|

|

市場調査レポート

商品コード

1801776

メインフレーム近代化の世界市場:提供別、組織規模別、業界別、地域別 - 予測(~2030年)Mainframe Modernization Market by Offering (Software, Services), Organization Size (Large Enterprises, SMEs), Vertical (BFSI, Telecom, IT & ITES, Retail & Ecommerce, Government, Others), and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| メインフレーム近代化の世界市場:提供別、組織規模別、業界別、地域別 - 予測(~2030年) |

|

出版日: 2025年08月21日

発行: MarketsandMarkets

ページ情報: 英文 269 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

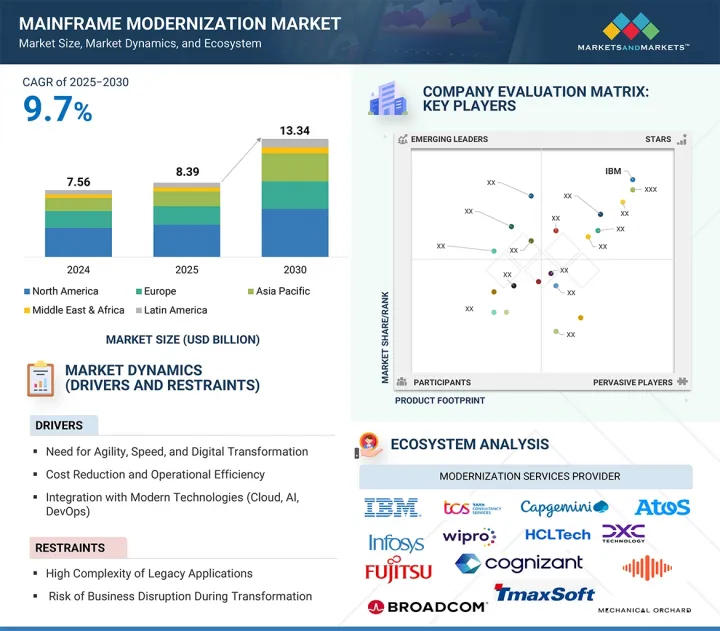

世界のメインフレーム近代化の市場規模は、2025年の83億9,000万米ドルから2030年までに133億4,000万米ドルに達すると予測され、2025年~2030年にCAGRで9.7%の成長が見込まれます。

メインフレーム近代化の主要企業は、AI主導のオートメーション、戦略的パートナーシップ、特殊フレームワークを通じて、急速に変革を進めています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2019年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 単位 | 100万/10億米ドル |

| セグメント | サービス、組織規模、業界、地域 |

| 対象地域 | 北米、欧州、アジア太平洋、中東・アフリカ、ラテンアメリカ |

IBMはAIでメインフレームを近代化し、銀行業務とデータ処理を強化するために他社と提携しています。AWSはKyndrylで金融のクラウド移行を加速しています。Capgemini、HCLTech、TCSもAIとオートメーションを活用し、規制部門におけるレガシーからクラウドへの効率的な移行と近代化を進めています。

しかし、文書化されていないコードや緊密に結合したビジネスロジックを含むことが多いレガシーコードベースの移行に伴う厄介な複雑性が、市場成長を抑制しています。移行が綿密に計画され実行されない限り、データ損失やビジネス中断のリスクは大きく、多くの場合、企業はオートメーションと専門家主導の介入の両方でサポートされるハイブリッドまたは段階的な近代化戦略を採用することになります。

「メインフレームアプリケーション近代化サービスセグメントが予測期間に最大の市場シェアを記録するとみられます。」

メインフレームアプリケーション近代化サービスは、組織が業務の継続性と規制遵守を確保しながら、レガシーアプリケーションをアジャイルでクラウド対応のソリューションに変換しようとしていることから、需要が高まっています。再ホスティング、再プラットフォーム化、再アーキテクチャ化、AIによるリファクタリングなどを含むこれらのサービスは、ほとんどの企業が複雑なレガシーアプリケーションを社内で近代化するための専門知識を欠いているため、非常に重要です。サービスプロバイダーは、顧客がリアルタイムアナリティクスを解放することを手伝い、APIによる統合を可能にし、ダウンタイムを最小化したシームレスなクラウド移行をサポートします。

例えば金融機関や通信企業は、デジタルファースト戦略を採用しながらビジネスクリティカルなワークロードを維持するために、アプリケーション近代化サービスに大きく依存しています。AIを活用したオートメーションツールの台頭は、コード変換を加速し、手作業によるミスを減らし、プロジェクトのタイムラインを短縮することで、新しいデジタルサービスの迅速な展開を可能にします。コンプライアンス要求とセキュリティリスクが高まる中、企業は複雑性を処理し、リスク管理された変革を確実にし、レガシー投資を最適化する、こうした包括的な近代化サービス契約を好んでいます。

「予測期間にBFSIセグメントが最大の市場シェアを記録する見込みです。」

BFSI部門は、大量のトランザクション処理とリアルタイムの金融サービスをサポートする安全でレジリエントなレガシーシステムに依存しているため、メインフレーム近代化の主な促進要因であり続けています。マネーロンダリング防止、デジタルバンキングの義務化、財務報告などの規制上の複雑性により、レガシーインフラを最新のクラウドやAIエコシステムと連携させるプラットフォームの継続的なアップグレードが求められています。

多くの金融機関は、イノベーションを導入しコンプライアンスを確保しながら重要なシステムの安定性を維持するために、AI支援コードリファクタリングやAPIイネーブルメントなどの近代化技術を使用しています。日本や米国の主要な銀行は、進化する顧客の期待や規制当局の監視に応えるため、段階的なクラウド統合戦略によって、中核的な決済プラットフォームやリスクプラットフォームを近代化しています。この部門の慎重かつ野心的なアプローチは、急速に変化する金融情勢における事業継続性、データ整合性、迅速な適応性へのニーズを反映しています。

当レポートでは、世界のメインフレーム近代化市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要な知見

- メインフレーム近代化市場の主要企業にとって魅力的な機会

- メインフレーム近代化市場:提供別

- メインフレーム近代化市場:近代化サービス別

- メインフレーム近代化市場:組織規模別

- メインフレーム近代化市場:業界別

- 北米のメインフレーム近代化市場:提供、上位3業界

第5章 市場の概要と産業動向

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- メインフレーム近代化ソフトウェアとサービスの進化

- メインフレーム近代化市場:エコシステム市場マップ

- ケーススタディ分析

- グローバル金融サービスプロバイダーが、レガシーメインフレームの近代化にCapgeminiとMicrosoftAzureを活用

- Lumen Technologies、メインフレーム近代化とクラウド移行に向けATOSと提携

- 北米の保険企業がInfosysのメインフレーム/アプリケーション近代化サービスによりTCOを30%削減

- サプライチェーン分析

- 規制情勢

- 規制機関、政府機関、その他の組織

- 主な規制

- 価格設定の分析

- メインフレーム近代化ソフトウェアの平均販売価格:主要企業別

- メインフレーム近代化サービスの価格帯:エンドユーザー別

- 技術分析

- 主要技術

- 隣接技術

- 補完技術

- 特許分析

- ポーターのファイブフォース分析

- カスタマービジネスに影響を与える動向/混乱

- 主なステークホルダーと購入基準

- 主な会議とイベント

- メインフレーム近代化市場の技術ロードマップ

- 短期ロードマップ(2023年~2025年)

- 中期ロードマップ(2026年~2028年)

- 長期ロードマップ(2029年~2030年)

- メインフレーム近代化市場におけるベストプラクティス

- 包括的な評価とビジネスアラインメント

- 段階的なモジュール式の近代化

- 自動コード変換、試験

- クロスファンクショナルチームと知識移転

- セキュリティとコンプライアンスの統合

- 投資と資金調達のシナリオ

- メインフレーム近代化市場における生成AIの影響

- 主なユースケースと市場の将来性

- ベストプラクティス

- 生成AI導入のケーススタディ

- 2025年の米国関税の影響 - 概要

- イントロダクション

- 主な関税率

- 価格の影響の分析

- 地域/国に対する影響

- 最終用途産業に対する影響

第6章 メインフレーム近代化市場:提供別

- イントロダクション

- ソフトウェア

- メインフレームアプリケーション近代化ソフトウェア

- メインフレーム最適化ソフトウェア

- 近代化サービス

- メインフレームアプリケーション近代化サービス

- メインフレーム最適化サービス

- メインフレーム運用

- Mainframe as a Service

第7章 メインフレーム近代化市場:組織規模別

- イントロダクション

- 大企業

- 中小企業

第8章 メインフレーム近代化市場:業界別

- イントロダクション

- BFSI

- IT・ITeS

- 医療

- メディア・エンターテインメント

- 小売・eコマース

- 教育

- 製造

- 政府

- 通信

- その他の業界

第9章 メインフレーム近代化市場:地域別

- イントロダクション

- 北米

- 北米のマクロ経済の見通し

- 米国

- カナダ

- 欧州

- 欧州のマクロ経済の見通し

- ドイツ

- 英国

- フランス

- スペイン

- イタリア

- 北欧諸国

- その他の欧州

- アジア太平洋

- アジア太平洋のマクロ経済の見通し

- 中国

- 日本

- インド

- オーストラリア・ニュージーランド

- 韓国

- 東南アジア

- その他のアジア太平洋

- 中東・アフリカ

- 中東・アフリカのマクロ経済の見通し

- 中東

- アフリカ

- ラテンアメリカ

- ラテンアメリカのマクロ経済の見通し

- ブラジル

- メキシコ

- その他のラテンアメリカ

第10章 競合情勢

- 概要

- 主要参入企業の戦略/強み(2023年~2025年)

- 市場シェア分析(2024年)

- 収益分析(2020年~2024年)

- ブランド/製品の比較

- 企業の評価と財務指標

- 企業の評価マトリクス:主要企業(2024年)

- 企業の評価マトリクス:スタートアップ/中小企業(2024年)

- 競合シナリオ

第11章 企業プロファイル

- 主要企業

- IBM

- AWS

- TCS

- CAPGEMINI

- HCLTECH

- ATOS

- MICRO FOCUS (OPENTEXT)

- BMC SOFTWARE

- INFOSYS

- WIPRO

- DXC TECHNOLOGY

- KYNDRYL

- ROCKET SOFTWARE

- FUJITSU

- COGNIZANT

- TECH MAHINDRA

- BROADCOM

- TMAXSOFT

- スタートアップ/中小企業

- PALMDIGITALZ

- TSRI

- MECHANICAL ORCHARD

- VIRTUALZ COMPUTING

- CLOUDFRAME

- HEIRLOOM COMPUTING

第12章 隣接市場と関連市場

- イントロダクション

- アプリケーション近代化サービス市場

- クラウドプロフェッショナルサービス市場

第13章 付録

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2020-2024

- TABLE 2 ROLE OF KEY PLAYERS IN MAINFRAME MODERNIZATION MARKET ECOSYSTEM

- TABLE 3 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 4 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 AVERAGE SELLING PRICE OF MAINFRAME MODERNIZATION SOFTWARE, BY KEY PLAYER, 2024 (USD/ HOUR)

- TABLE 8 PRICING RANGE OF MAINFRAME MODERNIZATION SERVICES, BY END USER, 2024

- TABLE 9 LIST OF KEY PATENTS, 2022-2025

- TABLE 10 PORTER'S FIVE FORCES' IMPACT ON MAINFRAME MODERNIZATION MARKET

- TABLE 11 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR END-USE VERTICALS

- TABLE 12 KEY BUYING CRITERIA FOR END USE VERTICALS

- TABLE 13 MAINFRAME MODERNIZATION MARKET: DETAILED LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 14 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 15 EXPECTED CHANGE IN PRICES AND LIKELY IMPACT ON END-USE MARKET DUE TO TARIFF IMPACT

- TABLE 16 MAINFRAME MODERNIZATION MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 17 MAINFRAME MODERNIZATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 18 SOFTWARE: MAINFRAME MODERNIZATION MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 19 SOFTWARE: MAINFRAME MODERNIZATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 20 MODERNIZATION SERVICES: MAINFRAME MODERNIZATION MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 21 MODERNIZATION SERVICES: MAINFRAME MODERNIZATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 22 MODERNIZATION SERVICES: MAINFRAME MODERNIZATION MARKET, BY SERVICES TYPE, 2019-2024 (USD MILLION)

- TABLE 23 MODERNIZATION SERVICES: MAINFRAME MODERNIZATION MARKET, BY SERVICES TYPE, 2025-2030 (USD MILLION)

- TABLE 24 MAINFRAME APPLICATION MODERNIZATION SERVICES: MAINFRAME MODERNIZATION MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 25 MAINFRAME APPLICATION MODERNIZATION SERVICES: MAINFRAME MODERNIZATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 26 MAINFRAME OPTIMIZATION SERVICES: MAINFRAME MODERNIZATION MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 27 MAINFRAME OPTIMIZATION SERVICES: MAINFRAME MODERNIZATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 28 MAINFRAME OPERATIONS: MAINFRAME MODERNIZATION MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 29 MAINFRAME OPERATIONS: MAINFRAME MODERNIZATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 30 MAINFRAME-AS-A-SERVICE: MAINFRAME MODERNIZATION MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 31 MAINFRAME-AS-A-SERVICE: MAINFRAME MODERNIZATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 32 MAINFRAME MODERNIZATION MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 33 MAINFRAME MODERNIZATION MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 34 LARGE ENTERPRISES: MAINFRAME MODERNIZATION MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 35 LARGE ENTERPRISES: MAINFRAME MODERNIZATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 36 SMES: MAINFRAME MODERNIZATION MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 37 SMES: MAINFRAME MODERNIZATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 38 MAINFRAME MODERNIZATION MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 39 MAINFRAME MODERNIZATION MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 40 BFSI: MAINFRAME MODERNIZATION MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 41 BFSI: MAINFRAME MODERNIZATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 42 IT & ITES: MAINFRAME MODERNIZATION MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 43 IT & ITES: MAINFRAME MODERNIZATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 44 HEALTHCARE: MAINFRAME MODERNIZATION MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 45 HEALTHCARE: MAINFRAME MODERNIZATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 46 MEDIA & ENTERTAINMENT: MAINFRAME MODERNIZATION MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 47 MEDIA & ENTERTAINMENT: MAINFRAME MODERNIZATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 48 RETAIL & E-COMMERCE: MAINFRAME MODERNIZATION MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 49 RETAIL & E-COMMERCE: MAINFRAME MODERNIZATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 50 EDUCATION: MAINFRAME MODERNIZATION MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 51 EDUCATION: MAINFRAME MODERNIZATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 52 MANUFACTURING: MAINFRAME MODERNIZATION MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 53 MANUFACTURING: MAINFRAME MODERNIZATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 54 GOVERNMENT: MAINFRAME MODERNIZATION MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 55 GOVERNMENT: MAINFRAME MODERNIZATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 56 TELECOM: MAINFRAME MODERNIZATION MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 57 TELECOM: MAINFRAME MODERNIZATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 58 OTHER VERTICALS: MAINFRAME MODERNIZATION MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 59 OTHER VERTICALS: MAINFRAME MODERNIZATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 60 MAINFRAME MODERNIZATION MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 61 MAINFRAME MODERNIZATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 62 NORTH AMERICA: MAINFRAME MODERNIZATION MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 63 NORTH AMERICA: MAINFRAME MODERNIZATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 64 NORTH AMERICA: MAINFRAME MODERNIZATION MARKET, BY MODERNIZATION SERVICE, 2019-2024 (USD MILLION)

- TABLE 65 NORTH AMERICA: MAINFRAME MODERNIZATION MARKET, BY MODERNIZATION SERVICE, 2025-2030 (USD MILLION)

- TABLE 66 NORTH AMERICA: MAINFRAME MODERNIZATION MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 67 NORTH AMERICA: MAINFRAME MODERNIZATION MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 68 NORTH AMERICA: MAINFRAME MODERNIZATION MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 69 NORTH AMERICA: MAINFRAME MODERNIZATION MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 70 NORTH AMERICA: MAINFRAME MODERNIZATION MARKET, BY COUNTRY, 2019-2024 (USD MILLION)

- TABLE 71 NORTH AMERICA: MAINFRAME MODERNIZATION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 72 US: MAINFRAME MODERNIZATION MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 73 US: MAINFRAME MODERNIZATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 74 US: MAINFRAME MODERNIZATION MARKET, BY MODERNIZATION SERVICE, 2019-2024 (USD MILLION)

- TABLE 75 US: MAINFRAME MODERNIZATION MARKET, BY MODERNIZATION SERVICE, 2025-2030 (USD MILLION)

- TABLE 76 US: MAINFRAME MODERNIZATION MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 77 US: MAINFRAME MODERNIZATION MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 78 US: MAINFRAME MODERNIZATION MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 79 US: MAINFRAME MODERNIZATION MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 80 CANADA: MAINFRAME MODERNIZATION MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 81 CANADA: MAINFRAME MODERNIZATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 82 CANADA: MAINFRAME MODERNIZATION MARKET, BY MODERNIZATION SERVICE, 2019-2024 (USD MILLION)

- TABLE 83 CANADA: MAINFRAME MODERNIZATION MARKET, BY MODERNIZATION SERVICE, 2025-2030 (USD MILLION)

- TABLE 84 CANADA: MAINFRAME MODERNIZATION MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 85 CANADA: MAINFRAME MODERNIZATION MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 86 CANADA: MAINFRAME MODERNIZATION MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 87 CANADA: MAINFRAME MODERNIZATION MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 88 EUROPE: MAINFRAME MODERNIZATION MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 89 EUROPE: MAINFRAME MODERNIZATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 90 EUROPE: MAINFRAME MODERNIZATION MARKET, BY MODERNIZATION SERVICE, 2019-2024 (USD MILLION)

- TABLE 91 EUROPE: MAINFRAME MODERNIZATION MARKET, BY MODERNIZATION SERVICE, 2025-2030 (USD MILLION)

- TABLE 92 EUROPE: MAINFRAME MODERNIZATION MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 93 EUROPE: MAINFRAME MODERNIZATION MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 94 EUROPE: MAINFRAME MODERNIZATION MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 95 EUROPE: MAINFRAME MODERNIZATION MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 96 EUROPE: MAINFRAME MODERNIZATION MARKET, BY COUNTRY, 2019-2024 (USD MILLION)

- TABLE 97 EUROPE: MAINFRAME MODERNIZATION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 98 GERMANY: MAINFRAME MODERNIZATION MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 99 GERMANY: MAINFRAME MODERNIZATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 100 GERMANY: MAINFRAME MODERNIZATION MARKET, BY MODERNIZATION SERVICE, 2019-2024 (USD MILLION)

- TABLE 101 GERMANY: MAINFRAME MODERNIZATION MARKET, BY MODERNIZATION SERVICE, 2025-2030 (USD MILLION)

- TABLE 102 GERMANY: MAINFRAME MODERNIZATION MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 103 GERMANY: MAINFRAME MODERNIZATION MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 104 GERMANY: MAINFRAME MODERNIZATION MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 105 GERMANY: MAINFRAME MODERNIZATION MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 106 ASIA PACIFIC: MAINFRAME MODERNIZATION MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 107 ASIA PACIFIC: MAINFRAME MODERNIZATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 108 ASIA PACIFIC: MAINFRAME MODERNIZATION MARKET, BY MODERNIZATION SERVICE, 2019-2024 (USD MILLION)

- TABLE 109 ASIA PACIFIC: MAINFRAME MODERNIZATION MARKET, BY MODERNIZATION SERVICE, 2025-2030 (USD MILLION)

- TABLE 110 ASIA PACIFIC: MAINFRAME MODERNIZATION MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 111 ASIA PACIFIC: MAINFRAME MODERNIZATION MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 112 ASIA PACIFIC: MAINFRAME MODERNIZATION MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 113 ASIA PACIFIC: MAINFRAME MODERNIZATION MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 114 ASIA PACIFIC: MAINFRAME MODERNIZATION MARKET, BY COUNTRY, 2019-2024 (USD MILLION)

- TABLE 115 ASIA PACIFIC: MAINFRAME MODERNIZATION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 116 CHINA: MAINFRAME MODERNIZATION MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 117 CHINA: MAINFRAME MODERNIZATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 118 CHINA: MAINFRAME MODERNIZATION MARKET, BY MODERNIZATION SERVICE, 2019-2024 (USD MILLION)

- TABLE 119 CHINA: MAINFRAME MODERNIZATION MARKET, BY MODERNIZATION SERVICE, 2025-2030 (USD MILLION)

- TABLE 120 CHINA: MAINFRAME MODERNIZATION MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 121 CHINA: MAINFRAME MODERNIZATION MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 122 CHINA: MAINFRAME MODERNIZATION MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 123 CHINA: MAINFRAME MODERNIZATION MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 124 MIDDLE EAST & AFRICA: MAINFRAME MODERNIZATION MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 125 MIDDLE EAST & AFRICA: MAINFRAME MODERNIZATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 126 MIDDLE EAST & AFRICA: MAINFRAME MODERNIZATION MARKET, BY MODERNIZATION SERVICE, 2019-2024 (USD MILLION)

- TABLE 127 MIDDLE EAST & AFRICA: MAINFRAME MODERNIZATION MARKET, BY MODERNIZATION SERVICE, 2025-2030 (USD MILLION)

- TABLE 128 MIDDLE EAST & AFRICA: MAINFRAME MODERNIZATION MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 129 MIDDLE EAST & AFRICA: MAINFRAME MODERNIZATION MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 130 MIDDLE EAST & AFRICA: MAINFRAME MODERNIZATION MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 131 MIDDLE EAST & AFRICA: MAINFRAME MODERNIZATION MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 132 MIDDLE EAST & AFRICA: MAINFRAME MODERNIZATION MARKET, BY COUNTRY, 2019-2024 (USD MILLION)

- TABLE 133 MIDDLE EAST & AFRICA: MAINFRAME MODERNIZATION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 134 KSA: MAINFRAME MODERNIZATION MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 135 KSA: MAINFRAME MODERNIZATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 136 KSA: MAINFRAME MODERNIZATION MARKET, BY MODERNIZATION SERVICE, 2019-2024 (USD MILLION)

- TABLE 137 KSA: MAINFRAME MODERNIZATION MARKET, BY MODERNIZATION SERVICE, 2025-2030 (USD MILLION)

- TABLE 138 KSA: MAINFRAME MODERNIZATION MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 139 KSA: MAINFRAME MODERNIZATION MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 140 KSA: MAINFRAME MODERNIZATION MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 141 KSA: MAINFRAME MODERNIZATION MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 142 LATIN AMERICA: MAINFRAME MODERNIZATION MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 143 LATIN AMERICA: MAINFRAME MODERNIZATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 144 LATIN AMERICA: MAINFRAME MODERNIZATION MARKET, BY MODERNIZATION SERVICE, 2019-2024 (USD MILLION)

- TABLE 145 LATIN AMERICA: MAINFRAME MODERNIZATION MARKET, BY MODERNIZATION SERVICE, 2025-2030 (USD MILLION)

- TABLE 146 LATIN AMERICA: MAINFRAME MODERNIZATION MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 147 LATIN AMERICA: MAINFRAME MODERNIZATION MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 148 LATIN AMERICA: MAINFRAME MODERNIZATION MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 149 LATIN AMERICA: MAINFRAME MODERNIZATION MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 150 LATIN AMERICA: MAINFRAME MODERNIZATION MARKET, BY COUNTRY, 2019-2024 (USD MILLION)

- TABLE 151 LATIN AMERICA: MAINFRAME MODERNIZATION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 152 BRAZIL: MAINFRAME MODERNIZATION MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 153 BRAZIL: MAINFRAME MODERNIZATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 154 BRAZIL: MAINFRAME MODERNIZATION MARKET, BY MODERNIZATION SERVICE, 2019-2024 (USD MILLION)

- TABLE 155 BRAZIL: MAINFRAME MODERNIZATION MARKET, BY MODERNIZATION SERVICE, 2025-2030 (USD MILLION)

- TABLE 156 BRAZIL: MAINFRAME MODERNIZATION MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 157 BRAZIL: MAINFRAME MODERNIZATION MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 158 BRAZIL: MAINFRAME MODERNIZATION MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 159 BRAZIL: MAINFRAME MODERNIZATION MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 160 OVERVIEW OF STRATEGIES DEPLOYED BY KEY MAINFRAME MODERNIZATION MARKET PLAYERS JANUARY 2023-JULY 2025

- TABLE 161 MAINFRAME MODERNIZATION MARKET: DEGREE OF COMPETITION

- TABLE 162 MAINFRAME MODERNIZATION MARKET: REGION FOOTPRINT

- TABLE 163 MAINFRAME MODERNIZATION MARKET: OFFERING FOOTPRINT

- TABLE 164 MAINFRAME MODERNIZATION MARKET: ORGANIZATION SIZE FOOTPRINT

- TABLE 165 MAINFRAME MODERNIZATION MARKET: VERTICAL FOOTPRINT

- TABLE 166 MAINFRAME MODERNIZATION MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 167 MAINFRAME MODERNIZATION MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 168 MAINFRAME MODERNIZATION MARKET: PRODUCT LAUNCHES, JANUARY 2023-JULY 2025

- TABLE 169 MAINFRAME MODERNIZATION MARKET: DEALS, JANUARY 2023-JULY 2025

- TABLE 170 IBM: COMPANY OVERVIEW

- TABLE 171 IBM: SOFTWARE/SERVICES OFFERED

- TABLE 172 IBM: PRODUCT LAUNCHES

- TABLE 173 IBM: DEALS

- TABLE 174 AWS: COMPANY OVERVIEW

- TABLE 175 AWS: SOFTWARE/SERVICES OFFERED

- TABLE 176 AWS: PRODUCT LAUNCHES

- TABLE 177 AWS: DEALS

- TABLE 178 TCS: COMPANY OVERVIEW

- TABLE 179 TCS: SOFTWARE/SERVICES OFFERED

- TABLE 180 TCS: PRODUCT LAUNCHES

- TABLE 181 CAPGEMINI: COMPANY OVERVIEW

- TABLE 182 CAPGEMINI: SOFTWARE/SERVICES OFFERED

- TABLE 183 CAPGEMINI: PRODUCT LAUNCHES

- TABLE 184 HCLTECH: COMPANY OVERVIEW

- TABLE 185 HCLTECH: SOFTWARE/SERVICES OFFERED

- TABLE 186 ATOS: COMPANY OVERVIEW

- TABLE 187 ATOS: SOFTWARE/SERVICES OFFERED

- TABLE 188 MICRO FOCUS: COMPANY OVERVIEW

- TABLE 189 MICRO FOCUS: SOFTWARE/SERVICES OFFERED

- TABLE 190 MICRO FOCUS: DEALS

- TABLE 191 BMC SOFTWARE: COMPANY OVERVIEW

- TABLE 192 BMC SOFTWARE: SOFTWARE/SERVICES OFFERED

- TABLE 193 INFOSYS: COMPANY OVERVIEW

- TABLE 194 INFOSYS: SOFTWARE/SERVICES OFFERED

- TABLE 195 WIPRO: COMPANY OVERVIEW

- TABLE 196 WIPRO: SOFTWARE/SERVICES OFFERED

- TABLE 197 APPLICATION MODERNIZATION SERVICES MARKET, BY SERVICE TYPE, 2018-2023 (USD MILLION)

- TABLE 198 APPLICATION MODERNIZATION SERVICES MARKET, BY SERVICE TYPE, 2024-2029 (USD MILLION)

- TABLE 199 APPLICATION PORTFOLIO ASSESSMENT SERVICES MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 200 APPLICATION PORTFOLIO ASSESSMENT SERVICES MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 201 CLOUD APPLICATION MIGRATION SERVICES MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 202 CLOUD APPLICATION MIGRATION SERVICES MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 203 APPLICATION REPLATFORMING SERVICES MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 204 APPLICATION REPLATFORMING SERVICES MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 205 APPLICATION INTEGRATION SERVICES MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 206 APPLICATION INTEGRATION SERVICES MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 207 UI/UX MODERNIZATION SERVICES MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 208 UI/UX MODERNIZATION SERVICES MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 209 POST-MODERNIZATION SERVICES MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 210 POST-MODERNIZATION SERVICES MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 211 APPLICATION MODERNIZATION SERVICES MARKET, BY APPLICATION TYPE, 2018-2023 (USD MILLION)

- TABLE 212 APPLICATION MODERNIZATION SERVICES MARKET, BY APPLICATION TYPE, 2024-2029 (USD MILLION)

- TABLE 213 LEGACY APPLICATION MODERNIZATION SERVICES MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 214 LEGACY APPLICATION MODERNIZATION SERVICES MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 215 CLOUD-HOSTED APPLICATION MODERNIZATION SERVICES MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 216 CLOUD-HOSTED APPLICATION MODERNIZATION SERVICES MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 217 CLOUD-NATIVE APPLICATION MODERNIZATION SERVICES MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 218 CLOUD-NATIVE APPLICATION MODERNIZATION SERVICES MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 219 APPLICATION MODERNIZATION SERVICES MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 220 APPLICATION MODERNIZATION SERVICES MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 221 APPLICATION MODERNIZATION SERVICES MARKET IN BFSI, BY REGION, 2018-2023 (USD MILLION)

- TABLE 222 APPLICATION MODERNIZATION SERVICES MARKET IN BFSI, BY REGION, 2024-2029 (USD MILLION)

- TABLE 223 APPLICATION MODERNIZATION SERVICES MARKET IN IT & ITES, BY REGION, 2018-2023 (USD MILLION)

- TABLE 224 APPLICATION MODERNIZATION SERVICES MARKET IN IT & ITES, BY REGION, 2024-2029 (USD MILLION)

- TABLE 225 APPLICATION MODERNIZATION SERVICES MARKET IN HEALTHCARE & LIFE SCIENCES, BY REGION, 2018-2023 (USD MILLION)

- TABLE 226 APPLICATION MODERNIZATION SERVICES MARKET IN HEALTHCARE & LIFE SCIENCES, BY REGION, 2024-2029 (USD MILLION)

- TABLE 227 APPLICATION MODERNIZATION SERVICES MARKET IN MANUFACTURING, BY REGION, 2018-2023 (USD MILLION)

- TABLE 228 APPLICATION MODERNIZATION SERVICES MARKET IN MANUFACTURING, BY REGION, 2024-2029 (USD MILLION)

- TABLE 229 APPLICATION MODERNIZATION SERVICES MARKET IN TELECOM, BY REGION, 2018-2023 (USD MILLION)

- TABLE 230 APPLICATION MODERNIZATION SERVICES MARKET IN TELECOM, BY REGION, 2024-2029 (USD MILLION)

- TABLE 231 TRANSPORTATION & LOGISTICS: APPLICATION MODERNIZATION SERVICES MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 232 TRANSPORTATION & LOGISTICS: APPLICATION MODERNIZATION SERVICES MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 233 APPLICATION MODERNIZATION SERVICES MARKET IN MEDIA & ENTERTAINMENT, BY REGION, 2018-2023 (USD MILLION)

- TABLE 234 APPLICATION MODERNIZATION SERVICES MARKET IN MEDIA & ENTERTAINMENT, BY REGION, 2024-2029 (USD MILLION)

- TABLE 235 APPLICATION MODERNIZATION SERVICES MARKET IN RETAIL & E-COMMERCE, BY REGION, 2018-2023 (USD MILLION)

- TABLE 236 APPLICATION MODERNIZATION SERVICES MARKET IN RETAIL & E-COMMERCE, BY REGION, 2024-2029 (USD MILLION)

- TABLE 237 APPLICATION MODERNIZATION SERVICES MARKET IN GOVERNMENT, BY REGION, 2018-2023 (USD MILLION)

- TABLE 238 APPLICATION MODERNIZATION SERVICES MARKET IN GOVERNMENT, BY REGION, 2024-2029 (USD MILLION)

- TABLE 239 APPLICATION MODERNIZATION SERVICES MARKET IN OTHER VERTICALS, BY REGION, 2018-2023 (USD MILLION)

- TABLE 240 APPLICATION MODERNIZATION SERVICES MARKET IN OTHER VERTICALS, BY REGION, 2024-2029 (USD MILLION)

- TABLE 241 APPLICATION MODERNIZATION SERVICES MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 242 APPLICATION MODERNIZATION SERVICES MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 243 CLOUD PROFESSIONAL SERVICES MARKET, BY SERVICE TYPE, 2019-2022 (USD MILLION)

- TABLE 244 CLOUD PROFESSIONAL SERVICES MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- TABLE 245 CLOUD PROFESSIONAL CONSULTING SERVICES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 246 CLOUD PROFESSIONAL CONSULTING SERVICES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 247 CLOUD PROFESSIONAL INTEGRATION & OPTIMIZATION SERVICES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 248 CLOUD PROFESSIONAL INTEGRATION & OPTIMIZATION SERVICES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 249 CLOUD PROFESSIONAL IMPLEMENTATION & MIGRATION SERVICES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 250 CLOUD PROFESSIONAL IMPLEMENTATION & MIGRATION SERVICES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 251 CLOUD PROFESSIONAL APPLICATION DEVELOPMENT & MODERNIZATION SERVICES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 252 CLOUD PROFESSIONAL APPLICATION DEVELOPMENT & MODERNIZATION SERVICES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 253 CLOUD PROFESSIONAL SERVICES MARKET, BY SERVICE MODEL, 2019-2022 (USD MILLION)

- TABLE 254 CLOUD PROFESSIONAL SERVICES MARKET, BY SERVICE MODEL, 2023-2028 (USD MILLION)

- TABLE 255 INFRASTRUCTURE-AS-A-SERVICE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 256 INFRASTRUCTURE-AS-A-SERVICE MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 257 PLATFORM-AS-A-SERVICE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 258 PLATFORM-AS-A-SERVICE MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 259 SOFTWARE-AS-A-SERVICE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 260 SOFTWARE-AS-A-SERVICE MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 261 CLOUD PROFESSIONAL SERVICES MARKET, BY DEPLOYMENT MODEL, 2019-2022 (USD MILLION)

- TABLE 262 CLOUD PROFESSIONAL SERVICES MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- TABLE 263 PUBLIC CLOUD PROFESSIONAL SERVICES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 264 PUBLIC CLOUD PROFESSIONAL SERVICES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 265 PRIVATE CLOUD PROFESSIONAL SERVICES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 266 PRIVATE CLOUD PROFESSIONAL SERVICES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 267 CLOUD PROFESSIONAL SERVICES MARKET, BY ORGANIZATION SIZE, 2019-2022 (USD MILLION)

- TABLE 268 CLOUD PROFESSIONAL SERVICES MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 269 LARGE ENTERPRISES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 270 LARGE ENTERPRISES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 271 SMALL & MEDIUM-SIZED ENTERPRISES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 272 SMALL & MEDIUM-SIZED ENTERPRISES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 273 CLOUD PROFESSIONAL SERVICES MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 274 CLOUD PROFESSIONAL SERVICES MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 275 BFSI VERTICAL MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 276 BFSI VERTICAL MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 277 RETAIL & CONSUMER GOODS VERTICAL MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 278 RETAIL & CONSUMER GOODS VERTICAL MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 279 IT & ITES VERTICAL MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 280 IT & ITES VERTICAL MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 281 TELECOMMUNICATIONS VERTICAL MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 282 TELECOMMUNICATIONS VERTICAL MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 283 HEALTHCARE & LIFE SCIENCES VERTICAL MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 284 HEALTHCARE & LIFE SCIENCES VERTICAL MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 285 MANUFACTURING VERTICAL MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 286 MANUFACTURING VERTICAL MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 287 ENERGY & UTILITIES VERTICAL MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 288 ENERGY & UTILITIES VERTICAL MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 289 GOVERNMENT & DEFENSE VERTICAL MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 290 GOVERNMENT & DEFENSE VERTICAL MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 291 OTHER VERTICALS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 292 OTHER VERTICALS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 293 CLOUD PROFESSIONAL SERVICES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 294 CLOUD PROFESSIONAL SERVICES MARKET, BY REGION, 2023-2028 (USD MILLION)

List of Figures

- FIGURE 1 MAINFRAME MODERNIZATION MARKET: RESEARCH DESIGN

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS, BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 3 MAINFRAME MODERNIZATION MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 1 (SUPPLY SIDE): REVENUE OF VENDORS IN MAINFRAME MODERNIZATION MARKET

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 2 (DEMAND SIDE): MAINFRAME MODERNIZATION MARKET

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: DEMAND-SIDE ANALYSIS

- FIGURE 7 MAINFRAME MODERNIZATION MARKET: DATA TRIANGULATION

- FIGURE 8 MAINFRAME MODERNIZATION MARKET, 2023-2030 (USD MILLION)

- FIGURE 9 MAINFRAME MODERNIZATION MARKET, BY REGION (2025)

- FIGURE 10 INCREASING ADOPTION OF AI-DRIVEN AUTOMATION TO DRIVE MAINFRAME MODERNIZATION MARKET

- FIGURE 11 MODERNIZATION SERVICE SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 12 MAINFRAME APPLICATION MODERNIZATION SERVICES SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 13 LARGE ENTERPRISES SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 14 BFSI SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 15 MODERNIZATION SERVICE AND BFSI SEGMENTS TO ACCOUNT FOR LARGEST MARKET SHARES IN NORTH AMERICA IN 2025

- FIGURE 16 MAINFRAME MODERNIZATION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 17 EVOLUTION: MAINFRAME MODERNIZATION SOFTWARE AND SERVICES

- FIGURE 18 MAINFRAME MODERNIZATION MARKET ECOSYSTEM MARKET MAP: KEY PLAYERS

- FIGURE 19 MAINFRAME MODERNIZATION MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 20 AVERAGE SELLING PRICE OF MAINFRAME MODERNIZATION SOFTWARE, BY KEY PLAYER, 2024, (USD/ HOUR)

- FIGURE 21 LIST OF KEY PATENTS FOR MAINFRAME MODERNIZATION, 2013-2024

- FIGURE 22 MAINFRAME MODERNIZATION MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 23 MAINFRAME MODERNIZATION MARKET: DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR END USE VERTICALS

- FIGURE 25 KEY BUYING CRITERIA FOR END-USE VERTICALS

- FIGURE 26 MAINFRAME MODERNIZATION MARKET: INVESTMENT AND FUNDING SCENARIO, 2021-2025 (USD MILLION)

- FIGURE 27 MARKET POTENTIAL OF GEN AI IN ENHANCING MAINFRAME MODERNIZATION ACROSS VARIOUS TYPES OF SOLUTIONS

- FIGURE 28 GEN AI BEST PRACTICES ACROSS MAJOR INDUSTRIES

- FIGURE 29 SOFTWARE SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 30 MAINFRAME OPTIMIZATION SERVICES TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 31 SMES TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 32 TELECOM SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 33 NORTH AMERICA: MAINFRAME MODERNIZATION MARKET SNAPSHOT

- FIGURE 34 ASIA PACIFIC: MAINFRAME MODERNIZATION MARKET SNAPSHOT

- FIGURE 35 SHARES OF LEADING COMPANIES IN MAINFRAME MODERNIZATION MARKET, 2024

- FIGURE 36 MAINFRAME MODERNIZATION MARKET: RANKING ANALYSIS OF TOP FIVE PLAYERS

- FIGURE 37 REVENUE ANALYSIS OF KEY PLAYERS IN MAINFRAME MODERNIZATION MARKET, 2020-2024 (USD MILLION)

- FIGURE 38 MAINFRAME MODERNIZATION MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 39 COMPANY VALUATION: 2025

- FIGURE 40 FINANCIAL METRICS OF KEY VENDORS: 2025

- FIGURE 41 MAINFRAME MODERNIZATION MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 42 MAINFRAME MODERNIZATION MARKET: COMPANY FOOTPRINT

- FIGURE 43 MAINFRAME MODERNIZATION MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 44 IBM: COMPANY SNAPSHOT

- FIGURE 45 AWS: COMPANY SNAPSHOT

- FIGURE 46 TCS: COMPANY SNAPSHOT

- FIGURE 47 CAPGEMINI: COMPANY SNAPSHOT

- FIGURE 48 HCLTECH: COMPANY SNAPSHOT

- FIGURE 49 ATOS: COMPANY SNAPSHOT

- FIGURE 50 INFOSYS: COMPANY SNAPSHOT

- FIGURE 51 WIPRO: COMPANY SNAPSHOT

The mainframe modernization market is projected to grow from USD 8.39 billion in 2025 to USD 13.34 billion by 2030, at a CAGR of 9.7%, from 2025 to 2030. Key players in mainframe modernization are rapidly advancing transformation through AI-driven automation, strategic partnerships, and specialized frameworks.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD) Million/Billion |

| Segments | By offering, organization size, vertical, and region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

IBM is modernizing mainframes with AI and partnering with others to enhance banking and data processing. AWS is accelerating cloud migration for finance with Kyndryl. Capgemini, HCLTech, and TCS are also leveraging AI and automation for efficient legacy-to-cloud transitions and modernization in regulated sectors.

However, the formidable complexity associated with migrating legacy codebases, which often include undocumented code and tightly coupled business logic, restrains market growth. The risk of data loss and business disruption is large unless migration is planned and executed meticulously, often leading organizations to adopt hybrid or gradual modernization strategies supported by both automation and expert-led interventions.

"Mainframe application modernization services segment will register the largest market share during the forecast period"

Mainframe application modernization services are in demand as organizations seek to transform legacy applications into agile and cloud-ready solutions while ensuring operational continuity and regulatory compliance. These services, encompassing re-hosting, re-platforming, re-architecting, and AI-driven refactoring, are critical because most enterprises lack the expertise to modernize complex legacy applications internally. Service providers help clients unlock real-time analytics, enable API-driven integration, and support seamless cloud migration with minimal downtime.

Financial institutions and telecom companies, for example, rely heavily on application modernization services to maintain business-critical workloads while adopting digital-first strategies. The rise of AI-powered automation tools accelerates code conversion, reduces manual errors, and shortens project timelines, enabling faster rollout of new digital services. With compliance demands and security risks rising, enterprises prefer these comprehensive modernization service engagements to handle complexity, ensure risk-managed transformation, and optimize legacy investments.

"BFSI segment is projected to register the largest market share during the forecast period"

The BFSI sector remains the primary driver of mainframe modernization due to its dependence on secure, resilient legacy systems supporting high-volume transaction processing and real-time financial services. Regulatory complexities such as anti-money laundering, digital banking mandates, and financial reporting demand continual platform upgrades that align legacy infrastructure with modern cloud and AI ecosystems.

Many institutions use modernization techniques, such as AI-assisted code refactoring and API enablement, to maintain critical system stability while introducing innovation and ensuring compliance. Leading banks in Japan and the US are modernizing core payment and risk platforms with incremental, cloud-integrated strategies to meet evolving customer expectations and regulatory scrutiny. The sector's cautious yet ambitious approach reflects its need for business continuity, data integrity, and fast adaptability in a rapidly shifting financial landscape.

"Asia Pacific will record the highest growth rate, while North America will hold the largest market share during the forecast period"

Asia Pacific is emerging as a key region for mainframe modernization driven by a unique blend of large, mature mainframe estates and fast-paced digital economy growth. India, Japan, China, and Southeast Asian nations prioritize modernizing legacy systems to support digital banking, mobile payments, public sector digital initiatives, and regulatory compliance. This modernization often involves phased migrations, hybrid cloud deployments, and AI-enabled automation to handle enormous transaction volumes while reducing operational risk.

Regulatory pressures around data sovereignty and open banking accelerate the urgency of modernization. Enterprises in Asia Pacific are embracing cloud-native integration and API-first architectures to transform traditional workflows and enhance real-time processing capabilities. The collaborative innovation ecosystem, combining global technology vendors with strong local IT service providers, further fuels growth of the Asia Pacific market.

North America maintains its dominant share in the mainframe modernization sector, primarily driven by a substantial presence of Fortune 500 companies and government agencies that manage extensive legacy systems. This region's leadership can be attributed to a history of early technology adoption and stringent compliance requirements, particularly in the finance and healthcare industries, and a persistent demand for robust and scalable IT infrastructures. These elements contribute to aggressive digital transformation initiatives focusing on enhancing operational resilience and agility.

Breakdown of primary interviews

The study contains insights from various industry experts, from solution vendors to Tier 1 companies. The break-up of the primary interviews is as follows:

- By Company Type: Tier 1 - 35%, Tier 2 - 40%, and Tier 3 - 25%

- By Designation: C-level - 25% , Directors -35%, and Others - 40%

- By Region: North America - 35%, Europe - 35%, Asia Pacific - 20%, Rest of the World - 10%

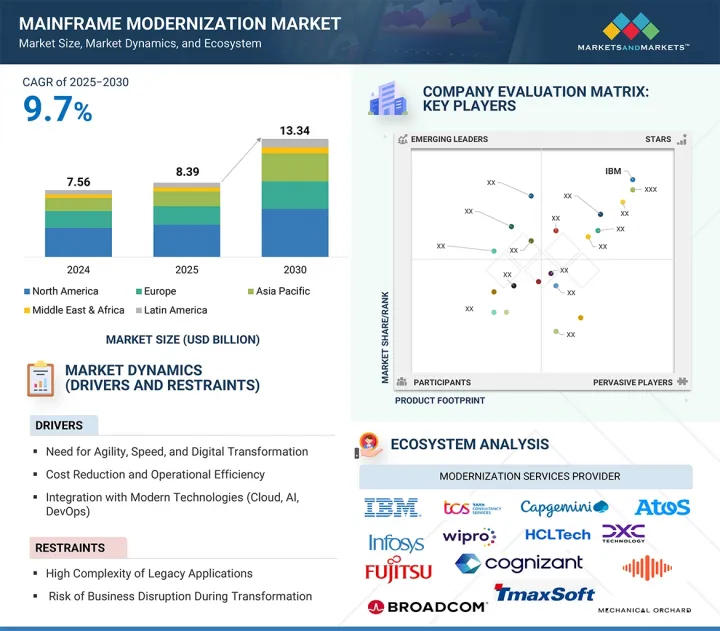

The major players in the mainframe modernization market are IBM (US), TCS (India), Capgemini (France), Atos (France), AWS (US), Micro Focus (UK), BMC Software (US), Infosys (India), Wipro (India), HCL Tech (India), DXC Technology (US), Kyndryl (US), Rocket Software (US), Fujitsu (Japan), Cognizant (US), Tech Mahindra (India), Broadcom (US), and TmaxSoft (US). These players have adopted various growth strategies, such as partnerships, agreements & collaborations, new product launches, product enhancements, and acquisitions, to expand their footprint in the mainframe modernization market.

Research Coverage

The market study covers the mainframe modernization market size across different segments. It aims to estimate the market size and the growth potential across different segments, including offering (software and modernization services), organization size (large enterprises and SMEs), verticals (BFSI, IT & ITES, healthcare, media & entertainment, retail & ecommerce, education, manufacturing, government, telecom, and other verticals), and regions. The study includes an in-depth competitive analysis of the leading market players, their company profiles, key observations related to product and business offerings, recent developments, and market strategies.

Key Benefits of Buying the Report

The report will help market leaders and new entrants with information on the closest approximations of the global mainframe modernization market's revenue numbers and subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. Moreover, the report will provide insights for stakeholders to understand the market's pulse and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Analysis of key drivers (workforce retirement and legacy skills shortage, increasing regulatory and compliance requirements, rapid adoption of AI and cloud for mission-critical workloads), restraints (complexity and risk of migrating legacy codebases, persistent high costs and budget constraints for large-scale transformations, insufficient documentation of legacy systems), opportunities (emerging SME adoption and mid-market demand, accelerated banking and fintech modernization in Asia Pacific, growth of AI-enabled and modular modernization solutions) and challenges (ensuring uninterrupted business operations during migration, overcoming resistance to organizational change, shortage of skilled modernization and integration talent) influencing the growth of the mainframe modernization market.

Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the mainframe modernization market

Market Development: Comprehensive information about lucrative markets - analysis of mainframe modernization market across various regions

Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the mainframe modernization market

Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players IBM (US), TCS (India), Capgemini (France), Atos (France), AWS (US), Micro Focus (UK), BMC Software (US), Infosys (India), Wipro (India), HCL Tech (India), DXC Technology (US), Kyndryl (US), Rocket Software (US), Fujitsu (Japan), Cognizant (US), Tech Mahindra (India), Broadcom (US), and TmaxSoft (US)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews with experts

- 2.1.2.2 Breakdown of primary profiles

- 2.1.2.3 Key insights from industry experts

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- 2.2.2 BOTTOM-UP APPROACH

- 2.2.3 MAINFRAME MODERNIZATION MARKET ESTIMATION: DEMAND-SIDE ANALYSIS

- 2.3 DATA TRIANGULATION

- 2.4 RISK ASSESSMENT

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR KEY PLAYERS IN MAINFRAME MODERNIZATION MARKET

- 4.2 MAINFRAME MODERNIZATION MARKET, BY OFFERING

- 4.3 MAINFRAME MODERNIZATION MARKET, BY MODERNIZATION SERVICE

- 4.4 MAINFRAME MODERNIZATION MARKET, BY ORGANIZATION SIZE

- 4.5 MAINFRAME MODERNIZATION MARKET, BY VERTICAL

- 4.6 NORTH AMERICA: MAINFRAME MODERNIZATION MARKET: OFFERINGS AND TOP THREE VERTICALS

5 MARKET OVERVIEW AND INDUSTRY TRENDS

Unpacking the Forces Shaping Mainframe Modernization & Future Growth Opportunities

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Need for agility, speed, and digital transformation

- 5.2.1.2 Cost reduction and operational efficiency

- 5.2.1.3 Integration with modern technologies (cloud, AI, DevOps)

- 5.2.2 RESTRAINTS

- 5.2.2.1 High complexity of legacy applications

- 5.2.2.2 Risk of business disruption during transformation

- 5.2.2.3 Shortage of modernization expertise

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Accelerated innovation with cloud-native and AI tools

- 5.2.3.2 Migration to pay-as-you-go and managed modernization services

- 5.2.3.3 Enhanced business agility through modular architectures

- 5.2.3.4 Modernization demand in highly regulated sectors

- 5.2.4 CHALLENGES

- 5.2.4.1 Understanding legacy system architecture and code complexity

- 5.2.4.2 Ensuring data integrity and compliance during migration

- 5.2.4.3 Long modernization timelines and resource management

- 5.2.4.4 Integrating mainframe and non-mainframe workloads smoothly

- 5.2.1 DRIVERS

- 5.3 EVOLUTION OF MAINFRAME MODERNIZATION SOFTWARE AND SERVICES

- 5.4 MAINFRAME MODERNIZATION MARKET: ECOSYSTEM MARKET MAP

- 5.5 CASE STUDY ANALYSIS

- 5.5.1 GLOBAL FINANCIAL SERVICES PROVIDER LEVERAGES CAPGEMINI AND MICROSOFT AZURE FOR LEGACY MAINFRAME MODERNIZATION

- 5.5.2 LUMEN TECHNOLOGIES PARTNERS WITH ATOS FOR MAINFRAME MODERNIZATION AND CLOUD MIGRATION

- 5.5.3 NORTH AMERICAN INSURANCE COMPANY REDUCES TCO BY 30% WITH INFOSYS MAINFRAME AND APPLICATION MODERNIZATION SERVICES

- 5.6 SUPPLY CHAIN ANALYSIS

- 5.7 REGULATORY LANDSCAPE

- 5.7.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.7.1.1 General Data Protection Regulation-European Union

- 5.7.1.2 Federal Risk and Authorization Management Program (FedRAMP) - US

- 5.7.1.3 National Institute of Standards and Technology (NIST)-US

- 5.7.2 KEY REGULATIONS

- 5.7.2.1 North America

- 5.7.2.1.1 US

- 5.7.2.2 Europe

- 5.7.2.2.1 UK

- 5.7.2.3 Asia Pacific

- 5.7.2.3.1 India

- 5.7.2.3.2 Japan

- 5.7.2.4 Middle East & Africa

- 5.7.2.4.1 Saudi Arabia

- 5.7.2.5 Latin America

- 5.7.2.5.1 Brazil

- 5.7.2.1 North America

- 5.7.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.8 PRICING ANALYSIS

- 5.8.1 AVERAGE SELLING PRICE OF MAINFRAME MODERNIZATION SOFTWARE, BY KEY PLAYER

- 5.8.2 PRICING RANGE OF MAINFRAME MODERNIZATION SERVICES, BY END USER

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Automated Code Conversion and Refactoring

- 5.9.1.2 Cloud Hosting and Mainframe-as-a-Service

- 5.9.2 ADJACENT TECHNOLOGIES

- 5.9.2.1 Hybrid cloud orchestration platforms

- 5.9.2.2 Low-code and no-code application platforms

- 5.9.3 COMPLEMENTARY TECHNOLOGIES

- 5.9.3.1 AI (including Gen AI for Code Transformation)

- 5.9.3.2 Data Migration and Integration Tools

- 5.9.1 KEY TECHNOLOGIES

- 5.10 PATENT ANALYSIS

- 5.11 PORTER'S FIVE FORCES ANALYSIS

- 5.11.1 THREAT OF NEW ENTRANTS

- 5.11.2 THREAT OF SUBSTITUTES

- 5.11.3 BARGAINING POWER OF SUPPLIERS

- 5.11.4 BARGAINING POWER OF BUYERS

- 5.11.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.12 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.13.2 BUYING CRITERIA

- 5.14 KEY CONFERENCES AND EVENTS

- 5.15 TECHNOLOGY ROADMAP FOR MAINFRAME MODERNIZATION MARKET

- 5.15.1 SHORT-TERM ROADMAP (2023-2025)

- 5.15.2 MID-TERM ROADMAP (2026-2028)

- 5.15.3 LONG-TERM ROADMAP (2029-2030)

- 5.16 BEST PRACTICES IN MAINFRAME MODERNIZATION MARKET

- 5.16.1 COMPREHENSIVE ASSESSMENT AND BUSINESS ALIGNMENT

- 5.16.2 INCREMENTAL AND MODULAR MODERNIZATION

- 5.16.3 AUTOMATED CODE TRANSFORMATION AND TESTING

- 5.16.4 CROSS-FUNCTIONAL TEAMS AND KNOWLEDGE TRANSFER

- 5.16.5 SECURITY AND COMPLIANCE INTEGRATION

- 5.17 INVESTMENT AND FUNDING SCENARIO

- 5.18 IMPACT OF GEN AI ON MAINFRAME MODERNIZATION MARKET

- 5.18.1 TOP USE CASES AND MARKET POTENTIAL

- 5.18.1.1 Key use cases

- 5.18.2 BEST PRACTICES

- 5.18.2.1 Banking & financial services industry

- 5.18.2.2 Healthcare industry

- 5.18.2.3 Telecom industry

- 5.18.3 CASE STUDIES OF GEN AI IMPLEMENTATION

- 5.18.3.1 Automating Mainframe Testing with AI (Micro Focus)

- 5.18.3.2 Mapping Legacy Dependencies Using AI for Mainframes (Deloitte)

- 5.18.3.3 Detecting Fraud on IBM Z Mainframes with AI/ML

- 5.18.3.4 Optimizing Mainframe Workloads through AI Analytics (BMC)

- 5.18.3.5 Enhancing Mainframe Code Security with AI Scanning (Veracode)

- 5.18.1 TOP USE CASES AND MARKET POTENTIAL

- 5.19 IMPACT OF 2025 US TARIFFS-OVERVIEW

- 5.19.1 INTRODUCTION

- 5.19.2 KEY TARIFF RATES

- 5.19.3 PRICE IMPACT ANALYSIS

- 5.19.4 IMPACT ON REGION/COUNTRY

- 5.19.4.1 North America

- 5.19.4.2 Europe

- 5.19.4.3 Asia Pacific

- 5.19.5 IMPACT ON END-USE INDUSTRIES

6 MAINFRAME MODERNIZATION MARKET, BY OFFERING

Detailed breakdown of market share and growth across Mainframe Modernization Software and Services

- 6.1 INTRODUCTION

- 6.1.1 OFFERINGS: MAINFRAME MODERNIZATION MARKET DRIVERS

- 6.2 SOFTWARE

- 6.2.1 MAINFRAME APPLICATION MODERNIZATION SOFTWARE

- 6.2.1.1 Gen-AI code analysis/refactoring and microservices adoption to propel rapid portfolio upgrades, signaling strong expansion ahead

- 6.2.2 MAINFRAME OPTIMIZATION SOFTWARE

- 6.2.2.1 Cost pressure and performance SLAs to push AI/ML tuning and MIPS reduction, underpinning steady, efficiency led growth

- 6.2.1 MAINFRAME APPLICATION MODERNIZATION SOFTWARE

- 6.3 MODERNIZATION SERVICES

- 6.3.1 MAINFRAME APPLICATION MODERNIZATION SERVICES

- 6.3.1.1 AI/DevOps led refactoring and CI/CD demand to accelerate migrations, pointing to robust multi year growth

- 6.3.1.2 Rehosting

- 6.3.1.2.1 Rapid migration of legacy workloads to modern infrastructure with minimal code change to reduce costs and preserve business continuity

- 6.3.1.3 Replatforming

- 6.3.1.3.1 Cloud adoption, containerization, and DevOps agility to drive lift and shift modernization, supporting steady, scalable growth

- 6.3.1.4 Refactoring

- 6.3.1.4.1 AI assisted code modularization to reduce technical debt and downtime, accelerating phased upgrades and multi year expansion

- 6.3.1.5 Rewriting

- 6.3.1.5.1 Strategic rebuilds for compliance and innovation to unlock long term capability gains, forecasting selective but high value growth

- 6.3.1.6 Replacing

- 6.3.1.6.1 COTS/SaaS substitution to cut cost and meet regulations speeds time to value, enabling broad, rapid adoption

- 6.3.2 MAINFRAME OPTIMIZATION SERVICES

- 6.3.2.1 Compliance and cost pressure to drive AMI, MIPS reduction, and license tuning, supporting steady efficiency led expansion

- 6.3.3 MAINFRAME OPERATIONS

- 6.3.3.1 24X7 resilience, security, and hybrid complexity to sustain managed operations demand, forecasting durable recurring growth

- 6.3.4 MAINFRAME-AS-A-SERVICE

- 6.3.4.1 Skills gaps and pay as you go economics to spur outsourced, consumption based mainframe management, signaling rapid, scalable adoption

- 6.3.1 MAINFRAME APPLICATION MODERNIZATION SERVICES

7 MAINFRAME MODERNIZATION MARKET, BY ORGANIZATION SIZE

Detailed breakdown of market share and growth across Mainframe Modernization Organization Size

- 7.1 INTRODUCTION

- 7.1.1 ORGANIZATION SIZE: MAINFRAME MODERNIZATION MARKET DRIVERS

- 7.2 LARGE ENTERPRISES

- 7.2.1 AI DRIVEN, COMPLIANCE FIRST MODERNIZATION IN LARGE ENTERPRISES TO PROPEL MULTI YEAR GROWTH

- 7.3 SMALL AND MEDIUM-SIZED ENTERPRISES

- 7.3.1 SME MODERNIZATION TO ACCELERATE THROUGH AI ENABLED, SAAS FIRST, MFAAS SUPPORTED APPROACHES WITH PREDICTABLE COSTS

8 MAINFRAME MODERNIZATION MARKET, BY VERTICAL

Detailed breakdown of market share and growth across Mainframe Modernization Verticals

- 8.1 INTRODUCTION

- 8.1.1 VERTICALS: MAINFRAME MODERNIZATION MARKET DRIVERS

- 8.2 BANKING, FINANCIAL SERVICES, & INSURANCE

- 8.2.1 COMPLIANCE AND AI DRIVEN CORE MODERNIZATION TO SCALE VIA PHASED REFACTORING, SUSTAINING MULTI YEAR GROWTH

- 8.3 IT & ITES

- 8.3.1 AI/DEVOPS MODERNIZATION TO BOOST PROVIDER AGILITY AND CLIENT DEMAND, DRIVING STEADY EXPANSION

- 8.4 HEALTHCARE

- 8.4.1 HIPAA/GDPR LED, AI ASSISTED CLOUD MODERNIZATION TO ADVANCE CAUTIOUSLY, UNDERPINNING DURABLE GROWTH

- 8.5 MEDIA & ENTERTAINMENT

- 8.5.1 CX AND RIGHTS COMPLIANCE TO DRIVE AI-ENABLED DEVOPS PIPELINES FOR RAPID RELEASES AND SUSTAINED GROWTH

- 8.6 RETAIL & E-COMMERCE

- 8.6.1 OMNICHANNEL DEMAND AND PEAK EVENTS TO DRIVE AI AND AUTOMATION LED MODERNIZATION FOR REAL TIME AGILITY AND SCALABLE GROWTH

- 8.7 EDUCATION

- 8.7.1 PRIVACY DRIVEN (FERPA/GDPR) CLOUD AND AI UPGRADES TO MODERNIZE STUDENT SYSTEMS, SUPPORTING STEADY ADOPTION AND INCLUSIVE EXPANSION

- 8.8 MANUFACTURING

- 8.8.1 INDUSTRY 4.0, ERP INTEGRATION, AND COMPLIANCE NEEDS TO PROPEL HYBRID REFACTORING AND DATA DRIVEN PLATFORMS FOR SUSTAINED COMPETITIVENESS

- 8.9 GOVERNMENT

- 8.9.1 COMPLIANCE, COST REDUCTION, AND CITIZEN SERVICE GOALS TO PUSH HYBRID CLOUD AND MFAAS MODERNIZATION, YIELDING GRADUAL BUT DURABLE PROGRESS

- 8.10 TELECOM

- 8.10.1 5G ROLLOUT, REAL-TIME BILLING, AND CUSTOMER EXPERIENCE PRESSURES TO DRIVE AI/DEVOPS MODERNIZATION TOWARD MICROSERVICES AND HYBRID CLOUD, ENABLING SUSTAINABLE GROWTH

- 8.11 OTHER VERTICALS

9 MAINFRAME MODERNIZATION MARKET, BY REGION

Regional market sizing, forecasts, and regulatory landscapes

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 9.2.2 US

- 9.2.2.1 Focus on transforming legacy systems with AI, automation, and cloud technologies to drive market

- 9.2.3 CANADA

- 9.2.3.1 Emphasis on hybrid cloud integration, compliance, workforce upskilling, and data accessibility in financial and public sectors to drive market

- 9.3 EUROPE

- 9.3.1 EUROPE: MACROECONOMIC OUTLOOK

- 9.3.2 GERMANY

- 9.3.2.1 Focus on industrial resilience, compliance, and secure stepwise mainframe-to-cloud integration to drive market

- 9.3.3 UK

- 9.3.3.1 Regulatory-driven banking transformation, public sector digitalization, and adoption of phased, risk-managed modernization to drive market

- 9.3.4 FRANCE

- 9.3.4.1 Public sector and banking initiatives, regulatory compliance, and high-profile AI adoption to drive market

- 9.3.5 SPAIN

- 9.3.5.1 Banking, insurance, and public sector transformation via cloud integration and modular migration strategies to drive market

- 9.3.6 ITALY

- 9.3.6.1 Focus on banking, insurance, and public sector modernization to drive market

- 9.3.7 NORDIC COUNTRIES

- 9.3.7.1 Public sector digital transformation and open banking to drive market

- 9.3.8 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 9.4.2 CHINA

- 9.4.2.1 Data sovereignty, strong public sector involvement, and modernization of banking and government platforms to drive market

- 9.4.3 JAPAN

- 9.4.3.1 Regulatory-driven transformation with stepwise upgrades and automation-led migration to drive market

- 9.4.4 INDIA

- 9.4.4.1 Public sector digital transformation and large-scale banking modernization to propel market

- 9.4.5 AUSTRALIA & NEW ZEALAND

- 9.4.5.1 Regulatory-driven banking and public sector modernization with strong vendor partnerships to drive market

- 9.4.6 SOUTH KOREA

- 9.4.6.1 Leveraging local technology leaders for modular migration in banking and telecom to drive market

- 9.4.7 SOUTHEAST ASIA

- 9.4.7.1 Digital banking, public sector upgrading, and greater cloud adoption to drive market

- 9.4.8 REST OF ASIA PACIFIC

- 9.5 MIDDLE EAST & AFRICA

- 9.5.1 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 9.5.2 MIDDLE EAST

- 9.5.2.1 Kingdom of Saudi Arabia

- 9.5.2.1.1 State-led digital transformation and mandated banking and public sector upgrades to drive market

- 9.5.2.2 UAE

- 9.5.2.2.1 Government-led digital initiatives, banking innovation, and widespread use of hybrid cloud and containerized mainframe models to fuel modernization

- 9.5.2.3 Rest of Middle East

- 9.5.2.1 Kingdom of Saudi Arabia

- 9.5.3 AFRICA

- 9.6 LATIN AMERICA

- 9.6.1 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 9.6.2 BRAZIL

- 9.6.2.1 Strategic public-private investments, regulatory reforms, and landmark banking sector projects to drive market

- 9.6.3 MEXICO

- 9.6.3.1 Cloud migration, talent upskilling, and system integration for financial and governmental sectors to drive market

- 9.6.4 REST OF LATIN AMERICA

10 COMPETITIVE LANDSCAPE

Strategic Profiles of Leading Players & Their Playbooks for Market Dominance

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2023-2025

- 10.3 MARKET SHARE ANALYSIS, 2024

- 10.3.1 MARKET RANKING ANALYSIS

- 10.4 REVENUE ANALYSIS, 2020-2024

- 10.5 BRAND/PRODUCT COMPARISON

- 10.6 COMPANY VALUATION AND FINANCIAL METRICS

- 10.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.7.1 STARS

- 10.7.2 EMERGING LEADERS

- 10.7.3 PERVASIVE PLAYERS

- 10.7.4 PARTICIPANTS

- 10.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.7.5.1 Company footprint

- 10.7.5.2 Region footprint

- 10.7.5.3 Offering footprint

- 10.7.5.4 Organization size footprint

- 10.7.5.5 Vertical footprint

- 10.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.8.1 PROGRESSIVE COMPANIES

- 10.8.2 RESPONSIVE COMPANIES

- 10.8.3 DYNAMIC COMPANIES

- 10.8.4 STARTING BLOCKS

- 10.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.8.5.1 Detailed list of key startups/SMEs

- 10.8.5.2 Competitive benchmarking of key startups/SMEs

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES

- 10.9.2 DEALS

11 COMPANY PROFILES

In-depth look at their Strengths, Weaknesses, Product Portfolios, Recent Developments, and Strategic Moves

- 11.1 KEY PLAYERS

- 11.1.1 IBM

- 11.1.1.1 Business overview

- 11.1.1.2 Software/Services offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product launches

- 11.1.1.3.2 Deals

- 11.1.1.4 MnM view

- 11.1.1.4.1 Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses and competitive threats

- 11.1.2 AWS

- 11.1.2.1 Business overview

- 11.1.2.2 Software/Services offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Product launches

- 11.1.2.3.2 Deals

- 11.1.2.4 MnM view

- 11.1.2.4.1 Right to win

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses and competitive threats

- 11.1.3 TCS

- 11.1.3.1 Business overview

- 11.1.3.2 Software/Services offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Product launches

- 11.1.3.4 MnM view

- 11.1.3.4.1 Right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses and competitive threats

- 11.1.4 CAPGEMINI

- 11.1.4.1 Business overview

- 11.1.4.2 Software/Services offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Product launches

- 11.1.4.4 MnM view

- 11.1.4.4.1 Right to win

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses and competitive threats

- 11.1.5 HCLTECH

- 11.1.5.1 Business overview

- 11.1.5.2 Software/Services offered

- 11.1.5.3 MnM view

- 11.1.5.3.1 Right to win

- 11.1.5.3.2 Strategic choices

- 11.1.5.3.3 Weaknesses and competitive threats

- 11.1.6 ATOS

- 11.1.6.1 Business overview

- 11.1.6.2 Software/Services offered

- 11.1.7 MICRO FOCUS (OPENTEXT)

- 11.1.7.1 Business overview

- 11.1.7.2 Software/Services offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Deals

- 11.1.8 BMC SOFTWARE

- 11.1.8.1 Business overview

- 11.1.8.2 Software/Services offered

- 11.1.9 INFOSYS

- 11.1.9.1 Business overview

- 11.1.9.2 Software/Services offered

- 11.1.10 WIPRO

- 11.1.10.1 Business overview

- 11.1.10.2 Software/Services offered

- 11.1.11 DXC TECHNOLOGY

- 11.1.12 KYNDRYL

- 11.1.13 ROCKET SOFTWARE

- 11.1.14 FUJITSU

- 11.1.15 COGNIZANT

- 11.1.16 TECH MAHINDRA

- 11.1.17 BROADCOM

- 11.1.18 TMAXSOFT

- 11.1.1 IBM

- 11.2 STARTUPS/SMES

- 11.2.1 PALMDIGITALZ

- 11.2.2 TSRI

- 11.2.3 MECHANICAL ORCHARD

- 11.2.4 VIRTUALZ COMPUTING

- 11.2.5 CLOUDFRAME

- 11.2.6 HEIRLOOM COMPUTING

12 ADJACENT AND RELATED MARKETS

- 12.1 INTRODUCTION

- 12.2 APPLICATION MODERNIZATION SERVICES MARKET

- 12.2.1 MARKET DEFINITION

- 12.3 CLOUD PROFESSIONAL SERVICES MARKET

- 12.3.1 MARKET DEFINITION

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS