|

|

市場調査レポート

商品コード

1545408

ワイヤレスオーディオデバイスの世界市場:製品別、技術別、用途別、機能別、地域別 - 予測(~2029年)Wireless Audio Device Market by Product (True Wireless Hearables/Earbuds, Headsets, Earphones), Technology (Bluetooth, Airplay, Wi-Fi), Application (Consumer, Home Audio, Automotive), Functionality (Smart, Non-smart) and Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| ワイヤレスオーディオデバイスの世界市場:製品別、技術別、用途別、機能別、地域別 - 予測(~2029年) |

|

出版日: 2024年08月05日

発行: MarketsandMarkets

ページ情報: 英文 250 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

ワイヤレスオーディオデバイスの市場規模は、2024年の565億米ドルから、予測期間中は4.7%のCAGRで推移し、2029年には709億米ドルの規模に成長すると予測されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2018-2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024-2029年 |

| 単位 | 金額 (米ドル) |

| セグメント | タイプ・用途・地域 |

| 対象地域 | 北米・アジア太平洋・欧州・中東&アフリカ・南米 |

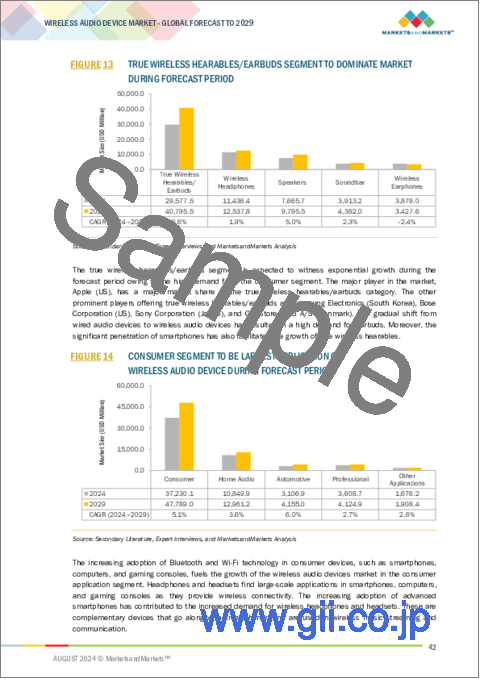

"トゥルーワイヤレスヒアラブル/イヤーバズの部門が予測期間中にもっとも高いCAGRで成長する見通し"

ノイズリダクション、ジェスチャーコントロール、オーディオアシスト、音質、バッテリー寿命、接続といった特性の継続的な開発が市場を牽引しています。スマートフォンの人気の高まりも、TWSイヤホン市場を後押ししています。

"Bluetooth技術が予測期間中にもっとも高い成長を遂げる見通し"

Bluetoothの使用は、適応性、効率性、継続的な技術革新など、さまざまな理由で人気を集めています。Bluetooth は、オーディオ、ヘルスケア、スマートホーム、産業用IoTなど、さまざまな産業で重要な技術としての地位を確立しています。機器間のワイヤレス通信が可能なため、先進技術には欠かせません。Bluetoothの低消費電力性能も、もっとも特徴的な性能のひとつです。この効率性は、頻繁な充電を必要とせずに長時間動作するバッテリー駆動機器にとって特に重要です。

”アジア太平洋地域がもっとも高いCAGRを記録する見通し"

アジア太平洋諸国の急速な発展は、自立したライフスタイルの進展によるものです。消費者は、通勤やワークアウトなどの外出時に便利なオーディオソリューションを求めています。また、アジア太平洋諸国の多くは可処分所得が向上しており、人々はワイヤレスオーディオデバイスなどの技術製品に投資する準備を整えています。消費者はまた、市場で入手可能な視覚的魅力と幅広いスタイルに惹かれ、独自のスタイルに合った製品を選ぶことができます。

当レポートでは、世界のワイヤレスオーディオデバイスの市場を調査し、市場概要、市場成長への各種影響因子の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域別の詳細分析、競合環境、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- エコシステム分析

- 投資と資金調達のシナリオ

- 価格分析

- 顧客ビジネスに影響を与える動向/ディスラプション

- 技術分析

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- ケーススタディ分析

- 貿易分析

- 特許分析

- 主な会議とイベント

- 規制状況

- AI/生成AIがワイヤレスオーディオデバイス市場に与える影響

第6章 ワイヤレスオーディオデバイス市場:製品別

- ヘッドフォン

- イヤホン

- トゥルーワイヤレスヒアラブル/イヤーバズ

- スピーカー

- サウンドバー

第7章 ワイヤレスオーディオデバイス市場:技術別

- Bluetooth

- WI-FI

- AIRPLAY

- 無線周波数

- その他

- ワイヤレススピーカー&オーディオ (WISA)

- KLEERNET

- ALLPLAY

- SKAA

- PLAY-FI

- 赤外線 (IR)

第8章 ワイヤレスオーディオデバイス市場:機能別

- スマートデバイス

- 非スマートデバイス

第9章 ワイヤレスオーディオデバイス市場:用途別

- ホームオーディオ

- プロフェッショナル

- 消費者

- 自動車

- その他

第10章 ワイヤレスオーディオデバイス市場:地域別

- 北米

- 欧州

- アジア太平洋

- その他の地域

第11章 競合情勢

- 概要

- 主要戦略/有力企業

- 市場シェア分析

- 収益分析

- 企業価値評価と財務指標

- ブランド/製品比較

- 企業評価マトリックス:主要企業

- 企業評価マトリックス:スタートアップ/中小企業

- 競合シナリオと動向

第12章 企業プロファイル

- 主要企業

- APPLE INC.

- HARMAN INTERNATIONAL (SUBSIDIARY OF SAMSUNG ELECTRONICS)

- XIAOMI

- SONY CORPORATION

- IMAGINE MARKETING LIMITED

- BOSE CORPORATION

- SONOS, INC.

- MASIMO

- SENNHEISER ELECTRONIC SE & CO. KG

- VIZIO, INC.

- VOXX INTERNATIONAL CORP.

- MARSHALL GROUP AB

- その他の企業

- YAMAHA CORPORATION

- LG ELECTRONICS

- BANG & OLUFSEN

- GN STORE NORD A/S

- PLANTRONICS, INC.

- SHURE

- DALI

- JAYBIRD

- ANKER INNOVATIONS

- RAZER INC.

- HP DEVELOPMENT COMPANY, L.P.

- EDIFIER

- NOTHING TECHNOLOGY LIMITED

第13章 付録

List of Tables

- TABLE 1 WIRELESS AUDIO DEVICE MARKET: RISK ASSESSMENT

- TABLE 2 GLOBAL SHIPMENT OF TRUE WIRELESS HEARABLES/EARBUDS/TWS, 2021-2022

- TABLE 3 WIRELESS AUDIO DEVICE MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 4 AVERAGE SELLING PRICE OF WIRELESS AUDIO DEVICES OFFERED BY KEY PLAYERS, 2020-2023 (USD)

- TABLE 5 AVERAGE SELLING PRICE OF WIRELESS AUDIO DEVICES, 2020-2023 (USD)

- TABLE 6 WIRELESS AUDIO DEVICE MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 7 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION (%)

- TABLE 8 KEY BUYING CRITERIA FOR APPLICATIONS

- TABLE 9 LIST OF MAJOR PATENTS

- TABLE 10 KEY CONFERENCES AND EVENTS, 2024-2025

- TABLE 11 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 WIRELESS AUDIO DEVICE MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 15 WIRELESS AUDIO DEVICE MARKET, BY PRODUCT, 2024-2029 (USD MILLION)

- TABLE 16 WIRELESS AUDIO DEVICE MARKET, BY PRODUCT, 2020-2023 (MILLION UNITS)

- TABLE 17 WIRELESS AUDIO DEVICE MARKET, BY PRODUCT, 2024-2029 (MILLION UNITS)

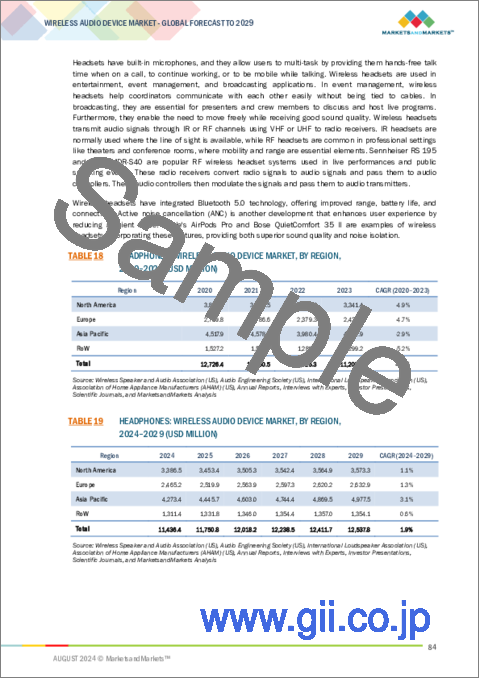

- TABLE 18 HEADPHONES: WIRELESS AUDIO DEVICE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 19 HEADPHONES: WIRELESS AUDIO DEVICE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 20 EARPHONES: WIRELESS AUDIO DEVICE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 21 EARPHONES: WIRELESS AUDIO DEVICE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 22 TRUE WIRELESS HEARABLES/EARBUDS: WIRELESS AUDIO DEVICE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 23 TRUE WIRELESS HEARABLES/EARBUDS: WIRELESS AUDIO DEVICE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 24 SPEAKERS: WIRELESS AUDIO DEVICE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 25 SPEAKERS: WIRELESS AUDIO DEVICE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 26 SOUNDBARS: WIRELESS AUDIO DEVICE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 27 SOUNDBARS: WIRELESS AUDIO DEVICE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 28 WIRELESS AUDIO DEVICE MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 29 WIRELESS AUDIO DEVICE MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 30 WIRELESS AUDIO DEVICE MARKET, BY FUNCTIONALITY, 2020-2023 (USD MILLION)

- TABLE 31 WIRELESS AUDIO DEVICE MARKET, BY FUNCTIONALITY, 2024-2029 (USD MILLION)

- TABLE 32 SMART DEVICES: WIRELESS AUDIO DEVICE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 33 SMART DEVICES: WIRELESS AUDIO DEVICE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 34 NON-SMART DEVICES: WIRELESS AUDIO DEVICE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 35 NON-SMART DEVICES: WIRELESS AUDIO DEVICE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 36 WIRELESS AUDIO DEVICE MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 37 WIRELESS AUDIO DEVICE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 38 HOME AUDIO: WIRELESS AUDIO DEVICE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 39 HOME AUDIO: WIRELESS AUDIO DEVICE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 40 PROFESSIONAL: WIRELESS AUDIO DEVICE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 41 PROFESSIONAL: WIRELESS AUDIO DEVICE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 42 CONSUMER: WIRELESS AUDIO DEVICE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 43 CONSUMER: WIRELESS AUDIO DEVICE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 44 AUTOMOTIVE: WIRELESS AUDIO DEVICE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 45 AUTOMOTIVE: WIRELESS AUDIO DEVICE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 46 OTHER APPLICATIONS: WIRELESS AUDIO DEVICE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 47 OTHER APPLICATIONS: WIRELESS AUDIO DEVICE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 48 WIRELESS AUDIO DEVICE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 49 WIRELESS AUDIO DEVICE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 50 NORTH AMERICA: WIRELESS AUDIO DEVICE MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 51 NORTH AMERICA: WIRELESS AUDIO DEVICE MARKET, BY PRODUCT, 2024-2029 (USD MILLION)

- TABLE 52 NORTH AMERICA: WIRELESS AUDIO DEVICE MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 53 NORTH AMERICA: WIRELESS AUDIO DEVICE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 54 NORTH AMERICA: WIRELESS AUDIO DEVICE MARKET, BY FUNCTIONALITY, 2020-2023 (USD MILLION)

- TABLE 55 NORTH AMERICA: WIRELESS AUDIO DEVICE MARKET, BY FUNCTIONALITY, 2024-2029 (USD MILLION)

- TABLE 56 NORTH AMERICA: WIRELESS AUDIO DEVICE MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 57 NORTH AMERICA: WIRELESS AUDIO DEVICE MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 58 US: WIRELESS AUDIO DEVICE MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 59 US: WIRELESS AUDIO DEVICE MARKET, BY PRODUCT, 2024-2029 (USD MILLION)

- TABLE 60 CANADA: WIRELESS AUDIO DEVICE MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 61 CANADA: WIRELESS AUDIO DEVICE MARKET, BY PRODUCT, 2024-2029 (USD MILLION)

- TABLE 62 MEXICO: WIRELESS AUDIO DEVICE MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 63 MEXICO: WIRELESS AUDIO DEVICE MARKET, BY PRODUCT, 2024-2029 (USD MILLION)

- TABLE 64 EUROPE: WIRELESS AUDIO DEVICE MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 65 EUROPE: WIRELESS AUDIO DEVICE MARKET, BY PRODUCT, 2024-2029 (USD MILLION)

- TABLE 66 EUROPE: WIRELESS AUDIO DEVICE MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 67 EUROPE: WIRELESS AUDIO DEVICE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 68 EUROPE: WIRELESS AUDIO DEVICE MARKET, BY FUNCTIONALITY, 2020-2023 (USD MILLION)

- TABLE 69 EUROPE: WIRELESS AUDIO DEVICE MARKET, BY FUNCTIONALITY, 2024-2029 (USD MILLION)

- TABLE 70 EUROPE: WIRELESS AUDIO DEVICE MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 71 EUROPE: WIRELESS AUDIO DEVICE MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 72 UK: WIRELESS AUDIO DEVICE MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 73 UK: WIRELESS AUDIO DEVICE MARKET, BY PRODUCT, 2024-2029 (USD MILLION)

- TABLE 74 GERMANY: WIRELESS AUDIO DEVICE MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 75 GERMANY: WIRELESS AUDIO DEVICE MARKET, BY PRODUCT, 2024-2029 (USD MILLION)

- TABLE 76 FRANCE: WIRELESS AUDIO DEVICE MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 77 FRANCE: WIRELESS AUDIO DEVICE MARKET, BY PRODUCT, 2024-2029 (USD MILLION)

- TABLE 78 REST OF EUROPE: WIRELESS AUDIO DEVICE MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 79 REST OF EUROPE: WIRELESS AUDIO DEVICE MARKET, BY PRODUCT, 2024-2029 (USD MILLION)

- TABLE 80 ASIA PACIFIC: WIRELESS AUDIO DEVICE MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 81 ASIA PACIFIC: WIRELESS AUDIO DEVICE MARKET, BY PRODUCT, 2024-2029 (USD MILLION)

- TABLE 82 ASIA PACIFIC: WIRELESS AUDIO DEVICE MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 83 ASIA PACIFIC: WIRELESS AUDIO DEVICE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 84 ASIA PACIFIC: WIRELESS AUDIO DEVICE MARKET, BY FUNCTIONALITY, 2020-2023 (USD MILLION)

- TABLE 85 ASIA PACIFIC: WIRELESS AUDIO DEVICE MARKET, BY FUNCTIONALITY, 2024-2029 (USD MILLION)

- TABLE 86 ASIA PACIFIC: WIRELESS AUDIO DEVICE MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 87 ASIA PACIFIC: WIRELESS AUDIO DEVICE MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 88 CHINA: WIRELESS AUDIO DEVICE MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 89 CHINA: WIRELESS AUDIO DEVICE MARKET, BY PRODUCT, 2024-2029 (USD MILLION)

- TABLE 90 JAPAN: WIRELESS AUDIO DEVICE MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 91 JAPAN: WIRELESS AUDIO DEVICE MARKET, BY PRODUCT, 2024-2029 (USD MILLION)

- TABLE 92 SOUTH KOREA: WIRELESS AUDIO DEVICE MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 93 SOUTH KOREA: WIRELESS AUDIO DEVICE MARKET, BY PRODUCT, 2024-2029 (USD MILLION)

- TABLE 94 INDIA: WIRELESS AUDIO DEVICE MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 95 INDIA: WIRELESS AUDIO DEVICE MARKET, BY PRODUCT, 2024-2029 (USD MILLION)

- TABLE 96 REST OF ASIA PACIFIC: WIRELESS AUDIO DEVICE MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 97 REST OF ASIA PACIFIC: WIRELESS AUDIO DEVICE MARKET, BY PRODUCT, 2024-2029 (USD MILLION)

- TABLE 98 ROW: WIRELESS AUDIO DEVICE MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 99 ROW: WIRELESS AUDIO DEVICE MARKET, BY PRODUCT, 2024-2029 (USD MILLION)

- TABLE 100 ROW: WIRELESS AUDIO DEVICE MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 101 ROW: WIRELESS AUDIO DEVICE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 102 ROW: WIRELESS AUDIO DEVICE MARKET, BY FUNCTIONALITY, 2020-2023 (USD MILLION)

- TABLE 103 ROW: WIRELESS AUDIO DEVICE MARKET, BY FUNCTIONALITY, 2024-2029 (USD MILLION)

- TABLE 104 ROW: WIRELESS AUDIO DEVICE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 105 ROW: WIRELESS AUDIO DEVICE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 106 SOUTH AMERICA: WIRELESS AUDIO DEVICE MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 107 SOUTH AMERICA: WIRELESS AUDIO DEVICE MARKET, BY PRODUCT, 2024-2029 (USD MILLION)

- TABLE 108 MIDDLE EAST & AFRICA: WIRELESS AUDIO DEVICE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 109 MIDDLE EAST & AFRICA: WIRELESS AUDIO DEVICE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 110 MIDDLE EAST & AFRICA: WIRELESS AUDIO DEVICE MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 111 MIDDLE EAST & AFRICA: WIRELESS AUDIO DEVICE MARKET, BY PRODUCT, 2024-2029 (USD MILLION)

- TABLE 112 WIRELESS AUDIO DEVICE MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, JANUARY 2020-JUNE 2024

- TABLE 113 WIRELESS AUDIO DEVICE MARKET: DEGREE OF COMPETITION, 2023

- TABLE 114 WIRELESS AUDIO DEVICE MARKET: PRODUCT FOOTPRINT

- TABLE 115 WIRELESS AUDIO DEVICE MARKET: APPLICATION FOOTPRINT

- TABLE 116 WIRELESS AUDIO DEVICE MARKET: REGION FOOTPRINT

- TABLE 117 WIRELESS AUDIO DEVICE MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 118 WIRELESS AUDIO DEVICE MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 119 WIRELESS AUDIO MARKET: PRODUCT LAUNCHES, JANUARY 2020-JUNE 2024

- TABLE 120 WIRELESS AUDIO DEVICE MARKET: DEALS, JANUARY 2020-JUNE 2024

- TABLE 121 APPLE INC.: COMPANY OVERVIEW

- TABLE 122 APPLE INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 123 APPLE INC.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 124 HARMAN INTERNATIONAL (SUBSIDIARY OF SAMSUNG ELECTRONICS): COMPANY OVERVIEW

- TABLE 125 HARMAN INTERNATIONAL (SUBSIDIARY OF SAMSUNG ELECTRONICS): PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 126 HARMAN INTERNATIONAL (SUBSIDIARY OF SAMSUNG ELECTRONICS): PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 127 HARMAN INTERNATIONAL (SUBSIDIARY OF SAMSUNG ELECTRONICS): DEALS

- TABLE 128 XIAOMI: COMPANY OVERVIEW

- TABLE 129 XIAOMI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 130 XIAOMI: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 131 SONY CORPORATION: COMPANY OVERVIEW

- TABLE 132 SONY CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 133 SONY CORPORATION: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 134 IMAGINE MARKETING LIMITED: COMPANY OVERVIEW

- TABLE 135 IMAGINE MARKETING LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 136 IMAGINE MARKETING LIMITED: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 137 BOSE CORPORATION: COMPANY OVERVIEW

- TABLE 138 BOSE CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 139 BOSE CORPORATION: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 140 BOSE CORPORATION: DEALS

- TABLE 141 SONOS, INC.: COMPANY OVERVIEW

- TABLE 142 SONOS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 143 SONOS, INC.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 144 SONOS, INC.: DEALS

- TABLE 145 MASIMO: COMPANY OVERVIEW

- TABLE 146 MASIMO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 147 MASIMO: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 148 MASIMO: DEALS

- TABLE 149 SENNHEISER ELECTRONIC SE & CO. KG: COMPANY OVERVIEW

- TABLE 150 SENNHEISER ELECTRONIC SE & CO. KG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 151 SENNHEISER ELECTRONIC SE & CO. KG: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 152 SENNHEISER ELECTRONIC SE & CO. KG: DEALS

- TABLE 153 VIZIO, INC.: COMPANY OVERVIEW

- TABLE 154 VIZIO, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 155 VIZIO, INC.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 156 VIZIO, INC.: DEALS

- TABLE 157 VOXX INTERNATIONAL CORP.: COMPANY OVERVIEW

- TABLE 158 VOXX INTERNATIONAL CORP.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 159 VOXX INTERNATIONAL CORP.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 160 VOXX INTERNATIONAL CORP.: DEALS

- TABLE 161 MARSHALL GROUP AB: COMPANY OVERVIEW

- TABLE 162 MARSHALL GROUP AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 163 MARSHALL GROUP AB: PRODUCT LAUNCHES/DEVELOPMENTS

List of Figures

- FIGURE 1 WIRELESS AUDIO DEVICE MARKET SEGMENTATION

- FIGURE 2 WIRELESS AUDIO DEVICE MARKET: RESEARCH DESIGN

- FIGURE 3 PRIMARY AND SECONDARY RESEARCH

- FIGURE 4 WIRELESS AUDIO DEVICE MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH (SUPPLY SIDE) - REVENUES GENERATED BY COMPANIES FROM SALES OF WIRELESS AUDIO DEVICE

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: DEMAND-SIDE ANALYSIS

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 9 DATA TRIANGULATION: WIRELESS AUDIO DEVICE MARKET

- FIGURE 10 WIRELESS AUDIO DEVICE MARKET: GLOBAL SNAPSHOT

- FIGURE 11 BLUETOOTH TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 12 SMART SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 13 TRUE WIRELESS HEARABLES/EARBUDS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 14 CONSUMER SEGMENT TO BE LARGEST APPLICATION OF WIRELESS AUDIO DEVICE DURING FORECAST PERIOD

- FIGURE 15 ASIA PACIFIC TO DOMINATE WIRELESS AUDIO DEVICE MARKET DURING FORECAST PERIOD

- FIGURE 16 GROWING NUMBER OF SMARTPHONES AND TRUE WIRELESS HEARABLES/EARBUDS TO DRIVE MARKET GROWTH

- FIGURE 17 CONSUMER APPLICATION TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 18 BLUETOOTH SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 19 TRUE WIRELESS HEARABLES/EARBUDS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 20 SMART DEVICES TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 21 CONSUMER TO BE LARGEST APPLICATION OF WIRELESS AUDIO DEVICE IN ASIA PACIFIC

- FIGURE 22 WIRELESS AUDIO DEVICE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 23 IMPACT OF DRIVERS ON WIRELESS AUDIO DEVICE MARKET

- FIGURE 24 IMPACT OF RESTRAINTS ON WIRELESS AUDIO DEVICE MARKET

- FIGURE 25 IMPACT OF OPPORTUNITIES ON WIRELESS AUDIO DEVICE MARKET

- FIGURE 26 IMPACT OF CHALLENGES ON WIRELESS AUDIO DEVICE MARKET

- FIGURE 27 WIRELESS AUDIO DEVICE MARKET: VALUE CHAIN ANALYSIS

- FIGURE 28 WIRELESS AUDIO DEVICE MARKET: ECOSYSTEM ANALYSIS

- FIGURE 29 INVESTMENT AND FUNDING SCENARIO, 2018-2024

- FIGURE 30 AVERAGE SELLING PRICE TREND OF WIRELESS AUDIO DEVICES OFFERED BY KEY PLAYERS

- FIGURE 31 AVERAGE SELLING PRICE TREND OF TRUE WIRELESS HEARABLES/EARBUDS, BY REGION, 2020-2023

- FIGURE 32 AVERAGE SELLING PRICE TREND OF HEADPHONES, BY REGION, 2020-2023

- FIGURE 33 TRENDS AND DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 34 WIRELESS AUDIO DEVICE MARKET: IMPACT ANALYSIS OF PORTER'S FIVE FORCES

- FIGURE 35 PORTER'S FIVE FORCES ANALYSIS: WIRELESS AUDIO DEVICE MARKET

- FIGURE 36 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION

- FIGURE 37 KEY BUYING CRITERIA FOR APPLICATIONS

- FIGURE 38 IMPORT DATA FOR HS CODE 851830-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023

- FIGURE 39 EXPORT DATA FOR HS CODE 851830-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023

- FIGURE 40 PATENTS APPLIED AND GRANTED, 2013-2023

- FIGURE 41 IMPACT OF AI/GEN AI ON WIRELESS AUDIO DEVICE MARKET

- FIGURE 42 TRUE WIRELESS HEARABLES/EARBUDS SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 43 BLUETOOTH SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 44 SMART DEVICES SEGMENT TO EXHIBIT HIGHER CAGR IN WIRELESS AUDIO DEVICE MARKET DURING FORECAST PERIOD

- FIGURE 45 CONSUMER SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 46 INDIA TO REGISTER HIGHEST CAGR IN WIRELESS AUDIO DEVICE MARKET DURING FORECAST PERIOD

- FIGURE 47 NORTH AMERICA: WIRELESS AUDIO DEVICE MARKET SNAPSHOT

- FIGURE 48 EUROPE: WIRELESS AUDIO DEVICE MARKET SNAPSHOT

- FIGURE 49 ASIA PACIFIC: WIRELESS AUDIO DEVICE MARKET SNAPSHOT

- FIGURE 50 WIRELESS AUDIO DEVICE MARKET SHARE ANALYSIS, 2023

- FIGURE 51 REVENUE ANALYSIS OF KEY PLAYERS IN WIRELESS AUDIO DEVICE MARKET, 2020-2023

- FIGURE 52 WIRELESS AUDIO DEVICE MARKET: COMPANY VALUATION

- FIGURE 53 WIRELESS AUDIO DEVICE MARKET: FINANCIAL METRICS (EV/EBITDA)

- FIGURE 54 WIRELESS AUDIO DEVICE MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 55 WIRELESS AUDIO DEVICE MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 56 WIRELESS AUDIO DEVICE MARKET: COMPANY FOOTPRINT

- FIGURE 57 WIRELESS AUDIO DEVICE MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 58 APPLE INC.: COMPANY SNAPSHOT

- FIGURE 59 HARMAN INTERNATIONAL (SUBSIDIARY OF SAMSUNG ELECTRONICS): COMPANY SNAPSHOT

- FIGURE 60 XIAOMI: COMPANY SNAPSHOT

- FIGURE 61 SONY CORPORATION: COMPANY SNAPSHOT

- FIGURE 62 SONOS, INC.: COMPANY SNAPSHOT

- FIGURE 63 MASIMO: COMPANY SNAPSHOT

- FIGURE 64 VIZIO, INC.: COMPANY SNAPSHOT

- FIGURE 65 VOXX INTERNATIONAL CORP.: COMPANY SNAPSHOT

- FIGURE 66 MARSHALL GROUP AB: COMPANY SNAPSHOT

The Wireless Audio Device Market is projected to reach from USD 56.5 billion in 2024 to USD 70.9 billion by 2029; it is expected to grow at a CAGR of 4.7% from 2024 to 2029. Consumers are becoming increasingly aware of smart gadget features, components, and value propositions. This empowers individuals to make better purchasing judgments. The popularity of smart voice assistants originates from their capacity to improve users' daily lives in a practical and enjoyable manner. Encouragement and social interaction influence user happiness with AI-enabled products. Smart speakers' broad adoption opens up new potential for radio to improve its technological reach and broadcasting, and also to grow into podcasting and in-car audio.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2018-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Million) |

| Segments | Type, Application, and Region |

| Regions covered | North America, Asia Pacific, Europe, Middle East & Africa, and South America |

Key players operating in the wireless audio device market are Apple Inc (US), SAMSUNG (South Korea), Bose Corporation (US), Sonos, Inc. (US), Sony Corporation (Japan).

"The true wireless hearable/earpods is projected to grow at the highest CAGR during the forecast period."

The market is driven by continuous developments in characteristics such as noise reduction, gesture controls, audio assistance, audio quality, lifespan of batteries, and connection. The potential to create an immersive, three-dimensional listening experience is growing into a popular attribute among consumers when selecting earbuds. The increased popularity of smartphones is boosting the TWS earbuds market, because they are commonly sold as smartphone accessories.

"The Bluetooth technology is projected to have the highest growth during the forecast period."

The use of Bluetooth is gaining popularity for various compelling reasons, including its adaptability, efficiency, and ongoing innovation. Bluetooth has proven its position as an important technology in a variety of industries, including audio, healthcare, smart homes, and industrial IoT. The ability to offer wireless communication between devices makes it indispensable for advanced technologies. Bluetooth's low power consumption is one of its most distinguishing characteristics. The efficiency is especially important for battery-powered devices, which may operate for a longer period of time without the need for frequent recharging.

"Asia Pacific region is likely to register highest CAGR."

Rapid development in Asia-Pacific countries is contributing to a more independent lifestyle. Consumers want audio solutions that are convenient for their on-the-go activities, such as commuting or working out. Wireless audio devices meet this desire by offering the option of unattached listening. As disposable incomes improve in many Asia-Pacific countries, people are more prepared to invest in technological goods, such as wireless audio devices. Consumers are also drawn to the visual appeal and range of styles available on the market, which allows them to select products that match their unique style.

Breakdown of primaries

The study contains insights from various industry experts, ranging from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type - Tier 1 - 18%, Tier 2 - 22%, Tier 3 - 60%

- By Designation- C-level Executives - 21%, Directors - 35%, Others - 44%

- By Region-North America - 45%, Europe - 20%, Asia Pacific - 30%, RoW - 5%

The wireless audio device market is dominated by a few globally established players such as Apple Inc (US), SAMSUNG (South Korea), Bose Corporation (US), Sonos, Inc. (US), Sony Corporation (Japan), Masimo (US), Sennheiser electronic SE & Co. KG (Germany), VOXX International Corp.(US), VIZIO, Inc. (US), Marshall Group AB (Sweden). The study includes an in-depth competitive analysis of these key players in the wireless audio device market, with their company profiles, recent developments, and key market strategies.

Research Coverage:

The report segments the wireless audio device market and forecasts its size by product, technology, application, functionality, and region. The report also discusses the drivers, restraints, opportunities, and challenges pertaining to the market. It gives a detailed view of the market across four main regions-North America, Europe, Asia Pacific, and RoW. Supply chain analysis has been included in the report, along with the key players and their competitive analysis in the wireless audio device ecosystem.

Key Benefits to Buy the Report:

- Analysis of Key Drivers (Surge in demand for truly wireless (TWS) earbuds and headphones, Adoption of wireless audio devices in commercial sector, Rising need for Bluetooth and portable speakers). Restraints (Restrictive radio frequency spectrum in audio equipment, Hearing impairment from prolonged use of headphones and earbuds, Interference caused by wireless audio devices in functioning of implanted medical devices). Opportunities (Gaining popularity among health and fitness sector, Advent of Bluetooth LE Audio, Integration of smart home assistants and home theaters) and Challenges (Compromising audio quality due to bandwidth constraints, coding delays, and errors).

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the wireless audio device market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the wireless audio device market across varied regions.

- Market Diversification: Exhaustive information about new solutions, untapped geographies, recent developments, and investments in the wireless audio device market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players like Apple Inc (US), SAMSUNG (South Korea), Bose Corporation (US), Sonos, Inc. (US), Sony Corporation (Japan) among others in the wireless audio device market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS & REGIONS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.3.3 INCLUSIONS AND EXCLUSIONS

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 INTRODUCTION

- 2.2 RESEARCH DATA

- 2.2.1 SECONDARY DATA

- 2.2.1.1 Secondary sources

- 2.2.1.2 Key data from secondary sources

- 2.2.2 PRIMARY DATA

- 2.2.2.1 Breakdown of primary interviews

- 2.2.2.2 Key data from primary sources

- 2.2.2.3 Key industry insights

- 2.2.2.4 Primary sources

- 2.2.1 SECONDARY DATA

- 2.3 FACTOR ANALYSIS

- 2.4 MARKET SIZE ESTIMATION

- 2.4.1 BOTTOM-UP APPROACH

- 2.4.1.1 Approach to estimate market size using bottom-up analysis

- 2.4.2 TOP-DOWN APPROACH

- 2.4.2.1 Approach to estimate market size using top-down approach (supply side)

- 2.4.1 BOTTOM-UP APPROACH

- 2.5 MARKET BREAKDOWN & DATA TRIANGULATION

- 2.6 RESEARCH ASSUMPTIONS

- 2.6.1 ASSUMPTIONS

- 2.7 RESEARCH LIMITATIONS

- 2.8 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN WIRELESS AUDIO DEVICE MARKET

- 4.2 WIRELESS AUDIO DEVICE MARKET, BY APPLICATION

- 4.3 WIRELESS AUDIO DEVICE MARKET, BY TECHNOLOGY

- 4.4 WIRELESS AUDIO DEVICE MARKET, BY PRODUCT

- 4.5 WIRELESS AUDIO DEVICE MARKET, BY FUNCTIONALITY

- 4.6 WIRELESS AUDIO DEVICE MARKET IN ASIA PACIFIC, BY APPLICATION AND FUNCTIONALITY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Elevating demand for true wireless earbuds and headphones

- 5.2.1.2 Rising adoption of wireless audio devices in commercial sector

- 5.2.1.3 Increasing use of Bluetooth and portable speakers

- 5.2.2 RESTRAINTS

- 5.2.2.1 Restrictive radio frequency spectrum in audio equipment

- 5.2.2.2 Hearing impairment from prolonged use of headphones and earbuds

- 5.2.2.3 Disruption in operation of implanted medical devices due to interference from wireless audio devices

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Popularity of wireless audio devices in health and fitness sector

- 5.2.3.2 Advent of Bluetooth LE Audio

- 5.2.3.3 Integration of smart home assistants and home theaters

- 5.2.4 CHALLENGES

- 5.2.4.1 Compromised audio quality due to bandwidth constraints, coding delays, and errors

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 INVESTMENT AND FUNDING SCENARIO

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY PRODUCT

- 5.6.2 AVERAGE SELLING PRICE TREND OF WIRELESS AUDIO DEVICES, BY REGION

- 5.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Bluetooth

- 5.8.1.2 Wi-Fi

- 5.8.2 CONTEMPORARY TECHNOLOGIES

- 5.8.2.1 Active voice cancellation (AVC)

- 5.8.2.2 Near field communication (NFC)

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 Augmented reality (AR) and virtual reality (VR)

- 5.8.3.2 Smart home integration

- 5.8.1 KEY TECHNOLOGIES

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- 5.9.1 THREAT OF NEW ENTRANTS

- 5.9.2 THREAT OF SUBSTITUTES

- 5.9.3 BARGAINING POWER OF SUPPLIERS

- 5.9.4 BARGAINING POWER OF BUYERS

- 5.9.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.10 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.10.2 BUYING CRITERIA

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 ROWKIN, INC. (US) INTEGRATES BLUETOOTH 5.0 TECHNOLOGY IN ITS EARBUDS FOR QUICK PAIRING AND ENHANCED AUDIO QUALITY

- 5.11.2 TIMEKETTLE TECHNOLOGY INTRODUCES AI-POWERED TRANSLATOR EARBUDS FOR SEAMLESS MULTILINGUAL COMMUNICATION

- 5.11.3 WISEER ENABLES INTUITIVE MUSIC CONTROLS USING NEURAL INTERFACE TECHNOLOGY

- 5.12 TRADE ANALYSIS

- 5.12.1 IMPORT SCENARIO (HS CODE 851830)

- 5.12.2 EXPORT SCENARIO (HS CODE 851830)

- 5.13 PATENT ANALYSIS

- 5.14 KEY CONFERENCES AND EVENTS

- 5.15 REGULATORY LANDSCAPE

- 5.15.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.15.2 STANDARDS

- 5.15.2.1 ISO/IEC 18000-6:2010

- 5.15.2.2 ISO 14915-1:2002

- 5.16 IMPACT OF AI/GEN AI ON WIRELESS AUDIO DEVICE MARKET

- 5.16.1 INTEGRATION OF AI INTO WIRELESS AUDIO DEVICES: USE CASES

- 5.16.1.1 Sony WH-100XM4

- 5.16.1.2 AirPods Pro by Apple

- 5.16.1.3 Noise Cancelling Headphones 700 by Bose

- 5.16.1.4 The Dash Pro by Bragi

- 5.16.1 INTEGRATION OF AI INTO WIRELESS AUDIO DEVICES: USE CASES

6 WIRELESS AUDIO DEVICE MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- 6.2 HEADPHONES

- 6.2.1 INCORPORATION OF ADVANCED NOISE-ISOLATING FEATURES TO FUEL DEMAND FOR WIRELESS HEADPHONES

- 6.3 EARPHONES

- 6.3.1 ASIA PACIFIC TO BE LARGEST MARKET FOR WIRELESS AUDIO DEVICE IN EARPHONES SEGMENT

- 6.4 TRUE WIRELESS HEARABLES/EARBUDS

- 6.4.1 AIRPLAY AND BLUETOOTH TECHNOLOGIES TO DRIVE GROWTH OF TRUE WIRELESS HEARABLES/EARBUDS

- 6.5 SPEAKERS

- 6.5.1 RISING DEMAND FOR PORTABLE WIRELESS AUDIO SOLUTIONS TO DRIVE MARKET

- 6.6 SOUNDBARS

- 6.6.1 DEMAND FOR SOUNDBARS GROWING DUE TO THEIR COMPATIBILITY WITH TV SETS, SMARTPHONES, AND MUSIC SYSTEMS

7 WIRELESS AUDIO DEVICE MARKET, BY TECHNOLOGY

- 7.1 INTRODUCTION

- 7.2 BLUETOOTH

- 7.2.1 OFFERS GOOD SOUND QUALITY AND LOWER LATENCY

- 7.3 WI-FI

- 7.3.1 CAPABILITY TO SEAMLESSLY STREAM SAME AUDIO AMONG MULTIPLE DEVICES TO DRIVE DEMAND

- 7.4 AIRPLAY

- 7.4.1 INTEGRATION OF AIRPLAY WITH APPLE DEVICES TO ENSURE USER-FRIENDLY EXPERIENCE TO SUPPORT MARKET GROWTH

- 7.5 RADIO FREQUENCY

- 7.5.1 RADIO FREQUENCY TECHNOLOGY CRITICAL FOR LIVE PERFORMANCES AND GAMING APPLICATIONS DUE TO ITS LOWER LATENCY

- 7.6 OTHER TECHNOLOGIES

- 7.6.1 WIRELESS SPEAKER & AUDIO (WISA)

- 7.6.2 KLEERNET

- 7.6.3 ALLPLAY

- 7.6.4 SKAA

- 7.6.5 PLAY-FI

- 7.6.6 INFRARED (IR)

8 WIRELESS AUDIO DEVICE MARKET, BY FUNCTIONALITY

- 8.1 INTRODUCTION

- 8.2 SMART DEVICES

- 8.2.1 INTEGRATION OF VOICE ASSISTANTS INTO WIRELESS HOME AUDIO DEVICES TO DRIVE MARKET

- 8.3 NON-SMART DEVICES

- 8.3.1 DURABILITY AND AFFORDABILITY DRIVING DEMAND FOR NON-SMART WIRELESS AUDIO DEVICES

9 WIRELESS AUDIO DEVICE MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 HOME AUDIO

- 9.2.1 REDUCED FLOOR SPACE WITH COMPACT DESIGNS TO FUEL MARKET GROWTH

- 9.3 PROFESSIONAL

- 9.3.1 ENHANCED REMOTE WORK EFFICIENCY WITH NOISE-CANCELLING TECHNOLOGY TO DRIVE MARKET GROWTH

- 9.4 CONSUMER

- 9.4.1 INCREASING ADOPTION OF BLUETOOTH + WI-FI TECHNOLOGY TO DRIVE MARKET

- 9.5 AUTOMOTIVE

- 9.5.1 INCORPORATION OF FULLY WIRELESS AUDIO DEVICES AND IN-CAR INFOTAINMENT SYSTEMS IN LUXURY VEHICLES TO DRIVE MARKET

- 9.6 OTHER APPLICATIONS

10 WIRELESS AUDIO DEVICE MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 10.2.2 US

- 10.2.2.1 Rising popularity of online streaming services to drive demand

- 10.2.3 CANADA

- 10.2.3.1 Adoption of innovative products to support market growth

- 10.2.4 MEXICO

- 10.2.4.1 Huge investments in E-commerce and retail channels to drive market

- 10.3 EUROPE

- 10.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 10.3.2 UK

- 10.3.2.1 Growing popularity of online music and radio streaming to fuel market growth

- 10.3.3 GERMANY

- 10.3.3.1 Increased adoption of soundbars and wireless portable speakers to drive demand

- 10.3.4 FRANCE

- 10.3.4.1 Adoption of voice assistants for smart home applications to contribute to market growth

- 10.3.5 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 10.4.2 CHINA

- 10.4.2.1 Strong manufacturing sector to fuel market growth

- 10.4.3 JAPAN

- 10.4.3.1 Surging demand for consumer electronics equipped with wireless audio devices to boost market

- 10.4.4 SOUTH KOREA

- 10.4.4.1 Increasing focus on developing wireless audio products to foster market growth

- 10.4.5 INDIA

- 10.4.5.1 True wireless hearables/earbuds segment to register highest CAGR during forecast period

- 10.4.6 REST OF ASIA PACIFIC

- 10.5 REST OF THE WORLD (ROW)

- 10.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 10.5.2 SOUTH AMERICA

- 10.5.2.1 Adoption of emerging technologies to support market growth

- 10.5.3 MIDDLE EAST & AFRICA

- 10.5.3.1 Rising demand for wireless headphones and wireless speakers to fuel market growth

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY STRATEGIES/RIGHT TO WIN

- 11.3 MARKET SHARE ANALYSIS

- 11.4 REVENUE ANALYSIS

- 11.5 COMPANY VALUATION AND FINANCIAL METRICS

- 11.6 BRAND/PRODUCT COMPARISON

- 11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- 11.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 11.7.5.1 Company footprint

- 11.7.5.2 Product footprint

- 11.7.5.3 Application footprint

- 11.7.5.4 Region footprint

- 11.8 STARTUPS/SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX, 2023

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 DYNAMIC COMPANIES

- 11.8.4 STARTING BLOCKS

- 11.8.5 COMPETITIVE BENCHMARKING

- 11.8.5.1 Detailed list of key startups/SMEs

- 11.8.5.2 Competitive benchmarking of key startups/SMEs

- 11.9 COMPETITIVE SCENARIO AND TRENDS

- 11.9.1 PRODUCT LAUNCHES

- 11.9.2 DEALS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 APPLE INC.

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Product launches/developments

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 HARMAN INTERNATIONAL (SUBSIDIARY OF SAMSUNG ELECTRONICS)

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Product launches/developments

- 12.1.2.3.2 Deals

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 XIAOMI

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Product launches/developments

- 12.1.3.4 MnM view

- 12.1.3.4.1 Key strengths

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 SONY CORPORATION

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Product launches/developments

- 12.1.4.4 MnM view

- 12.1.4.4.1 Key strengths

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses and competitive threats

- 12.1.5 IMAGINE MARKETING LIMITED

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions/Services offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Product launches/developments

- 12.1.5.4 MnM view

- 12.1.5.4.1 Key strengths

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses and competitive threats

- 12.1.6 BOSE CORPORATION

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Product launches/developments

- 12.1.6.3.2 Deals

- 12.1.6.4 MnM view

- 12.1.6.4.1 Key strengths

- 12.1.6.4.2 Strategic choices

- 12.1.6.4.3 Weaknesses and competitive threats

- 12.1.7 SONOS, INC.

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Product launches/developments

- 12.1.7.3.2 Deals

- 12.1.7.4 MnM view

- 12.1.7.4.1 Key strengths

- 12.1.7.4.2 Strategic choices

- 12.1.7.4.3 Weaknesses and competitive threats

- 12.1.8 MASIMO

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions/Services offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Product launches/developments

- 12.1.8.3.2 Deals

- 12.1.9 SENNHEISER ELECTRONIC SE & CO. KG

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Product launches/developments

- 12.1.9.3.2 Deals

- 12.1.10 VIZIO, INC.

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions/Services offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Product launches/developments

- 12.1.10.3.2 Deals

- 12.1.11 VOXX INTERNATIONAL CORP.

- 12.1.11.1 Business overview

- 12.1.11.2 Products/Solutions/Services offered

- 12.1.11.3 Recent developments

- 12.1.11.3.1 Product launches/developments

- 12.1.11.3.2 Deals

- 12.1.12 MARSHALL GROUP AB

- 12.1.12.1 Business overview

- 12.1.12.2 Products/Solutions/Services offered

- 12.1.12.3 Recent developments

- 12.1.12.3.1 Product launches/developments

- 12.1.1 APPLE INC.

- 12.2 OTHER PLAYERS

- 12.2.1 YAMAHA CORPORATION

- 12.2.2 LG ELECTRONICS

- 12.2.3 BANG & OLUFSEN

- 12.2.4 GN STORE NORD A/S

- 12.2.5 PLANTRONICS, INC.

- 12.2.6 SHURE

- 12.2.7 DALI

- 12.2.8 JAYBIRD

- 12.2.9 ANKER INNOVATIONS

- 12.2.10 RAZER INC.

- 12.2.11 HP DEVELOPMENT COMPANY, L.P.

- 12.2.12 EDIFIER

- 12.2.13 NOTHING TECHNOLOGY LIMITED

13 APPENDIX

- 13.1 INSIGHTS OF INDUSTRY EXPERTS

- 13.2 DISCUSSION GUIDE

- 13.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.4 CUSTOMIZATION OPTIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS