|

|

市場調査レポート

商品コード

1811751

分子診断の世界市場 (~2030年):製品&サービス・検査タイプ・サンプル・技術・用途 (感染症・がん) 別Molecular Diagnostics Market by Product & Service, Test Type, Sample, Technology, and Application (Infectious, Cancer ) - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 分子診断の世界市場 (~2030年):製品&サービス・検査タイプ・サンプル・技術・用途 (感染症・がん) 別 |

|

出版日: 2025年09月09日

発行: MarketsandMarkets

ページ情報: 英文 540 Pages

納期: 即納可能

|

概要

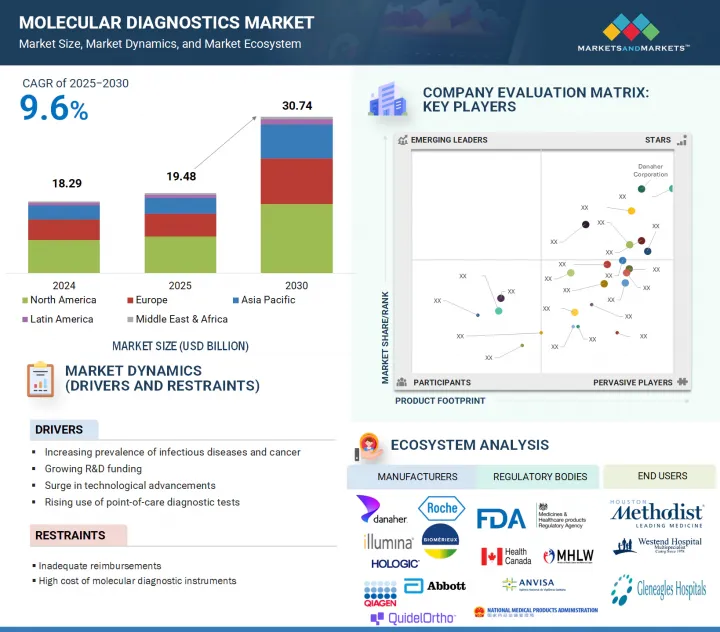

分子診断の市場規模は、2025年の約194億8,000万米ドルから、予測期間中はCAGR 9.6%で推移し、2030年までに307億4,000万米ドルの規模に成長すると予測されています。

分子診断は、疾患を分子および遺伝子レベルで検出できることから、現代医療において極めて重要な役割を果たしています。これらの技術は高い感度と特異性を備えており、病原体や遺伝子異常を早期に特定することを可能にします。処理時間の短縮、自動化プラットフォーム、アッセイ設計の改善といった継続的な技術革新により、分子検査の信頼性と利用しやすさは大きく向上しました。これらの革新は、多様な医療現場における大規模な検査体制を支えるうえで極めて重要です。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2024-2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025-2030年 |

| 単位 | 金額 (米ドル) |

| セグメント | 製品&サービス・検査タイプ・サンプルタイプ・技術・用途・手法・臨床応用・エンドユーザー |

| 対象地域 | 北米・欧州・アジア太平洋・ラテンアメリカ・中東&アフリカ |

さらに、インドなどの国々では、政府および民間セクターの取り組みによって、国民の認知度が高まり、診断および治療サービスへのアクセスが拡大しています。こうした努力は、今後数年間における分子診断の導入を加速させると期待されています。

"サンプルタイプ別では、血液、血清、血漿の部門が2024年の市場を支配"

これは、ウイルス感染症や腫瘍性疾患を含む幅広い疾病の検出において、これらのサンプルタイプが高い感度と特異性を有しているためです。また、輸送や保管時の安定性にも優れているため、集中型のラボやポイントオブケア環境に理想的です。さらに、個別化医療の採用拡大や臨床意思決定におけるバイオマーカーの利用増加が、血液ベースの分子検査の需要を押し上げています。これらの利点により、この部門は今後も堅調な成長が続くと見込まれます。

"技術別では、DNAシーケンシング&次世代シーケンシング (NGS) の部門が予測期間中に最も高い成長を達成する見通し"

この急成長は、遺伝子変異の検出、感染因子の同定、個別化治療計画の策定における活用拡大によって推進されています。さらに、処理速度の向上やデータ精度の改善により、研究や臨床現場での採用が広がっています。加えて、NGSは高スループット性能と包括的ゲノムプロファイリングにおける有用性から注目を集めています。精密医療が進展する中で、シーケンシングベースの診断需要は大幅に増加すると見込まれます。

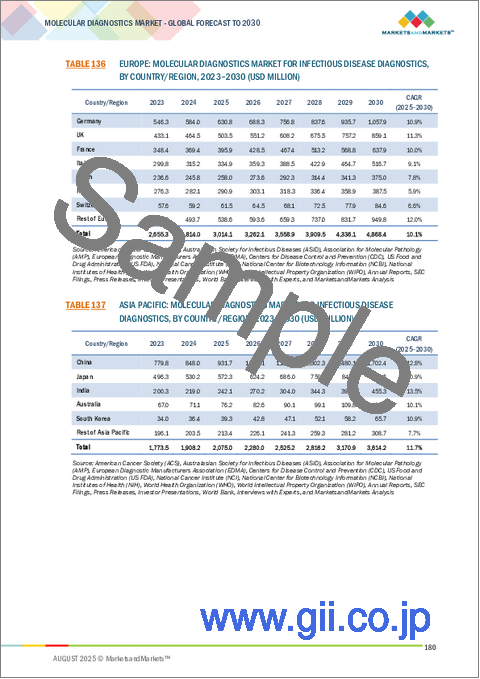

"アジア太平洋地域が予測期間中に最も急成長する地域市場になる見通し"

この成長は、医療投資の増加、早期疾患検出への意識向上、新興国における先進的診断技術の導入拡大によって支えられています。特に中国、インド、韓国などの国々では、医療インフラや検査ラボの能力が急速に改善されています。加えて、感染症監視の強化や分子検査へのアクセス拡大を目的とした政府の取り組みも市場成長に寄与しています。さらに、大規模な患者人口と個別化医療ソリューションへの需要拡大が、同地域の成長ポテンシャルを一層高めています。

当レポートでは、世界の分子診断の市場を調査し、市場概要、市場成長への各種影響因子の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 価格分析

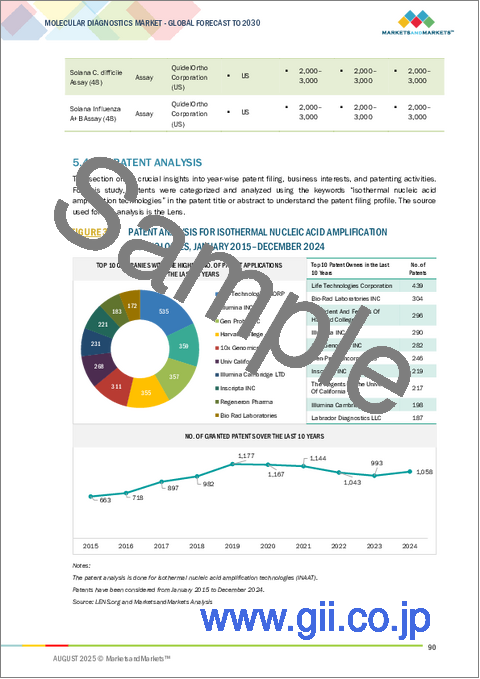

- 特許分析

- バリューチェーン分析

- サプライチェーン分析

- HSコード

- エコシステム分析

- ポーターのファイブフォース分析

- 規制状況

- 技術分析

- 2025-2026年の主な会議とイベント

- 顧客の事業に影響を与える動向/混乱

- 主要な利害関係者と購入基準

- 投資と資金調達のシナリオ

- ケーススタディ分析

- AI/生成AIが分子診断市場に与える影響

- 米国の2025年関税

第6章 分子診断市場:製品・サービス別

- 試薬・キット

- 機器

- サービス・ソフトウェア

第7章 分子診断市場:検査タイプ別

- ラボテスト

- POCテスト

第8章 分子診断市場:サンプルタイプ別

- 血液、血清、血漿

- 尿

- その他

第9章 分子診断市場:技術別

- ポリメラーゼ連鎖反応

- 等温核酸増幅技術

- DNAシーケンシング・次世代シーケンシング

- インサイチューハイブリダイゼーション

- DNAマイクロアレイ

- その他

第10章 分子診断市場:用途別

- 感染症診断

- 性感染症

- 肝炎

- 呼吸器感染症

- 院内感染症

- 媒介性疾患

- その他

- がん検査

- 乳がん

- 大腸がん

- 肺がん

- 前立腺がん

- その他

- 遺伝子検査

- その他

第11章 分子診断市場:技術別

- マルチプレックステスト

- シングルプレックステスト

第12章 分子診断市場:臨床応用別

- 診断

- スクリーニング

第13章 分子診断市場:エンドユーザー別

- 診断ラボ

- 病院・クリニック

- その他

第14章 分子診断市場:地域別

- 北米

- マクロ経済見通し

- 米国

- カナダ

- 欧州

- マクロ経済見通し

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- ロシア

- スイス

- その他

- アジア太平洋

- マクロ経済見通し

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- その他

- ラテンアメリカ

- マクロ経済見通し

- ブラジル

- メキシコ

- その他

- 中東・アフリカ

- マクロ経済見通し

- サウジアラビア

- アラブ首長国連邦

- その他

第15章 競合情勢

- 主要参入企業の戦略/強み

- 収益分配分析

- 市場シェア分析

- 企業評価マトリックス:主要企業

- 企業評価マトリックス:スタートアップ/中小企業

- 企業評価と財務指標

- ブランド/製品比較

- 競合シナリオ

第16章 企業プロファイル

- 主要企業

- DANAHER CORPORATION

- F. HOFFMANN-LA ROCHE LTD

- ILLUMINA, INC.

- HOLOGIC, INC.

- BIOMERIEUX

- ABBOTT LABORATORIES

- THERMO FISHER SCIENTIFIC INC.

- QIAGEN N.V.

- REVVITY, INC.

- MYRIAD GENETICS, INC.

- SIEMENS HEALTHINEERS AG

- その他の企業

- BECTON, DICKINSON AND COMPANY (BD)

- GRIFOLS, S.A.

- QUIDELORTHO CORPORATION

- DIASORIN S.P.A.

- EXACT SCIENCES CORPORATION

- GENETIC SIGNATURES

- AGILENT TECHNOLOGIES, INC.

- MDXHEALTH

- BIOCARTIS

- MEDIGEN BIOTECHNOLOGY CORP.

- VELA DIAGNOSTICS

- AMOY DIAGNOSTICS CO., LTD.

- BRUKER CORPORATION (ELITECHGROUP)

- MOLBIO DIAGNOSTICS LIMITED

- GENEOMBIOTECHNOLOGIES

- SAVYON DIAGNOSTICS

- UNIOGEN OY