|

|

市場調査レポート

商品コード

1781112

リチウムイオン電池用負極市場:材料別、電池製品別、最終用途別、生産技術別、地域別 - 予測(~2030年)Lithium-ion Battery Anode Market by Material (Active Anode Materials and Anode Binders), Battery Product (Cell and Battery Pack), End-use (Automotive and Non-automotive), Production Technology, and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| リチウムイオン電池用負極市場:材料別、電池製品別、最終用途別、生産技術別、地域別 - 予測(~2030年) |

|

出版日: 2025年07月28日

発行: MarketsandMarkets

ページ情報: 英文 228 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

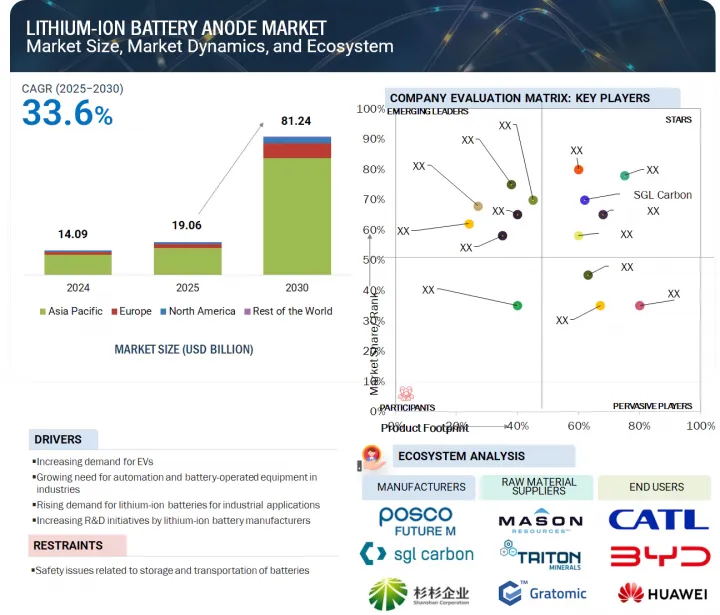

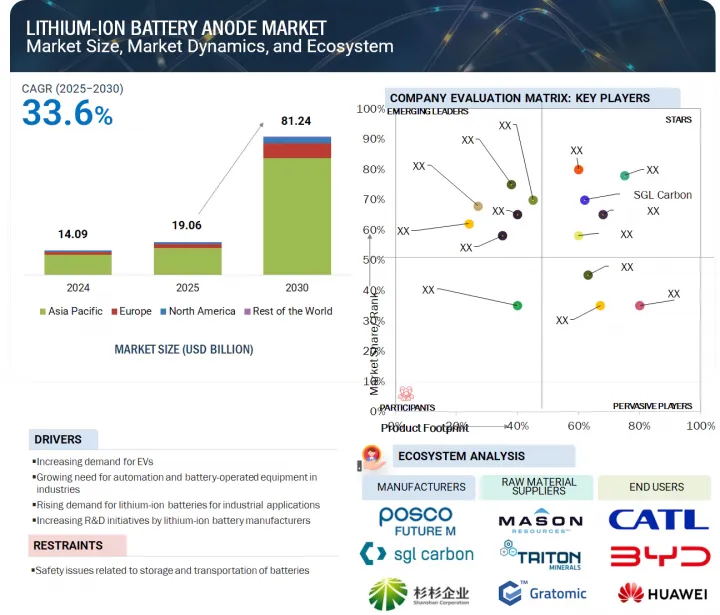

世界のリチウムイオン電池用負極の市場規模は、2025年の190億6,000万米ドルから2030年までに812億4,000万米ドルに達すると予測され、予測期間にCAGRで33.6%の成長が見込まれます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 単位 | 金額(100万米ドル)、数量(トン) |

| セグメント | 材料、最終用途、電池製品、生産技術、地域 |

| 対象地域 | 北米、アジア太平洋、欧州、その他の地域 |

市場の急成長は入手性の2つの利点に起因しています。これらのソリューションは、再生可能エネルギー源の大規模エネルギー貯蔵にコスト効率の高い方法を提供し、風力発電や太陽光発電の変動を管理するのに理想的です。さらに、標準的なナトリウムに依存するため、より持続可能な選択肢となり、環境に対する影響を低減するための世界の取り組みに合致しています。

「材料別では、人造黒鉛セグメントが予測期間に第2位の市場シェアを占めます。」

材料タイプ別では、予測期間に人造黒鉛セグメントがリチウムイオン電池用負極市場で第2位の市場シェアを占める見込みです。これは、特定の高エネルギー用途において、天然黒鉛と比較して安定した品質、高純度レベル、優れた性能特性があるためです。人造黒鉛は、より優れた構造均一性、より高い導電性、充放電サイクルの向上を実現し、電気自動車や産業用エネルギー貯蔵システムで使用される高性能電池に適しています。人造黒鉛は天然黒鉛より生産コストが高いですが、信頼性が高く、先進の電池化学との互換性があるため、高性能用途に適しています。EVインフラへの投資の増加と電池システムの技術の進歩が、この製品の採用をさらに後押ししています。また、メーカー各社は人造黒鉛のコスト削減のため、生産効率の向上に注力しています。これらの要因は、今後数年間における人造黒鉛セグメントの着実な成長と大きな市場シェアに寄与します。

「最終用途別では、予測期間に非自動車セグメントが第2位のシェアを占めます。」

非自動車セグメントが予測期間に金額ベースでリチウムイオン電池用負極市場で2番目に大きなシェアを占める見込みです。このセグメントには、コンシューマーエレクトロニクス、産業機器、エネルギー貯蔵システムなどの用途が含まれ、いずれも着実な成長を示しています。スマートフォン、ラップトップ、タブレットなどのポータブルデバイスの採用が増加しているため、信頼性の高い電池技術への需要が引き続き高まっています。これと並行して、据置型エネルギー貯蔵ソリューションも、特にグリッドサポートや再生可能エネルギー統合で勢いを増しています。電動工具やバックアップ電源システムなどの産業用途も、このセグメントの拡大に寄与しています。エネルギー効率と持続可能性が世界的に重要な優先事項となるにつれて、非自動車部門でも先進電池ソリューションへの投資が増加しています。これらの要因が相まって、リチウムイオン電池用負極の需要は、自動車以外の分野でも力強く持続することが確実視されています。

「欧州が予測期間に第2位のシェアを占めます。」

欧州は、強力な規制支援と加速するクリーンエネルギーへの取り組みにより、予測期間に金額ベースでリチウムイオン電池用負極市場の第2位のシェアを占める見込みです。欧州連合(EU)がカーボンニュートラルと排出基準の厳格化を推進する中、同地域では電気自動車の採用と再生可能エネルギーの統合が急成長しています。ドイツ、フランスなどの主要国は、電池製造とエネルギー貯蔵インフラに多額の投資を行っています。主要な電池メーカーのプレゼンスとバリューチェーン全体にわたる戦略的提携が、この地域市場をさらに強化しています。また、欧州は循環型経済の原則を重視しており、電池コンポーネントのリサイクルと技術革新を奨励しています。これらの要因が相まって、欧州は世界のリチウムイオン電池用負極市場における重要な拠点となっています。

当レポートでは、世界のリチウムイオン電池用負極市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要な知見

- リチウムイオン電池用負極市場における魅力的な機会

- リチウムイオン電池用負極市場:地域別

- リチウムイオン電池用負極市場:材料別

- リチウムイオン電池用負極市場:主要国別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ポーターのファイブフォース分析

第6章 産業動向

- 世界のマクロ経済の見通し

- サプライチェーン分析

- エコシステム分析

- 関税と規制情勢

- 技術分析

- 主要技術

- 補完技術

- 主な会議とイベント

- 貿易データ

- 輸入シナリオ(HSコード850650)

- 輸出シナリオ(HSコード850650)

- 価格分析

- リチウムイオン電池用負極の平均販売価格:地域別

- リチウムイオン電池用負極の平均販売価格:材料別

- 主なステークホルダーと購入基準

- 特許分析

- 調査手法

- 主要特許

- 投資と資金調達のシナリオ

- カスタマービジネスに影響を与える動向/混乱

- リチウムイオン電池用負極市場に対する生成AIの影響

- 2025年の米国関税の影響 - リチウムイオン電池用負極市場

- 主な関税率

- 価格の影響の分析

- 国/地域への主な影響

- 最終用途産業に対する影響

第7章 リチウムイオン電池用負極市場:電池製品別

- イントロダクション

- セル

- 電池パック

第8章 リチウムイオン電池用負極市場:生産技術別

- イントロダクション

- 化学蒸着

- スラリーコーティング

- その他の生産技術

第9章 リチウムイオン電池用負極市場:材料別

- イントロダクション

- 負極活物質

- 天然黒鉛

- 人造黒鉛

- ケイ素

- リチウム化合物・リチウム金属

- 負極バインダー

第10章 リチウムイオン電池用負極市場:用途別

- イントロダクション

- 自動車

- 非自動車

- エネルギー貯蔵

- 航空宇宙

- 船舶

- その他の用途

第11章 リチウムイオン電池用負極市場:地域別

- イントロダクション

- 北米

- アジア太平洋

- 中国

- 韓国

- 日本

- タイ

- オーストラリア

- 欧州

- ドイツ

- ハンガリー

- ポーランド

- スウェーデン

- フランス

- 英国

- その他の欧州

- その他の地域

第12章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 収益分析

- 市場シェア分析

- ブランド/製品の比較

- NINGBO SHANSHAN CO., LTD.の負極材料

- POSCO FUTURE Mの負極活物質

- MITSUBISHI CHEMICAL GROUP CORPORATIONの負極材料

- SIGRACELL

- HF-FREE

- 企業の評価マトリクス:主要企業(2024年)

- 企業の評価マトリクス:スタートアップ/中小企業(2024年)

- 企業の評価と財務指標

- 競合シナリオと動向

第13章 企業プロファイル

- 主要企業

- RESONAC HOLDINGS CORPORATION

- JFE CHEMICAL CORPORATION

- KUREHA CORPORATION

- SGL CARBON

- NINGBO SHANSHAN CO., LTD.

- POSCO FUTURE M

- NIPPON CARBON CO., LTD.

- NEI CORPORATION

- JIANGXI ZHENGTUO NEW ENERGY TECHNOLOGY

- SHANGHAI PTL NEW ENERGY TECHNOLOGY CO., LTD.

- MITSUBISHI CHEMICAL GROUP CORPORATION

- SHIN-ETSU CHEMICAL CO., LTD.

- HIMADRI SPECIALITY CHEMICAL LTD.

- TOKAI CARBON CO., LTD.

- KURARAY CO., LTD.

- INTERNATIONAL GRAPHITE LTD.

- ECOGRAF

- TALGA GROUP

- BTR NEW MATERIALS GROUP CO., LTD.

- GUANGDONG KAIJIN NEW ENERGY TECHNOLOGY CO., LTD.

- AEKYUNG CHEMICAL CO., LTD.

- EPSILON CARBON PRIVATE LIMITED

- BASF

- その他の企業

- ANOVION LLC

- AMSTED GRAPHITE MATERIALS

- REDWOOD MATERIALS INC.

- PRINCETON NUENERGY INC.

- ECHION TECHNOLOGIES LIMITED

第14章 隣接市場と関連市場

- イントロダクション

- 制限事項

- 相互接続された市場

- リチウムイオン電池材料市場

- 市場の定義

- 市場の概要

- 用途別

第15章 付録

List of Tables

- TABLE 1 LITHIUM-ION BATTERY ANODE MARKET SNAPSHOT: 2025 VS. 2030

- TABLE 2 LITHIUM-ION BATTERY ANODE MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 3 REAL GDP GROWTH (ANNUAL PERCENTAGE CHANGE), BY KEY COUNTRY, 2022-2024 (%)

- TABLE 4 UNEMPLOYMENT RATE, BY KEY COUNTRY, 2022-2024 (%)

- TABLE 5 INFLATION RATE AVERAGE CONSUMER PRICES, BY KEY COUNTRY, 2022-2024 (%)

- TABLE 6 FOREIGN DIRECT INVESTMENT, BY REGION, 2022 & 2023 (USD BILLION)

- TABLE 7 ROLE OF PLAYERS IN LITHIUM-ION BATTERY ANODE MARKET

- TABLE 8 TARIFF RELATED TO LITHIUM-ION BATTERY ANODE

- TABLE 9 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 LITHIUM-ION BATTERY ANODE MARKET: KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 13 IMPORT DATA FOR HS CODE 850650, BY KEY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 14 EXPORT DATA FOR HS CODE 4002, BY KEY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 15 AVERAGE SELLING PRICE OF LITHIUM-ION BATTERY ANODE, BY REGION, 2022-2024

- TABLE 16 AVERAGE SELLING PRICE OF LITHIUM-ION BATTERY ANODE, BY MATERIAL, 2024

- TABLE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR MAJOR END USES (%)

- TABLE 18 KEY BUYING CRITERIA FOR TOP THREE END USES

- TABLE 19 LITHIUM-ION BATTERY ANODE MARKET, BY MATERIAL, 2020-2023 (TON)

- TABLE 20 LITHIUM-ION BATTERY ANODE MARKET, BY MATERIAL, 2024-2030 (TON)

- TABLE 21 LITHIUM-ION BATTERY ANODE MARKET, BY MATERIAL, 2020-2023 (USD MILLION)

- TABLE 22 LITHIUM-ION BATTERY ANODE MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 23 LITHIUM-ION BATTERY ANODE MARKET, BY ACTIVE ANODE MATERIAL, 2020-2023 (TON)

- TABLE 24 LITHIUM-ION BATTERY ANODE MARKET, BY ACTIVE ANODE MATERIAL, 2024-2030 (TON)

- TABLE 25 LITHIUM-ION BATTERY ANODE MARKET, BY ACTIVE ANODE MATERIAL, 2020-2023 (USD MILLION)

- TABLE 26 LITHIUM-ION BATTERY ANODE MARKET, BY ACTIVE ANODE MATERIAL, 2024-2030 (USD MILLION)

- TABLE 27 NATURAL GRAPHITE: LITHIUM-ION BATTERY ANODE MARKET, BY REGION, 2020-2023 (TON)

- TABLE 28 NATURAL GRAPHITE: LITHIUM-ION BATTERY ANODE MARKET, BY REGION, 2024-2030 (TON)

- TABLE 29 NATURAL GRAPHITE: LITHIUM-ION BATTERY ANODE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 30 NATURAL GRAPHITE: LITHIUM-ION BATTERY ANODE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 31 SYNTHETIC GRAPHITE: LITHIUM-ION BATTERY ANODE MARKET, BY REGION, 2020-2023 (TON)

- TABLE 32 SYNTHETIC GRAPHITE: LITHIUM-ION BATTERY ANODE MARKET, BY REGION, 2024-2030 (TON)

- TABLE 33 SYNTHETIC GRAPHITE: LITHIUM-ION BATTERY ANODE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 34 SYNTHETIC GRAPHITE: LITHIUM-ION BATTERY ANODE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 35 SILICON: LITHIUM-ION BATTERY ANODE MARKET, BY REGION, 2020-2023 (TON)

- TABLE 36 SILICON: LITHIUM-ION BATTERY ANODE MARKET, BY REGION, 2024-2030 (TON)

- TABLE 37 SILICON: LITHIUM-ION BATTERY ANODE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 38 SILICON: LITHIUM-ION BATTERY ANODE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 39 LI-COMPOUNDS & LI-METALS: LITHIUM-ION BATTERY ANODE MARKET, BY REGION, 2020-2023 (TON)

- TABLE 40 LI-COMPOUNDS & LI-METALS: LITHIUM-ION BATTERY ANODE MARKET, BY REGION, 2024-2030 (TON)

- TABLE 41 LI-COMPOUNDS & LI-METALS: LITHIUM-ION BATTERY ANODE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 42 LI-COMPOUNDS & LI-METALS: LITHIUM-ION BATTERY ANODE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 43 ANODE BINDERS: LITHIUM-ION BATTERY ANODE MARKET, BY REGION, 2020-2023 (TON)

- TABLE 44 ANODE BINDERS: LITHIUM-ION BATTERY ANODE MARKET, BY REGION, 2024-2030 (TON)

- TABLE 45 ANODE BINDERS: LITHIUM-ION BATTERY ANODE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 46 ANODE BINDERS: LITHIUM-ION BATTERY ANODE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 47 LITHIUM-ION BATTERY ANODE MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 48 LITHIUM-ION BATTERY ANODE MARKET, BY END USE, 2024-2030 (USD MILLION)

- TABLE 49 NON-AUTOMOTIVE: LITHIUM-ION BATTERY ANODE MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 50 NON-AUTOMOTIVE: LITHIUM-ION BATTERY ANODE MARKET, BY END USE, 2024-2030 (USD MILLION)

- TABLE 51 LITHIUM-ION BATTERY ANODE MARKET, BY REGION, 2020-2023 (TON)

- TABLE 52 LITHIUM-ION BATTERY ANODE MARKET, BY REGION, 2024-2030 (TON)

- TABLE 53 LITHIUM-ION BATTERY ANODE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 54 LITHIUM-ION BATTERY ANODE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 55 NORTH AMERICA: LITHIUM-ION BATTERY ANODE MARKET, BY COUNTRY, 2020-2023 (TON)

- TABLE 56 NORTH AMERICA: LITHIUM-ION BATTERY ANODE MARKET, BY COUNTRY, 2024-2030 (TON)

- TABLE 57 NORTH AMERICA: LITHIUM-ION BATTERY ANODE MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 58 NORTH AMERICA: LITHIUM-ION BATTERY ANODE MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 59 US: LITHIUM-ION BATTERY ANODE MARKET, BY MATERIAL, 2020-2023 (TON)

- TABLE 60 US: LITHIUM-ION BATTERY ANODE MARKET, BY MATERIAL, 2024-2030 (TON)

- TABLE 61 US: LITHIUM-ION BATTERY ANODE MARKET, BY ACTIVE ANODE MATERIAL, 2020-2023 (TON)

- TABLE 62 US: LITHIUM-ION BATTERY ANODE MARKET, BY ACTIVE ANODE MATERIAL, 2024-2030 (TON)

- TABLE 63 US: LITHIUM-ION BATTERY ANODE MARKET, BY MATERIAL, 2020-2023 (USD MILLION)

- TABLE 64 US: LITHIUM-ION BATTERY ANODE MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 65 US: LITHIUM-ION BATTERY ANODE MARKET, BY ACTIVE ANODE MATERIAL, 2020-2023 (USD MILLION)

- TABLE 66 US: LITHIUM-ION BATTERY ANODE MARKET, BY ACTIVE ANODE MATERIAL, 2024-2030 (USD MILLION)

- TABLE 67 ASIA PACIFIC: LITHIUM-ION BATTERY ANODE MARKET, BY COUNTRY, 2020-2023 (TON)

- TABLE 68 ASIA PACIFIC: LITHIUM-ION BATTERY ANODE MARKET, BY COUNTRY, 2024-2030 (TON)

- TABLE 69 ASIA PACIFIC: LITHIUM-ION BATTERY ANODE MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 70 ASIA PACIFIC: LITHIUM-ION BATTERY ANODE MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 71 ASIA PACIFIC: LITHIUM-ION BATTERY ANODE MARKET, BY MATERIAL, 2020-2023 (TON)

- TABLE 72 ASIA PACIFIC: LITHIUM-ION BATTERY ANODE MARKET, BY MATERIAL, 2024-2030 (TON)

- TABLE 73 ASIA PACIFIC: LITHIUM-ION BATTERY ANODE MARKET, B Y ACTIVE ANODE MATERIAL, 2020-2023 (TON)

- TABLE 74 ASIA PACIFIC: LITHIUM-ION BATTERY ANODE MARKET, BY ACTIVE ANODE MATERIAL, 2024-2030 (TON)

- TABLE 75 ASIA PACIFIC: LITHIUM-ION BATTERY ANODE MARKET, BY MATERIAL, 2020-2023 (USD MILLION)

- TABLE 76 ASIA PACIFIC: LITHIUM-ION BATTERY ANODE MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 77 ASIA PACIFIC: LITHIUM-ION BATTERY ANODE MARKET, BY ACTIVE ANODE MATERIAL, 2020-2023 (USD MILLION)

- TABLE 78 ASIA PACIFIC: LITHIUM-ION BATTERY ANODE MARKET, BY ACTIVE ANODE MATERIAL, 2024-2030 (USD MILLION)

- TABLE 79 CHINA: LITHIUM-ION BATTERY ANODE MARKET, BY MATERIAL, 2020-2023 (TON)

- TABLE 80 CHINA: LITHIUM-ION BATTERY ANODE MARKET, BY MATERIAL, 2024-2030 (TON)

- TABLE 81 CHINA: LITHIUM-ION BATTERY ANODE MARKET, BY ACTIVE ANODE MATERIAL, 2020-2023 (TON)

- TABLE 82 CHINA: LITHIUM-ION BATTERY ANODE MARKET, BY ACTIVE ANODE MATERIAL, 2024-2030 (TON)

- TABLE 83 CHINA: LITHIUM-ION BATTERY ANODE MARKET, BY MATERIAL, 2020-2023 (USD MILLION)

- TABLE 84 CHINA: LITHIUM-ION BATTERY ANODE MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 85 CHINA: LITHIUM-ION BATTERY ANODE MARKET, BY ACTIVE ANODE MATERIAL, 2020-2023 (USD MILLION)

- TABLE 86 CHINA: LITHIUM-ION BATTERY ANODE MARKET, BY ACTIVE ANODE MATERIAL, 2024-2030 (USD MILLION)

- TABLE 87 SOUTH KOREA: LITHIUM-ION BATTERY ANODE MARKET, BY MATERIAL, 2020-2023 (TON)

- TABLE 88 SOUTH KOREA: LITHIUM-ION BATTERY ANODE MARKET, BY MATERIAL, 2024-2030 (TON)

- TABLE 89 SOUTH KOREA: LITHIUM-ION BATTERY ANODE MARKET, BY ACTIVE ANODE MATERIAL, 2020-2023 (TON)

- TABLE 90 SOUTH KOREA: LITHIUM-ION BATTERY ANODE MARKET, BY ACTIVE ANODE MATERIAL, 2024-2030 (TON)

- TABLE 91 SOUTH KOREA: LITHIUM-ION BATTERY ANODE MARKET, BY MATERIAL, 2020-2023 (USD MILLION)

- TABLE 92 SOUTH KOREA: LITHIUM-ION BATTERY ANODE MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 93 SOUTH KOREA: LITHIUM-ION BATTERY ANODE MARKET, BY ACTIVE ANODE MATERIAL, 2020-2023 (USD MILLION)

- TABLE 94 SOUTH KOREA: LITHIUM-ION BATTERY ANODE MARKET, BY ACTIVE ANODE MATERIAL, 2024-2030 (USD MILLION)

- TABLE 95 JAPAN: LITHIUM-ION BATTERY ANODE MARKET, BY MATERIAL, 2020-2023 (TON)

- TABLE 96 JAPAN: LITHIUM-ION BATTERY ANODE MARKET, BY MATERIAL, 2024-2030 (TON)

- TABLE 97 JAPAN: LITHIUM-ION BATTERY ANODE MARKET, BY ACTIVE ANODE MATERIAL, 2020-2023 (TON)

- TABLE 98 JAPAN: LITHIUM-ION BATTERY ANODE MARKET, BY ACTIVE ANODE MATERIAL, 2024-2030 (TON)

- TABLE 99 JAPAN: LITHIUM-ION BATTERY ANODE MARKET, BY MATERIAL, 2020-2023 (USD MILLION)

- TABLE 100 JAPAN: LITHIUM-ION BATTERY ANODE MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 101 JAPAN: LITHIUM-ION BATTERY ANODE MARKET, BY ACTIVE ANODE MATERIAL, 2020-2023 (USD MILLION)

- TABLE 102 JAPAN: LITHIUM-ION BATTERY ANODE MARKET, BY ACTIVE ANODE MATERIAL, 2024-2030 (USD MILLION)

- TABLE 103 THAILAND: LITHIUM-ION BATTERY ANODE MARKET, BY MATERIAL, 2020-2023 (TON)

- TABLE 104 THAILAND: LITHIUM-ION BATTERY ANODE MARKET, BY MATERIAL, 2024-2030 (TON)

- TABLE 105 THAILAND: LITHIUM-ION BATTERY ANODE MARKET, BY ACTIVE ANODE MATERIAL, 2020-2023 (TON)

- TABLE 106 THAILAND: LITHIUM-ION BATTERY ANODE MARKET, BY ACTIVE ANODE MATERIAL, 2024-2030 (TON)

- TABLE 107 THAILAND: LITHIUM-ION BATTERY ANODE MARKET, BY MATERIAL, 2020-2023 (USD MILLION)

- TABLE 108 THAILAND: LITHIUM-ION BATTERY ANODE MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 109 THAILAND: LITHIUM-ION BATTERY ANODE MARKET, BY ACTIVE ANODE MATERIAL, 2020-2023 (USD MILLION)

- TABLE 110 THAILAND: LITHIUM-ION BATTERY ANODE MARKET, BY ACTIVE ANODE MATERIAL, 2024-2030 (USD MILLION)

- TABLE 111 AUSTRALIA: LITHIUM-ION BATTERY ANODE MARKET, BY MATERIAL, 2020-2023 (TON)

- TABLE 112 AUSTRALIA: LITHIUM-ION BATTERY ANODE MARKET, BY MATERIAL, 2024-2030 (TON)

- TABLE 113 AUSTRALIA: LITHIUM-ION BATTERY ANODE MARKET, BY ACTIVE ANODE MATERIAL, 2020-2023 (TON)

- TABLE 114 AUSTRALIA: LITHIUM-ION BATTERY ANODE MARKET, BY ACTIVE ANODE MATERIAL, 2024-2030 (TON)

- TABLE 115 AUSTRALIA: LITHIUM-ION BATTERY ANODE MARKET, BY MATERIAL, 2020-2023 (USD MILLION)

- TABLE 116 AUSTRALIA: LITHIUM-ION BATTERY ANODE MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 117 AUSTRALIA: LITHIUM-ION BATTERY ANODE MARKET, BY ACTIVE ANODE MATERIAL, 2020-2023 (USD MILLION)

- TABLE 118 AUSTRALIA: LITHIUM-ION BATTERY ANODE MARKET, BY ACTIVE ANODE MATERIAL, 2024-2030 (USD MILLION)

- TABLE 119 EUROPE: LITHIUM-ION BATTERY ANODE MARKET, BY COUNTRY, 2020-2023 (TON)

- TABLE 120 EUROPE: LITHIUM-ION BATTERY ANODE MARKET, BY COUNTRY, 2024-2030 (TON)

- TABLE 121 EUROPE: LITHIUM-ION BATTERY ANODE MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 122 EUROPE: LITHIUM-ION BATTERY ANODE MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 123 EUROPE: LITHIUM-ION BATTERY ANODE MARKET, BY MATERIAL, 2020-2023 (TON)

- TABLE 124 EUROPE: LITHIUM-ION BATTERY ANODE MARKET, BY MATERIAL, 2024-2030 (TON)

- TABLE 125 EUROPE: LITHIUM-ION BATTERY ANODE MARKET, BY ACTIVE ANODE MATERIAL, 2020-2023 (TON)

- TABLE 126 EUROPE: LITHIUM-ION BATTERY ANODE MARKET, BY ACTIVE ANODE MATERIAL, 2024-2030 (TON)

- TABLE 127 EUROPE: LITHIUM-ION BATTERY ANODE MARKET, BY MATERIAL, 2020-2023 (USD MILLION)

- TABLE 128 EUROPE: LITHIUM-ION BATTERY ANODE MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 129 EUROPE: LITHIUM-ION BATTERY ANODE MARKET, BY ACTIVE ANODE MATERIAL, 2020-2023 (USD MILLION)

- TABLE 130 EUROPE: LITHIUM-ION BATTERY ANODE MARKET, BY ACTIVE ANODE MATERIAL, 2024-2030 (USD MILLION)

- TABLE 131 GERMANY: LITHIUM-ION BATTERY ANODE MARKET, BY MATERIAL, 2020-2023 (TON)

- TABLE 132 GERMANY: LITHIUM-ION BATTERY ANODE MARKET, BY MATERIAL, 2024-2030 (TON)

- TABLE 133 GERMANY: LITHIUM-ION BATTERY ANODE MARKET, BY ACTIVE ANODE MATERIAL, 2020-2023 (TON)

- TABLE 134 GERMANY: LITHIUM-ION BATTERY ANODE MARKET, BY ACTIVE ANODE MATERIAL, 2024-2030 (TON)

- TABLE 135 GERMANY: LITHIUM-ION BATTERY ANODE MARKET, BY MATERIAL, 2020-2023 (USD MILLION)

- TABLE 136 GERMANY: LITHIUM-ION BATTERY ANODE MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 137 GERMANY: LITHIUM-ION BATTERY ANODE MARKET, BY ACTIVE ANODE MATERIAL, 2020-2023 (USD MILLION)

- TABLE 138 GERMANY: LITHIUM-ION BATTERY ANODE MARKET, BY ACTIVE ANODE MATERIAL, 2024-2030 (USD MILLION)

- TABLE 139 HUNGARY: LITHIUM-ION BATTERY ANODE MARKET, BY MATERIAL, 2020-2023 (TON)

- TABLE 140 HUNGARY: LITHIUM-ION BATTERY ANODE MARKET, BY MATERIAL, 2024-2030 (TON)

- TABLE 141 HUNGARY: LITHIUM-ION BATTERY ANODE MARKET, BY ACTIVE ANODE MATERIAL, 2020-2023 (TON)

- TABLE 142 HUNGARY: LITHIUM-ION BATTERY ANODE MARKET, BY ACTIVE ANODE MATERIAL, 2024-2030 (TON)

- TABLE 143 HUNGARY: LITHIUM-ION BATTERY ANODE MARKET, BY MATERIAL, 2020-2023 (USD MILLION)

- TABLE 144 HUNGARY: LITHIUM-ION BATTERY ANODE MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 145 HUNGARY: LITHIUM-ION BATTERY ANODE MARKET, BY ACTIVE ANODE MATERIAL, 2020-2023 (USD MILLION)

- TABLE 146 HUNGARY: LITHIUM-ION BATTERY ANODE MARKET, BY ACTIVE ANODE MATERIAL, 2024-2030 (USD MILLION)

- TABLE 147 POLAND: LITHIUM-ION BATTERY ANODE MARKET, BY MATERIAL, 2020-2023 (TON)

- TABLE 148 POLAND: LITHIUM-ION BATTERY ANODE MARKET, BY MATERIAL, 2024-2030 (TON)

- TABLE 149 POLAND: LITHIUM-ION BATTERY ANODE MARKET, BY ACTIVE ANODE MATERIAL, 2020-2023 (TON)

- TABLE 150 POLAND: LITHIUM-ION BATTERY ANODE MARKET, BY ACTIVE ANODE MATERIAL, 2024-2030 (TON)

- TABLE 151 POLAND: LITHIUM-ION BATTERY ANODE MARKET, BY MATERIAL, 2020-2023 (USD MILLION)

- TABLE 152 POLAND: LITHIUM-ION BATTERY ANODE MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 153 POLAND: LITHIUM-ION BATTERY ANODE MARKET, BY ACTIVE ANODE MATERIAL, 2020-2023 (USD MILLION)

- TABLE 154 POLAND: LITHIUM-ION BATTERY ANODE MARKET, BY ACTIVE ANODE MATERIAL, 2024-2030 (USD MILLION)

- TABLE 155 SWEDEN: LITHIUM-ION BATTERY ANODE MARKET, BY MATERIAL, 2020-2023 (TON)

- TABLE 156 SWEDEN: LITHIUM-ION BATTERY ANODE MARKET, BY MATERIAL, 2024-2030 (TON)

- TABLE 157 SWEDEN: LITHIUM-ION BATTERY ANODE MARKET, BY ACTIVE ANODE MATERIAL, 2020-2023 (TON)

- TABLE 158 SWEDEN: LITHIUM-ION BATTERY ANODE MARKET, BY ACTIVE ANODE MATERIAL, 2024-2030 (TON)

- TABLE 159 SWEDEN: LITHIUM-ION BATTERY ANODE MARKET, BY MATERIAL, 2020-2023 (USD MILLION)

- TABLE 160 SWEDEN: LITHIUM-ION BATTERY ANODE MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 161 SWEDEN: LITHIUM-ION BATTERY ANODE MARKET, BY ACTIVE ANODE MATERIAL, 2020-2023 (USD MILLION)

- TABLE 162 SWEDEN: LITHIUM-ION BATTERY ANODE MARKET, BY ACTIVE ANODE MATERIAL, 2024-2030 (USD MILLION)

- TABLE 163 FRANCE: LITHIUM-ION BATTERY ANODE MARKET, BY MATERIAL, 2020-2023 (TON)

- TABLE 164 FRANCE: LITHIUM-ION BATTERY ANODE MARKET, BY MATERIAL, 2024-2030 (TON)

- TABLE 165 FRANCE: LITHIUM-ION BATTERY ANODE MARKET, BY ACTIVE ANODE MATERIAL, 2020-2023 (TON)

- TABLE 166 FRANCE: LITHIUM-ION BATTERY ANODE MARKET, BY ACTIVE ANODE MATERIAL, 2024-2030 (TON)

- TABLE 167 FRANCE: LITHIUM-ION BATTERY ANODE MARKET, BY MATERIAL, 2020-2023 (USD MILLION)

- TABLE 168 FRANCE: LITHIUM-ION BATTERY ANODE MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 169 FRANCE: LITHIUM-ION BATTERY ANODE MARKET, BY ACTIVE ANODE MATERIAL, 2020-2023 (USD MILLION)

- TABLE 170 FRANCE: LITHIUM-ION BATTERY ANODE MARKET, BY ACTIVE ANODE MATERIAL, 2024-2030 (USD MILLION)

- TABLE 171 UK: LITHIUM-ION BATTERY ANODE MARKET, BY MATERIAL, 2020-2023 (TON)

- TABLE 172 UK: LITHIUM-ION BATTERY ANODE MARKET, BY MATERIAL, 2024-2030 (TON)

- TABLE 173 UK: LITHIUM-ION BATTERY ANODE MARKET, BY ACTIVE ANODE MATERIAL, 2020-2023 (TON)

- TABLE 174 UK: LITHIUM-ION BATTERY ANODE MARKET, BY ACTIVE ANODE MATERIAL, 2024-2030 (TON)

- TABLE 175 UK: LITHIUM-ION BATTERY ANODE MARKET, BY MATERIAL, 2020-2023 (USD MILLION)

- TABLE 176 UK: LITHIUM-ION BATTERY ANODE MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 177 UK: LITHIUM-ION BATTERY ANODE MARKET, BY ACTIVE ANODE MATERIAL, 2020-2023 (USD MILLION)

- TABLE 178 UK: LITHIUM-ION BATTERY ANODE MARKET, BY ACTIVE ANODE MATERIAL, 2024-2030 (USD MILLION)

- TABLE 179 REST OF EUROPE: LITHIUM-ION BATTERY ANODE MARKET, BY MATERIAL, 2020-2023 (TON)

- TABLE 180 REST OF EUROPE: LITHIUM-ION BATTERY ANODE MARKET, BY MATERIAL, 2024-2030 (TON)

- TABLE 181 REST OF EUROPE: LITHIUM-ION BATTERY ANODE MARKET, BY ACTIVE ANODE MATERIAL, 2020-2023 (TON)

- TABLE 182 REST OF EUROPE: LITHIUM-ION BATTERY ANODE MARKET, BY ACTIVE ANODE MATERIAL, 2024-2030 (TON)

- TABLE 183 REST OF EUROPE: LITHIUM-ION BATTERY ANODE MARKET, BY MATERIAL, 2020-2023 (USD MILLION)

- TABLE 184 REST OF EUROPE: LITHIUM-ION BATTERY ANODE MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 185 REST OF EUROPE: LITHIUM-ION BATTERY ANODE MARKET, BY ACTIVE ANODE MATERIAL, 2020-2023 (USD MILLION)

- TABLE 186 REST OF EUROPE: LITHIUM-ION BATTERY ANODE MARKET, BY ACTIVE ANODE MATERIAL, 2024-2030 (USD MILLION)

- TABLE 187 REST OF THE WORLD: LITHIUM-ION BATTERY ANODE MARKET, BY REGION, 2020-2023 (TON)

- TABLE 188 REST OF THE WORLD: LITHIUM-ION BATTERY ANODE MARKET, BY REGION, 2024-2030 (TON)

- TABLE 189 REST OF THE WORLD: LITHIUM-ION BATTERY ANODE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 190 REST OF THE WORLD: LITHIUM-ION BATTERY ANODE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 191 REST OF THE WORLD: LITHIUM-ION BATTERY ANODE MARKET, BY MATERIAL, 2020-2023 (TON)

- TABLE 192 REST OF THE WORLD: LITHIUM-ION BATTERY ANODE MARKET, BY MATERIAL, 2024-2030 (TON)

- TABLE 193 REST OF THE WORLD: LITHIUM-ION BATTERY ANODE MARKET, BY ACTIVE ANODE MATERIAL, 2020-2023 (TON)

- TABLE 194 REST OF THE WORLD: LITHIUM-ION BATTERY ANODE MARKET, BY ACTIVE ANODE MATERIAL, 2024-2030 (TON)

- TABLE 195 REST OF THE WORLD: LITHIUM-ION BATTERY ANODE MARKET, BY MATERIAL, 2020-2023 (USD MILLION)

- TABLE 196 REST OF THE WORLD: LITHIUM-ION BATTERY ANODE MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 197 REST OF THE WORLD: LITHIUM-ION BATTERY ANODE MARKET, BY ACTIVE ANODE MATERIAL, 2020-2023 (USD MILLION)

- TABLE 198 REST OF THE WORLD: LITHIUM-ION BATTERY ANODE MARKET, BY ACTIVE ANODE MATERIAL, 2024-2030 (USD MILLION)

- TABLE 199 OVERVIEW OF STRATEGIES ADOPTED BY KEY MARKET PLAYERS, JANUARY 2020-MAY 2025

- TABLE 200 DEGREE OF COMPETITION: LITHIUM-ION BATTERY ANODE MARKET

- TABLE 201 LITHIUM-ION BATTERY ANODE MARKET: REGION FOOTPRINT

- TABLE 202 LITHIUM-ION BATTERY ANODE MARKET: MATERIAL FOOTPRINT

- TABLE 203 LITHIUM-ION BATTERY ANODE MARKET: END-USE FOOTPRINT

- TABLE 204 LITHIUM-ION BATTERY ANODE MARKET: BATTERY PRODUCT FOOTPRINT

- TABLE 205 LITHIUM-ION BATTERY ANODE MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 206 LITHIUM-ION BATTERY ANODE MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 207 LITHIUM-ION BATTERY ANODE MARKET: PRODUCT LAUNCHES, JANUARY 2020-MAY 2025

- TABLE 208 LITHIUM-ION BATTERY ANODE MARKET: DEALS, JANUARY 2020-MAY 2025

- TABLE 209 LITHIUM-ION BATTERY ANODE MARKET: EXPANSIONS, JANUARY 2020-MAY 2025

- TABLE 210 RESONAC HOLDINGS CORPORATION: COMPANY OVERVIEW

- TABLE 211 RESONAC HOLDINGS CORPORATION: PRODUCTS OFFERED

- TABLE 212 RESONAC HOLDINGS CORPORATION: DEALS

- TABLE 213 JFE CHEMICAL CORPORATION: COMPANY OVERVIEW

- TABLE 214 JFE CHEMICAL CORPORATION: PRODUCTS OFFERED

- TABLE 215 KUREHA CORPORATION: COMPANY OVERVIEW

- TABLE 216 KUREHA CORPORATION: PRODUCTS OFFERED

- TABLE 217 SGL CARBON: COMPANY OVERVIEW

- TABLE 218 SGL CARBON: PRODUCTS OFFERED

- TABLE 219 SGL CARBON: DEALS

- TABLE 220 SGL CARBON: OTHER DEVELOPMENTS

- TABLE 221 SGL CARBON: EXPANSIONS

- TABLE 222 NINGBO SHANSHAN CO., LTD.: COMPANY OVERVIEW

- TABLE 223 NINGBO SHANSHAN CO., LTD.: PRODUCTS OFFERED

- TABLE 224 NINGBO SHANSHAN CO., LTD.: DEALS

- TABLE 225 NINGBO SHANSHAN CO., LTD.: EXPANSIONS

- TABLE 226 POSCO FUTURE M: COMPANY OVERVIEW

- TABLE 227 POSCO FUTURE M: PRODUCTS OFFERED

- TABLE 228 POSCO FUTURE M: PRODUCT LAUNCHES

- TABLE 229 POSCO FUTURE M: DEALS

- TABLE 230 POSCO FUTURE M: EXPANSIONS

- TABLE 231 NIPPON CARBON CO., LTD.: COMPANY OVERVIEW

- TABLE 232 NIPPON CARBON CO LTD.: PRODUCTS OFFERED

- TABLE 233 NEI CORPORATION: COMPANY OVERVIEW

- TABLE 234 NEI CORPORATION: PRODUCTS OFFERED

- TABLE 235 NEI CORPORATION: PRODUCT LAUNCHES

- TABLE 236 NEI CORPORATION: CONTRACTS

- TABLE 237 JIANGXI ZHENGTUO NEW ENERGY TECHNOLOGY: COMPANY OVERVIEW

- TABLE 238 JIANGXI ZHENGTUO NEW ENERGY TECHNOLOGY: PRODUCTS OFFERED

- TABLE 239 SHANGHAI PTL NEW ENERGY TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 240 SHANGHAI PTL NEW ENERGY TECHNOLOGY CO., LTD.: PRODUCTS OFFERED

- TABLE 241 SHANGHAI PTL NEW ENERGY TECHNOLOGY CO., LTD.: DEALS

- TABLE 242 SHANGHAI PTL NEW ENERGY TECHNOLOGY CO., LTD.: EXPANSIONS

- TABLE 243 MITSUBISHI CHEMICAL GROUP CORPORATION: COMPANY OVERVIEW

- TABLE 244 MITSUBISHI CHEMICAL GROUP CORPORATION: PRODUCTS OFFERED

- TABLE 245 MITSUBISHI CHEMICAL GROUP CORPORATION: DEALS

- TABLE 246 MITSUBISHI CHEMICAL GROUP CORPORATION: EXPANSIONS

- TABLE 247 SHIN-ETSU CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 248 SHIN-ETSU CHEMICAL CO., LTD.: PRODUCTS OFFERED

- TABLE 249 HIMADRI SPECIALITY CHEMICAL LTD.: COMPANY OVERVIEW

- TABLE 250 HIMADRI SPECIALITY CHEMICAL LTD.: PRODUCTS OFFERED

- TABLE 251 HIMADRI SPECIALITY CHEMICAL LTD.: DEALS

- TABLE 252 TOKAI CARBON CO., LTD.: COMPANY OVERVIEW

- TABLE 253 TOKAI CARBON CO., LTD.: PRODUCTS OFFERED

- TABLE 254 KURARAY CO., LTD.: COMPANY OVERVIEW

- TABLE 255 KURARAY CO., LTD.: PRODUCTS OFFERED

- TABLE 256 INTERNATIONAL GRAPHITE LTD.: COMPANY OVERVIEW

- TABLE 257 INTERNATIONAL GRAPHITE LTD.: PRODUCTS OFFERED

- TABLE 258 INTERNATIONAL GRAPHITE LTD.: DEALS

- TABLE 259 INTERNATIONAL GRAPHITE LTD.: EXPANSIONS

- TABLE 260 ECOGRAF: COMPANY OVERVIEW

- TABLE 261 ECOGRAF: PRODUCTS OFFERED

- TABLE 262 ECOGRAF: DEALS

- TABLE 263 TALGA GROUP: COMPANY OVERVIEW

- TABLE 264 TALGA GROUP: PRODUCTS OFFERED

- TABLE 265 BTR NEW MATERIALS GROUP CO., LTD.: COMPANY OVERVIEW

- TABLE 266 BTR NEW MATERIALS GROUP CO., LTD.: PRODUCTS OFFERED

- TABLE 267 GUANGDONG KAIJIN NEW ENERGY TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 268 GUANGDONG KAIJIN NEW ENERGY TECHNOLOGY CO., LTD.: PRODUCTS OFFERED

- TABLE 269 AEKYUNG CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 270 AEKYUNG CHEMICAL CO., LTD.: PRODUCTS OFFERED

- TABLE 271 EPSILON: COMPANY OVERVIEW

- TABLE 272 EPSILON: PRODUCTS OFFERED

- TABLE 273 EPSILON: DEALS

- TABLE 274 EPSILON: EXPANSIONS

- TABLE 275 BASF: COMPANY OVERVIEW

- TABLE 276 BASF: PRODUCTS OFFERED

- TABLE 277 BASF: DEALS

- TABLE 278 BASF: EXPANSIONS

- TABLE 279 ANOVION LLC: COMPANY OVERVIEW

- TABLE 280 ANOVION LLC: DEALS

- TABLE 281 ANOVION LLC: OTHER DEVELOPMENTS

- TABLE 282 ANOVION LLC: EXPANSIONS

- TABLE 283 AMSTED GRAPHITE MATERIALS: COMPANY OVERVIEW

- TABLE 284 REDWOOD MATERIALS INC.: COMPANY OVERVIEW

- TABLE 285 REDWOOD MATERIALS INC.: DEALS

- TABLE 286 PRINCETON NUENERGY INC.: COMPANY OVERVIEW

- TABLE 287 ECHION TECHNOLOGIES LIMITED: COMPANY OVERVIEW

- TABLE 288 ECHION TECHNOLOGIES LIMITED: DEALS

- TABLE 289 ECHION TECHNOLOGIES LIMITED: EXPANSIONS

- TABLE 290 LITHIUM-ION BATTERY MATERIALS MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 291 LITHIUM-ION BATTERY MATERIALS MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 292 LITHIUM-ION BATTERY MATERIALS MARKET, BY APPLICATION, 2018-2022 (KILOTON)

- TABLE 293 LITHIUM-ION BATTERY MATERIALS MARKET, BY APPLICATION, 2023-2029 (KILOTON)

List of Figures

- FIGURE 1 LITHIUM-ION BATTERY ANODE MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 LITHIUM-ION BATTERY ANODE MARKET: RESEARCH DESIGN

- FIGURE 3 MAIN MATRIX CONSIDERED TO ASSESS DEMAND FOR LITHIUM-ION BATTERY ANODES

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 METHODOLOGY FOR SUPPLY-SIDE SIZING OF LITHIUM-ION BATTERY ANODE MARKET (1/2)

- FIGURE 7 METHODOLOGY FOR SUPPLY-SIDE SIZING OF LITHIUM-ION BATTERY ANODE MARKET (2/2)

- FIGURE 8 LITHIUM-ION BATTERY ANODE MARKET: DATA TRIANGULATION

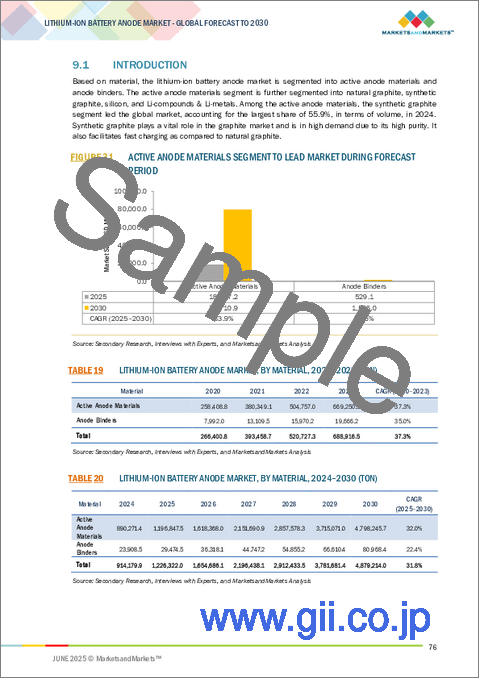

- FIGURE 9 ACTIVE ANODE MATERIALS SEGMENT TO REGISTER HIGHER GROWTH DURING FORECAST PERIOD

- FIGURE 10 AUTOMOTIVE SEGMENT TO REGISTER HIGHER GROWTH DURING FORECAST PERIOD

- FIGURE 11 ASIA PACIFIC ACCOUNTED FOR LARGEST MARKET SHARE IN 2024

- FIGURE 12 INNOVATION AND TECHNOLOGICAL ADVANCES IN LITHIUM-ION BATTERY ANODE MATERIALS TO CREATE LUCRATIVE OPPORTUNITIES FOR MARKET PLAYERS

- FIGURE 13 ASIA PACIFIC TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 14 ACTIVE ANODE MATERIALS SEGMENT TO WITNESS HIGH GROWTH FROM 2025 TO 2030

- FIGURE 15 JAPAN TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 16 LITHIUM-ION BATTERY ANODE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 17 GLOBAL COMBINED SALES OF BATTERY ELECTRIC VEHICLES AND PLUG-IN HYBRIDS

- FIGURE 18 LITHIUM-ION BATTERY ANODE MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 19 SUPPLY CHAIN ANALYSIS FOR LITHIUM-ION BATTERY ANODE MARKET

- FIGURE 20 LITHIUM-ION BATTERY ANODE MARKET: ECOSYSTEM

- FIGURE 21 IMPORT DATA RELATED TO HS CODE 850650, BY KEY COUNTRY, 2021-2024 (USD THOUSAND)

- FIGURE 22 EXPORT DATA RELATED TO HS CODE 850650, BY KEY COUNTRY, 2021-2024 (USD THOUSAND)

- FIGURE 23 AVERAGE SELLING PRICE OF LITHIUM-ION BATTERY ANODE, BY REGION, 2022-2024

- FIGURE 24 AVERAGE SELLING PRICE OF LITHIUM-ION BATTERY ANODE, BY MATERIAL, 2024

- FIGURE 25 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR MAJOR END USES

- FIGURE 26 KEY BUYING CRITERIA FOR TOP THREE END USES

- FIGURE 27 LIST OF MAJOR PATENTS FOR LITHIUM-ION BATTERY ANODE

- FIGURE 28 INVESTMENT & FUNDING OF STARTUPS/SMES FOR LITHIUM-ION BATTERY ANODE

- FIGURE 29 TRENDS/DISRUPTIONS IMPACTING LITHIUM-ION BATTERY ECOSYSTEM

- FIGURE 30 LITHIUM-ION BATTERY PRODUCTS, BY TYPE

- FIGURE 31 ACTIVE ANODE MATERIALS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 32 AUTOMOTIVE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 33 ASIA PACIFIC TO LEAD LITHIUM-ION BATTERY ANODE MARKET DURING FORECAST PERIOD

- FIGURE 34 NORTH AMERICA: LITHIUM-ION BATTERY ANODE MARKET SNAPSHOT

- FIGURE 35 ASIA PACIFIC: LITHIUM-ION BATTERY ANODE MARKET SNAPSHOT

- FIGURE 36 EUROPE: LITHIUM-ION BATTERY ANODE MARKET SNAPSHOT

- FIGURE 37 LITHIUM-ION BATTERY ANODE MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2020-2024 (USD BILLION)

- FIGURE 38 LITHIUM-ION BATTERY ANODE MARKET SHARE ANALYSIS, 2024

- FIGURE 39 LITHIUM-ION BATTERY ANODE MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 40 LITHIUM-ION BATTERY ANODE MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 41 LITHIUM-ION BATTERY ANODE MARKET: COMPANY FOOTPRINT

- FIGURE 42 LITHIUM-ION BATTERY ANODE MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 43 EV/EBITDA OF KEY MANUFACTURERS

- FIGURE 44 ENTERPRISE VALUE OF KEY MANUFACTURERS

- FIGURE 45 YEAR-TO-DATE PRICE TOTAL RETURN AND FIVE-YEAR STOCK BETA OF KEY MANUFACTURERS

- FIGURE 46 RESONAC HOLDINGS CORPORATION: COMPANY SNAPSHOT

- FIGURE 47 KUREHA CORPORATION: COMPANY SNAPSHOT

- FIGURE 48 SGL CARBON: COMPANY SNAPSHOT

- FIGURE 49 NINGBO SHANSHAN CO., LTD.: COMPANY SNAPSHOT

- FIGURE 50 POSCO FUTURE M: COMPANY SNAPSHOT

- FIGURE 51 NIPPON CARBON CO., LTD.: COMPANY SNAPSHOT

- FIGURE 52 SHANGHAI PTL NEW ENERGY TECHNOLOGY CO., LTD.: COMPANY SNAPSHOT

- FIGURE 53 MITSUBISHI CHEMICAL GROUP CORPORATION: COMPANY SNAPSHOT

- FIGURE 54 SHIN-ETSU CHEMICAL CO., LTD.: COMPANY SNAPSHOT

- FIGURE 55 HIMADRI SPECIALITY CHEMICAL LTD.: COMPANY SNAPSHOT

- FIGURE 56 TOKAI CARBON CO., LTD.: COMPANY SNAPSHOT

- FIGURE 57 KURARAY CO., LTD.: COMPANY SNAPSHOT

- FIGURE 58 INTERNATIONAL GRAPHITE LTD.: COMPANY SNAPSHOT

- FIGURE 59 ECOGRAF: COMPANY SNAPSHOT

- FIGURE 60 TALGA GROUP: COMPANY SNAPSHOT

- FIGURE 61 AEKYUNG CHEMICAL CO., LTD.: COMPANY SNAPSHOT

- FIGURE 62 BASF: COMPANY SNAPSHOT

The global lithium-ion battery anode market is projected to grow from USD 19.06 billion in 2025 to USD 81.24 billion by 2030, at a CAGR of 33.6% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) and Volume (Ton) |

| Segments | By Material, End-use, Battery Product, Production Technology, and Region |

| Regions covered | North America, Asia Pacific, Europe, and the Rest of the World |

The surge in the market is attributed to a dual advantage: affordability. These solutions provide a cost-effective method for large-scale energy storage in renewable sources, making them ideal for managing fluctuations in wind and solar power. Additionally, their reliance on standard sodium makes them a more sustainable option, aligning well with the global effort to reduce the environmental impact.

"By material, the synthetic graphite segment will account for the second-largest market share during the forecast period."

By material type, the synthetic graphite segment is projected to hold the second-largest market share in the lithium-ion battery anode market during the forecast period. This is due to its consistent quality, high purity levels, and superior performance characteristics compared to natural graphite in certain high-energy applications. Synthetic graphite offers better structural uniformity, higher conductivity, and enhanced charge-discharge cycles, making it suitable for high-performance batteries used in electric vehicles and industrial energy storage systems. While it is more expensive to produce than natural graphite, its reliability, and compatibility with advanced battery chemistries make it a preferred choice for premium applications. Growing investments in EV infrastructure and technological advancements in battery systems are further supporting its adoption. Additionally, manufacturers are focusing on improving production efficiency to reduce the cost of synthetic graphite. These factors contribute to the steady growth and significant market share of the synthetic graphite segment in the coming years.

"By end use, the non-automotive segment will account for the second-largest share during the forecast period."

The non-automotive segment is expected to account for the second-largest share of the lithium-ion battery anode market in terms of value during the forecast period. This segment includes applications such as consumer electronics, industrial equipment, and energy storage systems, all of which are witnessing steady growth. The increasing adoption of portable devices, such as smartphones, laptops, and tablets, continues to drive demand for reliable battery technologies. In parallel, stationary energy storage solutions are gaining momentum, particularly in grid support and renewable energy integration. Industrial applications, including power tools and backup power systems, also contribute to this segment's expansion. As energy efficiency and sustainability become key global priorities, non-automotive sectors are increasingly investing in advanced battery solutions. These factors collectively ensure a strong and sustained demand for lithium-ion battery anodes beyond the automotive space.

"Europe will account for the second-largest share during the forecast period."

Europe is expected to account for the second-largest share of the lithium-ion battery anode market in terms of value during the forecast period, driven by strong regulatory support and accelerating clean energy initiatives. With the European Union pushing for carbon neutrality and stricter emission norms, the region is witnessing rapid growth in electric vehicle adoption and renewable energy integration. Major economies like Germany, France, and other countries are investing heavily in battery manufacturing and energy storage infrastructure. The presence of key battery manufacturers and strategic collaborations across the value chain are further strengthening the regional market. Europe's strong focus on circular economy principles also encourages recycling and innovation in battery components. These combined factors are positioning Europe as a crucial hub in the global lithium-ion battery anode market.

Profile break-up of primary participants for the report:

- By Company Type: Tier 1 - 65%, Tier 2 - 20%, and Tier 3 - 15%

- By Designation: Directors - 25%, Managers - 30%, and Others - 45%

- By Region: North America - 30%, Asia Pacific - 40%, Europe - 20%, and the Rest of the World- 10%

Ningbo Shanshan Co., Ltd. (China), Jiangxi Zhengtuo New Energy Technology (China), Resonac Holdings Corporation (Japan), POSCO FUTURE M (South Korea), Mitsubishi Chemical Group Corporation (Japan), and SGL Carbon (Germany) are some of the major players operating in the lithium-ion battery anode market. These players have adopted expansions to increase their market share and business revenue.

Research Coverage:

The report defines, segments, and projects the lithium-ion battery anode market based on material, battery product, end-use, production technology, and region. It provides detailed information regarding the major factors influencing the market growth, such as drivers, restraints, opportunities, and challenges. It strategically profiles lithium-ion battery anode manufacturers, comprehensively analyzes their market shares and core competencies, and tracks and analyzes competitive developments, such as product launches, acquisitions, agreements, and others.

Reasons to Buy the Report:

The report is expected to help the market leaders/new entrants by providing them with the closest approximations of revenue numbers of the lithium-ion battery anode market and its segments. This report is also expected to help stakeholders obtain an improved understanding of the market's competitive landscape, gain insights to improve the position of their businesses and make suitable go-to-market strategies. It also enables stakeholders to understand the market's pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of drivers (increase in demand for EVs, growing need for automation and battery-operated equipment in industries, rising demand for lithium-ion batteries for industrial applications, and increasing R&D initiatives by lithium-ion battery manufacturers), opportunities (increasing adoption of lithium-ion batteries in new applications and innovation and technological advances in lithium-ion battery anode materials), restraints (safety issues related to storage and transportation of batteries), and challenges (overheating issues of lithium-ion batteries and high cost of lithium-ion battery-operated industrial vehicles) influencing the growth of the lithium-ion battery anode market.

- Product development/innovation: Detailed insights on upcoming technologies and research & development activities in the lithium-ion battery anode market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the lithium-ion battery anode market across varied regions.

- Market Diversification: Exhaustive information about new products, various materials, untapped geographies, recent developments, and investments in the lithium-ion battery anode market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players in the lithium-ion battery anode market, such as Ningbo Shanshan Co., Ltd. (China), Jiangxi Zhengtuo New Energy Technology (China), Resonac Holdings Corporation (Japan), POSCO FUTURE M (South Korea), Mitsubishi Chemical Group Corporation (Japan), and SGL Carbon (Germany).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS OF STUDY

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNIT CONSIDERED

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Industry insights

- 2.1.2.3 Breakdown of interviews with experts

- 2.1.1 SECONDARY DATA

- 2.2 DEMAND-SIDE ANALYSIS

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- 2.4 SUPPLY SIDE ANALYSIS

- 2.4.1 CALCULATIONS FOR SUPPLY-SIDE ANALYSIS

- 2.5 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

- 2.6 DATA TRIANGULATION

- 2.7 RESEARCH ASSUMPTIONS

- 2.7.1 KEY ASSUMPTIONS WHILE CALCULATING DEMAND-SIDE MARKET SIZE

- 2.8 RESEARCH LIMITATIONS

- 2.9 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN LITHIUM-ION BATTERY ANODE MARKET

- 4.2 LITHIUM-ION BATTERY ANODE MARKET, BY REGION

- 4.3 LITHIUM-ION BATTERY ANODE MARKET, BY MATERIAL

- 4.4 LITHIUM-ION BATTERY ANODE MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing demand for EVs

- 5.2.1.2 Growing need for automation and battery-operated equipment in industries

- 5.2.1.3 Rising demand for lithium-ion batteries in industrial applications

- 5.2.1.4 Increasing R&D initiatives by lithium-ion battery manufacturers

- 5.2.2 RESTRAINTS

- 5.2.2.1 Safety issues related to storage and transportation of batteries

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing adoption of lithium-ion batteries in new applications

- 5.2.3.2 Innovation and technological advances in lithium-ion battery anode materials

- 5.2.4 CHALLENGES

- 5.2.4.1 Overheating issues of lithium-ion batteries

- 5.2.4.2 High cost of lithium-ion battery-operated industrial vehicles

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF SUBSTITUTES

- 5.3.2 BARGAINING POWER OF SUPPLIERS

- 5.3.3 BARGAINING POWER OF BUYERS

- 5.3.4 THREAT OF NEW ENTRANTS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

6 INDUSTRY TRENDS

- 6.1 GLOBAL MACROECONOMIC OUTLOOK

- 6.2 SUPPLY CHAIN ANALYSIS

- 6.3 ECOSYSTEM ANALYSIS

- 6.4 TARIFF AND REGULATORY LANDSCAPE

- 6.4.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.5 TECHNOLOGY ANALYSIS

- 6.5.1 KEY TECHNOLOGIES

- 6.5.1.1 Silicon anode

- 6.5.2 COMPLEMENTARY TECHNOLOGIES

- 6.5.2.1 Nanostructured electrodes

- 6.5.1 KEY TECHNOLOGIES

- 6.6 KEY CONFERENCES AND EVENTS

- 6.7 TRADE DATA

- 6.7.1 IMPORT SCENARIO (HS CODE 850650)

- 6.7.2 EXPORT SCENARIO (HS CODE 850650)

- 6.8 PRICING ANALYSIS

- 6.8.1 AVERAGE SELLING PRICE OF LITHIUM-ION BATTERY ANODE, BY REGION

- 6.8.2 AVERAGE SELLING PRICE OF LITHIUM-ION BATTERY ANODE, BY MATERIAL

- 6.9 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.9.2 BUYING CRITERIA

- 6.10 PATENT ANALYSIS

- 6.10.1 METHODOLOGY

- 6.10.2 MAJOR PATENTS

- 6.11 INVESTMENT & FUNDING SCENARIO

- 6.12 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.13 IMPACT OF GENERATIVE AI ON LITHIUM-ION BATTERY ANODE MARKET

- 6.14 IMPACT OF 2025 US TARIFF - LITHIUM-ION BATTERY ANODE MARKET

- 6.14.1 KEY TARIFF RATES

- 6.14.2 PRICE IMPACT ANALYSIS

- 6.14.3 KEY IMPACT ON COUNTRY/REGION

- 6.14.3.1 US

- 6.14.3.2 Europe

- 6.14.3.3 Asia Pacific

- 6.14.4 IMPACT ON END-USE INDUSTRIES

- 6.14.4.1 Automotive

- 6.14.4.2 Non-automotive

7 LITHIUM-ION BATTERY ANODE MARKET, BY BATTERY PRODUCT

- 7.1 INTRODUCTION

- 7.2 CELLS

- 7.2.1 LOW WEIGHT AND COMPACT SIZE TO INCREASE DEMAND

- 7.3 BATTERY PACKS

- 7.3.1 DEMAND FOR HIGH ENERGY DENSITY APPLICATIONS TO DRIVE MARKET

8 LITHIUM-ION BATTERY ANODE MARKET, BY PRODUCTION TECHNOLOGY

- 8.1 INTRODUCTION

- 8.2 CHEMICAL VAPOR DEPOSITION

- 8.2.1 PROVIDES HIGHLY PURE AND UNIFORM COATINGS, RESULTING IN HIGH DEMAND

- 8.3 SLURRY COATING

- 8.3.1 LOWER EQUIPMENT AND PROCESSING COSTS TO DRIVE MARKET

- 8.4 OTHER PRODUCTION TECHNOLOGIES

9 LITHIUM-ION BATTERY ANODE MARKET, BY MATERIAL

- 9.1 INTRODUCTION

- 9.2 ACTIVE ANODE MATERIALS

- 9.2.1 NATURAL GRAPHITE

- 9.2.1.1 Cost-effectiveness to boost adoption

- 9.2.2 SYNTHETIC GRAPHITE

- 9.2.2.1 Fast charging and long-life cycle to drive market

- 9.2.3 SILICON

- 9.2.3.1 Higher charge capacity than graphite to drive market

- 9.2.4 LI-COMPOUNDS & LI-METALS

- 9.2.4.1 Fast charging and high energy density to propel demand

- 9.2.1 NATURAL GRAPHITE

- 9.3 ANODE BINDERS

- 9.3.1 GROWING DEMAND FOR LITHIUM-ION BATTERIES TO DRIVE MARKET

10 LITHIUM-ION BATTERY ANODE MARKET, BY END USE

- 10.1 INTRODUCTION

- 10.2 AUTOMOTIVE

- 10.2.1 RISING DEMAND FOR ELECTRIC VEHICLES TO BOOST MARKET

- 10.3 NON-AUTOMOTIVE

- 10.3.1 ENERGY STORAGE

- 10.3.1.1 Increasing infrastructure to enhance demand

- 10.3.2 AEROSPACE

- 10.3.2.1 Growing demand from leading players in aircraft industry to drive market

- 10.3.3 MARINE

- 10.3.3.1 Significant reductions in cost of fuel, maintenance, and emissions in electric and hybrid ships to drive market

- 10.3.4 OTHER END USES

- 10.3.1 ENERGY STORAGE

11 LITHIUM-ION BATTERY ANODE MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 US

- 11.2.1.1 High level of innovation and product development to drive market

- 11.2.1 US

- 11.3 ASIA PACIFIC

- 11.3.1 CHINA

- 11.3.1.1 Extensive growth in electronic devices and electric vehicles to drive market

- 11.3.2 SOUTH KOREA

- 11.3.2.1 Introduction of fuel cell electric and battery-powered electric buses to drive market

- 11.3.3 JAPAN

- 11.3.3.1 Presence of battery giants to drive market

- 11.3.4 THAILAND

- 11.3.4.1 Strong automotive sector to drive market

- 11.3.5 AUSTRALIA

- 11.3.5.1 Growing demand for EVs to drive market

- 11.3.1 CHINA

- 11.4 EUROPE

- 11.4.1 GERMANY

- 11.4.1.1 Increasing production of EVs to drive market

- 11.4.2 HUNGARY

- 11.4.2.1 Government focus on electromobility to drive market

- 11.4.3 POLAND

- 11.4.3.1 Adoption of EVs at significant pace to boost market

- 11.4.4 SWEDEN

- 11.4.4.1 Growing demand for electric vehicles to drive market

- 11.4.5 FRANCE

- 11.4.5.1 Government initiatives for enhancement of electric ship and boat sector to drive market

- 11.4.6 UK

- 11.4.6.1 Government initiatives for adoption of electric vehicles to support market growth

- 11.4.7 REST OF EUROPE

- 11.4.1 GERMANY

- 11.5 REST OF THE WORLD

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 12.3 REVENUE ANALYSIS

- 12.4 MARKET SHARE ANALYSIS

- 12.5 BRAND/PRODUCT COMPARISON

- 12.5.1 ANODE MATERIALS BY NINGBO SHANSHAN CO., LTD.

- 12.5.2 ANODE ACTIVE MATERIALS BY POSCO FUTURE M

- 12.5.3 ANODE MATERIALS BY MITSUBISHI CHEMICAL GROUP CORPORATION

- 12.5.4 SIGRACELL

- 12.5.5 HF-FREE

- 12.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.6.1 STARS

- 12.6.2 EMERGING LEADERS

- 12.6.3 PERVASIVE PLAYERS

- 12.6.4 PARTICIPANTS

- 12.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.6.5.1 Company footprint

- 12.6.5.2 Region footprint

- 12.6.5.3 Material footprint

- 12.6.5.4 End-use footprint

- 12.6.5.5 Battery product footprint

- 12.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.7.1 PROGRESSIVE COMPANIES

- 12.7.2 RESPONSIVE COMPANIES

- 12.7.3 DYNAMIC COMPANIES

- 12.7.4 STARTING BLOCKS

- 12.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.7.5.1 Detailed list of key startups/SMEs

- 12.7.5.2 Competitive benchmarking of key startups/SMEs

- 12.8 COMPANY VALUATION AND FINANCIAL METRICS

- 12.9 COMPETITIVE SCENARIO AND TRENDS

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

- 12.9.3 EXPANSIONS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 RESONAC HOLDINGS CORPORATION

- 13.1.1.1 Business overview

- 13.1.1.2 Products offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Deals

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 JFE CHEMICAL CORPORATION

- 13.1.2.1 Business overview

- 13.1.2.2 Products offered

- 13.1.2.3 MnM view

- 13.1.2.3.1 Key strengths

- 13.1.2.3.2 Strategic choices

- 13.1.2.3.3 Weaknesses and competitive threats

- 13.1.3 KUREHA CORPORATION

- 13.1.3.1 Business overview

- 13.1.3.2 Products offered

- 13.1.3.3 MnM view

- 13.1.3.3.1 Key strengths

- 13.1.3.3.2 Strategic choices

- 13.1.3.3.3 Weaknesses and competitive threats

- 13.1.4 SGL CARBON

- 13.1.4.1 Business overview

- 13.1.4.2 Products offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Deals

- 13.1.4.3.2 Other developments

- 13.1.4.3.3 Expansions

- 13.1.4.4 MnM view

- 13.1.4.4.1 Key strengths

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses and competitive threats

- 13.1.5 NINGBO SHANSHAN CO., LTD.

- 13.1.5.1 Business overview

- 13.1.5.2 Products offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Deals

- 13.1.5.3.2 Expansions

- 13.1.5.4 MnM view

- 13.1.5.4.1 Key strengths

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses and competitive threats

- 13.1.6 POSCO FUTURE M

- 13.1.6.1 Business overview

- 13.1.6.2 Products offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Product launches

- 13.1.6.3.2 Deals

- 13.1.6.3.3 Expansions

- 13.1.7 NIPPON CARBON CO., LTD.

- 13.1.7.1 Business overview

- 13.1.7.2 Products offered

- 13.1.8 NEI CORPORATION

- 13.1.8.1 Business overview

- 13.1.8.2 Products offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Product launches

- 13.1.8.3.2 Deals

- 13.1.9 JIANGXI ZHENGTUO NEW ENERGY TECHNOLOGY

- 13.1.9.1 Business overview

- 13.1.9.2 Products offered

- 13.1.10 SHANGHAI PTL NEW ENERGY TECHNOLOGY CO., LTD.

- 13.1.10.1 Business overview

- 13.1.10.2 Products offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Deals

- 13.1.10.3.2 Expansions

- 13.1.11 MITSUBISHI CHEMICAL GROUP CORPORATION

- 13.1.11.1 Business overview

- 13.1.11.2 Products offered

- 13.1.11.3 Recent developments

- 13.1.11.3.1 Deals

- 13.1.11.3.2 Expansions

- 13.1.12 SHIN-ETSU CHEMICAL CO., LTD.

- 13.1.12.1 Business overview

- 13.1.12.2 Products offered

- 13.1.13 HIMADRI SPECIALITY CHEMICAL LTD.

- 13.1.13.1 Business overview

- 13.1.13.2 Products offered

- 13.1.13.3 Recent developments

- 13.1.13.3.1 Deals

- 13.1.14 TOKAI CARBON CO., LTD.

- 13.1.14.1 Business overview

- 13.1.14.2 Products offered

- 13.1.15 KURARAY CO., LTD.

- 13.1.15.1 Business overview

- 13.1.15.2 Products offered

- 13.1.16 INTERNATIONAL GRAPHITE LTD.

- 13.1.16.1 Business overview

- 13.1.16.2 Products offered

- 13.1.16.3 Recent developments

- 13.1.16.3.1 Deals

- 13.1.16.3.2 Expansions

- 13.1.17 ECOGRAF

- 13.1.17.1 Business overview

- 13.1.17.2 Products offered

- 13.1.17.3 Recent developments

- 13.1.17.3.1 Deals

- 13.1.18 TALGA GROUP

- 13.1.18.1 Business overview

- 13.1.18.2 Products offered

- 13.1.19 BTR NEW MATERIALS GROUP CO., LTD.

- 13.1.19.1 Business overview

- 13.1.19.2 Products offered

- 13.1.20 GUANGDONG KAIJIN NEW ENERGY TECHNOLOGY CO., LTD.

- 13.1.20.1 Business overview

- 13.1.20.2 Products offered

- 13.1.21 AEKYUNG CHEMICAL CO., LTD.

- 13.1.21.1 Business overview

- 13.1.21.2 Products offered

- 13.1.22 EPSILON CARBON PRIVATE LIMITED

- 13.1.22.1 Business overview

- 13.1.22.2 Products offered

- 13.1.22.3 Recent developments

- 13.1.22.3.1 Deals

- 13.1.22.3.2 Expansions

- 13.1.23 BASF

- 13.1.23.1 Business overview

- 13.1.23.2 Products offered

- 13.1.23.3 Recent developments

- 13.1.23.3.1 Deals

- 13.1.23.3.2 Expansions

- 13.1.1 RESONAC HOLDINGS CORPORATION

- 13.2 OTHER PLAYERS

- 13.2.1 ANOVION LLC

- 13.2.1.1 Recent developments

- 13.2.1.1.1 Deals

- 13.2.1.1.2 Other developments

- 13.2.1.1.3 Expansions

- 13.2.1.1 Recent developments

- 13.2.2 AMSTED GRAPHITE MATERIALS

- 13.2.3 REDWOOD MATERIALS INC.

- 13.2.3.1 Recent developments

- 13.2.3.1.1 Deals

- 13.2.3.1 Recent developments

- 13.2.4 PRINCETON NUENERGY INC.

- 13.2.5 ECHION TECHNOLOGIES LIMITED

- 13.2.5.1 Recent developments

- 13.2.5.1.1 Deals

- 13.2.5.1.2 Expansions

- 13.2.5.1 Recent developments

- 13.2.1 ANOVION LLC

14 ADJACENT AND RELATED MARKETS

- 14.1 INTRODUCTION

- 14.2 LIMITATIONS

- 14.3 INTERCONNECTED MARKETS

- 14.4 LITHIUM-ION BATTERY MATERIALS MARKET

- 14.4.1 MARKET DEFINITION

- 14.4.2 MARKET OVERVIEW

- 14.4.3 BY APPLICATION

- 14.4.3.1 Portable devices

- 14.4.3.1.1 Rapid technological advancements to drive demand

- 14.4.3.2 Electric vehicles

- 14.4.3.2.1 Government efforts to promote clean energy solutions to drive segment

- 14.4.3.3 Industrial

- 14.4.3.3.1 Focus on environmental safety and equipment durability to increase demand

- 14.4.3.4 Other applications

- 14.4.3.1 Portable devices

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS