|

|

市場調査レポート

商品コード

1772632

プライベート5Gの世界市場:ネットワークタイプ別、クラウドモデル別、周波数帯域別、オファリング別、組織規模別、スペクトル分配別、業界別、地域別 - 2030年までの予測Private 5G Market by Offering (RAN, Base Station, Antenna, Core Network, Edge Server, Gateway, Delivery Network, Network Management, Managed Services), Spectrum Allocation (Licensed, Shared), Frequency Band (Low, Mid, mmWave) - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| プライベート5Gの世界市場:ネットワークタイプ別、クラウドモデル別、周波数帯域別、オファリング別、組織規模別、スペクトル分配別、業界別、地域別 - 2030年までの予測 |

|

出版日: 2025年06月25日

発行: MarketsandMarkets

ページ情報: 英文 325 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

プライベート5Gの市場規模は、2025年に38億6,000万米ドルになるとみられています。

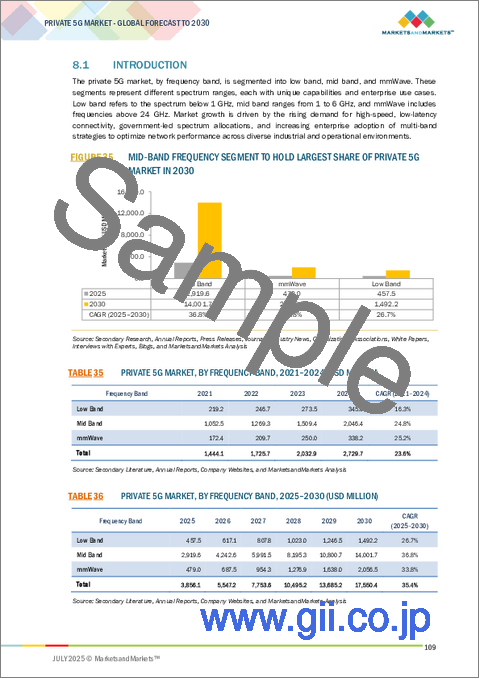

同市場は、予測期間中に35.4%のCAGRで拡大し、2030年には175億5,000万米ドルに達すると予測されています。プライベート5Gネットワークは、特定の企業ニーズに合わせた高信頼性、低遅延、セキュアな接続性を提供できるため、各業界で採用が進んでいます。製造業では、プライベート5Gはリアルタイムのモニタリング、無人搬送車(AGV)、ロボット制御を可能にし、インダストリー4.0の変革をサポートします。ヘルスケアでは、遠隔手術、リアルタイムの画像処理、安全な患者データ伝送が強化されます。物流・運輸業界では、資産追跡、車両管理、自動倉庫管理を通じて業務を合理化するためにプライベート5Gが利用されています。小売業はプライベート5Gを導入し、スマートシェルフ、顧客分析、没入型ショッピング体験を実現します。また、このテクノロジーは、予知保全やグリッドの自動化を可能にするエネルギー・公益事業セクターもサポートしています。専用周波数帯とローカライズされた制御により、プライベート5Gは企業によるネットワーク性能のカスタマイズを可能にし、ミッションクリティカルなアプリケーションの最適なサポートと運用制御の強化を保証します。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント別 | ネットワークタイプ別、クラウドモデル別、周波数帯域別、オファリング別、組織規模別、スペクトル分配別、業界別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

プライベート5Gサービス分野は、より大きな制御、セキュリティ、パフォーマンスを確保するカスタマイズされたネットワークサービスに対する需要の高まりにより、予測期間中に最も高いCAGRで成長する見込みです。ネットワークの設計と展開、既存インフラとの統合、スペクトラム管理、ライフサイクル管理などのサービスは、組織がプライベート5Gネットワークを効果的に実装・運用するために不可欠です。自動化、リアルタイム監視、ミッションクリティカルなアプリケーションのために超低遅延で高信頼性の接続性を必要とする製造、物流、エネルギーなどの産業で導入が進んでいることが市場成長の原動力となっています。これらのサービスは、計画や設置から継続的なメンテナンスや最適化まで、エンドツーエンドの展開で企業をサポートする上で重要な役割を果たしています。インダストリー4.0変革のニーズの高まり、IoTとエッジコンピューティングへの依存度の高まり、世界のプライベート周波数免許の利用可能性の増加は、プライベート5Gサービスの導入をさらに加速させ、デジタルトランスフォーメーションイニシアチブの重要なイネーブラーとして位置付けています。

スマート・マニュファクチャリングと産業オートメーションの導入が進んでいることから、予測期間中、プライベート5G市場では製造業向けが最大の市場シェアを占めると予想されます。製造業は、リアルタイム通信、マシン間接続、工場現場でのデータ主導の意思決定を可能にするため、プライベート5Gネットワークに投資しています。プライベート5Gは、ロボット工学、デジタルツイン、予知保全、自律システムなどの先進技術をサポートするために必要な、広帯域、超低遅延、セキュアな接続性を提供します。これらの機能は、業務効率の向上、ダウンタイムの削減、生産の柔軟性の強化に不可欠です。インダストリー4.0への移行は、企業がIoTデバイス、センサー、AI主導のアナリティクスを生産環境に統合しようとしているため、この動向をさらに加速させています。プライベート5Gを導入することで、メーカー各社はネットワーク・パフォーマンスとデータ・セキュリティをより詳細に制御できるようになり、複雑で高密度な産業環境における重要な使用事例をサポートし、プライベート5Gソリューションの主要導入国としてこの分野を位置づけることができます。

ドイツは、強力な産業基盤、規制の柔軟性、デジタル変革の緊急性(特に自動車分野)に後押しされ、予測期間中、欧州のプライベート5G市場を独占すると予想されます。公共の5Gネットワークとは異なり、ドイツのプライベート5GネットワークはBSIGやTKGの規制に縛られないため、企業は強制的な認証を受けずにカスタマイズされた安全なネットワークを展開できます。このような規制の明確化は、製造、物流、その他の業界分野での迅速な展開をサポートします。世界の競争と電気自動車へのシフトに直面しているドイツの自動車産業は、スマート・マニュファクチャリングへの移行を加速させています。プライベート5Gは、リアルタイム通信、エッジコンピューティング、ロボット工学、AR/VR、状態ベースのモニタリングのシームレスな統合を可能にし、最新のデータ駆動型生産に不可欠です。自動車大手が世界のリーダーシップを維持するために自動化と効率化を優先する中、プライベート5Gは重要なインフラになりつつあります。このように産業の優先事項とデジタル機能が戦略的に整合しているドイツは、欧州におけるプライベート5G導入の重要な拠点となっています。

当レポートでは、世界のプライベート5G市場について調査し、ネットワークタイプ別、クラウドモデル別、周波数帯域別、オファリング別、組織規模別、スペクトル分配別、業界別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- バリューチェーン分析

- エコシステム分析

- 顧客ビジネスに影響を与える動向/混乱

- 指標価格分析

- プライベート5G料金モデル

- 技術分析

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- ケーススタディ分析

- 投資と資金調達のシナリオ

- 貿易分析

- 特許分析

- 2025年7月~2026年12月の主な会議とイベント

- 関税と規制状況

- 政府行為

- 地域別のプライベート5Gに関する問題と課題

- プライベート5Gネットワーク向け国別周波数割り当て

- AIがプライベート5G市場に与える影響

- 2025年の米国関税がプライベート5G市場に与える影響:概要

第6章 プライベート5G市場(ネットワークタイプ別)

- イントロダクション

- 非スタンドアロン5G

- スタンドアロン5G

第7章 プライベート5G市場(クラウドモデル別)

- イントロダクション

- プライベート/専用クラウド

- パブリッククラウド

- ハイブリッドクラウド

第8章 プライベート5G市場(周波数帯域別)

- イントロダクション

- ローバンド

- ミッドバンド

- ミリ波

第9章 プライベート5G市場(オファリング別)

- イントロダクション

- ハードウェア

- ソフトウェア

- サービス

第10章 プライベート5G市場(組織規模別)

- イントロダクション

- 中小企業(SMES)

- 大企業

第11章 プライベート5G市場(スペクトル分配別)

- イントロダクション

- ライセンス外/共有スペクトル

- ライセンススペクトル

第12章 プライベート5G市場(業界別)

- イントロダクション

- 製造

- エネルギー・公益事業

- 小売・eコマース

- ヘルスケア

- 銀行、金融サービス、保険(BFSI)

- インフラストラクチャー

- 運輸・物流

- 航空宇宙

- メディア・エンターテインメント

- IT・通信

- その他

第13章 プライベート5G市場(地域別)

- イントロダクション

- 北米

- マクロ経済見通し

- 米国

- カナダ

- メキシコ

- 欧州

- マクロ経済見通し

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- ポーランド

- 北欧諸国

- その他

- アジア太平洋

- マクロ経済見通し

- 中国

- 日本

- 韓国

- インド

- オーストラリア

- インドネシア

- マレーシア

- タイ

- ベトナム

- その他

- その他の地域

- マクロ経済見通し

- 中東

- 南米

- アフリカ

第14章 競合情勢

- 概要

- 主要参入企業の戦略/強み、2022年1月~2025年6月

- 収益分析、2020年~2024年

- 市場シェア分析、2024年

- 企業評価と財務指標

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

第15章 企業プロファイル

- 主要参入企業

- TELEFONAKTIEBOLAGET LM ERICSSON

- HUAWEI TECHNOLOGIES CO., LTD.

- NOKIA

- ZTE CORPORATION

- HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP

- SAMSUNG

- NEC CORPORATION

- ORACLE

- CISCO SYSTEMS, INC.

- CIENA CORPORATION

- JUNIPER NETWORKS, INC.

- その他の企業

- CELONA INC.

- MAVENIR

- PARALLEL WIRELESS

- NTT DATA GROUP CORPORATION

- AT&T

- COMMSCOPE

- COMBA TELECOM SYSTEMS HOLDINGS LTD.

- LOGICALIS GROUP

- BOLDYN NETWORKS

- PENTE NETWORKS

- NEUTRAL WIRELESS

- FIRECELL

- NEUTROON TECHNOLOGIES S.L.

- KYNDRYL INC.

第16章 付録

List of Tables

- TABLE 1 PRIVATE 5G MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 2 INDICATIVE SELLING PRICE TREND OF PRIVATE 5G OFFERED BY KEY PLAYERS (USD)

- TABLE 3 PRIVATE 5G MARKET: IMPACT OF PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR PRIVATE 5G, BY TOP 3 VERTICALS

- TABLE 5 KEY BUYING CRITERIA FOR PRIVATE 5G, BY TOP 3 VERTICALS

- TABLE 6 TRANSFORMING MINING OPERATIONS AT JIUQUAN IRON AND STEEL CO., LTD. WITH HUAWEI'S 5G PRIVATE NETWORKS

- TABLE 7 DRIVING MANUFACTURING AGILITY AT JLR WITH ERICSSON'S PRIVATE 5G SOLUTION

- TABLE 8 BOOSTING SAFETY AND EFFICIENCY AT NEWMONT'S CADIA MINE WITH ERICSSON'S PRIVATE 5G NETWORK

- TABLE 9 TRANSFORMING GLOBAL WAREHOUSING OF CJ LOGISTICS WITH ERICSSON'S PRIVATE 5G NETWORK

- TABLE 10 REVOLUTIONIZING AIRCRAFT MAINTENANCE OF LUFTHANSA TECHNIK WITH NOKIA'S PRIVATE 5G TECHNOLOGY

- TABLE 11 IMPORT SCENARIO FOR HS CODE 8517-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 12 EXPORT SCENARIO FOR HS CODE 8517-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 13 PRIVATE 5G MARKET: LIST OF MAJOR PATENTS, 2023-2024

- TABLE 14 PRIVATE 5G MARKET: LIST OF KEY CONFERENCES AND EVENTS, JULY 2025-DECEMBER 2026

- TABLE 15 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 STANDARDS, BY KEY COUNTRIES

- TABLE 20 MFN TARIFF FOR HS CODE 9031-COMPLIANT PRODUCTS EXPORTED BY CHINA

- TABLE 21 NORTH AMERICA: ISSUES AND CHALLENGES RELATED TO PRIVATE 5G

- TABLE 22 EUROPE: ISSUES AND CHALLENGES RELATED TO PRIVATE 5G

- TABLE 23 ASIA PACIFIC: ISSUES AND CHALLENGES RELATED TO PRIVATE 5G

- TABLE 24 COUNTRY-WISE SPECTRUM ALLOCATION

- TABLE 25 US-ADJUSTED RECIPROCAL TARIFF RATES, 2024 (USD BILLION)

- TABLE 26 EXPECTED CHANGE IN PRICES AND IMPACT ON END-USE MARKETS DUE TO IMPACT OF TARIFFS

- TABLE 27 PRIVATE 5G MARKET, BY NETWORK TYPE, 2021-2024 (USD MILLION)

- TABLE 28 PRIVATE 5G MARKET, BY NETWORK TYPE, 2025-2030 (USD MILLION)

- TABLE 29 NON-STANDALONE 5G: PRIVATE 5G MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 30 NON-STANDALONE 5G: PRIVATE 5G MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 31 STANDALONE 5G: PRIVATE 5G MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 32 STANDALONE 5G: PRIVATE 5G MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 33 PRIVATE 5G MARKET, BY CLOUD MODEL, 2021-2024 (USD MILLION)

- TABLE 34 PRIVATE 5G MARKET, BY CLOUD MODEL, 2025-2030 (USD MILLION)

- TABLE 35 PRIVATE 5G MARKET, BY FREQUENCY BAND, 2021-2024 (USD MILLION)

- TABLE 36 PRIVATE 5G MARKET, BY FREQUENCY BAND, 2025-2030 (USD MILLION)

- TABLE 37 LOW BAND: PRIVATE 5G MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 38 LOW BAND: PRIVATE 5G MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 39 MID BAND: PRIVATE 5G MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 40 MID BAND: PRIVATE 5G MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 41 MMWAVE: PRIVATE 5G MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 42 MMWAVE: PRIVATE 5G MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 43 PRIVATE 5G MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 44 PRIVATE 5G MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 45 HARDWARE: PRIVATE 5G MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 46 HARDWARE: PRIVATE 5G MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 47 PRIVATE 5G MARKET, BY ORGANIZATION SIZE, 2021-2024 (USD MILLION)

- TABLE 48 PRIVATE 5G MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 49 SMALL AND MEDIUM ENTERPRISES: PRIVATE 5G MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 50 SMALL AND MEDIUM ENTERPRISES: PRIVATE 5G MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 51 LARGE ENTERPRISES: PRIVATE 5G MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 52 LARGE ENTERPRISES: PRIVATE 5G MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 53 PRIVATE 5G MARKET, BY SPECTRUM ALLOCATION, 2021-2024 (USD MILLION)

- TABLE 54 PRIVATE 5G MARKET, BY SPECTRUM ALLOCATION, 2025-2030 (USD MILLION)

- TABLE 55 UNLICENSED/SHARED SPECTRUM: PRIVATE 5G MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 56 UNLICENSED/SHARED SPECTRUM: PRIVATE 5G MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 57 LICENSED SPECTRUM: PRIVATE 5G MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 58 LICENSED SPECTRUM: PRIVATE 5G MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 59 PRIVATE 5G MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 60 PRIVATE 5G MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 61 MANUFACTURING: PRIVATE 5G MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 62 MANUFACTURING: PRIVATE 5G MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 63 ENERGY & UTILITIES: PRIVATE 5G MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 64 ENERGY & UTILITIES: PRIVATE 5G MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 65 RETAIL & E-COMMERCE: PRIVATE 5G MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 66 RETAIL & E-COMMERCE: PRIVATE 5G MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 67 HEALTHCARE: PRIVATE 5G MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 68 HEALTHCARE: PRIVATE 5G MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 69 BFSI: PRIVATE 5G MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 70 BFSI: PRIVATE 5G MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 71 INFRASTRUCTURE: PRIVATE 5G MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 72 INFRASTRUCTURE: PRIVATE 5G MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 73 TRANSPORTATION & LOGISTICS: PRIVATE 5G MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 74 TRANSPORTATION & LOGISTICS: PRIVATE 5G MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 75 AEROSPACE: PRIVATE 5G MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 76 AEROSPACE: PRIVATE 5G MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 77 MEDIA & ENTERTAINMENT: PRIVATE 5G MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 78 MEDIA & ENTERTAINMENT: PRIVATE 5G MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 79 IT & TELECOMMUNICATIONS: PRIVATE 5G MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 80 IT & TELECOMMUNICATIONS: PRIVATE 5G MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 81 OTHER VERTICALS: PRIVATE 5G MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 82 OTHER VERTICALS: PRIVATE 5G MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 83 PRIVATE 5G MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 84 PRIVATE 5G MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 85 NORTH AMERICA: PRIVATE 5G MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 86 NORTH AMERICA: PRIVATE 5G MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 87 NORTH AMERICA: PRIVATE 5G MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 88 NORTH AMERICA: PRIVATE 5G MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 89 NORTH AMERICA: PRIVATE 5G MARKET, BY NETWORK TYPE, 2021-2024 (USD MILLION)

- TABLE 90 NORTH AMERICA: PRIVATE 5G MARKET, BY NETWORK TYPE, 2025-2030 (USD MILLION)

- TABLE 91 NORTH AMERICA: PRIVATE 5G MARKET, BY FREQUENCY BAND, 2021-2024 (USD MILLION)

- TABLE 92 NORTH AMERICA: PRIVATE 5G MARKET, BY FREQUENCY BAND, 2025-2030 (USD MILLION)

- TABLE 93 NORTH AMERICA: PRIVATE 5G MARKET, BY SPECTRUM ALLOCATION, 2021-2024 (USD MILLION)

- TABLE 94 NORTH AMERICA: PRIVATE 5G MARKET, BY SPECTRUM ALLOCATION, 2025-2030 (USD MILLION)

- TABLE 95 NORTH AMERICA: PRIVATE 5G MARKET, BY ORGANIZATION SIZE, 2021-2024 (USD MILLION)

- TABLE 96 NORTH AMERICA: PRIVATE 5G MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 97 US: PRIVATE 5G MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 98 US: PRIVATE 5G MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 99 CANADA: PRIVATE 5G MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 100 CANADA: PRIVATE 5G MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 101 MEXICO: PRIVATE 5G MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 102 MEXICO: PRIVATE 5G MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 103 EUROPE: PRIVATE 5G MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 104 EUROPE: PRIVATE 5G MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 105 EUROPE: PRIVATE 5G MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 106 EUROPE: PRIVATE 5G MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 107 EUROPE: PRIVATE 5G MARKET, BY NETWORK TYPE, 2021-2024 (USD MILLION)

- TABLE 108 EUROPE: PRIVATE 5G MARKET, BY NETWORK TYPE, 2025-2030 (USD MILLION)

- TABLE 109 EUROPE: PRIVATE 5G MARKET, BY FREQUENCY BAND, 2021-2024 (USD MILLION)

- TABLE 110 EUROPE: PRIVATE 5G MARKET, BY FREQUENCY BAND, 2025-2030 (USD MILLION)

- TABLE 111 EUROPE: PRIVATE 5G MARKET, BY SPECTRUM ALLOCATION, 2021-2024 (USD MILLION)

- TABLE 112 EUROPE: PRIVATE 5G MARKET, BY SPECTRUM ALLOCATION, 2025-2030 (USD MILLION)

- TABLE 113 EUROPE: PRIVATE 5G MARKET, BY ORGANIZATION SIZE, 2021-2024 (USD MILLION)

- TABLE 114 EUROPE: PRIVATE 5G MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 115 GERMANY: PRIVATE 5G MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 116 GERMANY: PRIVATE 5G MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 117 UK: PRIVATE 5G MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 118 UK: PRIVATE 5G MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 119 FRANCE: PRIVATE 5G MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 120 FRANCE: PRIVATE 5G MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 121 ITALY: PRIVATE 5G MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 122 ITALY: PRIVATE 5G MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 123 SPAIN: PRIVATE 5G MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 124 SPAIN: PRIVATE 5G MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 125 POLAND: PRIVATE 5G MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 126 POLAND: PRIVATE 5G MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 127 NORDIC COUNTRIES: PRIVATE 5G MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 128 NORDIC COUNTRIES: PRIVATE 5G MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 129 REST OF EUROPE: PRIVATE 5G MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 130 REST OF EUROPE: PRIVATE 5G MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 131 ASIA PACIFIC: PRIVATE 5G MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 132 ASIA PACIFIC: PRIVATE 5G MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 133 ASIA PACIFIC: PRIVATE 5G MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 134 ASIA PACIFIC: PRIVATE 5G MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 135 ASIA PACIFIC: PRIVATE 5G MARKET, BY NETWORK TYPE, 2021-2024 (USD MILLION)

- TABLE 136 ASIA PACIFIC: PRIVATE 5G MARKET, BY NETWORK TYPE, 2025-2030 (USD MILLION)

- TABLE 137 ASIA PACIFIC: PRIVATE 5G MARKET, BY FREQUENCY BAND, 2021-2024 (USD MILLION)

- TABLE 138 ASIA PACIFIC: PRIVATE 5G MARKET, BY FREQUENCY BAND, 2025-2030 (USD MILLION)

- TABLE 139 ASIA PACIFIC: PRIVATE 5G MARKET, BY SPECTRUM ALLOCATION, 2021-2024 (USD MILLION)

- TABLE 140 ASIA PACIFIC: PRIVATE 5G MARKET, BY SPECTRUM ALLOCATION, 2025-2030 (USD MILLION)

- TABLE 141 ASIA PACIFIC: PRIVATE 5G MARKET, BY ORGANIZATION SIZE, 2021-2024 (USD MILLION)

- TABLE 142 ASIA PACIFIC: PRIVATE 5G MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 143 CHINA: PRIVATE 5G MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 144 CHINA: PRIVATE 5G MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 145 JAPAN: PRIVATE 5G MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 146 JAPAN: PRIVATE 5G MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 147 SOUTH KOREA: PRIVATE 5G MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 148 SOUTH KOREA: PRIVATE 5G MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 149 INDIA: PRIVATE 5G MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 150 INDIA: PRIVATE 5G MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 151 AUSTRALIA: PRIVATE 5G MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 152 AUSTRALIA: PRIVATE 5G MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 153 INDONESIA: PRIVATE 5G MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 154 INDONESIA: PRIVATE 5G MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 155 MALAYSIA: PRIVATE 5G MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 156 MALAYSIA: PRIVATE 5G MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 157 THAILAND: PRIVATE 5G MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 158 THAILAND: PRIVATE 5G MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 159 VIETNAM: PRIVATE 5G MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 160 VIETNAM: PRIVATE 5G MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 161 REST OF ASIA PACIFIC: PRIVATE 5G MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 162 REST OF ASIA PACIFIC: PRIVATE 5G MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 163 REST OF THE WORLD: PRIVATE 5G MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 164 REST OF THE WORLD: PRIVATE 5G MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 165 REST OF THE WORLD: PRIVATE 5G MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 166 REST OF THE WORLD: PRIVATE 5G MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 167 REST OF THE WORLD: PRIVATE 5G MARKET, BY NETWORK TYPE, 2021-2024 (USD MILLION)

- TABLE 168 REST OF THE WORLD: PRIVATE 5G MARKET, BY NETWORK TYPE, 2025-2030 (USD MILLION)

- TABLE 169 REST OF THE WORLD: PRIVATE 5G MARKET, BY FREQUENCY BAND, 2021-2024 (USD MILLION)

- TABLE 170 REST OF THE WORLD: PRIVATE 5G MARKET, BY FREQUENCY BAND, 2025-2030 (USD MILLION)

- TABLE 171 REST OF THE WORLD: PRIVATE 5G MARKET, BY SPECTRUM ALLOCATION, 2021-2024 (USD MILLION)

- TABLE 172 REST OF THE WORLD: PRIVATE 5G MARKET, BY SPECTRUM ALLOCATION, 2025-2030 (USD MILLION)

- TABLE 173 REST OF THE WORLD: PRIVATE 5G MARKET, BY ORGANIZATION SIZE, 2021-2024 (USD MILLION)

- TABLE 174 REST OF THE WORLD: PRIVATE 5G MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 175 MIDDLE EAST: PRIVATE 5G MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 176 MIDDLE EAST: PRIVATE 5G MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 177 MIDDLE EAST: PRIVATE 5G MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 178 MIDDLE EAST: PRIVATE 5G MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 179 SOUTH AMERICA: PRIVATE 5G MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 180 SOUTH AMERICA: PRIVATE 5G MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 181 AFRICA: PRIVATE 5G MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 182 AFRICA: PRIVATE 5G MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 183 AFRICA: PRIVATE 5G MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 184 AFRICA: PRIVATE 5G MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 185 OVERVIEW OF STRATEGIES ADOPTED BY MAJOR COMPANIES, JANUARY 2022-JUNE 2025

- TABLE 186 PRIVATE 5G MARKET: DEGREE OF COMPETITION, 2024

- TABLE 187 PRIVATE 5G MARKET: REGION FOOTPRINT

- TABLE 188 PRIVATE 5G MARKET: VERTICAL FOOTPRINT

- TABLE 189 PRIVATE 5G MARKET: NETWORK TYPE FOOTPRINT

- TABLE 190 PRIVATE 5G MARKET: OFFERING FOOTPRINT

- TABLE 191 PRIVATE 5G MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 192 PRIVATE 5G MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 193 PRIVATE 5G MARKET: PRODUCT LAUNCHES, JANUARY 2022-JUNE 2025

- TABLE 194 PRIVATE 5G MARKET: DEALS, JANUARY 2022-JUNE 2025

- TABLE 195 PRIVATE 5G MARKET: OTHERS, JANUARY 2022-JUNE 2025

- TABLE 196 TELEFONAKTIEBOLAGET LM ERICSSON: COMPANY OVERVIEW

- TABLE 197 TELEFONAKTIEBOLAGET LM ERICSSON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 198 TELEFONAKTIEBOLAGET LM ERICSSON: PRODUCT LAUNCHES

- TABLE 199 TELEFONAKTIEBOLAGET LM ERICSSON: DEALS

- TABLE 200 TELEFONAKTIEBOLAGET LM ERICSSON: OTHERS

- TABLE 201 HUAWEI TECHNOLOGIES CO., LTD.: COMPANY OVERVIEW

- TABLE 202 HUAWEI TECHNOLOGIES CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 203 HUAWEI TECHNOLOGIES CO., LTD.: PRODUCT LAUNCHES

- TABLE 204 HUAWEI TECHNOLOGIES CO., LTD.: DEALS

- TABLE 205 HUAWEI TECHNOLOGIES CO., LTD.: OTHERS

- TABLE 206 NOKIA: COMPANY OVERVIEW

- TABLE 207 NOKIA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 208 NOKIA: DEALS

- TABLE 209 ZTE CORPORATION: COMPANY OVERVIEW

- TABLE 210 ZTE CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 211 ZTE CORPORATION: PRODUCT LAUNCHES

- TABLE 212 ZTE CORPORATION: DEALS

- TABLE 213 ZTE CORPORATION: OTHERS

- TABLE 214 HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP: COMPANY OVERVIEW

- TABLE 215 HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 216 HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP: PRODUCT LAUNCHES

- TABLE 217 HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP: DEALS

- TABLE 218 HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP: OTHERS

- TABLE 219 SAMSUNG: COMPANY OVERVIEW

- TABLE 220 SAMSUNG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 221 SAMSUNG: PRODUCT LAUNCHES

- TABLE 222 SAMSUNG: DEALS

- TABLE 223 SAMSUNG: OTHERS

- TABLE 224 NEC CORPORATION: COMPANY OVERVIEW

- TABLE 225 NEC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 226 NEC CORPORATION: PRODUCT LAUNCHES

- TABLE 227 NEC CORPORATION: DEALS

- TABLE 228 NEC CORPORATION: OTHERS

- TABLE 229 ORACLE: COMPANY OVERVIEW

- TABLE 230 ORACLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 231 CISCO SYSTEMS, INC.: COMPANY OVERVIEW

- TABLE 232 CISCO SYSTEMS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 233 CISCO SYSTEMS, INC.: DEALS

- TABLE 234 CIENA CORPORATION: COMPANY OVERVIEW

- TABLE 235 CIENA CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 236 CIENA CORPORATION: DEALS

- TABLE 237 JUNIPER NETWORKS, INC.: COMPANY OVERVIEW

- TABLE 238 JUNIPER NETWORKS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 239 JUNIPER NETWORKS, INC.: DEALS

- TABLE 240 CELONA INC.: COMPANY OVERVIEW

- TABLE 241 MAVENIR: COMPANY OVERVIEW

- TABLE 242 PARALLEL WIRELESS: COMPANY OVERVIEW

- TABLE 243 NTT DATA GROUP CORPORATION: COMPANY OVERVIEW

- TABLE 244 AT&T: COMPANY OVERVIEW

- TABLE 245 COMMSCOPE: COMPANY OVERVIEW

- TABLE 246 COMBA TELECOM SYSTEMS HOLDINGS LTD.: COMPANY OVERVIEW

- TABLE 247 LOGICALIS GROUP: COMPANY OVERVIEW

- TABLE 248 BOLDYN NETWORKS: COMPANY OVERVIEW

- TABLE 249 PENTE NETWORKS: COMPANY OVERVIEW

- TABLE 250 NEUTRAL WIRELESS: COMPANY OVERVIEW

- TABLE 251 FIRECELL: COMPANY OVERVIEW

- TABLE 252 NEUTROON TECHNOLOGIES S.L.: COMPANY OVERVIEW

- TABLE 253 KYNDRYL INC.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 PRIVATE 5G MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (SUPPLY SIDE)-IDENTIFICATION OF REVENUE GENERATED BY COMPANIES FROM SALES OF PRIVATE 5G SYSTEMS

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 7 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 8 MID BAND TO BE LEADING FREQUENCY SEGMENT OF PRIVATE 5G MARKET FROM 2025 TO 2030

- FIGURE 9 STANDALONE 5G NETWORK TYPE TO CAPTURE LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 10 MANUFACTURING VERTICAL TO LEAD PRIVATE 5G MARKET BETWEEN 2025 AND 2030

- FIGURE 11 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 12 GROWING ADOPTION OF INDUSTRY 4.0 AND SMART FACTORIES TO DRIVE MARKET

- FIGURE 13 US AND MANUFACTURING SEGMENTS TO HOLD LARGEST SHARE OF NORTH AMERICAN PRIVATE 5G MARKET IN 2025

- FIGURE 14 MANUFACTURING VERTICAL TO ACCOUNT FOR LARGEST SHARE OF PRIVATE 5G MARKET IN ASIA PACIFIC DURING FORECAST PERIOD

- FIGURE 15 PRIVATE 5G MARKET IN INDIA TO GROW AT HIGHEST CAGR FROM 2025 TO 2030

- FIGURE 16 PRIVATE 5G MARKET DYNAMICS: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 17 IMPACT OF DRIVERS ON PRIVATE 5G MARKET

- FIGURE 18 IMPACT OF RESTRAINTS ON PRIVATE 5G MARKET

- FIGURE 19 IMPACT OF OPPORTUNITIES ON PRIVATE 5G MARKET

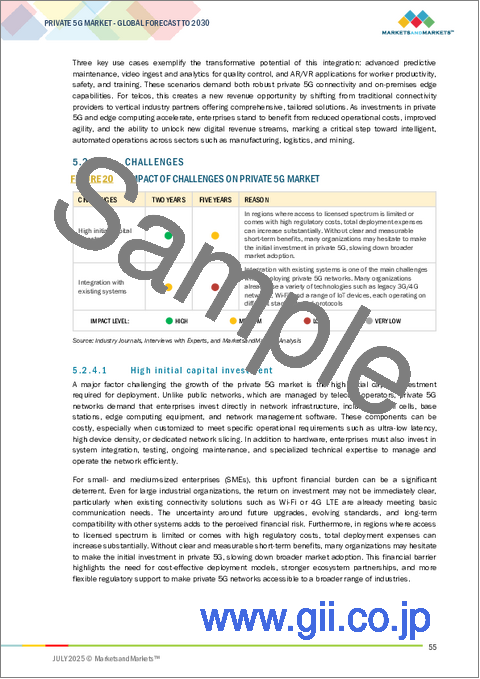

- FIGURE 20 IMPACT OF CHALLENGES ON PRIVATE 5G MARKET

- FIGURE 21 PRIVATE 5G MARKET: VALUE CHAIN ANALYSIS

- FIGURE 22 PRIVATE 5G MARKET: ECOSYSTEM ANALYSIS

- FIGURE 23 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS IN PRIVATE 5G MARKET

- FIGURE 24 PORTER'S FIVE FORCES ANALYSIS OF PRIVATE 5G MARKET

- FIGURE 25 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR PRIVATE 5G, BY TOP 3 VERTICALS

- FIGURE 26 KEY BUYING CRITERIA FOR PRIVATE 5G, BY TOP 3 VERTICALS

- FIGURE 27 FUNDS ACQUIRED BY COMPANIES IN 5G TECH AND SERVICES, 2020-2024

- FIGURE 28 IMPORT DATA FOR HS CODE 8517-COMPLIANT PRODUCTS FOR TOP 5 COUNTRIES, 2020-2024

- FIGURE 29 EXPORT DATA FOR HS CODE 8517-COMPLIANT PRODUCTS FOR TOP 5 COUNTRIES, 2020-2024

- FIGURE 30 NUMBER OF PATENTS GRANTED IN PRIVATE 5G MARKET, 2014-2024

- FIGURE 31 AI USE CASES

- FIGURE 32 NON-STANDALONE 5G VS. STANDALONE 5G

- FIGURE 33 STANDALONE 5G SEGMENT TO HOLD DOMINANT SHARE OF PRIVATE 5G MARKET IN 2030

- FIGURE 34 PUBLIC CLOUD SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 35 MID-BAND FREQUENCY SEGMENT TO HOLD LARGEST SHARE OF PRIVATE 5G MARKET IN 2030

- FIGURE 36 PRIVATE 5G SERVICES TO HOLD LARGEST MARKET SHARE IN 2030

- FIGURE 37 LARGE ENTERPRISES SEGMENT TO HOLD DOMINANT SHARE OF PRIVATE 5G MARKET IN 2030

- FIGURE 38 UNLICENSED/SHARED SPECTRUM TO HOLD DOMINANT SHARE OF PRIVATE 5G MARKET IN 2030

- FIGURE 39 MANUFACTURING VERTICAL TO CAPTURE LARGER SHARE OF PRIVATE 5G MARKET DURING FORECAST PERIOD

- FIGURE 40 PRIVATE 5G MARKET: GEOGRAPHIC SNAPSHOT

- FIGURE 41 NORTH AMERICA: PRIVATE 5G MARKET SNAPSHOT

- FIGURE 42 EUROPE: PRIVATE 5G MARKET SNAPSHOT

- FIGURE 43 ASIA PACIFIC: PRIVATE 5G MARKET SNAPSHOT

- FIGURE 44 REVENUE ANALYSIS OF KEY PLAYERS IN PRIVATE 5G MARKET, 2020-2024

- FIGURE 45 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2024

- FIGURE 46 COMPANY VALUATION, 2025

- FIGURE 47 FINANCIAL METRICS (EV/EBITDA), 2024

- FIGURE 48 BRAND/PRODUCT COMPARISON

- FIGURE 49 PRIVATE 5G MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 50 PRIVATE 5G MARKET: COMPANY FOOTPRINT

- FIGURE 51 PRIVATE 5G MARKET: COMPANY EVALUATION MATRIX (SMES/STARTUPS), 2024

- FIGURE 52 TELEFONAKTIEBOLAGET LM ERICSSON: COMPANY SNAPSHOT

- FIGURE 53 HUAWEI TECHNOLOGIES CO., LTD.: COMPANY SNAPSHOT

- FIGURE 54 NOKIA: COMPANY SNAPSHOT

- FIGURE 55 ZTE CORPORATION: COMPANY SNAPSHOT

- FIGURE 56 HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP: COMPANY SNAPSHOT

- FIGURE 57 SAMSUNG: COMPANY SNAPSHOT

- FIGURE 58 NEC CORPORATION: COMPANY SNAPSHOT

- FIGURE 59 ORACLE: COMPANY SNAPSHOT

- FIGURE 60 CISCO SYSTEMS, INC.: COMPANY SNAPSHOT

- FIGURE 61 CIENA CORPORATION: COMPANY SNAPSHOT

- FIGURE 62 JUNIPER NETWORKS, INC.: COMPANY SNAPSHOT

The private 5G market is valued at USD 3.86 billion in 2025 and is projected to reach USD 17.55 billion by 2030, registering a CAGR of 35.4% during the forecast period. Private 5G networks are being increasingly adopted across industries due to their ability to provide highly reliable, low-latency, and secure connectivity tailored to specific enterprise needs. In the manufacturing sector, private 5G enables real-time monitoring, automated guided vehicles (AGVs), and robotic control, supporting Industry 4.0 transformation. In healthcare, it enhances remote surgery, real-time imaging, and secure patient data transmission. The logistics and transportation industries use private 5G to streamline operations through asset tracking, fleet management, and automated warehousing. Retailers deploy private 5G to enable smart shelves, customer analytics, and immersive shopping experiences. The technology also supports the energy & utility sector in enabling predictive maintenance and grid automation. With dedicated spectrum and localized control, private 5G allows enterprises to customize network performance, ensuring optimal support for mission-critical applications and greater operational control, driving its growing relevance across digitally transforming industries.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By offering, network type, cloud models, organization size, spectrum allocation, frequency band, vertical, and region |

| Regions covered | North America, Europe, APAC, RoW |

"Private 5G services segment expected to grow at the highest CAGR during forecast period"

The private 5G services segment is expected to grow at the highest CAGR during the forecast period due to rising demand for customized network services that ensure greater control, security, and performance. Services such as network design and deployment, integration with existing infrastructure, spectrum management, and lifecycle management are critical in enabling organizations to implement and operate private 5G networks effectively. Market growth is driven by increased adoption across industries like manufacturing, logistics, and energy, which require ultra-low latency and high-reliability connectivity for automation, real-time monitoring, and mission-critical applications. These services play a crucial role in supporting enterprises with end-to-end deployment, from planning and installation to ongoing maintenance and optimization. The rising need for Industry 4.0 transformation, growing reliance on IoT and edge computing, and increasing availability of private spectrum licenses globally are further accelerating the uptake of private 5G services, positioning them as a key enabler of digital transformation initiatives.

"Manufacturing vertical to account for largest share of private 5G market during forecast period"

The manufacturing vertical is expected to hold the largest market share in the private 5G market during the forecast period, driven by the increasing adoption of smart manufacturing and industrial automation. Manufacturers are investing in private 5G networks to enable real-time communication, machine-to-machine connectivity, and data-driven decision-making on the factory floor. Private 5G provides high bandwidth, ultra-low latency, and secure connectivity required to support advanced technologies such as robotics, digital twins, predictive maintenance, and autonomous systems. These capabilities are critical for improving operational efficiency, reducing downtime, and enhancing production flexibility. The transition to Industry 4.0 is further accelerating this trend as companies seek to integrate IoT devices, sensors, and AI-driven analytics into their production environments. By deploying private 5G, manufacturers gain greater control over network performance and data security, supporting critical use cases in complex, high-density industrial settings and positioning the sector as a leading adopter of private 5G solutions.

"Germany to dominate private 5G market in Europe"

Germany is expected to dominate the private 5G market in Europe during the forecast period, driven by its strong industrial base, regulatory flexibility, and urgency for digital transformation, particularly in the automotive sector. Unlike public 5G networks, private 5G networks in Germany are not bound by the BSIG or TKG regulations, allowing enterprises to deploy tailored and secure networks without mandatory certifications. This regulatory clarity supports faster rollouts across manufacturing, logistics, and other verticals. The German automotive industry, facing global competition and the shift to electric vehicles, is accelerating its transition toward smart manufacturing. Private 5G enables real-time communication, edge computing, and seamless integration of robotics, AR/VR, and condition-based monitoring, essential for modern, data-driven production. As automotive giants prioritize automation and efficiency to retain global leadership, private 5G is becoming a critical infrastructure. This strategic alignment between industrial priorities and digital capability makes Germany a key hub for private 5G adoption in Europe.

- By Company Type: Tier 1 - 25%, Tier 2 - 40%, and Tier 3 - 35%

- By Designation: Directors - 30%, Managers - 28%, , and Others - 42%

- By Region: North America - 43%, Europe - 15%, Asia Pacific - 37%, and RoW - 5%

Huawei Technologies Co., Ltd. (China), Telefonaktiebolaget LM Ericsson (Sweden), Nokia (Finland), Samsung (South Korea), ZTE Corporation (China), NEC Corporation (Japan), Oracle (US), Cisco Systems, Inc. (US), Ciena Corporation (US), Juniper Networks, Inc. (US), Celona Inc. (US), Mavenir (US), Parallel Wireless (US), NTT DATA Group Corporation (Japan), and AT&T (US) are some of the key players in the private 5G market.

The study includes an in-depth competitive analysis of these key players in the private 5G market, with their company profiles, recent developments, and key market strategies.

Research Coverage

This research report categorizes the private 5G market by offering (hardware (radio access network, core network, backhaul & transport, edge computing infrastructure), software, and services), network type (non-standalone 5G and standalone 5G), cloud deployment models (private/dedicated cloud, public cloud, and hybrid cloud), organization size (small & medium enterprises and large enterprises), spectrum allocation (licensed spectrum and unlicensed/shared spectrum), and frequency band (low band, mid band, and mmWave), vertical (manufacturing, energy & utilities, retail & e-commerce, healthcare, BFSI, infrastructure, transportation & logistics, aerospace, media & entertainment, IT & telecommunication, and other verticals), and by region (North America, Europe, Asia Pacific, and RoW). The report's scope covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the private 5G market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, and products; key strategies; contracts, partnerships, agreements; new product launches; mergers & acquisitions; and other recent developments associated with the private 5G market. This report covers the competitive analysis of upcoming startups in the private 5G market ecosystem.

Reasons to buy this report

The report will help market leaders and new entrants with information on the closest approximations of the revenue numbers for the overall private 5G market and its subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Rising demand for industrial automation and smart manufacturing, Increasing demand for IIoT, Increasing demand for security and privacy in enterprise networks), restraints (Limited availability of spectrum), opportunities (Increasing adoption of private 5G in the healthcare vertical, Integration of edge computing in private 5G), and challenges (High initial capital investment, Integration with existing systems)

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the private 5G market

- Market Development: Comprehensive information about lucrative markets-the report analyses the private 5G market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the private 5G market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players like Huawei Technologies Co., Ltd. (China), Telefonaktiebolaget LM Ericsson (Sweden), Nokia (Finland), Samsung (South Korea), ZTE Corporation (China), NEC Corporation (Japan), Oracle (US), Cisco Systems, Inc. (US), Ciena Corporation (US), Juniper Networks, Inc. (US), among others, in the private 5G market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 INCLUSIONS AND EXCLUSIONS

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Intended participants and key opinion leaders in primary interviews

- 2.1.2.2 List of major participants in primary interviews

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Breakdown of primary interviews

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.3.1 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to arrive at market size using bottom-up approach (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to arrive at market size using top-down approach (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RISK ASSESSMENT

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN PRIVATE 5G MARKET

- 4.2 PRIVATE 5G MARKET IN NORTH AMERICA, BY COUNTRY AND VERTICAL

- 4.3 PRIVATE 5G MARKET IN ASIA PACIFIC, BY VERTICAL

- 4.4 PRIVATE 5G MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising demand for industrial automation and shift toward smart manufacturing

- 5.2.1.2 Increasing demand for Industrial Internet of Things

- 5.2.1.3 Surging demand for security and privacy in enterprise networks

- 5.2.2 RESTRAINTS

- 5.2.2.1 Limited availability of spectrum

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing adoption of private 5G in healthcare

- 5.2.3.2 Integration of edge computing in private 5G

- 5.2.4 CHALLENGES

- 5.2.4.1 High initial capital investment

- 5.2.4.2 Integration with existing systems

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.6 INDICATIVE PRICING ANALYSIS

- 5.7 PRIVATE 5G PRICING MODELS

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Network slicing

- 5.8.1.2 Radio access network (RAN)

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Edge computing

- 5.8.2.2 Industrial Internet of Things (IIoT)

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 Wi-Fi 6

- 5.8.3.2 Private LTE

- 5.8.1 KEY TECHNOLOGIES

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- 5.9.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.9.2 BARGAINING POWER OF SUPPLIERS

- 5.9.3 BARGAINING POWER OF BUYERS

- 5.9.4 THREAT OF SUBSTITUTES

- 5.9.5 THREAT OF NEW ENTRANTS

- 5.10 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.10.2 BUYING CRITERIA

- 5.11 CASE STUDY ANALYSIS

- 5.12 INVESTMENT AND FUNDING SCENARIO

- 5.13 TRADE ANALYSIS

- 5.13.1 IMPORT DATA (HS CODE 8517)

- 5.13.2 EXPORT DATA (HS CODE 8517)

- 5.14 PATENT ANALYSIS

- 5.15 KEY CONFERENCES AND EVENTS, JULY 2025-DECEMBER 2026

- 5.16 TARIFF AND REGULATORY LANDSCAPE

- 5.16.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.16.2 STANDARDS AND REGULATIONS RELATED TO PRIVATE 5G MARKET

- 5.16.3 TARIFF ANALYSIS

- 5.17 GOVERNMENT ACTS

- 5.17.1 GRAMM-LEACH-BLILEY ACT

- 5.17.2 CALIFORNIA CONSUMER PRIVACY ACT

- 5.17.3 ANTICYBERSQUATTING CONSUMER PROTECTION ACT

- 5.17.4 FAIR INFORMATION PRACTICE PRINCIPLES

- 5.18 ISSUES AND CHALLENGES RELATED TO PRIVATE 5G, BY REGION

- 5.19 COUNTRY-WISE SPECTRUM ALLOCATION FOR PRIVATE 5G NETWORKS

- 5.20 IMPACT OF AI ON PRIVATE 5G MARKET

- 5.20.1 INTRODUCTION

- 5.20.2 AI-SPECIFIC USE CASES

- 5.21 IMPACT OF 2025 US TARIFFS ON PRIVATE 5G MARKET: OVERVIEW

- 5.21.1 INTRODUCTION

- 5.21.2 KEY TARIFF RATES

- 5.21.3 PRICE IMPACT ANALYSIS

- 5.21.4 IMPACT ON KEY COUNTRIES/REGIONS

- 5.21.4.1 US

- 5.21.4.2 Europe

- 5.21.4.3 Asia Pacific

- 5.21.5 IMPACT ON END USERS

6 PRIVATE 5G MARKET, BY NETWORK TYPE

- 6.1 INTRODUCTION

- 6.2 NON-STANDALONE 5G

- 6.2.1 LOWER INITIAL INVESTMENT AND INTEGRATION WITH EXISTING 4G LTE INFRASTRUCTURE TO DRIVE GROWTH

- 6.3 STANDALONE 5G

- 6.3.1 ADVANCED SUPPORT FOR NETWORK SLICING AND SERVICE DIFFERENTIATION TO DRIVE GROWTH

7 PRIVATE 5G MARKET, BY CLOUD MODEL

- 7.1 INTRODUCTION

- 7.2 PRIVATE/DEDICATED CLOUD

- 7.2.1 EXPANSION OF ON-PREMISES AND VPC DEPLOYMENT OPTIONS TO DRIVE GROWTH

- 7.3 PUBLIC CLOUD

- 7.3.1 RISING INFRASTRUCTURE COSTS TO DRIVE PUBLIC CLOUD ADOPTION

- 7.4 HYBRID CLOUD

- 7.4.1 INCREASING NEED FOR FLEXIBLE WORKLOAD PLACEMENT ACROSS CLOUD ENVIRONMENTS TO DRIVE GROWTH

8 PRIVATE 5G MARKET, BY FREQUENCY BAND

- 8.1 INTRODUCTION

- 8.2 LOW BAND

- 8.2.1 LOWER INFRASTRUCTURE COSTS DUE TO FEWER BASE STATION REQUIREMENTS TO DRIVE GROWTH

- 8.3 MID BAND

- 8.3.1 BALANCED MIX OF COVERAGE AND CAPACITY FOR ENTERPRISE APPLICATIONS TO DRIVE GROWTH

- 8.4 MMWAVE

- 8.4.1 ULTRA-HIGH DATA RATES AND ULTRA-LOW NETWORK LATENCY FEATURES TO DRIVE GROWTH

9 PRIVATE 5G MARKET, BY OFFERING

- 9.1 INTRODUCTION

- 9.2 HARDWARE

- 9.2.1 RADIO ACCESS NETWORK (RAN)

- 9.2.1.1 Increasing need for secure and dedicated network access to drive growth

- 9.2.1.2 Base stations

- 9.2.1.3 Antenna systems

- 9.2.1.4 Remote radio units (RRUs)

- 9.2.2 BACKHAUL & TRANSPORT

- 9.2.2.1 Rising demand for compact, integrated routers and switches to drive growth

- 9.2.2.2 Routers and switches

- 9.2.2.3 Fiber optic cables

- 9.2.2.4 Microwave links

- 9.2.3 EDGE COMPUTING INFRASTRUCTURE

- 9.2.3.1 Rising adoption of edge gateways for protocol and device integration to drive growth

- 9.2.3.2 Edge servers

- 9.2.3.3 Edge gateways

- 9.2.3.4 Multi-access edge computing

- 9.2.3.5 Content delivery networks

- 9.2.1 RADIO ACCESS NETWORK (RAN)

- 9.3 SOFTWARE

- 9.3.1 INCREASING NEED FOR CENTRALIZED NETWORK MANAGEMENT TO DRIVE GROWTH

- 9.3.2 5G CORE

- 9.3.3 NETWORK MANAGEMENT SOFTWARE

- 9.3.4 NETWORK SECURITY SOFTWARE

- 9.3.5 CLOUD-BASED SOLUTIONS

- 9.4 SERVICES

- 9.4.1 SURGE IN CYBER THREATS NECESSITATING PROACTIVE SECURITY SERVICES TO DRIVE GROWTH

- 9.4.2 PROFESSIONAL SERVICES

- 9.4.2.1 Installation & integration

- 9.4.2.2 Training & enablement

- 9.4.3 MANAGED SERVICES

- 9.4.3.1 Network monitoring

- 9.4.3.2 Support & maintenance

- 9.4.4 SECURITY SERVICES

- 9.4.4.1 Identity and access management (IAM)

- 9.4.4.1.1 Multi-factor authentication (MFA)

- 9.4.4.1.2 Role-based access control (RBAC)

- 9.4.4.1.3 Device identity management

- 9.4.4.2 Encryption and data protection

- 9.4.4.1 Identity and access management (IAM)

- 9.4.5 EDGE COMPUTING SERVICES

- 9.4.5.1 Multi-access edge computing (MEC)

- 9.4.5.2 Edge application hosting

- 9.4.6 CONNECTIVITY SERVICES

- 9.4.6.1 Bandwidth provisioning

- 9.4.6.2 SIM/Device management

10 PRIVATE 5G MARKET, BY ORGANIZATION SIZE

- 10.1 INTRODUCTION

- 10.2 SMALL AND MEDIUM ENTERPRISES (SMES)

- 10.2.1 INCREASING DEMAND FOR AUTOMATION ACROSS SME MANUFACTURING OPERATIONS TO DRIVE GROWTH

- 10.3 LARGE ENTERPRISES

- 10.3.1 RISING FOCUS ON DIGITAL TRANSFORMATION ACROSS GLOBAL ENTERPRISE OPERATIONS TO DRIVE GROWTH

11 PRIVATE 5G MARKET, BY SPECTRUM ALLOCATION

- 11.1 INTRODUCTION

- 11.2 UNLICENSED/SHARED SPECTRUM

- 11.2.1 AVAILABILITY OF AFFORDABLE NETWORK EQUIPMENT TO DRIVE GROWTH

- 11.3 LICENSED SPECTRUM

- 11.3.1 REGULATORY PUSH FOR INDUSTRY-SPECIFIC LOCAL SPECTRUM LICENSING TO DRIVE GROWTH

12 PRIVATE 5G MARKET, BY VERTICAL

- 12.1 INTRODUCTION

- 12.2 MANUFACTURING

- 12.2.1 GROWING USE OF AI AND MACHINE LEARNING FOR PROCESS OPTIMIZATION TO DRIVE GROWTH

- 12.2.2 SMART FACTORY

- 12.2.3 INDUSTRIAL IOT

- 12.3 ENERGY & UTILITIES

- 12.3.1 INCREASING DEMAND FOR GRID AUTOMATION AND SMART INFRASTRUCTURE TO DRIVE GROWTH

- 12.3.2 SMART GRIDS

- 12.3.3 RENEWABLE ENERGY MANAGEMENT

- 12.3.4 SMART METERING

- 12.4 RETAIL & E-COMMERCE

- 12.4.1 SURGE IN ONLINE SHOPPING AND DIGITAL PAYMENT ADOPTION TO DRIVE GROWTH

- 12.4.2 CUSTOMER EXPERIENCE ENHANCEMENT

- 12.4.3 INVENTORY MANAGEMENT

- 12.5 HEALTHCARE

- 12.5.1 GROWING FOCUS ON PATIENT MONITORING AND REMOTE HEALTHCARE SERVICES TO DRIVE GROWTH

- 12.5.2 REMOTE PATIENT MONITORING

- 12.5.3 TELEMEDICINE

- 12.5.4 MEDICAL IMAGING

- 12.6 BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI)

- 12.6.1 RISING NEED FOR FRAUD DETECTION AND RISK MANAGEMENT SOLUTIONS TO DRIVE GROWTH

- 12.6.2 AUTOMATED TRADING SYSTEM

- 12.6.3 FRAUD DETECTION AND PREVENTION

- 12.6.4 MOBILE BANKING

- 12.7 INFRASTRUCTURE

- 12.7.1 EXPANSION OF CONNECTED INFRASTRUCTURE AND IOT-BASED URBAN SOLUTIONS TO DRIVE GROWTH

- 12.7.2 SMART CITY

- 12.7.3 SECURITY & SURVEILLANCE

- 12.7.4 FACILITY MANAGEMENT

- 12.8 TRANSPORTATION & LOGISTICS

- 12.8.1 RISING NEED FOR REAL-TIME VEHICLE AND ASSET TRACKING TO DRIVE GROWTH

- 12.8.2 FLEET MANAGEMENT

- 12.8.3 AUTONOMOUS VEHICLES

- 12.8.4 SUPPLY CHAIN MANAGEMENT

- 12.9 AEROSPACE

- 12.9.1 INCREASING FOCUS ON PREDICTIVE AIRCRAFT MAINTENANCE AND OPERATIONAL EFFICIENCY TO DRIVE GROWTH

- 12.9.2 SMART PORTS & AIRPORTS

- 12.9.3 TRAINING & SIMULATION

- 12.9.4 SECURE COMMUNICATIONS

- 12.9.5 REMOTE MONITORING & SURVEILLANCE

- 12.10 MEDIA & ENTERTAINMENT

- 12.10.1 DEMAND FOR PERSONALIZED CONTENT RECOMMENDATIONS AND USER ENGAGEMENT TO DRIVE GROWTH

- 12.10.2 LIVE EVENT BROADCASTING

- 12.10.3 AR/VR EXPERIENCE

- 12.10.4 CONTENT DELIVERY NETWORKS

- 12.11 IT & TELECOMMUNICATIONS

- 12.11.1 EXPANSION OF SMART SURVEILLANCE ACROSS TELECOM INFRASTRUCTURE ASSETS TO DRIVE GROWTH

- 12.11.2 NETWORK MANAGEMENT & OPTIMIZATION

- 12.11.3 NETWORK SLICING

- 12.11.4 SUPPLY CHAIN MANAGEMENT

- 12.12 OTHER VERTICALS

13 PRIVATE 5G MARKET, BY REGION

- 13.1 INTRODUCTION

- 13.2 NORTH AMERICA

- 13.2.1 MACROECONOMIC OUTLOOK

- 13.2.2 US

- 13.2.2.1 Digital transformation initiatives to drive growth

- 13.2.3 CANADA

- 13.2.3.1 Presence of strong manufacturing industry to drive growth

- 13.2.4 MEXICO

- 13.2.4.1 Focus on tailored connectivity solutions to drive growth

- 13.3 EUROPE

- 13.3.1 MACROECONOMIC OUTLOOK

- 13.3.2 GERMANY

- 13.3.2.1 Private 5G adoption in automotive sector to drive growth

- 13.3.3 UK

- 13.3.3.1 Commitment to enabling digital infrastructure in strategic research and innovation hubs to drive growth

- 13.3.4 FRANCE

- 13.3.4.1 Adoption of private 5G at airports to drive growth

- 13.3.5 ITALY

- 13.3.5.1 Hybrid private 5G network deployment in energy sector to drive growth

- 13.3.6 SPAIN

- 13.3.6.1 Growing demand for secure, low-latency connectivity to drive growth

- 13.3.7 POLAND

- 13.3.7.1 Regulatory approval of 3.8-4.2 GHz spectrum band to drive growth

- 13.3.8 NORDIC COUNTRIES

- 13.3.8.1 Growing enterprise interest in high-performance, secure connectivity to drive growth

- 13.3.9 REST OF EUROPE

- 13.4 ASIA PACIFIC

- 13.4.1 MACROECONOMIC OUTLOOK

- 13.4.2 CHINA

- 13.4.2.1 Rapid deployment of 5G base stations to drive growth

- 13.4.3 JAPAN

- 13.4.3.1 Adoption of energy-efficient, cloud-native architectures to drive growth

- 13.4.4 SOUTH KOREA

- 13.4.4.1 Announcement of nationwide 5G coverage to drive growth

- 13.4.5 INDIA

- 13.4.5.1 Establishment of 5G centers of excellence and collaborations between domestic and international vendors to drive growth

- 13.4.6 AUSTRALIA

- 13.4.6.1 Government spectrum planning through ACMA's draft outlook to drive growth

- 13.4.7 INDONESIA

- 13.4.7.1 Strategic direction toward smart infrastructure to drive growth

- 13.4.8 MALAYSIA

- 13.4.8.1 Private 5G coverage at key transport hubs to drive growth

- 13.4.9 THAILAND

- 13.4.9.1 Government-backed Industry 4.0 initiatives to drive growth

- 13.4.10 VIETNAM

- 13.4.10.1 Focus on telecom innovation to drive growth

- 13.4.11 REST OF ASIA PACIFIC

- 13.5 REST OF THE WORLD

- 13.5.1 MACROECONOMIC OUTLOOK

- 13.5.2 MIDDLE EAST

- 13.5.2.1 Saudi Arabia

- 13.5.2.1.1 National economic diversification initiatives to drive growth

- 13.5.2.2 UAE

- 13.5.2.2.1 Strong collaboration between telcos and vendors to drive growth

- 13.5.2.3 Qatar

- 13.5.2.3.1 Network modernization efforts to drive growth

- 13.5.2.4 Kuwait

- 13.5.2.4.1 Operator-driven digital transformation to drive growth

- 13.5.2.5 Oman

- 13.5.2.5.1 Spectrum allocation by TRA to major operators to drive growth

- 13.5.2.6 Bahrain

- 13.5.2.6.1 Enterprise-centric innovation to drive growth

- 13.5.2.7 Rest of Middle East

- 13.5.2.1 Saudi Arabia

- 13.5.3 SOUTH AMERICA

- 13.5.3.1 Government support for private 5G licensing to drive growth

- 13.5.4 AFRICA

- 13.5.4.1 South Africa

- 13.5.4.1.1 Deployment of Africa's largest private 5G mining network to drive growth

- 13.5.4.2 Rest of Africa

- 13.5.4.1 South Africa

14 COMPETITIVE LANDSCAPE

- 14.1 OVERVIEW

- 14.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, JANUARY 2022-JUNE 2025

- 14.3 REVENUE ANALYSIS, 2020-2024

- 14.4 MARKET SHARE ANALYSIS, 2024

- 14.5 COMPANY VALUATION AND FINANCIAL METRICS

- 14.6 BRAND/PRODUCT COMPARISON

- 14.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 14.7.1 STARS

- 14.7.2 EMERGING LEADERS

- 14.7.3 PERVASIVE PLAYERS

- 14.7.4 PARTICIPANTS

- 14.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 14.7.5.1 Company footprint

- 14.7.5.2 Region footprint

- 14.7.5.3 Vertical footprint

- 14.7.5.4 Network type footprint

- 14.7.5.5 Offering footprint

- 14.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 14.8.1 PROGRESSIVE COMPANIES

- 14.8.2 RESPONSIVE COMPANIES

- 14.8.3 DYNAMIC COMPANIES

- 14.8.4 STARTING BLOCKS

- 14.8.5 COMPETITIVE BENCHMARKING: KEY STARTUPS/SMES, 2024

- 14.8.5.1 List of startups/SMEs

- 14.8.5.2 Competitive benchmarking of key startups/SMEs

- 14.9 COMPETITIVE SCENARIO

- 14.9.1 PRODUCT LAUNCHES/DEVELOPMENTS

- 14.9.2 DEALS

- 14.9.3 OTHERS

15 COMPANY PROFILES

- 15.1 KEY PLAYERS

- 15.1.1 TELEFONAKTIEBOLAGET LM ERICSSON

- 15.1.1.1 Business overview

- 15.1.1.2 Products/Solutions/Services offered

- 15.1.1.3 Recent developments

- 15.1.1.3.1 Product launches

- 15.1.1.3.2 Deals

- 15.1.1.3.3 Others

- 15.1.1.4 MnM view

- 15.1.1.4.1 Right to win

- 15.1.1.4.2 Strategic choices

- 15.1.1.4.3 Weaknesses and competitive threats

- 15.1.2 HUAWEI TECHNOLOGIES CO., LTD.

- 15.1.2.1 Business overview

- 15.1.2.2 Products/Solutions/Services offered

- 15.1.2.3 Recent developments

- 15.1.2.3.1 Product launches

- 15.1.2.3.2 Deals

- 15.1.2.3.3 Others

- 15.1.2.4 MnM view

- 15.1.2.4.1 Right to win

- 15.1.2.4.2 Strategic choices

- 15.1.2.4.3 Weaknesses and competitive threats

- 15.1.3 NOKIA

- 15.1.3.1 Business overview

- 15.1.3.2 Products/Solutions/Services offered

- 15.1.3.3 Recent developments

- 15.1.3.3.1 Deals

- 15.1.3.4 MnM view

- 15.1.3.4.1 Right to win

- 15.1.3.4.2 Strategic choices

- 15.1.3.4.3 Weaknesses and competitive threats

- 15.1.4 ZTE CORPORATION

- 15.1.4.1 Business overview

- 15.1.4.2 Products/Solutions/Services offered

- 15.1.4.3 Recent developments

- 15.1.4.3.1 Product launches

- 15.1.4.3.2 Deals

- 15.1.4.3.3 Others

- 15.1.4.4 MnM view

- 15.1.4.4.1 Right to win

- 15.1.4.4.2 Strategic choices

- 15.1.4.4.3 Weaknesses and competitive threats

- 15.1.5 HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP

- 15.1.5.1 Business overview

- 15.1.5.2 Products/Solutions/Services offered

- 15.1.5.3 Recent developments

- 15.1.5.3.1 Product launches

- 15.1.5.3.2 Deals

- 15.1.5.3.3 Others

- 15.1.5.4 MnM view

- 15.1.5.4.1 Right to win

- 15.1.5.4.2 Strategic choices

- 15.1.5.4.3 Weaknesses and competitive threats

- 15.1.6 SAMSUNG

- 15.1.6.1 Business overview

- 15.1.6.2 Products/Solutions/Services offered

- 15.1.6.3 Recent developments

- 15.1.6.3.1 Product launches

- 15.1.6.3.2 Deals

- 15.1.6.3.3 Others

- 15.1.7 NEC CORPORATION

- 15.1.7.1 Business overview

- 15.1.7.2 Products/Solutions/Services offered

- 15.1.7.3 Recent developments

- 15.1.7.3.1 Product launches

- 15.1.7.3.2 Deals

- 15.1.7.3.3 Others

- 15.1.8 ORACLE

- 15.1.8.1 Business overview

- 15.1.8.2 Products/Solutions/Services offered

- 15.1.9 CISCO SYSTEMS, INC.

- 15.1.9.1 Business overview

- 15.1.9.2 Products/Solutions/Services offered

- 15.1.9.3 Recent developments

- 15.1.9.3.1 Deals

- 15.1.10 CIENA CORPORATION

- 15.1.10.1 Business overview

- 15.1.10.2 Products/Solutions/Services offered

- 15.1.10.3 Recent developments

- 15.1.10.3.1 Deals

- 15.1.11 JUNIPER NETWORKS, INC.

- 15.1.11.1 Business overview

- 15.1.11.2 Products/Solutions/Services offered

- 15.1.11.3 Recent developments

- 15.1.11.3.1 Deals

- 15.1.1 TELEFONAKTIEBOLAGET LM ERICSSON

- 15.2 OTHER PLAYERS

- 15.2.1 CELONA INC.

- 15.2.2 MAVENIR

- 15.2.3 PARALLEL WIRELESS

- 15.2.4 NTT DATA GROUP CORPORATION

- 15.2.5 AT&T

- 15.2.6 COMMSCOPE

- 15.2.7 COMBA TELECOM SYSTEMS HOLDINGS LTD.

- 15.2.8 LOGICALIS GROUP

- 15.2.9 BOLDYN NETWORKS

- 15.2.10 PENTE NETWORKS

- 15.2.11 NEUTRAL WIRELESS

- 15.2.12 FIRECELL

- 15.2.13 NEUTROON TECHNOLOGIES S.L.

- 15.2.14 KYNDRYL INC.

16 APPENDIX

- 16.1 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.2 CUSTOMIZATION OPTIONS

- 16.3 RELATED REPORTS

- 16.4 AUTHOR DETAILS