|

|

市場調査レポート

商品コード

1764341

開閉装置の世界市場:絶縁別、設置別、電圧別、電流別、エンドユーザー別、地域別 - 2030年までの予測Switchgear Market by Insulation (Gas-insulated, Air-insulated), Installation (Indoor, Outdoor), Current, Voltage (Low, Medium, High), End User (T&D Utilities, Industries, Commercial & Residential, Data center) and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 開閉装置の世界市場:絶縁別、設置別、電圧別、電流別、エンドユーザー別、地域別 - 2030年までの予測 |

|

出版日: 2025年07月04日

発行: MarketsandMarkets

ページ情報: 英文 351 Pages

納期: 即納可能

|

- 全表示

- 概要

- 図表

- 目次

開閉装置の市場規模は、2025年の1,037億1,000万米ドルから2030年には1,366億5,000万米ドルに成長すると予測され、予測期間中のCAGRは5.7%になるとみられています。

この成長の原動力は、電力需要の増加、急速な都市化、再生可能エネルギーの拡大、進行中の送電網近代化への取り組みです。しかし市場は、初期導入コストの高さ、サプライチェーンの混乱、開閉装置の種類によっては使用されるSF6ガスに関する環境問題などの抑制要因に直面しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 対象ユニット | 金額(100万米ドル/10億米ドル)、数量(1,000台) |

| セグメント別 | 絶縁別、設置別、電圧別電流別、エンドユーザー別、地域別 |

| 対象地域 | 北米、アジア太平洋、欧州、南米、中東・アフリカ |

予測期間中、中電圧(2~36kV)セグメントは、都市インフラ、産業施設、商業ビル、再生可能エネルギープロジェクトの配電において重要な役割を果たすため、世界の開閉装置市場で最も急成長しているセグメントです。都市が拡大し、スマートグリッドが進化するにつれて、局所的な配電を効率的かつ安全に管理するために高圧開閉装置の導入が増加しています。さらに、世界各国の政府は、エネルギー・アクセスを改善し、送電ロスを削減し、屋上太陽光発電や蓄電池システムなどの分散型エネルギー資源をサポートするため、高圧ネットワークの強化に投資しています。新興経済諸国、特にアジア太平洋とアフリカでは、農村部の電化と産業開発が加速しており、需要をさらに押し上げています。さらに、電気自動車充電インフラ、地下鉄プロジェクト、デジタル変電所の台頭が、コンパクトで信頼性が高く、自動化対応の高圧開閉装置の必要性を煽っています。

電流別では、世界の発電、送電、配電システムで使用される電気の主流であるため、ACセグメントが世界の開閉装置市場で最大のシェアを占めています。長距離送電の効率と変圧器による電圧変換の容易さから、ほとんどの国家送電網は交流で運用されています。その結果、電力会社や産業プラントから商業ビルや住宅に至るまで、電気インフラのほとんどが交流システムを中心に設計されています。このような広範な採用が、あらゆる電圧レベルのAC開閉装置に対する一貫した需要を後押ししています。さらに、風力発電や水力発電のような再生可能エネルギー発電の拡大も、AC開閉装置の世界市場の優位性をさらに強めています。

予測期間中、アジア太平洋は、急速な都市化、産業拡大、中国、インド、オーストラリア、日本などの新興国における電力インフラへの大規模な投資により、世界の開閉装置市場で最大かつ急成長するセグメントとなると予測されています。同地域では、人口増加、所得向上、農村部の電化の進展により、電力需要が大幅に伸びています。各国政府は、送電網の近代化、スマートシティ、再生可能エネルギーの統合に多額の投資を行っており、これらすべてにおいて開閉装置システムの大規模な導入が必要とされています。さらに、インドの配電部門刷新計画(RDSS)や中国の5ヵ年計画など、強力な製造基盤と支援的な政策枠組みが、公益事業や産業用途の高圧・高圧開閉装置の需要をさらに押し上げています。

当レポートでは、世界の開閉装置市場について調査し、絶縁別、設置別、電圧別電流別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客ビジネスに影響を与える動向/混乱

- 価格分析

- サプライチェーン分析

- エコシステム分析

- 技術分析

- 特許分析

- 貿易分析

- 2022年~2024年の主な会議とイベント

- 関税と規制状況

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- 投資と資金調達のシナリオ

- ケーススタディ分析

- 生成AI/AIが開閉装置市場に与える影響

- 開閉装置市場のマクロ経済見通し

- 2025年の米国関税の影響- 概要

第6章 開閉装置市場(絶縁別)

- イントロダクション

- 空気絶縁開閉装置

- ガス絶縁開閉装置

- その他

第7章 開閉装置市場(設置別)

- イントロダクション

- 屋内

- 屋外

第8章 開閉装置市場(電圧別)

- イントロダクション

- 低(最大1KV)

- 中(2~36 KV)

- 高(36KV以上)

第9章 開閉装置市場(電流別)

- イントロダクション

- AC

- DC

第10章 開閉装置市場(エンドユーザー別)

- イントロダクション

- 送電・配電設備

- 工業

- 商業施設および住宅

- 水と廃水

- データセンター

- その他

第11章 開閉装置市場(地域別)

- イントロダクション

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- その他

- 北米

- 米国

- カナダ

- メキシコ

- 中東・アフリカ

- GCC

- エジプト

- 南アフリカ

- その他

- 南米

- ブラジル

- アルゼンチン

- その他

第12章 競合情勢

- 概要

- 主要参入企業の戦略/強み、2022年~2025年

- 市場シェア分析、2024年

- 収益分析、2020年~2024年

- 企業評価と財務指標

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

第13章 企業プロファイル

- 主要参入企業

- SCHNEIDER ELECTRIC

- SIEMENS

- ABB

- HITACHI, LTD.

- EATON

- GE VERNOVA

- MITSUBISHI ELECTRIC CORPORATION

- POWELL INDUSTRIES

- HUBBELL

- HD HYUNDAI ELECTRIC CO., LTD.

- TOSHIBA CORPORATION

- BHARAT HEAVY ELECTRICALS LIMITED

- CG POWER & INDUSTRIAL SOLUTIONS LTD.

- HYOSUNG HEAVY INDUSTRIES

- FUJI ELECTRIC CO., LTD.

- WEG

- DOHO ELECTRIC

- LUCY GROUP LTD.

- LS ELECTRIC CO., LTD

- CHINT GROUP

- その他の企業

- SECHERON

- ELEKTROBUDOWA

- MEIDENSHA CORPORATION

- ORMAZABAL

- ALFANAR GROUP

第14章 付録

List of Tables

- TABLE 1 SWITCHGEAR MARKET SNAPSHOT

- TABLE 2 GLOBAL WARMING POTENTIAL OF GREENHOUSE GASES (100-YEAR TIME HORIZON)

- TABLE 3 AVERAGE SELLING PRICE TREND OF SWITCHGEAR, BY REGION, 2021-2024

- TABLE 4 PRICING RANGE OF SWITCHGEAR, BY VOLTAGE, 2024

- TABLE 5 SWITCHGEAR MARKET: ROLE OF COMPANIES IN SWITCHGEAR ECOSYSTEM

- TABLE 6 LIST OF MAJOR PATENTS PERTAINING TO SWITCHGEAR MARKET, 2022-2025

- TABLE 7 IMPORT SCENARIO FOR HS CODE 853590-COMPLIANT PRODUCTS, BY COUNTRY, 2022-2024 (USD THOUSAND)

- TABLE 8 EXPORT SCENARIO FOR HS CODE 853590-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2022 (USD THOUSAND)

- TABLE 9 IMPORT SCENARIO FOR HS CODE 853690-COMPLIANT PRODUCTS, BY COUNTRY, 2022-2024 (USD THOUSAND)

- TABLE 10 EXPORT SCENARIO FOR HS CODE 853690-COMPLIANT PRODUCTS, BY COUNTRY, 2022-2024 (USD THOUSAND)

- TABLE 11 LIST OF KEY CONFERENCES AND EVENTS, 2022-2024

- TABLE 12 IMPORT TARIFF FOR HS CODE 853590-COMPLIANT PRODUCTS, 2024

- TABLE 13 IMPORT TARIFF FOR HS CODE 853690-COMPLIANT PRODUCTS, 2024

- TABLE 14 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 SWITCHGEAR: CODES AND REGULATIONS

- TABLE 20 SWITCHGEAR MARKET: IMPACT OF PORTER'S FIVE FORCES

- TABLE 21 INFLUENCE OF KEY STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE END USERS (%)

- TABLE 22 KEY BUYING CRITERIA FOR TOP THREE END USERS

- TABLE 23 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 24 KEY PRODUCT-RELATED TARIFFS EFFECTIVE FOR SWITCHGEAR

- TABLE 25 EXPECTED CHANGE IN PRICES AND LIKELY IMPACT ON END USER MARKET DUE TO TARIFF IMPACT

- TABLE 26 SWITCHGEAR MARKET, BY INSULATION, 2021-2024 (USD BILLION)

- TABLE 27 SWITCHGEAR MARKET, BY INSULATION,2025-2030 (USD BILLION)

- TABLE 28 AIR-INSULATED SWITCHGEAR: SWITCHGEAR MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 29 AIR-INSULATED SWITCHGEAR: SWITCHGEAR MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 30 GAS-INSULATED SWITCHGEAR: SWITCHGEAR MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 31 GAS-INSULATED SWITCHGEAR: SWITCHGEAR MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 32 OTHER INUSLATION TYPES: SWITCHGEAR MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 33 OTHER INUSLATION TYPES: SWITCHGEAR MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 34 SWITCHGEAR MARKET, BY INSTALLATION, 2021-2024 (USD BILLION)

- TABLE 35 SWITCHGEAR MARKET, BY INSTALLATION, 2025-2030 (USD BILLION)

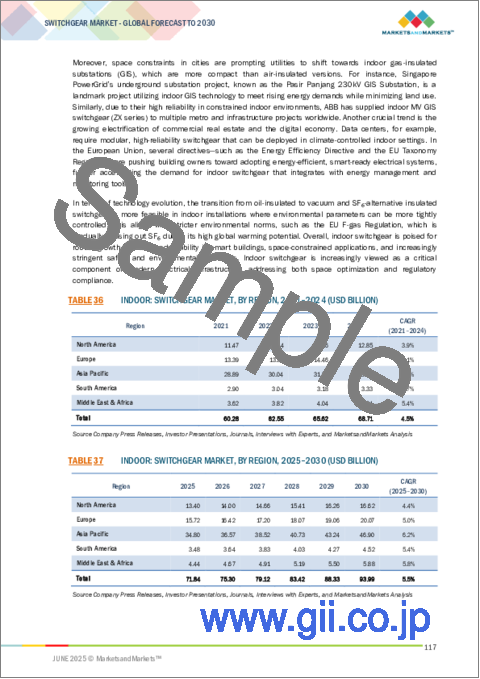

- TABLE 36 INDOOR: SWITCHGEAR MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 37 INDOOR: SWITCHGEAR MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 38 OUTDOOR: SWITCHGEAR MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 39 OUTDOOR: SWITCHGEAR MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 40 SWITCHGEAR MARKET, BY VOLTAGE, 2021-2024 (USD BILLION)

- TABLE 41 SWITCHGEAR MARKET, BY VOLTAGE, 2025-2030 (USD BILLION)

- TABLE 42 LOW (UP TO 1 KV): SWITCHGEAR MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 43 LOW (UP TO 1 KV): SWITCHGEAR MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 44 MEDIUM (2-36 KV): SWITCHGEAR MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 45 MEDIUM (2-36 KV): SWITCHGEAR MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 46 HIGH (ABOVE 36 KV): SWITCHGEAR MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 47 HIGH (ABOVE 36 KV): SWITCHGEAR MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 48 SWITCHGEAR MARKET, BY CURRENT, 2021-2024 (USD BILLION)

- TABLE 49 SWITCHGEAR MARKET, BY CURRENT, 2025-2030 (USD BILLION)

- TABLE 50 AC: SWITCHGEAR MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 51 AC: SWITCHGEAR MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 52 DC: SWITCHGEAR MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 53 DC: SWITCHGEAR MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 54 SWITCHGEAR MARKET, BY END USER, 2021-2024 (USD BILLION)

- TABLE 55 SWITCHGEAR MARKET, BY END USER, 2025-2030 (USD BILLION)

- TABLE 56 TRANSMISSION & DISTRIBUTION UTILITIES: SWITCHGEAR MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 57 TRANSMISSION & DISTRIBUTION UTILITIES: SWITCHGEAR MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 58 INDUSTRIAL: SWITCHGEAR MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 59 INDUSTRIAL: SWITCHGEAR MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 60 COMMERCIAL & RESIDENTIAL: SWITCHGEAR MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 61 COMMERCIAL & RESIDENTIAL: SWITCHGEAR MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 62 WATER & WASTEWATER: SWITCHGEAR MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 63 WATER & WASTEWATER: SWITCHGEAR MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 64 DATA CENTERS: SWITCHGEAR MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 65 DATA CENTERS: SWITCHGEAR MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 66 OTHER END USERS: SWITCHGEAR MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 67 OTHER END USERS: SWITCHGEAR MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 68 SWITCHGEAR MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 69 SWITCHGEAR MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 70 SWITCHGEAR MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 71 SWITCHGEAR MARKET, BY REGION, 2025-2030 (UNITS)

- TABLE 72 ASIA PACIFIC: SWITCHGEAR MARKET, BY INSULATION, 2021-2024 (USD BILLION)

- TABLE 73 ASIA PACIFIC: SWITCHGEAR MARKET, BY INSULATION, 2025-2030 (USD BILLION)

- TABLE 74 ASIA PACIFIC: SWITCHGEAR MARKET, BY INSTALLATION, 2021-2024 (USD BILLION)

- TABLE 75 ASIA PACIFIC: SWITCHGEAR MARKET, BY INSTALLATION, 2025-2030 (USD BILLION)

- TABLE 76 ASIA PACIFIC: SWITCHGEAR MARKET, BY VOLTAGE, 2021-2024 (USD BILLION)

- TABLE 77 ASIA PACIFIC: SWITCHGEAR MARKET, BY VOLTAGE, 2025-2030 (USD BILLION)

- TABLE 78 ASIA PACIFIC: SWITCHGEAR MARKET, BY CURRENT, 2021-2024 (USD BILLION)

- TABLE 79 ASIA PACIFIC: SWITCHGEAR MARKET, BY CURRENT, 2025-2030 (USD BILLION)

- TABLE 80 ASIA PACIFIC: SWITCHGEAR MARKET, BY END USER, 2021-2024 (USD BILLION)

- TABLE 81 ASIA PACIFIC: SWITCHGEAR MARKET, BY END USER, 2025-2030 (USD BILLION)

- TABLE 82 ASIA PACIFIC: SWITCHGEAR MARKET, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 83 ASIA PACIFIC: SWITCHGEAR MARKET, BY COUNTRY, 2025-2030 (USD BILLION)

- TABLE 84 CHINA: SWITCHGEAR MARKET, BY END USER, 2021-2024 (USD BILLION)

- TABLE 85 CHINA: SWITCHGEAR MARKET, BY END USER, 2025-2030 (USD BILLION)

- TABLE 86 INDIA: SWITCHGEAR MARKET, BY END USER, 2021-2024 (USD BILLION)

- TABLE 87 INDIA: SWITCHGEAR MARKET, BY END USER, 2025-2030 (USD BILLION)

- TABLE 88 JAPAN: SWITCHGEAR MARKET, BY END USER, 2021-2024 (USD BILLION)

- TABLE 89 JAPAN: SWITCHGEAR MARKET, BY END USER, 2025-2030 (USD BILLION)

- TABLE 90 AUSTRALIA: SWITCHGEAR MARKET, BY END USER, 2021-2024 (USD BILLION)

- TABLE 91 AUSTRALIA: SWITCHGEAR MARKET, BY END USER, 2025-2030 (USD BILLION)

- TABLE 92 REST OF ASIA PACIFIC: SWITCHGEAR MARKET, BY END USER, 2021-2024 (USD BILLION)

- TABLE 93 REST OF ASIA PACIFIC: SWITCHGEAR MARKET, BY END USER, 2025-2030 (USD BILLION)

- TABLE 94 EUROPE: SWITCHGEAR MARKET, BY INSULATION, 2021-2024 (USD BILLION)

- TABLE 95 EUROPE: SWITCHGEAR MARKET, BY INSULATION, 2025-2030 (USD BILLION)

- TABLE 96 EUROPE: SWITCHGEAR MARKET, BY INSTALLATION, 2021-2024 (USD BILLION)

- TABLE 97 EUROPE: SWITCHGEAR MARKET, BY INSTALLATION, 2025-2030 (USD BILLION)

- TABLE 98 EUROPE: SWITCHGEAR MARKET, BY VOLTAGE, 2021-2024 (USD BILLION)

- TABLE 99 EUROPE: SWITCHGEAR MARKET, BY VOLTAGE, 2025-2030 (USD BILLION)

- TABLE 100 EUROPE: SWITCHGEAR MARKET, BY CURRENT, 2021-2024 (USD BILLION)

- TABLE 101 EUROPE: SWITCHGEAR MARKET, BY CURRENT, 2025-2030 (USD BILLION)

- TABLE 102 EUROPE: SWITCHGEAR MARKET, BY END USER, 2021-2024 (USD BILLION)

- TABLE 103 EUROPE: SWITCHGEAR MARKET, BY END USER, 2025-2030 (USD BILLION)

- TABLE 104 EUROPE: SWITCHGEAR MARKET, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 105 EUROPE: SWITCHGEAR MARKET, BY COUNTRY, 2025-2030 (USD BILLION)

- TABLE 106 GERMANY: SWITCHGEAR MARKET, BY END USER, 2021-2024 (USD BILLION)

- TABLE 107 GERMANY: SWITCHGEAR MARKET, BY END USER, 2025-2030 (USD BILLION)

- TABLE 108 UK: SWITCHGEAR MARKET, BY END USER, 2021-2024 (USD BILLION)

- TABLE 109 UK: SWITCHGEAR MARKET, BY END USER, 2025-2030 (USD BILLION)

- TABLE 110 FRANCE: SWITCHGEAR MARKET, BY END USER, 2021-2024 (USD BILLION)

- TABLE 111 FRANCE: SWITCHGEAR MARKET, BY END USER, 2025-2030 (USD BILLION)

- TABLE 112 ITALY: SWITCHGEAR MARKET, BY END USER, 2021-2024 (USD BILLION)

- TABLE 113 ITALY: SWITCHGEAR MARKET, BY END USER, 2025-2030 (USD BILLION)

- TABLE 114 REST OF EUROPE: SWITCHGEAR MARKET, BY END USER, 2021-2024 (USD BILLION)

- TABLE 115 REST OF EUROPE: SWITCHGEAR MARKET, BY END USER, 2025-2030 (USD BILLION)

- TABLE 116 NORTH AMERICA: SWITCHGEAR MARKET, BY INSULATION, 2021-2024 (USD BILLION)

- TABLE 117 NORTH AMERICA: SWITCHGEAR MARKET, BY INSULATION, 2025-2030 (USD BILLION)

- TABLE 118 NORTH AMERICA: SWITCHGEAR MARKET, BY INSTALLATION, 2021-2024 (USD BILLION)

- TABLE 119 NORTH AMERICA: SWITCHGEAR MARKET, BY INSTALLATION, 2025-2030 (USD BILLION)

- TABLE 120 NORTH AMERICA: SWITCHGEAR MARKET, BY VOLTAGE, 2021-2024 (USD BILLION)

- TABLE 121 NORTH AMERICA: SWITCHGEAR MARKET, BY VOLTAGE, 2025-2030 (USD BILLION)

- TABLE 122 NORTH AMERICA: SWITCHGEAR MARKET, BY CURRENT, 2021-2024 (USD BILLION)

- TABLE 123 NORTH AMERICA: SWITCHGEAR MARKET, BY CURRENT, 2025-2030 (USD BILLION)

- TABLE 124 NORTH AMERICA: SWITCHGEAR MARKET, BY END USER, 2021-2024 (USD BILLION)

- TABLE 125 NORTH AMERICA: SWITCHGEAR MARKET, BY END USER, 2025-2030 (USD BILLION)

- TABLE 126 NORTH AMERICA: SWITCHGEAR MARKET, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 127 NORTH AMERICA: SWITCHGEAR MARKET, BY COUNTRY, 2025-2030 (USD BILLION)

- TABLE 128 US: SWITCHGEAR MARKET, BY END USER, 2021-2024 (USD BILLION)

- TABLE 129 US: SWITCHGEAR MARKET, BY END USER, 2025-2030 (USD BILLION)

- TABLE 130 CANADA: SWITCHGEAR MARKET, BY END USER, 2021-2024 (USD BILLION)

- TABLE 131 CANADA: SWITCHGEAR MARKET, BY END USER, 2025-2030 (USD BILLION)

- TABLE 132 MEXICO: SWITCHGEAR MARKET, BY END USER, 2021-2024 (USD BILLION)

- TABLE 133 MEXICO: SWITCHGEAR MARKET, BY END USER, 2025-2030 (USD BILLION)

- TABLE 134 MIDDLE EAST & AFRICA: SWITCHGEAR MARKET, BY INSULATION, 2021-2024 (USD BILLION)

- TABLE 135 MIDDLE EAST & AFRICA: SWITCHGEAR MARKET, BY INSULATION, 2025-2030 (USD BILLION)

- TABLE 136 MIDDLE EAST & AFRICA: SWITCHGEAR MARKET, BY INSTALLATION, 2021-2024 (USD BILLION)

- TABLE 137 MIDDLE EAST & AFRICA: SWITCHGEAR MARKET, BY INSTALLATION, 2025-2030 (USD BILLION)

- TABLE 138 MIDDLE EAST & AFRICA: SWITCHGEAR MARKET, BY VOLTAGE, 2021-2024 (USD BILLION)

- TABLE 139 MIDDLE EAST & AFRICA: SWITCHGEAR MARKET, BY VOLTAGE, 2025-2030 (USD BILLION)

- TABLE 140 MIDDLE EAST & ARICA: SWITCHGEAR MARKET, BY CURRENT, 2021-2024 (USD BILLION)

- TABLE 141 MIDDLE EAST & AFRICA: SWITCHGEAR MARKET, BY CURRENT, 2025-2030 (USD BILLION)

- TABLE 142 MIDDLE EAST & AFRICA: SWITCHGEAR MARKET, BY END USER, 2021-2024 (USD BILLION)

- TABLE 143 MIDDLE EAST & AFRICA: SWITCHGEAR MARKET, BY END USER, 2025-2030 (USD BILLION)

- TABLE 144 MIDDLE EAST & AFRICA: SWITCHGEAR MARKET, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 145 MIDDLE EAST & AFRICA: SWITCHGEAR MARKET, BY COUNTRY, 2025-2030 (USD BILLION)

- TABLE 146 GCC: SWITCHGEAR MARKET, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 147 GCC: SWITCHGEAR MARKET, BY COUNTRY, 2025-2030 (USD BILLION)

- TABLE 148 UAE: SWITCHGEAR MARKET, BY END USER, 2021-2024 (USD BILLION)

- TABLE 149 UAE: SWITCHGEAR MARKET, BY END USER, 2025-2030 (USD BILLION)

- TABLE 150 SAUDI ARABIA: SWITCHGEAR MARKET, BY END USER, 2021-2024 (USD BILLION)

- TABLE 151 SAUDI ARABIA: SWITCHGEAR MARKET, BY END USER, 2025-2030 (USD BILLION)

- TABLE 152 REST OF GCC: SWITCHGEAR MARKET, BY END USER, 2021-2024 (USD BILLION)

- TABLE 153 REST OF GCC: SWITCHGEAR MARKET, BY END USER, 2025-2030 (USD BILLION)

- TABLE 154 EGYPT: SWITCHGEAR MARKET, BY END USER, 2021-2024 (USD BILLION)

- TABLE 155 EGYPT: SWITCHGEAR MARKET, BY END USER, 2025-2030 (USD BILLION)

- TABLE 156 SOUTH AFRICA: SWITCHGEAR MARKET, BY END USER, 2021-2024 (USD BILLION)

- TABLE 157 SOUTH AFRICA: SWITCHGEAR MARKET, BY END USER, 2025-2030 (USD BILLION)

- TABLE 158 REST OF MIDDLE EAST & AFRICA: SWITCHGEAR MARKET, BY END USER, 2021-2024 (USD BILLION)

- TABLE 159 REST OF MIDDLE EAST & AFRICA: SWITCHGEAR MARKET, BY END USER, 2025-2030 (USD BILLION)

- TABLE 160 SOUTH AMERICA: SWITCHGEAR MARKET, BY INSULATION, 2021-2024 (USD BILLION)

- TABLE 161 SOUTH AMERICA: SWITCHGEAR MARKET, BY INSULATION, 2025-2030 (USD BILLION)

- TABLE 162 SOUTH AMERICA: SWITCHGEAR MARKET, BY INSTALLATION, 2021-2024 (USD BILLION)

- TABLE 163 SOUTH AMERICA: SWITCHGEAR MARKET, BY INSTALLATION, 2025-2030 (USD BILLION)

- TABLE 164 SOUTH AMERICA: SWITCHGEAR MARKET, BY VOLTAGE, 2021-2024 (USD BILLION)

- TABLE 165 SOUTH AMERICA: SWITCHGEAR MARKET, BY VOLTAGE, 2025-2030 (USD BILLION)

- TABLE 166 SOUTH AMERICA: SWITCHGEAR MARKET, BY CURRENT, 2021-2024 (USD BILLION)

- TABLE 167 SOUTH AMERICA: SWITCHGEAR MARKET, BY CURRENT, 2025-2030 (USD BILLION)

- TABLE 168 SOUTH AMERICA: SWITCHGEAR MARKET, BY END USER, 2021-2024 (USD BILLION)

- TABLE 169 SOUTH AMERICA: SWITCHGEAR MARKET, BY END USER, 2025-2030 (USD BILLION)

- TABLE 170 SOUTH AMERICA: SWITCHGEAR MARKET, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 171 SOUTH AMERICA: SWITCHGEAR MARKET, BY COUNTRY, 2025-2030 (USD BILLION)

- TABLE 172 BRAZIL: SWITCHGEAR MARKET, BY END USER, 2021-2024 (USD BILLION)

- TABLE 173 BRAZIL: SWITCHGEAR MARKET, BY END USER, 2025-2030 (USD BILLION)

- TABLE 174 ARGENTINA: SWITCHGEAR MARKET, BY END USER, 2021-2024 (USD BILLION)

- TABLE 175 ARGENTINA: SWITCHGEAR MARKET, BY END USER, 2025-2030 (USD BILLION)

- TABLE 176 REST OF SOUTH AMERICA: SWITCHGEAR MARKET, BY END USER, 2021-2024 (USD BILLION)

- TABLE 177 REST OF SOUTH AMERICA: SWITCHGEAR MARKET, BY END USER, 2025-2030 (USD BILLION)

- TABLE 178 SWITCHGEAR MARKET: OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS, MAY 2022-JUNE 2025

- TABLE 179 SWITCHGEAR MARKET: DEGREE OF COMPETITION

- TABLE 180 SWITCHGEAR MARKET: REGION FOOTPRINT

- TABLE 181 SWITCHGEAR MARKET: INSULATION FOOTPRINT

- TABLE 182 SWITCHGEAR MARKET: INSTALLATION FOOTPRINT

- TABLE 183 SWITCHGEAR MARKET: END USE FOOTPRINT

- TABLE 184 SWITCHGEAR MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 185 SWITCHGEAR MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 186 SWITCHGEAR MARKET: PRODUCT LAUNCHES, MAY 2022-JUNE 2025

- TABLE 187 SWITCHGEAR MARKET: DEALS, MAY 2022-JUNE 2025

- TABLE 188 SWITCHGEAR MARKET: EXPANSIONS, MAY 2022-JUNE 2025

- TABLE 189 SWITCHGEAR MARKET: OTHER DEVELOPMENTS, MAY 2022-JUNE 2025

- TABLE 190 SCHNEIDER ELECTRIC: COMPANY OVERVIEW

- TABLE 191 SCHNEIDER ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 192 SCHNEIDER ELECTRIC: PRODUCT LAUNCHES

- TABLE 193 SCHNEIDER ELECTRIC: DEALS

- TABLE 194 SCHNEIDER ELECTRIC: EXPANSIONS

- TABLE 195 SCHNEIDER ELECTRIC: OTHER DEVELOPMENTS

- TABLE 196 SIEMENS: COMPANY OVERVIEW

- TABLE 197 SIEMENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 198 SIEMENS: PRODUCT LAUNCHES

- TABLE 199 SIEMENS: DEALS

- TABLE 200 SIEMENS: OTHER DEVELOPMENTS

- TABLE 201 ABB: COMPANY OVERVIEW

- TABLE 202 ABB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 203 ABB: PRODUCT LAUNCHES

- TABLE 204 ABB: DEALS

- TABLE 205 ABB: EXPANSIONS

- TABLE 206 ABB: OTHER DEVELOPMENTS

- TABLE 207 HITACHI, LTD.: COMPANY OVERVIEW

- TABLE 208 HITACHI, LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 209 HITACHI, LTD.: PRODUCT LAUNCHES

- TABLE 210 HITACHI, LTD.: DEALS

- TABLE 211 HITACHI, LTD.: EXPANSIONS

- TABLE 212 HITACHI, LTD.: OTHER DEVELOPMENTS

- TABLE 213 EATON: COMPANY OVERVIEW

- TABLE 214 EATON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 215 EATON: PRODUCT LAUNCHES

- TABLE 216 EATON: DEALS

- TABLE 217 EATON: OTHER DEVELOPMENTS

- TABLE 218 GE VERNOVA: COMPANY OVERVIEW

- TABLE 219 GE VERNOVA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 220 GE VERNOVA: PRODUCT LAUNCHES

- TABLE 221 GE VERNOVA: DEALS

- TABLE 222 GE VERNOVA: EXPANSIONS

- TABLE 223 GE VERNOVA: OTHER DEVELOPMENTS

- TABLE 224 MITSUBISHI ELECTRIC CORPORATION: COMPANY OVERVIEW

- TABLE 225 MITSUBISHI ELECTRIC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 226 MITSUBISHI ELECTRIC CORPORATION: OTHER DEVELOPMENTS

- TABLE 227 POWELL INDUSTRIES: COMPANY OVERVIEW

- TABLE 228 POWELL INDUSTRIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 229 HUBBELL: COMPANY OVERVIEW

- TABLE 230 HUBBELL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 231 HUBBELL: DEALS

- TABLE 232 HD HYUNDAI ELECTRIC CO., LTD.: COMPANY OVERVIEW

- TABLE 233 HD HYUNDAI ELECTRIC CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 234 HD HYUNDAI ELECTRIC CO., LTD: DEVELOPMENTS

- TABLE 235 TOSHIBA CORPORATION: COMPANY OVERVIEW

- TABLE 236 TOSHIBA CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 237 TOSHIBA CORPORATION: DEVELOPMENTS

- TABLE 238 BHARAT HEAVY ELECTRICALS LIMITED: COMPANY OVERVIEW

- TABLE 239 BHARAT HEAVY ELECTRICALS LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 240 BHARAT HEAVY ELECTRICALS LIMITED: DEVELOPMENTS

- TABLE 241 CG POWER & INDUSTRIAL SOLUTIONS LTD.: COMPANY OVERVIEW

- TABLE 242 CG POWER & INDUSTRIAL SOLUTIONS LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 243 CG POWER & INDUSTRIAL SOLUTIONS LTD: DEALS

- TABLE 244 CG POWER & INDUSTRIAL SOLUTIONS LTD: EXPANSIONS

- TABLE 245 HYOSUNG HEAVY INDUSTRIES: COMPANY OVERVIEW

- TABLE 246 HYOSUNG HEAVY INDUSTRIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 247 HYOSUNG HEAVY INDUSTRIES : DEVELOPMENTS

- TABLE 248 FUJI ELECTRIC CO., LTD.: COMPANY OVERVIEW

- TABLE 249 FUJI ELECTRIC CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 250 FUJI ELECTRIC CO., LTD: DEVELOPMENTS

- TABLE 251 WEG: COMPANY OVERVIEW

- TABLE 252 WEG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 253 WEG: DEALS

- TABLE 254 WEG: OTHER DEVELOPMENTS

- TABLE 255 DOHO ELECTRIC: COMPANY OVERVIEW

- TABLE 256 DOHO ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 257 LUCY GROUP LTD.: COMPANY OVERVIEW

- TABLE 258 LUCY GROUP LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 259 LS ELECTRIC CO., LTD: COMPANY OVERVIEW

- TABLE 260 LS ELECTRIC CO., LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 261 LS ELECTRIC CO.,LTD: DEALS

- TABLE 262 LS ELECTRIC CO., LTD: OTHER DEVELOPMENTS

- TABLE 263 CHINT GROUP: COMPANY OVERVIEW

- TABLE 264 CHINT GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 265 CHINT GROUP: DEALS

List of Figures

- FIGURE 1 SWITCHGEAR MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 SWITCHGEAR MARKET: RESEARCH DESIGN

- FIGURE 3 DATA TRIANGULATION METHODOLOGY

- FIGURE 4 KEY INDUSTRY INSIGHTS

- FIGURE 5 METRICS CONSIDERED FOR ANALYZING AND ASSESSING DEMAND FOR SWITCHGEAR

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 8 KEY STEPS CONSIDERED FOR ASSESSING SUPPLY OF SWITCHGEARS

- FIGURE 9 SWITCHGEAR MARKET: SUPPLY-SIDE ANALYSIS

- FIGURE 10 ASIA PACIFIC CLAIMED LARGEST MARKET SHARE IN 2024

- FIGURE 11 AIR-INSULATED SWITCHGEAR SEGMENT TO LEAD MARKET IN 2030

- FIGURE 12 INDOOR SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2025

- FIGURE 13 HIGH (ABOVE 36 KV) SEGMENT TO DOMINATE MARKET IN 2025

- FIGURE 14 AC SEGMENT TO SECURE LARGER MARKET SHARE IN 2025

- FIGURE 15 TRANSMISSION & DISTRIBUTION UTILITIES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 16 ONGOING DEVELOPMENTS IN MICROPROCESSORS AND SENSORS TO DRIVE MARKET

- FIGURE 17 ASIA PACIFIC TO DISPLAY HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 18 TRANSMISSION & DISTRIBUTION UTILITIES AND CHINA HELD LARGEST MARKET SHARES IN 2024

- FIGURE 19 AIR-INSULATED SWITCHGEAR SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 20 INDOOR SEGMENT TO SECURE LARGER MARKET SHARE IN 2030

- FIGURE 21 HIGH (ABOVE 36 KV) SEGMENT TO HOLD LARGEST MARKET SHARE IN 2030

- FIGURE 22 AC SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2030

- FIGURE 23 TRANSMISSION & DISTRIBUTION UTILITIES SEGMENT TO LEAD MARKET IN 2030

- FIGURE 24 SWITCHGEAR MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 25 TOTAL ELECTRICITY GENERATION, BY REGION, 2010-2050

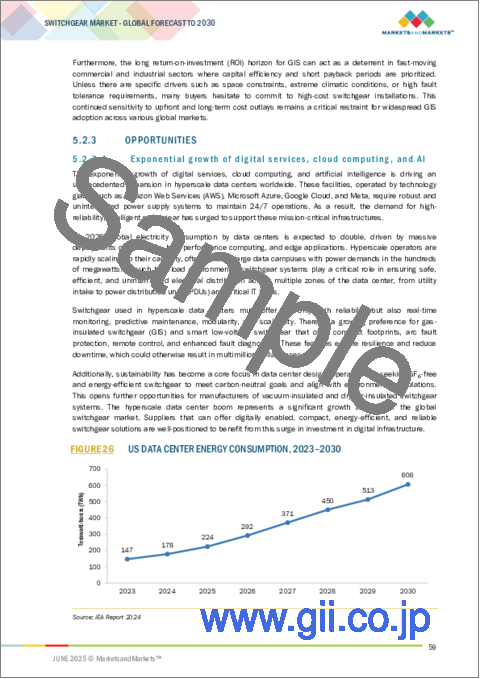

- FIGURE 26 US DATA CENTER ENERGY CONSUMPTION, 2023-2030

- FIGURE 27 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 28 AVERAGE SELLING PRICE TREND OF SWITCHGEAR, BY REGION

- FIGURE 29 SWITCHGEAR MARKET: VALUE CHAIN ANALYSIS

- FIGURE 30 SWITCHGEAR MARKET ECOSYSTEM

- FIGURE 31 SWITCHGEAR MARKET: PATENTS GRANTED AND APPLIED, 2014-2024

- FIGURE 32 IMPORT DATA FOR HS CODE 853590-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 33 EXPORT DATA FOR HS CODE 853590-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 34 IMPORT DATA FOR HS CODE 853690-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 35 EXPORT DATA HS CODE 853690-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 36 SWITCHGEAR MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 37 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- FIGURE 38 BUYING CRITERIA FOR TOP THREE END USERS

- FIGURE 39 INVESTMENT AND FUNDING SCENARIO, 2024

- FIGURE 40 IMPACT OF GEN AI/AI IN SWITCHGEAR MARKET, BY REGION

- FIGURE 41 SWITCHGEAR MARKET SHARE, BY INSULATION

- FIGURE 42 SWITCHGEAR MARKET SHARE, BY INSTALLATION

- FIGURE 43 SWITCHGEAR MARKET SHARE, BY VOLTAGE

- FIGURE 44 SWITCHGEAR MARKET SHARE, BY CURRENT

- FIGURE 45 SWITCHGEAR MARKET SHARE, BY END USER

- FIGURE 46 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 47 SWITCHGEAR MARKET SHARE, BY REGION

- FIGURE 48 ASIA PACIFIC: SWITCHGEAR MARKET SNAPSHOT

- FIGURE 49 EUROPE: SWITCHGEAR MARKET SNAPSHOT

- FIGURE 50 MARKET SHARE ANALYSIS OF COMPANIES OFFERING SWITCHGEAR, 2024

- FIGURE 51 SWITCHGEAR MARKET: REVENUE ANALYSIS OF FIVE KEY PLAYERS, 2020-2024

- FIGURE 52 COMPANY VALUATION

- FIGURE 53 FINANCIAL METRICS

- FIGURE 54 BRAND/PRODUCT COMPARISON

- FIGURE 55 SWITCHGEAR MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 56 SWITCHGEAR MARKET: COMPANY FOOTPRINT

- FIGURE 57 SWITCHGEAR MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 58 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

- FIGURE 59 SIEMENS: COMPANY SNAPSHOT

- FIGURE 60 ABB: COMPANY SNAPSHOT

- FIGURE 61 HITACHI, LTD.: COMPANY SNAPSHOT

- FIGURE 62 EATON: COMPANY SNAPSHOT

- FIGURE 63 GE VERNOVA: COMPANY SNAPSHOT

- FIGURE 64 MITSUBISHI ELECTRIC CORPORATION: COMPANY SNAPSHOT

- FIGURE 65 POWELL INDUSTRIES: COMPANY SNAPSHOT

- FIGURE 66 HUBBELL: COMPANY SNAPSHOT

- FIGURE 67 HD HYUNDAI ELECTRIC CO., LTD.: COMPANY SNAPSHOT

- FIGURE 68 TOSHIBA CORPORATION: COMPANY SNAPSHOT

- FIGURE 69 BHARAT HEAVY ELECTRICALS LIMITED: COMPANY SNAPSHOT

- FIGURE 70 CG POWER & INDUSTRIAL SOLUTIONS LTD.: COMPANY SNAPSHOT

- FIGURE 71 HYOSUNG HEAVY INDUSTRIES: COMPANY SNAPSHOT

- FIGURE 72 FUJI ELECTRIC CO., LTD.: COMPANY SNAPSHOT

- FIGURE 73 WEG: COMPANY SNAPSHOT

- FIGURE 74 LS ELECTRIC CO., LTD: COMPANY SNAPSHOT

The switchgear market is estimated to grow from USD 103.71 billion in 2025 to USD 136.65 billion by 2030, at a CAGR of 5.7% during the forecast period. This growth is driven by rising electricity demand, rapid urbanization, expansion of renewable energy, and ongoing grid modernization efforts. However, the market faces restraints such as high initial installation costs, supply chain disruptions, and environmental concerns related to SF6 gas used in some switchgear types.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Thousand Units) |

| Segments | By Insulation, By Installation, By Voltage, By Current, and By End User |

| Regions covered | North America, Asia Pacific, Europe, South America, and the Middle East & Africa. |

"By voltage, medium (2-36kV) is expected to be the fastest growing market during the forecast period."

During the forecasted period, the medium voltage (2-36kV) segment is the fastest-growing segment in the global switchgear market due to its critical role in power distribution for urban infrastructure, industrial facilities, commercial buildings, and renewable energy projects. As cities expand and smart grids evolve, medium voltage switchgear is increasingly deployed to manage localized distribution efficiently and safely. Additionally, governments worldwide are investing in strengthening medium-voltage networks to improve energy access, reduce transmission losses, and support distributed energy resources such as rooftop solar and battery storage systems. Emerging economies, particularly in Asia-Pacific and Africa, are accelerating rural electrification and industrial development, further propelling demand. Moreover, the rise of electric vehicle charging infrastructure, metro rail projects, and digital substations is fuelling the need for compact, reliable, and automation-ready medium voltage switchgear.

" By current, the AC segment is projected to be the largest market during the forecast period."

By current, the AC segment holds the largest share of the global switchgear market because it is the dominant form of electricity used in power generation, transmission, and distribution systems worldwide. Most national grids operate on AC due to its efficiency in transmitting power over long distances and ease of voltage transformation using transformers. As a result, most of the electrical infrastructure-ranging from utilities and industrial plants to commercial and residential buildings-is designed around AC systems. This widespread adoption drives consistent demand for AC switchgear across all voltage levels. Additionally, the expansion of renewable energy sources like wind and hydro, which predominantly generate AC power, further reinforces the global market dominance of AC switchgear.

"Asia Pacific is expected to be the largest and fastest-growing region in the switchgear market during the forecast period."

During the forecasted period, Asia Pacific is projected to be the largest and fastest-growing segment in the global switchgear market due to rapid urbanization, industrial expansion, and significant investments in power infrastructure across emerging economies such as China, India, Australia, and Japan. The region is witnessing substantial growth in electricity demand driven by population growth, rising incomes, and increased electrification of rural areas. Governments are heavily investing in grid modernization, smart cities, and renewable energy integration, all of which require extensive deployment of switchgear systems. Additionally, strong manufacturing bases and supportive policy frameworks, such as India's Revamped Distribution Sector Scheme (RDSS) and China's Five-Year Plans, are further fuelling demand for both high-voltage and medium-voltage switchgear in utility and industrial applications.

Breakdown of Primaries:

In-depth interviews have been conducted with various key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information and assess future market prospects. The distribution of primary interviews is as follows:

- By Company Type: Tier 1 - 65%, Tier 2 - 24%, and Tier 3 - 11%

- By Designation: C-level Executives - 25%, Directors - 30%, and Others - 45%

- By Region: North America- 25%, Europe - 40%, Asia Pacific- 25% and RoW- 10%

Note: Other designations include sales managers, marketing managers, product managers, and product engineers.

The tier of the companies is defined based on their total revenue as of 2024. Tier 1: USD 1 billion and above, Tier 2: From USD 500 million to USD 1 billion, and Tier 3: <USD 500 million.

A few major players with a wide regional presence dominate the switchgear market. The leading players in the switchgear market are ABB (Switzerland), Schneider Electric (France), Siemens (Germany), Eaton (Ireland), and Hitachi, Ltd. (Japan).

Study Coverage:

The report defines, describes, and forecasts the switchgear market by insulation, installation, voltage, current, end user, and region. It also offers a detailed qualitative and quantitative analysis of the market. The report comprehensively reviews the major market drivers, restraints, opportunities, and challenges. It also covers various important aspects of the market, which include the analysis of the competitive landscape, market dynamics, market estimates in terms of value, and future trends in the switchgear market.

Key Benefits of Buying the Report

- Product Development/ Innovation: In April 2025, Eaton launched a Rear-Access Arc-Resistant Magnum PXR Low-Voltage Switchgear, which is a cutting-edge solution designed to enhance safety, reliability, and maintainability in power distribution systems. This is engineered for applications up to 600V AC with interrupting capacities up to 100 kA, and features arc-resistant construction and rear-access design, allowing safer operation and maintenance by isolating personnel from potential arc flash zones.

- Market Development: In June 2024, Siemens invested USD 115 million in its Frankfurt switchgear plant, aimed at expanding its production capacity and advancing sustainable technologies. The initiative will support the manufacturing of Siemens' SF6-free 8DAB-blue GIS medium-voltage switchgear, which uses climate-neutral Clean Air insulation, reinforcing Siemens' commitment to sustainable and digital power distribution solutions.

- Market Diversification: In March 2025, ABB expanded the production capacity of its low-voltage electrification products in the US. The expansion will enable ABB to meet increasing customer demand in a wide range of key growth industries, including data centers, buildings, and utilities.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players, ABB (Switzerland), Schneider Electric (France), Siemens (Germany), Eaton (Ireland), and Hitachi, Ltd. (Japan), among others in the switchgear market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.2.1 SECONDARY DATA

- 2.2.1.1 Key data from secondary sources

- 2.2.1.2 List of key secondary sources

- 2.2.2 PRIMARY DATA

- 2.2.2.1 List of primary interview participants

- 2.2.2.2 Key data from primary sources

- 2.2.2.3 Breakdown of primaries

- 2.2.2.4 Key industry insights

- 2.2.1 SECONDARY DATA

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- 2.3.3 DEMAND-SIDE ANALYSIS

- 2.3.3.1 Regional analysis

- 2.3.3.2 Country analysis

- 2.3.3.3 Demand-side assumptions

- 2.3.3.4 Demand-side calculations

- 2.3.4 SUPPLY-SIDE ANALYSIS

- 2.3.4.1 Supply-side assumptions

- 2.3.4.2 Supply-side calculations

- 2.3.5 FORECAST

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SWITCHGEAR MARKET

- 4.2 SWITCHGEAR MARKET, BY REGION

- 4.3 SWITCHGEAR MARKET IN ASIA PACIFIC, BY END USER AND COUNTRY

- 4.4 SWITCHGEAR MARKET, BY INSULATION

- 4.5 SWITCHGEAR MARKET, BY INSTALLATION

- 4.6 SWITCHGEAR MARKET, BY VOLTAGE

- 4.7 SWITCHGEAR MARKET, BY CURRENT

- 4.8 SWITCHGEAR MARKET, BY END USER

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing demand for electricity

- 5.2.1.2 Integration of renewable energy sources

- 5.2.2 RESTRAINTS

- 5.2.2.1 Regulatory restrictions on SF6 gas emissions

- 5.2.2.2 High capital and lifecycle costs

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Exponential growth of digital services, cloud computing, and AI

- 5.2.3.2 Deployment of smart grid and digital substations

- 5.2.4 CHALLENGES

- 5.2.4.1 Fragmented regulatory and standardization landscape

- 5.2.4.2 Cybersecurity risks associated with digital switchgear systems

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE TREND OF SWITCHGEAR, BY REGION, 2020-2024

- 5.4.2 PRICING RANGE OF SWITCHGEAR, BY VOLTAGE, 2024

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 Digital switchgear

- 5.7.1.2 SF6-Free insulation

- 5.7.2 ADJACENT TECHNOLOGIES

- 5.7.2.1 Advanced energy storage systems (ESS)

- 5.7.2.2 Smart meters and AMI

- 5.7.3 COMPLEMENTARY TECHNOLOGIES

- 5.7.3.1 SCADA and grid automation systems

- 5.7.3.2 Arc flash detection & mitigation systems

- 5.7.1 KEY TECHNOLOGIES

- 5.8 PATENT ANALYSIS

- 5.9 TRADE ANALYSIS

- 5.9.1 TRADE ANALYSIS FOR HS CODE 853590

- 5.9.2 IMPORT SCENARIO (HS CODE 853590)

- 5.9.3 EXPORT SCENARIO (HS CODE 853590)

- 5.9.4 TRADE ANALYSIS FOR HS CODE 853690

- 5.9.5 IMPORT SCENARIO (HS CODE 853690)

- 5.9.6 EXPORT SCENARIO (HS CODE 853690)

- 5.10 KEY CONFERENCES AND EVENTS, 2022-2024

- 5.11 TARIFF AND REGULATORY LANDSCAPE

- 5.11.1 TARIFFS RELATED TO SWITCHGEAR

- 5.11.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11.3 CODES AND REGULATIONS

- 5.12 PORTER'S FIVE FORCES ANALYSIS

- 5.12.1 THREAT OF SUBSTITUTES

- 5.12.2 BARGAINING POWER OF SUPPLIERS

- 5.12.3 BARGAINING POWER OF BUYERS

- 5.12.4 THREAT OF NEW ENTRANTS

- 5.12.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.13.2 BUYING CRITERIA

- 5.14 INVESTMENT AND FUNDING SCENARIO

- 5.15 CASE STUDY ANALYSIS

- 5.15.1 ABB DEPLOYS MOLDED VACUUM MODULES TO MINIMIZE INFRASTRUCTURE REWORK

- 5.15.2 ENEMALTA REVIVES SWITCHGEAR PERFORMANCE THROUGH SSL-LED REFURBISHMENT AT MARSA POWER STATION

- 5.15.3 PROTEUS SWITCHGEAR ENHANCES HIGH-PERFORMANCE VEHICLE TESTING WITH CUSTOM ELECTRICAL SOLUTIONS

- 5.16 IMPACT OF GEN AI/AI ON SWITCHGEAR MARKET

- 5.16.1 ADOPTION OF GEN AI/AI IN SWITCHGEAR MARKET

- 5.16.2 IMPACT OF GEN AI/AI IN SWITCHGEAR MARKET, BY REGION

- 5.17 MACROECONOMIC OUTLOOK FOR SWITCHGEAR MARKET

- 5.18 IMPACT OF 2025 US TARIFF - OVERVIEW

- 5.18.1 INTRODUCTION

- 5.18.2 KEY TARIFF RATES

- 5.18.3 PRICE IMPACT ANALYSIS

- 5.18.4 IMPACT ON COUNTRY/REGION

- 5.18.4.1 US

- 5.18.4.2 Europe

- 5.18.4.3 Asia Pacific

- 5.18.5 IMPACT ON END USERS

6 SWITCHGEAR MARKET, BY INSULATION

- 6.1 INTRODUCTION

- 6.2 AIR-INSULATED SWITCHGEAR

- 6.2.1 HIGH PREVALENCE IN UTILITY-OWNED MEDIUM VOLTAGE NETWORKS TO FOSTER MARKET GROWTH

- 6.3 GAS-INSULATED SWITCHGEAR

- 6.3.1 FAVORABLE ENVIRONMENTAL REGULATIONS TO FUEL MARKET GROWTH

- 6.4 OTHER INSULATION TYPES

7 SWITCHGEAR MARKET, BY INSTALLATION

- 7.1 INTRODUCTION

- 7.2 INDOOR

- 7.2.1 DEPLOYMENT OF INDOOR GIS TECHNOLOGY TO MEET RISING ENERGY DEMANDS TO BOOST DEMAND

- 7.3 OUTDOOR

- 7.3.1 EXPANSION OF POWER TRANSMISSION & DISTRIBUTION NETWORKS TO FOSTER MARKET GROWTH

8 SWITCHGEAR MARKET, BY VOLTAGE

- 8.1 INTRODUCTION

- 8.2 LOW (UP TO 1 KV)

- 8.2.1 ELECTRIFICATION OF MOBILITY AND BUILDING SYSTEMS TO FUEL MARKET GROWTH

- 8.3 MEDIUM (2-36 KV)

- 8.3.1 ROBUST ELECTRIFICATION PROGRAMS AND RAPID INDUSTRIALIZATION IN DEVELOPING COUNTRIES TO SUPPORT MARKET GROWTH

- 8.4 HIGH (ABOVE 36 KV)

- 8.4.1 GROWING NEED TO REPLACE AGING INFRASTRUCTURE TO BOLSTER MARKET GROWTH

9 SWITCHGEAR MARKET, BY CURRENT

- 9.1 INTRODUCTION

- 9.2 AC

- 9.2.1 INSTALLATION OF AC SWITCHGEAR IN RENEWABLE ENERGY PLANTS TO FUEL MARKET GROWTH

- 9.3 DC

- 9.3.1 DEPLOYMENT OF BATTERY ENERGY STORAGE SYSTEMS TO FOSTER MARKET GROWTH

10 SWITCHGEAR MARKET, BY END USER

- 10.1 INTRODUCTION

- 10.2 TRANSMISSION & DISTRIBUTION UTILITIES

- 10.2.1 EXPANSION OF URBAN CENTERS AND ELECTRIFICATION OF RURAL AREAS TO STRENGTHEN MARKET

- 10.3 INDUSTRIAL

- 10.3.1 INDUSTRIAL MODERNIZATION, ELECTRIFICATION OF MANUFACTURING PROCESSES, AND ADOPTION OF AUTOMATION TECHNOLOGIES TO BOLSTER MARKET GROWTH

- 10.4 COMMERCIAL & RESIDENTIAL

- 10.4.1 RISE OF EV INFRASTRUCTURE IN RESIDENTIAL AND COMMERCIAL COMPLEXES TO OFFER LUCRATIVE GROWTH OPPORTUNITIES

- 10.5 WATER & WASTEWATER

- 10.5.1 GROWING EMPHASIS ON SUSTAINABLE WATER MANAGEMENT AND SMART UTILITY NETWORKS TO FUEL MARKET GROWTH

- 10.6 DATA CENTERS

- 10.6.1 SURGINGGLOBAL DATA CONSUMPTION AND CLOUD COMPUTING TO SUPPORT MARKET GROWTH

- 10.7 OTHER END USERS

11 SWITCHGEAR MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 ASIA PACIFIC

- 11.2.1 CHINA

- 11.2.1.1 Surging investment in grid and storage infrastructure to foster market growth

- 11.2.2 INDIA

- 11.2.2.1 Increasing popularity of clean energy to fuel market growth

- 11.2.3 JAPAN

- 11.2.3.1 Rising focus on decarbonizing energy and raw materials to spur demand

- 11.2.4 AUSTRALIA

- 11.2.4.1 Push toward integration of renewable energy and grid modernization to fuel market growth

- 11.2.5 REST OF ASIA PACIFIC

- 11.2.1 CHINA

- 11.3 EUROPE

- 11.3.1 GERMANY

- 11.3.1.1 Supportive regulatory framework and substantial public and private investments to drive market

- 11.3.2 UK

- 11.3.2.1 Surge in digital infrastructure to drive market

- 11.3.3 FRANCE

- 11.3.3.1 Deployment of clean energy technologies to foster market growth

- 11.3.4 ITALY

- 11.3.4.1 Growing cross-border energy cooperation to drive market

- 11.3.5 REST OF EUROPE

- 11.3.1 GERMANY

- 11.4 NORTH AMERICA

- 11.4.1 US

- 11.4.1.1 Government-led funding for power grid projects to fuel market growth

- 11.4.2 CANADA

- 11.4.2.1 Trend toward advanced digital and hybrid switchgear systems to offer lucrative growth opportunities

- 11.4.3 MEXICO

- 11.4.3.1 Rising emphasis on reforming energy sector to drive market

- 11.4.1 US

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 GCC

- 11.5.1.1 UAE

- 11.5.1.1.1 Emphasis on decarbonizing offshore operations to boost demand

- 11.5.1.2 Saudi Arabia

- 11.5.1.2.1 Rising focus on energy diversification and infrastructure modernization to drive market

- 11.5.1.3 Rest of GCC

- 11.5.1.1 UAE

- 11.5.2 EGYPT

- 11.5.2.1 Strategic investments and technological deployments to spur demand

- 11.5.3 SOUTH AFRICA

- 11.5.3.1 Need to modernize and expand transmission infrastructure to fuel market growth

- 11.5.4 REST OF MIDDLE EAST & AFRICA

- 11.5.1 GCC

- 11.6 SOUTH AMERICA

- 11.6.1 BRAZIL

- 11.6.1.1 Expanding electricity infrastructure to boost demand

- 11.6.2 ARGENTINA

- 11.6.2.1 Convergence of privatization, regulatory reform, and renewable energy growth to drive market

- 11.6.3 REST OF SOUTH AMERICA

- 11.6.1 BRAZIL

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022-2025

- 12.3 MARKET SHARE ANALYSIS, 2024

- 12.4 REVENUE ANALYSIS, 2020-2024

- 12.5 COMPANY VALUATION AND FINANCIAL METRICS

- 12.6 BRAND/PRODUCT COMPARISON

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.7.5.1 Company footprint

- 12.7.5.2 Region footprint

- 12.7.5.3 Insulation footprint

- 12.7.5.4 Installation footprint

- 12.7.5.5 End use footprint

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.8.5.1 Detailed list of key startups/SMEs

- 12.8.5.2 Competitive benchmarking of key startups/SMEs

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

- 12.9.3 EXPANSIONS

- 12.9.4 OTHER DEVELOPMENTS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 SCHNEIDER ELECTRIC

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product launches

- 13.1.1.3.2 Deals

- 13.1.1.3.3 Expansions

- 13.1.1.3.4 Other developments

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths/Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses/Competitive threats

- 13.1.2 SIEMENS

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Product launches

- 13.1.2.3.2 Deals

- 13.1.2.3.3 Other developments

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths/Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses/Competitive threats

- 13.1.3 ABB

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Product launches

- 13.1.3.3.2 Deals

- 13.1.3.3.3 Expansions

- 13.1.3.3.4 Other developments

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths/Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses/Competitive threats

- 13.1.4 HITACHI, LTD.

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Product launches

- 13.1.4.3.2 Deals

- 13.1.4.3.3 Expansions

- 13.1.4.3.4 Other developments

- 13.1.4.4 MnM view

- 13.1.4.4.1 Key strengths/Right to win

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses/Competitive threats

- 13.1.5 EATON

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Product launches

- 13.1.5.3.2 Deals

- 13.1.5.3.3 Other developments

- 13.1.5.4 MnM view

- 13.1.5.4.1 Key strengths/Right to win

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses/Competitive threats

- 13.1.6 GE VERNOVA

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Product launches

- 13.1.6.3.2 Deals

- 13.1.6.3.3 Expansions

- 13.1.6.3.4 Other developments

- 13.1.7 MITSUBISHI ELECTRIC CORPORATION

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Other developments

- 13.1.8 POWELL INDUSTRIES

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.9 HUBBELL

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Deals

- 13.1.10 HD HYUNDAI ELECTRIC CO., LTD.

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Developments

- 13.1.11 TOSHIBA CORPORATION

- 13.1.11.1 Business overview

- 13.1.11.2 Products/Solutions/Services offered

- 13.1.11.3 Recent developments

- 13.1.11.3.1 Developments

- 13.1.12 BHARAT HEAVY ELECTRICALS LIMITED

- 13.1.12.1 Business overview

- 13.1.12.2 Products/Solutions/Services offered

- 13.1.12.3 Recent developments

- 13.1.12.3.1 Developments

- 13.1.13 CG POWER & INDUSTRIAL SOLUTIONS LTD.

- 13.1.13.1 Business overview

- 13.1.13.2 Products/Solutions/Services offered

- 13.1.13.3 Recent developments

- 13.1.13.3.1 Deals

- 13.1.13.3.2 Expansions

- 13.1.14 HYOSUNG HEAVY INDUSTRIES

- 13.1.14.1 Business overview

- 13.1.14.2 Products/Solutions/Services offered

- 13.1.14.3 Recent developments

- 13.1.14.3.1 Developments

- 13.1.15 FUJI ELECTRIC CO., LTD.

- 13.1.15.1 Business overview

- 13.1.15.2 Products/Solutions/Services offered

- 13.1.15.3 Recent developments

- 13.1.15.3.1 Developments

- 13.1.16 WEG

- 13.1.16.1 Business overview

- 13.1.16.2 Products/Solutions/Services offered

- 13.1.16.3 Recent developments

- 13.1.16.3.1 Deals

- 13.1.16.3.2 Other developments

- 13.1.17 DOHO ELECTRIC

- 13.1.17.1 Business overview

- 13.1.17.2 Products/Solutions/Services offered

- 13.1.18 LUCY GROUP LTD.

- 13.1.18.1 Business overview

- 13.1.18.2 Products/Solutions/Services offered

- 13.1.19 LS ELECTRIC CO., LTD

- 13.1.19.1 Business overview

- 13.1.19.2 Products/Solutions/Services offered

- 13.1.19.3 Recent developments

- 13.1.19.3.1 Deals

- 13.1.19.3.2 Other developments

- 13.1.20 CHINT GROUP

- 13.1.20.1 Business overview

- 13.1.20.2 Products/Solutions/Services offered

- 13.1.20.3 Recent developments

- 13.1.20.3.1 Deals

- 13.1.1 SCHNEIDER ELECTRIC

- 13.2 OTHER PLAYERS

- 13.2.1 SECHERON

- 13.2.2 ELEKTROBUDOWA

- 13.2.3 MEIDENSHA CORPORATION

- 13.2.4 ORMAZABAL

- 13.2.5 ALFANAR GROUP

14 APPENDIX

- 14.1 INSIGHTS FROM INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS