|

|

市場調査レポート

商品コード

1653416

乳製品検査市場:エンドユーザー別、製品タイプ別、技術別、検査タイプ別、地域別 - 2030年までの予測Dairy Testing Market by Test Type (Safety Testing and Quality Testing), Product Type (Milk & Milk Powder, Cheese, Butter & Spreads, Infant Foods, Ice-creams & Desserts, Yogurt), Technology (Traditional, Rapid), and Region - Global Forecast 2030 |

||||||

カスタマイズ可能

|

|||||||

| 乳製品検査市場:エンドユーザー別、製品タイプ別、技術別、検査タイプ別、地域別 - 2030年までの予測 |

|

出版日: 2025年02月07日

発行: MarketsandMarkets

ページ情報: 英文 260 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

乳製品検査の市場規模は、2025年に74億2,000万米ドルと予測され、2025年から2030年までのCAGRは8.3%と見込まれており、2030年には110億5,000万米ドルに達すると予測されています。

新興国における乳製品市場の成長は、安全で高品質な乳製品に対する高い需要があるため、乳製品検査市場に新たな機会をもたらすと考えられます。中国、インド、ブラジル、東南アジアといった国々の人口が増加し、都市化が進む一方で、牛乳、ヨーグルト、チーズといった乳製品の消費は急速な伸びを見せています。この変化はまた、可処分所得の増加、食習慣の変化、中間層の増加と相まって、乳製品の需要を増大させています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2025年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(米ドル) |

| セグメント別 | エンドユーザー別、製品タイプ別、技術別、検査タイプ別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、南米、その他の地域 |

迅速技術セグメントは、より速く、より正確で、費用対効果の高い検査ソリューションに対する需要の高まりに応えることができるため、乳製品検査市場を独占しました。従来の検査方法では、食品の安全性と品質に対する要求が高まっている消費者のスピードと効率の要求を満たせないことが多いです。PCR(ポリメラーゼ連鎖反応)、ELISA(酵素結合免疫吸着測定法)、バイオセンサーを含む迅速検査技術の進歩は、乳製品中の病原体、汚染物質、品質パラメータをより迅速に、より高い精度で検出する可能性を提供します。乳製品生産者は、非常にタイトな生産スケジュールや、製品が販売可能になるまでの期間短縮に直面しているため、これらの技術は不可欠です。

牛乳・粉乳セグメントは、食品の安全性と品質に対する意識の高まりと相まって、そのような製品に対する世界の需要の高まりにより、乳製品検査市場を独占すると予測されています。牛乳と粉ミルクの消費量は、特に発展途上国において、必要不可欠な栄養源であるため、乳製品の中でも最も高い水準にあります。アジア太平洋やアフリカなどの地域で人口が増加し、中産階級が増加しているため、牛乳と粉ミルクの需要が増加します。消費量の増加は、安全性、品質、規制遵守に関する全数検査サービスに対する需要の高まりに直結します。

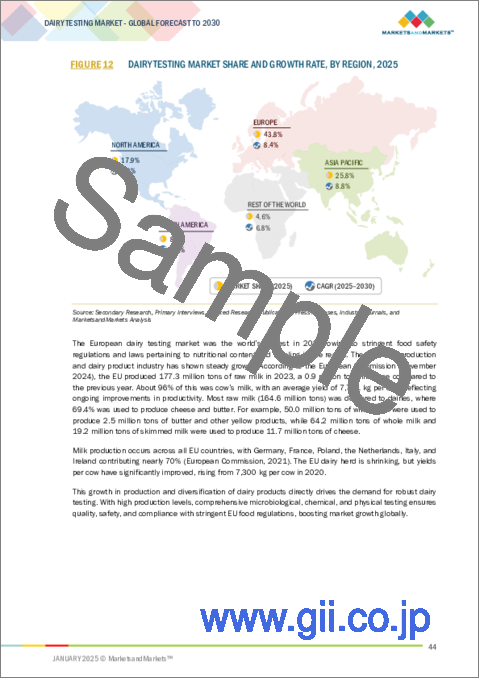

急速な人口増加、急速な都市化、乳製品の消費量の増加は、アジア太平洋が乳製品検査市場で最も大きな成長率を記録することになります。乳製品の需要は、世界で最も人口の多い地域のひとつであるアジア太平洋全域で急速に伸びており、中国、インド、東南アジアなどの国々がシェアの大半を占めています。さらにアジア太平洋は、特に農村部において、食中毒、製品の不純物混入、貧弱な保管インフラといった特有の課題にも直面しています。このため、製品が消費によって健康に害を及ぼさず、それぞれの衛生基準を満たしていることを確認するための、信頼性が高く効率的な乳製品検査ソリューションの負担が大きくなっています。

当レポートでは、世界の乳製品検査市場について調査し、エンドユーザー別、製品タイプ別、技術別、検査タイプ別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- マクロ経済見通し

- 市場力学

- 生成AIが食品安全に与える影響

第6章 業界の動向

- イントロダクション

- サプライチェーン分析

- バリューチェーン分析

- 貿易分析

- 技術分析

- 価格分析

- エコシステム分析/市場マップ

- 顧客ビジネスに影響を与える動向/混乱

- 特許分析

- 2024年~2025年の主な会議とイベント

- 規制状況

- 規制機関、政府機関、その他の組織

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- ケーススタディ分析

- 投資と資金調達のシナリオ

第7章 乳製品検査市場(エンドユーザー別)

- イントロダクション

- 乳製品生産者

- 乳製品加工業者

- 飲食品メーカー

- 規制当局

- その他

第8章 乳製品検査市場(製品タイプ別)

- イントロダクション

- 牛乳・粉乳

- チーズ、バター、スプレッド

- 乳児用食品

- アイスクリーム・デザート

- ヨーグルト

- その他

第9章 乳製品検査市場(技術別)

- イントロダクション

- 従来型

- 迅速型

第10章 乳製品検査市場(検査タイプ別)

- イントロダクション

- 安全性テスト

- 品質テスト

第11章 乳製品検査市場(地域別)

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリアとニュージーランド

- その他

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- ポーランド

- その他

- 南米

- ブラジル

- アルゼンチン

- その他

- その他の地域

- 中東

- アフリカ

第12章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 収益分析

- 市場シェア分析、2023年

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:新興企業/中小企業、2024年

- 企業評価と財務指標、2024年

- ブランド比較

- 競合シナリオと動向

第13章 企業プロファイル

- 主要参入企業

- SGS INSTITUT FRESENIUS

- BUREAU VERITAS

- EUROFINS SCIENTIFIC

- INTERTEK GROUP PLC.

- TUV SUD

- TUV NORD GROUP

- ALS LIMITED

- ASUREQUALITY

- MERIEUX NUTRISCIENCES CORPORATION

- ROMER LABS DIVISION HOLDING

- SYMBIO LABS

- NEOGEN CORPORATION

- MICROBAC LABORATORIES, INC.

- CERTIFIED LABORATORIES

- AGROLAB GROUP

- DAIRY ONE

- FARE LABS

- LACTANET

- DOCTORS'ANALYTICAL LABORATORIES PVT. LTD.

- CVR LABS PRIVATE LIMITED

- LILABA ANALYTICAL LABORATORIES

- その他の企業

- TENTAMUS

- MICROBIAL RESEARCH INC.

- ENVITRO LABORATORIES PVT. LTD.

- APEX TESTING AND RESEARCH LABORATORY

- OPAL RESEARCH AND ANALYTICAL SERVICES

第14章 隣接市場と関連市場

第15章 付録

List of Tables

- TABLE 1 DAIRY TESTING MARKET: INCLUSIONS & EXCLUSIONS

- TABLE 2 USD EXCHANGE RATES CONSIDERED, 2020-2024

- TABLE 3 DAIRY TESTING MARKET SHARE SNAPSHOT, 2025 VS. 2030 (USD MILLION)

- TABLE 4 DAIRY PRODUCTS & ALTERNATIVES: MAJOR ALLERGENS & ADVERSE REACTIONS

- TABLE 5 SPECIFIC RELEASE LIMITS (SRL) FOR HEAVY METALS & ALLOY COMPONENTS

- TABLE 6 DAIRY PRODUCT RECALLS IN US & CANADA, 2024

- TABLE 7 COW MILK PRODUCTION DATA OF MAJOR EXPORTERS (MILLON TONS)

- TABLE 8 EXPORT VALUE OF HS CODE 0401, BY KEY COUNTRY, 2022-2023 (USD THOUSAND)

- TABLE 9 EXPORT VOLUME OF HS CODE 0401, BY KEY COUNTRY, 2022-2023 (TONS)

- TABLE 10 IMPORT VALUE OF HS CODE 0401, BY KEY COUNTRY, 2022-2023 (USD THOUSAND)

- TABLE 11 IMPORT VOLUME OF HS CODE 0401, BY KEY COUNTRY, 2022-2023 (TONS)

- TABLE 12 EXPORT VALUE OF HS CODE 0402, BY KEY COUNTRY, 2022-2023 (USD THOUSAND)

- TABLE 13 EXPORT VOLUME OF HS CODE 0402, BY KEY COUNTRY, 2022-2023 (TONS)

- TABLE 14 IMPORT VALUE OF HS CODE 0402, BY KEY COUNTRY, 2022-2023 (USD THOUSAND)

- TABLE 15 IMPORT VOLUME OF HS CODE 0402, BY KEY COUNTRY, 2022-2023 (TONS)

- TABLE 16 EXPORT VALUE OF HS CODE 0403, BY KEY COUNTRY, 2022-2023 (USD THOUSAND)

- TABLE 17 EXPORT VOLUME OF HS CODE 0403 BY KEY COUNTRY, 2022-2023 (TONS)

- TABLE 18 IMPORT VALUE OF HS CODE 0403, BY KEY COUNTRY, 2022-2023 (USD THOUSAND)

- TABLE 19 IMPORT VOLUME OF HS CODE 0403, BY KEY COUNTRY, 2022-2023 (TONS)

- TABLE 20 AVERAGE SELLING PRICE (ASP) OF DAIRY TESTING, BY TEST TYPE, 2020-2024 (USD/TEST)

- TABLE 21 DAIRY TESTING MARKET: ECOSYSTEM

- TABLE 22 LIST OF MAJOR PATENTS IN DAIRY TESTING MARKET, 2020-2024

- TABLE 23 DAIRY TESTING MARKET: DETAILED LIST OF CONFERENCES AND EVENTS, 2024-2025

- TABLE 24 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 25 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 26 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 27 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 28 IMPACT OF PORTER'S FIVE FORCES ON DAIRY TESTING MARKET

- TABLE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP TWO TEST TYPES (%)

- TABLE 30 KEY BUYING CRITERIA FOR TEST TYPE

- TABLE 31 DAIRY TESTING MARKET, BY PRODUCT TYPE, 2020-2024 (USD MILLION)

- TABLE 32 DAIRY TESTING MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 33 MILK & MILK POWDER: DAIRY TESTING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 34 MILK & MILK POWDER: DAIRY TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 35 CHEESE, BUTTER & SPREADS: DAIRY TESTING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 36 CHEESE, BUTTER & SPREADS: DAIRY TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 37 INFANT FOODS: DAIRY TESTING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 38 INFANT FOODS: DAIRY TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 39 ICE-CREAMS & DESSERTS: DAIRY TESTING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 40 ICE-CREAMS & DESSERTS: DAIRY TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 41 YOGURT: DAIRY TESTING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 42 YOGURT: DAIRY TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 43 OTHER PRODUCT TYPES: DAIRY TESTING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 44 OTHER PRODUCT TYPES: DAIRY TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 45 DAIRY TESTING MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 46 DAIRY TESTING MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 47 TRADITIONAL TECHNOLOGY: DAIRY TESTING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 48 TRADITIONAL TECHNOLOGY: DAIRY TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 49 DAIRY TESTING MARKET, BY RAPID TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 50 DAIRY TESTING MARKET, BY RAPID TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 51 RAPID TECHNOLOGY: DAIRY TESTING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 52 RAPID TECHNOLOGY: DAIRY TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 53 CONVENIENCE-BASED: DAIRY TESTING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 54 CONVENIENCE-BASED: DAIRY TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 55 PCR: DAIRY TESTING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 56 PCR: DAIRY TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 57 IMMUNOASSAY: DAIRY TESTING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 58 IMMUNOASSAY: DAIRY TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 59 CHROMATOGRAPHY & SPECTROMETRY: DAIRY TESTING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 60 CHROMATOGRAPHY & SPECTROMETRY: DAIRY TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 61 DAIRY TESTING MARKET, BY TEST TYPE, 2020-2024 (USD MILLION)

- TABLE 62 DAIRY TESTING MARKET, BY TEST TYPE, 2025-2030 (USD MILLION)

- TABLE 63 DAIRY TESTING MARKET, BY TEST TYPE, 2020-2024 (USD/TEST)

- TABLE 64 DAIRY TESTING MARKET, BY TEST TYPE, 2025-2030 (USD/TEST)

- TABLE 65 SAFETY TESTING: DAIRY TESTING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 66 SAFETY TESTING: DAIRY TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 67 DAIRY TESTING MARKET, BY SAFETY TESTING, 2020-2024 (USD MILLION)

- TABLE 68 DAIRY TESTING MARKET, BY SAFETY TESTING, 2025-2030 (USD MILLION)

- TABLE 69 DAIRY TESTING MARKET, BY SAFETY TESTING, 2020-2024 (USD/TEST)

- TABLE 70 DAIRY TESTING MARKET, BY SAFETY TESTING, 2025-2030 (USD/TEST)

- TABLE 71 MAJOR MILK-BORNE PATHOGENS AND ASSOCIATED ILLNESSES

- TABLE 72 PATHOGENS: DAIRY TESTING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 73 PATHOGENS: DAIRY TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 74 SAFETY TESTING: DAIRY TESTING MARKET, BY PATHOGEN, 2020-2024 (USD MILLION)

- TABLE 75 SAFETY TESTING: DAIRY TESTING MARKET, BY PATHOGEN, 2025-2030 (USD MILLION)

- TABLE 76 ADULTERANTS: DAIRY TESTING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 77 ADULTERANTS: DAIRY TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 78 PESTICIDES: DAIRY TESTING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 79 PESTICIDES: DAIRY TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 80 GMO: DAIRY TESTING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 81 GMO: DAIRY TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 82 MYCOTOXINS: DAIRY TESTING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 83 MYCOTOXINS: DAIRY TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 84 OTHERS: DAIRY TESTING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 85 OTHERS: DAIRY TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 86 QUALITY TESTING: DAIRY TESTING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 87 QUALITY TESTING: DAIRY TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 88 DAIRY TESTING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 89 DAIRY TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 90 NORTH AMERICA: DAIRY TESTING MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 91 NORTH AMERICA: DAIRY TESTING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 92 NORTH AMERICA: DAIRY TESTING MARKET, BY TEST TYPE, 2020-2024 (USD MILLION)

- TABLE 93 NORTH AMERICA: DAIRY TESTING MARKET, BY TEST TYPE, 2025-2030 (USD MILLION)

- TABLE 94 NORTH AMERICA: DAIRY TESTING MARKET, BY SAFETY TESTING TYPE, 2020-2024 (USD MILLION)

- TABLE 95 NORTH AMERICA: DAIRY TESTING MARKET, BY SAFETY TESTING TYPE, 2025-2030 (USD MILLION)

- TABLE 96 NORTH AMERICA: DAIRY TESTING MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 97 NORTH AMERICA: DAIRY TESTING MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 98 NORTH AMERICA: DAIRY TESTING MARKET, BY RAPID TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 99 NORTH AMERICA: DAIRY TESTING MARKET, BY RAPID TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 100 NORTH AMERICA: DAIRY TESTING MARKET, BY PRODUCT TYPE, 2020-2024 (USD MILLION)

- TABLE 101 NORTH AMERICA: DAIRY TESTING MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 102 US: DAIRY TESTING MARKET, BY PRODUCT TYPE, 2020-2024 (USD MILLION)

- TABLE 103 US: DAIRY TESTING MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 104 CANADA: DAIRY TESTING MARKET, BY PRODUCT TYPE, 2020-2024 (USD MILLION)

- TABLE 105 CANADA: DAIRY TESTING MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 106 MEXICO: DAIRY TESTING MARKET, BY PRODUCT TYPE, 2020-2024 (USD MILLION)

- TABLE 107 MEXICO: DAIRY TESTING MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 108 ASIA PACIFIC: DAIRY TESTING MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 109 ASIA PACIFIC: DAIRY TESTING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 110 ASIA PACIFIC: DAIRY TESTING MARKET, BY TEST TYPE, 2020-2024 (USD MILLION)

- TABLE 111 ASIA PACIFIC: DAIRY TESTING MARKET, BY TEST TYPE, 2025-2030 (USD MILLION)

- TABLE 112 ASIA PACIFIC: DAIRY TESTING MARKET, BY SAFETY TESTING, 2020-2024 (USD MILLION)

- TABLE 113 ASIA PACIFIC: DAIRY TESTING MARKET, BY SAFETY TESTING, 2025-2030 (USD MILLION)

- TABLE 114 ASIA PACIFIC: DAIRY TESTING MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 115 ASIA PACIFIC: DAIRY TESTING MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 116 ASIA PACIFIC: DAIRY TESTING MARKET, BY RAPID TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 117 ASIA PACIFIC: DAIRY TESTING MARKET, BY RAPID TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 118 ASIA PACIFIC: DAIRY TESTING MARKET, BY PRODUCT TYPE, 2020-2024 (USD MILLION)

- TABLE 119 ASIA PACIFIC: DAIRY TESTING MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 120 CHINA: DAIRY TESTING MARKET, BY PRODUCT TYPE, 2020-2024 (USD MILLION)

- TABLE 121 CHINA: DAIRY TESTING MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 122 INDIA: DAIRY TESTING MARKET, BY PRODUCT TYPE, 2020-2024 (USD MILLION)

- TABLE 123 INDIA: DAIRY TESTING MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 124 JAPAN: DAIRY TESTING MARKET, BY PRODUCT TYPE, 2020-2024 (USD MILLION)

- TABLE 125 JAPAN: DAIRY TESTING MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 126 AUSTRALIA & NEW ZEALAND: DAIRY TESTING MARKET, BY PRODUCT TYPE, 2020-2024 (USD MILLION)

- TABLE 127 AUSTRALIA & NEW ZEALAND: DAIRY TESTING MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 128 REST OF ASIA PACIFIC: DAIRY TESTING MARKET, BY PRODUCT TYPE, 2020-2024 (USD MILLION)

- TABLE 129 REST OF ASIA PACIFIC: DAIRY TESTING MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 130 EUROPE: DAIRY TESTING MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 131 EUROPE: DAIRY TESTING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 132 EUROPE: DAIRY TESTING MARKET, BY TEST TYPE, 2020-2024 (USD MILLION)

- TABLE 133 EUROPE: DAIRY TESTING MARKET, BY TEST TYPE, 2025-2030 (USD MILLION)

- TABLE 134 EUROPE: DAIRY TESTING MARKET, BY SAFETY TESTING, 2020-2024 (USD MILLION)

- TABLE 135 EUROPE: DAIRY TESTING MARKET, BY SAFETY TESTING, 2025-2030 (USD MILLION)

- TABLE 136 EUROPE: DAIRY TESTING MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 137 EUROPE: DAIRY TESTING MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 138 EUROPE: DAIRY TESTING MARKET, BY RAPID TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 139 EUROPE: DAIRY TESTING MARKET, BY RAPID TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 140 EUROPE: DAIRY TESTING MARKET, BY PRODUCT TYPE, 2020-2024 (USD MILLION)

- TABLE 141 EUROPE: DAIRY TESTING MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 142 GERMANY: DAIRY TESTING MARKET, BY PRODUCT TYPE, 2020-2024 (USD MILLION)

- TABLE 143 GERMANY: DAIRY TESTING MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 144 UK: DAIRY TESTING MARKET, BY PRODUCT TYPE, 2020-2024 (USD MILLION)

- TABLE 145 UK: DAIRY TESTING MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 146 FRANCE: DAIRY TESTING MARKET, BY PRODUCT TYPE, 2020-2024 (USD MILLION)

- TABLE 147 FRANCE: DAIRY TESTING MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 148 ITALY: DAIRY TESTING MARKET, BY PRODUCT TYPE, 2020-2024 (USD MILLION)

- TABLE 149 ITALY: DAIRY TESTING MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 150 POLAND: DAIRY TESTING MARKET, BY PRODUCT TYPE, 2020-2024 (USD MILLION)

- TABLE 151 POLAND: DAIRY TESTING MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 152 REST OF EUROPE: DAIRY TESTING MARKET, BY PRODUCT TYPE, 2020-2024 (USD MILLION)

- TABLE 153 REST OF EUROPE: DAIRY TESTING MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 154 SOUTH AMERICA: DAIRY TESTING MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 155 SOUTH AMERICA: DAIRY TESTING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 156 SOUTH AMERICA: DAIRY TESTING MARKET, BY TEST TYPE, 2020-2024 (USD MILLION)

- TABLE 157 SOUTH AMERICA: DAIRY TESTING MARKET, BY TEST TYPE, 2025-2030 (USD MILLION)

- TABLE 158 SOUTH AMERICA: DAIRY TESTING MARKET, BY SAFETY TESTING, 2020-2024 (USD MILLION)

- TABLE 159 SOUTH AMERICA: DAIRY TESTING MARKET, BY SAFETY TESTING, 2025-2030 (USD MILLION)

- TABLE 160 SOUTH AMERICA: DAIRY TESTING MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 161 SOUTH AMERICA: DAIRY TESTING MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 162 SOUTH AMERICA: DAIRY TESTING MARKET, BY RAPID TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 163 SOUTH AMERICA: DAIRY TESTING MARKET, BY RAPID TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 164 SOUTH AMERICA: DAIRY TESTING MARKET, BY PRODUCT TYPE, 2020-2024 (USD MILLION)

- TABLE 165 SOUTH AMERICA: DAIRY TESTING MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 166 BRAZIL: DAIRY TESTING MARKET, BY PRODUCT TYPE, 2020-2024 (USD MILLION)

- TABLE 167 BRAZIL: DAIRY TESTING MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 168 ARGENTINA: DAIRY TESTING MARKET, BY PRODUCT TYPE, 2020-2024 (USD MILLION)

- TABLE 169 ARGENTINA: DAIRY TESTING MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 170 REST OF SOUTH AMERICA: DAIRY TESTING MARKET, BY PRODUCT TYPE, 2020-2024 (USD MILLION)

- TABLE 171 REST OF SOUTH AMERICA: DAIRY TESTING MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 172 ROW: DAIRY TESTING MARKET, BY COUNTRY/REGION, 2020-2024 (USD MILLION)

- TABLE 173 ROW: DAIRY TESTING MARKET, BY COUNTRY/REGION, 2025-2030 (USD MILLION)

- TABLE 174 ROW: DAIRY TESTING MARKET, BY TEST TYPE, 2020-2024 (USD MILLION)

- TABLE 175 ROW: DAIRY TESTING MARKET, BY TEST TYPE, 2025-2030 (USD MILLION)

- TABLE 176 ROW: DAIRY TESTING MARKET, BY SAFETY TESTING, 2020-2024 (USD MILLION)

- TABLE 177 ROW: DAIRY TESTING MARKET, BY SAFETY TESTING, 2025-2030 (USD MILLION)

- TABLE 178 ROW: DAIRY TESTING MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 179 ROW: DAIRY TESTING MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 180 ROW: DAIRY TESTING MARKET, BY RAPID TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 181 ROW: DAIRY TESTING MARKET, BY RAPID TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 182 ROW: DAIRY TESTING MARKET, BY PRODUCT TYPE, 2020-2024 (USD MILLION)

- TABLE 183 ROW: DAIRY TESTING MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 184 MIDDLE EAST: DAIRY TESTING MARKET, BY PRODUCT TYPE, 2020-2024 (USD MILLION)

- TABLE 185 MIDDLE EAST: DAIRY TESTING MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 186 AFRICA: DAIRY TESTING MARKET, BY PRODUCT TYPE, 2020-2024 (USD MILLION)

- TABLE 187 AFRICA: DAIRY TESTING MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 188 OVERVIEW OF STRATEGIES DEPLOYED BY KEY MARKET PLAYERS

- TABLE 189 DAIRY TESTING MARKET: DEGREE OF COMPETITION, 2024

- TABLE 190 DAIRY TESTING MARKET: REGIONAL FOOTPRINT

- TABLE 191 DAIRY TESTING MARKET: PRODUCT TYPE FOOTPRINT

- TABLE 192 DAIRY TESTING MARKET: TEST TYPE FOOTPRINT

- TABLE 193 DAIRY TESTING MARKET: KEY START-UPS/SMES

- TABLE 194 DAIRY TESTING MARKET: COMPETITIVE BENCHMARKING OF START-UPS/SMES, 2024

- TABLE 195 DAIRY TESTING MARKET: PRODUCT LAUNCHES, JANUARY 2020-OCTOBER 2024

- TABLE 196 DAIRY TESTING MARKET: DEALS, JANUARY 2020-OCTOBER 2024

- TABLE 197 DAIRY TESTING MARKET: EXPANSIONS, JANUARY 2020-OCTOBER 2024

- TABLE 198 SGS INSTITUT FRESENIUS: COMPANY OVERVIEW

- TABLE 199 SGS INSTITUT FRESENIUS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 200 SGS INSTITUT FRESENIUS: PRODUCT LAUNCHES

- TABLE 201 SGS INSTITUT FRESENIUS: DEALS

- TABLE 202 SGS INSTITUT FRESENIUS: EXPANSIONS

- TABLE 203 BUREAU VERITAS: COMPANY OVERVIEW

- TABLE 204 BUREAU VERITAS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 205 BUREAU VERITAS: DEALS

- TABLE 206 EUROFINS SCIENTIFIC: COMPANY OVERVIEW

- TABLE 207 EUROFINS SCIENTIFIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 208 EUROFINS SCIENTIFIC: PRODUCT LAUNCHES

- TABLE 209 EUROFINS SCIENTIFIC: DEALS

- TABLE 210 INTERTEK GROUP PLC.: COMPANY OVERVIEW

- TABLE 211 INTERTEK GROUP PLC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 212 INTERTEK GROUP PLC.: DEALS

- TABLE 213 TUV SUD: COMPANY OVERVIEW

- TABLE 214 TUV SUD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 215 TUV NORD GROUP: COMPANY OVERVIEW

- TABLE 216 TUV NORD GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 217 ALS LIMITED: COMPANY OVERVIEW

- TABLE 218 ALS LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 219 ALS LIMITED: DEALS

- TABLE 220 ALS LIMITED: EXPANSIONS

- TABLE 221 ASUREQUALITY: COMPANY OVERVIEW

- TABLE 222 ASUREQUALITY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 223 ASUREQUALITY: PRODUCT LAUNCHES

- TABLE 224 ASUREQUALITY: EXPANSIONS

- TABLE 225 MERIEUX NUTRISCIENCES CORPORATION: COMPANY OVERVIEW

- TABLE 226 MERIEUX NUTRISCIENCES CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 227 MERIEUX NUTRISCIENCES CORPORATION: DEALS

- TABLE 228 ROMER LABS DIVISION HOLDING: COMPANY OVERVIEW

- TABLE 229 ROMER LABS DIVISION HOLDING: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 230 SYMBIO LABS: COMPANY OVERVIEW

- TABLE 231 SYMBIO LABS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 232 NEOGEN CORPORATION: COMPANY OVERVIEW

- TABLE 233 NEOGEN CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 234 NEOGEN CORPORATION: PRODUCT LAUNCHES

- TABLE 235 NEOGEN CORPORATION: DEALS

- TABLE 236 MICROBAC LABORATORIES, INC.: COMPANY OVERVIEW

- TABLE 237 MICROBAC LABORATORIES, INC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 238 CERTIFIED LABORATORIES: COMPANY OVERVIEW

- TABLE 239 CERTIFIED LABORATORIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 240 CERTIFIED LABORATORIES: DEALS

- TABLE 241 AGROLAB GROUP: COMPANY OVERVIEW

- TABLE 242 AGROLAB GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 243 DAIRY ONE: COMPANY OVERVIEW

- TABLE 244 DAIRY ONE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 245 FARE LABS: COMPANY OVERVIEW

- TABLE 246 FARE LABS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 247 LACTANET: COMPANY OVERVIEW

- TABLE 248 LACTANET: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 249 LACTANET: DEALS

- TABLE 250 DOCTORS' ANALYTICAL LABORATORIES PVT. LTD: COMPANY OVERVIEW

- TABLE 251 DOCTORS' ANALYTICAL LABORATORIES PVT. LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 252 CVR LABS PRIVATE LIMITED: COMPANY OVERVIEW

- TABLE 253 CVR LABS PRIVATE LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 254 LILABA ANALYTICAL LABORATORIES: COMPANY OVERVIEW

- TABLE 255 LILABA ANALYTICAL LABORATORIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 256 TENTAMUS: COMPANY OVERVIEW

- TABLE 257 MICROBIAL RESEARCH INC.: COMPANY OVERVIEW

- TABLE 258 ENVITRO LABORATORIES PVT. LTD.: COMPANY OVERVIEW

- TABLE 259 APEX TESTING AND RESEARCH LABORATORY: COMPANY OVERVIEW

- TABLE 260 OPAL RESEARCH AND ANALYTICAL SERVICES: COMPANY OVERVIEW

- TABLE 261 ADJACENT MARKETS TO DAIRY TESTING MARKET

- TABLE 262 FOOD SAFETY TESTING MARKET SIZE, BY TARGET TESTED, 2017-2021 (USD MILLION)

- TABLE 263 FOOD SAFETY TESTING MARKET SIZE, BY TARGET TESTED, 2022-2027 (USD MILLION)

- TABLE 264 MYCOTOXIN TESTING MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 265 MYCOTOXIN TESTING MARKET, BY TYPE, 2024-2029 (USD MILLION)

List of Figures

- FIGURE 1 DAIRY TESTING MARKET SEGMENTATION

- FIGURE 2 DAIRY TESTING MARKET: RESEARCH DESIGN

- FIGURE 3 KEY DATA FROM PRIMARY SOURCES

- FIGURE 4 DAIRY TESTING MARKET SIZE ESTIMATION (SUPPLY SIDE)

- FIGURE 5 DEMAND-SIDE ASPECTS OF MARKET SIZING

- FIGURE 6 DAIRY TESTING MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 7 DAIRY TESTING MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 8 DATA TRIANGULATION

- FIGURE 9 SAFETY TESTING SEGMENT TO BE LARGER MARKET IN 2025

- FIGURE 10 RAPID TECHNOLOGY TO ACCOUNT FOR LARGER MARKET SIZE IN 2025

- FIGURE 11 MILK & MILK POWDER TO BE LARGEST PRODUCT TYPE SEGMENT IN 2025

- FIGURE 12 DAIRY TESTING MARKET SHARE AND GROWTH RATE, BY REGION, 2025

- FIGURE 13 INCREASING DEMAND FOR DAIRY PRODUCTS AND SAFETY REGULATIONS TO DRIVE MARKET

- FIGURE 14 US ACCOUNTED FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 15 GERMANY AND MILK & MILK POWDER PRODUCT TYPE SEGMENT TO ACCOUNT FOR SIGNIFICANT SHARES IN 2025

- FIGURE 16 MILK & MILK POWDER SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 17 DAIRY TESTING SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 18 RAPID TECHNOLOGY SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 19 PRODUCTION DATA OF RAW CATTLE MILK OF TOP 5 COUNTRIES, 2021-2023 (TONNES)

- FIGURE 20 MEDIAN INCOME/CONSUMPTION PER DAY, BY KEY COUNTRY (2013 VS. 2023)

- FIGURE 21 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: DAIRY TESTING MARKET

- FIGURE 22 FOOD RECALL IN AUSTRALIA, 2020-2024

- FIGURE 23 GLOBAL MILK TRADE, 2022

- FIGURE 24 COLLECTION OF COWS MILK IN EU, BY KEY COUNTRY, 2023 (PERCENTAGE)

- FIGURE 25 ADOPTION OF GEN AI IN DAIRY TESTING MARKET

- FIGURE 26 DAIRY SAFETY MANAGEMENT SYSTEM

- FIGURE 27 DAIRY TESTING MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 28 DAIRY TESTING MARKET: VALUE CHAIN ANALYSIS

- FIGURE 29 EXPORT VALUE OF HS CODE 0401, BY KEY COUNTRY, 2022-2023 (USD THOUSAND)

- FIGURE 30 IMPORT VALUE OF HS CODE 0401, BY KEY COUNTRY, 2022-2023 (USD THOUSAND)

- FIGURE 31 EXPORT VALUE OF HS CODE 0402, BY KEY COUNTRY, 2022-2023 (USD THOUSAND)

- FIGURE 32 IMPORT VALUE OF HS CODE 0402, BY KEY COUNTRY, 2022-2023 (USD THOUSAND)

- FIGURE 33 EXPORT VALUE OF HS CODE 0403, BY KEY COUNTRY, 2022-2023 (USD THOUSAND)

- FIGURE 34 IMPORT VALUE OF HS CODE 0403, BY KEY COUNTRY, 2022-2023 (USD THOUSAND)

- FIGURE 35 AVERAGE SELLING PRICE TREND, BY TEST TYPE, 2020-2024 (USD/TEST)

- FIGURE 36 KEY STAKEHOLDERS IN DAIRY TESTING MARKET ECOSYSTEM

- FIGURE 37 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 38 NUMBER OF PATENTS GRANTED FOR DAIRY TESTING MARKET, 2014-2024

- FIGURE 39 REGIONAL ANALYSIS OF PATENTS GRANTED FOR DAIRY TESTING MARKET, 2014-2024

- FIGURE 40 DAIRY TESTING MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 41 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP TWO TEST TYPES

- FIGURE 42 KEY BUYING CRITERIA FOR TEST TYPE

- FIGURE 43 INVESTMENT & FUNDING SCENARIO OF FEW MAJOR PLAYERS

- FIGURE 44 DAIRY TESTING MARKET, BY PRODUCT TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 45 DAIRY TESTING MARKET, BY TECHNOLOGY, 2025 VS. 2030 (USD MILLION)

- FIGURE 46 DAIRY TESTING MARKET, BY TEST TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 47 AUSTRALIA & NEW ZEALAND PROJECTED TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 48 NORTH AMERICA: DAIRY TESTING MARKET SNAPSHOT

- FIGURE 49 ASIA PACIFIC: DAIRY TESTING MARKET SNAPSHOT

- FIGURE 50 REVENUE ANALYSIS FOR KEY COMPANIES, 2020-2023 (USD MILLION)

- FIGURE 51 SHARE OF LEADING PLAYERS IN DAIRY TESTING MARKET, 2023

- FIGURE 52 RANKING OF TOP FIVE PLAYERS IN DAIRY TESTING MARKET, 2023

- FIGURE 53 DAIRY TESTING MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 54 DAIRY TESTING MARKET: COMPANY FOOTPRINT

- FIGURE 55 DAIRY TESTING MARKET: COMPANY EVALUATION MATRIX (START-UPS/SMES), 2024

- FIGURE 56 COMPANY VALUATION FOR FEW PLAYERS IN DAIRY TESTING MARKET

- FIGURE 57 DAIRY TESTING MARKET: BRAND COMPARISON

- FIGURE 58 SGS INSTITUT FRESENIUS: COMPANY SNAPSHOT

- FIGURE 59 BUREAU VERITAS: COMPANY SNAPSHOT

- FIGURE 60 EUROFINS SCIENTIFIC: COMPANY SNAPSHOT

- FIGURE 61 INTERTEK GROUP PLC.: COMPANY SNAPSHOT

- FIGURE 62 TUV SUD: COMPANY SNAPSHOT

- FIGURE 63 TUV NORD GROUP: COMPANY SNAPSHOT

- FIGURE 64 ALS LIMITED: COMPANY SNAPSHOT

- FIGURE 65 ASUREQUALITY: COMPANY SNAPSHOT

- FIGURE 66 NEOGEN CORPORATION: COMPANY SNAPSHOT

The dairy testing market is estimated at USD 7.42 billion in 2025 and is projected to reach USD 11.05 billion by 2030, at a CAGR of 8.3 % from 2025 to 2030. The growth of the dairy market in emerging economies is poised to hold new opportunities for the dairy testing market because there is a high demand for safe and high-quality dairy products. Whereas populations from countries such as China, India, Brazil, and Southeast Asia are increasing and changing to becoming more urban, dairy consumption is witnessing rapid growth in terms of milk, yogurt, and cheese. This shift is also coupled with growing disposable incomes, changes in dietary habits, and a growing middle class, which in turn increase the demand for dairy products.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2025-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD) |

| Segments | By Product Type, Test Type, Technology, and Region |

| Regions covered | North America, Europe, Asia Pacific, South America, and RoW |

"The rapid segment dominated the technology segment of the dairy testing market."

The rapid technology segment dominated the dairy testing market as it can meet the growing demand for faster, more accurate, and cost-effective testing solutions. Traditional testing methods often fail to meet the speed and efficiency requirements of consumers who are increasingly demanding food safety and quality. Advancements in rapid testing technologies, including PCR (Polymerase Chain Reaction), ELISA (enzyme-linked immunosorbent assays), and biosensors, provide the possibility of detecting pathogens, contaminants, and quality parameters in dairy products much faster and with greater accuracy. These technologies are essential since the dairy producer is confronted by very tight production schedules as well as the shortening period before the product is ready for marketing.

"The milk and milk powder segment dominated the form segment of the dairy testing market."

The milk and milk powder segment is projected to dominate the dairy testing market, due to the growing global demand for such products, coupled with heightened awareness over food safety and quality. The consumption of milk and milk powder is among the highest for dairy products, particularly in the developing world, as they form an essential source of nutrition. Higher population growth in such areas as Asia Pacific and Africa, coupled with a growing middle class, will lead to high increases in demand for milk and milk powder. The consumption increase directly relates to the growing demand for whole-testing services of safety, quality, and regulatory compliance.

During the forecast period, APAC within the region segment is estimated to witness a significant CAGR in the dairy testing market.

Both rapid population growth, rapid urbanization, and increasing consumption of dairy would result in Asia Pacific (APAC) recording the most significant growth rates in the market for dairy testing. The demand for dairy is rapidly growing across one of the world's most populous regions-the APAC, with countries like China, India, and Southeast Asia having a majority share. Additionally, the APAC region also encounters specific challenges, namely foodborne illness, product adulteration, and poor storage infrastructure, particularly in rural setups. This sets a greater burden on reliable, efficient dairy testing solutions to confirm that products do not pose hazards to health through consumption and still meet the respective health standards.

In-depth interviews have been conducted with chief executive officers (CEOs), Directors, and other executives from various key organizations operating in the dairy testing market:

- By Company Type: Tier 1 - 40%, Tier 2 - 20%, and Tier 3 - 40%

- By Designation: CXO's - 26%, Managers - 30%, Executives- 44%

- By Region: North America - 20%, Europe - 20%, Asia Pacific - 40%, South America - 10% and Rest of the World -10%

Prominent companies in the market include SGS Institut Fresenius (Germany), Bureau Veritas (France), Eurofins Scientific (Luxembourg), Intertek Group plc (UK), TUV SUD (Germany), TUV NORD GROUP (Germany), ALS Limited (Australia), AsureQuality (New Zealand), Merieux NutriSciences Corporation (US), Romer Labs Division Holding (Austria), Symbio Labs (Australia), Neogen Corporation (US), Microbac Laboratories, Inc. (US), Certified Laboratories (US), AGROLAB GROUP (Germany), Dairy One (US), FARE Labs (India), Lactanet (Canada), Doctors' Analytical Laboratories Pvt Ltd. (India), CVR Labs Private Limited (India), and Lilaba Analytical Laboratories (India).

Other players in the market include Tentamus (Germany), Microbial Research Inc. (US), Envitro Laboratories (India), Apex Testing and Research Laboratory (India), Opal Research And Analytical Services (India)

Research Coverage:

This research report categorizes the dairy market by test type (safety testing and quality testing), product type (milk and milk powder, cheese, butter & spreads, infant foods, icecream & desserts, yogurt, and others), technology (traditional and rapid), end-users (dairy producers, dairy processors, food & beverage manufacturers, regulatory authorities, others), and region (North America, Europe, Asia Pacific, South America, and Rest of the World). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of dairy testing. A detailed analysis of the key industry players has been done to provide insights into their business overview, services, key strategies, contracts, partnerships, agreements, new service launches, mergers and acquisitions, and recent developments associated with the dairy testing market. Competitive analysis of upcoming startups in the dairy testing market ecosystem is covered in this report. Furthermore, industry-specific trends such as technology analysis, ecosystem and market mapping, and patent, and regulatory landscape, among others, are also covered in the study.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall dairy testing and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (increasing applications in the food industry), restraints (corn and potato starches can serve as alternatives for certain applications), opportunities (rise in demand from the pet food industry), and challenges (evolving Food Labeling Standards and Regulations) influencing the growth of the dairy testing market.

- New product launch/Innovation: Detailed insights on research & development activities and new product launches in the dairy testing market.

- Market Development: Comprehensive information about lucrative markets - the report analyzes dairy testing across varied regions.

- Market Diversification: Exhaustive information about new services, untapped geographies, recent developments, and investments in the dairy testing market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, brand/product comparison, and product food prints of leading players such as SGS Institut Fresenius (Germany), Bureau Veritas (France), Eurofins Scientific (Luxembourg), Intertek Group plc (UK), TUV SUD (Germany), TUV NORD GROUP (Germany), ALS Limited (Australia), AsureQuality (New Zealand), Merieux NutriSciences Corporation (US), Romer Labs Division Holding (Austria) and other players in the dairy testing market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 UNIT CONSIDERED

- 1.4.1 CURRENCY

- 1.4.2 UNIT

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primaries

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- 2.2.2 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN DAIRY TESTING MARKET

- 4.2 DAIRY TESTING MARKET: MAJOR REGIONAL SUBMARKETS

- 4.3 EUROPE: DAIRY TESTING MARKET, BY PRODUCT TYPE AND COUNTRY

- 4.4 DAIRY TESTING MARKET, BY PRODUCT TYPE

- 4.5 DAIRY TESTING MARKET, BY TESTING TYPE

- 4.6 DAIRY TESTING MARKET, BY TECHNOLOGY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC OUTLOOK

- 5.2.1 INCREASE IN DAIRY PRODUCTION

- 5.2.2 INCREASE IN PER DAY MEDIAN INCOME OR CONSUMPTION

- 5.3 MARKET DYNAMICS

- 5.3.1 DRIVERS

- 5.3.1.1 Increase in outbreaks of foodborne illnesses

- 5.3.1.2 Globalization of dairy trade

- 5.3.1.3 Increased consumption of milk and dairy products

- 5.3.1.4 Stringent safety and quality regulations

- 5.3.2 RESTRAINTS

- 5.3.2.1 Inadequate supporting infrastructure in developing economies

- 5.3.2.2 High cost of dairy testing

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Technological advancements in testing industry

- 5.3.3.2 Increased adoption of dairy testing

- 5.3.4 CHALLENGES

- 5.3.4.1 Lack of harmonization of food safety standards

- 5.3.4.2 Time-consuming testing methods

- 5.3.1 DRIVERS

- 5.4 IMPACT OF GEN AI ON FOOD SAFETY

- 5.4.1 INTRODUCTION

- 5.4.2 USE OF GEN AI ON DAIRY TESTING MARKET

- 5.4.3 CASE STUDY ANALYSIS

- 5.4.3.1 Enhancing dairy farm efficiency with AI-driven lameness detection

- 5.4.4 IMPACT ON DAIRY TESTING MARKET

- 5.4.5 ADJACENT ECOSYSTEM WORKING ON GENERATIVE AI

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 SUPPLY CHAIN ANALYSIS

- 6.3 VALUE CHAIN ANALYSIS

- 6.3.1 RAW MATERIALS

- 6.3.2 DAIRY PROCESSING MILLS

- 6.3.3 MARKETING AND SALES

- 6.3.4 END-USERS

- 6.4 TRADE ANALYSIS

- 6.4.1 EXPORT SCENARIO OF HS CODE 0401 (2022-2023)

- 6.4.2 IMPORT SCENARIO OF HS CODE 0401 (2022-2023)

- 6.4.3 EXPORT SCENARIO OF HS CODE 0402 (2022-2023)

- 6.4.4 IMPORT SCENARIO OF HS CODE 0402 (2022-2023)

- 6.4.5 EXPORT SCENARIO OF HS CODE 0403 (2022-2023)

- 6.4.6 IMPORT SCENARIO OF HS CODE 0403 (2022-2023)

- 6.5 TECHNOLOGY ANALYSIS

- 6.5.1 KEY TECHNOLOGIES

- 6.5.1.1 Polymerase chain reaction (PCR) technology

- 6.5.1.2 Near-infrared spectroscopy (NIRS) technology

- 6.5.2 COMPLEMENTARY TECHNOLOGIES

- 6.5.2.1 Blockchain technology

- 6.5.2.2 Cloud computing

- 6.5.3 ADJACENT TECHNOLOGIES

- 6.5.3.1 Environmental monitoring and control system

- 6.5.1 KEY TECHNOLOGIES

- 6.6 PRICING ANALYSIS

- 6.6.1 AVERAGE SELLING PRICE TREND, BY TEST TYPE, 2020-2024

- 6.7 ECOSYSTEM ANALYSIS/MARKET MAP

- 6.7.1 DEMAND SIDE

- 6.7.2 SUPPLY SIDE

- 6.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.9 PATENT ANALYSIS

- 6.10 KEY CONFERENCES & EVENTS, 2024-2025

- 6.11 REGULATORY LANDSCAPE

- 6.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.12 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.12.1 NORTH AMERICA

- 6.12.1.1 US

- 6.12.1.2 Canada

- 6.12.1.3 Mexico

- 6.12.2 EUROPE

- 6.12.3 ASIA PACIFIC

- 6.12.3.1 India

- 6.12.3.2 China

- 6.12.3.3 Japan

- 6.12.4 SOUTH AMERICA

- 6.12.4.1 Brazil

- 6.12.5 ROW

- 6.12.1 NORTH AMERICA

- 6.13 PORTER'S FIVE FORCES ANALYSIS

- 6.13.1 INTENSITY OF COMPETITIVE RIVALRY

- 6.13.2 BARGAINING POWER OF SUPPLIERS

- 6.13.3 BARGAINING POWER OF BUYERS

- 6.13.4 THREAT OF SUBSTITUTES

- 6.13.5 THREAT OF NEW ENTRANTS

- 6.14 KEY STAKEHOLDERS & BUYING CRITERIA

- 6.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.14.2 BUYING CRITERIA

- 6.15 CASE STUDY ANALYSIS

- 6.15.1 ALLERGEN SENSORS FOR CONSUMERS

- 6.15.2 IMPROVED TURNAROUND TIMES WITH EUROFINS SCIENTIFIC'S EXPRESSMICRO SERVICE

- 6.16 INVESTMENT & FUNDING SCENARIO

7 DAIRY TESTING MARKET, BY END USER

- 7.1 INTRODUCTION

- 7.2 DAIRY PRODUCERS

- 7.2.1 INCREASE IN AWARENESS OF QUALITY AND TESTING TO DRIVE MARKET

- 7.3 DAIRY PROCESSORS

- 7.3.1 USE FOR ADHERENCE TO SAFETY STANDARDS AND MEETING QUALITY REQUIREMENTS TO DRIVE MARKET

- 7.4 FOOD & BEVERAGE MANUFACTURERS

- 7.4.1 INCREASE IN AWARENESS OF QUALITY AND TESTING TO DRIVE MARKET

- 7.5 REGULATORY AUTHORITIES

- 7.5.1 INCREASING USE BY REGULATORY AUTHORITIES TO DRIVE MARKET

- 7.6 OTHERS

8 DAIRY TESTING MARKET, BY PRODUCT TYPE

- 8.1 INTRODUCTION

- 8.2 MILK & MILK POWDER

- 8.2.1 INCREASE IN PER CAPITA MILK CONSUMPTION IN DEVELOPING COUNTRIES TO DRIVE MARKET

- 8.3 CHEESE, BUTTER & SPREADS

- 8.3.1 CHEESE CONTAMINATION TO DRIVE MARKET

- 8.4 INFANT FOODS

- 8.4.1 INCREASE IN DEMAND FOR ESSENTIAL NUTRIENTS REQUIRED FOR GROWTH AND DEVELOPMENT TO DRIVE MARKET

- 8.5 ICE-CREAMS & DESSERTS

- 8.5.1 INCREASE IN CONSUMPTION OF ICE-CREAMS AND FROZEN DESSERTS TO DRIVE MARKET

- 8.6 YOGURT

- 8.6.1 USE IN FERMENTATION PROCESS TO DRIVE MARKET

- 8.7 OTHER PRODUCT TYPES

9 DAIRY TESTING MARKET, BY TECHNOLOGY

- 9.1 INTRODUCTION

- 9.2 TRADITIONAL

- 9.2.1 DEMAND FOR SAFETY AND QUALITY OF DAIRY PRODUCTS TO DRIVE MARKET

- 9.2.2 STANDARD PLATE COUNT

- 9.3 RAPID

- 9.3.1 INCREASE IN DEMAND FOR CONVENIENCE-BASED TECHNOLOGIES TO BOOST MARKET GROWTH

- 9.3.2 CONVENIENCE-BASED

- 9.3.3 POLYMERASE CHAIN REACTION (PCR)

- 9.3.4 IMMUNOASSAY

- 9.3.5 CHROMATOGRAPHY & SPECTROMETRY

10 DAIRY TESTING MARKET, BY TEST TYPE

- 10.1 INTRODUCTION

- 10.2 SAFETY TESTING

- 10.2.1 INCREASE IN NUMBER OF FOODBORNE DISEASES

- 10.2.2 PATHOGENS

- 10.2.2.1 E. coli

- 10.2.2.2 Salmonella

- 10.2.2.3 Campylobacter

- 10.2.2.4 Listeria

- 10.2.2.5 Others

- 10.2.3 ADULTERANTS

- 10.2.4 PESTICIDES

- 10.2.5 GENETICALLY MODIFIED ORGANISMS (GMOS)

- 10.2.6 MYCOTOXINS

- 10.2.7 OTHERS

- 10.3 QUALITY TESTING

- 10.3.1 INCREASE IN CONSUMER AWARENESS REGARDING EATING CHOICES TO DRIVE MARKET

11 DAIRY TESTING MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 US

- 11.2.1.1 Rise in demand for US dairy products worldwide to drive market

- 11.2.2 CANADA

- 11.2.2.1 Increase in trade of milk & milk products to drive market

- 11.2.3 MEXICO

- 11.2.3.1 Significant increase in consumption of dairy products to drive market

- 11.2.1 US

- 11.3 ASIA PACIFIC

- 11.3.1 CHINA

- 11.3.1.1 Steady rise in demand for dairy products to drive market

- 11.3.2 INDIA

- 11.3.2.1 Consumer focus on product safety to drive market

- 11.3.3 JAPAN

- 11.3.3.1 Increase in consumer demand for cleaner and safer food to drive market

- 11.3.4 AUSTRALIA & NEW ZEALAND

- 11.3.4.1 Large-scale trade of dairy & dairy products to drive market

- 11.3.5 REST OF ASIA PACIFIC

- 11.3.1 CHINA

- 11.4 EUROPE

- 11.4.1 GERMANY

- 11.4.1.1 Detection of harmful organisms to boost demand

- 11.4.2 UK

- 11.4.2.1 Rise in milk exports and imports to boost market

- 11.4.3 FRANCE

- 11.4.3.1 Comprehensive milk quality chain to drive market

- 11.4.4 ITALY

- 11.4.4.1 Increase in milk imports to drive market

- 11.4.5 POLAND

- 11.4.5.1 Significant position in European dairy industry to drive market

- 11.4.6 REST OF EUROPE

- 11.4.1 GERMANY

- 11.5 SOUTH AMERICA

- 11.5.1 BRAZIL

- 11.5.1.1 Rise in global demand for Brazilian dairy products to drive market

- 11.5.2 ARGENTINA

- 11.5.2.1 High demand for dairy products to drive dairy testing market

- 11.5.3 REST OF SOUTH AMERICA

- 11.5.1 BRAZIL

- 11.6 REST OF THE WORLD (ROW)

- 11.6.1 MIDDLE EAST

- 11.6.1.1 Stringent regulations for food and food testing laboratories

- 11.6.2 AFRICA

- 11.6.2.1 High number of deaths from foodborne diseases to drive market

- 11.6.1 MIDDLE EAST

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 12.3 REVENUE ANALYSIS

- 12.4 MARKET SHARE ANALYSIS, 2023

- 12.4.1 MARKET RANKING ANALYSIS

- 12.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- 12.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.5.5.1 Company footprint

- 12.5.5.2 Regional footprint

- 12.5.5.3 Product type footprint

- 12.5.5.4 Test type footprint

- 12.6 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2024

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 RESPONSIVE COMPANIES

- 12.6.3 DYNAMIC COMPANIES

- 12.6.4 STARTING BLOCKS

- 12.6.5 COMPETITIVE BENCHMARKING, START-UPS/SMES, 2024

- 12.6.5.1 Detailed list of key start-ups/SMEs

- 12.6.5.2 Competitive benchmarking of start-ups/SMEs

- 12.7 COMPANY VALUATION AND FINANCIAL METRICS, 2024

- 12.8 BRAND COMPARISON

- 12.9 COMPETITIVE SCENARIO AND TRENDS

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

- 12.9.3 EXPANSIONS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 SGS INSTITUT FRESENIUS

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product launches

- 13.1.1.3.2 Deals

- 13.1.1.3.3 Expansions

- 13.1.1.4 MNM view

- 13.1.1.4.1 Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 BUREAU VERITAS

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Deals

- 13.1.2.4 MNM view

- 13.1.2.4.1 Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 EUROFINS SCIENTIFIC

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Product launches

- 13.1.3.3.2 Deals

- 13.1.3.4 MNM view

- 13.1.3.4.1 Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 INTERTEK GROUP PLC.

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Deals

- 13.1.4.4 MNM view

- 13.1.4.4.1 Right to win

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses and competitive threats

- 13.1.5 TUV SUD

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 Recent developments

- 13.1.5.4 MNM view

- 13.1.5.4.1 Right to win

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses and competitive threats

- 13.1.6 TUV NORD GROUP

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 Recent developments

- 13.1.6.4 MNM view

- 13.1.6.4.1 Right to win

- 13.1.6.4.2 Strategic choices

- 13.1.6.4.3 Weaknesses and competitive threats

- 13.1.7 ALS LIMITED

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.7.3 Recent developments

- 13.1.7.4 MnM view

- 13.1.8 ASUREQUALITY

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.8.3 Recent developments

- 13.1.8.4 MNM view

- 13.1.9 MERIEUX NUTRISCIENCES CORPORATION

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Deals

- 13.1.9.4 MNM view

- 13.1.10 ROMER LABS DIVISION HOLDING

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.10.3 MnM view

- 13.1.11 SYMBIO LABS

- 13.1.11.1 Business overview

- 13.1.11.2 Products/Solutions/Services offered

- 13.1.11.3 Recent developments

- 13.1.11.4 MnM view

- 13.1.12 NEOGEN CORPORATION

- 13.1.12.1 Business overview

- 13.1.12.2 Products/Solutions/Services offered

- 13.1.12.3 Recent developments

- 13.1.12.4 MnM view

- 13.1.13 MICROBAC LABORATORIES, INC.

- 13.1.13.1 Business overview

- 13.1.13.2 Products/Solutions/Services offered

- 13.1.13.3 Recent developments

- 13.1.13.4 MnM view

- 13.1.14 CERTIFIED LABORATORIES

- 13.1.14.1 Business overview

- 13.1.14.2 Products/Solutions/Services offered

- 13.1.14.3 Recent developments

- 13.1.14.4 MnM view

- 13.1.15 AGROLAB GROUP

- 13.1.15.1 Business overview

- 13.1.15.2 Products/Solutions/Services offered

- 13.1.15.3 Recent developments

- 13.1.15.4 MNM view

- 13.1.16 DAIRY ONE

- 13.1.16.1 Business overview

- 13.1.16.2 Products/Solutions/Services offered

- 13.1.16.3 Recent developments

- 13.1.16.4 MNM view

- 13.1.17 FARE LABS

- 13.1.17.1 Business overview

- 13.1.17.2 Products/Solutions/Services offered

- 13.1.17.3 Recent developments

- 13.1.17.4 MNM view

- 13.1.18 LACTANET

- 13.1.18.1 Business overview

- 13.1.18.2 Products/Solutions/Services offered

- 13.1.18.3 Recent developments

- 13.1.18.3.1 Deals

- 13.1.18.4 MNM view

- 13.1.19 DOCTORS' ANALYTICAL LABORATORIES PVT. LTD.

- 13.1.19.1 Business overview

- 13.1.19.2 Products/Solutions/Services offered

- 13.1.19.3 Recent developments

- 13.1.19.4 MNM view

- 13.1.20 CVR LABS PRIVATE LIMITED

- 13.1.20.1 Business overview

- 13.1.20.2 Products/Solutions/Services offered

- 13.1.20.3 Recent developments

- 13.1.20.4 MNM view

- 13.1.21 LILABA ANALYTICAL LABORATORIES

- 13.1.21.1 Business overview

- 13.1.21.2 Products/Solutions/Services offered

- 13.1.21.3 Recent developments

- 13.1.21.4 MNM view

- 13.1.1 SGS INSTITUT FRESENIUS

- 13.2 OTHER PLAYERS

- 13.2.1 TENTAMUS

- 13.2.2 MICROBIAL RESEARCH INC.

- 13.2.3 ENVITRO LABORATORIES PVT. LTD.

- 13.2.4 APEX TESTING AND RESEARCH LABORATORY

- 13.2.5 OPAL RESEARCH AND ANALYTICAL SERVICES

14 ADJACENT AND RELATED MARKETS

- 14.1 INTRODUCTION

- 14.2 LIMITATIONS

- 14.3 FOOD SAFETY MARKET

- 14.3.1 MARKET DEFINITION

- 14.3.2 MARKET OVERVIEW

- 14.4 MYCOTOXIN TESTING MARKET

- 14.4.1 MARKET DEFINITION

- 14.4.2 MARKET OVERVIEW

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS