|

|

市場調査レポート

商品コード

1762818

eコマースプラットフォームの世界市場:オファリング別、eコマースモデル別、最終用途産業別、地域別 - 2030年までの予測Ecommerce Platform Market by Solutions (Payment & Billing Solutions, Ecommerce Management Platform, End-To-End Platform), Ecommerce Model (B2B, B2C), By Industry (Beauty & Personal Care, Consumer Electronics, Fashion & Apparel) - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| eコマースプラットフォームの世界市場:オファリング別、eコマースモデル別、最終用途産業別、地域別 - 2030年までの予測 |

|

出版日: 2025年07月01日

発行: MarketsandMarkets

ページ情報: 英文 264 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

eコマースプラットフォームの市場規模は、2025年には90億7,820万米ドルと推定され、12.7%のCAGRで拡大し、2030年には165億690万米ドルに達すると予測されています。

世界のeコマースプラットフォーム市場は、インターネット普及率の上昇、スマートフォン利用率の増加、デジタルショッピング体験に対する消費者の嗜好の高まりによって牽引されています。人工知能(AI)、クラウドコンピューティング、ビッグデータ分析などの技術の進歩により、プラットフォーム機能が強化されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 100万/10億米ドル |

| セグメント | オファリング別、eコマースモデル別、最終用途産業別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、中東・アフリカ、ラテンアメリカ |

さらに、オムニチャネル小売の急増、パーソナライズされたショッピングの需要、国境を越えた取引の拡大が、世界中のさまざまな業界における堅牢で拡張可能なeコマースプラットフォームの採用を促進しています。しかし、サイバー脅威は絶えず進化しているため、組織がサイバー犯罪者から重要なビジネス・プロセスとデータを保護することは困難です。データ漏洩の頻度が増加していることから、オンライン取引の安全性に関する消費者の懸念が高まっており、市場の成長を抑制する可能性があります。

決済・課金ソリューションは、世界のeコマースプラットフォーム市場のソリューションセグメントの中で最も高いCAGRを記録すると予測されています。この成長は、顧客のショッピング体験を向上させる、高速で安全かつ柔軟なデジタル決済方法に対する需要の高まりが後押ししています。オンライン取引量の増加に伴い、eコマースベンダーは、多様で世界な顧客基盤に対応するため、自動請求書発行システム、デジタルウォレット、Buy Now Pay Later(BNPL)サービス、多通貨決済ゲートウェイなどの高度な課金技術を採用しています。さらに、国境を越えた電子商取引の急増や、進化する金融・規制基準に準拠する必要性から、導入が加速しています。これらのソリューションは、チェックアウトプロセスを最適化し、カート放棄を減らします。また、消費者の信頼を構築し、収益を促進することで、最新のeコマース・エコシステムの中核的要素として位置づけられています。

健康的な生活に対する消費者の関心の高まりは、eコマースのヘルス&ウェルネス産業の成長に大きな影響を与えています。デジタル化の進展に伴い、ヘルスケア部門はアクセシビリティの向上とサービス提供の改善のためにオンライン技術を急速に取り入れています。中小企業や新興企業は、アマゾンのようなデジタル・コマースプラットフォームを戦略的に活用することで、市場でのプレゼンスを拡大し、健康志向の消費者にリーチしています。

eコマースプラットフォームは、消費者が健康・ウェルネス・ソリューションを発見、購入、利用する方法を変革し、自宅にいながら情報へのアクセスや健康目標の追跡、持続可能な生活習慣の導入を容易にしました。

アジア太平洋は、新興技術の急速な導入とデジタルインフラの拡大により、世界のeコマースプラットフォーム市場で最も高い成長率を記録する見通しです。人口が多く、経済的に多様な地域であるアジア太平洋地域は、クラウドコンピューティング、モノのインターネット(IoT)、ビッグデータ分析、拡張現実(AR)、仮想現実(VR)の技術革新から、特に小売・商業分野で大きな利益を得ることができます。

中国、日本、韓国などの主要な地域経済は、デジタル変革への取り組みを主導しており、高度なeコマース・ソリューションに対する需要の拡大を促進しています。さらに、スマートフォンの普及率の上昇、インターネットへのアクセスの向上、中産階級の消費者層の増加といった要因が、オンライン小売活動を加速させています。このようなデジタル情勢の進化により、企業はスケーラブルで顧客中心のeコマースプラットフォームを採用できるようになり、アジア太平洋地域の市場成長が加速しています。

当レポートでは、世界のeコマースプラットフォーム市場について調査し、オファリング別、eコマースモデル別、最終用途産業別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と業界動向

- 市場概要

- 市場力学

- eコマースプラットフォームの簡単な歴史

- エコシステム分析

- サプライチェーン分析

- 価格分析

- 業界のユースケース

- 特許分析

- 顧客のビジネスに影響を与える動向と混乱

- ポーターのファイブフォース分析

- 規制状況

- 主要な利害関係者と購入基準

- 2025年~2026年の主な会議とイベント

- 技術分析

- eコマースプラットフォーム市場におけるベストプラクティス

- eコマースプラットフォーム市場向け技術ロードマップ

- AI/生成AIがeコマースプラットフォーム市場に与える影響

- 投資・資金調達シナリオ(2024年)

- 2025年の米国関税・電子商取引プラットフォーム市場への影響

第6章 eコマースプラットフォーム市場(オファリング別)

- イントロダクション

- ソリューション

- サービス

第7章 eコマースプラットフォーム市場(eコマースモデル別)

- イントロダクション

- ビジネス・ツー・ビジネス(B2B)

- ビジネス・ツー・カスタマー(B2C)

第8章 電子商取引プラットフォーム市場(最終用途産業別)

- イントロダクション

- 美容・パーソナルケア

- 家電

- ファッション・アパレル

- 食品・飲料

- 家庭用装飾

- 健康とウェルネス

- 家庭用消耗品

- その他

第9章 eコマースプラットフォーム市場(地域別)

- イントロダクション

- 北米

- 北米:マクロ経済見通し

- 米国

- カナダ

- 欧州

- 欧州:マクロ経済見通し

- 英国

- ドイツ

- フランス

- スペイン

- イタリア

- その他

- アジア太平洋

- アジア太平洋:マクロ経済見通し

- 中国

- インド

- 日本

- シンガポール

- オーストラリアとニュージーランド(ANZ)

- その他

- 中東・アフリカ

- 中東・アフリカ:マクロ経済見通し

- 中東

- アフリカ

- ラテンアメリカ

- ラテンアメリカ:マクロ経済見通し

- ブラジル

- メキシコ

- その他

第10章 競合情勢

- 概要

- 主要参入企業が採用した戦略

- 収益分析、2020年~2024年

- 2024年における主要企業の市場シェア分析

- 企業評価と財務指標

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業、2025年

- 企業評価マトリックス:スタートアップ/中小企業、2025年

- 競合シナリオ

第11章 企業プロファイル

- 主要参入企業

- SHOPIFY

- EBAY

- ETSY

- SQUARE

- BIGCOMMERCE

- AMAZON

- ADOBE

- WIX

- ORACLE

- SQUARESPACE

- SAP

- SALESFORCE

- VTEX

- TRADE ME

- スタートアップ/中小企業

- WOOCOMMERCE

- STOREHIPPO

- LIGHTSPEED

- OPENCART

- VOLUSION

- PRESTASHOP

- SHIFT4SHOP

- FASTSPRING

- NUVEMSHOP

- TRAY.IO

- SHOPWARE

第12章 隣接市場/関連市場

第13章 付録

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2020-2024

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 ROLE OF COMPANIES IN ECOMMERCE PLATFORM MARKET

- TABLE 4 PRICING MODELS AND PRICE POINTS, 2024

- TABLE 5 INDICATIVE PRICING ANALYSIS FOR ECOMMERCE PLATFORM SERVICES, 2024

- TABLE 6 LIST OF MAJOR PATENTS

- TABLE 7 ECOMMERCE PLATFORM MARKET: PORTER'S FIVE FORCES MODEL

- TABLE 8 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- TABLE 13 KEY BUYING CRITERIA

- TABLE 14 ECOMMERCE PLATFORM MARKET: DETAILED LIST OF CONFERENCES AND EVENTS, 2025-2026

- TABLE 15 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 16 ECOMMERCE PLATFORM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 17 ECOMMERCE PLATFORM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 18 SOLUTIONS: ECOMMERCE PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 19 SOLUTIONS: ECOMMERCE PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 20 SOLUTIONS: ECOMMERCE PLATFORM MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 21 SOLUTIONS: ECOMMERCE PLATFORM MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 22 PAYMENT & BILLING SOLUTIONS: ECOMMERCE PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 23 PAYMENT & BILLING SOLUTIONS: ECOMMERCE PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 24 ECOMMERCE MANAGEMENT PLATFORM: ECOMMERCE PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 25 ECOMMERCE MANAGEMENT PLATFORM: ECOMMERCE PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 26 END-TO-END PLATFORM: ECOMMERCE PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 27 END-TO-END PLATFORM: ECOMMERCE PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 28 SERVICES: ECOMMERCE PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 29 SERVICES: ECOMMERCE PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 30 ECOMMERCE PLATFORM MARKET, BY ECOMMERCE MODEL, 2020-2024 (USD MILLION)

- TABLE 31 ECOMMERCE PLATFORM MARKET, BY ECOMMERCE MODEL, 2025-2030 (USD MILLION)

- TABLE 32 B2B: ECOMMERCE PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 33 B2B: ECOMMERCE PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 34 B2C: ECOMMERCE PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 35 B2C: ECOMMERCE PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 36 ECOMMERCE PLATFORM MARKET, BY INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 37 ECOMMERCE PLATFORM MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 38 BEAUTY & PERSONAL CARE: ECOMMERCE PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 39 BEAUTY & PERSONAL CARE: ECOMMERCE PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 40 CONSUMER ELECTRONICS: ECOMMERCE PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 41 CONSUMER ELECTRONICS: ECOMMERCE PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 42 FASHION & APPAREL: ECOMMERCE PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 43 FASHION & APPAREL: ECOMMERCE PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 44 FOOD & BEVERAGE: ECOMMERCE PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 45 FOOD & BEVERAGE: ECOMMERCE PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 46 HOME DECOR: ECOMMERCE PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 47 HOME DECOR: ECOMMERCE PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 48 HEALTH & WELLNESS: ECOMMERCE PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 49 HEALTH & WELLNESS: ECOMMERCE PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 50 HOUSEHOLD CONSUMABLES: ECOMMERCE PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 51 HOUSEHOLD CONSUMABLES: ECOMMERCE PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 52 OTHER INDUSTRIES: ECOMMERCE PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 53 OTHER INDUSTRIES: ECOMMERCE PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 54 ECOMMERCE PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 55 ECOMMERCE PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 56 NORTH AMERICA: ECOMMERCE PLATFORM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 57 NORTH AMERICA: ECOMMERCE PLATFORM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 58 NORTH AMERICA: ECOMMERCE PLATFORM MARKET, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 59 NORTH AMERICA: ECOMMERCE PLATFORM MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 60 NORTH AMERICA: ECOMMERCE PLATFORM MARKET, BY INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 61 NORTH AMERICA: ECOMMERCE PLATFORM MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 62 NORTH AMERICA: ECOMMERCE PLATFORM MARKET, BY ECOMMERCE MODEL, 2020-2024 (USD MILLION)

- TABLE 63 NORTH AMERICA: ECOMMERCE PLATFORM MARKET, BY ECOMMERCE MODEL, 2025-2030 (USD MILLION)

- TABLE 64 NORTH AMERICA: ECOMMERCE PLATFORM MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 65 NORTH AMERICA: ECOMMERCE PLATFORM MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 66 US: ECOMMERCE PLATFORM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 67 US: ECOMMERCE PLATFORM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 68 US: ECOMMERCE PLATFORM MARKET, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 69 US: ECOMMERCE PLATFORM MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 70 US: ECOMMERCE PLATFORM MARKET, BY INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 71 US: ECOMMERCE PLATFORM MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 72 US: ECOMMERCE PLATFORM MARKET, BY ECOMMERCE MODEL, 2020-2024 (USD MILLION)

- TABLE 73 US: ECOMMERCE PLATFORM MARKET, BY ECOMMERCE MODEL, 2025-2030 (USD MILLION)

- TABLE 74 CANADA: ECOMMERCE PLATFORM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 75 CANADA: ECOMMERCE PLATFORM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 76 CANADA: ECOMMERCE PLATFORM MARKET, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 77 CANADA: ECOMMERCE PLATFORM MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 78 CANADA: ECOMMERCE PLATFORM MARKET, BY INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 79 CANADA: ECOMMERCE PLATFORM MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 80 CANADA: ECOMMERCE PLATFORM MARKET, BY ECOMMERCE MODEL, 2020-2024 (USD MILLION)

- TABLE 81 CANADA: ECOMMERCE PLATFORM MARKET, BY ECOMMERCE MODEL, 2025-2030 (USD MILLION)

- TABLE 82 EUROPE: ECOMMERCE PLATFORM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 83 EUROPE: ECOMMERCE PLATFORM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 84 EUROPE: ECOMMERCE PLATFORM MARKET, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 85 EUROPE: ECOMMERCE PLATFORM MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 86 EUROPE: ECOMMERCE PLATFORM MARKET, BY INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 87 EUROPE: ECOMMERCE PLATFORM MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 88 EUROPE: ECOMMERCE PLATFORM MARKET, BY ECOMMERCE MODEL, 2020-2024 (USD MILLION)

- TABLE 89 EUROPE: ECOMMERCE PLATFORM MARKET, BY ECOMMERCE MODEL, 2025-2030 (USD MILLION)

- TABLE 90 EUROPE: ECOMMERCE PLATFORM MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 91 EUROPE: ECOMMERCE PLATFORM MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 92 UK: ECOMMERCE PLATFORM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 93 UK: ECOMMERCE PLATFORM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 94 UK: ECOMMERCE PLATFORM MARKET, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 95 UK: ECOMMERCE PLATFORM MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 96 UK: ECOMMERCE PLATFORM MARKET, BY INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 97 UK: ECOMMERCE PLATFORM MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 98 UK: ECOMMERCE PLATFORM MARKET, BY ECOMMERCE MODEL, 2020-2024 (USD MILLION)

- TABLE 99 UK: ECOMMERCE PLATFORM MARKET, BY ECOMMERCE MODEL, 2025-2030 (USD MILLION)

- TABLE 100 GERMANY: ECOMMERCE PLATFORM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 101 GERMANY: ECOMMERCE PLATFORM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 102 GERMANY: ECOMMERCE PLATFORM MARKET, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 103 GERMANY: ECOMMERCE PLATFORM MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 104 GERMANY: ECOMMERCE PLATFORM MARKET, BY INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 105 GERMANY: ECOMMERCE PLATFORM MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 106 GERMANY: ECOMMERCE PLATFORM MARKET, BY ECOMMERCE MODEL, 2020-2024 (USD MILLION)

- TABLE 107 GERMANY: ECOMMERCE PLATFORM MARKET, BY ECOMMERCE MODEL, 2025-2030 (USD MILLION)

- TABLE 108 ASIA PACIFIC: ECOMMERCE PLATFORM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 109 ASIA PACIFIC: ECOMMERCE PLATFORM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 110 ASIA PACIFIC: ECOMMERCE PLATFORM MARKET, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 111 ASIA PACIFIC: ECOMMERCE PLATFORM MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 112 ASIA PACIFIC: ECOMMERCE PLATFORM MARKET, BY INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 113 ASIA PACIFIC: ECOMMERCE PLATFORM MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 114 ASIA PACIFIC: ECOMMERCE PLATFORM MARKET, BY ECOMMERCE MODEL, 2020-2024 (USD MILLION)

- TABLE 115 ASIA PACIFIC: ECOMMERCE PLATFORM MARKET, BY ECOMMERCE MODEL, 2025-2030 (USD MILLION)

- TABLE 116 ASIA PACIFIC: ECOMMERCE PLATFORM MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 117 ASIA PACIFIC: ECOMMERCE PLATFORM MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 118 CHINA: ECOMMERCE PLATFORM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 119 CHINA: ECOMMERCE PLATFORM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 120 CHINA: ECOMMERCE PLATFORM MARKET, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 121 CHINA: ECOMMERCE PLATFORM MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 122 CHINA: ECOMMERCE PLATFORM MARKET, BY INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 123 CHINA: ECOMMERCE PLATFORM MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 124 CHINA: ECOMMERCE PLATFORM MARKET, BY ECOMMERCE MODEL, 2020-2024 (USD MILLION)

- TABLE 125 CHINA: ECOMMERCE PLATFORM MARKET, BY ECOMMERCE MODEL, 2025-2030 (USD MILLION)

- TABLE 126 INDIA: ECOMMERCE PLATFORM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 127 INDIA: ECOMMERCE PLATFORM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 128 INDIA: ECOMMERCE PLATFORM MARKET, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 129 INDIA: ECOMMERCE PLATFORM MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 130 INDIA: ECOMMERCE PLATFORM MARKET, BY INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 131 INDIA: ECOMMERCE PLATFORM MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 132 INDIA: ECOMMERCE PLATFORM MARKET, BY ECOMMERCE MODEL, 2020-2024 (USD MILLION)

- TABLE 133 INDIA: ECOMMERCE PLATFORM MARKET, BY ECOMMERCE MODEL, 2025-2030 (USD MILLION)

- TABLE 134 AUSTRALIA & NEW ZEALAND: ECOMMERCE PLATFORM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 135 AUSTRALIA & NEW ZEALAND: ECOMMERCE PLATFORM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 136 AUSTRALIA & NEW ZEALAND: ECOMMERCE PLATFORM MARKET, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 137 AUSTRALIA & NEW ZEALAND: ECOMMERCE PLATFORM MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 138 AUSTRALIA & NEW ZEALAND: ECOMMERCE PLATFORM MARKET, BY INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 139 AUSTRALIA & NEW ZEALAND: ECOMMERCE PLATFORM MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 140 AUSTRALIA & NEW ZEALAND: ECOMMERCE PLATFORM MARKET, BY ECOMMERCE MODEL, 2020-2024 (USD MILLION)

- TABLE 141 AUSTRALIA & NEW ZEALAND: ECOMMERCE PLATFORM MARKET, BY ECOMMERCE MODEL, 2025-2030 (USD MILLION)

- TABLE 142 MIDDLE EAST & AFRICA: ECOMMERCE PLATFORM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 143 MIDDLE EAST & AFRICA: ECOMMERCE PLATFORM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 144 MIDDLE EAST & AFRICA: ECOMMERCE PLATFORM MARKET, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 145 MIDDLE EAST & AFRICA: ECOMMERCE PLATFORM MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 146 MIDDLE EAST & AFRICA: ECOMMERCE PLATFORM MARKET, BY INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 147 MIDDLE EAST & AFRICA: ECOMMERCE PLATFORM MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 148 MIDDLE EAST & AFRICA: ECOMMERCE PLATFORM MARKET, BY ECOMMERCE MODEL, 2020-2024 (USD MILLION)

- TABLE 149 MIDDLE EAST & AFRICA: ECOMMERCE PLATFORM MARKET, BY ECOMMERCE MODEL, 2025-2030 (USD MILLION)

- TABLE 150 MIDDLE EAST & AFRICA: ECOMMERCE PLATFORM MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 151 MIDDLE EAST & AFRICA: ECOMMERCE PLATFORM MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 152 UNITED ARAB EMIRATES: ECOMMERCE PLATFORM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 153 UNITED ARAB EMIRATES: ECOMMERCE PLATFORM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 154 UNITED ARAB EMIRATES: ECOMMERCE PLATFORM MARKET, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 155 UNITED ARAB EMIRATES: ECOMMERCE PLATFORM MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 156 UNITED ARAB EMIRATES: ECOMMERCE PLATFORM MARKET, BY INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 157 UNITED ARAB EMIRATES: ECOMMERCE PLATFORM MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 158 UNITED ARAB EMIRATES: ECOMMERCE PLATFORM MARKET, BY ECOMMERCE MODEL, 2020-2024 (USD MILLION)

- TABLE 159 UNITED ARAB EMIRATES: ECOMMERCE PLATFORM MARKET, BY ECOMMERCE MODEL, 2025-2030 (USD MILLION)

- TABLE 160 LATIN AMERICA: ECOMMERCE PLATFORM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 161 LATIN AMERICA: ECOMMERCE PLATFORM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 162 LATIN AMERICA: ECOMMERCE PLATFORM MARKET, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 163 LATIN AMERICA: ECOMMERCE PLATFORM MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 164 LATIN AMERICA: ECOMMERCE PLATFORM MARKET, BY INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 165 LATIN AMERICA: ECOMMERCE PLATFORM MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 166 LATIN AMERICA: ECOMMERCE PLATFORM MARKET, BY ECOMMERCE MODEL, 2020-2024 (USD MILLION)

- TABLE 167 LATIN AMERICA: ECOMMERCE PLATFORM MARKET, BY ECOMMERCE MODEL, 2025-2030 (USD MILLION)

- TABLE 168 LATIN AMERICA: ECOMMERCE PLATFORM MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 169 LATIN AMERICA: ECOMMERCE PLATFORM MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 170 BRAZIL: ECOMMERCE PLATFORM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 171 BRAZIL: ECOMMERCE PLATFORM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 172 BRAZIL: ECOMMERCE PLATFORM MARKET, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 173 BRAZIL: ECOMMERCE PLATFORM MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 174 BRAZIL: ECOMMERCE PLATFORM MARKET, BY INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 175 BRAZIL: ECOMMERCE PLATFORM MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 176 BRAZIL: ECOMMERCE PLATFORM MARKET, BY ECOMMERCE MODEL, 2020-2024 (USD MILLION)

- TABLE 177 BRAZIL: ECOMMERCE PLATFORM MARKET, BY ECOMMERCE MODEL, 2025-2030 (USD MILLION)

- TABLE 178 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN ECOMMERCE PLATFORM MARKET

- TABLE 179 ECOMMERCE PLATFORM MARKET: DEGREE OF COMPETITION

- TABLE 180 ECOMMERCE PLATFORM MARKET: REGIONAL FOOTPRINT

- TABLE 181 ECOMMERCE PLATFORM MARKET: OFFERING FOOTPRINT

- TABLE 182 ECOMMERCE MARKET: ECOMMERCE MODEL FOOTPRINT

- TABLE 183 ECOMMERCE PLATFORM MARKET: DETAILED LIST OF KEY STARTUP/SMES

- TABLE 184 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, BY OFFERING, ECOMMERCE MODEL, AND REGION

- TABLE 185 ECOMMERCE PLATFORM MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS, JANUARY 2022-MAY 2025

- TABLE 186 ECOMMERCE PLATFORM MARKET: DEALS, JANUARY 2022-MAY 2025

- TABLE 187 SHOPIFY: BUSINESS OVERVIEW

- TABLE 188 SHOPIFY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 189 SHOPIFY: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 190 SHOPIFY: DEALS

- TABLE 191 EBAY: BUSINESS OVERVIEW

- TABLE 192 EBAY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 193 EBAY: PRODUCT LAUNCHES

- TABLE 194 EBAY: DEALS

- TABLE 195 ETSY: BUSINESS OVERVIEW

- TABLE 196 ETSY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 197 ETSY: PRODUCT LAUNCHES

- TABLE 198 SQUARE: BUSINESS OVERVIEW

- TABLE 199 SQUARE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 200 SQUARE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 201 BIGCOMMERCE: BUSINESS OVERVIEW

- TABLE 202 BIGCOMMERCE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 203 BIGCOMMERCE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 204 BIGCOMMERCE: DEALS

- TABLE 205 AMAZON: BUSINESS OVERVIEW

- TABLE 206 AMAZON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 207 AMAZON: DEALS

- TABLE 208 ADOBE: BUSINESS OVERVIEW

- TABLE 209 ADOBE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 210 ADOBE: PRODUCT LAUNCHES

- TABLE 211 ADOBE: DEALS

- TABLE 212 WIX: BUSINESS OVERVIEW

- TABLE 213 WIX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 214 WIX: PRODUCT LAUNCHES

- TABLE 215 WIX: DEALS

- TABLE 216 ORACLE: BUSINESS OVERVIEW

- TABLE 217 ORACLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 218 ORACLE: DEALS

- TABLE 219 SQUARESPACE: BUSINESS OVERVIEW

- TABLE 220 SQUARESPACE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 221 SQUARESPACE: PRODUCT LAUNCHES

- TABLE 222 SQUARESPACE: DEALS

- TABLE 223 WOOCOMMERCE: BUSINESS OVERVIEW

- TABLE 224 WOOCOMMERCE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 225 WOOCOMMERCE: PRODUCT LAUNCHES

- TABLE 226 ADJACENT MARKETS AND FORECASTS

- TABLE 227 ARTIFICIAL INTELLIGENCE IN RETAIL MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 228 ARTIFICIAL INTELLIGENCE IN RETAIL MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 229 ARTIFICIAL INTELLIGENCE IN RETAIL MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 230 ARTIFICIAL INTELLIGENCE IN RETAIL MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 231 ARTIFICIAL INTELLIGENCE IN RETAIL MARKET, BY BUSINESS FUNCTION, 2019-2023 (USD MILLION)

- TABLE 232 ARTIFICIAL INTELLIGENCE IN RETAIL MARKET, BY BUSINESS FUNCTION, 2024-2030 (USD MILLION)

- TABLE 233 ARTIFICIAL INTELLIGENCE IN RETAIL MARKET, BY END USER, 2019-2023 (USD MILLION)

- TABLE 234 ARTIFICIAL INTELLIGENCE IN RETAIL MARKET, BY END USER, 2024-2030 (USD MILLION)

- TABLE 235 RETAIL CLOUD MARKET, BY COMPONENT, 2019-2022 (USD MILLION)

- TABLE 236 RETAIL CLOUD MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 237 RETAIL CLOUD MARKET, BY SERVICE MODEL, 2019-2022 (USD MILLION)

- TABLE 238 RETAIL CLOUD MARKET, BY SERVICE MODEL, 2023-2028 (USD MILLION)

- TABLE 239 RETAIL CLOUD MARKET, BY DEPLOYMENT MODEL, 2019-2022 (USD MILLION)

- TABLE 240 RETAIL CLOUD MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- TABLE 241 RETAIL CLOUD MARKET, BY ORGANIZATION SIZE, 2019-2022 (USD MILLION)

- TABLE 242 RETAIL CLOUD MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

List of Figures

- FIGURE 1 ECOMMERCE PLATFORM MARKET: RESEARCH DESIGN

- FIGURE 2 BREAKUP OF INTERVIEWS WITH EXPERTS: BY COMPANY, DESIGNATION, AND REGION

- FIGURE 3 ECOMMERCE PLATFORM MARKET: APPROACHES USED FOR MARKET SIZE ESTIMATION

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY, APPROACH 1: SUPPLY-SIDE ANALYSIS OF REVENUE FROM SOLUTIONS AND SERVICES

- FIGURE 5 BOTTOM-UP APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1, BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF ECOMMERCE PLATFORM VENDORS

- FIGURE 7 TOP-DOWN APPROACH

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: DEMAND-SIDE ANALYSIS

- FIGURE 9 ECOMMERCE PLATFORM MARKET: DATA TRIANGULATION

- FIGURE 10 GLOBAL ECOMMERCE PLATFORM MARKET, 2023-2030

- FIGURE 11 ECOMMERCE PLATFORM MARKET, BY OFFERING, 2025 VS. 2030

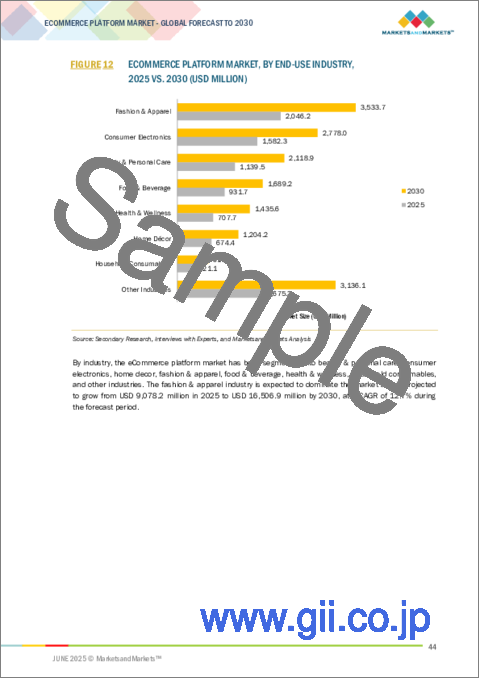

- FIGURE 12 ECOMMERCE PLATFORM MARKET, BY END-USE INDUSTRY, 2025 VS. 2030 (USD MILLION)

- FIGURE 13 ECOMMERCE PLATFORM MARKET, BY REGION, 2025

- FIGURE 14 INCREASING USE OF ONLINE PLATFORMS TO DRIVE MARKET GROWTH

- FIGURE 15 FASHION & APPAREL SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 16 B2C SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 17 FASHION & APPAREL SEGMENT AND US ESTIMATED TO LEAD IN NORTH AMERICAN MARKET IN 2025

- FIGURE 18 FASHION & APPAREL SEGMENT AND CHINA ESTIMATED TO LEAD ASIA PACIFIC MARKET IN 2025

- FIGURE 19 FASHION & APPAREL SEGMENT AND GERMANY ESTIMATED TO LEAD EUROPEAN MARKET IN 2025

- FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: ECOMMERCE PLATFORM MARKET

- FIGURE 21 SMARTPHONE ADOPTION TREND, BY REGION, 2024 VS. 2030

- FIGURE 22 BRIEF HISTORY OF ECOMMERCE PLATFORMS

- FIGURE 23 ECOMMERCE PLATFORM ECOSYSTEM

- FIGURE 24 ECOMMERCE PLATFORM MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 25 LIST OF MAJOR PATENTS FOR ECOMMERCE PLATFORM, 2016-2025

- FIGURE 26 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 27 ECOMMERCE PLATFORM MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- FIGURE 29 KEY BUYING CRITERIA

- FIGURE 30 USE CASES OF GENERATIVE AI IN ECOMMERCE PLATFORM

- FIGURE 31 ECOMMERCE PLATFORM MARKET: INVESTMENT AND FUNDING SCENARIO (USD MILLION)

- FIGURE 32 SERVICES TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 33 B2B SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 34 HEALTH & WELLNESS TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 35 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 36 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 37 REVENUE ANALYSIS OF KEY COMPANIES FROM 2020 TO 2024

- FIGURE 38 SHARE OF LEADING COMPANIES IN ECOMMERCE PLATFORM MARKET, 2024

- FIGURE 39 FINANCIAL METRICS OF KEY ECOMMERCE PLATFORM VENDORS

- FIGURE 40 COMPANY VALUATION OF KEY VENDORS IN ECOMMERCE PLATFORM MARKET

- FIGURE 41 BRAND/PRODUCT COMPARISON

- FIGURE 42 ECOMMERCE PLATFORM MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2025

- FIGURE 43 ECOMMERCE PLATFORM MARKET: COMPANY FOOTPRINT

- FIGURE 44 ECOMMERCE PLATFORM MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2025

- FIGURE 45 SHOPIFY: COMPANY SNAPSHOT

- FIGURE 46 EBAY: COMPANY SNAPSHOT

- FIGURE 47 ETSY: COMPANY SNAPSHOT

- FIGURE 48 SQUARE: COMPANY SNAPSHOT

- FIGURE 49 BIGCOMMERCE: COMPANY SNAPSHOT

- FIGURE 50 AMAZON: COMPANY SNAPSHOT

- FIGURE 51 ADOBE: COMPANY SNAPSHOT

- FIGURE 52 WIX: COMPANY SNAPSHOT

- FIGURE 53 ORACLE: COMPANY SNAPSHOT

The eCommerce platform market is estimated to be USD 9,078.2 million in 2025 and is expected to reach USD 16,506.9 million by 2030 at a CAGR of 12.7%. The global eCommerce platform market is driven by rising internet penetration, increasing smartphone usage, and growing consumer preference for digital shopping experiences. Advancements in technologies such as artificial intelligence (AI), cloud computing, and big data analytics are enhancing platform capabilities.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | (USD) Million/Billion |

| Segments | Offering, ECommerce Model, End-use Industry (Beauty & Personal Care, Consumer Electronics, Fashion & Apparel, Food & Beverage, Home Decor, Health & Wellness, Household Consumables, and Other Industries) |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

Additionally, the surge in omnichannel retailing, demand for personalized shopping, and the expansion of cross-border trade are propelling the adoption of robust and scalable eCommerce platforms across various industry verticals worldwide. However, cyber threats are continually evolving, which makes it difficult for organizations to protect their essential business processes and data from cybercriminals. The increasing frequency of data breaches has raised concerns among consumers regarding the security of their online transactions, potentially restraining market growth.

Payments & Billing solutions subsegment is expected to grow at the highest CAGR during the forecast period

Payment and billing solutions are anticipated to register the highest CAGR within the solutions segment of the global eCommerce platform market. This growth is fueled by the increasing demand for fast, secure, and flexible digital payment methods that elevate the customer shopping experience. As the volume of online transactions rises, eCommerce vendors are adopting advanced billing technologies, including automated invoicing systems, digital wallets, Buy Now Pay Later (BNPL) services, and multi-currency payment gateways to serve a diverse and global customer base. Furthermore, the surge in cross-border eCommerce and the necessity to comply with evolving financial and regulatory standards are accelerating adoption. These solutions optimize checkout processes and reduce cart abandonment. They also build consumer trust and drive revenue, positioning them as a core element of modern eCommerce ecosystems.

Health & Wellness segment is expected to grow with the highest CAGR during the forecast period

The growing consumer focus on healthy living has significantly influenced the growth of the eCommerce health and wellness industry. With increasing digitalization, the healthcare sector is rapidly embracing online technologies to enhance accessibility and improve service delivery. Small and medium enterprises (SMEs) and startups are strategically leveraging digital commerce platforms, such as Amazon to expand their market presence and reach health-conscious consumers.

The industry has responded to evolving consumer demands by offering a diverse portfolio of wellness products, personalized supplements, and fitness-related services, often bundled with attractive promotions. eCommerce platforms have transformed how consumers discover, purchase, and engage with health and wellness solutions, making it easier to access information, track health goals, and adopt sustainable lifestyle habits from the convenience of their homes.

Asia Pacific will register the highest growth rate during the forecast period

The Asia Pacific region is poised to experience the highest growth rate in the global eCommerce platform market, driven by its rapid adoption of emerging technologies and expanding digital infrastructure. As a highly populated and economically diverse region, Asia Pacific is positioned to benefit significantly from innovations in cloud computing, Internet of Things (IoT), big data analytics, augmented reality (AR), and virtual reality (VR), particularly within the retail and commercial sectors.

Key regional economies such as China, Japan, and South Korea are leading in digital transformation initiatives, fostering greater demand for advanced eCommerce solutions. Additionally, factors such as rising smartphone penetration, improved internet accessibility, and a growing middle-class consumer base are accelerating online retail activity. This evolving digital landscape is enabling enterprises to adopt scalable, customer-centric eCommerce platforms, thereby strengthening market growth across Asia Pacific.

Breakdown of primaries

The study contains insights from various industry experts, from solution vendors to Tier 1 companies. The break-up of the primaries is as follows:

- By Company Type: Tier 1 - 62%, Tier 2 - 23%, and Tier 3 - 15%

- By Designation: C-level -50%, D-level - 30%, and Others - 20%

- By Region: North America - 38%, Europe - 15%, Asia Pacific - 35%, Middle East & Africa - 7%, and Latin America - 5%

The major players in the eCommerce platform market include Shopify (Canada), eBay (US), Etsy (US), Square (US), BigCommerce (US), Amazon (US), Adobe (US), Wix (Israel), Oracle (US), Squarespace (US), SAP (Germany), Salesforce (US), VTEX (UK), Trade Me (New Zealand), WooCommerce (US), StoreHippo (India), Lightspeed (US), OpenCart (China), Volusion (US), PrestaShop (France), Shift4Shop (US), FastSpring (US), Nuvemshop (Brazil), Tray.io (US), Shopware (Germany). These players have adopted various growth strategies, such as partnerships, agreements, collaborations, new product launches, enhancements, and acquisitions, to expand their eCommerce platform market footprint.

Study Coverage

The market study covers the eCommerce platform market size across different segments. It estimates the market size and the growth potential across different segments, including offering, eCommerce model, end-use industry, and region. The study includes an in-depth competitive analysis of the leading market players, their company profiles, key observations related to product and business offerings, recent developments, and market strategies.

Key Benefits of Buying the Report

The report will help market leaders and new entrants with information on the closest approximations of the global eCommerce platform market's revenue numbers and subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. Moreover, the report will provide insights for stakeholders to understand the market's pulse and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

1. Analysis of key drivers (increasing online consumer base with growing adoption of smartphones will fuel the demand of ecommerce platform, omnichannel retailing is driving the demand of ecommerce platform, increasing internet penetration across the globe to fuelled the adoption of ecommerce platform, rising need to enhance global presence will increase the adoption of ecommerce platform), restraints (cyber security issue and online scams can hinder the growth), opportunities (development of supper apps to offer more simple and convenient shopping options, rising investment in the ecommerce sector, buy now pay later (BNPL) is a leading tech sector to support growth of ecommerce platform market), and challenges (logistics and fulfilment are critical aspects of the ecommerce process, and can pose substantial challenges for businesses, customer acquisition and retention can be expensive in this competitive era) influencing the growth of the eCommerce platform market

2. Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the eCommerce platform market

3. Market Development: Comprehensive information about lucrative markets - analysis of the eCommerce platform market across various regions

4. Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the eCommerce platform market.

5. Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players Shopify (Canada), eBay (US), Etsy (US), Square (US), BigCommerce (US), Amazon (US), Adobe (US), Wix (Israel), Oracle (US), Squarespace (US), SAP (Germany), Salesforce (US), VTEX (UK), Trade Me (New Zealand), WooCommerce (US), StoreHippo (India), Lightspeed (US), OpenCart (China), Volusion (US), PrestaShop (France), Shift4Shop (US), FastSpring (US), Nuvemshop (Brazil), Tray.io (US), and Shopware (Germany)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key primary participants

- 2.1.2.2 Breakup of interviews with experts

- 2.1.2.3 Key insights from industry experts

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.3 ECOMMERCE PLATFORM MARKET ESTIMATION: DEMAND-SIDE ANALYSIS

- 2.3 DATA TRIANGULATION

- 2.4 MARKET FORECAST

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ECOMMERCE PLATFORM MARKET

- 4.2 ECOMMERCE PLATFORM MARKET, BY END-USE INDUSTRY

- 4.3 ECOMMERCE PLATFORM MARKET, BY ECOMMERCE MODEL

- 4.4 NORTH AMERICA: ECOMMERCE PLATFORM MARKET, BY END-USE INDUSTRY AND COUNTRY

- 4.5 ASIA PACIFIC: ECOMMERCE PLATFORM MARKET, BY END-USE INDUSTRY AND COUNTRY

- 4.6 EUROPE: ECOMMERCE PLATFORM MARKET, BY END-USE INDUSTRY AND COUNTRY

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 MARKET OVERVIEW

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing online consumer base with growing adoption of smartphones to fuel demand for eCommerce platforms

- 5.2.1.2 Omnichannel retailing to drive demand for eCommerce platforms

- 5.2.1.3 Increasing internet penetration worldwide to fuel adoption of eCommerce platforms

- 5.2.1.4 Rising need to enhance global presence to increase adoption of eCommerce platforms

- 5.2.2 RESTRAINTS

- 5.2.2.1 Cybersecurity issues and online scams to hinder market growth

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Development of super apps to offer more simple and convenient shopping options

- 5.2.3.2 Rising investments in eCommerce sector

- 5.2.3.3 Buy now pay later (BNPL) to support growth of eCommerce platform market

- 5.2.4 CHALLENGES

- 5.2.4.1 Handling logistics and managing inventory to pose substantial challenges for businesses

- 5.2.4.2 Customer acquisition and retention to be expensive in competitive era

- 5.2.1 DRIVERS

- 5.3 BRIEF HISTORY OF ECOMMERCE PLATFORM

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.5.1 PLATFORM PROVIDERS

- 5.5.2 SERVICE PROVIDERS

- 5.5.3 SYSTEM INTEGRATORS

- 5.5.4 LOGISTICS PROVIDERS

- 5.5.5 PAYMENT GATEWAY PROVIDERS

- 5.5.6 END USERS

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE OF ECOMMERCE PLATFORM SOLUTIONS, BY KEY PLAYERS, 2024

- 5.6.2 INDICATIVE PRICING ANALYSIS OF ECOMMERCE PLATFORM SERVICES, BY KEY PLAYERS, 2024

- 5.7 INDUSTRY USE CASES

- 5.7.1 USE CASE 1: MOORE BROTHERS WINE COMPANY ADOPTED BIGCOMMERCE PLATFORM

- 5.7.2 USE CASE 2: BIGCOMMERCE HELPED BULK NUTRIENTS TO IMPROVE ITS WEBSITE PERFORMANCE

- 5.7.3 USE CASE 3: NZ POST ADOPTED BIGCOMMERCE ECOMMERCE SOLUTION TO ENHANCE ITS GLOBAL PRESENCE

- 5.7.4 USE CASE 4: HARVEY NORMAN IMPROVED DELIVERY EXPERIENCE WITH SHIPPIT

- 5.7.5 CASE STUDY 5: HMD GLOBAL ADOPTED BIGCOMMERCE PLATFORM TO ENHANCE CUSTOMER EXPERIENCE DURING ONLINE SHOPPING

- 5.7.6 CASE STUDY 6: EBAY ENABLED TEMPLE & WEBSTER TO MANAGE AND SELL PRODUCTS MORE EFFICIENTLY ON ONLINE PLATFORMS

- 5.7.7 CASE STUDY 7: KMART MIGRATED ITS COMMERCE SOLUTION INTO CLOUD-BASED OFFERING WITH COMMERCETOOLS

- 5.7.8 CASE STUDY 8: SHOPIFY PLUS ENABLED JB HI-FI TO SERVE CUSTOMERS MORE EFFICIENTLY DURING HOLIDAY SEASON

- 5.8 PATENT ANALYSIS

- 5.8.1 METHODOLOGY

- 5.8.2 ECOMMERCE PLATFORM MARKET: KEY PATENTS, 2016-2025

- 5.9 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.10 PORTER'S FIVE FORCES ANALYSIS

- 5.10.1 THREAT OF NEW ENTRANTS

- 5.10.2 THREAT OF SUBSTITUTES

- 5.10.3 BARGAINING POWER OF BUYERS

- 5.10.4 BARGAINING POWER OF SUPPLIERS

- 5.10.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.11 REGULATORY LANDSCAPE

- 5.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11.2 KEY REGULATIONS AND FRAMEWORKS

- 5.11.2.1 ISO/TC 184/SC 4

- 5.11.2.2 ISO/TC 184

- 5.11.2.3 General Personal Data Protection Law

- 5.11.2.4 General Data Protection Regulation

- 5.11.2.5 California Data Privacy Protection Act

- 5.12 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.12.2 BUYING CRITERIA

- 5.13 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.14 TECHNOLOGY ANALYSIS

- 5.14.1 INTRODUCTION

- 5.14.2 KEY TECHNOLOGIES

- 5.14.2.1 Content management systems

- 5.14.2.2 Database management systems

- 5.14.2.3 Cloud computing

- 5.14.3 ADJACENT TECHNOLOGIES

- 5.14.3.1 Payment gateways

- 5.14.3.2 Customer relationship management

- 5.14.3.3 Content delivery networks

- 5.14.4 COMPLEMENTARY TECHNOLOGIES

- 5.14.4.1 Augmented reality

- 5.14.4.2 Headless commerce architecture

- 5.14.4.3 Warehouse automation

- 5.15 BEST PRACTICES IN ECOMMERCE PLATFORM MARKET

- 5.16 TECHNOLOGY ROADMAP FOR ECOMMERCE PLATFORM MARKET

- 5.16.1 ECOMMERCE PLATFORM ROADMAP TILL 2033

- 5.16.1.1 Short-term roadmap (2025-2027)

- 5.16.1.2 Mid-term roadmap (2028-2030)

- 5.16.1.3 Long-term roadmap (2031-2033)

- 5.16.1 ECOMMERCE PLATFORM ROADMAP TILL 2033

- 5.17 IMPACT OF AI/GENERATIVE AI ON ECOMMERCE PLATFORM MARKET

- 5.17.1 USE CASES OF GENERATIVE AI IN ECOMMERCE PLATFORM

- 5.18 INVESTMENT AND FUNDING SCENARIO (2024)

- 5.19 IMPACT OF 2025 US TARIFF-ECOMMERCE PLATFORM MARKET

- 5.19.1 INTRODUCTION

- 5.19.2 KEY TARIFF RATES

- 5.19.3 PRICE IMPACT ANALYSIS

- 5.19.3.1 Strategic Shifts and Emerging Trends

- 5.19.4 IMPACT ON COUNTRY/REGION

- 5.19.4.1 US

- 5.19.4.2 China

- 5.19.4.3 Europe

- 5.19.4.4 Asia Pacific (excluding China)

- 5.19.5 IMPACT ON END-USE INDUSTRY

- 5.19.5.1 Beauty & Personal Care

- 5.19.5.2 Consumer Electronics

- 5.19.5.3 Fashion & Apparel

- 5.19.5.4 Food & Beverage

- 5.19.5.5 Home Decor

- 5.19.5.6 Health & Wellness

- 5.19.5.7 Household Consumables

- 5.19.5.8 Other Industries

6 ECOMMERCE PLATFORM MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.1.1 OFFERING: ECOMMERCE PLATFORM MARKET DRIVERS

- 6.2 SOLUTIONS

- 6.2.1 REDUCE EXPENSIVE AND TIME-CONSUMING PROCESSES FOR DEVELOPERS TO BUILD ECOMMERCE STORES

- 6.2.2 PAYMENT & BILLING SOLUTIONS

- 6.2.3 ECOMMERCE MANAGEMENT PLATFORM

- 6.2.4 END-TO-END PLATFORM

- 6.3 SERVICES

- 6.3.1 ENTERPRISES TO DEPLOY APPROPRIATE SERVICES TO IMPROVE OPERATIONAL EFFICIENCY

7 ECOMMERCE PLATFORM MARKET, BY ECOMMERCE MODEL

- 7.1 INTRODUCTION

- 7.1.1 ECOMMERCE MODEL: ECOMMERCE PLATFORM MARKET DRIVERS

- 7.2 BUSINESS-TO-BUSINESS

- 7.2.1 CATERS TO COMPLEX PURCHASING NEEDS OF BUSINESS-TO-BUSINESS CUSTOMERS

- 7.3 BUSINESS-TO-CUSTOMER (B2C)

- 7.3.1 PROVIDE UNIFIED EXPERIENCE FOR CUSTOMERS SHOPPING ONLINE OR BRICK-AND-MORTAR STORES

8 ECOMMERCE PLATFORM MARKET, BY END-USE INDUSTRY

- 8.1 INTRODUCTION

- 8.1.1 INDUSTRY: ECOMMERCE PLATFORM MARKET DRIVERS

- 8.2 BEAUTY & PERSONAL CARE

- 8.2.1 GROWING FOCUS ON PERSONAL CARE BY CONSUMERS TO DRIVE MARKET

- 8.2.2 USE CASES

- 8.2.2.1 KASH Beauty broke boundaries and sales records with Shopify Plus platform

- 8.2.2.2 Beard & Blade witnessed remarkable growth after deploying Shopify

- 8.3 CONSUMER ELECTRONICS

- 8.3.1 SOCIAL MEDIA TOOLS TO ENHANCE ONLINE PRESENCE OF CONSUMER ELECTRONICS INDUSTRY

- 8.3.2 USE CASES

- 8.3.2.1 Sony simplified process of buying security solutions with Amazon marketplace

- 8.3.2.2 Staples adopted Shopify Plus as new online marketplace

- 8.4 FASHION & APPAREL

- 8.4.1 EXPOSURE OF PEOPLE TO INTERNATIONAL FASHION TO DRIVE MARKET

- 8.4.2 USE CASES

- 8.4.2.1 Saddleback adopted BigCommerce to enhance its online presence

- 8.4.2.2 Agua Bendita expanded internationally with eCommerce platforms from Stripe and VTEX

- 8.5 FOOD & BEVERAGE

- 8.5.1 ECOMMERCE PLATFORMS TO HELP ENHANCE CROSS-BORDER SALES

- 8.5.2 USE CASES

- 8.5.2.1 Beer Cartel adopted BigCommerce platform to sell products directly from website

- 8.5.2.2 BigCommerce Streamlined Linz Shop's eCommerce Operations

- 8.6 HOME DECOR

- 8.6.1 CONVENIENCE AND COMPETITIVE PRICES OFFERED BY ECOMMERCE PLATFORMS EXPECTED TO DRIVE MARKET

- 8.6.2 USE CASES

- 8.6.2.1 StoreHippo's eCommerce platform to support brand growth

- 8.6.2.2 Shopify Capital to boost inventory for Fable

- 8.7 HEALTH & WELLNESS

- 8.7.1 INCREASING ONLINE HEALTH AND WELLNESS CONSULTING SERVICES TO FUEL DEMAND FOR ECOMMERCE PLATFORMS

- 8.7.2 USE CASE

- 8.7.2.1 AWS Marketplace empowered decision-makers at Tufts Medicine to achieve more with greater efficiency and consistency

- 8.7.2.2 Ambra Health successfully streamlined its software procurements with AWS

- 8.7.2.3 Hubble generated over USD 30 million in sales using Shopify Plus

- 8.8 HOUSEHOLD CONSUMABLES

- 8.8.1 RISING COMPETITION TO LEAD TO MORE DISCOUNTS AND OFFERS IN FMCG SECTOR

- 8.8.2 USE CASES

- 8.8.2.1 Berger Paints adopted eCommerce platform to offer fast and convenient painting services

- 8.9 OTHER INDUSTRIES

9 ECOMMERCE PLATFORM MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 9.2.2 US

- 9.2.2.1 Presence of key market players to drive demand for eCommerce platforms

- 9.2.3 CANADA

- 9.2.3.1 Implementing policies related to IT and eCommerce platforms to advance cybersecurity and safeguard critical infrastructure networks

- 9.3 EUROPE

- 9.3.1 EUROPE: MACROECONOMIC OUTLOOK

- 9.3.2 UK

- 9.3.2.1 Entry of supermarkets and department stores into online shopping arena to fuel demand for eCommerce platforms

- 9.3.3 GERMANY

- 9.3.3.1 eCommerce platforms to offer better price conditions, wider product selection, and enhanced convenience

- 9.3.4 FRANCE

- 9.3.4.1 Gaining traction of digital wallets and online shopping to drive French market

- 9.3.5 SPAIN

- 9.3.5.1 Rapid shift in consumer behavior from traditional brick-and-mortar retail to online shopping to drive Spanish market

- 9.3.6 ITALY

- 9.3.6.1 Increasing investment by retailers in Italy to shift offline platforms to online

- 9.3.7 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 9.4.2 CHINA

- 9.4.2.1 Early adoption of digital platforms to drive market

- 9.4.3 INDIA

- 9.4.3.1 Make in India initiative to raise global competitiveness

- 9.4.4 JAPAN

- 9.4.4.1 Rising adoption of cloud-based solutions to drive adoption of eCommerce platforms

- 9.4.5 SINGAPORE

- 9.4.5.1 Rising young and affluent population to drive adoption of eCommerce platforms

- 9.4.6 AUSTRALIA & NEW ZEALAND (ANZ)

- 9.4.6.1 Technological advancements to drive growth of eCommerce market

- 9.4.7 REST OF ASIA PACIFIC

- 9.5 MIDDLE EAST & AFRICA

- 9.5.1 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 9.5.2 MIDDLE EAST

- 9.5.2.1 Kingdom of Saudi Arabia

- 9.5.2.1.1 Focus on adopting advanced communications and IT systems and digital economy to fuel growth

- 9.5.2.2 United Arab Emirates

- 9.5.2.2.1 Rapid shift of traditional brick-and-mortar retailers to online platforms to increase demand for eCommerce platforms

- 9.5.2.3 Rest of Middle East

- 9.5.2.1 Kingdom of Saudi Arabia

- 9.5.3 AFRICA

- 9.5.3.1 Increasing digital skills of citizens and rising smartphone adoption to accelerate eCommerce platform market growth

- 9.6 LATIN AMERICA

- 9.6.1 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 9.6.2 BRAZIL

- 9.6.2.1 Convenience and attractive promotions offered by eCommerce to attract shoppers

- 9.6.3 MEXICO

- 9.6.3.1 Increasing adoption of IoT to boost growth of eCommerce platform market

- 9.6.4 REST OF LATIN AMERICA

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 10.3 REVENUE ANALYSIS, 2020-2024

- 10.4 MARKET SHARE ANALYSIS OF TOP PLAYERS, 2024

- 10.5 COMPANY VALUATION AND FINANCIAL METRICS

- 10.6 BRAND/PRODUCT COMPARISON

- 10.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2025

- 10.7.1 STARS

- 10.7.2 EMERGING LEADERS

- 10.7.3 PERVASIVE PLAYERS

- 10.7.4 PARTICIPANTS

- 10.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2025

- 10.7.5.1 Company footprint

- 10.7.5.2 Regional footprint

- 10.7.5.3 Offering footprint

- 10.7.5.4 eCommerce Model Footprint

- 10.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2025

- 10.8.1 PROGRESSIVE COMPANIES

- 10.8.2 RESPONSIVE COMPANIES

- 10.8.3 DYNAMIC COMPANIES

- 10.8.4 STARTING BLOCKS

- 10.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2025

- 10.8.5.1 Detailed list of key startups/SMEs

- 10.8.5.2 Competitive Benchmarking of key startups/SMEs

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES

- 10.9.2 DEALS

11 COMPANY PROFILES

- 11.1 MAJOR PLAYERS

- 11.1.1 SHOPIFY

- 11.1.1.1 Business overview

- 11.1.1.2 Products/Solutions/Services offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product launches and enhancements

- 11.1.1.3.2 Deals

- 11.1.1.4 MnM view

- 11.1.1.4.1 Key strengths

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses and competitive threats

- 11.1.2 EBAY

- 11.1.2.1 Business overview

- 11.1.2.2 Products/Solutions/Services offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Product launches

- 11.1.2.3.2 Deals

- 11.1.3 ETSY

- 11.1.3.1 Business overview

- 11.1.3.2 Products/Solutions/Services offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Product launches

- 11.1.4 SQUARE

- 11.1.4.1 Business overview

- 11.1.4.2 Products/Solutions/Services offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Product launches and enhancements

- 11.1.4.4 MnM view

- 11.1.4.4.1 Key strengths

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses and competitive threats

- 11.1.5 BIGCOMMERCE

- 11.1.5.1 Business overview

- 11.1.5.2 Products/Solutions/Services offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Product launches and enhancements

- 11.1.5.3.2 Deals

- 11.1.6 AMAZON

- 11.1.6.1 Business overview

- 11.1.6.2 Products/Solutions/Services offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Deals

- 11.1.7 ADOBE

- 11.1.7.1 Business overview

- 11.1.7.2 Products/Solutions/Services offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Product launches

- 11.1.7.3.2 Deals

- 11.1.7.4 MnM view

- 11.1.7.4.1 Key strengths

- 11.1.7.4.2 Strategic choices

- 11.1.7.4.3 Weaknesses and competitive threats

- 11.1.8 WIX

- 11.1.8.1 Business overview

- 11.1.8.2 Products/Solutions/Services offered

- 11.1.8.3 Recent developments

- 11.1.8.3.1 Product launches

- 11.1.8.3.2 Deals

- 11.1.8.4 MnM view

- 11.1.8.4.1 Key strengths

- 11.1.8.4.2 Strategic choices

- 11.1.8.4.3 Weaknesses and competitive threats

- 11.1.9 ORACLE

- 11.1.9.1 Business overview

- 11.1.9.2 Products/Solutions/Services offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Deals

- 11.1.9.4 MnM view

- 11.1.9.4.1 Key strengths

- 11.1.9.4.2 Strategic choices

- 11.1.9.4.3 Weaknesses and competitive threats

- 11.1.10 SQUARESPACE

- 11.1.10.1 Business overview

- 11.1.10.2 Products/Solutions/Services offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Product launches

- 11.1.10.3.2 Deals

- 11.1.11 SAP

- 11.1.12 SALESFORCE

- 11.1.13 VTEX

- 11.1.14 TRADE ME

- 11.1.1 SHOPIFY

- 11.2 SMES/STARTUPS

- 11.2.1 WOOCOMMERCE

- 11.2.1.1 Business overview

- 11.2.1.2 Products/Solutions/Services offered

- 11.2.1.3 Recent developments

- 11.2.1.3.1 Product launches

- 11.2.2 STOREHIPPO

- 11.2.3 LIGHTSPEED

- 11.2.4 OPENCART

- 11.2.5 VOLUSION

- 11.2.6 PRESTASHOP

- 11.2.7 SHIFT4SHOP

- 11.2.8 FASTSPRING

- 11.2.9 NUVEMSHOP

- 11.2.10 TRAY.IO

- 11.2.11 SHOPWARE

- 11.2.1 WOOCOMMERCE

12 ADJACENT/RELATED MARKETS

- 12.1 INTRODUCTION TO ADJACENT MARKETS

- 12.2 LIMITATIONS

- 12.3 ARTIFICIAL INTELLIGENCE IN RETAIL MARKET

- 12.3.1 MARKET DEFINITION

- 12.3.2 ARTIFICIAL INTELLIGENCE IN RETAIL MARKET, BY OFFERING

- 12.3.3 ARTIFICIAL INTELLIGENCE IN RETAIL MARKET, BY TYPE

- 12.3.4 ARTIFICIAL INTELLIGENCE IN RETAIL MARKET, BY BUSINESS FUNCTION

- 12.3.5 ARTIFICIAL INTELLIGENCE IN RETAIL MARKET, BY END USER

- 12.4 RETAIL CLOUD MARKET

- 12.4.1 MARKET DEFINITION

- 12.4.2 RETAIL CLOUD MARKET, BY COMPONENT

- 12.4.3 RETAIL CLOUD MARKET, BY SERVICE MODEL

- 12.4.4 RETAIL CLOUD MARKET, BY DEPLOYMENT MODEL

- 12.4.5 RETAIL CLOUD MARKET, BY ORGANIZATION SIZE

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS