|

|

市場調査レポート

商品コード

1718869

AIアズ・ア・サービスの世界市場:製品タイプ別、組織規模別、ビジネス機能別、サービスタイプ別、エンドユーザー別、地域別 - 2030年までの予測AI as a Service Market by Product Type (Chatbots & AI Agents, ML Framework, API, No Code/Low Code Tools, Data Labeling), Service Type (ML as a Service, NLP as a Service, Generative AI as a Service), Business Function, End User - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| AIアズ・ア・サービスの世界市場:製品タイプ別、組織規模別、ビジネス機能別、サービスタイプ別、エンドユーザー別、地域別 - 2030年までの予測 |

|

出版日: 2025年04月29日

発行: MarketsandMarkets

ページ情報: 英文 399 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

AIアズ・ア・サービスの市場規模は、2025年の202億6,000万米ドルから2030年には912億米ドルに成長し、予測期間中のCAGRは35.1%になると予測されます。

AIアズ・ア・サービス(AIaaS)市場の成長は主に、クラウドベースのソリューションの採用の増加、インテリジェントなバーチャルアシスタントに対する需要の高まり、業界全体の意思決定を強化するための高度なデータ分析の必要性によってもたらされます。企業はAIaaSを活用することで、運用コストの削減、顧客体験の向上、社内にAIインフラを構築する負担のない競争優位性の獲得を目指しています。しかし、データプライバシーやセキュリティリスクに関する懸念、AI技術を効果的に管理・導入できる熟練人材の不足などが市場の成長を抑制しています。さらに、既存システムとの統合課題や、中小企業向けの高度なAIサービスの高コストも、普及の制約要因となっています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 米ドル(10億米ドル) |

| セグメント | 製品タイプ別、組織規模別、ビジネス機能別、サービスタイプ別、エンドユーザー別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、中東・アフリカ、ラテンアメリカ |

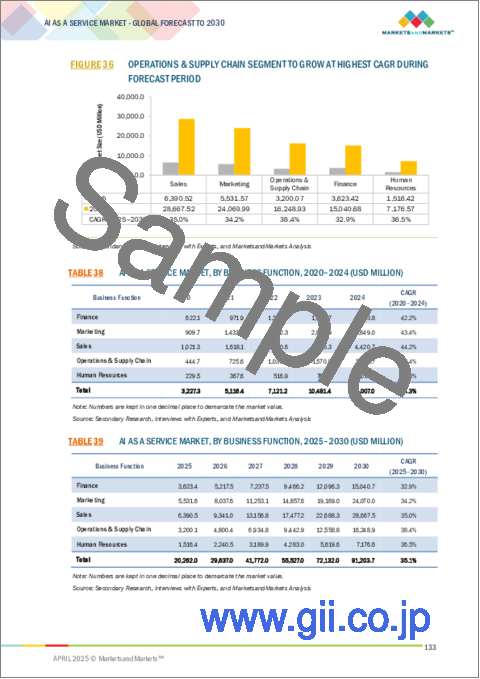

リアルタイムの洞察、需要予測、プロセス最適化のニーズが高まっていることから、オペレーション&サプライチェーン部門が予測期間中にAIaaS市場で最も速い成長を遂げると予測されます。AIを活用したソリューションは、予測分析と自動化を通じて、企業がサプライチェーンの可視性を高め、混乱を減らし、在庫管理を改善するのを支援します。世界・サプライチェーンが複雑化するなか、企業はAIaaSを導入してロジスティクスを合理化し、ルートを最適化し、意思決定の効率を高めています。さらに、AIをIoTや高度なアナリティクスと統合することで、オペレーションへの応用がさらに促進され、デジタルトランスフォーメーションと競争優位のための重要な分野となっています。

大企業は、潤沢な資金力、高度なITインフラ、新興技術を採用する準備が整っていることから、AIaaS市場で最大の市場シェアを占めると予想されます。これらの組織は、大量のデータを扱うことが多く、自動化、顧客エンゲージメント、意思決定のためのスケーラブルで効率的なソリューションを必要としており、AIaaSプラットフォームはこれを効果的に提供します。さらに、大企業は業務効率を高め、競争力を維持するために、AIを活用したデジタルトランスフォーメーションに積極的に投資しています。カスタマイズされたソリューションのためにAIベンダーと協業し、複雑な導入を管理する能力は、市場での支配的地位をさらに強化しています。

アジア太平洋は、急速なデジタルトランスフォーメーション、AI技術への投資の増加、インド、中国、東南アジア諸国におけるクラウドベースのサービスの採用拡大により、AIaa市場で最も急速な成長を遂げると予測されます。同地域の新興企業エコシステムの拡大とAIイノベーションを支援する政府の取り組みが、この成長を後押ししています。一方、北米は、先進技術の早期導入、大手AIベンダーの存在感、成熟したクラウドインフラストラクチャが原動力となり、最大の市場シェアを占めると思われます。高い研究開発投資、強固なデジタルエコシステム、ヘルスケア、金融、小売の各分野におけるAIの広範な統合が、北米市場の優位性に寄与しています。

当レポートでは、世界のAIアズ・ア・サービス(AIaaS)市場について調査し、製品タイプ別、組織規模別、ビジネス機能別、サービスタイプ別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と業界動向

- イントロダクション

- 市場力学

- 2025年の米国関税の影響-AIaaS市場

- AIaaS市場:進化

- エコシステム分析

- サプライチェーン分析

- 投資情勢と資金調達シナリオ

- ケーススタディ分析

- 技術分析

- 規制状況

- アーキテクチャ:サービスとしてのAI

- 特許分析

- 価格分析

- 2025年~2026年の主な会議とイベント

- ポーターのファイブフォース分析

- 顧客ビジネスに影響を与える動向/混乱

- 主要な利害関係者と購入基準

第6章 AIaaS市場(製品タイプ別)

- イントロダクション

- チャットボットとAIエージェント

- 機械学習フレームワーク

- アプリケーションプログラミングインターフェース

- ノーコードまたはローコードのMLツール

- データラベリングと前処理ツール

第7章 AIaaS市場(組織規模別)

- イントロダクション

- 中小企業

- 大企業

第8章 AIaaS市場(ビジネス機能別)

- イントロダクション

- ファイナンス

- マーケティング

- 販売

- オペレーションとサプライチェーン

- 人事

第9章 AIaaS市場(サービスタイプ別)

- イントロダクション

- 機械学習サービス(MLAAS)

- 自然言語処理サービス(NLPAAS)

- サービスとしてのコンピュータビジョン

- 予測分析とデータサイエンス・アズ・ア・サービス(DSAAS)

- 生成AIアズアサービス

第10章 AIaaS市場(エンドユーザー別)

- イントロダクション

- 企業

- 個人ユーザー

第11章 AIaaS市場(地域別)

- イントロダクション

- 北米

- 北米:AIaaS市場促進要因

- 北米:マクロ経済見通し

- 米国

- カナダ

- 欧州

- 欧州:AIaaS市場促進要因

- 欧州:マクロ経済見通し

- 英国

- ドイツ

- フランス

- イタリア

- スペイン

- その他

- アジア太平洋

- アジア太平洋:AIaaS市場促進要因

- アジア太平洋:マクロ経済見通し

- 中国

- インド

- 日本

- 韓国

- オーストラリアとニュージーランド

- シンガポール

- その他

- 中東・アフリカ

- 中東・アフリカ:AIaaS市場促進要因

- 中東・アフリカ:マクロ経済見通し

- 中東

- アフリカ

- ラテンアメリカ

- ラテンアメリカ:AIaaS市場促進要因

- ラテンアメリカ:マクロ経済見通し

- ブラジル

- メキシコ

- アルゼンチン

- その他

第12章 競合情勢

- 概要

- 主要参入企業の戦略/強み、2022年~2025年

- 収益分析、2020年~2024年

- 市場シェア分析、2024年

- 製品比較分析

- 企業評価と財務指標

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオと動向

第13章 企業プロファイル

- イントロダクション

- 主要参入企業

- AWS

- MICROSOFT

- IBM

- ORACLE

- SAP

- SALESFORCE

- NVIDIA

- ALIBABA CLOUD

- OPENAI

- RAINBIRD TECHNOLOGIES

- BIGML

- COHERE

- GLEAN

- SCALE AI

- LANDING AI

- YELLOW.AI

- ANYSCALE

- MISTRAL AI

- H20.AI

- SYNTHESIA

- CLARIFAI

- MONKEYLEARN

- その他の企業

- FICO

- CLOUDERA

- SERVICENOW

- HPE

- ALTAIR

- SAS INSTITUTE

- DATAROBOT

- DATABRICKS

- C3 AI

- DOMO

- INTELLIAS

- YOTTAMINE ANALYTICS

- INFLECTION AI

- ABRIDGE

- CODEIUM

- ARTHUR

- LEVITY AI

- UNSTRUCTURED.IO

- KATONIC AI

- DEEPSEARCH

- MINDTITAN

- VISO.AI

- SOFTWEB SOLUTIONS

第14章 隣接市場と関連市場

第15章 付録

List of Tables

- TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2020-2024

- TABLE 2 LIST OF PRIMARY PARTICIPANTS

- TABLE 3 FACTOR ANALYSIS

- TABLE 4 GLOBAL AI AS A SERVICE MARKET SIZE AND GROWTH RATE, 2020-2024 (USD MILLION, Y-O-Y %)

- TABLE 5 GLOBAL AI AS A SERVICE MARKET SIZE AND GROWTH RATE, 2025-2030 (USD MILLION, Y-O-Y %)

- TABLE 6 TABLE 1: US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 7 ROLE OF KEY PLAYERS IN AI AS A SERVICE MARKET ECOSYSTEM

- TABLE 8 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 PATENTS FILED, 2016-2025

- TABLE 14 LIST OF FEW PATENTS IN AI AS A SERVICE MARKET, 2024-2025

- TABLE 15 AVERAGE SELLING PRICE TREND OF AI AS A SERVICE SOLUTIONS, BY PRODUCT TYPE, 2025

- TABLE 16 AI AS A SERVICE MARKET: KEY CONFERENCES & EVENTS, 2025-2026

- TABLE 17 PORTERS' FIVE FORCES' IMPACT ON AI AS A SERVICE MARKET

- TABLE 18 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- TABLE 19 KEY BUYING CRITERIA FOR TOP THREE END USERS

- TABLE 20 AI AS A SERVICE MARKET, BY PRODUCT TYPE, 2020-2024 (USD MILLION)

- TABLE 21 AI AS A SERVICE MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 22 CHATBOTS & AI AGENTS: AI AS A SERVICE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 23 CHATBOTS & AI AGENTS: AI AS A SERVICE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 24 MACHINE LEARNING FRAMEWORKS: AI AS A SERVICE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 25 MACHINE LEARNING FRAMEWORKS: AI AS A SERVICE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 26 APPLICATION PROGRAMMING INTERFACE: AI AS A SERVICE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 27 APPLICATION PROGRAMMING INTERFACE: AI AS A SERVICE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 28 NO-CODE OR LOW-CODE ML TOOLS: AI AS A SERVICE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 29 NO-CODE OR LOW-CODE ML TOOLS: AI AS A SERVICE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 30 DATA LABELING & PRE-PROCESSING TOOLS: AI AS A SERVICE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 31 DATA LABELING & PRE-PROCESSING TOOLS: AI AS A SERVICE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 32 AI AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 33 AI AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 34 SMES: AI AS A SERVICE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 35 SMES: AI AS A SERVICE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 36 LARGE ENTERPRISES: AI AS A SERVICE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 37 LARGE ENTERPRISES: AI AS A SERVICE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 38 AI AS A SERVICE MARKET, BY BUSINESS FUNCTION, 2020-2024 (USD MILLION)

- TABLE 39 AI AS A SERVICE MARKET, BY BUSINESS FUNCTION, 2025-2030 (USD MILLION)

- TABLE 40 FINANCE: AI AS A SERVICE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 41 FINANCE: AI AS A SERVICE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 42 MARKETING: AI AS A SERVICE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 43 MARKETING: AI AS A SERVICE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 44 SALES: AI AS A SERVICE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 45 SALES: AI AS A SERVICE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 46 OPERATIONS & SUPPLY CHAIN: AI AS A SERVICE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 47 OPERATIONS & SUPPLY CHAIN: AI AS A SERVICE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 48 HUMAN RESOURCES: AI AS A SERVICE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 49 HUMAN RESOURCES: AI AS A SERVICE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 50 AI AS A SERVICE MARKET, BY SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 51 AI AS A SERVICE MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 52 MACHINE LEARNING AS A SERVICE: AI AS A SERVICE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 53 MACHINE LEARNING AS A SERVICE: AI AS A SERVICE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 54 NATURAL LANGUAGE PROCESSING AS A SERVICE: AI AS A SERVICE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 55 NATURAL LANGUAGE PROCESSING AS A SERVICE: AI AS A SERVICE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 56 COMPUTER VISION AS A SERVICE: AI AS A SERVICE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 57 COMPUTER VISION AS A SERVICE: AI AS A SERVICE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 58 PREDICTIVE ANALYTICS AND DATA SCIENCE AS A SERVICE: AI AS A SERVICE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 59 PREDICTIVE ANALYTICS AND DATA SCIENCE AS A SERVICE: AI AS A SERVICE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 60 GENERATIVE AI AS A SERVICE: AI AS A SERVICE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 61 GENERATIVE AI AS A SERVICE: AI AS A SERVICE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 62 AI AS A SERVICE MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 63 AI AS A SERVICE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 64 AI AS A SERVICE MARKET, BY ENTERPRISE, 2020-2024 (USD MILLION)

- TABLE 65 AI AS A SERVICE MARKET, BY ENTERPRISE, 2025-2030 (USD MILLION)

- TABLE 66 BFSI: AI AS A SERVICE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 67 BFSI: AI AS A SERVICE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 68 RETAIL & E-COMMERCE: AI AS A SERVICE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 69 RETAIL & E-COMMERCE: AI AS A SERVICE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 70 AI AS A SERVICE MARKET, BY TECHNOLOGY & SOFTWARE, 2020-2024 (USD MILLION)

- TABLE 71 AI AS A SERVICE MARKET, BY TECHNOLOGY & SOFTWARE, 2025-2030 (USD MILLION)

- TABLE 72 TECHNOLOGY & SOFTWARE: AI AS A SERVICE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 73 TECHNOLOGY & SOFTWARE: AI AS A SERVICE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 74 MEDIA & ENTERTAINMENT: AI AS A SERVICE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 75 MEDIA & ENTERTAINMENT: AI AS A SERVICE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 76 MANUFACTURING: AI AS A SERVICE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 77 MANUFACTURING: AI AS A SERVICE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 78 HEALTHCARE & LIFE SCIENCES: AI AS A SERVICE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 79 HEALTHCARE & LIFE SCIENCES: AI AS A SERVICE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 80 ENERGY & UTILITIES: AI AS A SERVICE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 81 ENERGY & UTILITIES: AI AS A SERVICE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 82 GOVERNMENT & DEFENSE: AI AS A SERVICE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 83 GOVERNMENT & DEFENSE: AI AS A SERVICE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 84 TELECOMMUNICATIONS: AI AS A SERVICE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 85 TELECOMMUNICATIONS: AI AS A SERVICE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 86 TRANSPORTATION & LOGISTICS: AI AS A SERVICE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 87 TRANSPORTATION & LOGISTICS: AI AS A SERVICE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 88 OTHER ENTERPRISE LEVEL END USERS: AI AS A SERVICE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 89 OTHER ENTERPRISE LEVEL END USERS: AI AS A SERVICE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 90 INDIVIDUAL USERS: AI AS A SERVICE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 91 INDIVIDUAL USERS: AI AS A SERVICE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 92 AI AS A SERVICE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 93 AI AS A SERVICE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 94 NORTH AMERICA: AI AS A SERVICE MARKET, BY PRODUCT TYPE, 2020-2024 (USD MILLION)

- TABLE 95 NORTH AMERICA: AI AS A SERVICE MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 96 NORTH AMERICA: AI AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 97 NORTH AMERICA: AI AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 98 NORTH AMERICA: AI AS A SERVICE MARKET, BY BUSINESS FUNCTION, 2020-2024 (USD MILLION)

- TABLE 99 NORTH AMERICA: AI AS A SERVICE MARKET, BY BUSINESS FUNCTION, 2025-2030 (USD MILLION)

- TABLE 100 NORTH AMERICA: AI AS A SERVICE MARKET, BY SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 101 NORTH AMERICA: AI AS A SERVICE MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 102 NORTH AMERICA: AI AS A SERVICE MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 103 NORTH AMERICA: AI AS A SERVICE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 104 NORTH AMERICA: AI AS A SERVICE MARKET, BY ENTERPRISES, 2020-2024 (USD MILLION)

- TABLE 105 NORTH AMERICA: AI AS A SERVICE MARKET, BY ENTERPRISES, 2025-2030 (USD MILLION)

- TABLE 106 NORTH AMERICA: AI AS A SERVICE MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 107 NORTH AMERICA: AI AS A SERVICE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 108 US: AI AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 109 US: AI AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 110 CANADA: AI AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 111 CANADA: AI AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 112 EUROPE: AI AS A SERVICE MARKET, BY PRODUCT TYPE, 2020-2024 (USD MILLION)

- TABLE 113 EUROPE: AI AS A SERVICE MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 114 EUROPE: AI AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 115 EUROPE: AI AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 116 EUROPE: AI AS A SERVICE MARKET, BY BUSINESS FUNCTION, 2020-2024 (USD MILLION)

- TABLE 117 EUROPE: AI AS A SERVICE MARKET, BY BUSINESS FUNCTION, 2025-2030 (USD MILLION)

- TABLE 118 EUROPE: AI AS A SERVICE MARKET, BY SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 119 EUROPE: AI AS A SERVICE MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 120 EUROPE: AI AS A SERVICE MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 121 EUROPE: AI AS A SERVICE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 122 EUROPE: AI AS A SERVICE MARKET, BY ENTERPRISES, 2020-2024 (USD MILLION)

- TABLE 123 EUROPE: AI AS A SERVICE MARKET, BY ENTERPRISES, 2025-2030 (USD MILLION)

- TABLE 124 EUROPE: AI AS A SERVICE MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 125 EUROPE: AI AS A SERVICE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 126 UK: AI AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 127 UK: AI AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 128 GERMANY: AI AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 129 GERMANY: AI AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 130 FRANCE: AI AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 131 FRANCE: AI AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 132 ITALY: AI AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 133 ITALY: AI AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 134 SPAIN: AI AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 135 SPAIN: AI AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 136 REST OF EUROPE: AI AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 137 REST OF EUROPE: AI AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 138 ASIA PACIFIC: AI AS A SERVICE MARKET, BY PRODUCT TYPE, 2020-2024 (USD MILLION)

- TABLE 139 ASIA PACIFIC: AI AS A SERVICE MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 140 ASIA PACIFIC: AI AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 141 ASIA PACIFIC: AI AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 142 ASIA PACIFIC: AI AS A SERVICE MARKET, BY BUSINESS FUNCTION, 2020-2024 (USD MILLION)

- TABLE 143 ASIA PACIFIC: AI AS A SERVICE MARKET, BY BUSINESS FUNCTION, 2025-2030 (USD MILLION)

- TABLE 144 ASIA PACIFIC: AI AS A SERVICE MARKET, BY SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 145 ASIA PACIFIC: AI AS A SERVICE MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 146 ASIA PACIFIC: AI AS A SERVICE MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 147 ASIA PACIFIC: AI AS A SERVICE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 148 ASIA PACIFIC: AI AS A SERVICE MARKET, BY ENTERPRISES, 2020-2024 (USD MILLION)

- TABLE 149 ASIA PACIFIC: AI AS A SERVICE MARKET, BY ENTERPRISES, 2025-2030 (USD MILLION)

- TABLE 150 ASIA PACIFIC: AI AS A SERVICE MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 151 ASIA PACIFIC: AI AS A SERVICE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 152 CHINA: AI AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 153 CHINA: AI AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 154 INDIA: AI AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 155 INDIA: AI AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 156 JAPAN: AI AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 157 JAPAN: AI AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 158 SOUTH KOREA: AI AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 159 SOUTH KOREA: AI AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 160 AUSTRALIA & NEW ZEALAND: AI AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 161 AUSTRALIA & NEW ZEALAND: AI AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 162 SINGAPORE: AI AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 163 SINGAPORE: AI AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 164 REST OF ASIA PACIFIC: AI AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 165 REST OF ASIA PACIFIC: AI AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 166 MIDDLE EAST & AFRICA: AI AS A SERVICE MARKET, BY PRODUCT TYPE, 2020-2024 (USD MILLION)

- TABLE 167 MIDDLE EAST & AFRICA: AI AS A SERVICE MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 168 MIDDLE EAST & AFRICA: AI AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 169 MIDDLE EAST & AFRICA: AI AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 170 MIDDLE EAST & AFRICA: AI AS A SERVICE MARKET, BY BUSINESS FUNCTION, 2020-2024 (USD MILLION)

- TABLE 171 MIDDLE EAST & AFRICA: AI AS A SERVICE MARKET, BY BUSINESS FUNCTION, 2025-2030 (USD MILLION)

- TABLE 172 MIDDLE EAST & AFRICA: AI AS A SERVICE MARKET, BY SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 173 MIDDLE EAST & AFRICA: AI AS A SERVICE MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 174 MIDDLE EAST & AFRICA: AI AS A SERVICE MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 175 MIDDLE EAST & AFRICA: AI AS A SERVICE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 176 MIDDLE EAST & AFRICA: AI AS A SERVICE MARKET, BY ENTERPRISES, 2020-2024 (USD MILLION)

- TABLE 177 MIDDLE EAST & AFRICA: AI AS A SERVICE MARKET, BY ENTERPRISES, 2025-2030 (USD MILLION)

- TABLE 178 MIDDLE EAST & AFRICA: AI AS A SERVICE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 179 MIDDLE EAST AND AFRICA: AI AS A SERVICE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 180 MIDDLE EAST: AI AS A SERVICE MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 181 MIDDLE EAST: AI AS A SERVICE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 182 SAUDI ARABIA: AI AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 183 SAUDI ARABIA: AI AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 184 UAE: AI AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 185 UAE: AI AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 186 QATAR: AI AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 187 QATAR: AI AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 188 TURKEY: AI AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 189 TURKEY: AI AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 190 REST OF MIDDLE EAST: AI AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 191 REST OF MIDDLE EAST: AI AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 192 AFRICA: AI AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 193 AFRICA: AI AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 194 LATIN AMERICA: AI AS A SERVICE MARKET, BY PRODUCT TYPE, 2020-2024 (USD MILLION)

- TABLE 195 LATIN AMERICA: AI AS A SERVICE MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 196 LATIN AMERICA: AI AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 197 LATIN AMERICA: AI AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 198 LATIN AMERICA: AI AS A SERVICE MARKET, BY BUSINESS FUNCTION, 2020-2024 (USD MILLION)

- TABLE 199 LATIN AMERICA: AI AS A SERVICE MARKET, BY BUSINESS FUNCTION, 2025-2030 (USD MILLION)

- TABLE 200 LATIN AMERICA: AI AS A SERVICE MARKET, BY SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 201 LATIN AMERICA: AI AS A SERVICE MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 202 LATIN AMERICA: AI AS A SERVICE MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 203 LATIN AMERICA: AI AS A SERVICE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 204 LATIN AMERICA: AI AS A SERVICE MARKET, BY ENTERPRISES, 2020-2024 (USD MILLION)

- TABLE 205 LATIN AMERICA: AI AS A SERVICE MARKET, BY ENTERPRISES, 2025-2030 (USD MILLION)

- TABLE 206 LATIN AMERICA: AI AS A SERVICE MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 207 LATIN AMERICA: AI AS A SERVICE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 208 BRAZIL: AI AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 209 BRAZIL: AI AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 210 MEXICO: AI AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 211 MEXICO: AI AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 212 ARGENTINA: AI AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 213 ARGENTINA: AI AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 214 REST OF LATIN AMERICA: AI AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 215 REST OF LATIN AMERICA: AI AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 216 OVERVIEW OF STRATEGIES ADOPTED BY KEY AI AS A SERVICE VENDORS, 2022-2025

- TABLE 217 AI AS A SERVICE MARKET: DEGREE OF COMPETITION

- TABLE 218 REGION FOOTPRINT

- TABLE 219 BUSINESS FUNCTION FOOTPRINT

- TABLE 220 PRODUCT TYPE FOOTPRINT

- TABLE 221 END USER FOOTPRINT

- TABLE 222 AI AS A SERVICE MARKET: KEY STARTUPS/SMES, 2024

- TABLE 223 AI AS A SERVICE MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES, 2024

- TABLE 224 AI AS A SERVICE MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS, JANUARY 2022-APRIL 2025

- TABLE 225 AI AS A SERVICE MARKET: DEALS, JANUARY 2022-APRIL 2025

- TABLE 226 AWS: COMPANY OVERVIEW

- TABLE 227 AWS: SOLUTIONS/SERVICES OFFERED

- TABLE 228 AWS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 229 AWS: DEALS

- TABLE 230 GOOGLE: COMPANY OVERVIEW

- TABLE 231 GOOGLE: SOLUTIONS OFFERED

- TABLE 232 GOOGLE: PRODUCT ENHANCEMENTS

- TABLE 233 GOOGLE: DEALS

- TABLE 234 MICROSOFT: COMPANY OVERVIEW

- TABLE 235 MICROSOFT: SOLUTIONS/SERVICES OFFERED

- TABLE 236 MICROSOFT: PRODUCT ENHANCEMENTS

- TABLE 237 MICROSOFT: DEALS

- TABLE 238 IBM: COMPANY OVERVIEW

- TABLE 239 IBM: SOLUTIONS/SERVICES OFFERED

- TABLE 240 IBM: PRODUCT ENHANCEMENTS

- TABLE 241 IBM: DEALS

- TABLE 242 ORACLE: COMPANY OVERVIEW

- TABLE 243 ORACLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 244 ORACLE: PRODUCT ENHANCEMENTS

- TABLE 245 ORACLE: DEALS

- TABLE 246 SAP: COMPANY OVERVIEW

- TABLE 247 SAP: SOLUTIONS/SERVICES OFFERED

- TABLE 248 SAP: PRODUCT ENHANCEMENTS

- TABLE 249 SAP: DEALS

- TABLE 250 SALESFORCE: COMPANY OVERVIEW

- TABLE 251 SALESFORCE: SOLUTIONS/SERVICES OFFERED

- TABLE 252 SALESFORCE: PRODUCT ENHANCEMENTS

- TABLE 253 SALESFORCE: DEALS

- TABLE 254 NVIDIA: COMPANY OVERVIEW

- TABLE 255 NVIDIA: SOLUTIONS OFFERED

- TABLE 256 NVIDIA: PRODUCT ENHANCEMENTS

- TABLE 257 NVIDIA: DEALS

- TABLE 258 FICO: COMPANY OVERVIEW

- TABLE 259 FICO: SOLUTIONS OFFERED

- TABLE 260 FICO: PRODUCT ENHANCEMENTS

- TABLE 261 FICO: DEALS

- TABLE 262 CLOUDERA: COMPANY OVERVIEW

- TABLE 263 CLOUDERA: SOLUTIONS OFFERED

- TABLE 264 CLOUDERA: PRODUCT ENHANCEMENTS

- TABLE 265 CLOUDERA: DEALS

- TABLE 266 ARTIFICIAL INTELLIGENCE MARKET, BY OFFERING, 2019-2023 (USD BILLION)

- TABLE 267 ARTIFICIAL INTELLIGENCE MARKET, BY OFFERING, 2024-2030 (USD BILLION)

- TABLE 268 ARTIFICIAL INTELLIGENCE MARKET, BY TECHNOLOGY, 2019-2023 (USD BILLION)

- TABLE 269 ARTIFICIAL INTELLIGENCE MARKET, BY TECHNOLOGY, 2024-2030 (USD BILLION)

- TABLE 270 ARTIFICIAL INTELLIGENCE MARKET, BY BUSINESS FUNCTION, 2019-2023 (USD BILLION)

- TABLE 271 ARTIFICIAL INTELLIGENCE MARKET, BY BUSINESS FUNCTION, 2024-2030 (USD BILLION)

- TABLE 272 ARTIFICIAL INTELLIGENCE MARKET, BY VERTICAL, 2019-2023 (USD BILLION)

- TABLE 273 ARTIFICIAL INTELLIGENCE MARKET, BY VERTICAL, 2024-2030 (USD BILLION)

- TABLE 274 ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2019-2023 (USD BILLION)

- TABLE 275 ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2024-2030 (USD BILLION)

- TABLE 276 GENERATIVE AI MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 277 GENERATIVE AI MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 278 GENERATIVE AI MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 279 GENERATIVE AI MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 280 GENERATIVE AI MARKET, BY VERTICAL, 2019-2023 (USD MILLION)

- TABLE 281 GENERATIVE AI MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 282 GENERATIVE AI MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 283 GENERATIVE AI MARKET, BY REGION, 2024-2030 (USD MILLION)

List of Figures

- FIGURE 1 AI AS A SERVICE MARKET: RESEARCH DESIGN

- FIGURE 2 DATA TRIANGULATION

- FIGURE 3 AI AS A SERVICE MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 1, BOTTOM UP (SUPPLY SIDE): REVENUE FROM PRODUCT TYPES OF AI AS A SERVICE MARKET

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 2, BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE FROM ALL PRODUCT TYPES OF AI AS A SERVICE MARKET

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 3, BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE FROM ALL PRODUCT TYPES OF AI AS A SERVICE MARKET

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 4, BOTTOM-UP (DEMAND SIDE): SHARE OF AI AS A SERVICE THROUGH OVERALL AI SPENDING

- FIGURE 8 MACHINE LEARNING FRAMEWORK SEGMENT TO HOLD LARGEST MARKET SHARE IN 2025

- FIGURE 9 SALES TO BE LEADING SEGMENT IN 2025

- FIGURE 10 SMALL & MEDIUM-SIZED ENTERPRISES TO BE FASTER-GROWING DURING FORECAST PERIOD

- FIGURE 11 MACHINE LEARNING AS A SERVICE SEGMENT OF TO HOLD LARGEST MARKET IN 2025

- FIGURE 12 ENTERPRISES SEGMENT SET TO REGISTER LARGER MARKET SHARE IN 2025

- FIGURE 13 HEALTHCARE & LIFE SCIENCES TO WITNESS HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 14 ASIA PACIFIC TO REGISTER FASTEST GROWTH BETWEEN 2025 AND 2030

- FIGURE 15 RISE OF PRE-TRAINED AI MODELS AND GROWING DEMAND FOR AI-ENHANCED CYBERSECURITY SOLUTIONS TO DRIVE MARKET GROWTH

- FIGURE 16 COMPUTER VISION AS A SERVICE SEGMENT TO ACCOUNT FOR HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 17 MACHINE LEARNING FRAMEWORKS AND BFSI TO BE LARGEST SHAREHOLDERS IN NORTH AMERICA AI AS A SERVICE MARKET IN 2025

- FIGURE 18 NORTH AMERICA TO HOLD LARGEST MARKET SHARE IN 2025

- FIGURE 19 AI AS A SERVICE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 DATA CENTERS PROJECTED TO REPRESENT 13% OF GLOBAL ANNUAL ELECTRICITY CONSUMPTION AND 6% OF CARBON FOOTPRINT BY 2030

- FIGURE 21 EVOLUTION OF AI AS A SERVICE MARKET

- FIGURE 22 AI AS A SERVICE MARKET ECOSYSTEM

- FIGURE 23 AI AS A SERVICE MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 24 GLOBAL AI FUNDING, 2015-2024

- FIGURE 25 LEADING AI AS A SERVICE VENDORS, BY FUNDING VALUE (BILLION) AND FUNDING ROUND, 2016-2025

- FIGURE 26 KEY ARCHITECTURAL COMPONENTS OF AIAAS

- FIGURE 27 NUMBER OF PATENTS GRANTED FOR AI AS A SERVICE MARKET, 2016-2025

- FIGURE 28 REGIONAL ANALYSIS OF PATENTS GRANTED, 2016-2025

- FIGURE 29 AVERAGE SELLING PRICE TREND OF KEY PLAYERS FOR TOP 3 SERVICE TYPES, 2025

- FIGURE 30 AI AS A SERVICE MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 31 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 32 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- FIGURE 33 KEY BUYING CRITERIA FOR TOP THREE END USERS

- FIGURE 34 NO-CODE OR LOW-CODE ML TOOLS TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 35 SMES SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 36 OPERATIONS & SUPPLY CHAIN SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 37 GENERATIVE AI AS A SERVICE SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 38 INDIVIDUAL USERS SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 39 HEALTHCARE & LIFE SCIENCES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 40 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 41 INDIA TO REGISTER HIGHEST GROWTH RATE IN AI AS A SERVICE MARKET DURING FORECAST PERIOD

- FIGURE 42 NORTH AMERICA: AI AS A SERVICE MARKET SNAPSHOT

- FIGURE 43 ASIA PACIFIC: AI AS A SERVICE MARKET SNAPSHOT

- FIGURE 44 REVENUE ANALYSIS OF KEY PLAYERS, 2020-2024

- FIGURE 45 SHARE OF LEADING COMPANIES IN AI AS A SERVICE MARKET, 2024

- FIGURE 46 PRODUCT COMPARATIVE ANALYSIS, BY AI AS A SERVICE MARKET

- FIGURE 47 FINANCIAL METRICS OF KEY VENDORS

- FIGURE 48 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 49 AI AS A SERVICE MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 50 COMPANY FOOTPRINT

- FIGURE 51 AI AS A SERVICE MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 52 AWS: COMPANY SNAPSHOT

- FIGURE 53 GOOGLE: COMPANY SNAPSHOT

- FIGURE 54 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 55 IBM: COMPANY SNAPSHOT

- FIGURE 56 ORACLE: COMPANY SNAPSHOT

- FIGURE 57 SAP: COMPANY SNAPSHOT

- FIGURE 58 SALESFORCE: COMPANY SNAPSHOT

- FIGURE 59 NVIDIA: COMPANY SNAPSHOT

- FIGURE 60 FICO: COMPANY SNAPSHOT

The AI as a Service market is projected to grow from USD 20.26 billion in 2025 to USD 91.20 billion by 2030, at a compound annual growth rate (CAGR) of 35.1% during the forecast period. The growth of the AI as a Service (AIaaS) market is primarily driven by the increasing adoption of cloud-based solutions, rising demand for intelligent virtual assistants, and the need for advanced data analytics to enhance decision-making across industries. Organizations are leveraging AIaaS to reduce operational costs, improve customer experience, and gain a competitive advantage without the burden of building in-house AI infrastructure. However, market growth is restrained by concerns related to data privacy, security risks, and the lack of skilled personnel to manage and implement AI technologies effectively. Additionally, integration challenges with existing systems and the high cost of advanced AI services for smaller businesses also pose limitations to widespread adoption.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | USD (Billion) |

| Segments | Product Type, Organization Size, Business Function, Service Type, End User, and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

"Operations & supply chain business function segment is expected to have the fastest growth rate during the forecast period"

The operations and supply chain segment is expected to witness the fastest growth in the AI as a Service market during the forecast period due to the increasing need for real-time insights, demand forecasting, and process optimization. AI-powered solutions help businesses enhance supply chain visibility, reduce disruptions, and improve inventory management through predictive analytics and automation. As global supply chains become more complex, organizations adopt AIaaS to streamline logistics, optimize routes, and enhance decision-making efficiency. Additionally, integrating AI with IoT and advanced analytics further drives its application in operations, making it a critical area for digital transformation and competitive advantage.

"The large enterprises of the organization size segment will hold the largest market share during the forecast period"

Large enterprises are expected to hold the largest market share in the AI as a Service market due to their substantial financial resources, advanced IT infrastructure, and greater readiness to adopt emerging technologies. These organizations often deal with massive volumes of data and require scalable, efficient solutions for automation, customer engagement, and decision-making, which AIaaS platforms effectively provide. Additionally, large enterprises actively invest in AI-driven digital transformation initiatives to enhance operational efficiency and maintain a competitive edge. Their ability to collaborate with AI vendors for customized solutions and to manage complex deployments further strengthens their dominant position in the market.

"Asia Pacific will likely witness rapid AI as a Service growth fueled by innovation and emerging technologies, while North America leads in market size"

Asia Pacific is projected to experience the fastest growth in the AI as a Service (AIaaS) market due to rapid digital transformation, increasing investments in AI technologies, and growing adoption of cloud-based services across India, China, and Southeast Asian nations. The region's expanding startup ecosystem and government initiatives supporting AI innovation fuel this growth. In contrast, North America will hold the largest market share, driven by the early adoption of advanced technologies, a strong presence of major AI vendors, and a mature cloud infrastructure. High R&D investments, robust digital ecosystems, and the widespread integration of AI across healthcare, finance, and retail sectors contribute to North America's market dominance.

Breakdown of primaries

In-depth interviews were conducted with Chief Executive Officers (CEOs), innovation and technology directors, system integrators, and executives from various key organizations operating in the AI as a Service market.

- By Company: Tier I - 35%, Tier II - 45%, and Tier III - 20%

- By Designation: C-Level Executives - 35%, D-Level Executives - 25%, and others - 40%

- By Region: North America - 40%, Europe - 25%, Asia Pacific - 20%, Middle East & Africa - 10%, and Latin America - 5%

The report includes a study of key players offering AI as a Service solution and service. It profiles major vendors in the AI as a Service market. These include Microsoft (US), IBM (US), Google (US), AWS (US), OpenAI (US), NVIDIA (US), Salesforce (US), Oracle (US), SAP (Germany), FICO (US), Cloudera (US), ServiceNow (US), HPE (US), Altair (US), SAS Institute (US), DataRobot (US), Databricks (US), C3 AI (US), H2O.ai (US), Alibaba Cloud (China), Domo (US), Intellias (US), Mistral AI (France), Rainbird Technologies (UK), BigML (US), Yottamine Analytics (US), Scale AI (US), Landing AI (US), Synthesia (UK), Yellow.ai (US), Cohere (Canada), Anyscale (US), Abridge (US), Inflection AI (US), Glean (US), Codeium (US), Arthur (US), Levty AI (US), Unstructured.io (US), Clarifai (US), DeepSearch (Austria), Katonic AI (Australia), MindTitan (Estonia), Viso.ai (Switzerland), MonkeyLearn (US), and Softweb Solutions (US).

Study Coverage

This research report covers the AI as a Service market and has been segmented based on product type, organization size, business function, service type, and end user. The product type segment comprises chatbots & AI agents, machine learning frameworks, application programming interface (API), no-code or low-code ML tools, and data labeling & pre-processing tools. The organization size segment contains small and medium-sized enterprises and large enterprises. The business function segment is classified into finance, marketing, sales, operations & supply chain, and human resources. The service type segment includes machine learning as a service (MLaaS), natural language processing as a service (NLPaaS), computer vision as a service, predictive analytics and data science as a service (DSaaS), and generative AI as a service. The end user segment is split into enterprises and individual users.

The enterprise end users consist of media & entertainment, BFSI, healthcare & life sciences, manufacturing, retail & e-commerce, transportation & logistics, energy & utilities, government & defense, IT & ITeS, telecommunications, and other enterprise end users (travel & hospitality, education, and construction & real estate). The regional analysis of the digital transformation market covers North America, Europe, Asia Pacific, the Middle East & Africa (MEA), and Latin America. The report also contains a detailed analysis of AI as a service architecture, pricing models, regulatory landscape, ecosystem analysis, supply chain analysis, technology roadmap, and technology analysis.

Key Benefits of Buying the Report

The report would provide the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall AI as a Service market and its subsegments. It would help stakeholders understand the competitive landscape and gain better insights to position their business and plan suitable go-to-market strategies. It also helps stakeholders understand the market's pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (AIaaS democratizes access for small and medium enterprises, growing demand for AI-enhanced cybersecurity solutions to combat sophisticated threats, and the rise of pre-trained AI models that require minimal customization accelerates AIaaS adoption), restraints (integration issues with legacy systems create inefficiencies, managing the environmental impact of energy-intensive AI computations and data centers, and high dependency on cloud providers hampers trust and hinders adoption), opportunities (emergence of federated learning techniques for collaborative AI model training, increasing demand for explainable AI (XAI) to enhance trust and transparency, and rising interest in quantum computing-based AI services for complex problem-solving), and challenges (balancing innovation with regulatory compliance, mitigating risks associated with AI model drift and maintaining model accuracy over time, and managing cost of high-performance AI infrastructure).

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the AI as a Service market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the AI as a Service market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the AI as a Service market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like Microsoft (US), IBM (US), Google (US), AWS (US), OpenAI (US), NVIDIA (US), Salesforce (US), Oracle (US), SAP (Germany), FICO (US), Cloudera (US), ServiceNow (US), HPE (US), Altair (US), SAS Institute (US), DataRobot (US), Databricks (US), C3 AI (US), H2O.ai (US), Alibaba Cloud (China), Domo (US), Intellias (US), Mistral AI (France), Rainbird Technologies (UK), BigML (US), Yottamine Analytics (US), Scale AI (US), Landing AI (US), Synthesia (UK), Yellow.ai (US), Cohere (Canada), Anyscale (US), Abridge (US), Inflection AI (US), Glean (US), Codeium (US), Arthur (US), Levty AI (US), Unstructured.io (US), Clarifai (US), DeepSearch (Austria), Katonic AI (Australia), MindTitan (Estonia), Viso.ai (Switzerland), MonkeyLearn (US), and Softweb Solutions (US), among others in the AI as a Service market. The report also helps stakeholders understand the pulse of the AI as a Service market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primary profiles

- 2.1.2.2 Key industry insights

- 2.2 MARKET BREAKUP AND DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- 2.4 MARKET FORECAST

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 STUDY LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AI AS A SERVICE MARKET

- 4.2 AI AS A SERVICE MARKET: TOP THREE SERVICE TYPES

- 4.3 NORTH AMERICA: AI AS A SERVICE MARKET, BY PRODUCT TYPE AND ENTERPRISE END USER

- 4.4 AI AS A SERVICE MARKET, BY REGION

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Democratization of advanced technologies

- 5.2.1.2 Growing demand for AI-enhanced cybersecurity solutions to combat sophisticated threats

- 5.2.1.3 Surge in pre-trained AI models requiring minimal customization

- 5.2.2 RESTRAINTS

- 5.2.2.1 Integration issues with legacy systems

- 5.2.2.2 Environmental impact of energy-intensive AI computations and data centers

- 5.2.2.3 High dependency on cloud providers

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Emergence of federated learning techniques for collaborative AI model training

- 5.2.3.2 Increasing demand for explainable AI

- 5.2.3.3 Rising interest in quantum computing-based AI services for complex problem-solving

- 5.2.4 CHALLENGES

- 5.2.4.1 Balancing innovation with regulatory compliance

- 5.2.4.2 Mitigating risks associated with AI model drift and maintaining model accuracy over time

- 5.2.4.3 Managing cost of high-performance AI infrastructure

- 5.2.1 DRIVERS

- 5.3 IMPACT OF 2025 US TARIFF - AI AS A SERVICE MARKET

- 5.3.1 INTRODUCTION

- 5.3.2 KEY TARIFF RATES

- 5.3.3 PRICE IMPACT ANALYSIS

- 5.3.3.1 Strategic Shifts and Emerging Trends

- 5.3.4 IMPACT ON COUNTRY/REGION

- 5.3.4.1 The US

- 5.3.4.2 Strategic Shifts and Key Observations

- 5.3.4.3 China

- 5.3.4.4 Strategic Shifts and Key Observations

- 5.3.4.5 Europe

- 5.3.4.6 Strategic Shifts and Key Observations

- 5.3.4.7 India

- 5.3.4.8 Strategic Shifts and Key Observations

- 5.3.5 IMPACT ON END-USE INDUSTRIES

- 5.3.5.1 Healthcare

- 5.3.5.2 Automotive

- 5.3.5.3 Finance

- 5.3.5.4 Manufacturing

- 5.3.5.5 Retail

- 5.4 AI AS A SERVICE MARKET: EVOLUTION

- 5.5 ECOSYSTEM ANALYSIS

- 5.5.1 CHATBOT & AI AGENT PROVIDERS

- 5.5.2 MACHINE LEARNING FRAMEWORK PROVIDERS

- 5.5.3 NO-CODE/LOW-CODE TOOL PROVIDERS

- 5.5.4 DATA PRE-PROCESSING TOOL PROVIDERS

- 5.5.5 API PROVIDERS

- 5.5.6 PUBLIC & MANAGED CLOUD PROVIDERS

- 5.6 SUPPLY CHAIN ANALYSIS

- 5.7 INVESTMENT LANDSCAPE AND FUNDING SCENARIO

- 5.8 CASE STUDY ANALYSIS

- 5.8.1 CASE STUDY 1: ADVANCED ANALYTICS AND VISUAL AI FOR ACCELERATING ION CHANNEL DRUG DISCOVERY

- 5.8.2 CASE STUDY 2: ELULA'S AI SOLUTIONS HELPED BANKS IMPROVE CUSTOMER RETENTION

- 5.8.3 CASE STUDY 3: NAMA RELIES ON GOOGLE CLOUD TO FURTHER GENERATIVE AI AND BECOME MORE STRATEGIC BUSINESS

- 5.8.4 CASE STUDY 4: IMPROVING CUSTOMER SERVICE AND FRAUD DETECTION WITH IBM AIAAS

- 5.8.5 CASE STUDY 5: AUTOMATING SUPPORT REQUEST TRIAGE WITH SALESFORCE AIAAS

- 5.8.6 CASE STUDY 6: MICROSOFT AZURE AIAAS EMPOWERED ALASKA AIRLINES TO OPTIMIZE ON-TIME PERFORMANCE WITH PREDICTIVE MAINTENANCE

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Generative AI

- 5.9.1.2 Machine Learning

- 5.9.1.3 Conversational AI

- 5.9.1.4 Cloud Computing

- 5.9.1.5 Natural Language Processing (NLP)

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.2.1 Cognitive Computing

- 5.9.2.2 Big Data Analytics

- 5.9.2.3 Robotic Process Automation (RPA)

- 5.9.3 ADJACENT TECHNOLOGIES

- 5.9.3.1 Quantum Computing

- 5.9.3.2 Internet of Things (IoT)

- 5.9.3.3 Cybersecurity

- 5.9.1 KEY TECHNOLOGIES

- 5.10 REGULATORY LANDSCAPE

- 5.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.10.2 REGULATIONS BY REGION

- 5.10.2.1 North America

- 5.10.2.1.1 SCR 17: Artificial Intelligence Bill (California)

- 5.10.2.1.2 SB 1103: Artificial Intelligence Automated Decision Bill (Connecticut)

- 5.10.2.1.3 National Artificial Intelligence Initiative Act (NAIIA)

- 5.10.2.1.4 The Artificial Intelligence and Data Act (AIDA) - Canada

- 5.10.2.2 Europe

- 5.10.2.2.1 The European Union (EU) - Artificial Intelligence Act (AIA)

- 5.10.2.2.2 General Data Protection Regulation (Europe)

- 5.10.2.3 Asia Pacific

- 5.10.2.3.1 Interim Administrative Measures for Generative Artificial Intelligence Services (China)

- 5.10.2.3.2 The National AI Strategy (Singapore)

- 5.10.2.3.3 The Hiroshima AI Process Comprehensive Policy Framework (Japan)

- 5.10.2.4 Middle East & Africa

- 5.10.2.4.1 The National Strategy for Artificial Intelligence (UAE)

- 5.10.2.4.2 The National Artificial Intelligence Strategy (Qatar)

- 5.10.2.4.3 The AI Ethics Principles and Guidelines (Dubai)

- 5.10.2.5 Latin America

- 5.10.2.5.1 The Santiago Declaration (Chile)

- 5.10.2.5.2 The Brazilian Artificial Intelligence Strategy (EBIA)

- 5.10.2.1 North America

- 5.11 ARCHITECTURE: AI AS A SERVICE

- 5.11.1 AI INFRASTRUCTURE

- 5.11.2 AI SERVICES

- 5.11.3 AI TOOLS

- 5.12 PATENT ANALYSIS

- 5.12.1 METHODOLOGY

- 5.12.2 PATENTS FILED, BY DOCUMENT TYPE

- 5.12.3 INNOVATION AND PATENT APPLICATIONS

- 5.13 PRICING ANALYSIS

- 5.13.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY SERVICE TYPE, 2025

- 5.13.2 AVERAGE SELLING PRICE TREND, BY PRODUCT TYPE, 2025

- 5.14 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.15 PORTER'S FIVE FORCES ANALYSIS

- 5.15.1 THREAT OF NEW ENTRANTS

- 5.15.2 THREAT OF SUBSTITUTES

- 5.15.3 BARGAINING POWER OF SUPPLIERS

- 5.15.4 BARGAINING POWER OF BUYERS

- 5.15.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.16 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.16.1 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.17 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.17.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.17.2 BUYING CRITERIA

6 AI AS A SERVICE MARKET, BY PRODUCT TYPE

- 6.1 INTRODUCTION

- 6.1.1 PRODUCT TYPE: AI AS A SERVICE MARKET DRIVERS

- 6.2 CHATBOTS & AI AGENTS

- 6.2.1 GROWING INTEGRATION OF AI TOOLS INTO CRM SYSTEMS TO ADOPT AI-DRIVEN CONVERSATIONAL SOLUTIONS

- 6.3 MACHINE LEARNING FRAMEWORKS

- 6.3.1 WIDE USE OF OPEN-SOURCE FRAMEWORKS SUCH AS TENSORFLOW, PYTORCH, AND SCIKIT-LEARN TO DRIVE MARKET

- 6.4 APPLICATION PROGRAMMING INTERFACE

- 6.4.1 RISING NEED FOR EFFICIENT METHODS THAT INTERACT WITH AI SERVICES TO INCORPORATE ADVANCED AI TECHNOLOGIES

- 6.5 NO-CODE OR LOW-CODE ML TOOLS

- 6.5.1 RISING DEMAND FOR EASY-TO-USE INTERFACES AND VISUAL WORKFLOWS TO PROMOTE USE OF AI IN DIFFERENT VERTICALS

- 6.6 DATA LABELING & PRE-PROCESSING TOOLS

- 6.6.1 NEED FOR TRANSFORMING RAW DATA INTO ANNOTATED DATASETS TO BOOST DEMAND FOR DATA LABELING TOOLS

7 AI AS A SERVICE MARKET, BY ORGANIZATION SIZE

- 7.1 INTRODUCTION

- 7.1.1 ORGANIZATION SIZE: AI AS A SERVICE MARKET DRIVERS

- 7.2 SMALL & MEDIUM-SIZED ENTERPRISES

- 7.2.1 USE OF GENERATIVE AIAAS IN AUTOMATING CUSTOMER SERVICE OR ANALYZING HUGE DATASETS TO DRIVE MARKET

- 7.3 LARGE ENTERPRISES

- 7.3.1 QUICK DEPLOYMENT AND INTEGRATION OF AI CAPABILITIES FOR LARGE ENTERPRISES TO DRIVE MARKET

8 AI AS A SERVICE MARKET, BY BUSINESS FUNCTION

- 8.1 INTRODUCTION

- 8.1.1 BUSINESS FUNCTION: AI AS A SERVICE MARKET DRIVERS

- 8.2 FINANCE

- 8.2.1 AI TO RESHAPE FINANCIAL SECTOR BY AUTOMATING TASKS AND ENHANCING COMPLIANCE WITH ADVANCED DATA ANALYSIS

- 8.3 MARKETING

- 8.3.1 AI TO REVOLUTIONIZE MARKETING TRENDS THROUGH HYPER-PERSONALIZATION AND PREDICTIVE ANALYTICS

- 8.4 SALES

- 8.4.1 AIAAS PLATFORMS TO OFFER IMMEDIATE UNDERSTANDING OF CUSTOMER ACTIONS TO CUSTOMIZE SALES

- 8.5 OPERATIONS & SUPPLY CHAIN

- 8.5.1 AI-DRIVEN PREDICTIVE ANALYSIS TO RECOGNIZE POSSIBLE INTERRUPTIONS AND RESTRICTIONS IN SUPPLY NETWORK

- 8.6 HUMAN RESOURCES

- 8.6.1 AI PROGRAMS ANTICIPATE SKILL DEFICIENCIES AND DETECT POSSIBLE TURNOVER CONCERNS

9 AI AS A SERVICE MARKET, BY SERVICE TYPE

- 9.1 INTRODUCTION

- 9.1.1 SERVICE TYPE: AI AS A SERVICE MARKET DRIVERS

- 9.2 MACHINE LEARNING AS A SERVICE (MLAAS)

- 9.2.1 USERS CAN LEVERAGE MLAAS PLATFORMS TO CREATE PREDICTIVE MODELS, TAKING ADVANTAGE OF SCALABILITY AND FLEXIBILITY

- 9.2.2 DATA PREPARATION AND PREPROCESSING

- 9.2.3 MODEL DEVELOPMENT AND TRAINING

- 9.2.4 MODEL DEPLOYMENT AND MANAGEMENT

- 9.2.5 MODEL EVALUATION AND TESTING

- 9.2.6 RECOMMENDATION SERVICES

- 9.2.7 OTHERS IN MACHINE LEARNING AS A SERVICE

- 9.3 NATURAL LANGUAGE PROCESSING AS A SERVICE (NLPAAS)

- 9.3.1 GROWING DEPENDENCE ON DATA-BASED DECISION-MAKING AND REQUIREMENT FOR EFFECTIVE COMMUNICATION TO FUEL DEMAND FOR NLPAAS

- 9.3.2 SPEECH RECOGNITION

- 9.3.3 SEMANTIC SEARCH

- 9.3.4 SENTIMENT ANALYSIS

- 9.3.5 VOICE RECOGNITION

- 9.3.6 TEXT-TO-SPEECH (TTS)

- 9.3.7 OTHERS IN NATURAL LANGUAGE PROCESSING AS A SERVICE

- 9.4 COMPUTER VISION AS A SERVICE

- 9.4.1 COMPUTER VISION TO USE COMPLEX ALGORITHMS AND ML FRAMEWORKS WITHOUT IN-HOUSE INFRASTRUCTURE OR EXPERTISE

- 9.4.2 IMAGE RECOGNITION

- 9.4.3 FACE RECOGNITION

- 9.4.4 VIDEO ANALYTICS

- 9.4.5 OBJECT DETECTION

- 9.4.6 OTHERS IN COMPUTER VISION AS A SERVICE

- 9.5 PREDICTIVE ANALYTICS AND DATA SCIENCE AS A SERVICE (DSAAS)

- 9.5.1 DSAAS TO SUPPORT PREDICTIVE ANALYTICS BY PROVIDING ADVANCED ANALYTICAL CAPABILITIES THAT DO NOT REQUIRE INTERNAL EXPERTISE

- 9.5.2 OPERATIONAL INTELLIGENCE

- 9.5.3 SUPPLY CHAIN ANALYTICS

- 9.5.4 PREDICTIVE MAINTENANCE

- 9.5.5 RISK MANAGEMENT

- 9.5.6 OTHERS IN PREDICTIVE ANALYTICS AND DATA SCIENCE AS A SERVICE

- 9.6 GENERATIVE AI AS A SERVICE

- 9.6.1 USE OF DATA AUGMENTATION, UTILIZING AI-CREATED SAMPLES TO IMPROVE TRAINING DATASETS FOR ML MODELS

- 9.6.2 CODE GENERATION & SOFTWARE DEVELOPMENT

- 9.6.3 CONTENT CREATION

- 9.6.4 FRAUD DETECTION

- 9.6.5 CONTENT MODERATION

- 9.6.6 DATA EXTRACTION

- 9.6.7 OTHERS IN GENERATIVE AI AS A SERVICE

10 AI AS A SERVICE MARKET, BY END USER

- 10.1 INTRODUCTION

- 10.1.1 END USER: AI AS A SERVICE MARKET DRIVERS

- 10.2 ENTERPRISES

- 10.2.1 BFSI

- 10.2.1.1 AIaaS and blockchain to create secure and transparent transactions

- 10.2.2 RETAIL & E-COMMERCE

- 10.2.2.1 Advancements in machine learning and natural language processing to drive retail & e-commerce market

- 10.2.3 TECHNOLOGY & SOFTWARE

- 10.2.3.1 AIaaS to enable technology firms to rapidly test new concepts and applications by offering pre-built algorithms and models

- 10.2.3.2 IT & ITeS

- 10.2.3.3 Software development companies

- 10.2.3.4 Other technology & software

- 10.2.4 MEDIA & ENTERTAINMENT

- 10.2.4.1 Use of ML algorithms to analyze viewer preferences and behaviors to provide personalized content suggestions

- 10.2.5 MANUFACTURING

- 10.2.5.1 Predictive maintenance capability to significantly reduce downtime and maintenance costs

- 10.2.6 HEALTHCARE & LIFE SCIENCES

- 10.2.6.1 AIaaS to help address critical challenges in patient care, diagnostics, and drug development

- 10.2.7 ENERGY & UTILITIES

- 10.2.7.1 Data obtained from sensors and smart meters to allow energy suppliers determine system inefficiencies

- 10.2.8 GOVERNMENT & DEFENSE

- 10.2.8.1 AI algorithms to detect potential threats and emerging patterns using large amounts of data from different sources

- 10.2.9 TELECOMMUNICATIONS

- 10.2.9.1 AI-powered analysis to help understand customer preferences and behaviors by using advanced ML models

- 10.2.10 TRANSPORTATION & LOGISTICS

- 10.2.10.1 Examining traffic patterns, weather conditions, and delivery windows to enhance fleet management

- 10.2.11 OTHER ENTERPRISE END USERS

- 10.2.1 BFSI

- 10.3 INDIVIDUAL USERS

11 AI AS A SERVICE MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 NORTH AMERICA: AI AS A SERVICE MARKET DRIVERS

- 11.2.2 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 11.2.3 US

- 11.2.3.1 US AIaaS market continues to grow with strong institutional backing and technical advancement

- 11.2.4 CANADA

- 11.2.4.1 Canada's strategic growth in AIaaS market: Innovation, investment, and ethical leadership

- 11.3 EUROPE

- 11.3.1 EUROPE: AI AS A SERVICE MARKET DRIVERS

- 11.3.2 EUROPE: MACROECONOMIC OUTLOOK

- 11.3.3 UK

- 11.3.3.1 UK's leadership in AIaaS Market: Innovation, safety, and sustainable growth

- 11.3.4 GERMANY

- 11.3.4.1 Germany's focus on ethical AI practices positions it well for continued growth in AIaaS market

- 11.3.5 FRANCE

- 11.3.5.1 France's emphasis on ethical AI practices and regulatory frameworks to foster trust among businesses and consumers

- 11.3.6 ITALY

- 11.3.6.1 Comprehensive AI strategy to balance opportunities presented by AI technologies

- 11.3.7 SPAIN

- 11.3.7.1 Transformative potential of AI to drive market

- 11.3.8 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 ASIA PACIFIC: AI AS A SERVICE MARKET DRIVERS

- 11.4.2 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 11.4.3 CHINA

- 11.4.3.1 Use of Nvidia chips via Azure and Google Cloud highlights its ability to leverage global resources

- 11.4.4 INDIA

- 11.4.4.1 Growth of AIaaS market in India driven by combination of government initiatives and technological innovation

- 11.4.5 JAPAN

- 11.4.5.1 Incorporation of cutting-edge technologies and solid government backing for modernization to drive market

- 11.4.6 SOUTH KOREA

- 11.4.6.1 Development and distribution of AI outlining guidelines for safe and ethical use of AI technologies to drive market

- 11.4.7 AUSTRALIA & NEW ZEALAND

- 11.4.7.1 Initiatives promoting innovation and ethical practices to foster environment conducive to sustainable AI development

- 11.4.8 SINGAPORE

- 11.4.8.1 Singapore government investment to support initiatives that uplift various sectors by integrating AI

- 11.4.9 REST OF ASIA PACIFIC

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 MIDDLE EAST & AFRICA: AI AS A SERVICE MARKET DRIVERS

- 11.5.2 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 11.5.3 MIDDLE EAST

- 11.5.3.1 Saudi Arabia

- 11.5.3.1.1 Need for fostering innovation, attracting international talent, and creating robust regulatory framework to drive market

- 11.5.3.2 UAE

- 11.5.3.2.1 Growing demand for AIaaS by driving economic growth to address societal challenges through innovative AI applications

- 11.5.3.3 QATAR

- 11.5.3.3.1 Integration of AI technologies across various sectors to boost market

- 11.5.3.4 Turkey

- 11.5.3.4.1 International collaborations to enhance economic growth

- 11.5.3.5 Rest of Middle East

- 11.5.3.1 Saudi Arabia

- 11.5.4 AFRICA

- 11.6 LATIN AMERICA

- 11.6.1 LATIN AMERICA: AI AS A SERVICE MARKET DRIVERS

- 11.6.2 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 11.6.3 BRAZIL

- 11.6.3.1 Brazilian government to unveil various initiatives to accelerate AI development

- 11.6.4 MEXICO

- 11.6.4.1 Vibrant startup ecosystem and increasing collaboration between government and private enterprises to drive market

- 11.6.5 ARGENTINA

- 11.6.5.1 Rising investments to promote AI and technological innovation to drive market

- 11.6.6 REST OF LATIN AMERICA

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022-2025

- 12.3 REVENUE ANALYSIS, 2020-2024

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.5 PRODUCT COMPARATIVE ANALYSIS

- 12.5.1 PRODUCT COMPARATIVE ANALYSIS, BY AI AS A SERVICE MARKET

- 12.6 COMPANY VALUATION AND FINANCIAL METRICS

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.7.5.1 Company footprint

- 12.7.5.2 Region footprint

- 12.7.5.3 Business function footprint

- 12.7.5.4 Product type footprint

- 12.7.5.5 End user footprint

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.8.5.1 Detailed list of key startups/SMEs

- 12.8.5.2 Competitive benchmarking of key startups/SMEs

- 12.9 COMPETITIVE SCENARIO AND TRENDS

- 12.9.1 PRODUCT LAUNCHES/ENHANCEMENTS

- 12.9.2 DEALS

13 COMPANY PROFILES

- 13.1 INTRODUCTION

- 13.2 KEY PLAYERS

- 13.2.1 AWS

- 13.2.1.1 Business overview

- 13.2.1.2 Products/Solutions/Services offered

- 13.2.1.3 Recent developments

- 13.2.1.3.1 Product launches and enhancements

- 13.2.1.3.2 Deals

- 13.2.1.4 MnM view

- 13.2.1.4.1 Right to win

- 13.2.1.4.2 Strategic choices made

- 13.2.1.4.3 Weaknesses and competitive threats

- 13.2.2 GOOGLE

- 13.2.2.1 Business overview

- 13.2.2.2 Products/Solutions/Services offered

- 13.2.2.3 Recent developments

- 13.2.2.3.1 Product enhancements

- 13.2.2.3.2 Deals

- 13.2.2.4 MnM view

- 13.2.2.4.1 Right to win

- 13.2.2.4.2 Strategic choices made

- 13.2.2.4.3 Weaknesses and competitive threats

- 13.2.3 MICROSOFT

- 13.2.3.1 Business overview

- 13.2.3.2 Products/Solutions/Services offered

- 13.2.3.3 Recent developments

- 13.2.3.3.1 Product enhancements

- 13.2.3.3.2 Deals

- 13.2.3.4 MnM view

- 13.2.3.4.1 Right to win

- 13.2.3.4.2 Strategic choices made

- 13.2.3.4.3 Weaknesses and competitive threats

- 13.2.4 IBM

- 13.2.4.1 Business overview

- 13.2.4.2 Products/Solutions/Services offered

- 13.2.4.3 Recent developments

- 13.2.4.3.1 Product enhancements

- 13.2.4.3.2 Deals

- 13.2.4.4 MnM view

- 13.2.4.4.1 Right to win

- 13.2.4.4.2 Strategic choices made

- 13.2.4.4.3 Weaknesses and competitive threats

- 13.2.5 ORACLE

- 13.2.5.1 Business overview

- 13.2.5.2 Products/Solutions/Services offered

- 13.2.5.3 Recent developments

- 13.2.5.3.1 Product enhancements

- 13.2.5.3.2 Deals

- 13.2.5.4 MnM view

- 13.2.5.4.1 Right to win

- 13.2.5.4.2 Strategic choices made

- 13.2.5.4.3 Weaknesses and competitive threats

- 13.2.6 SAP

- 13.2.6.1 Business overview

- 13.2.6.2 Products/Solutions/Services offered

- 13.2.6.3 Recent developments

- 13.2.6.3.1 Product Enhancements

- 13.2.6.3.2 Deals

- 13.2.7 SALESFORCE

- 13.2.7.1 Business overview

- 13.2.7.2 Products/Solutions/Services offered

- 13.2.7.3 Recent developments

- 13.2.7.3.1 Product enhancements

- 13.2.7.3.2 Deals

- 13.2.8 NVIDIA

- 13.2.8.1 Business overview

- 13.2.8.2 Products/Solutions/Services offered

- 13.2.8.3 Recent developments

- 13.2.8.3.1 Product enhancements

- 13.2.8.3.2 Deals

- 13.2.9 ALIBABA CLOUD

- 13.2.10 OPENAI

- 13.2.11 RAINBIRD TECHNOLOGIES

- 13.2.12 BIGML

- 13.2.13 COHERE

- 13.2.14 GLEAN

- 13.2.15 SCALE AI

- 13.2.16 LANDING AI

- 13.2.17 YELLOW.AI

- 13.2.18 ANYSCALE

- 13.2.19 MISTRAL AI

- 13.2.20 H20.AI

- 13.2.21 SYNTHESIA

- 13.2.22 CLARIFAI

- 13.2.23 MONKEYLEARN

- 13.2.1 AWS

- 13.3 OTHER PLAYERS

- 13.3.1 FICO

- 13.3.1.1 Business overview

- 13.3.1.2 Products/Solutions/Services Offered

- 13.3.1.3 Recent developments

- 13.3.1.3.1 Product Enhancements

- 13.3.1.3.2 Deals

- 13.3.2 CLOUDERA

- 13.3.2.1 Business overview

- 13.3.2.2 Products/Solutions/Services offered

- 13.3.2.3 Recent developments

- 13.3.2.3.1 Product Enhancements

- 13.3.2.3.2 Deals

- 13.3.3 SERVICENOW

- 13.3.4 HPE

- 13.3.5 ALTAIR

- 13.3.6 SAS INSTITUTE

- 13.3.7 DATAROBOT

- 13.3.8 DATABRICKS

- 13.3.9 C3 AI

- 13.3.10 DOMO

- 13.3.11 INTELLIAS

- 13.3.12 YOTTAMINE ANALYTICS

- 13.3.13 INFLECTION AI

- 13.3.14 ABRIDGE

- 13.3.15 CODEIUM

- 13.3.16 ARTHUR

- 13.3.17 LEVITY AI

- 13.3.18 UNSTRUCTURED.IO

- 13.3.19 KATONIC AI

- 13.3.20 DEEPSEARCH

- 13.3.21 MINDTITAN

- 13.3.22 VISO.AI

- 13.3.23 SOFTWEB SOLUTIONS

- 13.3.1 FICO

14 ADJACENT AND RELATED MARKETS

- 14.1 INTRODUCTION

- 14.2 ARTIFICIAL INTELLIGENCE (AI) MARKET - GLOBAL FORECAST TO 2030

- 14.2.1 MARKET DEFINITION

- 14.2.2 MARKET OVERVIEW

- 14.2.2.1 Artificial Intelligence Market, by Offering

- 14.2.2.2 Artificial Intelligence Market, by Technology

- 14.2.2.3 Artificial Intelligence Market, by Business Function

- 14.2.2.4 Artificial Intelligence Market, by Vertical

- 14.2.2.5 Artificial Intelligence Market, by Region

- 14.3 GENERATIVE AI MARKET- GLOBAL FORECAST TO 2030

- 14.3.1 MARKET DEFINITION

- 14.3.2 MARKET OVERVIEW

- 14.3.2.1 Generative AI Market, by Offering

- 14.3.2.2 Generative AI Market, by Application

- 14.3.2.3 Generative AI Market, by Vertical

- 14.3.2.4 Generative AI Market, by Region

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS