE 46 COMPARISON OF TOTAL COST OF OWNERSHIP: 12 M ELECTRIC BUSES VS. 12 M DIESEL BUSES

- FIGURE 47 TOTAL COST OF OWNERSHIP: FORD ELECTRIC TRANSIT VS. ICE TRANSIT 3.5 TONS MODELS

- FIGURE 48 INVESTMENT AND FUNDING, 2022-2024

- FIGURE 49 PATENT ANALYSIS, 2015-2025

- FIGURE 50 ELECTRIC COMMERCIAL VEHICLE MARKET: FUTURE TECHNOLOGY OVERVIEW OF ELECTRICAL COMMERCIAL BUSES

- FIGURE 51 PACKAGED FUEL CELL SYSTEM MODULE OF TOYOTA

- FIGURE 52 SMART EV CHARGING SYSTEM

- FIGURE 53 KEY BUYING CRITERIA FOR COMMERCIAL VEHICLE TYPE

- FIGURE 54 ELECTRIC COMMERCIAL VEHICLE MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 55 ELECTRIC COMMERCIAL VEHICLE MARKET, BY VEHICLE TYPE, 2024 VS. 2030 (USD MILLION)

- FIGURE 56 ELECTRIC COMMERCIAL VEHICLE MARKET, BY PROPULSION, 2024 VS. 2030 (THOUSAND UNITS)

- FIGURE 57 ELECTRIC COMMERCIAL VEHICLE MARKET, BY BATTERY TYPE, 2024-2030 (THOUSAND UNITS)

- FIGURE 58 ELECTRIC COMMERCIAL VEHICLE MARKET, BY BATTERY CAPACITY, 2024 VS. 2030 (THOUSAND UNITS)

- FIGURE 59 ELECTRIC COMMERCIAL VEHICLE MARKET, BY POWER OUTPUT, 2024 VS. 2030 (THOUSAND UNITS)

- FIGURE 60 ELECTRIC COMMERCIAL VEHICLE MARKET, BY RANGE, 2024 VS. 2030 (THOUSAND UNITS)

- FIGURE 61 ELECTRIC COMMERCIAL VEHICLE MARKET, BY END USE, 2024 VS. 2030 (THOUSAND UNITS)

- FIGURE 62 ELECTRIC COMMERCIAL VEHICLE MARKET, BY BODY CONSTRUCTION, 2024 VS. 2030 (THOUSAND UNITS)

- FIGURE 63 CONSTITUENTS OF ELECTRIC VEHICLE CHARGING SYSTEM

- FIGURE 64 DC-DC CONVERTER

- FIGURE 65 HYDROGEN FUEL CELL VEHICLE COMPONENTS

- FIGURE 66 GLOBAL LIGHT ELECTRIC COMMERCIAL VEHICLE TARGETS

- FIGURE 67 ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION, 2024 VS. 2030 (USD MILLION)

- FIGURE 68 TIMELINE OF ALL EXISTING AND UPCOMING REGULATIONS IN EUROPE, US, AND CHINA

- FIGURE 69 ASIA PACIFIC: REAL GDP GROWTH RATE, BY COUNTRY, 2023-2025

- FIGURE 70 ASIA PACIFIC: GDP PER CAPITA, BY COUNTRY, 2023-2025

- FIGURE 71 ASIA PACIFIC: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2023-2025

- FIGURE 72 ASIA PACIFIC: MANUFACTURING INDUSTRY CONTRIBUTION TO GDP, 2023

- FIGURE 73 ASIA PACIFIC: ELECTRIC COMMERCIAL VEHICLE MARKET SNAPSHOT

- FIGURE 74 EUROPE: REAL GDP GROWTH RATE, BY COUNTRY, 2023-2025

- FIGURE 75 EUROPE: GDP PER CAPITA, BY COUNTRY, 2023-2025

- FIGURE 76 EUROPE: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2023-2025

- FIGURE 77 EUROPE: MANUFACTURING INDUSTRY CONTRIBUTION TO GDP, 2023

- FIGURE 78 EUROPE: ELECTRIC COMMERCIAL VEHICLE MARKET, BY COUNTRY, 2024 VS. 2030 (USD MILLION)

- FIGURE 79 UK EV ROADMAP

- FIGURE 80 NORTH AMERICA: REAL GDP GROWTH RATE, BY COUNTRY, 2023-2025

- FIGURE 81 NORTH AMERICA: GDP PER CAPITA, BY COUNTRY, 2023-2025

- FIGURE 82 NORTH AMERICA: CPI INFLATION RATE, BY COUNTRY, 2023-2025

- FIGURE 83 NORTH AMERICA: MANUFACTURING INDUSTRY CONTRIBUTION TO GDP, 2023

- FIGURE 84 NORTH AMERICAN EV BATTERY INITIATIVES

- FIGURE 85 NORTH AMERICA: ELECTRIC COMMERCIAL VEHICLE MARKET SNAPSHOT

- FIGURE 86 ELECTRIC COMMERCIAL VEHICLE DEMAND, BY END USER

- FIGURE 87 ELECTRIC COMMERCIAL VEHICLE MARKET SHARE ANALYSIS, 2024

- FIGURE 88 ELECTRIC COMMERCIAL VEHICLE MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2019-2023

- FIGURE 89 COMPANY VALUATION OF KEY PLAYERS, 2024 (USD BILLION)

- FIGURE 90 FINANCIAL METRICS OF KEY PLAYERS (EV/EBITDA)

- FIGURE 91 ELECTRIC COMMERCIAL VEHICLE MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 92 ELECTRIC COMMERCIAL VEHICLE MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 93 ELECTRIC COMMERCIAL VEHICLE MARKET: COMPANY FOOTPRINT, 2024

- FIGURE 94 ELECTRIC COMMERCIAL VEHICLE MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 95 BYD: COMPANY SNAPSHOT (2023)

- FIGURE 96 MERCEDES-BENZ GROUP AG: COMPANY SNAPSHOT (2023)

- FIGURE 97 NEW MERCEDES-BENZ GROUP AG

- FIGURE 98 YUTONG BUS CO., LTD.: COMPANY SNAPSHOT (2023)

- FIGURE 99 AB VOLVO: COMPANY SNAPSHOT (2023)

- FIGURE 100 FORD MOTOR COMPANY: COMPANY SNAPSHOT (2023)

- FIGURE 101 FORD MOTOR COMPANY: ROAD TO CARBON NEUTRALITY

- FIGURE 102 TESLA, INC.: COMPANY SNAPSHOT, 2023

- FIGURE 103 TESLA, INC.: ROADMAP

- FIGURE 104 RENAULT: COMPANY SNAPSHOT (2023)

- FIGURE 105 PACCAR INC.: COMPANY SNAPSHOT, 2023

- FIGURE 106 SCANIA AB: COMPANY SNAPSHOT, 2023

- FIGURE 107 DONGFENG MOTOR CORPORATION: COMPANY SNAPSHOT, 2023

- FIGURE 108 GENERAL MOTORS: COMPANY SNAPSHOT, 2023

- FIGURE 109 VDL GROEP: COMPANY SNAPSHOT

- FIGURE 110 RIVIAN: COMPANY SNAPSHOT, 2023

The global electric commercial vehicles market is projected to grow from USD 70.9 Billion in 2024 to USD 255.6 Billion by 2030, registering a CAGR of 23.8%. The global EV market is experiencing explosive growth fueled by government incentives, environmental concerns, and advancements in battery technology. This surge in EV production translates to a higher demand for electric commercial vehicles. Also, electric commercial vehicles operate at lower cost than ICE commercial vehicles. Growing research of EV batteries and EV charging systems will drive the electric commercial vehicle market. Electric vehicle charging stations, battery swapping stations, and fleet stations must be installed globally to meet the growing demand for electric commercial vehicles.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2030 |

| Base Year | 2023 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD Billion) |

| Segments | Vehicle type, Power Output, Motor type, Design, Transmission, Axle Architecture and Region |

| Regions covered | Asia Pacific, Europe, and North America |

"The BEVs segment to hold largest market share during the forecast period."

The BEVs segment is expected to hold a larger share of the electric commercial vehicle market during the forecast period. Over the long term, BEVs can offer lower operating costs compared to traditional internal combustion engine vehicles. Lower fuel costs, reduced maintenance requirements (fewer moving parts), and potential incentives or subsidies contribute to a favorable Total Cost of Ownership, making BEVs economically viable for commercial applications. Ongoing advancements in battery technology, such as increased energy density, improved charging infrastructure, and longer battery life, address some of the concerns associated with electric vehicles. These advancements enhance the performance and competitiveness of BEVs in commercial applications. Automotive OEMs around the world also offer commercial BEVs. For instance, in the BEV market, K5, K6, K7M, K8, and K9 are some of the electric commercial bus series offered by BYD. Thus, the aforementioned factors will drive the demand for BEVs in the electric commercial vehicle market during the forecast period.

"NMC batteries is expected to be the largest market in the forecast period."

NMC batteries hold the largest market share due to the widespread use of these batteries globally. Many leading battery manufacturers, such as CATL (China), LG Energy Solutions (South Korea), Panasonic Corporation (Japan), and BYD (China), produce NMC batteries. NMC (Nickel Manganese Cobalt) batteries are widely adopted in the electric commercial vehicle market. These batteries have balanced cost and performance, making them cost-effective for electric commercial vehicles. This cost-effectiveness is crucial for the commercial sector, where the total cost of ownership is a significant consideration. Many leading OEMs also incorporate NMC batteries in their electric trucks, including Mercedes-Benz e-Actros, Volvo FL Electric, BYD T series, and Rivian R1T. These batteries have a higher energy density than LFP batteries, and the declining cost of NMC batteries further drives the segment.

"The last-mile delivery segment is estimated to lead end use segment market during the forecast period."

By end use, the last-mile delivery segment is expected to lead the market during the forecast period. This segment's growth is primarily driven by the evolving landscape of e-commerce and increased consumer demand for efficient and sustainable delivery solutions. Transition towards electric vans is on rise to lower operational cost for last mile deliveries particularly in urban areas. Electric commercial vehicles offer an ideal solution for last-mile delivery, providing a cost-effective and environmentally friendly alternative to traditional gasoline-powered vehicles. Additionally, the push towards stricter emission regulations and sustainability goals, both by governments and businesses, further propels the adoption of electric last-mile delivery vehicles. In September 2023, FedEx Express Europe announced the addition of 23 Mercedes-Benz eSprinter vans in its UK operations.

"Asia Pacific is projected to dominate the market for 151-300 miles segment during the forecast period."

Asia Pacific is poised to dominate the 151-300 miles segment of the electric commercial vehicle market in the coming years, primarily due to the increasing use of electric trucks and vans for urban deliveries and transport. These vehicles balance range and versatility, making them well-suited for regional logistics and inter-city transport in densely populated and dynamic markets. Moreover, the region's commitment to sustainable practices aligns with electric vehicles' zero-emission and low-noise characteristics, addressing environmental concerns and contributing to cleaner and quieter urban environments. Regional market players such as BYD (China) and Yutong (China) offer various electric commercial vehicles ranging from 151 to 300 miles. For instance, BYD's E1 pickup truck has a range of around 155 miles. The company also offers the T5 electric van with a range of up to 190 miles and the K6 electric bus with a range of up to 165 miles. As the transportation industry in Asia Pacific continues to prioritize efficiency and eco-friendliness, the demand for electric commercial vehicles with a range of 151-300 miles is expected to witness substantial growth, establishing the region as a leader in this pivotal segment.

In-depth interviews were conducted with CEOs, marketing directors, other innovation and technology directors, and executives from various key organizations operating in this market.

- By Company Type: OEMs - 50%, Tier I - 20%, Tier II- 30%,

- By Designation: CXOs - 15%, Directors- 20%, Others- 65%

- By Region: North America- 30%, Europe - 20%, Asia Pacific- 50%

The electric commercial vehicle market is dominated by global players such as BYD (China), Mercedes-Benz Group AG (Germany), Yutong (China), AB Volvo (Sweden), and Ford Motor Company (US). These companies adopted strategies such as product developments, deals, and others to gain traction in the market.

Research Coverage:

The Market Study Covers the electric commercial vehicle market By Propulsion (BEV, FCEV), Vehicle Type (Medium-duty Trucks, Heavy-duty Truck, Electric Pickup Trucks, Light Vans, Full-size Vans and Buses & Coaches), Range, Battery Type (LFP Batteries, NMC Batteries, Solid-state Batteries, and Others), Power Output (Less than 100 kW, 100-250 kW, and Above 250 kW), Battery Capacity (Less than 60 kWh, 60-120 kWh, 121-200 kWh, 201-300 kWh, 301-500 kWh, and 501-1,000 kWh), Component (Battery Packs, Onboard Chargers, Electric Motors, Inverters, DC-DC Converters, Fuel-cell Stacks, E-Axels (Including Gearboxes)), End Use (Last-mile Delivery, Field Services, Distribution Services, Refuse Trucks, Long-haul Transportation), by Body Construction (Integrated, Semi-integrated, and Full-sized ) and Region (Asia Pacific, Europe and North America). It also covers the competitive landscape and company profiles of the major players in the electric commercial vehicle market ecosystem.

Key Benefits of the Report

The study also includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall electric commercial vehicle market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Decreasing cost of EV batteries, rising fossil fuel prices, increasing demand for emission-free electric commercial vehicles in logistics industry, government initiatives promoting electric commercial vehicle adoption), restraints (High development costs, concerns over battery safety, insufficient EV charging infrastructure), opportunities (New revenue pockets in North America and Northern Europe, development of wireless EV charging technology for on-the-go charging), and challenges (Limited battery capacity, low availability of lithium for EV batteries, insufficient grid infrastructure) influencing the growth of the electric commercial vehicle market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the electric commercial vehicle market

- Market Development: Comprehensive information about lucrative markets - the report analyses the electric commercial vehicle market across varied regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the electric commercial vehicle market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like BYD (China), Mercedes-Benz Group AG (Germany), Yutong (China), AB Volvo (Sweden), Ford Motor Company (US) and among others in the electric commercial vehicle market Page 25 of 34 strategies.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 REGIONS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.3.3 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.1.2 List of secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakdown of primary interviews

- 2.1.2.2 Sampling techniques & data collection methods

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH: ELECTRIC COMMERCIAL VEHICLE MARKET

- 2.2.2 TOP-DOWN APPROACH: ELECTRIC COMMERCIAL VEHICLE MARKET

- 2.3 DATA TRIANGULATION

- 2.4 FACTOR ANALYSIS

- 2.4.1 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND AND SUPPLY SIDES

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ELECTRIC COMMERCIAL VEHICLE MARKET

- 4.2 ELECTRIC COMMERCIAL VEHICLE MARKET, BY VEHICLE TYPE

- 4.3 ELECTRIC COMMERCIAL VEHICLE MARKET, BY PROPULSION

- 4.4 ELECTRIC COMMERCIAL VEHICLE MARKET, BY BATTERY TYPE

- 4.5 ELECTRIC COMMERCIAL VEHICLE MARKET, BY RANGE

- 4.6 ELECTRIC COMMERCIAL VEHICLE MARKET, BY BATTERY CAPACITY

- 4.7 ELECTRIC COMMERCIAL VEHICLE MARKET, BY POWER OUTPUT

- 4.8 ELECTRIC COMMERCIAL VEHICLE MARKET, BY END USE

- 4.9 ELECTRIC COMMERCIAL VEHICLE MARKET, BY BODY CONSTRUCTION

- 4.10 ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Decreasing cost of EV batteries

- 5.2.1.2 Rising fossil fuel prices

- 5.2.1.3 Increasing demand for emission-free electric commercial vehicles in logistics industry

- 5.2.1.4 Government initiatives promoting electric commercial vehicle adoption

- 5.2.2 RESTRAINTS

- 5.2.2.1 High development costs

- 5.2.2.2 Concerns over battery safety

- 5.2.2.3 Insufficient EV charging infrastructure

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 New revenue pockets in North America and Northern Europe

- 5.2.3.2 Development of wireless EV charging technology for on-the-go charging

- 5.2.4 CHALLENGES

- 5.2.4.1 Limited battery capacity

- 5.2.4.2 Low availability of lithium for EV batteries

- 5.2.4.3 Insufficient grid infrastructure

- 5.2.1 DRIVERS

- 5.3 PRICING ANALYSIS

- 5.3.1 AVERAGE SELLING PRICE TREND, BY VEHICLE TYPE

- 5.3.2 PRICING ANALYSIS, BY REGION

- 5.4 POTENTIAL ELECTRIC COMMERCIAL VEHICLE LAUNCHES BY OEMS

- 5.5 BILL OF MATERIALS

- 5.6 OEM SOURCING STRATEGIES

- 5.6.1 SOURCING STRATEGIES BY ELECTRIC COMMERCIAL VEHICLE OEMS

- 5.6.2 OEM MOTOR RATING ANALYSIS, BY RANGE

- 5.6.3 COMPETITIVE MARKET ASSESSMENT, BY PAYLOAD CAPACITY

- 5.7 SUPPLY CHAIN ANALYSIS

- 5.8 ECOSYSTEM MAPPING

- 5.8.1 EV CHARGING INFRASTRUCTURE PROVIDERS

- 5.8.2 COMPONENT MANUFACTURERS

- 5.8.3 TIER II SUPPLIERS

- 5.8.4 TIER I SUPPLIERS

- 5.8.5 RAW MATERIAL SUPPLIERS

- 5.8.6 OEMS

- 5.9 TOTAL COST OF OWNERSHIP

- 5.9.1 TOTAL COST OF OWNERSHIP: DIESEL VS. ELECTRIC BUSES

- 5.10 INSIGHTS ON ELECTRIC COMMERCIAL VEHICLES

- 5.10.1 RANGE/BATTERY CAPACITY

- 5.10.2 RANGE/END USE

- 5.10.3 BATTERY CAPACITY/END USE

- 5.10.4 POWER/CHARGING DURATION

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 ASSESSMENT OF INVESTMENT IN ELECTRIC BUSES

- 5.11.2 USER EXPERIENCE OF BATTERY-ELECTRIC TRUCKS IN NORWAY

- 5.11.3 ELECTRIC VEHICLE FLEETS FOR PUBLIC SECTOR IN VERMONT

- 5.12 INVESTMENT AND FUNDING SCENARIO

- 5.13 PATENT ANALYSIS

- 5.13.1 INTRODUCTION

- 5.14 TECHNOLOGY ANALYSIS

- 5.14.1 FUTURE TECHNOLOGY OVERVIEW

- 5.14.2 OFFBOARD TOP-DOWN PANTOGRAPH CHARGING SYSTEMS

- 5.14.3 ONBOARD BOTTOM-UP PANTOGRAPH CHARGING SYSTEMS

- 5.14.4 GROUND-BASED STATIC/DYNAMIC WIRELESS CHARGING SYSTEMS

- 5.14.5 PACKAGED FUEL CELL SYSTEM MODULES

- 5.14.6 METHANE FUEL CELLS

- 5.14.7 SMART CHARGING SYSTEMS

- 5.14.8 IOT IN ELECTRIC VEHICLES

- 5.14.9 SOLID-STATE BATTERIES

- 5.15 TRADE ANALYSIS

- 5.15.1 IMPORT SCENARIO (HS CODE 8702)

- 5.15.2 EXPORT SCENARIO (HS CODE 8702)

- 5.16 REGULATORY LANDSCAPE

- 5.16.1 COUNTRY-WISE REGULATIONS

- 5.16.1.1 Netherlands

- 5.16.1.2 Germany

- 5.16.1.3 France

- 5.16.1.4 UK

- 5.16.1.5 China

- 5.16.1.6 US

- 5.16.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.16.1 COUNTRY-WISE REGULATIONS

- 5.17 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.18 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.18.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.18.2 BUYING CRITERIA

- 5.19 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

6 ELECTRIC COMMERCIAL VEHICLE MARKET, BY VEHICLE TYPE

- 6.1 INTRODUCTION

- 6.1.1 OPERATIONAL DATA

- 6.2 PICKUP TRUCKS

- 6.2.1 INCREASED OFFERINGS FROM OEMS TO DRIVE MARKET

- 6.3 TRUCKS

- 6.3.1 DEVELOPMENT OF ELECTRIC TRUCKS BY AUTOMOTIVE OEMS TO DRIVE MARKET

- 6.3.1.1 Medium-duty trucks

- 6.3.1.2 Heavy-duty trucks

- 6.3.1 DEVELOPMENT OF ELECTRIC TRUCKS BY AUTOMOTIVE OEMS TO DRIVE MARKET

- 6.4 VANS

- 6.4.1 BOOMING LOGISTICS INDUSTRY TO DRIVE MARKET

- 6.4.1.1 Light vans

- 6.4.1.2 Full-size vans

- 6.4.1 BOOMING LOGISTICS INDUSTRY TO DRIVE MARKET

- 6.5 BUSES & COACHES

- 6.5.1 GROWING DEMAND FOR EMISSION-FREE PUBLIC TRANSPORT TO DRIVE MARKET

- 6.6 KEY INDUSTRY INSIGHTS

7 ELECTRIC COMMERCIAL VEHICLE MARKET, BY PROPULSION

- 7.1 INTRODUCTION

- 7.1.1 OPERATIONAL DATA

- 7.2 BEVS

- 7.2.1 ADVANCEMENTS IN BATTERY TECHNOLOGY TO DRIVE MARKET

- 7.3 FCEVS

- 7.3.1 ONGOING DEVELOPMENTS BY OEMS TO DRIVE MARKET

- 7.4 KEY INDUSTRY INSIGHTS

8 ELECTRIC COMMERCIAL VEHICLE MARKET, BY BATTERY TYPE

- 8.1 INTRODUCTION

- 8.2 NMC BATTERIES

- 8.2.1 HIGH DENSITY AND COMPACT SIZE TO DRIVE MARKET

- 8.3 LFP BATTERIES

- 8.3.1 AFFORDABILITY AND SUPERIOR SAFETY TO DRIVE MARKET

- 8.4 SOLID-STATE BATTERIES

- 8.4.1 FAST RECHARGING CAPABILITIES TO DRIVE MARKET

- 8.5 OTHERS

- 8.6 KEY INDUSTRY INSIGHTS

9 ELECTRIC COMMERCIAL VEHICLE MARKET, BY BATTERY CAPACITY

- 9.1 INTRODUCTION

- 9.2 LESS THAN 60 KWH

- 9.2.1 INCREASING ADOPTION OF COMPACT ELECTRIC VANS FOR LOCAL TRANSPORTATION TO DRIVE MARKET

- 9.3 60-120 KWH

- 9.3.1 NORTH AMERICAN GOVERNMENT POLICIES FOR ELECTRIFICATION OF TRANSPORTATION TO DRIVE MARKET

- 9.4 121-200 KWH

- 9.4.1 RISING ADOPTION OF ELECTRIFICATION IN TRANSPORT SECTOR TO DRIVE MARKET

- 9.5 201-300 KWH

- 9.5.1 IMPROVED DRIVING RANGE TO FUEL MARKET GROWTH

- 9.6 301-500 KWH

- 9.6.1 INCREASING PREFERENCE FOR LONG-HAUL ELECTRIC COMMERCIAL VEHICLES TO DRIVE MARKET

- 9.7 501-1,000 KWH

- 9.7.1 RISING E-COMMERCE AND RETAIL SECTORS TO DRIVE MARKET

- 9.8 KEY INDUSTRY INSIGHTS

10 ELECTRIC COMMERCIAL VEHICLE MARKET, BY POWER OUTPUT

- 10.1 INTRODUCTION

- 10.2 LESS THAN 100 KW

- 10.2.1 GROWING ADOPTION OF ELECTRIC VANS FOR DELIVERIES BY LOGISTICS INDUSTRY TO DRIVE MARKET

- 10.3 100-250 KW

- 10.3.1 INCREASING DEMAND FOR ELECTRIC TRUCKS AND BUSES TO DRIVE MARKET

- 10.4 ABOVE 250 KW

- 10.4.1 RISING DEMAND FOR HIGH-POWERED ELECTRIC TRUCKS AND PICKUP TRUCKS TO DRIVE MARKET

- 10.5 KEY INDUSTRY INSIGHTS

11 ELECTRIC COMMERCIAL VEHICLE MARKET, BY RANGE

- 11.1 INTRODUCTION

- 11.2 LESS THAN 150 MILES

- 11.2.1 E-COMMERCE BOOM AND DELIVERY DEMANDS TO DRIVE MARKET

- 11.3 151-300 MILES

- 11.3.1 RISING DEMAND FOR ELECTRIC TRUCKS FROM TRANSPORTATION INDUSTRY TO DRIVE MARKET

- 11.4 ABOVE 300 MILES

- 11.4.1 RISING ADOPTION OF ELECTRIC PICKUP TRUCKS TO DRIVE MARKET

- 11.5 KEY INDUSTRY INSIGHTS

12 ELECTRIC COMMERCIAL VEHICLE MARKET, BY END USE

- 12.1 INTRODUCTION

- 12.2 LAST-MILE DELIVERY

- 12.2.1 RISING DEMAND FOR VEHICLE ELECTRIFICATION IN E-COMMERCE SECTOR TO DRIVE MARKET

- 12.3 FIELD SERVICES

- 12.3.1 RISING DEMAND FOR GREEN MOBILITY IN FIELD SERVICES SECTOR TO DRIVE MARKET

- 12.4 DISTRIBUTION SERVICES

- 12.4.1 INCREASING RELIANCE ON DELIVERY SERVICES TO FUEL MARKET EXPANSION

- 12.5 LONG-HAUL TRANSPORTATION

- 12.5.1 PUSH FOR SUSTAINABLE TRANSPORTATION TO DRIVE MARKET

- 12.6 REFUSE TRUCKS

- 12.6.1 GROWING PUBLIC AWARENESS ABOUT RESPONSIBLE WASTE COLLECTION TO DRIVE MARKET

- 12.7 KEY INDUSTRY INSIGHTS

13 ELECTRIC COMMERCIAL VEHICLE MARKET, BY BODY CONSTRUCTION

- 13.1 INTRODUCTION

- 13.2 INTEGRATED

- 13.2.1 REDUCED PRODUCTION COSTS TO DRIVE MARKET

- 13.3 SEMI-INTEGRATED

- 13.3.1 IMPROVED STRUCTURAL STRENGTH TO DRIVE MARKET

- 13.4 FULL-SIZED

- 13.4.1 SPACIOUS CARGO CAPACITY TO DRIVE MARKET

- 13.5 KEY INDUSTRY INSIGHTS

14 ELECTRIC COMMERCIAL VEHICLE MARKET, BY COMPONENT

- 14.1 INTRODUCTION

- 14.2 BATTERY PACKS

- 14.3 ONBOARD CHARGERS

- 14.4 ELECTRIC MOTORS

- 14.5 INVERTERS

- 14.6 DC-DC CONVERTERS

- 14.7 FUEL-CELL STACKS

15 ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION

- 15.1 INTRODUCTION

- 15.2 ASIA PACIFIC

- 15.2.1 MACROECONOMIC OUTLOOK

- 15.2.2 CHINA

- 15.2.2.1 Predominance of leading players to drive market

- 15.2.3 JAPAN

- 15.2.3.1 Increased investments in automotive R&D to drive market

- 15.2.4 INDIA

- 15.2.4.1 Expansion of major OEMs to support market growth

- 15.2.5 SOUTH KOREA

- 15.2.5.1 Rising demand for electric pickup trucks to drive market

- 15.3 EUROPE

- 15.3.1 MACROECONOMIC OUTLOOK

- 15.3.2 FRANCE

- 15.3.2.1 Increased adoption of electric vans for delivery purposes to drive market

- 15.3.3 GERMANY

- 15.3.3.1 Setting up of charging corridors to drive market

- 15.3.4 SPAIN

- 15.3.4.1 Government focus on replacing existing bus and van fleets to drive market

- 15.3.5 AUSTRIA

- 15.3.5.1 Government incentives to drive market

- 15.3.6 NORWAY

- 15.3.6.1 Development of charging infrastructure to drive market

- 15.3.7 SWEDEN

- 15.3.7.1 Presence of market-leading OEMs and startups to drive market

- 15.3.8 NETHERLANDS

- 15.3.8.1 Advancement in EV charging infrastructure to drive market

- 15.3.9 UK

- 15.3.9.1 Government electrification roadmap to drive market

- 15.3.10 ITALY

- 15.3.10.1 Advancements in electric commercial vehicles to drive market

- 15.3.11 OTHERS

- 15.4 NORTH AMERICA

- 15.4.1 MACROECONOMIC OUTLOOK

- 15.4.2 US

- 15.4.2.1 Rising adoption of electric vans to drive market

- 15.4.3 CANADA

- 15.4.3.1 Government plans to electrify transit to drive market

16 COMPETITIVE LANDSCAPE

- 16.1 OVERVIEW

- 16.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 16.2.1 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN ELECTRIC COMMERCIAL VEHICLES MARKET

- 16.3 MARKET SHARE ANALYSIS, 2024

- 16.4 REVENUE ANALYSIS, 2019-2023

- 16.5 COMPANY VALUATION AND FINANCIAL METRICS

- 16.5.1 COMPANY VALUATION

- 16.5.2 FINANCIAL METRICS

- 16.6 ELECTRIC BUS COMPARISON BY OEMS

- 16.7 BRAND/PRODUCT COMPARISON

- 16.8 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 16.8.1 STARS

- 16.8.2 EMERGING LEADERS

- 16.8.3 PERVASIVE PLAYERS

- 16.8.4 PARTICIPANTS

- 16.8.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 16.8.5.1 Company Footprint

- 16.8.5.2 Regional Footprint

- 16.8.5.3 Vehicle Type Footprint

- 16.8.5.4 Propulsion Type Footprint

- 16.8.5.5 Battery Type Footprint

- 16.9 COMPANY EVALUATION MATRIX: STARTUPS/SMES , 2024

- 16.9.1 PROGRESSIVE COMPANIES

- 16.9.2 RESPONSIVE COMPANIES

- 16.9.3 DYNAMIC COMPANIES

- 16.9.4 STARTING BLOCKS

- 16.9.5 COMPETITIVE BENCHMARKING, STARTUPS/SMES, 2024

- 16.9.5.1 Detailed list of key startups/SMEs

- 16.10 COMPETITIVE SCENARIO

- 16.10.1 PRODUCT LAUNCHES

- 16.10.2 DEALS

- 16.10.3 EXPANSIONS

- 16.10.4 OTHER DEVELOPMENTS

17 COMPANY PROFILES

- 17.1 KEY PLAYERS

- 17.1.1 BYD

- 17.1.1.1 Business overview

- 17.1.1.2 Products offered

- 17.1.1.3 Recent developments

- 17.1.1.3.1 Product launches

- 17.1.1.3.2 Deals

- 17.1.1.3.3 Expansions

- 17.1.1.3.4 Other developments

- 17.1.1.4 MnM view

- 17.1.1.4.1 Key strengths

- 17.1.1.4.2 Strategic choices

- 17.1.1.4.3 Weaknesses and competitive threats

- 17.1.2 MERCEDES-BENZ GROUP AG

- 17.1.2.1 Business overview

- 17.1.2.2 Products offered

- 17.1.2.3 Recent developments

- 17.1.2.3.1 Product launches

- 17.1.2.3.2 Deals

- 17.1.2.3.3 Expansions

- 17.1.2.3.4 Other developments

- 17.1.2.4 MnM view

- 17.1.2.4.1 Key strengths

- 17.1.2.4.2 Strategic choices

- 17.1.2.4.3 Weaknesses and competitive threats

- 17.1.3 YUTONG BUS CO., LTD.

- 17.1.3.1 Business overview

- 17.1.3.2 Products offered

- 17.1.3.3 Recent developments

- 17.1.3.3.1 Product launches

- 17.1.3.3.2 Deals

- 17.1.3.3.3 Expansions

- 17.1.3.4 Other developments

- 17.1.3.5 MnM view

- 17.1.3.5.1 Key strengths

- 17.1.3.5.2 Strategic choices

- 17.1.3.5.3 Weaknesses and competitive threats

- 17.1.4 AB VOLVO

- 17.1.4.1 Business overview

- 17.1.4.2 Products offered

- 17.1.4.3 Recent developments

- 17.1.4.3.1 Product launches

- 17.1.4.3.2 Deals

- 17.1.4.3.3 Expansions

- 17.1.4.4 MnM view

- 17.1.4.4.1 Key strengths

- 17.1.4.4.2 Strategic choices

- 17.1.4.4.3 Weaknesses and competitive threats

- 17.1.5 FORD MOTOR COMPANY

- 17.1.5.1 Business overview

- 17.1.5.2 Products offered

- 17.1.5.3 Recent developments

- 17.1.5.3.1 Product launches

- 17.1.5.3.2 Deals

- 17.1.5.3.3 Expansions

- 17.1.5.3.4 Other developments

- 17.1.5.4 MnM view

- 17.1.5.4.1 Key strengths

- 17.1.5.4.2 Strategic choices

- 17.1.5.4.3 Weaknesses and competitive threats

- 17.1.6 TESLA, INC.

- 17.1.6.1 Business overview

- 17.1.6.2 Products offered

- 17.1.6.3 Recent development

- 17.1.6.3.1 Product launches

- 17.1.6.3.2 Deals

- 17.1.6.3.3 Expansions

- 17.1.7 RENAULT

- 17.1.7.1 Business overview

- 17.1.7.2 Products offered

- 17.1.7.3 Recent development

- 17.1.7.3.1 Product launches

- 17.1.7.3.2 Deals

- 17.1.7.3.3 Expansions

- 17.1.7.3.4 Other developments

- 17.1.8 PACCAR INC.

- 17.1.8.1 Business overview

- 17.1.8.2 Products offered

- 17.1.8.3 Recent developments

- 17.1.8.3.1 Product launches

- 17.1.8.3.2 Deals

- 17.1.8.3.3 Expansions

- 17.1.8.3.4 Other developments

- 17.1.9 SCANIA AB

- 17.1.9.1 Business overview

- 17.1.9.2 Products offered

- 17.1.9.3 Recent developments

- 17.1.9.3.1 Product launches

- 17.1.9.3.2 Deals

- 17.1.9.3.3 Expansions

- 17.1.9.3.4 Other developments

- 17.1.10 DONGFENG MOTOR CORPORATION

- 17.1.10.1 Business overview

- 17.1.10.2 Products offered

- 17.1.10.3 Recent developments

- 17.1.10.3.1 Product launches

- 17.1.10.3.2 Deals

- 17.1.10.3.3 Expansions

- 17.1.10.3.4 Other developments

- 17.1.11 GENERAL MOTORS

- 17.1.11.1 Business overview

- 17.1.11.2 Products offered

- 17.1.11.3 Recent developments

- 17.1.11.3.1 Product launches

- 17.1.11.3.2 Deals

- 17.1.11.3.3 Expansions

- 17.1.11.3.4 Other developments

- 17.1.12 VDL GROEP

- 17.1.12.1 Business overview

- 17.1.12.2 Products offered

- 17.1.12.3 Recent developments

- 17.1.12.3.1 Product launches

- 17.1.12.3.2 Deals

- 17.1.12.3.3 Expansions

- 17.1.12.3.4 Other developments

- 17.1.13 RIVIAN

- 17.1.13.1 Business overview

- 17.1.13.2 Products offered

- 17.1.13.3 Recent developments

- 17.1.13.3.1 Product launches

- 17.1.13.3.2 Deals

- 17.1.13.3.3 Expansions

- 17.1.1 BYD

- 17.2 OTHER PLAYERS

- 17.2.1 TATA MOTORS LIMITED

- 17.2.2 WORKHORSE GROUP

- 17.2.3 NIKOLA CORPORATION

- 17.2.4 ASHOK LEYLAND

- 17.2.5 ISUZU MOTORS LTD.

- 17.2.6 IRIZAR GROUP

- 17.2.7 IVECO

- 17.2.8 BOLLINGER MOTORS

- 17.2.9 XOS TRUCKS INC.

- 17.2.10 MAN SE

- 17.2.11 GOLDEN DRAGON

- 17.2.12 ZENITH MOTORS

- 17.2.13 ARRIVAL

- 17.2.14 LORDSTOWN MOTORS

18 RECOMMENDATIONS BY MARKETSANDMARKETS

- 18.1 ASIA PACIFIC TO BE SIGNIFICANT MARKET FOR ELECTRIC COMMERCIAL VEHICLES

- 18.2 LESS THAN 150 MILES TO EMERGE AS LARGEST MARKET SEGMENT

- 18.3 NMC BATTERIES TO BE PROMISING SEGMENT

- 18.4 CONCLUSION

19 APPENDIX

- 19.1 KEY INSIGHTS FROM INDUSTRY EXPERTS

- 19.2 DISCUSSION GUIDE

- 19.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 19.4 CUSTOMIZATION OPTIONS

- 19.4.1 PROFILING OF ADDITIONAL MARKET PLAYERS (UP TO 5)

- 19.4.2 ELECTRIC COMMERCIAL VEHICLE MARKET, BY END USE, AT REGIONAL LEVEL

- 19.4.3 ELECTRIC COMMERCIAL VEHICLE MARKET, BY BODY CONSTRUCTION AT REGIONAL LEVEL

- 19.5 RELATED REPORTS

- 19.6 AUTHOR DETAILS