|

|

市場調査レポート

商品コード

1632127

データセンターチップの世界市場:提供別 - 予測(~2030年)Data Center Chip Market by Offerings (GPU, CPU, FPGA, Trainium, Inferentia, T-head, Athena ASIC, MTIA, LPU, Memory (DRAM (HBM, DDR)), Network (NIC/Network Adapters, Interconnects)) - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| データセンターチップの世界市場:提供別 - 予測(~2030年) |

|

出版日: 2024年12月19日

発行: MarketsandMarkets

ページ情報: 英文 270 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のデータセンターチップの市場規模は、2025年の2,069億6,000万米ドルから2030年までに3,906億5,000万米ドルに達すると予測され、2025年~2030年にCAGRで13.5%の成長が見込まれます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2030年 |

| 基準年 | 2023年 |

| 予測期間 | 2025年~2030年 |

| 単位 | 10億米ドル |

| セグメント | コンポーネント、用途、データセンター規模、エンドユーザー、地域 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

データセンターの処理能力の拡大は、データセンターチップ市場の成長促進要因の1つです。より多くのデジタルサービスに対する需要の高まりに伴い、企業はより大きなデータを扱うようになり、新たな技術を採用しており、データセンターの処理能力に対する需要が増加しています。このような拡大は、データ集約型用途の普及、クラウドコンピューティングの誕生、IoTデバイスの増加、データに基づく意思決定の増加の動向から生じています。

用途別では、生成AIが予測期間にもっとも高いCAGRで成長する見込みです。

データセンターチップ市場は、GPT-4、DALL-E、Stable Diffusionなどの生成モデルが産業全体で急速に採用されていることから、生成AIセグメントで高い成長率が見込まれています。これらのモデルはリアルタイムでテキスト、画像、動画などの高品質なコンテンツを生成するために大規模な計算能力を必要とします。コンテンツ作成、創薬、設計自動化などの用途への生成AIの展開により、さまざまな組織で高性能データセンターチップの需要が高まっています。NVIDIAやAMDのような企業は、生成モデルが必要とする並列処理需要に合わせて最適化された、高度に改良されたTensorコアを備えた特定のGPUの開発を続けています。CerebrasやGraphcoreのような、生成タスクに適合するように特別に設計されたカスタムAIアクセラレーターの市場の成長が、その急成長に拍車をかけています。生成AIモデルの先進の計算に対応し、レイテンシとエネルギー消費を削減する能力は、この市場の成長を加速させる主な要因です。

AIプロセッサーが予測期間にプロセッサー市場で最大の市場シェアを占める見込みです。

AIプロセッサーにはGPU、CPU、FPGAが含まれます。データセンターチップには主にCPUが搭載されており、データを処理するためのプロセス実行における計算作業の大半を担っているため、プロセッサーと呼ばれることも多いです。これらのプロセッサーは、算術演算や論理演算を実行し、コマンドに対して入出力演算を行い、データ内のその他のコンポーネントの活動を監督します。現在、最新の動向は、マルチコアプロセッサーの性能向上と、異なるタスクを同時に実行することによる消費電力の低減です。GPUは強力なプロセッサーで、複数のタスクを同時に処理できるため、機械学習、深層学習、データ解析などの複雑な計算の高速化に最適です。大量のデータや重い処理を必要とするタスクを高速化するため、大きなコンピューティング用途をより高速かつ効率的に実行することが可能になります。

当レポートでは、世界のデータセンターチップ市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- データセンターチップ市場の企業にとって魅力的な機会

- データセンターチップ市場:コンポーネント別

- 北米のデータセンターチップ市場:エンドユーザー別、国別

- データセンターチップ市場:データセンター規模別

- データセンターチップ市場:用途別

- データセンターチップ市場:国別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- 顧客ビジネスに影響を与える動向/混乱

- 価格分析

- 主要企業の参考価格:AIプロセッサー別(2023年)

- 平均販売価格の動向:地域別(2020年~2023年)

- バリューチェーン分析

- エコシステム分析

- 投資と資金調達のシナリオ

- 特許分析

- 貿易分析

- 輸入シナリオ(HSコード854231)

- 輸出シナリオ(HSコード854231)

- 関税と規制情勢

- 関税分析

- 規制機関、政府機関、その他の組織

- 標準

- 主な会議とイベント(2024年~2025年)

- ケーススタディ分析

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- データセンターチップ市場に対するAI/生成AIの影響

第6章 データセンターチップ市場:コンポーネント別

- イントロダクション

- プロセッサー

- メモリ

- ネットワーク

- センサー

- 電力管理

- アナログ・ミックスシグナルIC

第7章 データセンターチップ市場:データセンター規模別

- イントロダクション

- 小規模データセンター

- 中規模データセンター

- 大規模データセンター

第8章 データセンターチップ市場:用途別

- イントロダクション

- 生成AI

- 汎用コンピューティング

第9章 データセンターチップ市場:エンドユーザー別

- イントロダクション

- クラウドサービスプロバイダー

- 企業

- 政府機関

第10章 データセンターチップ市場:地域別

- イントロダクション

- 北米

- 北米のマクロ経済の見通し

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州のマクロ経済の見通し

- ドイツ

- 英国

- フランス

- その他の欧州

- アジア太平洋

- アジア太平洋のマクロ経済の見通し

- 中国

- 日本

- インド

- その他のアジア太平洋

- その他の地域

- その他の地域のマクロ経済の見通し

- 南米

- 中東・アフリカ

第11章 競合情勢

- 概要

- 主要参入企業の戦略/強み(2021年~2024年)

- 収益分析(2021年~2023年)

- 市場シェア分析(2023年)

- 企業の評価と財務指標(2024年)

- ブランド/製品の比較

- 企業の評価マトリクス:主要企業(2023年)

- 企業の評価マトリクス:スタートアップ/中小企業(2023年)

- 競合シナリオ

第12章 企業プロファイル

- 主要企業

- NVIDIA CORPORATION

- ADVANCED MICRO DEVICES, INC.

- INTEL CORPORATION

- SAMSUNG

- SK HYNIX INC.

- AMAZON WEB SERVICES, INC.

- MONOLITHIC POWER SYSTEMS, INC

- TEXAS INSTRUMENTS INCORPORATED

- MICRON TECHNOLOGY, INC.

- ANALOG DEVICES, INC.

- MICROSOFT

- その他の企業

- IMAGINATION TECHNOLOGIES

- GRAPHCORE

- CEREBRAS SYSTEMS INC.

- GROQ, INC.

- TESLA

- STMICROELECTRONICS

- SENSIRION AG

- AKCP

- BOSCH SENSORTEC GMBH

- RENESAS ELECTRONICS CORPORATION

- INFINEON TECHNOLOGIES AG

- DIODES INCORPORATED

- MICROCHIP TECHNOLOGY INC.

- HUAWEI TECHNOLOGIES CO., LTD.

- T-HEAD

- BLAIZE

- HAILO TECHNOLOGIES LTD

- KNERON, INC.

- TENSTORRENT

- TAALAS

- SAPEON INC.

- REBELLIONS INC.

第13章 付録

List of Tables

- TABLE 1 DATA CENTER CHIP MARKET: RESEARCH ASSUMPTIONS

- TABLE 2 DATA CENTER CHIP MARKET: RISK ANALYSIS

- TABLE 3 INDICATIVE PRICING OF AI PROCESSORS OFFERED BY KEY PLAYERS, BY TYPE, 2023 (USD)

- TABLE 4 INDICATIVE PRICING OF AI PROCESSORS, BY TYPE, 2020-2023 (USD)

- TABLE 5 ROLE OF COMPANIES IN DATA CENTER CHIP ECOSYSTEM

- TABLE 6 LIST OF MAJOR PATENTS, 2013-2024

- TABLE 7 IMPORT DATA FOR HS CODE 854231-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 8 EXPORT DATA FOR HS CODE 854231-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 9 MFN TARIFF FOR HS CODE 854231-COMPLIANT PRODUCTS EXPORTED BY CHINA, 2023

- TABLE 10 MFN TARIFF FOR HS CODE 854231-COMPLIANT PRODUCTS EXPORTED BY HONG KONG, 2023

- TABLE 11 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 LIST OF KEY CONFERENCES AND EVENTS, 2024-2025

- TABLE 16 PORTER'S FIVE FORCES ANALYSIS

- TABLE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS (%)

- TABLE 18 KEY BUYING CRITERIA FOR TOP THREE END USERS

- TABLE 19 DATA CENTER CHIP MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 20 DATA CENTER CHIP MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 21 DATA CENTER CHIP MARKET, BY SERVER SHIPMENT, 2021-2024 (THOUSAND UNITS)

- TABLE 22 DATA CENTER CHIP MARKET, BY SERVER SHIPMENT, 2025-2030 (THOUSAND UNITS)

- TABLE 23 DATA CENTER CHIP MARKET, BY PROCESSOR, 2021-2024 (USD MILLION)

- TABLE 24 DATA CENTER CHIP MARKET, BY PROCESSOR, 2025-2030 (USD MILLION)

- TABLE 25 DATA CENTER CHIP MARKET, BY AI PROCESSOR, 2021-2024 (USD MILLION)

- TABLE 26 DATA CENTER CHIP MARKET, BY AI PROCESSOR, 2025-2030 (USD MILLION)

- TABLE 27 DATA CENTER CHIP MARKET, BY AI PROCESSOR, 2021-2024 (THOUSAND UNITS)

- TABLE 28 DATA CENTER CHIP MARKET, BY AI PROCESSOR, 2025-2030 (THOUSAND UNITS)

- TABLE 29 DATA CENTER CHIP MARKET, BY GENERAL-PURPOSE COMPUTING PROCESSOR, 2021-2024 (USD MILLION)

- TABLE 30 DATA CENTER CHIP MARKET, BY GENERAL-PURPOSE COMPUTING PROCESSOR, 2025-2030 (USD MILLION)

- TABLE 31 DATA CENTER CHIP MARKET, BY GENERAL-PURPOSE COMPUTING PROCESSOR, 2021-2024 (THOUSAND UNITS)

- TABLE 32 DATA CENTER CHIP MARKET, BY GENERAL-PURPOSE COMPUTING PROCESSOR, 2025-2030 (THOUSAND UNITS)

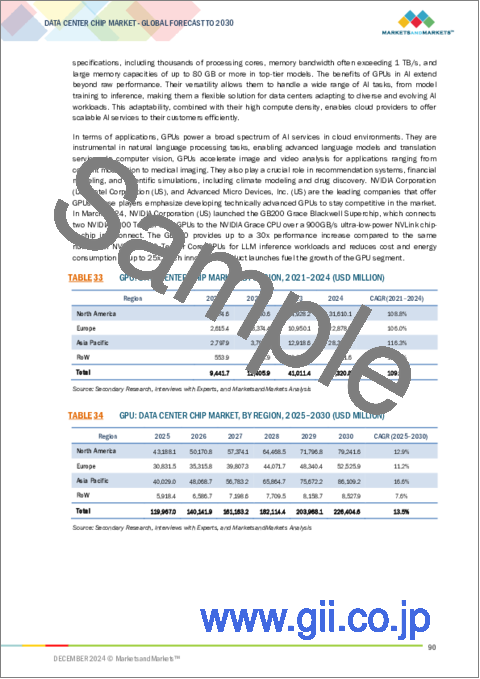

- TABLE 33 GPU: DATA CENTER CHIP MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 34 GPU: DATA CENTER CHIP MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 35 AI CPU: DATA CENTER CHIP MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 36 AI CPU: DATA CENTER CHIP MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 37 GENERAL-PURPOSE CPU: DATA CENTER CHIP MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 38 GENERAL-PURPOSE CPU: DATA CENTER CHIP MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 39 AI FPGA: DATA CENTER CHIP MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 40 AI FPGA: DATA CENTER CHIP MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 41 GENERAL-PURPOSE FPGA: DATA CENTER CHIP MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 42 GENERAL-PURPOSE FPGA: DATA CENTER CHIP MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 43 DATA CENTER CHIP MARKET, BY MEMORY, 2021-2024 (USD MILLION)

- TABLE 44 DATA CENTER CHIP MARKET, BY MEMORY, 2025-2030 (USD MILLION)

- TABLE 45 DATA CENTER CHIP MARKET, BY MEMORY, 2021-2024 (PETABYTE)

- TABLE 46 DATA CENTER CHIP MARKET, BY MEMORY, 2025-2030 (PETABYTE)

- TABLE 47 MEMORY: DATA CENTER CHIP MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 48 MEMORY: DATA CENTER CHIP MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 49 DATA CENTER CHIP MARKET, BY NETWORK, 2021-2024 (USD MILLION)

- TABLE 50 DATA CENTER CHIP MARKET, BY NETWORK, 2025-2030 (USD MILLION)

- TABLE 51 DATA CENTER CHIP MARKET, BY NETWORK, 2021-2024 (THOUSAND UNITS)

- TABLE 52 DATA CENTER CHIP MARKET, BY NETWORK, 2025-2030 (THOUSAND UNITS)

- TABLE 53 NETWORK: DATA CENTER CHIP MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 54 NETWORK: DATA CENTER CHIP MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 55 NIC/NETWORK ADAPTERS: DATA CENTER CHIP MARKET FOR AI PROCESSOR, BY TYPE 2021-2024 (USD MILLION)

- TABLE 56 NIC/NETWORK ADAPTERS: DATA CENTER CHIP MARKET FOR AI PROCESSOR, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 57 NIC/NETWORK ADAPTERS: DATA CENTER CHIP MARKET FOR AI PROCESSOR, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 58 NIC/NETWORK ADAPTERS: DATA CENTER CHIP MARKET FOR AI PROCESSOR, BY TYPE, 2025-2030 (THOUSAND UNITS)

- TABLE 59 NIC/NETWORK ADAPTERS: DATA CENTER CHIP MARKET FOR GENERAL-PURPOSE COMPUTING PROCESSOR, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 60 NIC/NETWORK ADAPTERS: DATA CENTER CHIP MARKET FOR GENERAL-PURPOSE COMPUTING PROCESSOR, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 61 NIC/NETWORK ADAPTERS: DATA CENTER CHIP MARKET FOR GENERAL-PURPOSE COMPUTING PROCESSOR, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 62 NIC/NETWORK ADAPTERS: DATA CENTER CHIP MARKET FOR GENERAL-PURPOSE COMPUTING PROCESSOR, BY TYPE, 2025-2030 (THOUSAND UNITS)

- TABLE 63 DATA CENTER CHIP MARKET, BY SENSORS, 2021-2024 (USD MILLION)

- TABLE 64 DATA CENTER CHIP MARKET, BY SENSORS, 2025-2030 (USD MILLION)

- TABLE 65 DATA CENTER CHIP MARKET, BY SENSORS, 2021-2024 (THOUSAND UNITS)

- TABLE 66 DATA CENTER CHIP MARKET, BY SENSORS, 2025-2030 (THOUSAND UNITS)

- TABLE 67 SENSORS: DATA CENTER CHIP MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 68 SENSORS: DATA CENTER CHIP MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 69 DATA CENTER CHIP MARKET, BY POWER MANAGEMENT, 2021-2024 (USD MILLION)

- TABLE 70 DATA CENTER CHIP MARKET, BY POWER MANAGEMENT, 2025-2030 (USD MILLION)

- TABLE 71 DATA CENTER CHIP MARKET, BY POWER MANAGEMENT, 2021-2024 (MILLION UNITS)

- TABLE 72 DATA CENTER CHIP MARKET, BY POWER MANAGEMENT, 2025-2030 (MILLION UNITS)

- TABLE 73 POWER MANAGEMENT: DATA CENTER CHIP MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 74 POWER MANAGEMENT: DATA CENTER CHIP MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 75 DATA CENTER CHIP MARKET, BY ANALOG & MIXED SIGNAL ICS, 2021-2024 (USD MILLION)

- TABLE 76 DATA CENTER CHIP MARKET, BY ANALOG & MIXED SIGNAL ICS, 2025-2030 (USD MILLION)

- TABLE 77 DATA CENTER CHIP MARKET, BY ANALOG & MIXED SIGNAL ICS, 2021-2024 (MILLION UNITS)

- TABLE 78 DATA CENTER CHIP MARKET, BY ANALOG & MIXED SIGNAL ICS, 2025-2030 (MILLION UNITS)

- TABLE 79 ANALOG & MIXED SIGNAL ICS: DATA CENTER CHIP MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 80 ANALOG & MIXED SIGNAL ICS: DATA CENTER CHIP MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 81 DATA CENTER CHIP MARKET, BY DATA CENTER SIZE, 2021-2024 (USD MILLION)

- TABLE 82 DATA CENTER CHIP MARKET, BY DATA CENTER SIZE, 2025-2030 (USD MILLION)

- TABLE 83 SMALL DATA CENTERS: DATA CENTER CHIP MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 84 SMALL DATA CENTERS: DATA CENTER CHIP MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 85 MEDIUM-SIZED DATA CENTERS: DATA CENTER CHIP MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 86 MEDIUM-SIZED DATA CENTERS: DATA CENTER CHIP MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 87 LARGE DATA CENTERS: DATA CENTER CHIP MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 88 LARGE DATA CENTERS: DATA CENTER CHIP MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 89 DATA CENTER CHIP MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 90 DATA CENTER CHIP MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 91 DATA CENTER CHIP MARKET, BY AI APPLICATION, 2021-2024 (USD MILLION)

- TABLE 92 DATA CENTER CHIP MARKET, BY AI APPLICATION, 2025-2030 (USD MILLION)

- TABLE 93 GENERATIVE AI: DATA CENTER CHIP MARKET, BY TECHNOLOGY 2021-2024 (USD MILLION)

- TABLE 94 GENERATIVE AI: DATA CENTER CHIP MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 95 DATA CENTER CHIP MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 96 DATA CENTER CHIP MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 97 CLOUD SERVICE PROVIDERS: DATA CENTER CHIP MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 98 CLOUD SERVICE PROVIDERS: DATA CENTER CHIP MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 99 ENTERPRISES: DATA CENTER CHIP MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 100 ENTERPRISES: DATA CENTER CHIP MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 101 HEALTHCARE: DATA CENTER CHIP MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 102 HEALTHCARE: DATA CENTER CHIP MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 103 BFSI: DATA CENTER CHIP MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 104 BFSI: DATA CENTER CHIP MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 105 AUTOMOTIVE: DATA CENTER CHIP MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 106 AUTOMOTIVE: DATA CENTER CHIP MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 107 RETAIL & E-COMMERCE: DATA CENTER CHIP MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 108 RETAIL & E-COMMERCE: DATA CENTER CHIP MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 109 MEDIA & ENTERTAINMENT: DATA CENTER CHIP MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 110 MEDIA & ENTERTAINMENT: DATA CENTER CHIP MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 111 OTHERS: DATA CENTER CHIP MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 112 OTHERS: DATA CENTER CHIP MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 113 GOVERNMENT ORGANIZATIONS: DATA CENTER CHIP MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 114 GOVERNMENT ORGANIZATIONS: DATA CENTER CHIP MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 115 DATA CENTER CHIP MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 116 DATA CENTER CHIP MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 117 NORTH AMERICA: DATA CENTER CHIP MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 118 NORTH AMERICA: DATA CENTER CHIP MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 119 NORTH AMERICA: DATA CENTER CHIP MARKET, BY DATA CENTER SIZE, 2021-2024 (USD MILLION)

- TABLE 120 NORTH AMERICA: DATA CENTER CHIP MARKET, BY DATA CENTER SIZE, 2025-2030 (USD MILLION)

- TABLE 121 NORTH AMERICA: DATA CENTER CHIP MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 122 NORTH AMERICA: DATA CENTER CHIP MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 123 NORTH AMERICA: DATA CENTER CHIP MARKET, BY ENTERPRISE TYPE, 2021-2024 (USD MILLION)

- TABLE 124 NORTH AMERICA: DATA CENTER CHIP MARKET, BY ENTERPRISE TYPE, 2025-2030 (USD MILLION)

- TABLE 125 NORTH AMERICA: DATA CENTER CHIP MARKET, BY AI PROCESSOR, 2021-2024 (USD MILLION)

- TABLE 126 NORTH AMERICA: DATA CENTER CHIP MARKET, BY AI PROCESSOR, 2025-2030 (USD MILLION)

- TABLE 127 NORTH AMERICA: DATA CENTER CHIP MARKET, BY GENERAL-PURPOSE COMPUTING PROCESSOR, 2021-2024 (USD MILLION)

- TABLE 128 NORTH AMERICA: DATA CENTER CHIP MARKET, BY GENERAL-PURPOSE COMPUTING PROCESSOR, 2025-2030 (USD MILLION)

- TABLE 129 EUROPE: DATA CENTER CHIP MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 130 EUROPE: DATA CENTER CHIP MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 131 EUROPE: DATA CENTER CHIP MARKET, BY DATA CENTER SIZE, 2021-2024 (USD MILLION)

- TABLE 132 EUROPE: DATA CENTER CHIP MARKET, BY DATA CENTER SIZE, 2025-2030 (USD MILLION)

- TABLE 133 EUROPE: DATA CENTER CHIP MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 134 EUROPE: DATA CENTER CHIP MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 135 EUROPE: DATA CENTER CHIP MARKET, BY ENTERPRISE TYPE, 2021-2024 (USD MILLION)

- TABLE 136 EUROPE: DATA CENTER CHIP MARKET, BY ENTERPRISE TYPE, 2025-2030 (USD MILLION)

- TABLE 137 EUROPE: DATA CENTER CHIP MARKET, BY AI PROCESSOR, 2021-2024 (USD MILLION)

- TABLE 138 EUROPE: DATA CENTER CHIP MARKET, BY AI PROCESSOR, 2025-2030 (USD MILLION)

- TABLE 139 EUROPE: DATA CENTER CHIP MARKET, BY GENERAL-PURPOSE COMPUTING PROCESSOR, 2021-2024 (USD MILLION)

- TABLE 140 EUROPE: DATA CENTER CHIP MARKET, BY GENERAL-PURPOSE COMPUTING PROCESSOR, 2025-2030 (USD MILLION)

- TABLE 141 ASIA PACIFIC: DATA CENTER CHIP MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 142 ASIA PACIFIC: DATA CENTER CHIP MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 143 ASIA PACIFIC: DATA CENTER CHIP MARKET, BY DATA CENTER SIZE, 2021-2024 (USD MILLION)

- TABLE 144 ASIA PACIFIC: DATA CENTER CHIP MARKET, BY DATA CENTER SIZE, 2025-2030 (USD MILLION)

- TABLE 145 ASIA PACIFIC: DATA CENTER CHIP MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 146 ASIA PACIFIC: DATA CENTER CHIP MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 147 ASIA PACIFIC: DATA CENTER CHIP MARKET, BY ENTERPRISE TYPE, 2021-2024 (USD MILLION)

- TABLE 148 ASIA PACIFIC: DATA CENTER CHIP MARKET, BY ENTERPRISE TYPE, 2025-2030 (USD MILLION)

- TABLE 149 ASIA PACIFIC: DATA CENTER CHIP MARKET, BY AI PROCESSOR, 2021-2024 (USD MILLION)

- TABLE 150 ASIA PACIFIC: DATA CENTER CHIP MARKET, BY AI PROCESSOR, 2025-2030 (USD MILLION)

- TABLE 151 ASIA PACIFIC: DATA CENTER CHIP MARKET, BY GENERAL-PURPOSE COMPUTING PROCESSOR, 2021-2024 (USD MILLION)

- TABLE 152 ASIA PACIFIC: DATA CENTER CHIP MARKET, BY GENERAL-PURPOSE COMPUTING PROCESSOR, 2025-2030 (USD MILLION)

- TABLE 153 ROW: DATA CENTER CHIP MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 154 ROW: DATA CENTER CHIP MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 155 MIDDLE EAST: DATA CENTER CHIP MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 156 MIDDLE EAST: DATA CENTER CHIP MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 157 ROW: DATA CENTER CHIP MARKET, BY DATA CENTER SIZE, 2021-2024 (USD MILLION)

- TABLE 158 ROW: DATA CENTER CHIP MARKET, BY DATA CENTER SIZE, 2025-2030 (USD MILLION)

- TABLE 159 MIDDLE EAST & AFRICA: DATA CENTER CHIP MARKET, BY DATA CENTER SIZE, 2021-2024 (USD MILLION)

- TABLE 160 MIDDLE EAST & AFRICA: DATA CENTER CHIP MARKET, BY DATA CENTER SIZE, 2025-2030 (USD MILLION)

- TABLE 161 SOUTH AMERICA: DATA CENTER CHIP MARKET, BY DATA CENTER SIZE, 2021-2024 (USD MILLION)

- TABLE 162 SOUTH AMERICA: DATA CENTER CHIP MARKET, BY DATA CENTER SIZE, 2025-2030 (USD MILLION)

- TABLE 163 ROW: DATA CENTER CHIP MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 164 ROW: DATA CENTER CHIP MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 165 ROW: DATA CENTER CHIP MARKET, BY ENTERPRISE TYPE, 2021-2024 (USD MILLION)

- TABLE 166 ROW: DATA CENTER CHIP MARKET, BY ENTERPRISE TYPE, 2025-2030 (USD MILLION)

- TABLE 167 ROW: DATA CENTER CHIP MARKET, BY AI PROCESSOR, 2021-2024 (USD MILLION)

- TABLE 168 ROW: DATA CENTER CHIP MARKET, BY AI PROCESSOR, 2025-2030 (USD MILLION)

- TABLE 169 ROW: DATA CENTER CHIP MARKET, BY GENERAL-PURPOSE COMPUTING PROCESSOR, 2021-2024 (USD MILLION)

- TABLE 170 ROW: DATA CENTER CHIP MARKET, BY GENERAL-PURPOSE COMPUTING PROCESSOR, 2025-2030 (USD MILLION)

- TABLE 171 DATA CENTER CHIP MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2021-2024

- TABLE 172 DATA CENTER CHIP MARKET FOR PROCESSORS: DEGREE OF COMPETITION

- TABLE 173 DATA CENTER CHIP MARKET: REGION FOOTPRINT

- TABLE 174 DATA CENTER CHIP MARKET: COMPONENT FOOTPRINT

- TABLE 175 DATA CENTER CHIP MARKET: END USER FOOTPRINT

- TABLE 176 DATA CENTER CHIP MARKET: APPLICATION FOOTPRINT

- TABLE 177 DATA CENTER CHIP MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 178 DATA CENTER CHIP MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 179 DATA CENTER CHIP MARKET: PRODUCT LAUNCHES, JANUARY 2021-NOVEMBER 2024

- TABLE 180 DATA CENTER CHIP MARKET: DEALS, JANUARY 2021-NOVEMBER 2024

- TABLE 181 DATA CENTER CHIP MARKET: OTHER DEVELOPMENTS, JANUARY 2021-NOVEMBER 2024

- TABLE 182 NVIDIA CORPORATION: COMPANY OVERVIEW

- TABLE 183 NVIDIA CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 184 NVIDIA CORPORATION: PRODUCT LAUNCHES

- TABLE 185 NVIDIA CORPORATION: DEALS

- TABLE 186 ADVANCED MICRO DEVICES, INC.: COMPANY OVERVIEW

- TABLE 187 ADVANCED MICRO DEVICES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 188 ADVANCED MICRO DEVICES, INC.: PRODUCT LAUNCHES

- TABLE 189 ADVANCED MICRO DEVICES, INC.: DEALS

- TABLE 190 INTEL CORPORATION: COMPANY OVERVIEW

- TABLE 191 INTEL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 192 INTEL CORPORATION: PRODUCT LAUNCHES

- TABLE 193 INTEL CORPORATION: DEALS

- TABLE 194 SAMSUNG: COMPANY OVERVIEW

- TABLE 195 SAMSUNG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 196 SAMSUNG: PRODUCT LAUNCHES

- TABLE 197 SAMSUNG: DEALS

- TABLE 198 SK HYNIX INC.: COMPANY OVERVIEW

- TABLE 199 SK HYNIX INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 200 SK HYNIX INC.: PRODUCT LAUNCHES

- TABLE 201 SK HYNIX INC.: DEALS

- TABLE 202 SK HYNIX INC.: OTHER DEVELOPMENTS

- TABLE 203 GOOGLE: COMPANY OVERVIEW

- TABLE 204 GOOGLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 205 GOOGLE: PRODUCT LAUNCHES

- TABLE 206 GOOGLE: DEALS

- TABLE 207 AMAZON WEB SERVICES, INC.: COMPANY OVERVIEW

- TABLE 208 AMAZON WEB SERVICES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 209 AMAZON WEB SERVICES, INC.: PRODUCT LAUNCHES

- TABLE 210 AMAZON WEB SERVICES, INC.: DEALS

- TABLE 211 MONOLITHIC POWER SYSTEMS, INC.: COMPANY OVERVIEW

- TABLE 212 MONOLITHIC POWER SYSTEMS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 213 MONOLITHIC POWER SYSTEMS, INC.: DEALS

- TABLE 214 TEXAS INSTRUMENTS INCORPORATED: COMPANY OVERVIEW

- TABLE 215 TEXAS INSTRUMENTS INCORPORATED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 216 TEXAS INSTRUMENTS INCORPORATED: OTHER DEVELOPMENTS

- TABLE 217 MICRON TECHNOLOGY, INC.: COMPANY OVERVIEW

- TABLE 218 MICRON TECHNOLOGY, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 219 MICRON TECHNOLOGY, INC.: PRODUCT LAUNCHES

- TABLE 220 MICRON TECHNOLOGY, INC.: DEALS

- TABLE 221 ANALOG DEVICES, INC.: COMPANY OVERVIEW

- TABLE 222 ANALOG DEVICES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 223 ANALOG DEVICES, INC.: EXPANSIONS

- TABLE 224 MICROSOFT: COMPANY OVERVIEW

- TABLE 225 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 226 MICROSOFT: PRODUCT LAUNCHES

- TABLE 227 MICROSOFT: DEALS

List of Figures

- FIGURE 1 DATA CENTER CHIP MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 DATA CENTER CHIP MARKET: RESEARCH FLOW

- FIGURE 3 DATA CENTER CHIP MARKET: RESEARCH DESIGN

- FIGURE 4 DATA CENTER CHIP MARKET SIZE ESTIMATION METHODOLOGY

- FIGURE 5 DATA CENTER CHIP MARKET: BOTTOM-UP APPROACH

- FIGURE 6 DATA CENTER CHIP MARKET: TOP-DOWN APPROACH

- FIGURE 7 DATA CENTER CHIP MARKET: DATA TRIANGULATION

- FIGURE 8 PROCESSORS TO ACCOUNT FOR LARGEST SHARE OF DATA CENTER CHIP MARKET DURING FORECAST PERIOD

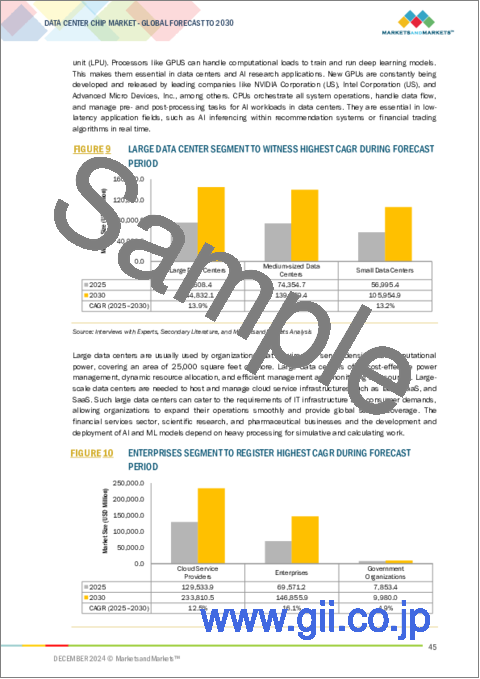

- FIGURE 9 LARGE DATA CENTER SEGMENT TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 10 ENTERPRISES SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 11 ASIA PACIFIC TO BE FASTEST-GROWING DATA CENTER CHIP MARKET DURING FORECAST PERIOD

- FIGURE 12 RISING DEMAND FOR AI-BASED PROCESSORS TO DRIVE MARKET GROWTH

- FIGURE 13 PROCESSORS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 14 US TO BE DOMINANT DATA CENTER CHIP MARKET IN NORTH AMERICA

- FIGURE 15 LARGE DATA CENTERS TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 16 AI TO BE DOMINANT APPLICATION OF DATA CENTER CHIP MARKET DURING FORECAST PERIOD

- FIGURE 17 CHINA TO EXHIBIT HIGHEST CAGR IN GLOBAL DATA CENTER CHIP MARKET DURING FORECAST PERIOD

- FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 IMPACT ANALYSIS: DRIVERS

- FIGURE 20 NUMBER OF DATA CENTERS GLOBALLY, 2023

- FIGURE 21 IMPACT ANALYSIS: RESTRAINTS

- FIGURE 22 IMPACT ANALYSIS: OPPORTUNITIES

- FIGURE 23 IMPACT ANALYSIS: CHALLENGES

- FIGURE 24 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 25 AVERAGE SELLING PRICE TREND OF GPU, BY REGION, 2020-2023

- FIGURE 26 AVERAGE SELLING PRICE TREND OF CPU, BY REGION, 2020-2023

- FIGURE 27 AVERAGE SELLING PRICE TREND OF FPGA, BY REGION, 2020-2023

- FIGURE 28 VALUE CHAIN ANALYSIS

- FIGURE 29 DATA CENTER CHIP ECOSYSTEM

- FIGURE 30 INVESTMENT AND FUNDING SCENARIO, 2020-2023

- FIGURE 31 PATENTS APPLIED AND GRANTED 2013-2024

- FIGURE 32 IMPORT DATA FOR HS CODE 854231-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2019-2023

- FIGURE 33 EXPORT DATA FOR HS CODE 854231-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2019-2023

- FIGURE 34 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 35 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- FIGURE 36 KEY BUYING CRITERIA FOR TOP THREE END USERS

- FIGURE 37 IMPACT OF AI/GEN AI ON DATA CENTER CHIP MARKET

- FIGURE 38 AI PROCESSOR SEGMENT TO HOLD LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 39 LARGE DATA CENTERS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 40 MACHINE LEARNING SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 41 CLOUD SERVICE PROVIDERS TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 42 CHINA TO EXHIBIT HIGHEST CAGR IN GLOBAL DATA CENTER CHIP MARKET DURING FORECAST PERIOD

- FIGURE 43 NORTH AMERICA: DATA CENTER CHIP MARKET SNAPSHOT

- FIGURE 44 EUROPE: DATA CENTER CHIP MARKET SNAPSHOT

- FIGURE 45 ASIA PACIFIC: DATA CENTER CHIP MARKET SNAPSHOT

- FIGURE 46 DATA CENTER CHIP MARKET: REVENUE ANALYSIS KEY PLAYERS, 2021-2023

- FIGURE 47 DATA CENTER CHIP MARKET SHARE FOR PROCESSORS, 2023

- FIGURE 48 COMPANY VALUATION, 2024

- FIGURE 49 FINANCIAL METRICS, 2024

- FIGURE 50 BRAND/PRODUCT COMPARISON

- FIGURE 51 DATA CENTER CHIP MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 52 DATA CENTER CHIP MARKET: COMPANY FOOTPRINT

- FIGURE 53 DATA CENTER CHIP MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 54 NVIDIA CORPORATION: COMPANY SNAPSHOT

- FIGURE 55 ADVANCED MICRO DEVICES, INC.: COMPANY SNAPSHOT

- FIGURE 56 INTEL CORPORATION: COMPANY SNAPSHOT

- FIGURE 57 SAMSUNG: COMPANY SNAPSHOT

- FIGURE 58 SK HYNIX INC.: COMPANY SNAPSHOT

- FIGURE 59 GOOGLE: COMPANY SNAPSHOT

- FIGURE 60 MONOLITHIC POWER SYSTEMS, INC.: COMPANY SNAPSHOT

- FIGURE 61 TEXAS INSTRUMENTS INCORPORATED: COMPANY SNAPSHOT

- FIGURE 62 MICRON TECHNOLOGY, INC.: COMPANY SNAPSHOT

- FIGURE 63 ANALOG DEVICES, INC.: COMPANY SNAPSHOT

- FIGURE 64 MICROSOFT: COMPANY SNAPSHOT

The global data center chip market is expected to grow from USD 206.96 billion in 2025 to USD 390.65 billion by 2030, growing at a CAGR of 13.5% from 2025 to 2030.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2023 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Component, Application, Data Center Size, End User and Region |

| Regions covered | North America, Europe, APAC, RoW |

The expansion of data center capacity is one of the primary drivers of growth in the data center chip market. With the growing demand for more digital services, organizations handle more significant volumes of data and are adopting emerging technologies, increasing the demand for data center capacity. This expansion comes from the proliferation of data-intensive applications, the birth of cloud computing, the rise in the number of IoT devices, and the trend of increased data-based decisions.

Generative AI in the Application segment to grow with the highest CAGR during the forecast period

The data center chip market is expected to experience a high growth rate in the Generative AI segment due to the rapid adoption of generative models such as GPT-4, DALL-E and Stable Diffusion across industries. In real-time, these models require massive computational power to generate high-quality content, such as text, images, and videos. The deployment of Generative AI for applications such as content creation, drug discovery, and design automation increases the demand for high-performance data center chips in various organizations. Companies like NVIDIA and AMD continue developing specific GPUs with highly improved tensor cores optimized to suit the parallel processing demands that the generative model requires. The growth in the market for custom AI accelerators, specially designed to fit generative tasks, such as those of Cerebras and Graphcore, is fueling its rapid growth. The capability to deal with the high computation of Generative AI models in reducing latency and energy consumption is a key factor fueling the accelerated growth in this market.

The AI processor is expected to have the largest market share in the processor market during the forecast period.

AI processor includes GPU, CPU, and FPGAs. Data center chips primarily contain the central processing unit, often called processors, as they have most of the computation work in executing processes to process data. These processors perform arithmetic and logical operations, perform input/output operations on the commands, and supervise the activities among other components in the data. Currently, the modern trend is for multicore processors with improvements in performance and decreasing power consumption through the execution of different tasks at a given time. A GPU is a powerful processor, which can handle multiple tasks simultaneously, making them ideal for accelerating complex computations, including machine learning, deep learning, and data analysis. It accelerates tasks that require lots of data and heavy processing, thus making it possible to execute big computing applications faster and more efficiently.

North America is expected to have the second-largest market during the forecast period.

North America took the second-largest market share of data center chip market share in 2024. The presence of prominent technology firms and data center operators is driving the market across the North American region. The region hosts companies such as NVIDIA Corporation (US), Intel Corporation (US), Advanced Micro Devices, Inc. (AMD) (US), and Google (US). Cloud service providers include Amazon Web Services, Inc. (AWS) (US), Microsoft Azure (US), and Google Cloud (US). These data centers are further backed by AI infrastructure to provide real-time services worldwide. The region also hosts several startups set up in the area for delivering data center chips for data centers, which include SAPEON Inc. (US), Tenstorrent (Canada), Taalas (Canada), Kneron, Inc. (US), SambaNova Systems, Inc. (US). Many modern data centers in this region are equipped with state-of-the-art AI hardware. The presence of large-scale data centers and leading data center chip developers in the area are driving the market growth.

In determining and verifying the market size for several segments and subsegments gathered through secondary research, extensive primary interviews have been conducted with key officials in the data center chip market. Following is the breakup of the profiles of the primary participants for the report.

- By Company Type: Tier 1 - 40 %, Tier 2 - 40%, and Tier 3 - 20%

- By Designation: Directors -40%, Managers- 40%, and Others - 20%

- By Region: North America- 40%, Asia Pacific - 20%, Europe- 30%, and RoW - 10%

The report profiles key players in the data center chip market and analyzes their market shares. Players profiled in this report are NVIDIA Corporation (US), Advanced Micro Devices, Inc. (AMD) (US), Intel Corporation (US), Micron Technology, Inc. (US), Google (US), SK HYNIX INC. (South Korea), AWS (US), Samsung (South Korea), Texas Instruments Incorporated (US), Alibaba (China), Analog Devices (US), Monolithic Power Systems, Inc., (US), STMicroelectronics (Switzerland), Sensirion AG (Switzerland), Honeywell International, Inc. (US), AKCP(US), Bosch Sensortec (Germany), Renesas Electronic Corporation (Japan), Infineon (Germany), Diodes Incorporated (US), Imagination Technologies (UK), Graphcore (UK), Cisco Systems, Inc. (US), Dell Inc. (US), Huawei Technologies Co., Ltd. (China).

Research Coverage

The report defines, describes, and forecasts the data center chip market based on component, data Center size, application, end-user, and region. It provides detailed information regarding drivers, restraints, opportunities, and challenges influencing its growth. It also analyzes competitive developments such as product launches, acquisitions, expansions, contracts, partnerships, and actions carried out by the key players to grow in the market.

Reasons to Buy This Report

The report will help market leaders and new entrants with information on the closest approximations of the revenue numbers for the overall data center chip market and the subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Expansion of data center capacity, Surging demand for high data volumes and pressing need for fast and efficient data processing, Continuous advancement in machine learning and deep learning technologies, Rising focus on parallel computing in AI data center), restraints (Shortage of skilled professional, High cost associated with data center GPUs), opportunities (Emergence of sovereign AI, Emergence of FPGA-based Accelerator), and challenges (High energy consumption of data centers, Security concerns associated with data centers) influencing the growth of the data center chip market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the data center chip market

- Market Development: Comprehensive information about lucrative markets - the report analyses the data center chip market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the data center chip market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and offerings of leading players NVIDIA Corporation (US), Advanced Micro Devices, Inc. (US), Intel Corporation (US), Micron Technology, Inc. (US), SK HYNIX INC. (South Korea), among others in the data center chip market strategies.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 List of key secondary sources

- 2.1.2.2 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 Key data from primary sources

- 2.1.3.2 List of primary interview participants

- 2.1.3.3 Breakdown of primaries

- 2.1.3.4 Key industry insights

- 2.2 MARKET SIZE ESTIMATION METHODOLOGY

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to arrive at market size using bottom-up analysis (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to arrive at market size using top-down analysis (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN DATA CENTER CHIP MARKET

- 4.2 DATA CENTER CHIP MARKET, BY COMPONENT

- 4.3 DATA CENTER CHIP MARKET IN NORTH AMERICA, BY END USER AND COUNTRY

- 4.4 DATA CENTER CHIP MARKET, BY DATA CENTER SIZE

- 4.5 DATA CENTER CHIP MARKET, BY APPLICATION

- 4.6 DATA CENTER CHIP MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rapid expansion of data center capacity

- 5.2.1.2 Rising need for low-latency and high-throughput data processing

- 5.2.1.3 Increasing deployment of machine learning and deep learning technologies

- 5.2.1.4 Growing emphasis on parallel computing in AI data centers

- 5.2.2 RESTRAINTS

- 5.2.2.1 Shortage of skilled workforce

- 5.2.2.2 High costs of data center GPUs

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Emergence of sovereign AI

- 5.2.3.2 Increasing adoption of FPGA-based accelerators

- 5.2.4 CHALLENGES

- 5.2.4.1 High energy consumption in data centers

- 5.2.4.2 Security concerns associated with data center hardware components

- 5.2.1 DRIVERS

- 5.3 TECHNOLOGY ANALYSIS

- 5.3.1 KEY TECHNOLOGIES

- 5.3.1.1 Generative AI

- 5.3.2 COMPLEMENTARY TECHNOLOGIES

- 5.3.2.1 Data center power management and cooling systems

- 5.3.3 ADJACENT TECHNOLOGIES

- 5.3.3.1 Quantum AI

- 5.3.1 KEY TECHNOLOGIES

- 5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.5 PRICING ANALYSIS

- 5.5.1 INDICATIVE PRICING OF KEY PLAYERS, BY AI PROCESSOR, 2023

- 5.5.2 AVERAGE SELLING PRICE TREND, BY REGION, 2020-2023

- 5.6 VALUE CHAIN ANALYSIS

- 5.7 ECOSYSTEM ANALYSIS

- 5.8 INVESTMENT AND FUNDING SCENARIO

- 5.9 PATENT ANALYSIS

- 5.10 TRADE ANALYSIS

- 5.10.1 IMPORT SCENARIO (HS CODE 854231)

- 5.10.2 EXPORT SCENARIO (HS CODE 854231)

- 5.11 TARIFF AND REGULATORY LANDSCAPE

- 5.11.1 TARIFF ANALYSIS

- 5.11.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11.3 STANDARDS

- 5.11.3.1 US

- 5.11.3.2 Europe

- 5.11.3.3 China

- 5.11.3.4 Japan

- 5.12 KEY CONFERENCES AND EVENTS, 2024-2025

- 5.13 CASE STUDY ANALYSIS

- 5.13.1 STMICROELECTRONICS DEPLOYS AMD EPYC PROCESSORS TO ENHANCE R&D DATA CENTER PERFORMANCE

- 5.13.2 JOCDN ADOPTS AMD EPYC PROCESSORS TO IMPROVE BROADCAST VIDEO STREAMING CAPABILITIES

- 5.13.3 DBS BANK LEVERAGES DELL SERVERS POWERED BY AMD EPYC PROCESSORS TO TRANSFORM DATA CENTER INFRASTRUCTURE

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.14.2 BARGAINING POWER OF SUPPLIERS

- 5.14.3 BARGAINING POWER OF BUYERS

- 5.14.4 THREAT OF SUBSTITUTES

- 5.14.5 THREAT OF NEW ENTRANTS

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 IMPACT OF AI/GEN AI ON DATA CENTER CHIP MARKET

6 DATA CENTER CHIP MARKET, BY COMPONENT

- 6.1 INTRODUCTION

- 6.2 PROCESSORS

- 6.2.1 AI PROCESSOR

- 6.2.2 GENERAL-PURPOSE COMPUTING PROCESSOR

- 6.2.2.1 GPU

- 6.2.2.1.1 Ability to handle AI workloads and process vast data volumes to boost adoption

- 6.2.2.2 CPU

- 6.2.2.2.1 Rising demand for versatile and general-purpose AI processing to augment market growth

- 6.2.2.3 FPGA

- 6.2.2.3.1 Growing need for flexibility and customization for AI workloads to spur demand

- 6.2.2.4 DOJO & FSD

- 6.2.2.4.1 High demand for high-performance, energy-efficient AI processing in autonomous vehicles to fuel adoption

- 6.2.2.5 Trainium & Inferentia

- 6.2.2.5.1 Ability to train complex AI and deep learning models to drive adoption

- 6.2.2.6 Athena ASIC

- 6.2.2.6.1 Increasing need to handle complex NLP and language-based AI tasks to accelerate market growth

- 6.2.2.7 T-Head

- 6.2.2.7.1 Rising demand for customized, high-performance AI chips across Chinese data centers to stimulate market growth

- 6.2.2.8 MTIA

- 6.2.2.8.1 Meta's expansion into AR, VR, and Metaverse to fuel market growth

- 6.2.2.9 LPU

- 6.2.2.9.1 Increasing need to handle complex NLP and language-based AI tasks to accelerate market growth

- 6.2.2.10 Other ASIC

- 6.2.2.1 GPU

- 6.3 MEMORY

- 6.3.1 DDR

- 6.3.1.1 Rising adoption of AI-enabled CPUs in data centers to support market growth

- 6.3.2 HBM

- 6.3.2.1 Elevating need for high throughput in data-intensive AI tasks to fuel market growth

- 6.3.1 DDR

- 6.4 NETWORK

- 6.4.1 NIC/NETWORK ADAPTERS

- 6.4.1.1 InfiniBand

- 6.4.1.1.1 Growing utilization of HPC and AI models to minimize latency and maximize throughput to boost segmental growth

- 6.4.1.2 Ethernet

- 6.4.1.2.1 Rising demand for scalable and cost-effective networking solutions to propel growth

- 6.4.1.3 Others

- 6.4.1.1 InfiniBand

- 6.4.2 INTERCONNECTS

- 6.4.2.1 Growing complexity of AI models requiring high-bandwidth data paths to fuel demand

- 6.4.1 NIC/NETWORK ADAPTERS

- 6.5 SENSORS

- 6.5.1 TEMPERATURE SENSOR

- 6.5.1.1 Increased requirement for optimal operational efficiency to drive demand for temperature sensor

- 6.5.2 HUMIDITY SENSOR

- 6.5.2.1 Growing awareness of environmental factors driving adoption of humidity monitoring

- 6.5.3 AIRFLOW SENSOR

- 6.5.3.1 Increasing server racks to drive market for airflow sensor

- 6.5.4 OTHER SENSORS

- 6.5.1 TEMPERATURE SENSOR

- 6.6 POWER MANAGEMENT

- 6.6.1 MULTIPHASE CONTROLLER

- 6.6.1.1 Need to manage and optimize performance to drive segmental growth

- 6.6.2 POINT-OF-LOAD (POL) (DC/DC CONVERTER)

- 6.6.2.1 Increasing demand for energy efficiency and high-performance computing to fuel market growth

- 6.6.3 LOW DROPOUT (LDO)

- 6.6.3.1 Ability to maintain stable output voltage to drive demand

- 6.6.4 48V INTERMEDIATE BUS CONVERTER (IBC)

- 6.6.4.1 Helps ensure adequate supply of efficient power management

- 6.6.5 HOT SWAP CONTROLLER/EFUSE

- 6.6.5.1 Increasing demand for low latency in data centers to drive market for hot swap controller

- 6.6.6 POWER SEQUENCER

- 6.6.6.1 Helps regulate power-up sequence of different voltage rails

- 6.6.7 BASEBOARD MANAGEMENT CONTROLLER (BMC)

- 6.6.7.1 Increasing demand for remote monitoring and management of server hardware to drive market

- 6.6.1 MULTIPHASE CONTROLLER

- 6.7 ANALOG & MIXED-SIGNAL ICS

- 6.7.1 MULTICHANNEL ADC/DAC

- 6.7.1.1 Converters used to provide efficient control of data generated from various sensors

- 6.7.2 MULTICHANNEL ADC/DAC

- 6.7.2.1 Helps in high-speed data transfer among other components in data center chip

- 6.7.3 MUX

- 6.7.3.1 Helps in streaming between multiple data center server

- 6.7.4 CURRENT SENSOR AMPLIFIER

- 6.7.4.1 Necessity for monitoring power consumption to drive demand

- 6.7.5 SUPERVISORY ICS

- 6.7.5.1 Need for stabilization of power supply to fuel market growth

- 6.7.6 FAN CONTROLLER

- 6.7.6.1 Increasing scale and performance of data centers creating demand for fan controllers

- 6.7.7 CLOCK IC

- 6.7.7.1 Importance of stable high-speed data transfer to support market growth

- 6.7.1 MULTICHANNEL ADC/DAC

7 DATA CENTER CHIP MARKET, BY DATA CENTER SIZE

- 7.1 INTRODUCTION

- 7.2 SMALL DATA CENTERS

- 7.2.1 NEED FOR EDGE, COMPUTING, COST EFFICIENCY, SCALABILITY, AND RAPID DEPLOYMENT TO DRIVE MARKET

- 7.3 MEDIUM-SIZED DATA CENTERS

- 7.3.1 REDUNDANCY AND HIGH AVAILABILITY FEATURES TO DRIVE DEMAND

- 7.4 LARGE DATA CENTERS

- 7.4.1 NEED FOR MASSIVE DATA PROCESSING, CLOUD COMPUTING, SCALABILITY, AND HIGH AVAILABILITY TO DRIVE MARKET

8 DATA CENTER CHIP MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 GENERATIVE AI

- 8.2.1 RULE-BASED MODELS

- 8.2.1.1 Rising need to detect fraud in finance sector to propel market

- 8.2.2 STATISTICAL MODELS

- 8.2.2.1 Requirement to make accurate predictions from complex data structures to boost segmental growth

- 8.2.3 DEEP LEARNING

- 8.2.3.1 Ability to advance AI technologies to boost demand

- 8.2.4 GENERATIVE ADVERSARIAL NETWORKS (GAN)

- 8.2.4.1 Pressing needs to handle large-scale data to fuel segmental growth

- 8.2.5 AUTOENCODERS

- 8.2.5.1 Ability to compress and restructure data to ensure optimum storage space in data centers to stimulate demand

- 8.2.6 CONVOLUTIONAL NEURAL NETWORKS (CNNS)

- 8.2.6.1 Surging demand for realistic and high-quality images and videos to accelerate market growth

- 8.2.7 TRANSFORMER MODELS

- 8.2.7.1 Increasing utilization in image synthesis and captioning applications to foster segmental growth

- 8.2.8 MACHINE LEARNING

- 8.2.8.1 Rising use in image and speech recognition and predictive analytics to contribute to market growth

- 8.2.9 NATURAL LANGUAGE PROCESSING

- 8.2.9.1 Increasing need for real-time applications to support market growth

- 8.2.10 COMPUTER VISION

- 8.2.10.1 Escalating need for advanced processing capabilities to boost demand

- 8.2.1 RULE-BASED MODELS

- 8.3 GENERAL-PURPOSE COMPUTING

9 DATA CENTER CHIP MARKET, BY END USER

- 9.1 INTRODUCTION

- 9.2 CLOUD SERVICE PROVIDERS

- 9.2.1 SURGING AI WORKLOADS AND CLOUD ADOPTION TO STIMULATE MARKET GROWTH

- 9.3 ENTERPRISES

- 9.3.1 ESCALATING USE OF NLP, IMAGE RECOGNITION, AND PREDICTIVE ANALYTICS TO CREATE GROWTH OPPORTUNITIES

- 9.3.2 HEALTHCARE

- 9.3.2.1 Integration of AI in computer-aided drug discovery and development to foster market growth

- 9.3.3 BFSI

- 9.3.3.1 Surging need for fraud detection in financial institutions to boost demand

- 9.3.4 AUTOMOTIVE

- 9.3.4.1 Growing focus on safe and enhanced driving experiences to fuel demand

- 9.3.5 RETAIL & E-COMMERCE

- 9.3.5.1 Increasing use of chatbots and virtual assistants to offer improved customer services to drive market

- 9.3.6 MEDIA & ENTERTAINMENT

- 9.3.6.1 Real-time analysis of viewer preferences and demographic information to augment market growth

- 9.3.7 OTHERS

- 9.4 GOVERNMENT ORGANIZATIONS

- 9.4.1 FOCUS ON AUTOMATING ROUTINE TASKS AND EXTRACTING REAL-TIME INSIGHTS TO SUPPORT MARKET GROWTH

10 DATA CENTER CHIP MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 10.2.2 US

- 10.2.2.1 Rising demand for digital solutions to drive market

- 10.2.3 CANADA

- 10.2.3.1 Growing digital transformation and 5G services to support market growth

- 10.2.4 MEXICO

- 10.2.4.1 Government-led initiatives to ensure connectivity within urban centers to boost demand

- 10.3 EUROPE

- 10.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 10.3.2 GERMANY

- 10.3.2.1 Adoption of industry 4.0 and advancement in technology infrastructure to drive market

- 10.3.3 UK

- 10.3.3.1 Increasing adoption of data centers and HPC by various verticals to support market growth

- 10.3.4 FRANCE

- 10.3.4.1 Federal support to promote data center infrastructure to augment market growth

- 10.3.5 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 10.4.2 CHINA

- 10.4.2.1 Rising demand for high-speed data processing to accelerate market growth

- 10.4.3 JAPAN

- 10.4.3.1 Surge in adoption of data-intensive technologies like AI and IoT to drive market

- 10.4.4 INDIA

- 10.4.4.1 Government initiatives to boost AI infrastructure to foster market growth

- 10.4.5 REST OF ASIA PACIFIC

- 10.5 ROW

- 10.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 10.5.2 SOUTH AMERICA

- 10.5.2.1 Strong government support to develop network infrastructure to boost demand

- 10.5.3 MIDDLE EAST & AFRICA

- 10.5.3.1 GCC countries

- 10.5.3.2 Rest of Middle East & Africa

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYERS' STRATEGIES/RIGHT TO WIN, 2021-2024

- 11.3 REVENUE ANALYSIS, 2021-2023

- 11.4 MARKET SHARE ANALYSIS, 2023

- 11.5 COMPANY VALUATION AND FINANCIAL METRICS, 2024

- 11.6 BRAND/PRODUCT COMPARISON

- 11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- 11.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 11.7.5.1 Company footprint

- 11.7.5.2 Region footprint

- 11.7.5.3 Component footprint

- 11.7.5.4 End user footprint

- 11.7.5.5 Application footprint

- 11.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 DYNAMIC COMPANIES

- 11.8.4 STARTING BLOCKS

- 11.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 11.8.5.1 Detailed list of key startups/SMEs

- 11.8.5.2 Competitive benchmarking of key startups/SMEs

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES

- 11.9.2 DEALS

- 11.9.3 OTHER DEVELOPMENTS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 NVIDIA CORPORATION

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Product launches

- 12.1.1.3.2 Deals

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths/Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses/Competitive threats

- 12.1.2 ADVANCED MICRO DEVICES, INC.

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Product launches

- 12.1.2.3.2 Deals

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths/Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses/Competitive threats

- 12.1.3 INTEL CORPORATION

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Product launches

- 12.1.3.3.2 Deals

- 12.1.3.4 MnM view

- 12.1.3.4.1 Key strengths/Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses/Competitive threats

- 12.1.4 SAMSUNG

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Product launches

- 12.1.4.3.2 Deals

- 12.1.4.4 MnM view

- 12.1.4.4.1 Key strengths/Right to win

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses/Competitive threats

- 12.1.5 SK HYNIX INC.

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions/Services offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Product launches

- 12.1.5.3.2 Deals

- 12.1.5.3.3 Other developments

- 12.1.5.4 MnM view

- 12.1.5.4.1 Key strengths/Right to win

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses/Competitive threats

- 12.1.6 GOOGLE

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Product launches

- 12.1.6.3.2 Deals

- 12.1.7 AMAZON WEB SERVICES, INC.

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Product launches

- 12.1.7.3.2 Deals

- 12.1.8 MONOLITHIC POWER SYSTEMS, INC

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions/Services Offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Deals

- 12.1.9 TEXAS INSTRUMENTS INCORPORATED

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Other developments

- 12.1.10 MICRON TECHNOLOGY, INC.

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions/Services offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Product launches

- 12.1.10.3.2 Deals

- 12.1.11 ANALOG DEVICES, INC.

- 12.1.11.1 Business overview

- 12.1.11.2 Products/Solutions/Services offered

- 12.1.11.3 Recent developments

- 12.1.11.3.1 Expansions

- 12.1.12 MICROSOFT

- 12.1.12.1 Business overview

- 12.1.12.2 Products/Solutions/Services offered

- 12.1.12.3 Recent developments

- 12.1.12.3.1 Product launches

- 12.1.12.3.2 Deals

- 12.1.1 NVIDIA CORPORATION

- 12.2 OTHER PLAYERS

- 12.2.1 IMAGINATION TECHNOLOGIES

- 12.2.2 GRAPHCORE

- 12.2.3 CEREBRAS SYSTEMS INC.

- 12.2.4 GROQ, INC.

- 12.2.5 TESLA

- 12.2.6 STMICROELECTRONICS

- 12.2.7 SENSIRION AG

- 12.2.8 AKCP

- 12.2.9 BOSCH SENSORTEC GMBH

- 12.2.10 RENESAS ELECTRONICS CORPORATION

- 12.2.11 INFINEON TECHNOLOGIES AG

- 12.2.12 DIODES INCORPORATED

- 12.2.13 MICROCHIP TECHNOLOGY INC.

- 12.2.14 HUAWEI TECHNOLOGIES CO., LTD.

- 12.2.15 T-HEAD

- 12.2.16 BLAIZE

- 12.2.17 HAILO TECHNOLOGIES LTD

- 12.2.18 KNERON, INC.

- 12.2.19 TENSTORRENT

- 12.2.20 TAALAS

- 12.2.21 SAPEON INC.

- 12.2.22 REBELLIONS INC.

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS