|

|

市場調査レポート

商品コード

1873969

公共安全・セキュリティの世界市場:ソリューション別、用途別、地域別 - 予測(~2030年)Public Safety and Security Market by Solution (Critical Communication, Biometric Security, Surveillance, Emergency & Disaster, Cybersecurity), Application (Homeland, Critical Infrastructure, Healthcare & Medical), and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 公共安全・セキュリティの世界市場:ソリューション別、用途別、地域別 - 予測(~2030年) |

|

出版日: 2025年10月06日

発行: MarketsandMarkets

ページ情報: 英文 589 Pages

納期: 即納可能

|

概要

世界の公共安全・セキュリティの市場規模は、2025年の5,750億5,000万米ドルから2030年には9,818億4,000万米ドルに達すると予測され、予測期間にCAGRで11.3%の成長が見込まれます。

市場は複数の要因によって牽引されています。

| 調査範囲 | |

|---|---|

| 調査対象期間 | 2019年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 単位 | 100万米ドル/10億米ドル |

| セグメント | 提供、展開方式、用途、地域 |

| 対象地域 | 北米、欧州、アジア太平洋、中東・アフリカ、ラテンアメリカ |

2024年7月、デリー州政府は公共安全の強化のため、都市全域に5万台の追加のCCTVカメラを設置する計画を発表しました。これは犯罪抑止とリアルタイムモニタリングを保証する監視インフラへの注目の高まりを示しています。同時に、AI、IoT、5G技術の発展が公共安全業務に革命をもたらしています。これらの革新により、緊急対応の迅速化、予測的な警察活動、効率的なリソース配分が可能となります。こうした進行は、進化する脅威に対処するための、よりスマートで統合されたセキュリティソリューションへの世界的な移行を反映しています。

安全システムが監視カメラや追跡装置からのデータの活用を進める中、プライバシーへの懸念が高まっています。個人データの管理不備は、悪用や社会的な不信感につながる可能性があります。安全と個人の権利のバランスを取ることは、政府や機関にとって依然として課題であり、市場成長を抑制しています。

「クラウドサイバーセキュリティセグメントが予測期間にもっとも高いCAGRで成長する見込みです。」

公共安全・セキュリティ市場において、クラウドセキュリティセグメントが急速に拡大しています。これはデジタルプラットフォームやコネクテッドシステムへの依存度が高まっているためです。公共機関や緊急サービスは、リアルタイムデータの管理、データの完全性の確保、インシデント対応の向上を目的として、セキュアなクラウド環境への業務の移行を加速させています。大規模な情報漏洩やランサムウェア攻撃が頻発する中、機密情報をサイバー脅威から保護する必要性が高まっていることが、この需要を後押ししています。2024年5月、FBIは公共部門機関に対するサイバー攻撃が前年比25%超増加したと報告し、より強力な保護の緊急性の増大を強く示しました。

クラウドベースソリューションは拡張性と柔軟性も提供するため、増加する都市人口を管理する政府や自治体にとって魅力的な選択肢となっています。法執行機関、災害対応チーム、国家安全保障機関が先進のデジタルツールを採用する中、クラウドセキュリティはもっとも急速に成長している分野として台頭しています。

「マネージドサービスセグメントが予測期間にもっとも高いCAGRで成長する見込みです。」

公共安全・セキュリティ市場において、マネージドサービスセグメントがもっとも急速に成長しています。これは組織が複雑なセキュリティ業務の処理でサービスプロバイダーを頼るようになっているためです。脅威の増加、進化するサイバーリスク、そして継続的なモニタリングへの需要が、機関や企業に迅速な対応時間とレジリエンスの向上を目的としたマネージドサービスの採用を促しています。2024年3月の世界調査では、公共機関の約65%が重要インフラ保護を強化するため外部委託モニタリングに投資していると報告されました。

この変化は、コスト効率、専門知識、リアルタイムアップデートの必要性によって推進されており、マネージドサービスプロバイダーは社内チームよりも効果的にこれらを提供できます。物理的セキュリティ、監視、サイバーセキュリティの統合管理を提供することで、これらのサービスは継続性と変化する規制への準拠を確保します。2025年にデジタルトランスフォーメーションが加速する中、公共・民間機関が機密資産の保護を優先していることから、マネージドサービスへの依存度が高まると予測されます。

「法執行・情報機関セグメントが予測期間に国土安全保障において最大の市場規模を占めると見込まれます」

法執行・情報機関セグメントは、国家と地域の保護戦略の中核を成すため、公共安全・セキュリティ市場において最大のシェアを占めています。テロリズム、組織犯罪、サイバー犯罪を含む脅威の増大により、各国政府は先進技術と統合情報ネットワークへの投資を優先するよう促されています。2025年4月、欧州連合は公共セキュリティ資金の60%超が法執行連携とインテリジェンスデータ共有の強化に向けられていると発表しました。

当レポートでは、世界の公共安全・セキュリティ市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

よくあるご質問

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要な知見

- 公共安全・セキュリティ市場の企業にとって魅力的な成長機会

- 公共安全・セキュリティ市場:提供別

- 公共安全・セキュリティ市場:ソリューション別

- 公共安全・セキュリティ市場:サービス別

- 公共安全・セキュリティ市場:プロフェッショナルサービス別

- 公共安全・セキュリティ市場:用途別

- 公共安全・セキュリティ市場:展開方式別

- 公共安全・セキュリティ市場:緊急・災害管理別

- 公共安全・セキュリティ市場:生体認証セキュリティ別

- 公共安全・セキュリティ市場:監視・モニタリング別

- 公共安全・セキュリティ市場:アクセス制御・境界セキュリティ別

- 公共安全・セキュリティ市場:サイバーセキュリティ別

- 公共安全・セキュリティ市場:国土安全保障別

- 公共安全・セキュリティ市場:重要インフラセキュリティ別

- 市場投資シナリオ

第5章 市場の概要と業界動向

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ケーススタディ分析

- 公共安全・セキュリティの進化

- バリューチェーン分析

- エコシステム分析

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- カスタマービジネスに影響を与える動向/混乱

- 価格設定の分析

- 主要企業の平均販売価格:ソリューション別(2024年)

- 参考価格分析:提供別

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- 特許分析

- 関税と規制情勢

- 公共安全・セキュリティ製品に関連する関税

- 規制枠組み

- 規制機関、政府機関、その他の組織

- 公共安全・セキュリティ市場におけるベストプラクティス

- テクノロジーロードマップ

- 貿易分析

- 輸入データ

- 輸出データ

- 主な会議とイベント(2026年)

- ビジネスモデル分析

- 投資と資金調達のシナリオ

- 公共安全・セキュリティ市場に対する生成AIの影響

- 主なユースケースと市場の将来性

- 相互接続された隣接エコシステムに対する生成AIの影響

- 2025年の米国関税の影響 - 公共安全・セキュリティ市場

- イントロダクション

- 主な関税率

- 価格の影響の分析

- 国/地域への影響

- 最終用途産業への影響

第6章 公共安全・セキュリティ市場:提供別

- イントロダクション

- ソリューション

- 重要通信ネットワーク

- 緊急・災害管理

- アクセス制御・境界セキュリティ

- 生体認証セキュリティ

- 監視・モニタリングシステム

- サイバーセキュリティ

- サービス

- プロフェッショナルサービス

- マネージドサービス

第7章 公共安全・セキュリティ市場:展開方式別

- イントロダクション

- オンプレミス

- クラウド

第8章 公共安全・セキュリティ市場:用途別

- イントロダクション

- 国土安全保障

- 緊急・災害サービス

- 医療・救急医療

- 重要インフラセキュリティ

第9章 公共安全・セキュリティ市場:地域別

- イントロダクション

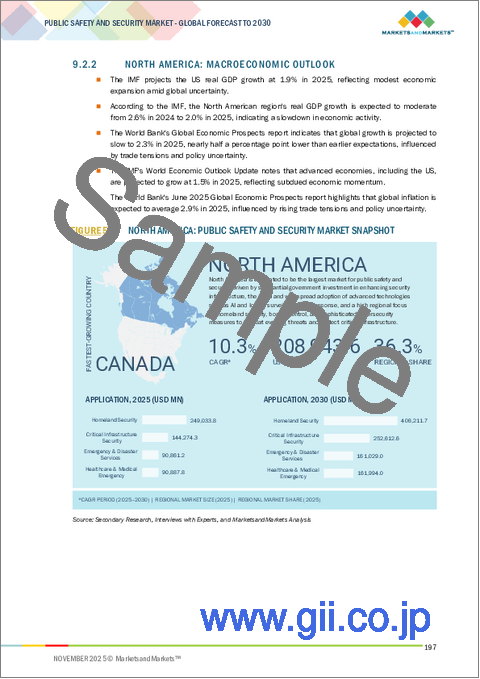

- 北米

- 北米市場の促進要因

- 北米のマクロ経済の見通し

- 米国

- カナダ

- 欧州

- 欧州市場の促進要因

- 欧州のマクロ経済の見通し

- 英国

- ドイツ

- フランス

- イタリア

- スペイン

- その他の欧州

- アジア太平洋

- アジア太平洋市場の促進要因

- アジア太平洋のマクロ経済の見通し

- 中国

- 日本

- インド

- オーストラリア・ニュージーランド(ANZ)

- シンガポール

- その他のアジア太平洋

- 中東・アフリカ

- 中東・アフリカ市場の促進要因

- 中東・アフリカのマクロ経済の見通し

- 中東

- アフリカ

- ラテンアメリカ

- ラテンアメリカの公共安全・セキュリティ市場の促進要因

- ラテンアメリカのマクロ経済の見通し

- ブラジル

- メキシコ

- その他のラテンアメリカ

第10章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み(2023年~2025年)

- 収益分析(2020年~2024年)

- 企業の評価と財務指標

- 市場シェア分析(2024年)

- ブランドの比較

- 企業の評価マトリクス:主要企業(2024年)

- 企業の評価マトリクス:スタートアップ/中小企業(2024年)

- 競合シナリオ

第11章 企業の概要

- 主要企業

- SIEMENS

- MOTOROLA SOLUTIONS

- GENERAL DYNAMICS

- HUAWEI

- IBM

- CISCO

- HONEYWELL

- AIRBUS

- L3HARRIS TECHNOLOGIES

- ATOS

- HEXAGON AB

- THALES

- ERICSSON

- ELBIT SYSTEMS

- NEC

- JOHNSON CONTROLS

- AXIS COMMUNICATIONS

- SAAB AB

- IDEMIA

- BOSCH SECURITY

- EVERBRIDGE

- GENETEC

- TELEDYNE FLIR

- SUN RIDGE SYSTEMS

- SECOM PLC

- TELTRONIC

- SECURE PASSAGE

- FOTOKITE

- VEOCI

- CITYSHOB

- IOTAS

- OPTASENSE

- VERKADA

- WESTMINSTER GROUP PLC

- INTRADO

- RAVE MOBILE SAFETY

- ALLEGION PLC

- FEDERAL SIGNAL CORPORATION

第12章 隣接市場

- 隣接市場の紹介

- 制限事項

- 物理的セキュリティ市場

- 重要インフラ保護市場