|

|

市場調査レポート

商品コード

1782038

加工キャッサバでんぷんの世界市場:製品タイプ別、形態別、用途別、加工タイプ別、機能別、地域別 - 予測(~2030年)Modified Cassava Starch Market by Product Type (Pre-Gelatinized Starches, Extruded Cassava Starch, Dextrinized Starches, Maltodextrins, Fermented Cassava Starch), Form, Application, Type of Modification, Function, and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 加工キャッサバでんぷんの世界市場:製品タイプ別、形態別、用途別、加工タイプ別、機能別、地域別 - 予測(~2030年) |

|

出版日: 2025年07月23日

発行: MarketsandMarkets

ページ情報: 英文 341 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

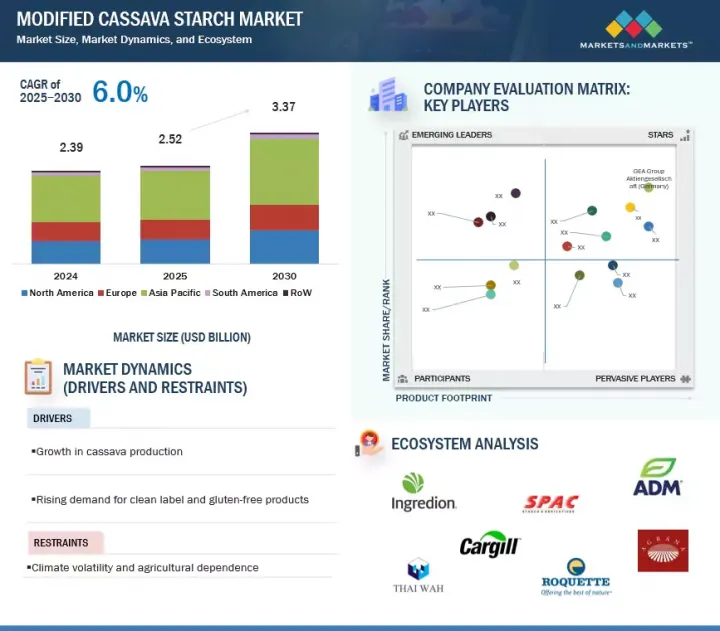

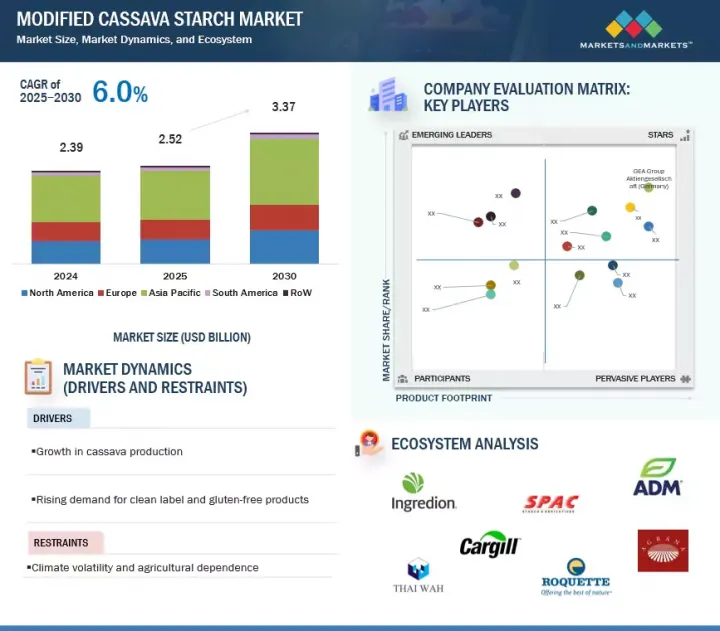

世界の加工キャッサバでんぷんの市場規模は、2025年の25億2,000万米ドルから2030年までに33億7,000万米ドルに達すると予測され、予測期間にCAGRで6.0%の成長が見込まれます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2025年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 単位 | 金額(米ドル)、数量(トン) |

| セグメント | 製品タイプ、形態、加工タイプ、機能、用途、地域 |

| 対象地域 | 北米、欧州、アジア太平洋、南米、その他の地域 |

加工キャッサバでんぷんは、伝統的な原材料と現代産業の高まる需要を結びつける重要な原材料として機能します。その汎用性と多くの用途にわたる性能により、食品と化学の両部門における技術革新の重要な促進要因となっています。産業界が環境にやさしく費用対効果の高いソリューションを求める中、この原料は世界中で好まれる選択肢となりつつあります。世界の優先付けがより高い持続可能性と業務効率へとシフトするにつれて、これらの産業の未来を形作る上で、加工キャッサバでんぷんの重要性はさらに高まると予測されます。

さらに、環境にやさしい生分解性の材料を開発するために加工タピオカでんぷんを使用する動向が強まっています。プラスチック廃棄物に対する世界の懸念が高まる中、加工キャッサバでんぷんは生分解性プラスチックや包装用皮膜の生産に用いる持続可能な原材料として人気を集めています。このシフトは、技術の進歩、活気ある消費者需要、でんぷんの利用の拡大により、世界の加工キャッサバでんぷん市場の力強い拡大に拍車をかけています。

「アルファ化でんぷんセグメントが大きな市場シェアを占めます。」

アルファ化キャッサバでんぷんが加工キャッサバでんぷん市場で大きなシェアを占めているのは、即溶性、使いやすさ、幅広い用途といった特性のためです。加熱せずに冷水で膨張するため、インスタントスープ、ソース、ベーカリーミックス、ベビーフードなど、迅速な調理と安定した食感が不可欠なコンビニエンスフードに最適です。そのクリーンラベルとグルテンフリーの特徴は、天然材料やアレルゲンフリー材料への需要の高まりにマッチしています。食品・飲料部門以外では、医薬品のバインダーとして機能したり、化粧品の質感を向上させたり、皮膜形成や結合を目的として製紙や接着剤で使用されたりしています。さらに、多くの化学加工でんぷんよりも安価であり、一般的に物理的加工または天然加工に分類されます。そのため、健康志向で価格を重視する消費者にとって魅力的です。これらの利点は総体的に、加工キャッサバでんぷん市場における強力なプレゼンスと成長に寄与しています。

「加工キャッサバの工業用途が予測期間に著しい速度で成長する見込みです。」

でんぷんには幅広い商業・工業用途があります。加工キャッサバでんぷん製品は、紙・コーン紙産業、糊・接着剤産業、医薬品、化粧品、その他のさまざまな関連部門で使用されています。これらの加工でんぷんブレンドは、壁板の縁の接着剤としての役割を果たすことができます。世界の加工でんぷんの利用は着実に拡大しています。所得水準が上昇し工業化が進んでいるアジア諸国では、食品用途に加えて、こうした非食品用途にも加工でんぷんが多く使用されています。医薬品では、加工キャッサバでんぷんは錠剤を固形に保ち、内服薬の有効成分の迅速な放出を促進するために使用されます。環境問題への懸念と規制圧力の高まりは、石油ベースの材料に代わる新しい生分解性で再生可能な代替材料を求めており、キャッサバでんぷんは魅力的で持続可能な選択肢として浮上しています。豊富な供給、安定したサプライチェーン、低いコスト(特に熱帯地域)が、キャッサバでんぷんの広範な産業利用を支えています。

当レポートでは、世界の加工キャッサバでんぷん市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要な知見

- 加工キャッサバでんぷん市場における魅力的な機会

- アジア太平洋の加工キャッサバでんぷん市場:主要用途別、国別

- 加工キャッサバでんぷん市場:国別

- 加工キャッサバでんぷん市場:加工タイプ別

- 加工キャッサバでんぷん市場:製品タイプ別

- 加工キャッサバでんぷん市場:形態別

- 加工キャッサバでんぷん市場:用途別

第5章 市場の概要

- イントロダクション

- マクロ経済の見通し

- 加工食品の需要の増加

- 都市人口の増加

- キャッサバ生産の増加

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 加工キャッサバでんぷん市場に対する生成AIの影響

- イントロダクション

- 加工キャッサバでんぷん市場における生成AIの利用

- ケーススタディ分析

- 加工キャッサバでんぷん市場に対する影響

- 生成AIに取り組む隣接エコシステム

第6章 産業動向

- イントロダクション

- バリューチェーン分析

- 調達

- 前処理と準備

- でんぷんの加工

- 後処理と乾燥

- 包装と品質認証

- マーケティング、販売、ロジスティクス

- エンドユーザー統合と用途

- 貿易分析

- 輸出シナリオ

- 輸入シナリオ

- サプライチェーン分析

- 技術分析

- 物理的方法

- 化学的方法

- 酵素法

- 主要技術

- 補完技術

- 隣接技術

- 価格分析

- 主要企業の平均販売価格:加工タイプ別

- 平均販売価格の動向:地域別

- エコシステム分析

- デマンドサイド

- サプライサイド

- カスタマービジネスに影響を与える動向/混乱

- 特許分析

- 主な会議とイベント(2025年~2026年)

- 規制情勢

- 規制機関、政府機関、その他の組織

- 規制枠組み

- 北米

- アジア太平洋

- 南米

- その他の地域

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- ケーススタディ分析

- 投資と資金調達のシナリオ

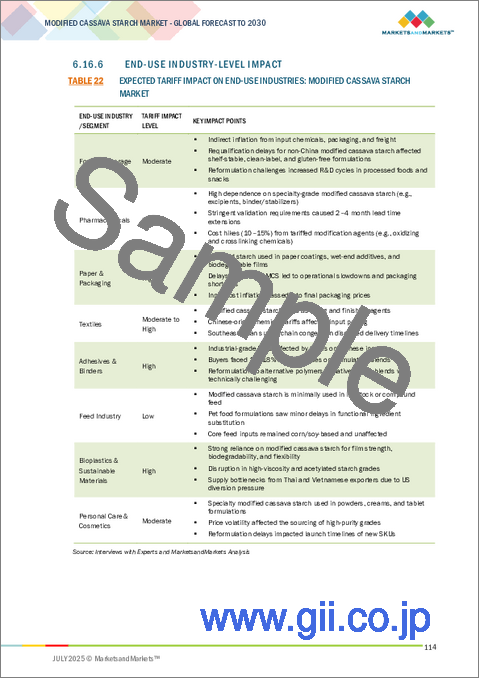

- 加工キャッサバでんぷん市場に対する関税の影響

- イントロダクション

- 主な関税率

- 加工キャッサバでんぷん市場の混乱

- 価格の影響の分析

- さまざまな地域への主な影響

- 最終用途産業レベルの影響

第7章 加工キャッサバでんぷんの市場:用途別

- イントロダクション

- 食品・飲料

- 飼料

- 工業

第8章 加工キャッサバでんぷん市場:形態別

- イントロダクション

- 乾燥

- 液体

第9章 加工キャッサバでんぷん市場:機能別

- イントロダクション

- 増粘剤

- 安定剤

- ゼラチン化

- 皮膜形成剤

- 結合剤

- その他の機能

第10章 加工キャッサバでんぷん市場:製品タイプ別

- イントロダクション

- アルファ化でんぷん

- 押出キャッサバでんぷん

- デキストリン化でんぷん

- マルトデキストリン

- 発酵キャッサバでんぷん

- その他の加工製品

第11章 加工キャッサバでんぷん市場:加工タイプ別

- イントロダクション

- 物理的加工

- 化学的加工

- 酵素加工

第12章 加工キャッサバでんぷん市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- その他の欧州

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリア・ニュージーランド

- 韓国

- タイ

- ベトナム

- インドネシア

- その他のアジア太平洋

- 南米

- ブラジル

- アルゼンチン

- その他の南米

- その他の地域

- 南アフリカ

- 中東

- その他のアフリカ

第13章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 収益分析(2020年~2024年)

- 市場シェア分析(2024年)

- 企業の評価と財務マトリクス

- ブランド/製品の比較

- ADM

- CARGILL, INCORPORATED

- INGREDION

- ROQUETTE FRERES

- THAI WAH PUBLIC COMPANY LIMITED

- 企業の評価マトリクス:主要企業(2024年)

- 企業の評価マトリクス:スタートアップ/中小企業(2024年)

- 競合シナリオと動向

第14章 企業プロファイル

- 主要企業

- ADM

- CARGILL, INCORPORATED

- ROQUETTE FRERES

- INGREDION

- THAI WAH

- AGRANA

- BANPONG TAPIOCA

- SONISH STARCH TECHNOLOGY

- BS STARCH CHEMICAL

- VEDAN ENTERPRISE CORPORATION

- ASIA MODIFIED STARCH CO., LTD.

- SPAC STARCH PRODUCTS INDIA PVT. LTD.

- SMS CORPORATION

- BENEVA

- VIETNAM TAPIOCA STARCH SOLUTIONS-VIEGO GLOBAL

- NEO NAM VIET CO., LTD.

- STARCH ASIA

- GENERAL STARCH LIMITED

- RVP STARCH PRODUCTS PVT. LTD.

- EXPORTVN COMPANY LIMITED

- VENUS STARCH INDUSTRIES

- NGUYEN STARCH

- PT. STARCH SOLUTION INTERNASIONAL

- BENZSON CORPORATION

- VARALAKSHMI STARCH INDUSTRIES(P)LTD

- PURA ORGANIC AGRO TECH LTD

第15章 隣接市場と関連市場

- イントロダクション

- 制限事項

- エンドウ豆でんぷん市場

- 市場の定義

- 市場の概要

- ジャガイモでんぷん市場

- 市場の定義

- 市場の概要

- 加工でんぷん市場

- 市場の定義

- 市場の概要

第16章 付録

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2020-2024

- TABLE 2 MODIFIED CASSAVA STARCH MARKET SNAPSHOT, 2025 VS. 2030

- TABLE 3 TOP 10 EXPORTERS OF HS CODE 110814, 2020-2024 (USD THOUSAND)

- TABLE 4 TOP 10 EXPORTERS OF HS CODE 110814, 2020-2024 (TONS)

- TABLE 5 TOP 10 IMPORTERS OF HS CODE 110814, 2020-2024 (USD THOUSAND)

- TABLE 6 TOP 10 IMPORTERS OF HS CODE 110814, 2020-2024 (TONS)

- TABLE 7 AVERAGE SELLING PRICE OF MODIFIED CASSAVA STARCH AMONG MARKET PLAYERS, BY TYPE OF MODIFICATION, 2024 (USD/TON)

- TABLE 8 AVERAGE SELLING PRICE TREND, BY REGION, 2020-2024 (USD/TON)

- TABLE 9 MODIFIED CASSAVA STARCH MARKET: ECOSYSTEM

- TABLE 10 LIST OF MAJOR PATENTS PERTAINING TO MODIFIED CASSAVA STARCH MARKET, 2020-2025

- TABLE 11 MODIFIED CASSAVA STARCH MARKET: KEY DETAILED LIST OF CONFERENCES AND EVENTS, 2025-2026

- TABLE 12 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 IMPACT OF PORTER'S FIVE FORCES ON MODIFIED CASSAVA STARCH MARKET

- TABLE 18 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR MODIFIED CASSAVA STARCH MARKET

- TABLE 19 KEY BUYING CRITERIA FOR DIFFERENT APPLICATIONS OF MODIFIED CASSAVA STARCH MARKET

- TABLE 20 US: ADJUSTED RECIPROCAL TARIFF RATES, 2024

- TABLE 21 EXPECTED IMPACT LEVEL ON TARGET INGREDIENTS WITH RELEVANT HS CODES DUE TO TRUMP TARIFFS

- TABLE 22 EXPECTED TARIFF IMPACT ON END-USE INDUSTRIES: MODIFIED CASSAVA STARCH MARKET

- TABLE 23 MODIFIED CASSAVA STARCH MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 24 MODIFIED CASSAVA STARCH MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 25 MODIFIED CASSAVA STARCH MARKET, BY APPLICATION, 2020-2024 (TONS)

- TABLE 26 MODIFIED CASSAVA STARCH MARKET, BY APPLICATION, 2025-2030 (TONS)

- TABLE 27 FOOD & BEVERAGES: MODIFIED CASSAVA STARCH MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 28 FOOD & BEVERAGES: MODIFIED CASSAVA STARCH MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 29 FOOD & BEVERAGES: MODIFIED CASSAVA STARCH MARKET, BY REGION, 2020-2024 (TONS)

- TABLE 30 FOOD & BEVERAGES: MODIFIED CASSAVA STARCH MARKET, BY REGION, 2025-2030 (TONS)

- TABLE 31 FOOD & BEVERAGES: MODIFIED CASSAVA STARCH MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 32 FOOD & BEVERAGES: MODIFIED CASSAVA STARCH MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 33 BAKERY: MODIFIED CASSAVA STARCH MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 34 BAKERY: MODIFIED CASSAVA STARCH MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 35 CONFECTIONERY: MODIFIED CASSAVA STARCH MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 36 CONFECTIONERY: MODIFIED CASSAVA STARCH MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 37 BEVERAGES: MODIFIED CASSAVA STARCH MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 38 BEVERAGES: MODIFIED CASSAVA STARCH MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 39 SNACKS: MODIFIED CASSAVA STARCH MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 40 SNACKS: MODIFIED CASSAVA STARCH MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 41 OTHER FOOD & BEVERAGES: MODIFIED CASSAVA STARCH MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 42 OTHER FOOD & BEVERAGES: MODIFIED CASSAVA STARCH MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 43 FEED: MODIFIED CASSAVA STARCH MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 44 FEED: MODIFIED CASSAVA STARCH MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 45 FEED: MODIFIED CASSAVA STARCH MARKET, BY REGION, 2020-2024 (TONS)

- TABLE 46 FEED: MODIFIED CASSAVA STARCH MARKET, BY REGION, 2025-2030 (TONS)

- TABLE 47 FEED: MODIFIED CASSAVA STARCH MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 48 FEED: MODIFIED CASSAVA STARCH MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 49 RUMINANT FEED: MODIFIED CASSAVA STARCH MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 50 RUMINANT FEED: MODIFIED CASSAVA STARCH MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 51 SWINE FEED: MODIFIED CASSAVA STARCH MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 52 SWINE FEED: MODIFIED CASSAVA STARCH MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 53 POULTRY FEED: MODIFIED CASSAVA STARCH MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 54 POULTRY FEED: MODIFIED CASSAVA STARCH MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 55 OTHER FEED APPLICATIONS: MODIFIED CASSAVA STARCH MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 56 OTHER FEED APPLICATIONS: MODIFIED CASSAVA STARCH MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 57 INDUSTRIAL: MODIFIED CASSAVA STARCH MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 58 INDUSTRIAL: MODIFIED CASSAVA STARCH MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 59 INDUSTRIAL: MODIFIED CASSAVA STARCH MARKET, BY REGION, 2020-2024 (TONS)

- TABLE 60 INDUSTRIAL: MODIFIED CASSAVA STARCH MARKET, BY REGION, 2025-2030 (TONS)

- TABLE 61 INDUSTRIAL: MODIFIED CASSAVA STARCH MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 62 INDUSTRIAL: MODIFIED CASSAVA STARCH MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 63 PAPERMAKING: MODIFIED CASSAVA STARCH MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 64 PAPERMAKING: MODIFIED CASSAVA STARCH MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 65 WEAVING & TEXTILES: MODIFIED CASSAVA STARCH MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 66 WEAVING & TEXTILES: MODIFIED CASSAVA STARCH MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 67 MEDICINES & PHARMACEUTICALS: MODIFIED CASSAVA STARCH MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 68 MEDICINES & PHARMACEUTICALS: MODIFIED CASSAVA STARCH MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 69 COSMETICS: MODIFIED CASSAVA STARCH MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 70 COSMETICS: MODIFIED CASSAVA STARCH MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 71 OTHER INDUSTRIAL APPLICATIONS: MODIFIED CASSAVA STARCH MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 72 OTHER INDUSTRIAL APPLICATIONS: MODIFIED CASSAVA STARCH MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 73 MODIFIED CASSAVA STARCH MARKET, BY FORM, 2020-2024 (USD MILLION)

- TABLE 74 MODIFIED CASSAVA STARCH MARKET, BY FORM, 2025-2030 (USD MILLION)

- TABLE 75 MODIFIED CASSAVA STARCH MARKET, BY FORM, 2020-2024 (TONS)

- TABLE 76 MODIFIED CASSAVA STARCH MARKET, BY FORM, 2025-2030 (TONS)

- TABLE 77 DRY: MODIFIED CASSAVA STARCH MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 78 DRY: MODIFIED CASSAVA STARCH MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 79 DRY: MODIFIED CASSAVA STARCH MARKET, BY REGION, 2020-2024 (TONS)

- TABLE 80 DRY: MODIFIED CASSAVA STARCH MARKET, BY REGION, 2025-2030 (TONS)

- TABLE 81 LIQUID: MODIFIED CASSAVA STARCH MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 82 LIQUID: MODIFIED CASSAVA STARCH MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 83 LIQUID: MODIFIED CASSAVA STARCH MARKET, BY REGION, 2020-2024 (TONS)

- TABLE 84 LIQUID: MODIFIED CASSAVA STARCH MARKET, BY REGION, 2025-2030 (TONS)

- TABLE 85 MODIFIED CASSAVA STARCH MARKET, BY PRODUCT TYPE, 2020-2024 (USD MILLION)

- TABLE 86 MODIFIED CASSAVA STARCH MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 87 MODIFIED CASSAVA STARCH MARKET, BY PRODUCT TYPE, 2020-2024 (TONS)

- TABLE 88 MODIFIED CASSAVA STARCH MARKET, BY PRODUCT TYPE, 2025-2030 (TONS)

- TABLE 89 PRE-GELATINIZED STARCHES: MODIFIED CASSAVA STARCH MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 90 PRE-GELATINIZED STARCHES: MODIFIED CASSAVA STARCH MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 91 PRE-GELATINIZED STARCHES: MODIFIED CASSAVA STARCH MARKET, BY REGION, 2020-2024 (TONS)

- TABLE 92 PRE-GELATINIZED STARCHES: MODIFIED CASSAVA STARCH MARKET, BY REGION, 2025-2030 (TONS)

- TABLE 93 EXTRUDED CASSAVA STARCH: MODIFIED CASSAVA STARCH MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 94 EXTRUDED CASSAVA STARCH: MODIFIED CASSAVA STARCH MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 95 EXTRUDED CASSAVA STARCH: MODIFIED CASSAVA STARCH MARKET, BY REGION, 2020-2024 (TONS)

- TABLE 96 EXTRUDED CASSAVA STARCH: MODIFIED CASSAVA STARCH MARKET, BY REGION, 2025-2030 (TONS)

- TABLE 97 EXTRUDED CASSAVA STARCH MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 98 EXTRUDED CASSAVA STARCH MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 99 SNACKS: EXTRUDED CASSAVA STARCH MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 100 SNACKS: EXTRUDED CASSAVA STARCH MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 101 INSTANT SOUPS: EXTRUDED CASSAVA STARCH MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 102 INSTANT SOUPS: EXTRUDED CASSAVA STARCH MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 103 SAUCES: EXTRUDED CASSAVA STARCH MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 104 SAUCES: EXTRUDED CASSAVA STARCH MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 105 FEED: EXTRUDED CASSAVA STARCH MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 106 FEED: EXTRUDED CASSAVA STARCH MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 107 OTHER APPLICATIONS: EXTRUDED CASSAVA STARCH MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 108 OTHER APPLICATIONS: EXTRUDED CASSAVA STARCH MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 109 DEXTRINIZED STARCHES: MODIFIED CASSAVA STARCH MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 110 DEXTRINIZED STARCHES: MODIFIED CASSAVA STARCH MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 111 DEXTRINIZED STARCHES: MODIFIED CASSAVA STARCH MARKET, BY REGION, 2020-2024 (TONS)

- TABLE 112 DEXTRINIZED STARCHES: MODIFIED CASSAVA STARCH MARKET, BY REGION, 2025-2030 (TONS)

- TABLE 113 MALTODEXTRINS: MODIFIED CASSAVA STARCH MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 114 MALTODEXTRINS: MODIFIED CASSAVA STARCH MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 115 MALTODEXTRINS: MODIFIED CASSAVA STARCH MARKET, BY REGION, 2020-2024 (TONS)

- TABLE 116 MALTODEXTRINS: MODIFIED CASSAVA STARCH MARKET, BY REGION, 2025-2030 (TONS)

- TABLE 117 FERMENTED CASSAVA STARCH: MODIFIED CASSAVA STARCH MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 118 FERMENTED CASSAVA STARCH: MODIFIED CASSAVA STARCH MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 119 FERMENTED CASSAVA STARCH: MODIFIED CASSAVA STARCH MARKET, BY REGION, 2020-2024 (TONS)

- TABLE 120 FERMENTED CASSAVA STARCH: MODIFIED CASSAVA STARCH MARKET, BY REGION, 2025-2030 (TONS)

- TABLE 121 OTHER MODIFIED PRODUCTS: MODIFIED CASSAVA STARCH MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 122 OTHER MODIFIED PRODUCTS: MODIFIED CASSAVA STARCH MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 123 OTHER MODIFIED PRODUCTS: MODIFIED CASSAVA STARCH MARKET, BY REGION, 2020-2024 (TONS)

- TABLE 124 OTHER MODIFIED PRODUCTS: MODIFIED CASSAVA STARCH MARKET, BY REGION, 2025-2030 (TONS)

- TABLE 125 MODIFIED CASSAVA STARCH MARKET, BY TYPE OF MODIFICATION, 2020-2024 (USD MILLION)

- TABLE 126 MODIFIED CASSAVA STARCH MARKET, BY TYPE OF MODIFICATION, 2025-2030 (USD MILLION)

- TABLE 127 PHYSICAL MODIFICATION: MODIFIED CASSAVA STARCH MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 128 PHYSICAL MODIFICATION: MODIFIED CASSAVA STARCH MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 129 CHEMICAL MODIFICATION: MODIFIED CASSAVA STARCH MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 130 CHEMICAL MODIFICATION: MODIFIED CASSAVA STARCH MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 131 ENZYMATIC MODIFICATION: MODIFIED CASSAVA STARCH MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 132 ENZYMATIC MODIFICATION: MODIFIED CASSAVA STARCH MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 133 MODIFIED CASSAVA STARCH MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 134 MODIFIED CASSAVA STARCH MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 135 MODIFIED CASSAVA STARCH MARKET, BY REGION, 2020-2024 (TONS)

- TABLE 136 MODIFIED CASSAVA STARCH MARKET, BY REGION, 2025-2030 (TONS)

- TABLE 137 NORTH AMERICA: MODIFIED CASSAVA STARCH MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 138 NORTH AMERICA: MODIFIED CASSAVA STARCH MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 139 NORTH AMERICA: MODIFIED CASSAVA STARCH MARKET, BY COUNTRY, 2020-2024 (TONS)

- TABLE 140 NORTH AMERICA: MODIFIED CASSAVA STARCH MARKET, BY COUNTRY, 2025-2030 (TONS)

- TABLE 141 NORTH AMERICA: MODIFIED CASSAVA STARCH MARKET, BY TYPE OF MODIFICATION, 2020-2024 (USD MILLION)

- TABLE 142 NORTH AMERICA: MODIFIED CASSAVA STARCH MARKET, BY TYPE OF MODIFICATION, 2025-2030 (USD MILLION)

- TABLE 143 NORTH AMERICA: MODIFIED CASSAVA STARCH MARKET, BY FORM, 2020-2024 (USD MILLION)

- TABLE 144 NORTH AMERICA: MODIFIED CASSAVA STARCH MARKET, BY FORM, 2025-2030 (USD MILLION)

- TABLE 145 NORTH AMERICA: MODIFIED CASSAVA STARCH MARKET, BY FORM, 2020-2024 (TONS)

- TABLE 146 NORTH AMERICA: MODIFIED CASSAVA STARCH MARKET, BY FORM, 2025-2030 (TONS)

- TABLE 147 NORTH AMERICA: MODIFIED CASSAVA STARCH MARKET, BY PRODUCT TYPE, 2020-2024 (USD MILLION)

- TABLE 148 NORTH AMERICA: MODIFIED CASSAVA STARCH MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 149 NORTH AMERICA: MODIFIED CASSAVA STARCH MARKET, BY PRODUCT TYPE, 2020-2024 (TONS)

- TABLE 150 NORTH AMERICA: MODIFIED CASSAVA STARCH MARKET, BY PRODUCT TYPE, 2025-2030 (TONS)

- TABLE 151 NORTH AMERICA: EXTRUDED CASSAVA STARCH MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 152 NORTH AMERICA: EXTRUDED CASSAVA STARCH MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 153 NORTH AMERICA: MODIFIED CASSAVA STARCH MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 154 NORTH AMERICA: MODIFIED CASSAVA STARCH MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 155 NORTH AMERICA: MODIFIED CASSAVA STARCH MARKET, BY APPLICATION, 2020-2024 (TONS)

- TABLE 156 NORTH AMERICA: MODIFIED CASSAVA STARCH MARKET, BY APPLICATION, 2025-2030 (TONS)

- TABLE 157 NORTH AMERICA: MODIFIED CASSAVA STARCH MARKET, BY FOOD & BEVERAGE, 2020-2024 (USD MILLION)

- TABLE 158 NORTH AMERICA: MODIFIED CASSAVA STARCH MARKET, BY FOOD & BEVERAGE, 2025-2030 (USD MILLION)

- TABLE 159 NORTH AMERICA: MODIFIED CASSAVA STARCH MARKET, BY FEED, 2020-2024 (USD MILLION)

- TABLE 160 NORTH AMERICA: MODIFIED CASSAVA STARCH MARKET, BY FEED, 2025-2030 (USD MILLION)

- TABLE 161 NORTH AMERICA: MODIFIED CASSAVA STARCH MARKET, BY INDUSTRIAL, 2020-2024 (USD MILLION)

- TABLE 162 NORTH AMERICA: MODIFIED CASSAVA STARCH MARKET, BY INDUSTRIAL, 2025-2030 (USD MILLION)

- TABLE 163 US: MODIFIED CASSAVA STARCH MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 164 US: MODIFIED CASSAVA STARCH MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 165 CANADA: MODIFIED CASSAVA STARCH MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 166 CANADA: MODIFIED CASSAVA STARCH MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 167 MEXICO: MODIFIED CASSAVA STARCH MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 168 MEXICO: MODIFIED CASSAVA STARCH MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 169 EUROPE: MODIFIED CASSAVA STARCH MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 170 EUROPE: MODIFIED CASSAVA STARCH MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 171 EUROPE: MODIFIED CASSAVA STARCH MARKET, BY COUNTRY, 2020-2024 (TONS)

- TABLE 172 EUROPE: MODIFIED CASSAVA STARCH MARKET, BY COUNTRY, 2025-2030 (TONS)

- TABLE 173 EUROPE: MODIFIED CASSAVA STARCH MARKET, BY TYPE OF MODIFICATION, 2020-2024 (USD MILLION)

- TABLE 174 EUROPE: MODIFIED CASSAVA STARCH MARKET, BY TYPE OF MODIFICATION, 2025-2030 (USD MILLION)

- TABLE 175 EUROPE: MODIFIED CASSAVA STARCH MARKET, BY FORM, 2020-2024 (USD MILLION)

- TABLE 176 EUROPE: MODIFIED CASSAVA STARCH MARKET, BY FORM, 2025-2030 (USD MILLION)

- TABLE 177 EUROPE: MODIFIED CASSAVA STARCH MARKET, BY FORM, 2020-2024 (TONS)

- TABLE 178 EUROPE: MODIFIED CASSAVA STARCH MARKET, BY FORM, 2025-2030 (TONS)

- TABLE 179 EUROPE: MODIFIED CASSAVA STARCH MARKET, BY PRODUCT TYPE, 2020-2024 (USD MILLION)

- TABLE 180 EUROPE: MODIFIED CASSAVA STARCH MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 181 EUROPE: MODIFIED CASSAVA STARCH MARKET, BY PRODUCT TYPE, 2020-2024 (TONS)

- TABLE 182 EUROPE: MODIFIED CASSAVA STARCH MARKET, BY PRODUCT TYPE, 2025-2030 (TONS)

- TABLE 183 EUROPE: EXTRUDED CASSAVA STARCH MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 184 EUROPE: EXTRUDED CASSAVA STARCH MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 185 EUROPE: MODIFIED CASSAVA STARCH MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 186 EUROPE: MODIFIED CASSAVA STARCH MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 187 EUROPE: MODIFIED CASSAVA STARCH MARKET, BY APPLICATION, 2020-2024 (TONS)

- TABLE 188 EUROPE: MODIFIED CASSAVA STARCH MARKET, BY APPLICATION, 2025-2030 (TONS)

- TABLE 189 EUROPE: MODIFIED CASSAVA STARCH MARKET, BY FOOD & BEVERAGE, 2020-2024 (USD MILLION)

- TABLE 190 EUROPE: MODIFIED CASSAVA STARCH MARKET, BY FOOD & BEVERAGE, 2025-2030 (USD MILLION)

- TABLE 191 EUROPE: MODIFIED CASSAVA STARCH MARKET, BY FEED, 2020-2024 (USD MILLION)

- TABLE 192 EUROPE: MODIFIED CASSAVA STARCH MARKET, BY FEED, 2025-2030 (USD MILLION)

- TABLE 193 EUROPE: MODIFIED CASSAVA STARCH MARKET, BY INDUSTRIAL, 2020-2024 (USD MILLION)

- TABLE 194 EUROPE: MODIFIED CASSAVA STARCH MARKET, BY INDUSTRIAL, 2025-2030 (USD MILLION)

- TABLE 195 GERMANY: MODIFIED CASSAVA STARCH MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 196 GERMANY: MODIFIED CASSAVA STARCH MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 197 FRANCE: MODIFIED CASSAVA STARCH MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 198 FRANCE: MODIFIED CASSAVA STARCH MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 199 UK: MODIFIED CASSAVA STARCH MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 200 UK: MODIFIED CASSAVA STARCH MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 201 ITALY: MODIFIED CASSAVA STARCH MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 202 ITALY: MODIFIED CASSAVA STARCH MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 203 SPAIN: MODIFIED CASSAVA STARCH MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 204 SPAIN: MODIFIED CASSAVA STARCH MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 205 REST OF EUROPE: MODIFIED CASSAVA STARCH MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 206 REST OF EUROPE: MODIFIED CASSAVA STARCH MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 207 ASIA PACIFIC: MODIFIED CASSAVA STARCH MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 208 ASIA PACIFIC: MODIFIED CASSAVA STARCH MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 209 ASIA PACIFIC: MODIFIED CASSAVA STARCH MARKET, BY COUNTRY, 2020-2024 (TONS)

- TABLE 210 ASIA PACIFIC: MODIFIED CASSAVA STARCH MARKET, BY COUNTRY, 2025-2030 (TONS)

- TABLE 211 ASIA PACIFIC: MODIFIED CASSAVA STARCH MARKET, BY TYPE OF MODIFICATION, 2020-2024 (USD MILLION)

- TABLE 212 ASIA PACIFIC: MODIFIED CASSAVA STARCH MARKET, BY TYPE OF MODIFICATION, 2025-2030 (USD MILLION)

- TABLE 213 ASIA PACIFIC: MODIFIED CASSAVA STARCH MARKET, BY FORM, 2020-2024 (USD MILLION)

- TABLE 214 ASIA PACIFIC: MODIFIED CASSAVA STARCH MARKET, BY FORM, 2025-2030 (USD MILLION)

- TABLE 215 ASIA PACIFIC: MODIFIED CASSAVA STARCH MARKET, BY FORM, 2020-2024 (TONS)

- TABLE 216 ASIA PACIFIC: MODIFIED CASSAVA STARCH MARKET, BY FORM, 2025-2030 (TONS)

- TABLE 217 ASIA PACIFIC: MODIFIED CASSAVA STARCH MARKET, BY PRODUCT TYPE, 2020-2024 (USD MILLION)

- TABLE 218 ASIA PACIFIC: MODIFIED CASSAVA STARCH MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 219 ASIA PACIFIC: MODIFIED CASSAVA STARCH MARKET, BY PRODUCT TYPE, 2020-2024 (TONS)

- TABLE 220 ASIA PACIFIC: MODIFIED CASSAVA STARCH MARKET, BY PRODUCT TYPE, 2025-2030 (TONS)

- TABLE 221 ASIA PACIFIC: EXTRUDED CASSAVA STARCH MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 222 ASIA PACIFIC: EXTRUDED CASSAVA STARCH MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 223 ASIA PACIFIC: MODIFIED CASSAVA STARCH MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 224 ASIA PACIFIC: MODIFIED CASSAVA STARCH MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 225 ASIA PACIFIC: MODIFIED CASSAVA STARCH MARKET, BY APPLICATION, 2020-2024 (TONS)

- TABLE 226 ASIA PACIFIC: MODIFIED CASSAVA STARCH MARKET, BY APPLICATION, 2025-2030 (TONS)

- TABLE 227 ASIA PACIFIC: MODIFIED CASSAVA STARCH MARKET, BY FOOD & BEVERAGE, 2020-2024 (USD MILLION)

- TABLE 228 ASIA PACIFIC: MODIFIED CASSAVA STARCH MARKET, BY FOOD & BEVERAGE, 2025-2030 (USD MILLION)

- TABLE 229 ASIA PACIFIC: MODIFIED CASSAVA STARCH MARKET, BY FEED, 2020-2024 (USD MILLION)

- TABLE 230 ASIA PACIFIC: MODIFIED CASSAVA STARCH MARKET, BY FEED, 2025-2030 (USD MILLION)

- TABLE 231 ASIA PACIFIC: MODIFIED CASSAVA STARCH MARKET, BY INDUSTRIAL, 2020-2024 (USD MILLION)

- TABLE 232 ASIA PACIFIC: MODIFIED CASSAVA STARCH MARKET, BY INDUSTRIAL, 2025-2030 (USD MILLION)

- TABLE 233 CHINA: MODIFIED CASSAVA STARCH MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 234 CHINA: MODIFIED CASSAVA STARCH MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 235 JAPAN: MODIFIED CASSAVA STARCH MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 236 JAPAN: MODIFIED CASSAVA STARCH MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 237 INDIA: MODIFIED CASSAVA STARCH MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 238 INDIA: MODIFIED CASSAVA STARCH MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 239 AUSTRALIA & NEW ZEALAND: MODIFIED CASSAVA STARCH MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 240 AUSTRALIA & NEW ZEALAND: MODIFIED CASSAVA STARCH MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 241 SOUTH KOREA: MODIFIED CASSAVA STARCH MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 242 SOUTH KOREA: MODIFIED CASSAVA STARCH MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 243 THAILAND: MODIFIED CASSAVA STARCH MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 244 THAILAND: MODIFIED CASSAVA STARCH MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 245 VIETNAM: MODIFIED CASSAVA STARCH MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 246 VIETNAM: MODIFIED CASSAVA STARCH MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 247 INDONESIA: MODIFIED CASSAVA STARCH MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 248 INDONESIA: MODIFIED CASSAVA STARCH MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 249 REST OF ASIA PACIFIC: MODIFIED CASSAVA STARCH MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 250 REST OF ASIA PACIFIC: MODIFIED CASSAVA STARCH MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 251 SOUTH AMERICA: MODIFIED CASSAVA STARCH MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 252 SOUTH AMERICA: MODIFIED CASSAVA STARCH MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 253 SOUTH AMERICA: MODIFIED CASSAVA STARCH MARKET, BY COUNTRY, 2020-2024 (TONS)

- TABLE 254 SOUTH AMERICA: MODIFIED CASSAVA STARCH MARKET, BY COUNTRY, 2025-2030 (TONS)

- TABLE 255 SOUTH AMERICA: MODIFIED CASSAVA STARCH MARKET, BY TYPE OF MODIFICATION, 2020-2024 (USD MILLION)

- TABLE 256 SOUTH AMERICA: MODIFIED CASSAVA STARCH MARKET, BY TYPE OF MODIFICATION, 2025-2030 (USD MILLION)

- TABLE 257 SOUTH AMERICA: MODIFIED CASSAVA STARCH MARKET, BY FORM, 2020-2024 (USD MILLION)

- TABLE 258 SOUTH AMERICA: MODIFIED CASSAVA STARCH MARKET, BY FORM, 2025-2030 (USD MILLION)

- TABLE 259 SOUTH AMERICA: MODIFIED CASSAVA STARCH MARKET, BY FORM, 2020-2024 (TONS)

- TABLE 260 SOUTH AMERICA: MODIFIED CASSAVA STARCH MARKET, BY FORM, 2025-2030 (TONS)

- TABLE 261 SOUTH AMERICA: MODIFIED CASSAVA STARCH MARKET, BY PRODUCT TYPE, 2020-2024 (USD MILLION)

- TABLE 262 SOUTH AMERICA: MODIFIED CASSAVA STARCH MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 263 SOUTH AMERICA: MODIFIED CASSAVA STARCH MARKET, BY PRODUCT TYPE, 2020-2024 (TONS)

- TABLE 264 SOUTH AMERICA: MODIFIED CASSAVA STARCH MARKET, BY PRODUCT TYPE, 2025-2030 (TONS)

- TABLE 265 SOUTH AMERICA: EXTRUDED CASSAVA STARCH MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 266 SOUTH AMERICA: EXTRUDED CASSAVA STARCH MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 267 SOUTH AMERICA: MODIFIED CASSAVA STARCH MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 268 SOUTH AMERICA: MODIFIED CASSAVA STARCH MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 269 SOUTH AMERICA: MODIFIED CASSAVA STARCH MARKET, BY APPLICATION, 2020-2024 (TONS)

- TABLE 270 SOUTH AMERICA: MODIFIED CASSAVA STARCH MARKET, BY APPLICATION, 2025-2030 (TONS)

- TABLE 271 SOUTH AMERICA: MODIFIED CASSAVA STARCH MARKET, BY FOOD & BEVERAGE, 2020-2024 (USD MILLION)

- TABLE 272 SOUTH AMERICA: MODIFIED CASSAVA STARCH MARKET, BY FOOD & BEVERAGE, 2025-2030 (USD MILLION)

- TABLE 273 SOUTH AMERICA: MODIFIED CASSAVA STARCH MARKET, BY FEED, 2020-2024 (USD MILLION)

- TABLE 274 SOUTH AMERICA: MODIFIED CASSAVA STARCH MARKET, BY FEED, 2025-2030 (USD MILLION)

- TABLE 275 SOUTH AMERICA: MODIFIED CASSAVA STARCH MARKET, BY INDUSTRIAL, 2020-2024 (USD MILLION)

- TABLE 276 SOUTH AMERICA: MODIFIED CASSAVA STARCH MARKET, BY INDUSTRIAL, 2025-2030 (USD MILLION)

- TABLE 277 BRAZIL: MODIFIED CASSAVA STARCH MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 278 BRAZIL: MODIFIED CASSAVA STARCH MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 279 ARGENTINA: MODIFIED CASSAVA STARCH MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 280 ARGENTINA: MODIFIED CASSAVA STARCH MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 281 REST OF SOUTH AMERICA: MODIFIED CASSAVA STARCH MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 282 REST OF SOUTH AMERICA: MODIFIED CASSAVA STARCH MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 283 ROW: MODIFIED CASSAVA STARCH MARKET, BY COUNTRY/REGION, 2020-2024 (USD MILLION)

- TABLE 284 ROW: MODIFIED CASSAVA STARCH MARKET, BY COUNTRY/REGION, 2025-2030 (USD MILLION)

- TABLE 285 ROW: MODIFIED CASSAVA STARCH MARKET, BY COUNTRY/REGION, 2020-2024 (TONS)

- TABLE 286 ROW: MODIFIED CASSAVA STARCH MARKET, BY COUNTRY/REGION, 2025-2030 (TONS)

- TABLE 287 ROW: MODIFIED CASSAVA STARCH MARKET, BY TYPE OF MODIFICATION, 2020-2024 (USD MILLION)

- TABLE 288 ROW: MODIFIED CASSAVA STARCH MARKET, BY TYPE OF MODIFICATION, 2025-2030 (USD MILLION)

- TABLE 289 ROW: MODIFIED CASSAVA STARCH MARKET, BY FORM, 2020-2024 (USD MILLION)

- TABLE 290 ROW: MODIFIED CASSAVA STARCH MARKET, BY FORM, 2025-2030 (USD MILLION)

- TABLE 291 ROW: MODIFIED CASSAVA STARCH MARKET, BY FORM, 2020-2024 (TONS)

- TABLE 292 ROW: MODIFIED CASSAVA STARCH MARKET, BY FORM, 2025-2030 (TONS)

- TABLE 293 ROW: MODIFIED CASSAVA STARCH MARKET, BY PRODUCT TYPE, 2020-2024 (USD MILLION)

- TABLE 294 ROW: MODIFIED CASSAVA STARCH MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 295 ROW: MODIFIED CASSAVA STARCH MARKET, BY PRODUCT TYPE, 2020-2024 (TONS)

- TABLE 296 ROW: MODIFIED CASSAVA STARCH MARKET, BY PRODUCT TYPE, 2025-2030 (TONS)

- TABLE 297 ROW: EXTRUDED CASSAVA STARCH MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 298 ROW: EXTRUDED CASSAVA STARCH MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 299 ROW: MODIFIED CASSAVA STARCH MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 300 ROW: MODIFIED CASSAVA STARCH MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 301 ROW: MODIFIED CASSAVA STARCH MARKET, BY APPLICATION, 2020-2024 (TONS)

- TABLE 302 ROW: MODIFIED CASSAVA STARCH MARKET, BY APPLICATION, 2025-2030 (TONS)

- TABLE 303 ROW: MODIFIED CASSAVA STARCH MARKET, BY FOOD & BEVERAGE, 2020-2024 (USD MILLION)

- TABLE 304 ROW: MODIFIED CASSAVA STARCH MARKET, BY FOOD & BEVERAGE, 2025-2030 (USD MILLION)

- TABLE 305 ROW: MODIFIED CASSAVA STARCH MARKET, BY FEED, 2020-2024 (USD MILLION)

- TABLE 306 ROW: MODIFIED CASSAVA STARCH MARKET, BY FEED, 2025-2030 (USD MILLION)

- TABLE 307 ROW: MODIFIED CASSAVA STARCH MARKET, BY INDUSTRIAL, 2020-2024 (USD MILLION)

- TABLE 308 ROW: MODIFIED CASSAVA STARCH MARKET, BY INDUSTRIAL, 2025-2030 (USD MILLION)

- TABLE 309 SOUTH AFRICA: MODIFIED CASSAVA STARCH MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 310 SOUTH AFRICA: MODIFIED CASSAVA STARCH MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 311 MIDDLE EAST: MODIFIED CASSAVA STARCH MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 312 MIDDLE EAST: MODIFIED CASSAVA STARCH MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 313 REST OF AFRICA: MODIFIED CASSAVA STARCH MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 314 REST OF AFRICA: MODIFIED CASSAVA STARCH MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 315 OVERVIEW OF STRATEGIES ADOPTED BY KEY MODIFIED CASSAVA STARCH MANUFACTURERS

- TABLE 316 MODIFIED CASSAVA STARCH MARKET: INTENSITY OF COMPETITIVE RIVALRY

- TABLE 317 MODIFIED CASSAVA STARCH MARKET: REGION FOOTPRINT

- TABLE 318 MODIFIED CASSAVA STARCH MARKET: PRODUCT TYPE FOOTPRINT

- TABLE 319 MODIFIED CASSAVA STARCH MARKET: FUNCTION FOOTPRINT

- TABLE 320 MODIFIED CASSAVA STARCH MARKET: TYPE OF MODIFICATION FOOTPRINT

- TABLE 321 MODIFIED CASSAVA STARCH MARKET: APPLICATION FOOTPRINT

- TABLE 322 MODIFIED CASSAVA STARCH MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 323 MODIFIED CASSAVA STARCH MARKET: PRODUCT LAUNCHES, OCTOBER 2020-APRIL 2025

- TABLE 324 MODIFIED CASSAVA STARCH MARKET: DEALS, OCTOBER 2020-APRIL 2025

- TABLE 325 MODIFIED CASSAVA STARCH MARKET: EXPANSIONS, OCTOBER 2022-APRIL 2025

- TABLE 329 CARGILL, INCORPORATED: COMPANY OVERVIEW

- TABLE 330 CARGILL, INCORPORATED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 332 ROQUETTE FRERES: COMPANY OVERVIEW

- TABLE 333 ROQUETTE FRERES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 334 ROQUETTE FRERES: PRODUCT LAUNCHES

- TABLE 335 INGREDION: COMPANY OVERVIEW

- TABLE 336 INGREDION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 337 INGREDION: EXPANSIONS

- TABLE 338 THAI WAH: COMPANY OVERVIEW

- TABLE 339 THAI WAH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 340 THAI WAH: DEALS

- TABLE 341 AGRANA: COMPANY OVERVIEW

- TABLE 342 AGRANA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 343 AGRANA: DEALS

- TABLE 344 BANPONG TAPIOCA: COMPANY OVERVIEW

- TABLE 345 BANPONG TAPIOCA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 346 SONISH STARCH TECHNOLOGY: COMPANY OVERVIEW

- TABLE 347 SONISH STARCH TECHNOLOGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 348 BS STARCH CHEMICAL: COMPANY OVERVIEW

- TABLE 349 BS STARCH CHEMICAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 350 VEDAN ENTERPRISE CORPORATION: COMPANY OVERVIEW

- TABLE 351 VEDAN ENTERPRISE CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 352 ASIA MODIFIED STARCH CO., LTD.: COMPANY OVERVIEW

- TABLE 353 ASIA MODIFIED STARCH CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 354 ASIA MODIFIED STARCH CO., LTD.: DEALS

- TABLE 355 SPAC STARCH PRODUCTS INDIA PVT. LTD.: COMPANY OVERVIEW

- TABLE 356 SPAC STARCH PRODUCTS INDIA PVT. LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 357 SMS CORPORATION CO., LTD.: COMPANY OVERVIEW

- TABLE 358 SMS CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 359 SMS CORPORATION: PRODUCT LAUNCHES

- TABLE 360 SMS CORPORATION: DEALS

- TABLE 361 BENEVA: COMPANY OVERVIEW

- TABLE 362 BENEVA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 363 VIETNAM TAPIOCA STARCH SOLUTIONS: COMPANY OVERVIEW

- TABLE 364 VIETNAM TAPIOCA STARCH SOLUTIONS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 365 NEO NAM VIET CO., LTD.: COMPANY OVERVIEW

- TABLE 366 NEO NAM VIET CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 367 STARCH ASIA: COMPANY OVERVIEW

- TABLE 368 STARCH ASIA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 369 GENERAL STARCH LIMITED: COMPANY OVERVIEW

- TABLE 370 GENERAL STARCH LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 371 GENERAL STARCH LIMITED: DEALS

- TABLE 372 RVP STARCH PRODUCTS PVT. LTD.: COMPANY OVERVIEW

- TABLE 373 RVP STARCH PRODUCTS PVT. LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 374 EXPORTVN COMPANY LIMITED: COMPANY OVERVIEW

- TABLE 375 VENUS STARCH INDUSTRIES: COMPANY OVERVIEW

- TABLE 376 ADJACENT MARKETS TO MODIFIED CASSAVA STARCH

- TABLE 377 PEA STARCH MARKET, BY NATURE, 2019-2023 (USD MILLION)

- TABLE 378 PEA STARCH MARKET, BY NATURE, 2024-2029 (USD MILLION)

- TABLE 379 POTATO STARCH MARKET, BY NATURE, 2019-2021 (USD MILLION)

- TABLE 380 POTATO STARCH MARKET, BY NATURE, 2022-2027 (USD MILLION)

- TABLE 381 MODIFIED STARCH MARKET, BY FORM, 2018-2021 (USD MILLION)

- TABLE 382 MODIFIED STARCH MARKET, BY FORM, 2022-2027 (USD MILLION)

List of Figures

- FIGURE 1 MODIFIED CASSAVA STARCH MARKET SEGMENTATION

- FIGURE 2 MODIFIED CASSAVA STARCH MARKET: REGIONAL SCOPE

- FIGURE 3 MODIFIED CASSAVA STARCH MARKET: RESEARCH DESIGN

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS, BY VALUE CHAIN, DESIGNATION, AND REGION

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 7 SUPPLY-SIDE ANALYSIS

- FIGURE 8 DATA TRIANGULATION METHODOLOGY

- FIGURE 9 MODIFIED CASSAVA STARCH MARKET, BY TYPE OF MODIFICATION, 2025 VS. 2030 (USD MILLION)

- FIGURE 10 MODIFIED CASSAVA STARCH MARKET, BY PRODUCT TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 11 MODIFIED CASSAVA STARCH MARKET, BY FORM, 2025 VS. 2030 (USD MILLION)

- FIGURE 12 MODIFIED CASSAVA STARCH MARKET, BY APPLICATION, 2025 VS. 2030 (USD MILLION)

- FIGURE 13 MODIFIED CASSAVA STARCH MARKET, BY REGION

- FIGURE 14 RISING NEED FOR CONVENIENCE FOOD TO BOOST DEMAND FOR MODIFIED CASSAVA STARCH

- FIGURE 15 CHINA AND FOOD & BEVERAGES APPLICATION OF MODIFIED CASSAVA STARCH TO DOMINATE MARKET IN 2025

- FIGURE 16 US TO DOMINATE MODIFIED CASSAVA STARCH MARKET DURING STUDY PERIOD

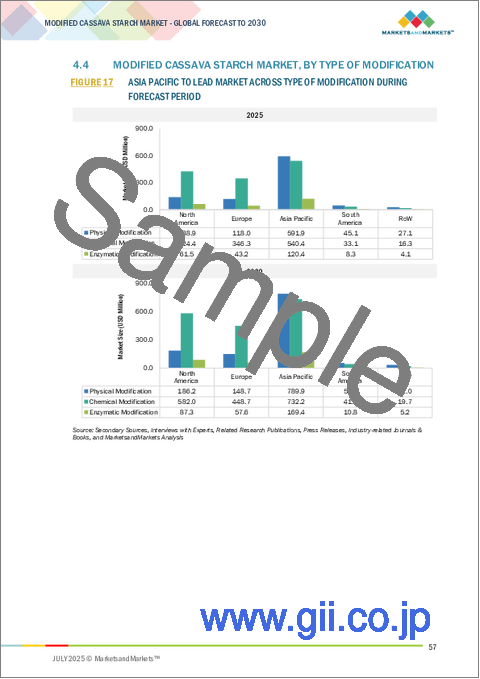

- FIGURE 17 ASIA PACIFIC TO LEAD MARKET ACROSS TYPE OF MODIFICATION DURING FORECAST PERIOD

- FIGURE 18 PRE-GELATINIZED STARCHES ESTIMATED TO DOMINATE MARKET

- FIGURE 19 DRY SEGMENT TO ACCOUNT FOR MAJORITY OF MARKET

- FIGURE 20 FOOD & BEVERAGES SEGMENT TO LEAD DURING FORECAST PERIOD

- FIGURE 21 US CONSUMERS' PERCEPTION OF PROCESSED FOODS, 2025

- FIGURE 22 GLOBAL URBAN POPULATION, 2017-2050 (MILLION)

- FIGURE 23 CASSAVA PRODUCTION, 2014-2023 (MILLION TONS)

- FIGURE 24 ADOPTION OF GEN AI IN MODIFIED CASSAVA STARCH MARKET

- FIGURE 25 VALUE CHAIN ANALYSIS: MODIFIED CASSAVA STARCH MARKET

- FIGURE 26 EXPORT SCENARIO FOR HS CODE (110814), BY KEY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 27 IMPORT SCENARIO OF HS CODE (110814), BY KEY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 28 SUPPLY CHAIN OF MODIFIED CASSAVA STARCH MARKET

- FIGURE 29 MODIFIED CASSAVA STARCH MARKET: TECHNOLOGY ANALYSIS

- FIGURE 30 AVERAGE SELLING PRICE OF MODIFIED CASSAVA STARCH AMONG MARKET PLAYERS, BY TYPE OF MODIFICATION, 2024

- FIGURE 31 AVERAGE SELLING PRICE TREND, BY REGION, 2020-2024

- FIGURE 32 KEY PLAYERS IN MODIFIED CASSAVA STARCH MARKET ECOSYSTEM

- FIGURE 33 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 34 NUMBER OF PATENTS GRANTED FOR MODIFIED CASSAVA STARCH MARKET, 2014-2024

- FIGURE 35 REGIONAL ANALYSIS OF PATENTS GRANTED FOR MODIFIED CASSAVA STARCH, 2014-2024

- FIGURE 36 PORTER'S FIVE FORCES ANALYSIS: MODIFIED CASSAVA STARCH MARKET

- FIGURE 37 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- FIGURE 38 KEY BUYING CRITERIA FOR DIFFERENT APPLICATIONS

- FIGURE 39 INVESTMENT AND FUNDING SCENARIO (USD THOUSAND)

- FIGURE 40 MODIFIED CASSAVA STARCH MARKET, BY APPLICATION, 2025 VS. 2030 (USD MILLION)

- FIGURE 41 MODIFIED CASSAVA STARCH MARKET, BY FORM, 2025 VS. 2030 (USD MILLION)

- FIGURE 42 MODIFIED CASSAVA STARCH MARKET, BY PRODUCT TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 43 MODIFIED CASSAVA STARCH MARKET, BY TYPE OF MODIFICATION, 2025 VS. 2030 (USD MILLION)

- FIGURE 44 INDIA ANTICIPATED TO BE FASTEST-GROWING MARKET

- FIGURE 45 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 46 ASIA PACIFIC: MODIFIED CASSAVA STARCH MARKET SNAPSHOT

- FIGURE 47 REVENUE ANALYSIS FOR KEY PLAYERS IN MODIFIED CASSAVA STARCH MARKET, 2020-2024 (USD BILLION)

- FIGURE 48 SHARE OF LEADING COMPANIES IN MODIFIED CASSAVA STARCH MARKET, 2024

- FIGURE 49 COMPANY VALUATION (USD BILLION)

- FIGURE 50 FINANCIAL METRICS (EV/EBITDA), 2024

- FIGURE 51 BRAND/PRODUCT COMPARISON ANALYSIS, BY PRODUCT BRAND

- FIGURE 52 MODIFIED CASSAVA STARCH MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 53 MODIFIED CASSAVA STARCH MARKET: COMPANY FOOTPRINT

- FIGURE 54 MODIFIED CASSAVA STARCH MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 55 MODIFIED CASSAVA STARCH MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, 2024

- FIGURE 57 CARGILL, INCORPORATED: COMPANY SNAPSHOT

- FIGURE 58 INGREDION: COMPANY SNAPSHOT

- FIGURE 59 THAI WAH: COMPANY SNAPSHOT

- FIGURE 60 AGRANA: COMPANY SNAPSHOT

The market for modified cassava starch is projected to grow from USD 2.52 billion in 2025 to USD 3.37 billion by 2030, at a CAGR of 6.0% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2025-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD) and Volume (Tons) |

| Segments | By Product Type, Form, Type of Modification, Function, Application, and Region |

| Regions covered | North America, Europe, Asia Pacific, South America, and RoW |

Modified cassava starch acts as a crucial ingredient, linking traditional raw materials with the growing demands of modern industries. Its versatility and performance across many applications have made it a key driver of innovation in both the food and chemical sectors. As industries seek eco-friendly and cost-effective solutions, this ingredient is becoming a preferred choice worldwide. As global priorities shift toward greater sustainability and operational efficiency, the importance of modified cassava starch is expected to grow even more in shaping the future of these industries.

Furthermore, there is an increasing trend of using modified tapioca starch to develop eco-friendly and biodegradable materials. With rising global concerns about plastic waste, modified cassava starch is gaining popularity as a sustainable raw material for producing biodegradable plastics and packaging films. This shift is fueling a strong expansion in the global modified cassava starch market, driven by technological advancements, vibrant consumer demand, and expanding applications of the starch.

"The pre-gelatinized starches segment accounts for a significant market share."

Pre-gelatinized cassava starch holds a significant share of the modified cassava starch market because of its properties, such as instant solubility, ease of use, and a wide range of applications. It expands in cold water without heating, making it perfect for convenience foods such as instant soups, sauces, bakery mixes, and baby foods, where quick preparation and a stable texture are essential. Its clean-label and gluten-free features match the increasing demand for natural and allergen-free ingredients. Apart from the food and beverage sector, it serves as a binder in pharmaceuticals, improves texture in cosmetics, and is used in paper and adhesives for its film-forming and binding qualities. Moreover, it is less expensive than many chemically modified starches and typically qualifies as a physical or natural modification. This makes it appealing to health-conscious and price-sensitive consumers. These advantages collectively contribute to its strong and growing presence in the modified cassava starch market.

"The industrial applications of modified cassava are expected to grow at a significant rate during the forecast period."

Starch has a wide range of commercial and industrial uses. Modified cassava starch products are used in the paper and paper cone industry, the glue and adhesive industry, pharmaceuticals, cosmetics, and various other related sectors. These modified starch blends can serve as adhesives for the edges of wallboards. The global applications of modified starch are steadily expanding. Asian countries with rising income levels and increasing industrialization are using modified starches more for these non-food purposes, in addition to their food uses. In pharmaceuticals, modified cassava starch is used to keep tablets solid and promote the quick release of active ingredients in oral medications. Growing environmental concerns and regulatory pressures are pushing for new biodegradable, renewable alternatives to petroleum-based materials, and cassava starch emerges as an attractive, sustainable option. Ample supply, stable supply chains, and low costs-especially in tropical regions-are supporting the widespread industrial use of cassava starch.

"Asia Pacific is expected to have a significant share in the modified cassava starch market."

Asia Pacific's dominance is due to factors such as the region's large-scale production and consumption of modified cassava starch in food, beverages, and various industrial uses. Asian countries, especially China, have become key markets, shifting focus from developed to developing economies. Unlike other regions where starch is processed mainly by large corporations, in Asia Pacific, small and medium-sized firms conduct starch processing. Starch modification is a vital industry in Thailand, evolving from both small-scale and large-scale production technologies. One of the main drivers is the high demand for diversified cassava-based products, produced through modification technologies, both internationally and locally. Currently, cassava is the primary raw material for starch production in Thailand. The technologies and industries involved in starch processing are rapidly changing across Asia Pacific countries. Modified cassava starch is increasingly sought after by numerous regional industries. The rise in consumer spending on food and beverages, along with the desire for convenience and comfort in a fast-paced, urbanized world, has boosted the demand for processed foods.

In-depth interviews were conducted with chief executive officers (CEOs), Directors, and other executives from various key organizations operating in the modified cassava starch market:

- By Company Type: Tier 1 - 25%, Tier 2 - 45%, and Tier 3 - 30%

- By Designation: CXO's - 20%, Managers - 50%, Executives- 30%

- By Region: North America - 25%, Europe - 30%, Asia Pacific - 20%, South America - 15% and Rest of the World -10%

Prominent companies in the market include ADM (US), Cargill, Incorporated (US), Roquette (France), Ingredion (US), Thai Wah (Thailand) and Agrana (Austria), Banpong Tapioca (Thailand), Sonish Starch Technology Co., Ltd. (Thailand), BS Starch Chemical (Thailand), Vedan Enterprise Corporation (Taiwan), Asia Modified Starch Co., Ltd. (Thailand), SPAC Starch Products Private Limited (India), SMS Corporation (Thailand), Beneva (Thailand), and Vietnam Tapioca Starch Solutions (Vietnam).

Other players include Neo Nam Viet Co., Ltd. (Vietnam), Starch Asia (Thailand), General Starch Limited (Thailand), RVP Starch Products Pvt. Ltd. (India), ExportVN Company Limited (Vietnam), Venus Starch Industries (India), Nguyen Starch (Vietnam), PT. Starch Solution Internasional (Indonesia), Benzson Corporation (Thailand), Varalakshmi Starch Industries (P) Ltd. (India), and Pura Organic Agro Tech Ltd. (Uganda)

Research Coverage:

This research report categorizes the modified cassava starch market by product type (pre-gelatinized starches, extruded cassava starches, dextrinized starches, maltodextrins, fermented cassava starches), form (dry, liquid), application (food & beverages, feed, industrial), function, type of modification, and region (North America, Europe, Asia Pacific, South America, and Rest of the World). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of modified cassava starch. A detailed analysis of the key industry players has been done to provide insights into their business overview, services, key strategies, contracts, partnerships, agreements, new service launches, mergers and acquisitions, and recent developments associated with the modified cassava starch market. This report covers a competitive analysis of upcoming startups in the modified cassava starch market ecosystem. Furthermore, industry-specific trends such as technology analysis, ecosystem and market mapping, patent, regulatory landscape, among others, are also covered in the study.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall modified cassava starch and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (diversified food and industrial applications), restraints (technological and infrastructure limitations), opportunities (rise of clean label and gluten-free trends), and challenges (competitive threat from substitute starches) influencing the growth of the modified cassava starch market.

- New product launch/Innovation: Detailed insights on research & development activities and new product launches in the modified cassava starch market.

- Market Development: Comprehensive information about lucrative markets - the report analyzes the modified cassava starch across varied regions.

- Market Diversification: Exhaustive information about new services, untapped geographies, recent developments, and investments in the modified cassava starch market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, brand/product comparison, and product food prints of leading players such as ADM (US), Cargill, Incorporated (US), Roquette (France), Ingredion (US), Thai Wah (Thailand), and Agrana (Austria), and others in the modified cassava starch market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 UNIT CONSIDERED

- 1.4.1 CURRENCY CONSIDERED

- 1.4.2 VOLUME UNITS

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.3 SUPPLY-SIDE ANALYSIS

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN MODIFIED CASSAVA STARCH MARKET

- 4.2 ASIA PACIFIC: MODIFIED CASSAVA STARCH MARKET, BY KEY APPLICATION AND COUNTRY

- 4.3 MODIFIED CASSAVA STARCH MARKET, BY COUNTRY

- 4.4 MODIFIED CASSAVA STARCH MARKET, BY TYPE OF MODIFICATION

- 4.5 MODIFIED CASSAVA STARCH MARKET, BY PRODUCT TYPE

- 4.6 MODIFIED CASSAVA STARCH MARKET, BY FORM

- 4.7 MODIFIED CASSAVA STARCH MARKET, BY APPLICATION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC OUTLOOK

- 5.2.1 GROWING DEMAND FOR PROCESSED FOOD

- 5.2.2 GROWING URBAN POPULATION

- 5.2.3 INCREASED CASSAVA PRODUCTION

- 5.3 MARKET DYNAMICS

- 5.3.1 DRIVERS

- 5.3.1.1 Diversified food and industrial applications

- 5.3.1.2 Superior functional properties

- 5.3.1.3 Government support and agricultural development

- 5.3.2 RESTRAINTS

- 5.3.2.1 Climate volatility & agricultural dependence

- 5.3.2.2 Technological and infrastructure limitations

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Rise of clean-label and gluten-free trends

- 5.3.3.2 Emerging applications of modified cassava starch

- 5.3.4 CHALLENGES

- 5.3.4.1 Competitive threat from substitute starches

- 5.3.4.2 Geopolitical tensions and trade barriers stirring market volatility

- 5.3.1 DRIVERS

- 5.4 IMPACT OF GEN AI ON MODIFIED CASSAVA STARCH MARKET

- 5.4.1 INTRODUCTION

- 5.4.2 USE OF GEN AI IN MODIFIED CASSAVA STARCH MARKET

- 5.4.3 CASE STUDY ANALYSIS

- 5.4.3.1 Ingredion Leverages AI for Failure Detection and Enhanced Machine Uptime

- 5.4.4 IMPACT ON MODIFIED CASSAVA STARCH MARKET

- 5.4.5 ADJACENT ECOSYSTEMS WORKING ON GENERATIVE AI

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 VALUE CHAIN ANALYSIS

- 6.2.1 SOURCING

- 6.2.2 PRE-PROCESSING AND PREPARATION

- 6.2.3 STARCH MODIFICATION

- 6.2.4 POST-PROCESSING AND DRYING

- 6.2.5 PACKAGING AND QUALITY CERTIFICATION

- 6.2.6 MARKETING, SALES, AND LOGISTICS

- 6.2.7 END-USER INTEGRATION AND APPLICATION

- 6.3 TRADE ANALYSIS

- 6.3.1 EXPORT SCENARIO

- 6.3.2 IMPORT SCENARIO

- 6.4 SUPPLY CHAIN ANALYSIS

- 6.5 TECHNOLOGY ANALYSIS

- 6.5.1 PHYSICAL METHODS

- 6.5.2 CHEMICAL METHODS

- 6.5.3 ENZYMATIC METHODS

- 6.5.4 KEY TECHNOLOGIES

- 6.5.4.1 Automation and Process Control Systems

- 6.5.4.2 Drying and Thermal Processing Technologies

- 6.5.5 COMPLEMENTARY TECHNOLOGIES

- 6.5.5.1 Process Automation and IoT-based Monitoring Systems

- 6.5.5.2 Analytical and Quality Control Instrumentation

- 6.5.5.3 Starch Extraction and Pre-processing Equipment

- 6.5.6 ADJACENT TECHNOLOGIES

- 6.5.6.1 Precision Agriculture and Cassava Farming Technologies

- 6.5.6.2 Food and Beverage Processing Technologies

- 6.5.6.3 Biodegradable Packaging and Biopolymer Processing

- 6.6 PRICING ANALYSIS

- 6.6.1 AVERAGE SELLING PRICE OF KEY PLAYERS, BY TYPE OF MODIFICATION

- 6.6.2 AVERAGE SELLING PRICE TREND, BY REGION

- 6.7 ECOSYSTEM ANALYSIS

- 6.7.1 DEMAND SIDE

- 6.7.2 SUPPLY SIDE

- 6.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.9 PATENT ANALYSIS

- 6.9.1 LIST OF MAJOR PATENTS

- 6.10 KEY CONFERENCES AND EVENTS, 2025-2026

- 6.11 REGULATORY LANDSCAPE

- 6.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.11.2 REGULATORY FRAMEWORK

- 6.11.3 NORTH AMERICA

- 6.11.3.1 US

- 6.11.3.2 Canada

- 6.11.3.3 Europe

- 6.11.4 ASIA PACIFIC

- 6.11.4.1 China

- 6.11.4.2 India

- 6.11.4.3 Japan

- 6.11.4.4 South Korea

- 6.11.4.5 Thailand

- 6.11.4.6 Indonesia

- 6.11.5 SOUTH AMERICA

- 6.11.5.1 Brazil

- 6.11.6 ROW

- 6.11.6.1 Nigeria

- 6.11.6.2 South Africa

- 6.12 PORTER'S FIVE FORCES ANALYSIS

- 6.12.1 THREAT OF NEW ENTRANTS

- 6.12.2 THREAT OF SUBSTITUTES

- 6.12.3 BARGAINING POWER OF SUPPLIERS

- 6.12.4 BARGAINING POWER OF BUYERS

- 6.12.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.13.2 BUYING CRITERIA

- 6.14 CASE STUDY ANALYSIS

- 6.14.1 APPLICATION OF MODIFIED CASSAVA STARCH AS FAT SUBSTITUTE IN CRACKER PRODUCTION

- 6.14.2 APPLICATION OF MODIFIED CASSAVA STARCH FOR IMPROVING QUALITY CHARACTERISTICS OF GLUTEN-FREE BREAD

- 6.15 INVESTMENT AND FUNDING SCENARIO

- 6.16 TARIFF IMPACT ON MODIFIED CASSAVA STARCH MARKET

- 6.16.1 INTRODUCTION

- 6.16.2 KEY TARIFF RATES

- 6.16.3 DISRUPTION IN MODIFIED CASSAVA STARCH MARKET

- 6.16.4 PRICE IMPACT ANALYSIS

- 6.16.5 KEY IMPACTS ON VARIOUS REGIONS

- 6.16.5.1 North America

- 6.16.5.2 Europe

- 6.16.5.3 Asia Pacific

- 6.16.5.4 South America

- 6.16.5.5 RoW

- 6.16.6 END-USE INDUSTRY-LEVEL IMPACT

7 MODIFIED CASSAVA STARCH MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.2 FOOD & BEVERAGES

- 7.2.1 FUNCTIONAL ADVANTAGES AND CLEAN-LABEL DEMAND PROPEL MODIFIED CASSAVA STARCH USE IN FOOD & BEVERAGE INDUSTRY

- 7.2.2 BAKERY

- 7.2.2.1 Functional and Allergen-free Benefits Boost Adoption of Modified Cassava Starch in Baking

- 7.2.3 CONFECTIONERY

- 7.2.3.1 Optimizing Texture and Shelf Life in Confectionery with Modified Cassava Starch

- 7.2.4 BEVERAGES

- 7.2.4.1 Revolutionizing Beverage Formulations with Cassava-based Functional Starches

- 7.2.5 SNACKS

- 7.2.5.1 Boosting Snack Innovation and Crunch Appeal with Modified Cassava Starch

- 7.2.6 OTHER FOOD & BEVERAGE APPLICATIONS

- 7.3 FEED

- 7.3.1 GROWING FOCUS ON FEED EFFICIENCY AND COST OPTIMIZATION TO DRIVE DEMAND

- 7.3.2 RUMINANT FEED

- 7.3.2.1 Enhancing ruminant feed formulations with cassava-based functional starches

- 7.3.3 SWINE FEED

- 7.3.3.1 Modified cassava starch improves gut health in swine

- 7.3.4 POULTRY FEED

- 7.3.4.1 Growing demand for cost-effective and performance-enhancing energy ingredient solutions

- 7.3.5 OTHER FEED APPLICATIONS

- 7.4 INDUSTRIAL

- 7.4.1 RISING NEED FOR SUSTAINABLE INPUTS AND FUNCTIONAL PERFORMANCE IS BOOSTING INDUSTRIAL STARCH DEMAND

- 7.4.2 PAPERMAKING

- 7.4.2.1 Cost-effective and sustainable additives gain traction in papermaking industry

- 7.4.3 WEAVING & TEXTILES

- 7.4.3.1 Rising demand for renewable and biodegradable boosts industrial use of cassava starch

- 7.4.4 MEDICINES & PHARMACEUTICALS

- 7.4.4.1 Rising demand for renewable and biodegradable boosts industrial use of cassava starch

- 7.4.5 COSMETICS

- 7.4.5.1 Growing shift toward natural ingredients boosts cassava starch adoption in personal care

- 7.4.6 OTHER INDUSTRIAL APPLICATIONS

8 MODIFIED CASSAVA STARCH MARKET, BY FORM

- 8.1 INTRODUCTION

- 8.2 DRY

- 8.2.1 VERSATILE, SHELF-STABLE SOLUTION FOR BULK APPLICATIONS

- 8.3 LIQUID

- 8.3.1 OPTIMIZING FORMULATIONS WITH LIQUID MODIFIED CASSAVA STARCH IN HIGH-THROUGHPUT ENVIRONMENTS

9 MODIFIED CASSAVA STARCH MARKET, BY FUNCTION

- 9.1 INTRODUCTION

- 9.2 THICKENING AGENT

- 9.3 STABILIZER

- 9.4 GELATINIZATION

- 9.5 FILM-FORMING AGENT

- 9.6 BINDING AGENT

- 9.7 OTHER FUNCTIONS

10 MODIFIED CASSAVA STARCH MARKET, BY PRODUCT TYPE

- 10.1 INTRODUCTION

- 10.2 PRE-GELATINIZED STARCHES

- 10.2.1 INSTANT FUNCTIONALITY AND WIDE APPLICATION RANGE DRIVE DEMAND FOR PRE-GELATINIZED CASSAVA STARCH

- 10.3 EXTRUDED CASSAVA STARCH

- 10.3.1 PROCESSING ADVANTAGES POSITION EXTRUDED CASSAVA STARCH AS HIGH-VALUE FUNCTIONAL INGREDIENT

- 10.3.2 SNACKS

- 10.3.2.1 Increasing demand for healthy low-fat snacks to drive market growth

- 10.3.3 INSTANT SOUPS

- 10.3.3.1 Consumer shift toward ready-to-eat foods to drive use of instant thickeners

- 10.3.4 SAUCES

- 10.3.4.1 Texture stability and instant functionality drive innovation in sauce ingredients

- 10.3.5 FEED

- 10.3.5.1 Increasing focus on digestibility and feed efficiency to drive use of functional carbohydrates in animal nutrition

- 10.3.6 OTHER APPLICATIONS

- 10.4 DEXTRINIZED STARCHES

- 10.4.1 MULTI-INDUSTRY DEMAND AND BIO-BASED PERFORMANCE FUEL GROWTH OF DEXTRINIZED CASSAVA STARCHES

- 10.5 MALTODEXTRINS

- 10.5.1 MULTI-SECTOR ADOPTION OF PLANT-BASED CARRIERS DRIVES MARKET GROWTH

- 10.6 FERMENTED CASSAVA STARCH

- 10.6.1 FERMENTATION TRANSFORMS CASSAVA STARCH INTO HIGH-PERFORMANCE, MULTI-USE INGREDIENT

- 10.7 OTHER MODIFIED PRODUCTS

11 MODIFIED CASSAVA STARCH MARKET, BY TYPE OF MODIFICATION

- 11.1 INTRODUCTION

- 11.2 PHYSICAL MODIFICATION

- 11.2.1 CLEAN-LABEL APPEAL AND FUNCTIONAL BENEFITS OF PHYSICALLY MODIFIED CASSAVA STARCH TO DRIVE DEMAND

- 11.2.2 PRE-GELATINIZED STARCH

- 11.2.3 HEAT-MOISTURE TREATMENT

- 11.2.4 ANNEALED STARCH

- 11.3 CHEMICAL MODIFICATION

- 11.3.1 RISING DEMAND FOR CHEMICALLY MODIFIED CASSAVA STARCH DRIVEN BY FUNCTIONAL VERSATILITY AND INDUSTRIAL EFFICIENCY

- 11.3.2 CATIONIC STARCH

- 11.3.3 ETHERIFIED STARCH

- 11.3.4 ESTERIFIED STARCH

- 11.4 ENZYMATIC MODIFICATION

- 11.4.1 INCREASING DEMAND FOR SUSTAINABLE SOLUTIONS TO PROPEL GROWTH

12 MODIFIED CASSAVA STARCH MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 NORTH AMERICA

- 12.2.1 US

- 12.2.1.1 Functional and sustainable demand drives growth in US modified cassava starch market

- 12.2.2 CANADA

- 12.2.2.1 Specialty applications and eco-friendly trends shape Canada's cassava starch landscape

- 12.2.3 MEXICO

- 12.2.3.1 Modified cassava starch gains ground in Mexico through functional food applications and emerging industrial use

- 12.2.1 US

- 12.3 EUROPE

- 12.3.1 GERMANY

- 12.3.1.1 Advanced food industry and increased demand from consumers to fuel Germany's market growth

- 12.3.2 FRANCE

- 12.3.2.1 Rising industrial applications fueling demand for modified cassava starch in France

- 12.3.3 UK

- 12.3.3.1 Rising demand for clean-label foods fuels UK's reliance on imported modified cassava starch

- 12.3.4 ITALY

- 12.3.4.1 Widespread baker & confectionery industry in Italy to drive demand

- 12.3.5 SPAIN

- 12.3.5.1 Rising demand for modified cassava starch in Spain's functional and processed food markets

- 12.3.6 REST OF EUROPE

- 12.3.1 GERMANY

- 12.4 ASIA PACIFIC

- 12.4.1 CHINA

- 12.4.1.1 Surging demand in processed foods and bioplastics fuels cassava starch growth in China

- 12.4.2 JAPAN

- 12.4.2.1 Growth in processed food industry in Japan drives modified starch market

- 12.4.3 INDIA

- 12.4.3.1 Biotech-enabled starch reformulation to boost clean-label and functional food demand in India

- 12.4.4 AUSTRALIA & NEW ZEALAND

- 12.4.4.1 Health-driven innovation and clean-label trends fuel modified cassava starch demand in Australia & New Zealand

- 12.4.5 SOUTH KOREA

- 12.4.5.1 Functional versatility and import reliance drive modified cassava starch demand in South Korea

- 12.4.6 THAILAND

- 12.4.6.1 Abundance of cassava as raw material to drive Thai market

- 12.4.7 VIETNAM

- 12.4.7.1 Diversifying Vietnam's modified cassava starch market beyond China for sustainable growth

- 12.4.8 INDONESIA

- 12.4.8.1 Indonesia's expanding industrial applications and export strategy drive modified cassava starch market growth

- 12.4.9 REST OF ASIA PACIFIC

- 12.4.1 CHINA

- 12.5 SOUTH AMERICA

- 12.5.1 BRAZIL

- 12.5.1.1 Industrial upgrades and regional specialization drive modified cassava starch growth in Brazil

- 12.5.2 ARGENTINA

- 12.5.2.1 Growth in processed food industry in Japan to drive modified starch market

- 12.5.3 REST OF SOUTH AMERICA

- 12.5.1 BRAZIL

- 12.6 REST OF THE WORLD (ROW)

- 12.6.1 SOUTH AFRICA

- 12.6.1.1 Growth in industrial applications in South Africa fuels demand for modified cassava starch

- 12.6.2 MIDDLE EAST

- 12.6.2.1 Consumers witnessing increased demand for clean-label food products in Middle East

- 12.6.3 REST OF AFRICA

- 12.6.1 SOUTH AFRICA

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 13.3 REVENUE ANALYSIS, 2020-2024

- 13.4 MARKET SHARE ANALYSIS, 2024

- 13.5 COMPANY VALUATION AND FINANCIAL MATRIX

- 13.6 BRAND/PRODUCT COMPARISON

- 13.6.1 ADM

- 13.6.2 CARGILL, INCORPORATED

- 13.6.3 INGREDION

- 13.6.4 ROQUETTE FRERES

- 13.6.5 THAI WAH PUBLIC COMPANY LIMITED

- 13.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.7.1 STARS

- 13.7.2 EMERGING LEADERS

- 13.7.3 PERVASIVE PLAYERS

- 13.7.4 PARTICIPANTS

- 13.7.5 COMPANY FOOTPRINT: KEY PLAYERS

- 13.7.5.1 Company footprint

- 13.7.5.2 Region footprint

- 13.7.5.3 Product type footprint

- 13.7.5.4 Function footprint

- 13.7.5.5 Type of modification footprint

- 13.7.5.6 Application footprint

- 13.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.8.1 PROGRESSIVE COMPANIES

- 13.8.2 RESPONSIVE COMPANIES

- 13.8.3 DYNAMIC COMPANIES

- 13.8.4 STARTING BLOCKS

- 13.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 13.8.5.1 Detailed list of key startups/SMEs

- 13.8.5.2 Competitive benchmarking of key startups/SMEs

- 13.9 COMPETITIVE SCENARIO AND TRENDS

- 13.9.1 PRODUCT LAUNCHES

- 13.9.2 DEALS

- 13.9.3 EXPANSIONS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 ADM

- 14.1.1.1 Business overview

- 14.1.1.2 Products/Solutions/Services offered

- 14.1.1.3 Recent developments

- 14.1.1.4 MnM view

- 14.1.1.4.1 Right to win

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses and competitive threats

- 14.1.2 CARGILL, INCORPORATED

- 14.1.2.1 Business overview

- 14.1.2.2 Products/Solutions/Services offered

- 14.1.2.3 Recent developments

- 14.1.2.4 MnM view

- 14.1.2.4.1 Right to win

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses and competitive threats

- 14.1.3 ROQUETTE FRERES

- 14.1.3.1 Business overview

- 14.1.3.2 Products/Solutions/Services offered

- 14.1.3.3 Recent developments

- 14.1.3.4 MnM view

- 14.1.3.4.1 Right to win

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses and competitive threats

- 14.1.4 INGREDION

- 14.1.4.1 Business overview

- 14.1.4.2 Products/Solutions/Services offered

- 14.1.4.3 Recent developments

- 14.1.4.4 MnM view

- 14.1.4.4.1 Right to win

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses and competitive threats

- 14.1.5 THAI WAH

- 14.1.5.1 Business overview

- 14.1.5.2 Products/Solutions/Services offered

- 14.1.5.3 Recent developments

- 14.1.5.4 MnM view

- 14.1.5.4.1 Right to win

- 14.1.5.4.2 Strategic choices

- 14.1.5.4.3 Weaknesses and competitive threats

- 14.1.6 AGRANA

- 14.1.6.1 Business overview

- 14.1.6.2 Products/Solutions/Services offered

- 14.1.6.3 Recent developments

- 14.1.6.4 MnM view

- 14.1.7 BANPONG TAPIOCA

- 14.1.7.1 Business overview

- 14.1.7.2 Products/Solutions/Services offered

- 14.1.7.3 MnM view

- 14.1.8 SONISH STARCH TECHNOLOGY

- 14.1.8.1 Business overview

- 14.1.8.2 Products/Solutions/Services offered

- 14.1.8.3 MnM view

- 14.1.9 BS STARCH CHEMICAL

- 14.1.9.1 Business overview

- 14.1.9.2 Products/Solutions/Services offered

- 14.1.9.3 MnM view

- 14.1.10 VEDAN ENTERPRISE CORPORATION

- 14.1.10.1 Business overview

- 14.1.10.2 Products/Solutions/Services offered

- 14.1.10.3 MnM view

- 14.1.11 ASIA MODIFIED STARCH CO., LTD.

- 14.1.11.1 Business overview

- 14.1.11.2 Products/Solutions/Services offered

- 14.1.11.3 Recent developments

- 14.1.11.4 MnM view

- 14.1.12 SPAC STARCH PRODUCTS INDIA PVT. LTD.

- 14.1.12.1 Business overview

- 14.1.12.2 Products/Solutions/Services offered

- 14.1.12.3 MnM view

- 14.1.13 SMS CORPORATION

- 14.1.13.1 Business overview

- 14.1.13.2 Products/Solutions/Services offered

- 14.1.13.3 Recent developments

- 14.1.13.4 MnM view

- 14.1.14 BENEVA

- 14.1.14.1 Business overview

- 14.1.14.2 Products/Solutions/Services offered

- 14.1.14.3 MnM view

- 14.1.15 VIETNAM TAPIOCA STARCH SOLUTIONS - VIEGO GLOBAL

- 14.1.15.1 Business overview

- 14.1.15.2 Products/Solutions/Services offered

- 14.1.15.3 MnM view

- 14.1.16 NEO NAM VIET CO., LTD.

- 14.1.16.1 Business overview

- 14.1.16.2 Products/Solutions/Services offered

- 14.1.16.3 MnM view

- 14.1.17 STARCH ASIA

- 14.1.17.1 Business overview

- 14.1.17.2 Products/Solutions/Services offered

- 14.1.17.3 MnM view

- 14.1.18 GENERAL STARCH LIMITED

- 14.1.18.1 Business overview

- 14.1.18.2 Products/Solutions/Services offered

- 14.1.18.3 MnM view

- 14.1.19 RVP STARCH PRODUCTS PVT. LTD.

- 14.1.19.1 Business overview

- 14.1.19.2 Products/Solutions/Services offered

- 14.1.19.3 MnM view

- 14.1.20 EXPORTVN COMPANY LIMITED

- 14.1.21 VENUS STARCH INDUSTRIES

- 14.1.22 NGUYEN STARCH

- 14.1.23 PT. STARCH SOLUTION INTERNASIONAL

- 14.1.24 BENZSON CORPORATION

- 14.1.25 VARALAKSHMI STARCH INDUSTRIES (P) LTD

- 14.1.26 PURA ORGANIC AGRO TECH LTD

- 14.1.1 ADM

15 ADJACENT AND RELATED MARKETS

- 15.1 INTRODUCTION

- 15.2 LIMITATIONS

- 15.3 PEA STARCH MARKET

- 15.3.1 MARKET DEFINITION

- 15.3.2 MARKET OVERVIEW

- 15.4 POTATO STARCH MARKET

- 15.4.1 MARKET DEFINITION

- 15.4.2 MARKET OVERVIEW

- 15.5 MODIFIED STARCH MARKET

- 15.5.1 MARKET DEFINITION

- 15.5.2 MARKET OVERVIEW

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS