|

|

市場調査レポート

商品コード

1724752

自動車用カメラの世界市場:技術別、ICE/EV用途別、車両タイプ別、ビュー別、EVタイプ別、自動運転レベル別、地域別 - 予測(~2032年)Automotive Camera Market by Technology (Digital, Infrared, Thermal), ICE and EV Application (ACC, BSD, AFL, IPA, DMS, NVS, & PA), Vehicle Type (PC, LCV, HCV), View (Front, Rear, Surround), EV Type, Level of Autonomy, and Region - Global Forecast to 2032 |

||||||

カスタマイズ可能

|

|||||||

| 自動車用カメラの世界市場:技術別、ICE/EV用途別、車両タイプ別、ビュー別、EVタイプ別、自動運転レベル別、地域別 - 予測(~2032年) |

|

出版日: 2025年05月07日

発行: MarketsandMarkets

ページ情報: 英文 386 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の自動車用カメラの市場規模は、2025年の84億米ドルから2032年までに153億4,000万米ドルに達すると予測され、CAGRで9.0%の成長が見込まれます。

市場は、高級車への需要の高まりと自動運転車技術の急速な進歩により、世界的に拡大しています。この動向は、アダプティブクルーズコントロール、ナイトビジョンシステム、レーンキープアシストなどの運転支援機能にADAS(先進運転支援システム)が使用され、安全性と運転体験が向上していることを浮き彫りにしています。さらに、自動車用カメラシステムにおけるAI統合などの最先端技術の統合は、市場成長をさらに加速させます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2032年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2032年 |

| 単位 | 金額(100万米ドル/1,000米ドル) |

| セグメント | 技術、ICE用途、車両タイプ、ビュータイプ、EVタイプ、EV用途、自動運転レベル |

| 対象地域 | アジア太平洋、欧州、北米、その他の地域 |

「ビュータイプ別では、サラウンドビューカメラが世界の自動車用カメラ市場でもっとも急成長します。」

サラウンドビューカメラは、車両の周囲360度の視界を提供するもので、安全性と利便性に大きな利点があることから、さまざまな車両クラスで普及が進んでいます。サラウンドビューシステムは、通常、車両のフロント、リア、サイドミラーに搭載される複数の高解像度カメラを統合したものです。これらのシステムは、クルマの周囲360度を上から見下ろしたような仮想映像を生成し、障害物や歩行者、他のクルマとの衝突を事実上回避します。この技術は、ダイナミックガイドライン、死角警告・検知、自動駐車支援などの機能を包含する中核機能を超えて、迅速かつ効果的なサポートを提供します。この技術は、超音波センサー、レーダー、LiDAR技術などの重要なコンポーネントによってより効果的になり、車両の安全性を高めます。この技術は当初、高級SUVや高級セダンで提供されていましたが、OEM各社は現在、ハッチバック、クロスオーバー、ミッドサイズセダン、一部のハイトリムコンパクトカーにもこの技術を拡大しています。したがって、安全性と運転支援機能に対する消費者の関心の変化、政府の強力な規範、主要OEMの投資の増加により、サラウンドビューカメラシステムは予測期間にもっとも速く成長する見込みです。

「EV用途別では、死角検知が自動車用カメラ市場で最大のセグメントになると予測されます。」

死角検知(BSD)は、近年EVでの採用が増加しています。この動向は、EVの静音性により特に注目されています。BSDシステムは、複数のカメラとセンサーを使用してドライバーの視界外の領域をモニターし、障害物に関する警告を発します。都市化の進行により、世界各地の大都市圏では都市交通の混雑や狭い道路が増え、視界の不明瞭さによる事故のリスクが高まっています。BSDセグメントはもっとも急速に成長すると予測されます。Mercedes-Benz EQSのようなモデルは、WITTE Automotive GmbH(ドイツ)のリアビューカメラを使用した死角検知機能を備えており、Airways U5はBSDを含む先進運転支援システム(ADAS)を標準搭載しています。このことは、EVにおける運転支援技術に対する需要の高まりを浮き彫りにしており、電気自動車における予測期間のBSD市場の促進要因となっています。

当レポートでは、世界の自動車用カメラ市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 主な調査結果

- 自動車用カメラ市場における魅力的な機会

- 自動車用カメラ市場:EVタイプ別

- 自動車用カメラ市場:自動運転レベル別

- 自動車用カメラ市場:ビュータイプ別

- 自動車用カメラ市場:技術別

- 自動車用カメラ市場:ICE用途別

- 自動車用カメラ市場:車両タイプ別

- 自動車用カメラ市場:EV用途別

- 自動車用カメラ市場:地域別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客のビジネスに影響を与える動向と混乱

- エコシステム分析

- サプライチェーン分析

- 原材料サプライヤー

- コンポーネントメーカー/技術プロバイダー

- クラウドサービスプロバイダー

- OEM

- エンドユーザー

- 主なステークホルダーと購入基準

- 主な会議とイベント(2025年~2026年)

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- 自動車用カメラ市場に対するAI/生成AIの影響

- 投資と資金調達のシナリオ

- 特許分析

- 貿易分析

- 自動車用カメラの輸入シナリオ

- 自動車用カメラの輸出シナリオ

- ケーススタディ分析

- ビジョンシステムの柔軟性

- DENSOのドライバーモニタリングシステム

- MOMENTAのMPILOT PARKING

- RenesasによるADAS/自動運転用途に向けた深層学習の開発

- MIKROTRONのハイスピードカメラを用いた回避支援システム

- SONY IMAGE SENSING SOLUTIONSによる、堅牢なFCBブロックカメラを用いたセキュリティの強化

- NIDEC ELESYSのADAS(先進運転支援システム)向けセンサーフュージョン

- 教育効果に向けたレーザー技術の活用

- 規制情勢

- 米国関税の影響の概要

- イントロダクション

- 主な関税率

- 自動車の最終製品と部品に対する各国の関税

- 自動車用カメラ市場に対する米国関税の影響

- 価格分析

- 平均販売価格の動向:ビュータイプ別(2022年~2024年)

- 平均販売価格分析:地域別(2022年~2024年)

- 自動車用カメラ市場:各OEMのサプライヤー

- 自動車用カメラの製品開発:サプライヤー別

- ROBERT BOSCH GMBH

- MOBILEYE

- SONY SEMICONDUCTOR SOLUTIONS

第6章 自動車用カメラ市場:ICE用途別

- イントロダクション

- アダプティブクルーズコントロール

- アダプティブクルーズコントロール+前方衝突警報

- アダプティブクルーズコントロール+前方衝突警報+交通標識認識

- 死角検知

- 死角検知+レーンキープアシスト+車線逸脱警報

- アダプティブライティングシステム

- インテリジェント駐車支援

- ドライバーモニタリングシステム

- ナイトビジョンシステム

- 駐車支援

- 主な調査結果

第7章 自動車用カメラ市場:ビュータイプ別

- イントロダクション

- フロントビュー

- リアビュー

- サラウンドビュー

- 主な調査結果

第8章 自動車用カメラ市場:技術別

- イントロダクション

- デジタル

- 赤外線

- サーマル

- 主な調査結果

第9章 自動車用カメラ市場:車両タイプ別

- イントロダクション

- 乗用車

- 小型商用車

- 大型商用車

- 主な調査結果

第10章 自動車用カメラ市場:自動運転レベル別

- イントロダクション

- レベル0/レベル1

- レベル2

- レベル3

- 主な調査結果

第11章 電気自動車用カメラ市場:用途別

- イントロダクション

- アダプティブクルーズコントロール

- アダプティブクルーズコントロール+前方衝突警報

- アダプティブクルーズコントロール+前方衝突警報+交通標識認識

- 死角検知

- 死角検知+レーンキープアシスト+車線逸脱警報

- アダプティブライティングシステム

- インテリジェント駐車支援

- ドライバーモニタリングシステム

- ナイトビジョンシステム

- 駐車支援

- 主な調査結果

第12章 電気自動車用カメラ市場:電気自動車タイプ別

- イントロダクション

- バッテリー電気自動車

- プラグインハイブリッド電気自動車

- 燃料電池電気自動車

- 主な調査結果

第13章 自動車用カメラ市場:地域別

- イントロダクション

- アジア太平洋

- マクロ経済の見通し

- 中国

- インド

- 日本

- 韓国

- タイ

- その他のアジア太平洋

- 欧州

- ミクロ経済の見通し

- ドイツ

- フランス

- スペイン

- ロシア

- 英国

- トルコ

- その他の欧州

- 北米

- マクロ経済の見通し

- 米国

- カナダ

- メキシコ

- その他の地域

- マクロ経済の見通し

- ブラジル

- イラン

- その他

第14章 競合情勢

- イントロダクション

- 市場シェア分析

- 主要参入企業の戦略/強み(2021年~2025年)

- 企業の評価と財務指標

- ブランド/製品の比較

- 収益分析

- 企業の評価マトリクス:主要企業(2024年)

- 企業の評価マトリクス:スタートアップ/中小企業(2024年)

- 競合シナリオ

第15章 企業プロファイル

- 主要企業

- ROBERT BOSCH GMBH

- CONTINENTAL AG

- VALEO

- ZF FRIEDRICHSHAFEN AG

- DENSO CORPORATION

- FICOSA INTERNACIONAL SA

- APTIV

- MAGNA INTERNATIONAL INC.

- FORVIA

- RICOH

- KYOCERA CORPORATION

- その他の企業

- SONY SEMICONDUCTOR SOLUTIONS CORPORATION

- PANASONIC AUTOMOTIVE SYSTEMS CO., LTD

- LG ELECTRONICS

- MOTHERSON

- AMBARELLA INTERNATIONAL LP

- OMNIVISION

- HITACHI ASTEMO, LTD.

- GENTEX CORPORATION

- SAMSUNG ELECTRO-MECHANICS

- TELEDYNE FLIR LLC

- HYUNDAI MOBIS

- MCNEX CO., LTD.

- STONKAM CO., LTD.

- BRIGADE ELECTRONICS GROUP PLC

- H.P.B. OPTOELECTRONICS CO., LTD.

- GARMIN LTD.

第16章 MARKETSANDMARKETSによる提言

- アジア太平洋が自動車用カメラ市場を独占する

- サーマルカメラと赤外線カメラ、そしてAIの統合が自動運転車のイノベーションを推進する

- 自動車用カメラ市場を牽引する、運転の快適性とADASの安全機能に対する需要の増加

- 結論

第17章 付録

List of Tables

- TABLE 1 AUTOMOTIVE CAMERA MARKET DEFINITION, BY TECHNOLOGY

- TABLE 2 AUTOMOTIVE CAMERA MARKET DEFINITION, BY ICE AND ELECTRIC VEHICLE APPLICATION

- TABLE 3 AUTOMOTIVE CAMERA MARKET DEFINITION, BY VEHICLE TYPE

- TABLE 4 AUTOMOTIVE CAMERA MARKET DEFINITION, BY VIEW TYPE

- TABLE 5 AUTOMOTIVE CAMERA MARKET DEFINITION, BY ELECTRIC VEHICLE TYPE

- TABLE 6 AUTOMOTIVE CAMERA MARKET DEFINITION, BY LEVEL OF AUTONOMY

- TABLE 7 INCLUSIONS AND EXCLUSIONS

- TABLE 8 CURRENCY EXCHANGE RATES

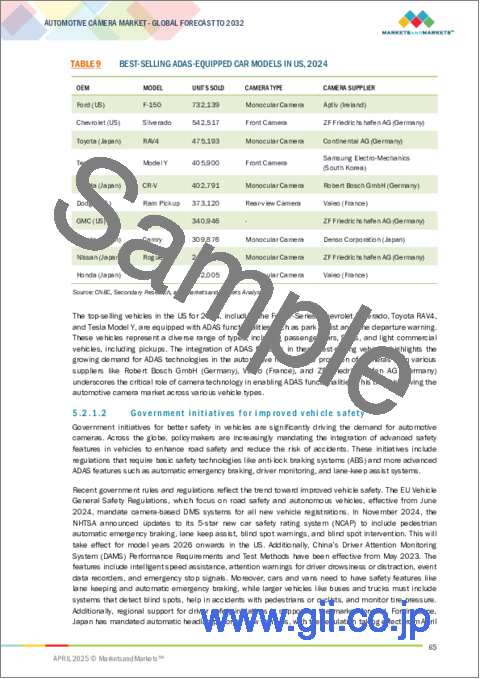

- TABLE 9 BEST-SELLING ADAS-EQUIPPED CAR MODELS IN US, 2024

- TABLE 10 REGULATIONS FOR DRIVER ASSISTANCE SYSTEMS

- TABLE 11 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 12 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP VEHICLE TYPES (%)

- TABLE 13 KEY BUYING CRITERIA FOR TECHNOLOGY

- TABLE 14 AUTOMOTIVE CAMERA MARKET: KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 15 SUPERIORITY OF CAMERAS OVER OTHER AUTOMOTIVE SENSORS

- TABLE 16 IMPORTANT PATENT REGISTRATIONS RELATED TO AUTOMOTIVE CAMERA MARKET

- TABLE 17 IMPORT DATA FOR HS CODE 900211, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 18 EXPORT DATA FOR HS CODE 900211, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 19 REGULATIONS AND INITIATIVES

- TABLE 20 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 US: TOTAL IMPORTS (2024) AND ADJUSTED RECIPROCAL TARIFFS

- TABLE 24 US: AUTOMOTIVE IMPORTS (2024) AND ADJUSTED RECIPROCAL TARIFFS

- TABLE 25 CHINA: EXPORTS TO US AND MEXICO MARKETS (2022-2024)

- TABLE 26 AVERAGE SELLING PRICE TREND, BY VEHICLE TYPE, 2022-2024 (USD)

- TABLE 27 AVERAGE SELLING PRICE ANALYSIS, BY REGION AND VEHICLE TYPE, 2023 (USD)

- TABLE 28 AUTOMOTIVE CAMERA MARKET, OEM-WISE SUPPLIER

- TABLE 29 AUTOMOTIVE CAMERA MARKET, BY ICE APPLICATION, 2021-2024 (THOUSAND UNITS)

- TABLE 30 AUTOMOTIVE CAMERA MARKET, BY ICE APPLICATION, 2025-2032 (THOUSAND UNITS)

- TABLE 31 AUTOMOTIVE CAMERA MARKET, BY ICE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 32 AUTOMOTIVE CAMERA MARKET, BY ICE APPLICATION, 2025-2032 (USD MILLION)

- TABLE 33 OEM MODELS WITH ADAPTIVE CRUISE CONTROL, BY CAMERA SUPPLIER

- TABLE 34 ADAPTIVE CRUISE CONTROL: AUTOMOTIVE CAMERA MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 35 ADAPTIVE CRUISE CONTROL: AUTOMOTIVE CAMERA MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 36 ADAPTIVE CRUISE CONTROL: AUTOMOTIVE CAMERA MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 37 ADAPTIVE CRUISE CONTROL: AUTOMOTIVE CAMERA MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 38 OEM MODELS WITH ADAPTIVE CRUISE CONTROL + FORWARD COLLISION WARNING, BY CAMERA SUPPLIER

- TABLE 39 ADAPTIVE CRUISE CONTROL + FORWARD COLLISION WARNING: AUTOMOTIVE CAMERA MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 40 ADAPTIVE CRUISE CONTROL + FORWARD COLLISION WARNING: AUTOMOTIVE CAMERA MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 41 ADAPTIVE CRUISE CONTROL + FORWARD COLLISION WARNING: AUTOMOTIVE CAMERA MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 42 ADAPTIVE CRUISE CONTROL + FORWARD COLLISION WARNING: AUTOMOTIVE CAMERA MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 43 ADAPTIVE CRUISE CONTROL + FORWARD COLLISION WARNING + TRAFFIC SIGN RECOGNITION: AUTOMOTIVE CAMERA MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 44 ADAPTIVE CRUISE CONTROL + FORWARD COLLISION WARNING + TRAFFIC SIGN RECOGNITION: AUTOMOTIVE CAMERA MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 45 ADAPTIVE CRUISE CONTROL + FORWARD COLLISION WARNING + TRAFFIC SIGN RECOGNITION: AUTOMOTIVE CAMERA MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 46 ADAPTIVE CRUISE CONTROL + FORWARD COLLISION WARNING + TRAFFIC SIGN RECOGNITION: AUTOMOTIVE CAMERA MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 47 OEM MODELS WITH BLIND SPOT DETECTION, BY CAMERA SUPPLIER

- TABLE 48 BLIND SPOT DETECTION: AUTOMOTIVE CAMERA MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 49 BLIND SPOT DETECTION: AUTOMOTIVE CAMERA MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 50 BLIND SPOT DETECTION: AUTOMOTIVE CAMERA MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 51 BLIND SPOT DETECTION: AUTOMOTIVE CAMERA MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 52 OEM MODELS WITH BLIND SPOT DETECTION + LANE KEEP ASSIST + LANE DEPARTURE WARNING, BY CAMERA SUPPLIER

- TABLE 53 BLIND SPOT DETECTION + LANE KEEP ASSIST + LANE DEPARTURE WARNING: AUTOMOTIVE CAMERA MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 54 BLIND SPOT DETECTION + LANE KEEP ASSIST + LANE DEPARTURE WARNING: AUTOMOTIVE CAMERA MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 55 BLIND SPOT DETECTION + LANE KEEP ASSIST + LANE DEPARTURE WARNING: AUTOMOTIVE CAMERA MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 56 BLIND SPOT DETECTION + LANE KEEP ASSIST + LANE DEPARTURE WARNING: AUTOMOTIVE CAMERA MARKET, BY REGION, 2025-2032 (USD MILLION)

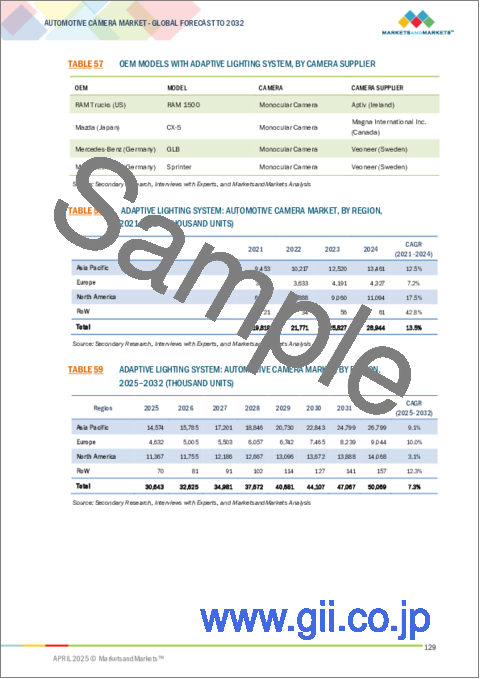

- TABLE 57 OEM MODELS WITH ADAPTIVE LIGHTING SYSTEM, BY CAMERA SUPPLIER

- TABLE 58 ADAPTIVE LIGHTING SYSTEM: AUTOMOTIVE CAMERA MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 59 ADAPTIVE LIGHTING SYSTEM: AUTOMOTIVE CAMERA MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 60 ADAPTIVE LIGHTING SYSTEM: AUTOMOTIVE CAMERA MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 61 ADAPTIVE LIGHTING SYSTEM: AUTOMOTIVE CAMERA MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 62 OEM MODELS WITH INTELLIGENT PARKING ASSIST, BY CAMERA SUPPLIER

- TABLE 63 INTELLIGENT PARKING ASSIST: AUTOMOTIVE CAMERA MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 64 INTELLIGENT PARKING ASSIST: AUTOMOTIVE CAMERA MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 65 INTELLIGENT PARKING ASSIST: AUTOMOTIVE CAMERA MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 66 INTELLIGENT PARKING ASSIST: AUTOMOTIVE CAMERA MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 67 OEM MODELS WITH DRIVER MONITORING SYSTEM, BY CAMERA SUPPLIER

- TABLE 68 DRIVER MONITORING SYSTEM: AUTOMOTIVE CAMERA MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 69 DRIVER MONITORING SYSTEM: AUTOMOTIVE CAMERA MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 70 DRIVER MONITORING SYSTEM: AUTOMOTIVE CAMERA MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 71 DRIVER MONITORING SYSTEM: AUTOMOTIVE CAMERA MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 72 OEM MODELS WITH NIGHT VISION SYSTEM, BY CAMERA SUPPLIER

- TABLE 73 NIGHT VISION SYSTEM: AUTOMOTIVE CAMERA MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 74 NIGHT VISION SYSTEM: AUTOMOTIVE CAMERA MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 75 NIGHT VISION SYSTEM: AUTOMOTIVE CAMERA MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 76 NIGHT VISION SYSTEM: AUTOMOTIVE CAMERA MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 77 OEM MODELS WITH PARKING ASSIST, BY CAMERA SUPPLIER

- TABLE 78 PARKING ASSIST: AUTOMOTIVE CAMERA MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 79 PARKING ASSIST: AUTOMOTIVE CAMERA MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 80 PARKING ASSIST: AUTOMOTIVE CAMERA MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 81 PARKING ASSIST: AUTOMOTIVE CAMERA MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 82 AUTOMOTIVE CAMERA MARKET, BY VIEW TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 83 AUTOMOTIVE CAMERA MARKET, BY VIEW TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 84 AUTOMOTIVE CAMERA MARKET, BY VIEW TYPE, 2021-2024 (USD MILLION)

- TABLE 85 AUTOMOTIVE CAMERA MARKET, BY VIEW TYPE, 2025-2032 (USD MILLION)

- TABLE 86 FRONT-VIEW AUTOMOTIVE CAMERA MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 87 FRONT-VIEW AUTOMOTIVE CAMERA MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 88 FRONT-VIEW AUTOMOTIVE CAMERA MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 89 FRONT-VIEW AUTOMOTIVE CAMERA MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 90 REAR-VIEW AUTOMOTIVE CAMERA MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 91 REAR-VIEW AUTOMOTIVE CAMERA MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 92 REAR-VIEW AUTOMOTIVE CAMERA MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 93 REAR-VIEW AUTOMOTIVE CAMERA MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 94 SURROUND-VIEW AUTOMOTIVE CAMERA MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 95 SURROUND-VIEW AUTOMOTIVE CAMERA MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 96 SURROUND-VIEW AUTOMOTIVE CAMERA MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 97 SURROUND-VIEW AUTOMOTIVE CAMERA MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 98 AUTOMOTIVE CAMERA MARKET, BY TECHNOLOGY, 2021-2024 (THOUSAND UNITS)

- TABLE 99 AUTOMOTIVE CAMERA MARKET, BY TECHNOLOGY, 2025-2032 (THOUSAND UNITS)

- TABLE 100 AUTOMOTIVE CAMERA MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 101 AUTOMOTIVE CAMERA MARKET, BY TECHNOLOGY, 2025-2032 (USD MILLION)

- TABLE 102 DIGITAL CAMERA MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 103 DIGITAL CAMERA MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 104 DIGITAL CAMERA MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 105 DIGITAL CAMERA MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 106 INFRARED CAMERA MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 107 INFRARED CAMERA MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 108 INFRARED CAMERA MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 109 INFRARED CAMERA MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 110 THERMAL CAMERA MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 111 THERMAL CAMERA MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 112 THERMAL CAMERA MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 113 THERMAL CAMERA MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 114 AUTOMOTIVE CAMERA MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 115 AUTOMOTIVE CAMERA MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 116 AUTOMOTIVE CAMERA MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 117 AUTOMOTIVE CAMERA MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 118 PASSENGER CAR CAMERA MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 119 PASSENGER CAR CAMERA MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 120 PASSENGER CAR CAMERA MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 121 PASSENGER CAR CAMERA MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 122 LIGHT COMMERCIAL VEHICLE CAMERA MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 123 LIGHT COMMERCIAL VEHICLE CAMERA MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 124 LIGHT COMMERCIAL VEHICLE CAMERA MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 125 LIGHT COMMERCIAL VEHICLE CAMERA MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 126 HEAVY COMMERCIAL VEHICLE CAMERA MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 127 HEAVY COMMERCIAL VEHICLE CAMERA MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 128 HEAVY COMMERCIAL VEHICLE CAMERA MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 129 HEAVY COMMERCIAL VEHICLE CAMERA MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 130 AUTOMOTIVE CAMERA MARKET, BY LEVEL OF AUTONOMY, 2021-2024 (THOUSAND UNITS)

- TABLE 131 AUTOMOTIVE CAMERA MARKET, BY LEVEL OF AUTONOMY, 2025-2032 (THOUSAND UNITS)

- TABLE 132 AUTOMOTIVE CAMERA MARKET, BY LEVEL OF AUTONOMY, 2021-2024 (USD MILLION)

- TABLE 133 AUTOMOTIVE CAMERA MARKET, BY LEVEL OF AUTONOMY, 2025-2032 (USD MILLION)

- TABLE 134 LEVEL 0/LEVEL 1: AUTOMOTIVE CAMERA MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 135 LEVEL 0/LEVEL 1: AUTOMOTIVE CAMERA MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 136 LEVEL 0/LEVEL 1: AUTOMOTIVE CAMERA MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 137 LEVEL 0/LEVEL 1: AUTOMOTIVE CAMERA MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 138 LEVEL 2: AUTOMOTIVE CAMERA MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 139 LEVEL 2: AUTOMOTIVE CAMERA MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 140 LEVEL 2: AUTOMOTIVE CAMERA MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 141 LEVEL 2: AUTOMOTIVE CAMERA MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 142 LEVEL 3: AUTOMOTIVE CAMERA MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 143 LEVEL 3: AUTOMOTIVE CAMERA MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 144 LEVEL 3: AUTOMOTIVE CAMERA MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 145 LEVEL 3: AUTOMOTIVE CAMERA MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 146 ELECTRIC VEHICLE CAMERA MARKET, BY APPLICATION, 2021-2024 (THOUSAND UNITS)

- TABLE 147 ELECTRIC VEHICLE CAMERA MARKET, BY APPLICATION, 2025-2032 (THOUSAND UNITS)

- TABLE 148 ELECTRIC VEHICLE CAMERA MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 149 ELECTRIC VEHICLE CAMERA MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 150 OEM MODELS WITH ADAPTIVE CRUISE CONTROL, BY CAMERA SUPPLIER

- TABLE 151 ELECTRIC VEHICLE CAMERA MARKET FOR ADAPTIVE CRUISE CONTROL, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 152 ELECTRIC VEHICLE CAMERA MARKET FOR ADAPTIVE CRUISE CONTROL, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 153 ELECTRIC VEHICLE CAMERA MARKET FOR ADAPTIVE CRUISE CONTROL, BY REGION, 2021-2024 (USD MILLION)

- TABLE 154 ELECTRIC VEHICLE CAMERA MARKET FOR ADAPTIVE CRUISE CONTROL, BY REGION, 2025-2032 (USD MILLION)

- TABLE 155 ELECTRIC VEHICLE CAMERA MARKET FOR ADAPTIVE CRUISE CONTROL + FORWARD COLLISION WARNING, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 156 ELECTRIC VEHICLE CAMERA MARKET FOR ADAPTIVE CRUISE CONTROL + FORWARD COLLISION WARNING, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 157 ELECTRIC VEHICLE CAMERA MARKET FOR ADAPTIVE CRUISE CONTROL + FORWARD COLLISION WARNING, BY REGION, 2021-2024 (USD MILLION)

- TABLE 158 ELECTRIC VEHICLE CAMERA MARKET FOR ADAPTIVE CRUISE CONTROL + FORWARD COLLISION WARNING, BY REGION, 2025-2032 (USD MILLION)

- TABLE 159 ELECTRIC VEHICLE CAMERA MARKET FOR ADAPTIVE CRUISE CONTROL + FORWARD COLLISION WARNING + TRAFFIC SIGN RECOGNITION, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 160 ELECTRIC VEHICLE CAMERA MARKET FOR ADAPTIVE CRUISE CONTROL + FORWARD COLLISION WARNING + TRAFFIC SIGN RECOGNITION, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 161 ELECTRIC VEHICLE CAMERA MARKET FOR ADAPTIVE CRUISE CONTROL + FORWARD COLLISION WARNING + TRAFFIC SIGN RECOGNITION, BY REGION, 2021-2024 (USD MILLION)

- TABLE 162 ELECTRIC VEHICLE CAMERA MARKET FOR ADAPTIVE CRUISE CONTROL + FORWARD COLLISION WARNING + TRAFFIC SIGN RECOGNITION, BY REGION, 2025-2032 (USD MILLION)

- TABLE 163 OEM MODELS WITH BLIND SPOT DETECTION, BY CAMERA SUPPLIER

- TABLE 164 ELECTRIC VEHICLE CAMERA MARKET FOR BLIND SPOT DETECTION, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 165 ELECTRIC VEHICLE CAMERA MARKET FOR BLIND SPOT DETECTION, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 166 ELECTRIC VEHICLE CAMERA MARKET FOR BLIND SPOT DETECTION, BY REGION, 2021-2024 (USD MILLION)

- TABLE 167 ELECTRIC VEHICLE CAMERA MARKET FOR BLIND SPOT DETECTION, BY REGION, 2025-2032 (USD MILLION)

- TABLE 168 OEM MODELS WITH BLIND SPOT DETECTION + LANE KEEP ASSIST + LANE DEPARTURE WARNING, BY CAMERA SUPPLIER

- TABLE 169 ELECTRIC VEHICLE CAMERA MARKET FOR BLIND SPOT DETECTION + LANE KEEP ASSIST + LANE DEPARTURE WARNING, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 170 ELECTRIC VEHICLE CAMERA MARKET FOR BLIND SPOT DETECTION + LANE KEEP ASSIST + LANE DEPARTURE WARNING, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 171 ELECTRIC VEHICLE CAMERA MARKET FOR BLIND SPOT DETECTION + LANE KEEP ASSIST + LANE DEPARTURE WARNING, BY REGION, 2021-2024 (USD MILLION)

- TABLE 172 ELECTRIC VEHICLE CAMERA MARKET FOR BLIND SPOT DETECTION + LANE KEEP ASSIST + LANE DEPARTURE WARNING, BY REGION, 2025-2032 (USD MILLION)

- TABLE 173 ADAPTIVE LIGHTING SYSTEM: ELECTRIC VEHICLE CAMERA MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 174 ELECTRIC VEHICLE CAMERA MARKET FOR ADAPTIVE LIGHTING SYSTEM, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 175 ELECTRIC VEHICLE CAMERA MARKET FOR ADAPTIVE LIGHTING SYSTEM, BY REGION, 2021-2024 (USD MILLION)

- TABLE 176 ELECTRIC VEHICLE CAMERA MARKET FOR ADAPTIVE LIGHTING SYSTEM, BY REGION, 2025-2032 (USD MILLION)

- TABLE 177 OEM MODELS WITH INTELLIGENT PARKING ASSIST, BY CAMERA SUPPLIER

- TABLE 178 ELECTRIC VEHICLE CAMERA MARKET FOR INTELLIGENT PARKING ASSIST, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 179 ELECTRIC VEHICLE CAMERA MARKET FOR INTELLIGENT PARKING ASSIST, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 180 ELECTRIC VEHICLE CAMERA MARKET FOR INTELLIGENT PARKING ASSIST, BY REGION, 2021-2024 (USD MILLION)

- TABLE 181 ELECTRIC VEHICLE CAMERA MARKET FOR INTELLIGENT PARKING ASSIST, BY REGION, 2025-2032 (USD MILLION)

- TABLE 182 ELECTRIC VEHICLE CAMERA MARKET FOR DRIVER MONITORING SYSTEM, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 183 ELECTRIC VEHICLE CAMERA MARKET FOR DRIVER MONITORING SYSTEM, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 184 ELECTRIC VEHICLE CAMERA MARKET FOR DRIVER MONITORING SYSTEM, BY REGION, 2021-2024 (USD MILLION)

- TABLE 185 ELECTRIC VEHICLE CAMERA MARKET FOR DRIVER MONITORING SYSTEM, BY REGION, 2025-2032 (USD MILLION)

- TABLE 186 OEM ELECTRIC MODELS WITH NIGHT VISION SYSTEM, BY CAMERA SUPPLIER

- TABLE 187 ELECTRIC VEHICLE CAMERA MARKET FOR NIGHT VISION SYSTEM, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 188 ELECTRIC VEHICLE CAMERA MARKET FOR NIGHT VISION SYSTEM, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 189 ELECTRIC VEHICLE CAMERA MARKET FOR NIGHT VISION SYSTEM, BY REGION, 2021-2024 (USD MILLION)

- TABLE 190 ELECTRIC VEHICLE CAMERA MARKET FOR NIGHT VISION SYSTEM, BY REGION, 2025-2032 (USD MILLION)

- TABLE 191 ELECTRIC VEHICLE CAMERA MARKET FOR PARKING ASSIST, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 192 ELECTRIC VEHICLE CAMERA MARKET FOR PARKING ASSIST, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 193 ELECTRIC VEHICLE CAMERA MARKET FOR PARKING ASSIST, BY REGION, 2021-2024 (USD MILLION)

- TABLE 194 ELECTRIC VEHICLE CAMERA MARKET FOR PARKING ASSIST, BY REGION, 2025-2032 (USD MILLION)

- TABLE 195 ELECTRIC VEHICLE CAMERA MARKET, BY ELECTRIC VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 196 ELECTRIC VEHICLE CAMERA MARKET, BY ELECTRIC VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 197 ELECTRIC VEHICLE CAMERA MARKET, BY ELECTRIC VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 198 ELECTRIC VEHICLE CAMERA MARKET, BY ELECTRIC VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 199 BATTERY ELECTRIC VEHICLE CAMERA MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 200 BATTERY ELECTRIC VEHICLE CAMERA MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 201 BATTERY ELECTRIC VEHICLE CAMERA MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 202 BATTERY ELECTRIC VEHICLE CAMERA MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 203 PLUG-IN HYBRID ELECTRIC VEHICLE CAMERA MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 204 PLUG-IN HYBRID ELECTRIC VEHICLE CAMERA MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 205 PLUG-IN HYBRID ELECTRIC VEHICLE CAMERA MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 206 PLUG-IN HYBRID ELECTRIC VEHICLE CAMERA MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 207 FUEL CELL ELECTRIC VEHICLE CAMERA MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 208 FUEL CELL ELECTRIC VEHICLE CAMERA MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 209 FUEL CELL ELECTRIC VEHICLE CAMERA MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 210 FUEL CELL ELECTRIC VEHICLE CAMERA MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 211 AUTOMOTIVE CAMERA MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 212 AUTOMOTIVE CAMERA MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 213 AUTOMOTIVE CAMERA MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 214 AUTOMOTIVE CAMERA MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 215 ASIA PACIFIC: AUTOMOTIVE CAMERA MARKET, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 216 ASIA PACIFIC: AUTOMOTIVE CAMERA MARKET, BY COUNTRY, 2025-2032 (THOUSAND UNITS)

- TABLE 217 ASIA PACIFIC: AUTOMOTIVE CAMERA MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 218 ASIA PACIFIC: AUTOMOTIVE CAMERA MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 219 CHINA: L3 AND L4 TESTING LICENSES BY OEM

- TABLE 220 CHINA: AUTOMOTIVE CAMERA MARKET, BY APPLICATION, 2021-2024 (THOUSAND UNITS)

- TABLE 221 CHINA: AUTOMOTIVE CAMERA MARKET, BY APPLICATION, 2025-2032 (THOUSAND UNITS)

- TABLE 222 CHINA: AUTOMOTIVE CAMERA MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 223 CHINA: AUTOMOTIVE CAMERA MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 224 INDIA: AUTOMOTIVE CAMERA MARKET, BY APPLICATION, 2021-2024 (THOUSAND UNITS)

- TABLE 225 INDIA: AUTOMOTIVE CAMERA MARKET, BY APPLICATION, 2025-2032 (THOUSAND UNITS)

- TABLE 226 INDIA: AUTOMOTIVE CAMERA MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 227 INDIA: AUTOMOTIVE CAMERA MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 228 JAPAN: AUTOMOTIVE CAMERA MARKET, BY APPLICATION, 2021-2024 (THOUSAND UNITS)

- TABLE 229 JAPAN: AUTOMOTIVE CAMERA MARKET, BY APPLICATION, 2025-2032 (THOUSAND UNITS)

- TABLE 230 JAPAN: AUTOMOTIVE CAMERA MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 231 JAPAN: AUTOMOTIVE CAMERA MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 232 SOUTH KOREA: AUTOMOTIVE CAMERA MARKET, BY APPLICATION, 2021-2024 (THOUSAND UNITS)

- TABLE 233 SOUTH KOREA: AUTOMOTIVE CAMERA MARKET, BY APPLICATION, 2025-2032 (THOUSAND UNITS)

- TABLE 234 SOUTH KOREA: AUTOMOTIVE CAMERA MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 235 SOUTH KOREA: AUTOMOTIVE CAMERA MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 236 THAILAND: AUTOMOTIVE CAMERA MARKET, BY APPLICATION, 2021-2024 (THOUSAND UNITS)

- TABLE 237 THAILAND: AUTOMOTIVE CAMERA MARKET, BY APPLICATION, 2025-2032 (THOUSAND UNITS)

- TABLE 238 THAILAND: AUTOMOTIVE CAMERA MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 239 THAILAND: AUTOMOTIVE CAMERA MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 240 REST OF ASIA PACIFIC: AUTOMOTIVE CAMERA MARKET, BY APPLICATION, 2021-2024 (THOUSAND UNITS)

- TABLE 241 REST OF ASIA PACIFIC: AUTOMOTIVE CAMERA MARKET, BY APPLICATION, 2025-2032 (THOUSAND UNITS)

- TABLE 242 REST OF ASIA PACIFIC: AUTOMOTIVE CAMERA MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 243 REST OF ASIA PACIFIC: AUTOMOTIVE CAMERA MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 244 EUROPE: AUTOMOTIVE CAMERA MARKET, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 245 EUROPE: AUTOMOTIVE CAMERA MARKET, BY COUNTRY, 2025-2032 (THOUSAND UNITS)

- TABLE 246 EUROPE: AUTOMOTIVE CAMERA MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 247 EUROPE: AUTOMOTIVE CAMERA MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 248 GERMANY: AUTOMOTIVE CAMERA MARKET, BY APPLICATION, 2021-2024 (THOUSAND UNITS)

- TABLE 249 GERMANY: AUTOMOTIVE CAMERA MARKET, BY APPLICATION, 2025-2032 (THOUSAND UNITS)

- TABLE 250 GERMANY: AUTOMOTIVE CAMERA MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 251 GERMANY: AUTOMOTIVE CAMERA MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 252 FRANCE: AUTOMOTIVE CAMERA MARKET, BY APPLICATION, 2021-2024 (THOUSAND UNITS)

- TABLE 253 FRANCE: AUTOMOTIVE CAMERA MARKET, BY APPLICATION, 2025-2032 (THOUSAND UNITS)

- TABLE 254 FRANCE: AUTOMOTIVE CAMERA MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 255 FRANCE: AUTOMOTIVE CAMERA MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 256 SPAIN: AUTOMOTIVE CAMERA MARKET, BY APPLICATION, 2021-2024 (THOUSAND UNITS)

- TABLE 257 SPAIN: AUTOMOTIVE CAMERA MARKET, BY APPLICATION, 2025-2032 (THOUSAND UNITS)

- TABLE 258 SPAIN: AUTOMOTIVE CAMERA MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 259 SPAIN: AUTOMOTIVE CAMERA MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 260 RUSSIA: AUTOMOTIVE CAMERA MARKET, BY APPLICATION, 2021-2024 (THOUSAND UNITS)

- TABLE 261 RUSSIA: AUTOMOTIVE CAMERA MARKET, BY APPLICATION, 2025-2032 (THOUSAND UNITS)

- TABLE 262 RUSSIA: AUTOMOTIVE CAMERA MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 263 RUSSIA: AUTOMOTIVE CAMERA MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 264 UK: AUTOMOTIVE CAMERA MARKET, BY APPLICATION, 2021-2024 (THOUSAND UNITS)

- TABLE 265 UK: AUTOMOTIVE CAMERA MARKET, BY APPLICATION, 2025-2032 (THOUSAND UNITS)

- TABLE 266 UK: AUTOMOTIVE CAMERA MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 267 UK: AUTOMOTIVE CAMERA MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 268 TURKEY: AUTOMOTIVE CAMERA MARKET, BY APPLICATION, 2021-2024 (THOUSAND UNITS)

- TABLE 269 TURKEY: AUTOMOTIVE CAMERA MARKET, BY APPLICATION, 2025-2032 (THOUSAND UNITS)

- TABLE 270 TURKEY: AUTOMOTIVE CAMERA MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 271 TURKEY: AUTOMOTIVE CAMERA MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 272 REST OF EUROPE: AUTOMOTIVE CAMERA MARKET, BY APPLICATION, 2021-2024 (THOUSAND UNITS)

- TABLE 273 REST OF EUROPE: AUTOMOTIVE CAMERA MARKET, BY APPLICATION, 2025-2032 (THOUSAND UNITS)

- TABLE 274 REST OF EUROPE: AUTOMOTIVE CAMERA MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 275 REST OF EUROPE: AUTOMOTIVE CAMERA MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 276 NORTH AMERICA: AUTOMOTIVE CAMERA MARKET, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 277 NORTH AMERICA: AUTOMOTIVE CAMERA MARKET, BY COUNTRY, 2025-2032 (THOUSAND UNITS)

- TABLE 278 NORTH AMERICA: AUTOMOTIVE CAMERA MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 279 NORTH AMERICA: AUTOMOTIVE CAMERA MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 280 US: AUTOMOTIVE CAMERA MARKET, BY APPLICATION, 2021-2024 (THOUSAND UNITS)

- TABLE 281 US: AUTOMOTIVE CAMERA MARKET, BY APPLICATION, 2025-2032 (THOUSAND UNITS)

- TABLE 282 US: AUTOMOTIVE CAMERA MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 283 US: AUTOMOTIVE CAMERA MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 284 CANADA: AUTOMOTIVE CAMERA MARKET, BY APPLICATION, 2021-2024 (THOUSAND UNITS)

- TABLE 285 CANADA: AUTOMOTIVE CAMERA MARKET, BY APPLICATION, 2025-2032 (THOUSAND UNITS)

- TABLE 286 CANADA: AUTOMOTIVE CAMERA MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 287 CANADA: AUTOMOTIVE CAMERA MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 288 MEXICO: AUTOMOTIVE CAMERA MARKET, BY APPLICATION, 2021-2024 (THOUSAND UNITS)

- TABLE 289 MEXICO: AUTOMOTIVE CAMERA MARKET, BY APPLICATION, 2025-2032 (THOUSAND UNITS)

- TABLE 290 MEXICO: AUTOMOTIVE CAMERA MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 291 MEXICO: AUTOMOTIVE CAMERA MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 292 REST OF THE WORLD: AUTOMOTIVE CAMERA MARKET, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 293 REST OF THE WORLD: AUTOMOTIVE CAMERA MARKET, BY COUNTRY, 2025-2032 (THOUSAND UNITS)

- TABLE 294 REST OF THE WORLD: AUTOMOTIVE CAMERA MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 295 REST OF THE WORLD: AUTOMOTIVE CAMERA MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 296 BRAZIL: AUTOMOTIVE CAMERA MARKET, BY APPLICATION, 2021-2024 (THOUSAND UNITS)

- TABLE 297 BRAZIL: AUTOMOTIVE CAMERA MARKET, BY APPLICATION, 2025-2032 (THOUSAND UNITS)

- TABLE 298 BRAZIL: AUTOMOTIVE CAMERA MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 299 BRAZIL: AUTOMOTIVE CAMERA MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 300 IRAN: AUTOMOTIVE CAMERA MARKET, BY APPLICATION, 2021-2024 (THOUSAND UNITS)

- TABLE 301 IRAN: AUTOMOTIVE CAMERA MARKET, BY APPLICATION, 2025-2032 (THOUSAND UNITS)

- TABLE 302 IRAN: AUTOMOTIVE CAMERA MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 303 IRAN: AUTOMOTIVE CAMERA MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 304 OTHERS: AUTOMOTIVE CAMERA MARKET, BY APPLICATION, 2021-2024 (THOUSAND UNITS)

- TABLE 305 OTHERS: AUTOMOTIVE CAMERA MARKET, BY APPLICATION, 2025-2032 (THOUSAND UNITS)

- TABLE 306 OTHERS: AUTOMOTIVE CAMERA MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 307 OTHERS: AUTOMOTIVE CAMERA MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 308 MARKET SHARE ANALYSIS, 2024

- TABLE 309 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- TABLE 310 AUTOMOTIVE CAMERA MARKET: REGION FOOTPRINT, 2024

- TABLE 311 AUTOMOTIVE CAMERA MARKET: VIEW TYPE FOOTPRINT, 2024

- TABLE 312 AUTOMOTIVE CAMERA MARKET: LEVEL OF AUTONOMY FOOTPRINT, 2024

- TABLE 313 AUTOMOTIVE CAMERA MARKET: TECHNOLOGY FOOTPRINT, 2024

- TABLE 314 AUTOMOTIVE CAMERA MARKET: VEHICLE TYPE FOOTPRINT, 2024

- TABLE 315 AUTOMOTIVE CAMERA MARKET: KEY START-UPS/SMES

- TABLE 316 AUTOMOTIVE CAMERA MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- TABLE 317 AUTOMOTIVE CAMERA MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, JANUARY 2021- APRIL 2025

- TABLE 318 AUTOMOTIVE CAMERA MARKET: DEALS, JANUARY 2021-APRIL 2025

- TABLE 319 AUTOMOTIVE CAMERA MARKET: EXPANSIONS, JANUARY 2021-APRIL 2025

- TABLE 320 AUTOMOTIVE CAMERA MARKET: OTHER DEVELOPMENTS, JANUARY 2021- APRIL 2025

- TABLE 321 ROBERT BOSCH GMBH: COMPANY OVERVIEW

- TABLE 322 ROBERT BOSCH GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 323 ROBERT BOSCH GMBH: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 324 ROBERT BOSCH GMBH: DEALS

- TABLE 325 ROBERT BOSCH GMBH: EXPANSIONS

- TABLE 326 ROBERT BOSCH GMBH: OTHERS

- TABLE 327 CONTINENTAL AG: COMPANY OVERVIEW

- TABLE 328 CONTINENTAL AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 329 CONTINENTAL AG: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 330 CONTINENTAL AG: DEALS

- TABLE 331 CONTINENTAL AG: EXPANSIONS

- TABLE 332 CONTINENTAL AG: OTHERS

- TABLE 333 VALEO: COMPANY OVERVIEW

- TABLE 334 VALEO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 335 VALEO: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 336 VALEO: DEALS

- TABLE 337 VALEO: EXPANSIONS

- TABLE 338 VALEO: OTHERS

- TABLE 339 ZF FRIEDRICHSHAFEN AG: COMPANY OVERVIEW

- TABLE 340 ZF FRIEDRICHSHAFEN AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 341 ZF FRIEDRICHSHAFEN AG: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 342 ZF FRIEDRICHSHAFEN AG: DEALS

- TABLE 343 ZF FRIEDRICHSHAFEN AG: EXPANSIONS

- TABLE 344 ZF FRIEDRICHSHAFEN AG: OTHERS

- TABLE 345 DENSO CORPORATION: COMPANY OVERVIEW

- TABLE 346 DENSO CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 347 DENSO CORPORATION: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 348 DENSO CORPORATION: DEALS

- TABLE 349 DENSO CORPORATION: EXPANSIONS

- TABLE 350 DENSO CORPORATION: OTHERS

- TABLE 351 FICOSA INTERNACIONAL SA.: COMPANY OVERVIEW

- TABLE 352 FICOSA INTERNACIONAL SA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 353 FICOSA INTERNACIONAL SA: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 354 FICOSA INTERNACIONAL SA: DEALS

- TABLE 355 FICOSA INTERNACIONAL SA: EXPANSIONS

- TABLE 356 FICOSA INTERNACIONAL SA: OTHERS

- TABLE 357 APTIV: COMPANY OVERVIEW

- TABLE 358 APTIV: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 359 APTIV: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 360 APTIV: DEALS

- TABLE 361 APTIV: EXPANSIONS

- TABLE 362 APTIV: OTHERS

- TABLE 363 MAGNA INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 364 MAGNA INTERNATIONAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 365 MAGNA INTERNATIONAL INC.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 366 MAGNA INTERNATIONAL INC.: DEALS

- TABLE 367 MAGNA INTERNATIONAL INC.: EXPANSIONS

- TABLE 368 MAGNA INTERNATIONAL INC.: OTHERS

- TABLE 369 FORVIA: COMPANY OVERVIEW

- TABLE 370 FORVIA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 371 FORVIA: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 372 FORVIA: DEALS

- TABLE 373 FORVIA: EXPANSIONS

- TABLE 374 FORVIA: OTHERS

- TABLE 375 RICOH: COMPANY OVERVIEW

- TABLE 376 RICOH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 377 RICOH: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 378 KYOCERA CORPORATION: COMPANY OVERVIEW

- TABLE 379 KYOCERA CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 380 KYOCERA CORPORATION: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 381 KYOCERA CORPORATION: EXPANSIONS

- TABLE 382 KYOCERA CORPORATION: OTHERS

- TABLE 383 SONY SEMICONDUCTOR SOLUTIONS CORPORATION: COMPANY OVERVIEW

- TABLE 384 PANASONIC AUTOMOTIVE SYSTEMS CO., LTD: COMPANY OVERVIEW

- TABLE 385 LG ELECTRONICS: COMPANY OVERVIEW

- TABLE 386 MOTHERSON: COMPANY OVERVIEW

- TABLE 387 AMBARELLA INTERNATIONAL LP: COMPANY OVERVIEW

- TABLE 388 OMNIVISION: COMPANY OVERVIEW

- TABLE 389 HITACHI ASTEMO, LTD.: COMPANY OVERVIEW

- TABLE 390 GENTEX CORPORATION: COMPANY OVERVIEW

- TABLE 391 SAMSUNG ELECTRO-MECHANICS: COMPANY OVERVIEW

- TABLE 392 TELEDYNE FLIR LLC: COMPANY OVERVIEW

- TABLE 393 HYUNDAI MOBIS: COMPANY OVERVIEW

- TABLE 394 MCNEX CO., LTD.: COMPANY OVERVIEW

- TABLE 395 STONKAM CO., LTD.: COMPANY OVERVIEW

- TABLE 396 BRIGADE ELECTRONICS GROUP PLC: COMPANY OVERVIEW

- TABLE 397 H.P.B. OPTOELECTRONICS CO., LTD.: COMPANY OVERVIEW

- TABLE 398 GARMIN LTD.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 AUTOMOTIVE CAMERA: MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 RESEARCH PROCESS FLOW

- FIGURE 4 KEY DATA FROM SECONDARY SOURCES

- FIGURE 5 BREAKDOWN OF PRIMARIES

- FIGURE 6 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 7 AUTOMOTIVE CAMERA MARKET: BOTTOM-UP APPROACH

- FIGURE 8 AUTOMOTIVE CAMERA MARKET: TOP-DOWN APPROACH

- FIGURE 9 DATA TRIANGULATION

- FIGURE 10 AUTOMOTIVE CAMERA: MARKET OVERVIEW

- FIGURE 11 AUTOMOTIVE CAMERA MARKET, BY REGION, 2025 VS 2032

- FIGURE 12 AUTOMOTIVE CAMERA MARKET, BY VIEW TYPE, 2025 VS. 2032

- FIGURE 13 RISING DEMAND FOR PASSENGER SAFETY AND IMPROVEMENTS IN ADAS TECHNOLOGY TO DRIVE MARKET

- FIGURE 14 BEVS TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 15 L0/L1 TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 16 SURROUND VIEW TO WITNESS FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 17 DIGITAL CAMERA TO HOLD HIGHEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 18 BLIND SPOT DETECTION TO LEAD ICE SEGMENT IN 2032

- FIGURE 19 PASSENGER CARS TO BE DOMINANT SEGMENT DURING FORECAST PERIOD

- FIGURE 20 ADAPTIVE CRUISE CONTROL TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 21 ASIA TO LEAD AUTOMOTIVE CAMERA MARKET IN 2025

- FIGURE 22 AUTOMOTIVE CAMERA MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 23 SONY AUTOMOTIVE CMOS SENSOR WITH LED FLICKER MITIGATION

- FIGURE 24 LACK OF SUPPORTIVE INFRASTRUCTURE FOR AUTOMOTIVE CAMERA-BASED ADAS APPLICATIONS IN EMERGING ECONOMIES

- FIGURE 25 OPTICS IN AUTONOMOUS VEHICLES

- FIGURE 26 AUTOMOTIVE CAMERA MARKET: TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 27 AUTOMOTIVE CAMERA MARKET: ECOSYSTEM ANALYSIS

- FIGURE 28 AUTOMOTIVE CAMERA MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR

- FIGURE 30 KEY BUYING CRITERIA FOR TECHNOLOGY

- FIGURE 31 MULTI-CAMERA SYSTEM IN VEHICLES

- FIGURE 32 MULTI-CAMERA SYSTEMS

- FIGURE 33 PROCESS FLOW OF MULTI-CAMERA SYSTEMS

- FIGURE 34 CONSTITUENTS OF AUTOMOTIVE CAMERA WITH AI CHIP

- FIGURE 35 AUTOMOTIVE CAMERA SYSTEMS WITH AI FOR PERCEPTION AND SENSING

- FIGURE 36 EXAMPLE OF THERMAL IMAGING IN VEHICLES

- FIGURE 37 RANGE OF THERMAL IMAGING COMPARED TO OTHER SENSORS

- FIGURE 38 BIT RATES FOR DIFFERENT NETWORKS

- FIGURE 39 INVESTMENT AND FUNDING SCENARIO, 2021-2025 (USD BILLION)

- FIGURE 40 PATENT ANALYSIS OF AUTOMOTIVE CAMERA MARKET, 2013-2025

- FIGURE 41 EVASIVE MANEUVER ASSIST SYSTEM

- FIGURE 42 AVERAGE SELLING PRICE TREND, BY VIEW TYPE, 2022-2024 (USD)

- FIGURE 43 AVERAGE SELLING PRICE ANALYSIS, BY REGION AND VEHICLE TYPE, 2023 (USD)

- FIGURE 44 ROBERT BOSCH GMBH, PRODUCT DEVELOPMENTS

- FIGURE 45 MOBILEYE, PRODUCT DEVELOPMENTS

- FIGURE 46 SONY SEMICONDUCTOR SOLUTIONS, PRODUCT DEVELOPMENTS

- FIGURE 47 AUTOMOTIVE CAMERA MARKET, BY ICE APPLICATION, 2025 VS. 2032 (USD MILLION)

- FIGURE 48 AUTOMOTIVE CAMERA MARKET, BY VIEW TYPE, 2025 VS. 2032 (USD MILLION)

- FIGURE 49 AUTOMOTIVE CAMERA MARKET, BY TECHNOLOGY, 2025 VS. 2032 (USD MILLION)

- FIGURE 50 AUTOMOTIVE CAMERA MARKET, BY VEHICLE TYPE, 2025 VS. 2032 (USD MILLION)

- FIGURE 51 CAMERA MONITORING SYSTEMS IN PASSENGER CARS

- FIGURE 52 HEAVY COMMERCIAL VEHICLES: POSSIBLE BLIND SPOTS

- FIGURE 53 LEVELS OF AUTONOMY BY CAMERAS PRESENT

- FIGURE 54 AUTOMOTIVE CAMERA MARKET, BY LEVEL OF AUTONOMY, 2025 VS. 2032 (USD MILLION)

- FIGURE 55 VARIOUS SENSORS INVOLVED IN MERCEDES-BENZ LEVEL 3 DRIVE PILOT

- FIGURE 56 ELECTRIC VEHICLE CAMERA MARKET, BY APPLICATION, 2025 VS. 2032 (USD MILLION)

- FIGURE 57 ELECTRIC VEHICLE CAMERA MARKET, BY ELECTRIC VEHICLE TYPE, 2025 VS. 2032 (USD MILLION)

- FIGURE 58 AUTOMOTIVE CAMERA MARKET, BY REGION, 2025 VS. 2032 (USD MILLION)

- FIGURE 59 ASIA PACIFIC: AUTOMOTIVE CAMERA MARKET SNAPSHOT

- FIGURE 60 ASIA PACIFIC: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 61 ASIA PACIFIC: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 62 ASIA PACIFIC: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 63 ASIA PACIFIC: MANUFACTURING INDUSTRY CONTRIBUTION TO GDP, 2024

- FIGURE 64 EUROPE: AUTOMOTIVE CAMERA MARKET, BY COUNTRY, 2025 VS. 2032 (USD MILLION)

- FIGURE 65 EUROPE: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 66 EUROPE: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 67 EUROPE: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 68 EUROPE: MANUFACTURING INDUSTRY CONTRIBUTION TO GDP, 2024

- FIGURE 69 NORTH AMERICA: AUTOMOTIVE CAMERA MARKET SNAPSHOT

- FIGURE 70 NORTH AMERICA: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 71 NORTH AMERICA: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 72 NORTH AMERICA: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 73 NORTH AMERICA: MANUFACTURING INDUSTRY CONTRIBUTION TO GDP, 2024

- FIGURE 74 REST OF THE WORLD: AUTOMOTIVE CAMERA MARKET, BY COUNTRY, 2025 VS. 2032 (USD MILLION)

- FIGURE 75 ROW: REAL GDP ANNUAL PERCENTAGE CHANGE, 2024-2026

- FIGURE 76 ROW: AVERAGE CPI INFLATION RATE, BY COUNTRY, 2024-2026

- FIGURE 77 ROW: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 78 ROW: MANUFACTURING INDUSTRY VALUE (AS PART OF GDP 2024)

- FIGURE 79 MARKET SHARE ANALYSIS, 2024

- FIGURE 80 COMPANY VALUATION OF TOP 5 PLAYERS, 2024

- FIGURE 81 FINANCIAL METRICS OF TOP 5 PLAYERS, 2024

- FIGURE 82 BRAND/PRODUCT COMPARISON OF TOP 5 PLAYERS

- FIGURE 83 REVENUE ANALYSIS OF TOP 5 PLAYERS, 2020-2024

- FIGURE 84 COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 85 AUTOMOTIVE CAMERA MARKET: COMPANY FOOTPRINT, 2024

- FIGURE 86 COMPANY EVALUATION MATRIX (START-UPS/SMES), 2024

- FIGURE 87 ROBERT BOSCH GMBH: COMPANY SNAPSHOT

- FIGURE 88 CONTINENTAL AG: COMPANY SNAPSHOT

- FIGURE 89 VALEO: COMPANY SNAPSHOT

- FIGURE 90 ZF FRIEDRICHSHAFEN AG: COMPANY SNAPSHOT

- FIGURE 91 DENSO CORPORATION: COMPANY SNAPSHOT

- FIGURE 92 FICOSA INTERNACIONAL SA.: COMPANY SNAPSHOT

- FIGURE 93 APTIV: COMPANY SNAPSHOT

- FIGURE 94 MAGNA INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 95 FORVIA: COMPANY SNAPSHOT

- FIGURE 96 RICOH: COMPANY SNAPSHOT

- FIGURE 97 KYOCERA CORPORATION: COMPANY SNAPSHOT

The global automotive camera market size is projected to grow from USD 8.40 billion in 2025 to USD 15.34 billion by 2032 at a CAGR of 9.0%. The automotive camera market is expanding globally due to the growing demand for premium vehicles and rapid advancements in autonomous vehicle technologies. This trend highlights the use of advanced camera systems for driver assistance features such as adaptive cruise control, night vision system, and lane keep assist to enhance safety and driving experience. Additionally, the integration of cutting-edge technologies, such as AI integration in automotive camera systems, further accelerates market growth.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD Million/USD Thousand) |

| Segments | Technology, ICE Application, Vehicle Type, View Type, EV Type, EV Application, Level of Autonomy |

| Regions covered | Asia Pacific, Europe, North America, and Rest of the World |

"Surround view camera will be the fastest-growing segment in the global automotive camera market, by view type."

Surround-view cameras offer a 360° view around the vehicle, which is becoming increasingly popular across various vehicle classes due to its significant safety and convenience benefits. Surround-view systems integrate multiple high-resolution cameras typically situated at the front, rear, and side mirrors of the vehicles. These systems produce a virtual top-down 360-degree depiction of the car's immediate environment, virtually eliminating collisions with obstacles, pedestrians, and other cars. The technology offers quick & effective support beyond its core capabilities to encompass features such as dynamic guidelines, blind spot warning & detection, and automated parking assistance. The technology becomes more effective and enhances vehicle safety with critical components like ultrasonic sensors, radars, and LiDAR technologies. This technology was initially offered in premium SUVs and luxury sedans; however, the OEMs have extended this offering now in hatchbacks, crossovers, mid-size sedans, and a few high-trim compact vehicles. Hence, with the shifting consumer focus on safety and driver-assistance features, along with strong government norms and increasing investment from key OEMs, the surround-view camera systems are projected to grow at the fastest rate during the forecast period.

"Blind spot detection of EV application segment is predicted to be the largest segment in the automotive camera market."

Blind spot detection (BSD) has seen increased adoption in EVs in recent times. This trend is particularly noteworthy for EVs due to their silent operation. BSD systems use multiple cameras and sensors to monitor areas outside the driver's vision and alert them regarding the obstacle. Rising urbanization leads to crowded city traffic and narrow roadways in several metropolitan areas across the world, which increases the risk of accidents caused by obscured vision. The BSD segment is expected to have the fastest growth. Models such as the Mercedes-Benz EQS feature blind spot detection using rear-view cameras from WITTE Automotive GmbH (Germany), and the Airways U5 comes standard with an Advanced Driver Assistance System (ADAS), including BSD. This highlights the growing demand for driver assistance technologies in EVs, which drives the market for BSD during the forecast period in electric vehicles.

"Asia Pacific is estimated to be the largest automotive camera market."

Asia Pacific is expected to be the largest market for automotive cameras, driven by rapid advancements in vehicle safety, higher vehicle production, and strong government regulatory frameworks. China, as the world's largest vehicle producer, will lead the region with a market share of ~45% due to the growing adoption of autonomous vehicles by key OEMs in the country. In 2024, China produced over 31 million vehicles, with a significant share from economy segments (Class A-C), while premium segments (Class D and above) also saw strong output. Economy cars are increasingly equipped with basic camera-based ADAS features such as lane departure warning and rear-view cameras. Premium vehicles now integrate high-end systems like multi-camera 360° views and AI-powered lane change support. In the heavy commercial vehicle (HCV) segment, camera-based ADAS like blind spot detection and driver monitoring are gaining traction, driven by safety and regulatory focus.

In India, growth in the automotive sector is being driven by increasing consumer awareness of vehicle safety. Regulatory mandates from the Indian government, which require all new vehicles manufactured from July 2019 to be equipped with speed warning systems and rear parking sensors, have also contributed to the rise in the adoption of rear-view cameras. Recently, Hyundai and Kia have been equipping their new models, such as the Hyundai IONIQ 5 and the 2025 Kia Seltos, with high-resolution rear-view cameras for obstacle detection and dynamic parking guidelines. Further, Japan and South Korea markets are also experiencing promising demand due to the rising adoption of ADAS technologies, fueled by vehicle safety regulations. The presence of leading automotive and component manufacturers like Toyota, Honda, Hyundai, and Kia complements this trend & launches some models with Level 2 and Level 2.5 autonomy, thereby driving the automotive camera market. Additionally, camera-based ADAS features are also increasingly adopted across commercial vehicles (CVs), including light (LCVs) and heavy-duty vehicles (HCVs). Models like the Isuzu Elf and Mitsubishi Fuso Canter in Japan, and Hyundai Mighty and Kia Bongo in South Korea, now offer front and rear cameras, blind spot detection, lane departure warnings, and driver monitoring systems. Driven by urban logistics needs, this trend is expected to grow steadily. Both countries are prioritizing safety and autonomous readiness, fostering ADAS integration across all vehicle classes.

In-depth interviews were conducted with CEOs, marketing directors, other innovation and technology directors, and executives from various key organizations operating in the automotive camera market. The break-up of the primaries is as follows:

- By Respondent Type: OEMs-32%, Tier 1-37%, and Others-28%,

- By Designation: CXOs-33%, Managers-52%, and Executives-15%

- By Region: North America-26%, Europe-35%, Asia Pacific-30%, and Rest of the World-9%

The automotive camera market comprises major players such as Robert Bosch GmbH (Germany), Continental AG (Germany), Valeo (France), ZF Friedrichshafen AG (Germany), Denso Corporation (Japan), and Ficosa International SA (Spain).

Research Coverage:

The study covers the automotive camera market across various segments. It aims to estimate the market size and future growth potential across different segments such as technology, ICE application, vehicle type, view type, EV type, EV application, level of autonomy, and region. The study also includes an in-depth competitive analysis of key market players, their company profiles, key observations related to product and business offerings, recent developments, and acquisitions.

This research report categorizes the automotive camera market by technology (digital, infrared, and thermal), ICE application (adaptive cruise control; adaptive cruise control + forward collision warning; adaptive cruise control + forward collision warning + traffic sign recognition; blind spot detection; blind spot detection + lane keep assist + lane departure warning; adaptive lighting system; intelligent park assist; driver monitoring system; night vision system; parking assist), vehicle type (ICE) (passenger car, light commercial vehicle, heavy commercial vehicle), view type (front view, surround view, and rear view), EV type [battery electric vehicle (BEV), plug-in hybrid electric vehicle (PHEV), fuel cell electric vehicle (FCEV)], EV application (adaptive cruise control; adaptive cruise control + forward collision warning; adaptive cruise control + forward collision warning + traffic sign recognition; blind spot detection; blind spot detection + lane keep assist + lane departure warning; adaptive lighting systems; intelligent park assist; driver monitoring systems; night vision systems; parking assist), level of autonomy (Level 0/Level 1, Level 2, and Level 3), and Region (Asia Pacific, Europe, North America, and Rest of the World).

The report's scope covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the automotive camera market. A detailed analysis of the key industry players provides insights into their business overview, solutions, and services; key strategies; contracts, partnerships, agreements, new product & service launches, mergers and acquisitions; and recent developments associated with the automotive camera market. This report also covers competitive analysis of SMEs/startups in the automotive camera market ecosystem, supplier analysis, and development by key suppliers.

Reasons to buy this report:

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall automotive camera market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Increasing consumer demand for ADAS in vehicles, government initiatives for improved vehicle safety, advancements in camera technology), restraints (Impact of adverse weather conditions, lack of infrastructure in emerging economies), opportunities (Growing push for autonomous vehicles, surge in demand for premium vehicles), and challenges (Low adoption and high cost of newer technologies, integration with other vehicle sensors) influencing the growth of the automotive camera market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the automotive camera market.

- Market Development: Comprehensive information about lucrative markets - the report analyzes the automotive camera market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the automotive camera market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Robert Bosch GmbH (Germany), Continental AG (Germany), Valeo (France), ZF Friedrichshafen AG (Germany), Denso Corporation (Japan), and Ficosa International SA (Spain) among others in the automotive camera market.

- Strategies: The report also helps stakeholders understand the pulse of the automotive camera market and provides them with information on key market drivers, restraints, challenges, and opportunities

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.3 SAMPLING TECHNIQUES AND DATA COLLECTION METHODS

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS AND RISK ASSESSMENT

- 2.5 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AUTOMOTIVE CAMERA MARKET

- 4.2 AUTOMOTIVE CAMERA MARKET, BY EV TYPE

- 4.3 AUTOMOTIVE CAMERA MARKET, BY LEVEL OF AUTONOMY

- 4.4 AUTOMOTIVE CAMERA MARKET, BY VIEW TYPE

- 4.5 AUTOMOTIVE CAMERA MARKET, BY TECHNOLOGY

- 4.6 AUTOMOTIVE CAMERA MARKET, BY ICE APPLICATION

- 4.7 AUTOMOTIVE CAMERA MARKET, BY VEHICLE TYPE

- 4.8 AUTOMOTIVE CAMERA MARKET, BY EV APPLICATION

- 4.9 AUTOMOTIVE CAMERA MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing consumer demand for ADAS in vehicles

- 5.2.1.2 Government initiatives for improved vehicle safety

- 5.2.1.3 Advancements in camera technology

- 5.2.2 RESTRAINTS

- 5.2.2.1 Impact of adverse weather conditions

- 5.2.2.2 Lack of infrastructure in emerging economies

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing push for autonomous vehicles

- 5.2.4 CHALLENGES

- 5.2.4.1 Low adoption and high cost of advanced technologies

- 5.2.4.2 Integration with other vehicle sensors

- 5.2.1 DRIVERS

- 5.3 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.5.1 RAW MATERIAL SUPPLIERS

- 5.5.2 COMPONENT MANUFACTURERS/TECHNOLOGY PROVIDERS

- 5.5.3 CLOUD SERVICE PROVIDERS

- 5.5.4 OEMS

- 5.5.5 END-USERS

- 5.6 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.6.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.6.2 KEY BUYING CRITERIA

- 5.7 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Multi-camera systems

- 5.8.1.1.1 Functions of multi-camera systems

- 5.8.1.1.2 2D and 3D displays

- 5.8.1.2 Camera systems for autonomous vehicle and truck platooning

- 5.8.1.3 High-speed connectivity, simulation, and autofocus imaging

- 5.8.1.1 Multi-camera systems

- 5.8.2 COMPLIMENTARY TECHNOLOGIES

- 5.8.2.1 Automotive camera systems with artificial intelligence

- 5.8.2.1.1 Upper body analytics

- 5.8.2.1.2 Face analytics

- 5.8.2.2 Automotive camera systems with thermal imaging

- 5.8.2.1 Automotive camera systems with artificial intelligence

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 Impact of 5G network on machine-to-machine communication

- 5.8.1 KEY TECHNOLOGIES

- 5.9 IMPACT OF AI/GEN AI ON AUTOMOTIVE CAMERA MARKET

- 5.10 INVESTMENT AND FUNDING SCENARIO

- 5.11 PATENT ANALYSIS

- 5.12 TRADE ANALYSIS

- 5.12.1 IMPORT SCENARIO OF AUTOMOTIVE CAMERA

- 5.12.2 EXPORT SCENARIO OF AUTOMOTIVE CAMERA

- 5.13 CASE STUDY ANALYSIS

- 5.13.1 FLEXIBILITY IN VISION SYSTEMS

- 5.13.2 DRIVER MONITORING SYSTEM BY DENSO

- 5.13.3 MPILOT PARKING BY MOMENTA

- 5.13.4 DEEP LEARNING DEVELOPMENT FOR ADAS AND AUTOMATED DRIVING APPLICATIONS BY RENESAS

- 5.13.5 EVASIVE MANEUVER ASSIST SYSTEM USING MIKROTRON HIGH-SPEED CAMERAS

- 5.13.6 ENHANCING SECURITY WITH RUGGED FCB BLOCK CAMERAS BY SONY IMAGE SENSING SOLUTIONS

- 5.13.7 SENSOR FUSION BY NIDEC ELESYS FOR ADVANCED DRIVER ASSISTANCE SYSTEMS

- 5.13.8 LEVERAGING LASER TECHNOLOGY FOR EDUCATIONAL IMPACT

- 5.14 REGULATORY LANDSCAPE

- 5.15 OVERVIEW OF IMPACT OF US TARIFFS

- 5.15.1 INTRODUCTION

- 5.15.2 KEY TARIFF RATES

- 5.15.3 COUNTRY-WISE TARIFFS ON AUTOMOTIVE END PRODUCTS AND COMPONENTS

- 5.15.3.1 North America

- 5.15.3.1.1 United States-Mexico-Canada Agreement (USMCA)

- 5.15.3.2 Europe

- 5.15.3.2.1 Germany

- 5.15.3.2.2 UK

- 5.15.3.2.3 Slovakia

- 5.15.3.2.4 Belgium

- 5.15.3.2.5 Other countries

- 5.15.3.3 Asia Pacific

- 5.15.3.3.1 China

- 5.15.3.3.2 Japan

- 5.15.3.3.3 South Korea

- 5.15.3.3.4 India

- 5.15.3.1 North America

- 5.15.4 IMPACT OF US TARIFFS ON AUTOMOTIVE CAMERA MARKET

- 5.16 PRICING ANALYSIS

- 5.16.1 AVERAGE SELLING PRICE TREND, BY VIEW TYPE, 2022-2024

- 5.16.2 AVERAGE SELLING PRICE ANALYSIS, BY REGION, 2022-2024

- 5.17 AUTOMOTIVE CAMERA MARKET: OEM-WISE SUPPLIER

- 5.18 AUTOMOTIVE CAMERA PRODUCT DEVELOPMENTS, BY SUPPLIER

- 5.18.1 ROBERT BOSCH GMBH

- 5.18.2 MOBILEYE

- 5.18.3 SONY SEMICONDUCTOR SOLUTIONS

6 AUTOMOTIVE CAMERA MARKET, BY ICE APPLICATION

- 6.1 INTRODUCTION

- 6.2 ADAPTIVE CRUISE CONTROL

- 6.2.1 INCREASING INVESTMENT BY AUTOMAKERS TO DRIVE MARKET

- 6.3 ADAPTIVE CRUISE CONTROL + FORWARD COLLISION WARNING

- 6.3.1 INTEGRATION OF ADAPTIVE CRUISE CONTROL AND FORWARD COLLISION WARNING IN MID-RANGE VEHICLES TO DRIVE MARKET

- 6.4 ADAPTIVE CRUISE CONTROL + FORWARD COLLISION WARNING + TRAFFIC SIGN RECOGNITION

- 6.4.1 AUTOMAKERS' PUSH FOR DIFFERENTIATION THROUGH ADVANCED SAFETY FEATURES TO DRIVE MARKET

- 6.5 BLIND SPOT DETECTION

- 6.5.1 RISING DEMAND FOR ADAS IN EMERGING MARKETS TO DRIVE MARKET

- 6.6 BLIND SPOT DETECTION + LANE KEEP ASSIST + LANE DEPARTURE WARNING

- 6.6.1 GROWING DEMAND FOR COMPREHENSIVE SAFETY PACKAGES IN VEHICLES TO DRIVE MARKET

- 6.7 ADAPTIVE LIGHTING SYSTEM

- 6.7.1 ABILITY TO ENHANCE DRIVER VISIBILITY IN ADVERSE WEATHER CONDITIONS TO DRIVE MARKET

- 6.8 INTELLIGENT PARKING ASSIST

- 6.8.1 GROWING URBANIZATION AND TIGHTER PARKING SPACES TO DRIVE MARKET

- 6.9 DRIVER MONITORING SYSTEM

- 6.9.1 RISING CONCERNS ABOUT DRIVER FATIGUE AND DISTRACTION TO DRIVE MARKET

- 6.10 NIGHT VISION SYSTEM

- 6.10.1 IMPROVED INFRARED AND THERMAL IMAGING TECHNOLOGIES TO DRIVE MARKET

- 6.11 PARKING ASSIST

- 6.11.1 EMPHASIS ON REDUCING DRIVER STRESS AND IMPROVING PARKING EFFICIENCY TO DRIVE MARKET

- 6.12 KEY PRIMARY INSIGHTS

7 AUTOMOTIVE CAMERA MARKET, BY VIEW TYPE

- 7.1 INTRODUCTION

- 7.2 FRONT VIEW

- 7.2.1 NEED TO COMPLY WITH NCAP STANDARDS TO DRIVE MARKET

- 7.3 REAR VIEW

- 7.3.1 REGULATORY MANDATES DRIVING ADOPTION OF REAR-VIEW CAMERAS

- 7.4 SURROUND VIEW

- 7.4.1 ENHANCED PARKING AND MANEUVERING ASSISTANCE IN CONGESTED URBAN AREAS TO DRIVE MARKET

- 7.5 KEY PRIMARY INSIGHTS

8 AUTOMOTIVE CAMERA MARKET, BY TECHNOLOGY

- 8.1 INTRODUCTION

- 8.2 DIGITAL

- 8.2.1 INCREASING ADOPTION OF DIGITAL CAMERAS FOR SEVERAL APPLICATIONS TO DRIVE MARKET

- 8.3 INFRARED

- 8.3.1 ABILITY TO DETECT DRIVER FATIGUE AND DISTRACTION TO DRIVE MARKET

- 8.4 THERMAL

- 8.4.1 ADVANCEMENTS IN THERMAL IMAGING TECHNOLOGY FOR OBJECT DETECTION CAPABILITY ENHANCEMENT TO DRIVE MARKET

- 8.5 KEY PRIMARY INSIGHTS

9 AUTOMOTIVE CAMERA MARKET, BY VEHICLE TYPE

- 9.1 INTRODUCTION

- 9.2 PASSENGER CAR

- 9.2.1 GOVERNMENT REGULATIONS FOR MAKING ADAS MANDATORY IN PASSENGER CARS TO DRIVE MARKET

- 9.3 LIGHT COMMERCIAL VEHICLE

- 9.3.1 INCREASING EMPHASIS ON LOGISTICS EFFICIENCY AND SAFETY TO DRIVE MARKET

- 9.4 HEAVY COMMERCIAL VEHICLE

- 9.4.1 GROWING NEED FOR IMPROVED DRIVER VISIBILITY TO DRIVE MARKET

- 9.5 KEY PRIMARY INSIGHTS

10 AUTOMOTIVE CAMERA MARKET, BY LEVEL OF AUTONOMY

- 10.1 INTRODUCTION

- 10.2 LEVEL 0/LEVEL 1

- 10.2.1 AUTOMAKERS ADDING BASIC ADAS FEATURES TO CATER TO CONSUMER DEMAND TO DRIVE MARKET

- 10.3 LEVEL 2

- 10.3.1 HIGH DEMAND FOR ADVANCED DRIVER ASSISTANCE IN PREMIUM VEHICLES SEGMENT TO DRIVE MARKET

- 10.4 LEVEL 3

- 10.4.1 OEM PUSH FOR HIGHER LEVELS OF AUTONOMOUS VEHICLES TO DRIVE MARKET

- 10.5 KEY PRIMARY INSIGHTS

11 ELECTRIC VEHICLE CAMERA MARKET, BY APPLICATION

- 11.1 INTRODUCTION

- 11.2 ADAPTIVE CRUISE CONTROL

- 11.2.1 GROWING ADOPTION OF ADAS IN MID-SEGMENT VEHICLES TO DRIVE MARKET

- 11.3 ADAPTIVE CRUISE CONTROL + FORWARD COLLISION WARNING

- 11.3.1 FOCUS ON REDUCING DRIVER FATIGUE THROUGH ADAS FEATURES TO DRIVE MARKET

- 11.4 ADAPTIVE CRUISE CONTROL + FORWARD COLLISION WARNING + TRAFFIC SIGN RECOGNITION

- 11.4.1 REGULATORY BODIES PUSHING FOR ENHANCED ROAD SAFETY STANDARDS TO DRIVE MARKET

- 11.5 BLIND SPOT DETECTION

- 11.5.1 GROWING NUMBER OF CONGESTED CITYSCAPES TO DRIVE MARKET

- 11.6 BLIND SPOT DETECTION + LANE KEEP ASSIST + LANE DEPARTURE WARNING

- 11.6.1 ASIA PACIFIC AND EUROPE TO DRIVE MARKET

- 11.7 ADAPTIVE LIGHTING SYSTEM

- 11.7.1 ENHANCED VISIBILITY IN ADVERSE WEATHER CONDITIONS TO DRIVE MARKET

- 11.8 INTELLIGENT PARKING ASSIST

- 11.8.1 INCREASING PROMINENCE IN UPSCALE ELECTRIC AND PLUG-IN HYBRID VEHICLES TO DRIVE MARKET

- 11.9 DRIVER MONITORING SYSTEM

- 11.9.1 GROWING ADOPTION IN DEVELOPED ECONOMIES TO DRIVE MARKET

- 11.10 NIGHT VISION SYSTEM

- 11.10.1 DEVELOPMENT OF SEMI AND FULLY AUTONOMOUS CARS NECESSITATING ADVANCED NIGHT VISION CAPABILITIES TO DRIVE MARKET

- 11.11 PARKING ASSIST

- 11.11.1 GROWING DEMAND FOR SAFETY FEATURES DURING VEHICLE REVERSALS TO PREVENT COLLISIONS TO DRIVE MARKET

- 11.12 KEY PRIMARY INSIGHTS

12 ELECTRIC VEHICLE CAMERA MARKET, BY ELECTRIC VEHICLE TYPE

- 12.1 INTRODUCTION

- 12.2 BATTERY ELECTRIC VEHICLE

- 12.2.1 DEPLOYMENT OF PEDESTRIAN AND CYCLIST DETECTION SYSTEMS TO DRIVE MARKET

- 12.3 PLUG-IN HYBRID ELECTRIC VEHICLE

- 12.3.1 CONSUMER PREFERENCE FOR ADVANCED SAFETY TECHNOLOGIES TO DRIVE MARKET

- 12.4 FUEL CELL ELECTRIC VEHICLE

- 12.4.1 INTEGRATION OF ADAPTIVE CRUISE CONTROL AND LANE KEEP ASSISTANCE TO DRIVE MARKET

- 12.5 KEY PRIMARY INSIGHTS

13 AUTOMOTIVE CAMERA MARKET, BY REGION

- 13.1 INTRODUCTION

- 13.2 ASIA PACIFIC

- 13.2.1 MACROECONOMIC OUTLOOK

- 13.2.2 CHINA

- 13.2.2.1 Push toward commercialization of autonomous vehicles to drive market

- 13.2.3 INDIA

- 13.2.3.1 Consumer demand for enhanced vehicle safety features to drive market

- 13.2.4 JAPAN

- 13.2.4.1 Mandated safety features and innovation to drive market

- 13.2.5 SOUTH KOREA

- 13.2.5.1 Rising investment in autonomous driving solutions to drive market

- 13.2.6 THAILAND

- 13.2.6.1 Increasing vehicle manufacturing and exports to drive market

- 13.2.7 REST OF ASIA PACIFIC

- 13.3 EUROPE

- 13.3.1 MICROECONOMIC OUTLOOK

- 13.3.2 GERMANY

- 13.3.2.1 Advancements in automotive camera technology to drive market

- 13.3.3 FRANCE

- 13.3.3.1 Stringent government policies aimed at enhancing road safety to drive market

- 13.3.4 SPAIN

- 13.3.4.1 Initiatives for advanced automotive systems to drive market

- 13.3.5 RUSSIA

- 13.3.5.1 Government regulations mandating advanced safety systems to drive market

- 13.3.6 UK

- 13.3.6.1 Government's commitment to autonomy and safety to drive market

- 13.3.7 TURKEY

- 13.3.7.1 Surging adoption of driver assistance functions to drive market

- 13.3.8 REST OF EUROPE

- 13.4 NORTH AMERICA

- 13.4.1 MACROECONOMIC OUTLOOK

- 13.4.2 US

- 13.4.2.1 Major automakers equipping premium vehicles with automotive cameras to drive market

- 13.4.3 CANADA

- 13.4.3.1 Growth of connected and autonomous vehicles to drive market

- 13.4.4 MEXICO

- 13.4.4.1 Emergence as key manufacturing hub for automakers and vehicle parts to drive market

- 13.5 REST OF THE WORLD

- 13.5.1 MACROECONOMIC OUTLOOK

- 13.5.2 BRAZIL

- 13.5.2.1 Government encouraging adoption of camera-enabled ADAS to drive market

- 13.5.3 IRAN

- 13.5.3.1 Consumer demand for safety features in vehicles to drive market

- 13.5.4 OTHERS

14 COMPETITIVE LANDSCAPE

- 14.1 INTRODUCTION

- 14.2 MARKET SHARE ANALYSIS

- 14.3 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 14.4 COMPANY VALUATION AND FINANCIAL METRICS

- 14.5 BRAND/PRODUCT COMPARISON

- 14.6 REVENUE ANALYSIS

- 14.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 14.7.1 STARS

- 14.7.2 EMERGING LEADERS

- 14.7.3 PERVASIVE PLAYERS

- 14.7.4 PARTICIPANTS

- 14.7.5 COMPANY FOOTPRINT

- 14.7.5.1 Company footprint

- 14.7.5.2 Region footprint

- 14.7.5.3 View type footprint

- 14.7.5.4 Level of autonomy footprint

- 14.7.5.5 Technology footprint

- 14.7.5.6 Vehicle type footprint

- 14.8 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2024

- 14.8.1 PROGRESSIVE COMPANIES

- 14.8.2 RESPONSIVE COMPANIES

- 14.8.3 DYNAMIC COMPANIES

- 14.8.4 STARTING BLOCKS

- 14.8.5 COMPETITIVE BENCHMARKING

- 14.8.5.1 List of Star-tups/SMEs

- 14.8.5.2 Competitive benchmarking of start-ups/SMEs

- 14.9 COMPETITIVE SCENARIO

- 14.9.1 PRODUCT LAUNCHES/DEVELOPMENTS

- 14.9.2 DEALS

- 14.9.3 EXPANSIONS

- 14.9.4 OTHER DEVELOPMENTS

15 COMPANY PROFILES

- 15.1 KEY PLAYERS

- 15.1.1 ROBERT BOSCH GMBH

- 15.1.1.1 Business overview

- 15.1.1.2 Products/Solutions/Services offered

- 15.1.1.3 Recent developments

- 15.1.1.4 MnM view

- 15.1.1.4.1 Key strengths

- 15.1.1.4.2 Strategic choices

- 15.1.1.4.3 Weaknesses and competitive threats

- 15.1.2 CONTINENTAL AG

- 15.1.2.1 Business overview

- 15.1.2.2 Products/Solutions/Services offered

- 15.1.2.3 Recent developments

- 15.1.2.4 MnM view

- 15.1.2.4.1 Key strengths

- 15.1.2.4.2 Strategic choices

- 15.1.2.4.3 Weaknesses and competitive threats

- 15.1.3 VALEO

- 15.1.3.1 Business overview

- 15.1.3.2 Products/Solutions/Services offered

- 15.1.3.3 Recent developments

- 15.1.3.4 MnM view

- 15.1.3.4.1 Key strengths

- 15.1.3.4.2 Strategic choices

- 15.1.3.4.3 Weaknesses and competitive threats

- 15.1.4 ZF FRIEDRICHSHAFEN AG

- 15.1.4.1 Business overview

- 15.1.4.2 Products/Solutions/Services offered

- 15.1.4.3 Recent developments

- 15.1.4.4 MnM view

- 15.1.4.4.1 Key strengths

- 15.1.4.4.2 Strategic choices

- 15.1.4.4.3 Weaknesses and competitive threats

- 15.1.5 DENSO CORPORATION

- 15.1.5.1 Business overview

- 15.1.5.2 Products/Solutions/Services offered

- 15.1.5.3 Recent developments

- 15.1.5.4 MnM view

- 15.1.5.4.1 Key strengths

- 15.1.5.4.2 Strategic choices

- 15.1.5.4.3 Weaknesses and competitive threats

- 15.1.6 FICOSA INTERNACIONAL SA

- 15.1.6.1 Business overview

- 15.1.6.2 Products/Solutions/Services offered

- 15.1.6.3 Recent developments

- 15.1.7 APTIV

- 15.1.7.1 Business overview

- 15.1.7.2 Products/Solutions/Services offered

- 15.1.7.3 Recent developments

- 15.1.8 MAGNA INTERNATIONAL INC.

- 15.1.8.1 Business overview

- 15.1.8.2 Products/Solutions/Services offered

- 15.1.8.3 Recent developments

- 15.1.9 FORVIA

- 15.1.9.1 Business overview

- 15.1.9.2 Products/Solutions/Services offered

- 15.1.9.3 Recent developments

- 15.1.10 RICOH

- 15.1.10.1 Business overview

- 15.1.10.2 Products/Solutions/Services offered

- 15.1.10.3 Recent developments

- 15.1.11 KYOCERA CORPORATION

- 15.1.11.1 Business overview

- 15.1.11.2 Products/Solutions/Services offered

- 15.1.11.3 Recent developments

- 15.1.1 ROBERT BOSCH GMBH

- 15.2 OTHER PLAYERS

- 15.2.1 SONY SEMICONDUCTOR SOLUTIONS CORPORATION

- 15.2.2 PANASONIC AUTOMOTIVE SYSTEMS CO., LTD

- 15.2.3 LG ELECTRONICS

- 15.2.4 MOTHERSON

- 15.2.5 AMBARELLA INTERNATIONAL LP

- 15.2.6 OMNIVISION

- 15.2.7 HITACHI ASTEMO, LTD.

- 15.2.8 GENTEX CORPORATION

- 15.2.9 SAMSUNG ELECTRO-MECHANICS

- 15.2.10 TELEDYNE FLIR LLC

- 15.2.11 HYUNDAI MOBIS

- 15.2.12 MCNEX CO., LTD.

- 15.2.13 STONKAM CO., LTD.

- 15.2.14 BRIGADE ELECTRONICS GROUP PLC

- 15.2.15 H.P.B. OPTOELECTRONICS CO., LTD.

- 15.2.16 GARMIN LTD.

16 RECOMMENDATIONS BY MARKETSANDMARKETS

- 16.1 AUTOMOTIVE CAMERA MARKET TO WITNESS ASIA PACIFIC'S ASCENDANCY AS PREDOMINANT FORCE

- 16.2 THERMAL AND INFRARED CAMERAS, ALONG WITH AI INTEGRATION, DRIVE AUTONOMOUS VEHICLE INNOVATION

- 16.3 INCREASING DEMAND FOR DRIVING COMFORT AND SAFETY FEATURES OF ADAS TO PROPEL MARKET FOR AUTOMOTIVE CAMERAS

- 16.4 CONCLUSION

17 APPENDIX

- 17.1 INSIGHTS FROM INDUSTRY EXPERTS

- 17.2 DISCUSSION GUIDE

- 17.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 17.4 CUSTOMIZATION OPTIONS

- 17.4.1 GLOBAL AUTOMOTIVE CAMERA MARKET, BY APPLICATION AND VEHICLE TYPE (ICE)

- 17.4.2 ELECTRIC & HYBRID VEHICLE CAMERA MARKET, BY APPLICATION AND ELECTRIC VEHICLE TYPE

- 17.4.3 COMPANY INFORMATION:

- 17.4.3.1 Profiling of additional market players (Up to 5)

- 17.5 RELATED REPORTS

- 17.6 AUTHOR DETAILS