|

|

市場調査レポート

商品コード

1802924

デジタルワークプレイスの世界市場:タイプ別、展開モード別、組織規模別、業界別、地域別 - 2030年までの予測Digital Workplace Market by Type (Security and Compliance (IAM, DLP, Threat Detection & Response), End-user Computing, Communication and Collaboration (UCaaS, Video Conferencing)), Deployment Mode (Cloud), Vertical, Region - Global forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| デジタルワークプレイスの世界市場:タイプ別、展開モード別、組織規模別、業界別、地域別 - 2030年までの予測 |

|

出版日: 2025年08月19日

発行: MarketsandMarkets

ページ情報: 英文 397 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

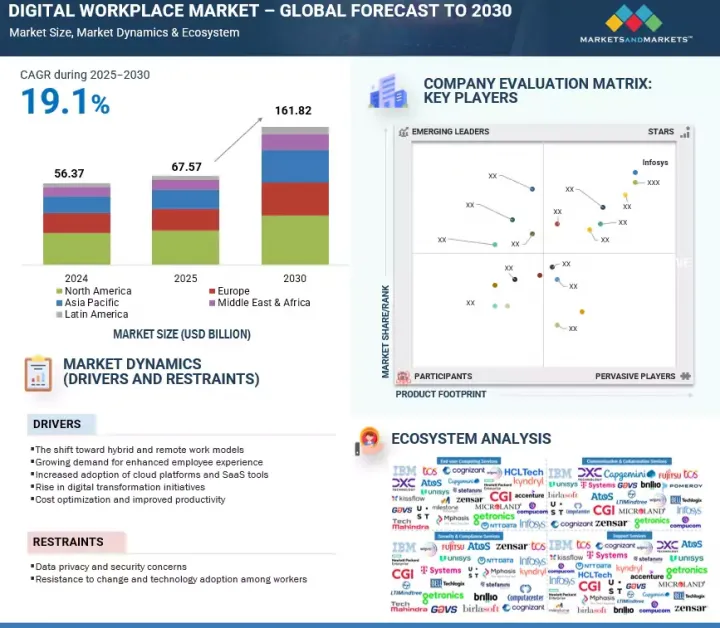

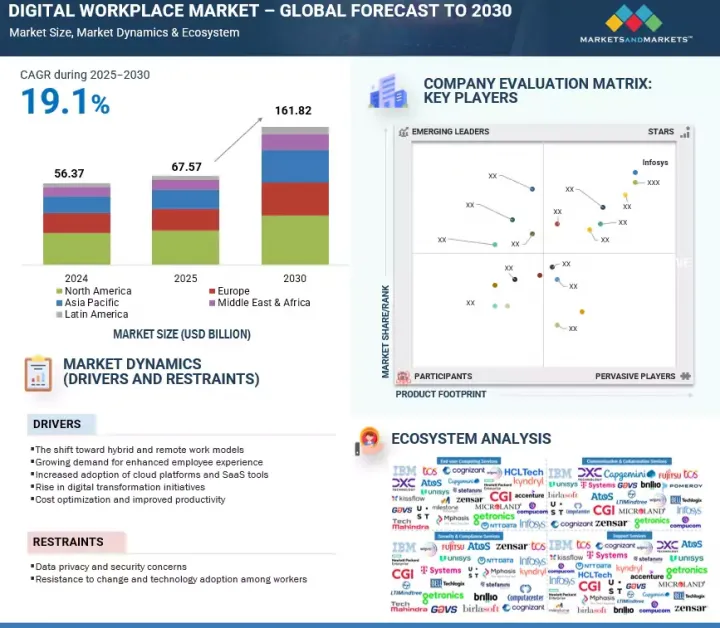

世界のデジタルワークプレイスの市場規模は、2025年の675億7,000万米ドルから2030年には1,618億2,000万米ドルに成長し、予測期間中の年間平均成長率(CAGR)は19.1%になると予測されています。

デジタルトランスフォーメーションへの取り組みの高まりは、組織の運営方法を再構築し、デジタルワークプレイスソリューションの需要を促進しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2019年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(100万米ドル/10億米ドル) |

| セグメント | タイプ別、展開モード別、組織規模別、業界別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、中東・アフリカ、ラテンアメリカ |

企業はリモートやハイブリッドモデルをサポートするためにワークフローを再設計しており、Microsoft TeamsやGoogle Workspaceのようなツールがコラボレーションに不可欠になっています。2024年4月、ユニリーバはAIを活用した新しいデジタルワークプレイスプラットフォームを立ち上げ、従業員の経験をパーソナライズし、社内コミュニケーションを合理化し、グローバルな従業員全体でワークツールを統一しました。同時に、コストの最適化と生産性の向上も引き続き重要な推進力となっています。例えば、シーメンスは2025年2月にクラウドベースのデジタルワークプレイスフレームワークを展開し、インテリジェントな自動化とリソースへの統合アクセスを通じてインフラコストを削減し、チームの生産性を向上させました。

クラウドセグメントは、その拡張性、アクセス性、費用対効果により、デジタルワークプレイスサービス市場で最大の市場シェアを占めています。あらゆる業種の企業が、リモートワークへの対応、ITプロセスの最適化、インフラの容易な管理のために、クラウドホストのデジタルワークプレイスツールを採用しています。クラウドの導入により、従業員は必要なワークプレイスツールやアプリケーションをどこでも、どのデバイスでも使用できるようになるため、リモートワークやハイブリッドワーク環境での使用に適しています。また、ITチームは、オンプレミスを維持するためのオーバーヘッドなしに、アップデート、セキュリティパッチ、システム監視を一元管理できます。クラウドプラットフォームは、コラボレーションツール、エンドポイント管理、従業員体験ソリューションの容易な統合を可能にし、サービスプロバイダーが統合デジタルワークプレイスサービスを提供する作業を簡素化します。Wipro、HCLTech、TCSなどのベンダーは、クラウドネイティブなエコシステムを提供しており、その相互運用性と価値実現までの時間の短さから、企業の採用が進んでいます。小売、ヘルスケア、プロフェッショナル・サービスなどのダイナミックなワークフォース業界におけるクラウド導入は、多額のハードウェア投資を行うことなく、ビジネスクリティカルなシステムへの常時アクセスを提供します。クラウドベースの分析、自動化、セルフサービス・ポータルも、サービス・プロバイダーがサービス提供を改善するために取り入れています。このような営業支出モデルから資本支出モデルへの移行動向は、クラウドの従量課金モデルにも合致しており、デジタルワークプレイスで柔軟性と対応力を必要とする組織では、クラウドを採用することが便利で戦略的な決定となります。

米国は、最新のワークプレイステクノロジーをいち早く採用し、大手サービスプロバイダーの存在感が強いため、北米のデジタルワークプレイス市場で最大の市場シェアを占めています。IBM、アクセンチュア、コグニザント、DXCテクノロジーなどの企業が米国で大きな存在感を示しており、業界全体でデジタルソリューションの迅速な展開を可能にしています。ハイブリッドワークやリモートワークモデルへのシフトにより、クラウドベースのコラボレーションプラットフォーム、仮想デスクトップ、AIを活用した生産性向上ツールが広く採用されています。2024年5月、JPMorgan Chaseは自動化と機械学習を活用し、各部門の業務を効率化する新しいデジタルワークプレイス基盤を導入しました。米国は企業のSaaS導入でもリードしており、Microsoft 365やSlackなどのプラットフォームが企業のワークフローに深く組み込まれています。BFSI、ヘルスケア、製造業など、安全で拡張性の高いデジタルワークプレイスモデルを必要とするセクターからの強い需要が、この成長に寄与しています。連邦政府や公共機関も、レガシーシステムを近代化し、社内コミュニケーションを改善するためにデジタルワークプレイス戦略を採用しています。サイバーセキュリティ、デジタルインフラ、従業員体験プラットフォームへの強力な投資は、この市場における米国の地位を強化しています。これらの開発により、米国はデジタルワークプレイス市場において主導的な役割を維持することができます。

当レポートでは、世界のデジタルワークプレイス市場について調査し、タイプ別、展開モード別、組織規模別、業界別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と業界動向

- イントロダクション

- 市場力学

- ケーススタディ分析

- バリューチェーン分析

- エコシステム

- ポーターのファイブフォース分析

- 価格分析

- 技術分析

- 特許分析

- 顧客のビジネスに影響を与える動向と混乱

- 主要な利害関係者と購入基準

- 規制状況

- 2026年の主な会議とイベント

- 投資と資金調達のシナリオ

- 生成AIがデジタルワークプレイス市場に与える影響

- 2025年の米国関税の影響- 概要

第6章 デジタルワークプレイス市場(タイプ別)

- イントロダクション

- エンドユーザーコンピューティング

- コミュニケーションとコラボレーション

- セキュリティとコンプライアンス

- サポートサービス

第7章 デジタルワークプレイス市場(展開モード別)

- イントロダクション

- オンプレミス

- クラウド

- ハイブリッド

第8章 デジタルワークプレイス市場(組織規模別)

- イントロダクション

- 大企業

- 中小企業

第9章 デジタルワークプレイス市場(業界別)

- イントロダクション

- BFSI

- 政府・公共部門

- 製造

- ヘルスケア・ライフサイエンス

- IT・通信

- 小売・eコマース

- エネルギー・公益事業

- その他

第10章 デジタルワークプレイス市場(地域別)

- イントロダクション

- 北米

- 北米:マクロ経済見通し

- 北米:デジタルワークプレイス市場促進要因

- 米国

- カナダ

- 欧州

- 欧州:マクロ経済見通し

- 欧州:デジタルワークプレイス市場促進要因

- 英国

- ドイツ

- フランス

- イタリア

- その他

- アジア太平洋

- アジア太平洋:マクロ経済見通し

- アジア太平洋:デジタルワークプレイス市場促進要因

- 中国

- 日本

- インド

- その他

- 中東・アフリカ

- 中東・アフリカ:マクロ経済見通し

- 中東・アフリカ:デジタルワークプレイス市場促進要因

- 中東

- アフリカ

- ラテンアメリカ

- ラテンアメリカ:マクロ経済見通し

- ラテンアメリカ:デジタルワークプレイス市場促進要因

- ブラジル

- メキシコ

- その他

第11章 競合情勢

- 主要参入企業の戦略/強み

- 収益分析

- 市場シェア分析

- ブランド/製品比較

- 企業評価と財務指標

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオと動向

第12章 企業プロファイル

- 主要参入企業

- TCS

- WIPRO

- DXC TECHNOLOGY

- HCLTECH

- INFOSYS

- FUJITSU

- ATOS

- NTT DATA

- IBM

- COGNIZANT

- ACCENTURE

- KYNDRYL

- HPE

- CAPGEMINI

- UNISYS

- TECH MAHINDRA

- その他の企業

- STEFANINI

- COMPUTACENTER

- COMPUCOM

- T-SYSTEMS

- GETRONICS

- CGI

- MILESTONE TECHNOLOGIES

- MPHASIS

- BIRLASOFT

- NEUREALM(GAVS TECHNOLOGIES)

- UST

- MICROLAND

- BRILLIO

- BELL TECHLOGIX

- POMEROY

- LTIMINDTREE

- KISSFLOW

- GROUPE.IO

- AXERO SOLUTIONS

- YOROSIS TECHNOLOGIES

- WORKGRID SOFTWARE

- FLEXSIN

第13章 隣接市場/関連市場

第14章 付録

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2019-2024

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 DIGITAL WORKPLACE MARKET: ECOSYSTEM

- TABLE 4 PORTER'S FIVE FORCES' IMPACT ON DIGITAL WORKPLACE MARKET

- TABLE 5 AVERAGE SELLING PRICE OF KEY PLAYERS, BY SERVICE TYPE

- TABLE 6 INDICATIVE PRICING OF DIGITAL WORKPLACE, BY KEY PLAYER, 2025 (USD)

- TABLE 7 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- TABLE 8 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 9 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 DETAILED LIST OF CONFERENCES & EVENTS, 2026

- TABLE 15 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 16 DIGITAL WORKPLACE MARKET, BY TYPE, 2019-2024 (USD MILLION)

- TABLE 17 DIGITAL WORKPLACE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 18 DIGITAL WORKPLACE MARKET, BY END-USER COMPUTING, 2019-2024 (USD MILLION)

- TABLE 19 DIGITAL WORKPLACE MARKET, BY END-USER COMPUTING, 2025-2030 (USD MILLION)

- TABLE 20 END-USER COMPUTING: DIGITAL WORKPLACE MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 21 END-USER COMPUTING: DIGITAL WORKPLACE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 22 DIGITAL WORKPLACE MARKET, BY COMMUNICATION AND COLLABORATION, 2019-2024 (USD MILLION)

- TABLE 23 DIGITAL WORKPLACE MARKET, BY COMMUNICATION AND COLLABORATION, 2025-2030 (USD MILLION)

- TABLE 24 COMMUNICATION AND COLLABORATION: DIGITAL WORKPLACE MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 25 COMMUNICATION AND COLLABORATION: DIGITAL WORKPLACE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 26 DIGITAL WORKPLACE MARKET, BY SECURITY AND COMPLIANCE, 2019-2024 (USD MILLION)

- TABLE 27 DIGITAL WORKPLACE MARKET, BY SECURITY AND COMPLIANCE, 2025-2030 (USD MILLION)

- TABLE 28 SECURITY AND COMPLIANCE: DIGITAL WORKPLACE MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 29 SECURITY AND COMPLIANCE: DIGITAL WORKPLACE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 30 DIGITAL WORKPLACE MARKET, BY SUPPORT SERVICE, 2019-2024 (USD MILLION)

- TABLE 31 DIGITAL WORKPLACE MARKET, BY SUPPORT SERVICE, 2025-2030 (USD MILLION)

- TABLE 32 SUPPORT SERVICES: DIGITAL WORKPLACE MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 33 SUPPORT SERVICES: DIGITAL WORKPLACE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 34 DIGITAL WORKPLACE MARKET, BY DEPLOYMENT MODE, 2019-2024 (USD MILLION)

- TABLE 35 DIGITAL WORKPLACE MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 36 ON-PREMISES: DIGITAL WORKPLACE MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 37 ON-PREMISES: DIGITAL WORKPLACE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 38 CLOUD: DIGITAL WORKPLACE MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 39 CLOUD: DIGITAL WORKPLACE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 40 HYBRID: DIGITAL WORKPLACE MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 41 HYBRID: DIGITAL WORKPLACE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 42 DIGITAL WORKPLACE MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 43 DIGITAL WORKPLACE MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 44 LARGE ENTERPRISES: DIGITAL WORKPLACE MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 45 LARGE ENTERPRISES: DIGITAL WORKPLACE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 46 SMES: DIGITAL WORKPLACE MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 47 SMES: DIGITAL WORKPLACE MARKET, BY REGION, 2025-2030 (USD MILLION)

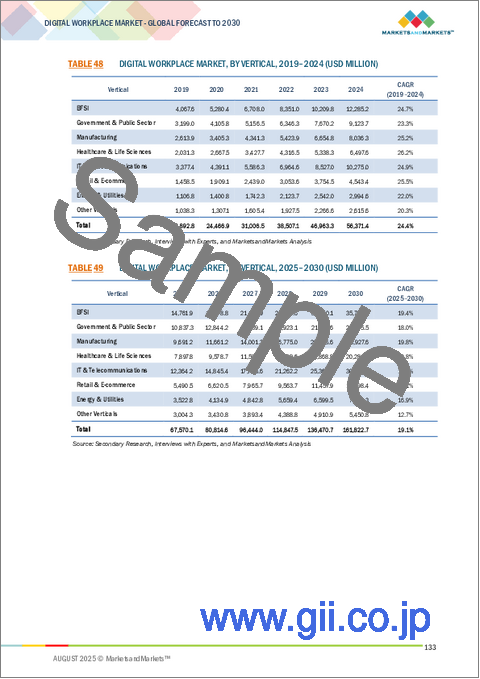

- TABLE 48 DIGITAL WORKPLACE MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 49 DIGITAL WORKPLACE MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 50 BFSI: DIGITAL WORKPLACE MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 51 BFSI: DIGITAL WORKPLACE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 52 GOVERNMENT & PUBLIC SECTOR: DIGITAL WORKPLACE MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 53 GOVERNMENT & PUBLIC SECTOR: DIGITAL WORKPLACE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 54 MANUFACTURING: DIGITAL WORKPLACE MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 55 MANUFACTURING: DIGITAL WORKPLACE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 56 HEALTHCARE & LIFE SCIENCES: DIGITAL WORKPLACE MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 57 HEALTHCARE & LIFE SCIENCES: DIGITAL WORKPLACE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 58 IT & TELECOMMUNICATIONS: DIGITAL WORKPLACE MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 59 IT & TELECOMMUNICATIONS: DIGITAL WORKPLACE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 60 RETAIL & E-COMMERCE: DIGITAL WORKPLACE MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 61 RETAIL & E-COMMERCE: DIGITAL WORKPLACE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 62 ENERGY & UTILITIES: DIGITAL WORKPLACE MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 63 ENERGY & UTILITIES: DIGITAL WORKPLACE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 64 DIGITAL WORKPLACE MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 65 DIGITAL WORKPLACE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 66 NORTH AMERICA: DIGITAL WORKPLACE MARKET, BY TYPE, 2019-2024 (USD MILLION)

- TABLE 67 NORTH AMERICA: DIGITAL WORKPLACE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 68 NORTH AMERICA: DIGITAL WORKPLACE MARKET, BY END-USER COMPUTING, 2019-2024 (USD MILLION)

- TABLE 69 NORTH AMERICA: DIGITAL WORKPLACE MARKET, BY END-USER COMPUTING, 2025-2030 (USD MILLION)

- TABLE 70 NORTH AMERICA: DIGITAL WORKPLACE MARKET, BY COMMUNICATION AND COLLABORATION, 2019-2024 (USD MILLION)

- TABLE 71 NORTH AMERICA: DIGITAL WORKPLACE MARKET, BY COMMUNICATION AND COLLABORATION, 2025-2030 (USD MILLION)

- TABLE 72 NORTH AMERICA: DIGITAL WORKPLACE MARKET, BY SECURITY AND COMPLIANCE, 2019-2024 (USD MILLION)

- TABLE 73 NORTH AMERICA: DIGITAL WORKPLACE MARKET, BY SECURITY AND COMPLIANCE, 2025-2030 (USD MILLION)

- TABLE 74 NORTH AMERICA: DIGITAL WORKPLACE MARKET, BY SUPPORT SERVICES, 2019-2024 (USD MILLION)

- TABLE 75 NORTH AMERICA: DIGITAL WORKPLACE MARKET, BY SUPPORT SERVICES, 2025-2030 (USD MILLION)

- TABLE 76 NORTH AMERICA: DIGITAL WORKPLACE MARKET, BY DEPLOYMENT MODE, 2019-2024 (USD MILLION)

- TABLE 77 NORTH AMERICA: DIGITAL WORKPLACE MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 78 NORTH AMERICA: DIGITAL WORKPLACE MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 79 NORTH AMERICA: DIGITAL WORKPLACE MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 80 NORTH AMERICA: DIGITAL WORKPLACE MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 81 NORTH AMERICA: DIGITAL WORKPLACE MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 82 NORTH AMERICA: DIGITAL WORKPLACE MARKET, BY COUNTRY, 2019-2024 (USD MILLION)

- TABLE 83 NORTH AMERICA: DIGITAL WORKPLACE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 84 US: DIGITAL WORKPLACE MARKET, BY TYPE, 2019-2024 (USD MILLION)

- TABLE 85 US: DIGITAL WORKPLACE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 86 US: DIGITAL WORKPLACE MARKET, BY END-USER COMPUTING, 2019-2024 (USD MILLION)

- TABLE 87 US: DIGITAL WORKPLACE MARKET, BY END-USER COMPUTING, 2025-2030 (USD MILLION)

- TABLE 88 US: DIGITAL WORKPLACE MARKET, BY COMMUNICATION AND COLLABORATION, 2019-2024 (USD MILLION)

- TABLE 89 US: DIGITAL WORKPLACE MARKET, BY COMMUNICATION AND COLLABORATION, 2025-2030 (USD MILLION)

- TABLE 90 US: DIGITAL WORKPLACE MARKET, BY SECURITY AND COMPLIANCE, 2019-2024 (USD MILLION)

- TABLE 91 US: DIGITAL WORKPLACE MARKET, BY SECURITY AND COMPLIANCE, 2025-2030 (USD MILLION)

- TABLE 92 US: DIGITAL WORKPLACE MARKET, BY SUPPORT SERVICES, 2019-2024 (USD MILLION)

- TABLE 93 US: DIGITAL WORKPLACE MARKET, BY SUPPORT SERVICES, 2025-2030 (USD MILLION)

- TABLE 94 US: DIGITAL WORKPLACE MARKET, BY DEPLOYMENT MODE, 2019-2024 (USD MILLION)

- TABLE 95 US: DIGITAL WORKPLACE MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 96 US: DIGITAL WORKPLACE MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 97 US: DIGITAL WORKPLACE MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 98 US: DIGITAL WORKPLACE MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 99 US: DIGITAL WORKPLACE MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 100 CANADA: DIGITAL WORKPLACE MARKET, BY TYPE, 2019-2024 (USD MILLION)

- TABLE 101 CANADA: DIGITAL WORKPLACE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 102 CANADA: DIGITAL WORKPLACE MARKET, BY END-USER COMPUTING, 2019-2024 (USD MILLION)

- TABLE 103 CANADA: DIGITAL WORKPLACE MARKET, BY END-USER COMPUTING, 2025-2030 (USD MILLION)

- TABLE 104 CANADA: DIGITAL WORKPLACE MARKET, BY COMMUNICATION AND COLLABORATION, 2019-2024 (USD MILLION)

- TABLE 105 CANADA: DIGITAL WORKPLACE MARKET, BY COMMUNICATION AND COLLABORATION, 2025-2030 (USD MILLION)

- TABLE 106 CANADA: DIGITAL WORKPLACE MARKET, BY SECURITY AND COMPLIANCE, 2019-2024 (USD MILLION)

- TABLE 107 CANADA: DIGITAL WORKPLACE MARKET, BY SECURITY AND COMPLIANCE, 2025-2030 (USD MILLION)

- TABLE 108 CANADA: DIGITAL WORKPLACE MARKET, BY SUPPORT SERVICES, 2019-2024 (USD MILLION)

- TABLE 109 CANADA: DIGITAL WORKPLACE MARKET, BY SUPPORT SERVICES, 2025-2030 (USD MILLION)

- TABLE 110 CANADA: DIGITAL WORKPLACE MARKET, BY DEPLOYMENT MODE, 2019-2024 (USD MILLION)

- TABLE 111 CANADA: DIGITAL WORKPLACE MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 112 CANADA: DIGITAL WORKPLACE MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 113 CANADA: DIGITAL WORKPLACE MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 114 CANADA: DIGITAL WORKPLACE MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 115 CANADA: DIGITAL WORKPLACE MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 116 EUROPE: DIGITAL WORKPLACE MARKET, BY TYPE, 2019-2024 (USD MILLION)

- TABLE 117 EUROPE: DIGITAL WORKPLACE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 118 EUROPE: DIGITAL WORKPLACE MARKET, BY END-USER COMPUTING, 2019-2024 (USD MILLION)

- TABLE 119 EUROPE: DIGITAL WORKPLACE MARKET, BY END-USER COMPUTING, 2025-2030 (USD MILLION)

- TABLE 120 EUROPE: DIGITAL WORKPLACE MARKET, BY COMMUNICATION AND COLLABORATION, 2019-2024 (USD MILLION)

- TABLE 121 EUROPE: DIGITAL WORKPLACE MARKET, BY COMMUNICATION AND COLLABORATION, 2025-2030 (USD MILLION)

- TABLE 122 EUROPE: DIGITAL WORKPLACE MARKET, BY SECURITY AND COMPLIANCE, 2019-2024 (USD MILLION)

- TABLE 123 EUROPE: DIGITAL WORKPLACE MARKET, BY SECURITY AND COMPLIANCE, 2025-2030 (USD MILLION)

- TABLE 124 EUROPE: DIGITAL WORKPLACE MARKET, BY SUPPORT SERVICES, 2019-2024 (USD MILLION)

- TABLE 125 EUROPE: DIGITAL WORKPLACE MARKET, BY SUPPORT SERVICES, 2025-2030 (USD MILLION)

- TABLE 126 EUROPE: DIGITAL WORKPLACE MARKET, BY DEPLOYMENT MODE, 2019-2024 (USD MILLION)

- TABLE 127 EUROPE: DIGITAL WORKPLACE MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 128 EUROPE: DIGITAL WORKPLACE MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 129 EUROPE: DIGITAL WORKPLACE MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 130 EUROPE: DIGITAL WORKPLACE MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 131 EUROPE: DIGITAL WORKPLACE MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 132 EUROPE: DIGITAL WORKPLACE MARKET, BY COUNTRY, 2019-2024 (USD MILLION)

- TABLE 133 EUROPE: DIGITAL WORKPLACE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 134 UK: DIGITAL WORKPLACE MARKET, BY TYPE, 2019-2024 (USD MILLION)

- TABLE 135 UK: DIGITAL WORKPLACE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 136 UK: DIGITAL WORKPLACE MARKET, BY END-USER COMPUTING, 2019-2024 (USD MILLION)

- TABLE 137 UK: DIGITAL WORKPLACE MARKET, BY END-USER COMPUTING, 2025-2030 (USD MILLION)

- TABLE 138 UK: DIGITAL WORKPLACE MARKET, BY COMMUNICATION AND COLLABORATION, 2019-2024 (USD MILLION)

- TABLE 139 UK: DIGITAL WORKPLACE MARKET, BY COMMUNICATION AND COLLABORATION, 2025-2030 (USD MILLION)

- TABLE 140 UK: DIGITAL WORKPLACE MARKET, BY SECURITY AND COMPLIANCE, 2019-2024 (USD MILLION)

- TABLE 141 UK: DIGITAL WORKPLACE MARKET, BY SECURITY AND COMPLIANCE, 2025-2030 (USD MILLION)

- TABLE 142 UK: DIGITAL WORKPLACE MARKET, BY SUPPORT SERVICES, 2019-2024 (USD MILLION)

- TABLE 143 UK: DIGITAL WORKPLACE MARKET, BY SUPPORT SERVICES, 2025-2030 (USD MILLION)

- TABLE 144 UK: DIGITAL WORKPLACE MARKET, BY DEPLOYMENT MODE, 2019-2024 (USD MILLION)

- TABLE 145 UK: DIGITAL WORKPLACE MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 146 UK: DIGITAL WORKPLACE MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 147 UK: DIGITAL WORKPLACE MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 148 UK: DIGITAL WORKPLACE MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 149 UK: DIGITAL WORKPLACE MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 150 GERMANY: DIGITAL WORKPLACE MARKET, BY TYPE, 2019-2024 (USD MILLION)

- TABLE 151 GERMANY: DIGITAL WORKPLACE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 152 GERMANY: DIGITAL WORKPLACE MARKET, BY END-USER COMPUTING, 2019-2024 (USD MILLION)

- TABLE 153 GERMANY: DIGITAL WORKPLACE MARKET, BY END-USER COMPUTING, 2025-2030 (USD MILLION)

- TABLE 154 GERMANY: DIGITAL WORKPLACE MARKET, BY COMMUNICATION AND COLLABORATION, 2019-2024 (USD MILLION)

- TABLE 155 GERMANY: DIGITAL WORKPLACE MARKET, BY COMMUNICATION AND COLLABORATION, 2025-2030 (USD MILLION)

- TABLE 156 GERMANY: DIGITAL WORKPLACE MARKET, BY SECURITY AND COMPLIANCE, 2019-2024 (USD MILLION)

- TABLE 157 GERMANY: DIGITAL WORKPLACE MARKET, BY SECURITY AND COMPLIANCE, 2025-2030 (USD MILLION)

- TABLE 158 GERMANY: DIGITAL WORKPLACE MARKET, BY SUPPORT SERVICES, 2019-2024 (USD MILLION)

- TABLE 159 GERMANY: DIGITAL WORKPLACE MARKET, BY SUPPORT SERVICES, 2025-2030 (USD MILLION)

- TABLE 160 GERMANY: DIGITAL WORKPLACE MARKET, BY DEPLOYMENT MODE, 2019-2024 (USD MILLION)

- TABLE 161 GERMANY: DIGITAL WORKPLACE MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 162 GERMANY: DIGITAL WORKPLACE MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 163 GERMANY: DIGITAL WORKPLACE MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 164 GERMANY: DIGITAL WORKPLACE MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 165 GERMANY: DIGITAL WORKPLACE MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 166 FRANCE: DIGITAL WORKPLACE MARKET, BY TYPE, 2019-2024 (USD MILLION)

- TABLE 167 FRANCE: DIGITAL WORKPLACE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 168 FRANCE: DIGITAL WORKPLACE MARKET, BY END-USER COMPUTING, 2019-2024 (USD MILLION)

- TABLE 169 FRANCE: DIGITAL WORKPLACE MARKET, BY END-USER COMPUTING, 2025-2030 (USD MILLION)

- TABLE 170 FRANCE: DIGITAL WORKPLACE MARKET, BY COMMUNICATION AND COLLABORATION, 2019-2024 (USD MILLION)

- TABLE 171 FRANCE: DIGITAL WORKPLACE MARKET, BY COMMUNICATION AND COLLABORATION, 2025-2030 (USD MILLION)

- TABLE 172 FRANCE: DIGITAL WORKPLACE MARKET, BY SECURITY AND COMPLIANCE, 2019-2024 (USD MILLION)

- TABLE 173 FRANCE: DIGITAL WORKPLACE MARKET, BY SECURITY AND COMPLIANCE, 2025-2030 (USD MILLION)

- TABLE 174 FRANCE: DIGITAL WORKPLACE MARKET, BY SUPPORT SERVICES, 2019-2024 (USD MILLION)

- TABLE 175 FRANCE: DIGITAL WORKPLACE MARKET, BY SUPPORT SERVICES, 2025-2030 (USD MILLION)

- TABLE 176 FRANCE: DIGITAL WORKPLACE MARKET, BY DEPLOYMENT MODE, 2019-2024 (USD MILLION)

- TABLE 177 FRANCE: DIGITAL WORKPLACE MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 178 FRANCE: DIGITAL WORKPLACE MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 179 FRANCE: DIGITAL WORKPLACE MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 180 FRANCE: DIGITAL WORKPLACE MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 181 FRANCE: DIGITAL WORKPLACE MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 182 ITALY: DIGITAL WORKPLACE MARKET, BY TYPE, 2019-2024 (USD MILLION)

- TABLE 183 ITALY: DIGITAL WORKPLACE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 184 ITALY: DIGITAL WORKPLACE MARKET, BY END-USER COMPUTING, 2019-2024 (USD MILLION)

- TABLE 185 ITALY: DIGITAL WORKPLACE MARKET, BY END-USER COMPUTING, 2025-2030 (USD MILLION)

- TABLE 186 ITALY: DIGITAL WORKPLACE MARKET, BY COMMUNICATION AND COLLABORATION, 2019-2024 (USD MILLION)

- TABLE 187 ITALY: DIGITAL WORKPLACE MARKET, BY COMMUNICATION AND COLLABORATION, 2025-2030 (USD MILLION)

- TABLE 188 ITALY: DIGITAL WORKPLACE MARKET, BY SECURITY AND COMPLIANCE, 2019-2024 (USD MILLION)

- TABLE 189 ITALY: DIGITAL WORKPLACE MARKET, BY SECURITY AND COMPLIANCE, 2025-2030 (USD MILLION)

- TABLE 190 ITALY: DIGITAL WORKPLACE MARKET, BY SUPPORT SERVICES, 2019-2024 (USD MILLION)

- TABLE 191 ITALY: DIGITAL WORKPLACE MARKET, BY SUPPORT SERVICES, 2025-2030 (USD MILLION)

- TABLE 192 ITALY: DIGITAL WORKPLACE MARKET, BY DEPLOYMENT MODE, 2019-2024 (USD MILLION)

- TABLE 193 ITALY: DIGITAL WORKPLACE MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 194 ITALY: DIGITAL WORKPLACE MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 195 ITALY: DIGITAL WORKPLACE MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 196 ITALY: DIGITAL WORKPLACE MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 197 ITALY: DIGITAL WORKPLACE MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 198 REST OF EUROPE: DIGITAL WORKPLACE MARKET, BY TYPE, 2019-2024 (USD MILLION)

- TABLE 199 REST OF EUROPE: DIGITAL WORKPLACE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 200 REST OF EUROPE: DIGITAL WORKPLACE MARKET, BY END-USER COMPUTING, 2019-2024 (USD MILLION)

- TABLE 201 REST OF EUROPE: DIGITAL WORKPLACE MARKET, BY END-USER COMPUTING, 2025-2030 (USD MILLION)

- TABLE 202 REST OF EUROPE: DIGITAL WORKPLACE MARKET, BY COMMUNICATION AND COLLABORATION, 2019-2024 (USD MILLION)

- TABLE 203 REST OF EUROPE: DIGITAL WORKPLACE MARKET, BY COMMUNICATION AND COLLABORATION, 2025-2030 (USD MILLION)

- TABLE 204 REST OF EUROPE: DIGITAL WORKPLACE MARKET, BY SECURITY AND COMPLIANCE, 2019-2024 (USD MILLION)

- TABLE 205 REST OF EUROPE: DIGITAL WORKPLACE MARKET, BY SECURITY AND COMPLIANCE, 2025-2030 (USD MILLION)

- TABLE 206 REST OF EUROPE: DIGITAL WORKPLACE MARKET, BY SUPPORT SERVICES, 2019-2024 (USD MILLION)

- TABLE 207 REST OF EUROPE: DIGITAL WORKPLACE MARKET, BY SUPPORT SERVICES, 2025-2030 (USD MILLION)

- TABLE 208 REST OF EUROPE: DIGITAL WORKPLACE MARKET, BY DEPLOYMENT MODE, 2019-2024 (USD MILLION)

- TABLE 209 REST OF EUROPE: DIGITAL WORKPLACE MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 210 REST OF EUROPE: DIGITAL WORKPLACE MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 211 REST OF EUROPE: DIGITAL WORKPLACE MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 212 REST OF EUROPE: DIGITAL WORKPLACE MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 213 REST OF EUROPE: DIGITAL WORKPLACE MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 214 ASIA PACIFIC: DIGITAL WORKPLACE MARKET, BY TYPE, 2019-2024 (USD MILLION)

- TABLE 215 ASIA PACIFIC: DIGITAL WORKPLACE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 216 ASIA PACIFIC: DIGITAL WORKPLACE MARKET, BY END-USER COMPUTING, 2019-2024 (USD MILLION)

- TABLE 217 ASIA PACIFIC: DIGITAL WORKPLACE MARKET, BY END-USER COMPUTING, 2025-2030 (USD MILLION)

- TABLE 218 ASIA PACIFIC: DIGITAL WORKPLACE MARKET, BY COMMUNICATION AND COLLABORATION, 2019-2024 (USD MILLION)

- TABLE 219 ASIA PACIFIC: DIGITAL WORKPLACE MARKET, BY COMMUNICATION AND COLLABORATION, 2025-2030 (USD MILLION)

- TABLE 220 ASIA PACIFIC: DIGITAL WORKPLACE MARKET, BY SECURITY AND COMPLIANCE, 2019-2024 (USD MILLION)

- TABLE 221 ASIA PACIFIC: DIGITAL WORKPLACE MARKET, BY SECURITY AND COMPLIANCE, 2025-2030 (USD MILLION)

- TABLE 222 ASIA PACIFIC: DIGITAL WORKPLACE MARKET, BY SUPPORT SERVICES, 2019-2024 (USD MILLION)

- TABLE 223 ASIA PACIFIC: DIGITAL WORKPLACE MARKET, BY SUPPORT SERVICES, 2025-2030 (USD MILLION)

- TABLE 224 ASIA PACIFIC: DIGITAL WORKPLACE MARKET, BY DEPLOYMENT MODE, 2019-2024 (USD MILLION)

- TABLE 225 ASIA PACIFIC: DIGITAL WORKPLACE MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 226 ASIA PACIFIC: DIGITAL WORKPLACE MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 227 ASIA PACIFIC: DIGITAL WORKPLACE MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 228 ASIA PACIFIC: DIGITAL WORKPLACE MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 229 ASIA PACIFIC: DIGITAL WORKPLACE MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 230 ASIA PACIFIC: DIGITAL WORKPLACE MARKET, BY COUNTRY, 2019-2024 (USD MILLION)

- TABLE 231 ASIA PACIFIC: DIGITAL WORKPLACE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 232 CHINA: DIGITAL WORKPLACE MARKET, BY TYPE, 2019-2024 (USD MILLION)

- TABLE 233 CHINA: DIGITAL WORKPLACE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 234 CHINA: DIGITAL WORKPLACE MARKET, BY END-USER COMPUTING, 2019-2024 (USD MILLION)

- TABLE 235 CHINA: DIGITAL WORKPLACE MARKET, BY END-USER COMPUTING, 2025-2030 (USD MILLION)

- TABLE 236 CHINA: DIGITAL WORKPLACE MARKET, BY COMMUNICATION AND COLLABORATION, 2019-2024 (USD MILLION)

- TABLE 237 CHINA: DIGITAL WORKPLACE MARKET, BY COMMUNICATION AND COLLABORATION, 2025-2030 (USD MILLION)

- TABLE 238 CHINA: DIGITAL WORKPLACE MARKET, BY SECURITY AND COMPLIANCE, 2019-2024 (USD MILLION)

- TABLE 239 CHINA: DIGITAL WORKPLACE MARKET, BY SECURITY AND COMPLIANCE, 2025-2030 (USD MILLION)

- TABLE 240 CHINA: DIGITAL WORKPLACE MARKET, BY SUPPORT SERVICES, 2019-2024 (USD MILLION)

- TABLE 241 CHINA: DIGITAL WORKPLACE MARKET, BY SUPPORT SERVICES, 2025-2030 (USD MILLION)

- TABLE 242 CHINA: DIGITAL WORKPLACE MARKET, BY DEPLOYMENT MODE, 2019-2024 (USD MILLION)

- TABLE 243 CHINA: DIGITAL WORKPLACE MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 244 CHINA: DIGITAL WORKPLACE MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 245 CHINA: DIGITAL WORKPLACE MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 246 CHINA: DIGITAL WORKPLACE MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 247 CHINA: DIGITAL WORKPLACE MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 248 JAPAN: DIGITAL WORKPLACE MARKET, BY TYPE, 2019-2024 (USD MILLION)

- TABLE 249 JAPAN: DIGITAL WORKPLACE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 250 JAPAN: DIGITAL WORKPLACE MARKET, BY END-USER COMPUTING, 2019-2024 (USD MILLION)

- TABLE 251 JAPAN: DIGITAL WORKPLACE MARKET, BY END-USER COMPUTING, 2025-2030 (USD MILLION)

- TABLE 252 JAPAN: DIGITAL WORKPLACE MARKET, BY COMMUNICATION AND COLLABORATION, 2019-2024 (USD MILLION)

- TABLE 253 JAPAN: DIGITAL WORKPLACE MARKET, BY COMMUNICATION AND COLLABORATION, 2025-2030 (USD MILLION)

- TABLE 254 JAPAN: DIGITAL WORKPLACE MARKET, BY SECURITY AND COMPLIANCE, 2019-2024 (USD MILLION)

- TABLE 255 JAPAN: DIGITAL WORKPLACE MARKET, BY SECURITY AND COMPLIANCE, 2025-2030 (USD MILLION)

- TABLE 256 JAPAN: DIGITAL WORKPLACE MARKET, BY SUPPORT SERVICES, 2019-2024 (USD MILLION)

- TABLE 257 JAPAN: DIGITAL WORKPLACE MARKET, BY SUPPORT SERVICES, 2025-2030 (USD MILLION)

- TABLE 258 JAPAN: DIGITAL WORKPLACE MARKET, BY DEPLOYMENT MODE, 2019-2024 (USD MILLION)

- TABLE 259 JAPAN: DIGITAL WORKPLACE MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 260 JAPAN: DIGITAL WORKPLACE MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 261 JAPAN: DIGITAL WORKPLACE MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 262 JAPAN: DIGITAL WORKPLACE MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 263 JAPAN: DIGITAL WORKPLACE MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 264 INDIA: DIGITAL WORKPLACE MARKET, BY TYPE, 2019-2024 (USD MILLION)

- TABLE 265 INDIA: DIGITAL WORKPLACE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 266 INDIA: DIGITAL WORKPLACE MARKET, BY END-USER COMPUTING, 2019-2024 (USD MILLION)

- TABLE 267 INDIA: DIGITAL WORKPLACE MARKET, BY END-USER COMPUTING, 2025-2030 (USD MILLION)

- TABLE 268 INDIA: DIGITAL WORKPLACE MARKET, BY COMMUNICATION AND COLLABORATION, 2019-2024 (USD MILLION)

- TABLE 269 INDIA: DIGITAL WORKPLACE MARKET, BY COMMUNICATION AND COLLABORATION, 2025-2030 (USD MILLION)

- TABLE 270 INDIA: DIGITAL WORKPLACE MARKET, BY SECURITY AND COMPLIANCE, 2019-2024 (USD MILLION)

- TABLE 271 INDIA: DIGITAL WORKPLACE MARKET, BY SECURITY AND COMPLIANCE, 2025-2030 (USD MILLION)

- TABLE 272 INDIA: DIGITAL WORKPLACE MARKET, BY SUPPORT SERVICES, 2019-2024 (USD MILLION)

- TABLE 273 INDIA: DIGITAL WORKPLACE MARKET, BY SUPPORT SERVICES, 2025-2030 (USD MILLION)

- TABLE 274 INDIA: DIGITAL WORKPLACE MARKET, BY DEPLOYMENT MODE, 2019-2024 (USD MILLION)

- TABLE 275 INDIA: DIGITAL WORKPLACE MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 276 INDIA: DIGITAL WORKPLACE MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 277 INDIA: DIGITAL WORKPLACE MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 278 INDIA: DIGITAL WORKPLACE MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 279 INDIA: DIGITAL WORKPLACE MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 280 REST OF ASIA PACIFIC: DIGITAL WORKPLACE MARKET, BY TYPE, 2019-2024 (USD MILLION)

- TABLE 281 REST OF ASIA PACIFIC: DIGITAL WORKPLACE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 282 REST OF ASIA PACIFIC: DIGITAL WORKPLACE MARKET, BY END-USER COMPUTING, 2019-2024 (USD MILLION)

- TABLE 283 REST OF ASIA PACIFIC: DIGITAL WORKPLACE MARKET, BY END-USER COMPUTING, 2025-2030 (USD MILLION)

- TABLE 284 REST OF ASIA PACIFIC: DIGITAL WORKPLACE MARKET, BY COMMUNICATION AND COLLABORATION, 2019-2024 (USD MILLION)

- TABLE 285 REST OF ASIA PACIFIC: DIGITAL WORKPLACE MARKET, BY COMMUNICATION AND COLLABORATION, 2025-2030 (USD MILLION)

- TABLE 286 REST OF ASIA PACIFIC: DIGITAL WORKPLACE MARKET, BY SECURITY AND COMPLIANCE, 2019-2024 (USD MILLION)

- TABLE 287 REST OF ASIA PACIFIC: DIGITAL WORKPLACE MARKET, BY SECURITY AND COMPLIANCE, 2025-2030 (USD MILLION)

- TABLE 288 REST OF ASIA PACIFIC: DIGITAL WORKPLACE MARKET, BY SUPPORT SERVICES, 2019-2024 (USD MILLION)

- TABLE 289 REST OF ASIA PACIFIC: DIGITAL WORKPLACE MARKET, BY SUPPORT SERVICES, 2025-2030 (USD MILLION)

- TABLE 290 REST OF ASIA PACIFIC: DIGITAL WORKPLACE MARKET, BY DEPLOYMENT MODE, 2019-2024 (USD MILLION)

- TABLE 291 REST OF ASIA PACIFIC: DIGITAL WORKPLACE MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 292 REST OF ASIA PACIFIC: DIGITAL WORKPLACE MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 293 REST OF ASIA PACIFIC: DIGITAL WORKPLACE MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 294 REST OF ASIA PACIFIC: DIGITAL WORKPLACE MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 295 REST OF ASIA PACIFIC: DIGITAL WORKPLACE MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 296 MIDDLE EAST & AFRICA: DIGITAL WORKPLACE MARKET, BY TYPE, 2019-2024 (USD MILLION)

- TABLE 297 MIDDLE EAST & AFRICA: DIGITAL WORKPLACE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 298 MIDDLE EAST & AFRICA: DIGITAL WORKPLACE MARKET, BY END-USER COMPUTING, 2019-2024 (USD MILLION)

- TABLE 299 MIDDLE EAST & AFRICA: DIGITAL WORKPLACE MARKET, BY END-USER COMPUTING, 2025-2030 (USD MILLION)

- TABLE 300 MIDDLE EAST & AFRICA: DIGITAL WORKPLACE MARKET, BY COMMUNICATION AND COLLABORATION, 2019-2024 (USD MILLION)

- TABLE 301 MIDDLE EAST & AFRICA: DIGITAL WORKPLACE MARKET, BY COMMUNICATION AND COLLABORATION, 2025-2030 (USD MILLION)

- TABLE 302 MIDDLE EAST & AFRICA: DIGITAL WORKPLACE MARKET, BY SECURITY AND COMPLIANCE, 2019-2024 (USD MILLION)

- TABLE 303 MIDDLE EAST & AFRICA: DIGITAL WORKPLACE MARKET, BY SECURITY AND COMPLIANCE, 2025-2030 (USD MILLION)

- TABLE 304 MIDDLE EAST & AFRICA: DIGITAL WORKPLACE MARKET, BY SUPPORT SERVICES, 2019-2024 (USD MILLION)

- TABLE 305 MIDDLE EAST & AFRICA: DIGITAL WORKPLACE MARKET, BY SUPPORT SERVICES, 2025-2030 (USD MILLION)

- TABLE 306 MIDDLE EAST & AFRICA: DIGITAL WORKPLACE MARKET, BY DEPLOYMENT MODE, 2019-2024 (USD MILLION)

- TABLE 307 MIDDLE EAST & AFRICA: DIGITAL WORKPLACE MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 308 MIDDLE EAST & AFRICA: DIGITAL WORKPLACE MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 309 MIDDLE EAST & AFRICA: DIGITAL WORKPLACE MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 310 MIDDLE EAST & AFRICA: DIGITAL WORKPLACE MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 311 MIDDLE EAST & AFRICA: DIGITAL WORKPLACE MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 312 MIDDLE EAST & AFRICA: DIGITAL WORKPLACE MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 313 MIDDLE EAST & AFRICA: DIGITAL WORKPLACE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 314 MIDDLE EAST: DIGITAL WORKPLACE MARKET, BY TYPE, 2019-2024 (USD MILLION)

- TABLE 315 MIDDLE EAST: DIGITAL WORKPLACE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 316 MIDDLE EAST: DIGITAL WORKPLACE MARKET, BY END-USER COMPUTING, 2019-2024 (USD MILLION)

- TABLE 317 MIDDLE EAST: DIGITAL WORKPLACE MARKET, BY END-USER COMPUTING, 2025-2030 (USD MILLION)

- TABLE 318 MIDDLE EAST: DIGITAL WORKPLACE MARKET, BY COMMUNICATION AND COLLABORATION, 2019-2024 (USD MILLION)

- TABLE 319 MIDDLE EAST: DIGITAL WORKPLACE MARKET, BY COMMUNICATION AND COLLABORATION, 2025-2030 (USD MILLION)

- TABLE 320 MIDDLE EAST: DIGITAL WORKPLACE MARKET, BY SECURITY AND COMPLIANCE, 2019-2024 (USD MILLION)

- TABLE 321 MIDDLE EAST: DIGITAL WORKPLACE MARKET, BY SECURITY AND COMPLIANCE, 2025-2030 (USD MILLION)

- TABLE 322 MIDDLE EAST: DIGITAL WORKPLACE MARKET, BY SUPPORT SERVICES, 2019-2024 (USD MILLION)

- TABLE 323 MIDDLE EAST: DIGITAL WORKPLACE MARKET, BY SUPPORT SERVICES, 2025-2030 (USD MILLION)

- TABLE 324 MIDDLE EAST: DIGITAL WORKPLACE MARKET, BY DEPLOYMENT MODE, 2019-2024 (USD MILLION)

- TABLE 325 MIDDLE EAST: DIGITAL WORKPLACE MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 326 MIDDLE EAST: DIGITAL WORKPLACE MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 327 MIDDLE EAST: DIGITAL WORKPLACE MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 328 MIDDLE EAST: DIGITAL WORKPLACE MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 329 MIDDLE EAST: DIGITAL WORKPLACE MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 330 MIDDLE EAST: DIGITAL WORKPLACE MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 331 MIDDLE EAST & AFRICA: DIGITAL WORKPLACE MARKET, BY REGION , 2025-2030 (USD MILLION)

- TABLE 332 GCC: DIGITAL WORKPLACE MARKET, BY TYPE, 2019-2024 (USD MILLION)

- TABLE 333 GCC: DIGITAL WORKPLACE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 334 GCC: DIGITAL WORKPLACE MARKET, BY END-USER COMPUTING, 2019-2024 (USD MILLION)

- TABLE 335 GCC: DIGITAL WORKPLACE MARKET, BY END-USER COMPUTING, 2025-2030 (USD MILLION)

- TABLE 336 GCC COUNTRIES: DIGITAL WORKPLACE MARKET, BY COMMUNICATION AND COLLABORATION, 2019-2024 (USD MILLION)

- TABLE 337 GCC: DIGITAL WORKPLACE MARKET, BY COMMUNICATION AND COLLABORATION, 2025-2030 (USD MILLION)

- TABLE 338 GCC COUNTRIES: DIGITAL WORKPLACE MARKET, BY SECURITY AND COMPLIANCE, 2019-2024 (USD MILLION)

- TABLE 339 GCC COUNTRIES: DIGITAL WORKPLACE MARKET, BY SECURITY AND COMPLIANCE, 2025-2030 (USD MILLION)

- TABLE 340 GCC COUNTRIES: DIGITAL WORKPLACE MARKET, BY SUPPORT SERVICES, 2019-2024 (USD MILLION)

- TABLE 341 GCC COUNTRIES: DIGITAL WORKPLACE MARKET, BY SUPPORT SERVICES, 2025-2030 (USD MILLION)

- TABLE 342 GCC COUNTRIES: DIGITAL WORKPLACE MARKET, BY DEPLOYMENT MODE, 2019-2024 (USD MILLION)

- TABLE 343 GCC COUNTRIES: DIGITAL WORKPLACE MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 344 GCC COUNTRIES: DIGITAL WORKPLACE MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 345 GCC COUNTRIES: DIGITAL WORKPLACE MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 346 GCC COUNTRIES: DIGITAL WORKPLACE MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 347 GCC COUNTRIES: DIGITAL WORKPLACE MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 348 GCC: DIGITAL WORKPLACE MARKET, BY GCC, 2019-2024 (USD MILLION)

- TABLE 349 GCC: DIGITAL WORKPLACE MARKET, BY GCC, 2025-2030 (USD MILLION)

- TABLE 350 REST OF MIDDLE EAST: DIGITAL WORKPLACE MARKET, BY TYPE, 2019-2024 (USD MILLION)

- TABLE 351 REST OF MIDDLE EAST: DIGITAL WORKPLACE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 352 REST OF MIDDLE EAST: DIGITAL WORKPLACE MARKET, BY END-USER COMPUTING, 2019-2024 (USD MILLION)

- TABLE 353 REST OF MIDDLE EAST: DIGITAL WORKPLACE MARKET, BY END-USER COMPUTING, 2025-2030 (USD MILLION)

- TABLE 354 REST OF MIDDLE EAST: DIGITAL WORKPLACE MARKET, BY COMMUNICATION AND COLLABORATION, 2019-2024 (USD MILLION)

- TABLE 355 REST OF MIDDLE EAST: DIGITAL WORKPLACE MARKET, BY COMMUNICATION AND COLLABORATION, 2025-2030 (USD MILLION)

- TABLE 356 REST OF MIDDLE EAST: DIGITAL WORKPLACE MARKET, BY SECURITY AND COMPLIANCE, 2019-2024 (USD MILLION)

- TABLE 357 REST OF MIDDLE EAST: DIGITAL WORKPLACE MARKET, BY SECURITY AND COMPLIANCE, 2025-2030 (USD MILLION)

- TABLE 358 REST OF MIDDLE EAST: DIGITAL WORKPLACE MARKET, BY SUPPORT SERVICES, 2019-2024 (USD MILLION)

- TABLE 359 REST OF MIDDLE EAST: DIGITAL WORKPLACE MARKET, BY SUPPORT SERVICES, 2025-2030 (USD MILLION)

- TABLE 360 REST OF MIDDLE EAST: DIGITAL WORKPLACE MARKET, BY DEPLOYMENT MODE, 2019-2024 (USD MILLION)

- TABLE 361 REST OF MIDDLE EAST: DIGITAL WORKPLACE MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 362 REST OF MIDDLE EAST: DIGITAL WORKPLACE MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 363 REST OF MIDDLE EAST: DIGITAL WORKPLACE MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 364 REST OF MIDDLE EAST: DIGITAL WORKPLACE MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 365 REST OF MIDDLE EAST: DIGITAL WORKPLACE MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 366 AFRICA: DIGITAL WORKPLACE MARKET, BY TYPE, 2019-2024 (USD MILLION)

- TABLE 367 AFRICA: DIGITAL WORKPLACE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 368 AFRICA: DIGITAL WORKPLACE MARKET, BY END-USER COMPUTING, 2019-2024 (USD MILLION)

- TABLE 369 AFRICA: DIGITAL WORKPLACE MARKET, BY END-USER COMPUTING, 2025-2030 (USD MILLION)

- TABLE 370 AFRICA: DIGITAL WORKPLACE MARKET, BY COMMUNICATION AND COLLABORATION, 2019-2024 (USD MILLION)

- TABLE 371 AFRICA: DIGITAL WORKPLACE MARKET, BY COMMUNICATION AND COLLABORATION, 2025-2030 (USD MILLION)

- TABLE 372 AFRICA: DIGITAL WORKPLACE MARKET, BY SECURITY AND COMPLIANCE, 2019-2024 (USD MILLION)

- TABLE 373 AFRICA: DIGITAL WORKPLACE MARKET, BY SECURITY AND COMPLIANCE, 2025-2030 (USD MILLION)

- TABLE 374 AFRICA: DIGITAL WORKPLACE MARKET, BY SUPPORT SERVICES, 2019-2024 (USD MILLION)

- TABLE 375 AFRICA: DIGITAL WORKPLACE MARKET, BY SUPPORT SERVICES, 2025-2030 (USD MILLION)

- TABLE 376 AFRICA: DIGITAL WORKPLACE MARKET, BY DEPLOYMENT MODE, 2019-2024 (USD MILLION)

- TABLE 377 AFRICA: DIGITAL WORKPLACE MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 378 AFRICA: DIGITAL WORKPLACE MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 379 AFRICA: DIGITAL WORKPLACE MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 380 AFRICA: DIGITAL WORKPLACE MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 381 AFRICA: DIGITAL WORKPLACE MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 382 AFRICA: DIGITAL WORKPLACE MARKET, BY COUNTRY, 2019-2024 (USD MILLION)

- TABLE 383 AFRICA: DIGITAL WORKPLACE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 384 LATIN AMERICA: DIGITAL WORKPLACE MARKET, BY TYPE, 2019-2024 (USD MILLION)

- TABLE 385 LATIN AMERICA: DIGITAL WORKPLACE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 386 LATIN AMERICA: DIGITAL WORKPLACE MARKET, BY END-USER COMPUTING, 2019-2024 (USD MILLION)

- TABLE 387 LATIN AMERICA: DIGITAL WORKPLACE MARKET, BY END-USER COMPUTING, 2025-2030 (USD MILLION)

- TABLE 388 LATIN AMERICA: DIGITAL WORKPLACE MARKET, BY COMMUNICATION AND COLLABORATION, 2019-2024 (USD MILLION)

- TABLE 389 LATIN AMERICA: DIGITAL WORKPLACE MARKET, BY COMMUNICATION AND COLLABORATION, 2025-2030 (USD MILLION)

- TABLE 390 LATIN AMERICA: DIGITAL WORKPLACE MARKET, BY SECURITY AND COMPLIANCE, 2019-2024 (USD MILLION)

- TABLE 391 LATIN AMERICA: DIGITAL WORKPLACE MARKET, BY SECURITY AND COMPLIANCE, 2025-2030 (USD MILLION)

- TABLE 392 LATIN AMERICA: DIGITAL WORKPLACE MARKET, BY SUPPORT SERVICES, 2019-2024 (USD MILLION)

- TABLE 393 LATIN AMERICA: DIGITAL WORKPLACE MARKET, BY SUPPORT SERVICES, 2025-2030 (USD MILLION)

- TABLE 394 LATIN AMERICA: DIGITAL WORKPLACE MARKET, BY DEPLOYMENT MODE, 2019-2024 (USD MILLION)

- TABLE 395 LATIN AMERICA: DIGITAL WORKPLACE MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 396 LATIN AMERICA: DIGITAL WORKPLACE MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 397 LATIN AMERICA: DIGITAL WORKPLACE MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 398 LATIN AMERICA: DIGITAL WORKPLACE MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 399 LATIN AMERICA: DIGITAL WORKPLACE MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 400 LATIN AMERICA: DIGITAL WORKPLACE MARKET, BY COUNTRY, 2019-2024 (USD MILLION)

- TABLE 401 LATIN AMERICA: DIGITAL WORKPLACE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 402 BRAZIL: DIGITAL WORKPLACE MARKET, BY TYPE, 2019-2024 (USD MILLION)

- TABLE 403 BRAZIL: DIGITAL WORKPLACE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 404 BRAZIL: DIGITAL WORKPLACE MARKET, BY END-USER COMPUTING, 2019-2024 (USD MILLION)

- TABLE 405 BRAZIL: DIGITAL WORKPLACE MARKET, BY END-USER COMPUTING, 2025-2030 (USD MILLION)

- TABLE 406 BRAZIL: DIGITAL WORKPLACE MARKET, BY COMMUNICATION AND COLLABORATION, 2019-2024 (USD MILLION)

- TABLE 407 BRAZIL: DIGITAL WORKPLACE MARKET, BY COMMUNICATION AND COLLABORATION, 2025-2030 (USD MILLION)

- TABLE 408 BRAZIL: DIGITAL WORKPLACE MARKET, BY SECURITY AND COMPLIANCE, 2019-2024 (USD MILLION)

- TABLE 409 BRAZIL: DIGITAL WORKPLACE MARKET, BY SECURITY AND COMPLIANCE, 2025-2030 (USD MILLION)

- TABLE 410 BRAZIL: DIGITAL WORKPLACE MARKET, BY SUPPORT SERVICES, 2019-2024 (USD MILLION)

- TABLE 411 BRAZIL: DIGITAL WORKPLACE MARKET, BY SUPPORT SERVICES, 2025-2030 (USD MILLION)

- TABLE 412 BRAZIL: DIGITAL WORKPLACE MARKET, BY DEPLOYMENT MODE, 2019-2024 (USD MILLION)

- TABLE 413 BRAZIL: DIGITAL WORKPLACE MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 414 BRAZIL: DIGITAL WORKPLACE MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 415 BRAZIL: DIGITAL WORKPLACE MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 416 BRAZIL: DIGITAL WORKPLACE MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 417 BRAZIL: DIGITAL WORKPLACE MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 418 MEXICO: DIGITAL WORKPLACE MARKET, BY TYPE, 2019-2024 (USD MILLION)

- TABLE 419 MEXICO: DIGITAL WORKPLACE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 420 MEXICO: DIGITAL WORKPLACE MARKET, BY END-USER COMPUTING, 2019-2024 (USD MILLION)

- TABLE 421 MEXICO: DIGITAL WORKPLACE MARKET, BY END-USER COMPUTING, 2025-2030 (USD MILLION)

- TABLE 422 MEXICO: DIGITAL WORKPLACE MARKET, BY COMMUNICATION AND COLLABORATION, 2019-2024 (USD MILLION)

- TABLE 423 MEXICO: DIGITAL WORKPLACE MARKET, BY COMMUNICATION AND COLLABORATION, 2025-2030 (USD MILLION)

- TABLE 424 MEXICO: DIGITAL WORKPLACE MARKET, BY SECURITY AND COMPLIANCE, 2019-2024 (USD MILLION)

- TABLE 425 MEXICO: DIGITAL WORKPLACE MARKET, BY SECURITY AND COMPLIANCE, 2025-2030 (USD MILLION)

- TABLE 426 MEXICO: DIGITAL WORKPLACE MARKET, BY SUPPORT SERVICES, 2019-2024 (USD MILLION)

- TABLE 427 MEXICO: DIGITAL WORKPLACE MARKET, BY SUPPORT SERVICES, 2025-2030 (USD MILLION)

- TABLE 428 MEXICO: DIGITAL WORKPLACE MARKET, BY DEPLOYMENT MODE, 2019-2024 (USD MILLION)

- TABLE 429 MEXICO: DIGITAL WORKPLACE MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 430 MEXICO: DIGITAL WORKPLACE MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 431 MEXICO: DIGITAL WORKPLACE MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 432 MEXICO: DIGITAL WORKPLACE MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 433 MEXICO: DIGITAL WORKPLACE MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 434 REST OF LATIN AMERICA: DIGITAL WORKPLACE MARKET, BY TYPE, 2019-2024 (USD MILLION)

- TABLE 435 REST OF LATIN AMERICA: DIGITAL WORKPLACE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 436 REST OF LATIN AMERICA: DIGITAL WORKPLACE MARKET, BY END-USER COMPUTING, 2019-2024 (USD MILLION)

- TABLE 437 REST OF LATIN AMERICA: DIGITAL WORKPLACE MARKET, BY END-USER COMPUTING, 2025-2030 (USD MILLION)

- TABLE 438 REST OF LATIN AMERICA: DIGITAL WORKPLACE MARKET, BY COMMUNICATION AND COLLABORATION, 2019-2024 (USD MILLION)

- TABLE 439 REST OF LATIN AMERICA: DIGITAL WORKPLACE MARKET, BY COMMUNICATION AND COLLABORATION, 2025-2030 (USD MILLION)

- TABLE 440 REST OF LATIN AMERICA: DIGITAL WORKPLACE MARKET, BY SECURITY AND COMPLIANCE, 2019-2024 (USD MILLION)

- TABLE 441 REST OF LATIN AMERICA: DIGITAL WORKPLACE MARKET, BY SECURITY AND COMPLIANCE, 2025-2030 (USD MILLION)

- TABLE 442 REST OF LATIN AMERICA: DIGITAL WORKPLACE MARKET, BY SUPPORT SERVICES, 2019-2024 (USD MILLION)

- TABLE 443 REST OF LATIN AMERICA: DIGITAL WORKPLACE MARKET, BY SUPPORT SERVICES, 2025-2030 (USD MILLION)

- TABLE 444 REST OF LATIN AMERICA: DIGITAL WORKPLACE MARKET, BY DEPLOYMENT MODE, 2019-2024 (USD MILLION)

- TABLE 445 REST OF LATIN AMERICA: DIGITAL WORKPLACE MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 446 REST OF LATIN AMERICA: DIGITAL WORKPLACE MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 447 REST OF LATIN AMERICA: DIGITAL WORKPLACE MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 448 REST OF LATIN AMERICA: DIGITAL WORKPLACE MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 449 REST OF LATIN AMERICA: DIGITAL WORKPLACE MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 450 DIGITAL WORKPLACE MARKET: DEGREE OF COMPETITION

- TABLE 451 DIGITAL WORKPLACE MARKET: TYPE FOOTPRINT

- TABLE 452 DIGITAL WORKPLACE MARKET: DEPLOYMENT MODE FOOTPRINT

- TABLE 453 DIGITAL WORKPLACE MARKET: VERTICAL FOOTPRINT

- TABLE 454 DIGITAL WORKPLACE MARKET: REGIONAL FOOTPRINT

- TABLE 455 DETAILED LIST OF KEY STARTUPS

- TABLE 456 DIGITAL WORKPLACE MARKET: TYPE FOOTPRINT OF STARTUPS

- TABLE 457 DIGITAL WORKPLACE MARKET: DEPLOYMENT MODE FOOTPRINT OF STARTUPS

- TABLE 458 DIGITAL WORKPLACE MARKET: VERTICAL FOOTPRINT OF KEY STARTUPS

- TABLE 459 DIGITAL WORKPLACE MARKET: REGIONAL FOOTPRINT OF KEY STARTUPS

- TABLE 460 DIGITAL WORKPLACE MARKET: PRODUCT LAUNCHES, JANUARY 2023-JULY 2025

- TABLE 461 DIGITAL WORKPLACE MARKET: DEALS, JANUARY 2023-JULY 2025

- TABLE 462 TCS: COMPANY OVERVIEW

- TABLE 463 TCS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 464 TCS: PRODUCT LAUNCHES/DEVELOPMENTS, JANUARY 2023-JULY 2025

- TABLE 465 TCS: DEALS, JANUARY 2023-JULY 2025

- TABLE 466 TCS: EXPANSIONS, JANUARY 2023-JULY 2025

- TABLE 467 WIPRO: COMPANY OVERVIEW

- TABLE 468 WIPRO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 469 WIPRO: DEALS, JANUARY 2023-JULY 2025

- TABLE 470 WIPRO: EXPANSIONS, JANUARY 2023-JULY 2025

- TABLE 471 DXC TECHNOLOGY: COMPANY OVERVIEW

- TABLE 472 DXC TECHNOLOGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 473 DXC TECHNOLOGY: PRODUCT LAUNCHES/DEVELOPMENTS, JANUARY 2023-JULY 2025

- TABLE 474 DXC TECHNOLOGY: DEALS, JANUARY 2023-JULY 2025

- TABLE 475 HCLTECH: COMPANY OVERVIEW

- TABLE 476 HCLTECH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 477 HCLTECH: DEALS, JANUARY 2023-JULY 2025

- TABLE 478 HCLTECH: EXPANSIONS, JANUARY 2023-JULY 2025

- TABLE 479 INFOSYS: COMPANY OVERVIEW

- TABLE 480 INFOSYS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 481 INFOSYS: PRODUCT LAUNCHES/DEVELOPMENTS, JANUARY 2023-JULY 2025

- TABLE 482 INFOSYS: DEALS, JANUARY 2023-JULY 2025

- TABLE 483 FUJITSU: COMPANY OVERVIEW

- TABLE 484 FUJITSU: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 485 FUJITSU: DEALS, JANUARY 2023-JULY 2025

- TABLE 486 ATOS: COMPANY OVERVIEW

- TABLE 487 ATOS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 488 ATOS: PRODUCT LAUNCHES/DEVELOPMENTS, JANUARY 2023-JULY 2025

- TABLE 489 ATOS: DEALS, JANUARY 2023-JULY 2025

- TABLE 490 NTT DATA: COMPANY OVERVIEW

- TABLE 491 NTT DATA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 492 NTT DATA: DEALS, JANUARY 2023-JULY 2025

- TABLE 493 IBM: COMPANY OVERVIEW

- TABLE 494 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 495 IBM: PRODUCT LAUNCHES/DEVELOPMENTS, JANUARY 2023-JULY 2025

- TABLE 496 IBM: DEALS, JANUARY 2023-JULY 2025

- TABLE 497 COGNIZANT: COMPANY OVERVIEW

- TABLE 498 COGNIZANT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 499 COGNIZANT: PRODUCT LAUNCHES/DEVELOPMENTS, JANUARY 2023-JULY 2025

- TABLE 500 COGNIZANT: DEALS, JANUARY 2023-JULY 2025

- TABLE 501 ACCENTURE: COMPANY OVERVIEW

- TABLE 502 ACCENTURE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 503 ACCENTURE: PRODUCT LAUNCHES/DEVELOPMENTS, JANUARY 2023-JULY 2025

- TABLE 504 ACCENTURE: DEALS, JANUARY 2023-JULY 2025

- TABLE 505 KYNDRYL: COMPANY OVERVIEW

- TABLE 506 KYNDRYL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 507 KYNDRYL: PRODUCT LAUNCHES/DEVELOPMENTS, JANUARY 2023-JULY 2025

- TABLE 508 KYNDRYL: DEALS, JANUARY 2023-JULY 2025

- TABLE 509 HPE: COMPANY OVERVIEW

- TABLE 510 HPE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 511 HPE: DEALS, JANUARY 2023-JULY 2025

- TABLE 512 CAPGEMINI: COMPANY OVERVIEW

- TABLE 513 CAPGEMINI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 514 UNISYS: COMPANY OVERVIEW

- TABLE 515 UNISYS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 516 TECH MAHINDRA: COMPANY OVERVIEW

- TABLE 517 TECH MAHINDRA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 518 TECH MAHINDRA: PRODUCT LAUNCHES/DEVELOPMENTS, JANUARY 2023-JULY 2025

- TABLE 519 TECH MAHINDRA: DEALS, JANUARY 2023-JULY 2025

- TABLE 520 ADJACENT MARKETS AND FORECASTS

- TABLE 521 WORKPLACE SAFETY MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 522 WORKPLACE SAFETY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 523 WORKPLACE SAFETY MARKET, BY SYSTEM, 2019-2024 (USD MILLION)

- TABLE 524 WORKPLACE SAFETY MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 525 WORKPLACE SAFETY MARKET, BY APPLICATION, 2019-2024 (USD MILLION)

- TABLE 526 WORKPLACE SAFETY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 527 WORKPLACE SAFETY MARKET, BY DEPLOYMENT MODE, 2019-2024 (USD MILLION)

- TABLE 528 WORKPLACE SAFETY MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 529 WORKPLACE SAFETY MARKET, BY END-USE INDUSTRY, 2019-2024 (USD MILLION)

- TABLE 530 WORKPLACE SAFETY MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 531 WORKPLACE SAFETY MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 532 WORKPLACE SAFETY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 533 REMOTE WORKPLACE SERVICES MARKET, BY COMPONENT, 2017-2021 (USD MILLION)

- TABLE 534 REMOTE WORKPLACE SERVICES MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 535 REMOTE WORKPLACE SERVICES MARKET, BY DEPLOYMENT TYPE, 2017-2021 (USD MILLION)

- TABLE 536 REMOTE WORKPLACE SERVICES MARKET, BY DEPLOYMENT TYPE, 2022-2027 (USD MILLION)

- TABLE 537 REMOTE WORKPLACE SERVICES MARKET, BY ORGANIZATION SIZE, 2017-2021 (USD MILLION)

- TABLE 538 REMOTE WORKPLACE SERVICES MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 539 REMOTE WORKPLACE SERVICES MARKET, BY VERTICAL, 2017-2021 (USD MILLION)

- TABLE 540 REMOTE WORKPLACE SERVICES MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 541 REMOTE WORKPLACE SERVICES MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 542 REMOTE WORKPLACE SERVICES MARKET, BY REGION, 2022-2027 (USD MILLION)

List of Figures

- FIGURE 1 DIGITAL WORKPLACE MARKET: RESEARCH DESIGN

- FIGURE 2 DIGITAL WORKPLACE MARKET: RESEARCH FLOW

- FIGURE 3 APPROACH 1 (SUPPLY-SIDE): REVENUE FROM DIGITAL WORKPLACE VENDORS

- FIGURE 4 APPROACH 1: SUPPLY-SIDE ANALYSIS

- FIGURE 5 APPROACH 2: BOTTOM-UP (DEMAND-SIDE)

- FIGURE 6 GLOBAL DIGITAL WORKPLACE MARKET TO WITNESS SIGNIFICANT GROWTH DURING FORECAST PERIOD

- FIGURE 7 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

- FIGURE 8 DIGITAL WORKPLACE MARKET: FASTEST-GROWING SEGMENTS

- FIGURE 9 RISE IN DIGITAL TRANSFORMATION AND HYBRID WORK MODELS EXPECTED TO DRIVE GROWTH OF DIGITAL WORKPLACE MARKET

- FIGURE 10 SECURITY AND COMPLIANCE SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 11 WORKFLOW AUTOMATION TOOLS SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 12 UNIFIED COMMUNICATIONS-AS-A-SERVICE (UCAAS) SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 13 THREAT DETECTION AND RESPONSE SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 14 TRAINING AND DEVELOPMENT SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 15 CLOUD SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2025

- FIGURE 16 LARGE ENTERPRISES TO ACCOUNT FOR LARGER SHARE IN 2025

- FIGURE 17 HEALTHCARE AND LIFE SCIENCES SEGMENT TO GROW AT HIGHEST RATE

- FIGURE 18 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENTS IN NEXT FIVE YEARS

- FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: DIGITAL WORKPLACE MARKET

- FIGURE 20 DIGITAL WORKPLACE MARKET: VALUE CHAIN ANALYSIS

- FIGURE 21 DIGITAL WORKPLACE MARKET: ECOSYSTEM

- FIGURE 22 DIGITAL WORKPLACE MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 23 AVERAGE SELLING PRICE OF KEY PLAYERS, BY SERVICE TYPE

- FIGURE 24 NUMBER OF PATENTS GRANTED FOR DIGITAL WORKPLACE MARKET, 2015-2025

- FIGURE 25 REGIONAL ANALYSIS OF PATENTS GRANTED FOR DIGITAL WORKPLACE MARKET

- FIGURE 26 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- FIGURE 28 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- FIGURE 29 LEADING GLOBAL DIGITAL WORKPLACE STARTUPS AND SMES, BY NUMBER OF INVESTORS AND FUNDING ROUNDS

- FIGURE 30 MARKET POTENTIAL OF GEN AI IN ENHANCING DIGITAL WORKPLACES ACROSS INDUSTRIES

- FIGURE 31 IMPACT OF GEN AI ON INTERCONNECTED AND ADJACENT ECOSYSTEMS

- FIGURE 32 SECURITY AND COMPLIANCE SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 33 WORKFLOW AUTOMATION TOOLS SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 34 UNIFIED COMMUNICATIONS-AS-A-SERVICE (UCAAS) SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 35 THREAT DETECTION AND RESPONSE SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 36 TRAINING AND DEVELOPMENT SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 37 CLOUD SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 38 SMES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 39 HEALTHCARE & LIFE SCIENCES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 40 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 41 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 42 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 43 REVENUE ANALYSIS OF KEY PLAYERS, 2020-2024 (USD MILLION)

- FIGURE 44 SHARE OF LEADING COMPANIES IN DIGITAL WORKPLACE MARKET, 2024 (%)

- FIGURE 45 DIGITAL WORKPLACE MARKET: COMPARISON OF VENDORS' BRANDS/PRODUCTS

- FIGURE 46 COMPANY VALUATION (USD BILLION), 2025

- FIGURE 47 EV/EBIDTA, 2025

- FIGURE 48 DIGITAL WORKPLACE MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 49 DIGITAL WORKPLACE MARKET: COMPANY FOOTPRINT

- FIGURE 50 DIGITAL WORKPLACE MARKET: COMPANY EVALUATION MATRIX (STARTUPS), 2024

- FIGURE 51 TCS: COMPANY SNAPSHOT

- FIGURE 52 WIPRO: COMPANY SNAPSHOT

- FIGURE 53 DXC TECHNOLOGY: COMPANY SNAPSHOT

- FIGURE 54 HCLTECH: COMPANY SNAPSHOT

- FIGURE 55 INFOSYS: COMPANY SNAPSHOT

- FIGURE 56 FUJITSU: COMPANY SNAPSHOT

- FIGURE 57 ATOS: COMPANY SNAPSHOT

- FIGURE 58 NTT DATA: COMPANY SNAPSHOT

- FIGURE 59 IBM: COMPANY SNAPSHOT

- FIGURE 60 COGNIZANT: COMPANY SNAPSHOT

- FIGURE 61 ACCENTURE: COMPANY SNAPSHOT

- FIGURE 62 KYNDRYL: COMPANY SNAPSHOT

- FIGURE 63 HPE: COMPANY SNAPSHOT

- FIGURE 64 CAPGEMINI: COMPANY SNAPSHOT

- FIGURE 65 UNISYS: COMPANY SNAPSHOT

- FIGURE 66 TECH MAHINDRA: COMPANY SNAPSHOT

The global digital workplace market size is projected to grow from USD 67.57 billion in 2025 to USD 161.82 billion by 2030 at a Compound Annual Growth Rate (CAGR) of 19.1% during the forecast period. The rise in digital transformation initiatives is reshaping how organizations operate, driving demand for digital workplace solutions.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/USD Billion) |

| Segments | Type, Deployment Mode, Organization Size, Vertical, and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

Companies are redesigning workflows to support remote and hybrid models, with tools like Microsoft Teams and Google Workspace becoming essential for collaboration. In April 2024, Unilever launched a new AI-powered digital workplace platform to personalize employee experiences, streamline internal communications, and unify work tools across its global workforce. At the same time, cost optimization and productivity gains remain key drivers. For instance, in February 2025, Siemens rolled out a cloud-based digital workplace framework to reduce infrastructure costs and improve team productivity through intelligent automation and unified access to resources.

"By deployment mode, the cloud segment is expected to hold the largest market share during the forecast period."

The cloud segment holds the largest market share in the digital workplace services market due to its scalability, accessibility, and cost-effectiveness. Businesses of all industries are adopting cloud-hosted digital workplace tools to accommodate remote workforces, optimize IT processes, and manage infrastructure easily. Cloud deployment allows employees to use the necessary workplace tools and applications anywhere and on any device, which makes it suitable for use in remote and hybrid work environments. It also enables IT teams to centrally manage updates, security patches, and system monitoring without the overhead of maintaining on-premises. Cloud platforms enable an easy integration of collaboration tools, endpoint management, and employee experience solutions, simplifying the task of service providers to offer unified digital workplace services. Vendors such as Wipro, HCLTech, and TCS provide cloud-native ecosystems that enterprises are increasingly adopting because of their interoperability and shorter time-to-value. Cloud deployment in dynamic workforce industries like retail, healthcare, and professional services provides constant access to business-critical systems without significant hardware investments. The cloud-based analytics, automation, and self-service portals are also being incorporated by service providers to improve service delivery. This increasing trend of operating expenditure model to capital expenditure model also fits the pay-as-you-go model of cloud, which is a convenient and strategic decision to adopt the cloud in organizations that need flexibility and responsiveness in their digital workplace.

The US is expected to hold the largest market size in the North American region during the forecast period.

The US holds the largest market share in the North American digital workplace market due to its early adoption of modern workplace technologies and strong presence of major service providers. Companies such as IBM, Accenture, Cognizant, and DXC Technology have a significant presence in the US, enabling rapid deployment of digital solutions across industries. The shift toward hybrid and remote working models has led to widespread adoption of cloud-based collaboration platforms, virtual desktops, and AI-powered productivity tools. In May 2024, JPMorgan Chase implemented a new digital workplace infrastructure designed to streamline operations across departments using automation and machine learning. The US also leads in enterprise SaaS adoption, with platforms such as Microsoft 365 and Slack being deeply integrated into corporate workflows. Strong demand from sectors such as BFSI, healthcare, and manufacturing, all of which require secure and scalable digital workplace models, contributes to this growth. The federal government and public sector agencies are also adopting digital workplace strategies to modernize legacy systems and improve internal communication. Strong investment in cybersecurity, digital infrastructure, and employee experience platforms strengthens the US position in this market. These developments collectively enable the US to maintain a leading role in the digital workplace market.

Breakdown of primaries

The study contains insights from various industry experts, from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type: Tier 1 - 35%, Tier 2 - 45%, and Tier 3 - 20%

- By Designation: Managerial and Other Levels - 60%, C-Level - 40%

- By Region: North America - 35%, Europe - 20%, Asia Pacific - 20%, Middle East & Africa - 20%, Latin America - 5%

Major vendors in the global digital workplace market include Atos (France), Cognizant (US), IBM (US), Wipro (India), TCS (India), Infosys (India), DXC Technology (US), Accenture (Ireland), Capgemini (France), Fujitsu (Japan), HCL Technology (India), HPE (US), Kyndryl (US), NTT Data (Japan), Unisys (US), Tech Mahindra (Pune), Stefanini (Brazil), Computacenter (England), CompuCom (US), T-Systems (Germany), Getronics (Netherlands), CGI (Canada), Milestone Technologies (US), Mphasis (India), Birlasoft (India), Neurealm (US), UST (US), Microland (India), Brillio (US), Bell Techlogix (US), Pomeroy (US), LTIMindtree (India), Kissflow (US), and Groupe.io (US).

The study includes an in-depth competitive analysis of the key players in the digital workplace market, their company profiles, recent developments, and key market strategies.

Research Coverage

The report segments the digital workplace market and forecasts its size type (end-user computing, communication and collaboration, security and compliance, and support services), deployment mode (on-premises, cloud, and hybrid), organization size (large enterprises and SMEs), and vertical (banking, financial services, and insurance, retail & e-commerce, government & public sector, healthcare & life sciences, manufacturing, telecommunications, energy & utilities, other verticals (education and media & entertainment)).

The study also includes an in-depth competitive analysis of the market's key players, their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report

The report will help market leaders and new entrants with information on the closest approximations of the revenue numbers for the overall digital workplace market and its subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (the shift toward hybrid and remote work models, Growing demand for enhanced employee experience, increased adoption of cloud platforms and SaaS tools, Rise in digital transformation initiatives, cost optimization and improved productivity), restraints (Data privacy and security concerns, resistance to change and technology adoption among workers), opportunities (rising demand for Experience-Level Agreements (XLAs), integration of AI, automation and analytics, integration with digital twin and IoT technologies, employee upskilling and learning platforms), and challenges (Fragmented tool ecosystems, evolving cybersecurity threat landscape, ensuring consistent user experience across devices and locations)

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the digital workplace market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the digital workplace market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the digital workplace market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players in digital workplace market strategies, including Atos (France), Cognizant (US), IBM (US), Wipro (India), and TCS (India).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primary profiles

- 2.1.2.2 Key industry insights

- 2.2 DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- 2.4 MARKET REVENUE ESTIMATION

- 2.5 MARKET FORECAST

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 STUDY LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 OVERVIEW OF DIGITAL WORKPLACE MARKET

- 4.2 DIGITAL WORKPLACE MARKET, BY TYPE

- 4.3 DIGITAL WORKPLACE MARKET, BY END-USER COMPUTING

- 4.4 DIGITAL WORKPLACE MARKET, BY COMMUNICATION AND COLLABORATION

- 4.5 DIGITAL WORKPLACE MARKET, BY SECURITY AND COMPLIANCE

- 4.6 DIGITAL WORKPLACE MARKET, BY SUPPORT SERVICES

- 4.7 DIGITAL WORKPLACE MARKET, BY DEPLOYMENT MODE

- 4.8 DIGITAL WORKPLACE MARKET, BY ORGANIZATION SIZE

- 4.9 DIGITAL WORKPLACE MARKET, BY VERTICAL

- 4.10 MARKET INVESTMENT SCENARIO

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Shift toward hybrid and remote work models

- 5.2.1.2 Growing demand for enhanced employee experience

- 5.2.1.3 Increased adoption of cloud platforms and SaaS tools

- 5.2.1.4 Rise in digital transformation initiatives

- 5.2.1.5 Cost optimization and improved productivity

- 5.2.2 RESTRAINTS

- 5.2.2.1 Data privacy and security concerns

- 5.2.2.2 Resistance to change and technology adoption among workers

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising demand for experience-level agreements (XLAs)

- 5.2.3.2 Integration of AI, automation, and analytics

- 5.2.3.3 Integration with digital twin and IoT technologies

- 5.2.3.4 Employee upskilling and learning platforms

- 5.2.4 CHALLENGES

- 5.2.4.1 Fragmented tool ecosystems

- 5.2.4.2 Evolving cybersecurity threat landscape

- 5.2.4.3 Ensuring consistent user experience across devices and locations

- 5.2.1 DRIVERS

- 5.3 CASE STUDY ANALYSIS

- 5.3.1 ACCENTURE'S DIGITAL WORKPLACE SOLUTION HELPED TECHSOL MODERNIZE EMPLOYEE EXPERIENCE

- 5.3.2 HCLTECH ENABLED EDUCORE TO CREATE HYBRID DIGITAL LEARNING WORKPLACE

- 5.3.3 INFOSYS HELPED RETAILVERSE MODERNIZE FRONTLINE WORKER EXPERIENCE

- 5.4 VALUE CHAIN ANALYSIS

- 5.4.1 TECHNOLOGY PROVIDERS

- 5.4.2 PLANNING & DESIGNING

- 5.4.3 SYSTEM INTEGRATION

- 5.4.4 MANAGED SERVICE PROVIDERS

- 5.4.5 END-USER GROUPS

- 5.5 ECOSYSTEM

- 5.6 PORTER'S FIVE FORCES ANALYSIS

- 5.6.1 THREAT OF NEW ENTRANTS

- 5.6.2 THREAT OF SUBSTITUTES

- 5.6.3 BARGAINING POWER OF SUPPLIERS

- 5.6.4 BARGAINING POWER OF BUYERS

- 5.6.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.7 PRICING ANALYSIS

- 5.7.1 AVERAGE SELLING PRICE OF KEY PLAYERS, BY SERVICE TYPE

- 5.7.2 INDICATIVE PRICING ANALYSIS, BY PLATFORM AND SERVICE, 2025

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Machine Learning (ML) and Artificial Intelligence (AI)

- 5.8.1.2 Cloud Computing

- 5.8.1.3 AR/VR (Augmented Reality/Virtual Reality)

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Internet of Things (IoT)

- 5.8.2.2 Analytics

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 Real-time Authentication (RTA)

- 5.8.1 KEY TECHNOLOGIES

- 5.9 PATENT ANALYSIS

- 5.9.1 LIST OF TOP PATENTS IN DIGITAL WORKPLACE MARKET, 2023-2025

- 5.10 TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.11 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.11.2 BUYING CRITERIA

- 5.12 REGULATORY LANDSCAPE

- 5.12.1 INTERNATIONAL ORGANIZATION FOR STANDARDIZATION

- 5.12.2 NATIONAL INSTITUTE OF STANDARDS AND TECHNOLOGY

- 5.12.3 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT

- 5.12.4 CALIFORNIA CONSUMER PRIVACY ACT (CCPA)

- 5.12.5 GENERAL DATA PROTECTION REGULATION

- 5.12.6 SARBANES-OXLEY ACT (SOX)

- 5.12.7 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13 KEY CONFERENCES & EVENTS, 2026

- 5.14 INVESTMENT & FUNDING SCENARIO

- 5.15 IMPACT OF GENERATIVE AI ON DIGITAL WORKPLACE MARKET

- 5.15.1 TOP USE CASES AND MARKET POTENTIAL

- 5.15.2 IMPACT OF GEN AI ON INTERCONNECTED AND ADJACENT ECOSYSTEMS

- 5.15.2.1 IT Service Management (ITSM) & Helpdesks

- 5.15.2.2 Digital Experience Platforms (DXPs)

- 5.15.2.3 Knowledge Management Systems

- 5.15.2.4 Unified Endpoint Management (UEM)

- 5.15.2.5 Security & Identity Management

- 5.16 IMPACT OF 2025 US TARIFF - OVERVIEW

- 5.16.1 INTRODUCTION

- 5.16.2 KEY TARIFF RATES

- 5.16.3 PRICE IMPACT ANALYSIS

- 5.16.3.1 Strategic shifts and emerging trends

- 5.16.4 IMPACT ON COUNTRY/REGION

- 5.16.4.1 US

- 5.16.4.2 Europe

- 5.16.4.3 APAC

- 5.16.5 IMPACT ON END-USE INDUSTRIES

6 DIGITAL WORKPLACE MARKET, BY TYPE

- 6.1 INTRODUCTION

- 6.1.1 TYPE: DIGITAL WORKPLACE MARKET DRIVERS

- 6.2 END-USER COMPUTING

- 6.2.1 INCREASING DEMAND FOR CLOUD-BASED END-USER COMPUTING SOLUTIONS DRIVING GROWTH OF DIGITAL WORKPLACE MARKET

- 6.2.2 VIRTUAL DESKTOP INFRASTRUCTURE

- 6.2.2.1 Enabling secure and scalable workspaces with virtual desktop infrastructure

- 6.2.3 DEVICE MANAGEMENT

- 6.2.3.1 Managing enterprise devices efficiently through centralized control solutions

- 6.2.4 APPLICATION VIRTUALIZATION

- 6.2.4.1 Assist in supporting remote and hybrid work models

- 6.2.5 WORKFLOW AUTOMATION TOOLS

- 6.2.5.1 Accelerating business processes with intelligent workflow automation tools

- 6.3 COMMUNICATION AND COLLABORATION

- 6.3.1 ENHANCING TEAM PRODUCTIVITY WITH SEAMLESS COMMUNICATION AND COLLABORATION SERVICES

- 6.3.2 UNIFIED COMMUNICATIONS-AS-A-SERVICE (UCAAS)

- 6.3.2.1 Streamlining enterprise communication with UCAAS

- 6.3.3 VIDEO CONFERENCING MANAGEMENT

- 6.3.3.1 Optimizing remote collaboration through video conferencing management

- 6.3.4 COLLABORATION PLATFORM ADMINISTRATION

- 6.3.4.1 Enabling seamless teamwork through collaboration platform administration services

- 6.4 SECURITY AND COMPLIANCE

- 6.4.1 SAFEGUARD USER IDENTITIES, DEVICES, APPLICATIONS, AND COMMUNICATION CHANNELS IN DISTRIBUTED ENVIRONMENTS

- 6.4.2 IDENTITY AND ACCESS MANAGEMENT (IAM)

- 6.4.2.1 Rise of hybrid work models, multi-device access, and cloud-based applications drive the market growth

- 6.4.3 DATA LOSS PREVENTION

- 6.4.3.1 Help organizations enforce security policies and ensure compliance with data protection regulations

- 6.4.4 ENDPOINT SECURITY

- 6.4.4.1 Protecting digital work environments with robust endpoint security solutions

- 6.4.5 THREAT DETECTION AND RESPONSE

- 6.4.5.1 Enhancing workplace security with threat detection and response tools

- 6.4.6 COMPLIANCE MONITORING

- 6.4.6.1 Rising data privacy laws and remote work environments drive adoption of compliance monitoring services

- 6.5 SUPPORT SERVICES

- 6.5.1 ENABLING SEAMLESS OPERATIONS WITH RELIABLE WORKPLACE SUPPORT SERVICES

- 6.5.2 CONSULTING AND ADVISORY SERVICES

- 6.5.2.1 Assist in navigating complexities of hybrid work environments

- 6.5.3 TRAINING AND DEVELOPMENT SERVICES

- 6.5.3.1 Help organizations to maintain agility, enhance digital literacy, and support long-term business transformation

- 6.5.4 TECHNICAL SUPPORT

- 6.5.4.1 Ensuring workplace continuity with scalable technical support services

7 DIGITAL WORKPLACE MARKET, BY DEPLOYMENT MODE

- 7.1 INTRODUCTION

- 7.1.1 DEPLOYMENT MODE: DIGITAL WORKPLACE MARKET DRIVERS

- 7.2 ON-PREMISES

- 7.2.1 MANAGING DATA WITHIN SECURED DATABASES AND MINIMIZING EXPOSURE TO EXTERNAL THREATS

- 7.3 CLOUD

- 7.3.1 REDUCING IT BURDEN AND COSTS THROUGH CLOUD-ENABLED DIGITAL WORKPLACES

- 7.4 HYBRID

- 7.4.1 FLEXIBLE, SECURE DIGITAL WORKPLACE TRANSFORMATION AT SCALE WITH HYBRID DEPLOYMENT

8 DIGITAL WORKPLACE MARKET, BY ORGANIZATION SIZE

- 8.1 INTRODUCTION

- 8.1.1 ORGANIZATION SIZE: DIGITAL WORKPLACE MARKET DRIVERS

- 8.2 LARGE ENTERPRISES

- 8.2.1 IMPROVED WORKPLACE EXPERIENCE DUE TO DIGITAL WORKPLACE SERVICES

- 8.3 SMALL & MEDIUM-SIZED ENTERPRISES

- 8.3.1 SMES' RAPID DIGITAL ADOPTION SIGNIFICANTLY DRIVES DIGITAL WORKPLACE MARKET GROWTH

9 DIGITAL WORKPLACE MARKET, BY VERTICAL

- 9.1 INTRODUCTION

- 9.1.1 VERTICAL: DIGITAL WORKPLACE MARKET DRIVERS

- 9.2 BFSI

- 9.2.1 REDUCE OPERATIONAL COSTS, IMPROVE TIME-TO-MARKET FOR NEW OFFERINGS, AND ENHANCE CUSTOMER ENGAGEMENT

- 9.3 GOVERNMENT & PUBLIC SECTOR

- 9.3.1 USE OF VAST AMOUNTS OF CONFIDENTIAL AND SENSITIVE INFORMATION IN GOVERNMENT ENTITIES TO ENCOURAGE MARKET EXPANSION

- 9.4 MANUFACTURING

- 9.4.1 MODERNIZING MANUFACTURING WORKFLOWS WITH DIGITAL WORKPLACE INTEGRATION

- 9.5 HEALTHCARE & LIFE SCIENCES

- 9.5.1 ENABLING SMARTER CARE DELIVERY THROUGH DIGITAL WORKPLACE INTEGRATION

- 9.6 IT & TELECOMMUNICATIONS

- 9.6.1 EMPOWERING IT & TELECOMMUNICATIONS WORKFORCES WITH SMART, SCALABLE DIGITAL WORKPLACE SERVICES

- 9.7 RETAIL & E-COMMERCE

- 9.7.1 ENHANCING RETAIL AND E-COMMERCE EFFICIENCY WITH INTELLIGENT DIGITAL WORKPLACE INTEGRATION

- 9.8 ENERGY & UTILITIES

- 9.8.1 ACCELERATING DIGITALIZATION WITH SEAMLESS WORKPLACE COLLABORATION AND CONNECTIVITY

- 9.9 OTHER VERTICALS

10 DIGITAL WORKPLACE MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA