|

|

市場調査レポート

商品コード

1563538

テクニカルセラミックス市場:材料別、製品タイプ別、最終用途産業別、地域別 - 2029年までの予測Technical Ceramics Market by Material (Oxide, Non-Oxide), Product Type (Monolithic Ceramics, Ceramic Matrix Composites, Ceramic Coatings), End-Use Industry (Electronics, Automotive, Energy & Power, Medical, Military), & Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| テクニカルセラミックス市場:材料別、製品タイプ別、最終用途産業別、地域別 - 2029年までの予測 |

|

出版日: 2024年09月26日

発行: MarketsandMarkets

ページ情報: 英文 245 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

テクニカルセラミックスの市場規模は、2024年の122億米ドルから2029年には175億米ドルに成長し、予測期間中のCAGRは7.4%になると予測されています。

テクニカルセラミックスの需要は、その耐摩耗性の低さと排出ガスの削減能力により、世界的に増加しています。テクニカルセラミックスは、航空機エンジン、ガスタービン、燃料電池のような極端な高温用途で使用されてもその形状とサイズを保持し、寸法安定性と安全性を高めます。また、チタン、アルミニウム、スチールなどの他の代替材料よりも高い剛性を発揮します。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 検討単位 | 金額(100万米ドル/10億米ドル) |

| セグメント別 | 材料別、製品タイプ別、最終用途産業別、地域別 |

| 対象地域 | アジア太平洋、北米、欧州、ラテンアメリカ、中東・アフリカ |

セラミックコーティングは、多様な組成と特性を持つセラミック材料の大家族からなる無機材料です。アルミナ、アルミナ・マグネシア、クロミア、シリカ、炭化ケイ素、チタニア、窒化ケイ素、ジルコニアなど、さまざまな材料組成があります。セラミック・コーティングは、耐摩耗性、耐高温性、耐腐食性の用途に使用されます。セラミック・コーティングは、輸送・自動車、エネルギー、航空宇宙・防衛、ヘルスケア、工業製品など、さまざまな最終用途産業で用途を見出しています。セラミック・コーティングを施すために最も広く使用されているプロセスは、物理的気相成長法(PVD)、化学的気相成長法(CVD)、溶射です。

医療産業は、テクニカルセラミックス市場で最も急成長している分野です。耐摩耗性と生体適合性の特性により、テクニカルセラミックスは、ドラッグデリバリー装置から人工関節、刺激装置、電子センサーに至る医療用途で重要性を増しています。これらは、骨や歯の置換のための医療機器やインプラントに使用されています。アルミナとジルコニアは、その機械的強度と化学的不活性から、骨インプラントに使用される主なテクニカルセラミックス材料です。テクニカルセラミックスは、その骨誘導性と生体適合性の特性から、骨組織工学に使用されています。

北米は、テクニカルセラミックスの第2位の消費国です。米国は、テクニカルセラミックスに対する好意的な需要を示しており、これは近い将来も続くと予測されています。テクニカルセラミックスは、その優れた性能によりこの地域で広く受け入れられており、成長している航空宇宙、自動車、エネルギー・電力産業も、この地域のテクニカルセラミックス市場の成長を刺激しています。最終用途産業におけるテクニカルセラミックスの高い受容性とセラミックファイバーの生産増加は、北米における低価格の重要な要因です。CoorsTek Inc.(米国)は、テクニカルセラミックスを製造する主要企業の一つであり、軍事・防衛、自動車、医療など様々な最終用途産業にサービスを提供しています。

当レポートでは、世界のテクニカルセラミックス市場について調査し、材料別、製品タイプ別、最終用途産業別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- GEN AIの影響

- 市場力学

- ポーターのファイブフォース分析

- マクロ経済指標

- 主な利害関係者と購入基準

- バリューチェーン分析

- エコシステム分析

- ケーススタディ分析

- 規制状況

- 技術分析

- 顧客ビジネスに影響を与える動向/混乱

- 貿易分析

- 2024年~2025年の主な会議とイベント

- 価格分析

- 投資と資金調達のシナリオ

- 特許分析

第6章 テクニカルセラミックス市場(材料別)

- イントロダクション

- 酸化物セラミックス

- 非酸化物セラミック

第7章 テクニカルセラミックス市場(製品タイプ別)

- イントロダクション

- モノリシックセラミックス

- セラミックマトリックス複合材料

- セラミックコーティング

- その他

第8章 テクニカルセラミックス市場(最終用途産業別)

- イントロダクション

- エレクトロニクス・半導体

- 自動車

- エネルギー・電力

- 工業

- 医療

- 軍事・防衛

- その他

第9章 テクニカルセラミックス市場(地域別)

- イントロダクション

- 北米

- 欧州 li>アジア太平洋

- 中東・アフリカ

- 南米

第10章 競合情勢

- 概要

- 主要参入企業の戦略

- 収益分析

- 市場シェア分析

- 企業価値評価と財務指標

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2023年

- 競合シナリオ

第11章 企業プロファイル

- 主要参入企業

- COORSTEK, INC.

- CERAMTEC GMBH

- KYOCERA CORPORATION

- MORGAN ADVANCED MATERIALS PLC

- 3M

- SAINT-GOBAIN PERFORMANCE CERAMICS & REFRACTORIES

- NITERRA CO., LTD.

- AGC CERAMICS

- PAUL RAUSCHERT GMBH & CO. KG

- ELAN TECHNOLOGY

- OERLIKON

- その他の企業

- JYOTI CERAMICS

- TECHNO CERA INDUSTRIES

- BCE SPECIAL CERAMICS GMBH

- SUPERIOR TECHNICAL CERAMICS

- DYSON TECHNICAL CERAMICS

- ORTECH ADVANCED CERAMICS

- INTERNATIONAL SYALONS

- BAKONY TECHNICAL CERAMICS

- ADVANCED CERAMIC MATERIALS

- MCDANEL ADVANCED CERAMIC TECHNOLOGIES

- ADVANCED CERAMICS MANUFACTURING

- BLASCH PRECISION CERAMICS, INC.

- PRECISION CERAMICS

- MANTEC TECHNICAL CERAMICS

- K-TECH CERAMICS

第12章 付録

List of Tables

- TABLE 1 TECHNICAL CERAMICS MARKET: INCLUSIONS & EXCLUSIONS

- TABLE 2 TECHNICAL CERAMICS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 3 PROJECTED REAL GDP GROWTH (ANNUAL PERCENT CHANGE) OF KEY COUNTRIES, 2021-2029

- TABLE 4 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE KEY END-USE INDUSTRIES (%)

- TABLE 5 TECHNICAL CERAMICS: ECOSYSTEM

- TABLE 6 EUROPE: REGULATORY BODIES, GOVERNMENT BODIES, AND OTHER AGENCIES

- TABLE 7 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT BODIES, AND OTHER AGENCIES

- TABLE 8 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 9 EXPORT TRADE DATA OF TECHNICAL CERAMICS FOR TOP COUNTRIES, 2019-2023 (USD THOUSAND)

- TABLE 10 IMPORT TRADE DATA OF TECHNICAL CERAMICS FOR TOP COUNTRIES, 2019-2023 (USD THOUSAND)

- TABLE 11 TECHNICAL CERAMICS MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2024-2025

- TABLE 12 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY MATERIAL, USD/KG

- TABLE 13 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TOP THREE END-USE INDUSTRIES, USD/KG

- TABLE 14 TOTAL NUMBER OF PATENTS

- TABLE 15 PATENTS BY GUANGDONG UNIVERSITY OF TECHNOLOGY

- TABLE 16 PATENTS BY GUANGDONG DONGPENG HOLDINGS CO., LTD.

- TABLE 17 PATENTS BY FOSHAN DONGPENG CERAMICS DEVELOPMENT CO., LTD.

- TABLE 18 TOP TEN PATENT OWNERS

- TABLE 19 TECHNICAL CERAMICS MARKET, BY MATERIAL, 2020-2023 (USD MILLION)

- TABLE 20 TECHNICAL CERAMICS MARKET, BY MATERIAL, 2024-2029 (USD MILLION)

- TABLE 21 TECHNICAL CERAMICS MARKET, BY MATERIAL, 2020-2023 (KILOTON)

- TABLE 22 TECHNICAL CERAMICS MARKET, BY MATERIAL, 2024-2029 (KILOTON)

- TABLE 23 TECHNICAL CERAMICS MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 24 TECHNICAL CERAMICS MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 25 TECHNICAL CERAMICS MARKET, BY PRODUCT TYPE, 2020-2023 (KILOTON)

- TABLE 26 TECHNICAL CERAMICS MARKET, BY PRODUCT TYPE, 2024-2029 (KILOTON)

- TABLE 27 TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 28 TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 29 TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 30 TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 31 TECHNICAL CERAMICS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 32 TECHNICAL CERAMICS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 33 TECHNICAL CERAMICS MARKET, BY REGION, 2020-2023 (KILOTON)

- TABLE 34 TECHNICAL CERAMICS MARKET, BY REGION, 2024-2029 (KILOTON)

- TABLE 35 NORTH AMERICA: TECHNICAL CERAMICS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 36 NORTH AMERICA: TECHNICAL CERAMICS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 37 NORTH AMERICA: TECHNICAL CERAMICS MARKET, BY COUNTRY, 2020-2023 (KILOTON)

- TABLE 38 NORTH AMERICA: TECHNICAL CERAMICS MARKET, BY COUNTRY, 2024-2029 (KILOTON)

- TABLE 39 NORTH AMERICA: TECHNICAL CERAMICS MARKET, BY MATERIAL, 2020-2023 (USD MILLION)

- TABLE 40 NORTH AMERICA: TECHNICAL CERAMICS MARKET, BY MATERIAL, 2024-2029 (USD MILLION)

- TABLE 41 NORTH AMERICA: TECHNICAL CERAMICS MARKET, BY MATERIAL, 2020-2023 (KILOTON)

- TABLE 42 NORTH AMERICA: TECHNICAL CERAMICS MARKET, BY MATERIAL, 2024-2029 (KILOTON)

- TABLE 43 NORTH AMERICA: TECHNICAL CERAMICS MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 44 NORTH AMERICA: TECHNICAL CERAMICS MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 45 NORTH AMERICA: TECHNICAL CERAMICS MARKET, BY PRODUCT TYPE, 2020-2023 (KILOTON)

- TABLE 46 NORTH AMERICA: TECHNICAL CERAMICS MARKET, BY PRODUCT TYPE, 2024-2029 (KILOTON)

- TABLE 47 NORTH AMERICA: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 48 NORTH AMERICA: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 49 NORTH AMERICA: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 50 NORTH AMERICA: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 51 US: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 52 US: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 53 US: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 54 US: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 55 CANADA: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 56 CANADA: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 57 CANADA: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 58 CANADA: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 59 MEXICO: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 60 MEXICO: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 61 MEXICO: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 62 MEXICO: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 63 EUROPE: TECHNICAL CERAMICS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 64 EUROPE: TECHNICAL CERAMICS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 65 EUROPE: TECHNICAL CERAMICS MARKET, BY COUNTRY, 2020-2023 (KILOTON)

- TABLE 66 EUROPE: TECHNICAL CERAMICS MARKET, BY COUNTRY, 2024-2029 (KILOTON)

- TABLE 67 EUROPE: TECHNICAL CERAMICS MARKET, BY MATERIAL, 2020-2023 (USD MILLION)

- TABLE 68 EUROPE: TECHNICAL CERAMICS MARKET, BY MATERIAL, 2024-2029 (USD MILLION)

- TABLE 69 EUROPE: TECHNICAL CERAMICS MARKET, BY MATERIAL, 2020-2023 (KILOTON)

- TABLE 70 EUROPE: TECHNICAL CERAMICS MARKET, BY MATERIAL, 2024-2029 (KILOTON)

- TABLE 71 EUROPE: TECHNICAL CERAMICS MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 72 EUROPE: TECHNICAL CERAMICS MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 73 EUROPE: TECHNICAL CERAMICS MARKET, BY PRODUCT TYPE, 2020-2023 (KILOTON)

- TABLE 74 EUROPE: TECHNICAL CERAMICS MARKET, BY PRODUCT TYPE, 2024-2029 (KILOTON)

- TABLE 75 EUROPE: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 76 EUROPE: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 77 EUROPE: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 78 EUROPE: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 79 GERMANY: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 80 GERMANY: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 81 GERMANY: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 82 GERMANY: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 83 FRANCE: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 84 FRANCE: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 85 FRANCE: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 86 FRANCE: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 87 SPAIN: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 88 SPAIN: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 89 SPAIN: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 90 SPAIN: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 91 UK: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 92 UK: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 93 UK: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 94 UK: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 95 ITALY: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 96 ITALY: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 97 ITALY: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 98 ITALY: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 99 REST OF EUROPE: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 100 REST OF EUROPE: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 101 REST OF EUROPE: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 102 REST OF EUROPE: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 103 ASIA PACIFIC: TECHNICAL CERAMICS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 104 ASIA PACIFIC: TECHNICAL CERAMICS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 105 ASIA PACIFIC: TECHNICAL CERAMICS MARKET, BY COUNTRY, 2020-2023 (KILOTON)

- TABLE 106 ASIA PACIFIC: TECHNICAL CERAMICS MARKET, BY COUNTRY, 2024-2029 (KILOTON)

- TABLE 107 ASIA PACIFIC: TECHNICAL CERAMICS MARKET, BY MATERIAL, 2020-2023 (USD MILLION)

- TABLE 108 ASIA PACIFIC: TECHNICAL CERAMICS MARKET, BY MATERIAL, 2024-2029 (USD MILLION)

- TABLE 109 ASIA PACIFIC: TECHNICAL CERAMICS MARKET, BY MATERIAL, 2020-2023 (KILOTON)

- TABLE 110 ASIA PACIFIC: TECHNICAL CERAMICS MARKET, BY MATERIAL, 2024-2029 (KILOTON)

- TABLE 111 ASIA PACIFIC: TECHNICAL CERAMICS MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 112 ASIA PACIFIC: TECHNICAL CERAMICS MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 113 ASIA PACIFIC: TECHNICAL CERAMICS MARKET, BY PRODUCT TYPE, 2020-2023 (KILOTON)

- TABLE 114 ASIA PACIFIC: TECHNICAL CERAMICS MARKET, BY PRODUCT TYPE, 2024-2029 (KILOTON)

- TABLE 115 ASIA PACIFIC: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 116 ASIA PACIFIC: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 117 ASIA PACIFIC: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 118 ASIA PACIFIC: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 119 CHINA: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 120 CHINA: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 121 CHINA: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 122 CHINA: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 123 JAPAN: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 124 JAPAN: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 125 JAPAN: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 126 JAPAN: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 127 INDIA: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 128 INDIA: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 129 INDIA: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 130 INDIA: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 131 SOUTH KOREA: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 132 SOUTH KOREA: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 133 SOUTH KOREA: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 134 SOUTH KOREA: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 135 REST OF ASIA PACIFIC: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 136 REST OF ASIA PACIFIC: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 137 REST OF ASIA PACIFIC: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 138 REST OF ASIA PACIFIC: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 139 MIDDLE EAST & AFRICA: TECHNICAL CERAMICS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 140 MIDDLE EAST & AFRICA: TECHNICAL CERAMICS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 141 MIDDLE EAST & AFRICA: TECHNICAL CERAMICS MARKET, BY COUNTRY, 2020-2023 (KILOTON)

- TABLE 142 MIDDLE EAST & AFRICA: TECHNICAL CERAMICS MARKET, BY COUNTRY, 2024-2029 (KILOTON)

- TABLE 143 MIDDLE EAST & AFRICA: TECHNICAL CERAMICS MARKET, BY MATERIAL, 2020-2023 (USD MILLION)

- TABLE 144 MIDDLE EAST & AFRICA: TECHNICAL CERAMICS MARKET, BY MATERIAL, 2024-2029 (USD MILLION)

- TABLE 145 MIDDLE EAST & AFRICA: TECHNICAL CERAMICS MARKET, BY MATERIAL, 2020-2023 (KILOTON)

- TABLE 146 MIDDLE EAST & AFRICA: TECHNICAL CERAMICS MARKET, BY MATERIAL, 2024-2029 (KILOTON)

- TABLE 147 MIDDLE EAST & AFRICA: TECHNICAL CERAMICS MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 148 MIDDLE EAST & AFRICA: TECHNICAL CERAMICS MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 149 MIDDLE EAST & AFRICA: TECHNICAL CERAMICS MARKET, BY PRODUCT TYPE, 2020-2023 (KILOTON)

- TABLE 150 MIDDLE EAST & AFRICA: TECHNICAL CERAMICS MARKET, BY PRODUCT TYPE, 2024-2029 (KILOTON)

- TABLE 151 MIDDLE EAST & AFRICA: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 152 MIDDLE EAST & AFRICA: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 153 MIDDLE EAST & AFRICA: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 154 MIDDLE EAST & AFRICA: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 155 GCC: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 156 GCC: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 157 GCC: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 158 GCC: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 159 SAUDI ARABIA: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 160 SAUDI ARABIA: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 161 SAUDI ARABIA: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 162 SAUDI ARABIA: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 163 UAE: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 164 UAE: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 165 UAE: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 166 UAE: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 167 REST OF GCC: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 168 REST OF GCC: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 169 REST OF GCC: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 170 REST OF GCC: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 171 SOUTH AFRICA: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 172 SOUTH AFRICA: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 173 SOUTH AFRICA: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 174 SOUTH AFRICA: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 175 REST OF MIDDLE EAST & AFRICA: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 176 REST OF MIDDLE EAST & AFRICA: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 177 REST OF MIDDLE EAST & AFRICA: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 178 REST OF MIDDLE EAST & AFRICA: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 179 SOUTH AMERICA: TECHNICAL CERAMICS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 180 SOUTH AMERICA: TECHNICAL CERAMICS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 181 SOUTH AMERICA: TECHNICAL CERAMICS MARKET, BY COUNTRY, 2020-2023 (KILOTON)

- TABLE 182 SOUTH AMERICA: TECHNICAL CERAMICS MARKET, BY COUNTRY, 2024-2029 (KILOTON)

- TABLE 183 SOUTH AMERICA: TECHNICAL CERAMICS MARKET, BY MATERIAL, 2020-2023 (USD MILLION)

- TABLE 184 SOUTH AMERICA: TECHNICAL CERAMICS MARKET, BY MATERIAL, 2024-2029 (USD MILLION)

- TABLE 185 SOUTH AMERICA: TECHNICAL CERAMICS MARKET, BY MATERIAL, 2020-2023 (KILOTON)

- TABLE 186 SOUTH AMERICA: TECHNICAL CERAMICS MARKET, BY MATERIAL, 2024-2029 (KILOTON)

- TABLE 187 SOUTH AMERICA: TECHNICAL CERAMICS MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 188 SOUTH AMERICA: TECHNICAL CERAMICS MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 189 SOUTH AMERICA: TECHNICAL CERAMICS MARKET, BY PRODUCT TYPE, 2020-2023 (KILOTON)

- TABLE 190 SOUTH AMERICA: TECHNICAL CERAMICS MARKET, BY PRODUCT TYPE, 2024-2029 (KILOTON)

- TABLE 191 SOUTH AMERICA: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 192 SOUTH AMERICA: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 193 SOUTH AMERICA: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 194 SOUTH AMERICA: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 195 BRAZIL: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 196 BRAZIL: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 197 BRAZIL: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 198 BRAZIL: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 199 ARGENTINA: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 200 ARGENTINA: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 201 ARGENTINA: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 202 ARGENTINA: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 203 REST OF SOUTH AMERICA: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 204 REST OF SOUTH AMERICA: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 205 REST OF SOUTH AMERICA: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 206 REST OF SOUTH AMERICA: TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 207 TECHNICAL CERAMICS MARKET: DEGREE OF COMPETITION

- TABLE 208 TECHNICAL CERAMICS MARKET: MATERIAL FOOTPRINT

- TABLE 209 TECHNICAL CERAMICS MARKET: PRODUCT TYPE FOOTPRINT

- TABLE 210 TECHNICAL CERAMICS MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 211 TECHNICAL CERAMICS MARKET: REGION FOOTPRINT

- TABLE 212 TECHNICAL CERAMICS: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 213 TECHNICAL CERAMICS MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 214 TECHNICAL CERAMICS MARKET: INVESTMENTS & EXPANSIONS, JANUARY 2019-AUGUST 2024

- TABLE 215 TECHNICAL CERAMICS MARKET: DEALS, JANUARY 2019-AUGUST 2024

- TABLE 216 TECHNICAL CERAMICS MARKET: PRODUCT LAUNCHES/TECHNOLOGY DEVELOPMENTS, JANUARY 2019-AUGUST 2024

- TABLE 217 COORSTEK, INC.: COMPANY OVERVIEW

- TABLE 218 COORSTEK, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 219 COORSTEK, INC.: OTHER DEVELOPMENTS, JANUARY 2019-AUGUST 2024

- TABLE 220 CERAMTEC GMBH: COMPANY OVERVIEW

- TABLE 221 CERAMTEC GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 222 CERAMTEC GMBH: PRODUCT LAUNCHES, JANUARY 2019-AUGUST 2024

- TABLE 223 KYOCERA CORPORATION: COMPANY OVERVIEW

- TABLE 224 KYOCERA CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 225 KYOCERA CORPORATION: DEALS, JANUARY 2019-AUGUST 2024

- TABLE 226 KYOCERA CORPORATION: OTHER DEVELOPMENTS, JANUARY 2019-AUGUST 2024

- TABLE 227 MORGAN ADVANCED MATERIALS PLC: COMPANY OVERVIEW

- TABLE 228 MORGAN ADVANCED MATERIALS PLC: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 229 MORGAN ADVANCED MATERIALS PLC: DEALS, JANUARY 2019-AUGUST 2024

- TABLE 230 3M: COMPANY OVERVIEW

- TABLE 231 3M: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 232 SAINT-GOBAIN PERFORMANCE CERAMICS & REFRACTORIES: COMPANY OVERVIEW

- TABLE 233 SAINT-GOBAIN PERFORMANCE CERAMICS & REFRACTORIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 234 NITERRA CO., LTD.: COMPANY OVERVIEW

- TABLE 235 NITERRA CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 236 AGC CERAMICS: COMPANY OVERVIEW

- TABLE 237 AGC CERAMICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 238 AGC CERAMICS: DEALS, JANUARY 2019-AUGUST 2024

- TABLE 239 PAUL RAUSCHERT GMBH & CO. KG.: COMPANY OVERVIEW

- TABLE 240 PAUL RAUSCHERT GMBH & CO. KG.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 241 ELAN TECHNOLOGY: COMPANY OVERVIEW

- TABLE 242 ELAN TECHNOLOGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 243 OERLIKON: COMPANY OVERVIEW

- TABLE 244 OERLIKON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 245 JYOTI CERAMICS: COMPANY OVERVIEW

- TABLE 246 TECHNO CERA INDUSTRIES: COMPANY OVERVIEW

- TABLE 247 BCE SPECIAL CERAMICS GMBH: COMPANY OVERVIEW

- TABLE 248 SUPERIOR TECHNICAL CERAMICS: COMPANY OVERVIEW

- TABLE 249 DYSON TECHNICAL CERAMICS: COMPANY OVERVIEW

- TABLE 250 ORTECH ADVANCED CERAMICS: COMPANY OVERVIEW

- TABLE 251 INTERNATIONAL SYALONS: COMPANY OVERVIEW

- TABLE 252 BAKONY TECHNICAL CERAMICS: COMPANY OVERVIEW

- TABLE 253 ADVANCED CERAMIC MATERIALS: COMPANY OVERVIEW

- TABLE 254 MCDANEL ADVANCED CERAMIC TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 255 ADVANCED CERAMICS MANUFACTURING: COMPANY OVERVIEW

- TABLE 256 BLASCH PRECISION CERAMICS, INC.: COMPANY OVERVIEW

- TABLE 257 PRECISION CERAMICS: COMPANY OVERVIEW

- TABLE 258 MANTEC TECHNICAL CERAMICS: COMPANY OVERVIEW

- TABLE 259 K-TECH CERAMICS: COMPANY OVERVIEW

List of Figures

- FIGURE 1 TECHNICAL CERAMICS MARKET SEGMENTATION & REGIONS COVERED

- FIGURE 2 TECHNICAL CERAMICS MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 5 TECHNICAL CERAMICS MARKET: DATA TRIANGULATION

- FIGURE 6 CERAMIC MATRIX COMPOSITES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 7 OXIDE CERAMIC MATERIALS TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

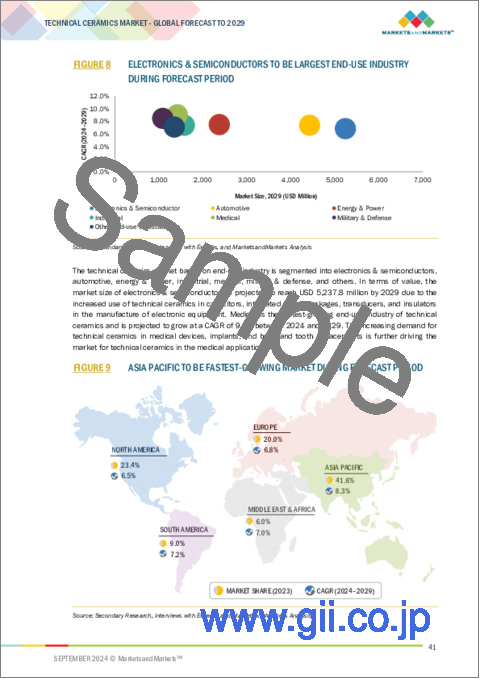

- FIGURE 8 ELECTRONICS & SEMICONDUCTORS TO BE LARGEST END-USE INDUSTRY DURING FORECAST PERIOD

- FIGURE 9 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 10 INCREASING DEMAND FROM ELECTRONICS & SEMICONDUCTORS END-USE INDUSTRY TO DRIVE MARKET DURING FORECAST PERIOD

- FIGURE 11 CERAMIC COATINGS SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 12 OXIDE SEGMENT TO LEAD TECHNICAL CERAMICS MARKET DURING FORECAST PERIOD

- FIGURE 13 MEDICAL SEGMENT TO WITNESS HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 14 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN TECHNICAL CERAMICS MARKET

- FIGURE 16 TECHNICAL CERAMICS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF THREE KEY END-USE INDUSTRIES

- FIGURE 18 KEY BUYING CRITERIA FOR TOP 3 END-USE INDUSTRIES

- FIGURE 19 OVERVIEW OF TECHNICAL CERAMICS VALUE CHAIN

- FIGURE 20 TECHNICAL CERAMICS: ECOSYSTEM

- FIGURE 21 RISING DEMAND IN TEXTILE INDUSTRY LEADING TO GROWTH OF TECHNICAL CERAMICS MARKET

- FIGURE 22 COUNTRY-WISE EXPORT TRADE VALUE (USD THOUSAND)

- FIGURE 23 COUNTRY-WISE IMPORT TRADE VALUE (USD THOUSAND)

- FIGURE 24 AVERAGE SELLING PRICE BASED ON REGION, USD/KG

- FIGURE 25 INVESTMENT AND FUNDING SCENARIO, 2019-2023 (USD MILLION)

- FIGURE 26 TOTAL NUMBER OF PATENTS

- FIGURE 27 NUMBER OF PATENTS YEAR-WISE FROM 2013 TO 2023

- FIGURE 28 PATENT ANALYSIS, BY LEGAL STATUS

- FIGURE 29 TOP JURISDICTION - BY DOCUMENT

- FIGURE 30 TOP 10 COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS

- FIGURE 31 OXIDE CERAMICS ESTIMATED TO BE LARGER MATERIAL SEGMENT OF TECHNICAL CERAMICS MARKET IN 2024

- FIGURE 32 MONOLITHIC CERAMICS ESTIMATED TO BE LARGEST SEGMENT OF TECHNICAL CERAMICS MARKET IN 2024

- FIGURE 33 ELECTRONICS & SEMICONDUCTORS WAS LARGEST END-USE INDUSTRY SEGMENT OF TECHNICAL CERAMICS MARKET IN 2023

- FIGURE 34 CHINA TO REGISTER HIGHEST CAGR IN TECHNICAL CERAMICS MARKET DURING FORECAST PERIOD

- FIGURE 35 NORTH AMERICA: TECHNICAL CERAMICS MARKET SNAPSHOT

- FIGURE 36 MEDICAL INDUSTRY TO REGISTER HIGHEST CAGR IN EUROPE TECHNICAL CERAMICS MARKET DURING FORECAST PERIOD

- FIGURE 37 ASIA PACIFIC: TECHNICAL CERAMICS MARKET SNAPSHOT

- FIGURE 38 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN TECHNICAL CERAMICS MARKET BETWEEN 2019 AND 2024

- FIGURE 39 REVENUE ANALYSIS OF KEY COMPANIES IN TECHNICAL CERAMICS MARKET, 2023

- FIGURE 40 SHARES OF LEADING COMPANIES IN TECHNICAL CERAMICS MARKET, 2023

- FIGURE 41 COMPANY VALUATION OF KEY COMPANIES IN TECHNICAL CERAMICS MARKET, 2023

- FIGURE 42 FINANCIAL METRICS OF KEY COMPANIES IN TECHNICAL CERAMICS MARKET, 2023

- FIGURE 43 TECHNICAL CERAMICS MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 44 TECHNICAL CERAMICS MARKET: COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- FIGURE 45 TECHNICAL CERAMICS MARKET: OVERALL COMPANY FOOTPRINT

- FIGURE 46 TECHNICAL CERAMICS MARKET: COMPANY EVALUATION MATRIX, STARTUPS/SMES, 2023

- FIGURE 47 CERAMTEC GMBH: COMPANY SNAPSHOT

- FIGURE 48 KYOCERA CORPORATION: COMPANY SNAPSHOT

- FIGURE 49 MORGAN ADVANCED MATERIALS PLC: COMPANY SNAPSHOT

- FIGURE 50 3M: COMPANY SNAPSHOT

- FIGURE 51 NITERRA CO., LTD.: COMPANY SNAPSHOT

- FIGURE 52 OERLIKON: COMPANY SNAPSHOT

The technical ceramics market size is projected to grow from USD 12.2 billion in 2024 to USD 17.5 billion by 2029, registering a CAGR of 7.4% during the forecast period. The demand for technical ceramics is increasing globally on account of their low wear resistance and ability to reduce emissions. Technical ceramics retain their shape and size when used in extreme high temperature applications such as aircraft engines, gas turbines, and fuel cells, providing dimensional stability and increasing safety. They also provide greater stiffness than other alternative materials such as titanium, aluminum, and steel.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Million/Billion) |

| Segments | By Material, By Product Type, End -User Industry, and Region |

| Regions covered | Asia Pacific, North America, Europe, Latin America, and the Middle East and Africa |

"Ceramic coatings is projected to be the third largest segment by product type in terms of value."

Ceramic coatings are inorganic materials comprising a large family of ceramic materials with diversified compositions and properties. The various material compositions include alumina, alumina-magnesia, chromia, silica, silicon carbide, titania, silicon nitride, zirconia, and others. Ceramic coatings are used for wear, high temperature, and corrosion-resistant applications. Ceramic coatings find applications in various end-use industries such as transportation & automotive, energy, aerospace & defense, healthcare, and industrial goods. The most widely used processes for applying ceramic coatings are physical vapor deposition (PVD), chemical vapor deposition (CVD), and thermal spraying.

"Medical industry accounted for the fastest-growing end-use industry segment of technical ceramics market in terms of value."

The medical industry is the fastest-growing segment of the technical ceramics market. Due to their wear resistance and biocompatibility properties, technical ceramics have gained importance in medical applications ranging from drug delivery devices to artificial joints, stimulators, and electronic sensors. They are used in medical devices and implants for bone and tooth replacement. Alumina and zirconia are the main technical ceramics materials that are used for bone implants, due to their mechanical strength and chemical inertness. Technical ceramics are used in bone tissue engineering because of their osteo inductive and biocompatible properties.

"North America is the second-largest market for technical ceramics."

North America is the second-largest consumer of technical ceramics. The US has shown favorable demand for technical ceramics, and this is projected to continue in the near future. Technical ceramics are broadly accepted in this region due to their superior performance and the growing aerospace; automotive, and energy & power industries are also stimulating the growth of the technical ceramics market in the region. The high acceptance of technical ceramics in end-use industries and increased production of ceramic fibers are important factors for the lower prices in North America. CoorsTek Inc. (US) is one of the major players manufacturing technical ceramics and is serving various end-use industries such as military & defense, automotive, and medical.

In-depth interviews were conducted with Chief Executive Officers (CEOs), marketing directors, other innovation and technology directors, and executives from various key organizations operating in the technical ceramics market, and information was gathered from secondary research to determine and verify the market size of several segments.

- By Company Type: Tier 1 - 40%, Tier 2 - 30%, and Tier 3 - 30%

- By Designation: C Level Executives- 20%, Directors - 10%, and Others - 70%

- By Region: North America - 20%, Europe - 20%, APAC - 40%, South America- 10% , and

the Middle East & Africa -5%

The technical ceramics market comprises major players such as Coorstek Inc. (US), Kyocera Corporation (Japan), CeramTec (Germany), Morgan Advanced Ceramics (UK), Saint-Gobain Performance Ceramics & Refractories (France), 3M (US), Niterra Co., Ltd. (Japan), AGC Ceramics (Japan) Paul Rauschert GmbH & Co. KG. (Germany), Elan Technology (US), Oerlikon (Switzerland). The study includes in-depth competitive analysis of these key players in the technical ceramics market, with their company profiles, recent developments, and key market strategies.

Research Coverage

This report segments the market for technical ceramics on the basis of material, product type, end-use industry, and region, and provides estimations for the overall value of the market across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, products & services, key strategies, mergers & acquisitions and investment & expansions associated with the technical ceramics market.

Key benefits of buying this report

This research report is focused on various levels of analysis - industry analysis (industry trends), market ranking analysis of top players, and company profiles, which together provide an overall view on the competitive landscape; emerging and high-growth segments of the technical ceramics market; high-growth regions; and market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Market Penetration: Comprehensive information on the technical ceramics market offered by top players in the global technical ceramics market.

- Analysis of drivers: (increased demand for technical ceramics in extreme environments, innovation in medical and electronic technologies), restraints (higher costs and time, slow fiber production), opportunities (nanotechnology, new manufacturing innovations), and challenges (limited resources drive up costs, complexity and expense) influencing the growth of technical ceramics market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the technical ceramics market.

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the markets for technical ceramics market across regions.

- Market Capacity: Production capacities of companies producing technical ceramics are provided wherever available with upcoming capacities for the technical ceramics market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the technical ceramics market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION & REGIONS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.3.3 INCLUSIONS & EXCLUSIONS

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of interviews with experts

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- 2.2.2 BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 GROWTH FORECAST

- 2.4.1 SUPPLY SIDE

- 2.4.2 DEMAND SIDE

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN TECHNICAL CERAMICS MARKET

- 4.2 TECHNICAL CERAMICS MARKET, BY PRODUCT TYPE

- 4.3 TECHNICAL CERAMICS MARKET, BY MATERIAL

- 4.4 TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY

- 4.5 TECHNICAL CERAMICS MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 IMPACT OF GEN AI

- 5.3 MARKET DYNAMICS

- 5.3.1 DRIVERS

- 5.3.1.1 Increased demand for technical ceramics in extreme environments

- 5.3.1.2 Innovation in medical and electronic technologies

- 5.3.2 RESTRAINTS

- 5.3.2.1 Higher costs and time associated with customized technical ceramics

- 5.3.2.2 Slow fiber production and high cost of technical ceramics in key industries

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Nanotechnology enabling development of technical ceramics in various industries

- 5.3.3.2 Innovations enhancing growth prospects of technical ceramics

- 5.3.4 CHALLENGES

- 5.3.4.1 Limited resources to increase costs

- 5.3.4.2 Complexity and high expenditure limiting entry of technical ceramics in diverse applications

- 5.3.1 DRIVERS

- 5.4 PORTER'S FIVE FORCES ANALYSIS

- 5.4.1 THREAT OF NEW ENTRANTS

- 5.4.2 THREAT OF SUBSTITUTES

- 5.4.3 BARGAINING POWER OF SUPPLIERS

- 5.4.4 BARGAINING POWER OF BUYERS

- 5.4.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.5 MACROECONOMIC INDICATORS

- 5.5.1 GLOBAL GDP TRENDS

- 5.6 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.6.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.6.2 BUYING CRITERIA

- 5.7 VALUE CHAIN ANALYSIS

- 5.7.1 VALUE CHAIN OF TECHNICAL CERAMICS

- 5.7.2 RAW MATERIAL SUPPLIERS

- 5.7.3 MANUFACTURERS

- 5.7.4 SUPPLIERS/DISTRIBUTORS

- 5.7.5 COMPONENT MANUFACTURERS/OEMS

- 5.7.6 END-USE INDUSTRIES

- 5.8 ECOSYSTEM ANALYSIS

- 5.9 CASE STUDY ANALYSIS

- 5.9.1 ADVANCING SATELLITE PROPULSION: ROLE OF AL300 ALUMINA IN HDLTFLOW

- 5.9.2 SHIFT FROM METAL TO CERAMIC IN WIRE PRODUCTION EFFICIENCY

- 5.9.3 ENHANCING ALUMINUM CASTING PROCESS WITH SILICON NITRIDE

- 5.10 REGULATORY LANDSCAPE

- 5.10.1 REGULATIONS

- 5.10.1.1 Europe

- 5.10.1.2 Asia Pacific

- 5.10.1.3 North America

- 5.10.2 STANDARDS

- 5.10.2.1 Occupational Safety and Health Act of 1970 (OSHA Standards)

- 5.10.2.2 European Committee for Standardization (CEN)

- 5.10.3 REGULATORY BODIES, GOVERNMENT BODIES, AND OTHER AGENCIES

- 5.10.1 REGULATIONS

- 5.11 TECHNOLOGY ANALYSIS

- 5.11.1 KEY TECHNOLOGY

- 5.11.1.1 Unlocking potential of technical ceramics in nanotechnology

- 5.11.1.2 Harnessing strength of technical ceramics through advanced 3D printing

- 5.11.2 COMPLEMENTARY TECHNOLOGY

- 5.11.2.1 Technical ceramics for global expansion of 5G networks

- 5.11.3 ADJACENT TECHNOLOGY

- 5.11.3.1 Intersection of technical ceramics and renewable energy technologies

- 5.11.1 KEY TECHNOLOGY

- 5.12 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.13 TRADE ANALYSIS

- 5.13.1 EXPORT SCENARIO

- 5.13.2 IMPORT SCENARIO

- 5.14 KEY CONFERENCES & EVENTS, 2024-2025

- 5.15 PRICING ANALYSIS

- 5.15.1 AVERAGE SELLING PRICE TREND, BY REGION

- 5.15.2 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY MATERIAL, 2023

- 5.15.3 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY END-USE INDUSTRY, 2023

- 5.16 INVESTMENT AND FUNDING SCENARIO

- 5.17 PATENT ANALYSIS

- 5.17.1 INTRODUCTION

- 5.17.2 APPROACH

- 5.17.3 DOCUMENT TYPES

- 5.17.4 PUBLICATION TRENDS, LAST 11 YEARS (2013-2023)

- 5.17.5 INSIGHTS

- 5.17.6 LEGAL STATUS OF PATENTS

- 5.17.7 JURISDICTION ANALYSIS

- 5.17.8 TOP COMPANIES/APPLICANTS

- 5.17.9 TOP 10 PATENT OWNERS (US) IN LAST 11 YEARS

6 TECHNICAL CERAMICS MARKET, BY MATERIAL

- 6.1 INTRODUCTION

- 6.2 OXIDE CERAMICS

- 6.2.1 HIGH FRACTURE TOUGHNESS AND HIGH WEAR, TEMPERATURE, AND CORROSION RESISTANCE PROPERTIES TO DRIVE MARKET

- 6.2.2 ALUMINA CERAMICS

- 6.2.2.1 Extreme hardness, thermal conductivity, chemical resistance, and compressive strength to drive market

- 6.2.3 TITANATE CERAMICS

- 6.2.3.1 Excellent resistance to chemicals and thermal shock to drive market

- 6.2.4 ZIRCONIA CERAMICS

- 6.2.4.1 Manufacture of mechanical, automotive, and medical components to propel market

- 6.2.5 OTHER OXIDE MATERIALS

- 6.3 NON-OXIDE CERAMICS

- 6.3.1 HIGH STRENGTH, HARDNESS, ALONG WITH EXCELLENT RESISTANCE TO CORROSION AND WEAR TO BOOST MARKET

- 6.3.2 ALUMINA NITRIDE

- 6.3.2.1 Extensive use in power and microelectronics applications to drive market

- 6.3.3 SILICON NITRIDE

- 6.3.3.1 Mechanical fatigue, creep resistance, and high fracture toughness at varied temperatures to propel market

- 6.3.4 SILICON CARBIDE

- 6.3.4.1 Increasing demand in nuclear energy, space technology, automobile, marine engineering, and electrical & electronics to drive market

- 6.3.5 OTHER NON-OXIDE MATERIALS

7 TECHNICAL CERAMICS MARKET, BY PRODUCT TYPE

- 7.1 INTRODUCTION

- 7.2 MONOLITHIC CERAMICS

- 7.2.1 RISING DEMAND FROM MEDICAL AND ELECTRICAL & ELECTRONICS INDUSTRIES TO DRIVE MARKET

- 7.3 CERAMIC MATRIX COMPOSITES

- 7.3.1 SUITABILITY FOR INTERNAL ENGINE COMPONENTS, EXHAUST SYSTEMS, AND OTHER HOT-ZONE STRUCTURES TO PROPEL MARKET

- 7.4 CERAMIC COATINGS

- 7.4.1 GROWING DEMAND FOR PLASMA-SPRAYED COATINGS IN SEMICONDUCTORS AND LCD EQUIPMENT TO DRIVE MARKET

- 7.5 OTHER PRODUCT TYPES

8 TECHNICAL CERAMICS MARKET, BY END-USE INDUSTRY

- 8.1 INTRODUCTION

- 8.2 ELECTRONICS & SEMICONDUCTORS

- 8.2.1 SURGE IN DEMAND IN CONSUMER ELECTRONICS, ROBOTICS, AUTOMOTIVE, SENSORS, AND INSTRUMENTATION TO DRIVE MARKET

- 8.2.2 ELECTRICAL INSULATORS

- 8.2.3 PASSIVE COMPONENTS

- 8.2.4 PIEZOELECTRIC CERAMICS

- 8.2.5 OTHER ELECTRONIC & SEMICONDUCTOR END-USE INDUSTRIES

- 8.3 AUTOMOTIVE

- 8.3.1 WIDE APPLICATIONS IN HIGH-PERFORMANCE VEHICLES, CERAMIC BRAKE COMPONENTS, AND ENGINE COMPONENTS TO BOOST MARKET

- 8.4 ENERGY & POWER

- 8.4.1 PRESSING NEED IN RENEWABLE ENERGY TECHNOLOGIES, SOLAR PANELS, AND FUEL CELLS TO DRIVE MARKET

- 8.5 INDUSTRIAL

- 8.5.1 RISING NEED FOR ABRASIVES IN MACHINERY AND CONSUMER GOODS INDUSTRIES TO DRIVE MARKET

- 8.6 MEDICAL

- 8.6.1 INCREASING DEMAND IN IMPLANTS, PROSTHETICS, AND SURGICAL INSTRUMENTS TO PROPEL MARKET

- 8.6.2 MEDICAL IMPLANTS

- 8.6.3 DENTAL CERAMICS

- 8.6.4 IMPLANTABLE ELECTRONIC DEVICES

- 8.6.5 OTHER MEDICAL APPLICATIONS

- 8.7 MILITARY & DEFENSE

- 8.7.1 RISE IN DEMAND FOR AIRCRAFT ENGINES, ARMOR PLATES, BODY ARMOR, AND DEFENSE-RELATED TECHNOLOGIES TO DRIVE MARKET

- 8.8 OTHER END-USE INDUSTRIES

9 TECHNICAL CERAMICS MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 US

- 9.2.1.1 Development of novel materials and sustainable use of technical ceramics to boost market

- 9.2.2 CANADA

- 9.2.2.1 Expanding applications in automotive and aerospace industries to drive market

- 9.2.3 MEXICO

- 9.2.3.1 Surge in aircraft production and presence of global automotive companies to drive market

- 9.2.1 US

- 9.3 EUROPE

- 9.3.1 GERMANY

- 9.3.1.1 Development and production of high-quality, research-focused products to drive market

- 9.3.2 FRANCE

- 9.3.2.1 Growth of healthcare and electronics sectors to drive demand

- 9.3.3 SPAIN

- 9.3.3.1 Growing demand for eco and electric mobility and electromedical devices to propel market

- 9.3.4 UK

- 9.3.4.1 Significant demand for orthopedic implants and aircraft components to drive market

- 9.3.5 ITALY

- 9.3.5.1 Chemicals, renewable energy, and aerospace & defense sectors to boost demand

- 9.3.6 REST OF EUROPE

- 9.3.1 GERMANY

- 9.4 ASIA PACIFIC

- 9.4.1 CHINA

- 9.4.1.1 Exponential economic growth, demand from medical and aviation sectors to boost market

- 9.4.2 JAPAN

- 9.4.2.1 Demand from chemical, aerospace, defense, and electronic sectors to propel market

- 9.4.3 INDIA

- 9.4.3.1 Growth of aviation and electronics sectors to drive market

- 9.4.4 SOUTH KOREA

- 9.4.4.1 Presence of electronic giants and significant exports to propel market

- 9.4.5 REST OF ASIA PACIFIC

- 9.4.1 CHINA

- 9.5 MIDDLE EAST & AFRICA

- 9.5.1 GCC COUNTRIES

- 9.5.1.1 Growing foreign investments and economic diversification to drive market

- 9.5.1.2 Saudi Arabia

- 9.5.1.2.1 Growth of aviation and medical sectors to drive market

- 9.5.1.3 UAE

- 9.5.1.3.1 Investments in aerospace infrastructure to propel market

- 9.5.1.4 Rest of GCC

- 9.5.2 SOUTH AFRICA

- 9.5.2.1 Healthcare & medical, mechanical equipment, chemical, and electronics industries to drive market

- 9.5.3 REST OF MIDDLE EAST & AFRICA

- 9.5.1 GCC COUNTRIES

- 9.6 SOUTH AMERICA

- 9.6.1 BRAZIL

- 9.6.1.1 Presence of major aerospace manufacturer and rapid growth of chemical industry to drive market

- 9.6.2 ARGENTINA

- 9.6.2.1 Rising consumer electronics and aviation industries to fuel market

- 9.6.3 REST OF SOUTH AMERICA

- 9.6.1 BRAZIL

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES

- 10.3 REVENUE ANALYSIS

- 10.4 MARKET SHARE ANALYSIS

- 10.5 COMPANY VALUATION AND FINANCIAL METRICS

- 10.6 BRAND/PRODUCT COMPARISON

- 10.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 10.7.1 STARS

- 10.7.2 EMERGING LEADERS

- 10.7.3 PERVASIVE PLAYERS

- 10.7.4 PARTICIPANTS

- 10.7.4.1 Company material footprint

- 10.7.4.2 Company product type footprint

- 10.7.4.3 Company end-use industry footprint

- 10.7.4.4 Company region footprint

- 10.7.4.5 Overall company footprint

- 10.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 10.8.1 PROGRESSIVE COMPANIES

- 10.8.2 RESPONSIVE COMPANIES

- 10.8.3 DYNAMIC COMPANIES

- 10.8.4 STARTING BLOCKS

- 10.8.5 COMPETITIVE BENCHMARKING

- 10.8.5.1 Competitive benchmarking of key startups/SMEs

- 10.8.5.2 Competitive benchmarking of key startups/SMEs

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 INVESTMENTS & EXPANSIONS

- 10.9.2 DEALS

- 10.9.3 PRODUCT LAUNCHES/TECHNOLOGY DEVELOPMENTS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 COORSTEK, INC.

- 11.1.1.1 Business overview

- 11.1.1.2 Products/Solutions/Services offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Other developments

- 11.1.1.4 MnM view

- 11.1.1.4.1 Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses and competitive threats

- 11.1.2 CERAMTEC GMBH

- 11.1.2.1 Business overview

- 11.1.2.2 Products/Solutions/Services offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Product launches

- 11.1.2.4 MnM view

- 11.1.2.4.1 Right to win

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses and competitive threats

- 11.1.3 KYOCERA CORPORATION

- 11.1.3.1 Business overview

- 11.1.3.2 Products/Solutions/Services offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Deals

- 11.1.3.3.2 Other developments

- 11.1.3.4 MnM view

- 11.1.3.4.1 Right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses and competitive threats

- 11.1.4 MORGAN ADVANCED MATERIALS PLC

- 11.1.4.1 Business overview

- 11.1.4.2 Products/Solutions/Services offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Deals

- 11.1.4.4 MnM view

- 11.1.4.4.1 Right to win

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses and competitive threats

- 11.1.5 3M

- 11.1.5.1 Business overview

- 11.1.5.2 Products/Solutions/Services offered

- 11.1.5.3 MnM view

- 11.1.5.3.1 Right to win

- 11.1.5.3.2 Strategic choices

- 11.1.5.3.3 Weaknesses and competitive threats

- 11.1.6 SAINT-GOBAIN PERFORMANCE CERAMICS & REFRACTORIES

- 11.1.6.1 Business overview

- 11.1.6.2 Products/Solutions/Services offered

- 11.1.6.3 MnM view

- 11.1.7 NITERRA CO., LTD.

- 11.1.7.1 Business overview

- 11.1.7.2 Products/Solutions/Services offered

- 11.1.7.3 MnM view

- 11.1.8 AGC CERAMICS

- 11.1.8.1 Business overview

- 11.1.8.2 Products/Solutions/Services offered

- 11.1.8.3 Recent developments

- 11.1.8.3.1 Deals

- 11.1.8.4 MnM view

- 11.1.9 PAUL RAUSCHERT GMBH & CO. KG

- 11.1.9.1 Business overview

- 11.1.9.2 Products/Solutions/Services offered

- 11.1.9.3 MnM view

- 11.1.10 ELAN TECHNOLOGY

- 11.1.10.1 Business overview

- 11.1.10.2 Products/Solutions/Services offered

- 11.1.10.3 MnM view

- 11.1.11 OERLIKON

- 11.1.11.1 Business overview

- 11.1.11.2 Products/Solutions/Services offered

- 11.1.11.3 MnM view

- 11.1.1 COORSTEK, INC.

- 11.2 OTHER PLAYERS

- 11.2.1 JYOTI CERAMICS

- 11.2.2 TECHNO CERA INDUSTRIES

- 11.2.3 BCE SPECIAL CERAMICS GMBH

- 11.2.4 SUPERIOR TECHNICAL CERAMICS

- 11.2.5 DYSON TECHNICAL CERAMICS

- 11.2.6 ORTECH ADVANCED CERAMICS

- 11.2.7 INTERNATIONAL SYALONS

- 11.2.8 BAKONY TECHNICAL CERAMICS

- 11.2.9 ADVANCED CERAMIC MATERIALS

- 11.2.10 MCDANEL ADVANCED CERAMIC TECHNOLOGIES

- 11.2.11 ADVANCED CERAMICS MANUFACTURING

- 11.2.12 BLASCH PRECISION CERAMICS, INC.

- 11.2.13 PRECISION CERAMICS

- 11.2.14 MANTEC TECHNICAL CERAMICS

- 11.2.15 K-TECH CERAMICS

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS