|

|

市場調査レポート

商品コード

1727399

風力タービン運転・保守の世界市場:立地タイプ別、タイプ別、タービン接続形態別、地域別 - 2030年までの予測Wind Turbine Operations and Maintenance Market by Type (Scheduled Maintenance, Unscheduled Maintenance), Location type (Onshore, Offshore), Turbine Connectivity (Grid-connected, Standalone), and Region - Global Forecast & Trends to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 風力タービン運転・保守の世界市場:立地タイプ別、タイプ別、タービン接続形態別、地域別 - 2030年までの予測 |

|

出版日: 2025年05月08日

発行: MarketsandMarkets

ページ情報: 英文 240 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の風力タービン運転・保守(O&M)の市場規模は、2024年の356億2,000万米ドルから2030年には596億7,000万米ドルに達すると予測され、予測期間のCAGRは8.5%と見込まれています。

洋上風力発電所の拡大と予知保全技術の導入が市場を活性化しています。また、各地域で環境目標や政策が義務化されたことで、長期的な資産管理ソリューションを検討する必要性が高まっています。世界および地域の主な参入企業は、豊富なO&M経験に基づく多様なサービスポートフォリオを開発することで、風力タービンの運転・保守市場で確固たる足跡を築いています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(100万米ドル/10億米ドル) |

| セグメント別 | 立地タイプ別、タイプ別、タービン接続性別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、南米、中東・アフリカ |

洋上風力タービンの運転・保守市場は、持続可能なエネルギーに対する世界の需要と洋上風力発電所の大きな可能性により成長を遂げています。洋上風力発電所は、より安定した風速の恩恵を受けるが、運用がより複雑になるため、より高度なO&Mサービスの必要性が高まっています。リモート・メンテナンス技術や予知保全技術など、監視・診断ツールの分野における最近の進歩は、効率を向上させ、運転コストを削減しています。さらに、洋上風力発電プロジェクトに対する政府投資と民間投資の両方が増加するにつれて、洋上O&Mの成長見通しが高まっています。

風力タービンの運転・保守市場の非定期的セグメントは、部品の予期せぬ故障への対応が急務であることに影響されています。定期メンテナンスの需要は、設置されているタービンの年数や状態に影響されます。このような予期せぬ故障は、タービンのダウンタイムの長期化、エネルギー出力の損失、O&M費用の増加につながる可能性があり、特にアクセスや修理のコストが著しく高い洋上風力発電プロジェクトではその傾向が顕著です。しかし、デジタル化は、SCADAデータ、IoTセンサー、AIを利用したリアルタイムの状態監視、予測診断、自動故障警告を可能にすることで、予定外のセグメントに変革をもたらしつつあります。

アジア太平洋は、再生可能エネルギーに関する政府の支持的な政策と、洋上および陸上風力発電プロジェクトに対する旺盛な投資により、風力タービンの運転・保守(O&M)市場で最大の市場となっています。中国、インド、日本を含む主要市場は、すでに高い再生可能エネルギー目標を掲げて成長に貢献しています。世界的に認知された目標には、2030年までに1200GWの風力・太陽光発電容量を導入する中国の計画や、再生可能エネルギー証書プログラムへのインドの参加などがあります。アジア太平洋の成長は、タービンの効率を高め、ダウンタイムを削減するAI対応の予知保全や遠隔監視システムなどの技術革新によってさらに強化されると予想されます。

当レポートでは、風力タービンの運転・保守(O&M)市場を、タイプ別(定期・非定期)、立地タイプ別(陸上・洋上)、タービン接続形態別(系統連系・独立型)、地域別(北米、欧州、アジア太平洋、中東・アフリカ、南米)に定義、記述、予測しています。当レポートの調査範囲は、風力タービン運転保守市場の成長に影響を与える市場促進要因・課題などの主な要因に関する詳細情報を網羅しています。主な業界参入企業を詳細に分析し、事業概要、ソリューション、サービス、契約、パートナーシップ、協定、合併、買収などの主要戦略、風力タービン運転保守市場に関連する最近の動向に関する洞察を提供しています。風力タービン運転保守市場のエコシステムにおける新興企業の競合分析も当レポートでカバーしています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客ビジネスに影響を与える動向/混乱

- サプライチェーン分析

- エコシステム分析

- 貿易分析

- ケーススタディ分析

- 技術分析

- 価格分析

- 特許分析

- 2025年~2026年の主な会議とイベント

- 投資と資金調達のシナリオ

- 規制状況

- 2025年の米国関税の影響- 概要

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- 生成AI/AIが風力タービンの運転・保守市場に与える影響

- 世界マクロ経済見通し

第6章 風力タービンの運転・保守市場(立地タイプ別)

- イントロダクション

- 陸上

- 洋上

第7章 風力タービンの運転・保守市場(タイプ別)

- イントロダクション

- 予定内

- 予定外

第8章 風力タービンの運転・保守市場(タービン接続形態別)

- イントロダクション

- グリッド接続

- スタンドアロン

第9章 風力タービン運転・保守市場(地域別)

- イントロダクション

- アジア太平洋

- 中国

- 日本

- 韓国

- インド

- オーストラリア

- その他

- 欧州

- ドイツ

- 英国

- イタリア

- フランス

- スウェーデン

- スペイン

- その他

- 北米

- 米国

- カナダ

- メキシコ

- 南米

- ブラジル

- アルゼンチン

- その他

- 中東・アフリカ

- サウジアラビア

- エジプト

- 南アフリカ

- その他

第10章 競合情勢

- 概要

- 主要参入企業の戦略/強み、2022年~2025年

- 市場シェア分析、2024年

- 収益分析、2020年~2024年

- 企業評価と財務指標

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

第11章 企業プロファイル

- 主要参入企業

- SIEMENS GAMESA RENEWABLE ENERGY, S.A.U.

- GE VERNOVA

- GOLDWIND

- NORDEX SE

- VESTAS

- SUZLON ENERGY LIMITED

- MINGYANG SMART ENERGY GROUP CO., LTD.

- SKF

- GLOBAL WIND SERVICE

- RES

- ENVISION GROUP

- WINDEY ENERGY TECHNOLOGY GROUP CO., LTD.

- SANY RENEWABLE ENERGY CO., LTD.

- ENERCON GLOBAL GMBH

- DEUTSCHE WINDTECHNIK AG

- その他の企業

- BHI ENERGY

- WIND PROSPECT SP. Z O.O.

- EOS ENGINEERING & SERVICE CO., LTD.

- CRRC SHANDONG WIND POWER CO., LTD.

- REGEN POWERTECH

- NEARTHLAB

- ZEPHYR WIND SERVICES

- ALERION TECHNOLOGIES

- RRB ENERGY

- RTS WIND AG

- AERONES ENGINEERING

第12章 付録

List of Tables

- TABLE 1 WIND TURBINE OPERATIONS AND MAINTENANCE MARKET: RISK ANALYSIS

- TABLE 2 SNAPSHOT OF WIND TURBINE OPERATIONS AND MAINTENANCE MARKET

- TABLE 3 WIND TURBINE OPERATIONS AND MAINTENANCE MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 4 EXPORT DATA FOR HS CODE 850231-COMPLIANT PRODUCTS, BY COUNTRY, 2022-2024 (USD THOUSAND)

- TABLE 5 IMPORT DATA FOR HS CODE 850231-COMPLIANT PRODUCTS, BY COUNTRY, 2022-2024 (USD THOUSAND)

- TABLE 6 INDICATIVE PRICING OF WIND TURBINE OPERATIONS AND MAINTENANCE, BY LOCATION TYPE, 2024 (USD/KW/YEAR)

- TABLE 7 AVERAGE SELLING PRICE TREND OF ONSHORE WIND TURBINE OPERATIONS AND MAINTENANCE, BY REGION, 2021-2024 (USD/MW/YEAR)

- TABLE 8 AVERAGE SELLING PRICE TREND OF OFFSHORE WIND TURBINE OPERATIONS AND MAINTENANCE, BY REGION, 2021-2024 (USD/MW/YEAR)

- TABLE 9 WIND TURBINE OPERATIONS AND MAINTENANCE MARKET: LIST OF CONFERENCES AND EVENTS, 2025-2026

- TABLE 10 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 WIND TURBINE OPERATIONS AND MAINTENANCE MARKET: CODES AND REGULATIONS

- TABLE 15 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 16 EXPECTED CHANGE IN PRICES AND LIKELY IMPACT ON END-USE MARKET DUE TO TARIFF

- TABLE 17 WIND TURBINE OPERATIONS AND MAINTENANCE MARKET: PORTER'S FIVE FORCES ANALYSIS

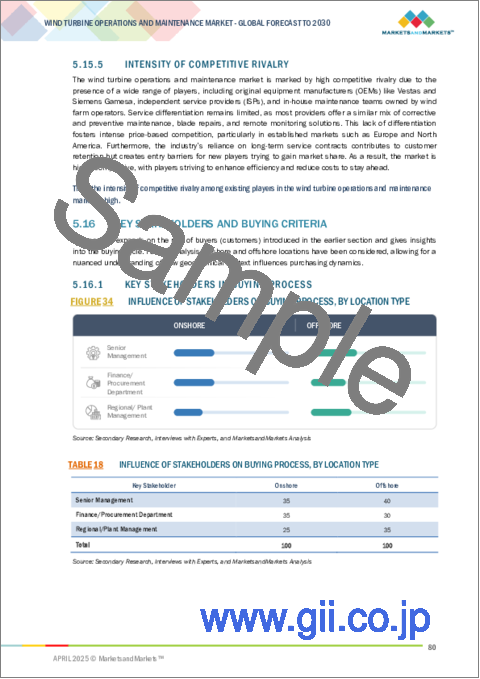

- TABLE 18 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY LOCATION TYPE

- TABLE 19 KEY BUYING CRITERIA, BY LOCATION TYPE

- TABLE 20 WORLD GDP GROWTH, 2021-2028 (USD TRILLION)

- TABLE 21 INFLATION RATE (ANNUAL PERCENT CHANGE), 2024

- TABLE 22 WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY LOCATION TYPE, 2021-2024 (USD MILLION)

- TABLE 23 WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY LOCATION TYPE, 2025-2030 (USD MILLION)

- TABLE 24 ONSHORE: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 25 ONSHORE: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 26 OFFSHORE: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 27 OFFSHORE: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 28 WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 29 WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 30 SCHEDULED: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 31 SCHEDULED: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 32 UNSCHEDULED: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 33 UNSCHEDULED: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 34 WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY TURBINE CONNECTIVITY, 2021-2024 (USD MILLION)

- TABLE 35 WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY TURBINE CONNECTIVITY, 2025-2030 (USD MILLION)

- TABLE 36 GRID-CONNECTED: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 37 GRID-CONNECTED: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 38 STANDALONE: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 39 STANDALONE: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 40 WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 41 WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 42 GLOBAL WIND CAPACITY, BY REGION, 2021-2024 (GW)

- TABLE 43 GLOBAL WIND CAPACITY, BY REGION, 2025-2030 (GW)

- TABLE 44 ASIA PACIFIC: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 45 ASIA PACIFIC: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 46 ASIA PACIFIC: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY LOCATION TYPE, 2021-2024 (USD MILLION)

- TABLE 47 ASIA PACIFIC: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY LOCATION TYPE, 2025-2030 (USD MILLION)

- TABLE 48 ASIA PACIFIC: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY TURBINE CONNECTIVITY, 2021-2024 (USD MILLION)

- TABLE 49 ASIA PACIFIC: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY TURBINE CONNECTIVITY, 2025-2030 (USD MILLION)

- TABLE 50 ASIA PACIFIC: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 51 ASIA PACIFIC: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 52 CHINA: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY LOCATION TYPE, 2021-2024 (USD MILLION)

- TABLE 53 CHINA: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY LOCATION TYPE, 2025-2030 (USD MILLION)

- TABLE 54 JAPAN: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY LOCATION TYPE, 2021-2024 (USD MILLION)

- TABLE 55 JAPAN: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY LOCATION TYPE, 2025-2030 (USD MILLION)

- TABLE 56 SOUTH KOREA: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY LOCATION TYPE, 2021-2024 (USD MILLION)

- TABLE 57 SOUTH KOREA: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY LOCATION TYPE, 2025-2030 (USD MILLION)

- TABLE 58 INDIA: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY LOCATION TYPE, 2021-2024 (USD MILLION)

- TABLE 59 INDIA: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY LOCATION TYPE, 2025-2030 (USD MILLION)

- TABLE 60 AUSTRALIA: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY LOCATION TYPE, 2021-2024 (USD MILLION)

- TABLE 61 AUSTRALIA: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY LOCATION TYPE, 2025-2030 (USD MILLION)

- TABLE 62 REST OF ASIA PACIFIC: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY LOCATION TYPE, 2021-2024 (USD MILLION)

- TABLE 63 REST OF ASIA PACIFIC: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY LOCATION TYPE, 2025-2030 (USD MILLION)

- TABLE 64 EUROPE: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 65 EUROPE: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 66 EUROPE: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY LOCATION TYPE, 2021-2024 (USD MILLION)

- TABLE 67 EUROPE: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY LOCATION TYPE, 2025-2030 (USD MILLION)

- TABLE 68 EUROPE: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY TURBINE CONNECTIVITY, 2021-2024 (USD MILLION)

- TABLE 69 EUROPE: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY TURBINE CONNECTIVITY, 2025-2030 (USD MILLION)

- TABLE 70 EUROPE: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 71 EUROPE: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 72 GERMANY: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY LOCATION TYPE, 2021-2024 (USD MILLION)

- TABLE 73 GERMANY: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY LOCATION TYPE, 2025-2030 (USD MILLION)

- TABLE 74 UK: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY LOCATION TYPE, 2021-2024 (USD MILLION)

- TABLE 75 UK: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY LOCATION TYPE, 2025-2030 (USD MILLION)

- TABLE 76 ITALY: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY LOCATION TYPE, 2021-2024 (USD MILLION)

- TABLE 77 ITALY: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY LOCATION TYPE, 2025-2030 (USD MILLION)

- TABLE 78 FRANCE: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY LOCATION TYPE, 2021-2024 (USD MILLION)

- TABLE 79 FRANCE: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY LOCATION TYPE, 2025-2030 (USD MILLION)

- TABLE 80 SWEDEN: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY LOCATION TYPE, 2021-2024 (USD MILLION)

- TABLE 81 SWEDEN: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY LOCATION TYPE, 2025-2030 (USD MILLION)

- TABLE 82 SPAIN: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY LOCATION TYPE, 2021-2024 (USD MILLION)

- TABLE 83 SPAIN: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY LOCATION TYPE, 2025-2030 (USD MILLION)

- TABLE 84 REST OF EUROPE: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY LOCATION TYPE, 2021-2024 (USD MILLION)

- TABLE 85 REST OF EUROPE: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY LOCATION TYPE, 2025-2030 (USD MILLION)

- TABLE 86 NORTH AMERICA: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 87 NORTH AMERICA: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 88 NORTH AMERICA: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY LOCATION TYPE, 2021-2024 (USD MILLION)

- TABLE 89 NORTH AMERICA: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY LOCATION TYPE, 2025-2030 (USD MILLION)

- TABLE 90 NORTH AMERICA: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY TURBINE CONNECTIVITY, 2021-2024 (USD MILLION)

- TABLE 91 NORTH AMERICA: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY TURBINE CONNECTIVITY, 2025-2030 (USD MILLION)

- TABLE 92 NORTH AMERICA: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 93 NORTH AMERICA: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 94 US: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY LOCATION TYPE, 2021-2024 (USD MILLION)

- TABLE 95 US: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY LOCATION TYPE, 2025-2030 (USD MILLION)

- TABLE 96 CANADA: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY LOCATION TYPE, 2021-2024 (USD MILLION)

- TABLE 97 CANADA: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY LOCATION TYPE, 2025-2030 (USD MILLION)

- TABLE 98 MEXICO: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY LOCATION TYPE, 2021-2024 (USD MILLION)

- TABLE 99 MEXICO: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY LOCATION TYPE, 2025-2030 (USD MILLION)

- TABLE 100 SOUTH AMERICA: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 101 SOUTH AMERICA: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 102 SOUTH AMERICA: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY LOCATION TYPE, 2021-2024 (USD MILLION)

- TABLE 103 SOUTH AMERICA: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY LOCATION TYPE, 2025-2030 (USD MILLION)

- TABLE 104 SOUTH AMERICA: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY TURBINE CONNECTIVITY, 2021-2024 (USD MILLION)

- TABLE 105 SOUTH AMERICA: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY TURBINE CONNECTIVITY, 2025-2030 (USD MILLION)

- TABLE 106 SOUTH AMERICA: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 107 SOUTH AMERICA: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 108 NUMBER OF ENVIRONMENTAL LICENSING PROJECTS FOR OFFSHORE, IBAMA, 2023

- TABLE 109 BRAZIL: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY LOCATION TYPE, 2021-2024 (USD MILLION)

- TABLE 110 BRAZIL: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY LOCATION TYPE, 2025-2030 (USD MILLION)

- TABLE 111 ARGENTINA: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY LOCATION TYPE, 2021-2024 (USD MILLION)

- TABLE 112 ARGENTINA: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY LOCATION TYPE, 2025-2030 (USD MILLION)

- TABLE 113 REST OF SOUTH AMERICA: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY LOCATION TYPE, 2021-2024 (USD MILLION)

- TABLE 114 REST OF SOUTH AMERICA: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY LOCATION TYPE, 2025-2030 (USD MILLION)

- TABLE 115 MIDDLE EAST & AFRICA: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 116 MIDDLE EAST & AFRICA: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 117 MIDDLE EAST & AFRICA: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY LOCATION TYPE, 2021-2024 (USD MILLION)

- TABLE 118 MIDDLE EAST & AFRICA: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY LOCATION TYPE, 2025-2030 (USD MILLION)

- TABLE 119 MIDDLE EAST & AFRICA: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY TURBINE CONNECTIVITY, 2021-2024 (USD MILLION)

- TABLE 120 MIDDLE EAST & AFRICA: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY TURBINE CONNECTIVITY, 2025-2030 (USD MILLION)

- TABLE 121 MIDDLE EAST & AFRICA: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 122 MIDDLE EAST & AFRICA: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 123 SAUDI ARABIA: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY LOCATION TYPE, 2021-2024 (USD MILLION)

- TABLE 124 SAUDI ARABIA: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY LOCATION TYPE, 2025-2030 (USD MILLION)

- TABLE 125 EGYPT: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY LOCATION TYPE, 2021-2024 (USD MILLION)

- TABLE 126 EGYPT: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY LOCATION TYPE, 2025-2030 (USD MILLION)

- TABLE 127 SOUTH AFRICA: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY LOCATION TYPE, 2021-2024 (USD MILLION)

- TABLE 128 SOUTH AFRICA: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY LOCATION TYPE, 2025-2030 (USD MILLION)

- TABLE 129 REST OF MIDDLE EAST & AFRICA: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY LOCATION TYPE, 2021-2024 (USD MILLION)

- TABLE 130 REST OF MIDDLE EAST & AFRICA: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY LOCATION TYPE, 2025-2030 (USD MILLION)

- TABLE 131 WIND TURBINE OPERATIONS AND MAINTENANCE MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2022-2025

- TABLE 133 WIND TURBINE OPERATIONS AND MAINTENANCE MARKET: REGION FOOTPRINT

- TABLE 134 WIND TURBINE OPERATIONS AND MAINTENANCE MARKET: TYPE FOOTPRINT

- TABLE 135 WIND TURBINE OPERATIONS AND MAINTENANCE MARKET: LOCATION TYPE FOOTPRINT

- TABLE 136 WIND TURBINE OPERATIONS AND MAINTENANCE MARKET: LIST OF KEY START-UPS/SMES

- TABLE 137 WIND TURBINE OPERATIONS AND MAINTENANCE MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- TABLE 138 WIND TURBINE OPERATIONS AND MAINTENANCE MARKET: DEALS, MAY 2022-APRIL 2025

- TABLE 139 WIND TURBINE OPERATIONS AND MAINTENANCE MARKET: EXPANSIONS, MAY 2022-APRIL 2025

- TABLE 140 WIND TURBINE OPERATIONS AND MAINTENANCE MARKET: OTHERS, MAY 2022-APRIL 2025

- TABLE 141 SIEMENS GAMESA RENEWABLE ENERGY, S.A.U.: COMPANY OVERVIEW

- TABLE 142 SIEMENS GAMESA RENEWABLE ENERGY, S.A.U.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 143 SIEMENS GAMESA RENEWABLE ENERGY, S.A.U.: DEALS

- TABLE 144 GE VERNOVA: COMPANY OVERVIEW

- TABLE 145 GE VERNOVA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 146 GE VERNOVA: DEALS

- TABLE 147 GOLDWIND: COMPANY OVERVIEW

- TABLE 148 GOLDWIND: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 149 GOLDWIND: DEALS

- TABLE 150 NORDEX SE: COMPANY OVERVIEW

- TABLE 151 NORDEX SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 152 NORDEX SE: DEALS

- TABLE 153 NORDEX SE: OTHERS

- TABLE 154 VESTAS: COMPANY OVERVIEW

- TABLE 155 VESTAS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 156 VESTAS: DEALS

- TABLE 157 VESTAS: EXPANSIONS

- TABLE 158 SUZLON ENERGY LIMITED: COMPANY OVERVIEW

- TABLE 159 SUZLON ENERGY LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 160 SUZLON ENERGY LIMITED: DEALS

- TABLE 161 MINGYANG SMART ENERGY GROUP CO., LTD.: COMPANY OVERVIEW

- TABLE 162 MINGYANG SMART ENERGY GROUP CO., LTD.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 163 MINGYANG SMART ENERGY GROUP CO., LTD.: DEALS

- TABLE 164 SKF: COMPANY OVERVIEW

- TABLE 165 SKF: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 166 SKF: DEALS

- TABLE 167 GLOBAL WIND SERVICE: COMPANY OVERVIEW

- TABLE 168 GLOBAL WIND SERVICE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 169 GLOBAL WIND SERVICE: DEALS

- TABLE 170 GLOBAL WIND SERVICE: EXPANSIONS

- TABLE 171 RES: COMPANY OVERVIEW

- TABLE 172 RES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 173 RES: DEALS

- TABLE 174 ENVISION GROUP: COMPANY OVERVIEW

- TABLE 175 ENVISION GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 176 ENVISION GROUP: DEALS

- TABLE 177 ENVISION GROUP: OTHERS

- TABLE 178 WINDEY ENERGY TECHNOLOGY GROUP CO., LTD.: COMPANY OVERVIEW

- TABLE 179 WINDEY ENERGY TECHNOLOGY GROUP CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 180 WINDEY ENERGY TECHNOLOGY GROUP CO., LTD.: DEALS

- TABLE 181 WINDEY ENERGY TECHNOLOGY GROUP CO., LTD.: EXPANSIONS

- TABLE 182 SANY RENEWABLE ENERGY CO., LTD.: COMPANY OVERVIEW

- TABLE 183 SANY RENEWABLE ENERGY CO., LTD.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 184 SANY RENEWABLE ENERGY CO., LTD.: DEALS

- TABLE 185 ENERCON GLOBAL GMBH: COMPANY OVERVIEW

- TABLE 186 ENERCON GLOBAL GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 187 ENERCON GLOBAL GMBH: DEALS

- TABLE 188 ENERCON GLOBAL GMBH: OTHERS

- TABLE 189 DEUTSCHE WINDTECHNIK AG: COMPANY OVERVIEW

- TABLE 190 DEUTSCHE WINDTECHNIK AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 191 DEUTSCHE WINDTECHNIK AG: DEALS

- TABLE 192 DEUTSCHE WINDTECHNIK AG: EXPANSIONS

- TABLE 193 DEUTSCHE WINDTECHNIK AG: OTHERS

- TABLE 194 BHI ENERGY: COMPANY OVERVIEW

- TABLE 195 WIND PROSPECT SP. Z O.O.: COMPANY OVERVIEW

- TABLE 196 EOS ENGINEERING & SERVICE CO., LTD.: COMPANY OVERVIEW

- TABLE 197 CRRC SHANDONG WIND POWER CO., LTD.: COMPANY OVERVIEW

- TABLE 198 REGEN POWERTECH: COMPANY OVERVIEW

- TABLE 199 NEARTHLAB: COMPANY OVERVIEW

- TABLE 200 ZEPHYR WIND SERVICES: COMPANY OVERVIEW

- TABLE 201 ALERION TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 202 RRB ENERGY: COMPANY OVERVIEW

- TABLE 203 RTS WIND AG: COMPANY OVERVIEW

- TABLE 204 AERONES ENGINEERING: COMPANY OVERVIEW

List of Figures

- FIGURE 1 WIND TURBINE OPERATIONS AND MAINTENANCE MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 WIND TURBINE OPERATIONS AND MAINTENANCE MARKET: RESEARCH DESIGN

- FIGURE 3 WIND TURBINE OPERATIONS AND MAINTENANCE MARKET: DATA TRIANGULATION

- FIGURE 4 WIND TURBINE OPERATIONS AND MAINTENANCE MARKET: BOTTOM-UP APPROACH

- FIGURE 5 WIND TURBINE OPERATIONS AND MAINTENANCE MARKET: TOP-DOWN APPROACH

- FIGURE 6 WIND TURBINE OPERATIONS AND MAINTENANCE MARKET: DEMAND- SIDE ANALYSIS

- FIGURE 7 KEY METRICS CONSIDERED TO ASSESS SUPPLY OF WIND TURBINE OPERATIONS AND MAINTENANCE

- FIGURE 8 WIND TURBINE OPERATIONS AND MAINTENANCE MARKET: SUPPLY-SIDE ANALYSIS

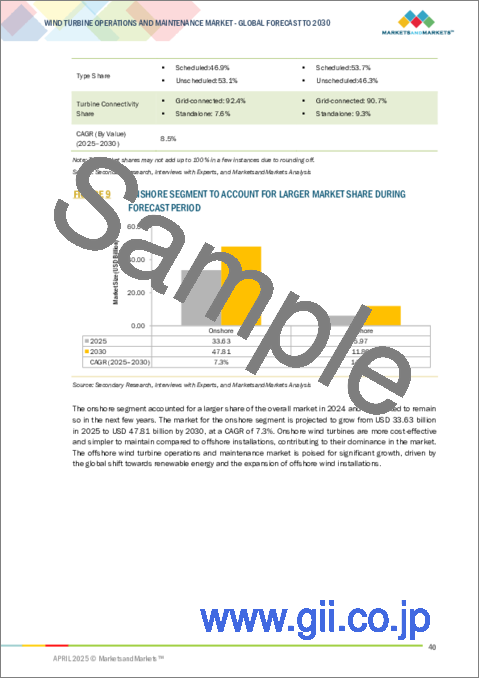

- FIGURE 9 ONSHORE SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 10 GRID-CONNECTED SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 11 SCHEDULED SEGMENT TO LEAD WIND TURBINE OPERATIONS AND MAINTENANCE MARKET DURING FORECAST PERIOD

- FIGURE 12 ASIA PACIFIC ACCOUNTED FOR LARGEST SHARE OF WIND TURBINE OPERATIONS AND MAINTENANCE MARKET IN 2024

- FIGURE 13 GOVERNMENT POLICIES AND DIGITALIZATION TO FOSTER GROWTH OF WIND TURBINE OPERATIONS AND MAINTENANCE MARKET

- FIGURE 14 CHINA HELD LARGEST SHARE OF ASIA PACIFIC WIND TURBINE OPERATIONS AND MAINTENANCE MARKET IN 2024

- FIGURE 15 ONSHORE SEGMENT TO DOMINATE WIND TURBINE OPERATIONS AND MAINTENANCE MARKET IN 2030

- FIGURE 16 SCHEDULED SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2030

- FIGURE 17 GRID-CONNECTED SEGMENT TO LEAD WIND TURBINE OPERATIONS AND MAINTENANCE MARKET IN 2030

- FIGURE 18 MIDDLE EAST & AFRICA MARKET TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 19 WIND TURBINE OPERATIONS AND MAINTENANCE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 RENEWABLE ENERGY CAPACITY GROWTH, 2022 VS. 2030 (GW)

- FIGURE 21 GLOBAL ELECTRICITY GENERATION, BY RENEWABLE ENERGY TECHNOLOGY, 2023 & 2030

- FIGURE 22 ANNUAL FINANCIAL COMMITMENTS IN ONSHORE AND OFFSHORE WIND ENERGY, 2013-2022

- FIGURE 23 GLOBAL INVESTMENT IN CLEAN ENERGY PROJECTS, 2015-2024

- FIGURE 24 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 25 SUPPLY CHAIN ANALYSIS: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET

- FIGURE 26 WIND TURBINE OPERATIONS AND MAINTENANCE MARKET: ECOSYSTEM ANALYSIS

- FIGURE 27 EXPORT SCENARIO FOR HS CODE 850231-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2022-2024

- FIGURE 28 IMPORT SCENARIO FOR HS CODE 850231-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2022-2024

- FIGURE 29 AVERAGE SELLING PRICE TREND OF ONSHORE WIND TURBINE OPERATIONS AND MAINTENANCE, BY REGION, 2021-2024

- FIGURE 30 AVERAGE SELLING PRICE TREND OF OFFSHORE WIND TURBINE OPERATIONS AND MAINTENANCE, BY REGION, 2021-2024

- FIGURE 31 PATENTS APPLIED AND GRANTED, 2014-2024

- FIGURE 32 INVESTMENT AND FUNDING SCENARIO, 2024

- FIGURE 33 PORTER'S FIVE FORCES ANALYSIS FOR WIND TURBINE OPERATIONS AND MAINTENANCE MARKET

- FIGURE 34 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY LOCATION TYPE

- FIGURE 35 KEY BUYING CRITERIA, BY LOCATION TYPE

- FIGURE 36 IMPACT OF GEN AI/AI ON WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY LOCATION TYPE

- FIGURE 37 WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY LOCATION TYPE, 2024

- FIGURE 38 WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY TYPE, 2024

- FIGURE 39 WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY TURBINE CONNECTIVITY, 2024

- FIGURE 40 WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY REGION, 2024

- FIGURE 41 MIDDLE EAST & AFRICA TO REGISTER HIGHEST CAGR IN WIND TURBINE OPERATIONS AND MAINTENANCE MARKET

- FIGURE 42 ASIA PACIFIC: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET SNAPSHOT

- FIGURE 43 EUROPE: WIND TURBINE OPERATIONS AND MAINTENANCE MARKET SNAPSHOT

- FIGURE 44 WIND TURBINE OPERATIONS AND MAINTENANCE MARKET: MARKET SHARE ANALYSIS, 2024

- FIGURE 45 WIND TURBINE OPERATIONS AND MAINTENANCE MARKET: SEGMENTAL REVENUE ANALYSIS OF FIVE KEY PLAYERS, 2020-2024

- FIGURE 46 WIND TURBINE OPERATIONS AND MAINTENANCE MARKET: COMPANY VALUATION, 2025

- FIGURE 47 WIND TURBINE OPERATIONS AND MAINTENANCE MARKET: FINANCIAL METRICS, 2025

- FIGURE 48 WIND TURBINE OPERATIONS AND MAINTENANCE MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 49 WIND TURBINE OPERATIONS AND MAINTENANCE MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 50 WIND TURBINE OPERATIONS AND MAINTENANCE MARKET: MARKET FOOTPRINT

- FIGURE 51 WIND TURBINE OPERATIONS AND MAINTENANCE MARKET: COMPANY FOOTPRINT

- FIGURE 52 WIND TURBINE OPERATIONS AND MAINTENANCE MARKET: COMPANY EVALUATION MATRIX (START-UPS/SMES), 2024

- FIGURE 53 SIEMENS GAMESA RENEWABLE ENERGY, S.A.U.: COMPANY SNAPSHOT

- FIGURE 54 GE VERNOVA: COMPANY SNAPSHOT

- FIGURE 55 GOLDWIND: COMPANY SNAPSHOT

- FIGURE 56 NORDEX SE: COMPANY SNAPSHOT

- FIGURE 57 VESTAS: COMPANY SNAPSHOT

- FIGURE 58 SUZLON ENERGY LIMITED: COMPANY SNAPSHOT

- FIGURE 59 MINGYANG SMART ENERGY GROUP CO., LTD.: COMPANY SNAPSHOT

- FIGURE 60 SKF: COMPANY SNAPSHOT

The global wind turbine operations and maintenance (O&M) market is projected to reach USD 59.67 billion by 2030, up from USD 35.62 billion in 2024, registering a CAGR of 8.5% over the forecast period. The expansion of offshore wind farms and the introduction of predictive maintenance technologies are fueling the market. The implementation of environmental targets and policy mandates across regions is further compelling the market to consider longer-term asset management solutions. Key global and regional players have created a strong footprint in the wind turbine operation and maintenance market by developing diverse service portfolios derived from extensive O&M experience.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) |

| Segments | By type, location type, turbine connectivity |

| Regions covered | North America, Europe, Asia Pacific, South America, and Middle East & Africa |

"The offshore segment is expected to register the highest growth during the forecast period"

The offshore wind turbine operations and maintenance market is experiencing growth due to the global demand for sustainable energy and the substantial potential of offshore wind farms. Offshore wind farms benefit from more consistent wind speeds, but they are also much more complex to operate, demonstrating the need for more advanced O&M services. Recent advancements in the realm of monitoring and diagnosing tools, including remote and predictive maintenance technologies, are improving efficiencies and reducing operational costs. Additionally, as both government and private investment increase in offshore wind projects, the growth prospects of offshore O&M are growing.

"The unscheduled segment accounted for the largest market share in 2024"

The unscheduled segment of the wind turbine operations and maintenance market is influenced by the urgent need to respond to unexpected failures of components. The demand for unscheduled maintenance is affected by the age and state of the installed turbine base, as older assets will fail at a higher frequency. These unexpected breakdowns can lead to prolonged turbine downtime, lost energy output, and increased O&M expenses, particularly for offshore wind projects where access and repair costs are significantly higher. However, digitalization is transforming the unscheduled segment by enabling real-time condition monitoring, predictive diagnostics, and automated fault alerts using SCADA data, IoT sensors, and AI.

"Asia Pacific to account for the largest share of wind turbine operations and maintenance market during the forecast period"

The Asia Pacific region is the largest wind turbine operations and maintenance (O&M) market because of supportive governmental policies on renewable energy and strong investments in both offshore and onshore wind projects. Major markets, including China, India, and Japan, are already contributing to growth with high renewable energy targets. Globally recognized targets include China's plan to install 1200 GW of wind and solar capacity by 2030, and India's participation in Renewable Energy Certificate programs. The growth in the Asia Pacific region is expected to be further strengthened by technological innovations such as AI-enabled predictive maintenance and remote monitoring systems that enhance the efficiency of turbines and reduce downtime.

In-depth interviews have been conducted with various key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information, as well as to assess future market prospects. The distribution of primary interviews is as follows:

By Company Type: Tier 1- 57%, Tier 2- 29%, and Tier 3- 14%

By Designation: C-Level- 35%, Managers- 20%, and Others- 45%

By Region: North America - 20%, Europe - 15%, Asia Pacific - 30%, the Middle East & Africa - 25%, and South America - 10%

Note: The tiers of the companies are defined based on their total revenues as of 2023. Tier 1: > USD 1 billion, Tier 2: From USD 500 million to USD 1 billion, and Tier 3: < USD 500 million

Siemens Gamesa Renewable Energy, S.A.U. (Spain), Nordex SE (Germany), Vestas (Denmark), GE Vernova (US), Goldwind (China), Suzlon Energy Limited (India), Wind Prospect Sp. z o.o. (Poland), Mingyang Smart Energy Group Co., Ltd. (China), Global Wind Service (Denmark), BHI Energy (US), EOS Engineering & Service Co., Ltd. (Japan), RES (UK), and Deutsche Windtechnik AG (Germany) are some of the key players in the wind turbine operation and maintenance (O&M) market. The study includes an in-depth competitive analysis of these key players in the wind turbine operation and maintenance (O&M) market.

Research Coverage:

The report defines, describes, and forecasts the wind turbine operation and maintenance (O&M) market by type (Scheduled and unscheduled), location type (Onshore and offshore), turbine connectivity (Grid connected and standalone), and region (North America, Europe, Asia Pacific, Middle East & Africa, and South America). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the wind turbine operation and maintenance market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, and services; key strategies such as contracts, partnerships, agreements, mergers, and acquisitions; and recent developments associated with the wind turbine operation and maintenance market. Competitive analysis of startups in the wind turbine operation and maintenance market ecosystem is covered in this report.

Key Benefits of Buying the Report

- Analysis of key drivers (Government policies and mandates regarding renewable energy targets, expansion of wind energy installations, and need for efficient maintenance to maximize wind turbine lifespan), restraints (High O&M costs and weather-related constraints, regulatory uncertainty presents significant challenges), opportunities (Increasing investments in clean energy projects, aging wind turbine fleet driving O&M transformation, and shift towards predictive maintenance and remote monitoring), and challenges (Access to offshore sites) influencing the growth of the wind turbine operation and maintenance market

- Product Development/Innovation: New technology is redefining the market for wind turbine operations and maintenance and will eventually be designed to use superior digital tools enabled by automation. The global wind turbine operations and maintenance (O&M) market is aligned with ongoing technological advancements, ongoing research and development aimed at increasing turbine performance and reliability. New service offerings are based on predictive maintenance, remote monitoring, and advanced analytics that improve overall turbine uptime and energy production. These advancements will continue to drive growth in the market as operators aim to reduce their costs and improve efficiency.

- Market Development: In April 2025, GE Vernova and BBWind reached their nineteenth agreement to supply onshore wind turbines for community wind farms in Germany. Under this agreement, GE Vernova will supply three 6.0 MW-164m wind turbines for the Heiden and Dorsten projects in North Rhine-Westphalia. The wind turbines will be manufactured at GE's facility in Salzbergen, Germany. This alliance is part of Germany's goal of achieving 80% renewable energy supplies by 2030. This report provides a detailed analysis of O&M strategies that are critical for project success, providing stakeholders with actionable insights into trends and opportunities for growth in the wind energy market.

- Market Diversification: Siemens Gamesa Renewable Energy, S.A.U. and a TPG-led consortium (with MAVCO Investments) agreed to purchase Siemens Gamesa's onshore wind turbine business in India and Sri Lanka in March 2025. The consortium will own 90% of the onshore business while Siemens Gamesa will own a 10% stake and will license the technology through a long-term licensing agreement. The deal includes the transfer of about 1,000 employees, as well as existing manufacturing facilities, to a new independent company that will manufacture, install, and service onshore wind turbines in the area. The report provides an in-depth look at O&M strategies that can help support market diversification by providing stakeholders with new service/operating models, new partnership models across regions, and technology-enabled business lines. The report identifies opportunities to expand beyond traditional maintenance and identifies geographical and customer segments that are underserved and are open to strategic entry.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Siemens Gamesa Renewable Energy, S.A.U. (Spain), Nordex SE (Germany), Vestas (Denmark), GE Vernova (US), Goldwind (China), Suzlon Energy Limited (India), Wind Prospect Sp. z o.o. (Poland), Mingyang Smart Energy Group Co., Ltd. (China), Global Wind Service (Denmark), BHI Energy (US), ReGen Powertech (India), SKF (Sweden), and Zephyr Wind Services (US), among others, in the wind turbine operation and maintenance market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 YEARS CONSIDERED

- 1.3.3 INCLUSIONS AND EXCLUSIONS

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of primary interview participants

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primaries

- 2.1.2.4 Key data from primary sources

- 2.1.1 SECONDARY DATA

- 2.2 DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- 2.3.3 DEMAND-SIDE ANALYSIS

- 2.3.3.1 Demand-side assumptions

- 2.3.3.2 Demand-side calculations

- 2.3.4 SUPPLY-SIDE ANALYSIS

- 2.3.4.1 Supply-side assumptions

- 2.3.4.2 Supply-side calculations

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN WIND TURBINE OPERATIONS AND MAINTENANCE MARKET

- 4.2 ASIA PACIFIC WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY LOCATION TYPE AND COUNTRY

- 4.3 WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY LOCATION TYPE

- 4.4 WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY TYPE

- 4.5 WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY TURBINE CONNECTIVITY

- 4.6 WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Government policies regarding renewable energy targets

- 5.2.1.2 Expansion of wind energy installations

- 5.2.1.3 Need for efficient maintenance to maximize wind turbine lifespan

- 5.2.2 RESTRAINTS

- 5.2.2.1 High O&M costs and weather-related constraints

- 5.2.2.2 Fragmented and evolving regulatory landscape

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing investments in clean energy projects

- 5.2.3.2 Increase in aging wind infrastructure

- 5.2.3.3 Shift towards predictive maintenance and remote monitoring

- 5.2.4 CHALLENGES

- 5.2.4.1 Access to offshore sites

- 5.2.4.2 Overdependence on OEMs

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 SUPPLY CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 TRADE ANALYSIS

- 5.6.1 EXPORT SCENARIO (HS CODE 850231)

- 5.6.2 IMPORT SCENARIO (HS CODE 850231)

- 5.7 CASE STUDY ANALYSIS

- 5.7.1 OPTIMIZING WIND TURBINE MAINTENANCE AT LOS MONTEROS WIND FARM

- 5.7.2 ENHANCING OFFSHORE WIND OPERATIONS WITH 3D LASER SCANNING AND DIGITAL TWINS

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Predictive maintenance

- 5.8.1.2 Digital twin technology

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 IoT and smart sensors

- 5.8.2.2 AI and ML for wind turbine operations and maintenance

- 5.8.1 KEY TECHNOLOGIES

- 5.9 PRICING ANALYSIS

- 5.9.1 INDICATIVE PRICING OF WIND TURBINE OPERATIONS AND MAINTENANCE, BY LOCATION TYPE, 2024

- 5.9.2 AVERAGE SELLING PRICE TREND OF ONSHORE WIND TURBINE OPERATIONS AND MAINTENANCE, BY REGION, 2021-2024

- 5.10 PATENT ANALYSIS

- 5.10.1 LIST OF PATENTS, 2020-2024

- 5.11 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.12 INVESTMENT AND FUNDING SCENARIO

- 5.13 REGULATORY LANDSCAPE

- 5.13.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.2 CODES AND REGULATIONS

- 5.14 IMPACT OF 2025 US TARIFF - OVERVIEW

- 5.14.1 INTRODUCTION

- 5.14.2 KEY TARIFF RATES

- 5.14.3 PRICE IMPACT ANALYSIS

- 5.14.4 IMPACT ON COUNTRY/REGION

- 5.14.4.1 US

- 5.14.4.2 Europe

- 5.14.4.3 Asia Pacific

- 5.14.5 IMPACT ON END-USE INDUSTRIES

- 5.15 PORTER'S FIVE FORCES ANALYSIS

- 5.15.1 THREAT OF SUBSTITUTES

- 5.15.2 BARGAINING POWER OF SUPPLIERS

- 5.15.3 BARGAINING POWER OF BUYERS

- 5.15.4 THREAT OF NEW ENTRANTS

- 5.15.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.16 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.16.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.16.2 BUYING CRITERIA

- 5.17 IMPACT OF GEN AI/AI ON WIND TURBINE OPERATIONS AND MAINTENANCE MARKET

- 5.17.1 ADOPTION OF GEN AI/AI IN WIND TURBINE OPERATIONS AND MAINTENANCE MARKET

- 5.17.2 IMPACT OF GEN AI/AI ON WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY LOCATION TYPE

- 5.17.3 IMPACT OF GEN AI/AI ON WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY REGION

- 5.18 GLOBAL MACROECONOMIC OUTLOOK

- 5.18.1 INTRODUCTION

- 5.18.2 GDP TRENDS AND FORECAST

- 5.18.3 IMPACT OF INFLATION ON WIND TURBINE OPERATIONS AND MAINTENANCE MARKET

6 WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY LOCATION TYPE

- 6.1 INTRODUCTION

- 6.2 ONSHORE

- 6.2.1 AGING INFRASTRUCTURE AND INCREASED ONSHORE EXPANSION FUELING NEED FOR O&M

- 6.3 OFFSHORE

- 6.3.1 RAPID EXPANSION OF OFFSHORE WIND ENERGY TO DRIVE MARKET GROWTH

7 WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 SCHEDULED

- 7.2.1 NEED FOR ENSURING LONG-TERM TURBINE PERFORMANCE AND OPERATIONAL STABILITY TO DRIVE DEMAND

- 7.3 UNSCHEDULED

- 7.3.1 AGING TURBINES FUELING NEED FOR RAPID FAULT RESPONSE AND ASSET LIFECYCLE PRESERVATION

8 WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY TURBINE CONNECTIVITY

- 8.1 INTRODUCTION

- 8.2 GRID-CONNECTED

- 8.2.1 INCREASE IN LARGE-SCALE UTILITY-BASED PROJECTS TO FUEL DEMAND

- 8.3 STANDALONE

- 8.3.1 GROWTH IN INSTALLATION OF SMALL TURBINES IN REMOTE AREAS TO DRIVE GROWTH

9 WIND TURBINE OPERATIONS AND MAINTENANCE MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 ASIA PACIFIC

- 9.2.1 CHINA

- 9.2.1.1 Aging fleet and tech upgrades fueling rapid market growth

- 9.2.2 JAPAN

- 9.2.2.1 Technological innovation for efficient wind turbine maintenance and grid integration to support market growth

- 9.2.3 SOUTH KOREA

- 9.2.3.1 Strong government support fueling market growth

- 9.2.4 INDIA

- 9.2.4.1 Need for enhancing wind energy capabilities and improving reliability to fuel market growth

- 9.2.5 AUSTRALIA

- 9.2.5.1 Government net-zero emissions target to drive market growth

- 9.2.6 REST OF ASIA PACIFIC

- 9.2.6.1 Expanding wind energy capacity to support market growth

- 9.2.1 CHINA

- 9.3 EUROPE

- 9.3.1 GERMANY

- 9.3.1.1 Expanding wind energy infrastructure to support market growth

- 9.3.2 UK

- 9.3.2.1 Expanding offshore wind capacity and supporting government policies to drive market

- 9.3.3 ITALY

- 9.3.3.1 Strong renewable energy goals to drive market growth

- 9.3.4 FRANCE

- 9.3.4.1 Significant expansion in onshore wind capacity to fuel demand

- 9.3.5 SWEDEN

- 9.3.5.1 Growing need to maintain wind turbines and increase energy efficiency to drive O&M services

- 9.3.6 SPAIN

- 9.3.6.1 Rising need for wind turbine upkeep and improved energy efficiency to fuel demand for O&M services

- 9.3.7 REST OF EUROPE

- 9.3.1 GERMANY

- 9.4 NORTH AMERICA

- 9.4.1 US

- 9.4.1.1 Need for ensuring long-term efficiency and reliability of wind assets to drive maintenance activities

- 9.4.2 CANADA

- 9.4.2.1 Expanding wind capacity and aging assets driving market growth

- 9.4.3 MEXICO

- 9.4.3.1 Policy support and renewable infrastructure expansion fueling demand for wind turbines

- 9.4.1 US

- 9.5 SOUTH AMERICA

- 9.5.1 BRAZIL

- 9.5.1.1 Strong presence of onshore wind energy sector and government support to drive growth

- 9.5.2 ARGENTINA

- 9.5.2.1 Abundant wind resources and strong policies to drive significant growth

- 9.5.3 REST OF SOUTH AMERICA

- 9.5.3.1 Supportive policies and rising investments to boost wind energy growth

- 9.5.1 BRAZIL

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 SAUDI ARABIA

- 9.6.1.1 Government-backed megaprojects and rising clean energy initiatives to propel market

- 9.6.2 EGYPT

- 9.6.2.1 Strong government targets and large-scale project rollouts to drive market

- 9.6.3 SOUTH AFRICA

- 9.6.3.1 Growing renewable energy capacity and strong government backing to fuel turbine O&M market

- 9.6.4 REST OF MIDDLE EAST & AFRICA

- 9.6.4.1 Supportive policies and rising investments to boost wind energy growth

- 9.6.1 SAUDI ARABIA

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022-2025

- 10.2.1 MARKET SHARE ANALYSIS, 2024

- 10.3 REVENUE ANALYSIS, 2020-2024

- 10.4 COMPANY VALUATION AND FINANCIAL METRICS

- 10.5 BRAND/PRODUCT COMPARISON

- 10.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.6.1 STARS

- 10.6.2 EMERGING LEADERS

- 10.6.3 PERVASIVE PLAYERS

- 10.6.4 PARTICIPANTS

- 10.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.6.5.1 Market footprint

- 10.6.5.2 Company footprint

- 10.6.5.3 Region footprint

- 10.6.5.4 Type footprint

- 10.6.5.5 Location type footprint

- 10.7 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2024

- 10.7.1 PROGRESSIVE COMPANIES

- 10.7.2 RESPONSIVE COMPANIES

- 10.7.3 DYNAMIC COMPANIES

- 10.7.4 STARTING BLOCKS

- 10.7.5 COMPETITIVE BENCHMARKING, KEY START-UPS/SMES, 2024

- 10.7.5.1 List of key start-ups/SMEs

- 10.7.5.2 Competitive benchmarking of key start-ups/SMEs

- 10.8 COMPETITIVE SCENARIO

- 10.8.1 DEALS

- 10.8.1.1 Expansions

- 10.8.1.2 Others

- 10.8.1 DEALS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 SIEMENS GAMESA RENEWABLE ENERGY, S.A.U.

- 11.1.1.1 Business overview

- 11.1.1.2 Products/Solutions/Services offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Deals

- 11.1.1.4 MnM view

- 11.1.1.4.1 Key strengths

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses and competitive threats

- 11.1.2 GE VERNOVA

- 11.1.2.1 Business overview

- 11.1.2.2 Products/Solutions/Services offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Deals

- 11.1.2.4 MnM view

- 11.1.2.4.1 Key strengths

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses and competitive threats

- 11.1.3 GOLDWIND

- 11.1.3.1 Business overview

- 11.1.3.2 Products/Solutions/Services offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Deals

- 11.1.3.4 MnM view

- 11.1.3.4.1 Key strengths

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses and competitive threats

- 11.1.4 NORDEX SE

- 11.1.4.1 Business overview

- 11.1.4.2 Products/Solutions/Services offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Deals

- 11.1.4.3.2 Others

- 11.1.4.4 MnM view

- 11.1.4.4.1 Key strengths

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses and competitive threats

- 11.1.5 VESTAS

- 11.1.5.1 Business overview

- 11.1.5.2 Products/Solutions/Services offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Deals

- 11.1.5.3.2 Expansions

- 11.1.5.4 MnM view

- 11.1.5.4.1 Key strengths

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses and competitive threats

- 11.1.6 SUZLON ENERGY LIMITED

- 11.1.6.1 Business overview

- 11.1.6.2 Products/Solutions/Services offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Deals

- 11.1.7 MINGYANG SMART ENERGY GROUP CO., LTD.

- 11.1.7.1 Business overview

- 11.1.7.2 Products/Solutions/Services offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Deals

- 11.1.8 SKF

- 11.1.8.1 Business overview

- 11.1.8.2 Products/Solutions/Services offered

- 11.1.8.3 Recent developments

- 11.1.8.3.1 Deals

- 11.1.9 GLOBAL WIND SERVICE

- 11.1.9.1 Business overview

- 11.1.9.2 Products/Solutions/Services offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Deals

- 11.1.9.3.2 Expansions

- 11.1.10 RES

- 11.1.10.1 Business overview

- 11.1.10.2 Products/Solutions/Services offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Deals

- 11.1.11 ENVISION GROUP

- 11.1.11.1 Business overview

- 11.1.11.2 Products/Solutions/Services offered

- 11.1.11.3 Recent developments

- 11.1.11.3.1 Deals

- 11.1.11.3.2 Others

- 11.1.12 WINDEY ENERGY TECHNOLOGY GROUP CO., LTD.

- 11.1.12.1 Business overview

- 11.1.12.2 Products/Solutions/Services offered

- 11.1.12.3 Recent developments

- 11.1.12.3.1 Deals

- 11.1.12.3.2 Expansions

- 11.1.13 SANY RENEWABLE ENERGY CO., LTD.

- 11.1.13.1 Business overview

- 11.1.13.2 Products/Solutions/Services offered

- 11.1.13.3 Recent developments

- 11.1.13.3.1 Deals

- 11.1.14 ENERCON GLOBAL GMBH

- 11.1.14.1 Business overview

- 11.1.14.2 Products/Solutions/Services offered

- 11.1.14.3 Recent developments

- 11.1.14.3.1 Deals

- 11.1.14.3.2 Others

- 11.1.15 DEUTSCHE WINDTECHNIK AG

- 11.1.15.1 Business overview

- 11.1.15.2 Products/Solutions/Services offered

- 11.1.15.3 Recent developments

- 11.1.15.3.1 Deals

- 11.1.15.3.2 Expansions

- 11.1.15.3.3 Others

- 11.1.1 SIEMENS GAMESA RENEWABLE ENERGY, S.A.U.

- 11.2 OTHER PLAYERS

- 11.2.1 BHI ENERGY

- 11.2.2 WIND PROSPECT SP. Z O.O.

- 11.2.3 EOS ENGINEERING & SERVICE CO., LTD.

- 11.2.4 CRRC SHANDONG WIND POWER CO., LTD.

- 11.2.5 REGEN POWERTECH

- 11.2.6 NEARTHLAB

- 11.2.7 ZEPHYR WIND SERVICES

- 11.2.8 ALERION TECHNOLOGIES

- 11.2.9 RRB ENERGY

- 11.2.10 RTS WIND AG

- 11.2.11 AERONES ENGINEERING

12 APPENDIX

- 12.1 INSIGHTS FROM INDUSTRY EXPERTS

- 12.2 DISCUSSION GUIDE

- 12.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.4 CUSTOMIZATION OPTIONS

- 12.5 RELATED REPORTS

- 12.6 AUTHOR DETAILS