|

|

市場調査レポート

商品コード

1754855

温度センサーの世界市場 (~2030年):コネクティビティ (有線・無線)・接触タイプ (熱電対・サーミスタ)・非接触タイプ (赤外線温度・光ファイバー)・出力 (デジタル・アナログ)・エンドユーザー産業・地域別Temperature Sensor Market by Connectivity (Wired, Wireless), Contact Type (Thermocouple, Thermistor), Non-Contact Type (Infrared Temperature, Fiber Optic), Output (Digital, Analog), End Use Industry and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 温度センサーの世界市場 (~2030年):コネクティビティ (有線・無線)・接触タイプ (熱電対・サーミスタ)・非接触タイプ (赤外線温度・光ファイバー)・出力 (デジタル・アナログ)・エンドユーザー産業・地域別 |

|

出版日: 2025年06月18日

発行: MarketsandMarkets

ページ情報: 英文 265 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の温度センサーの市場規模は、2025年の74億3,000万米ドルから、予測期間中はCAGR 3.8%で推移し、2030年には89億4,000万米ドルに成長すると予測されています。

ウェアラブルデバイスの採用は急速に増加しており、多くのエンドユーザーがフィットネスや健康全般を改善するためにこのような技術を求めています。現在、6人に1人がウェアラブルデバイスを所有・使用しており、この採用動向は今後数年で拡大すると予想されます。ウェアラブルデバイスには、身体パラメータをモニターするための温度センサーがいくつか組み込まれています。これらのセンサーは、スマートウォッチやフィットネス活動トラッカーなどの機器に使用されています。スマートウォッチやフィットネストラッカーなどのウェアラブルデバイスにおける温度センサーの需要は、心拍数や体温などの身体活動の効果的なモニタリングや測定を可能にする技術として増加しています。技術の進歩に伴い、強化・改良されたウェアラブルの需要も拡大すると予想されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021-2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025-2030年 |

| 単位 | 金額 (米ドル) |

| セグメント別 | コネクティビティ 、出力、製品、エンドユーザー産業、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

"接触タイプが2030年に大きな市場シェアを占める見通し"

接触タイプの温度センサーは、物質/物体/ソースとの物理的接触を必要とします。接触タイプの温度センサーは、固体、液体、気体など、さまざまな温度範囲を検出することができます。これらのセンサーには、熱電対、RTD、サーミスタ、温度センサーIC、バイメタル温度センサーなどがあります。これらのセンサーの用途は適用先によって異なります。接触タイプ温度センサーの用途は、その低コスト、温度範囲、精度の高さから、化学、CE製品、石油・ガス、エネルギー・電力、自動車など様々な産業で普及しています。

"予測期間中、有線温度センサーが市場で最大シェアを獲得する見通し"

有線温度センサーは、温度を測定し、入力データを測定可能な信号に変換するデバイスであり、温度変化を追跡するために記録・監視することができます。信頼性が高く正確な温度モニタリングへの需要が高まっています。その接続性から、有線温度センサー分野は温度センサー市場でより大きなシェアを占めると予想されています。近年、低価格、広い温度範囲、高い精度により、複数の産業で温度センサーの使用が増加しています。例えば、化学、CE製品、石油・ガス、エネルギー・電力、自動車産業では、接触タイプの温度センサーの使用が大幅に増加しています。その他の有線温度センサーは、安定性、精度、高速応答時間を提供できるため、温度制御を必要とする重要な産業プロセスに最適です。

"中国は2030年にアジア太平洋で最大のシェアを占める"

中国は2030年現在、アジア太平洋の温度センサー市場をリードする国のひとつであり、予測期間中も市場規模をリードし続ける可能性が高いです。同国は積極的な経済成長を遂げており、温度センサー市場の開拓を後押ししています。アジア太平洋地域最大の電力消費国であり、その主な理由は急速な工業化と人口の多さです。エネルギー・電力セクターからの需要拡大は、市場の主要促進要因のひとつです。同国は再生可能エネルギー資源に多額の投資を計画しており、これが温度センサーの需要を押し上げると予想されています。同国では、温度センサーを導入した変圧器監視システムの利用が増加しており、今後数年間で温度センサーの需要が急増する可能性が高いです。

当レポートでは、世界の温度センサーの市場を調査し、市場概要、市場成長への各種影響因子の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- エコシステム分析

- 顧客のビジネスに影響を与える動向/混乱

- 価格分析

- 技術分析

- ケーススタディ分析

- 投資と資金調達のシナリオ

- 生成AI/AIが温度センサー市場に与える影響

- 特許分析

- 貿易分析

- 関税分析

- 主要な利害関係者と購入基準

- ポーターのファイブフォース分析

- 主な会議とイベント

- 規制状況と基準

- 米国関税の影響- 温度センサー市場

第6章 温度センサー市場:製品タイプ別

- 接触タイプ

- バイメタル温度センサー

- 熱電対

- 抵抗型温度検出器

- サーミスター

- 温度センサーICS

- 非接触タイプ

- 赤外線温度センサー

- 光ファイバー温度センサー

第7章 温度センサー市場:出力別

- アナログ

- デジタル

- シングルチャンネルデジタル温度センサー

- マルチチャンネルデジタル温度センサー

第8章 温度センサー市場:コネクティビティ別

- 無線

- 有線

第9章 温度センサー市場:エンドユーザー産業別

- 化学薬品

- 石油・ガス

- CE製品

- エネルギー・電力

- ヘルスケア

- 自動車

- 金属・鉱業

- 食品・飲料

- パルプ・紙

- 航空宇宙・防衛

- ガラス

- その他

第10章 温度センサー市場:地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- 英国

- ドイツ

- フランス

- イタリア

- その他

- アジア太平洋

- 中国

- 日本

- 韓国

- インド

- その他

- 行

- 南米

- 中東

- アフリカ

第11章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 市場シェア分析、2024年

- 収益分析、2020-2024年

- 市場シェア分析、2024年

- 企業評価と財務指標

- ブランド比較

- 企業評価マトリックス

- スタートアップ/中小企業評価マトリックス

- 競争シナリオ

第12章 企業プロファイル

- 主要企業

- HONEYWELL INTERNATIONAL INC.

- TE CONNECTIVITY

- TEXAS INSTRUMENTS INCORPORATED

- ENDRESS+HAUSER GROUP SERVICES AG

- SIEMENS

- EMERSON ELECTRIC CO.

- ANALOG DEVICES, INC.

- AMPHENOL CORPORATION

- WIKA ALEXANDER WIEGAND SE & CO. KG

- MICROCHIP TECHNOLOGY INC.

- その他の企業

- STMICROELECTRONICS

- NXP SEMICONDUCTORS

- OMEGA ENGINEERING, INC.

- YOKOGAWA ELECTRIC CORPORATION

- MURATA MANUFACTURING CO., LTD.

- IFM ELECTRONIC GMBH

- DWYER INSTRUMENTS, LLC.

- VISHAY INTERTECHNOLOGY, INC.

- PANASONIC CORPORATION

- DENSO CORPORATION

- KONGSBERG MARITIME

- AMETEK, INC.

- AMS-OSRAM AG

- FLIR SYSTEMS, INC.

- PYROMATION

第13章 付録

List of Tables

- TABLE 1 TEMPERATURE SENSOR MARKET: RESEARCH ASSUMPTIONS

- TABLE 2 COMPANIES AND THEIR ROLES IN ECOSYSTEM

- TABLE 3 AVERAGE SELLING PRICE TREND, BY PRODUCT TYPE, 2024

- TABLE 4 PRICING RANGE OF THERMISTORS, BY KEY PLAYER,2024

- TABLE 5 AVERAGE SELLING PRICE TREND OF TEMPERATURE SENSORS, BY REGION, 2021-2024 (USD)

- TABLE 6 TEMPERATURE SENSOR MARKET: LIST OF MAJOR PATENTS

- TABLE 7 IMPORT DATA FOR HS CODE 902519-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 8 EXPORT DATA FOR HS CODE 902519-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 9 MFN TARIFF FOR HS CODE 902519-COMPLIANT TEMPERATURE SENSORS EXPORTED BY US, 2024

- TABLE 10 MFN TARIFF FOR HS CODE 902519-COMPLIANT TEMPERATURE SENSORS EXPORTED BY CHINA, 2024

- TABLE 11 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USER INDUSTRIES

- TABLE 12 KEY BUYING CRITERIA FOR TOP THREE END-USER INDUSTRIES

- TABLE 13 TEMPERATURE SENSOR MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 14 TEMPERATURE SENSOR MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 15 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 NORTH AMERICA: SAFETY STANDARDS FOR TEMPERATURE SENSORS

- TABLE 20 EUROPE: SAFETY STANDARDS FOR TEMPERATURE SENSORS

- TABLE 21 ASIA PACIFIC: SAFETY STANDARDS FOR TEMPERATURE SENSORS

- TABLE 22 ROW: SAFETY STANDARDS FOR TEMPERATURE SENSORS

- TABLE 23 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 24 TEMPERATURE SENSOR MARKET, BY VALUE AND VOLUME, 2021-2024

- TABLE 25 TEMPERATURE SENSOR MARKET, BY VALUE AND VOLUME, 2025-2030

- TABLE 26 TEMPERATURE SENSOR MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 27 TEMPERATURE SENSOR MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 28 CHARACTERISTICS OF DIFFERENT TYPES OF CONTACT TEMPERATURE SENSORS

- TABLE 29 CONTACT: TEMPERATURE SENSOR MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

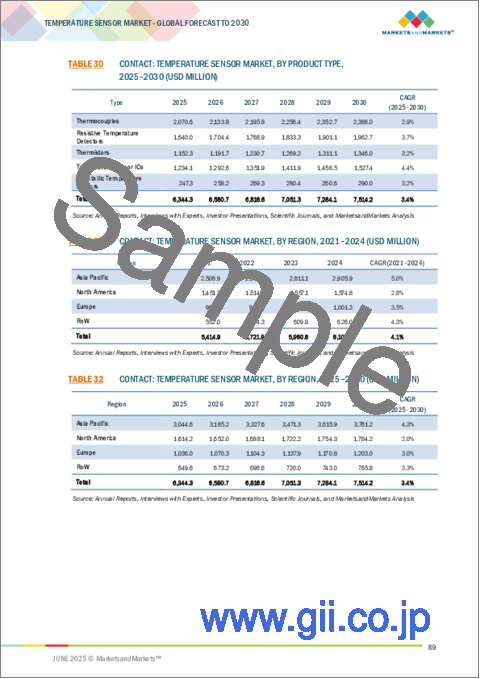

- TABLE 30 CONTACT: TEMPERATURE SENSOR MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 31 CONTACT: TEMPERATURE SENSOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 32 CONTACT: TEMPERATURE SENSOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 33 CONTACT: ASIA PACIFIC TEMPERATURE SENSOR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 34 CONTACT: ASIA PACIFIC TEMPERATURE SENSOR MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 35 CONTACT: NORTH AMERICA TEMPERATURE SENSOR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 36 CONTACT: NORTH AMERICA TEMPERATURE SENSOR MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 37 CONTACT: EUROPE TEMPERATURE SENSOR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 38 CONTACT: EUROPE TEMPERATURE SENSOR MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 39 CONTACT: ROW TEMPERATURE SENSOR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 40 CONTACT: ROW TEMPERATURE SENSOR MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 41 NON-CONTACT: TEMPERATURE SENSOR MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 42 NON-CONTACT: TEMPERATURE SENSOR MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 43 NON-CONTACT: TEMPERATURE SENSOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 44 NON-CONTACT: TEMPERATURE SENSOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 45 NON-CONTACT: TEMPERATURE SENSOR MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 46 NON-CONTACT: TEMPERATURE SENSOR MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 47 NON-CONTACT: TEMPERATURE SENSOR MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 48 NON-CONTACT: TEMPERATURE SENSOR MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 49 NON-CONTACT: TEMPERATURE SENSOR MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 50 NON-CONTACT: TEMPERATURE SENSOR MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 51 NON-CONTACT: TEMPERATURE SENSOR MARKET IN ROW, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 52 NON-CONTACT: TEMPERATURE SENSOR MARKET IN ROW, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 53 TEMPERATURE SENSOR MARKET, BY OUTPUT, 2021-2024 (USD MILLION)

- TABLE 54 TEMPERATURE SENSOR MARKET, BY OUTPUT, 2025-2030 (USD MILLION)

- TABLE 55 ANALOG: TEMPERATURE SENSOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 56 ANALOG: TEMPERATURE SENSOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 57 DIGITAL: TEMPERATURE SENSOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 58 DIGITAL: TEMPERATURE SENSOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 59 TEMPERATURE SENSOR MARKET, BY CONNECTIVITY, 2021-2024 (USD MILLION)

- TABLE 60 TEMPERATURE SENSOR MARKET, BY CONNECTIVITY, 2025-2030 (USD MILLION)

- TABLE 61 TEMPERATURE SENSOR MARKET, BY END-USER INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 62 TEMPERATURE SENSOR MARKET, BY END-USER INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 63 CHEMICALS: TEMPERATURE SENSOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 64 CHEMICALS: TEMPERATURE SENSOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 65 CHEMICALS: TEMPERATURE SENSOR MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 66 CHEMICALS: TEMPERATURE SENSOR MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 67 OIL & GAS: TEMPERATURE SENSOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 68 OIL & GAS: TEMPERATURE SENSOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 69 OIL & GAS: TEMPERATURE SENSOR MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 70 OIL & GAS: TEMPERATURE SENSOR MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 71 CONSUMER ELECTRONICS: TEMPERATURE SENSOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 72 CONSUMER ELECTRONICS: TEMPERATURE SENSOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 73 CONSUMER ELECTRONICS: TEMPERATURE SENSOR MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 74 CONSUMER ELECTRONICS: TEMPERATURE SENSOR MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 75 ENERGY & POWER: TEMPERATURE SENSOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 76 ENERGY & POWER: TEMPERATURE SENSOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 77 ENERGY & POWER: TEMPERATURE SENSOR MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 78 ENERGY & POWER: TEMPERATURE SENSOR MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 79 HEALTHCARE: TEMPERATURE SENSOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 80 HEALTHCARE: TEMPERATURE SENSOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 81 HEALTHCARE: TEMPERATURE SENSOR MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 82 HEALTHCARE: TEMPERATURE SENSOR MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 83 AUTOMOTIVE: TEMPERATURE SENSOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 84 AUTOMOTIVE: TEMPERATURE SENSOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 85 AUTOMOTIVE: TEMPERATURE SENSOR MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 86 AUTOMOTIVE: TEMPERATURE SENSOR MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 87 METALS & MINING: TEMPERATURE SENSOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 88 METALS & MINING: TEMPERATURE SENSOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 89 METALS & MINING: TEMPERATURE SENSOR MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 90 METALS & MINING: TEMPERATURE SENSOR MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 91 FOOD & BEVERAGES: TEMPERATURE SENSOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 92 FOOD & BEVERAGES: TEMPERATURE SENSOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 93 FOOD & BEVERAGES: TEMPERATURE SENSOR MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 94 FOOD & BEVERAGES: TEMPERATURE SENSOR MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 95 PULP & PAPER: TEMPERATURE SENSOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 96 PULP & PAPER: TEMPERATURE SENSOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 97 PULP & PAPER: TEMPERATURE SENSOR MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 98 PULP & PAPER: TEMPERATURE SENSOR MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 99 AEROSPACE & DEFENSE: TEMPERATURE SENSOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 100 AEROSPACE & DEFENSE: TEMPERATURE SENSOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 101 AEROSPACE & DEFENSE: TEMPERATURE SENSOR MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 102 AEROSPACE & DEFENSE: TEMPERATURE SENSOR MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 103 GLASS: TEMPERATURE SENSOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 104 GLASS: TEMPERATURE SENSOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 105 GLASS: TEMPERATURE SENSOR MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 106 GLASS: TEMPERATURE SENSOR MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 107 OTHER END-USER INDUSTRIES: TEMPERATURE SENSOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 108 OTHER END-USER INDUSTRIES: TEMPERATURE SENSOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 109 OTHER END-USER INDUSTRIES: TEMPERATURE SENSOR MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 110 OTHER END-USER INDUSTRIES: TEMPERATURE SENSOR MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 111 TEMPERATURE SENSOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 112 TEMPERATURE SENSOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 113 NORTH AMERICA: TEMPERATURE SENSOR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 114 NORTH AMERICA: TEMPERATURE SENSOR MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 115 NORTH AMERICA: TEMPERATURE SENSOR MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 116 NORTH AMERICA: TEMPERATURE SENSOR MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 117 NORTH AMERICA: TEMPERATURE SENSOR MARKET, BY END-USER INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 118 NORTH AMERICA: TEMPERATURE SENSOR MARKET, BY END-USER INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 119 NORTH AMERICA: TEMPERATURE SENSOR MARKET, BY OUTPUT, 2021-2024 (USD MILLION)

- TABLE 120 NORTH AMERICA: TEMPERATURE SENSOR MARKET, BY OUTPUT, 2025-2030 (USD MILLION)

- TABLE 121 US: TEMPERATURE SENSOR MARKET, BY END-USER INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 122 US: TEMPERATURE SENSOR MARKET, BY END-USER INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 123 CANADA: TEMPERATURE SENSOR MARKET, BY END-USER INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 124 CANADA: TEMPERATURE SENSOR MARKET, BY END-USER INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 125 MEXICO: TEMPERATURE SENSOR MARKET, BY END-USER INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 126 MEXICO: TEMPERATURE SENSOR MARKET, BY END-USER INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 127 EUROPE: TEMPERATURE SENSOR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 128 EUROPE: TEMPERATURE SENSOR MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 129 EUROPE: TEMPERATURE SENSOR MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 130 EUROPE: TEMPERATURE SENSOR MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 131 EUROPE: TEMPERATURE SENSOR MARKET, BY END-USER INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 132 EUROPE: TEMPERATURE SENSOR MARKET, BY END-USER INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 133 EUROPE: TEMPERATURE SENSOR MARKET, BY OUTPUT, 2021-2024 (USD MILLION)

- TABLE 134 EUROPE: TEMPERATURE SENSOR MARKET, BY OUTPUT, 2025-2030 (USD MILLION)

- TABLE 135 UK: TEMPERATURE SENSOR MARKET, BY END-USER INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 136 UK: TEMPERATURE SENSOR MARKET, BY END-USER INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 137 GERMANY: TEMPERATURE SENSOR MARKET, BY END-USER INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 138 GERMANY: TEMPERATURE SENSOR MARKET, BY END-USER INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 139 FRANCE: TEMPERATURE SENSOR MARKET, BY END-USER INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 140 FRANCE: TEMPERATURE SENSOR MARKET, BY END-USER INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 141 ITALY: TEMPERATURE SENSOR MARKET, BY END-USER INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 142 ITALY: TEMPERATURE SENSOR MARKET, BY END-USER INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 143 REST OF EUROPE: TEMPERATURE SENSOR MARKET, BY END-USER INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 144 REST OF EUROPE: TEMPERATURE SENSOR MARKET, BY END-USER INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 145 ASIA PACIFIC: TEMPERATURE SENSOR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 146 ASIA PACIFIC: TEMPERATURE SENSOR MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 147 ASIA PACIFIC: TEMPERATURE SENSOR MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 148 ASIA PACIFIC: TEMPERATURE SENSOR MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 149 ASIA PACIFIC: TEMPERATURE SENSOR MARKET, BY END-USER INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 150 ASIA PACIFIC: TEMPERATURE SENSOR MARKET, BY END-USER INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 151 ASIA PACIFIC: TEMPERATURE SENSOR MARKET, BY OUTPUT, 2021-2024 (USD MILLION)

- TABLE 152 ASIA PACIFIC: TEMPERATURE SENSOR MARKET, BY OUTPUT, 2025-2030 (USD MILLION)

- TABLE 153 CHINA: TEMPERATURE SENSOR MARKET, BY END-USER INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 154 CHINA: TEMPERATURE SENSOR MARKET, BY END-USER INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 155 JAPAN: TEMPERATURE SENSOR MARKET, BY END-USER INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 156 JAPAN: TEMPERATURE SENSOR MARKET, BY END-USER INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 157 SOUTH KOREA: TEMPERATURE SENSOR MARKET, BY END-USER INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 158 SOUTH KOREA: TEMPERATURE SENSOR MARKET, BY END-USER INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 159 INDIA: TEMPERATURE SENSOR MARKET, BY END-USER INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 160 INDIA: TEMPERATURE SENSOR MARKET, BY END-USER INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 161 REST OF ASIA PACIFIC: TEMPERATURE SENSOR MARKET, BY END-USER INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 162 REST OF ASIA PACIFIC: TEMPERATURE SENSOR MARKET, BY END-USER INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 163 ROW: TEMPERATURE SENSOR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 164 ROW: TEMPERATURE SENSOR MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 165 ROW: TEMPERATURE SENSOR MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 166 ROW: TEMPERATURE SENSOR MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 167 ROW: TEMPERATURE SENSOR MARKET, BY END-USER INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 168 ROW: TEMPERATURE SENSOR MARKET, BY END-USER INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 169 ROW: TEMPERATURE SENSOR MARKET, BY OUTPUT, 2021-2024 (USD MILLION)

- TABLE 170 ROW: TEMPERATURE SENSOR MARKET, BY OUTPUT, 2025-2030 (USD MILLION)

- TABLE 171 SOUTH AMERICA: TEMPERATURE SENSOR MARKET, BY END-USER INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 172 SOUTH AMERICA: TEMPERATURE SENSOR MARKET, BY END-USER INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 173 MIDDLE EAST: TEMPERATURE SENSOR MARKET, BY END-USER INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 174 MIDDLE EAST: TEMPERATURE SENSOR MARKET, BY END-USER INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 175 MIDDLE EAST: TEMPERATURE SENSOR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 176 MIDDLE EAST: TEMPERATURE SENSOR MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 177 GCC: TEMPERATURE SENSOR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 178 GCC: TEMPERATURE SENSOR MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 179 AFRICA: TEMPERATURE SENSOR MARKET, BY END-USER INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 180 AFRICA: TEMPERATURE SENSOR MARKET, BY END-USER INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 181 TEMPERATURE SENSOR MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, JANUARY 2021-MAY 2025

- TABLE 182 TEMPERATURE SENSOR MARKET SHARE ANALYSIS, 2024

- TABLE 183 TEMPERATURE SENSOR MARKET: REGION FOOTPRINT

- TABLE 184 TEMPERATURE SENSOR MARKET: PRODUCT TYPE FOOTPRINT

- TABLE 185 TEMPERATURE SENSOR MARKET: CONNECTIVITY FOOTPRINT

- TABLE 186 TEMPERATURE SENSOR MARKET: OUTPUT FOOTPRINT

- TABLE 187 TEMPERATURE SENSOR MARKET: END-USER INDUSTRY FOOTPRINT

- TABLE 188 TEMPERATURE SENSOR MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 189 TEMPERATURE SENSOR MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 190 TEMPERATURE SENSOR MARKET: PRODUCT LAUNCHES, JANUARY 2021-MAY 2025

- TABLE 191 TEMPERATURE SENSOR MARKET: DEALS, JANUARY 2021-MAY 2025

- TABLE 192 TEMPERATURE SENSOR MARKET: OTHER DEVELOPMENTS, JANUARY 2021-MAY 2025

- TABLE 193 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 194 HONEYWELL INTERNATIONAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 195 HONEYWELL INTERNATIONAL INC.: DEALS

- TABLE 196 TE CONNECTIVITY: COMPANY OVERVIEW

- TABLE 197 TE CONNECTIVITY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 198 TE CONNECTIVITY: DEALS

- TABLE 199 TEXAS INSTRUMENTS INCORPORATED: COMPANY OVERVIEW

- TABLE 200 TEXAS INSTRUMENTS INCORPORATED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 201 ENDRESS+HAUSER GROUP SERVICES AG: COMPANY OVERVIEW

- TABLE 202 ENDRESS+HAUSER GROUP SERVICES AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 203 ENDRESS+HAUSER GROUP SERVICES AG: DEALS

- TABLE 204 ENDRESS+HAUSER GROUP SERVICES AG: EXPANSIONS

- TABLE 205 SIEMENS: COMPANY OVERVIEW

- TABLE 206 SIEMENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 207 SIEMENS: PRODUCT LAUNCHES

- TABLE 208 SIEMENS: DEALS

- TABLE 209 EMERSON ELECTRIC CO.: COMPANY OVERVIEW

- TABLE 210 EMERSON ELECTRIC CO.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 211 EMERSON ELECTRIC CO.: PRODUCT LAUNCHES

- TABLE 212 ANALOG DEVICES, INC.: COMPANY OVERVIEW

- TABLE 213 ANALOG DEVICES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 214 ANALOG DEVICES, INC.: DEALS

- TABLE 215 ANALOG DEVICES, INC.: OTHERS

- TABLE 216 AMPHENOL CORPORATION: COMPANY OVERVIEW

- TABLE 217 AMPHENOL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 218 AMPHENOL CORPORATION: DEALS

- TABLE 219 WIKA ALEXANDER WIEGAND SE & CO. KG: COMPANY OVERVIEW

- TABLE 220 WIKA ALEXANDER WIEGAND SE & CO. KG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 221 MICROCHIP TECHNOLOGY INC.: COMPANY OVERVIEW

- TABLE 222 MICROCHIP TECHNOLOGY INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

List of Figures

- FIGURE 1 TEMPERATURE SENSOR MARKET SEGMENTATION

- FIGURE 2 TEMPERATURE SENSOR MARKET: RESEARCH DESIGN

- FIGURE 3 TEMPERATURE SENSOR MARKET: BOTTOM-UP APPROACH

- FIGURE 4 TEMPERATURE SENSOR MARKET SIZE ESTIMATION METHODOLOGY

- FIGURE 5 TEMPERATURE SENSOR MARKET: TOP-DOWN APPROACH

- FIGURE 6 TEMPERATURE SENSOR MARKET: DATA TRIANGULATION

- FIGURE 7 CONTACT SEGMENT TO ACCOUNT FOR HIGHER MARKET SHARE IN 2025

- FIGURE 8 DIGITAL OUTPUT TO EXHIBIT HIGHER CAGR IN TEMPERATURE SENSOR MARKET FROM 2025 TO 2030

- FIGURE 9 WIRELESS SEGMENT TO GARNER LARGER MARKET SHARE IN 2025

- FIGURE 10 CONSUMER ELECTRONICS INDUSTRY TO DOMINATE MARKET SHARE 2030

- FIGURE 11 ASIA PACIFIC HELD LARGEST MARKET SHARE IN 2024

- FIGURE 12 INCREASING DEMAND FOR PORTABLE HEALTHCARE EQUIPMENT TO FUEL MARKET GROWTH

- FIGURE 13 CONTACT TYPE SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2030

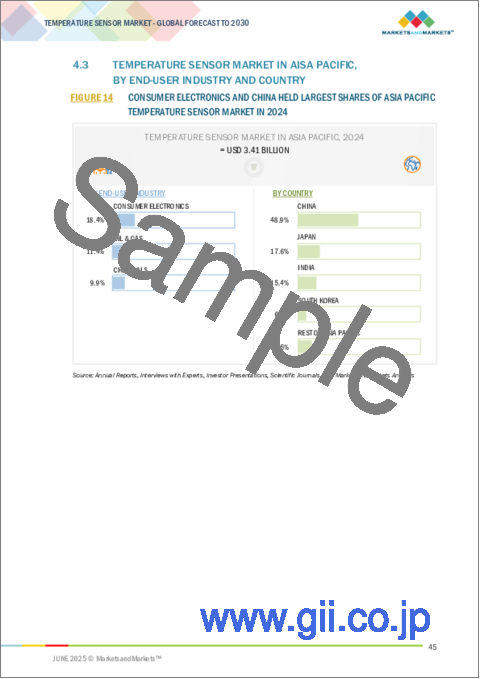

- FIGURE 14 CONSUMER ELECTRONICS AND CHINA HELD LARGEST SHARES OF ASIA PACIFIC TEMPERATURE SENSOR MARKET IN 2024

- FIGURE 15 INDIA TO GROW AT FASTEST CAGR DURING FORECAST PERIOD

- FIGURE 16 TEMPERATURE SENSOR MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 17 TEMPERATURE SENSOR MARKET: DRIVERS AND THEIR IMPACT

- FIGURE 18 AUTOMOTIVE SALES, BY VEHICLE TYPE, 2020-2024 (THOUSAND UNITS)

- FIGURE 19 TEMPERATURE SENSOR MARKET: RESTRAINTS AND THEIR IMPACT

- FIGURE 20 TEMPERATURE SENSOR MARKET: OPPORTUNITIES AND THEIR IMPACT

- FIGURE 21 TEMPERATURE SENSOR MARKET: CHALLENGES AND THEIR IMPACT

- FIGURE 22 VALUE CHAIN ANALYSIS

- FIGURE 23 TEMPERATURE SENSOR MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 24 PRICING RANGE OF THERMISTORS, BY KEY PLAYER, 2024

- FIGURE 25 AVERAGE SELLING PRICE TREND OF TEMPERATURE SENSORS, BY REGION, 2021-2024

- FIGURE 26 INVESTMENT AND FUNDING SCENARIO

- FIGURE 27 TEMPERATURE SENSOR MARKET: PATENTS APPLIED AND GRANTED, 2014-2024

- FIGURE 28 IMPORT DATA FOR PRODUCTS COVERED UNDER HS CODE 902519, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 29 EXPORT DATA FOR PRODUCTS COVERED UNDER HS CODE 902519, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 30 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USER INDUSTRIES

- FIGURE 31 KEY BUYING CRITERIA FOR TOP THREE END-USER INDUSTRIES

- FIGURE 32 TEMPERATURE SENSOR MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 33 TEMPERATURE SENSOR MARKET, BY PRODUCT TYPE

- FIGURE 34 NON-CONTACT SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 35 TEMPERATURE SENSOR MARKET, BY OUTPUT

- FIGURE 36 DIGITAL OUTPUT TO DOMINATE TEMPERATURE SENSOR MARKET FROM 2025 TO 2030

- FIGURE 37 TEMPERATURE SENSOR MARKET, BY CONNECTIVITY

- FIGURE 38 WIRED CONNECTIVITY TO SECURE LARGER MARKET SHARE IN 2025

- FIGURE 39 TEMPERATURE SENSOR MARKET, BY END-USER INDUSTRY

- FIGURE 40 CONSUMER ELECTRONICS INDUSTRY TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 41 TEMPERATURE SENSOR MARKET, BY REGION

- FIGURE 42 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 43 NORTH AMERICA: TEMPERATURE SENSOR MARKET SNAPSHOT

- FIGURE 44 EUROPE: TEMPERATURE SENSOR MARKET SNAPSHOT

- FIGURE 45 ASIA PACIFIC: TEMPERATURE SENSOR MARKET SNAPSHOT

- FIGURE 46 TEMPERATURE SENSOR MARKET: REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2020-2024

- FIGURE 47 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS, 2024

- FIGURE 48 COMPANY VALUATION

- FIGURE 49 FINANCIAL METRICS (EV/EBITDA)

- FIGURE 50 BRAND COMPARISON

- FIGURE 51 TEMPERATURE SENSOR MARKET: COMPANY EVALUATION MATRIX, 2024

- FIGURE 52 TEMPERATURE SENSOR MARKET: COMPANY FOOTPRINT

- FIGURE 53 TEMPERATURE SENSOR MARKET: STARTUPS/SME EVALUATION MATRIX, 2024

- FIGURE 54 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 55 TE CONNECTIVITY: COMPANY SNAPSHOT

- FIGURE 56 TEXAS INSTRUMENTS INCORPORATED: COMPANY SNAPSHOT

- FIGURE 57 ENDRESS+HAUSER GROUP SERVICES AG: COMPANY SNAPSHOT

- FIGURE 58 SIEMENS: COMPANY SNAPSHOT

- FIGURE 59 EMERSON ELECTRIC CO.: COMPANY SNAPSHOT

- FIGURE 60 ANALOG DEVICES, INC.: COMPANY SNAPSHOT

- FIGURE 61 AMPHENOL CORPORATION: COMPANY SNAPSHOT

- FIGURE 62 MICROCHIP TECHNOLOGY INC: COMPANY SNAPSHOT

The global temperature sensor market is projected to grow from USD 7.43 billion in 2025 to USD 8.94 billion by 2030 at a CAGR of 3.8% from 2025 to 2030. The adoption of wearable devices is increasing rapidly, with many end users seeking such technologies to improve their fitness and overall health. Currently, 1 in 6 people own and use a wearable device, and this adoption trend is expected to grow in the coming years. Several temperature sensors are embedded in wearable devices to monitor body parameters. These sensors are used in devices such as smartwatches and fitness activity trackers. The demand for temperature sensors in wearables, such as smartwatches and fitness trackers, is increasing as the technology enables the effective monitoring and measurement of bodily activities, such as heart rate and body temperature. With technological advancements, the demand for enhanced and improved wearables is also expected to grow.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Connectivity, Output, Product, End-use Industry, and Region |

| Regions covered | North America, Europe, APAC, RoW |

"Contact type to account for larger market share in 2030"

Contact temperature sensors require physical contact with the substance/object/source. They can detect solid, liquid, or gaseous elements covering a range of temperatures. These sensors include thermocouples, RTDs, thermistors, temperature sensor ICs, and bimetallic temperature sensors. The use of these sensors differs based on the application. The application of contact temperature sensors is prevalent in a variety of industries, including chemicals, consumer electronics, oil & gas, energy & power, and automotive, due to their low cost, temperature range, and accuracy. Some of the major players that offer contact temperature sensors are Honeywell International Inc. (US), TE Connectivity (Switzerland), Dwyer Instruments, LLC. (US), and Texas Instruments Incorporated (US).

"Wired to capture the largest share of the temperature sensor market during the forecast period"

A wired temperature sensor is a device that measures temperature and converts the input data into a measurable signal, which can be recorded and monitored to track temperature changes. The demand for reliable and accurate temperature monitoring is increasing. Due to its connectivity, the wired temperature sensor segment is expected to hold a larger share of the temperature sensor market. Recent years have seen an increasing use of temperature sensors across multiple industries due to their low price, broad temperature range, and high levels of accuracy. For example, the chemical, consumer electronics, oil & gas, energy & power, or automotive industries have seen significant increases in the use of contact temperature sensors. Other wired temperature sensors can provide stability, accuracy, and a fast response time, making them the best candidates for critical industrial processes that require temperature control. Several manufacturers have started to manufacture temperature sensors. For example, in 2022, Temp-Pro, which manufactures temperature sensors, unveiled Helical Thermowell, which was developed to fill the void in the temperature sensor industry for high-velocity services.

"China to hold largest share in Asia Pacific of temperature sensor market in 2030"

China is one of the leaders in the Asia Pacific temperature sensor market as of 2030 and is most likely going to continue to lead the market size during the forecast period. The country has an aggressively growing economy that is aiding in the development of the temperature sensor market. It is the largest consumer of electricity in the Asia Pacific, primarily owing to its rapid industrialization and high population. Growing demand from the energy & power sector will be one of the key drivers for the market. It plans to invest heavily in renewable energy resources, which is anticipated to boost the demand for temperature sensors. Transformer monitoring systems, which deploy temperature sensors, are increasingly used in the country, which is likely to surge the demand for temperature sensors in the coming years.

Extensive primary interviews were conducted with key industry experts in the temperature sensor market space to determine and verify the market size for various segments and subsegments gathered through secondary research. The breakup of primary participants for the report is shown below: The study contains insights from various industry experts, from component suppliers to Tier 1

companies and OEMs. The breakup of the primaries is as follows:

- By Company Type: Tier 1 - 40%, Tier 2 - 35%, and Tier 3 - 25%

- By Designation: C-level Executives - 45%, Directors - 35%, and Others - 20%

- By Region: North America - 30%, Europe - 22%, Asia Pacific - 40%, and RoW - 8%

Note: Three tiers of companies are defined based on their total revenue as of 2024; tier 1: revenue more than or equal to USD 500 million, tier 2: revenue between USD 100 million and USD 500 million, and tier 3: revenue less than or equal to USD 100 million. Other designations include sales and marketing executives and researchers, as well as members of various temperature sensor organizations.

Some key players in the temperature sensor market are Honeywell International Inc. (US), TE Connectivity (Switzerland), Texas Instruments Incorporated (US), Endress+Hauser Group Services AG (Switzerland), Siemens (Germany), Emerson Electric Co. (US), Analog Devices, Inc. (US), Amphenol Corporation (US), WIKA Alexander Wiegand SE & Co. KG (Germany), and Microchip Technology Inc. (US).

The study includes an in-depth competitive analysis of these key players in the temperature sensor market, with their company profiles, recent developments, and key market strategies.

Study Coverage: This research report categorizes the temperature sensor market based on connectivity (wired, wireless), product (contact type, non-contact type), output (analog, digital), end-use industry (chemicals, oil & gas, consumer electronics, energy & power, healthcare, automotive, metals & mining, food & beverages, pulp & paper, aerospace & defense, glass, others), and region (North America, Europe, Asia Pacific, and RoW). The report describes the major drivers, restraints, challenges, and opportunities pertaining to the temperature sensor market and forecasts the same till 2030. The report also consists of leadership mapping and analysis of all the companies included in the temperature sensor ecosystem.

Key Benefits of Buying the Report The report will help the market leaders/new entrants in this market by providing information on the closest approximations of the revenue numbers for the overall temperature sensor market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (surging demand for portable health monitoring systems, rising popularity of autonomous vehicles, escalating adoption of Industry 4.0 and IoT technologies, increasing need for sensors to control spacecraft remotely), restraints (fluctuations in raw material costs), opportunities (rising preference for wearable devices, increasing consumption of packaged foods, mounting investment in IoT research projects), and challenges (stringent performance requirements for advanced applications, intense price competition among manufacturers) influencing the growth of the temperature sensor market

- Product Development/Innovation: Detailed insights into upcoming technologies, research and development activities, and the latest product and service launches in the temperature sensor market

- Market Development: Comprehensive information about lucrative markets - the report analyzes the temperature sensor market across varied regions

- Market Diversification: Exhaustive information about new products and services, untapped geographies, recent developments, and investments in the temperature sensor market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players, such as Honeywell International Inc. (US), TE Connectivity (Switzerland), Texas Instruments Incorporated (US), Endress+Hauser Group Services AG (Switzerland), and Siemens (Germany), in the temperature sensor market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.3.3 CURRENCY CONSIDERED

- 1.3.4 UNIT CONSIDERED

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of primary interview participants

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Breakdown of primaries

- 2.1.2.4 Key industry insights

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION METHODOLOGY

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to derive market size using bottom-up approach (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to derive market size using top-down approach (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN TEMPERATURE SENSOR MARKET

- 4.2 TEMPERATURE SENSOR MARKET, BY PRODUCT TYPE

- 4.3 TEMPERATURE SENSOR MARKET IN Asia Pacific, BY END-USER INDUSTRY AND COUNTRY

- 4.4 TEMPERATURE SENSOR MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Surging demand for portable health monitoring systems

- 5.2.1.2 Rising popularity of autonomous vehicles

- 5.2.1.3 Escalating adoption of Industry 4.0 and IoT technologies

- 5.2.1.4 Increasing need for sensors to control spacecraft remotely

- 5.2.2 RESTRAINTS

- 5.2.2.1 Fluctuations in raw material costs

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising preference for wearable devices

- 5.2.3.2 Increasing consumption of packaged foods

- 5.2.3.3 Surging investments in IoT research projects

- 5.2.4 CHALLENGES

- 5.2.4.1 Stringent performance requirements for advanced applications

- 5.2.4.2 Intense price competition among manufacturers

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE TREND, BY PRODUCT TYPE, 2024

- 5.6.2 PRICING RANGE OF THERMISTORS, BY KEY PLAYER, 2024

- 5.6.3 AVERAGE SELLING PRICE TREND OF TEMPERATURE SENSORS, BY REGION, 2021-2024

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 MEMS temperature sensors

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 IoT

- 5.7.3 ADJACENT TECHNOLOGIES

- 5.7.3.1 Miniature fiber-optic temperature sensors

- 5.7.1 KEY TECHNOLOGIES

- 5.8 CASE STUDY ANALYSIS

- 5.8.1 PEAK SENSORS LTD DESIGNS TYPE B THERMOCOUPLES TO ADDRESS CERAMIC COMPONENT FAILURE ISSUES

- 5.8.2 PYROCONTROLE PROPOSES TEMPERATURE SENSOR ASSEMBLY USING IN-SITU CALIBRATION TECHNOLOGY

- 5.8.3 PEAK SENSORS LTD IMPROVES DOUBLE-PRESSURE CONTAINMENT TO EASE DEVELOPMENT OF NOVEL REACTION VESSELS

- 5.9 INVESTMENT AND FUNDING SCENARIO

- 5.10 IMPACT OF GEN AI/AI ON TEMPERATURE SENSOR MARKET

- 5.11 PATENT ANALYSIS

- 5.12 TRADE ANALYSIS

- 5.13 TARIFF ANALYSIS

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.14.2 BUYING CRITERIA

- 5.15 PORTER'S FIVE FORCES ANALYSIS

- 5.15.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.15.2 THREAT OF SUBSTITUTES

- 5.15.3 BARGAINING POWER OF BUYERS

- 5.15.4 BARGAINING POWER OF SUPPLIERS

- 5.15.5 THREAT OF NEW ENTRANTS

- 5.16 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.17 REGULATORY LANDSCAPE AND STANDARDS

- 5.17.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.17.2 STANDARDS

- 5.18 IMPACT OF US TARIFF- TEMPERATURE SENSOR MARKET

- 5.18.1 INTRODUCTION

- 5.18.2 KEY TARIFF RATES

- 5.18.3 PRICE IMPACT ANALYSIS

- 5.18.4 IMPACT ON COUNTRY/REGION

- 5.18.4.1 US

- 5.18.5 EUROPE

- 5.18.6 ASIA PACIFIC

- 5.18.7 IMPACT ON END-USER INDUSTRIES

- 5.18.7.1 Consumer Electronics

- 5.18.7.2 Oil & Gas

- 5.18.7.3 Chemical

- 5.18.7.4 Energy & Power

6 TEMPERATURE SENSOR MARKET, BY PRODUCT TYPE

- 6.1 INTRODUCTION

- 6.2 CONTACT

- 6.2.1 BIMETALLIC TEMPERATURE SENSORS

- 6.2.1.1 Growing adoption of wearable devices and increasing need in food safety to boost demand

- 6.2.2 THERMOCOUPLES

- 6.2.2.1 Growing application in petrochemicals, processes, and metal industries to boost demand

- 6.2.3 RESISTIVE TEMPERATURE DETECTORS

- 6.2.3.1 Rising demand for advanced temperature monitoring solutions to fuel market growth

- 6.2.4 THERMISTORS

- 6.2.4.1 Emergence of new technologies in healthcare industry to boost demand

- 6.2.5 TEMPERATURE SENSOR ICS

- 6.2.5.1 Recent trends in personal computing applications to offer lucrative growth opportunities

- 6.2.1 BIMETALLIC TEMPERATURE SENSORS

- 6.3 NON-CONTACT

- 6.3.1 INFRARED TEMPERATURE SENSORS

- 6.3.1.1 Adoption of infrared sensors to detect hazardous activities in chemical facilities to fuel segmental growth

- 6.3.2 FIBER-OPTIC TEMPERATURE SENSORS

- 6.3.2.1 Intrinsic safety and high-temperature operating capabilities to boost segmental growth

- 6.3.1 INFRARED TEMPERATURE SENSORS

7 TEMPERATURE SENSOR MARKET, BY OUTPUT

- 7.1 INTRODUCTION

- 7.2 ANALOG

- 7.2.1 GROWING DEMAND IN AUTOMOTIVE, CONSUMER ELECTRONICS, AND MEDICAL & HEALTHCARE SECTORS TO DRIVE MARKET

- 7.3 DIGITAL

- 7.3.1 ADVANTAGES REGARDING RANGE-BOUND ALERT SIGNALING TO DRIVE MARKET

- 7.3.2 SINGLE-CHANNEL DIGITAL TEMPERATURE SENSORS

- 7.3.3 MULTI-CHANNEL DIGITAL TEMPERATURE SENSORS

8 TEMPERATURE SENSOR MARKET, BY CONNECTIVITY

- 8.1 INTRODUCTION

- 8.2 WIRELESS

- 8.2.1 INCREASING DEVELOPMENT OF SENSORS WITH IN-BUILT EDGE AI AND MESH CONNECTIVITY TO ACCELERATE SEGMENTAL GROWTH

- 8.3 WIRED

- 8.3.1 HIGH ACCURACY AND LOW COST TO BOOST DEMAND

9 TEMPERATURE SENSOR MARKET, BY END-USER INDUSTRY

- 9.1 INTRODUCTION

- 9.2 CHEMICALS

- 9.2.1 DEPLOYMENT OF AUTOMATION AND PROCESS CONTROL TECHNOLOGIES IN CHEMICAL PLANTS TO BOOST SEGMENTAL GROWTH

- 9.3 OIL & GAS

- 9.3.1 NEED FOR EARLY DETECTION OF POTENTIAL HAZARDS IN OIL & GAS INDUSTRIES TO DRIVE MARKET

- 9.4 CONSUMER ELECTRONICS

- 9.4.1 ONGOING TECHNOLOGICAL ADVANCEMENTS IN CONSUMER ELECTRONICS TO OFFER LUCRATIVE GROWTH OPPORTUNITIES

- 9.5 ENERGY & POWER

- 9.5.1 GROWING CONCERNS REGARDING ENVIRONMENTAL POLLUTION TO BOOST DEMAND

- 9.6 HEALTHCARE

- 9.6.1 REDUCED HEALTHCARE COSTS AND IMPROVED TREATMENT OUTCOMES TO DRIVE MARKET

- 9.7 AUTOMOTIVE

- 9.7.1 RISING APPLICATION IN HVAC SYSTEMS OF CARS TO SUPPORT MARKET GROWTH

- 9.8 METALS & MINING

- 9.8.1 INCREASING APPLICATION FOR MINERAL EXTRACTION, REFINING, ENGINE MONITORING, AND DIE CASTING TO FUEL MARKET GROWTH

- 9.9 FOOD & BEVERAGES

- 9.9.1 NEED TO DETECT SUDDEN TEMPERATURE CHANGES TO REDUCE FOOD WASTAGE TO FOSTER MARKET GROWTH

- 9.10 PULP & PAPER

- 9.10.1 NEED TO MAINTAIN ACCURATE TEMPERATURE LEVELS IN PULPING AND BLEACHING PROCESSES TO DRIVE MARKET

- 9.11 AEROSPACE & DEFENSE

- 9.11.1 NEED TO MEASURE AIRCRAFT SKIN TEMPERATURE, ENVIRONMENTAL TEMPERATURE, AND FLUID TEMPERATURE THROUGH CONDUIT SURFACE TO FUEL MARKET GROWTH

- 9.12 GLASS

- 9.12.1 IMPROVED EFFICIENCY OF GLASS PLANTS BY MAINTAINING STANDARDIZED QUALITY AND REDUCED SCRAPS OF GLASS PRODUCTS TO FUEL MARKET GROWTH

- 9.13 OTHER END-USER INDUSTRIES

10 TEMPERATURE SENSOR MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 US

- 10.2.1.1 Increasing adoption of smart home devices to contribute to market growth

- 10.2.2 CANADA

- 10.2.2.1 Rising production of heavy machinery and electronic devices to fuel market growth

- 10.2.3 MEXICO

- 10.2.3.1 Emphasis on achieving universal healthcare coverage to fuel market growth

- 10.2.1 US

- 10.3 EUROPE

- 10.3.1 UK

- 10.3.1.1 Thriving high-end consumer electronics industry to foster market growth

- 10.3.2 GERMANY

- 10.3.2.1 Rising implementation of Industry 4.0 to digitalize manufacturing operations to propel market growth

- 10.3.3 FRANCE

- 10.3.3.1 Increasing focus on electricity generation using recycled nuclear fuels to boost demand

- 10.3.4 ITALY

- 10.3.4.1 Increasing focus on Industry 4.0 fuels to accelerate demand

- 10.3.5 REST OF EUROPE

- 10.3.1 UK

- 10.4 ASIA PACIFIC

- 10.4.1 CHINA

- 10.4.1.1 Launch of 5G services and surging technological developments to offer lucrative growth opportunities

- 10.4.2 JAPAN

- 10.4.2.1 Heightened demand for home automation systems to boost market growth

- 10.4.3 SOUTH KOREA

- 10.4.3.1 Increased funds for semiconductor manufacturing to augment market growth

- 10.4.4 INDIA

- 10.4.4.1 Expanding oil refineries to contribute to market growth

- 10.4.5 REST OF ASIA PACIFIC

- 10.4.1 CHINA

- 10.5 ROW

- 10.5.1 SOUTH AMERICA

- 10.5.1.1 Surging electronics manufacturing to fuel market growth

- 10.5.2 MIDDLE EAST

- 10.5.2.1 Expanding oil & gas, petrochemical, power generation, and consumer electronics industries to boost demand

- 10.5.2.2 GCC

- 10.5.2.2.1 Saudi Arabia

- 10.5.2.2.1.1 Rising investments in industrial diversification, energy optimization, and infrastructure upgrades to drive market

- 10.5.2.2.2 UAE

- 10.5.2.2.2.1 Government-led initiatives to support IoT, AI, and automation to fuel market growth

- 10.5.2.2.3 Rest of GCC

- 10.5.2.2.1 Saudi Arabia

- 10.5.2.3 Rest of Middle East

- 10.5.3 AFRICA

- 10.5.3.1 Increasing adoption of electronic devices in connected devices and automobile industry to boost demand

- 10.5.1 SOUTH AMERICA

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 11.3 MARKET SHARE ANALYSIS, 2024

- 11.4 REVENUE ANALYSIS, 2020-2024

- 11.5 MARKET SHARE ANALYSIS, 2024

- 11.6 COMPANY VALUATION AND FINANCIAL METRICS

- 11.7 BRAND COMPARISON

- 11.8 COMPANY EVALUATION MATRIX, 2024

- 11.8.1 STARS

- 11.8.2 EMERGING LEADERS

- 11.8.3 PERVASIVE PLAYERS

- 11.8.4 PARTICIPANTS

- 11.8.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.8.5.1 Company footprint

- 11.8.5.2 Region footprint

- 11.8.5.3 Product type footprint

- 11.8.5.4 Connectivity footprint

- 11.8.5.5 Output footprint

- 11.8.5.6 End-user industry footprint

- 11.9 STARTUP/SMALL- AND MEDIUM-SIZED ENTERPRISE (SME) EVALUATION MATRIX, 2024

- 11.9.1 PROGRESSIVE COMPANIES

- 11.9.2 RESPONSIVE COMPANIES

- 11.9.3 DYNAMIC COMPANIES

- 11.9.4 STARTING BLOCKS

- 11.9.5 COMPETITIVE BENCHMARKING

- 11.10 COMPETITIVE SCENARIOS

- 11.10.1 PRODUCT LAUNCHES

- 11.10.2 DEALS

- 11.10.3 OTHER DEVELOPMENTS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 HONEYWELL INTERNATIONAL INC.

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Deals

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths/Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses/Competitive threats

- 12.1.2 TE CONNECTIVITY

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Deals

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths/Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses/Competitive threats

- 12.1.3 TEXAS INSTRUMENTS INCORPORATED

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 MnM view

- 12.1.3.3.1 Key strengths/Right to win

- 12.1.3.3.2 Strategic choices

- 12.1.3.3.3 Weaknesses/Competitive threats

- 12.1.4 ENDRESS+HAUSER GROUP SERVICES AG

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Deals

- 12.1.4.3.2 Expansions

- 12.1.4.4 MnM view

- 12.1.4.4.1 Key strengths/Right to win

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses/Competitive threats

- 12.1.5 SIEMENS

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions/Services offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Product launches

- 12.1.5.3.2 Deals

- 12.1.5.4 MnM view

- 12.1.5.4.1 Key strengths/Right to win

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses/Competitive threats

- 12.1.6 EMERSON ELECTRIC CO.

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Product launches

- 12.1.7 ANALOG DEVICES, INC.

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Deals

- 12.1.7.3.2 Others

- 12.1.8 AMPHENOL CORPORATION

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions/Services offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Deals

- 12.1.9 WIKA ALEXANDER WIEGAND SE & CO. KG

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.10 MICROCHIP TECHNOLOGY INC.

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions/Services offered

- 12.1.1 HONEYWELL INTERNATIONAL INC.

- 12.2 OTHER PLAYERS

- 12.2.1 STMICROELECTRONICS

- 12.2.2 NXP SEMICONDUCTORS

- 12.2.3 OMEGA ENGINEERING, INC.

- 12.2.4 YOKOGAWA ELECTRIC CORPORATION

- 12.2.5 MURATA MANUFACTURING CO., LTD.

- 12.2.6 IFM ELECTRONIC GMBH

- 12.2.7 DWYER INSTRUMENTS, LLC.

- 12.2.8 VISHAY INTERTECHNOLOGY, INC.

- 12.2.9 PANASONIC CORPORATION

- 12.2.10 DENSO CORPORATION

- 12.2.11 KONGSBERG MARITIME

- 12.2.12 AMETEK, INC.

- 12.2.13 AMS-OSRAM AG

- 12.2.14 FLIR SYSTEMS, INC.

- 12.2.15 PYROMATION

13 APPENDIX

- 13.1 INSIGHT FROM INDUSTRY EXPERTS

- 13.2 DISCUSSION GUIDE

- 13.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.4 CUSTOMIZATION OPTIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS