|

|

市場調査レポート

商品コード

1822290

ニューロモデュレーションの世界市場:技術別、刺激タイプ別、用途別、エンドユーザー別、地域別 - 2030年までの予測Neuromodulation Market by Technology (Internal, External), Stimulation Type (Spinal Cord, Deep Brain, Vagus Nerve Stimulation), Application (Ischemia, Depression, Epilepsy, Obesity), End User (Hospitals, ASCs, Clinics) & Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| ニューロモデュレーションの世界市場:技術別、刺激タイプ別、用途別、エンドユーザー別、地域別 - 2030年までの予測 |

|

出版日: 2025年09月15日

発行: MarketsandMarkets

ページ情報: 英文 367 Pages

納期: 即納可能

|

概要

世界のニューロモデュレーションの市場規模は、予測期間中に9.4%のCAGRで拡大し、2025年の68億1,000万米ドルから2030年には106億8,000万米ドルに達すると予測されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2024年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント | 技術別、刺激タイプ別、用途別、エンドユーザー別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカ |

ニューロモデュレーション市場は、神経疾患の有病率の上昇、新しいニューロモデュレーション技術の開発、高齢者人口の増加などにより拡大しており、これらすべてが市場成長の要因となっています。さらに、ニューロモデュレーション手技のコストが高いことが市場成長を制限する可能性があります。

エンドユーザー別では、病院&外来手術センター、クリニック&理学療法センター、その他のエンドユーザーに区分されます。2024年には、病院&外来手術センターが最大の市場シェアを占めています。病院・外来医療部門は、包括的で集学的なケアを提供し、高度なニューロモデュレーション療法を利用できることから、ニューロモデュレーション療法市場を独占しています。このような環境には、専門的な手術設備、訓練を受けた臨床医、移植可能で複雑なニューロモデュレーション手技に必要なモニタリングシステムが備わっています。また、病院や外来センターは確立された償還制度の恩恵を受けているため、高額な手技を患者がより利用しやすくなっています。さらに、慢性疾患の管理、術後ケア、患者のフォローアップにますます重点が置かれるようになっているため、これらの施設では手技量が多く、ニューロモデュレーションの提供ソリューションにおけるリーダーシップが強化されています。

ニューロモデュレーション技術市場は、内部ニューロモデュレーションと外部ニューロモデュレーションに区分されます。2024年のニューロモデュレーション市場では、内部ニューロモデュレーションセグメントが最大のシェアを占めています。内部ニューロモデュレーションは、特定の神経経路の標的刺激を容易にする洗練された技術により、市場で支配的なアプローチとなっています。このプロセスは、侵害受容性疼痛、パーキンソン病、尿失禁や便失禁などの症状の慢性管理に役立っています。植え込み型デバイスは、充電式または長持ちするバッテリー、カスタマイズ可能な刺激プロトコル、閉ループフィードバック機構、ワイヤレス接続などの特徴を備えています。これらの機能により、患者の転帰を向上させるためのリアルタイムのモニタリングやオーダーメイドの治療調整が可能になります。技術の進歩は、侵襲性を最小化するコンパクトな装置設計をサポートし、それによって患者の快適性と治療へのアドヒアランスを向上させる。さらに、材料科学、電極アーキテクチャ、ソフトウェア・アルゴリズムにおける継続的な技術革新により、これらのシステムの有効性、安全性、寿命が改善され続けています。その結果、臨床現場では、非侵襲的介入よりも体内ニューロモデュレーションがますます支持されるようになっています。

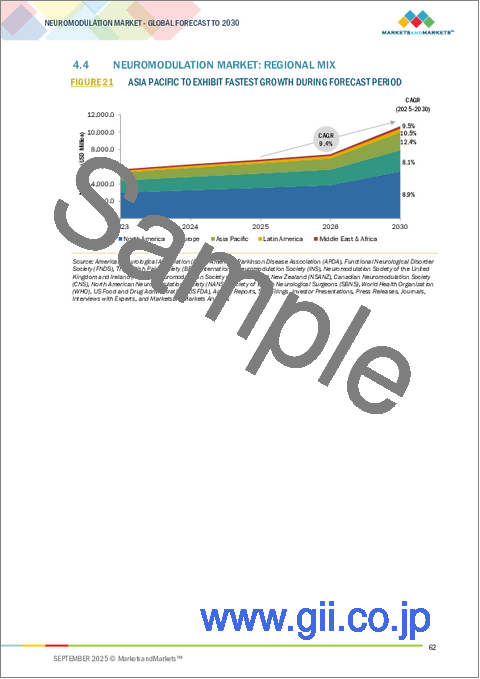

世界のニューロモデュレーション市場は5つの地域(北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカ)に分けられます。アジア太平洋は、健康意識の高まり、神経疾患や慢性疼痛疾患の増加率、中国、インド、日本などの国における医療インフラの拡大により、ニューロモデュレーション市場で最も急成長している地域です。同地域では、より良い償還政策や医療機器へのアクセスを改善するための政府の取り組みも後押しとなり、先進的なニューロモデュレーション技術の採用が拡大しています。加えて、患者人口の多さ、可処分所得の増加、世界および現地の機器メーカーによる投資の増加が市場の成長を後押ししています。専門治療センターの設立が推進され、低侵襲で移植可能な製品が徐々に採用されていることも、この地域でのニューロモデュレーションの使用をさらに後押ししています。さらに、インド、タイ、シンガポールなどの国々における医療ツーリズムの増加は手術件数を増加させ、ひいては術後ケアとニューロモデュレーションの需要を高めています。

当レポートでは、世界のニューロモデュレーション市場について調査し、技術別、刺激タイプ別、用途別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客のビジネスに影響を与える動向/混乱

- 価格分析

- バリューチェーン分析

- サプライチェーン分析

- エコシステム分析

- 投資と資金調達のシナリオ

- 技術分析

- 特許分析

- 貿易データ分析

- 2025年~2026年の主な会議とイベント

- ケーススタディ分析

- 規制分析

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- AI/生成AIがニューロモジュレーション市場に与える影響

- 2025年の米国関税がニューロモデュレーション市場に与える影響

第6章 ニューロモジュレーション市場(技術別)

- イントロダクション

- 内部ニューロモデュレーション

- 外的ニューロモデュレーション

第7章 ニューロモデュレーション市場(刺激タイプ別)

- イントロダクション

- 脊髄刺激療法

- 脳深部刺激療法

- 仙骨神経刺激

- 迷走神経刺激

- 胃神経刺激

- 経皮的電気神経刺激

- 経頭蓋磁気刺激

- 呼吸電気刺激

- その他

第8章 ニューロモデュレーション市場(用途別)

- イントロダクション

- 脊髄刺激

- 深部脳刺激

- 仙骨神経刺激

- 迷走神経刺激

- 胃電気刺激

- 経皮電気神経刺激

- 経頭蓋磁気刺激

- 呼吸電気刺激

- その他

第9章 ニューロモジュレーション市場(エンドユーザー別)

- イントロダクション

- 病院および外来手術センター

- クリニックと理学療法センター

- その他

第10章 ニューロモジュレーション市場(地域別)

- イントロダクション

- 北米

- 北米のマクロ経済見通し

- 米国

- カナダ

- 欧州

- 欧州のマクロ経済見通し

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- ロシア

- その他

- アジア太平洋

- アジア太平洋のマクロ経済見通し

- 中国

- 日本

- インド

- オーストラリア

- その他

- ラテンアメリカ

- ラテンアメリカのマクロ経済見通し

- ブラジル

- メキシコ

- その他

- 中東・アフリカ

- ヘルスケアインフラの改善と神経学的ケアに対する意識の高まりが市場を牽引

- 中東・アフリカのマクロ経済見通し

第11章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 収益分析、2020年~2024年

- 市場シェア分析、2024年

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 企業評価と財務指標

- ブランド/製品比較

- 競合シナリオ

第12章 企業プロファイル

- 主要参入企業

- MEDTRONIC

- BOSTON SCIENTIFIC CORPORATION

- ABBOTT

- LIVANOVA PLC

- NEVRO CORP.

- NEUROPACE, INC.

- BIOVENTUS

- ELECTROCORE, INC.

- HELIUS MEDICAL TECHNOLOGIES, INC.

- NEURONETICS

- その他の企業

- NEUROSIGMA, INC.

- SOTERIX MEDICAL INC.

- SYNAPSE BIOMEDICAL INC.

- ALEVA NEUROTHERAPEUTICS

- THERANICA BIO-ELECTRONICS LTD.

- GIMER MEDICAL

- NALU MEDICAL, INC.

- MICROTRANSPONDER INC.

- MAGSTIM

- AMBER THERAPEUTICS

- TVNS TECHNOLOGIES GMBH

- BIOWAVE

- BIOTRONIK

- SALUDA MEDICAL PTY LTD.

- SPR