|

|

市場調査レポート

商品コード

1643941

自動車用LiDAR市場:ICE車両タイプ別、電気自動車タイプ別、画像タイプ別、レーザー波長別、自律性レベル別、位置別、測定プロセス別、技術別、航続距離別、地域別 - 2030年までの予測Automotive LiDAR Market by Technology, Image Type, ICE Vehicle Type, Location, Electric Vehicle, Range, Laser Wavelength, Measurement Process, Level of Autonomy, and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 自動車用LiDAR市場:ICE車両タイプ別、電気自動車タイプ別、画像タイプ別、レーザー波長別、自律性レベル別、位置別、測定プロセス別、技術別、航続距離別、地域別 - 2030年までの予測 |

|

出版日: 2025年01月17日

発行: MarketsandMarkets

ページ情報: 英文 342 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の自動車用LiDARの市場規模は、2024年に11億9,000万米ドル、2030年には95億9,000万米ドルに達すると予測され、2024年から2030年までのCAGRは41.6%になるとみられています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2019年~2030年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2030年 |

| 対象台数 | 数量(台)および金額(100万米ドル) |

| セグメント | ICE車両タイプ別、電気自動車タイプ別、画像タイプ別、レーザー波長別、自律性レベル別、位置別、測定プロセス別、技術別、航続距離別、地域別 |

| 対象地域 | アジア太平洋、欧州、北米 |

自動車用LiDAR市場は、イメージングと検出技術の絶え間ない進歩、LiDARを搭載した高級車への需要の高まり、より高いレベルの車両自律化への推進により、急速に拡大しています。Mercedes-Benz Group AG(ドイツ)、BMW Group(ドイツ)、BYD(中国)などの自動車メーカーは、Mercedes-Benz EQS、BMW i7、BYD Han DM-iなどのモデルにLiDARを搭載し、運転支援システムを強化し、より高い車両自律性レベルを可能にしています。アジア太平洋では、2025年までに新車の70%にレベル2またはレベル3の自律性を装備するという中国の目標や、Baidu Inc.(中国)やWeRide.(中国)などの企業によるロボットタクシー・サービスの開発など、政府の取り組みや技術の進歩に後押しされ、市場が大きく成長しています。Ai(中国)。さらに、量産用に設計された初の4D LiDARセンサーであるAeva(米国)のAtlasのような技術革新は、業界に新たなベンチマークを打ち立てつつあります。自動車の安全性を重視する規制が強化され、利便性と自動化に対する消費者の要求が高まる中、自動車用LiDAR市場はアジア太平洋を筆頭に世界的に大きく成長する態勢を整えています。

乗用車セグメントは、いくつかの重要な要因によって、予測期間中に最大の市場シェアを保持すると予測されています。乗用車における自律移動の動向の高まりは、LiDAR技術の需要に大きく影響しています。LiDAR技術は、自動車の安全性と性能を高めるADAS(先進運転支援システム)に不可欠だからです。自動緊急ブレーキ、アダプティブ・クルーズ・コントロール、緊急車線維持システムなどの機能が標準化されつつあり、メーカーがLiDARを自動車に組み込むことを後押ししています。Mercedes-Benz EQS、Xpeng G9、BMW iX3、BYD Han DM-iなど、数多くの乗用車モデルがすでにLiDARを搭載しており、この技術の採用に対する業界のコミットメントを反映しています。さらに、2024年8月に発売されたWaymo LLC(米国)の第6世代Waymo Driverシステムは4つのLiDARセンサーを搭載しており、Lotus Emeyaのような車両も4つのLiDAR台を組み込み、GAC AionのHYPTEC HTとHYPTEC GTモデルはそれぞれ3つのLiDARセンサーを搭載しています。安全機能に対する消費者の意識が高まり、規制当局からの圧力が強まるにつれて、乗用車へのLiDARの搭載はさらに拡大すると予想されます。全体として、技術の進歩と消費者の需要の高まりが組み合わさることで、乗用車セグメントは自動車用LiDAR市場の大幅な成長につながります。

当レポートでは、世界の自動車用LiDAR市場について調査し、ICE車両タイプ別、電気自動車タイプ別、画像タイプ別、レーザー波長別、自律性レベル別、位置別、測定プロセス別、技術別、航続距離別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客ビジネスに影響を与える動向と混乱

- 価格分析

- 自動車用LiDAR市場におけるAIの影響

- エコシステム分析

- バリューチェーン分析

- ケーススタディ分析

- 投資と資金調達のシナリオ

- 特許分析

- 技術分析

- HSコード

- 規制状況

- 2025年~2026年の主な会議とイベント

- 主な利害関係者と購入基準

- 購入基準

- OEM分析

第6章 自動車用LiDAR市場、ICE車両タイプ別

- イントロダクション

- 乗用車

- 軽商用車(LCV)

- 大型商用車(HCV)

- 業界の専門家からの洞察

第7章 自動車用LiDAR市場、電気自動車タイプ別

- イントロダクション

- バッテリー電気自動車(BEV)

- 燃料電池電気自動車(FCEV)

- プラグインハイブリッド電気自動車(PHEV)

- ハイブリッド電気自動車(HEV)

- 業界の専門家からの洞察

第8章 自動車用LiDAR市場、画像タイプ別

- イントロダクション

- 2D

- 3D

- 業界の専門家からの洞察

第9章 自動車用LiDAR市場、レーザー波長別

- イントロダクション

- 近赤外線

- 短波赤外線

- 長波赤外線

- 業界の専門家からの洞察

第10章 自動車用LiDAR市場、自律性レベル別

- イントロダクション

- 半自律型

- 自律型

- 業界の専門家からの洞察

第11章 自動車用LiDAR市場、位置別

- イントロダクション

- バンパー、グリル

- ヘッドライト、テールライト

- ルーフ、アッパーピラー

- その他

- 業界の専門家からの洞察

第12章 自動車用LiDAR市場、測定プロセス別

- イントロダクション

- 飛行時間(TOF)

- 周波数測定連続波(FMCW)

- 業界の専門家からの洞察

第13章 自動車用LiDAR市場、技術別

- イントロダクション

- 機械式ライダー

- ソリッドステートLiDAR

- 業界の専門家からの洞察

第14章 自動車用LiDAR市場、航続距離別

- イントロダクション

- 短距離および中距離(170メートル以下)

- 長距離(170メートル以上)

- 業界の専門家からの洞察

第15章 自動車用LiDAR市場、地域別

- イントロダクション

- アジア太平洋

- マクロ経済見通し

- 中国

- インド

- 日本

- 韓国

- 欧州

- マクロ経済見通し

- ドイツ

- フランス

- イタリア

- 英国

- スペイン

- 北米

- マクロ経済見通し

- 米国

- カナダ

第16章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み、2022年~2024年

- 収益分析

- 市場シェア分析

- 企業価値評価と財務指標

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

第17章 企業プロファイル

- 主要参入企業

- FROBOSENSE

- HESAI GROUP

- LUMINAR TECHNOLOGIES, INC.

- SEYOND

- HUAWEI TECHNOLOGIES CO., LTD.

- INNOVIZ TECHNOLOGIES LTD

- VALEO

- OUSTER INC.

- DENSO CORPORATION

- CONTINENTAL AG

- ZF FRIEDRICHSHAFEN AG

- APTIV

- MAGNA INTERNATIONAL INC.

- その他の企業

- INFINEON TECHNOLOGIES AG

- RENESAS ELECTRONICS CORPORATION

- CEPTON, INC.

- QUANERGY SOLUTIONS, INC.

- MARELLI HOLDINGS CO., LTD.

- AEVA INC.

- BLICKFELD GMBH

- AEYE, INC.

- LIVOX

- HEXAGON AB

第18章 市場への提言

第19章 付録

List of Tables

- TABLE 1 AUTOMOTIVE LIDAR MARKET DEFINITION, BY TECHNOLOGY

- TABLE 2 AUTOMOTIVE LIDAR MARKET DEFINITION, BY ICE VEHICLE TYPE

- TABLE 3 AUTOMOTIVE LIDAR MARKET DEFINITION, BY LASER WAVELENGTH

- TABLE 4 AUTOMOTIVE LIDAR MARKET DEFINITION, BY ELECTRIC VEHICLE TYPE

- TABLE 5 AUTOMOTIVE LIDAR MARKET DEFINITION, BY LEVEL OF AUTONOMY

- TABLE 6 AUTOMOTIVE LIDAR MARKET DEFINITION, BY IMAGE TYPE

- TABLE 7 USD EXCHANGE RATES, 2019-2024

- TABLE 8 PRICE OF LIVOX LIDAR MODELS, BY RANGE

- TABLE 9 NUMBER OF LIDAR SYSTEMS USED BY ROBOTAXI MANUFACTURERS

- TABLE 10 IMPACT OF MARKET DYNAMICS ON AUTOMOTIVE LIDAR MARKET

- TABLE 11 AVERAGE SELLING PRICE, BY KEY PLAYER, 2024 (USD)

- TABLE 12 AVERAGE SELLING PRICE, BY ICE VEHICLE TYPE, 2021-2024 (USD)

- TABLE 13 AVERAGE SELLING PRICE TREND, BY REGION, 2021-2024 (USD)

- TABLE 14 ROLE OF PLAYERS IN MARKET ECOSYSTEM

- TABLE 15 FUNDING, BY USE CASE, 2021-2023

- TABLE 16 PATENTS GRANTED, 2022-2024

- TABLE 17 COMPARISON BETWEEN FMCW AND TOF LIDARS

- TABLE 18 IMPORT DATA FOR HS CODE 901320-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD BILLION)

- TABLE 19 EXPORT DATA FOR HS CODE 901320-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD BILLION)

- TABLE 20 TESTING PARAMETERS FOR NEW CAR MODELS, BY REGULATORY BODY

- TABLE 21 REGULATIONS AND LEGISLATION FOR AUTONOMOUS VEHICLES IN US

- TABLE 22 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 24 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 25 KEY CONFERENCES & EVENTS, 2025-2026

- TABLE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR ICE VEHICLE TYPES

- TABLE 27 KEY BUYING CRITERIA FOR ICE VEHICLE TYPES

- TABLE 28 AUTOMOTIVE LIDAR MARKET: SUPPLIER ANALYSIS, 2024-2025

- TABLE 29 AUTOMOTIVE LIDAR MARKET, BY ICE VEHICLE TYPE, 2021-2023 (THOUSAND UNITS)

- TABLE 30 AUTOMOTIVE LIDAR MARKET, BY ICE VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 31 AUTOMOTIVE LIDAR MARKET, BY ICE VEHICLE TYPE, 2021-2023 (USD MILLION)

- TABLE 32 AUTOMOTIVE LIDAR MARKET, BY ICE VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 33 PASSENGER CAR: AUTOMOTIVE LIDAR MARKET, BY REGION, 2021-2023 (THOUSAND UNITS)

- TABLE 34 PASSENGER CAR: AUTOMOTIVE LIDAR MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 35 PASSENGER CAR: AUTOMOTIVE LIDAR MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 36 PASSENGER CAR: AUTOMOTIVE LIDAR MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 37 LIGHT COMMERCIAL VEHICLE: AUTOMOTIVE LIDAR MARKET, BY REGION, 2021-2023 (THOUSAND UNITS)

- TABLE 38 LIGHT COMMERCIAL VEHICLE: AUTOMOTIVE LIDAR MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 39 LIGHT COMMERCIAL VEHICLE: AUTOMOTIVE LIDAR MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 40 LIGHT COMMERCIAL VEHICLE: AUTOMOTIVE LIDAR MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 41 HEAVY COMMERCIAL VEHICLE: AUTOMOTIVE LIDAR MARKET, BY REGION, 2021-2023 (THOUSAND UNITS)

- TABLE 42 HEAVY COMMERCIAL VEHICLE: AUTOMOTIVE LIDAR MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 43 HEAVY COMMERCIAL VEHICLE: AUTOMOTIVE LIDAR MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 44 HEAVY COMMERCIAL VEHICLE: AUTOMOTIVE LIDAR MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 45 AUTOMOTIVE LIDAR MARKET, BY ELECTRIC VEHICLE TYPE, 2021-2023 (THOUSAND UNITS)

- TABLE 46 AUTOMOTIVE LIDAR MARKET, BY ELECTRIC VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 47 AUTOMOTIVE LIDAR MARKET, BY ELECTRIC VEHICLE TYPE, 2021-2023 (USD MILLION)

- TABLE 48 AUTOMOTIVE LIDAR MARKET, BY ELECTRIC VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 49 LIDAR SUPPLIERS FOR BEVS, 2022-2025

- TABLE 50 BATTERY ELECTRIC VEHICLE: AUTOMOTIVE LIDAR MARKET, BY REGION, 2021-2023 (THOUSAND UNITS)

- TABLE 51 BATTERY ELECTRIC VEHICLE: AUTOMOTIVE LIDAR MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 52 BATTERY ELECTRIC VEHICLE: AUTOMOTIVE LIDAR MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 53 BATTERY ELECTRIC VEHICLE: AUTOMOTIVE LIDAR MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 54 LIDAR SUPPLIERS FOR FCEVS, 2022-2023

- TABLE 55 FUEL CELL ELECTRIC VEHICLE: AUTOMOTIVE LIDAR MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 56 FUEL CELL ELECTRIC VEHICLE: AUTOMOTIVE LIDAR MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 57 LIDAR SUPPLIERS FOR PHEVS, 2022-2025

- TABLE 58 PLUG-IN HYBRID ELECTRIC VEHICLE: AUTOMOTIVE LIDAR MARKET, BY REGION, 2021-2023 (THOUSAND UNITS)

- TABLE 59 PLUG-IN HYBRID ELECTRIC VEHICLE: AUTOMOTIVE LIDAR MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 60 PLUG-IN HYBRID ELECTRIC VEHICLE: AUTOMOTIVE LIDAR MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 61 PLUG-IN HYBRID ELECTRIC VEHICLE: AUTOMOTIVE LIDAR MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 62 AUTOMOTIVE LIDAR MARKET, BY IMAGE TYPE, 2021-2023 (THOUSAND UNITS)

- TABLE 63 AUTOMOTIVE LIDAR MARKET, BY IMAGE TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 64 AUTOMOTIVE LIDAR MARKET, BY IMAGE TYPE, 2021-2023 (USD MILLION)

- TABLE 65 AUTOMOTIVE LIDAR MARKET, BY IMAGE TYPE, 2024-2030 (USD MILLION)

- TABLE 66 2D: AUTOMOTIVE LIDAR MARKET, BY REGION, 2021-2023 (THOUSAND UNITS)

- TABLE 67 2D: AUTOMOTIVE LIDAR MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 68 2D: AUTOMOTIVE LIDAR MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 69 2D: AUTOMOTIVE LIDAR MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 70 VEHICLE MODELS EQUIPPED WITH 3D LIDAR

- TABLE 71 3D: AUTOMOTIVE LIDAR MARKET, BY REGION, 2021-2023 (THOUSAND UNITS)

- TABLE 72 3D: AUTOMOTIVE LIDAR MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 73 3D: AUTOMOTIVE LIDAR MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 74 3D: AUTOMOTIVE LIDAR MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 75 KEY PLAYERS OFFERING NIR, SWIR, AND LWIR LIDAR SYSTEMS

- TABLE 76 AUTOMOTIVE LIDAR MARKET, BY LASER WAVELENGTH, 2021-2023 (THOUSAND UNITS)

- TABLE 77 AUTOMOTIVE LIDAR MARKET, BY LASER WAVELENGTH, 2024-2030 (THOUSAND UNITS)

- TABLE 78 AUTOMOTIVE LIDAR MARKET, BY LASER WAVELENGTH, 2021-2023 (USD MILLION)

- TABLE 79 AUTOMOTIVE LIDAR MARKET, BY LASER WAVELENGTH, 2024-2030 (USD MILLION)

- TABLE 80 AUTOMOTIVE LIDAR MARKET, BY LEVEL OF AUTONOMY, 2021-2023 (THOUSAND UNITS)

- TABLE 81 AUTOMOTIVE LIDAR MARKET, BY LEVEL OF AUTONOMY, 2024-2030 (THOUSAND UNITS)

- TABLE 82 AUTOMOTIVE LIDAR MARKET, BY LEVEL OF AUTONOMY, 2021-2023 (USD MILLION)

- TABLE 83 AUTOMOTIVE LIDAR MARKET, BY LEVEL OF AUTONOMY, 2024-2030 (USD MILLION)

- TABLE 84 SEMI-AUTONOMOUS: AUTOMOTIVE LIDAR MARKET, BY REGION, 2021-2023 (THOUSAND UNITS)

- TABLE 85 SEMI-AUTONOMOUS: AUTOMOTIVE LIDAR MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 86 SEMI-AUTONOMOUS: AUTOMOTIVE LIDAR MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 87 SEMI-AUTONOMOUS: AUTOMOTIVE LIDAR MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 88 AUTONOMOUS: AUTOMOTIVE LIDAR MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 89 AUTONOMOUS: AUTOMOTIVE LIDAR MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 90 AUTOMOTIVE LIDAR MARKET, BY LOCATION, 2021-2023 (THOUSAND UNITS)

- TABLE 91 AUTOMOTIVE LIDAR MARKET, BY LOCATION, 2024-2030 (THOUSAND UNITS)

- TABLE 92 AUTOMOTIVE LIDAR MARKET, BY LOCATION, 2021-2023 (USD MILLION)

- TABLE 93 AUTOMOTIVE LIDAR MARKET, BY LOCATION, 2024-2030 (USD MILLION)

- TABLE 94 BUMPER & GRILLE: AUTOMOTIVE LIDAR MARKET, BY REGION, 2021-2023 (THOUSAND UNITS)

- TABLE 95 BUMPER & GRILLE: AUTOMOTIVE LIDAR MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 96 BUMPER & GRILLE: AUTOMOTIVE LIDAR MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 97 BUMPER & GRILLE: AUTOMOTIVE LIDAR MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 98 HEADLIGHT & TAILLIGHT: AUTOMOTIVE LIDAR MARKET, BY REGION, 2021-2023 (THOUSAND UNITS)

- TABLE 99 HEADLIGHT & TAILLIGHT: AUTOMOTIVE LIDAR MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 100 HEADLIGHT & TAILLIGHT: AUTOMOTIVE LIDAR MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 101 HEADLIGHT & TAILLIGHT: AUTOMOTIVE LIDAR MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 102 ROOF & UPPER PILLAR: AUTOMOTIVE LIDAR MARKET, BY REGION, 2021-2023 (THOUSAND UNITS)

- TABLE 103 ROOF & UPPER PILLAR: AUTOMOTIVE LIDAR MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 104 ROOF & UPPER PILLAR: AUTOMOTIVE LIDAR MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 105 ROOF & UPPER PILLAR: AUTOMOTIVE LIDAR MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 106 OTHER LOCATIONS: AUTOMOTIVE LIDAR MARKET, BY REGION, 2021-2023 (THOUSAND UNITS)

- TABLE 107 OTHER LOCATIONS: AUTOMOTIVE LIDAR MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 108 OTHER LOCATIONS: AUTOMOTIVE LIDAR MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 109 OTHER LOCATIONS: AUTOMOTIVE LIDAR MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 110 AUTOMOTIVE LIDAR MARKET, BY MEASUREMENT PROCESS, 2021-2023 (THOUSAND UNITS)

- TABLE 111 AUTOMOTIVE LIDAR MARKET, BY MEASUREMENT PROCESS, 2024-2030 (THOUSAND UNITS)

- TABLE 112 AUTOMOTIVE LIDAR MARKET, BY MEASUREMENT PROCESS, 2021-2023 (USD MILLION)

- TABLE 113 AUTOMOTIVE LIDAR MARKET, BY MEASUREMENT PROCESS, 2024-2030 (USD MILLION)

- TABLE 114 COMPARISON BETWEEN TOF AND FMCW MEASUREMENT PROCESSES

- TABLE 115 MECHANICAL AND SOLID-STATE LIDAR OFFERINGS, BY KEY PLAYER

- TABLE 116 AUTOMOTIVE LIDAR MARKET, BY TECHNOLOGY, 2021-2023 (THOUSAND UNITS)

- TABLE 117 AUTOMOTIVE LIDAR MARKET, BY TECHNOLOGY, 2024-2030 (THOUSAND UNITS)

- TABLE 118 AUTOMOTIVE LIDAR MARKET, BY TECHNOLOGY, 2021-2023 (USD MILLION)

- TABLE 119 AUTOMOTIVE LIDAR MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 120 MECHANICAL LIDAR: AUTOMOTIVE LIDAR MARKET, BY REGION, 2021-2023 (THOUSAND UNITS)

- TABLE 121 MECHANICAL LIDAR: AUTOMOTIVE LIDAR MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 122 MECHANICAL LIDAR: AUTOMOTIVE LIDAR MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 123 MECHANICAL LIDAR: AUTOMOTIVE LIDAR MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 124 SOLID-STATE LIDAR: AUTOMOTIVE LIDAR MARKET, BY REGION, 2021-2023 (THOUSAND UNITS)

- TABLE 125 SOLID-STATE LIDAR: AUTOMOTIVE LIDAR MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 126 SOLID-STATE LIDAR: AUTOMOTIVE LIDAR MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 127 SOLID-STATE LIDAR: AUTOMOTIVE LIDAR MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 128 SHORT- & MID-RANGE AND LONG-RANGE LIDAR OFFERINGS, BY KEY PLAYER

- TABLE 129 AUTOMOTIVE LIDAR MARKET, BY RANGE, 2021-2023 (THOUSAND UNITS)

- TABLE 130 AUTOMOTIVE LIDAR MARKET, BY RANGE, 2024-2030 (THOUSAND UNITS)

- TABLE 131 AUTOMOTIVE LIDAR MARKET, BY RANGE, 2021-2023 (USD MILLION)

- TABLE 132 AUTOMOTIVE LIDAR MARKET, BY RANGE, 2024-2030 (USD MILLION)

- TABLE 133 AUTOMOTIVE LIDAR MARKET, BY REGION, 2021-2023 (THOUSAND UNITS)

- TABLE 134 AUTOMOTIVE LIDAR MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 135 AUTOMOTIVE LIDAR MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 136 AUTOMOTIVE LIDAR MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 137 ASIA PACIFIC: AUTOMOTIVE LIDAR MARKET, BY COUNTRY, 2021-2023 (UNITS)

- TABLE 138 ASIA PACIFIC: AUTOMOTIVE LIDAR MARKET, BY COUNTRY, 2024-2030 (UNITS)

- TABLE 139 ASIA PACIFIC: AUTOMOTIVE LIDAR MARKET, BY COUNTRY, 2021-2023 (USD THOUSAND)

- TABLE 140 ASIA PACIFIC: AUTOMOTIVE LIDAR MARKET, BY COUNTRY, 2024-2030 (USD THOUSAND)

- TABLE 141 CHINA: AUTOMOTIVE LIDAR MARKET, BY VEHICLE TYPE, 2021-2023 (UNITS)

- TABLE 142 CHINA: AUTOMOTIVE LIDAR MARKET, BY VEHICLE TYPE, 2024-2030 (UNITS)

- TABLE 143 CHINA: AUTOMOTIVE LIDAR MARKET, BY VEHICLE TYPE, 2021-2023 (USD THOUSAND)

- TABLE 144 CHINA: AUTOMOTIVE LIDAR MARKET, BY VEHICLE TYPE, 2024-2030 (USD THOUSAND)

- TABLE 145 INDIA: AUTOMOTIVE LIDAR MARKET, BY VEHICLE TYPE, 2021-2023 (UNITS)

- TABLE 146 INDIA: AUTOMOTIVE LIDAR MARKET, BY VEHICLE TYPE, 2024-2030 (UNITS)

- TABLE 147 INDIA: AUTOMOTIVE LIDAR MARKET, BY VEHICLE TYPE, 2021-2023 (USD THOUSAND)

- TABLE 148 INDIA: AUTOMOTIVE LIDAR MARKET, BY VEHICLE TYPE, 2024-2030 (USD THOUSAND)

- TABLE 149 JAPAN: AUTOMOTIVE LIDAR MARKET, BY VEHICLE TYPE, 2021-2023 (UNITS)

- TABLE 150 JAPAN: AUTOMOTIVE LIDAR MARKET, BY VEHICLE TYPE, 2024-2030 (UNITS)

- TABLE 151 JAPAN: AUTOMOTIVE LIDAR MARKET, BY VEHICLE TYPE, 2021-2023 (USD THOUSAND)

- TABLE 152 JAPAN: AUTOMOTIVE LIDAR MARKET, BY VEHICLE TYPE, 2024-2030 (USD THOUSAND)

- TABLE 153 SOUTH KOREA: AUTOMOTIVE LIDAR MARKET, BY VEHICLE TYPE, 2021-2023 (UNITS)

- TABLE 154 SOUTH KOREA: AUTOMOTIVE LIDAR MARKET, BY VEHICLE TYPE, 2024-2030 (UNITS)

- TABLE 155 SOUTH KOREA: AUTOMOTIVE LIDAR MARKET, BY VEHICLE TYPE, 2021-2023 (USD THOUSAND)

- TABLE 156 SOUTH KOREA: AUTOMOTIVE LIDAR MARKET, BY VEHICLE TYPE, 2024-2030 (USD THOUSAND)

- TABLE 157 EUROPE: AUTOMOTIVE LIDAR MARKET, BY COUNTRY, 2021-2023 (UNITS)

- TABLE 158 EUROPE: AUTOMOTIVE LIDAR MARKET, BY COUNTRY, 2024-2030 (UNITS)

- TABLE 159 EUROPE: AUTOMOTIVE LIDAR MARKET, BY COUNTRY, 2021-2023 (USD THOUSAND)

- TABLE 160 EUROPE: AUTOMOTIVE LIDAR MARKET, BY COUNTRY, 2024-2030 (USD THOUSAND)

- TABLE 161 GERMANY: AUTOMOTIVE LIDAR MARKET, BY VEHICLE TYPE, 2021-2023 (UNITS)

- TABLE 162 GERMANY: AUTOMOTIVE LIDAR MARKET, BY VEHICLE TYPE, 2024-2030 (UNITS)

- TABLE 163 GERMANY: AUTOMOTIVE LIDAR MARKET, BY VEHICLE TYPE, 2021-2023 (USD THOUSAND)

- TABLE 164 GERMANY: AUTOMOTIVE LIDAR MARKET, BY VEHICLE TYPE, 2024-2030 (USD THOUSAND)

- TABLE 165 FRANCE: AUTOMOTIVE LIDAR MARKET, BY VEHICLE TYPE, 2021-2023 (UNITS)

- TABLE 166 FRANCE: AUTOMOTIVE LIDAR MARKET, BY VEHICLE TYPE, 2024-2030 (UNITS)

- TABLE 167 FRANCE: AUTOMOTIVE LIDAR MARKET, BY VEHICLE TYPE, 2021-2023 (USD THOUSAND)

- TABLE 168 FRANCE: AUTOMOTIVE LIDAR MARKET, BY VEHICLE TYPE, 2024-2030 (USD THOUSAND)

- TABLE 169 ITALY: AUTOMOTIVE LIDAR MARKET, BY VEHICLE TYPE, 2021-2023 (UNITS)

- TABLE 170 ITALY: AUTOMOTIVE LIDAR MARKET, BY VEHICLE TYPE, 2024-2030 (UNITS)

- TABLE 171 ITALY: AUTOMOTIVE LIDAR MARKET, BY VEHICLE TYPE, 2021-2023 (USD THOUSAND)

- TABLE 172 ITALY: AUTOMOTIVE LIDAR MARKET, BY VEHICLE TYPE, 2024-2030 (USD THOUSAND)

- TABLE 173 UK: AUTOMOTIVE LIDAR MARKET, BY VEHICLE TYPE, 2021-2023 (UNITS)

- TABLE 174 UK: AUTOMOTIVE LIDAR MARKET, BY VEHICLE TYPE, 2024-2030 (UNITS)

- TABLE 175 UK: AUTOMOTIVE LIDAR MARKET, BY VEHICLE TYPE, 2021-2023 (USD THOUSAND)

- TABLE 176 UK: AUTOMOTIVE LIDAR MARKET, BY VEHICLE TYPE, 2024-2030 (USD THOUSAND)

- TABLE 177 SPAIN: AUTOMOTIVE LIDAR MARKET, BY VEHICLE TYPE, 2021-2023 (UNITS)

- TABLE 178 SPAIN: AUTOMOTIVE LIDAR MARKET, BY VEHICLE TYPE, 2024-2030 (UNITS)

- TABLE 179 SPAIN: AUTOMOTIVE LIDAR MARKET, BY VEHICLE TYPE, 2021-2023 (USD THOUSAND)

- TABLE 180 SPAIN: AUTOMOTIVE LIDAR MARKET, BY VEHICLE TYPE, 2024-2030 (USD THOUSAND)

- TABLE 181 NORTH AMERICA: AUTOMOTIVE LIDAR MARKET, BY COUNTRY, 2021-2023 (UNITS)

- TABLE 182 NORTH AMERICA: AUTOMOTIVE LIDAR MARKET, BY COUNTRY, 2024-2030 (UNITS)

- TABLE 183 NORTH AMERICA: AUTOMOTIVE LIDAR MARKET, BY COUNTRY, 2021-2023 (USD THOUSAND)

- TABLE 184 NORTH AMERICA: AUTOMOTIVE LIDAR MARKET, BY COUNTRY, 2024-2030 (USD THOUSAND)

- TABLE 185 US: AUTOMOTIVE LIDAR MARKET, BY VEHICLE TYPE, 2021-2023 (UNITS)

- TABLE 186 US: AUTOMOTIVE LIDAR MARKET, BY VEHICLE TYPE, 2024-2030 (UNITS)

- TABLE 187 US: AUTOMOTIVE LIDAR MARKET, BY VEHICLE TYPE, 2021-2023 (USD THOUSAND)

- TABLE 188 US: AUTOMOTIVE LIDAR MARKET, BY VEHICLE TYPE, 2024-2030 (USD THOUSAND)

- TABLE 189 CANADA: AUTOMOTIVE LIDAR MARKET, BY VEHICLE TYPE, 2021-2023 (UNITS)

- TABLE 190 CANADA: AUTOMOTIVE LIDAR MARKET, BY VEHICLE TYPE, 2024-2030 (UNITS)

- TABLE 191 CANADA: AUTOMOTIVE LIDAR MARKET, BY VEHICLE TYPE, 2021-2023 (USD THOUSAND)

- TABLE 192 CANADA: AUTOMOTIVE LIDAR MARKET, BY VEHICLE TYPE, 2024-2030 (USD THOUSAND)

- TABLE 193 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022-2024

- TABLE 194 MARKET SHARE ANALYSIS, 2023

- TABLE 195 REGION FOOTPRINT

- TABLE 196 TECHNOLOGY FOOTPRINT

- TABLE 197 IMAGE TYPE FOOTPRINT

- TABLE 198 RANGE FOOTPRINT

- TABLE 199 LIST OF STARTUPS/SMES

- TABLE 200 COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 201 AUTOMOTIVE LIDAR MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, JANUARY 2022-OCTOBER 2024

- TABLE 202 AUTOMOTIVE LIDAR MARKET: DEALS, JANUARY 2022-OCTOBER 2024

- TABLE 203 AUTOMOTIVE LIDAR MARKET: EXPANSION, JANUARY 2022-OCTOBER 2024

- TABLE 204 AUTOMOTIVE LIDAR MARKET: OTHER DEVELOPMENTS, JANUARY 2022-OCTOBER 2024

- TABLE 205 ROBOSENSE: COMPANY OVERVIEW

- TABLE 206 VEHICLE MODELS EQUIPPED WITH LIDAR OFFERED BY ROBOSENSE, BY OEM, 2022-2025

- TABLE 207 ROBOSENSE: PRODUCTS/SOLUTIONS OFFERED

- TABLE 208 ROBOSENSE: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 209 ROBOSENSE: DEALS

- TABLE 210 ROBOSENSE: OTHER DEVELOPMENTS

- TABLE 211 HESAI GROUP: COMPANY OVERVIEW

- TABLE 212 VEHICLE MODELS EQUIPPED WITH LIDAR OFFERED BY HESAI, BY OEM, 2022-2024

- TABLE 213 HESAI GROUP: PRODUCTS/SOLUTIONS OFFERED

- TABLE 214 HESAI GROUP: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 215 HESAI GROUP: DEALS

- TABLE 216 HESAI GROUP: OTHER DEVELOPMENTS

- TABLE 217 LUMINAR TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 218 VEHICLE MODELS EQUIPPED WITH LIDAR OFFERED BY LUMINAR TECHNOLOGIES, BY OEM, 2022-2024

- TABLE 219 LUMINAR TECHNOLOGIES, INC.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 220 LUMINAR TECHNOLOGIES, INC.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 221 LUMINAR TECHNOLOGIES, INC.: DEALS

- TABLE 222 LUMINAR TECHNOLOGIES, INC.: EXPANSION

- TABLE 223 SEYOND: COMPANY OVERVIEW

- TABLE 224 NIO VEHICLE MODELS EQUIPPED WITH LIDAR OFFERED BY SEYOND, 2022-2024

- TABLE 225 SEYOND: PRODUCTS/SOLUTIONS OFFERED

- TABLE 226 SEYOND: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 227 SEYOND: DEALS

- TABLE 228 SEYOND: OTHER DEVELOPMENTS

- TABLE 229 HUAWEI TECHNOLOGIES CO., LTD.: COMPANY OVERVIEW

- TABLE 230 VEHICLE MODELS EQUIPPED WITH LIDAR OFFERED BY HUAWEI TECHNOLOGIES, BY OEM, 2022-2024

- TABLE 231 HUAWEI TECHNOLOGIES CO., LTD.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 232 HUAWEI TECHNOLOGIES CO., LTD.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 233 HUAWEI TECHNOLOGIES CO., LTD.: EXPANSION

- TABLE 234 HUAWEI TECHNOLOGIES CO., LTD.: OTHER DEVELOPMENTS

- TABLE 235 INNOVIZ TECHNOLOGIES LTD: COMPANY OVERVIEW

- TABLE 236 VEHICLE MODELS EQUIPPED WITH LIDAR OFFERED BY INNOVIZ TECHNOLOGIES, BY OEM, 2022-2024

- TABLE 237 INNOVIZ TECHNOLOGIES LTD: PRODUCTS/SOLUTIONS OFFERED

- TABLE 238 INNOVIZ TECHNOLOGIES LTD: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 239 INNOVIZ TECHNOLOGIES LTD: DEALS

- TABLE 240 INNOVIZ TECHNOLOGIES LTD: EXPANSION

- TABLE 241 INNOVIZ TECHNOLOGIES LTD: OTHER DEVELOPMENTS

- TABLE 242 VALEO: COMPANY OVERVIEW

- TABLE 243 VEHICLE MODELS EQUIPPED WITH LIDAR OFFERED BY VALEO, BY OEM, 2022-2024

- TABLE 244 VALEO: PRODUCTS/SOLUTIONS OFFERED

- TABLE 245 VALEO: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 246 VALEO: DEALS

- TABLE 247 VALEO: EXPANSION

- TABLE 248 VALEO: OTHER DEVELOPMENTS

- TABLE 249 OUSTER INC.: COMPANY OVERVIEW

- TABLE 250 OUSTER INC.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 251 OUSTER INC.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 252 OUSTER INC.: DEALS

- TABLE 253 OUSTER INC.: OTHER DEVELOPMENTS

- TABLE 254 DENSO CORPORATION: COMPANY OVERVIEW

- TABLE 255 TOYOTA VEHICLE MODELS EQUIPPED WITH LIDAR OFFERED BY DENSO CORPORATION, 2022

- TABLE 256 DENSO CORPORATION: PRODUCTS/SOLUTIONS OFFERED

- TABLE 257 DENSO CORPORATION: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 258 DENSO CORPORATION: DEALS

- TABLE 259 DENSO CORPORATION: EXPANSION

- TABLE 260 DENSO CORPORATION: OTHER DEVELOPMENTS

- TABLE 261 CONTINENTAL AG: COMPANY OVERVIEW

- TABLE 262 CONTINENTAL AG: PRODUCTS/SOLUTIONS OFFERED

- TABLE 263 CONTINENTAL AG: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 264 CONTINENTAL AG: DEALS

- TABLE 265 CONTINENTAL AG: EXPANSION

- TABLE 266 CONTINENTAL AG: OTHER DEVELOPMENTS

- TABLE 267 ZF FRIEDRICHSHAFEN AG: COMPANY OVERVIEW

- TABLE 268 ZF FRIEDRICHSHAFEN AG: PRODUCTS/SOLUTIONS OFFERED

- TABLE 269 ZF FRIEDRICHSHAFEN AG: DEALS

- TABLE 270 ZF FRIEDRICHSHAFEN AG: EXPANSION

- TABLE 271 ZF FRIEDRICHSHAFEN AG: OTHER DEVELOPMENTS

- TABLE 272 APTIV: COMPANY OVERVIEW

- TABLE 273 APTIV: PRODUCTS/SOLUTIONS OFFERED

- TABLE 274 APTIV: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 275 APTIV: DEALS

- TABLE 276 APTIV: EXPANSION

- TABLE 277 APTIV: OTHER DEVELOPMENTS

- TABLE 278 MAGNA INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 279 MAGNA INTERNATIONAL INC.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 280 MAGNA INTERNATIONAL INC.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 281 MAGNA INTERNATIONAL INC.: DEALS

- TABLE 282 MAGNA INTERNATIONAL INC.: EXPANSION

- TABLE 283 MAGNA INTERNATIONAL INC.: OTHER DEVELOPMENTS

- TABLE 284 INFINEON TECHNOLOGIES AG: COMPANY OVERVIEW

- TABLE 285 RENESAS ELECTRONICS CORPORATION: COMPANY OVERVIEW

- TABLE 286 MOTHERSON: COMPANY OVERVIEW

- TABLE 287 QUANERGY SOLUTIONS, INC.: COMPANY OVERVIEW

- TABLE 288 MARELLI HOLDINGS CO., LTD.: COMPANY OVERVIEW

- TABLE 289 AEVA INC.: COMPANY OVERVIEW

- TABLE 290 BLICKFELD GMBH: COMPANY OVERVIEW

- TABLE 291 AEYE, INC.: COMPANY OVERVIEW

- TABLE 292 LIVOX: COMPANY OVERVIEW

- TABLE 293 HEXAGON AB: COMPANY OVERVIEW

List of Figures

- FIGURE 1 RESEARCH DESIGN

- FIGURE 2 RESEARCH DESIGN MODEL

- FIGURE 3 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 4 BOTTOM-UP APPROACH

- FIGURE 5 TOP-DOWN APPROACH

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 GROWTH PROJECTIONS FROM DEMAND-SIDE DRIVERS

- FIGURE 8 DEMAND- AND SUPPLY-SIDE FACTORS IMPACTING OVERALL MARKET

- FIGURE 9 AUTOMOTIVE LIDAR MARKET OVERVIEW

- FIGURE 10 ASIA PACIFIC TO ACCOUNT FOR LARGEST SHARE BY 2030

- FIGURE 11 PASSENGER CAR SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 12 SURGE IN DEVELOPMENT OF AUTONOMOUS VEHICLES TO DRIVE MARKET

- FIGURE 13 ASIA PACIFIC TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 14 SOLID-STATE LIDAR SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 15 3D SEGMENT TO ACCOUNT FOR LARGER SHARE THAN 2D SEGMENT BY 2030

- FIGURE 16 PASSENGER CAR SEGMENT TO ACCOUNT FOR LARGEST SHARE BY 2030

- FIGURE 17 BUMPER & GRILLE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 18 BATTERY ELECTRIC VEHICLE SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 19 LONG-RANGE LIDAR SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 20 NEAR-INFRARED SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 21 FREQUENCY-MODULATED CONTINUOUS WAVE SEGMENT TO ACHIEVE HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 22 SEMI-AUTONOMOUS SEGMENT TO ACHIEVE SIGNIFICANT GROWTH DURING FORECAST PERIOD

- FIGURE 23 AUTOMOTIVE LIDAR MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 24 EFFECT OF SOLAR LOADING ON AMCW AND FMCW LIDAR SYSTEMS

- FIGURE 25 GENERAL SAFETY REGULATIONS (GSR 2) IN EUROPE

- FIGURE 26 COMPARISON BETWEEN CAMERA, FMCW LIDAR, AND IMAGE RADAR

- FIGURE 27 FEATURES OF WERIDE'S GXR ROBOTAXI

- FIGURE 28 POPULAR ROBOTAXIS OPERATIONAL ACROSS MAJOR CITIES

- FIGURE 29 SENSOR MODULES DEPLOYED IN AUTONOMOUS TRUCKS

- FIGURE 30 COMPARISON BETWEEN PERFORMANCE METRICS OF CAMERA, RADAR, AND LIDAR

- FIGURE 31 TRENDS & DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 32 AVERAGE SELLING PRICE, BY KEY PLAYER, 2024 (USD)

- FIGURE 33 AVERAGE SELLING PRICE TREND, BY ICE VEHICLE TYPE, 2021-2024 (USD)

- FIGURE 34 AVERAGE SELLING PRICE TREND, BY REGION, 2021-2024 (USD)

- FIGURE 35 ECOSYSTEM ANALYSIS

- FIGURE 36 VALUE CHAIN ANALYSIS

- FIGURE 37 INVESTMENT AND FUNDING SCENARIO, 2021-2023 (USD MILLION)

- FIGURE 38 PATENT ANALYSIS, 2014-2023

- FIGURE 39 FEATURES OF MICROVISION'S PERCEPTION SOFTWARE

- FIGURE 40 LM10: LUMOTIVE'S OPTICAL BEAM STEERING-BASED LIDAR

- FIGURE 41 LCM CHIP: PROJECTED ROADMAP

- FIGURE 42 IMPORT DATA FOR HS CODE 901320-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD BILLION)

- FIGURE 43 EXPORT DATA FOR HS CODE 901320-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD BILLION)

- FIGURE 44 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR ICE VEHICLE TYPES

- FIGURE 45 KEY BUYING CRITERIA FOR ICE VEHICLE TYPES

- FIGURE 46 INTEGRATION OF LIDAR SOLUTIONS INTO VEHICLES BY OEMS

- FIGURE 47 INSTALLATION OF LIDAR SYSTEMS IN PASSENGER CARS

- FIGURE 48 DESIGN WINS FOR KEY LIDAR COMPANIES

- FIGURE 49 AUTOMOTIVE LIDAR MARKET, BY ICE VEHICLE TYPE, 2024 VS. 2030 (USD MILLION)

- FIGURE 50 VALEO'S LIDAR AND SENSORS USED IN MERCEDES-BENZ S-CLASS

- FIGURE 51 FIFTH-GENERATION WAYMO DRIVER FOR TRUCKS

- FIGURE 52 AUTOMOTIVE LIDAR MARKET, BY ELECTRIC VEHICLE TYPE, 2024 VS. 2030 (USD MILLION)

- FIGURE 53 AUTOMOTIVE LIDAR MARKET, BY IMAGE TYPE, 2024 VS. 2030 (USD MILLION)

- FIGURE 54 COMPARISON BETWEEN LIDAR WAVELENGTHS

- FIGURE 55 ELECTROMAGNETIC SPECTRUM: WAVELENGTH RANGE OF NIR, SWIR, AND LWIR

- FIGURE 56 AUTOMOTIVE LIDAR MARKET, BY LASER WAVELENGTH, 2024 VS. 2030 (USD MILLION)

- FIGURE 57 AUTOMOTIVE LIDAR MARKET, BY LEVEL OF AUTONOMY, 2024 VS. 2030 (USD MILLION)

- FIGURE 58 ADAS FEATURES IN VEHICLES EQUIPPED WITH SENSORS, BY RANGE

- FIGURE 59 SIXTH-GENERATION WAYMO ROBOTAXI EQUIPPED WITH LIDAR

- FIGURE 60 INSTALLATION OF LIDAR IN VEHICLES: BENEFITS AND CHALLENGES

- FIGURE 61 AUTOMOTIVE LIDAR MARKET, BY LOCATION, 2024 VS. 2030 (USD MILLION)

- FIGURE 62 HESAI'S AT128 LIDAR INSTALLED ON ROOF OF LI AUTO'S L9 MODEL

- FIGURE 63 HESAI GROUP'S LIDAR INSTALLED BEHIND WINDSHIELD

- FIGURE 64 WORKING OF LIDAR SYSTEMS

- FIGURE 65 AUTOMOTIVE LIDAR MARKET, BY MEASUREMENT PROCESS, 2024 VS. 2030 (USD MILLION)

- FIGURE 66 WORKING OF TOF-BASED LIDAR SYSTEMS

- FIGURE 67 WORKING OF FMCW-BASED LIDAR SYSTEMS

- FIGURE 68 AUTOMOTIVE LIDAR MARKET, BY TECHNOLOGY, 2024 VS. 2030 (USD MILLION)

- FIGURE 69 MECHANICAL LIDAR AND OTHER SENSORS INSTALLED IN WAYMO DRIVER SYSTEMS

- FIGURE 70 INNOVIZONE: SOLID-STATE LIDAR INSTALLED IN BMW I7

- FIGURE 71 AUTOMOTIVE LIDAR MARKET, BY RANGE, 2024 VS. 2030 (USD MILLION)

- FIGURE 72 AUTOMOTIVE LIDAR MARKET, BY REGION, 2024 VS. 2030 (USD MILLION)

- FIGURE 73 ASIA PACIFIC: REAL GDP GROWTH RATE, BY COUNTRY, 2023-2025

- FIGURE 74 ASIA PACIFIC: GDP PER CAPITA, BY COUNTRY, 2023-2025

- FIGURE 75 ASIA PACIFIC: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2023-2025

- FIGURE 76 ASIA PACIFIC: AUTOMOTIVE INDUSTRY'S CONTRIBUTION TO GDP, 2023 (USD TRILLION)

- FIGURE 77 ASIA PACIFIC: AUTOMOTIVE LIDAR MARKET SNAPSHOT

- FIGURE 78 EUROPE: REAL GDP GROWTH RATE, BY COUNTRY, 2023-2025

- FIGURE 79 EUROPE: GDP PER CAPITA, BY COUNTRY, 2023-2025

- FIGURE 80 EUROPE: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2023-2025

- FIGURE 81 EUROPE: AUTOMOTIVE INDUSTRY'S CONTRIBUTION TO GDP, 2023 (USD TRILLION)

- FIGURE 82 EUROPE: AUTOMOTIVE LIDAR MARKET, BY COUNTRY, 2024 VS. 2030 (USD MILLION)

- FIGURE 83 NORTH AMERICA: REAL GDP GROWTH RATE, BY COUNTRY, 2023-2025

- FIGURE 84 NORTH AMERICA: GDP PER CAPITA, BY COUNTRY, 2023-2025

- FIGURE 85 NORTH AMERICA: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2023-2025

- FIGURE 86 NORTH AMERICA: AUTOMOTIVE INDUSTRY'S CONTRIBUTION TO GDP, 2023 (USD TRILLION)

- FIGURE 87 NORTH AMERICA: AUTOMOTIVE LIDAR MARKET SNAPSHOT

- FIGURE 88 REVENUE ANALYSIS, 2019-2023 (USD MILLION)

- FIGURE 89 MARKET SHARE ANALYSIS, 2023

- FIGURE 90 COMPANY VALUATION OF KEY PLAYERS

- FIGURE 91 EV/EBITDA OF KEY PLAYERS

- FIGURE 92 BRAND/PRODUCT COMPARISON

- FIGURE 93 AUTOMOTIVE LIDAR MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 94 COMPANY FOOTPRINT

- FIGURE 95 AUTOMOTIVE LIDAR MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 96 ROBOSENSE: COMPANY SNAPSHOT

- FIGURE 97 HESAI GROUP: COMPANY SNAPSHOT

- FIGURE 98 LUMINAR TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- FIGURE 99 LUMINAR'S ECOSYSTEM OF EXISTING AND TARGET PARTNERS

- FIGURE 100 LUMINAR TECHNOLOGIES, INC.: R&D AND BUSINESS STRATEGIES

- FIGURE 101 SEYOND: COMPANY SNAPSHOT

- FIGURE 102 HUAWEI TECHNOLOGIES CO., LTD.: COMPANY SNAPSHOT

- FIGURE 103 INNOVIZ TECHNOLOGIES LTD: COMPANY SNAPSHOT

- FIGURE 104 VALEO: COMPANY SNAPSHOT

- FIGURE 105 VALEO: R&D CENTERS

- FIGURE 106 OUSTER INC.: COMPANY SNAPSHOT

- FIGURE 107 DENSO CORPORATION: COMPANY SNAPSHOT

- FIGURE 108 CONTINENTAL AG: COMPANY SNAPSHOT

- FIGURE 109 CONTINENTAL AG: GLOBAL PRESENCE, 2023

- FIGURE 110 ZF FRIEDRICHSHAFEN AG: COMPANY SNAPSHOT

- FIGURE 111 APTIV: COMPANY SNAPSHOT

- FIGURE 112 APTIV: SENSOR SOLUTIONS FOR AUTONOMOUS VEHICLES, BY LEVEL OF AUTONOMY

- FIGURE 113 MAGNA INTERNATIONAL INC.: COMPANY SNAPSHOT

The global automotive LiDAR market is projected to reach USD 1.19 billion in 2024 to USD 9.59 billion in 2030, at a CAGR of 41.6% from 2024-2030.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2030 |

| Base Year | 2023 |

| Forecast Period | 2024-2030 |

| Units Considered | Volume (Units) and Value (USD Million) |

| Segments | Technology, Image Type, ICE Vehicle Type, Location, Electric Vehicle Type, Range, Laser Wavelength, Measurement Process, Level of Autonomy |

| Regions covered | Asia Pacific, Europe, and North America |

The automotive LiDAR market is expanding rapidly, driven by continuous advancements in imaging and detection technologies, rising demand for luxury vehicles equipped with LiDAR, and a push toward higher levels of vehicle autonomy. Automakers like Mercedes-Benz Group AG (Germany), BMW Group (Germany), and BYD Co., Ltd. (China) are integrating LiDAR into models such as the Mercedes-Benz EQS, BMW i7, and BYD Han DM-i, enhancing driver assistance systems and enabling higher vehicle autonomy levels. In Asia Pacific, the market is witnessing significant growth, fueled by government initiatives and technological advancements, including China's goal to equip 70% of new cars with Level 2 or Level 3 autonomy by 2025 and developments in robotaxi services by companies like Baidu Inc. (China) and WeRide. Ai (China). Additionally, innovations like Aeva Inc.'s (US) Atlas, the first 4D LiDAR sensor designed for mass production, are setting new benchmarks in the industry. With growing regulatory emphasis on vehicle safety and increasing consumer demand for convenience and automation, the automotive LiDAR market is poised for substantial global growth, with Asia Pacific leading the way.

"Passenger Cars segment is expected to hold the largest share in the automotive LiDAR market during the forecast period."

The passenger cars segment is anticipated to hold the largest market share over the forecast period, driven by several key factors. The growing trend of autonomous mobility in passenger cars significantly impacts the demand for LiDAR technology, as it is essential for advanced driver assistance systems that enhance vehicle safety and performance. Features such as automatic emergency braking, adaptive cruise control, and emergency lane keeping systems are increasingly becoming standard, pushing manufacturers to integrate LiDAR into their vehicles. Numerous passenger car models are already equipped with LiDAR, including the Mercedes-Benz EQS, Xpeng G9, BMW iX3, and BYD Han DM-i, reflecting the industry's commitment to adopting this technology. Furthermore, Waymo LLC's (US) 6th generation Waymo Driver system, launched in August 2024, features four LiDAR sensors, while vehicles like the Lotus Emeya also incorporate four LiDAR units, and GAC Aion's HYPTEC HT and HYPTEC GT models feature three LiDAR sensors each. As consumer awareness of safety features rises and regulatory pressures increase, the integration of LiDAR in passenger vehicles is expected to expand further. Overall, the combination of technological advancements and heightened consumer demand positions the passenger car segment for substantial growth in the automotive LiDAR market.

"Bumper & Grill segment is expected to hold the largest share in the automotive LiDAR market during the forecast period."

The bumper and grill segment is set to establish a strong foothold in the automotive LiDAR market, driven by its suitability for seamless integration and optimal placement for front-facing perception. Installing LiDAR in the bumper or grill allows manufacturers to embed sensors without compromising vehicle aesthetics or aerodynamics, making it a preferred choice. Many luxury vehicles, such as the Mercedes-Benz S-Class and BMW i7, feature LiDAR integrated into the grill, highlighting its practicality and effectiveness in advanced driver-assistance systems. As the demand for autonomous capabilities grows, the bumper and grill location is poised to remain a key focus for LiDAR integration. Additionally, companies are innovating with LiDAR integration in various vehicle locations. In April 2024, Marelli Holdings Co., Ltd. (Japan) and Hesai Group (China) introduced LiDAR-integrated headlamps, blending Hesai's compact ATX LiDAR into Marelli's lighting system, reducing volume by nearly 60% for seamless and affordable integration. For roof-mounted solutions, Luminar Technologies, Inc.'s (US) LiDAR, featured in the Volvo EX90, and Hesai Group's AT128, integrated with Webasto Group's (Germany) roof sensor module as shown in September 2023, demonstrate the versatility of LiDAR placement. As demand for autonomy grows, the bumper and grill, along with these innovative placements, remain key areas for LiDAR adoption.

"Germany is expected to lead in European automotive LiDAR market during the forecast period."

Germany is set to lead the automotive LiDAR market in Europe, driven by several key factors. The country boasts a robust automotive hub, home to major players such as Mercedes-Benz Group AG (Germany), BMW Group (Germany), and Volkswagen Group (Germany), which are at the forefront of developing advanced autonomous technologies. Germany's progressive regulatory environment already permits Level 3 autonomous vehicles, with models like the Mercedes S-Class and EQS operating in designated areas, highlighting the country's commitment to integrating cutting-edge technology into its automotive landscape. Additionally, BMW Group (Germany) is expanding its lineup with LiDAR-equipped models to enhance autonomous capabilities; for instance, in January 2024, Innoviz demonstrated the BMW i7, which features InnovizOne LiDAR for Level 3 driving. As Germany continues to prioritize innovation and safety in its automotive sector, it is well-positioned to maintain its leadership in the European automotive LiDAR market.

In-depth interviews were conducted with CEOs, marketing directors, other innovation and technology directors, and executives from various key organizations operating in this market.

- By Company Type: Tier I - 33%, Tier II - 43%, and Tier III - 24%

- By Designation: Directors - 28%, Managers - 53%, and Others - 19%

- By Region: Asia Pacific - 27%, North America - 42%, and Europe - 31%

The automotive LiDAR market is dominated by major players, including RoboSense Technology Co., Ltd. (China), Hesai Group (China), Luminar Technologies, Inc. (US), Seyond (US), Huawei Technologies Co., Ltd. (China), Innoviz Technologies Ltd. (Israel), Valeo (France) and more. These companies are expanding their portfolios to strengthen their automotive LiDAR market position.

Research Coverage:

The report covers the automotive LiDAR market in terms of Technology (Mechanical LiDAR and Solid-state LiDAR), Image Type (2D and 3D), ICE Vehicle Type (Passenger Cars, Light Commercial Vehicles, and Heavy Commercial Vehicles), Location (Bumper & Grill, Headlight & Taillight, Roof & Upper Pillars, and Others), Electric Vehicle Type (Battery Electric Vehicles, Plug-in Hybrid Electric Vehicles, Fuel Cell Electric Vehicles, Hybrid Electric Vehicles), Range (Short and Mid-range (170m and Below) and Long range (Above 170m), Laser Wavelength (Near Infrared, Short-wave Infrared, and Long-wave Infrared), Measurement Process (Frequency Modulated Continuous Wave and Time of Flight), Level of Autonomy (Semi-autonomous and Autonomous), and Region. It covers the competitive landscape and company profiles of the significant automotive LiDAR market players.

The study also includes an in-depth competitive analysis of the key market players, their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report:

- The report will help market leaders/new entrants with information on the closest approximations of revenue numbers for the automotive LiDAR market and its subsegments.

- This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies.

- The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

- The report also helps stakeholders understand the current and future pricing trends of the automotive LiDAR market.

- The report will help market leaders/new entrants with information on various trends in LiDAR market based on range, image type, technology, and other parameters.

The report provides insight on the following pointers:

- Analysis of key drivers (LiDAR's technological edge to fuel market expansion, OEM focus on testing and deployment of vehicles with higher level of autonomy, Government regulations for integration of advanced safety technologies), restraints (Higher cost of LiDAR, Emergence of alternative technologies), opportunities (Rise of robotaxi and ride-hailing services, Commercial vehicle automation in logistics and transportation), and challenges (Fluctuating raw material prices and supply chain disruptions, Infrastructure Gaps Hinder growth in Emerging markets)

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the automotive LiDAR market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the automotive LiDAR market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the automotive LiDAR market.

- Competitive Assessment: In-depth assessment of market share, growth strategies, and service offerings of leading players like RoboSense Technology Co., Ltd. (China), Hesai Group (China), Luminar Technologies, Inc. (US), Seyond (US), Huawei Technologies Co., Ltd. (China), Innoviz Technologies Ltd. (Israel), and Valeo (France) among others in automotive LiDAR market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 UNIT CONSIDERED

- 1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviewees from demand and supply sides

- 2.1.2.2 Breakdown of primary interviews

- 2.1.2.3 Primary participants

- 2.1.2.4 Objectives of primary research

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 FACTOR ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AUTOMOTIVE LIDAR MARKET

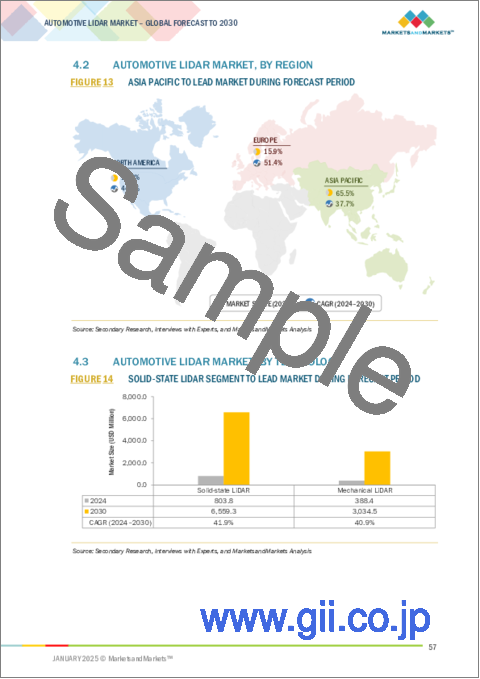

- 4.2 AUTOMOTIVE LIDAR MARKET, BY REGION

- 4.3 AUTOMOTIVE LIDAR MARKET, BY TECHNOLOGY

- 4.4 AUTOMOTIVE LIDAR MARKET, BY IMAGE TYPE

- 4.5 AUTOMOTIVE LIDAR MARKET, BY ICE VEHICLE TYPE

- 4.6 AUTOMOTIVE LIDAR MARKET, BY LOCATION

- 4.7 AUTOMOTIVE LIDAR MARKET, BY ELECTRIC VEHICLE TYPE

- 4.8 AUTOMOTIVE LIDAR MARKET, BY RANGE

- 4.9 AUTOMOTIVE LIDAR MARKET, BY LASER WAVELENGTH

- 4.10 AUTOMOTIVE LIDAR MARKET, BY MEASUREMENT PROCESS

- 4.11 AUTOMOTIVE LIDAR MARKET, BY LEVEL OF AUTONOMY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rapid advancements in LiDAR technology

- 5.2.1.2 Focus of OEMs on testing and deploying vehicles with high level of autonomy

- 5.2.1.3 Stringent government regulations for integrating advanced safety technologies

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of LiDAR

- 5.2.2.2 Emergence of alternative technologies

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rise of robotaxi and ride-hailing services

- 5.2.3.2 Automation of commercial vehicles

- 5.2.4 CHALLENGES

- 5.2.4.1 Fluctuating prices of raw materials and supply chain disruptions

- 5.2.4.2 Poor performance in challenging weather conditions

- 5.2.1 DRIVERS

- 5.3 TRENDS & DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE, BY KEY PLAYER, 2024

- 5.4.2 AVERAGE SELLING PRICE, BY ICE VEHICLE TYPE

- 5.4.3 AVERAGE SELLING PRICE, BY REGION

- 5.5 IMPACT OF AI ON AUTOMOTIVE LIDAR MARKET

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 VALUE CHAIN ANALYSIS

- 5.8 CASE STUDY ANALYSIS

- 5.8.1 TATA ELXSI LEVERAGED AI-POWERED LIDAR TECHNOLOGY TO ENHANCE VEHICLE DETECTION CAPABILITY IN AUTONOMOUS DRIVING SYSTEMS

- 5.8.2 IMERIT PROVIDED EXPERT LIDAR DATA ANNOTATION SERVICES, ENABLING AUTONOMOUS VEHICLE COMPANY TO LABEL AND SEGMENT 3D POINT CLOUD DATA

- 5.8.3 FORTERRA DEPLOYED OUSTER'S DIGITAL LIDAR SENSORS TO ENHANCE VISIBILITY AND NAVIGATION CAPABILITIES OF ITS AUTODRIVE PLATFORM

- 5.8.4 LUMINAR INTEGRATED ITS LIDAR TECHNOLOGY INTO ITS SOFTWARE TO HELP MANUFACTURERS ACCELERATE DEPLOYMENT OF AUTONOMOUS VEHICLES

- 5.8.5 AVANTIER HELPED AUTONOMOUS VEHICLE COMPANY DEVELOP COST-EFFICIENT AND HIGH-PERFORMANCE LIDAR SOLUTIONS

- 5.9 INVESTMENT AND FUNDING SCENARIO

- 5.10 PATENT ANALYSIS

- 5.11 TECHNOLOGY ANALYSIS

- 5.11.1 KEY TECHNOLOGIES

- 5.11.1.1 Frequency-modulated continuous wave (FMCW) LiDAR

- 5.11.1.2 4D LiDAR

- 5.11.2 COMPLEMENTARY TECHNOLOGIES

- 5.11.2.1 Sensor suite

- 5.11.2.2 Flash LiDAR technology

- 5.11.3 ADJACENT TECHNOLOGIES

- 5.11.3.1 Perception software

- 5.11.3.2 Simultaneous localization and mapping (SLAM)

- 5.11.3.3 Optical beam-steering

- 5.11.1 KEY TECHNOLOGIES

- 5.12 HS CODE

- 5.12.1 IMPORT SCENARIO

- 5.12.2 EXPORT SCENARIO

- 5.13 REGULATORY LANDSCAPE

- 5.13.1 REGULATIONS PERTAINING TO USAGE OF AUTONOMOUS VEHICLES, BY KEY COUNTRY

- 5.13.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14 KEY CONFERENCES & EVENTS, 2025-2026

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.16 BUYING CRITERIA

- 5.17 OEM ANALYSIS

- 5.17.1 INTEGRATION OF LIDAR SOLUTIONS INTO VEHICLES BY OEMS

- 5.17.2 INSTALLATION OF LIDAR SYSTEMS IN PASSENGER CARS

- 5.17.3 DESIGN WINS FOR KEY LIDAR COMPANIES

- 5.17.4 AUTOMOTIVE LIDAR MARKET: SUPPLIER ANALYSIS

6 AUTOMOTIVE LIDAR MARKET, BY ICE VEHICLE TYPE

- 6.1 INTRODUCTION

- 6.2 PASSENGER CAR

- 6.2.1 GROWING DEMAND FOR ADVANCED SAFETY FEATURES TO DRIVE MARKET

- 6.3 LIGHT COMMERCIAL VEHICLE (LCV)

- 6.3.1 RISING NEED FOR REAL-TIME OBSTACLE DETECTION IN LCVS TO BOOST MARKET

- 6.4 HEAVY COMMERCIAL VEHICLE (HCV)

- 6.4.1 ADVANCEMENTS IN TRUCK AUTOMATION TO FUEL MARKET GROWTH

- 6.5 INSIGHTS FROM INDUSTRY EXPERTS

7 AUTOMOTIVE LIDAR MARKET, BY ELECTRIC VEHICLE TYPE

- 7.1 INTRODUCTION

- 7.2 BATTERY ELECTRIC VEHICLE (BEV)

- 7.2.1 SHIFT TOWARD FULLY AUTOMATED DRIVING TECHNOLOGIES TO ACCELERATE NEED FOR RELIABLE LIDAR

- 7.3 FUEL CELL ELECTRIC VEHICLE (FCEV)

- 7.3.1 FOCUS OF OEMS ON ENHANCING SAFETY AND RELIABILITY IN CHALLENGING WEATHER CONDITIONS TO BOOST MARKET

- 7.4 PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV)

- 7.4.1 RISING DEMAND FOR HIGH LEVEL OF AUTONOMY IN VEHICLES TO FUEL GROWTH

- 7.5 HYBRID ELECTRIC VEHICLE (HEV)

- 7.5.1 NEED FOR IMPROVEMENT AND INNOVATION IN HEVS TO BOOST ADOPTION OF LIDAR TECHNOLOGY

- 7.6 INSIGHTS FROM INDUSTRY EXPERTS

8 AUTOMOTIVE LIDAR MARKET, BY IMAGE TYPE

- 8.1 INTRODUCTION

- 8.2 2D

- 8.2.1 EASE OF USE AND COST EFFICIENCY OF 2D LIDAR TO DRIVE GROWTH

- 8.3 3D

- 8.3.1 ADVANCEMENTS IN AUTONOMOUS DRIVING TECHNOLOGY TO DRIVE MARKET

- 8.4 INSIGHTS FROM INDUSTRY EXPERTS

9 AUTOMOTIVE LIDAR MARKET, BY LASER WAVELENGTH

- 9.1 INTRODUCTION

- 9.2 NEAR-INFRARED

- 9.2.1 COST EFFICIENCY OF NEAR-INFRARED LIDAR TO DRIVE MARKET GROWTH

- 9.3 SHORT-WAVE INFRARED

- 9.3.1 ABILITY OF SHORT-WAVE INFRARED LIDAR TO ENHANCE DETECTION IN CHALLENGING WEATHER CONDITIONS TO BOOST ITS POPULARITY

- 9.4 LONG-WAVE INFRARED

- 9.4.1 ABILITY OF LONG-WAVE INFRARED LIDAR TO PRODUCT HIGH-QUALITY IMAGES TO BOOST DEMAND

- 9.5 INSIGHTS FROM INDUSTRY EXPERTS

10 AUTOMOTIVE LIDAR MARKET, BY LEVEL OF AUTONOMY

- 10.1 INTRODUCTION

- 10.2 SEMI-AUTONOMOUS

- 10.2.1 STRINGENT REGULATIONS TO DRIVE INTEGRATION OF LIDAR TECHNOLOGY INTO SEMI-AUTONOMOUS VEHICLES

- 10.3 AUTONOMOUS

- 10.3.1 FOCUS ON ENHANCING OBJECT DETECTION USING 3D MAPPING TO BOOST MARKET

- 10.4 INSIGHTS FROM INDUSTRY EXPERTS

11 AUTOMOTIVE LIDAR MARKET, BY LOCATION

- 11.1 INTRODUCTION

- 11.2 BUMPER & GRILLE

- 11.2.1 INCREASING FOCUS OF OEMS ON ADAS FEATURES TO PROPEL MARKET

- 11.3 HEADLIGHT & TAILLIGHT

- 11.3.1 NEED FOR ENHANCED SAFETY IN VEHICLES TO BOOST MARKET

- 11.4 ROOF & UPPER PILLAR

- 11.4.1 DEMAND FOR LONG-RANGE OBJECT DETECTION SYSTEM TO SPUR DEMAND

- 11.5 OTHER LOCATIONS

- 11.6 INSIGHTS FROM INDUSTRY EXPERTS

12 AUTOMOTIVE LIDAR MARKET, BY MEASUREMENT PROCESS

- 12.1 INTRODUCTION

- 12.2 TIME OF FLIGHT (TOF)

- 12.3 FREQUENCY-MEASUREMENT CONTINUOUS WAVE (FMCW)

- 12.4 INSIGHTS FROM INDUSTRY EXPERTS

13 AUTOMOTIVE LIDAR MARKET, BY TECHNOLOGY

- 13.1 INTRODUCTION

- 13.2 MECHANICAL LIDAR

- 13.2.1 FOCUS ON INCREASING VEHICLE SAFETY TO DRIVE MARKET

- 13.3 SOLID-STATE LIDAR

- 13.3.1 NEED FOR INCREASED RELIABILITY AND DURABILITY TO DRIVE MARKET

- 13.3.1.1 Microelectromechanical system (MEMS) LiDAR

- 13.3.1.2 Flash LiDAR

- 13.3.1.3 Optical phased array (OPA) LiDAR

- 13.3.1.4 Others

- 13.3.1 NEED FOR INCREASED RELIABILITY AND DURABILITY TO DRIVE MARKET

- 13.4 INSIGHTS FROM INDUSTRY EXPERTS

14 AUTOMOTIVE LIDAR MARKET, BY RANGE

- 14.1 INTRODUCTION

- 14.2 SHORT- & MID-RANGE (170 METERS AND BELOW)

- 14.2.1 NEED FOR IMPROVED, ADVANCED DRIVER-ASSISTANCE CAPABILITY IN VEHICLES TO DRIVE MARKET

- 14.3 LONG-RANGE (ABOVE 170 METERS)

- 14.3.1 DEMAND FOR LIDAR SYSTEMS FEATURING ENHANCED CAPABILITIES TO BOOST MARKET

- 14.4 INSIGHTS FROM INDUSTRY EXPERTS

15 AUTOMOTIVE LIDAR MARKET, BY REGION

- 15.1 INTRODUCTION

- 15.2 ASIA PACIFIC

- 15.2.1 MACROECONOMIC OUTLOOK

- 15.2.2 CHINA

- 15.2.2.1 Increased production of passenger cars to drive growth

- 15.2.3 INDIA

- 15.2.3.1 Growing demand for vehicles equipped with ADASs to boost market

- 15.2.4 JAPAN

- 15.2.4.1 Technological advancements by prominent players to propel demand

- 15.2.5 SOUTH KOREA

- 15.2.5.1 Strategic collaboration between LiDAR manufacturers and OEMs to drive market

- 15.3 EUROPE

- 15.3.1 MACROECONOMIC OUTLOOK

- 15.3.2 GERMANY

- 15.3.2.1 Significant presence of prominent automakers and suppliers to drive market

- 15.3.3 FRANCE

- 15.3.3.1 Emphasis on autonomous transportation solutions and advanced mobility services to drive market

- 15.3.4 ITALY

- 15.3.4.1 Expansion of autonomous technologies in commercial vehicles to drive market

- 15.3.5 UK

- 15.3.5.1 Increased focus on cutting-edge innovation in autonomous mobility to drive growth

- 15.3.6 SPAIN

- 15.3.6.1 Government's push for improving road safety to drive market

- 15.4 NORTH AMERICA

- 15.4.1 MACROECONOMIC OUTLOOK

- 15.4.2 US

- 15.4.2.1 Presence of major players like Seyond and Luminar Technologies to drive popularity of LiDAR systems

- 15.4.3 CANADA

- 15.4.3.1 Surge in adoption of autonomous vehicles to drive market

16 COMPETITIVE LANDSCAPE

- 16.1 INTRODUCTION

- 16.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022-2024

- 16.3 REVENUE ANALYSIS

- 16.4 MARKET SHARE ANALYSIS

- 16.5 COMPANY VALUATION AND FINANCIAL METRICS

- 16.6 BRAND/PRODUCT COMPARISON

- 16.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 16.7.1 STARS

- 16.7.2 EMERGING LEADERS

- 16.7.3 PERVASIVE PLAYERS

- 16.7.4 PARTICIPANTS

- 16.7.5 COMPANY FOOTPRINT

- 16.7.5.1 Company footprint

- 16.7.5.2 Region footprint

- 16.7.5.3 Technology footprint

- 16.7.5.4 Image type footprint

- 16.7.5.5 Range footprint

- 16.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 16.8.1 PROGRESSIVE COMPANIES

- 16.8.2 RESPONSIVE COMPANIES

- 16.8.3 DYNAMIC COMPANIES

- 16.8.4 STARTING BLOCKS

- 16.8.5 COMPETITIVE BENCHMARKING

- 16.8.5.1 List of startups/SMEs

- 16.8.5.2 Competitive benchmarking of startups/SMEs

- 16.9 COMPETITIVE SCENARIO

- 16.9.1 PRODUCT LAUNCHES

- 16.9.2 DEALS

- 16.9.3 EXPANSION

- 16.9.4 OTHER DEVELOPMENTS

17 COMPANY PROFILES

- 17.1 KEY PLAYERS

- 17.1.1 FROBOSENSE

- 17.1.1.1 Business overview

- 17.1.1.2 Products/Solutions offered

- 17.1.1.3 Recent developments

- 17.1.1.4 MnM view

- 17.1.1.4.1 Key strengths

- 17.1.1.4.2 Strategic choices

- 17.1.1.4.3 Weaknesses and competitive threats

- 17.1.2 HESAI GROUP

- 17.1.2.1 Business overview

- 17.1.2.2 Products/Solutions offered

- 17.1.2.3 Recent developments

- 17.1.2.4 MnM view

- 17.1.2.4.1 Key strengths

- 17.1.2.4.2 Strategic choices

- 17.1.2.4.3 Weaknesses and competitive threats

- 17.1.3 LUMINAR TECHNOLOGIES, INC.

- 17.1.3.1 Business overview

- 17.1.3.2 Products/Solutions offered

- 17.1.3.3 Recent developments

- 17.1.3.4 MnM view

- 17.1.3.4.1 Key strengths

- 17.1.3.4.2 Strategic choices

- 17.1.3.4.3 Weaknesses and competitive threats

- 17.1.4 SEYOND

- 17.1.4.1 Business overview

- 17.1.4.2 Products/Solutions offered

- 17.1.4.3 Recent developments

- 17.1.4.4 MnM view

- 17.1.4.4.1 Key strengths

- 17.1.4.4.2 Strategic choices

- 17.1.4.4.3 Weaknesses and competitive threats

- 17.1.5 HUAWEI TECHNOLOGIES CO., LTD.

- 17.1.5.1 Business overview

- 17.1.5.2 Products/Solutions offered

- 17.1.5.3 Recent developments

- 17.1.5.4 MnM view

- 17.1.5.4.1 Key strengths

- 17.1.5.4.2 Strategic choices

- 17.1.5.4.3 Weaknesses and competitive threats

- 17.1.6 INNOVIZ TECHNOLOGIES LTD

- 17.1.6.1 Business overview

- 17.1.6.2 Products/Solutions offered

- 17.1.6.3 Recent developments

- 17.1.7 VALEO

- 17.1.7.1 Business overview

- 17.1.7.2 Products/Solutions offered

- 17.1.7.3 Recent developments

- 17.1.8 OUSTER INC.

- 17.1.8.1 Business overview

- 17.1.8.2 Products/Solutions offered

- 17.1.8.3 Recent developments

- 17.1.9 DENSO CORPORATION

- 17.1.9.1 Business overview

- 17.1.9.2 Products/Solutions offered

- 17.1.9.3 Recent developments

- 17.1.10 CONTINENTAL AG

- 17.1.10.1 Business overview

- 17.1.10.2 Products/Solutions offered

- 17.1.10.3 Recent developments

- 17.1.11 ZF FRIEDRICHSHAFEN AG

- 17.1.11.1 Business overview

- 17.1.11.2 Products/Solutions offered

- 17.1.11.3 Recent developments

- 17.1.12 APTIV

- 17.1.12.1 Business overview

- 17.1.12.2 Products/Solutions offered

- 17.1.12.3 Recent developments

- 17.1.13 MAGNA INTERNATIONAL INC.

- 17.1.13.1 Business overview

- 17.1.13.2 Products/Solutions offered

- 17.1.13.3 Recent developments

- 17.1.1 FROBOSENSE

- 17.2 OTHER PLAYERS

- 17.2.1 INFINEON TECHNOLOGIES AG

- 17.2.2 RENESAS ELECTRONICS CORPORATION

- 17.2.3 CEPTON, INC.

- 17.2.4 QUANERGY SOLUTIONS, INC.

- 17.2.5 MARELLI HOLDINGS CO., LTD.

- 17.2.6 AEVA INC.

- 17.2.7 BLICKFELD GMBH

- 17.2.8 AEYE, INC.

- 17.2.9 LIVOX

- 17.2.10 HEXAGON AB

18 RECOMMENDATIONS BY MARKETSANDMARKETS

- 18.1 ASIA PACIFIC TO BE LARGEST MARKET DURING FORECAST PERIOD

- 18.2 LONG-RANGE LIDAR SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- 18.3 PASSENGER CAR SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- 18.4 AI TO BE PIVOTAL IN INTEGRATION OF LIDAR INTO AUTONOMOUS VEHICLES

- 18.5 CONCLUSION

19 APPENDIX

- 19.1 INSIGHTS FROM INDUSTRY EXPERTS

- 19.2 DISCUSSION GUIDE

- 19.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 19.4 CUSTOMIZATION OPTIONS

- 19.4.1 AUTOMOTIVE LIDAR MARKET, BY LEVEL OF AUTONOMY, AT COUNTRY LEVEL

- 19.4.2 AUTOMOTIVE LIDAR MARKET, BY ELECTRIC VEHICLE TYPE, AT COUNTRY LEVEL

- 19.4.3 COMPANY INFORMATION

- 19.4.3.1 Profiling of additional market players (up to five)

- 19.5 RELATED REPORTS

- 19.6 AUTHOR DETAILS