|

|

市場調査レポート

商品コード

1807086

NDTおよび検査の世界市場 (~2030年):技術 (超音波探傷・目視・磁粉探傷・液体浸透・渦流探傷・放射線探傷・アコースティックエミッション)・サービス・手法・産業・用途・地域別NDT and Inspection Market by Technique (Ultrasonic Testing, Visual, Magnetic Particle, Liquid Penetration, Eddy-Current, Radiographic, Acoustic Emission), Service, Method, Vertical, Application and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| NDTおよび検査の世界市場 (~2030年):技術 (超音波探傷・目視・磁粉探傷・液体浸透・渦流探傷・放射線探傷・アコースティックエミッション)・サービス・手法・産業・用途・地域別 |

|

出版日: 2025年08月28日

発行: MarketsandMarkets

ページ情報: 英文 293 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

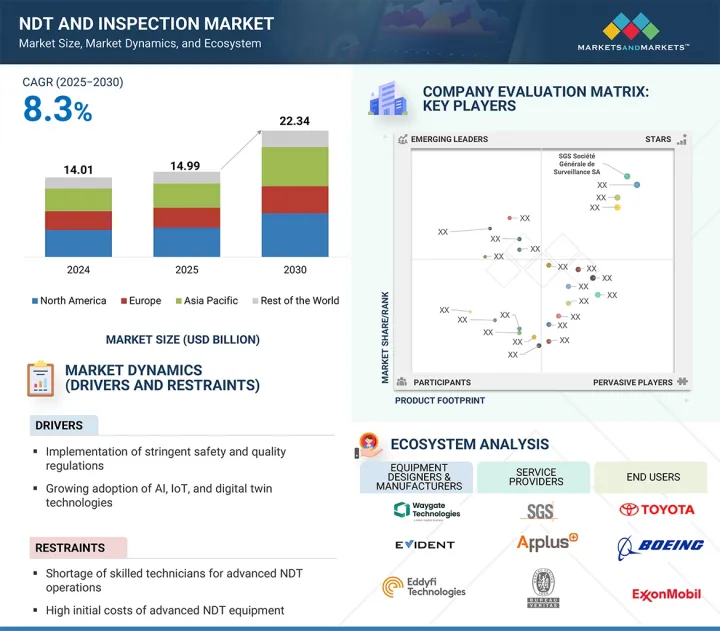

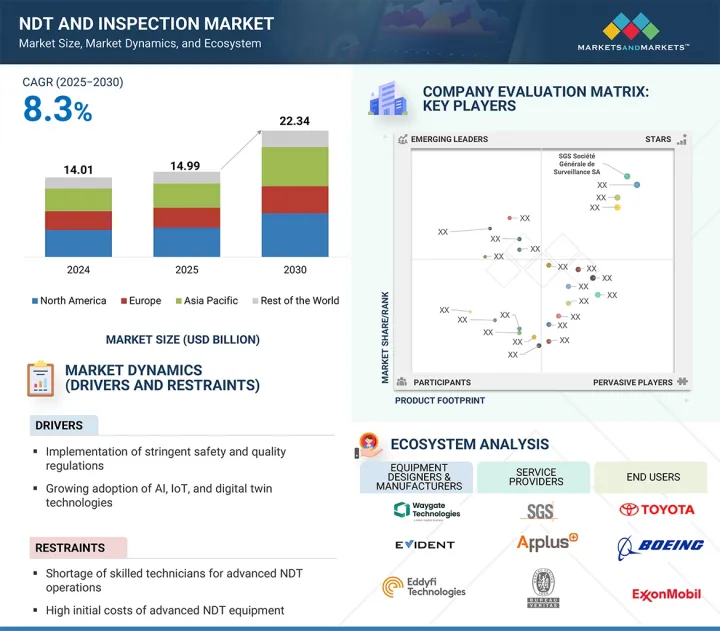

NDTおよび検査の市場規模は、2025年の149億9,000万米ドルから、予測期間中はCAGR 8.3%で推移し、2030年には223億4,000万米ドルに達すると予測されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021-2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025-2030年 |

| 単位 | 金額 (米ドル) |

| セグメント | 技術、サービス、産業、用途、地域 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

いくつかの要因が、NDTおよび検査市場の力強い成長を牽引しています。資産の健全性、公共の安全、製品品質への関心の高まりに加え、ASME、API、ISOといった機関による厳格な規制が、産業界に高度な試験・検査ソリューションへの投資を促しています。先進地域におけるインフラの老朽化や、石油・ガス、航空宇宙、発電、自動車分野における大規模プロジェクトの増加も、信頼性の高いNDT技術への需要をさらに押し上げています。さらに、AIによる分析、IoT対応センサー、ロボティクス、デジタルツインといった技術革新は、リアルタイム監視、予知保全、欠陥検出能力の向上を可能にすることで、検査プロセスを変革しています。

しかし、高度なNDT機器に関連する高コストに加え、熟練した専門家の不足や既存システムとの統合における課題が、導入を抑制する可能性があります。さらに、新興市場における認知度の低さや、産業分野ごとに異なる検査プロセスを標準化することの複雑さが、市場の広範な拡大に対するさらなる障害となっています。

"技術別では、アコースティックエミッション検査 (AET) が予測期間中に最も高いCAGRを示す見込み"

この背景には重要資産におけるリアルタイムの構造健全性モニタリングや早期故障検知への採用拡大があります。AETは、亀裂の進展、腐食、応力下での材料変形といった動的変化を検知できる能力により、従来のNDT手法では早期に把握できない場合でも検出可能であるため、石油・ガス、発電、航空宇宙、公共インフラといった産業でますます支持されています。

この技術は、AIによる信号解析、IoT対応センサー、クラウドベースのデータ管理といった先進的なデジタル技術との互換性を持つことから、その精度と有用性がさらに高まっています。AETシステムは、連続的かつ非侵襲的なモニタリングを可能にし、ダウンタイムと運用リスクを低減しながら予知保全戦略を支援します。その用途は、パイプライン、圧力容器、橋梁、風力タービンといった安全性と信頼性が極めて重要な分野で急速に拡大しています。

スマート資産管理やインダストリー4.0の実践への移行が、AETソリューションの導入を加速させています。市場の主要企業は、遠隔モニタリング機能を備えた携帯型、ワイヤレス、自動化されたAETシステムの開発に注力しています。産業界が効率性、安全性、コスト最適化を重視する中で、AETはNDTおよび検査分野における中核的技術となることが見込まれています。

当レポートでは、世界のNDTおよび検査の市場を調査し、市場概要、市場成長への各種影響因子の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客の事業に影響を与える動向/混乱

- 価格分析

- バリューチェーン分析

- エコシステム分析

- 技術分析

- 特許分析

- 貿易分析

- 2025-2026年の主な会議とイベント

- ケーススタディ分析

- 関税と規制状況

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- AI/生成AIがNDTおよび検査市場に与える影響

- 2025年の米国関税がNDTおよび検査市場に与える影響- 概要

第6章 NDTおよび検査の応用

- 欠陥検出

- 応力および構造解析

- 漏れ検出

- 寸法測定

- 物理的特性評価

- 溶接検証

- 化学組成測定

- プラズマ発光分光器

- 耐食性試験

- その他

第7章 NDTおよび検査市場:技術別

- 超音波探傷試験

- 垂直探傷

- 斜角探傷

- 浸漬探傷試験

- フェーズドアレイ探傷試験

- 飛行時間回折 (TOFD)

- ガイド波探傷試験

- 目視検査

- 一般目視検査

- 補助視覚検査

- ボアスコープ

- 内視鏡

- ビデオスコープ

- 磁粉探傷試験

- 浸透探傷試験

- 渦流探傷試験

- 交流電場測定法 (ACFM)

- リモートフィールド試験 (RFT)

- 渦流アレイ探傷 (ECA)

- 放射線透過試験

- X線検査

- ガンマ線検査

- コンピュータ放射線撮影

- フィルムラジオグラフィ

- 直接放射線撮影 (リアルタイム)

- アコースティックエミッション検査

- その他

- テラヘルツイメージング

- 近赤外分光法

第8章 NDTおよび検査市場:サービス別

- 検査サービス

- 超音波検査

- 放射線透過検査

- 目視検査

- 磁粉検査

- 高度渦流検査

- 浸透検査

- 機器レンタルサービス

- 校正サービス

- その他

第9章 NDTおよび検査市場:産業別

- 製造

- 石油・ガス

- 製油所

- 送電パイプライン

- 海底パイプライン

- 貯蔵タンク

- 航空宇宙

- 航空機エンジン部品製造

- 複合材機体製造

- 航空機整備

- 材料分析

- 公共インフラ

- 軍事・防衛

- 空港セキュリティ

- 鉄道

- 橋・トンネル

- 国境

- 核廃棄物の貯蔵と廃止措置

- 自動車

- 電力

- 原子力発電所

- 風力タービン

- 太陽光発電

- 化石燃料発電所

- その他

- 海洋・船舶

- 医療・ヘルスケア

- プラスチック・ポリマー

第10章 NDTおよび検査市場:地域別

- 北米

- マクロ経済見通し

- 米国

- カナダ

- メキシコ

- 欧州

- マクロ経済見通し

- 英国

- ドイツ

- フランス

- イタリア

- スペイン

- ポーランド

- 北欧

- その他

- アジア太平洋

- マクロ経済見通し

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- インドネシア

- マレーシア

- タイ

- ベトナム

- その他

- その他の地域

- マクロ経済見通し

- 中東

- アフリカ

- 南米

第11章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 市場シェア分析

- 収益分析

- 企業評価と財務指標、2025年

- 企業評価マトリックス:主要企業

- 企業評価マトリックス:スタートアップ/中小企業

- ブランド/製品比較

- 競合シナリオ

第12章 企業プロファイル

- 主要企業

- SGS SOCIETE GENERALE DE SURVEILLANCE SA

- BUREAU VERITAS

- BAKER HUGHES COMPANY

- APPLUS+

- INTERTEK GROUP PLC

- MISTRAS GROUP

- WABTEC CORPORATION

- ASHTEAD TECHNOLOGY

- TUV RHEINLAND

- DEKRA

- その他の企業

- COMET GROUP

- ACUREN

- VIDISCO

- TEAM, INC.

- CYGNUS INSTRUMENTS LTD.

- FPRIMEC SOLUTIONS INC.

- CARESTREAM HEALTH

- ELEMENT MATERIALS TECHNOLOGY

- HELMUT FISCHER GMBH

- AMERAPEX CORPORATION

- NIKON METROLOGY NV

- MAGNAFLUX

- SONATEST

- EDDYFI TECHNOLOGIES

- OKONDT GROUP

第13章 付録

List of Tables

- TABLE 1 RISK ASSESSMENT

- TABLE 2 AVERAGE SELLING PRICE OF ULTRASONIC TESTING TECHNIQUES OFFERED BY BAKER HUGHES COMPANY (WAYGATE TECHNOLOGIES), 2021-2024 (USD)

- TABLE 3 AVERAGE SELLING PRICE TREND OF ULTRASONIC TESTING TECHNIQUES, 2021-2024 (USD)

- TABLE 4 AVERAGE SELLING PRICE TREND OF ULTRASONIC TESTING TECHNIQUES, BY REGION, 2021-2024 (USD)

- TABLE 5 NDT AND INSPECTION: ROLES OF COMPANIES IN ECOSYSTEM

- TABLE 6 LIST OF MAJOR PATENTS, 2021-2024

- TABLE 7 IMPORT DATA FOR HS CODE 9031-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 8 EXPORT DATA FOR HS CODE 9031-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 9 NDT AND INSPECTION MARKET: KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 10 MFN TARIFF LEVIED ON HS CODE 9031-COMPLIANT PRODUCTS LEVIED BY CHINA, 2024

- TABLE 11 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 NDT AND INSPECTION MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 16 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS (%)

- TABLE 17 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 18 DIFFERENT TYPES OF ULTRASONIC TRANSDUCERS USED IN FLAW DETECTION

- TABLE 19 NDT TECHNIQUES TO DETECT STRUCTURAL DAMAGES

- TABLE 20 LEAK TESTING TECHNIQUES

- TABLE 21 DIMENSIONAL MEASUREMENT TECHNIQUES

- TABLE 22 OBJECTIVES OF DIMENSIONAL MEASUREMENTS

- TABLE 23 OTHER APPLICATIONS OF NDT AND INSPECTION

- TABLE 24 NDT AND INSPECTION MARKET, BY TECHNIQUE, 2021-2024 (USD MILLION)

- TABLE 25 NDT AND INSPECTION MARKET, BY TECHNIQUE, 2025-2030 (USD MILLION)

- TABLE 26 TECHNIQUE: NDT AND INSPECTION MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 27 TECHNIQUE: NDT AND INSPECTION MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 28 TECHNIQUE: NDT AND INSPECTION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 29 TECHNIQUE: NDT AND INSPECTION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 30 NDT AND INSPECTION MARKET, BY TECHNIQUE, 2021-2024 (THOUSAND UNITS)

- TABLE 31 NDT AND INSPECTION MARKET, BY TECHNIQUE, 2025-2030 (THOUSAND UNITS)

- TABLE 32 MANUFACTURING: NDT AND INSPECTION TECHNIQUE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 33 MANUFACTURING: NDT AND INSPECTION TECHNIQUE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 34 OIL & GAS: NDT AND INSPECTION TECHNIQUE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 35 OIL & GAS: NDT AND INSPECTION TECHNIQUE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 36 AEROSPACE: NDT AND INSPECTION TECHNIQUE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 37 AEROSPACE: NDT AND INSPECTION TECHNIQUE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 38 PUBLIC INFRASTRUCTURE: NDT AND INSPECTION TECHNIQUE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 39 PUBLIC INFRASTRUCTURE: NDT AND INSPECTION TECHNIQUE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 40 AUTOMOTIVE: NDT AND INSPECTION TECHNIQUE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 41 AUTOMOTIVE: NDT AND INSPECTION TECHNIQUE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 42 POWER: NDT AND INSPECTION TECHNIQUE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 43 POWER: NDT AND INSPECTION TECHNIQUE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 44 OTHER VERTICALS: NDT AND INSPECTION TECHNIQUE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 45 OTHER VERTICALS: NDT AND INSPECTION TECHNIQUE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 46 ULTRASONIC TESTING: NDT AND INSPECTION MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 47 ULTRASONIC TESTING: NDT AND INSPECTION MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 48 VISUAL TESTING: NDT AND INSPECTION MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 49 VISUAL TESTING: NDT AND INSPECTION MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 50 MAGNETIC PARTICLE TESTING: NDT AND INSPECTION MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 51 MAGNETIC PARTICLE TESTING: NDT AND INSPECTION MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 52 LIQUID PENETRANT TESTING: NDT AND INSPECTION MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 53 LIQUID PENETRANT TESTING: NDT AND INSPECTION MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 54 EDDY-CURRENT TESTING: NDT AND INSPECTION MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 55 EDDY-CURRENT TESTING: NDT AND INSPECTION MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 56 RADIOGRAPHIC TESTING: NDT AND INSPECTION MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 57 RADIOGRAPHIC TESTING: NDT AND INSPECTION MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 58 ACOUSTIC EMISSION TESTING: NDT AND INSPECTION MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 59 ACOUSTIC EMISSION TESTING: NDT AND INSPECTION MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 60 OTHER TECHNIQUES: NDT AND INSPECTION MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 61 OTHER TECHNIQUES: NDT AND INSPECTION MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 62 APPLICATIONS OF TERAHERTZ IMAGING, BY INDUSTRY

- TABLE 63 APPLICATIONS OF NEAR-INFRARED SPECTROSCOPY, BY INDUSTRY

- TABLE 64 NDT AND INSPECTION MARKET, BY SERVICE, 2021-2024 (USD MILLION)

- TABLE 65 NDT AND INSPECTION MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 66 SERVICE: NDT AND INSPECTION MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 67 SERVICE: NDT AND INSPECTION MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 68 SERVICE: NDT AND INSPECTION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 69 SERVICE: NDT AND INSPECTION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 70 MANUFACTURING: NDT AND INSPECTION SERVICES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 71 MANUFACTURING: NDT AND INSPECTION SERVICES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 72 OIL & GAS: NDT AND INSPECTION SERVICES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 73 OIL & GAS: NDT AND INSPECTION SERVICES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 74 AEROSPACE: NDT AND INSPECTION SERVICES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 75 AEROSPACE: NDT AND INSPECTION SERVICES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 76 PUBLIC INFRASTRUCTURE: NDT AND INSPECTION SERVICES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 77 PUBLIC INFRASTRUCTURE: NDT AND INSPECTION SERVICES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 78 AUTOMOTIVE: NDT AND INSPECTION SERVICES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 79 AUTOMOTIVE: NDT AND INSPECTION SERVICES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 80 POWER: NDT AND INSPECTION SERVICES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 81 POWER: NDT AND INSPECTION SERVICES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 82 OTHER VERTICALS: NDT AND INSPECTION SERVICES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 83 OTHER VERTICALS: NDT AND INSPECTION SERVICES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 84 INSPECTION SERVICES: NDT AND INSPECTION MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 85 INSPECTION SERVICES: NDT AND INSPECTION MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 86 EQUIPMENT RENTAL SERVICES: NDT AND INSPECTION MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 87 EQUIPMENT RENTAL SERVICES: NDT AND INSPECTION MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 88 CALIBRATION SERVICES: NDT AND INSPECTION MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 89 CALIBRATION SERVICES: NDT AND INSPECTION MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 90 OTHER SERVICES: NDT AND INSPECTION MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 91 OTHER SERVICES: NDT AND INSPECTION MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 92 NDT AND INSPECTION REQUIREMENTS OF DIFFERENT VERTICALS

- TABLE 93 NDT AND INSPECTION MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 94 NDT AND INSPECTION MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 95 MANUFACTURING: NDT AND INSPECTION MARKET, BY TECHNIQUE AND SERVICE, 2021-2024 (USD MILLION)

- TABLE 96 MANUFACTURING: NDT AND INSPECTION MARKET, BY TECHNIQUE AND SERVICE, 2025-2030 (USD MILLION)

- TABLE 97 MANUFACTURING: NDT AND INSPECTION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 98 MANUFACTURING: NDT AND INSPECTION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 99 OIL & GAS: NDT AND INSPECTION MARKET, BY TECHNIQUE AND SERVICE, 2021-2024 (USD MILLION)

- TABLE 100 OIL & GAS: NDT AND INSPECTION MARKET, BY TECHNIQUE AND SERVICE, 2025-2030 (USD MILLION)

- TABLE 101 OIL & GAS: NDT AND INSPECTION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 102 OIL & GAS: NDT AND INSPECTION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 103 APPLICATIONS OF NDT AND INSPECTION TECHNIQUES IN AEROSPACE VERTICAL

- TABLE 104 NDT AND INSPECTION METHODS USED IN AEROSPACE VERTICAL

- TABLE 105 AEROSPACE: NDT AND INSPECTION MARKET, BY TECHNIQUE AND SERVICE, 2021-2024 (USD MILLION)

- TABLE 106 AEROSPACE: NDT AND INSPECTION MARKET, BY TECHNIQUE AND SERVICE, 2025-2030 (USD MILLION)

- TABLE 107 AEROSPACE: NDT AND INSPECTION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 108 AEROSPACE: NDT AND INSPECTION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 109 ESSENTIAL NDT AND INSPECTION TECHNIQUES FOR AIRCRAFT MAINTENANCE

- TABLE 110 PUBLIC INFRASTRUCTURE: NDT AND INSPECTION MARKET, BY TECHNIQUE AND SERVICE, 2021-2024 (USD MILLION)

- TABLE 111 PUBLIC INFRASTRUCTURE: NDT AND INSPECTION MARKET, BY TECHNIQUE AND SERVICE, 2025-2030 (USD MILLION)

- TABLE 112 PUBLIC INFRASTRUCTURE: NDT AND INSPECTION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 113 PUBLIC INFRASTRUCTURE: NDT AND INSPECTION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 114 ADVANTAGES OF USING DIFFERENT NDT AND INSPECTION TECHNOLOGIES IN AUTOMOTIVE VERTICAL

- TABLE 115 AUTOMOTIVE: NDT AND INSPECTION MARKET, BY TECHNIQUE AND SERVICE, 2021-2024 (USD MILLION)

- TABLE 116 AUTOMOTIVE: NDT AND INSPECTION MARKET, BY TECHNIQUE AND SERVICE, 2025-2030 (USD MILLION)

- TABLE 117 AUTOMOTIVE: NDT AND INSPECTION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 118 AUTOMOTIVE: NDT AND INSPECTION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 119 POWER: NDT AND INSPECTION MARKET, BY TECHNIQUE AND SERVICE, 2021-2024 (USD MILLION)

- TABLE 120 POWER: NDT AND INSPECTION MARKET, BY TECHNIQUE AND SERVICE, 2025-2030 (USD MILLION)

- TABLE 121 POWER: NDT AND INSPECTION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 122 POWER: NDT AND INSPECTION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 123 APPLICATIONS OF NDT AND INSPECTION TECHNIQUES IN NUCLEAR POWER PLANTS

- TABLE 124 OTHER VERTICALS: NDT AND INSPECTION MARKET, BY TECHNIQUE AND SERVICE, 2021-2024 (USD MILLION)

- TABLE 125 OTHER VERTICALS: NDT AND INSPECTION MARKET, BY TECHNIQUE AND SERVICE, 2025-2030 (USD MILLION)

- TABLE 126 OTHER VERTICALS: NDT AND INSPECTION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 127 OTHER VERTICALS: NDT AND INSPECTION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 128 NDT AND INSPECTION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 129 NDT AND INSPECTION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 130 NORTH AMERICA: NDT AND INSPECTION MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 131 NORTH AMERICA: NDT AND INSPECTION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 132 NORTH AMERICA: NDT AND INSPECTION MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 133 NORTH AMERICA: NDT AND INSPECTION MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 134 NORTH AMERICA: NDT AND INSPECTION MARKET, BY TECHNIQUE & SERVICE, 2021-2024 (USD MILLION)

- TABLE 135 NORTH AMERICA: NDT AND INSPECTION MARKET, BY TECHNIQUE & SERVICE, 2025-2030 (USD MILLION)

- TABLE 136 EUROPE: NDT AND INSPECTION MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 137 EUROPE: NDT AND INSPECTION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 138 EUROPE: NDT AND INSPECTION MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 139 EUROPE: NDT AND INSPECTION MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 140 EUROPE: NDT AND INSPECTION MARKET, BY TECHNIQUE & SERVICE, 2021-2024 (USD MILLION)

- TABLE 141 EUROPE: NDT AND INSPECTION MARKET, BY TECHNIQUE & SERVICE, 2025-2030 (USD MILLION)

- TABLE 142 ASIA PACIFIC: NDT AND INSPECTION MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 143 ASIA PACIFIC: NDT AND INSPECTION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 144 ASIA PACIFIC: NDT AND INSPECTION MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 145 ASIA PACIFIC: NDT AND INSPECTION MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 146 ASIA PACIFIC: NDT AND INSPECTION MARKET, BY TECHNIQUE & SERVICE, 2021-2024 (USD MILLION)

- TABLE 147 ASIA PACIFIC: NDT AND INSPECTION MARKET, BY TECHNIQUE & SERVICE, 2025-2030 (USD MILLION)

- TABLE 148 ROW: NDT AND INSPECTION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 149 ROW: NDT AND INSPECTION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 150 ROW: NDT AND INSPECTION MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 151 ROW: NDT AND INSPECTION MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 152 ROW: NDT AND INSPECTION MARKET, BY TECHNIQUE & SERVICE, 2021-2024 (USD MILLION)

- TABLE 153 ROW: NDT AND INSPECTION MARKET, BY TECHNIQUE & SERVICE, 2025-2030 (USD MILLION)

- TABLE 154 MIDDLE EAST: NDT AND INSPECTION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 155 MIDDLE EAST: NDT AND INSPECTION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 156 NDT AND INSPECTION MARKET: KEY PLAYERS' STRATEGIES/RIGHT TO WIN, 2020-2025

- TABLE 157 NDT AND INSPECTION MARKET: MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS, 2024

- TABLE 158 NDT AND INSPECTION MARKET: REGION FOOTPRINT, 2024

- TABLE 159 NDT AND INSPECTION MARKET: SERVICE FOOTPRINT, 2024

- TABLE 160 NDT AND INSPECTION MARKET: VERTICAL FOOTPRINT, 2024

- TABLE 161 NDT AND INSPECTION MARKET: DETAILED LIST OF KEY STARTUPS/SMES, 2024

- TABLE 162 NDT AND INSPECTION MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, 2024

- TABLE 163 NDT AND INSPECTION MARKET: PRODUCT/SERVICE LAUNCHES, JANUARY 2020-JULY 2025

- TABLE 164 NDT AND INSPECTION MARKET: DEALS, JANUARY 2020-JULY 2025

- TABLE 165 NDT AND INSPECTION MARKET: EXPANSIONS, JANUARY 2020-JULY 2025

- TABLE 166 NDT AND INSPECTION MARKET: OTHER DEVELOPMENTS, JANUARY 2020-JULY 2025

- TABLE 167 SGS SOCIETE GENERALE DE SURVEILLANCE SA: COMPANY OVERVIEW

- TABLE 168 SGS SOCIETE GENERALE DE SURVEILLANCE SA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 169 SGS SOCIETE GENERALE DE SURVEILLANCE SA: DEALS

- TABLE 170 BUREAU VERITAS: COMPANY OVERVIEW

- TABLE 171 BUREAU VERITAS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 172 BUREAU VERITAS: EXPANSIONS

- TABLE 173 BAKER HUGHES COMPANY: COMPANY OVERVIEW

- TABLE 174 BAKER HUGHES COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 175 BAKER HUGHES COMPANY: PRODUCT/SERVICE LAUNCHES

- TABLE 176 BAKER HUGHES COMPANY: DEALS

- TABLE 177 APPLUS+: COMPANY OVERVIEW

- TABLE 178 APPLUS+: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 179 APPLUS+: DEALS

- TABLE 180 APPLUS+: OTHER DEVELOPMENTS

- TABLE 181 INTERTEK GROUP PLC: COMPANY OVERVIEW

- TABLE 182 INTERTEK GROUP PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 183 INTERTEK GROUP PLC: PRODUCT/SERVICE LAUNCHES

- TABLE 184 INTERTEK GROUP PLC: EXPANSIONS

- TABLE 185 MISTRAS GROUP: COMPANY OVERVIEW

- TABLE 186 MISTRAS GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 187 MISTRAS GROUP: PRODUCT/SERVICE LAUNCHES

- TABLE 188 MISTRAS GROUP: DEALS

- TABLE 189 MISTRAS GROUP: OTHER DEVELOPMENTS

- TABLE 190 WABTEC CORPORATION: COMPANY OVERVIEW

- TABLE 191 WABTEC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 192 WABTEC CORPORATION: DEALS

- TABLE 193 ASHTEAD TECHNOLOGY: COMPANY OVERVIEW

- TABLE 194 ASHTEAD TECHNOLOGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 195 ASHTEAD TECHNOLOGY: PRODUCT/SERVICE LAUNCHES

- TABLE 196 ASHTEAD TECHNOLOGY: DEALS

- TABLE 197 TUV RHEINLAND: COMPANY OVERVIEW

- TABLE 198 TUV RHEINLAND: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 199 TUV RHEINLAND: DEALS

- TABLE 200 DEKRA: COMPANY OVERVIEW

- TABLE 201 DEKRA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 202 DEKRA: EXPANSIONS

List of Figures

- FIGURE 1 NDT AND INSPECTION MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 NDT AND INSPECTION MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): REVENUE GENERATED BY KEY PLAYERS

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (SUPPLY SIDE): ILLUSTRATION OF REVENUE ESTIMATION OF KEY PLAYERS

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3 (DEMAND SIDE) -BOTTOM-UP ESTIMATION OF MARKET SIZE BASED ON REGION

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 8 DATA TRIANGULATION: NDT AND INSPECTION MARKET

- FIGURE 9 NDT AND INSPECTION MARKET SNAPSHOT

- FIGURE 10 OTHER SERVICES SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 11 ULTRASONIC TESTING SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

- FIGURE 12 OIL & GAS TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 13 ASIA PACIFIC NDT AND INSPECTION MARKET TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 14 INCREASED DEMAND FOR ACOUSTIC EMISSION TESTING TO CREATE LUCRATIVE OPPORTUNITIES FOR MARKET PLAYERS

- FIGURE 15 ULTRASONIC TESTING SEGMENT TO ACCOUNT FOR LARGEST SHARE OF NDT AND INSPECTION MARKET IN 2025

- FIGURE 16 OTHER SERVICES SEGMENT TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 17 OIL & GAS TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 18 NORTH AMERICA TO BE LARGEST NDT AND INSPECTION MARKET DURING FORECAST PERIOD

- FIGURE 19 INDIA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 20 NDT AND INSPECTION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 21 NDT AND INSPECTION MARKET: IMPACT ANALYSIS OF DRIVERS

- FIGURE 22 NDT AND INSPECTION MARKET: IMPACT ANALYSIS OF RESTRAINTS

- FIGURE 23 NDT AND INSPECTION MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

- FIGURE 24 NDT AND INSPECTION MARKET: IMPACT ANALYSIS OF CHALLENGES

- FIGURE 25 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 26 AVERAGE SELLING PRICE TREND OF ULTRASONIC TESTING TECHNIQUES, 2021-2024

- FIGURE 27 AVERAGE SELLING PRICE TREND OF ULTRASONIC TESTING TECHNIQUES, BY REGION, 2021-2024

- FIGURE 28 NDT AND INSPECTION MARKET: VALUE CHAIN ANALYSIS

- FIGURE 29 NDT AND INSPECTION MARKET: ECOSYSTEM ANALYSIS

- FIGURE 30 PATENTS ANALYSIS

- FIGURE 31 IMPORT SCENARIO FOR HS CODE 9031-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024

- FIGURE 32 EXPORT SCENARIO FOR HS CODE 9031-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024

- FIGURE 33 NDT AND INSPECTION MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 34 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- FIGURE 35 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- FIGURE 36 IMPACT OF AI/GEN AI ON NDT AND INSPECTION MARKET

- FIGURE 37 KEY APPLICATIONS OF NDT AND INSPECTION TECHNIQUES

- FIGURE 38 ULTRASONIC TESTING SEGMENT TO ACCOUNT FOR LARGEST SHARE OF NDT AND INSPECTION MARKET IN 2030

- FIGURE 39 INSPECTION SERVICES SEGMENT TO ACCOUNT FOR LARGEST SHARE OF NDT AND INSPECTION MARKET IN 2030

- FIGURE 40 OIL & GAS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

- FIGURE 41 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE OF NDT AND INSPECTION MARKET IN 2030

- FIGURE 42 NORTH AMERICA: NDT AND INSPECTION MARKET SNAPSHOT

- FIGURE 43 EUROPE: NDT AND INSPECTION MARKET SNAPSHOT

- FIGURE 44 ASIA PACIFIC: NDT AND INSPECTION MARKET SNAPSHOT

- FIGURE 45 NDT AND INSPECTION MARKET SHARE ANALYSIS, 2024

- FIGURE 46 REVENUE ANALYSIS OF KEY PLAYERS IN NDT AND INSPECTION MARKET, 2020-2024

- FIGURE 47 COMPANY VALUATION, 2025

- FIGURE 48 FINANCIAL METRICS, 2025

- FIGURE 49 NDT AND INSPECTION SERVICES MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 50 NDT AND INSPECTION EQUIPMENT MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 51 NDT AND INSPECTION MARKET: COMPANY FOOTPRINT, 2024

- FIGURE 52 NDT AND INSPECTION MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 53 NDT AND INSPECTION MARKET: BRAND/SERVICE COMPARISON

- FIGURE 54 SGS SOCIETE GENERALE DE SURVEILLANCE SA: COMPANY SNAPSHOT

- FIGURE 55 BUREAU VERITAS: COMPANY SNAPSHOT

- FIGURE 56 BAKER HUGHES COMPANY: COMPANY SNAPSHOT

- FIGURE 57 APPLUS+: COMPANY SNAPSHOT

- FIGURE 58 INTERTEK GROUP PLC: COMPANY SNAPSHOT

- FIGURE 59 MISTRAS GROUP: COMPANY SNAPSHOT

- FIGURE 60 WABTEC CORPORATION: COMPANY SNAPSHOT

- FIGURE 61 ASHTEAD TECHNOLOGY: COMPANY SNAPSHOT

- FIGURE 62 TUV RHEINLAND: COMPANY SNAPSHOT

- FIGURE 63 DEKRA: COMPANY SNAPSHOT

The NDT and inspection market is projected to reach USD 22.34 billion by 2030 from USD 14.99 billion in 2025 at a CAGR of 8.3% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Technique, Service, Vertical, Application, and Region |

| Regions covered | North America, Europe, APAC, RoW |

Several factors are driving the robust growth of the NDT and inspection market. Increasing focus on asset integrity, public safety, and product quality, coupled with stringent regulations from bodies such as ASME, API, and ISO, is compelling industries to invest in advanced testing and inspection solutions. The aging infrastructure in developed regions and the surge in large-scale projects across oil & gas, aerospace, power generation, and automotive sectors further boost the demand for reliable NDT techniques. Technological advancements, including AI-driven analytics, IoT-enabled sensors, robotics, and digital twins, are transforming inspection processes by enabling real-time monitoring, predictive maintenance, and improved defect detection.

However, high costs associated with advanced NDT equipment, coupled with the shortage of skilled professionals and integration challenges with legacy systems, can restrain adoption. Additionally, limited awareness in emerging markets and the complexity of standardizing inspection processes across diverse industries pose further challenges to widespread market expansion.

"By technique, acoustic emission testing (AET) is expected to register the highest CAGR during the forecast period."

The acoustic emission testing (AET) segment is projected to register the highest CAGR in the NDT and inspection market during the forecast period, driven by its growing adoption for real-time structural health monitoring and early fault detection in critical assets. AET is increasingly favoured in industries such as oil & gas, power generation, aerospace, and public infrastructure due to its ability to detect dynamic changes like crack growth, corrosion, and material deformation under stress, which traditional NDT methods may not identify at an early stage.

The technique's compatibility with advanced digital technologies, including AI-based signal analysis, IoT-enabled sensors, and cloud-based data management, is further enhancing its accuracy and usability. AET systems enable continuous, non-invasive monitoring, reducing downtime and operational risks while supporting predictive maintenance strategies. Its applications are expanding rapidly in pipelines, pressure vessels, bridges, and wind turbines, where safety and reliability are critical.

The shift toward smart asset management and Industry 4.0 practices is accelerating the deployment of AET solutions. Key players in the market are focusing on developing portable, wireless, and automated AET systems that provide remote monitoring capabilities. As industries prioritize efficiency, safety, and cost optimization, AET is set to become a pivotal technology within the NDT and inspection landscape.

By service, the inspection services segment is projected to account for the largest market share during the forecast period."

The inspection services segment is expected to hold the largest share of the NDT and inspection market during the forecast period, driven by the growing demand for outsourced expertise, cost efficiency, and compliance with stringent safety and quality standards. Inspection services are critical across industries such as oil & gas, aerospace, power generation, automotive, and infrastructure, where ensuring asset integrity and operational safety is paramount. These services involve a wide range of NDT techniques, including ultrasonic testing (UT), radiographic testing (RT), magnetic particle testing (MPT), and eddy-current testing (ECT), which enable accurate defect detection without damaging critical components.

The rising complexity of industrial assets and the growing need for predictive maintenance are encouraging companies to rely on specialized service providers that offer advanced inspection solutions integrated with AI, IoT, and digital twin technologies. Additionally, the adoption of drones, robotics, and automated inspection platforms is enhancing the efficiency and safety of field operations, especially in hazardous or remote environments. Many companies are turning to third-party inspection services to ensure regulatory compliance with standards set by ASME, ISO, and other global bodies, while minimizing downtime and operational risks. With rapid industrialization and infrastructure development in emerging markets, the demand for professional inspection services is expected to grow steadily, reinforcing its dominant position in the NDT and inspection market.

"Asia Pacific is projected to account for the second-largest market share during the forecast period."

The Asia Pacific region is projected to hold the second-largest share of the global NDT and inspection market during the forecast period, driven by rapid industrialization, expanding infrastructure, and stringent safety regulations across key industries. Countries such as China, India, Japan, South Korea, and Australia are witnessing significant investments in sectors like oil & gas, power generation, aerospace, and automotive, all of which require advanced inspection technologies to ensure operational safety, quality, and compliance with international standards.

Government initiatives promoting infrastructure modernization, coupled with growing energy demand and pipeline development projects, are boosting the adoption of non-destructive testing methods such as ultrasonic testing (UT), radiographic testing (RT), and eddy-current testing (ECT). Additionally, the rapid growth of renewable energy projects, particularly wind and solar, is driving the need for structural health monitoring and predictive maintenance.

Asia Pacific is also emerging as a hub for manufacturing and exports, which is increasing the demand for advanced, cost-efficient inspection solutions. Local players, in collaboration with global NDT companies, are expanding their service capabilities by integrating AI, IoT, and robotics to enhance accuracy and reduce downtime. With its dynamic industrial base and supportive regulatory frameworks, Asia Pacific continues to be a key growth engine for the global NDT and inspection market.

Break-up of the profile of primary participants in the NDT and inspection market:

- By Company Type: Tier 1 - 25%, Tier 2 - 35%, Tier 3 - 40%

- By Designation Type: C Level - 40%, Director Level - 30%, Others - 30%

- By Region: North America - 35%, Europe - 30%, Asia Pacific - 25%, Rest of the World - 10%

Note: Other designations include sales, marketing, and product managers.

The three tiers of the companies are based on their total revenues as of 2024; Tier 1: >USD 1 billion, Tier 2: USD 500 million-1 billion, and Tier 3: USD 500 million

The major players in the NDT and inspection market with a significant global presence include SGS Societe Generale de Surveillance SA (SGS SA) (Switzerland), Bureau Veritas (France), Baker Hughes Company (US), Applus+ (Spain), and Intertek Group plc (UK).

Research Coverage

The report segments the NDT and inspection market and forecasts its size by technique, service, vertical, application, and region. It also provides a comprehensive review of drivers, restraints, opportunities, and challenges influencing the market growth. The report covers qualitative aspects in addition to quantitative aspects of the market.

Reasons to buy the report:

The report will help the market leaders/new entrants in this market with information on the closest approximate revenues for the overall NDT and inspection market and related segments. This report will help stakeholders understand the competitive landscape and gain more insights to strengthen their position in the market and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of key drivers (Implementation of stringent safety regulations to ensure public safety and product quality, Increased adoption in electronics, automation, and robotics industries to extend equipment lifespan, enhance production efficiency, and improve product quality , Growing use of AI and IoT technologies in NDT and inspection, Increased demand for structural health monitoring and maintenance of infrastructure), restraints (Lack of skilled technicians for conducting NDT and inspection, High cost of NDT equipment and related technologies), opportunities (Extensive infrastructure development in Asia Pacific, Europe, and South America, Growing demand for NDT and inspection services in power industry, Advancements in NDT and inspection techniques and emergence of new technologies, Growing demand for miniaturized and portable NDT devices, Growing emphasis on sustainability and eco-friendly practices), and challenges (Growing complexity of industrial structures and machines, High replacement costs associated with automated NDT and inspection equipment)

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product/service launches, agreements, partnerships, collaborations, acquisitions, and investments in the NDT and inspection market

- Market Development: Comprehensive information about lucrative markets - the report analyses the NDT and inspection market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the NDT and inspection market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product/service offerings of leading players, such as SGS Societe Generale de Surveillance SA (SGS SA) (Switzerland), Bureau Veritas (France), Baker Hughes Company (US), Applus+ (Spain), Intertek Group plc (UK), MISTRAS Group (US), TUV Rheinland (Germany), DEKRA (Germany), Evident (US), and Ashtead Technology (UK)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 List of key secondary sources

- 2.1.2.2 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 Key data from primary sources

- 2.1.3.2 Breakdown of primaries

- 2.1.3.3 Key industry insights

- 2.2 MARKET SIZE ESTIMATION METHODOLOGY

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to derive market size using bottom-up analysis

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to derive market size using top-down analysis

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET SHARE ESTIMATION

- 2.4 DATA TRIANGULATION

- 2.5 RISK ASSESSMENT

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN NDT AND INSPECTION MARKET

- 4.2 NDT AND INSPECTION MARKET, BY TECHNIQUE

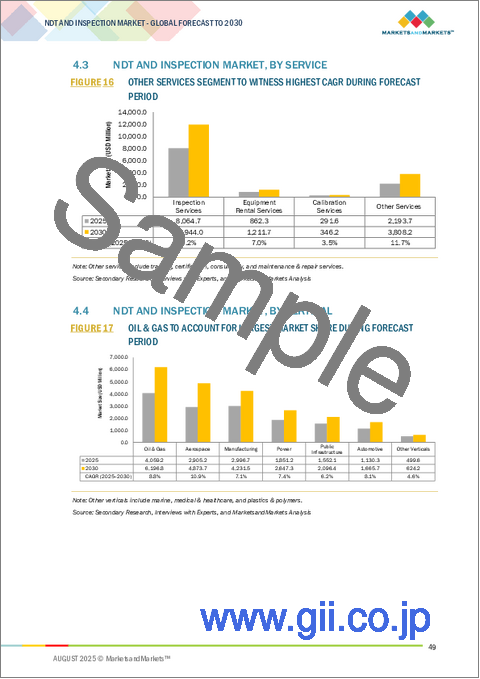

- 4.3 NDT AND INSPECTION MARKET, BY SERVICE

- 4.4 NDT AND INSPECTION MARKET, BY VERTICAL

- 4.5 NDT AND INSPECTION MARKET, BY REGION

- 4.6 NDT AND INSPECTION MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Implementation of stringent safety regulations to ensure public safety and product quality

- 5.2.1.2 Expansion of industrial automation and robotics in inspection

- 5.2.1.3 Growing adoption of AI, IoT, and digital twin technologies

- 5.2.1.4 Rising demand for structural health monitoring of aging infrastructure

- 5.2.1.5 Expansion of subscription-based and service-driven models

- 5.2.1.6 Increasing demand for remote and contactless inspection solutions

- 5.2.2 RESTRAINTS

- 5.2.2.1 Shortage of skilled technicians for advanced NDT operations

- 5.2.2.2 High cost of NDT equipment and related technologies

- 5.2.2.3 Legacy system incompatibility hampering scalable integration of advanced NDT solutions

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing demand for NDT and inspection services in renewable energy and power sectors

- 5.2.3.2 Growing demand for miniaturized and portable NDT devices

- 5.2.3.3 Emphasis on eco-friendly and digitalized inspection solutions

- 5.2.4 CHALLENGES

- 5.2.4.1 Increasing complexity of modern industrial structures and materials

- 5.2.4.2 High replacement and upgrade costs

- 5.2.4.3 Cybersecurity risks in IoT-enabled NDT systems

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE OF ULTRASONIC TESTING TECHNIQUES

- 5.4.2 AVERAGE SELLING PRICE TREND OF ULTRASONIC TESTING TECHNIQUES, 2021-2024

- 5.4.3 AVERAGE SELLING PRICE TREND OF ULTRASONIC TESTING TECHNIQUES, BY REGION, 2021-2024

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 Real-time NDT with IoT integration

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 Artificial intelligence (AI) for defect detection

- 5.7.2.2 Data analytics & cloud platforms

- 5.7.2.3 Green NDT technologies

- 5.7.3 ADJACENT TECHNOLOGIES

- 5.7.3.1 Drone-based inspection

- 5.7.3.2 Robotics & crawlers

- 5.7.3.3 Digital twins

- 5.7.1 KEY TECHNOLOGIES

- 5.8 PATENT ANALYSIS

- 5.9 TRADE ANALYSIS

- 5.9.1 IMPORT SCENARIO (HS CODE 9031)

- 5.9.2 EXPORT SCENARIO (HS CODE 9031)

- 5.10 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 PIPELINE OPERATOR ENHANCED PIPELINE INTEGRITY BY DEPLOYING ADVANCED INSPECTION TECHNOLOGIES BY NDT GLOBAL

- 5.11.2 INSPECTION INNERSPEC TECHNOLOGIES INC. INTRODUCED INNOVATIVE NDT TECHNOLOGIES FOR INSPECTION AND MONITORING OF BOLT LOAD IN SERVICE

- 5.11.3 NDT GLOBAL REVOLUTIONIZED NGL PIPELINE INSPECTION WITH ADVANCED ULTRASONIC CRACK DETECTION TECHNOLOGY

- 5.12 TARIFF AND REGULATORY LANDSCAPE

- 5.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13 PORTER'S FIVE FORCES ANALYSIS

- 5.13.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.13.2 THREAT OF NEW ENTRANTS

- 5.13.3 THREAT OF SUBSTITUTES

- 5.13.4 BARGAINING POWER OF BUYERS

- 5.13.5 BARGAINING POWER OF SUPPLIERS

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.14.2 BUYING CRITERIA

- 5.15 IMPACT OF AI/GEN AI ON NDT AND INSPECTION MARKET

- 5.16 IMPACT OF 2025 US TARIFF ON NDT AND INSPECTION MARKET - OVERVIEW

- 5.16.1 PRICE IMPACT ANALYSIS

- 5.16.2 KEY IMPACTS ON VARIOUS COUNTRIES/REGIONS

- 5.16.2.1 US

- 5.16.2.2 Europe

- 5.16.2.3 Asia Pacific

- 5.16.3 IMPACT ON END-USE VERTICALS

6 APPLICATIONS OF NDT AND INSPECTION

- 6.1 INTRODUCTION

- 6.2 FLAW DETECTION

- 6.3 STRESS AND STRUCTURE ANALYSIS

- 6.4 LEAK DETECTION

- 6.5 DIMENSIONAL MEASUREMENT

- 6.6 PHYSICAL PROPERTIES ESTIMATION

- 6.7 WELD VERIFICATION

- 6.8 CHEMICAL COMPOSITION DETERMINATION

- 6.8.1 PLASMA EMISSION SPECTROGRAPH

- 6.8.2 CORROSION RESISTANCE TESTING

- 6.9 OTHER APPLICATIONS

7 NDT AND INSPECTION MARKET, BY TECHNIQUE

- 7.1 INTRODUCTION

- 7.2 ULTRASONIC TESTING

- 7.2.1 ADOPTION OF SMART ULTRASONIC NDT GAINING MOMENTUM WITH PHASED ARRAY, TOFD, AND AI INTEGRATION

- 7.2.2 STRAIGHT BEAM TESTING

- 7.2.3 ANGLE BEAM TESTING

- 7.2.4 IMMERSION TESTING

- 7.2.5 PHASED ARRAY TESTING

- 7.2.6 TIME-OF-FLIGHT DIFFRACTION (TOFD)

- 7.2.7 GUIDED WAVE TESTING

- 7.3 VISUAL TESTING

- 7.3.1 NEED FOR CONTACTLESS INSPECTION IN CONFINED OR HAZARDOUS ENVIRONMENTS TO DRIVE MARKET

- 7.3.2 GENERAL VISUAL INSPECTION

- 7.3.3 AIDED VISUAL INSPECTION

- 7.3.4 BORESCOPES

- 7.3.5 ENDOSCOPES

- 7.3.6 VIDEOSCOPES

- 7.4 MAGNETIC PARTICLE TESTING

- 7.4.1 HIGH DEMAND IN OIL & GAS INDUSTRY FOR PIPELINE INSPECTION TO DRIVE GROWTH

- 7.5 LIQUID PENETRANT TESTING

- 7.5.1 EXPANSION OF ADDITIVE MANUFACTURING SECTOR FUELING MARKET GROWTH

- 7.6 EDDY-CURRENT TESTING

- 7.6.1 RISING UPTAKE OF ELECTROMAGNETIC PROBES TO FUEL MARKET GROWTH

- 7.6.2 ALTERNATING CURRENT FIELD MEASUREMENT (ACFM)

- 7.6.3 REMOTE FIELD TESTING (RFT)

- 7.6.4 EDDY-CURRENT ARRAY (ECA)

- 7.7 RADIOGRAPHIC TESTING

- 7.7.1 ADOPTION OF ADVANCED IMAGING TOOLS CREATING SEGMENTAL GROWTH OPPORTUNITIES

- 7.7.2 X-RAY TESTING

- 7.7.3 GAMMA RAY TESTING

- 7.7.4 COMPUTED RADIOGRAPHY

- 7.7.5 FILM RADIOGRAPHY

- 7.7.6 DIRECT RADIOGRAPHY (REAL TIME)

- 7.8 ACOUSTIC EMISSION TESTING

- 7.8.1 RISING DEMAND FOR REAL-TIME STRUCTURAL MONITORING BOOSTING ADOPTION OF ACOUSTIC EMISSION TESTING

- 7.9 OTHER TECHNIQUES

- 7.9.1 TERAHERTZ IMAGING

- 7.9.2 NEAR-INFRARED SPECTROSCOPY

8 NDT AND INSPECTION MARKET, BY SERVICE

- 8.1 INTRODUCTION

- 8.2 INSPECTION SERVICES

- 8.2.1 RISING ADOPTION OF REMOTE & INLINE PIPELINE INSPECTION SERVICES TO DRIVE SCALABLE GROWTH

- 8.2.2 ULTRASONIC INSPECTION

- 8.2.3 RADIOGRAPHIC INSPECTION

- 8.2.4 VISUAL INSPECTION

- 8.2.5 MAGNETIC PARTICLE INSPECTION

- 8.2.6 ADVANCED EDDY-CURRENT INSPECTION

- 8.2.7 LIQUID PENETRANT INSPECTION

- 8.3 EQUIPMENT RENTAL SERVICES

- 8.3.1 CLOUD-ENABLED RENTAL PLATFORMS AND ASSET-LIGHT STRATEGIES ACCELERATING ADOPTION

- 8.4 CALIBRATION SERVICES

- 8.4.1 DEVELOPMENT OF ROBOTIC AND DIGITAL CALIBRATION SYSTEMS TO FUEL MARKET GROWTH

- 8.5 OTHER SERVICES

9 NDT AND INSPECTION MARKET, BY VERTICAL

- 9.1 INTRODUCTION

- 9.2 MANUFACTURING

- 9.2.1 RISING DEMAND FROM MINING AND SHIPBUILDING INDUSTRIES DRIVING ADOPTION

- 9.3 OIL & GAS

- 9.3.1 AGING PIPELINE INFRASTRUCTURE AND ENERGY TRANSITION DRIVING NDT ADOPTION IN OIL & GAS SECTOR

- 9.3.2 REFINERIES

- 9.3.3 TRANSMISSION PIPELINES

- 9.3.4 SUBSEA PIPELINES

- 9.3.5 STORAGE TANKS

- 9.3.6 ADVANCED NDT TECHNIQUES USED IN OIL & GAS VERTICAL

- 9.3.6.1 Long-range ultrasonic technique (LRUT)

- 9.3.6.2 Positive metal identification technique

- 9.4 AEROSPACE

- 9.4.1 RISING ADOPTION OF ADVANCED ULTRASONIC AND BOND INSPECTION METHODS DRIVING MARKET GROWTH

- 9.4.2 AIRCRAFT ENGINE PART PRODUCTION

- 9.4.3 COMPOSITE AIRFRAME MANUFACTURING

- 9.4.4 AIRCRAFT MAINTENANCE

- 9.4.5 MATERIAL ANALYSIS

- 9.4.6 ADVANCED NDT AND INSPECTION TECHNIQUES USED IN AEROSPACE VERTICAL

- 9.4.6.1 Dynamic thermography

- 9.4.6.2 Air-coupled ultrasound

- 9.4.6.3 Dynamic interferometry

- 9.5 PUBLIC INFRASTRUCTURE

- 9.5.1 SMART CITY INVESTMENTS AND RESILIENCE INITIATIVES FUELING ADOPTION OF NDT AND INSPECTION TECHNOLOGIES

- 9.5.2 MILITARY & DEFENSE

- 9.5.3 AIRPORT SECURITY

- 9.5.4 RAILWAYS

- 9.5.5 BRIDGES AND TUNNELS

- 9.5.6 BORDER CROSSING

- 9.5.7 NUCLEAR WASTE STORAGE AND DECOMMISSIONING

- 9.5.8 ADVANCED NDT AND INSPECTION TECHNIQUES USED IN PUBLIC INFRASTRUCTURE VERTICAL

- 9.5.8.1 Impact echo

- 9.5.8.2 Ground penetrating radars (GPRs)

- 9.6 AUTOMOTIVE

- 9.6.1 SURGING AUTOMOTIVE SAFETY STANDARDS DRIVING ADOPTION OF ADVANCED NDT SOLUTIONS

- 9.6.2 ADVANCED NDT AND INSPECTION TECHNIQUES USED IN AUTOMOTIVE VERTICAL

- 9.6.2.1 High-energy digital radiography

- 9.7 POWER

- 9.7.1 AGING POWER INFRASTRUCTURE AND EXPANDING RENEWABLE INSTALLATIONS FUELING MARKET GROWTH

- 9.7.2 NUCLEAR POWER PLANTS

- 9.7.3 WIND TURBINES

- 9.7.4 SOLAR POWER

- 9.7.5 FOSSIL FUEL ENERGY PLANTS

- 9.7.6 ADVANCED NDT AND INSPECTION TECHNIQUES USED IN POWER VERTICAL

- 9.7.6.1 Galvano static pulse measurement

- 9.7.6.2 Ultrasonic pulse echo testing

- 9.8 OTHER VERTICALS

- 9.8.1 MARINE

- 9.8.2 MEDICAL & HEALTHCARE

- 9.8.3 PLASTICS & POLYMERS

10 NDT AND INSPECTION MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 10.2.2 US

- 10.2.2.1 Rising defense expenditures and aircraft production to fuel market growth

- 10.2.3 CANADA

- 10.2.3.1 Increasing demand for advanced material testing to drive market

- 10.2.4 MEXICO

- 10.2.4.1 Strong emphasis on urban mobility and expansion of natural gas pipeline network to fuel market growth

- 10.3 EUROPE

- 10.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 10.3.2 UK

- 10.3.2.1 Growth in aircraft export to support market growth

- 10.3.3 GERMANY

- 10.3.3.1 Growing demand in automotive vertical to drive market

- 10.3.4 FRANCE

- 10.3.4.1 Increased demand in aerospace vertical to fuel market growth

- 10.3.5 ITALY

- 10.3.5.1 Expansion of oil refining capacity and shale gas development to drive market

- 10.3.6 SPAIN

- 10.3.6.1 Rising industrial investments and advancements in aerospace sector to fuel market growth

- 10.3.7 POLAND

- 10.3.7.1 Manufacturing sector expansion and power infrastructure upgrades to drive market

- 10.3.8 NORDICS

- 10.3.8.1 Renewable energy projects and innovation in aerospace sector to accelerate demand

- 10.3.9 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 10.4.2 CHINA

- 10.4.2.1 Rapid infrastructure development and expanding automotive sector to drive demand

- 10.4.3 JAPAN

- 10.4.3.1 Expanding nuclear power generation sector to propel market

- 10.4.4 INDIA

- 10.4.4.1 Increased demand in manufacturing sector to drive market

- 10.4.5 SOUTH KOREA

- 10.4.5.1 Defense modernization and strong automotive sector to support market growth

- 10.4.6 AUSTRALIA

- 10.4.6.1 Energy projects and mining investments strengthening market outlook

- 10.4.7 INDONESIA

- 10.4.7.1 Expansion of oil & gas sector and infrastructure boom to fuel demand

- 10.4.8 MALAYSIA

- 10.4.8.1 Strong oil & gas sector and increased investments in aerospace to drive market growth

- 10.4.9 THAILAND

- 10.4.9.1 Expansion of automotive sector and infrastructure modernization fueling demand

- 10.4.10 VIETNAM

- 10.4.10.1 Government initiatives to support economic development fueling market growth

- 10.4.11 REST OF ASIA PACIFIC

- 10.5 ROW

- 10.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 10.5.2 MIDDLE EAST

- 10.5.2.1 High investment in infrastructure development to drive market

- 10.5.2.2 GCC countries

- 10.5.2.2.1 Increasing infrastructure development to support market growth

- 10.5.2.3 Rest of Middle East

- 10.5.3 AFRICA

- 10.5.3.1 Booming power sector to fuel demand during forecast period

- 10.5.4 SOUTH AMERICA

- 10.5.4.1 Rising demand in oil & gas and power verticals to drive market

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2025

- 11.3 MARKET SHARE ANALYSIS, 2024

- 11.4 REVENUE ANALYSIS, 2020-2024

- 11.5 COMPANY VALUATION AND FINANCIAL METRICS, 2025

- 11.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.6.1 COMPANY EVALUATION MATRIX: NDT AND INSPECTION SERVICES MARKET, 2024

- 11.6.1.1 Stars

- 11.6.1.2 Emerging leaders

- 11.6.1.3 Pervasive players

- 11.6.1.4 Participants

- 11.6.2 COMPANY EVALUATION MATRIX: NDT AND INSPECTION EQUIPMENT MARKET, 2024

- 11.6.2.1 Stars

- 11.6.2.2 Emerging leaders

- 11.6.2.3 Pervasive players

- 11.6.2.4 Participants

- 11.6.3 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.6.3.1 Company footprint

- 11.6.3.2 Region footprint

- 11.6.3.3 Service footprint

- 11.6.3.4 Vertical footprint

- 11.6.1 COMPANY EVALUATION MATRIX: NDT AND INSPECTION SERVICES MARKET, 2024

- 11.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.7.1 PROGRESSIVE COMPANIES

- 11.7.2 RESPONSIVE COMPANIES

- 11.7.3 DYNAMIC COMPANIES

- 11.7.4 STARTING BLOCKS

- 11.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.7.5.1 Detailed list of key startups/SMEs

- 11.7.5.2 Competitive benchmarking of key startups/SMEs

- 11.8 BRAND/PRODUCT COMPARISON

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT/SERVICE LAUNCHES

- 11.9.2 DEALS

- 11.9.3 EXPANSIONS

- 11.9.4 OTHER DEVELOPMENTS

12 COMPANY PROFILES

- 12.1 INTRODUCTION

- 12.2 KEY PLAYERS

- 12.2.1 SGS SOCIETE GENERALE DE SURVEILLANCE SA

- 12.2.1.1 Business overview

- 12.2.1.2 Products/Solutions/Services offered

- 12.2.1.3 Recent developments

- 12.2.1.3.1 Deals

- 12.2.1.4 MnM view

- 12.2.1.4.1 Key strengths

- 12.2.1.4.2 Strategic choices

- 12.2.1.4.3 Weaknesses and competitive threats

- 12.2.2 BUREAU VERITAS

- 12.2.2.1 Business overview

- 12.2.2.2 Products/Solutions/Services offered

- 12.2.2.3 Recent developments

- 12.2.2.3.1 Expansions

- 12.2.2.4 MnM view

- 12.2.2.4.1 Key strengths

- 12.2.2.4.2 Strategic choices

- 12.2.2.4.3 Weaknesses and competitive threats

- 12.2.3 BAKER HUGHES COMPANY

- 12.2.3.1 Business overview

- 12.2.3.2 Products/Solutions/Services offered

- 12.2.3.3 Recent developments

- 12.2.3.3.1 Product/service launches

- 12.2.3.3.2 Deals

- 12.2.3.4 MnM view

- 12.2.3.4.1 Key strengths

- 12.2.3.4.2 Strategic choices

- 12.2.3.4.3 Weaknesses and competitive threats

- 12.2.4 APPLUS+

- 12.2.4.1 Business overview

- 12.2.4.2 Products/Solutions/Services offered

- 12.2.4.3 Recent developments

- 12.2.4.3.1 Deals

- 12.2.4.3.2 Other developments

- 12.2.4.4 MnM view

- 12.2.4.4.1 Key strengths

- 12.2.4.4.2 Strategic choices

- 12.2.4.4.3 Weaknesses and competitive threats

- 12.2.5 INTERTEK GROUP PLC

- 12.2.5.1 Business overview

- 12.2.5.2 Products/Solutions/Services offered

- 12.2.5.3 Recent developments

- 12.2.5.3.1 Product/Service launches

- 12.2.5.3.2 Expansions

- 12.2.5.4 MnM view

- 12.2.5.4.1 Key strengths

- 12.2.5.4.2 Strategic choices

- 12.2.5.4.3 Weaknesses and competitive threats

- 12.2.6 MISTRAS GROUP

- 12.2.6.1 Business overview

- 12.2.6.2 Products/Solutions/Services offered

- 12.2.6.3 Recent developments

- 12.2.6.3.1 Product/Service launches

- 12.2.6.3.2 Deals

- 12.2.6.3.3 Other developments

- 12.2.7 WABTEC CORPORATION

- 12.2.7.1 Business overview

- 12.2.7.2 Products/Solutions/Services offered

- 12.2.7.3 Recent developments

- 12.2.7.3.1 Deals

- 12.2.8 ASHTEAD TECHNOLOGY

- 12.2.8.1 Business overview

- 12.2.8.2 Products/Solutions/Services offered

- 12.2.8.3 Recent developments

- 12.2.8.3.1 Product/Service launches

- 12.2.8.3.2 Deals

- 12.2.9 TUV RHEINLAND

- 12.2.9.1 Business overview

- 12.2.9.2 Products/Solutions/Services offered

- 12.2.9.3 Recent developments

- 12.2.9.3.1 Deals

- 12.2.10 DEKRA

- 12.2.10.1 Business overview

- 12.2.10.2 Products/Solutions/Services offered

- 12.2.10.3 Recent developments

- 12.2.10.3.1 Expansions

- 12.2.1 SGS SOCIETE GENERALE DE SURVEILLANCE SA

- 12.3 OTHER PLAYERS

- 12.3.1 COMET GROUP

- 12.3.2 ACUREN

- 12.3.3 VIDISCO

- 12.3.4 TEAM, INC.

- 12.3.5 CYGNUS INSTRUMENTS LTD.

- 12.3.6 FPRIMEC SOLUTIONS INC.

- 12.3.7 CARESTREAM HEALTH

- 12.3.8 ELEMENT MATERIALS TECHNOLOGY

- 12.3.9 HELMUT FISCHER GMBH

- 12.3.10 AMERAPEX CORPORATION

- 12.3.11 NIKON METROLOGY NV

- 12.3.12 MAGNAFLUX

- 12.3.13 SONATEST

- 12.3.14 EDDYFI TECHNOLOGIES

- 12.3.15 OKONDT GROUP

13 APPENDIX

- 13.1 INSIGHTS FROM INDUSTRY EXPERTS

- 13.2 DISCUSSION GUIDE

- 13.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.4 CUSTOMIZATION OPTIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS