|

|

市場調査レポート

商品コード

1762820

エポキシ樹脂の世界市場:物理的形態別、用途別、最終用途産業別、原材料別、地域別 - 2030年までの予測Epoxy Resin Market by Physical Form (Liquids, Solids, Solutions), Raw Material (Badge, BFDGE, Novolac, Aliphatic, Glycidyl Amine), Application (Paints & Coatings, Adhesives & Sealants, Composites), End-use Industry, and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| エポキシ樹脂の世界市場:物理的形態別、用途別、最終用途産業別、原材料別、地域別 - 2030年までの予測 |

|

出版日: 2025年07月02日

発行: MarketsandMarkets

ページ情報: 英文 247 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

エポキシ樹脂の市場規模は、2026年から2030年にかけて6.6%のCAGRで拡大し、2025年の147億7,000万米ドルから2030年には203億1,000万米ドルに成長すると予測されています。

エポキシ樹脂溶液は、エポキシ樹脂市場で3番目に大きいタイプです。溶液とは、エポキシ樹脂とアセトンやトルエンなどの溶剤の組み合わせと定義され、塗布しやすいように粘度を下げます。粘度が低下するため、溶液の形態は優れた流動性、濡れ特性、基材との適合性を示し、コーティング、接着剤、複合材料に有利です。これらの材料は、航空宇宙用コーティング、機械用保護コーティング、風力タービンブレード部品の接着などの高性能用途で重宝されています。建設、自動車、その他の産業市場からの需要の増加が、エポキシ樹脂ソリューションの成長を牽引し続けています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2022年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(100万米ドル)および数量(キロトン) |

| セグメント別 | 物理的形態別、用途別、最終用途産業別、原材料別、地域別 |

| 対象地域 | 欧州、北米、アジア太平洋、中東・アフリカ、南米 |

エポキシ樹脂は、高い強度と剛性、炭素繊維、ガラス繊維、アラミド繊維などの補強材との耐久性のある接着性など、卓越した機械的特性を持っているため、複合材料は依然としてエポキシ樹脂の主要な需要用途となっています。エポキシ樹脂をベースとする複合材料は、航空宇宙、自動車、風力エネルギー、海洋など、最終用途産業にわたるいくつかの高性能用途の基礎材料となっています。これらの分野での需要は、エネルギー効率と信頼性を高める軽量で高強度な材料への戦略的シフトにより伸びています。特に、航空宇宙市場や風力エネルギー市場では、強靭な構造部品や大型ローターブレードの開発にエポキシ樹脂の採用が加速しています。さらに、樹脂注入、自動レイアップ、速硬化配合などの製造技術の進歩により、生産効率と拡張性が向上し、次世代用途に選ばれる複合材料としてのエポキシ樹脂の地位がさらに強固なものとなっています。

エポキシ樹脂は、エレクトロニクス、繊維、包装、工具、機械など、多くの一般産業分野で広く使用されています。その強力な絶縁特性、耐薬品性、機械的耐久性により、さまざまな過酷な用途で信頼できる選択肢となっています。産業界がより高度な技術と自動化を採用し続けるにつれて、信頼性の高い高性能材料への需要が高まっています。エポキシ樹脂は、回路基板、接着剤、保護コーティングなどの分野でますます一般的になっています。高温に耐え、難燃性基準を満たす新しい配合は、機器の筐体や頑丈な部品に使用されるようになっています。さらに、湿気やほこり、振動にさらされることが懸念される自動化された生産環境において、電子機器を密封・保護するためにエポキシ樹脂を採用するメーカーも増えています。これらの動向は、エポキシ樹脂が現代の産業環境において効率性と長寿命を支え続けていることを反映しています。

欧州がエポキシ樹脂にとって2番目に重要な地域であるのは、強力な産業基盤があり、品質と持続可能性を重視する規制があるからです。景気減速により逆風が吹いているが、建設、モビリティ、再生可能エネルギーなどの分野が回復しているため、需要は戻りつつあるようです。グリーン技術や先端材料への地域的な後押しが、高価値用途におけるエポキシ樹脂の需要を引き続き牽引しています。産業の回復がイノベーション主導の成長とますます足並みを揃える中、欧州は世界のエポキシ樹脂サプライチェーンの重要な柱であり続けています。

当レポートでは、世界のエポキシ樹脂市場について調査し、物理的形態別、用途別、最終用途産業別、原材料別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- マクロ経済指標

- AI/生成AIの影響

- バリューチェーン分析

- ケーススタディ分析

- 規制状況

- 技術分析

- 顧客のビジネスに影響を与える動向/混乱

- 貿易分析

- 2025年~2026年の主な会議とイベント

- 価格分析

- 投資と資金調達のシナリオ

- 特許分析

- 2025年の米国関税の影響- エポキシ樹脂市場

- イントロダクション

- 主要関税率

- 価格影響分析

- 国/地域への影響

- 最終用途産業への影響

第6章 エポキシ樹脂市場(物理的形態別)

- エポキシ樹脂

- 固形エポキシ樹脂

- 液状エポキシ樹脂

- 溶液エポキシ樹脂

第7章 エポキシ樹脂市場(用途別)

- イントロダクション

- 塗料・コーティング剤

- 接着剤・シーラント

- 複合材料

- その他

第8章 エポキシ樹脂市場(最終用途産業別)

- イントロダクション

- 建築・建設

- 自動車

- 一般産業

- 風力

- 消費財

- 航空宇宙

- 船舶

- その他

第9章 エポキシ樹脂市場(原材料別)

- イントロダクション

- DGEBA(ビスフェノールAのジグリシジルエーテル)

- DGBEF(ビスフェノールFのジグリシジルエーテル)

- ノボラック

- 脂肪族

- その他

第10章 エポキシ樹脂市場(地域別)

- イントロダクション

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- インドネシア

- その他

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- ベルギー

- その他

- 中東・アフリカ

- サウジアラビア

- 南アフリカ

- アラブ首長国連邦

- その他

- 南米

- ブラジル

- アルゼンチン

- その他

第11章 競合情勢

- 概要

- 主要参入企業の戦略

- 収益分析

- 市場シェア分析

- 企業評価と財務指標

- ブランド/製品比較分析

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

第12章 企業プロファイル

- 主要参入企業

- 3M

- OLIN CORPORATION

- WESTLAKE EPOXY

- KUKDO CHEMICAL CO., LTD.

- DIC CORPORATION

- HUNTSMAN CORPORATION

- NAN YA PLASTICS CORPORATION

- SINOPEC CORPORATION

- ADITYA BIRLA CHEMICALS

- BASF SE

- その他の企業

- MITSUBISHI CHEMICAL GROUP CORPORATION

- CHANG CHUN GROUP

- MOMENTIVE PERFORMANCE MATERIALS

- EVONIK INDUSTRIES AG

- SIKA AG

- EASTMAN CHEMICAL COMPANY

- KOLON INDUSTRIES, INC.

- LEUNA HARZE

- SPOLCHEMIE

- ADHESIVES TECHNOLOGY CORPORATION

- ATUL LTD.

- COVESTRO AG

- JIANGSU SANMU GROUP

- NAMA CHEMICALS COMPANY

- 3N COMPOSITE PRODUCTS LLP

第13章 付録

List of Tables

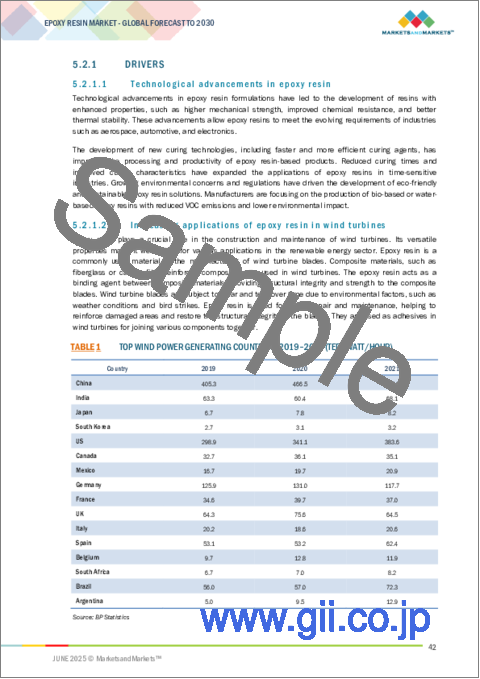

- TABLE 1 TOP WIND POWER GENERATING COUNTRIES, 2019-2021 (TERAWATT/HOUR)

- TABLE 2 TEMPERATURE RANGE OF EPOXY RESINS IN VARIOUS APPLICATIONS

- TABLE 3 EPOXY RESIN MARKET: PORTER'S FIVE FORCES

- TABLE 4 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY END-USE INDUSTRIES (%)

- TABLE 5 KEY BUYING CRITERIA FOR TOP 3 END-USE INDUSTRIES

- TABLE 6 PROJECTED REAL GDP GROWTH (ANNUAL PERCENT CHANGE) OF KEY COUNTRIES, 2021-2030

- TABLE 7 EPOXY RESIN MARKET: VALUE CHAIN STAKEHOLDERS

- TABLE 8 EPOXY RESIN MARKET: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EPOXY RESIN MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2024-2025

- TABLE 10 TOTAL PATENT COUNT

- TABLE 11 TOP 10 PATENT OWNERS IN LAST 11 YEARS

- TABLE 12 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 13 KEY PRODUCT-RELATED TARIFF EFFECTIVE FOR EPOXY RESIN

- TABLE 14 EXPECTED CHANGE IN PRICES AND LIKELY IMPACT ON END-USE SEGMENTS DUE TO TARIFF IMPACT

- TABLE 15 EPOXY RESIN MARKET, BY PHYSICAL FORM, 2022-2024 (KILOTON)

- TABLE 16 EPOXY RESIN MARKET, BY PHYSICAL FORM, 2025-2030 (KILOTON)

- TABLE 17 EPOXY RESIN MARKET, BY PHYSICAL FORM, 2022-2024 (USD MILLION)

- TABLE 18 EPOXY RESIN MARKET, BY PHYSICAL FORM, 2025-2030 (USD MILLION)

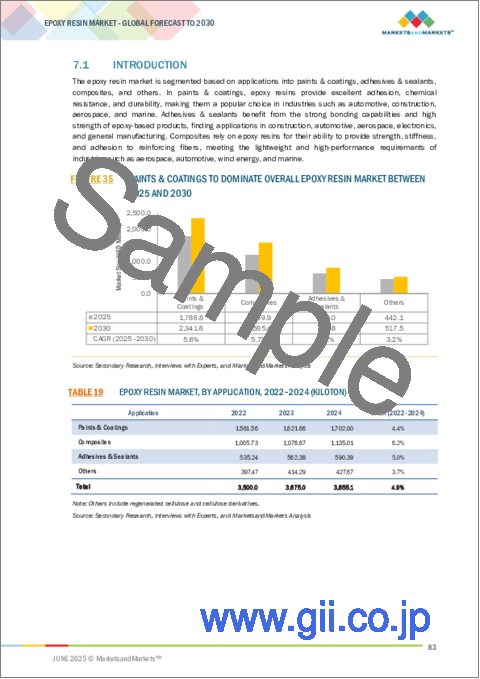

- TABLE 19 EPOXY RESIN MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 20 EPOXY RESIN MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 21 EPOXY RESIN MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 22 EPOXY RESIN MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 23 EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 24 EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 25 EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 26 EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 27 EPOXY RESIN MARKET, BY REGION, 2022-2024 (KILOTON)

- TABLE 28 EPOXY RESIN MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 29 EPOXY RESIN MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 30 EPOXY RESIN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 31 ASIA PACIFIC: EPOXY RESIN MARKET, BY COUNTRY, 2022-2024 (KILOTON)

- TABLE 32 ASIA PACIFIC: EPOXY RESIN MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 33 ASIA PACIFIC: EPOXY RESIN MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 34 ASIA PACIFIC: EPOXY RESIN MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 35 ASIA PACIFIC: EPOXY RESIN MARKET, BY PHYSICAL FORM, 2022-2024 (KILOTON)

- TABLE 36 ASIA PACIFIC: EPOXY RESIN MARKET, BY PHYSICAL FORM, 2025-2030 (KILOTON)

- TABLE 37 ASIA PACIFIC: EPOXY RESIN MARKET, BY PHYSICAL FORM, 2022-2024 (USD MILLION)

- TABLE 38 ASIA PACIFIC: EPOXY RESIN MARKET, BY PHYSICAL FORM, 2025-2030 (USD MILLION)

- TABLE 39 ASIA PACIFIC: EPOXY RESIN MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 40 ASIA PACIFIC: EPOXY RESIN MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 41 ASIA PACIFIC: EPOXY RESIN MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 42 ASIA PACIFIC: EPOXY RESIN MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 43 ASIA PACIFIC: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 44 ASIA PACIFIC: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 45 ASIA PACIFIC: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 46 ASIA PACIFIC: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 47 CHINA: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 48 CHINA: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 49 CHINA: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 50 CHINA: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 51 INDIA: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 52 INDIA: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 53 INDIA: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 54 INDIA: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 55 JAPAN: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 56 JAPAN: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 57 JAPAN: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 58 JAPAN: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 59 SOUTH KOREA: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 60 SOUTH KOREA: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 61 SOUTH KOREA: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 62 SOUTH KOREA: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 63 INDONESIA: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 64 INDONESIA: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 65 INDONESIA: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 66 INDONESIA: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 67 REST OF ASIA PACIFIC: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 68 REST OF ASIA PACIFIC: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 69 REST OF ASIA PACIFIC: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 70 REST OF ASIA PACIFIC: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 71 NORTH AMERICA: EPOXY RESIN MARKET, BY COUNTRY, 2022-2024 (KILOTON)

- TABLE 72 NORTH AMERICA: EPOXY RESIN MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 73 NORTH AMERICA: EPOXY RESIN MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 74 NORTH AMERICA: EPOXY RESIN MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 75 NORTH AMERICA: EPOXY RESIN MARKET, BY PHYSICAL FORM, 2022-2024 (KILOTON)

- TABLE 76 NORTH AMERICA: EPOXY RESIN MARKET, BY PHYSICAL FORM, 2025-2030 (KILOTON)

- TABLE 77 NORTH AMERICA: EPOXY RESIN MARKET, BY PHYSICAL FORM, 2022-2024 (USD MILLION)

- TABLE 78 NORTH AMERICA: EPOXY RESIN MARKET, BY PHYSICAL FORM, 2025-2030 (USD MILLION)

- TABLE 79 NORTH AMERICA: EPOXY RESIN MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 80 NORTH AMERICA: EPOXY RESIN MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 81 NORTH AMERICA: EPOXY RESIN MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 82 NORTH AMERICA: EPOXY RESIN MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 83 NORTH AMERICA: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 84 NORTH AMERICA: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 85 NORTH AMERICA: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 86 NORTH AMERICA: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 87 US: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 88 US: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 89 US: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 90 US: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 91 CANADA: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 92 CANADA: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 93 CANADA: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 94 CANADA: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 95 MEXICO: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 96 MEXICO: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 97 MEXICO: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 98 MEXICO: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 99 EUROPE: EPOXY RESIN MARKET, BY COUNTRY, 2022-2024 (KILOTON)

- TABLE 100 EUROPE: EPOXY RESIN MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 101 EUROPE: EPOXY RESIN MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 102 EUROPE: EPOXY RESIN MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 103 EUROPE: EPOXY RESIN MARKET, BY PHYSICAL FORM, 2022-2024 (KILOTON)

- TABLE 104 EUROPE: EPOXY RESIN MARKET, BY PHYSICAL FORM, 2025-2030 (KILOTON)

- TABLE 105 EUROPE: EPOXY RESIN MARKET, BY PHYSICAL FORM, 2022-2024 (USD MILLION)

- TABLE 106 EUROPE: EPOXY RESIN MARKET, BY PHYSICAL FORM, 2025-2030 (USD MILLION)

- TABLE 107 EUROPE: EPOXY RESIN MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 108 EUROPE: EPOXY RESIN MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 109 EUROPE: EPOXY RESIN MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 110 EUROPE: EPOXY RESIN MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 111 EUROPE: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 112 EUROPE: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 113 EUROPE: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 114 EUROPE: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 115 GERMANY: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 116 GERMANY: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 117 GERMANY: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 118 GERMANY: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 119 FRANCE: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 120 FRANCE: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 121 FRANCE: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 122 FRANCE: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 123 UK: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 124 UK: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 125 UK: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 126 UK: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 127 ITALY: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 128 ITALY: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 129 ITALY: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 130 ITALY: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 131 SPAIN: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 132 SPAIN: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 133 SPAIN: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 134 SPAIN: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 135 BELGIUM: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 136 BELGIUM: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 137 BELGIUM: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 138 BELGIUM: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 139 REST OF EUROPE: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 140 REST OF EUROPE: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 141 REST OF EUROPE: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 142 REST OF EUROPE: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 143 MIDDLE EAST & AFRICA: EPOXY RESIN MARKET, BY COUNTRY, 2022-2024 (KILOTON)

- TABLE 144 MIDDLE EAST & AFRICA: EPOXY RESIN MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 145 MIDDLE EAST & AFRICA: EPOXY RESIN MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 146 MIDDLE EAST & AFRICA: EPOXY RESIN MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 147 MIDDLE EAST & AFRICA: EPOXY RESIN MARKET, BY PHYSICAL FORM, 2022-2024 (KILOTON)

- TABLE 148 MIDDLE EAST & AFRICA: EPOXY RESIN MARKET, BY PHYSICAL FORM, 2025-2030 (KILOTON)

- TABLE 149 MIDDLE EAST & AFRICA: EPOXY RESIN MARKET, BY PHYSICAL FORM, 2022-2024 (USD MILLION)

- TABLE 150 MIDDLE EAST & AFRICA: EPOXY RESIN MARKET, BY PHYSICAL FORM, 2025-2030 (USD MILLION)

- TABLE 151 MIDDLE EAST & AFRICA: EPOXY RESIN MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 152 MIDDLE EAST & AFRICA: EPOXY RESIN MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 153 MIDDLE EAST & AFRICA: EPOXY RESIN MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 154 MIDDLE EAST & AFRICA: EPOXY RESIN MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 155 MIDDLE EAST & AFRICA: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 156 MIDDLE EAST & AFRICA: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 157 MIDDLE EAST & AFRICA: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 158 MIDDLE EAST & AFRICA: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 159 SAUDI ARABIA: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 160 SAUDI ARABIA: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 161 SAUDI ARABIA: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 162 SAUDI ARABIA: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 163 SOUTH AFRICA: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 164 SOUTH AFRICA: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 165 SOUTH AFRICA: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 166 SOUTH AFRICA: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 167 UAE: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 168 UAE: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 169 UAE: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 170 UAE: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 171 REST OF MIDDLE EAST & AFRICA: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 172 REST OF MIDDLE EAST & AFRICA: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 173 REST OF MIDDLE EAST & AFRICA: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 174 REST OF MIDDLE EAST & AFRICA: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 175 SOUTH AMERICA: EPOXY RESIN MARKET, BY COUNTRY, 2022-2024 (KILOTON)

- TABLE 176 SOUTH AMERICA: EPOXY RESIN MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 177 SOUTH AMERICA: EPOXY RESIN MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 178 SOUTH AMERICA: EPOXY RESIN MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 179 SOUTH AMERICA: EPOXY RESIN MARKET, BY PHYSICAL FORM, 2022-2024 (KILOTON)

- TABLE 180 SOUTH AMERICA: EPOXY RESIN MARKET, BY PHYSICAL FORM, 2025-2030 (KILOTON)

- TABLE 181 SOUTH AMERICA: EPOXY RESIN MARKET, BY PHYSICAL FORM, 2022-2024 (USD MILLION)

- TABLE 182 SOUTH AMERICA: EPOXY RESIN MARKET, BY PHYSICAL FORM, 2025-2030 (USD MILLION)

- TABLE 183 SOUTH AMERICA: EPOXY RESIN MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 184 SOUTH AMERICA: EPOXY RESIN MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 185 SOUTH AMERICA: EPOXY RESIN MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 186 SOUTH AMERICA: EPOXY RESIN MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 187 SOUTH AMERICA: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 188 SOUTH AMERICA: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 189 SOUTH AMERICA: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 190 SOUTH AMERICA: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 191 BRAZIL: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 192 BRAZIL: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 193 BRAZIL: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 194 BRAZIL: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 195 ARGENTINA: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 196 ARGENTINA: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 197 ARGENTINA: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 198 ARGENTINA: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 199 REST OF SOUTH AMERICA: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 200 REST OF SOUTH AMERICA: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 201 REST OF SOUTH AMERICA: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 202 REST OF SOUTH AMERICA: EPOXY RESIN MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 203 STRATEGIES ADOPTED BY KEY EPOXY RESIN MANUFACTURERS, JANUARY 2020 - APRIL 2025

- TABLE 204 EPOXY RESIN MARKET: DEGREE OF COMPETITION

- TABLE 205 EPOXY RESIN MARKET: REGION FOOTPRINT

- TABLE 206 EPOXY RESIN MARKET: PHYSICAL FORM FOOTPRINT

- TABLE 207 EPOXY RESIN MARKET: APPLICATION FOOTPRINT

- TABLE 208 EPOXY RESIN MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 209 EPOXY RESIN MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 210 EPOXY RESIN MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 211 EPOXY RESIN MARKET: PRODUCT LAUNCHES, JANUARY 2020-APRIL 2025

- TABLE 212 EPOXY RESIN MARKET: DEALS, JANUARY 2021-APRIL 2025

- TABLE 213 3M: COMPANY OVERVIEW

- TABLE 214 3M: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 215 OLIN CORPORATION: COMPANY OVERVIEW

- TABLE 216 OLIN CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 217 WESTLAKE EPOXY: COMPANY OVERVIEW

- TABLE 218 WESTLAKE EPOXY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 219 WESTLAKE CHEMICAL CORPORATION: PRODUCT LAUNCHES, JANUARY 2021-APRIL 2025

- TABLE 220 WESTLAKE CHEMICAL CORPORATION: DEALS, JANUARY 2021-APRIL 2025

- TABLE 221 KUKDO CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 222 KUKDO CHEMICAL CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 223 DIC CORPORATION: COMPANY OVERVIEW

- TABLE 224 DIC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 225 DIC CORPORATION: PRODUCT LAUNCHES, JANUARY 2021-APRIL 2025

- TABLE 226 DIC CORPORATION: DEALS, JANUARY 2021-APRIL 2025

- TABLE 227 HUNTSMAN CORPORATION: COMPANY OVERVIEW

- TABLE 228 HUNTSMAN CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 229 HUNTSMAN CORPORATION: ACQUISITIONS, JANUARY 2021-APRIL 2025

- TABLE 230 NAN YA PLASTICS CORPORATION: COMPANY OVERVIEW

- TABLE 231 NAN YA PLASTICS CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 232 NAN YA PLASTICS CORPORATION: ACQUISITIONS, JANUARY 2021-APRIL 2025

- TABLE 233 SINOPEC CORPORATION: COMPANY OVERVIEW

- TABLE 234 SINOPEC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 235 SINOPEC CORPORATION: DEALS, JANUARY 2021-APRIL 2025

- TABLE 236 ADITYA BIRLA CHEMICALS: COMPANY OVERVIEW

- TABLE 237 ADITYA BIRLA CHEMICALS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 238 BASF SE: COMPANY OVERVIEW

- TABLE 239 BASF SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 240 MITSUBISHI CHEMICAL GROUP CORPORATION: COMPANY OVERVIEW

- TABLE 241 CHANG CHUN GROUP: COMPANY OVERVIEW

- TABLE 242 MOMENTIVE PERFORMANCE MATERIALS: COMPANY OVERVIEW

- TABLE 243 EVONIK INDUSTRIES AG: COMPANY OVERVIEW

- TABLE 244 SIKA AG: COMPANY OVERVIEW

- TABLE 245 EASTMAN CHEMICAL COMPANY: COMPANY OVERVIEW

- TABLE 246 KOLON INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 247 LEUNA HARZE: COMPANY OVERVIEW

- TABLE 248 SPOLCHEMIE: COMPANY OVERVIEW

- TABLE 249 ADHESIVES TECHNOLOGY CORPORATION: COMPANY OVERVIEW

- TABLE 250 ATUL LTD.: COMPANY OVERVIEW

- TABLE 251 COVESTRO AG: COMPANY OVERVIEW

- TABLE 252 JIANGSU SANMU GROUP: COMPANY OVERVIEW

- TABLE 253 NAMA CHEMICALS COMPANY: COMPANY OVERVIEW

- TABLE 254 3N COMPOSITE PRODUCTS LLP: COMPANY OVERVIEW

List of Figures

- FIGURE 1 EPOXY RESIN MARKET: SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 EPOXY RESIN MARKET: RESEARCH DESIGN

- FIGURE 3 EPOXY RESIN MARKET: BOTTOM-UP APPROACH

- FIGURE 4 EPOXY RESIN MARKET: TOP-DOWN APPROACH

- FIGURE 5 DEMAND-SIDE FORECAST PROJECTIONS

- FIGURE 6 EPOXY RESIN MARKET: DATA TRIANGULATION

- FIGURE 7 LIQUID SEGMENT TO HOLD LARGEST MARKET SHARE IN 2030

- FIGURE 8 PAINTS & COATINGS SEGMENT TO DOMINATE MARKET IN 2030

- FIGURE 9 BUILDING & CONSTRUCTION SEGMENT TO HOLD SECOND-LARGEST SHARE IN 2030

- FIGURE 10 ASIA PACIFIC TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 11 GROWING DEMAND IN EPOXY RESINS ACROSS EMERGING ECONOMIES TO DRIVE MARKET EXPANSION AND OPPORTUNITIES FOR KEY PLAYERS

- FIGURE 12 LIQUID PHYSICAL FORM TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 13 PAINTS & COATINGS SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 14 BUILDING & CONSTRUCTION SEGMENT TO EXHIBIT HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 15 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 16 EPOXY RESIN MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 17 EPOXY RESIN MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 18 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF KEY END-USE INDUSTRIES

- FIGURE 19 KEY BUYING CRITERIA FOR TOP 3 END-USE INDUSTRIES

- FIGURE 20 OVERVIEW OF EPOXY RESIN VALUE CHAIN

- FIGURE 21 EPOXY RESIN MARKET: ECOSYSTEM

- FIGURE 22 AUTOMOTIVE AND CONSTRUCTION INDUSTRIES TO DRIVE DEMAND FOR EPOXY RESIN

- FIGURE 23 COUNTRY-WISE EXPORT TRADE VALUE FOR HS CODE 390730 (USD THOUSAND)

- FIGURE 24 COUNTRY-WISE IMPORT TRADE VALUE FOR HS CODE 390730 (USD THOUSAND)

- FIGURE 25 AVERAGE SELLING PRICE, BY REGION (USD/KG), 2022 TO 2024

- FIGURE 26 AVERAGE SELLING PRICE TREND, BY APPLICATION (USD/KG), 2022 TO 2024

- FIGURE 27 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY END-USE INDUSTRY (USD/KG)

- FIGURE 28 INVESTMENT AND FUNDING OF KEY PLAYERS

- FIGURE 29 TOTAL NUMBER OF PATENTS

- FIGURE 30 NUMBER OF PATENTS YEAR-WISE FROM 2014 TO 2024

- FIGURE 31 PATENT ANALYSIS, BY LEGAL STATUS

- FIGURE 32 TOP JURISDICTION, BY DOCUMENT

- FIGURE 33 TOP 10 COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS

- FIGURE 34 LIQUID EPOXY RESIN TO DOMINATE OVERALL EPOXY RESIN MARKET BETWEEN 2025 AND 2030

- FIGURE 35 PAINTS & COATINGS TO DOMINATE OVERALL EPOXY RESIN MARKET BETWEEN 2025 AND 2030

- FIGURE 36 BUILDING & CONSTRUCTION TO ACCOUNT FOR LARGEST SHARE OF EPOXY RESIN MARKET BETWEEN 2025 AND 2030

- FIGURE 37 CHINA TO BE FASTEST-GROWING EPOXY RESIN MARKET BETWEEN 2025 AND 2030

- FIGURE 38 ASIA PACIFIC: EPOXY RESIN MARKET SNAPSHOT

- FIGURE 39 NORTH AMERICA: EPOXY RESIN MARKET SNAPSHOT

- FIGURE 40 EUROPE: EPOXY RESIN MARKET SNAPSHOT

- FIGURE 41 EPOXY RESIN MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2020-2024 (USD BILLION)

- FIGURE 42 EPOXY RESIN MARKET SHARE ANALYSIS, 2024

- FIGURE 43 COMPANY VALUATION OF KEY COMPANIES IN EPOXY RESIN MARKET, 2024

- FIGURE 44 FINANCIAL METRICS OF KEY COMPANIES IN EPOXY RESIN MARKET, 2024

- FIGURE 45 EPOXY RESIN MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 46 EPOXY RESIN MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 47 EPOXY RESIN MARKET: COMPANY FOOTPRINT

- FIGURE 48 EPOXY RESIN MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 49 3M: COMPANY SNAPSHOT

- FIGURE 50 OLIN CORPORATION: COMPANY SNAPSHOT

- FIGURE 51 WESTLAKE EPOXY: COMPANY SNAPSHOT

- FIGURE 52 KUKDO CHEMICAL CO., LTD.: COMPANY SNAPSHOT

- FIGURE 53 DIC CORPORATION: COMPANY SNAPSHOT

- FIGURE 54 HUNTSMAN CORPORATION: COMPANY SNAPSHOT

- FIGURE 55 NAN YA PLASTICS CORPORATION: COMPANY SNAPSHOT

- FIGURE 56 SINOPEC CORPORATION: COMPANY SNAPSHOT

- FIGURE 57 ADITYA BIRLA CHEMICALS: COMPANY SNAPSHOT

- FIGURE 58 BASF SE: COMPANY SNAPSHOT

The epoxy resin market is estimated to grow from USD 14.77 billion in 2025 to USD 20.31 billion by 2030, at a CAGR of 6.6% from 2026 to 2030. Epoxy resin solution is the third-largest type in the epoxy resin market. A solution is defined as a combination of epoxy resin and other solvents, such as acetone or toluene, which reduce viscosity for easier application. Due to the reduced viscosity, the solution form exhibits superior flowability, wetting properties, and compatibility with substrates, making it advantageous for coatings, adhesives, and composites. These materials are valuable in high-performance applications, including aerospace coatings, protective coatings for machinery, and bonding wind turbine blade components. The increasing demand from construction, automotive, and other industrial markets continues to drive the growth of epoxy resin solutions.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) and Volume (Kiloton) |

| Segments | By Physical Form, Application, End-use Industry, and Region |

| Regions covered | Europe, North America, Asia Pacific, Middle East & Africa, and South America |

''In terms of value, composites accounted for the second-largest share of the overall epoxy resin market.''

Composites remain a primary demand application for epoxy resins due to their exceptional mechanical properties, including high strength and stiffness, as well as durable adhesion to reinforcement materials such as carbon, glass, and aramid fibers. Epoxy-based composites have become foundational materials in several high-performance applications across end-use industries, including aerospace, automotive, wind energy, and marine. Demand in these sectors is growing due to a strategic shift toward lightweight, high-strength materials that enhance energy efficiency and reliability. Notably, there is an accelerating adoption of epoxy resins in the aerospace and wind energy markets for developing hard-wearing structural components and large rotor blades. Furthermore, ongoing advancements in manufacturing technologies, such as resin infusion, automated layup, and fast-cure formulations, provide greater efficiency and scalability in production, further solidifying epoxy's position as the composite material of choice for next-generation applications.

"The general industrial end-use industry segment accounted for the third-largest market share."

Epoxy resins are widely used across many general industrial sectors, including electronics, textiles, packaging, tooling, and machinery. Their strong insulation properties, resistance to chemicals, and mechanical durability make them a dependable choice for a range of tough applications. As industries continue to adopt more advanced technologies and automation, the demand for reliable, high-performance materials has grown. Epoxy resins have become increasingly common in items like circuit boards, adhesives, and protective coatings. Newer formulations that can withstand high temperatures and meet flame-retardant standards are now used in equipment enclosures and heavy-duty components. Additionally, manufacturers are turning to epoxy materials for sealing and protecting electronics in automated production environments, where exposure to moisture, dust, or vibrations can be a concern. These trends reflect how epoxy resins continue to support efficiency and longevity in modern industrial settings.

"The epoxy resin market in Europe accounted for the second-largest market share."

Europe is the second most important region for epoxy resin because it has a strong industrial base and regulatory focus on quality and sustainability. The economic slowdowns have created some headwinds; however, demand appears to be returning as segments such as construction, mobility, and renewable energy are rebounding. The regional push for green technologies and advanced materials continues to drive the demand for epoxy resins in high-value applications. As industrial recovery increasingly aligns with innovation-led growth, Europe remains a crucial pillar in the global epoxy resin supply chain.

This study has been validated through primary interviews with industry experts globally. These primary sources have been divided into the following three categories:

- By Company Type: Tier 1 - 60%, Tier 2 - 20%, and Tier 3 - 20%

- By Designation: C Level - 33%, Director Level - 33%, and Managers - 34%

- By Region: North America - 20%, Europe - 25%, Asia Pacific - 25%, the Middle East & Africa - 15%, and Latin America - 15%

The report provides a comprehensive analysis of company profiles:

Prominent companies in this market include Sinopec Corporation (China), 3M (US), Westlake Epoxy (US), DIC Corporation (Japan), Olin Corporation (US), Huntsman Corporation (US), Nan Ya Plastics Corporation (Taiwan), Kukdo Chemical Co., Ltd. (South Korea), Aditya Birla Chemicals (India), Mitsubishi Chemical Group Corporation (Japan), and BASF SE (Germany).

Research Coverage

This research report categorizes the epoxy resin market by physical form (liquids, solids, and solutions), raw material (badge, BFDGE, novolac, aliphatic, and glycidyl amine), application (paints & coatings, adhesives & sealants, and composites), end-use industry, and region (North America, Europe, Asia Pacific, Middle East & Africa, and South America). The scope of the report includes detailed information about the major factors influencing the growth of the epoxy resin market, such as drivers, restraints, challenges, and opportunities. A thorough examination of the key industry players has been conducted in order to provide insights into their business overview, solutions and services, key strategies, contracts, partnerships, and agreements. Product launches, mergers and acquisitions, and recent developments in the epoxy resin market are all covered. This report includes a competitive analysis of upcoming startups in the epoxy resin market ecosystem.

Reasons to Buy This Report:

The report will help market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall epoxy resin market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (technological advancements, expanding application of epoxy resin, increasing market trends, and growing demand for lightweight materials in various industries), restraints (volatility in raw material prices and workplace safety concerns during resin processing), opportunities (growing demand from emerging economies and the increasing demand from electrical & electronics), and challenges (availability of competitive substitute materials and strong market competition and pricing pressure).

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and product launches in the epoxy resin market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the epoxy resin market across varied regions.

- Market Diversification: Exhaustive information about products, untapped geographies, recent developments, and investments in the epoxy resin market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and product offerings of leading players like Sinopec Corporation (China), 3M (US), Westlake Epoxy (US), DIC Corporation (Japan), Olin Corporation (US), Huntsman Corporation (US), Nan Ya Plastics Corporation (Taiwan), Kukdo Chemical Co., Ltd. (South Korea), Aditya Birla Chemicals (India), Mitsubishi Chemical Group Corporation (Japan), and BASF SE (Germany) in the epoxy resin market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNIT CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Primary interviews - demand and supply sides

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 FORECAST NUMBER CALCULATION

- 2.4 DATA TRIANGULATION

- 2.5 FACTOR ANALYSIS

- 2.6 ASSUMPTIONS

- 2.7 LIMITATIONS AND MARKET RISKS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN EPOXY RESIN MARKET

- 4.2 EPOXY RESIN MARKET, BY PHYSICAL FORM

- 4.3 EPOXY RESIN MARKET, BY APPLICATION

- 4.4 EPOXY RESIN MARKET, BY END-USE INDUSTRY

- 4.5 EPOXY RESIN MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Technological advancements in epoxy resin

- 5.2.1.2 Increasing applications of epoxy resin in wind turbines

- 5.2.1.3 Growing demand for lightweight materials in various industries

- 5.2.2 RESTRAINTS

- 5.2.2.1 Volatility in raw material prices

- 5.2.2.2 Workplace safety concerns during resin processing

- 5.2.2.3 Limited application temperature range

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing demand from emerging economies

- 5.2.3.2 Increasing applications in electrical & electronics

- 5.2.4 CHALLENGES

- 5.2.4.1 Availability of competitive substitute materials

- 5.2.4.2 Strong market competition and pricing pressure

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 BARGAINING POWER OF SUPPLIERS

- 5.3.2 BARGAINING POWER OF BUYERS

- 5.3.3 THREAT OF NEW ENTRANTS

- 5.3.4 THREAT OF SUBSTITUTES

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.4.2 BUYING CRITERIA

- 5.5 MACROECONOMIC INDICATORS

- 5.5.1 GLOBAL GDP TRENDS

- 5.6 IMPACT OF AI/GEN AI

- 5.7 VALUE CHAIN ANALYSIS

- 5.7.1 RAW MATERIAL SUPPLIERS

- 5.7.2 MANUFACTURERS

- 5.7.3 DISTRIBUTORS

- 5.7.4 END USERS

- 5.8 CASE STUDY ANALYSIS

- 5.8.1 CATALYX SETS A NEW STANDARD IN EPOXY RESIN FORMULATION

- 5.8.2 SETTING SAIL WITH BIO-BASED EPOXY INNOVATION

- 5.8.3 OPTIMIZING EPOXY MIXING AND APPLICATION FOR BETTER RESULTS

- 5.9 REGULATORY LANDSCAPE

- 5.9.1 REGULATIONS

- 5.9.1.1 Europe

- 5.9.1.2 Asia Pacific

- 5.9.1.3 North America

- 5.9.2 STANDARDS

- 5.9.2.1 ISO 3673-2:2007

- 5.9.2.2 ISO 14322:2018

- 5.9.2.3 ISO 4597-1:200

- 5.9.3 REGULATORY BODIES, GOVERNMENT BODIES, AND OTHER AGENCIES

- 5.9.1 REGULATIONS

- 5.10 TECHNOLOGY ANALYSIS

- 5.10.1 KEY TECHNOLOGIES

- 5.10.1.1 Bio-Based Epoxy Resins

- 5.10.1.2 High-Performance Curing Technologies

- 5.10.2 COMPLEMENTARY TECHNOLOGIES

- 5.10.2.1 Nanotechnology and Nanocomponents

- 5.10.2.2 Additive Manufacturing (3D Printing)

- 5.10.3 ADJACENT TECHNOLOGIES

- 5.10.3.1 Self-Healing and Smart Epoxy Systems

- 5.10.1 KEY TECHNOLOGIES

- 5.11 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.12 TRADE ANALYSIS

- 5.12.1 EXPORT SCENARIO

- 5.12.2 IMPORT SCENARIO

- 5.13 KEY CONFERENCES & EVENTS IN 2025-2026

- 5.14 PRICING ANALYSIS

- 5.14.1 AVERAGE SELLING PRICE TREND, BY REGION

- 5.14.2 AVERAGE SELLING PRICE TREND, BY APPLICATION, 2022 TO 2024

- 5.14.3 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY END-USE INDUSTRY, 2024

- 5.15 INVESTMENT AND FUNDING SCENARIO

- 5.16 PATENT ANALYSIS

- 5.16.1 APPROACH

- 5.16.2 DOCUMENT TYPES

- 5.16.3 PUBLICATION TRENDS, LAST 11 YEARS (2014-2024)

- 5.16.4 INSIGHTS

- 5.16.5 LEGAL STATUS OF PATENTS

- 5.16.6 JURISDICTION ANALYSIS

- 5.16.7 TOP COMPANIES/APPLICANTS

- 5.16.8 TOP 10 PATENT OWNERS (US) LAST 11 YEARS

- 5.17 IMPACT OF 2025 US TARIFF - EPOXY RESIN MARKET

- 5.18 INTRODUCTION

- 5.19 KEY TARIFF RATES

- 5.20 PRICE IMPACT ANALYSIS

- 5.21 IMPACTS ON COUNTRY/REGION

- 5.21.1 US

- 5.21.2 EUROPE

- 5.21.3 ASIA PACIFIC

- 5.22 IMPACT ON END-USE INDUSTRIES

6 EPOXY RESIN MARKET, BY PHYSICAL FORM

- 6.1 EPOXY RESIN

- 6.2 SOLID EPOXY RESIN

- 6.2.1 AUTOMOTIVE AND CONSTRUCTION SECTORS TO DRIVE DEMAND

- 6.3 LIQUID EPOXY RESIN

- 6.3.1 GROWTH IN ELECTRONICS INDUSTRY TO FUEL MARKET IN THIS SEGMENT

- 6.4 SOLUTION EPOXY RESIN

- 6.4.1 RISE IN CONSTRUCTION ACTIVITIES TO INCREASE DEMAND

7 EPOXY RESIN MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.2 PAINTS & COATINGS

- 7.2.1 GROWING CONSTRUCTION SECTOR TO BOOST DEMAND

- 7.3 ADHESIVES & SEALANTS

- 7.3.1 AUTOMOTIVE INDUSTRY TO BE MAJOR CONSUMER OF ADHESIVES & SEALANTS

- 7.4 COMPOSITES

- 7.4.1 ADVANCEMENTS IN TECHNOLOGY TO DRIVE SEGMENT GROWTH

- 7.5 OTHERS

- 7.5.1 INCREASING USAGE IN TOOLING, EXPOSED AGGREGATE, AND PRINTING INKS TO DRIVE MARKET

8 EPOXY RESIN MARKET, BY END-USE INDUSTRY

- 8.1 INTRODUCTION

- 8.2 BUILDING & CONSTRUCTION

- 8.2.1 GROWING DEMAND IN CONSTRUCTION SECTOR DUE TO ENHANCE DURABILITY AND PERFORMANCE

- 8.3 AUTOMOTIVE

- 8.3.1 EPOXY COMPOSITES USED IN AUTOMOBILES TO ENABLE LIGHTWEIGHTING AND IMPROVE SAFETY

- 8.4 GENERAL INDUSTRIAL

- 8.4.1 VERSATILE SOLUTIONS FOR GENERAL INDUSTRIAL MANUFACTURING TO DRIVE MARKET

- 8.5 WIND POWER

- 8.5.1 INCREASING USE IN WIND TURBINE BLADE MANUFACTURING TO DRIVE MARKET

- 8.6 CONSUMER GOODS

- 8.6.1 USE OF EPOXY RESIN IN CONSUMER GOODS SECTOR TO DRIVE MARKET

- 8.7 AEROSPACE

- 8.7.1 HIGH DEMAND FOR EPOXY RESIN-BASED COMPOSITE IN AIRCRAFT MAINTENANCE TO DRIVE MARKET

- 8.8 MARINE

- 8.8.1 INCREASING USE OF EPOXY SEALANTS FOR UNDERWATER REPAIR AND MAINTENANCE TO DRIVE MARKET

- 8.9 OTHERS

9 EPOXY RESIN MARKET, BY RAW MATERIAL

- 9.1 INTRODUCTION

- 9.2 DGEBA (DIGLYCIDYL ETHER OF BISPHENOL A)

- 9.3 DGBEF (DIGLYCIDYL ETHER OF BISPHENOL F)

- 9.4 NOVOLAC

- 9.5 ALIPHATIC

- 9.6 OTHERS

10 EPOXY RESIN MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 ASIA PACIFIC

- 10.2.1 CHINA

- 10.2.1.1 Growing construction industry to drive market

- 10.2.2 INDIA

- 10.2.2.1 Government infrastructure projects to fuel market

- 10.2.3 JAPAN

- 10.2.3.1 Rising demand for paints & coatings to drive market

- 10.2.4 SOUTH KOREA

- 10.2.4.1 Automobile industry to be largest consumer of epoxy resin

- 10.2.5 INDONESIA

- 10.2.5.1 Growing construction and automotive sectors to fuel market

- 10.2.6 REST OF ASIA PACIFIC

- 10.2.6.1 Construction sector to boost market

- 10.2.1 CHINA

- 10.3 NORTH AMERICA

- 10.3.1 US

- 10.3.1.1 Construction sector to be largest consumer of epoxy resin

- 10.3.2 CANADA

- 10.3.2.1 Aerospace sector to be fastest-growing end user of epoxy resin during forecast period

- 10.3.3 MEXICO

- 10.3.3.1 Construction sector to be largest consumer of epoxy resin

- 10.3.1 US

- 10.4 EUROPE

- 10.4.1 GERMANY

- 10.4.1.1 Industrial sector to boost epoxy resin consumption

- 10.4.2 FRANCE

- 10.4.2.1 Construction and automotive industries to drive market

- 10.4.3 UK

- 10.4.3.1 Epoxy resin market in wind energy segment to witness high growth

- 10.4.4 ITALY

- 10.4.4.1 Wind energy sector to drive market during forecast period

- 10.4.5 SPAIN

- 10.4.5.1 Paints & coatings sector to fuel market growth

- 10.4.6 BELGIUM

- 10.4.6.1 Investments by government in construction industry to fuel demand

- 10.4.7 REST OF EUROPE

- 10.4.7.1 Paints & coatings application to propel market

- 10.4.1 GERMANY

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 SAUDI ARABIA

- 10.5.1.1 Development in real estate to fuel demand for epoxy resin

- 10.5.2 SOUTH AFRICA

- 10.5.2.1 Construction sector to be major growth contributor

- 10.5.3 UAE

- 10.5.3.1 Government construction projects to support market growth

- 10.5.4 REST OF MIDDLE EAST & AFRICA

- 10.5.4.1 Implementation of infrastructure projects to boost market

- 10.5.1 SAUDI ARABIA

- 10.6 SOUTH AMERICA

- 10.6.1 BRAZIL

- 10.6.1.1 Upcoming construction projects to support market growth

- 10.6.2 ARGENTINA

- 10.6.2.1 Rising urban population to increase demand for residential and commercial buildings

- 10.6.3 REST OF SOUTH AMERICA

- 10.6.3.1 Automotive industry to be largest end user of epoxy resin

- 10.6.1 BRAZIL

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES

- 11.3 REVENUE ANALYSIS

- 11.4 MARKET SHARE ANALYSIS

- 11.4.1 3M

- 11.4.2 OLIN CORPORATION

- 11.4.3 WESTLAKE CHEMICAL CORPORATION

- 11.4.4 KUKDO CHEMICAL CO., LTD.

- 11.4.5 DIC CORPORATION

- 11.5 COMPANY VALUATION AND FINANCIAL METRICS

- 11.6 BRAND/PRODUCT COMPARISON ANALYSIS

- 11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- 11.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.7.5.1 Company footprint

- 11.7.5.2 Region footprint

- 11.7.5.3 Physical form footprint

- 11.7.5.4 Application footprint

- 11.7.5.5 End-use industry footprint

- 11.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 DYNAMIC COMPANIES

- 11.8.4 STARTING BLOCKS

- 11.8.5 COMPETITIVE BENCHMARKING: KEY STARTUPS/SMES, 2024

- 11.8.5.1 Detailed list of key startups/SMEs

- 11.8.5.2 Competitive benchmarking of key startups/SMEs

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES

- 11.9.2 DEALS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 3M

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 MnM view

- 12.1.1.3.1 Key strengths

- 12.1.1.3.2 Strategic choices

- 12.1.1.3.3 Weaknesses and competitive threats

- 12.1.2 OLIN CORPORATION

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 MnM view

- 12.1.2.3.1 Key strengths

- 12.1.2.3.2 Strategic choices

- 12.1.2.3.3 Weaknesses and competitive threats

- 12.1.3 WESTLAKE EPOXY

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Product launches

- 12.1.3.3.2 Deals

- 12.1.3.4 MnM view

- 12.1.3.4.1 Key strengths

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 KUKDO CHEMICAL CO., LTD.

- 12.1.4.1 Business overview

- 12.1.5 KUKDO CHEMICAL CO., LTD.

- 12.1.5.1 Products/Solutions/Services offered

- 12.1.5.2 MnM view

- 12.1.5.2.1 Key strengths

- 12.1.5.2.2 Strategic choices

- 12.1.5.2.3 Weaknesses and competitive threats

- 12.1.6 DIC CORPORATION

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Product launches

- 12.1.6.3.2 Deals

- 12.1.6.4 MnM view

- 12.1.7 HUNTSMAN CORPORATION

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Acquisitions

- 12.1.7.4 MnM view

- 12.1.8 NAN YA PLASTICS CORPORATION

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions/Services offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Acquisitions

- 12.1.8.4 MnM view

- 12.1.9 SINOPEC CORPORATION

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Deals

- 12.1.9.4 MnM view

- 12.1.10 ADITYA BIRLA CHEMICALS

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions/Services offered

- 12.1.10.3 MnM view

- 12.1.11 BASF SE

- 12.1.11.1 Business overview

- 12.1.11.2 Products/Solutions/Services offered

- 12.1.11.3 MnM view

- 12.1.1 3M

- 12.2 OTHER PLAYERS

- 12.2.1 MITSUBISHI CHEMICAL GROUP CORPORATION

- 12.2.2 CHANG CHUN GROUP

- 12.2.3 MOMENTIVE PERFORMANCE MATERIALS

- 12.2.4 EVONIK INDUSTRIES AG

- 12.2.5 SIKA AG

- 12.2.6 EASTMAN CHEMICAL COMPANY

- 12.2.7 KOLON INDUSTRIES, INC.

- 12.2.8 LEUNA HARZE

- 12.2.9 SPOLCHEMIE

- 12.2.10 ADHESIVES TECHNOLOGY CORPORATION

- 12.2.11 ATUL LTD.

- 12.2.12 COVESTRO AG

- 12.2.13 JIANGSU SANMU GROUP

- 12.2.14 NAMA CHEMICALS COMPANY

- 12.2.15 3N COMPOSITE PRODUCTS LLP

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS