|

|

市場調査レポート

商品コード

1745108

配送ロボットの世界市場:車輪数別、積載量別、タイプ別、制限速度別、最終用途産業別、地域別 - 2030年までの予測Delivery Robots Market by Type (Indoor and Outdoor), Load Carrying Capacity (Up to 10 kg, more than 10 kg to 50 kg, more than 50 kg), Number of Wheels (3 wheels, 4 wheels, 6 wheels), Speed Limit, End-use Industry and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 配送ロボットの世界市場:車輪数別、積載量別、タイプ別、制限速度別、最終用途産業別、地域別 - 2030年までの予測 |

|

出版日: 2025年06月03日

発行: MarketsandMarkets

ページ情報: 英文 252 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

配送ロボットの市場規模は、予測期間中のCAGRが32.4%となり、2025年の7億9,560万米ドルから2030年には32億3,650万米ドルに達すると予測されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(100万米ドル) |

| セグメント別 | 車輪数別、積載量別、タイプ別、制限速度別、最終用途産業別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

ロボット工学と人工知能(AI)の進歩により、配送ロボットの能力は大幅に向上しています。これらの技術により、ロボットは複雑な都市環境をナビゲートし、障害物を回避し、効率的に商品を届けることができます。このような有望な利点があるにもかかわらず、配送ロボットの導入は初期コストの高さと規制上のハードルによって妨げられています。自律型配送ロボットの開発・導入には、技術、インフラ、地域規制への対応に多額の投資が必要となります。

予測期間中、配送ロボットが最も高い成長を遂げるのは小売業分野とみられています。これは、特に食料品やeコマースの分野で、便利で低コストのラストワンマイル配送ソリューションに対する需要が高まっているためです。Sグループ(フィンランド)やアマゾン(米国)のような企業は、迅速なサービスを求める顧客の要望に応えるだけでなく、配達の効率性を高めるために自律型ロボットの利用を増やしています。例えば、Sグループ(フィンランド)は、ロボットの保有店舗を100店舗以上に拡大し、15万件以上の配送を行っています。一方、アマゾン(米国)は、フルフィルメントセンターにロボットを導入し続け、工程の削減を目指しています。

可搬重量50kg以上のロボットは、主に食料品の配送やオンラインショッパーが求める重い小包の配送に使用されます。量的には、これらのロボットは2024年に~25%の市場シェアを占めました。中国第2位のオンライン小売業者JD.comは、JDXと名付けられた自動運転車両を開発し、積載量300kgのラスト・マイル・デリバリーを実施しています。Nuro(米国)が開発したR1もこのカテゴリーに入る配送ロボットで、125kgの荷物を運ぶことができます。

過去20年間の急速な経済開発により、中国は製造業主導からイノベーション主導の経済へと移行する意欲を高めてきました。その結果、中国政府は、この移行をリードするために必要となる高度なスキルを持つ人材を育成し、引きつけるために、多くの大胆な研究イニシアチブを支援してきました。

中国市場で有数のeコマース企業であるJD.com(中国)は、1億5,000万米ドル以上を投じて西安国家民間航空宇宙産業基地と共同で研究開発センターを建設し、未来型スマート・ロジスティクス・ソリューションの開発を計画しています。同社が開発した配送ロボットは、最大積載量300kg、時速15KPHで複数の商品を配送することができます。2021年4月、中国を拠点とするAlibaba Groupは、荷物の配送プロセスをより迅速かつコスト効率的にするため、今後1年間で中国の大学キャンパスや地域コミュニティに1,000台のロボットを配備すると発表しました。

当レポートでは、世界の配送ロボット市場について調査し、車輪数別、積載量別、タイプ別、制限速度別、最終用途産業別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客ビジネスに影響を与える動向/混乱

- 価格分析

- バリューチェーン分析

- エコシステム分析

- 投資と資金調達のシナリオ

- 技術動向

- ケーススタディ分析

- 特許分析

- 貿易分析

- 関税と規制状況

- 主要な会議とイベント

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- AI/生成AIが配送ロボット市場に与える影響

- 2025年の米国関税が配送ロボット市場に与える影響

第6章 配送ロボット市場(車輪数別)

- イントロダクション

- 3輪

- 4輪

- 6輪

第7章 配送ロボット市場(積載量別)

- イントロダクション

- 10kg未満

- 10kg~50kg

- 50kg超

第8章 配送ロボット市場(タイプ別)

- イントロダクション

- 屋外

- 屋内

第9章 配送ロボット市場(制限速度別)

- イントロダクション

- 時速3キロメートル未満

- 時速3~6キロ

- 時速6キロ超

第10章 配送ロボット市場(最終用途産業別)

- イントロダクション

- 食品・飲料

- 小売

- ヘルスケア

- 郵便

- その他

第11章 配送ロボット市場(地域別)

- イントロダクション

- 北米

- 北米のマクロ経済見通し

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州のマクロ経済見通し

- 英国

- ドイツ

- スイス

- フランス

- イタリア

- スペイン

- ポーランド

- 北欧

- その他

- アジア太平洋

- アジア太平洋のマクロ経済見通し

- 中国

- 日本

- 韓国

- インド

- オーストラリア

- インドネシア

- マレーシア

- ベトナム

- タイ

- その他

- その他の地域

- その他の地域のマクロ経済見通し

- 中東

- アフリカ

- 南米

第12章 競合情勢

- 概要

- 市場評価フレームワーク

- 配送ロボット市場における主要企業の収益分析

- 市場シェア分析、2024年

- 企業評価と財務指標、2024年

- ブランド/製品比較分析

- 企業評価象限

- 企業評価マトリックス:スタートアップ/中小企業(2024年)

- 競争シナリオ

第13章 企業プロファイル

- イントロダクション

- 主要参入企業

- STARSHIP TECHNOLOGIES

- JD.COM, INC.

- PANASONIC HOLDINGS CORPORATION

- RELAY ROBOTICS INC.

- NURO, INC.

- BOSTON DYNAMICS

- ELIPORT

- KIWIBOT

- ALIBABA GROUP HOLDING LIMITED

- OTTONOMY.IO

- その他の企業

- PIAGGIO & C. SPA

- TELERETAIL

- AETHON

- CLEVERON AS

- UDELV, INC.

- SEGWAY ROBOTICS

- SERVE ROBOTICS

- EFFIDENCE

- ANYBOTICS

- NEOLIX HUITONG(BEIJING)TECHNOLOGY CO., LTD.

- BEIJING ZHEN ROBOTICS CO. LTD

- TWINSWHEEL

- DELIVERS.AI LTD

- SHENZHEN REEMAN INTELLIGENT EQUIPMENT CO., LTD.

- PUDU TECHNOLOGY INC.

第14章 付録

List of Tables

- TABLE 1 AVERAGE SELLING PRICE ANALYSIS OF DELIVERY ROBOTS OFFERED BY KEY PLAYERS, 2024

- TABLE 2 AVERAGE SELLING PRICE OF DELIVERY ROBOTS WITH 3 WHEELS

- TABLE 3 AVERAGE SELLING PRICE OF DELIVERY ROBOTS WITH 4 WHEELS

- TABLE 4 AVERAGE SELLING PRICE OF DELIVERY ROBOTS WITH 6 WHEELS

- TABLE 5 AVERAGE SELLING PRICE TREND OF 3-WHEELS DELIVERY ROBOTS, BY REGION, 2021 TO 2024

- TABLE 6 COMPANIES AND THEIR ROLE IN DELIVERY ROBOTS ECOSYSTEM

- TABLE 7 TOP 20 PATENT OWNERS IN LAST 10 YEARS

- TABLE 8 MAJOR PATENTS RELATED TO DELIVERY ROBOTS

- TABLE 9 IMPORT SCENARIO FOR HS CODE 842710-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD THOUSAND)

- TABLE 10 EXPORT SCENARIO FOR HS CODE 842710-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD THOUSAND)

- TABLE 11 MFN TARIFFS FOR HS CODE 842710-COMPLIANT PRODUCTS EXPORTED BY US, 2024

- TABLE 12 MFN TARIFFS FOR HS CODE 842710-COMPLIANT PRODUCTS EXPORTED BY CHINA, 2024

- TABLE 13 MFN TARIFFS FOR HS CODE 842710-COMPLIANT PRODUCTS EXPORTED BY GERMANY, 2024

- TABLE 14 MFN TARIFFS FOR HS CODE 842710-COMPLIANT PRODUCTS EXPORTED BY ITALY, 2024

- TABLE 15 MFN TARIFFS FOR HS CODE 842710-COMPLIANT PRODUCTS EXPORTED BY UK, 2024

- TABLE 16 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 DELIVERY ROBOTS MARKET: CONFERENCES AND EVENTS, 2025-2026

- TABLE 21 IMPACT OF PORTER'S FIVE FORCES ON DELIVERY ROBOTS MARKET

- TABLE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES

- TABLE 23 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- TABLE 24 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 25 DELIVERY ROBOTS MARKET, BY NUMBER OF WHEELS, 2021-2024 (USD MILLION)

- TABLE 26 DELIVERY ROBOTS MARKET, BY NUMBER OF WHEELS, 2025-2030 (USD MILLION)

- TABLE 27 DELIVERY ROBOTS MARKET, BY NUMBER OF WHEELS, 2021-2024 (UNITS)

- TABLE 28 DELIVERY ROBOTS MARKET, BY NUMBER OF WHEELS, 2025-2030 (UNITS)

- TABLE 29 DELIVERY ROBOTS MARKET, BY LOAD CARRYING CAPACITY, 2021-2024 (USD MILLION)

- TABLE 30 DELIVERY ROBOTS MARKET, BY LOAD CARRYING CAPACITY, 2025-2030 (USD MILLION)

- TABLE 31 DELIVERY ROBOTS MARKET, BY LOAD CARRYING CAPACITY, 2021-2024 (UNITS)

- TABLE 32 DELIVERY ROBOTS MARKET, BY LOAD CARRYING CAPACITY, 2025-2030 (UNITS)

- TABLE 33 UP TO 10 KG: DELIVERY ROBOTS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD THOUSAND)

- TABLE 34 UP TO 10 KG: DELIVERY ROBOTS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD THOUSAND)

- TABLE 35 UP TO 10 KG: DELIVERY ROBOTS MARKET, BY END-USE INDUSTRY, 2021-2024 (UNITS)

- TABLE 36 UP TO 10 KG: DELIVERY ROBOTS MARKET, BY END-USE INDUSTRY, 2025-2030 (UNITS)

- TABLE 37 MORE THAN 10 KG UP TO 50 KG: DELIVERY ROBOTS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD THOUSAND)

- TABLE 38 MORE THAN 10 KG UP TO 50 KG: DELIVERY ROBOTS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD THOUSAND)

- TABLE 39 MORE THAN 10 KG UP TO 50 KG: DELIVERY ROBOTS MARKET, BY END-USE INDUSTRY, 2021-2024 (UNITS)

- TABLE 40 MORE THAN 10 KG UP TO 50 KG: DELIVERY ROBOTS MARKET, BY END-USE INDUSTRY, 2025-2030 (UNITS)

- TABLE 41 MORE THAN 50 KG: DELIVERY ROBOTS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD THOUSAND)

- TABLE 42 MORE THAN 50 KG: DELIVERY ROBOTS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD THOUSAND)

- TABLE 43 MORE THAN 50 KG: DELIVERY ROBOTS MARKET, BY END-USE INDUSTRY, 2021-2024 (UNITS)

- TABLE 44 MORE THAN 50 KG: DELIVERY ROBOTS MARKET, BY END-USE INDUSTRY, 2025-2030 (UNITS)

- TABLE 45 DELIVERY ROBOTS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 46 DELIVERY ROBOTS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 47 DELIVERY ROBOTS MARKET, BY SPEED LIMIT, 2021-2024 (USD MILLION)

- TABLE 48 DELIVERY ROBOTS MARKET, BY SPEED LIMIT, 2025-2030 (USD MILLION)

- TABLE 49 DELIVERY ROBOTS MARKET, BY SPEED LIMIT, 2021-2024 (UNITS)

- TABLE 50 DELIVERY ROBOTS MARKET, BY SPEED LIMIT, 2025-2030 (UNITS)

- TABLE 51 DELIVERY ROBOTS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 52 DELIVERY ROBOTS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 53 DELIVERY ROBOTS MARKET, BY END-USE INDUSTRY, 2021-2024 (UNITS)

- TABLE 54 DELIVERY ROBOTS MARKET, BY END-USE INDUSTRY, 2025-2030 (UNITS)

- TABLE 55 FOOD & BEVERAGE: DELIVERY ROBOTS MARKET, BY REGION, 2021-2024 (USD THOUSAND)

- TABLE 56 FOOD & BEVERAGE: DELIVERY ROBOTS MARKET, BY REGION, 2025-2030 (USD THOUSAND)

- TABLE 57 FOOD & BEVERAGE: DELIVERY ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 58 FOOD & BEVERAGE: DELIVERY ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD THOUSAND)

- TABLE 59 FOOD & BEVERAGE: DELIVERY ROBOTS MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 60 FOOD & BEVERAGE: DELIVERY ROBOTS MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD THOUSAND)

- TABLE 61 FOOD & BEVERAGE: DELIVERY ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 62 FOOD & BEVERAGE: DELIVERY ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD THOUSAND)

- TABLE 63 FOOD & BEVERAGE: DELIVERY ROBOTS MARKET IN ROW, BY REGION, 2021-2024 (USD THOUSAND)

- TABLE 64 FOOD & BEVERAGE: DELIVERY ROBOTS MARKET IN ROW, BY REGION, 2025-2030 (USD THOUSAND)

- TABLE 65 FOOD & BEVERAGE: DELIVERY ROBOTS MARKET IN MIDDLE EAST, BY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 66 FOOD & BEVERAGE: DELIVERY ROBOTS MARKET IN MIDDLE EAST & AFRICA, BY COUNTRY, 2025-2030 (USD THOUSAND)

- TABLE 67 FOOD & BEVERAGE: DELIVERY ROBOTS MARKET IN AFRICA, BY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 68 FOOD & BEVERAGE: DELIVERY ROBOTS MARKET IN AFRICA, BY COUNTRY, 2025-2030 (USD THOUSAND)

- TABLE 69 FOOD & BEVERAGE: DELIVERY ROBOTS MARKET, BY LOAD CARRYING CAPACITY, 2021-2024 (USD THOUSAND)

- TABLE 70 FOOD & BEVERAGE: DELIVERY ROBOTS MARKET, BY LOAD CARRYING CAPACITY, 2025-2030 (USD THOUSAND)

- TABLE 71 FOOD & BEVERAGE: DELIVERY ROBOTS MARKET, BY LOAD CARRYING CAPACITY, 2021-2024 (UNITS)

- TABLE 72 FOOD & BEVERAGE: DELIVERY ROBOTS MARKET, BY LOAD CARRYING CAPACITY, 2025-2030 (UNITS)

- TABLE 73 RETAIL: DELIVERY ROBOTS MARKET, BY REGION, 2021-2024 (USD THOUSAND)

- TABLE 74 RETAIL: DELIVERY ROBOTS MARKET, BY REGION, 2025-2030 (USD THOUSAND)

- TABLE 75 RETAIL: DELIVERY ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 76 RETAIL: DELIVERY ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD THOUSAND)

- TABLE 77 RETAIL: DELIVERY ROBOTS MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 78 RETAIL: DELIVERY ROBOTS MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD THOUSAND)

- TABLE 79 RETAIL: DELIVERY ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 80 RETAIL: DELIVERY ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD THOUSAND)

- TABLE 81 RETAIL: DELIVERY ROBOTS MARKET IN ROW, BY REGION, 2021-2024 (USD THOUSAND)

- TABLE 82 RETAIL: DELIVERY ROBOTS MARKET IN ROW, BY REGION, 2025-2030 (USD THOUSAND)

- TABLE 83 RETAIL: DELIVERY ROBOTS MARKET IN MIDDLE EAST, BY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 84 RETAIL: DELIVERY ROBOTS MARKET IN MIDDLE EAST, BY COUNTRY, 2025-2030 (USD THOUSAND)

- TABLE 85 RETAIL: DELIVERY ROBOTS MARKET IN AFRICA, BY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 86 RETAIL: DELIVERY ROBOTS MARKET IN AFRICA, BY COUNTRY, 2025-2030 (USD THOUSAND)

- TABLE 87 RETAIL: DELIVERY ROBOTS MARKET, BY LOAD CARRYING CAPACITY, 2021-2024 (USD THOUSAND)

- TABLE 88 RETAIL: DELIVERY ROBOTS MARKET, BY LOAD CARRYING CAPACITY, 2025-2030 (USD THOUSAND)

- TABLE 89 RETAIL: DELIVERY ROBOTS MARKET, BY LOAD CARRYING CAPACITY, 2021-2024 (UNITS)

- TABLE 90 RETAIL: DELIVERY ROBOTS MARKET, BY LOAD CARRYING CAPACITY, 2025-2030 (UNITS)

- TABLE 91 HEALTHCARE: DELIVERY ROBOTS MARKET, BY REGION, 2021-2024 (USD THOUSAND)

- TABLE 92 HEALTHCARE: DELIVERY ROBOTS MARKET, BY REGION, 2025-2030 (USD THOUSAND)

- TABLE 93 HEALTHCARE: DELIVERY ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 94 HEALTHCARE: DELIVERY ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD THOUSAND)

- TABLE 95 HEALTHCARE: DELIVERY ROBOTS MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 96 HEALTHCARE: DELIVERY ROBOTS MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD THOUSAND)

- TABLE 97 HEALTHCARE: DELIVERY ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 98 HEALTHCARE: DELIVERY ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD THOUSAND)

- TABLE 99 HEALTHCARE: DELIVERY ROBOTS MARKET IN ROW, BY REGION, 2021-2024 (USD THOUSAND)

- TABLE 100 HEALTHCARE: DELIVERY ROBOTS MARKET IN ROW, BY REGION, 2025-2030 (USD THOUSAND)

- TABLE 101 HEALTHCARE: DELIVERY ROBOTS MARKET IN MIDDLE EAST, BY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 102 HEALTHCARE: DELIVERY ROBOTS MARKET IN MIDDLE EAST, BY COUNTRY, 2025-2030 (USD THOUSAND)

- TABLE 103 HEALTHCARE: DELIVERY ROBOTS MARKET IN AFRICA, BY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 104 HEALTHCARE: DELIVERY ROBOTS MARKET IN AFRICA, BY COUNTRY, 2025-2030 (USD THOUSAND)

- TABLE 105 HEALTHCARE: DELIVERY ROBOTS MARKET, BY LOAD CARRYING CAPACITY, 2021-2024 (USD THOUSAND)

- TABLE 106 HEALTHCARE: DELIVERY ROBOTS MARKET, BY LOAD CARRYING CAPACITY, 2025-2030 (USD THOUSAND)

- TABLE 107 HEALTHCARE: DELIVERY ROBOTS MARKET, BY LOAD CARRYING CAPACITY, 2021-2024 (UNITS)

- TABLE 108 HEALTHCARE: DELIVERY ROBOTS MARKET, BY LOAD CARRYING CAPACITY, 2025-2030 (UNITS)

- TABLE 109 POSTAL: DELIVERY ROBOTS MARKET, BY REGION, 2021-2024 (USD THOUSAND)

- TABLE 110 POSTAL: DELIVERY ROBOTS MARKET, BY REGION, 2025-2030 (USD THOUSAND)

- TABLE 111 POSTAL: DELIVERY ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 112 POSTAL: DELIVERY ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD THOUSAND)

- TABLE 113 POSTAL: DELIVERY ROBOTS MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 114 POSTAL: DELIVERY ROBOTS MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD THOUSAND)

- TABLE 115 POSTAL: DELIVERY ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 116 POSTAL: DELIVERY ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD THOUSAND)

- TABLE 117 POSTAL: DELIVERY ROBOTS MARKET IN ROW, BY REGION, 2021-2024 (USD THOUSAND)

- TABLE 118 POSTAL: DELIVERY ROBOTS MARKET IN ROW, BY REGION, 2025-2030 (USD THOUSAND)

- TABLE 119 POSTAL: DELIVERY ROBOTS MARKET IN MIDDLE EAST, BY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 120 POSTAL: DELIVERY ROBOTS MARKET IN MIDDLE EAST, BY COUNTRY, 2025-2030 (USD THOUSAND)

- TABLE 121 POSTAL: DELIVERY ROBOTS MARKET IN AFRICA, BY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 122 POSTAL: DELIVERY ROBOTS MARKET IN AFRICA, BY COUNTRY, 2025-2030 (USD THOUSAND)

- TABLE 123 POSTAL: DELIVERY ROBOTS MARKET, BY LOAD CARRYING CAPACITY, 2021-2024 (USD THOUSAND)

- TABLE 124 POSTAL: DELIVERY ROBOTS MARKET, BY LOAD CARRYING CAPACITY, 2025-2030 (USD THOUSAND)

- TABLE 125 POSTAL: DELIVERY ROBOTS MARKET, BY LOAD CARRYING CAPACITY, 2021-2024 (UNITS)

- TABLE 126 POSTAL: DELIVERY ROBOTS MARKET, BY LOAD CARRYING CAPACITY, 2025-2030 (UNITS)

- TABLE 127 OTHERS: DELIVERY ROBOTS MARKET, BY REGION, 2021-2024 (USD THOUSAND)

- TABLE 128 OTHERS: DELIVERY ROBOTS MARKET, BY REGION, 2025-2030 (USD THOUSAND)

- TABLE 129 OTHERS: DELIVERY ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 130 OTHERS: DELIVERY ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD THOUSAND)

- TABLE 131 OTHERS: DELIVERY ROBOTS MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 132 OTHERS: DELIVERY ROBOTS MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD THOUSAND)

- TABLE 133 OTHERS: DELIVERY ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 134 OTHERS: DELIVERY ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD THOUSAND)

- TABLE 135 OTHERS: DELIVERY ROBOTS MARKET IN ROW, BY REGION, 2021-2024 (USD THOUSAND)

- TABLE 136 OTHERS: DELIVERY ROBOTS MARKET IN ROW, BY REGION, 2025-2030 (USD THOUSAND)

- TABLE 137 OTHERS: DELIVERY ROBOTS MARKET IN MIDDLE EAST, BY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 138 OTHERS: DELIVERY ROBOTS MARKET IN MIDDLE EAST, BY COUNTRY, 2025-2030 (USD THOUSAND)

- TABLE 139 OTHERS: DELIVERY ROBOTS MARKET IN AFRICA, BY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 140 OTHERS: DELIVERY ROBOTS MARKET IN AFRICA, BY COUNTRY, 2025-2030 (USD THOUSAND)

- TABLE 141 OTHERS: DELIVERY ROBOTS MARKET, BY LOAD CARRYING CAPACITY, 2021-2024 (USD THOUSAND)

- TABLE 142 OTHERS: DELIVERY ROBOTS MARKET, BY LOAD CARRYING CAPACITY, 2025-2030 (USD THOUSAND)

- TABLE 143 OTHERS: DELIVERY ROBOTS MARKET, BY LOAD CARRYING CAPACITY, 2021-2024 (UNITS)

- TABLE 144 OTHERS: DELIVERY ROBOTS MARKET, BY LOAD CARRYING CAPACITY, 2025-2030 (UNITS)

- TABLE 145 DELIVERY ROBOTS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 146 DELIVERY ROBOTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 147 NORTH AMERICA: DELIVERY ROBOTS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 148 NORTH AMERICA: DELIVERY ROBOTS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 149 NORTH AMERICA: DELIVERY ROBOTS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 150 NORTH AMERICA: DELIVERY ROBOTS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 151 US: DELIVERY ROBOTS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 152 US: DELIVERY ROBOTS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 153 CANADA: DELIVERY ROBOTS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 154 CANADA: DELIVERY ROBOTS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 155 MEXICO: DELIVERY ROBOTS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 156 MEXICO: DELIVERY ROBOTS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 157 EUROPE: DELIVERY ROBOTS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 158 EUROPE: DELIVERY ROBOTS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 159 EUROPE: DELIVERY ROBOTS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 160 EUROPE: DELIVERY ROBOTS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 161 UK: DELIVERY ROBOTS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 162 UK: DELIVERY ROBOTS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 163 GERMANY: DELIVERY ROBOTS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 164 GERMANY: DELIVERY ROBOTS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 165 SWITZERLAND: DELIVERY ROBOTS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 166 SWITZERLAND: DELIVERY ROBOTS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 167 FRANCE: DELIVERY ROBOTS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 168 FRANCE: DELIVERY ROBOTS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 169 ITALY: DELIVERY ROBOTS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 170 ITALY: DELIVERY ROBOTS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 171 SPAIN: DELIVERY ROBOTS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 172 SPAIN: DELIVERY ROBOTS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 173 POLAND: DELIVERY ROBOTS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 174 POLAND: DELIVERY ROBOTS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 175 NORDICS: DELIVERY ROBOTS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 176 NORDICS: DELIVERY ROBOTS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 177 REST OF EUROPE: DELIVERY ROBOTS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 178 REST OF EUROPE: DELIVERY ROBOTS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 179 ASIA PACIFIC: DELIVERY ROBOTS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 180 ASIA PACIFIC: DELIVERY ROBOTS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 181 ASIA PACIFIC: DELIVERY ROBOTS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 182 ASIA PACIFIC: DELIVERY ROBOTS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 183 CHINA: DELIVERY ROBOTS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 184 CHINA: DELIVERY ROBOTS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 185 JAPAN: DELIVERY ROBOTS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 186 JAPAN: DELIVERY ROBOTS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 187 SOUTH KOREA: DELIVERY ROBOTS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 188 SOUTH KOREA: DELIVERY ROBOTS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 189 INDIA: DELIVERY ROBOTS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 190 INDIA: DELIVERY ROBOTS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 191 AUSTRALIA: DELIVERY ROBOTS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 192 AUSTRALIA: DELIVERY ROBOTS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 193 INDONESIA: DELIVERY ROBOTS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 194 INDONESIA: DELIVERY ROBOTS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 195 MALAYSIA: DELIVERY ROBOTS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 196 MALAYSIA: DELIVERY ROBOTS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 197 VIETNAM: DELIVERY ROBOTS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 198 VIETNAM: DELIVERY ROBOTS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 199 THAILAND: DELIVERY ROBOTS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 200 THAILAND: DELIVERY ROBOTS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 201 REST OF ASIA PACIFIC: DELIVERY ROBOTS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 202 REST OF ASIA PACIFIC: DELIVERY ROBOTS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 203 ROW: DELIVERY ROBOTS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 204 ROW: DELIVERY ROBOTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 205 ROW: DELIVERY ROBOTS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 206 ROW: DELIVERY ROBOTS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 207 MIDDLE EAST: DELIVERY ROBOTS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 208 MIDDLE EAST: DELIVERY ROBOTS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 209 MIDDLE EAST: DELIVERY ROBOTS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 210 MIDDLE EAST: DELIVERY ROBOTS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 211 AFRICA: DELIVERY ROBOTS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 212 AFRICA: DELIVERY ROBOTS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 213 AFRICA: DELIVERY ROBOTS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 214 AFRICA: DELIVERY ROBOTS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 215 SOUTH AMERICA: DELIVERY ROBOTS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 216 SOUTH AMERICA: DELIVERY ROBOTS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 217 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN DELIVERY ROBOTS MARKET

- TABLE 218 DELIVERY ROBOTS MARKET: DEGREE OF COMPETITION

- TABLE 219 REGIONAL FOOTPRINT OF COMPANIES

- TABLE 220 NUMBER OF WHEELS FOOTPRINT OF COMPANIES

- TABLE 221 END-USE INDUSTRY FOOTPRINT OF COMPANIES

- TABLE 222 TYPE FOOTPRINT OF COMPANIES

- TABLE 223 SPEED FOOTPRINT OF COMPANIES

- TABLE 224 CAPACITY OF COMPANIES

- TABLE 225 STARTUPS/SMES MATRIX: DETAILED LIST OF KEY STARTUPS

- TABLE 226 DELIVERY ROBOTS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 227 PRODUCT LAUNCHES AND DEVELOPMENTS, JUNE 2021-AUGUST 2024

- TABLE 228 DEALS, JUNE 2021-AUGUST 2024

- TABLE 229 OTHERS, JUNE 2021-AUGUST 2024

- TABLE 230 STARSHIP TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 231 STARSHIP TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 232 STARSHIP TECHNOLOGIES: DEALS, 2021-2024

- TABLE 233 JD.COM, INC.: COMPANY OVERVIEW

- TABLE 234 JD.COM, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 235 JD.COM, INC.: PRODUCT LAUNCHES, 2021-2024

- TABLE 236 JD.COM, INC.: DEALS, 2021-2024

- TABLE 237 PANASONIC HOLDINGS CORPORATION: COMPANY OVERVIEW

- TABLE 238 PANASONIC HOLDINGS CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 239 RELAY ROBOTICS INC.: COMPANY OVERVIEW

- TABLE 240 RELAY ROBOTICS INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 241 RELAY ROBOTICS INC.: PRODUCT LAUNCHES, 2021-2024

- TABLE 242 RELAY ROBOTICS INC.: DEALS, 2021-2024

- TABLE 243 NURO, INC.: COMPANY OVERVIEW

- TABLE 244 NURO, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 245 NURO, INC.: PRODUCT LAUNCHES, 2021-2024

- TABLE 246 NURO, INC.: DEALS, 2021-2024

- TABLE 247 NURO, INC.: OTHER DEVELOPMENTS, 2021-2024

- TABLE 248 BOSTON DYNAMICS: COMPANY OVERVIEW

- TABLE 249 BOSTON DYNAMICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 250 BOSTON DYNAMICS: PRODUCT LAUNCHES, 2021-2024

- TABLE 251 BOSTON DYNAMICS: DEALS, 2021-2024

- TABLE 252 ELIPORT: COMPANY OVERVIEW

- TABLE 253 ELIPORT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 254 KIWIBOT: COMPANY OVERVIEW

- TABLE 255 KIWIBOT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 256 KIWIBOT: PRODUCT LAUNCHES, 2021-2024

- TABLE 257 KIWIBOT: DEALS, 2021-2024

- TABLE 258 ALIBABA GROUP HOLDING LIMITED: COMPANY OVERVIEW

- TABLE 259 ALIBABA GROUP HOLDING LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 260 OTTONOMY.IO: COMPANY OVERVIEW

- TABLE 261 OTTONOMY.IO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 262 OTTONOMY.IO: PRODUCT LAUNCHES, 2021-2024

- TABLE 263 OTTONOMY.IO: DEALS, 2021-2024

- TABLE 264 PIAGGIO & C. SPA: COMPANY OVERVIEW

- TABLE 265 TELERETAIL: COMPANY OVERVIEW

- TABLE 266 AETHON: COMPANY OVERVIEW

- TABLE 267 CLEVERON AS: COMPANY OVERVIEW

- TABLE 268 UDELV, INC.: COMPANY OVERVIEW

- TABLE 269 SEGWAY ROBOTICS: COMPANY OVERVIEW

- TABLE 270 SERVE ROBOTICS: COMPANY OVERVIEW

- TABLE 271 EFFIDENCE: COMPANY OVERVIEW

- TABLE 272 ANYBOTICS: COMPANY OVERVIEW

- TABLE 273 NEOLIX HUITONG (BEIJING) TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 274 BEIJING ZHEN ROBOTICS CO. LTD: COMPANY OVERVIEW

- TABLE 275 TWINSWHEEL: COMPANY OVERVIEW

- TABLE 276 DELIVERS.AI LTD: COMPANY OVERVIEW

- TABLE 277 SHENZHEN REEMAN INTELLIGENT EQUIPMENT CO., LTD.: COMPANY OVERVIEW

- TABLE 278 PUDU TECHNOLOGY INC.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 DELIVERY ROBOTS: MARKET SEGMENTATION

- FIGURE 2 DELIVERY ROBOTS MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY FOR DELIVERY ROBOTS MARKET USING SUPPLY-SIDE ANALYSIS

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 DATA TRIANGULATION: DELIVERY ROBOTS MARKET

- FIGURE 7 MORE THAN 50 KG SEGMENT TO BE LARGEST SEGMENT OF DELIVERY ROBOTS MARKET FROM 2025 TO 2030

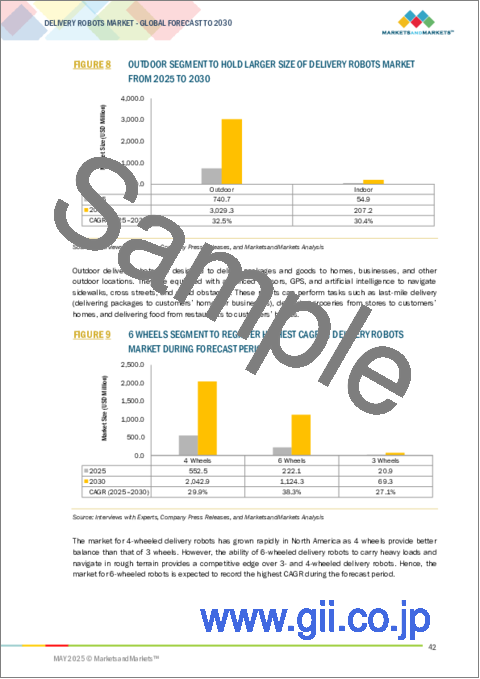

- FIGURE 8 OUTDOOR SEGMENT TO HOLD LARGER SIZE OF DELIVERY ROBOTS MARKET FROM 2025 TO 2030

- FIGURE 9 6 WHEELS SEGMENT TO REGISTER HIGHEST CAGR IN DELIVERY ROBOTS MARKET DURING FORECAST PERIOD

- FIGURE 10 HIGHER THAN 3 KPH UP TO 6 KPH SEGMENT TO HOLD LARGEST SIZE OF DELIVERY ROBOTS MARKET IN 2030

- FIGURE 11 RETAIL SEGMENT TO GROW AT HIGHEST CAGR IN DELIVERY ROBOTS MARKET DURING FORECAST PERIOD

- FIGURE 12 NORTH AMERICA ACCOUNTED FOR LARGEST SHARE OF DELIVERY ROBOTS MARKET IN 2024

- FIGURE 13 EXPANDING E-COMMERCE INDUSTRY TO DRIVE DELIVERY ROBOTS MARKET DURING FORECAST PERIOD

- FIGURE 14 OUTDOOR SEGMENT TO ACCOUNT FOR LARGER MARKET FROM 2025 TO 2030

- FIGURE 15 MORE THAN 50 KG TO BE LARGEST SEGMENT OF DELIVERY ROBOTS MARKET FROM 2025 TO 2030

- FIGURE 16 6-WHEELS SEGMENT TO GROW AT HIGHEST CAGR FROM 2025 TO 2030

- FIGURE 17 3 KPH SEGMENT TO GROW AT HIGHEST CAGR FROM 2025 TO 2030

- FIGURE 18 RETAIL SEGMENT TO GROW AT HIGHEST CAGR FROM 2025 TO 2030

- FIGURE 19 DELIVERY ROBOTS MARKET IN INDIA TO GROW AT HIGHEST CAGR FROM 2025 TO 2030

- FIGURE 20 DELIVERY ROBOTS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 21 IMPACT OF DRIVERS ON DELIVERY ROBOTS MARKET

- FIGURE 22 IMPACT OF RESTRAINTS ON DELIVERY ROBOTS MARKET

- FIGURE 23 IMPACT OF OPPORTUNITIES ON DELIVERY ROBOTS MARKET

- FIGURE 24 IMPACT OF CHALLENGES ON DELIVERY ROBOTS MARKET

- FIGURE 25 TRENDS INFLUENCING DELIVERY ROBOTS BUSINESS OWNERS

- FIGURE 26 AVERAGE SELLING PRICE OF DELIVERY ROBOTS OFFERED BY KEY PLAYERS, 2024

- FIGURE 27 AVERAGE SELLING PRICE TREND OF 3-WHEEL DELIVERY ROBOTS, BY REGION, 2021 TO 2024

- FIGURE 28 VALUE CHAIN ANALYSIS: DELIVERY ROBOTS MARKET

- FIGURE 29 DELIVERY ROBOTS ECOSYSTEM

- FIGURE 30 FUNDS ACQUIRED BY COMPANIES IN DELIVERY ROBOTS MARKET, 2020-2023

- FIGURE 31 PATENT APPLICATIONS IN LAST 10 YEARS

- FIGURE 32 NUMBER OF PATENTS GRANTED, 2014-2024

- FIGURE 33 IMPORT DATA FOR HS CODE 842710-COMPLIANT PRODUCTS FOR TOP 5 COUNTRIES, 2019-2023 (USD THOUSAND)

- FIGURE 34 EXPORT DATA FOR HS CODE 842710-COMPLIANT PRODUCTS FOR TOP 5 COUNTRIES, 2019-2023 (USD THOUSAND)

- FIGURE 35 PORTER'S FIVE FORCES ANALYSIS: DELIVERY ROBOTS MARKET

- FIGURE 36 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES

- FIGURE 37 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- FIGURE 38 DELIVERY ROBOTS MARKET: IMPACT OF AI/GEN AI

- FIGURE 39 6 WHEELS SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 40 MORE THAN 50 KG TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 41 OUTDOOR SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 42 HIGHER THAN 3 KPH UP TO 6 KPH SEGMENT TO CAPTURE LARGEST MARKET SIZE DURING FORECAST PERIOD

- FIGURE 43 RETAIL INDUSTRY TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

- FIGURE 44 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 45 NORTH AMERICA: DELIVERY ROBOTS MARKET SNAPSHOT

- FIGURE 46 EUROPE: DELIVERY ROBOTS MARKET SNAPSHOT

- FIGURE 47 ASIA PACIFIC: DELIVERY ROBOTS MARKET SNAPSHOT

- FIGURE 48 REVENUE ANALYSIS OF TOP PLAYERS IN DELIVERY ROBOTS MARKET

- FIGURE 49 DELIVERY ROBOTS MARKET SHARE ANALYSIS, 2024

- FIGURE 50 COMPANY VALUATION, 2024

- FIGURE 51 FINANCIAL METRICS: EV/EBITDA OF KEY VENDORS, 2024

- FIGURE 52 DELIVERY ROBOTS MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 53 DELIVERY ROBOTS MARKET: COMPANY EVALUATION QUADRANT, 2024

- FIGURE 54 COMPANY FOOTPRINT

- FIGURE 55 DELIVERY ROBOTS MARKET: STARTUPS/SMES EVALUATION MATRIX, 2024

- FIGURE 56 JD.COM, INC.: COMPANY SNAPSHOT

- FIGURE 57 PANASONIC HOLDINGS CORPORATION: COMPANY SNAPSHOT

- FIGURE 58 ALIBABA GROUP HOLDING LIMITED: COMPANY SNAPSHOT

The delivery robots market is projected to reach USD 3,236.5 million by 2030 from USD 795.6 million in 2025 at a CAGR of 32.4% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) |

| Segments | By Type, Load Carrying Capacity, Speed Limit, End-use Industry and Region |

| Regions covered | North America, Europe, APAC, RoW |

Advancements in robotics and artificial intelligence (AI) have significantly improved the capabilities of delivery robots. These technologies enable robots to navigate complex urban environments, avoid obstacles, and deliver goods efficiently. Despite the promising benefits, the adoption of delivery robots is hindered by high initial costs and regulatory hurdles. The development and deployment of autonomous delivery robots require significant investment in technology, infrastructure, and compliance with local regulations.

"Retail end-use industry segment to register highest growth during the forecast period."

The retail sector is likely to see the highest growth in delivery robots during the forecast period. This is because there is an increasing demand for convenient, low-cost last-mile delivery solutions, particularly in the grocery and e-commerce sectors. Companies like S Group (Finland) and Amazon (US) are increasingly using autonomous robots to enhance efficiency in deliveries as well as meet customer demands for rapid service. For instance, S Group (Finland) has expanded its robot fleet to over 100 stores, with it having made over 150,000 deliveries, while Amazon (US) continues to incorporate robots into its fulfillment centers in a bid to cut down on its processes.

"More than 50 kg load carrying capacity is expected to have the largest market share during the forecast period."

Load carrying capacity of more than 50 kg robots is used mainly for grocery delivery and heavy parcel delivery demanded by online shoppers. In terms of volume, these robots commanded the market share of ~25% in 2024. China's second-largest online retailer, JD.com, developed a self-driving vehicle named JDX to carry out its last-mile delivery with a load carrying capacity of 300 kg. Another delivery robot that falls into this category is R1, developed by Nuro (US), which is capable of carrying 125 kg of cargo.

"China is expected to have the highest growth rate in Asia Pacific during the forecast period."

Rapid economic development over the past 20 years has motivated China to move from a manufacturing-driven to an innovation-driven economy. Consequently, the Chinese government has been supporting many bold research initiatives to develop and attract highly skilled individuals who will be needed to lead this transition.

JD.com, Inc. (China), one of the prominent e-commerce players in the Chinese market, is planning to spend more than USD 150 million to build an R&D center in collaboration with Xi'an National Civil Aerospace Industrial Base for developing its futuristic smart logistics solution. Delivery robots developed by the company can be used to deliver multiple products owing to their maximum load-carrying capacity of 300 kg, at a speed of 15 KPH. In April 2021, China-based Alibaba Group announced it would deploy 1,000 robots across Chinese university campuses and local communities over the next year to make the process of package deliveries faster and cost-efficient.

The study contains insights from various industry experts, ranging from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type: Tier 1 - 40%, Tier 2 - 30%, and Tier 3 - 30%

- By Designation: C-level Executives - 40%, Directors - 40%, and Others - 20%

- By Region: Europe - 40%, North America - 30%, Asia Pacific - 20%, RoW - 10%

The report profiles key players in the delivery robots market with their respective market ranking analysis. Prominent players profiled in this report are Starship Technologies (US), JD.com, Inc. (China), Panasonic Holdings Corporation (Japan), Relay Robotics, Inc. (US), and Nuro, Inc. (US), Boston Dynamics (US), Eliport (Spain), Kiwibot (US), Alibaba Group Holding Limited (China), and Ottonomy.IO among others.

Research Coverage:

This research report categorizes the delivery robots market based on load-carrying capacity, type, number of wheels, speed limit, end-use industry, and region. The report describes the major drivers, restraints, challenges, and opportunities pertaining to the delivery robots market and forecasts the same till 2030. Apart from these, the report also consists of leadership mapping and analysis of all the companies included in the delivery robots ecosystem.

Reason to buy this Report

The report will help market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall delivery robots market and the subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

Analysis of key drivers (Reduction in delivery costs in last-mile deliveries), restraints (Stringent regulations pertaining to operations of delivery robots), opportunities (Advancements in features of autonomous delivery robots), and challenges (Limited range of operation of ground delivery robots) influencing the growth of the delivery robots market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the delivery robots market

- Market Development: Comprehensive information about lucrative markets - the report analyzes the delivery robots market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the delivery robots market

Competitive Assessment: In-depth assessment of market shares, growth strategies, and offerings of leading players, such as Starship Technologies (US), JD.com, Inc. (China), Panasonic Holdings Corporation (Japan), Relay Robotics, Inc. (US), and Nuro, Inc. (US), among others in the delivery robots market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 INCLUSIONS AND EXCLUSIONS

- 1.3.2 MARKETS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of primary interview participants

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of primaries

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to arrive at market size using bottom-up analysis

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to capture market size using top-down analysis

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RISK ASSESSMENT

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR PLAYERS IN DELIVERY ROBOTS MARKET

- 4.2 DELIVERY ROBOTS MARKET, BY TYPE

- 4.3 DELIVERY ROBOTS MARKET, BY LOAD CARRYING CAPACITY

- 4.4 DELIVERY ROBOTS MARKET, BY NUMBER OF WHEELS

- 4.5 DELIVERY ROBOTS MARKET, BY SPEED LIMIT

- 4.6 DELIVERY ROBOTS MARKET, BY END-USE INDUSTRY

- 4.7 DELIVERY ROBOTS MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Reduction in delivery costs in last-mile deliveries

- 5.2.1.2 Increase in venture funding

- 5.2.2 RESTRAINTS

- 5.2.2.1 Stringent regulations pertaining to operations of delivery robots

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Advancements in features of autonomous delivery robots

- 5.2.3.2 Worldwide growth of e-commerce market

- 5.2.3.3 Restrictions on use of drones for delivery services

- 5.2.4 CHALLENGES

- 5.2.4.1 Limited range of operation of ground delivery robots

- 5.2.4.2 Safety issues associated with operations of delivery robots in populated areas

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.3.1 GROWING ADOPTION OF DELIVERY ROBOTS IN E-COMMERCE

- 5.3.2 INCREASING USE OF DELIVERY ROBOTS TO DELIVER PARCELS, GROCERIES, AND FOOD ITEMS

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE ANALYSIS OF DELIVERY ROBOTS OFFERED BY KEY PLAYERS

- 5.4.2 AVERAGE SELLING PRICE TREND OF 3-WHEEL DELIVERY ROBOT SYSTEMS, BY REGION, 2021 TO 2024

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.6.1 SUPPLIERS

- 5.6.2 ROBOT INTEGRATORS

- 5.6.3 SOFTWARE SOLUTION PROVIDERS

- 5.7 INVESTMENT AND FUNDING SCENARIO

- 5.8 TECHNOLOGY TRENDS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 LiDAR sensors

- 5.8.1.2 GPS

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Vision guidance

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 Laser guidance

- 5.8.1 KEY TECHNOLOGIES

- 5.9 CASE STUDY ANALYSIS

- 5.9.1 STRETCH ENHANCES LOGISTICS & MAINTENANCE AT OTTO GROUP

- 5.9.2 ETISALAT BY E&, SPAN, AND CLEVERON COLLABORATION REVOLUTIONIZED RETAIL EXPERIENCES

- 5.9.3 TINY MILE UTILIZES AWS WAVELENGTH TO MAKE DELIVERIES FASTER AND AT LOWER COST

- 5.10 PATENT ANALYSIS

- 5.10.1 KEY PATENTS

- 5.11 TRADE ANALYSIS

- 5.11.1 IMPORT SCENARIO (HS CODE 842710)

- 5.11.2 EXPORT SCENARIO (HS CODE 842710)

- 5.12 TARIFF AND REGULATORY LANDSCAPE

- 5.12.1 TARIFF ANALYSIS

- 5.12.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12.3 REGULATIONS RELATED TO DELIVERY ROBOTS

- 5.13 KEY CONFERENCES AND EVENTS

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.14.2 BARGAINING POWER OF SUPPLIERS

- 5.14.3 BARGAINING POWER OF BUYERS

- 5.14.4 THREAT OF SUBSTITUTES

- 5.14.5 THREAT OF NEW ENTRANTS

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 IMPACT OF AI/GEN AI ON DELIVERY ROBOTS MARKET

- 5.17 2025 US TARIFF IMPACT ON DELIVERY ROBOTS MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 IMPACT ON COUNTRIES/REGIONS

- 5.17.4.1 US

- 5.17.4.2 Europe

- 5.17.4.3 Asia Pacific

- 5.17.5 IMPACT ON END-USE INDUSTRIES

6 DELIVERY ROBOTS MARKET, BY NUMBER OF WHEELS

- 6.1 INTRODUCTION

- 6.2 3 WHEELS

- 6.2.1 3-WHEELED DELIVERY ROBOTS LIKELY TO SIMPLIFY INDUSTRIAL LOGISTICS OPERATIONS

- 6.3 4 WHEELS

- 6.3.1 4 WHEELS MAKE ROTATING IN PLACE EASY FOR DELIVERY ROBOTS

- 6.4 6 WHEELS

- 6.4.1 6 WHEELS PROVIDE HIGH STABILITY TO DELIVERY ROBOTS

7 DELIVERY ROBOTS MARKET, BY LOAD CARRYING CAPACITY

- 7.1 INTRODUCTION

- 7.2 UP TO 10 KG

- 7.2.1 USED FOR DELIVERY OF FOOD AND BEVERAGES

- 7.3 MORE THAN 10 KG UP TO 50 KG

- 7.3.1 USED FOR DELIVERY OF GROCERIES

- 7.4 MORE THAN 50 KG

- 7.4.1 IDEAL FOR DELIVERY OF HEAVY PARCELS

8 DELIVERY ROBOTS MARKET, BY TYPE

- 8.1 INTRODUCTION

- 8.2 OUTDOOR

- 8.2.1 INCREASING CONVENIENCE IN DELIVERING PRODUCTS

- 8.3 INDOOR

- 8.3.1 INCREASING DEMAND IN HOSPITALS AND HEALTHCARE CENTERS

9 DELIVERY ROBOTS MARKET, BY SPEED LIMIT

- 9.1 INTRODUCTION

- 9.2 UP TO 3 KPH

- 9.2.1 IDEAL FOR APPLICATIONS IN HEALTHCARE INDUSTRY

- 9.3 3 KPH TO 6 KPH

- 9.3.1 SUITABLE FOR DELIVERY OF PACKAGES, IMPORTANT DOCUMENTS, AND FOOD ITEMS

- 9.4 HIGHER THAN 6 KPH

- 9.4.1 PREFERRED FOR DELIVERY OF GOODS IN SHORT TIME

10 DELIVERY ROBOTS MARKET, BY END-USE INDUSTRY

- 10.1 INTRODUCTION

- 10.2 FOOD & BEVERAGE

- 10.2.1 FOOD & BEVERAGE INDUSTRY HELD LARGEST MARKET SHARE IN TERMS OF UNITS SOLD IN 2024

- 10.3 RETAIL

- 10.3.1 INCREASING DEMAND FOR DELIVERY ROBOTS IN E-COMMERCE TO DRIVE MARKET

- 10.4 HEALTHCARE

- 10.4.1 GROWING USE IN HOSPITALS TO OPTIMIZE LABOR PRODUCTIVITY TO DRIVE MARKET

- 10.5 POSTAL

- 10.5.1 GROWING ADOPTION OF DELIVERY ROBOTS FOR PACKAGE DELIVERIES TO DRIVE MARKET

- 10.6 OTHERS

11 DELIVERY ROBOTS MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 11.2.2 US

- 11.2.2.1 Presence of major ground delivery robot manufacturers to drive market

- 11.2.2.2 Regulations for delivery robots in US

- 11.2.3 CANADA

- 11.2.3.1 Government grants and funds to encourage developments related to robotics to drive market

- 11.2.4 MEXICO

- 11.2.4.1 Booming e-commerce sector to drive market

- 11.3 EUROPE

- 11.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 11.3.2 UK

- 11.3.2.1 High adoption of delivery robots in food & beverage industry to drive market

- 11.3.3 GERMANY

- 11.3.3.1 Increasing use of delivery robots for food deliveries to drive market

- 11.3.4 SWITZERLAND

- 11.3.4.1 Switzerland to register highest CAGR in European delivery robots market during forecast period

- 11.3.5 FRANCE

- 11.3.5.1 Digital transformation in industrial sector to boost adoption

- 11.3.6 ITALY

- 11.3.6.1 Industrial and logistics sectors to contribute to market growth

- 11.3.7 SPAIN

- 11.3.7.1 Surging demand from automotive and logistics companies to create opportunities

- 11.3.8 POLAND

- 11.3.8.1 Increasing adoption of technology in retail to drive market

- 11.3.9 NORDICS

- 11.3.9.1 Autonomous deliveries supported by 5G and IoT technologies to drive market

- 11.3.10 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 11.4.2 CHINA

- 11.4.2.1 Growing adoption of delivery robots for e-commerce deliveries to drive market

- 11.4.3 JAPAN

- 11.4.3.1 Increasing use of delivery robots to fulfill requirements of aging population to support market growth

- 11.4.4 SOUTH KOREA

- 11.4.4.1 Demand from food & beverage industry to drive market

- 11.4.5 INDIA

- 11.4.5.1 Increasing adoption in e-commerce and logistics sectors to drive market

- 11.4.6 AUSTRALIA

- 11.4.6.1 Increasing navigation innovation and adoption to drive market

- 11.4.7 INDONESIA

- 11.4.7.1 Enhancing efficiency in food delivery operations to drive market

- 11.4.8 MALAYSIA

- 11.4.8.1 Enhancing delivery services across sectors to drive market

- 11.4.9 VIETNAM

- 11.4.9.1 Merging tradition with robotic innovation to drive market

- 11.4.10 THAILAND

- 11.4.10.1 Enhancing efficiency in hospitality and healthcare sectors to drive market

- 11.4.11 REST OF ASIA PACIFIC

- 11.5 ROW

- 11.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 11.5.2 MIDDLE EAST

- 11.5.2.1 Growing adoption of delivery robots in hospitality and food delivery sectors to drive market

- 11.5.2.2 Bahrain

- 11.5.2.2.1 Enhancing healthcare and customer service through automation to drive market

- 11.5.2.3 Kuwait

- 11.5.2.3.1 Adoption of autonomous delivery to drive market

- 11.5.2.4 Oman

- 11.5.2.4.1 Ro-WAITER transforms hospitality and retail services

- 11.5.2.5 Qatar

- 11.5.2.5.1 Adoption of delivery robots in urban logistics to drive market

- 11.5.2.6 Saudi Arabia

- 11.5.2.6.1 Saudi Arabia's expansion of autonomous delivery services to drive market

- 11.5.2.7 UAE

- 11.5.2.7.1 Smart and sustainable urban logistics to drive market

- 11.5.2.8 Rest of Middle East

- 11.5.3 AFRICA

- 11.5.3.1 Growing demand for medical deliveries to drive market

- 11.5.3.2 South Africa

- 11.5.3.2.1 Transforming logistics across continent to drive market

- 11.5.3.3 Other African countries

- 11.5.4 SOUTH AMERICA

- 11.5.4.1 Use of delivery robots for e-commerce deliveries to drive market

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 MARKET EVALUATION FRAMEWORK

- 12.3 REVENUE ANALYSIS OF TOP PLAYERS IN DELIVERY ROBOTS MARKET

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.5 COMPANY VALUATION AND FINANCIAL METRICS, 2024

- 12.6 BRAND/PRODUCT COMPARATIVE ANALYSIS

- 12.7 COMPANY EVALUATION QUADRANT

- 12.7.1 STARS

- 12.7.2 PERVASIVE PLAYERS

- 12.7.3 EMERGING LEADERS

- 12.7.4 PARTICIPANTS

- 12.7.5 DELIVERY ROBOTS MARKET: COMPANY FOOTPRINT

- 12.7.5.1 Company footprint

- 12.7.5.2 Region footprint

- 12.7.5.3 Number of wheels footprint

- 12.7.5.4 End-use industry footprint

- 12.7.5.5 Type footprint

- 12.7.5.6 Speed footprint

- 12.7.5.7 Capacity footprint

- 12.8 STARTUPS/SMES EVALUATION MATRIX, 2024

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING

- 12.8.5.1 Detailed list of key startups/SMEs

- 12.8.5.2 Competitive benchmarking of key startups/SMEs

- 12.9 COMPETITIVE SCENARIOS

- 12.9.1 PRODUCT LAUNCHES AND DEVELOPMENTS

- 12.9.2 DEALS

- 12.9.3 OTHERS

13 COMPANY PROFILES

- 13.1 INTRODUCTION

- 13.2 KEY PLAYERS

- 13.2.1 STARSHIP TECHNOLOGIES

- 13.2.1.1 Business overview

- 13.2.1.2 Products/Solutions/Services offered

- 13.2.1.3 Recent developments

- 13.2.1.3.1 Deals

- 13.2.2 JD.COM, INC.

- 13.2.2.1 Business overview

- 13.2.2.2 Products/Solutions/Services offered

- 13.2.2.3 Recent developments

- 13.2.2.3.1 Product launches

- 13.2.2.3.2 Deals

- 13.2.3 PANASONIC HOLDINGS CORPORATION

- 13.2.3.1 Business overview

- 13.2.3.2 Products/Solutions/Services offered

- 13.2.4 RELAY ROBOTICS INC.

- 13.2.4.1 Business overview

- 13.2.4.2 Products/Solutions/Services offered

- 13.2.4.3 Recent developments

- 13.2.4.3.1 Product launches

- 13.2.4.3.2 Deals

- 13.2.5 NURO, INC.

- 13.2.5.1 Business overview

- 13.2.5.2 Products/Solutions/Services offered

- 13.2.5.3 Recent developments

- 13.2.5.3.1 Product launches

- 13.2.5.3.2 Deals

- 13.2.5.3.3 Other developments

- 13.2.6 BOSTON DYNAMICS

- 13.2.6.1 Business overview

- 13.2.6.2 Products/Solutions/Services offered

- 13.2.6.3 Recent developments

- 13.2.6.3.1 Product launches

- 13.2.6.3.2 Deals

- 13.2.7 ELIPORT

- 13.2.7.1 Business overview

- 13.2.7.2 Products/Solutions/Services offered

- 13.2.8 KIWIBOT

- 13.2.8.1 Business overview

- 13.2.8.2 Products/Solutions/Services offered

- 13.2.8.3 Recent developments

- 13.2.8.3.1 Product launches

- 13.2.8.3.2 Deals

- 13.2.9 ALIBABA GROUP HOLDING LIMITED

- 13.2.9.1 Business overview

- 13.2.9.2 Products/Solutions/Services offered

- 13.2.10 OTTONOMY.IO

- 13.2.10.1 Business overview

- 13.2.10.2 Products/Solutions/Services offered

- 13.2.10.3 Recent developments

- 13.2.10.3.1 Product launches

- 13.2.10.3.2 Deals

- 13.2.1 STARSHIP TECHNOLOGIES

- 13.3 OTHER PLAYERS

- 13.3.1 PIAGGIO & C. SPA

- 13.3.2 TELERETAIL

- 13.3.3 AETHON

- 13.3.4 CLEVERON AS

- 13.3.5 UDELV, INC.

- 13.3.6 SEGWAY ROBOTICS

- 13.3.7 SERVE ROBOTICS

- 13.3.8 EFFIDENCE

- 13.3.9 ANYBOTICS

- 13.3.10 NEOLIX HUITONG (BEIJING) TECHNOLOGY CO., LTD.

- 13.3.11 BEIJING ZHEN ROBOTICS CO. LTD

- 13.3.12 TWINSWHEEL

- 13.3.13 DELIVERS.AI LTD

- 13.3.14 SHENZHEN REEMAN INTELLIGENT EQUIPMENT CO., LTD.

- 13.3.15 PUDU TECHNOLOGY INC.

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS