|

|

市場調査レポート

商品コード

1783246

電気自動車用タイヤの世界市場:推進力別、車両タイプ別、荷重指数別、用途別、リムサイズ別、販売チャネル別、地域別 - 予測(~2032年)Electric Vehicle Tires Market by Propulsion (Battery Electric Vehicle, Plug-in Hybrid Electric Vehicle, Fuel Cell Electric Vehicle ), Vehicle Type, Load Index, Application, Rim Size, Sales Channel, and Region - Global Forecast to 2032 |

||||||

カスタマイズ可能

|

|||||||

| 電気自動車用タイヤの世界市場:推進力別、車両タイプ別、荷重指数別、用途別、リムサイズ別、販売チャネル別、地域別 - 予測(~2032年) |

|

出版日: 2025年07月30日

発行: MarketsandMarkets

ページ情報: 英文 313 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

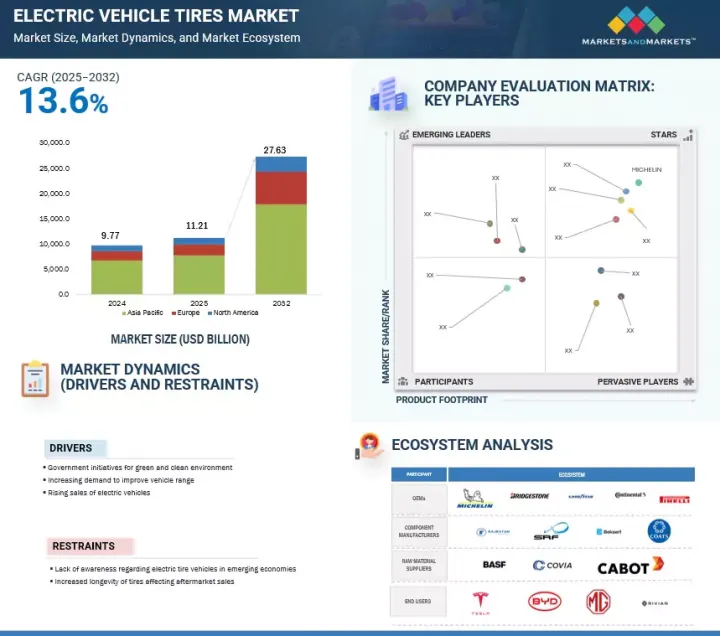

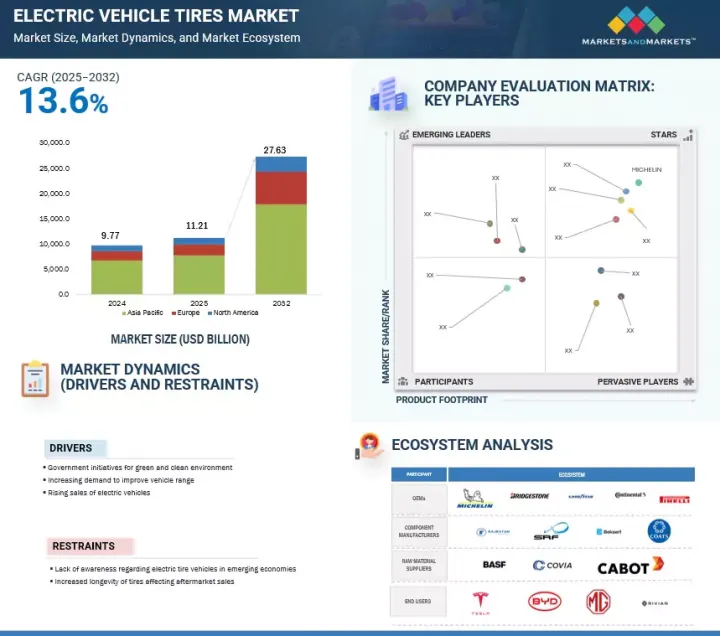

世界の電気自動車用タイヤの市場規模は、2025年の112億1,000万米ドルから2032年までに276億3,000万米ドルに達すると予測され、CAGRで13.6%の成長が見込まれます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2032年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2032年 |

| 単位 | 数量、金額(1,000米ドル) |

| セグメント | 推進力、車両タイプ、荷重指数、用途、リムサイズ、販売チャネル、地域 |

| 対象地域 | アジア太平洋、欧州、北米、中東・アフリカ |

世界の電気自動車の売上の増加により、電気自動車用タイヤの需要は増加すると予測されます。さらに、予測される環境的に持続可能な輸送の増加や政府の政策により、今後数年間は電気自動車用タイヤ市場の収益成長が促進される見込みです。

アフターマーケットセグメントが予測期間に市場を主導する見込みです。

販売チャネル別では、アフターマーケットセグメントが予測期間に大幅に成長する見込みです。このセグメントの成長促進要因は、電気自動車の急速な普及であり、これが交換用タイヤ全体の需要を促進しています。電気自動車はその重さとトルクの大きさのためにタイヤの摩耗が早く、従来の自動車よりもタイヤ交換の頻度が高くなります。このこともこのセグメントの成長を押し上げると予測されます。世界的な電動モビリティへの移行が加速するにつれて、特殊な交換用タイヤへのニーズは高まり続け、電気自動車用タイヤアフターマーケットは予測期間に企業にとって重要な機会となります。

2025年2月、Michelinは欧州全域でe.Primacy EV交換用タイヤラインを発売しました。このタイヤは、人気のある電気セダンやコンパクトSUVに適合するよう特別に設計されており、転がり抵抗の低減と耐久性の向上を実現しています。同様に2025年4月、BridgestoneはTesla Model 3やHyundai IONIQ 5のような電気自動車に適合するTuranza EV EverDriveアフターマーケットを発表しました。これらの戦略的な製品展開は、タイヤエコシステムの変化を示すもので、特にEVの早期採用者が純正タイヤをEV専用の代替品に交換し始めるにつれて、アフターマーケットが重要な収益チャネルになりつつあります。

16~18インチセグメントが予測期間にもっとも高く成長する見込みです。

リムサイズ別では、16~18インチセグメントが予測期間に最大の市場となる見込みです。この範囲のタイヤは、小型乗用車、中型セダン、クロスオーバーなど、幅広い車両に装着されるもっとも一般的なタイヤの1つであるためです。例えば、Tesla Model 3のリムサイズは18インチ、Ford Mustang Mach-Eのリムサイズは18インチ、Chevrolet Boltのリムサイズは17インチ、Renault Zoeのリムサイズは16インチです。中国や日本などでは、電気小型乗用車やクロスオーバーの売上が増加しており、今後数年間にこのセグメントの成長が後押しされると予測されます。これらの自動車は、自動車市場のかなりの部分を占めています。この汎用性により、このサイズ範囲の電気自動車用タイヤは幅広い顧客層を持っています。リムサイズが16~18インチのタイヤのアフターマーケット需要はその他のどのタイヤサイズよりも高く、多くの消費者が純正タイヤが摩耗した際にアフターマーケットの電気自動車用タイヤオプションに交換します。このことが予測期間に16~18インチセグメントに成長機会をもたらす見込みです。

当レポートでは、世界の電気自動車用タイヤ市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要な知見

- 電気自動車用タイヤ市場における魅力的な機会

- 電気自動車用タイヤ市場:推進タイプ別

- 電気自動車用タイヤ市場:車両タイプ別

- 電気自動車用タイヤ市場:用途別

- 電気自動車用タイヤ市場:リムサイズ別

- 電気自動車用タイヤ市場:荷重指数別

- 電気自動車用タイヤ市場:地域別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- カスタマービジネスに影響を与える動向と混乱

- エコシステム分析

- サプライチェーン分析

- 規制情勢

- 規制枠組み

- 規制機関、政府機関、その他の組織のリスト

- 価格設定の分析

- 主要企業の電気自動車用タイヤの平均販売価格:車両タイプ別(2024年)

- 電気自動車用タイヤの平均販売価格:地域別(2024年)

- 貿易分析

- 輸入データ(HSコード401110)

- 輸出データ(HSコード401110)

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- 特許分析

- ケーススタディ分析

- ケーススタディ1:MICHELINとPORSCHEが提携し、Porsche車向けにカスタマイズされた高性能タイヤを製造

- ケーススタディ2:BRIDGESTONE、ARLANXEOおよびSOLVAYと協力し、環境性能を向上させる共同開発のTECHSYNタイヤ技術を発表

- ケーススタディ3:BRIDGESTONE、BMW IX電気SUV用タイヤを開発

- ケーススタディ4:PIRELLI & C. SPA、LUCID AIR DREAM EDITION専用タイヤを開発

- ケーススタディ5:GOODYEAR TIRE & RUBBER COMPANY、低転がり抵抗のレンジマックスRSDタイヤを開発

- 投資と資金調達のシナリオ

- 主なステークホルダーと購入基準

- 主な会議とイベント(2025年~2026年)

- AI/生成AIの影響

- 電気自動車用タイヤに使用される材料に関する考察

- シリカ

- 合成ゴム

- スチールベルト

- ナイロン

- 電気自動車用タイヤの提供と戦略に関する考察

- 電気自動車用タイヤ提供:主要企業別

- 電気自動車用タイヤ戦略:主要OEM別

- 次世代電気自動車用タイヤ技術

- 電気自動車用タイヤと内燃機関車用タイヤ:マージンの分析

- 電気自動車用タイヤに対する自動運転車の影響

- 自己修復タイヤ技術

- スマートセンサーによる予知保全

- ランフラットタイヤと拡張モビリティ設計

- 低い転がり抵抗と音響快適性

- タイヤの選択とサービス革新に関する考察

- デジタルタイヤ選択:AI搭載タイヤ推奨システム

- 搭載サービス:モバイルタイヤ搭載と利便性

- パフォーマンスモニタリング:リアルタイムのタイヤの状態と効率の追跡

- ロイヤルティプログラム:サブスクリプションモデルとリピート購入インセンティブ

第6章 電気自動車用タイヤ市場:車両タイプ別

- イントロダクション

- 乗用車

- 小型商用車

- 大型商用車

- バス

- 主な産業考察

第7章 電気自動車用タイヤ市場:推進タイプ別

- イントロダクション

- バッテリー電気自動車(BEV)

- プラグインハイブリッド電気自動車(PHEV)

- 燃料電池電気自動車(FCEV)

- ハイブリッド電気自動車(HEV)

- 主な産業考察

第8章 電気自動車用タイヤ市場:リムサイズ別

- イントロダクション

- 13~15インチ

- 16~18インチ

- 19~21インチ

- 21インチ超

- 主な産業考察

第9章 電気自動車用タイヤ市場:荷重指数別

- イントロダクション

- 100未満

- 100超

- 主な産業考察

第10章 電気自動車用タイヤ市場:用途別

- イントロダクション

- オンロード

- オフロード

- 主な産業考察

第11章 電気自動車用タイヤ市場:販売チャネル別

- イントロダクション

- OEM

- アフターマーケット

- 主な産業考察

第12章 電気自動車用タイヤ市場:地域別

- イントロダクション

- アジア太平洋

- マクロ経済の見通し

- 中国

- 日本

- インド

- 韓国

- タイ

- インドネシア

- マレーシア

- ベトナム

- 欧州

- マクロ経済の見通し

- フランス

- ドイツ

- オランダ

- ノルウェー

- スウェーデン

- 英国

- オーストリア

- スペイン

- スイス

- デンマーク

- 北米

- マクロ経済の見通し

- 米国

- カナダ

- 中東・アフリカ

- マクロ経済の見通し

- 南アフリカ

- イラン

第13章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 市場シェア分析

- 収益分析(2020年~2024年)

- 企業の評価

- 財務指標

- ブランド/製品の比較

- 企業の評価マトリクス:主要企業(2024年)

- 企業の評価マトリクス:スタートアップ/中小企業(2024年)

- 競合シナリオ

第14章 企業プロファイル

- 主要企業

- MICHELIN

- BRIDGESTONE CORPORATION

- THE GOODYEAR TIRE & RUBBER COMPANY

- CONTINENTAL AG

- PIRELLI & C. S.P.A.

- SUMITOMO RUBBER INDUSTRIES, LTD.

- HANKOOK TIRE & TECHNOLOGY

- NOKIAN TYRES PLC

- KUMHO TIRE CO., INC.

- ZHONGCE RUBBER GROUP CO., LTD.

- その他の企業

- SAILUN GROUP CO., LTD.

- CHENG SHIN RUBBER INDUSTRY CO., LTD. (CST)

- APOLLO TYRES

- SHANDONG LINGLONG TYRE CO., LTD.

- GITI TIRE

- THE YOKOHAMA RUBBER CO., LTD.

- NEXEN TIRE

- TOYO TIRE CORPORATION

- CEAT LIMITED

- BALKRISHNA INDUSTRIES LIMITED (BKT)

- KENDA TIRES

第15章 MARKETSANDMARKETSによる提言

- アジア太平洋が電気自動車用タイヤの最大の市場となる

- タイヤメーカーは高性能電気自動車用タイヤを好む

- 結論

第16章 付録

List of Tables

- TABLE 1 ELECTRIC VEHICLE TIRES MARKET, BY SALES CHANNEL

- TABLE 2 ELECTRIC VEHICLE TIRES MARKET, BY VEHICLE TYPE

- TABLE 3 ELECTRIC VEHICLE TIRES MARKET, BY PROPULSION TYPE

- TABLE 4 ELECTRIC VEHICLE TIRES MARKET, BY LOAD INDEX

- TABLE 5 INCLUSIONS & EXCLUSIONS

- TABLE 6 CURRENCY EXCHANGE RATES, 2020-2024

- TABLE 7 CO2 EMISSION REDUCTION TARGETS WORLDWIDE

- TABLE 8 NEW ELECTRIC VEHICLE MODELS, BY OEM

- TABLE 9 IMPACT OF RANGE OPTIMIZATION ON ELECTRIC VEHICLE TIRE DESIGN

- TABLE 10 SHIFT TOWARD ELECTRIC VEHICLE-SPECIFIC TIRES, BY OEM

- TABLE 11 TIRE LONGEVITY FOR ELECTRIC VEHICLES, BY OEM

- TABLE 12 KEY FACTORS AFFECTING TIRE LONGEVITY IN ELECTRIC VEHICLES

- TABLE 13 TECHNOLOGICAL ADVANCEMENTS IN ELECTRIC VEHICLE TIRES

- TABLE 14 ENVIRONMENTAL SUSTAINABILITY INITIATIVES IN ELECTRIC VEHICLES, BY KEY PLAYER

- TABLE 15 FACTORS CONTRIBUTING TO HIGH STRESS RATE OF ELECTRIC VEHICLE TIRES

- TABLE 16 COMPARISON BETWEEN AVERAGE PRICES OF VARIOUS TIRE TYPES, BY OEM

- TABLE 17 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 18 REGULATORY FRAMEWORK, BY REGION

- TABLE 19 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 AVERAGE SELLING PRICE OF ELECTRIC VEHICLE TIRES FOR KEY PLAYERS, BY VEHICLE TYPE, 2024 (USD)

- TABLE 23 AVERAGE SELLING PRICE OF ELECTRIC VEHICLE TIRES, BY REGION, 2024 (USD)

- TABLE 24 US: IMPORT DATA FOR HS CODE: 401110-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (PERCENTAGE OF TOTAL VALUE IMPORTED)

- TABLE 25 GERMANY: IMPORT DATA FOR HS CODE: 401110-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (PERCENTAGE OF TOTAL VALUE IMPORTED)

- TABLE 26 FRANCE: IMPORT DATA FOR HS CODE: 401110-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (PERCENTAGE OF TOTAL VALUE IMPORTED)

- TABLE 27 UK: IMPORT DATA FOR HS CODE: 401110-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (PERCENTAGE OF TOTAL VALUE IMPORTED)

- TABLE 28 ITALY: IMPORT DATA FOR HS CODE: 401110-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (PERCENTAGE OF TOTAL VALUE IMPORTED)

- TABLE 29 NETHERLANDS: IMPORT DATA FOR HS CODE: 401110-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (PERCENTAGE OF TOTAL VALUE IMPORTED)

- TABLE 30 CANADA: IMPORT DATA FOR HS CODE: 401110-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (PERCENTAGE OF TOTAL VALUE IMPORTED)

- TABLE 31 US: EXPORT DATA FOR HS CODE: 401110-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (PERCENTAGE OF TOTAL VALUE EXPORTED)

- TABLE 32 CHINA: EXPORT DATA FOR HS CODE: 401110-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (PERCENTAGE OF TOTAL VALUE EXPORTED)

- TABLE 33 MEXICO: EXPORT DATA FOR HS CODE: 401110-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (PERCENTAGE OF TOTAL VALUE EXPORTED)

- TABLE 34 GERMANY: EXPORT DATA FOR HS CODE: 401110-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (PERCENTAGE OF TOTAL VALUE EXPORTED)

- TABLE 35 JAPAN: EXPORT DATA FOR HS CODE: 401110-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (PERCENTAGE OF TOTAL VALUE EXPORTED)

- TABLE 36 THAILAND: EXPORT DATA FOR HS CODE: 401110-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (PERCENTAGE OF TOTAL VALUE EXPORTED)

- TABLE 37 SWEDEN: EXPORT DATA FOR HS CODE: 401110-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (PERCENTAGE OF TOTAL VALUE EXPORTED)

- TABLE 38 PATENTS PUBLISHED

- TABLE 39 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS, BY VEHICLE TYPE (%)

- TABLE 40 KEY BUYING CRITERIA, BY VEHICLE TYPE

- TABLE 41 KEY CONFERENCES & EVENTS, 2025-2026

- TABLE 42 MATERIAL COMPOSITION OF ELECTRIC VEHICLE TIRES (APPROXIMATE % RANGE BY WEIGHT)

- TABLE 43 ELECTRIC VEHICLE TIRE OFFERINGS, BY KEY PLAYER

- TABLE 44 ELECTRIC VEHICLE TIRE STRATEGIES, BY KEY OEM

- TABLE 45 NEXT-GENERATION ELECTRIC VEHICLE TIRE TECHNOLOGIES

- TABLE 46 ELECTRIC VEHICLE TIRES VS. INTERNAL COMBUSTION ENGINE TIRES: MARGIN ANALYSIS

- TABLE 47 ELECTRIC VEHICLE TIRES MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 48 ELECTRIC VEHICLE TIRES MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 49 ELECTRIC VEHICLE TIRES MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 50 ELECTRIC VEHICLE TIRES MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 51 PASSENGER CARS: ELECTRIC VEHICLE TIRES MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 52 PASSENGER CARS: ELECTRIC VEHICLE TIRES MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 53 PASSENGER CARS: ELECTRIC VEHICLE TIRES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 54 PASSENGER CARS: ELECTRIC VEHICLE TIRES MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 55 LIGHT COMMERCIAL VEHICLES: ELECTRIC VEHICLE TIRES MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 56 LIGHT COMMERCIAL VEHICLES: ELECTRIC VEHICLE TIRES MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 57 LIGHT COMMERCIAL VEHICLES: ELECTRIC VEHICLE TIRES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 58 LIGHT COMMERCIAL VEHICLES: ELECTRIC VEHICLE TIRES MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 59 HEAVY COMMERCIAL VEHICLES: ELECTRIC VEHICLE TIRES MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 60 HEAVY COMMERCIAL VEHICLES: ELECTRIC VEHICLE TIRES MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 61 HEAVY COMMERCIAL VEHICLES: ELECTRIC VEHICLE TIRES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 62 HEAVY COMMERCIAL VEHICLES: ELECTRIC VEHICLE TIRES MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 63 BUSES: ELECTRIC VEHICLE TIRES MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 64 BUSES: ELECTRIC VEHICLE TIRES MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 65 BUSES: ELECTRIC VEHICLE TIRES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 66 BUSES: ELECTRIC VEHICLE TIRES MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 67 ELECTRIC VEHICLE TIRES MARKET, BY PROPULSION TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 68 ELECTRIC VEHICLE TIRES MARKET, BY PROPULSION TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 69 ELECTRIC VEHICLE TIRES MARKET, BY PROPULSION TYPE, 2021-2024 (USD MILLION)

- TABLE 70 ELECTRIC VEHICLE TIRES MARKET, BY PROPULSION TYPE, 2025-2032 (USD MILLION)

- TABLE 71 BATTERY ELECTRIC VEHICLE (BEV): ELECTRIC VEHICLE TIRES MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 72 BATTERY ELECTRIC VEHICLE (BEV): ELECTRIC VEHICLE TIRES MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 73 BATTERY ELECTRIC VEHICLE (BEV): ELECTRIC VEHICLE TIRES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 74 BATTERY ELECTRIC VEHICLE (BEV): ELECTRIC VEHICLE TIRES MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 75 PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV): ELECTRIC VEHICLE TIRES MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 76 PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV): ELECTRIC VEHICLE TIRES MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 77 PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV): ELECTRIC VEHICLE TIRES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 78 PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV): ELECTRIC VEHICLE TIRES MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 79 FUEL CELL ELECTRIC VEHICLE (FCEV): ELECTRIC VEHICLE TIRES MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 80 FUEL CELL ELECTRIC VEHICLE (FCEV): ELECTRIC VEHICLE TIRES MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 81 FUEL CELL ELECTRIC VEHICLE (FCEV): ELECTRIC VEHICLE TIRES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 82 FUEL CELL ELECTRIC VEHICLE (FCEV): ELECTRIC VEHICLE TIRES MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 83 ELECTRIC VEHICLE TIRES MARKET, BY RIM SIZE, 2021-2024 (THOUSAND UNITS)

- TABLE 84 ELECTRIC VEHICLE TIRES MARKET, BY RIM SIZE, 2025-2032 (THOUSAND UNITS)

- TABLE 85 ELECTRIC VEHICLE TIRES MARKET, BY RIM SIZE, 2021-2024 (USD MILLION)

- TABLE 86 ELECTRIC VEHICLE TIRES MARKET, BY RIM SIZE, 2025-2032 (USD MILLION)

- TABLE 87 VEHICLE MODELS AND THEIR RIM SIZES, BY OEM

- TABLE 88 13-15": ELECTRIC VEHICLE TIRES MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 89 13-15": ELECTRIC VEHICLE TIRES MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 90 13-15": ELECTRIC VEHICLE TIRES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 91 13-15": ELECTRIC VEHICLE TIRES MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 92 16-18": ELECTRIC VEHICLE TIRES MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 93 16-18": ELECTRIC VEHICLE TIRES MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 94 16-18": ELECTRIC VEHICLE TIRES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 95 16-18": ELECTRIC VEHICLE TIRES MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 96 19-21": ELECTRIC VEHICLE TIRES MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 97 19-21": ELECTRIC VEHICLE TIRES MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 98 19-21": ELECTRIC VEHICLE TIRES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 99 19-21": ELECTRIC VEHICLE TIRES MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 100 > 21": ELECTRIC VEHICLE TIRES MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 101 > 21": ELECTRIC VEHICLE TIRES MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 102 > 21": ELECTRIC VEHICLE TIRES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 103 > 21": ELECTRIC VEHICLE TIRES MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 104 ELECTRIC VEHICLE TIRES MARKET, BY LOAD INDEX, 2021-2024 (THOUSAND UNITS)

- TABLE 105 ELECTRIC VEHICLE TIRES MARKET, BY LOAD INDEX, 2025-2032 (THOUSAND UNITS)

- TABLE 106 ELECTRIC VEHICLE TIRES MARKET, BY LOAD INDEX, 2021-2024 (USD MILLION)

- TABLE 107 ELECTRIC VEHICLE TIRES MARKET, BY LOAD INDEX, 2025-2032 (USD MILLION)

- TABLE 108 OPERATIONAL DATA OF LOAD INDEX, BY OEM

- TABLE 109 LESS THAN 100: ELECTRIC VEHICLE TIRES MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 110 LESS THAN 100: ELECTRIC VEHICLE TIRES MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 111 LESS THAN 100: ELECTRIC VEHICLE TIRES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 112 LESS THAN 100: ELECTRIC VEHICLE TIRES MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 113 ABOVE 100: ELECTRIC VEHICLE TIRES MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 114 ABOVE 100: ELECTRIC VEHICLE TIRES MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 115 ABOVE 100: ELECTRIC VEHICLE TIRES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 116 ABOVE 100: ELECTRIC VEHICLE TIRES MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 117 ELECTRIC VEHICLE TIRES MARKET, BY APPLICATION, 2021-2024 (THOUSAND UNITS)

- TABLE 118 ELECTRIC VEHICLE TIRES MARKET, BY APPLICATION, 2025-2032 (THOUSAND UNITS)

- TABLE 119 ELECTRIC VEHICLE TIRES MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 120 ELECTRIC VEHICLE TIRES MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 121 ON-ROAD: ELECTRIC VEHICLE TIRES MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 122 ON-ROAD: ELECTRIC VEHICLE TIRES MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 123 ON-ROAD: ELECTRIC VEHICLE TIRES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 124 ON-ROAD: ELECTRIC VEHICLE TIRES MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 125 OFF-ROAD: ELECTRIC VEHICLE TIRES MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 126 OFF-ROAD: ELECTRIC VEHICLE TIRES MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 127 OFF-ROAD: ELECTRIC VEHICLE TIRES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 128 OFF-ROAD: ELECTRIC VEHICLE TIRES MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 129 OPERATIONAL DATA, BY OEM

- TABLE 130 ELECTRIC VEHICLE TIRES MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 131 ELECTRIC VEHICLE TIRES MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 132 ELECTRIC VEHICLE TIRES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 133 ELECTRIC VEHICLE TIRES MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 134 ASIA PACIFIC: ELECTRIC VEHICLE TIRES MARKET, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 135 ASIA PACIFIC: ELECTRIC VEHICLE TIRES MARKET, BY COUNTRY, 2025-2032 (THOUSAND UNITS)

- TABLE 136 ASIA PACIFIC: ELECTRIC VEHICLE TIRES MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 137 ASIA PACIFIC: ELECTRIC VEHICLE TIRES MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 138 CHINA: ELECTRIC VEHICLE TIRES MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 139 CHINA: ELECTRIC VEHICLE TIRES MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 140 CHINA: ELECTRIC VEHICLE TIRES MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 141 CHINA: ELECTRIC VEHICLE TIRES MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 142 JAPAN: ELECTRIC VEHICLE TIRES MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 143 JAPAN: ELECTRIC VEHICLE TIRES MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 144 JAPAN: ELECTRIC VEHICLE TIRES MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 145 JAPAN: ELECTRIC VEHICLE TIRES MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 146 INDIA: ELECTRIC VEHICLE TIRES MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 147 INDIA: ELECTRIC VEHICLE TIRES MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 148 INDIA: ELECTRIC VEHICLE TIRES MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 149 INDIA: ELECTRIC VEHICLE TIRES MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 150 SOUTH KOREA: ELECTRIC VEHICLE TIRES MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 151 SOUTH KOREA: ELECTRIC VEHICLE TIRES MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 152 SOUTH KOREA: ELECTRIC VEHICLE TIRES MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 153 SOUTH KOREA: ELECTRIC VEHICLE TIRES MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 154 EUROPE: ELECTRIC VEHICLE TIRES MARKET, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 155 EUROPE: ELECTRIC VEHICLE TIRES MARKET, BY COUNTRY, 2025-2032 (THOUSAND UNITS)

- TABLE 156 EUROPE: ELECTRIC VEHICLE TIRES MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 157 EUROPE: ELECTRIC VEHICLE TIRES MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 158 FRANCE: ELECTRIC VEHICLE TIRES MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 159 FRANCE: ELECTRIC VEHICLE TIRES MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 160 FRANCE: ELECTRIC VEHICLE TIRES MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 161 FRANCE: ELECTRIC VEHICLE TIRES MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 162 GERMANY: ELECTRIC VEHICLE TIRES MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 163 GERMANY: ELECTRIC VEHICLE TIRES MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 164 GERMANY: ELECTRIC VEHICLE TIRES MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 165 GERMANY: ELECTRIC VEHICLE TIRES MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 166 NETHERLANDS: ELECTRIC VEHICLE TIRES MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 167 NETHERLANDS: ELECTRIC VEHICLE TIRES MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 168 NETHERLANDS: ELECTRIC VEHICLE TIRES MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 169 NETHERLANDS: ELECTRIC VEHICLE TIRES MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 170 NORWAY: ELECTRIC VEHICLE TIRES MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 171 NORWAY: ELECTRIC VEHICLE TIRES MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 172 NORWAY: ELECTRIC VEHICLE TIRES MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 173 NORWAY: ELECTRIC VEHICLE TIRES MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 174 SWEDEN: ELECTRIC VEHICLE TIRES MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 175 SWEDEN: ELECTRIC VEHICLE TIRES MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 176 SWEDEN: ELECTRIC VEHICLE TIRES MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 177 SWEDEN: ELECTRIC VEHICLE TIRES MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 178 UK: ELECTRIC VEHICLE TIRES MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 179 UK: ELECTRIC VEHICLE TIRES MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 180 UK: ELECTRIC VEHICLE TIRES MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 181 UK: ELECTRIC VEHICLE TIRES MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 182 AUSTRIA: ELECTRIC VEHICLE TIRES MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 183 AUSTRIA: ELECTRIC VEHICLE TIRES MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 184 AUSTRIA: ELECTRIC VEHICLE TIRES MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 185 AUSTRIA: ELECTRIC VEHICLE TIRES MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 186 SPAIN: ELECTRIC VEHICLE TIRES MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 187 SPAIN: ELECTRIC VEHICLE TIRES MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 188 SPAIN: ELECTRIC VEHICLE TIRES MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 189 SPAIN: ELECTRIC VEHICLE TIRES MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 190 NORTH AMERICA: ELECTRIC VEHICLE TIRES MARKET, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 191 NORTH AMERICA: ELECTRIC VEHICLE TIRES MARKET, BY COUNTRY, 2025-2032 (THOUSAND UNITS)

- TABLE 192 NORTH AMERICA: ELECTRIC VEHICLE TIRES MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 193 NORTH AMERICA: ELECTRIC VEHICLE TIRES MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 194 US: ELECTRIC VEHICLE TIRES MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 195 US: ELECTRIC VEHICLE TIRES MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 196 US: ELECTRIC VEHICLE TIRES MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 197 US: ELECTRIC VEHICLE TIRES MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 198 CANADA: ELECTRIC VEHICLE TIRES MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 199 CANADA: ELECTRIC VEHICLE TIRES MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 200 CANADA: ELECTRIC VEHICLE TIRES MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 201 CANADA: ELECTRIC VEHICLE TIRES MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 202 KEY PLAYER STRATEGIES/RIGHT TO WIN

- TABLE 203 MARKET SHARE ANALYSIS, 2024

- TABLE 204 ELECTRIC VEHICLE TIRES MARKET: VEHICLE TYPE FOOTPRINT

- TABLE 205 ELECTRIC VEHICLE TIRES MARKET: PROPULSION TYPE FOOTPRINT

- TABLE 206 ELECTRIC VEHICLE TIRES MARKET: REGION FOOTPRINT

- TABLE 207 ELECTRIC VEHICLE TIRES MARKET: KEY STARTUPS/SMES

- TABLE 208 ELECTRIC VEHICLE TIRES MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 209 ELECTRIC VEHICLE TIRES MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, JANUARY 2022-JUNE 2025

- TABLE 210 ELECTRIC VEHICLE TIRES MARKET: DEALS, JANUARY 2022-JUNE 2025

- TABLE 211 ELECTRIC VEHICLE TIRES MARKET: EXPANSIONS, JANUARY 2022-JUNE 2025

- TABLE 212 ELECTRIC VEHICLE TIRES MARKET: OTHER DEVELOPMENTS, JANUARY 2022-JUNE 2025

- TABLE 213 MICHELIN: COMPANY OVERVIEW

- TABLE 214 MICHELIN: PRODUCTS OFFERED

- TABLE 215 MICHELIN: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 216 MICHELIN: DEALS

- TABLE 217 MICHELIN: OTHER DEVELOPMENTS

- TABLE 218 BRIDGESTONE CORPORATION: COMPANY OVERVIEW

- TABLE 219 BRIDGESTONE CORPORATION: PRODUCTS OFFERED

- TABLE 220 BRIDGESTONE CORPORATION: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 221 BRIDGESTONE CORPORATION: DEALS

- TABLE 222 BRIDGESTONE CORPORATION: OTHER DEVELOPMENTS

- TABLE 223 THE GOODYEAR TIRE & RUBBER COMPANY: COMPANY OVERVIEW

- TABLE 224 THE GOODYEAR TIRE & RUBBER COMPANY: PRODUCTS OFFERED

- TABLE 225 THE GOODYEAR TIRE & RUBBER COMPANY: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 226 THE GOODYEAR TIRE & RUBBER COMPANY: DEALS

- TABLE 227 THE GOODYEAR TIRE & RUBBER COMPANY: OTHER DEVELOPMENTS

- TABLE 228 CONTINENTAL AG: COMPANY OVERVIEW

- TABLE 229 CONTINENTAL AG: PRODUCTS OFFERED

- TABLE 230 CONTINENTAL AG: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 231 CONTINENTAL AG: OTHER DEVELOPMENTS

- TABLE 232 PIRELLI & C. S.P.A.: COMPANY OVERVIEW

- TABLE 233 PIRELLI & C. S.P.A.: PRODUCTS OFFERED

- TABLE 234 PIRELLI & C. S.P.A.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 235 PIRELLI & C. S.P.A.: DEALS

- TABLE 236 PIRELLI & C. S.P.A.: EXPANSIONS

- TABLE 237 PIRELLI & C. S.P.A.: OTHER DEVELOPMENTS

- TABLE 238 SUMITOMO RUBBER INDUSTRIES, LTD.: COMPANY OVERVIEW

- TABLE 239 SUMITOMO RUBBER INDUSTRIES, LTD.: PRODUCTS OFFERED

- TABLE 240 SUMITOMO RUBBER INDUSTRIES, LTD.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 241 SUMITOMO RUBBER INDUSTRIES, LTD.: DEALS

- TABLE 242 SUMITOMO RUBBER INDUSTRIES, LTD.: EXPANSIONS

- TABLE 243 SUMITOMO RUBBER INDUSTRIES, LTD.: OTHER DEVELOPMENTS

- TABLE 244 HANKOOK TIRE & TECHNOLOGY: COMPANY OVERVIEW

- TABLE 245 HANKOOK TIRE & TECHNOLOGY: PRODUCTS OFFERED

- TABLE 246 HANKOOK TIRE & TECHNOLOGY: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 247 HANKOOK TIRE & TECHNOLOGY: DEALS

- TABLE 248 HANKOOK TIRE & TECHNOLOGY: EXPANSIONS

- TABLE 249 HANKOOK TIRE & TECHNOLOGY: OTHER DEVELOPMENTS

- TABLE 250 NOKIAN TYRES PLC: COMPANY OVERVIEW

- TABLE 251 NOKIAN TYRES PLC: PRODUCTS OFFERED

- TABLE 252 NOKIAN TYRES PLC: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 253 NOKIAN TYRES PLC: DEALS

- TABLE 254 NOKIAN TYRES PLC: EXPANSIONS

- TABLE 255 KUMHO TIRE CO., INC.: COMPANY OVERVIEW

- TABLE 256 KUMHO TIRE CO., INC.: PRODUCTS OFFERED

- TABLE 257 KUMHO TIRE CO., INC.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 258 KUMHO TIRE CO., INC.: DEALS

- TABLE 259 KUMHO TIRE CO., INC.: EXPANSIONS

- TABLE 260 KUMHO TIRE CO., INC.: OTHER DEVELOPMENTS

- TABLE 261 ZHONGCE RUBBER GROUP CO., LTD.: COMPANY OVERVIEW

- TABLE 262 ZHONGCE RUBBER GROUP CO., LTD.: PRODUCTS OFFERED

- TABLE 263 ZHONGCE RUBBER CO., LTD: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 264 ZHONGCE RUBBER CO., LTD: EXPANSIONS

- TABLE 265 ZHONGCE RUBBER CO., LTD: OTHER DEVELOPMENTS

- TABLE 266 SAILUN GROUP CO., LTD.: COMPANY OVERVIEW

- TABLE 267 CHENG SHIN RUBBER INDUSTRY. CO., LTD. (CST): COMPANY OVERVIEW

- TABLE 268 APOLLO TYRES: COMPANY OVERVIEW

- TABLE 269 SHANDONG LINGLONG TYRE CO., LTD.: COMPANY OVERVIEW

- TABLE 270 GITI TIRE: COMPANY OVERVIEW

- TABLE 271 THE YOKOHAMA RUBBER CO., LTD.: COMPANY OVERVIEW

- TABLE 272 NEXEN TIRE: COMPANY OVERVIEW

- TABLE 273 TOYO TIRE CORPORATION: COMPANY OVERVIEW

- TABLE 274 CEAT LIMITED: COMPANY OVERVIEW

- TABLE 275 BALKRISHNA INDUSTRIES LIMITED (BKT): COMPANY OVERVIEW

- TABLE 276 KENDA TIRES: COMPANY OVERVIEW

List of Figures

- FIGURE 1 RESEARCH DESIGN

- FIGURE 2 RESEARCH PROCESS FLOW

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 4 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 5 ELECTRIC VEHICLE TIRES: MARKET SIZE ESTIMATION

- FIGURE 6 BOTTOM-UP APPROACH

- FIGURE 7 TOP-DOWN APPROACH

- FIGURE 8 ELECTRIC VEHICLE TIRES: MARKET SIZE ESTIMATION NOTES

- FIGURE 9 DATA TRIANGULATION

- FIGURE 10 ELECTRIC VEHICLE TIRES: MARKET OVERVIEW

- FIGURE 11 PASSENGER CARS SEGMENT TO LEAD MARKET IN 2025

- FIGURE 12 BATTERY ELECTRIC VEHICLE (BEV) SEGMENT TO LEAD MARKET IN 2O25

- FIGURE 13 ELECTRIC VEHICLE TIRES MARKET, BY REGION, 2025 VS. 2032 (USD MILLION)

- FIGURE 14 KEY PLAYERS IN ELECTRIC VEHICLE TIRES MARKET

- FIGURE 15 INCREASING ADOPTION OF ELECTRIC PASSENGER CARS TO DRIVE MARKET

- FIGURE 16 BATTERY ELECTRIC VEHICLE (BEV) SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 17 HEAVY COMMERCIAL VEHICLES SEGMENT TO ACHIEVE HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 18 ON-ROAD SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 19 19-21" SEGMENT TO ACHIEVE HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 20 LESS THAN 100 SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 21 NORTH AMERICA TO ACHIEVE HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 22 ELECTRIC VEHICLE TIRES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 23 GLOBAL BEV AND PHEV SALES, 2019-2024 (MILLION UNITS)

- FIGURE 24 REVENUE SHIFT FOR PLAYERS IN ELECTRIC VEHICLE TIRES MARKET

- FIGURE 25 ECOSYSTEM MAPPING

- FIGURE 26 SUPPLY CHAIN ANALYSIS

- FIGURE 27 IMPORT DATA FOR 401110-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD BILLION)

- FIGURE 28 EXPORT DATA FOR 401110-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD BILLION)

- FIGURE 29 PATENTS GRANTED, 2014-2024

- FIGURE 30 INVESTMENT SCENARIO, 2022-2025

- FIGURE 31 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS, BY VEHICLE TYPE

- FIGURE 32 KEY BUYING CRITERIA, BY VEHICLE TYPE

- FIGURE 33 ELECTRIC VEHICLE TIRES MARKET, BY VEHICLE TYPE, 2025 VS. 2032 (USD MILLION)

- FIGURE 34 ELECTRIC VEHICLE TIRES MARKET, BY PROPULSION TYPE, 2025 VS. 2032 (USD MILLION)

- FIGURE 35 ELECTRIC VEHICLE TIRES MARKET, BY RIM SIZE, 2025 VS. 2032 (USD MILLION)

- FIGURE 36 TIRE SIDEWALL INFORMATION

- FIGURE 37 ELECTRIC VEHICLE TIRES MARKET, BY LOAD INDEX, 2025 VS. 2032 (USD MILLION)

- FIGURE 38 ELECTRIC VEHICLE TIRES MARKET, BY APPLICATION, 2025 VS. 2032 (USD MILLION)

- FIGURE 39 ELECTRIC VEHICLE TIRES MARKET, BY REGION, 2025 VS. 2032 (USD MILLION)

- FIGURE 40 ASIA PACIFIC: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 41 ASIA PACIFIC: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 42 ASIA PACIFIC: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 43 ASIA PACIFIC: MANUFACTURING INDUSTRY'S CONTRIBUTION TO GDP, 2024 (US TRILLION)

- FIGURE 44 ASIA PACIFIC: ELECTRIC VEHICLE TIRES MARKET SNAPSHOT

- FIGURE 45 EUROPE: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 46 EUROPE: GDP PER CAPITA, BY COUNTRY, 2024-2026 (USD)

- FIGURE 47 EUROPE: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 48 EUROPE: MANUFACTURING'S INDUSTRY CONTRIBUTION TO GDP, 2024 (USD TRILLION)

- FIGURE 49 EUROPE: ELECTRIC VEHICLE TIRES MARKET SNAPSHOT

- FIGURE 50 NORTH AMERICA: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 51 NORTH AMERICA: GDP PER CAPITA, BY COUNTRY, 2024-2026 (USD)

- FIGURE 52 NORTH AMERICA: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 53 NORTH AMERICA: MANUFACTURING INDUSTRY'S CONTRIBUTION TO GDP, 2024 (USD TRILLION)

- FIGURE 54 NORTH AMERICA: ELECTRIC VEHICLE TIRES MARKET SNAPSHOT

- FIGURE 55 MIDDLE EAST & AFRICA: REAL GDP GROWTH RATE, 2024-2026

- FIGURE 56 MIDDLE EAST & AFRICA: GDP PER CAPITA, 2024-2026 (USD)

- FIGURE 57 MIDDLE EAST & AFRICA: INFLATION RATE AVERAGE CONSUMER PRICES, 2024-2026

- FIGURE 58 MIDDLE EAST & AFRICA: MANUFACTURING INDUSTRY'S CONTRIBUTION TO GDP, 2024 (USD TRILLION)

- FIGURE 59 MARKET SHARE ANALYSIS, 2024

- FIGURE 60 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2020-2024 (USD BILLION)

- FIGURE 61 COMPANY VALUATION OF KEY PLAYERS, 2024

- FIGURE 62 FINANCIAL METRICS OF KEY PLAYERS, 2024

- FIGURE 63 BRAND/PRODUCT COMPARISON

- FIGURE 64 ELECTRIC VEHICLE TIRES MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 65 ELECTRIC VEHICLE TIRES MARKET: COMPANY FOOTPRINT, 2024

- FIGURE 66 ELECTRIC VEHICLE TIRES MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 67 MICHELIN: COMPANY SNAPSHOT

- FIGURE 68 BRIDGESTONE CORPORATION: COMPANY SNAPSHOT

- FIGURE 69 THE GOODYEAR TIRE & RUBBER COMPANY: COMPANY SNAPSHOT

- FIGURE 70 CONTINENTAL AG: COMPANY SNAPSHOT

- FIGURE 71 PIRELLI & C. S.P.A: COMPANY SNAPSHOT

- FIGURE 72 SUMITOMO RUBBER INDUSTRIES, LTD.: COMPANY SNAPSHOT

- FIGURE 73 HANKOOK TIRE & TECHNOLOGY: COMPANY SNAPSHOT

- FIGURE 74 NOKIAN TYRES PLC: COMPANY SNAPSHOT

- FIGURE 75 KUMHO TIRE CO., INC.: COMPANY SNAPSHOT

The global electric vehicle tires market is projected to grow from USD 11.21 billion in 2025 to USD 27.63 billion by 2032, at a CAGR of 13.6%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Volume (Units) & Value (USD Thousand) |

| Segments | Propulsion, Vehicle Type, Load Index, Application, Rim Size, Sales Channel, and Region |

| Regions covered | Asia Pacific, Europe, North America, the Middle East & Africa |

The demand for electric vehicle tires is anticipated to increase, owing to the rising sales of electric vehicles globally. Additionally, the anticipated rise in environmentally sustainable transport and government policies is expected to bolster the revenue growth of the electric vehicle tires market in the coming years.

The aftermarket segment is projected to lead the market during the forecast period.

By sales channel, the aftermarket segment is projected to witness substantial growth during the forecast period. The segment's growth is driven by the rapid increase in the adoption of electric vehicles, which encourages the overall demand for replacement tires. Electric vehicles cause faster tire wear due to their heavy weight and high torque, resulting in more frequent tire replacements than traditional vehicles. This is also expected to boost the growth of the segment. As the global transition to electric mobility accelerates, the need for specialized replacement tires will continue to rise, making the electric vehicle tire aftermarket a key opportunity for players during the forecast period.

In February 2025, Michelin launched its e.Primacy EV replacement tire line across Europe, specifically engineered to fit popular electric sedans and compact SUVs, offering lower rolling resistance and extended durability. Similarly, in April 2025, Bridgestone introduced the Turanza EV EverDrive aftermarket, compatible with electric vehicles like the Tesla Model 3 and Hyundai IONIQ 5, featuring ENLITEN technology for improved wear life and noise reduction. These strategic product rollouts signal a shift in the tire ecosystem, where the aftermarket is becoming a key revenue channel, particularly as early EV adopters begin to replace their original equipment tires with EV-specific alternatives.

The 16-18" segment is projected to achieve the highest growth during the forecast period.

By rim size, the 16-18" segment is projected to be the largest market during the forecast period, as tires in this range are among the most common tires found on a wide range of vehicles, including small passenger cars, mid-size sedans, and crossovers. For instance, the Tesla Model 3 has a rim size of 18", the Ford Mustang Mach-E has a rim size of 18", the Chevrolet Bolt has a rim size of 17", and the Renault Zoe has a rim size of 16". The increasing sales of electric small passenger cars and crossovers in China, Japan, and more, are expected to boost the segment's growth in the coming years. These vehicles make up a significant portion of the automotive market. Due to this versatility, electric vehicle tires in this size range have a broad customer base. The aftermarket demand for tires with a rim size of 16-18" is higher than any other tire size, as many consumers replace their tires with aftermarket electric vehicle tire options when their original equipment tires wear out. This is expected to present growth opportunities for the 16-18" segment during the forecast period.

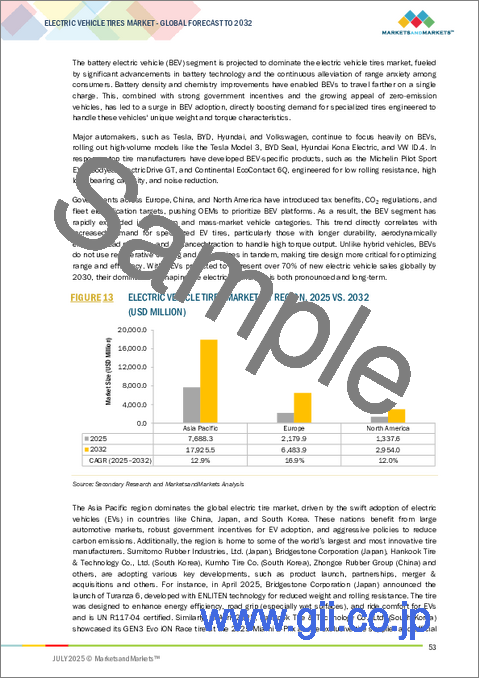

Asia Pacific is projected to show significant growth in the electric vehicle tires market during the forecast period.

Asia Pacific is projected to be the largest market during the forecast period. China is the world's largest producer and consumer of electric vehicles and dominates the electric vehicle industry in the region. This increased industry growth in the country contributes to the overall development of the electric vehicle tires market in Asia Pacific. Additionally, governments in other countries in the region have taken steps to encourage regional market growth. This includes subsidies for electric vehicle buyers, compulsory laws by which all vehicle manufacturers must manufacture EVs per number of vehicles manufactured, and regulations against excessively polluting vehicles. The governments in Japan and South Korea have been supporting the growth in demand for electric vehicles by installing electric vehicle charging stations, setting emission norms, setting deadlines for shifting to fully electric or hybrid EVs from ICE vehicles, etc. Many tire manufacturing companies have made expansions in Asia Pacific.

In April 2025, Bridgestone Corporation announced the launch of Turanza 6, developed with ENLITEN technology for reduced weight and rolling resistance. It was selected as the original equipment tire for the NEW MG S5 EV launched in Thailand. The tire enhances energy efficiency, road grip (especially on wet surfaces), and ride comfort for electric vehicles. It is UN R117-04 certified. Similarly, in December 2024, Sumitomo Rubber Industries, Ltd. launched DUNLOP "SPORT MAXX LUX" premium comfort tires, featuring an "EV Suitable" mark. These tires are engineered to meet EV requirements for rolling resistance, load, quietness, anti-wear, and wet grip.

In-depth interviews were conducted with CEOs, marketing directors, other innovation and technology directors, and executives from various key organizations operating in the electric vehicle tires market. The break-up of the primaries is as follows:

- By Company Type: OEMs - 40%, Tier 1 - 42%, and Tier 2 - 18%,

- By Designation: CXOs - 23%, Directors - 43%, and Others - 34%

- By Region: Asia Pacific - 60%, Europe - 25%, North America - 15%

The electric vehicle tires market comprises major manufacturers such as Michelin (France), Bridgestone Corporation (Japan), The Goodyear Tire & Rubber Corporation (US), Continental AG (Germany), and Pirelli & C. SpA (Italy), Sumitomo Rubber Industries, Ltd. (Japan), and Hankook Tire & Technology Co., Ltd. (South Korea), among others.

Research Coverage:

The study covers the electric vehicle tires market across various segments. It aims to estimate the market size and future growth potential of this market across different segments based on propulsion, vehicle type, load index, application, rim size, sales channel, and region. The study also includes an in-depth competitive analysis of key market players, their company profiles, key observations related to product and business offerings, recent developments, and acquisitions.

This research report categorizes electric vehicle tires market by propulsion (battery electric vehicle (BEV), plug-in hybrid electric vehicle (PHEV), fuel cell electric vehicle (FCEV), and hybrid electric vehicle (HEV), vehicle type (passenger cars, light commercial vehicles, heavy commercial vehicles, and buses), load index (less than 100 and above 100), application (on-road and off-road), rim size (13-15", 16-18", 19-21", and > 21"), sales channel (OEM and aftermarket), and region (Asia Pacific, Europe, North America, and Middle East & Africa).

The report's scope covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the electric vehicle tires market. A thorough analysis of the key industry players provides insights into their business overview, solutions and services, key strategies (contracts, partnerships, agreements, product & service launches, mergers, and acquisitions), and recent market developments. The competitive analysis of SMEs/startups in the electric vehicle tires market ecosystem is also covered in this report.

Reasons to buy this report:

The report will provide the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall electric vehicle tires market and the subsegments. Additionally, the report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and to plan suitable go-to-market strategies. The report will further help them understand the market pulse and provide information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of Market Dynamics: These dynamics include growing initiatives for green and clean environment, rising sales of electric commercial vehicles), restraints (lack of awareness in electric vehicle tire benefits in emerging economies, increasing longevity of tires affecting aftermarket sales), opportunities (increasing demand for replacement tires, growing focus on environmental sustainability), and challenges (higher cost and limited availability of electric vehicle tires) influencing the growth of the electric vehicle tires market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, product & service launches in the electric vehicle tires market

- Market Development: Comprehensive information about lucrative markets across varied regions

- Market Diversification: Exhaustive information about products & services, untapped geographies, recent developments, and investments in the electric vehicle tires market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Michelin (France), Bridgestone Corporation (Japan), The Goodyear Tire & Rubber Corporation (US), Continental AG (Germany), and Pirelli & C. SpA (Italy), Hankook Tire & Technology Co., Ltd. (South Korea) among others in the electric vehicle tires market.

- Strategies: The report also helps stakeholders understand the pulse of the electric vehicle tires market and provides information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 UNITS CONSIDERED

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 List of companies participating in primary research

- 2.1.2.3 Market objectives of primary research

- 2.1.2.4 List of primary participants

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION METHODOLOGY

- 2.3 MARKET SIZE ESTIMATION APPROACH

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- 2.4 DATA TRIANGULATION

- 2.5 FACTOR ANALYSIS

- 2.5.1 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND AND SUPPLY SIDES

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ELECTRIC VEHICLE TIRES MARKET

- 4.2 ELECTRIC VEHICLE TIRES MARKET, BY PROPULSION TYPE

- 4.3 ELECTRIC VEHICLE TIRES MARKET, BY VEHICLE TYPE

- 4.4 ELECTRIC VEHICLE TIRES MARKET, BY APPLICATION

- 4.5 ELECTRIC VEHICLE TIRES MARKET, BY RIM SIZE

- 4.6 ELECTRIC VEHICLE TIRES MARKET, BY LOAD INDEX

- 4.7 ELECTRIC VEHICLE TIRES MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Government initiatives for green and clean environment

- 5.2.1.2 Increasing demand to improve vehicle range

- 5.2.1.3 Increase in electric vehicle sales

- 5.2.2 RESTRAINTS

- 5.2.2.1 Lack of awareness regarding electric vehicle tires in emerging economies

- 5.2.2.2 Increased longevity of tires affecting aftermarket sales

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Development of smart and connected electric vehicle tires

- 5.2.3.2 Focus on environmental sustainability

- 5.2.4 CHALLENGES

- 5.2.4.1 High stress rates due to instant torque and vehicle weight

- 5.2.4.2 High cost and limited availability of electric vehicle tires

- 5.2.1 DRIVERS

- 5.3 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.6 REGULATORY LANDSCAPE

- 5.6.1 REGULATORY FRAMEWORK

- 5.6.2 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.6.2.1 North America

- 5.6.2.2 Europe

- 5.6.2.3 Asia Pacific

- 5.7 PRICING ANALYSIS

- 5.7.1 AVERAGE SELLING PRICE OF ELECTRIC VEHICLE TIRES FOR KEY PLAYERS, BY VEHICLE TYPE, 2024

- 5.7.2 AVERAGE SELLING PRICE OF ELECTRIC VEHICLE TIRES, BY REGION, 2024

- 5.8 TRADE ANALYSIS

- 5.8.1 IMPORT DATA (HS CODE 401110)

- 5.8.1.1 US

- 5.8.1.2 Germany

- 5.8.1.3 France

- 5.8.1.4 UK

- 5.8.1.5 Italy

- 5.8.1.6 Netherlands

- 5.8.1.7 Canada

- 5.8.2 EXPORT DATA (HS CODE 401110)

- 5.8.2.1 US

- 5.8.2.2 China

- 5.8.2.3 Mexico

- 5.8.2.4 Germany

- 5.8.2.5 Japan

- 5.8.2.6 Thailand

- 5.8.2.7 Sweden

- 5.8.1 IMPORT DATA (HS CODE 401110)

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Smart tires

- 5.9.1.2 Tread design

- 5.9.1.3 Structural Innovation: Sidewall reinforcement and puncture resistance

- 5.9.1.4 Smart Tire Integration: Sensor embedding and connectivity features

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.2.1 Run-flat tires

- 5.9.2.2 Connectivity technology

- 5.9.3 ADJACENT TECHNOLOGIES

- 5.9.3.1 3D-printed tires

- 5.9.3.2 Green tires

- 5.9.3.3 Compound Innovation: Silica-enhanced rubber formulations

- 5.9.1 KEY TECHNOLOGIES

- 5.10 PATENT ANALYSIS

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 CASE STUDY 1: MICHELIN AND PORSCHE PARTNERED TO MANUFACTURE HIGH-PERFORMANCE TIRES TAILORED FOR PORSCHE VEHICLES

- 5.11.2 CASE STUDY 2: BRIDGESTONE CORPORATION COLLABORATED WITH ARLANXEO AND SOLVAY TO LAUNCH CO-DEVELOPED TECHSYN TIRE TECHNOLOGY TO BOOST ENVIRONMENTAL PERFORMANCE

- 5.11.3 CASE STUDY 3: BRIDGESTONE CORPORATION DEVELOPED TIRES FOR BMW IX ELECTRIC SUV

- 5.11.4 CASE STUDY 4: PIRELLI & C. SPA DEVELOPED SPECIAL TIRE FOR LUCID AIR DREAM EDITION

- 5.11.5 CASE STUDY 5: GOODYEAR TIRE & RUBBER COMPANY DEVELOPED RANGEMAX RSD TIRES WITH LOW ROLLING RESISTANCE

- 5.12 INVESTMENT & FUNDING SCENARIO

- 5.13 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.13.2 BUYING CRITERIA

- 5.14 KEY CONFERENCES & EVENTS, 2025-2026

- 5.15 IMPACT OF AI/GEN AI

- 5.16 INSIGHTS INTO MATERIALS USED FOR ELECTRIC VEHICLE TIRES

- 5.16.1 SILICA

- 5.16.2 SYNTHETIC RUBBER

- 5.16.3 STEEL BELTS

- 5.16.4 NYLON

- 5.17 INSIGHTS INTO ELECTRIC VEHICLE TIRE OFFERINGS AND STRATEGIES

- 5.17.1 ELECTRIC VEHICLE TIRE OFFERINGS, BY KEY PLAYER

- 5.17.2 ELECTRIC VEHICLE TIRE STRATEGIES, BY KEY OEM

- 5.17.3 NEXT-GENERATION ELECTRIC VEHICLE TIRE TECHNOLOGIES

- 5.18 ELECTRIC VEHICLE TIRES VS. INTERNAL COMBUSTION ENGINE TIRES: MARGIN ANALYSIS

- 5.19 IMPACT OF AUTONOMOUS VEHICLES ON ELECTRIC VEHICLE TIRES

- 5.19.1 SELF-HEALING TIRE TECHNOLOGIES

- 5.19.2 PREDICTIVE MAINTENANCE THROUGH SMART SENSORS

- 5.19.3 RUN-FLAT TIRE AND EXTENDED MOBILITY DESIGN

- 5.19.4 LOW ROLLING RESISTANCE AND ACOUSTIC COMFORT

- 5.20 INSIGHTS INTO TIRE SELECTION AND SERVICE INNOVATION

- 5.20.1 DIGITAL TIRE SELECTION: AI-POWERED TIRE RECOMMENDATION SYSTEMS

- 5.20.2 INSTALLATION SERVICES: MOBILE TIRE INSTALLATION AND CONVENIENCE

- 5.20.3 PERFORMANCE MONITORING: REAL-TIME TIRE HEALTH AND EFFICIENCY TRACKING

- 5.20.4 LOYALTY PROGRAMS: SUBSCRIPTION MODELS AND REPEAT PURCHASE INCENTIVES

6 ELECTRIC VEHICLE TIRES MARKET, BY VEHICLE TYPE

- 6.1 INTRODUCTION

- 6.2 PASSENGER CARS

- 6.2.1 INCREASING SPENDING POWER OF CONSUMERS AND SALES OF PRIVATELY OWNED PASSENGER CARS TO DRIVE MARKET

- 6.3 LIGHT COMMERCIAL VEHICLES

- 6.3.1 GROWING NEED FOR REDUCING OPERATING COST OF COMMERCIAL VEHICLES TO DRIVE MARKET

- 6.4 HEAVY COMMERCIAL VEHICLES

- 6.4.1 RISING TRANSPORTATION OF SUSTAINABLE GOODS TO DRIVE MARKET

- 6.5 BUSES

- 6.5.1 ELECTRIFICATION OF PUBLIC TRANSPORT TO DRIVE MARKET

- 6.6 KEY INDUSTRY INSIGHTS

7 ELECTRIC VEHICLE TIRES MARKET, BY PROPULSION TYPE

- 7.1 INTRODUCTION

- 7.2 BATTERY ELECTRIC VEHICLE (BEV)

- 7.2.1 GROWING INVESTMENTS BY OEMS IN R&D TO DRIVE MARKET

- 7.3 PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV)

- 7.3.1 REDUCTION IN VEHICLE OWNERSHIP TAX AND INCREASED CHARGING-BASED INCENTIVES TO DRIVE MARKET

- 7.4 FUEL CELL ELECTRIC VEHICLE (FCEV)

- 7.4.1 FOCUS ON EXPANDING HYDROGEN REFUELING INFRASTRUCTURE TO DRIVE MARKET

- 7.5 HYBRID ELECTRIC VEHICLE (HEV)

- 7.5.1 AFFORDABLE PRICES OF HEVS TO DRIVE MARKET GROWTH

- 7.6 KEY INDUSTRY INSIGHTS

8 ELECTRIC VEHICLE TIRES MARKET, BY RIM SIZE

- 8.1 INTRODUCTION

- 8.2 13-15"

- 8.2.1 RISING SALES OF SMALL AND MID-SIZED ELECTRIC PASSENGER CARS TO DRIVE MARKET

- 8.3 16-18"

- 8.3.1 EXPANDING LOGISTICS INDUSTRY TO DRIVE MARKET

- 8.4 19-21"

- 8.4.1 GROWING DEMAND FOR SPORTS AND LUXURY PASSENGER CARS TO DRIVE MARKET

- 8.5 > 21"

- 8.5.1 INCREASE IN NUMBER OF CONSTRUCTION PROJECTS AND ADOPTION OF ELECTRIC BUSES TO DRIVE MARKET

- 8.6 KEY INDUSTRY INSIGHTS

9 ELECTRIC VEHICLE TIRES MARKET, BY LOAD INDEX

- 9.1 INTRODUCTION

- 9.2 LESS THAN 100

- 9.2.1 INCREASING SALES OF ELECTRIC AND HYBRID SMALL PASSENGER CARS TO DRIVE MARKET

- 9.3 ABOVE 100

- 9.3.1 GROWING DEMAND FOR ELECTRIC LUXURY CARS AND SUVS TO DRIVE MARKET

- 9.4 KEY INDUSTRY INSIGHTS

10 ELECTRIC VEHICLE TIRES MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- 10.2 ON-ROAD

- 10.2.1 RISING ADOPTION OF ELECTRIC BUSES TO DRIVE MARKET

- 10.3 OFF-ROAD

- 10.3.1 GROWING AVAILABILITY OF ELECTRIC TRUCKS TO DRIVE MARKET

- 10.4 KEY INDUSTRY INSIGHTS

11 ELECTRIC VEHICLE TIRES MARKET, BY SALES CHANNEL

- 11.1 INTRODUCTION

- 11.2 OEM

- 11.2.1 INCREASING PREFERENCE OF CONSUMERS FOR SPECIALLY DEVELOPED TIRES FOR ELECTRIC VEHICLES TO DRIVE MARKET

- 11.3 AFTERMARKET

- 11.3.1 SURGE IN DEMAND FOR AFTERMARKET DRIVEN BY ELECTRIFICATION AND USAGE PATTERNS

- 11.4 KEY INDUSTRY INSIGHTS

12 ELECTRIC VEHICLE TIRES MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 ASIA PACIFIC

- 12.2.1 MACROECONOMIC OUTLOOK

- 12.2.2 CHINA

- 12.2.2.1 Initiatives like 'Preferential vehicle licensing system' and 'Made in China' to drive market

- 12.2.3 JAPAN

- 12.2.3.1 Growing domestic automobile manufacturing to drive market

- 12.2.4 INDIA

- 12.2.4.1 Rising disposable income and affordable electric vehicle models to drive market

- 12.2.5 SOUTH KOREA

- 12.2.5.1 Growing investments in electric vehicles to drive market

- 12.2.6 THAILAND

- 12.2.6.1 Increasing tax rebates and subsidies to drive market

- 12.2.7 INDONESIA

- 12.2.7.1 Declining battery cost and increasing consumer awareness to drive market

- 12.2.8 MALAYSIA

- 12.2.8.1 Initiatives undertaken by global leaders in battery electric vehicles to drive market

- 12.2.9 VIETNAM

- 12.2.9.1 Focus on setting up new manufacturing plants to drive market

- 12.3 EUROPE

- 12.3.1 MACROECONOMIC OUTLOOK

- 12.3.2 FRANCE

- 12.3.2.1 Growing incentives to promote eco-friendly vehicles to drive market

- 12.3.3 GERMANY

- 12.3.3.1 Increasing penetration of electric passenger cars to drive market

- 12.3.4 NETHERLANDS

- 12.3.4.1 Growing demand for sustainable transportation to drive market

- 12.3.5 NORWAY

- 12.3.5.1 Government incentives and tax rebates to drive market

- 12.3.6 SWEDEN

- 12.3.6.1 Growing initiatives for vehicle electrification to drive market

- 12.3.7 UK

- 12.3.7.1 Increasing government investments to drive market

- 12.3.8 AUSTRIA

- 12.3.8.1 Rising demand for passenger and commercial electric vehicles to drive market

- 12.3.9 SPAIN

- 12.3.9.1 Growing implementation of subsidy schemes to drive market

- 12.3.10 SWITZERLAND

- 12.3.10.1 Increasing focus on reducing carbon footprint to drive market

- 12.3.11 DENMARK

- 12.3.11.1 Rising adoption of electric fleets by taxi companies to drive market

- 12.4 NORTH AMERICA

- 12.4.1 MACROECONOMIC OUTLOOK

- 12.4.2 US

- 12.4.2.1 Use of electric vehicles for construction, landscaping, and delivery services to drive market

- 12.4.3 CANADA

- 12.4.3.1 Awareness regarding benefits of electric vehicles and favorable trade agreements to drive market

- 12.5 MIDDLE EAST & AFRICA

- 12.5.1 MACROECONOMIC OUTLOOK

- 12.5.2 SOUTH AFRICA

- 12.5.2.1 Policy support and commercial electric vehicle uptake to drive innovation

- 12.5.3 IRAN

- 12.5.3.1 Push for domestic electrification amid sanction-induced innovation to drive market

13 COMPETITIVE LANDSCAPE

- 13.1 INTRODUCTION

- 13.2 KEY PLAYER STRATEGIES /RIGHT TO WIN

- 13.3 MARKET SHARE ANALYSIS

- 13.4 REVENUE ANALYSIS, 2020-2024

- 13.5 COMPANY VALUATION

- 13.6 FINANCIAL METRICS

- 13.7 BRAND/PRODUCT COMPARISON

- 13.8 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.8.1 STARS

- 13.8.2 EMERGING LEADERS

- 13.8.3 PERVASIVE PLAYERS

- 13.8.4 PARTICIPANTS

- 13.8.5 COMPANY FOOTPRINT

- 13.8.5.1 Company footprint

- 13.8.5.2 Vehicle type footprint

- 13.8.5.3 Propulsion type footprint

- 13.8.5.4 Region Footprint

- 13.9 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.9.1 PROGRESSIVE COMPANIES

- 13.9.2 RESPONSIVE COMPANIES

- 13.9.3 DYNAMIC COMPANIES

- 13.9.4 STARTING BLOCKS

- 13.9.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 13.9.5.1 List of key startups/SMEs

- 13.9.5.2 Competitive benchmarking of startups/SMEs

- 13.10 COMPETITIVE SCENARIO

- 13.10.1 PRODUCT LAUNCHES/DEVELOPMENTS

- 13.10.2 DEALS

- 13.10.3 EXPANSIONS

- 13.10.4 OTHER DEVELOPMENTS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 MICHELIN

- 14.1.1.1 Business overview

- 14.1.1.2 Products offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Product launches/developments

- 14.1.1.3.2 Deals

- 14.1.1.3.3 Other developments

- 14.1.1.4 MnM view

- 14.1.1.4.1 Key strengths

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses and competitive threats

- 14.1.2 BRIDGESTONE CORPORATION

- 14.1.2.1 Business overview

- 14.1.2.2 Products offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Product launches/developments

- 14.1.2.3.2 Deals

- 14.1.2.3.3 Other developments

- 14.1.2.4 MnM view

- 14.1.2.4.1 Key strengths

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses and competitive threats

- 14.1.3 THE GOODYEAR TIRE & RUBBER COMPANY

- 14.1.3.1 Business overview

- 14.1.3.2 Products offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Product launches/developments

- 14.1.3.3.2 Deals

- 14.1.3.3.3 Other developments

- 14.1.3.4 MnM view

- 14.1.3.4.1 Key strengths

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses and competitive threats

- 14.1.4 CONTINENTAL AG

- 14.1.4.1 Business overview

- 14.1.4.2 Products offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Product launches/developments

- 14.1.4.3.2 Other developments

- 14.1.4.4 MnM view

- 14.1.4.4.1 Key strengths

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses and competitive threats

- 14.1.5 PIRELLI & C. S.P.A.

- 14.1.5.1 Business overview

- 14.1.5.2 Products offered

- 14.1.5.3 Recent developments

- 14.1.5.3.1 Product launches/developments

- 14.1.5.3.2 Deals

- 14.1.5.3.3 Expansions

- 14.1.5.3.4 Other developments

- 14.1.5.4 MnM view

- 14.1.5.4.1 Key strengths

- 14.1.5.4.2 Strategic choices

- 14.1.5.4.3 Weaknesses and competitive threats

- 14.1.6 SUMITOMO RUBBER INDUSTRIES, LTD.

- 14.1.6.1 Business overview

- 14.1.6.2 Products offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Product launches/developments

- 14.1.6.3.2 Deals

- 14.1.6.3.3 Expansions

- 14.1.6.3.4 Other developments

- 14.1.7 HANKOOK TIRE & TECHNOLOGY

- 14.1.7.1 Business overview

- 14.1.7.2 Products offered

- 14.1.7.3 Recent developments

- 14.1.7.3.1 Product launches/developments

- 14.1.7.3.2 Deals

- 14.1.7.3.3 Expansions

- 14.1.7.3.4 Other developments

- 14.1.8 NOKIAN TYRES PLC

- 14.1.8.1 Business overview

- 14.1.8.2 Products offered

- 14.1.8.3 Recent developments

- 14.1.8.3.1 Product launches/developments

- 14.1.8.3.2 Deals

- 14.1.8.3.3 Expansions

- 14.1.9 KUMHO TIRE CO., INC.

- 14.1.9.1 Business overview

- 14.1.9.2 Products offered

- 14.1.9.3 Recent developments

- 14.1.9.3.1 Product launches/developments

- 14.1.9.3.2 Deals

- 14.1.9.3.3 Expansions

- 14.1.9.3.4 Other developments

- 14.1.10 ZHONGCE RUBBER GROUP CO., LTD.

- 14.1.10.1 Business overview

- 14.1.10.2 Products offered

- 14.1.10.3 Recent developments

- 14.1.10.3.1 Product launches/developments

- 14.1.10.3.2 Expansions

- 14.1.10.3.3 Other developments

- 14.1.1 MICHELIN

- 14.2 OTHER PLAYERS

- 14.2.1 SAILUN GROUP CO., LTD.

- 14.2.2 CHENG SHIN RUBBER INDUSTRY CO., LTD. (CST)

- 14.2.3 APOLLO TYRES

- 14.2.4 SHANDONG LINGLONG TYRE CO., LTD.

- 14.2.5 GITI TIRE

- 14.2.6 THE YOKOHAMA RUBBER CO., LTD.

- 14.2.7 NEXEN TIRE

- 14.2.8 TOYO TIRE CORPORATION

- 14.2.9 CEAT LIMITED

- 14.2.10 BALKRISHNA INDUSTRIES LIMITED (BKT)

- 14.2.11 KENDA TIRES

15 RECOMMENDATIONS BY MARKETSANDMARKETS

- 15.1 ASIA PACIFIC TO BE LARGEST MARKET FOR ELECTRIC VEHICLE TIRES

- 15.2 TIRE MANUFACTURERS PREFER HIGH-PERFORMANCE ELECTRIC VEHICLE TIRES

- 15.3 CONCLUSION

16 APPENDIX

- 16.1 KEY INSIGHTS FROM INDUSTRY EXPERTS

- 16.2 DISCUSSION GUIDE

- 16.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.4 CUSTOMIZATION OPTIONS

- 16.5 RELATED REPORTS

- 16.6 AUTHOR DETAILS