|

|

市場調査レポート

商品コード

1630474

不動産管理の世界市場:オファリング別、地理的場所別、不動産タイプ別、エンドユーザー別、地域別 - 2030年までの予測Property Management Market by Software Type (Lease Management (Portfolio Management, Document Storage & Management, AI Lease Abstraction, Lease Accounting & Administration), Facility Management, Reporting & Analytics), End User - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 不動産管理の世界市場:オファリング別、地理的場所別、不動産タイプ別、エンドユーザー別、地域別 - 2030年までの予測 |

|

出版日: 2024年12月20日

発行: MarketsandMarkets

ページ情報: 英文 355 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

不動産管理の市場規模は、2024年の264億9,000万米ドルから2030年には427億8,000万米ドルに達し、予測期間中にの8.3%のCAGRで拡大すると予測されています。

この市場を牽引しているのは、家賃回収とキャッシュフロー管理を強化する安全で自動化された決済システムへのシフトと、気候リスクの高まりに対応した災害対策、リスク評価、資産保護のためのテクノロジーの採用です。さらに、共同生活や共同作業スペースの需要の高まりから、独自の課題に対応するための管理手法も必要とされています。しかし、市場は、複雑で進化する規制や、物件の維持管理、修繕、人材派遣、技術投資にかかる多額のコストといった制約に直面しており、特に中小企業にとっては収益性を圧迫しています。さらに、迅速なメンテナンス、個別サービス、より良いアメニティに対するテナントの期待の高まりは、期待に応えられない場合、離職率の上昇、収入の減少、風評被害につながる可能性があります。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2019年~2030年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2030年 |

| 検討単位 | 米ドル(10億米ドル) |

| セグメント別 | オファリング別、地理的場所別、不動産タイプ別、エンドユーザー別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、中東・アフリカ、ラテンアメリカ |

プロフェッショナルサービスは、いくつかの要因から不動産管理市場で最大の市場シェアを占めるとみられています。第一に、YardiやRealPageのような組織は、包括的なオンボーディング、トレーニング、カスタマーサポートを提供し、顧客がソフトウェアへの投資を最大限に活用できるようにしています。第二に、不動産管理業務の複雑化に伴い、専門家によるコンサルティング・サービスが必要となり、不動産管理会社が法規制の遵守やテナントとの関係などの課題を解決できるよう支援しています。第三に、Appfolioのような企業は、専門的なサービスレベル契約(SLA)管理を提供し、一貫したサービス提供と顧客満足度の向上を実現しています。最後に、不動産オーナーが業務の最適化とコスト削減を追求する中で、専門サービスのアウトソーシングが戦略的な選択肢となり、こうした必要不可欠なサービスの需要がさらに高まっています。

不動産管理市場では、いくつかの重要な要因により、リース管理ソフトウェアが最も高い市場成長を遂げると予想されます。EntrataやRentec Directのような企業は、このニーズに合わせた包括的なリース管理ツールを提供しています。第二に、米国における会計基準編纂書842の施行などの規制変更により、企業はコンプライアンスを確保するために高度なリース管理システムを導入する必要があり、これらのプロセスを簡素化するソフトウェアの需要が高まっています。第三に、クラウドベースのソリューションへの動向の高まりは、アクルーエントのようなプロバイダーがクラウド統合型のリース管理オプションを提供することで、アクセス性と拡張性を高めています。最後に、自動化とAIの進歩がリース管理をより効率的にしています。

当レポートでは、世界の不動産管理市場について調査し、オファリング別、地理的場所別、不動産タイプ別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と業界動向

- イントロダクション

- 市場力学

- 不動産管理の進化

- サプライチェーン分析

- エコシステム分析

- 投資情勢と資金調達シナリオ

- 不動産管理市場における生成AIの役割

- ケーススタディ分析

- 技術分析

- 規制状況

- 特許分析

- 価格分析

- 2024年~2025年の主な会議とイベント

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- 顧客ビジネスに影響を与える動向/混乱

第6章 不動産管理市場、オファリング別

- イントロダクション

- ソフトウェア

- サービス

第7章 不動産管理市場、地理的場所別

- イントロダクション

- 都市部

- 郊外

- 地方

第8章 不動産管理市場、不動産タイプ別

- イントロダクション

- 商業

- 工業

- 住宅

- 政府・軍隊

- 別荘

- 複合利用

第9章 不動産管理市場、エンドユーザー別

- イントロダクション

- 不動産管理業者および不動産業者

- 不動産投資家/開発業者および所有者

- 住宅協会

- 政府機関

- テナント/居住者

- 施設管理者

- フランチャイズオペレーター

- 不動産管理会社

- その他

第10章 不動産管理市場、地域別

- イントロダクション

- 北米

- 促進要因:北米の不動産管理市場

- 北米:マクロ経済見通し

- 米国

- カナダ

- 欧州

- 促進要因:欧州の不動産管理市場

- 欧州:マクロ経済見通し

- 英国

- ドイツ

- フランス

- イタリア

- スペイン

- その他

- アジア太平洋

- 促進要因:アジア太平洋の不動産管理市場

- アジア太平洋:マクロ経済見通し

- 中国

- 日本

- インド

- 韓国

- オーストラリアとニュージーランド

- ASEAN諸国

- その他

- 中東・アフリカ

- 促進要因:中東・アフリカの不動産管理市場

- 中東・アフリカ:マクロ経済見通し

- 中東

- アフリカ

- ラテンアメリカ

- 促進要因:ラテンアメリカの不動産管理市場

- ラテンアメリカ:マクロ経済見通し

- ブラジル

- メキシコ

- アルゼンチン

- その他

第11章 競合情勢

- 概要

- 主要参入企業の戦略/強み、2021年~2024年

- 収益分析、2019年~2023年

- 市場シェア分析、2023年

- 製品比較

- 企業価値評価と財務指標

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2023年

- 競合シナリオ

第12章 企業プロファイル

- イントロダクション

- 主要参入企業

- ORACLE KEY PLAYERS

- IBM

- APPFOLIO

- SAP

- HITACHI VANTARA

- YARDI

- REALPAGE

- SS&C

- TRIMBLE

- EPTURA

- COSTAR GROUP

- その他の企業

- HEMLANE

- ENTRATA

- RENT MANAGER

- RENTEC DIRECT

- RE-LEASED

- DOORLOOP

- STESSA

- JLL

- MCS RENTAL SOFTWARE

- ACCRUENT

- PLANON

- GUESTY

- スタートアップ/中小企業

- HIVE

- AVAIL

- PROPERTY MATRIX

- HAPPYCO

- RESMAN

- INNAGO

- RENTREDI

- TURBOTENANT

- BREEZEWAY

- LIVLY

- SIMPLIFYEM

- CONDO CONTROL

- PAYHOA

第13章 隣接市場と関連市場

第14章 付録

List of Tables

- TABLE 1 USD EXCHANGE RATE, 2019-2023

- TABLE 2 KEY PARTICIPANTS IN INTERVIEWS WITH EXPERTS

- TABLE 3 FACTOR ANALYSIS

- TABLE 4 PROPERTY MANAGEMENT: RISK ANALYSIS

- TABLE 5 PROPERTY MANAGEMENT MARKET SIZE AND GROWTH RATE, 2019-2023 (USD MILLION, Y-O-Y %)

- TABLE 6 PROPERTY MANAGEMENT MARKET SIZE AND GROWTH RATE, 2024-2030 (USD MILLION, Y-O-Y %)

- TABLE 7 PROPERTY MANAGEMENT MARKET: ECOSYSTEM

- TABLE 8 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 PATENTS FILED, 2015-2024

- TABLE 14 LIST OF PATENTS IN PROPERTY MANAGEMENT MARKET, 2022-2024

- TABLE 15 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TOP THREE SOFTWARE TYPES

- TABLE 16 PRICING DATA OF PROPERTY MANAGEMENT, BY PROPERTY TYPE

- TABLE 17 PROPERTY MANAGEMENT MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2024-2025

- TABLE 18 IMPACT OF PORTER'S FIVE FORCES ON PROPERTY MANAGEMENT MARKET

- TABLE 19 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- TABLE 20 KEY BUYING CRITERIA FOR TOP THREE END USERS

- TABLE 21 PROPERTY MANAGEMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 22 PROPERTY MANAGEMENT MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 23 SOFTWARE: PROPERTY MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 24 SOFTWARE: PROPERTY MANAGEMENT MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 25 SOFTWARE: PROPERTY MANAGEMENT MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 26 SOFTWARE: PROPERTY MANAGEMENT MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 27 LEASE MANAGEMENT: PROPERTY MANAGEMENT MARKET, BY SOFTWARE TYPE, 2019-2023 (USD MILLION)

- TABLE 28 LEASE MANAGEMENT: PROPERTY MANAGEMENT MARKET, BY SOFTWARE TYPE, 2024-2030 (USD MILLION)

- TABLE 29 LEASE MANAGEMENT: PROPERTY MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 30 LEASE MANAGEMENT: PROPERTY MANAGEMENT MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 31 AI LEASE ABSTRACTION: PROPERTY MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 32 AI LEASE ABSTRACTION: PROPERTY MANAGEMENT MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 33 LEASE ACCOUNTING AND ADMINISTRATION: PROPERTY MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 34 LEASE ACCOUNTING AND ADMINISTRATION: PROPERTY MANAGEMENT MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 35 PORTFOLIO MANAGEMENT: PROPERTY MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 36 PORTFOLIO MANAGEMENT: PROPERTY MANAGEMENT MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 37 TENANT AND LEASE TRACKING: PROPERTY MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 38 TENANT AND LEASE TRACKING: PROPERTY MANAGEMENT MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 39 DOCUMENT STORAGE & MANAGEMENT: PROPERTY MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 40 DOCUMENT STORAGE & MANAGEMENT: PROPERTY MANAGEMENT MARKET, BY REGION, 2024-2030 (USD MILLION)

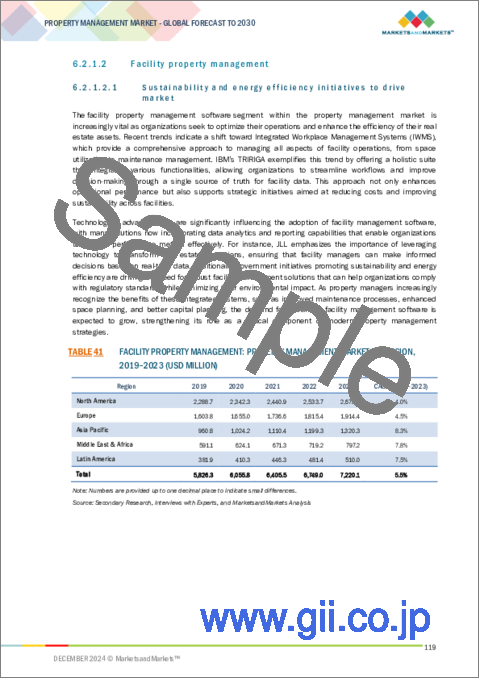

- TABLE 41 FACILITY PROPERTY MANAGEMENT: PROPERTY MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 42 FACILITY PROPERTY MANAGEMENT: PROPERTY MANAGEMENT MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 43 SECURITY & PAYMENTS: PROPERTY MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 44 SECURITY & PAYMENTS: PROPERTY MANAGEMENT MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 45 MARKETING & TENANT COMMUNICATION: PROPERTY MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 46 MARKETING & TENANT COMMUNICATION: PROPERTY MANAGEMENT MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 47 REPORTING & ANALYTICS: PROPERTY MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 48 REPORTING & ANALYTICS: PROPERTY MANAGEMENT MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 49 SOFTWARE: PROPERTY MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 50 SOFTWARE: PROPERTY MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2024-2030 (USD MILLION)

- TABLE 51 CLOUD: PROPERTY MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 52 CLOUD: PROPERTY MANAGEMENT MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 53 ON-PREMISES: PROPERTY MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 54 ON-PREMISES: PROPERTY MANAGEMENT MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 55 SOFTWARE: PROPERTY MANAGEMENT MARKET, BY CHANNEL MODE, 2019-2023 (USD MILLION)

- TABLE 56 SOFTWARE: PROPERTY MANAGEMENT MARKET, BY CHANNEL MODE, 2024-2030 (USD MILLION)

- TABLE 57 APP-BASED: PROPERTY MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 58 APP-BASED: PROPERTY MANAGEMENT MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 59 WEB-BASED: PROPERTY MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 60 WEB-BASED: PROPERTY MANAGEMENT MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 61 PROPERTY MANAGEMENT MARKET, BY SERVICES, 2019-2023 (USD MILLION)

- TABLE 62 PROPERTY MANAGEMENT MARKET, BY SERVICES, 2024-2030 (USD MILLION)

- TABLE 63 SERVICES: PROPERTY MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 64 SERVICES: PROPERTY MANAGEMENT MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 65 PROPERTY MANAGEMENT MARKET, BY PROFESSIONAL SERVICE TYPE, 2019-2023 (USD MILLION)

- TABLE 66 PROPERTY MANAGEMENT MARKET, BY PROFESSIONAL SERVICE TYPE, 2024-2030 (USD MILLION)

- TABLE 67 PROFESSIONAL SERVICES TYPE: PROPERTY MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 68 PROFESSIONAL SERVICES TYPE: PROPERTY MANAGEMENT MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 69 ONBOARDING: PROPERTY MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 70 ONBOARDING: PROPERTY MANAGEMENT MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 71 CUSTOMER SUPPORT: PROPERTY MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 72 CUSTOMER SUPPORT: PROPERTY MANAGEMENT MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 73 TRAINING & CONSULTING: PROPERTY MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 74 TRAINING & CONSULTING: PROPERTY MANAGEMENT MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 75 SLA MANAGEMENT: PROPERTY MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 76 SLA MANAGEMENT: PROPERTY MANAGEMENT MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 77 MANAGED SERVICES: PROPERTY MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 78 MANAGED SERVICES: PROPERTY MANAGEMENT MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 79 PROPERTY MANAGEMENT MARKET, BY GEOGRAPHIC LOCATION, 2019-2023 (USD MILLION)

- TABLE 80 PROPERTY MANAGEMENT MARKET, BY GEOGRAPHIC LOCATION, 2024-2030 (USD MILLION)

- TABLE 81 URBAN: PROPERTY MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 82 URBAN: PROPERTY MANAGEMENT MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 83 SUBURBAN: PROPERTY MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 84 SUBURBAN: PROPERTY MANAGEMENT MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 85 RURAL: PROPERTY MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 86 RURAL: PROPERTY MANAGEMENT MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 87 PROPERTY MANAGEMENT MARKET, BY PROPERTY TYPE, 2019-2023 (USD MILLION)

- TABLE 88 PROPERTY MANAGEMENT MARKET, BY PROPERTY TYPE, 2024-2030 (USD MILLION)

- TABLE 89 COMMERCIAL: PROPERTY MANAGEMENT MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 90 COMMERCIAL: PROPERTY MANAGEMENT MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 91 COMMERCIAL: PROPERTY MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 92 COMMERCIAL: PROPERTY MANAGEMENT MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 93 INDUSTRIAL: PROPERTY MANAGEMENT MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 94 INDUSTRIAL: PROPERTY MANAGEMENT MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 95 INDUSTRIAL: PROPERTY MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 96 INDUSTRIAL: PROPERTY MANAGEMENT MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 97 RESIDENTIAL: PROPERTY MANAGEMENT MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 98 RESIDENTIAL: PROPERTY MANAGEMENT MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 99 RESIDENTIAL: PROPERTY MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 100 RESIDENTIAL: PROPERTY MANAGEMENT MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 101 GOVERNMENT & MILITARY: PROPERTY MANAGEMENT MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 102 GOVERNMENT & MILITARY: PROPERTY MANAGEMENT MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 103 GOVERNMENT & MILITARY: PROPERTY MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 104 GOVERNMENT & MILITARY: PROPERTY MANAGEMENT MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 105 VACATION HOMES: PROPERTY MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 106 VACATION HOMES: PROPERTY MANAGEMENT MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 107 MIXED-USE: PROPERTY MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 108 MIXED-USE: PROPERTY MANAGEMENT MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 109 PROPERTY MANAGEMENT MARKET, BY END USER, 2019-2023 (USD MILLION)

- TABLE 110 PROPERTY MANAGEMENT MARKET, BY END USER, 2024-2030 (USD MILLION)

- TABLE 111 PROPERTY MANAGERS AND REAL ESTATE AGENTS: PROPERTY MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 112 PROPERTY MANAGERS AND REAL ESTATE AGENTS: PROPERTY MANAGEMENT MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 113 REAL ESTATE INVESTORS/DEVELOPERS AND OWNERS: PROPERTY MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 114 REAL ESTATE INVESTORS/DEVELOPERS AND OWNERS: PROPERTY MANAGEMENT MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 115 HOUSING ASSOCIATIONS: PROPERTY MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 116 HOUSING ASSOCIATIONS: PROPERTY MANAGEMENT MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 117 GOVERNMENT AGENCIES: PROPERTY MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 118 GOVERNMENT AGENCIES: PROPERTY MANAGEMENT MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 119 TENANTS/RESIDENTS: PROPERTY MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 120 TENANTS/RESIDENTS: PROPERTY MANAGEMENT MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 121 FACILITY MANAGERS: PROPERTY MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 122 FACILITY MANAGERS: PROPERTY MANAGEMENT MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 123 FRANCHISE OPERATORS: PROPERTY MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 124 FRANCHISE OPERATORS: PROPERTY MANAGEMENT MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 125 PROPERTY MANAGEMENT FIRMS: PROPERTY MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 126 PROPERTY MANAGEMENT FIRMS: PROPERTY MANAGEMENT MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 127 OTHER END USERS: PROPERTY MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 128 OTHER END USERS: PROPERTY MANAGEMENT MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 129 PROPERTY MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 130 PROPERTY MANAGEMENT MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 131 NORTH AMERICA: PROPERTY MANAGEMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 132 NORTH AMERICA: PROPERTY MANAGEMENT MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 133 NORTH AMERICA: PROPERTY MANAGEMENT MARKET, BY SOFTWARE TYPE, 2019-2023 (USD MILLION)

- TABLE 134 NORTH AMERICA: PROPERTY MANAGEMENT MARKET, BY SOFTWARE TYPE, 2024-2030 (USD MILLION)

- TABLE 135 NORTH AMERICA: PROPERTY MANAGEMENT MARKET, BY LEASE MANAGEMENT SOFTWARE TYPE, 2019-2023 (USD MILLION)

- TABLE 136 NORTH AMERICA: PROPERTY MANAGEMENT MARKET, BY LEASE MANAGEMENT SOFTWARE TYPE, 2024-2030 (USD MILLION)

- TABLE 137 NORTH AMERICA: PROPERTY MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 138 NORTH AMERICA: PROPERTY MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2024-2030 (USD MILLION)

- TABLE 139 NORTH AMERICA: PROPERTY MANAGEMENT MARKET, BY MODE OF CHANNEL, 2019-2023 (USD MILLION)

- TABLE 140 NORTH AMERICA: PROPERTY MANAGEMENT MARKET, BY MODE OF CHANNEL, 2024-2030 (USD MILLION)

- TABLE 141 NORTH AMERICA: PROPERTY MANAGEMENT MARKET, BY SERVICES, 2019-2023 (USD MILLION)

- TABLE 142 NORTH AMERICA: PROPERTY MANAGEMENT MARKET, BY SERVICES, 2024-2030 (USD MILLION)

- TABLE 143 NORTH AMERICA: PROPERTY MANAGEMENT MARKET, BY PROFESSIONAL SERVICES, 2019-2023 (USD MILLION)

- TABLE 144 NORTH AMERICA: PROPERTY MANAGEMENT MARKET, BY PROFESSIONAL SERVICES, 2024-2030 (USD MILLION)

- TABLE 145 NORTH AMERICA: PROPERTY MANAGEMENT MARKET, BY GEOGRAPHIC LOCATION, 2019-2023 (USD MILLION)

- TABLE 146 NORTH AMERICA: PROPERTY MANAGEMENT MARKET, BY GEOGRAPHIC LOCATION, 2024-2030 (USD MILLION)

- TABLE 147 NORTH AMERICA: PROPERTY MANAGEMENT MARKET, BY PROPERTY TYPE, 2019-2023 (USD MILLION)

- TABLE 148 NORTH AMERICA: PROPERTY MANAGEMENT MARKET, BY PROPERTY TYPE, 2024-2030 (USD MILLION)

- TABLE 149 NORTH AMERICA: PROPERTY MANAGEMENT MARKET, BY END USER, 2019-2023 (USD MILLION)

- TABLE 150 NORTH AMERICA: PROPERTY MANAGEMENT MARKET, BY END USER, 2024-2030 (USD MILLION)

- TABLE 151 NORTH AMERICA: PROPERTY MANAGEMENT MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 152 NORTH AMERICA: PROPERTY MANAGEMENT MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 153 EUROPE: PROPERTY MANAGEMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 154 EUROPE: PROPERTY MANAGEMENT MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 155 EUROPE: PROPERTY MANAGEMENT MARKET, BY SOFTWARE TYPE, 2019-2023 (USD MILLION)

- TABLE 156 EUROPE: PROPERTY MANAGEMENT MARKET, BY SOFTWARE TYPE, 2024-2030 (USD MILLION)

- TABLE 157 EUROPE: PROPERTY MANAGEMENT MARKET, BY LEASE MANAGEMENT SOFTWARE TYPE, 2019-2023 (USD MILLION)

- TABLE 158 EUROPE: PROPERTY MANAGEMENT MARKET, BY LEASE MANAGEMENT SOFTWARE TYPE, 2024-2030 (USD MILLION)

- TABLE 159 EUROPE: PROPERTY MANAGEMENT MARKET, BY SERVICES, 2019-2023 (USD MILLION)

- TABLE 160 EUROPE: PROPERTY MANAGEMENT MARKET, BY SERVICES, 2024-2030 (USD MILLION)

- TABLE 161 EUROPE: PROPERTY MANAGEMENT MARKET, BY PROFESSIONAL SERVICES, 2019-2023 (USD MILLION)

- TABLE 162 EUROPE: PROPERTY MANAGEMENT MARKET, BY PROFESSIONAL SERVICES, 2024-2030 (USD MILLION)

- TABLE 163 EUROPE: PROPERTY MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 164 EUROPE: PROPERTY MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2024-2030 (USD MILLION)

- TABLE 165 EUROPE: PROPERTY MANAGEMENT MARKET, BY CHANNEL MODE, 2019-2023 (USD MILLION)

- TABLE 166 EUROPE: PROPERTY MANAGEMENT MARKET, BY CHANNEL MODE, 2024-2030 (USD MILLION)

- TABLE 167 EUROPE: PROPERTY MANAGEMENT MARKET, BY GEOGRAPHIC LOCATION, 2019-2023 (USD MILLION)

- TABLE 168 EUROPE: PROPERTY MANAGEMENT MARKET, BY GEOGRAPHIC LOCATION, 2024-2030 (USD MILLION)

- TABLE 169 EUROPE: PROPERTY MANAGEMENT MARKET, BY PROPERTY TYPE, 2019-2023 (USD MILLION)

- TABLE 170 EUROPE: PROPERTY MANAGEMENT MARKET, BY PROPERTY TYPE, 2024-2030 (USD MILLION)

- TABLE 171 EUROPE: PROPERTY MANAGEMENT MARKET, BY END USER, 2019-2023 (USD MILLION)

- TABLE 172 EUROPE: PROPERTY MANAGEMENT MARKET, BY END USER, 2024-2030 (USD MILLION)

- TABLE 173 EUROPE: PROPERTY MANAGEMENT MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 174 EUROPE: PROPERTY MANAGEMENT MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 175 ASIA PACIFIC: PROPERTY MANAGEMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 176 ASIA PACIFIC: PROPERTY MANAGEMENT MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 177 ASIA PACIFIC: PROPERTY MANAGEMENT MARKET, BY SOFTWARE TYPE, 2019-2023 (USD MILLION)

- TABLE 178 ASIA PACIFIC: PROPERTY MANAGEMENT MARKET, BY SOFTWARE TYPE, 2024-2030 (USD MILLION)

- TABLE 179 ASIA PACIFIC: PROPERTY MANAGEMENT MARKET, BY LEASE MANAGEMENT TYPE, 2019-2023 (USD MILLION)

- TABLE 180 ASIA PACIFIC: PROPERTY MANAGEMENT MARKET, BY LEASE MANAGEMENT TYPE, 2024-2030 (USD MILLION)

- TABLE 181 ASIA PACIFIC: PROPERTY MANAGEMENT MARKET, BY SERVICES, 2019-2023 (USD MILLION)

- TABLE 182 ASIA PACIFIC: PROPERTY MANAGEMENT MARKET, BY SERVICES, 2024-2030 (USD MILLION)

- TABLE 183 ASIA PACIFIC: PROPERTY MANAGEMENT MARKET, BY PROFESSIONAL SERVICES, 2019-2023 (USD MILLION)

- TABLE 184 ASIA PACIFIC: PROPERTY MANAGEMENT MARKET, BY PROFESSIONAL SERVICES, 2024-2030 (USD MILLION)

- TABLE 185 ASIA PACIFIC: PROPERTY MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 186 ASIA PACIFIC: PROPERTY MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2024-2030 (USD MILLION)

- TABLE 187 ASIA PACIFIC: PROPERTY MANAGEMENT MARKET, BY CHANNEL MODE, 2019-2023 (USD MILLION)

- TABLE 188 ASIA PACIFIC: PROPERTY MANAGEMENT MARKET, BY CHANNEL MODE, 2024-2030 (USD MILLION)

- TABLE 189 ASIA PACIFIC: PROPERTY MANAGEMENT MARKET, BY GEOGRAPHIC LOCATION, 2019-2023 (USD MILLION)

- TABLE 190 ASIA PACIFIC: PROPERTY MANAGEMENT MARKET, BY GEOGRAPHIC LOCATION, 2024-2030 (USD MILLION)

- TABLE 191 ASIA PACIFIC: PROPERTY MANAGEMENT MARKET, BY PROPERTY TYPE, 2019-2023 (USD MILLION)

- TABLE 192 ASIA PACIFIC: PROPERTY MANAGEMENT MARKET, BY PROPERTY TYPE, 2024-2030 (USD MILLION)

- TABLE 193 ASIA PACIFIC: PROPERTY MANAGEMENT MARKET, BY END USER, 2019-2023 (USD MILLION)

- TABLE 194 ASIA PACIFIC: PROPERTY MANAGEMENT MARKET, BY END USER, 2024-2030 (USD MILLION)

- TABLE 195 ASIA PACIFIC: PROPERTY MANAGEMENT MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 196 ASIA PACIFIC: PROPERTY MANAGEMENT MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 197 MIDDLE EAST & AFRICA: PROPERTY MANAGEMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 198 MIDDLE EAST & AFRICA: PROPERTY MANAGEMENT MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 199 MIDDLE EAST & AFRICA: PROPERTY MANAGEMENT MARKET, BY SOFTWARE TYPE, 2019-2023 (USD MILLION)

- TABLE 200 MIDDLE EAST & AFRICA: PROPERTY MANAGEMENT MARKET, BY SOFTWARE TYPE, 2024-2030 (USD MILLION)

- TABLE 201 MIDDLE EAST & AFRICA: PROPERTY MANAGEMENT MARKET, BY LEASE MANAGEMENT TYPE, 2019-2023 (USD MILLION)

- TABLE 202 MIDDLE EAST & AFRICA: PROPERTY MANAGEMENT MARKET, BY LEASE MANAGEMENT TYPE, 2024-2030 (USD MILLION)

- TABLE 203 MIDDLE EAST & AFRICA: PROPERTY MANAGEMENT MARKET, BY SERVICES, 2019-2023 (USD MILLION)

- TABLE 204 MIDDLE EAST & AFRICA: PROPERTY MANAGEMENT MARKET, BY SERVICES, 2024-2030 (USD MILLION)

- TABLE 205 MIDDLE EAST & AFRICA: PROPERTY MANAGEMENT MARKET, BY PROFESSIONAL SERVICES, 2019-2023 (USD MILLION)

- TABLE 206 MIDDLE EAST & AFRICA: PROPERTY MANAGEMENT MARKET, BY PROFESSIONAL SERVICES, 2024-2030 (USD MILLION)

- TABLE 207 MIDDLE EAST & AFRICA: PROPERTY MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 208 MIDDLE EAST & AFRICA: PROPERTY MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2024-2030 (USD MILLION)

- TABLE 209 MIDDLE EAST & AFRICA: PROPERTY MANAGEMENT MARKET, BY CHANNEL MODE, 2019-2023 (USD MILLION)

- TABLE 210 MIDDLE EAST & AFRICA: PROPERTY MANAGEMENT MARKET, BY CHANNEL MODE, 2024-2030 (USD MILLION)

- TABLE 211 MIDDLE EAST & AFRICA: PROPERTY MANAGEMENT MARKET, BY GEOGRAPHIC LOCATION, 2019-2023 (USD MILLION)

- TABLE 212 MIDDLE EAST & AFRICA: PROPERTY MANAGEMENT MARKET, BY GEOGRAPHIC LOCATION, 2024-2030 (USD MILLION)

- TABLE 213 MIDDLE EAST & AFRICA: PROPERTY MANAGEMENT MARKET, BY PROPERTY TYPE, 2019-2023 (USD MILLION)

- TABLE 214 MIDDLE EAST & AFRICA: PROPERTY MANAGEMENT MARKET, BY PROPERTY TYPE, 2024-2030 (USD MILLION)

- TABLE 215 MIDDLE EAST & AFRICA: PROPERTY MANAGEMENT MARKET, BY END USER, 2019-2023 (USD MILLION)

- TABLE 216 MIDDLE EAST & AFRICA: PROPERTY MANAGEMENT MARKET, BY END USER, 2024-2030 (USD MILLION)

- TABLE 217 MIDDLE EAST & AFRICA: PROPERTY MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 218 MIDDLE EAST & AFRICA: PROPERTY MANAGEMENT MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 219 MIDDLE EAST: PROPERTY MANAGEMENT MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 220 MIDDLE EAST: PROPERTY MANAGEMENT MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 221 LATIN AMERICA: PROPERTY MANAGEMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 222 LATIN AMERICA: PROPERTY MANAGEMENT MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 223 LATIN AMERICA: PROPERTY MANAGEMENT MARKET, BY SOFTWARE TYPE, 2019-2023 (USD MILLION)

- TABLE 224 LATIN AMERICA: PROPERTY MANAGEMENT MARKET, BY SOFTWARE TYPE, 2024-2030 (USD MILLION)

- TABLE 225 LATIN AMERICA: PROPERTY MANAGEMENT MARKET, BY LEASE MANAGEMENT TYPE, 2019-2023 (USD MILLION)

- TABLE 226 LATIN AMERICA: PROPERTY MANAGEMENT MARKET, BY LEASE MANAGEMENT TYPE, 2024-2030 (USD MILLION)

- TABLE 227 LATIN AMERICA: PROPERTY MANAGEMENT MARKET, BY SERVICES, 2019-2023 (USD MILLION)

- TABLE 228 LATIN AMERICA: PROPERTY MANAGEMENT MARKET, BY SERVICES, 2024-2030 (USD MILLION)

- TABLE 229 LATIN AMERICA: PROPERTY MANAGEMENT MARKET, BY PROFESSIONAL SERVICES, 2019-2023 (USD MILLION)

- TABLE 230 LATIN AMERICA: PROPERTY MANAGEMENT MARKET, BY PROFESSIONAL SERVICES, 2024-2030 (USD MILLION)

- TABLE 231 LATIN AMERICA: PROPERTY MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 232 LATIN AMERICA: PROPERTY MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2024-2030 (USD MILLION)

- TABLE 233 LATIN AMERICA: PROPERTY MANAGEMENT MARKET, BY CHANNEL MODE, 2019-2023 (USD MILLION)

- TABLE 234 LATIN AMERICA: PROPERTY MANAGEMENT MARKET, BY CHANNEL MODE, 2024-2030 (USD MILLION)

- TABLE 235 LATIN AMERICA: PROPERTY MANAGEMENT MARKET, BY GEOGRAPHIC LOCATION, 2019-2023 (USD MILLION)

- TABLE 236 LATIN AMERICA: PROPERTY MANAGEMENT MARKET, BY GEOGRAPHIC LOCATION, 2024-2030 (USD MILLION)

- TABLE 237 LATIN AMERICA: PROPERTY MANAGEMENT MARKET, BY PROPERTY TYPE, 2019-2023 (USD MILLION)

- TABLE 238 LATIN AMERICA: PROPERTY MANAGEMENT MARKET, BY PROPERTY TYPE, 2024-2030 (USD MILLION)

- TABLE 239 LATIN AMERICA: PROPERTY MANAGEMENT MARKET, BY END USER, 2019-2023 (USD MILLION)

- TABLE 240 LATIN AMERICA: PROPERTY MANAGEMENT MARKET, BY END USER, 2024-2030 (USD MILLION)

- TABLE 241 LATIN AMERICA: PROPERTY MANAGEMENT MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 242 LATIN AMERICA: PROPERTY MANAGEMENT MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 243 OVERVIEW OF STRATEGIES ADOPTED BY KEY PROPERTY MANAGEMENT VENDORS, 2021-2024

- TABLE 244 PROPERTY MANAGEMENT MARKET: DEGREE OF COMPETITION

- TABLE 245 PROPERTY MANAGEMENT MARKET: REGION FOOTPRINT

- TABLE 246 PROPERTY MANAGEMENT MARKET: OFFERING FOOTPRINT

- TABLE 247 PROPERTY MANAGEMENT MARKET: PROPERTY TYPE FOOTPRINT

- TABLE 248 PROPERTY MANAGEMENT MARKET: END USER FOOTPRINT

- TABLE 249 PROPERTY MANAGEMENT MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 250 PROPERTY MANAGEMENT MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 251 PROPERTY MANAGEMENT MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS, JANUARY 2021-NOVEMBER 2024

- TABLE 252 PROPERTY MANAGEMENT MARKET: DEALS, JANUARY 2021-NOVEMBER 2024

- TABLE 253 ORACLE: COMPANY OVERVIEW

- TABLE 254 ORACLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 255 ORACLE: PRODUCT LAUNCHES AND ENHANCEMENTS, JANUARY 2021-NOVEMBER 2024

- TABLE 256 ORACLE: DEALS, JANUARY 2021-NOVEMBER 2024

- TABLE 257 IBM: COMPANY OVERVIEW

- TABLE 258 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 259 IBM: PRODUCT LAUNCHES AND ENHANCEMENTS, JANUARY 2021-NOVEMBER 2024

- TABLE 260 IBM: DEALS, JANUARY 2021-NOVEMBER 2024

- TABLE 261 APPFOLIO: COMPANY OVERVIEW

- TABLE 262 APPFOLIO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 263 APPFOLIO: PRODUCT LAUNCHES AND ENHANCEMENTS, JANUARY 2021-NOVEMBER 2024

- TABLE 264 APPFOLIO: DEALS, JANUARY 2021-NOVEMBER 2024

- TABLE 265 SAP: COMPANY OVERVIEW

- TABLE 266 SAP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 267 SAP: PRODUCT LAUNCHES AND ENHANCEMENTS, JANUARY 2021-NOVEMBER 2024

- TABLE 268 SAP: DEALS, JANUARY 2021-NOVEMBER 2024

- TABLE 269 HITACHI VANTARA: COMPANY OVERVIEW

- TABLE 270 HITACHI VANTARA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 271 HITACHI VANTARA: PRODUCT LAUNCHES AND ENHANCEMENTS, JANUARY 2021-NOVEMBER 2024

- TABLE 272 HITACHI VANTARA: DEALS, JANUARY 2021-NOVEMBER 2024

- TABLE 273 YARDI: COMPANY OVERVIEW

- TABLE 274 YARDI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 275 YARDI: PRODUCT LAUNCHES AND ENHANCEMENTS, JANUARY 2021-NOVEMBER 2024

- TABLE 276 YARDI: DEALS, JANUARY 2021-NOVEMBER 2024

- TABLE 277 REALPAGE: COMPANY OVERVIEW

- TABLE 278 REALPAGE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 279 REALPAGE: PRODUCT LAUNCHES AND ENHANCEMENTS, JANUARY 2021-NOVEMBER 2024

- TABLE 280 REALPAGE: DEALS, JANUARY 2021-NOVEMBER 2024

- TABLE 281 SS&C: COMPANY OVERVIEW

- TABLE 282 SS&C: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 283 SS&C: PRODUCT LAUNCHES AND ENHANCEMENTS, JANUARY 2021-NOVEMBER 2024

- TABLE 284 SS&C: DEALS, JANUARY 2021-NOVEMBER 2024

- TABLE 285 TRIMBLE: COMPANY OVERVIEW

- TABLE 286 TRIMBLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 287 TRIMBLE: PRODUCT LAUNCHES AND ENHANCEMENTS, JANUARY 2021-NOVEMBER 2024

- TABLE 288 TRIMBLE: DEALS, JANUARY 2021-NOVEMBER 2024

- TABLE 289 EPTURA: COMPANY OVERVIEW

- TABLE 290 EPTURA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 291 EPTURA: PRODUCT LAUNCHES AND ENHANCEMENTS, JANUARY 2021-NOVEMBER 2024

- TABLE 292 EPTURA: DEALS

- TABLE 293 COSTAR GROUP: COMPANY OVERVIEW

- TABLE 294 COSTAR GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 295 COSTAR GROUP: DEALS, JANUARY 2021-NOVEMBER 2024

- TABLE 296 HEMLANE: COMPANY OVERVIEW

- TABLE 297 ENTRATA: COMPANY OVERVIEW

- TABLE 298 RENT MANAGER: COMPANY OVERVIEW

- TABLE 299 RENTEC DIRECT: COMPANY OVERVIEW

- TABLE 300 RE-LEASED: COMPANY OVERVIEW

- TABLE 301 DOORLOOP: COMPANY OVERVIEW

- TABLE 302 STESSA: COMPANY OVERVIEW

- TABLE 303 JLL: COMPANY OVERVIEW

- TABLE 304 MCS RENTAL SOFTWARE: COMPANY OVERVIEW

- TABLE 305 ACCRUENT: COMPANY OVERVIEW

- TABLE 306 PLANON: COMPANY OVERVIEW

- TABLE 307 GUESTY: COMPANY OVERVIEW

- TABLE 308 FACILITY MANAGEMENT MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 309 FACILITY MANAGEMENT MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 310 FACILITY MANAGEMENT MARKET, BY SOLUTION, 2017-2022 (USD MILLION)

- TABLE 311 FACILITY MANAGEMENT MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 312 FACILITY MANAGEMENT MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 313 FACILITY MANAGEMENT MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 314 FACILITY MANAGEMENT MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 315 FACILITY MANAGEMENT MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 316 FACILITY MANAGEMENT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 317 FACILITY MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 318 IT OPERATIONS ANALYTICS MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 319 IT OPERATIONS ANALYTICS MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 320 IT OPERATIONS ANALYTICS MARKET, BY DATA SOURCE, 2019-2023 (USD MILLION)

- TABLE 321 IT OPERATIONS ANALYTICS MARKET, BY DATA SOURCE, 2024-2029 (USD MILLION)

- TABLE 322 IT OPERATIONS ANALYTICS MARKET, BY TECHNOLOGY, 2019-2023 (USD MILLION)

- TABLE 323 IT OPERATIONS ANALYTICS MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 324 IT OPERATIONS ANALYTICS MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 325 IT OPERATIONS ANALYTICS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 326 IT OPERATIONS ANALYTICS MARKET, BY END USER, 2019-2023 (USD MILLION)

- TABLE 327 IT OPERATIONS ANALYTICS MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 328 IT OPERATIONS ANALYTICS MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 329 IT OPERATIONS ANALYTICS MARKET, BY REGION, 2024-2029 (USD MILLION)

List of Figures

- FIGURE 1 PROPERTY MANAGEMENT MARKET: RESEARCH DESIGN

- FIGURE 2 PROPERTY MANAGEMENT MARKET: DATA TRIANGULATION

- FIGURE 3 TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1 (SUPPLY SIDE): REVENUE FROM PROPERTY MANAGEMENT PRODUCTS

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2, BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF ALL PROPERTY MANAGEMENT PRODUCTS

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 3, BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE FROM ALL PROPERTY MANAGEMENT PRODUCTS

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 4, BOTTOM-UP (DEMAND SIDE): SHARE OF PROPERTY MANAGEMENT MARKET THROUGH OVERALL PROPERTY MANAGEMENT SPENDING

- FIGURE 8 SOFTWARE SEGMENT ESTIMATED TO DOMINATE MARKET IN 2024

- FIGURE 9 FACILITY PROPERTY MANAGEMENT SOFTWARE SEGMENT ESTIMATED TO ACCOUNT FOR LARGEST MARKET SHARE IN 2024

- FIGURE 10 PORTFOLIO MANAGEMENT SOFTWARE SEGMENT ESTIMATED TO LEAD MARKET IN 2024

- FIGURE 11 PROFESSIONAL SERVICES SEGMENT ESTIMATED TO DOMINATE PROPERTY MANAGEMENT MARKET IN 2024

- FIGURE 12 ONBOARDING SERVICES SOFTWARE SEGMENT ESTIMATED TO ACCOUNT FOR LARGEST MARKET SHARE IN 2024

- FIGURE 13 CLOUD DEPLOYMENT MODE SEGMENT ESTIMATED TO DOMINATE PROPERTY MANAGEMENT MARKET IN 2024

- FIGURE 14 WEB-BASED MODE OF CHANNEL SEGMENT ESTIMATED TO ACCOUNT FOR LARGEST MARKET SHARE IN 2024

- FIGURE 15 URBAN GEOGRAPHIC LOCATION SEGMENT ESTIMATED TO DOMINATE MARKET IN 2024

- FIGURE 16 COMMERCIAL PROPERTY SEGMENT ESTIMATED TO LEAD PROPERTY MANAGEMENT MARKET IN 2024

- FIGURE 17 COMMERCIAL RETAIL SPACES SEGMENT ESTIMATED TO ACCOUNT FOR LARGEST MARKET SHARE IN 2024

- FIGURE 18 INDUSTRIAL CONSTRUCTION SITES SEGMENT ESTIMATED TO DOMINATE PROPERTY MANAGEMENT MARKET IN 2024

- FIGURE 19 RESIDENTIAL GATED COMMUNITIES SEGMENT ESTIMATED TO ACCOUNT FOR LARGEST MARKET SHARE IN 2024

- FIGURE 20 FEDERAL, STATE, & LOCAL GOVERNMENT OFFICE BUILDINGS SEGMENT ESTIMATED TO DOMINATE MARKET IN 2024

- FIGURE 21 PROPERTY MANAGERS & REAL ESTATE AGENTS SEGMENT TO ACCOUNT FOR LARGEST MARKET SIZE IN 2024

- FIGURE 22 ASIA PACIFIC TO GROW AT HIGHEST CAGR IN PROPERTY MANAGEMENT MARKET DURING FORECAST PERIOD

- FIGURE 23 LEVERAGING PREDICTIVE MAINTENANCE FOR PROACTIVE MAINTENANCE AND REPAIR MANAGEMENT TO DRIVE MARKET GROWTH

- FIGURE 24 RESIDENTIAL SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 25 SOFTWARE AND WEB-BASED SEGMENTS ESTIMATED TO ACCOUNT FOR LARGEST MARKET SHARES IN NORTH AMERICA IN 2024

- FIGURE 26 NORTH AMERICA ESTIMATED TO ACCOUNT FOR LARGEST MARKET SHARE IN 2024

- FIGURE 27 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN PROPERTY MANAGEMENT MARKET

- FIGURE 28 EVOLUTION OF PROPERTY MANAGEMENT

- FIGURE 29 PROPERTY MANAGEMENT MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 30 KEY PLAYERS IN PROPERTY MANAGEMENT MARKET ECOSYSTEM

- FIGURE 31 PROPERTY MANAGEMENT MARKET: INVESTMENT LANDSCAPE AND FUNDING SCENARIO

- FIGURE 32 MARKET POTENTIAL OF GENERATIVE AI IN VARIOUS PROPERTY MANAGEMENT USE CASES

- FIGURE 33 NUMBER OF PATENTS GRANTED IN LAST 10 YEARS, 2015-2024

- FIGURE 34 REGIONAL ANALYSIS OF PATENTS GRANTED, 2015-2024

- FIGURE 35 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TOP THREE SOFTWARE TYPES

- FIGURE 36 PROPERTY MANAGEMENT MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 37 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- FIGURE 38 KEY BUYING CRITERIA FOR TOP THREE END USERS

- FIGURE 39 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 40 SERVICES SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 41 LEASE MANAGEMENT SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST

- FIGURE 42 AI LEASE ABSTRACTION SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST

- FIGURE 43 CLOUD SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 44 APP-BASED SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 45 MANAGED SERVICES SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 46 SLA MANAGEMENT SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 47 SUBURBAN GEOGRAPHIC LOCATION SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 48 RESIDENTIAL SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 49 EDUCATIONAL INSTITUTES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 50 ENERGY & UTILITIES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 51 APARTMENTS SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 52 PUBLIC HOUSING AUTHORITY SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 53 GOVERNMENT AGENCIES SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 54 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 55 INDIA TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 56 NORTH AMERICA: PROPERTY MANAGEMENT MARKET SNAPSHOT

- FIGURE 57 ASIA PACIFIC: PROPERTY MANAGEMENT MARKET SNAPSHOT

- FIGURE 58 TOP FIVE PLAYERS DOMINATED MARKET OVER LAST FIVE YEARS

- FIGURE 59 SHARE OF LEADING COMPANIES IN PROPERTY MANAGEMENT MARKET, 2023

- FIGURE 60 PROPERTY MANAGEMENT MARKET: PRODUCT COMPARISON, BY OFFERING

- FIGURE 61 PROPERTY MANAGEMENT MARKET: BRAND/PRODUCT COMPARISON, BY PROPERTY TYPE

- FIGURE 62 PROPERTY MANAGEMENT MARKET: COMPANY VALUATION AND FINANCIAL METRICS OF KEY VENDORS

- FIGURE 63 PROPERTY MANAGEMENT MARKET: YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND FIVE-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 64 PROPERTY MANAGEMENT MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 65 PROPERTY MANAGEMENT MARKET: COMPANY FOOTPRINT

- FIGURE 66 PROPERTY MANAGEMENT MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 67 ORACLE: COMPANY SNAPSHOT

- FIGURE 68 IBM: COMPANY SNAPSHOT

- FIGURE 69 APPFOLIO: COMPANY SNAPSHOT

- FIGURE 70 SAP: COMPANY SNAPSHOT

- FIGURE 71 SS&C: COMPANY SNAPSHOT

- FIGURE 72 TRIMBLE: COMPANY SNAPSHOT

- FIGURE 73 COSTAR GROUP: COMPANY SNAPSHOT

The property management market is projected to grow from USD 26.49 billion in 2024 to USD 42.78 billion by 2030, at a compound annual growth rate (CAGR) of 8.3% during the forecast period. The market is driven by the shift towards secure, automated payment systems that enhance rent collection and cash flow management, as well as the adoption of technologies for disaster preparedness, risk assessment, and asset protection in response to rising climate risks. Additionally, the growing demand for shared living and working spaces requires tailored management approaches to address unique challenges. However, the market faces restrains such as complex and evolving regulations, significant costs for property maintenance, repairs, staffing, and technology investments, which strain profitability, especially for smaller firms. Moreover, rising tenant expectations for faster maintenance, personalized services, and better amenities can lead to higher turnover, reduced income, and reputational damage if expectations are unmet.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2030 |

| Base Year | 2023 |

| Forecast Period | 2024-2030 |

| Units Considered | USD (Billion) |

| Segments | By Offering, By Geographic Location, By Property Type, By End User. |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

"Professional services segment is expected to hold the largest market share during the forecast period"

Professional services are set to hold the largest market share in the property management market due to several factors. First, organizations like Yardi and RealPage provide comprehensive onboarding, training, and customer support, ensuring clients maximize their software investments. Second, the increasing complexity of property management tasks necessitates expert consulting services, helping property managers navigate challenges such as regulatory compliance and tenant relations. Third, companies like Appfolio offer specialized service-level agreement (SLA) management, ensuring consistent service delivery and enhancing client satisfaction. Lastly, as property owners seek to optimize operations and reduce costs, outsourcing professional services becomes a strategic choice, further driving demand for these essential offerings in the market.

"The Lease management software type will have the fastest growth rate during the forecast period"

Lease management software is expected to have the highest market growth in the property management market due to several key factors. First, the increasing complexity of lease agreements necessitates robust software solutions that can efficiently track terms, payments, and compliance; companies like Entrata and Rentec Direct provide comprehensive lease management tools tailored for this need. Second, regulatory changes, such as the implementation of ASC 842 in the U.S., require organizations to adopt sophisticated lease management systems to ensure compliance, driving demand for software that simplifies these processes. Third, the growing trend towards cloud-based solutions enhances accessibility and scalability, with providers like Accruent offering cloud-integrated lease management options. Lastly, advancements in automation and AI are making lease management more efficient.

"Asia Pacific's to witness rapid property management growth while North America to hold largest market share"

The Asia Pacific property management market is expected to experience the highest growth due to several factors. Rapid urbanization and population growth in countries like India and China are driving demand for residential and commercial properties, leading to increased need for effective property management services. Moreover, the region's real estate market is booming, with projections indicating significant investments in infrastructure and housing, creating opportunities for property managers. Third, the adoption of technology is accelerating, as firms seek efficient solutions for managing properties; for example, companies like Eptura are providing innovative software to streamline operations. In contrast, North America will maintain the largest market share, supported by a mature real estate sector and a strong demand for comprehensive property management solutions. The presence of major Real Estate Investment Trusts (REITs) facilitates substantial capital flows into property management, enhancing service demand. Established players like Yardi and RealPage solidifies their positions in this market by offering advanced software that enhances operational efficiency and tenant engagement.

Breakdown of primaries

In-depth interviews were conducted with Chief Executive Officers (CEOs), innovation and technology directors, system integrators, and executives from various key organizations operating in the property management market.

- By Company: Tier I - 30%, Tier II - 40%, and Tier III - 30%

- By Designation: C-Level Executives - 35%, D-Level Executives - 25%, and others - 40%

- By Region: North America - 30%, Europe - 25%, Asia Pacific - 35%, Middle East & Africa - 5%, and Latin America - 5%

The report includes the study of key players offering property management solutions and services. It profiles major vendors in the property management market. The major players in the property management market include Oracle (US), IBM (US), Appfolio (US), SAP (Germany), Hitachi Vantara (US), Yardi (US), RealPage (US), SS&C (US), Trimble (US), Eptura (US), Costar Group (US), Hemlane (US), Entrata (US), Rent Manager (US), Rentec Direct (US), Re-leased (UK), Doorlop (US), Stessa (US), JLL (US), MCS Rental Software (UK), Accruent (US), Planon (Netherlands), Guesty (Israel), Hive (Germany), Avail (Sweden), Property Matrix (US), HappyCo (US), Resman (US), Innago (US), Finquery (US), Rentredi (US), Turbotenant (US), Breezeway (US), Livly (US), Simplifyem (US), Condo Control (US) and PayHOA (US).

Research coverage

This research report categorizes the property management market By Offering (Software by Type (Lease Management, Facility Management, Security & Payments, Marketing & Tenant Communication and Reporting & Analytics), software by deployment mode (cloud and on-premises) and software by Mode of Channel (App Based and Web-Based), By Services (Professional Services (Onboarding, Customer Support, Training & Consulting, SLA Management and Others), and Managed Services)), By Geographical Location (Urban, Suburban and Rural), By property Type (Commercial, Industrial, Residential, Government & Military, Vacational Homes and Mixed-use), By end user (Property Managers and Real Estate Agents, Real Estate Investors/Developers and Owners, Housing Associations, Government Agencies, Tenants/Residents, Facility Managers, Franchise Operators, Property Management Firms and Others), and By Region (North America, Europe, Asia Pacific, Middle East & Africa, and Latin America). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the property management market. A detailed analysis of the key industry players has been done to provide insights into their business overview, products, and services; key strategies; contracts, partnerships, agreements, new product & service launches, mergers and acquisitions, and recent developments associated with the property management market. Competitive analysis of upcoming startups in the property management market ecosystem is covered in this report.

Key Benefits of Buying the Report

The report would provide the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall property management market and its subsegments. It would help stakeholders understand the competitive landscape and gain more insights better to position their business and plan suitable go-to-market strategies. It also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (leveraging predictive analytics for proactive maintenance and repair management, smart building management with iot and ai for energy-efficiency and sustainability and increasing demand for saas-based property management solutions for better scalability), restraints (financial limitations encompass broader spectrum of risks and compliance risks in property laws, tenant rights, eviction procedures, and data privacy regulations), opportunities (revolutionizing property descriptions, lease agreements, and tenant communication with generative ai and advent of AR/VR technologies for better efficiency and immersive buyer experience), and challenges (ensuring data security in software implementation and bias in AI and risks of poor training leading to reputational and legal issues).

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the property management market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the property management market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the property management market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like Oracle (US), IBM (US), Appfolio (US), SAP (Germany), Hitachi Vantara (US), Yardi (US), RealPage (US), SS&C (US), Trimble (US), Eptura (US), Costar Group (US), Hemlane (US), Entrata (US), Rent Manager (US), Rentec Direct (US), Re-leased (UK), Doorlop (US), Stessa (US), JLL (US), MCS Rental Software (UK), Accruent (US), Planon (Netherlands), Guesty (Israel), Hive (Germany), Avail (Sweden), Property Matrix (US), HappyCo (US), Resman (US), Innago (US), Finquery (US), Rentredi (US), Turbotenant (US), Breezeway (US), Livly (US), Simplifyem (US), Condo Control (US) and PayHOA (US), among others in the property management market. The report also helps stakeholders understand the pulse of the property management market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of interviews with experts

- 2.1.2.2 Key industry insights

- 2.2 DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- 2.4 MARKET FORECAST

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RISK ANALYSIS

- 2.7 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN PROPERTY MANAGEMENT MARKET

- 4.2 PROPERTY MANAGEMENT MARKET: TOP THREE PROPERTY TYPES

- 4.3 NORTH AMERICA: PROPERTY MANAGEMENT MARKET, BY OFFERING AND CHANNEL MODE

- 4.4 PROPERTY MANAGEMENT MARKET, BY REGION

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Leveraging predictive analytics for proactive maintenance and repair management

- 5.2.1.2 Smart building management with IoT and AI for energy-efficiency and sustainability

- 5.2.1.3 Increasing demand for SaaS-based property management solutions for better scalability

- 5.2.2 RESTRAINTS

- 5.2.2.1 Financial limitations encompass broader spectrum of risks

- 5.2.2.2 Compliance risks in property laws, tenant rights, eviction procedures, and data privacy regulations

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Revolutionizing property descriptions, lease agreements, and tenant communication with generative AI

- 5.2.3.2 Advent of AR/VR technologies for higher efficiency and immersive buyer experience

- 5.2.4 CHALLENGES

- 5.2.4.1 Ensuring data security in software implementation

- 5.2.4.2 Bias in AI and risks of poor training leading to reputational and legal issues

- 5.2.1 DRIVERS

- 5.3 EVOLUTION OF PROPERTY MANAGEMENT

- 5.4 SUPPLY CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- 5.5.1 FACILITY MANAGEMENT PROVIDERS

- 5.5.2 SERVICE PROVIDERS

- 5.5.3 LEASE MANAGEMENT PROVIDERS

- 5.5.4 PORTFOLIO MANAGEMENT PROVIDERS

- 5.5.5 TECHNOLOGY PARTNERS/INTEGRATORS

- 5.5.6 END USERS IN PROPERTY MANAGEMENT MARKET

- 5.6 INVESTMENT LANDSCAPE AND FUNDING SCENARIO

- 5.7 ROLE OF GENERATIVE AI IN PROPERTY MANAGEMENT MARKET

- 5.7.1 AUTOMATED DOCUMENT CREATION

- 5.7.2 TENANT COMMUNICATION

- 5.7.3 PROPERTY DESCRIPTIONS & MARKETING

- 5.7.4 DYNAMIC PRICING MODELS

- 5.7.5 MAINTENANCE FORECASTING

- 5.7.6 VIRTUAL PROPERTY TOURS AND STAGING

- 5.8 CASE STUDY ANALYSIS

- 5.8.1 RE-LEASED EMPOWERS COMMERCIAL PROPERTY PARTNERS TO STREAMLINE OPERATIONS AND DRIVE GROWTH

- 5.8.2 SIEMENS REAL ESTATE ENHANCES GLOBAL OPERATIONS AND COST-EFFICIENCY WITH PLANON REM SOFTWARE

- 5.8.3 JG CAPITAL REALTY INC. BOOSTS REVENUES BY 25% AND FINDS 70% MORE LISTINGS USING COSTAR AND LOOPNET

- 5.8.4 ENHANCING SMART ACCESS AND OPERATIONAL EFFICIENCY THROUGH LIVLY AND SALTO INTEGRATION

- 5.8.5 ENHANCING EFFICIENCY AND GUEST SATISFACTION AT BRIGHTWORKS PROPERTY WITH BREEZEWAY AUTOMATION

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Cloud computing

- 5.9.1.2 Artificial intelligence (AI) and machine learning (ML)

- 5.9.1.3 Internet of things (IoT)

- 5.9.1.4 Data analytics

- 5.9.1.5 Customer relationship management (CRM)

- 5.9.2 ADJACENT TECHNOLOGIES

- 5.9.2.1 Building information modeling (BIM)

- 5.9.2.2 PropTech

- 5.9.2.3 Blockchain

- 5.9.2.4 AR/VR

- 5.9.3 COMPLEMENTARY TECHNOLOGIES

- 5.9.3.1 Digital twins

- 5.9.3.2 Geospatial and mapping

- 5.9.3.3 Cybersecurity

- 5.9.3.4 E-signature

- 5.9.1 KEY TECHNOLOGIES

- 5.10 REGULATORY LANDSCAPE

- 5.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.10.2 REGULATORY FRAMEWORK

- 5.10.2.1 North America

- 5.10.2.1.1 Fair housing act (FHA)

- 5.10.2.1.2 Landlord-tenant laws

- 5.10.2.2 Europe

- 5.10.2.2.1 Energy performance certificates (EPC)

- 5.10.2.2.2 Anti-money laundering (AML) regulations

- 5.10.2.3 Asia Pacific

- 5.10.2.3.1 Zoning and land use regulations

- 5.10.2.4 Middle East & Africa

- 5.10.2.4.1 Foreign ownership restrictions

- 5.10.2.5 Latin America

- 5.10.2.5.1 Foreign ownership restrictions in Mexico

- 5.10.2.1 North America

- 5.11 PATENT ANALYSIS

- 5.11.1 METHODOLOGY

- 5.11.2 PATENTS FILED, BY DOCUMENT TYPE

- 5.11.3 INNOVATIONS AND PATENT APPLICATIONS

- 5.12 PRICING ANALYSIS

- 5.12.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY SOFTWARE TYPE

- 5.12.2 PRICING DATA, BY PROPERTY TYPE

- 5.13 KEY CONFERENCES AND EVENTS, 2024-2025

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 THREAT OF NEW ENTRANTS

- 5.14.2 THREAT OF SUBSTITUTES

- 5.14.3 BARGAINING POWER OF SUPPLIERS

- 5.14.4 BARGAINING POWER OF BUYERS

- 5.14.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.15 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

6 PROPERTY MANAGEMENT MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.1.1 DRIVERS: PROPERTY MANAGEMENT MARKET, BY OFFERING

- 6.2 SOFTWARE

- 6.2.1 BY TYPE

- 6.2.1.1 Lease management

- 6.2.1.1.1 Enhancement of tenant relations through operational efficiency to drive market

- 6.2.1.1.2 AI lease abstraction

- 6.2.1.1.3 Lease accounting and administration

- 6.2.1.1.3.1 Maintenance request management

- 6.2.1.1.3.2 Lease and land-use compliance

- 6.2.1.1.3.3 Lease negotiation and workflow

- 6.2.1.1.4 Portfolio management

- 6.2.1.1.5 Tenant and lease tracking

- 6.2.1.1.5.1 Tenant screening and onboarding

- 6.2.1.1.6 Document storage & management

- 6.2.1.1.6.1 Rent collection and automated invoicing

- 6.2.1.1.6.2 Vendor and contract management

- 6.2.1.1.6.3 Compliance and risk management

- 6.2.1.2 Facility property management

- 6.2.1.2.1 Sustainability and energy efficiency initiatives to drive market

- 6.2.1.2.2 Asset maintenance & management

- 6.2.1.2.3 Workspace & relocation

- 6.2.1.3 Security & payments

- 6.2.1.3.1 Real-time monitoring of transactions and data encryption to propel market

- 6.2.1.3.2 Secure access and control

- 6.2.1.3.3 Property budgeting and forecasting

- 6.2.1.3.4 Rent collection

- 6.2.1.4 Marketing & tenant communication

- 6.2.1.4.1 Government initiatives promoting transparency in housing practices to boost demand

- 6.2.1.5 Reporting & analytics

- 6.2.1.5.1 Integration of customizable dashboard KPIs tailored to specific needs to fuel market

- 6.2.1.1 Lease management

- 6.2.2 BY DEPLOYMENT MODE

- 6.2.2.1 Cloud

- 6.2.2.1.1 Adapting to market changes due to scalability and flexibility to drive demand

- 6.2.2.2 On-premises

- 6.2.2.2.1 Customization offering enhanced property management processes and security to fuel market

- 6.2.2.1 Cloud

- 6.2.3 BY CHANNEL MODE

- 6.2.3.1 App-based

- 6.2.3.1.1 Increased automation and user-centric design to drive market

- 6.2.3.2 Web-based

- 6.2.3.2.1 Facilitation of real-time decision-making and response to boost market

- 6.2.3.1 App-based

- 6.2.1 BY TYPE

- 6.3 SERVICES

- 6.3.1 PROFESSIONAL SERVICES

- 6.3.1.1 Onboarding

- 6.3.1.1.1 Enhanced user experience and consistent service to tenants to propel market

- 6.3.1.2 Customer support

- 6.3.1.2.1 Easy navigation of complex software features and sense of reliability and trust among tenants to boost market

- 6.3.1.3 Training & consulting

- 6.3.1.3.1 Enhancement of capabilities of property management firms to propel market

- 6.3.1.4 SLA management

- 6.3.1.4.1 Defining, monitoring, and enforcing performance metrics for service delivery to drive market

- 6.3.1.1 Onboarding

- 6.3.2 MANAGED SERVICES

- 6.3.1 PROFESSIONAL SERVICES

7 PROPERTY MANAGEMENT MARKET, BY GEOGRAPHIC LOCATION

- 7.1 INTRODUCTION

- 7.1.1 DRIVERS: PROPERTY MANAGEMENT MARKET, BY GEOGRAPHIC LOCATION

- 7.2 URBAN

- 7.2.1 RISING ABSENTEE OWNERSHIP WITH INCREASED RELIANCE ON PROFESSIONAL MANAGEMENT SERVICES TO DRIVE MARKET

- 7.3 SUBURBAN

- 7.3.1 DEVELOPMENT OF INFRASTRUCTURE TO CONTRIBUTE TO MARKET GROWTH

- 7.4 RURAL

- 7.4.1 LARGER LIVING SPACES, LOWER COSTS, AND TRANQUIL ENVIRONMENTS TO BOOST MARKET

8 PROPERTY MANAGEMENT MARKET, BY PROPERTY TYPE

- 8.1 INTRODUCTION

- 8.1.1 DRIVERS: PROPERTY MANAGEMENT MARKET, BY PROPERTY TYPE

- 8.2 COMMERCIAL

- 8.2.1 RETAIL SPACES

- 8.2.1.1 Evolving consumer behavior and technological advancements to drive market

- 8.2.2 LOGISTICS & DISTRIBUTION CENTERS

- 8.2.2.1 Growing demand for efficiency and flexibility in supply chain operations to boost market

- 8.2.3 EDUCATIONAL INSTITUTIONS

- 8.2.3.1 Maximizing use of physical assets and support for modern teaching methodologies to drive demand

- 8.2.4 HEALTHCARE INSTITUTIONS

- 8.2.4.1 Demand for navigating complexities of modern healthcare environments to drive market

- 8.2.5 OFFICES AND COWORKING SPACES

- 8.2.5.1 Requirement for maximizing space utilization and enhancing tenant experiences to fuel demand

- 8.2.6 CAMPGROUNDS & RV PARKS

- 8.2.6.1 Growing popularity of outdoor recreation and travel to boost market

- 8.2.7 DATA CENTER HUBS/TECH PARKS

- 8.2.7.1 Demand for innovative workspaces fostering collaboration and creativity to drive market

- 8.2.1 RETAIL SPACES

- 8.3 INDUSTRIAL

- 8.3.1 CONSTRUCTION SITES

- 8.3.1.1 Real-time collaboration among stakeholders, streamlining project workflows, and improving project visibility to boost market

- 8.3.2 MANUFACTURING FACILITIES/PLANTS

- 8.3.2.1 Increasing complexity of production processes and demand for operational efficiency to fuel demand

- 8.3.3 ENERGY & UTILITIES

- 8.3.3.1 Streamlining energy operations, monitoring consumption patterns, and ensuring compliance with evolving regulations to fuel market

- 8.3.4 OTHER INDUSTRIAL PROPERTY TYPES

- 8.3.1 CONSTRUCTION SITES

- 8.4 RESIDENTIAL

- 8.4.1 GATED COMMUNITIES

- 8.4.1.1 Preference for security, convenience, and community living to propel demand

- 8.4.1.2 Single-family housing

- 8.4.1.3 Multifamily housing

- 8.4.2 APARTMENTS

- 8.4.2.1 Keyless entry, energy-efficient systems, and IoT-enabled devices to enhance convenience and sustainability

- 8.4.2.2 Private

- 8.4.2.3 Large

- 8.4.2.4 Luxury

- 8.4.2.5 Student housing

- 8.4.3 VILLAS COMPOUNDS

- 8.4.3.1 Growing demand for luxury living spaces offering privacy and community environment to boost market

- 8.4.4 ASSOCIATION MANAGEMENT

- 8.4.4.1 Increasing demand for transparency, efficiency, and resident engagement to propel market

- 8.4.5 OTHER RESIDENTIAL PROPERTY TYPES

- 8.4.1 GATED COMMUNITIES

- 8.5 GOVERNMENT & MILITARY

- 8.5.1 FEDERAL, STATE, AND LOCAL GOVERNMENT OFFICE BUILDINGS

- 8.5.1.1 Prioritization of eco-friendly practices, including retrofitting structures with energy-efficient systems to boost market

- 8.5.2 LAW ENFORCEMENT FACILITIES

- 8.5.2.1 Demand for accountability, transparency, and operational efficiency to drive market

- 8.5.3 PUBLIC HOUSING AUTHORITIES

- 8.5.3.1 Provision of affordable housing solutions to low-income individuals, seniors, and people with disabilities to drive demand

- 8.5.4 MILITARY BASES AND INSTALLATIONS

- 8.5.4.1 Management of family housing, barracks, and unaccompanied personnel housing to fuel demand

- 8.5.5 DEPARTMENT OF DEFENSE FACILITIES

- 8.5.5.1 Requirement of comprehensive tools streamlining asset management, inventory tracking, and compliance reporting to drive demand

- 8.5.6 OTHER GOVERNMENT PROPERTY TYPES

- 8.5.1 FEDERAL, STATE, AND LOCAL GOVERNMENT OFFICE BUILDINGS

- 8.6 VACATION HOMES

- 8.7 MIXED-USE

9 PROPERTY MANAGEMENT MARKET, BY END USER

- 9.1 INTRODUCTION

- 9.1.1 DRIVERS: PROPERTY MANAGEMENT MARKET, BY END USER

- 9.2 PROPERTY MANAGERS AND REAL ESTATE AGENTS

- 9.2.1 FACILITATION OF PROPERTY TRANSACTIONS TO BOOST MARKET

- 9.3 REAL ESTATE INVESTORS/DEVELOPERS AND OWNERS

- 9.3.1 HEAVY RELIANCE ON SOPHISTICATED SOFTWARE AND SERVICES TO OPTIMIZE INVESTMENT STRATEGIES TO FUEL DEMAND

- 9.4 HOUSING ASSOCIATIONS

- 9.4.1 ENHANCEMENT OF OPERATIONAL EFFICIENCY AND IMPROVEMENT OF QUALITY OF LIFE TO BOOST DEMAND

- 9.5 GOVERNMENT AGENCIES

- 9.5.1 COMPLIANCE WITH REGULATIONS AND EFFECTIVE MANAGEMENT OF PUBLIC ASSETS TO INCREASE DEMAND

- 9.6 TENANTS/RESIDENTS

- 9.6.1 USER-FRIENDLY PORTALS FACILITATING TASKS TO DRIVE DEMAND

- 9.7 FACILITY MANAGERS

- 9.7.1 STREAMLINING OPERATIONS, MONITORING BUILDING SYSTEMS, AND MANAGING RESOURCES TO DRIVE GROWTH

- 9.8 FRANCHISE OPERATORS

- 9.8.1 ABILITY TO STREAMLINE OPERATIONS, IMPROVE CLIENT COMMUNICATION, AND OPTIMIZE RESOURCE ALLOCATION TO FUEL DEMAND

- 9.9 PROPERTY MANAGEMENT FIRMS

- 9.9.1 CLIENT SATISFACTION AND ENHANCEMENT OF OPERATIONAL EFFICIENCY TO DRIVE MARKET

- 9.10 OTHER END USERS

10 PROPERTY MANAGEMENT MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 DRIVERS: PROPERTY MANAGEMENT MARKET IN NORTH AMERICA

- 10.2.2 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 10.2.3 US

- 10.2.3.1 Rise of remote and hybrid work models to boost market

- 10.2.4 CANADA

- 10.2.4.1 Technological advancements and government initiatives to fuel demand

- 10.3 EUROPE

- 10.3.1 DRIVERS: PROPERTY MANAGEMENT MARKET IN EUROPE

- 10.3.2 EUROPE: MACROECONOMIC OUTLOOK

- 10.3.3 UK

- 10.3.3.1 Increasing foreign investments and significant rise in flexible workspace transactions to drive market

- 10.3.4 GERMANY

- 10.3.4.1 Growing demand for age-appropriate housing to boost market

- 10.3.5 FRANCE

- 10.3.5.1 Incentivization of rental investments through tax reductions for landlords to fuel demand

- 10.3.6 ITALY

- 10.3.6.1 Commitment to modernizing property management landscape to propel market

- 10.3.7 SPAIN

- 10.3.7.1 Government initiatives and private sector investments to drive market

- 10.3.8 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 DRIVERS: PROPERTY MANAGEMENT MARKET IN ASIA PACIFIC

- 10.4.2 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 10.4.3 CHINA

- 10.4.3.1 Reductions in taxes for developers and incentives for home buyers to boost market

- 10.4.4 JAPAN

- 10.4.4.1 Enhanced demand for short-term rental opportunities to boost market

- 10.4.5 INDIA

- 10.4.5.1 Government initiatives to revitalize property management market to boost demand

- 10.4.6 SOUTH KOREA

- 10.4.6.1 Government incentives, high demand, and adoption of smart building solutions to propel market

- 10.4.7 AUSTRALIA & NEW ZEALAND

- 10.4.7.1 National Rental Affordability Scheme and focus on property and construction management to boost market

- 10.4.8 ASEAN COUNTRIES

- 10.4.8.1 Favorable tax environments to attract investments in real estate development and emphasis on integrating technology to propel demand

- 10.4.9 REST OF ASIA PACIFIC

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 DRIVERS: PROPERTY MANAGEMENT MARKET IN MIDDLE EAST & AFRICA

- 10.5.2 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 10.5.3 MIDDLE EAST

- 10.5.3.1 Saudi Arabia

- 10.5.3.1.1 Strategic objectives of technology for housing delivery and improving transparency to boost market

- 10.5.3.2 UAE

- 10.5.3.2.1 Streamlined approach to managing housing projects to drive market

- 10.5.3.3 Bahrain

- 10.5.3.3.1 Promotion of urban development projects aligning with sustainable development goals to drive demand

- 10.5.3.4 Kuwait

- 10.5.3.4.1 Real estate loans offering favorable terms to drive market

- 10.5.3.5 Rest of Middle East

- 10.5.3.1 Saudi Arabia

- 10.5.4 AFRICA

- 10.6 LATIN AMERICA

- 10.6.1 DRIVERS: PROPERTY MANAGEMENT MARKET IN LATIN AMERICA

- 10.6.2 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 10.6.3 BRAZIL

- 10.6.3.1 Initiatives to address housing deficit and integration of social rental housing options to fuel demand

- 10.6.4 MEXICO

- 10.6.4.1 UN-recognized sustainable housing program and technological integration to boost market

- 10.6.5 ARGENTINA

- 10.6.5.1 Lifting of rent controls improving accessibility for tenants to boost market

- 10.6.6 REST OF LATIN AMERICA

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2024

- 11.3 REVENUE ANALYSIS, 2019-2023

- 11.4 MARKET SHARE ANALYSIS, 2023

- 11.5 PRODUCT COMPARISON

- 11.5.1 PRODUCT COMPARISON, BY OFFERING

- 11.5.1.1 AppFolio Property Manager

- 11.5.1.2 Trimble Manhattan

- 11.5.1.3 Yardi Voyager

- 11.5.1.4 RealPage OneSite

- 11.5.1.5 Entrata Core

- 11.5.2 PRODUCT COMPARISON, BY PROPERTY TYPE

- 11.5.2.1 Re-Leased Property Management Software

- 11.5.2.2 DoorLoop Property Management Software

- 11.5.2.3 Rent Manager Software

- 11.5.2.4 Hemlane Software

- 11.5.2.5 Guesty

- 11.5.1 PRODUCT COMPARISON, BY OFFERING

- 11.6 COMPANY VALUATION AND FINANCIAL METRICS

- 11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- 11.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 11.7.5.1 Company footprint

- 11.7.5.2 Region footprint

- 11.7.5.3 Offering footprint

- 11.7.5.4 Property type footprint

- 11.7.5.5 End user footprint

- 11.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 DYNAMIC COMPANIES

- 11.8.4 STARTING BLOCKS

- 11.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.8.5.1 Detailed list of key startups/SMEs

- 11.8.5.2 Competitive benchmarking of key startups/SMEs

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES AND ENHANCEMENTS

- 11.9.2 DEALS

12 COMPANY PROFILES

- 12.1 INTRODUCTION

- 12.2 KEY PLAYERS

- 12.2.1 ORACLE KEY PLAYERS

- 12.2.1.1 Business overview

- 12.2.1.2 Products/Solutions/Services offered

- 12.2.1.3 Recent developments

- 12.2.1.3.1 Product launches and enhancements

- 12.2.1.3.2 Deals

- 12.2.1.4 MnM view

- 12.2.1.4.1 Right to win

- 12.2.1.4.2 Strategic choices

- 12.2.1.4.3 Weaknesses and competitive threats

- 12.2.2 IBM

- 12.2.2.1 Business overview

- 12.2.2.2 Products/Solutions/Services offered

- 12.2.2.3 Recent developments

- 12.2.2.3.1 Product launches and enhancements

- 12.2.2.3.2 Deals

- 12.2.2.4 MnM view

- 12.2.2.4.1 Right to win

- 12.2.2.4.2 Strategic choices

- 12.2.2.4.3 Weaknesses and competitive threats

- 12.2.3 APPFOLIO

- 12.2.3.1 Business overview

- 12.2.3.2 Products/Solutions/Services offered

- 12.2.3.3 Recent developments

- 12.2.3.3.1 Product launches and enhancements

- 12.2.3.3.2 Deals

- 12.2.3.4 MnM view

- 12.2.3.4.1 Right to win

- 12.2.3.4.2 Strategic choices

- 12.2.3.4.3 Weaknesses and competitive threats

- 12.2.4 SAP

- 12.2.4.1 Business overview

- 12.2.4.2 Products/Solutions/Services offered

- 12.2.4.3 Recent developments

- 12.2.4.3.1 Product launches and enhancements

- 12.2.4.3.2 Deals

- 12.2.4.4 MnM view

- 12.2.4.4.1 Right to win

- 12.2.4.4.2 Strategic choices

- 12.2.4.4.3 Weaknesses and competitive threats

- 12.2.5 HITACHI VANTARA

- 12.2.5.1 Business overview

- 12.2.5.2 Products/Solutions/Services offered

- 12.2.5.3 Recent developments

- 12.2.5.3.1 Product launches and enhancements

- 12.2.5.3.2 Deals

- 12.2.5.4 MnM view

- 12.2.5.4.1 Right to win

- 12.2.5.4.2 Strategic choices

- 12.2.5.4.3 Weaknesses and competitive threats

- 12.2.6 YARDI

- 12.2.6.1 Business overview

- 12.2.6.2 Products/Solutions/Services offered

- 12.2.6.3 Recent developments

- 12.2.6.3.1 Product launches and enhancements

- 12.2.6.3.2 Deals

- 12.2.6.4 MnM view

- 12.2.6.4.1 Right to win

- 12.2.6.4.2 Strategic choices

- 12.2.6.4.3 Weaknesses and competitive threats

- 12.2.7 REALPAGE

- 12.2.7.1 Business overview

- 12.2.7.2 Products/Solutions/Services offered

- 12.2.7.3 Recent developments

- 12.2.7.3.1 Product launches and enhancements

- 12.2.7.3.2 Deals

- 12.2.7.4 MnM view

- 12.2.7.4.1 Right to win

- 12.2.7.4.2 Strategic choices

- 12.2.7.4.3 Weaknesses and competitive threats

- 12.2.8 SS&C

- 12.2.8.1 Business overview

- 12.2.8.2 Products/Solutions/Services offered

- 12.2.8.3 Recent developments

- 12.2.8.3.1 Product launches and enhancements

- 12.2.8.3.2 Deals

- 12.2.8.4 MnM view

- 12.2.8.4.1 Right to win

- 12.2.8.4.2 Strategic choices

- 12.2.8.4.3 Weaknesses and competitive threats

- 12.2.9 TRIMBLE

- 12.2.9.1 Business overview

- 12.2.9.2 Products/Solutions/Services offered

- 12.2.9.3 Recent developments

- 12.2.9.3.1 Product launches and enhancements

- 12.2.9.3.2 Deals

- 12.2.9.4 MnM view

- 12.2.9.4.1 Right to win

- 12.2.9.4.2 Strategic choices

- 12.2.9.4.3 Weaknesses and competitive threats

- 12.2.10 EPTURA

- 12.2.10.1 Business overview

- 12.2.10.2 Products/Solutions/Services offered

- 12.2.10.3 Recent developments

- 12.2.10.3.1 Product launches and enhancements

- 12.2.10.3.2 Deals

- 12.2.10.4 MnM view

- 12.2.10.4.1 Right to win

- 12.2.10.4.2 Strategic choices

- 12.2.10.4.3 Weaknesses and competitive threats

- 12.2.11 COSTAR GROUP

- 12.2.11.1 Business overview

- 12.2.11.2 Products/Solutions/Services offered

- 12.2.11.3 Recent developments

- 12.2.11.3.1 Deals

- 12.2.1 ORACLE KEY PLAYERS

- 12.3 OTHER PLAYERS

- 12.3.1 HEMLANE

- 12.3.2 ENTRATA

- 12.3.3 RENT MANAGER

- 12.3.4 RENTEC DIRECT

- 12.3.5 RE-LEASED

- 12.3.6 DOORLOOP

- 12.3.7 STESSA

- 12.3.8 JLL

- 12.3.9 MCS RENTAL SOFTWARE

- 12.3.10 ACCRUENT

- 12.3.11 PLANON

- 12.3.12 GUESTY

- 12.4 STARTUPS/SMES

- 12.4.1 HIVE

- 12.4.2 AVAIL

- 12.4.3 PROPERTY MATRIX

- 12.4.4 HAPPYCO

- 12.4.5 RESMAN

- 12.4.6 INNAGO

- 12.4.7 RENTREDI

- 12.4.8 TURBOTENANT

- 12.4.9 BREEZEWAY

- 12.4.10 LIVLY

- 12.4.11 SIMPLIFYEM

- 12.4.12 CONDO CONTROL

- 12.4.13 PAYHOA

13 ADJACENT AND RELATED MARKETS

- 13.1 INTRODUCTION

- 13.2 FACILITY MANAGEMENT MARKET - GLOBAL FORECAST TO 2028

- 13.2.1 MARKET DEFINITION

- 13.2.2 MARKET OVERVIEW

- 13.2.2.1 Facility management market, by offering

- 13.2.2.2 Facility management market, by solution

- 13.2.2.3 Facility management market, by service

- 13.2.2.4 Facility management market, by vertical

- 13.2.2.5 Facility management market, by region

- 13.3 ITOA MARKET - GLOBAL FORECAST TO 2029

- 13.3.1 MARKET DEFINITION

- 13.3.2 MARKET OVERVIEW

- 13.3.2.1 ITOA market, by offering

- 13.3.2.2 ITOA market, by data source

- 13.3.2.3 ITOA market, by technology

- 13.3.2.4 ITOA market, by application

- 13.3.2.5 ITOA market, by end user

- 13.3.2.6 ITOA market, by region

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS