|

|

市場調査レポート

商品コード

1524080

デジタルサイネージの世界市場、市場規模、シェア、産業成長分析:製品別、ディスプレイ別、解像度別、ソフトウェア別、ディスプレイサイズ別、用途別、地域別 - 予測(~2029年)Digital Signage Market Size, Share & Industry Growth Analysis Report,by Product (Video Walls, Kiosks, Billboards, System-on-chip), Displays, Resolution (4K, 8K, FHD, HD), Software, Display Size, Application and Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| デジタルサイネージの世界市場、市場規模、シェア、産業成長分析:製品別、ディスプレイ別、解像度別、ソフトウェア別、ディスプレイサイズ別、用途別、地域別 - 予測(~2029年) |

|

出版日: 2024年07月15日

発行: MarketsandMarkets

ページ情報: 英文 280 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のデジタルサイネージの市場規模は、2024年の201億米ドルから2029年までに273億米ドルに達すると予測され、予測期間にCAGRで6.3%の成長が見込まれます。

商業用途でのデジタルサイネージの採用の増加、インフラ用途でのデジタルサイネージへのニーズの増加、4Kや8Kディスプレイなどの先進のディスプレイ技術に対する需要の増加、ディスプレイ関連の絶え間なく進化する技術の進歩などが、デジタルサイネージ市場の主な成長促進要因です。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 単位 | 10億米ドル |

| セグメント | 製品別、ディスプレイ別、解像度別、ソフトウェア別、ディスプレイサイズ別、用途別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

「屋外設置場所が2024年~2029年に市場を独占します。」

より高い輝度とコントラストを持つさまざまなサイズのディスプレイの開発と利用の拡大が、屋外デジタルサイネージ市場の主な成長促進要因となっています。さらに、ディスプレイ技術の大幅な向上により、市場企業は屋外での悪影響を受けにくい、製品寿命の長いディスプレイを提供できるようになっています。革新的なディスプレイの急速な開発が、屋外用デジタルサイネージの市場成長を促進すると推定されます。

「52インチ超が予測期間に大幅な成長率で成長すると予測されます。」

52インチ超セグメントが、2024年~2029年にもっとも高いCAGRで拡大すると予測されています。デジタルサイネージディスプレイの技術の進歩と、それに伴う屋内外での大型ディスプレイ需要の増加が、52インチ超市場の主な成長促進要因です。さらに、アジア太平洋における都市化の進行が、さまざまな用途での屋外デジタルサイネージディスプレイの利用を促進しています。さらに、小売店やインフラ用途での大型OLEDディスプレイの使用の増加が、この分野における市場拡大の大きな促進要因となっています。

「アジア太平洋が予測期間に世界のデジタルサイネージ市場でもっとも高いCAGRを示す可能性が高いです。」

アジア太平洋が予測期間にもっとも高いCAGRで拡大すると予測されます。IoTなど、商業、施設、インフラ、工業部門全体でデジタルトランスフォーメーションを促進する技術の浸透が進んでいることから、同地域ではデジタルサイネージの需要が急増しています。さらに、大幅な都市化と消費者の可処分所得の増加が、アジア太平洋におけるデジタルサイネージ市場の成長を促進すると予測されます。

当レポートでは、世界のデジタルサイネージ市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- デジタルサイネージ市場における魅力的成長機会

- デジタルサイネージ市場:提供別

- デジタルサイネージ市場:用途別

- デジタルサイネージ市場:設置場所別

- デジタルサイネージ市場:企業規模別

- デジタルサイネージ市場:製品タイプ別

- デジタルサイネージ市場:ディスプレイサイズ別

- デジタルサイネージ市場:地域別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- エコシステム分析

- 技術分析

- 主要技術

- 隣接技術

- 補完技術

- 価格分析

- 主要企業の平均販売価格の動向:提供別

- 平均販売価格の動向:地域別

- 投資と資金調達のシナリオ

- 特許分析

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- ケーススタディ

- 貿易分析

- 輸入データ(HSコード8525)

- 輸入データ(HSコード8525)

- 規制情勢

- 規制機関、政府機関、その他の組織

- 標準

- 規制

- 顧客ビジネスに影響を与える動向/混乱

- 主な会議とイベント(2024年~2025年)

第6章 デジタルサイネージ市場:提供別

- イントロダクション

- ハードウェア

- ディスプレイ

- メディア企業

- プロジェクター

- その他のハードウェア製品

- ソフトウェア

- エッジサーバーソフトウェア

- コンテンツマネジメントシステム

- その他のソフトウェア製品

- サービス

- インストール

- メンテナンス・サポート

- コンサルティング・その他のサービス

第7章 デジタルサイネージ市場:ディスプレイサイズ別

- イントロダクション

- 32インチ未満

- 32~52インチ

- 52インチ超

第8章 デジタルサイネージ市場:製品タイプ別

- イントロダクション

- ビデオウォール

- スタンドアロンディスプレイ

第9章 デジタルサイネージ市場:設置場所別

- イントロダクション

- 屋内

- 屋外

第10章 デジタルサイネージ市場:用途別

- イントロダクション

- 商業

- 小売店

- コーポレートオフィス

- 医療施設

- ホスピタリティ施設・レストラン

- 政府機関

- インフラ

- 交通ハブ・公共の場所

- スポーツ・エンターテインメント会場

- 機関

- BFSI施設

- 教育機関

- 工業

第11章 デジタルサイネージ市場:企業規模別

- イントロダクション

- 小規模オフィス/ホームオフィス

- 中小企業

- 大企業

第12章 デジタルサイネージ市場:地域別

- イントロダクション

- 北米

- 北米に対する不況の影響

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州に対する不況の影響

- ドイツ

- フランス

- 英国

- スペイン

- イタリア

- その他の欧州

- アジア太平洋

- アジア太平洋に対する不況の影響

- 中国

- 日本

- 韓国

- インド

- オーストラリア

- その他のアジア太平洋

- その他の地域

- その他の地域に対する不況の影響

- 中東

- アフリカ

- 南米

第13章 競合情勢

- イントロダクション

- 主要企業戦略/有力企業(2023年)

- 市場シェア分析(2023年)

- 収益分析(2019年~2023年)

- 企業の評価と財務指標

- ブランド/製品の比較

- 企業の評価マトリクス:主要企業(2023年)

- 企業の評価マトリクス:スタートアップ/中小企業(2023年)

- 競合シナリオと動向

第14章 企業プロファイル

- イントロダクション

- 主要企業

- SAMSUNG ELECTRONICS CO., LTD.

- LG ELECTRONICS

- SHARP NEC DISPLAY SOLUTIONS, LTD.

- LEYARD

- SONY GROUP CORPORATION

- BARCO

- PANASONIC HOLDINGS CORPORATION

- SHANGHAI XIANSHI ELECTRONIC TECHNOLOGY CO., LTD

- AUO CORPORATION

- BRIGHTSIGN LLC

- その他の企業

- STRATACACHE

- BENQ

- INTUIFACE

- DAKTRONICS DR.

- OMNIVEX CORPORATION

- DELTA ELECTRONICS, INC.

- KEYWEST TECHNOLOGY, INC.

- REMOTE MEDIA GROUP LIMITED

- CHRISTIE DIGITAL SYSTEMS USA, INC.

- BROADSIGN INTERNATIONAL, LLC

- DISE

- TRUKNOX TECHNOLOGIES PVT. LTD.

- YCD MULTIMEDIA

- L SQUARED DIGITAL SIGNAGE

- VISIX, INC.

第15章 付録

List of Tables

- TABLE 1 INCLUSIONS AND EXCLUSIONS, BY COMPANY

- TABLE 2 INCLUSIONS AND EXCLUSIONS, BY OFFERING

- TABLE 3 INCLUSIONS AND EXCLUSIONS, BY PRODUCT TYPE

- TABLE 4 INCLUSIONS AND EXCLUSIONS, BY INSTALLATION LOCATION

- TABLE 5 INCLUSIONS AND EXCLUSIONS, BY DISPLAY SIZE

- TABLE 6 INCLUSIONS AND EXCLUSIONS, BY APPLICATION

- TABLE 7 INCLUSIONS AND EXCLUSIONS, BY ENTERPRISE SIZE

- TABLE 8 INCLUSIONS AND EXCLUSIONS, BY REGION

- TABLE 9 MARKET GROWTH ANALYSIS

- TABLE 10 DIGITAL SIGNAGE MARKET RISK ANALYSIS

- TABLE 11 ROLE OF KEY COMPANIES IN DIGITAL SIGNAGE ECOSYSTEM

- TABLE 12 AVERAGE SELLING PRICE TREND OF HARDWARE AND SOFTWARE PRODUCTS PROVIDED BY KEY PLAYERS, 2020-2023

- TABLE 13 DIGITAL SIGNAGE MARKET: LIST OF KEY PATENTS, 2014-2023

- TABLE 14 DIGITAL SIGNAGE MARKET: PORTER'S FIVE FORCES ANALYSIS, 2023

- TABLE 15 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR PRODUCT TYPE (%)

- TABLE 16 KEY BUYING CRITERIA FOR PRODUCT TYPES

- TABLE 17 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 DIGITAL SIGNAGE MARKET: LIST OF CONFERENCES AND EVENTS, 2024-2025

- TABLE 22 DIGITAL SIGNAGE MARKET, BY OFFERING, 2020-2023 (USD BILLION)

- TABLE 23 DIGITAL SIGNAGE MARKET, BY OFFERING, 2024-2029 (USD BILLION)

- TABLE 24 HARDWARE: DIGITAL SIGNAGE MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 25 HARDWARE: DIGITAL SIGNAGE MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 26 HARDWARE: DIGITAL SIGNAGE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 27 HARDWARE: DIGITAL SIGNAGE MARKET, BY REGION, 2024-2029 (USD MILLION)

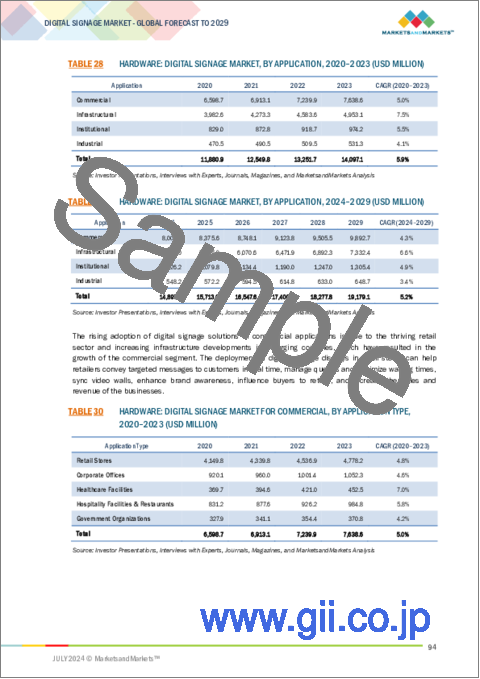

- TABLE 28 HARDWARE: DIGITAL SIGNAGE MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 29 HARDWARE: DIGITAL SIGNAGE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 30 HARDWARE: DIGITAL SIGNAGE MARKET FOR COMMERCIAL, BY APPLICATION TYPE, 2020-2023 (USD MILLION)

- TABLE 31 HARDWARE: DIGITAL SIGNAGE MARKET FOR COMMERCIAL, BY APPLICATION TYPE, 2024-2029 (USD MILLION)

- TABLE 32 HARDWARE: DIGITAL SIGNAGE MARKET FOR INFRASTRUCTURAL, BY APPLICATION TYPE, 2020-2023 (USD BILLION)

- TABLE 33 HARDWARE: DIGITAL SIGNAGE MARKET FOR INFRASTRUCTURAL, BY APPLICATION TYPE, 2024-2029 (USD MILLION)

- TABLE 34 HARDWARE: DIGITAL SIGNAGE MARKET FOR INSTITUTIONAL, BY APPLICATION TYPE, 2020-2023 (USD MILLION)

- TABLE 35 HARDWARE: DIGITAL SIGNAGE MARKET FOR INSTITUTIONAL, BY APPLICATION TYPE, 2024-2029 (USD MILLION)

- TABLE 36 HARDWARE: DIGITAL SIGNAGE MARKET FOR DISPLAYS, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 37 HARDWARE: DIGITAL SIGNAGE MARKET FOR DISPLAYS, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 38 SOFTWARE: DIGITAL SIGNAGE MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 39 SOFTWARE: DIGITAL SIGNAGE MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 40 SOFTWARE: DIGITAL SIGNAGE MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 41 SOFTWARE: DIGITAL SIGNAGE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 42 SOFTWARE: DIGITAL SIGNAGE MARKET FOR COMMERCIAL, BY APPLICATION TYPE, 2020-2023 (USD MILLION)

- TABLE 43 SOFTWARE: DIGITAL SIGNAGE MARKET FOR COMMERCIAL, BY APPLICATION TYPE, 2024-2029 (USD MILLION)

- TABLE 44 SOFTWARE: DIGITAL SIGNAGE MARKET FOR INFRASTRUCTURAL, BY APPLICATION TYPE, 2020-2023 (USD MILLION)

- TABLE 45 SOFTWARE: DIGITAL SIGNAGE MARKET FOR INFRASTRUCTURAL, BY APPLICATION TYPE, 2024-2029 (USD MILLION)

- TABLE 46 SOFTWARE: DIGITAL SIGNAGE MARKET FOR INSTITUTIONAL, BY APPLICATION TYPE, 2020-2023 (USD MILLION)

- TABLE 47 SOFTWARE: DIGITAL SIGNAGE MARKET FOR INSTITUTIONAL, BY APPLICATION TYPE, 2024-2029 (USD MILLION)

- TABLE 48 SOFTWARE: DIGITAL SIGNAGE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 49 SOFTWARE: DIGITAL SIGNAGE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 50 SERVICES: DIGITAL SIGNAGE MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 51 SERVICES: DIGITAL SIGNAGE MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 52 SERVICES: DIGITAL SIGNAGE MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 53 SERVICES: DIGITAL SIGNAGE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 54 SERVICES: DIGITAL SIGNAGE MARKET FOR COMMERCIAL, BY APPLICATION TYPE, 2020-2023 (USD MILLION)

- TABLE 55 SERVICES: DIGITAL SIGNAGE MARKET FOR COMMERCIAL, BY APPLICATION TYPE, 2024-2029 (USD MILLION)

- TABLE 56 SERVICES: DIGITAL SIGNAGE MARKET FOR INFRASTRUCTURAL, BY APPLICATION TYPE, 2020-2023 (USD MILLION)

- TABLE 57 SERVICES: DIGITAL SIGNAGE MARKET FOR INFRASTRUCTURAL, BY APPLICATION TYPE, 2024-2029 (USD MILLION)

- TABLE 58 SERVICES: DIGITAL SIGNAGE MARKET FOR INSTITUTIONAL, BY APPLICATION TYPE, 2020-2023 (USD MILLION)

- TABLE 59 SERVICES: DIGITAL SIGNAGE MARKET FOR INSTITUTIONAL, BY APPLICATION TYPE, 2024-2029 (USD MILLION)

- TABLE 60 SERVICES: DIGITAL SIGNAGE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 61 SERVICES: DIGITAL SIGNAGE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 62 DIGITAL SIGNAGE MARKET, BY DISPLAY SIZE, 2020-2023 (USD MILLION)

- TABLE 63 DIGITAL SIGNAGE MARKET, BY DISPLAY SIZE, 2024-2029 (USD MILLION)

- TABLE 64 DIGITAL SIGNAGE MARKET, BY PRODUCT TYPE, 2020-2023 (USD BILLION)

- TABLE 65 DIGITAL SIGNAGE MARKET, BY PRODUCT TYPE, 2024-2029 (USD BILLION)

- TABLE 66 DIGITAL SIGNAGE MARKET, BY PRODUCT TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 67 DIGITAL SIGNAGE MARKET, BY PRODUCT TYPE, 2024-2029 (THOUSAND UNITS)

- TABLE 68 DIGITAL SIGNAGE MARKET, BY INSTALLATION LOCATION, 2020-2023 (USD BILLION)

- TABLE 69 DIGITAL SIGNAGE MARKET, BY INSTALLATION LOCATION, 2024-2029 (USD BILLION)

- TABLE 70 INDOOR: DIGITAL SIGNAGE MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 71 INDOOR: DIGITAL SIGNAGE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 72 INDOOR: DIGITAL SIGNAGE MARKET FOR COMMERCIAL, BY APPLICATION TYPE, 2020-2023 (USD MILLION)

- TABLE 73 INDOOR: DIGITAL SIGNAGE MARKET FOR COMMERCIAL, BY APPLICATION TYPE, 2024-2029 (USD MILLION)

- TABLE 74 INDOOR: DIGITAL SIGNAGE MARKET FOR INFRASTRUCTURAL, BY APPLICATION TYPE, 2020-2023 (USD MILLION)

- TABLE 75 INDOOR: DIGITAL SIGNAGE MARKET FOR INFRASTRUCTURAL, BY APPLICATION TYPE, 2024-2029 (USD MILLION)

- TABLE 76 INDOOR: DIGITAL SIGNAGE MARKET FOR INSTITUTIONAL, BY APPLICATION TYPE, 2020-2023 (USD MILLION)

- TABLE 77 INDOOR: DIGITAL SIGNAGE MARKET FOR INSTITUTIONAL, BY APPLICATION TYPE, 2024-2029 (USD MILLION)

- TABLE 78 OUTDOOR: DIGITAL SIGNAGE MARKET, BY APPLICATION TYPE, 2020-2023 (USD MILLION)

- TABLE 79 OUTDOOR: DIGITAL SIGNAGE MARKET, BY APPLICATION TYPE, 2024-2029 (USD MILLION)

- TABLE 80 OUTDOOR: DIGITAL SIGNAGE MARKET FOR COMMERCIAL, BY APPLICATION TYPE, 2020-2023 (USD MILLION)

- TABLE 81 OUTDOOR: DIGITAL SIGNAGE MARKET FOR COMMERCIAL, BY APPLICATION TYPE, 2024-2029 (USD MILLION)

- TABLE 82 OUTDOOR: DIGITAL SIGNAGE MARKET FOR INFRASTRUCTURAL, BY APPLICATION TYPE, 2020-2023 (USD MILLION)

- TABLE 83 OUTDOOR: DIGITAL SIGNAGE MARKET FOR INFRASTRUCTURAL, BY APPLICATION TYPE, 2024-2029 (USD MILLION)

- TABLE 84 OUTDOOR: DIGITAL SIGNAGE MARKET FOR INSTITUTIONAL, BY APPLICATION TYPE, 2020-2023 (USD MILLION)

- TABLE 85 OUTDOOR: DIGITAL SIGNAGE MARKET FOR INSTITUTIONAL, BY APPLICATION TYPE, 2024-2029 (USD MILLION)

- TABLE 86 DIGITAL SIGNAGE MARKET, BY APPLICATION, 2020-2023 (USD BILLION)

- TABLE 87 DIGITAL SIGNAGE MARKET, BY APPLICATION, 2024-2029 (USD BILLION)

- TABLE 88 COMMERCIAL: DIGITAL SIGNAGE MARKET, BY APPLICATION TYPE, 2020-2023 (USD MILLION)

- TABLE 89 COMMERCIAL: DIGITAL SIGNAGE MARKET, BY APPLICATION TYPE, 2024-2029 (USD MILLION)

- TABLE 90 COMMERCIAL: DIGITAL SIGNAGE MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 91 COMMERCIAL: DIGITAL SIGNAGE MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 92 COMMERCIAL: DIGITAL SIGNAGE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 93 COMMERCIAL: DIGITAL SIGNAGE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 94 RETAIL STORES: DIGITAL SIGNAGE MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 95 RETAIL STORES: DIGITAL SIGNAGE MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 96 RETAIL STORES: DIGITAL SIGNAGE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 97 RETAIL STORES: DIGITAL SIGNAGE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 98 CORPORATE OFFICES: DIGITAL SIGNAGE MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 99 CORPORATE OFFICES: DIGITAL SIGNAGE MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 100 CORPORATE OFFICES: DIGITAL SIGNAGE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 101 CORPORATE OFFICES: DIGITAL SIGNAGE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 102 HEALTHCARE FACILITIES: DIGITAL SIGNAGE MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 103 HEALTHCARE FACILITIES: DIGITAL SIGNAGE MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 104 HEALTHCARE FACILITIES: DIGITAL SIGNAGE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 105 HEALTHCARE FACILITIES: DIGITAL SIGNAGE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 106 HOSPITALITY FACILITIES & RESTAURANTS: DIGITAL SIGNAGE MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 107 HOSPITALITY FACILITIES & RESTAURANTS: DIGITAL SIGNAGE MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 108 HOSPITALITY FACILITIES & RESTAURANTS: DIGITAL SIGNAGE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 109 HOSPITALITY FACILITIES & RESTAURANTS: DIGITAL SIGNAGE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 110 GOVERNMENT ORGANIZATIONS: DIGITAL SIGNAGE MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 111 GOVERNMENT ORGANIZATIONS: DIGITAL SIGNAGE MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 112 GOVERNMENT ORGANIZATIONS: DIGITAL SIGNAGE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 113 GOVERNMENT ORGANIZATIONS: DIGITAL SIGNAGE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 114 INFRASTRUCTURAL: DIGITAL SIGNAGE MARKET, BY APPLICATION TYPE, 2020-2023 (USD MILLION)

- TABLE 115 INFRASTRUCTURAL: DIGITAL SIGNAGE MARKET, BY APPLICATION TYPE, 2024-2029 (USD MILLION)

- TABLE 116 INFRASTRUCTURAL: DIGITAL SIGNAGE MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 117 INFRASTRUCTURAL: DIGITAL SIGNAGE MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 118 INFRASTRUCTURAL: DIGITAL SIGNAGE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 119 INFRASTRUCTURAL: DIGITAL SIGNAGE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 120 TRANSPORTATION HUBS & PUBLIC PLACES: DIGITAL SIGNAGE MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 121 TRANSPORTATION HUBS & PUBLIC PLACES: DIGITAL SIGNAGE MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 122 TRANSPORTATION HUBS & PUBLIC PLACES: DIGITAL SIGNAGE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 123 TRANSPORTATION HUBS & PUBLIC PLACES: DIGITAL SIGNAGE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 124 SPORTS & ENTERTAINMENT VENUES: DIGITAL SIGNAGE MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 125 SPORTS & ENTERTAINMENT VENUES: DIGITAL SIGNAGE MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 126 SPORTS & ENTERTAINMENT VENUES: DIGITAL SIGNAGE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 127 SPORTS & ENTERTAINMENT VENUES: DIGITAL SIGNAGE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 128 INSTITUTIONAL: DIGITAL SIGNAGE MARKET, BY APPLICATION TYPE, 2020-2023 (USD MILLION)

- TABLE 129 INSTITUTIONAL: DIGITAL SIGNAGE MARKET, BY APPLICATION TYPE, 2024-2029 (USD MILLION)

- TABLE 130 INSTITUTIONAL: DIGITAL SIGNAGE MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 131 INSTITUTIONAL: DIGITAL SIGNAGE MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 132 INSTITUTIONAL: DIGITAL SIGNAGE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 133 INSTITUTIONAL: DIGITAL SIGNAGE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 134 BFSI FACILITIES: DIGITAL SIGNAGE MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 135 BFSI FACILITIES: DIGITAL SIGNAGE MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 136 BFSI FACILITIES: DIGITAL SIGNAGE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 137 BFSI FACILITIES: DIGITAL SIGNAGE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 138 EDUCATIONAL INSTITUTIONS: DIGITAL SIGNAGE MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 139 EDUCATIONAL INSTITUTIONS: DIGITAL SIGNAGE MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 140 EDUCATIONAL INSTITUTIONS: DIGITAL SIGNAGE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 141 EDUCATIONAL INSTITUTIONS: DIGITAL SIGNAGE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 142 INDUSTRIAL: DIGITAL SIGNAGE MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 143 INDUSTRIAL: DIGITAL SIGNAGE MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 144 INDUSTRIAL: DIGITAL SIGNAGE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 145 INDUSTRIAL: DIGITAL SIGNAGE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 146 DIGITAL SIGNAGE MARKET, BY ENTERPRISE SIZE, 2020-2023 (USD MILLION)

- TABLE 147 DIGITAL SIGNAGE MARKET, BY ENTERPRISE SIZE, 2024-2029 (USD MILLION)

- TABLE 148 DIGITAL SIGNAGE MARKET, BY REGION, 2020-2023 (USD BILLION)

- TABLE 149 DIGITAL SIGNAGE MARKET, BY REGION, 2024-2029 (USD BILLION)

- TABLE 150 NORTH AMERICA: DIGITAL SIGNAGE MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 151 NORTH AMERICA: DIGITAL SIGNAGE MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 152 NORTH AMERICA: DIGITAL SIGNAGE MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 153 NORTH AMERICA: DIGITAL SIGNAGE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 154 EUROPE: DIGITAL SIGNAGE MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 155 EUROPE: DIGITAL SIGNAGE MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 156 EUROPE: DIGITAL SIGNAGE MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 157 EUROPE: DIGITAL SIGNAGE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 158 ASIA PACIFIC: DIGITAL SIGNAGE MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 159 ASIA PACIFIC: DIGITAL SIGNAGE MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 160 ASIA PACIFIC: DIGITAL SIGNAGE MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 161 ASIA PACIFIC: DIGITAL SIGNAGE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 162 ROW: DIGITAL SIGNAGE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 163 ROW: DIGITAL SIGNAGE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 164 ROW: DIGITAL SIGNAGE MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 165 ROW: DIGITAL SIGNAGE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 166 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN DIGITAL SIGNAGE MARKET

- TABLE 167 MARKET SHARE ANALYSIS OF KEY COMPANIES, 2023

- TABLE 168 DIGITAL SIGNAGE MARKET: OFFERING FOOTPRINT

- TABLE 169 DIGITAL SIGNAGE MARKET: APPLICATION FOOTPRINT

- TABLE 170 DIGITAL SIGNAGE MARKET: DISPLAY SIZE FOOTPRINT

- TABLE 171 DIGITAL SIGNAGE MARKET: PRODUCT TYPE FOOTPRINT

- TABLE 172 DIGITAL SIGNAGE MARKET: INSTALLATION LOCATION FOOTPRINT

- TABLE 173 DIGITAL SIGNAGE MARKET: ENTERPRISE SIZE FOOTPRINT

- TABLE 174 DIGITAL SIGNAGE MARKET: REGION FOOTPRINT

- TABLE 175 DIGITAL SIGNAGE MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 176 COMPETITIVE BENCHMARKING FOR STARTUPS/SMES

- TABLE 177 DIGITAL SIGNAGE MARKET: PRODUCT LAUNCHES, MARCH 2020-APRIL 2024

- TABLE 178 DIGITAL SIGNAGE MARKET: DEALS, MARCH 2020-APRIL 2024

- TABLE 179 SAMSUNG ELECTRONICS CO., LTD.: COMPANY OVERVIEW

- TABLE 180 SAMSUNG ELECTRONICS CO., LTD.: PRODUCT LAUNCHES

- TABLE 181 SAMSUNG ELECTRONICS CO., LTD.: DEALS

- TABLE 182 LG ELECTRONICS: COMPANY OVERVIEW

- TABLE 183 LG ELECTRONICS: PRODUCT LAUNCHES

- TABLE 184 SHARP NEC DISPLAY SOLUTIONS, LTD.: COMPANY OVERVIEW

- TABLE 185 SHARP NEC DISPLAY SOLUTIONS, LTD.: PRODUCT LAUNCHES

- TABLE 186 SHARP NEC DISPLAY SOLUTIONS, LTD.: DEALS

- TABLE 187 LEYARD: COMPANY OVERVIEW

- TABLE 188 LEYARD: PRODUCT LAUNCHES

- TABLE 189 SONY GROUP CORPORATION: COMPANY OVERVIEW

- TABLE 190 SONY GROUP CORPORATION: PRODUCT LAUNCHES

- TABLE 191 SONY GROUP CORPORATION: DEALS

- TABLE 192 BARCO: COMPANY OVERVIEW

- TABLE 193 BARCO: PRODUCT LAUNCHES

- TABLE 194 BARCO: DEALS

- TABLE 195 PANASONIC HOLDINGS CORPORATION: COMPANY OVERVIEW

- TABLE 196 PANASONIC HOLDINGS CORPORATION: PRODUCT LAUNCHES

- TABLE 197 SHANGHAI XIANSHI ELECTRONIC TECHNOLOGY CO., LTD: COMPANY OVERVIEW

- TABLE 198 SHANGHAI XIANSHI ELECTRONIC TECHNOLOGY CO., LTD: PRODUCT LAUNCHES

- TABLE 199 AUO CORPORATION: COMPANY OVERVIEW

- TABLE 200 AUO CORPORATION: PRODUCT LAUNCHES

- TABLE 201 AUO CORPORATION: DEALS

- TABLE 202 AUO CORPORATION: OTHERS

- TABLE 203 BRIGHTSIGN LLC: COMPANY OVERVIEW

- TABLE 204 BRIGHTSIGN LLC: PRODUCT LAUNCHES

- TABLE 205 BRIGHTSIGN LLC: DEALS

List of Figures

- FIGURE 1 MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 DIGITAL SIGNAGE MARKET: RESEARCH DESIGN

- FIGURE 3 BOTTOM-UP APPROACH

- FIGURE 4 TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: DEMAND-SIDE ANALYSIS

- FIGURE 6 MARKET SIZE ESTIMATION: SUPPLY-SIDE ANALYSIS

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 DIGITAL SIGNAGE MARKET SIZE: GLOBAL SNAPSHOT, 2020-2029

- FIGURE 9 SOFTWARE OFFERINGS TO REGISTER HIGHEST CAGR IN DIGITAL SIGNAGE MARKET BETWEEN 2024 AND 2029

- FIGURE 10 LARGER THAN 52-INCH DISPLAYS TO LEAD DIGITAL SIGNAGE MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 11 VIDEO WALLS TO REGISTER HIGHER CAGR IN DIGITAL SIGNAGE MARKET, BY PRODUCT TYPE, FROM 2024 TO 2029

- FIGURE 12 OUTDOOR DIGITAL SIGNAGE SOLUTIONS TO WITNESS HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 13 COMMERCIAL APPLICATIONS TO ACCOUNT FOR LARGEST SHARE OF DIGITAL SIGNAGE MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 14 LARGE ENTERPRISES TO COMMAND DIGITAL SIGNAGE MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 15 ASIA PACIFIC TO BE FASTEST-GROWING DIGITAL SIGNAGE MARKET DURING FORECAST PERIOD

- FIGURE 16 GROWING USE OF DIGITAL SIGNAGE IN COMMERCIAL APPLICATIONS TO DRIVE MARKET

- FIGURE 17 HARDWARE SEGMENT TO ACCOUNT FOR LARGEST SHARE OF DIGITAL SIGNAGE MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 18 COMMERCIAL SEGMENT TO LEAD DIGITAL SIGNAGE MARKET DURING FORECAST PERIOD

- FIGURE 19 INDOOR SEGMENT TO DOMINATE DIGITAL SIGNAGE MARKET IN 2029

- FIGURE 20 LARGE ENTERPRISES TO ACCOUNT FOR LARGEST MARKET SHARE BETWEEN 2024 AND 2029

- FIGURE 21 STANDALONE DISPLAYS TO LEAD DIGITAL SIGNAGE MARKET BETWEEN 2024 AND 2029

- FIGURE 22 DISPLAYS WITH LARGER THAN 52 INCHES TO DOMINATE DIGITAL SIGNAGE MARKET FROM 2024 TO 2029

- FIGURE 23 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR IN DIGITAL SIGNAGE MARKET DURING FORECAST PERIOD

- FIGURE 24 MARKET DYNAMICS: DIGITAL SIGNAGE MARKET

- FIGURE 25 SHIPMENTS OF OLED DISPLAY PANELS, 2022-2028

- FIGURE 26 IMPACT ANALYSIS OF DRIVERS ON DIGITAL SIGNAGE MARKET

- FIGURE 27 IMPACT ANALYSIS OF RESTRAINTS ON DIGITAL SIGNAGE MARKET

- FIGURE 28 IMPACT ANALYSIS OF OPPORTUNITIES ON DIGITAL SIGNAGE MARKET

- FIGURE 29 NUMBER OF GLOBAL DISTRIBUTED DENIAL-OF-SERVICE (DDOS) ATTACKS, 2018-2023

- FIGURE 30 IMPACT ANALYSIS OF CHALLENGES ON DIGITAL SIGNAGE MARKET

- FIGURE 31 DIGITAL SIGNAGE MARKET: VALUE CHAIN ANALYSIS

- FIGURE 32 DIGITAL SIGNAGE MARKET: ECOSYSTEM ANALYSIS

- FIGURE 33 AVERAGE SELLING PRICE OF HARDWARE AND SOFTWARE PRODUCTS OFFERED BY KEY PLAYERS

- FIGURE 34 AVERAGE SELLING PRICE TREND OF HARDWARE, BY REGION, 2019-2023

- FIGURE 35 INVESTMENT AND FUNDING SCENARIO

- FIGURE 36 PATENT APPLICANTS AND OWNERS, 2014-2023

- FIGURE 37 DIGITAL SIGNAGE MARKET: PORTER'S FIVE FORCES ANALYSIS, 2023

- FIGURE 38 WEIGHTED AVERAGE FOR EACH FORCE, 2023

- FIGURE 39 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY PRODUCT TYPE

- FIGURE 40 KEY BUYING CRITERIA FOR PRODUCT TYPES

- FIGURE 41 IMPORT DATA FOR HS CODE 8528-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023

- FIGURE 42 EXPORT DATA FOR HS CODE 8528-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023

- FIGURE 43 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 44 SOFTWARE OFFERINGS TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 45 DISPLAYS TO DOMINATE DIGITAL SIGNAGE HARDWARE MARKET BETWEEN 2024 AND 2029

- FIGURE 46 MICRO-LED DISPLAYS TO EXHIBIT HIGHEST CAGR IN DIGITAL SIGNAGE MARKET FOR HARDWARE BETWEEN 2024 AND 2029

- FIGURE 47 CONTENT MANAGEMENT SYSTEM TO REGISTER HIGHEST CAGR IN DIGITAL SIGNAGE MARKET FOR SOFTWARE FROM 2024 TO 2029

- FIGURE 48 INSTALLATION SERVICES TO ACCOUNT FOR LARGEST MARKET SHARE THROUGHOUT FORECAST PERIOD

- FIGURE 49 LARGER THAN 52 INCHES SEGMENT TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 50 VIDEO WALLS TO REGISTER HIGHER CAGR IN DIGITAL SIGNAGE MARKET DURING FORECAST PERIOD

- FIGURE 51 OUTDOOR SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 52 INFRASTRUCTURAL APPLICATIONS TO RECORD HIGHEST CAGR IN DIGITAL SIGNAGE MARKET DURING FORECAST PERIOD

- FIGURE 53 RETAIL STORES TO ACCOUNT FOR LARGEST MARKET SHARE FOR COMMERCIAL APPLICATIONS THROUGHOUT FORECAST PERIOD

- FIGURE 54 TRANSPORTATION HUBS & PUBLIC PLACES TO DOMINATE MARKET FOR INFRASTRUCTURAL APPLICATIONS BETWEEN 2024 AND 2029

- FIGURE 55 EDUCATIONAL INSTITUTIONS TO LEAD DIGITAL SIGNAGE MARKET FOR INSTITUTIONAL APPLICATIONS DURING FORECAST PERIOD

- FIGURE 56 LARGE ENTERPRISES TO LEAD DIGITAL SIGNAGE MARKET DURING FORECAST PERIOD

- FIGURE 57 INDIA TO REGISTER HIGHEST CAGR IN GLOBAL DIGITAL SIGNAGE MARKET FROM 2024 TO 2029

- FIGURE 58 ASIA PACIFIC TO RECORD HIGHEST CAGR BETWEEN 2024 AND 2029

- FIGURE 59 NORTH AMERICA: DIGITAL SIGNAGE MARKET SNAPSHOT

- FIGURE 60 EUROPE: DIGITAL SIGNAGE MARKET SNAPSHOT

- FIGURE 61 ASIA PACIFIC: DIGITAL SIGNAGE MARKET SNAPSHOT

- FIGURE 62 ROW: DIGITAL SIGNAGE MARKET SNAPSHOT

- FIGURE 63 DIGITAL SIGNAGE MARKET SHARE ANALYSIS, 2023

- FIGURE 64 DIGITAL SIGNAGE MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2019-2023 (USD BILLION)

- FIGURE 65 COMPANY VALUATION (USD BILLION), 2023

- FIGURE 66 FINANCIAL METRICS (EV/EBITDA), 2023

- FIGURE 67 DIGITAL SIGNAGE MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 68 DIGITAL SIGNAGE MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 69 DIGITAL SIGNAGE MARKET: COMPANY FOOTPRINT

- FIGURE 70 DIGITAL SIGNAGE MARKET: EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 71 SAMSUNG ELECTRONICS CO., LTD.: COMPANY SNAPSHOT

- FIGURE 72 LG ELECTRONICS: COMPANY SNAPSHOT

- FIGURE 73 SHARP NEC DISPLAY SOLUTIONS, LTD.: COMPANY SNAPSHOT

- FIGURE 74 LEYARD: COMPANY SNAPSHOT

- FIGURE 75 SONY GROUP CORPORATION: COMPANY SNAPSHOT

- FIGURE 76 BARCO: COMPANY SNAPSHOT

- FIGURE 77 PANASONIC HOLDINGS CORPORATION: COMPANY SNAPSHOT

- FIGURE 78 AUO CORPORATION: COMPANY SNAPSHOT

The global digital signage market is projected to grow from USD 20.1 billion in 2024 to USD 27.3 billion by 2029, registering a CAGR of 6.3% during the forecast period. Rising adoption of digital signage in commercial applications, increasing need for digital signage in infrastructural applications, growing demand for advanced display technologies such as 4K and 8K displays and constantly evolving technological advancements related to displays are some of the major factors driving the growth of the digital signage market.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Billion) |

| Segments | By Product, Displays, Resolution, Software, Display Size, Application and Region |

| Regions covered | North America, Europe, APAC, RoW |

"The outdoor installation location to dominate the market between 2024 and 2029."

The development and growing usage of displays of various sizes with higher brightness and contrast is a major driver driving the growth of the outdoor digital signage market. Furthermore, significant improvements in display technologies have enabled market players to offer displays with longer product life that are less susceptible to the negative impacts of being outdoors. The rapid development of innovative displays is estimated to drive the market growth of outdoor digital signage.

"The above 52 inches is projected to grow at a significant growth rate during the forecast period."

The above-52-inch segment is projected to expand at the highest CAGR between 2024 and 2029. Technological advancements in digital signage displays, coupled with consequent rise in demand for large displays for both indoor and outdoor applications, are major factors leading to the market growth of over 52 inches. Furthermore, rising urbanization in Asia-Pacific is driving the usage of outdoor digital signage displays for a range of applications. Furthermore, the increased usage of large-format OLED displays for retail and infrastructure applications is a prominent factor driving market expansion in the area.

"Asia Pacific is likely to exhibit highest CAGR in the global digital signage market during the forecast period"

Asia Pacific is projected to expand at the highest CAGR during the forecast period. The growing penetration of technologies such as the Internet of Things (IoT) and other technologies that promote digital transformation across commercial, institutional, infrastructural, and industrial sectors has resulted in a boom in demand for digital signage in the region. Furthermore, significant urbanization and rising disposable incomes among consumers are projected to fuel the digital signage market growth in Asia Pacific..

Breakdown of profiles of primary participants:

- By Company Type: Tier 1 = 30%, Tier 2 = 50%, and Tier 3 = 20%

- By Designation: C-level Executives = 25%, Directors = 35%, and Others = 40%

- By Region: North America = 35%, Europe = 30%, Asia Pacific = 25%, and Rest of the World = 10%

The major companies in the digital signage market Samsung Electronics Co., Ltd. (South Korea), LG Electronics (South Korea), Sharp NEC Display Solutions, Ltd. (Japan), LEYARD (China), and Sony Group Corporation (Japan) among others.

Research Coverage

The report segments the digital signage market and forecasts its size, by value, based on offering, display size, product type, installation location, application, enterprise size, and region (North America, Europe, Asia Pacific, and the Rest of the World). The report also comprehensively reviews market drivers, restraints, opportunities, and challenges in the digital signage market. The report also covers qualitative aspects in addition to the quantitative aspects of these markets.

Reasons to Buy the Report:

- Analysis of key drivers (growing adoption of digital signage in commercial applications, rising demand of demand signage in infrastructural applications, increasing demand for 4K and 8K resolution displays, and continuous technological advancements in displays), restraints (high cost of digital signage), opportunities (burgeoning infrastructure advancemnets in emerging economies, increasing popularity of digital signage in instituitional settings, and rising adoption of digital signage in industrial sector), and challenges (security concerns linked with digital signage, infrastructure-related issues associated with installation of digital signage solutions, and power consumption and environmental impact) influencing the growth of the digital signage market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the digital signage market

- Market Development: Comprehensive information about lucrative markets - the report analyses the digital signage market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the digital signage market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies and product offerings of leading players like Samsung Electronics Co., Ltd. (South Korea), LG Electronics (South Korea), Sharp NEC Display Solutions, Ltd. (Japan), LEYARD (China), and Sony Group Corporation (Japan). among others.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 LIMITATIONS

- 1.6 UNITS CONSIDERED

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

- 1.9 IMPACT OF RECESSION ON DIGITAL SIGNAGE MARKET

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Intended participants in primary interviews

- 2.1.2.2 List of key primary interview participants

- 2.1.2.3 Breakdown of primaries

- 2.1.2.4 Key data from primary sources

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.3.1 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION METHODOLOGY

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to arrive at market size using bottom-up analysis

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to arrive at market size using top-down analysis

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 FACTOR ANALYSIS

- 2.3.1 DEMAND-SIDE ANALYSIS

- 2.3.2 SUPPLY-SIDE ANALYSIS

- 2.3.3 MARKET GROWTH ANALYSIS

- 2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RISK ANALYSIS

- 2.7 RECESSION IMPACT ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN DIGITAL SIGNAGE MARKET

- 4.2 DIGITAL SIGNAGE MARKET, BY OFFERING

- 4.3 DIGITAL SIGNAGE MARKET, BY APPLICATION

- 4.4 DIGITAL SIGNAGE MARKET, BY INSTALLATION LOCATION

- 4.5 DIGITAL SIGNAGE MARKET, BY ENTERPRISE SIZE

- 4.6 DIGITAL SIGNAGE MARKET, BY PRODUCT TYPE

- 4.7 DIGITAL SIGNAGE MARKET, BY DISPLAY SIZE

- 4.8 DIGITAL SIGNAGE MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing adoption of digital signage solutions in commercial applications

- 5.2.1.2 Rising deployment of digital signage solutions in infrastructural applications

- 5.2.1.3 Surging demand for 4K and 8K resolution displays

- 5.2.1.4 Elevating use of digital signage in institutional settings

- 5.2.1.5 Increasing focus on launching technologically advanced displays

- 5.2.2 RESTRAINTS

- 5.2.2.1 High ownership cost of digital signage solutions

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Ongoing infrastructure improvements in emerging economies

- 5.2.3.2 Rising adoption of digital signage in industrial sector

- 5.2.4 CHALLENGES

- 5.2.4.1 Security concerns associated with digital signage solutions

- 5.2.4.2 Infrastructure-related issues with digital signage installation

- 5.2.4.3 Significant power consumption and environmental impact

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 TECHNOLOGY ANALYSIS

- 5.5.1 KEY TECHNOLOGIES

- 5.5.1.1 Micro-LED displays

- 5.5.1.2 8K displays

- 5.5.1.3 System-on-chip (SoC) displays

- 5.5.2 ADJACENT TECHNOLOGIES

- 5.5.2.1 Interactive displays

- 5.5.3 COMPLEMENTARY TECHNOLOGIES

- 5.5.3.1 Artificial intelligence (AI)

- 5.5.3.2 Internet of Things (IoT)

- 5.5.1 KEY TECHNOLOGIES

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY OFFERING

- 5.6.2 AVERAGE SELLING PRICE TREND, BY REGION

- 5.7 INVESTMENT AND FUNDING SCENARIO

- 5.8 PATENT ANALYSIS

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- 5.9.1 THREAT OF NEW ENTRANTS

- 5.9.2 THREAT OF SUBSTITUTES

- 5.9.3 BARGAINING POWER OF SUPPLIERS

- 5.9.4 BARGAINING POWER OF BUYERS

- 5.9.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.10 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.10.2 BUYING CRITERIA

- 5.11 CASE STUDIES

- 5.11.1 ACCENTURE ADOPTS SONY CRYSTAL'S LED LARGE-SCALE DISPLAY SYSTEMS TO CREATE HIGH-RESOLUTION IMAGES

- 5.11.2 MCDONALD'S REPLACES TRADITIONAL MENU BOARDS WITH SAMSUNG ELECTRONICS' DIGITAL SIGNAGE TO ENHANCE CUSTOMER ENGAGEMENT

- 5.11.3 NJIT UTILIZES PANASONIC'S VIDEO WALL TO ENHANCE COMMUNICATION AND ACTIVE LEARNING IN CLASSROOMS

- 5.11.4 SUZUKI STREAMLINES DIGITAL CONTENT MANAGEMENT AND DISTRIBUTION IN ALL STORES WITH BRAVIA 4K PROFESSIONAL DISPLAYS

- 5.11.5 CITE DES SCIENCES ET DE L'INDUSTRIE CREATES IMMERSIVE VIEW IN ITS PLANETARIUM WITH SONY'S LASER PROJECTION TECHNOLOGY

- 5.12 TRADE ANALYSIS

- 5.12.1 IMPORT DATA (HS CODE 8525)

- 5.12.2 IMPORT DATA (HS CODE 8525)

- 5.13 REGULATORY LANDSCAPE

- 5.13.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.2 STANDARDS

- 5.13.3 REGULATIONS

- 5.14 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.15 KEY CONFERENCES AND EVENTS, 2024-2025

6 DIGITAL SIGNAGE MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.2 HARDWARE

- 6.2.1 DISPLAYS

- 6.2.1.1 Development of advanced technology-based displays for indoor and outdoor digital signage applications to boost segmental growth

- 6.2.1.2 Display, by technology

- 6.2.1.2.1 LCD

- 6.2.1.2.1.1 Clear imagery, vibrant colors, high stability, brightness, and energy efficiency to boost demand

- 6.2.1.2.2 OLED

- 6.2.1.2.2.1 Better clarity, contrast, and high-resolution images to fuel adoption

- 6.2.1.2.3 Direct-view LED

- 6.2.1.2.3.1 Lightweight, flexibility, and easy installation features to support segmental growth

- 6.2.1.2.3.2 Direct-view fine-pixel LED

- 6.2.1.2.3.3 Direct-view large-pixel LED

- 6.2.1.2.4 Micro-LED

- 6.2.1.2.4.1 Better contrast, faster response times, and greater energy efficiency than LCDs to accelerate demand

- 6.2.1.2.5 Other display technologies

- 6.2.1.2.1 LCD

- 6.2.1.3 Display, by resolution

- 6.2.1.3.1 8K

- 6.2.1.3.2 4K

- 6.2.1.3.3 FHD

- 6.2.1.3.4 HD

- 6.2.1.3.5 Lower than HD

- 6.2.1.4 Display, by brightness

- 6.2.1.4.1 0-500 nits

- 6.2.1.4.2 501-1,000 nits

- 6.2.1.4.3 1,001-2,000 nits

- 6.2.1.4.4 2,001-3,000 nits

- 6.2.1.4.5 More than 3,000 nits

- 6.2.2 MEDIA PLAYERS

- 6.2.2.1 Ability to handle and monitor 4K and 8K UHD content on digital screens to contribute to segmental growth

- 6.2.3 PROJECTORS

- 6.2.3.1 Capability to deliver sharp and impressively large images to drive demand

- 6.2.4 OTHER HARDWARE OFFERINGS

- 6.2.1 DISPLAYS

- 6.3 SOFTWARE

- 6.3.1 EDGE SERVER SOFTWARE

- 6.3.1.1 High computing capabilities, reliable connectivity, improved data security to drive adoption

- 6.3.2 CONTENT MANAGEMENT SYSTEM

- 6.3.2.1 Ability to easily create, modify, and publish different types of digital content to accelerate demand

- 6.3.3 OTHER SOFTWARE OFFERINGS

- 6.3.1 EDGE SERVER SOFTWARE

- 6.4 SERVICES

- 6.4.1 INSTALLATION

- 6.4.1.1 Need to ensure proper setup and configuration of digital signage solutions to fuel segmental growth

- 6.4.2 MAINTENANCE & SUPPORT

- 6.4.2.1 Requirement for high-quality and uninterrupted content delivery services to boost segmental growth

- 6.4.3 CONSULTING & OTHER SERVICES

- 6.4.3.1 Necessity to maximize effectiveness and longevity of digital signage solutions to foster segmental growth

- 6.4.1 INSTALLATION

7 DIGITAL SIGNAGE MARKET, BY DISPLAY SIZE

- 7.1 INTRODUCTION

- 7.2 SMALLER THAN 32 INCHES

- 7.2.1 BUILT-IN MEDIA PLAYER FUNCTIONALITY AND COST-EFFECTIVENESS TO BOOST SEGMENTAL GROWTH

- 7.3 BETWEEN 32 AND 52 INCHES

- 7.3.1 HIGH BRIGHTNESS AND CLARITY TO BOOST ADOPTION IN INDOOR AND OUTDOOR ENVIRONMENTS

- 7.4 LARGER THAN 52 INCHES

- 7.4.1 RAPID ADVANCEMENTS IN VIDEO STREAMING SERVICES AND NETWORK INFRASTRUCTURE TO FUEL DEMAND

8 DIGITAL SIGNAGE MARKET, BY PRODUCT TYPE

- 8.1 INTRODUCTION

- 8.2 VIDEO WALLS

- 8.2.1 RISING DEPLOYMENT OF VIDEO WALLS IN RETAIL STORES AND RESTAURANTS TO DRIVE MARKET

- 8.3 STANDALONE DISPLAYS

- 8.3.1 SURGING USE OF ATMS AND INTERACTIVE AND VENDING KIOSKS TO SUPPORT MARKET GROWTH

- 8.3.2 KIOSKS

- 8.3.2.1 Interactive kiosks

- 8.3.2.2 Automated teller machines (ATMs)

- 8.3.2.3 Self-service kiosks

- 8.3.2.4 Vending kiosks

- 8.3.3 MENU BOARDS

- 8.3.3.1 Interactive menu boards

- 8.3.3.2 Non-interactive menu boards

- 8.3.4 BILLBOARDS

- 8.3.5 GENERAL-PURPOSE INFORMATION DISPLAYS

- 8.3.6 SYSTEM-ON-CHIP (SOC) DISPLAYS

9 DIGITAL SIGNAGE MARKET, BY INSTALLATION LOCATION

- 9.1 INTRODUCTION

- 9.2 INDOOR

- 9.2.1 ESCALATING DEMAND FROM RETAIL, HEALTHCARE, AND GOVERNMENT SECTORS TO CONTRIBUTE TO MARKET GROWTH

- 9.3 OUTDOOR

- 9.3.1 INCREASING INSTALLATION TO ENHANCE BRANDING AND ENGAGEMENT TO FUEL MARKET GROWTH

10 DIGITAL SIGNAGE MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- 10.2 COMMERCIAL

- 10.2.1 RETAIL STORES

- 10.2.1.1 Growing emphasis on enhancing customer experience and driving sales to boost adoption

- 10.2.2 CORPORATE OFFICES

- 10.2.2.1 Rising focus on enhancing corporate communication and boosting employee engagement to spur demand

- 10.2.3 HEALTHCARE FACILITIES

- 10.2.3.1 Escalating requirement to improve patient care and operational efficiency to drive market

- 10.2.4 HOSPITALITY FACILITIES & RESTAURANTS

- 10.2.4.1 Increasing focus on enhancing guest experience to boost demand

- 10.2.5 GOVERNMENT ORGANIZATIONS

- 10.2.5.1 Pressing need to effectively promote government policies and schemes to accelerate demand

- 10.2.1 RETAIL STORES

- 10.3 INFRASTRUCTURAL

- 10.3.1 TRANSPORTATION HUBS & PUBLIC PLACES

- 10.3.1.1 Increasing need to simplify reservation process and monitor schedules to fuel adoption

- 10.3.2 SPORTS & ENTERTAINMENT VENUES

- 10.3.2.1 Rising emphasis on offering immersive viewing experience to spectators to drive market

- 10.3.1 TRANSPORTATION HUBS & PUBLIC PLACES

- 10.4 INSTITUTIONAL

- 10.4.1 BFSI FACILITIES

- 10.4.1.1 Vital requirement to display real-time stock-related information to increase deployment

- 10.4.2 EDUCATIONAL INSTITUTIONS

- 10.4.2.1 Growing focus on enhancing learning experience to boost deployment

- 10.4.1 BFSI FACILITIES

- 10.5 INDUSTRIAL

- 10.5.1 INCREASING DEMAND FROM MANUFACTURING AND OIL & GAS COMPANIES TO DRIVE MARKET

11 DIGITAL SIGNAGE MARKET, BY ENTERPRISE SIZE

- 11.1 INTRODUCTION

- 11.2 SMALL OFFICES/HOME OFFICES

- 11.2.1 STRONG FOCUS ON BRANDING AND IMPROVING OPERATIONAL EFFICIENCY TO FUEL SEGMENTAL GROWTH

- 11.3 SMALL & MEDIUM-SIZED ENTERPRISES

- 11.3.1 EASY AVAILABILITY OF INNOVATIVE SOLUTIONS TO EFFECTIVELY ENGAGE TARGET AUDIENCE TO FOSTER DEMAND

- 11.4 LARGE ENTERPRISES

- 11.4.1 URGENT NEED TO IMPLEMENT COHESIVE AND SCALABLE COMMUNICATION STRATEGIES TO STIMULATE DEMAND

12 DIGITAL SIGNAGE MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 NORTH AMERICA

- 12.2.1 NORTH AMERICA: RECESSION IMPACT

- 12.2.2 US

- 12.2.2.1 Presence of established digital signage hardware, software, and service providers to drive market

- 12.2.3 CANADA

- 12.2.3.1 Rising adoption of interactive kiosks and displays across industries to accelerate market growth

- 12.2.4 MEXICO

- 12.2.4.1 Extensive metro networks to contribute to market growth

- 12.3 EUROPE

- 12.3.1 EUROPE: RECESSION IMPACT

- 12.3.2 GERMANY

- 12.3.2.1 Presence of numerous healthcare facilities to support market growth

- 12.3.3 FRANCE

- 12.3.3.1 Existence of largest airlines and airports to fuel market growth

- 12.3.4 UK

- 12.3.4.1 Rising adoption of digital screens by restaurants, fast-food chains, and commodity showrooms to drive market

- 12.3.5 SPAIN

- 12.3.5.1 Transition from traditional retail stores to smart stores to augment market growth

- 12.3.6 ITALY

- 12.3.6.1 Expanding retail and quick service restaurant chains to create opportunities

- 12.3.7 REST OF EUROPE

- 12.4 ASIA PACIFIC

- 12.4.1 ASIA PACIFIC: RECESSION IMPACT

- 12.4.2 CHINA

- 12.4.2.1 Significant presence of key display manufacturers to fuel market growth

- 12.4.3 JAPAN

- 12.4.3.1 Rising adoption of DOOH landscape in advertising to support market growth

- 12.4.4 SOUTH KOREA

- 12.4.4.1 Presence of key manufacturers of display and related products to drive market

- 12.4.5 INDIA

- 12.4.5.1 Digital India program to support market growth

- 12.4.6 AUSTRALIA

- 12.4.6.1 Surging deployment of digital signage in retail and transportation applications to drive market

- 12.4.7 REST OF ASIA PACIFIC

- 12.5 ROW

- 12.5.1 ROW: RECESSION IMPACT

- 12.5.2 MIDDLE EAST

- 12.5.2.1 Rising focus on advertising and branding to foster market growth

- 12.5.3 AFRICA

- 12.5.3.1 Expansion of retail sector to promote demand for digital signage solutions

- 12.5.4 SOUTH AMERICA

- 12.5.4.1 Increasing urbanization and industrialization to boost market growth

13 COMPETITIVE LANDSCAPE

- 13.1 INTRODUCTION

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2023

- 13.3 MARKET SHARE ANALYSIS, 2023

- 13.4 REVENUE ANALYSIS, 2019-2023

- 13.5 COMPANY VALUATION AND FINANCIAL METRICS

- 13.6 BRAND/PRODUCT COMPARISON

- 13.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 13.7.1 STARS

- 13.7.2 EMERGING LEADERS

- 13.7.3 PERVASIVE PLAYERS

- 13.7.4 PARTICIPANTS

- 13.7.5 COMPANY PRODUCT FOOTPRINT: KEY PLAYERS, 2023

- 13.7.5.1 Company footprint

- 13.7.5.2 Offering footprint

- 13.7.5.3 Application footprint

- 13.7.5.4 Display size footprint

- 13.7.5.5 Product type footprint

- 13.7.5.6 Installation location footprint

- 13.7.5.7 Enterprise size footprint

- 13.7.5.8 Region footprint

- 13.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 13.8.1 PROGRESSIVE COMPANIES

- 13.8.2 RESPONSIVE COMPANIES

- 13.8.3 DYNAMIC COMPANIES

- 13.8.4 STARTING BLOCKS

- 13.8.5 COMPETITIVE BENCHMARKING, STARTUPS/SMES, 2023

- 13.8.5.1 Detailed list of key startups/SMEs

- 13.8.5.2 Competitive benchmarking of key startups/SMEs

- 13.9 COMPETITIVE SCENARIO AND TRENDS

- 13.9.1 PRODUCT LAUNCHES

- 13.9.2 DEALS

14 COMPANY PROFILES

- 14.1 INTRODUCTION

- 14.2 KEY PLAYERS

- 14.2.1 SAMSUNG ELECTRONICS CO., LTD.

- 14.2.1.1 Business overview

- 14.2.1.2 Products offered

- 14.2.1.3 Recent developments

- 14.2.1.3.1 Product launches

- 14.2.1.3.2 Deals

- 14.2.1.4 MnM view

- 14.2.1.4.1 Key strengths

- 14.2.1.4.2 Strategic choices

- 14.2.1.4.3 Weaknesses/Competitive threats

- 14.2.2 LG ELECTRONICS

- 14.2.2.1 Business overview

- 14.2.2.2 Products offered

- 14.2.2.3 Recent developments

- 14.2.2.3.1 Product launches

- 14.2.2.4 MnM view

- 14.2.2.4.1 Key strengths

- 14.2.2.4.2 Strategic choices

- 14.2.2.4.3 Weaknesses/Competitive threats

- 14.2.3 SHARP NEC DISPLAY SOLUTIONS, LTD.

- 14.2.3.1 Business overview

- 14.2.3.2 Products offered

- 14.2.3.3 Recent developments

- 14.2.3.3.1 Product launches

- 14.2.3.3.2 Deals

- 14.2.3.4 MnM view

- 14.2.3.4.1 Key strengths

- 14.2.3.4.2 Strategic choices

- 14.2.3.4.3 Weaknesses/Competitive threats

- 14.2.4 LEYARD

- 14.2.4.1 Business overview

- 14.2.4.2 Products offered

- 14.2.4.3 Recent developments

- 14.2.4.3.1 Product launches

- 14.2.4.4 MnM view

- 14.2.4.4.1 Key strengths

- 14.2.4.4.2 Strategic choices

- 14.2.4.4.3 Weaknesses/Competitive threats

- 14.2.5 SONY GROUP CORPORATION

- 14.2.5.1 Business overview

- 14.2.5.2 Products offered

- 14.2.5.3 Recent developments

- 14.2.5.3.1 Product launches

- 14.2.5.3.2 Deals

- 14.2.5.4 MnM view

- 14.2.5.4.1 Key strengths

- 14.2.5.4.2 Strategic choices

- 14.2.5.4.3 Weaknesses/Competitive threats

- 14.2.6 BARCO

- 14.2.6.1 Business overview

- 14.2.6.2 Products offered

- 14.2.6.3 Recent developments

- 14.2.6.3.1 Product launches

- 14.2.6.3.2 Deals

- 14.2.7 PANASONIC HOLDINGS CORPORATION

- 14.2.7.1 Business overview

- 14.2.7.2 Products offered

- 14.2.7.3 Recent developments

- 14.2.7.3.1 Product launches

- 14.2.8 SHANGHAI XIANSHI ELECTRONIC TECHNOLOGY CO., LTD

- 14.2.8.1 Business overview

- 14.2.8.2 Products offered

- 14.2.8.3 Recent developments

- 14.2.8.3.1 Product launches

- 14.2.9 AUO CORPORATION

- 14.2.9.1 Business overview

- 14.2.9.2 Products offered

- 14.2.9.3 Recent developments

- 14.2.9.3.1 Product launches

- 14.2.9.3.2 Deals

- 14.2.9.3.3 Others

- 14.2.10 BRIGHTSIGN LLC

- 14.2.10.1 Business overview

- 14.2.10.2 Products offered

- 14.2.10.3 Recent developments

- 14.2.10.3.1 Product launches

- 14.2.10.3.2 Deals

- 14.2.1 SAMSUNG ELECTRONICS CO., LTD.

- 14.3 OTHER PLAYERS

- 14.3.1 STRATACACHE

- 14.3.2 BENQ

- 14.3.3 INTUIFACE

- 14.3.4 DAKTRONICS DR.

- 14.3.5 OMNIVEX CORPORATION

- 14.3.6 DELTA ELECTRONICS, INC.

- 14.3.7 KEYWEST TECHNOLOGY, INC.

- 14.3.8 REMOTE MEDIA GROUP LIMITED

- 14.3.9 CHRISTIE DIGITAL SYSTEMS USA, INC.

- 14.3.10 BROADSIGN INTERNATIONAL, LLC

- 14.3.11 DISE

- 14.3.12 TRUKNOX TECHNOLOGIES PVT. LTD.

- 14.3.13 YCD MULTIMEDIA

- 14.3.14 L SQUARED DIGITAL SIGNAGE

- 14.3.15 VISIX, INC.

15 APPENDIX

- 15.1 INSIGHTS FROM INDUSTRY EXPERTS

- 15.2 DISCUSSION GUIDE

- 15.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.4 CUSTOMIZATION OPTIONS

- 15.5 RELATED REPORTS

- 15.6 AUTHOR DETAILS