|

|

市場調査レポート

商品コード

1514362

オフショア支援船の世界市場:用途別、エンドユーザー産業別、タイプ別、地域別 - 2029年までの予測Offshore Support Vessel Market by Technology (AHTS, PSV, MPSV, Standby & Rescue Vessels, Crew Vessels, Chase Vessels, Seismic Vessels), Application (Shallow water, Deepwater), End-user Industry, Material, Fuel Type and Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| オフショア支援船の世界市場:用途別、エンドユーザー産業別、タイプ別、地域別 - 2029年までの予測 |

|

出版日: 2024年06月25日

発行: MarketsandMarkets

ページ情報: 英文 317 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のオフショア支援船の市場規模は、2024年の256億米ドルから2029年には363億米ドルに成長すると予測されており、予測期間中のCAGRは7.2%になるとみられています。

石油価格の改善とコスト効率化によってオフショア・プロジェクトの経済性が向上するにつれ、より多くのオフショア・プロジェクトが実行可能になり、これらの作業をサポートするOSVのニーズが高まっています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2019年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 対象台数 | 金額(100万米ドル)/数量(台) |

| セグメント別 | オフショア支援船市場:用途別、エンドユーザー産業別、タイプ別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

多目的支援船は予測期間中に最も急成長するセグメントとなる見込みです。多目的支援船(MSV)は、海底建設や設置プロジェクトに不可欠な資産であり、パイプラインの敷設、海底構造物の設置、水中保守作業の実施において重要な役割を果たします。高度な技術と特殊な機器を備えたMSVは、さまざまな海底条件下でパイプラインを正確に配置し、確実に接続します。MSVは、ダイナミックポジショニングシステムと重量物クレーンを利用して、坑井ヘッドやマニホールドのような海底構造物を正確に設置します。

深海セグメントは、予測期間中、オフショア支援船市場の2番目に大きなセグメントになると予想されます。特に自律型船舶、ロボット工学、デジタル化などの技術革新が、特に深海用途のオフショア支援船(OSV)分野を再構築しています。自律技術は、無人または最小限の有人操業を可能にし、課題である深海環境での正確なナビゲーションのために高度なセンサーとAIを採用することで安全性と効率を高める。遠隔操作車両(ROV)や自律型水中探査機(AUV)を含むロボティクスは、海底点検やメンテナンスなどの重要な作業を行う一方、デジタル化によってリアルタイムのモニタリング、予知保全、データ主導の意思決定が容易になり、船舶の性能を最適化し、運用コストを削減します。

当レポートでは、世界のオフショア支援船市場について調査し、用途別、エンドユーザー産業別、タイプ別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客のビジネスに影響を与える動向/混乱

- 価格分析

- バリューチェーン分析

- エコシステム分析

- 規制状況

- 特許分析

- ケーススタディ分析

- 技術分析

- 2024年~2025年の主な会議とイベント

- 貿易分析

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- 投資と資金調達のシナリオ

第6章 オフショア支援船の建造に使用される材料

- イントロダクション

- 建設資材

- クラッディング材

第7章 オフショア支援船で使用される燃料

- イントロダクション

- 燃料油

- 液化天然ガス(LNG)

第8章 オフショア支援船市場(用途別)

- イントロダクション

- 浅海

- 深海

第9章 オフショア支援船市場(エンドユーザー産業別)

- イントロダクション

- 石油ガス

- 風力エネルギー

第10章 オフショア支援船市場(タイプ別)

- イントロダクション

- アンカーハンドリングタグサプライ船

- プラットフォーム補給船

- 多目的支援船

- 待機・救助船

- クルー船

- 地震探査船

- 追跡船

- その他

第11章 オフショア支援船市場(地域別)

- イントロダクション

- アジア太平洋

- 欧州

- 北米

- 南米

- 中東・アフリカ

第12章 競合情勢

- 概要

- 主要参入企業の戦略/強み、2019年~2024年

- 市場シェア分析、2023年

- 市場評価フレームワーク、2019年~2024年

- 収益分析、2019年~2023年

- 企業価値評価と財務指標

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業、2023年

- 競合シナリオと動向

第13章 企業プロファイル

- 主要参入企業

- TIDEWATER INC.

- A.P. MOLLER-MAERSK

- BOURBON

- GALLIANO MARINE SERVICE

- DELTAMARIN LTD

- SEA1 OFFSHORE

- SOLSTAD OFFSHORE ASA

- DOF

- VROON

- SEACOR MARINE

- HAVILA SHIPPING ASA

- KAWASAKI KISEN KAISHA LTD.

- OSTENSJO REDERI

- NAM CHEONG LIMITED

- MMA OFFSHORE LIMITED

- GRUPO CBO

- POSH

- VALLIANZ HOLDINGS LIMITED

- PACIFIC RADIANCE LTD

- その他の企業

- ROYAL IHC

- HARVEY GULF INTERNATIONAL MARINE

- GC RIEBER

- M3 MARINE GROUP

- HORNBECK OFFSHORE

- FEG

- BUMI ARMADA BERHAD

第14章 付録

List of Tables

- TABLE 1 OFFSHORE SUPPORT VESSEL MARKET: RISK ASSESSMENT

- TABLE 2 OFFSHORE SUPPORT VESSEL MARKET SNAPSHOT

- TABLE 3 MAJOR OFFSHORE PROJECTS AND CONTRACTS

- TABLE 4 AVERAGE SELLING PRICE (AVERAGE DAY RATE) OF OFFSHORE SUPPORT VESSELS AT NORTH SEA (USD)

- TABLE 5 AVERAGE SELLING PRICE (AVERAGE DAY RATE) OF OFFSHORE SUPPORT VESSELS, BY REGION, 2019-2023 (USD)

- TABLE 6 AVERAGE SELLING PRICE (AVERAGE DAY RATE) OF OFFSHORE SUPPORT VESSELS, BY TYPE, 2019-2023 (USD)

- TABLE 7 ROLE OF COMPANIES IN OFFSHORE SUPPORT VESSEL ECOSYSTEM

- TABLE 8 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 REGULATIONS

- TABLE 14 LIST OF KEY PATENTS, 2018-2023

- TABLE 15 KEY CONFERENCES AND EVENTS, 2024-2025

- TABLE 16 EXPORT DATA FOR HS CODE 72-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2023 (USD THOUSAND)

- TABLE 17 IMPORT DATA FOR HS CODE 72-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2023 (USD THOUSAND)

- TABLE 18 EXPORT DATA FOR HS CODE 2606-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2023 (USD THOUSAND)

- TABLE 19 IMPORT DATA FOR HS CODE 2606-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2023 (USD THOUSAND)

- TABLE 20 EXPORT DATA FOR HS CODE 7019-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2023 (USD THOUSAND)

- TABLE 21 IMPORT DATA FOR HS CODE 7019-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2023 (USD THOUSAND)

- TABLE 22 PORTER'S FIVE FORCES ANALYSIS

- TABLE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION (%)

- TABLE 24 KEY BUYING CRITERIA, BY APPLICATION

- TABLE 25 OFFSHORE SUPPORT VESSEL MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 26 OFFSHORE SUPPORT VESSEL MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 27 SHALLOW WATER: OFFSHORE SUPPORT VESSEL MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 28 SHALLOW WATER: OFFSHORE SUPPORT VESSEL MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 29 DEEPWATER: OFFSHORE SUPPORT VESSEL MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 30 DEEPWATER: OFFSHORE SUPPORT VESSEL MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 31 OFFSHORE SUPPORT VESSEL MARKET, BY END-USER INDUSTRY, 2019-2023 (USD MILLION)

- TABLE 32 OFFSHORE SUPPORT VESSEL MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 33 OIL & GAS: OFFSHORE SUPPORT VESSEL MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 34 OIL & GAS: OFFSHORE SUPPORT VESSEL MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 35 WIND ENERGY: OFFSHORE SUPPORT VESSEL MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 36 WIND ENERGY: OFFSHORE SUPPORT VESSEL MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 37 SUPPLY SIDE: OFFSHORE SUPPORT VESSEL MARKET, BY TYPE, 2019-2023 (UNITS)

- TABLE 38 SUPPLY SIDE: OFFSHORE SUPPORT VESSEL MARKET, BY TYPE, 2024-2029 (UNITS)

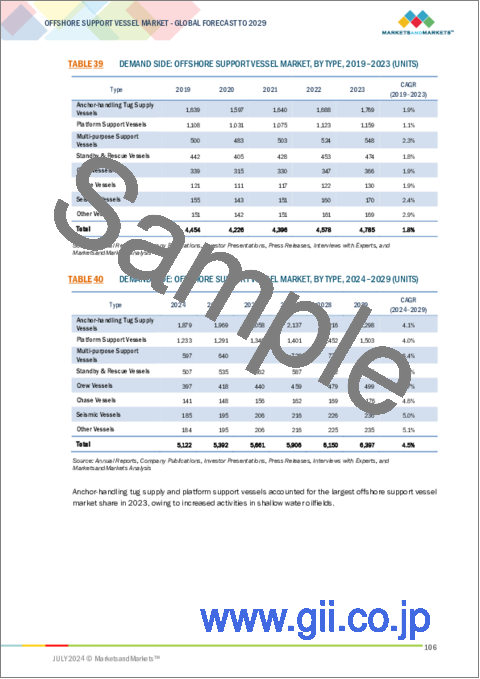

- TABLE 39 DEMAND SIDE: OFFSHORE SUPPORT VESSEL MARKET, BY TYPE, 2019-2023 (UNITS)

- TABLE 40 DEMAND SIDE: OFFSHORE SUPPORT VESSEL MARKET, BY TYPE, 2024-2029 (UNITS)

- TABLE 41 OFFSHORE SUPPORT VESSEL MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 42 OFFSHORE SUPPORT VESSEL MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 43 SUPPLY SIDE: OFFSHORE SUPPORT VESSEL MARKET FOR ANCHOR-HANDLING TUG SUPPLY VESSELS, BY REGION, 2019-2023 (UNITS)

- TABLE 44 SUPPLY SIDE: OFFSHORE SUPPORT VESSEL MARKET FOR ANCHOR-HANDLING TUG SUPPLY VESSELS, BY REGION, 2024-2029 (UNITS)

- TABLE 45 DEMAND SIDE: OFFSHORE SUPPORT VESSEL MARKET FOR ANCHOR-HANDLING TUG SUPPLY VESSELS, BY REGION, 2019-2023 (UNITS)

- TABLE 46 DEMAND SIDE: OFFSHORE SUPPORT VESSEL MARKET FOR ANCHOR-HANDLING TUG SUPPLY VESSELS, BY REGION, 2024-2029 (UNITS)

- TABLE 47 ANCHOR-HANDLING TUG SUPPLY VESSELS: OFFSHORE SUPPORT VESSEL MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 48 ANCHOR-HANDLING TUG SUPPLY VESSELS: OFFSHORE SUPPORT VESSEL MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 49 SUPPLY SIDE: OFFSHORE SUPPORT VESSEL MARKET FOR PLATFORM SUPPLY VESSELS, BY REGION, 2019-2023 (UNITS)

- TABLE 50 SUPPLY SIDE: OFFSHORE SUPPORT VESSEL MARKET FOR PLATFORM SUPPLY VESSELS, BY REGION, 2024-2029 (UNITS)

- TABLE 51 DEMAND SIDE: OFFSHORE SUPPORT VESSEL MARKET FOR PLATFORM SUPPLY VESSELS, BY REGION, 2019-2023 (UNITS)

- TABLE 52 DEMAND SIDE: OFFSHORE SUPPORT VESSEL MARKET FOR PLATFORM SUPPLY VESSELS, BY REGION, 2024-2029 (UNITS)

- TABLE 53 PLATFORM SUPPLY VESSELS: OFFSHORE SUPPORT VESSEL MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 54 PLATFORM SUPPLY VESSELS: OFFSHORE SUPPORT VESSEL MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 55 SUPPLY SIDE: MULTI-PURPOSE SUPPORT VESSEL MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 56 SUPPLY SIDE: MULTI-PURPOSE SUPPORT VESSEL MARKET, BY REGION, 2024-2029 (UNITS)

- TABLE 57 DEMAND SIDE: MULTI-PURPOSE SUPPORT VESSEL MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 58 DEMAND SIDE: MULTI-PURPOSE SUPPORT VESSEL MARKET, BY REGION, 2024-2029 (UNITS)

- TABLE 59 MULTI-PURPOSE SUPPORT VESSELS: OFFSHORE SUPPORT VESSEL MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 60 MULTI-PURPOSE SUPPORT VESSELS: OFFSHORE SUPPORT VESSEL MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 61 SUPPLY SIDE: OFFSHORE SUPPORT VESSEL MARKET FOR STANDBY & RESCUE VESSELS, BY REGION, 2019-2023 (UNITS)

- TABLE 62 SUPPLY SIDE: OFFSHORE SUPPORT VESSEL MARKET FOR STANDBY & RESCUE VESSELS, BY REGION, 2024-2029 (UNITS)

- TABLE 63 DEMAND SIDE: OFFSHORE SUPPORT VESSEL MARKET FOR STANDBY & RESCUE VESSELS, BY REGION, 2019-2023 (UNITS)

- TABLE 64 DEMAND SIDE: OFFSHORE SUPPORT VESSEL MARKET FOR STANDBY & RESCUE VESSELS, BY REGION, 2024-2029 (UNITS)

- TABLE 65 STANDBY & RESCUE VESSELS: OFFSHORE SUPPORT VESSEL MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 66 STANDBY & RESCUE VESSELS: OFFSHORE SUPPORT VESSEL MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 67 SUPPLY SIDE: OFFSHORE SUPPORT VESSEL MARKET FOR CREW VESSELS, BY REGION, 2019-2023 (UNITS)

- TABLE 68 SUPPLY SIDE: OFFSHORE SUPPORT VESSEL MARKET FOR CREW VESSELS, BY REGION, 2024-2029 (UNITS)

- TABLE 69 DEMAND SIDE: OFFSHORE SUPPORT VESSEL MARKET FOR CREW VESSELS, BY REGION, 2019-2023 (UNITS)

- TABLE 70 DEMAND SIDE: OFFSHORE SUPPORT VESSEL MARKET FOR CREW VESSELS, BY REGION, 2024-2029 (UNITS)

- TABLE 71 CREW VESSELS: OFFSHORE SUPPORT VESSEL MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 72 CREW VESSELS: OFFSHORE SUPPORT VESSEL MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 73 SUPPLY SIDE: OFFSHORE SUPPORT VESSEL MARKET FOR SEISMIC VESSELS, BY REGION, 2019-2023 (UNITS)

- TABLE 74 SUPPLY SIDE: OFFSHORE SUPPORT VESSEL MARKET FOR SEISMIC VESSELS, BY REGION, 2024-2029 (UNITS)

- TABLE 75 DEMAND SIDE: OFFSHORE SUPPORT VESSEL MARKET FOR SEISMIC VESSELS, BY REGION, 2019-2023 (UNITS)

- TABLE 76 DEMAND SIDE: OFFSHORE SUPPORT VESSEL MARKET FOR SEISMIC VESSELS, BY REGION, 2024-2029 (UNITS)

- TABLE 77 SEISMIC VESSELS: OFFSHORE SUPPORT VESSEL MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 78 SEISMIC VESSELS: OFFSHORE SUPPORT VESSEL MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 79 SUPPLY SIDE: OFFSHORE SUPPORT VESSEL MARKET FOR CHASE VESSELS, BY REGION, 2019-2023 (UNITS)

- TABLE 80 SUPPLY SIDE: OFFSHORE SUPPORT VESSEL MARKET FOR CHASE VESSELS, BY REGION, 2024-2029 (UNITS)

- TABLE 81 DEMAND SIDE: OFFSHORE SUPPORT VESSEL MARKET FOR CHASE VESSELS, BY REGION, 2019-2023 (UNITS)

- TABLE 82 DEMAND SIDE: OFFSHORE SUPPORT VESSEL MARKET FOR CHASE VESSELS, BY REGION, 2024-2029 (UNITS)

- TABLE 83 CHASE VESSELS: OFFSHORE SUPPORT VESSEL MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 84 CHASE VESSELS: OFFSHORE SUPPORT VESSEL MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 85 SUPPLY SIDE: OFFSHORE SUPPORT VESSEL MARKET FOR OTHER VESSELS, BY REGION, 2019-2023 (UNITS)

- TABLE 86 SUPPLY SIDE: OFFSHORE SUPPORT VESSEL MARKET FOR OTHER VESSELS, BY REGION, 2024-2029 (UNITS)

- TABLE 87 DEMAND SIDE: OFFSHORE SUPPORT VESSEL MARKET FOR OTHER VESSELS, BY REGION, 2019-2023 (UNITS)

- TABLE 88 DEMAND SIDE: OFFSHORE SUPPORT VESSEL MARKET FOR OTHER VESSELS, BY REGION, 2024-2029 (UNITS)

- TABLE 89 OTHER VESSELS: OFFSHORE SUPPORT VESSEL MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 90 OTHER VESSELS: OFFSHORE SUPPORT VESSEL MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 91 SUPPLY SIDE: OFFSHORE SUPPORT VESSEL MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 92 SUPPLY SIDE: OFFSHORE SUPPORT VESSEL MARKET, BY REGION, 2024-2029 (UNITS)

- TABLE 93 DEMAND SIDE: OFFSHORE SUPPORT VESSEL MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 94 DEMAND SIDE: OFFSHORE SUPPORT VESSEL MARKET, BY REGION, 2024-2029 (UNITS)

- TABLE 95 OFFSHORE SUPPORT VESSEL MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 96 OFFSHORE SUPPORT VESSEL MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 97 SUPPLY SIDE: OFFSHORE SUPPORT VESSEL MARKET IN ASIA PACIFIC, BY TYPE, 2019-2023 (UNITS)

- TABLE 98 SUPPLY SIDE: OFFSHORE SUPPORT VESSEL MARKET IN ASIA PACIFIC, BY TYPE, 2024-2029 (UNITS)

- TABLE 99 DEMAND SIDE: OFFSHORE SUPPORT VESSEL MARKET IN ASIA PACIFIC, BY TYPE, 2019-2023 (UNITS)

- TABLE 100 DEMAND SIDE: OFFSHORE SUPPORT VESSEL MARKET IN ASIA PACIFIC, BY TYPE, 2024-2029 (UNITS)

- TABLE 101 ASIA PACIFIC: OFFSHORE SUPPORT VESSEL MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 102 ASIA PACIFIC: OFFSHORE SUPPORT VESSEL MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 103 ASIA PACIFIC: OFFSHORE SUPPORT VESSEL MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 104 ASIA PACIFIC: OFFSHORE SUPPORT VESSEL MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 105 ASIA PACIFIC: OFFSHORE SUPPORT VESSEL MARKET, BY END-USER INDUSTRY, 2019-2023 (USD MILLION)

- TABLE 106 ASIA PACIFIC: OFFSHORE SUPPORT VESSEL MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 107 ASIA PACIFIC: OFFSHORE SUPPORT VESSEL MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 108 ASIA PACIFIC: OFFSHORE SUPPORT VESSEL MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 109 CHINA: OFFSHORE SUPPORT VESSEL MARKET, BY END-USER INDUSTRY, 2019-2023 (USD MILLION)

- TABLE 110 CHINA: OFFSHORE SUPPORT VESSEL MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 111 INDIA: OFFSHORE SUPPORT VESSEL MARKET, BY END-USER INDUSTRY, 2019-2023 (USD MILLION)

- TABLE 112 INDIA: OFFSHORE SUPPORT VESSEL MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 113 MALAYSIA: OFFSHORE SUPPORT VESSEL MARKET, BY END-USER INDUSTRY, 2019-2023 (USD MILLION)

- TABLE 114 MALAYSIA: OFFSHORE SUPPORT VESSEL MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 115 THAILAND: OFFSHORE SUPPORT VESSEL MARKET, BY END-USER INDUSTRY, 2019-2023 (USD MILLION)

- TABLE 116 THAILAND: OFFSHORE SUPPORT VESSEL MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 117 VIETNAM: OFFSHORE SUPPORT VESSEL MARKET, BY END-USER INDUSTRY, 2019-2023 (USD MILLION)

- TABLE 118 VIETNAM: OFFSHORE SUPPORT VESSEL MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 119 REST OF ASIA PACIFIC: OFFSHORE SUPPORT VESSEL MARKET, BY END-USER INDUSTRY, 2019-2023 (USD MILLION)

- TABLE 120 REST OF ASIA PACIFIC: OFFSHORE SUPPORT VESSEL MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 121 SUPPLY SIDE: OFFSHORE SUPPORT VESSEL MARKET IN EUROPE, BY TYPE, 2019-2023 (UNITS)

- TABLE 122 SUPPLY SIDE: OFFSHORE SUPPORT VESSEL MARKET IN EUROPE, BY TYPE, 2024-2029 (UNITS)

- TABLE 123 DEMAND SIDE: OFFSHORE SUPPORT VESSEL MARKET IN EUROPE, BY TYPE, 2019-2023 (UNITS)

- TABLE 124 DEMAND SIDE: OFFSHORE SUPPORT VESSEL MARKET IN EUROPE, BY TYPE, 2024-2029 (UNITS)

- TABLE 125 EUROPE: OFFSHORE SUPPORT VESSEL MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 126 EUROPE: OFFSHORE SUPPORT VESSEL MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 127 EUROPE: OFFSHORE SUPPORT VESSEL MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 128 EUROPE: OFFSHORE SUPPORT VESSEL MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 129 EUROPE: OFFSHORE SUPPORT VESSEL MARKET, BY END-USER INDUSTRY, 2019-2023 (USD MILLION)

- TABLE 130 EUROPE: OFFSHORE SUPPORT VESSEL MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 131 EUROPE: OFFSHORE SUPPORT VESSEL MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 132 EUROPE: OFFSHORE SUPPORT VESSEL MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 133 UK: OFFSHORE SUPPORT VESSEL MARKET, BY END-USER INDUSTRY, 2019-2023 (USD MILLION)

- TABLE 134 UK: OFFSHORE SUPPORT VESSEL MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 135 NORWAY: OFFSHORE SUPPORT VESSEL MARKET, BY END-USER INDUSTRY, 2019-2023 (USD MILLION)

- TABLE 136 NORWAY: OFFSHORE SUPPORT VESSEL MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 137 NETHERLANDS: OFFSHORE SUPPORT VESSEL MARKET, BY END-USER INDUSTRY, 2019-2023 (USD MILLION)

- TABLE 138 NETHERLANDS: OFFSHORE SUPPORT VESSEL MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 139 REST OF EUROPE: OFFSHORE SUPPORT VESSEL MARKET, BY END-USER INDUSTRY, 2019-2023 (USD MILLION)

- TABLE 140 REST OF EUROPE: OFFSHORE SUPPORT VESSEL MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 141 SUPPLY SIDE: OFFSHORE SUPPORT VESSEL MARKET IN NORTH AMERICA, BY TYPE, 2019-2023 (UNITS)

- TABLE 142 SUPPLY SIDE: OFFSHORE SUPPORT VESSEL MARKET IN NORTH AMERICA, BY TYPE, 2024-2029 (UNITS)

- TABLE 143 DEMAND SIDE: OFFSHORE SUPPORT VESSEL MARKET IN NORTH AMERICA, BY TYPE, 2019-2023 (UNITS)

- TABLE 144 DEMAND SIDE: OFFSHORE SUPPORT VESSEL MARKET IN NORTH AMERICA, BY TYPE, 2024-2029 (UNITS)

- TABLE 145 NORTH AMERICA: OFFSHORE SUPPORT VESSEL MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 146 NORTH AMERICA: OFFSHORE SUPPORT VESSEL MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 147 NORTH AMERICA: OFFSHORE SUPPORT VESSEL MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 148 NORTH AMERICA: OFFSHORE SUPPORT VESSEL MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 149 NORTH AMERICA: OFFSHORE SUPPORT VESSEL MARKET, BY END-USER INDUSTRY, 2019-2023 (USD MILLION)

- TABLE 150 NORTH AMERICA: OFFSHORE SUPPORT VESSEL MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 151 NORTH AMERICA: OFFSHORE SUPPORT VESSEL MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 152 NORTH AMERICA: OFFSHORE SUPPORT VESSEL MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 153 US: OFFSHORE SUPPORT VESSEL MARKET, BY END-USER INDUSTRY, 2019-2023 (USD MILLION)

- TABLE 154 US: OFFSHORE SUPPORT VESSEL MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 155 CANADA: OFFSHORE SUPPORT VESSEL MARKET, BY END-USER INDUSTRY, 2019-2023 (USD MILLION)

- TABLE 156 CANADA: OFFSHORE SUPPORT VESSEL MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 157 MEXICO: OFFSHORE SUPPORT VESSEL MARKET, BY END-USER INDUSTRY, 2019-2023 (USD MILLION)

- TABLE 158 MEXICO: OFFSHORE SUPPORT VESSEL MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 159 SUPPLY SIDE: OFFSHORE SUPPORT VESSEL MARKET IN SOUTH AMERICA, BY TYPE, 2019-2023 (UNITS)

- TABLE 160 SUPPLY SIDE: OFFSHORE SUPPORT VESSEL MARKET IN SOUTH AMERICA, BY TYPE, 2024-2029 (UNITS)

- TABLE 161 DEMAND SIDE: OFFSHORE SUPPORT VESSEL MARKET IN SOUTH AMERICA, BY TYPE, 2019-2023 (UNITS)

- TABLE 162 DEMAND SIDE: OFFSHORE SUPPORT VESSEL MARKET IN SOUTH AMERICA, BY TYPE, 2024-2029 (UNITS)

- TABLE 163 SOUTH AMERICA: OFFSHORE SUPPORT VESSEL MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 164 SOUTH AMERICA: OFFSHORE SUPPORT VESSEL MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 165 SOUTH AMERICA: OFFSHORE SUPPORT VESSEL MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 166 SOUTH AMERICA: OFFSHORE SUPPORT VESSEL MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 167 SOUTH AMERICA: OFFSHORE SUPPORT VESSEL MARKET, BY END-USER INDUSTRY, 2019-2023 (USD MILLION)

- TABLE 168 SOUTH AMERICA: OFFSHORE SUPPORT VESSEL MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 169 SOUTH AMERICA: OFFSHORE SUPPORT VESSEL MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 170 SOUTH AMERICA: OFFSHORE SUPPORT VESSEL MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 171 BRAZIL: OFFSHORE SUPPORT VESSEL MARKET, BY END-USER INDUSTRY, 2019-2023 (USD MILLION)

- TABLE 172 BRAZIL: OFFSHORE SUPPORT VESSEL MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 173 REST OF SOUTH AMERICA: OFFSHORE SUPPORT VESSEL MARKET, BY END-USER INDUSTRY, 2019-2023 (USD MILLION)

- TABLE 174 REST OF SOUTH AMERICA: OFFSHORE SUPPORT VESSEL MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 175 SUPPLY SIDE: OFFSHORE SUPPORT VESSEL MARKET IN MIDDLE EAST & AFRICA, BY TYPE, 2019-2023 (UNITS)

- TABLE 176 SUPPLY SIDE: OFFSHORE SUPPORT VESSEL MARKET IN MIDDLE EAST & AFRICA, BY TYPE, 2024-2029 (UNITS)

- TABLE 177 DEMAND SIDE: OFFSHORE SUPPORT VESSEL MARKET IN MIDDLE EAST & AFRICA, BY TYPE, 2019-2023 (UNITS)

- TABLE 178 DEMAND SIDE: OFFSHORE SUPPORT VESSEL MARKET IN MIDDLE EAST & AFRICA, BY TYPE, 2024-2029 (UNITS)

- TABLE 179 MIDDLE EAST & AFRICA: OFFSHORE SUPPORT VESSEL MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 180 MIDDLE EAST & AFRICA: OFFSHORE SUPPORT VESSEL MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 181 MIDDLE EAST & AFRICA: OFFSHORE SUPPORT VESSEL MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 182 MIDDLE EAST & AFRICA: OFFSHORE SUPPORT VESSEL MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 183 MIDDLE EAST & AFRICA: OFFSHORE SUPPORT VESSEL MARKET, BY END-USER INDUSTRY, 2019-2023 (USD MILLION)

- TABLE 184 MIDDLE EAST & AFRICA: OFFSHORE SUPPORT VESSEL MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 185 MIDDLE EAST & AFRICA: OFFSHORE SUPPORT VESSEL MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 186 MIDDLE EAST & AFRICA: OFFSHORE SUPPORT VESSEL MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 187 GCC: OFFSHORE SUPPORT VESSEL MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 188 GCC: OFFSHORE SUPPORT VESSEL MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 189 SAUDI ARABIA: OFFSHORE SUPPORT VESSEL MARKET, BY END-USER INDUSTRY, 2019-2023 (USD MILLION)

- TABLE 190 SAUDI ARABIA: OFFSHORE SUPPORT VESSEL MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 191 UAE: OFFSHORE SUPPORT VESSEL MARKET, BY END-USER INDUSTRY, 2019-2023 (USD MILLION)

- TABLE 192 UAE: OFFSHORE SUPPORT VESSEL MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 193 QATAR: OFFSHORE SUPPORT VESSEL MARKET, BY END-USER INDUSTRY, 2019-2023 (USD MILLION)

- TABLE 194 QATAR: OFFSHORE SUPPORT VESSEL MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 195 OMAN: OFFSHORE SUPPORT VESSEL MARKET, BY END-USER INDUSTRY, 2019-2023 (USD MILLION)

- TABLE 196 OMAN: OFFSHORE SUPPORT VESSEL MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 197 NIGERIA: OFFSHORE SUPPORT VESSEL MARKET, BY END-USER INDUSTRY, 2019-2023 (USD MILLION)

- TABLE 198 NIGERIA: OFFSHORE SUPPORT VESSEL MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 199 ANGOLA: OFFSHORE SUPPORT VESSEL MARKET, BY END-USER INDUSTRY, 2019-2023 (USD MILLION)

- TABLE 200 ANGOLA: OFFSHORE SUPPORT VESSEL MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 201 REST OF MIDDLE EAST & AFRICA: OFFSHORE SUPPORT VESSEL MARKET, BY END-USER INDUSTRY, 2019-2023 (USD MILLION)

- TABLE 202 REST OF MIDDLE EAST & AFRICA: OFFSHORE SUPPORT VESSEL MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 203 OFFSHORE SUPPORT VESSEL MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2019-2024

- TABLE 204 OFFSHORE SUPPORT VESSEL MARKET: DEGREE OF COMPETITION

- TABLE 205 MARKET EVALUATION FRAMEWORK, 2019-2024

- TABLE 206 OFFSHORE SUPPORT VESSEL MARKET: REGION FOOTPRINT

- TABLE 207 OFFSHORE SUPPORT VESSEL MARKET: END-USER INDUSTRY FOOTPRINT

- TABLE 208 OFFSHORE SUPPORT VESSEL MARKET: APPLICATION FOOTPRINT

- TABLE 209 OFFSHORE SUPPORT VESSEL MARKET: TYPE FOOTPRINT

- TABLE 210 OFFSHORE SUPPORT VESSEL MARKET: PRODUCT LAUNCHES, JANUARY 2019-MAY 2024

- TABLE 211 OFFSHORE SUPPORT VESSEL MARKET: DEALS, JANUARY 2019-MAY 2024

- TABLE 212 OFFSHORE SUPPORT VESSEL MARKET: EXPANSIONS, JANUARY 2019-MAY 2024

- TABLE 213 OFFSHORE SUPPORT VESSEL MARKET: OTHERS, JANUARY 2019-MAY 2024

- TABLE 214 TIDEWATER INC.: COMPANY OVERVIEW

- TABLE 215 TIDEWATER INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 216 TIDEWATER INC.: DEALS

- TABLE 217 A.P. MOLLER - MAERSK: COMPANY OVERVIEW

- TABLE 218 A.P. MOLLER - MAERSK: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 219 A.P. MOLLER - MAERSK: PRODUCT LAUNCHES

- TABLE 220 A.P. MOLLER - MAERSK: DEALS

- TABLE 221 A.P. MOLLER - MAERSK: OTHERS

- TABLE 222 BOURBON: COMPANY OVERVIEW

- TABLE 223 BOURBON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 224 BOURBON: PRODUCT LAUNCHES

- TABLE 225 BOURBON: DEALS

- TABLE 226 BOURBON: OTHERS

- TABLE 227 GALLIANO MARINE SERVICE: COMPANY OVERVIEW

- TABLE 228 GALLIANO MARINE SERVICE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 229 GALLIANO MARINE SERVICE: DEALS

- TABLE 230 GALLIANO MARINE SERVICE: EXPANSIONS

- TABLE 231 DELTAMARINE LTD: COMPANY OVERVIEW

- TABLE 232 DELTAMARINE LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 233 DELTAMARINE LTD: DEALS

- TABLE 234 DELTAMARINE LTD: OTHERS

- TABLE 235 SEA1 OFFSHORE: COMPANY OVERVIEW

- TABLE 236 SEA1 OFFSHORE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 237 SEA1 OFFSHORE: PRODUCT LAUNCHES

- TABLE 238 SEA1 OFFSHORE: DEALS

- TABLE 239 SEA1 OFFSHORE: OTHERS

- TABLE 240 SOLSTAD OFFSHORE ASA: COMPANY OVERVIEW

- TABLE 241 SOLSTAD OFFSHORE ASA: PRODUCTS SOLUTIONS/SERVICES OFFERED

- TABLE 242 SOLSTAD OFFSHORE ASA: PRODUCT LAUNCHES

- TABLE 243 SOLSTAD OFFSHORE ASA: DEALS

- TABLE 244 SOLSTAD OFFSHORE ASA: OTHERS

- TABLE 245 DOF: COMPANY OVERVIEW

- TABLE 246 DOF: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 247 DOF: DEALS

- TABLE 248 DOF: OTHERS

- TABLE 249 VROON: COMPANY OVERVIEW

- TABLE 250 VROON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 251 VROON: DEALS

- TABLE 252 VROON: OTHERS

- TABLE 253 SEACOR MARINE: COMPANY OVERVIEW

- TABLE 254 SEACOR MARINE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 255 SEACOR MARINE: DEALS

- TABLE 256 HAVILA SHIPPING ASA: COMPANY OVERVIEW

- TABLE 257 HAVILA SHIPPING ASA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 258 HAVILA SHIPPING ASA: OTHERS

- TABLE 259 KAWASAKI KISEN KAISHA LTD.: COMPANY OVERVIEW

- TABLE 260 KAWASAKI KISEN KAISHA LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 261 KAWASAKI KISEN KAISHA LTD.: DEALS

- TABLE 262 KAWASAKI KISEN KAISHA LTD.: OTHERS

- TABLE 263 OSTENSJO REDERI: COMPANY OVERVIEW

- TABLE 264 OSTENSJO REDERI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 265 OSTENSJO REDERI: DEALS

- TABLE 266 OSTENSJO REDERI: OTHERS

- TABLE 267 NAM CHEONG LIMITED: COMPANY OVERVIEW

- TABLE 268 NAM CHEONG LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 269 MMA OFFSHORE LIMITED: COMPANY OVERVIEW

- TABLE 270 MMA OFFSHORE LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 271 MMA OFFSHORE LIMITED: DEALS

- TABLE 272 MMA OFFSHORE LIMITED: OTHERS

- TABLE 273 GRUPO CBO: COMPANY OVERVIEW

- TABLE 274 GRUPO CBO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 275 GRUPO CBO: DEALS

- TABLE 276 POSH: COMPANY OVERVIEW

- TABLE 277 POSH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 278 VALLIANZ HOLDINGS LIMITED: COMPANY OVERVIEW

- TABLE 279 VALLIANZ HOLDINGS LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 280 PACIFIC RADIANCE LTD: COMPANY OVERVIEW

- TABLE 281 PACIFIC RADIANCE LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

List of Figures

- FIGURE 1 OFFSHORE SUPPORT VESSEL MARKET SEGMENTATION

- FIGURE 2 OFFSHORE SUPPORT VESSEL MARKET: RESEARCH DESIGN

- FIGURE 3 OFFSHORE SUPPORT VESSEL MARKET: DATA TRIANGULATION

- FIGURE 4 OFFSHORE SUPPORT VESSEL MARKET: BOTTOM-UP APPROACH

- FIGURE 5 OFFSHORE SUPPORT VESSEL MARKET: TOP-DOWN APPROACH

- FIGURE 6 KEY METRICS CONSIDERED TO ANALYZE DEMAND FOR OFFSHORE SUPPORT VESSELS

- FIGURE 7 KEY METRICS CONSIDERED TO ANALYZE SUPPLY OF OFFSHORE SUPPORT VESSELS

- FIGURE 8 OFFSHORE SUPPORT VESSEL MARKET: SUPPLY-SIDE ANALYSIS

- FIGURE 9 ANCHOR-HANDLING TUG SUPPLY VESSELS TO DOMINATE OFFSHORE SUPPORT VESSEL MARKET, BY TYPE, DURING FORECAST PERIOD

- FIGURE 10 SHALLOW WATER TO HOLD LARGER SHARE OF OFFSHORE SUPPORT VESSEL MARKET, BY APPLICATION, IN 2029

- FIGURE 11 WIND ENERGY TO EXHIBIT HIGHER CAGR IN MARKET, BY END-USER INDUSTRY, BETWEEN 2024 AND 2029

- FIGURE 12 ASIA PACIFIC ACCOUNTED FOR LARGEST SHARE OF GLOBAL OFFSHORE SUPPORT VESSEL MARKET IN 2023

- FIGURE 13 INCREASING DEEPWATER EXPLORATION AND OFFSHORE WIND FARM CONSTRUCTION TO DRIVE OFFSHORE SUPPORT VESSEL MARKET

- FIGURE 14 ANCHOR-HANDLING TUG SUPPLY VESSELS SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2023

- FIGURE 15 SHALLOW WATER SEGMENT HELD LARGER SHARE OF OFFSHORE SUPPORT VESSEL MARKET IN 2023

- FIGURE 16 OIL & GAS SEGMENT ACCOUNTED FOR LARGER MARKET SHARE IN 2023

- FIGURE 17 OIL & GAS SEGMENT AND CHINA HELD LARGEST SHARES OF ASIA PACIFIC OFFSHORE SUPPORT VESSEL MARKET IN 2023

- FIGURE 18 NORTH AMERICA TO RECORD HIGHEST CAGR IN GLOBAL OFFSHORE SUPPORT VESSEL MARKET FROM 2024 TO 2029

- FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 CUMULATIVE INSTALLED OFFSHORE WIND CAPACITY IN EUROPE, 2011-2022 (MW)

- FIGURE 21 CUMULATIVE INSTALLED OFFSHORE WIND ENERGY CAPACITY, BY SEA BASIN, 2020 (MW)

- FIGURE 22 WEST TEXAS INTERMEDIATE (WTI) CRUDE OIL PRICES, JANUARY 2018-MARCH 2023 (USD/BARREL)

- FIGURE 23 AVERAGE VESSEL UTILIZATION RATE, BY TYPE, JANUARY 2023

- FIGURE 24 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 25 AVERAGE SELLING PRICE (AVERAGE DAY RATE) OF OFFSHORE SUPPORT VESSELS, BY REGION, 2019-2023 (USD)

- FIGURE 26 AVERAGE SELLING PRICE (AVERAGE DAY RATE) OF OFFSHORE SUPPORT VEHICLES, BY TYPE, 2019-2023 (USD)

- FIGURE 27 VALUE CHAIN ANALYSIS

- FIGURE 28 ECOSYSTEM ANALYSIS

- FIGURE 29 PATENTS APPLIED AND GRANTED, 2013-2023

- FIGURE 30 EXPORT DATA FOR HS CODE 72-COMPLIANT PRODUCTS FOR TOP 5 COUNTRIES, 2021-2023 (USD THOUSAND)

- FIGURE 31 IMPORT DATA FOR HS CODE 72-COMPLIANT PRODUCTS FOR TOP 5 COUNTRIES, 2021-2023 (USD THOUSAND)

- FIGURE 32 EXPORT DATA FOR HS CODE 2606-COMPLIANT PRODUCTS FOR TOP 5 COUNTRIES, 2021-2023 (USD THOUSAND)

- FIGURE 33 IMPORT DATA FOR HS CODE 2606-COMPLIANT PRODUCTS FOR TOP 5 COUNTRIES, 2021-2023 (USD THOUSAND)

- FIGURE 34 EXPORT DATA FOR HS CODE 7019-COMPLIANT PRODUCTS FOR TOP 5 COUNTRIES, 2021-2023 (USD THOUSAND)

- FIGURE 35 IMPORT DATA FOR HS CODE 7019-COMPLIANT PRODUCTS FOR TOP 5 COUNTRIES, 2021-2023 (USD THOUSAND)

- FIGURE 36 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 37 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION

- FIGURE 38 KEY BUYING CRITERIA, BY APPLICATION

- FIGURE 39 INVESTMENT AND FUNDING SCENARIO (USD MILLION)

- FIGURE 40 OFFSHORE SUPPORT VESSEL MARKET SHARE, BY APPLICATION, 2023

- FIGURE 41 OFFSHORE SUPPORT VESSEL MARKET SHARE, BY END-USER INDUSTRY, 2023

- FIGURE 42 OFFSHORE SUPPORT VESSEL MARKET SHARE, BY TYPE, 2023

- FIGURE 43 OFFSHORE SUPPORT VESSEL MARKET SHARE, BY REGION, 2023

- FIGURE 44 NORTH AMERICA TO REGISTER HIGHEST CAGR IN GLOBAL OFFSHORE SUPPORT VESSEL MARKET DURING FORECAST PERIOD

- FIGURE 45 ASIA PACIFIC: OFFSHORE SUPPORT VESSEL MARKET SNAPSHOT

- FIGURE 46 EUROPE: OFFSHORE SUPPORT VESSEL MARKET SNAPSHOT

- FIGURE 47 OFFSHORE SUPPORT VESSEL MARKET SHARE ANALYSIS, 2023

- FIGURE 48 OFFSHORE SUPPORT VESSEL MARKET: REVENUE ANALYSIS OF TWO KEY PLAYERS, 2019-2023 (USD MILLION)

- FIGURE 49 COMPANY VALUATION, 2024 (USD MILLION)

- FIGURE 50 FINANCIAL METRICS, 2024 (EV/EBITDA)

- FIGURE 51 BRAND/PRODUCT COMPARISON

- FIGURE 52 OFFSHORE SUPPORT VESSEL MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 53 OFFSHORE SUPPORT VESSEL: COMPANY FOOTPRINT

- FIGURE 54 OFFSHORE SUPPORT VESSEL: MARKET FOOTPRINT

- FIGURE 55 TIDEWATER INC.: COMPANY SNAPSHOT

- FIGURE 56 A.P. MOLLER - MAERSK: COMPANY SNAPSHOT

- FIGURE 57 SEA1 OFFSHORE: COMPANY SNAPSHOT

- FIGURE 58 SOLSTAD OFFSHORE ASA: COMPANY SNAPSHOT

- FIGURE 59 DOF: COMPANY SNAPSHOT

- FIGURE 60 SEACOR MARINE: COMPANY SNAPSHOT

- FIGURE 61 HAVILA SHIPPING ASA: COMPANY SNAPSHOT

- FIGURE 62 KAWASAKI KISEN KAISHA LTD.: COMPANY SNAPSHOT

- FIGURE 63 NAM CHEONG LIMITED: COMPANY SNAPSHOT

- FIGURE 64 MMA OFFSHORE LIMITED: COMPANY SNAPSHOT

- FIGURE 65 VALLIANZ HOLDINGS LIMITED: COMPANY SNAPSHOT

- FIGURE 66 PACIFIC RADIANCE LTD: COMPANY SNAPSHOT

The global offshore support vessel market is estimated to grow from USD 25.6 billion in 2024 to USD 36.3 billion by 2029; it is expected to record a CAGR of 7.2% during the forecast period. As the economics of offshore projects improve with better oil prices and cost efficiencies, more offshore projects become viable, boosting the need for OSVs to support these operations.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Million)/ Volume (Units) |

| Segments | Offshore support vessel Market by materials used, fuels used, type, application, end-user and region. |

| Regions covered | North America, Europe, Asia Pacific, and RoW. |

"Multipurpose support vessel": The fastest growing segment of the Offshore support vessel market, by type"

Based on type, the offshore support vessel market has been segmented into anchor-handling tug supply vessels, platform supply vessels, multipurpose support vessels, standby & rescue vessels, crew vessels, seismic vessels, chase vessels, other vessels. The multipurpose support vessels is expected to be the fastest-growing segment during the forecast period. Multipurpose support vessels (MSVs) are indispensable assets in subsea construction and installation projects, serving critical roles in laying pipelines, installing subsea structures, and performing underwater maintenance tasks. Equipped with advanced technology and specialized equipment, MSVs ensure precise placement and secure connections of pipelines across varying seabed conditions. They utilize dynamic positioning systems and heavy-lift cranes to install subsea structures like wellheads and manifolds with accuracy, essential for the integrity of offshore oil and gas infrastructure.

"By application, the deepwater segment is expected to be the second largest segment during the forecast period."

Based on application, the offshore support vessel market is segmented into shallow water and deepwater. The deepwater segment is expected to be the second largest segment of the offshore support vessel market during the forecast period. Technological innovations, particularly in autonomous vessels, robotics, and digitalization, are reshaping the offshore support vessel (OSV) sector, particularly in deepwater applications. Autonomous technology enables unmanned or minimally manned operations, enhancing safety and efficiency by employing advanced sensors and AI for precise navigation in challenging deepwater environments. Robotics, including remotely operated vehicles (ROVs) and autonomous underwater vehicles (AUVs), perform crucial tasks such as subsea inspection and maintenance, while digitalization facilitates real-time monitoring, predictive maintenance, and data-driven decision-making, optimizing vessel performance and reducing operational costs.

"Asia Pacific" is expected to be the largest region in the Offshore support vessel market."

Asia pacific is expected to be the largest region in the Offshore support vessel market during the forecast period. The rapid economic growth and urbanization in the Asia-Pacific region are boosting the demand for clean and efficient transportation solutions, creating a substantial market opportunity for offshore support vessel.

Breakdown of Primaries:

In-depth interviews have been conducted with various key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information and assess future market prospects. The distribution of primary interviews is as follows:

By Company Type: Tier 1- 65%, Tier 2- 24%, and Tier 3- 11%

By Designation: C-Level- 30%, Director Level- 25%, and Others- 45%

By Region: North America- 10%, Europe- 25%, Asia Pacific- 35%, Middle East - 5%, Africa - 15%, South America - 10%

Note: Others include sales managers, engineers, and regional managers.

Note: The tiers of the companies are defined on the basis of their total revenues as of 2022. Tier 1: > USD 1 billion, Tier 2: From USD 500 million to USD 1 billion, and Tier 3: < USD 500 million

The Offshore support vessel market is dominated by a few major players that have a wide regional presence. The leading players in the Offshore support vessel market are A.P. Moller - Maersk (Denmark), Tidewater Inc. (US), BOURBON (France), Edison Chouset Offshore (US), and Deltamarin Ltd (Europe). The major strategy adopted by the players includes new product launches, contracts, agreements, partnerships, joint ventures, acquisitions, and investments & expansions.

Research Coverage:

The report defines, describes, and forecasts the global offshore support vessel Market based on materials used, fuels used, type, application, end-user, and region. It also offers a detailed qualitative and quantitative analysis of the market. The report comprehensively reviews the major market drivers, restraints, opportunities, and challenges. It also covers various important aspects of the market. These include an analysis of the competitive landscape, market dynamics, market estimates in terms of value, and future trends in the offshore support vessel market.

Key Benefits of Buying the Report

- Government initiatives at the national and international levels amplify the impact of investment on the offshore support vessel market. Robust policy frameworks, often accompanied by financial incentives, subsidies, and regulatory support, encourage widespread adoption of offshore support vessel. Factors such as high initial cost and lack of infrastructure restrain the growth of the market. The growing energy transition towards renewable energy sources and rapid urbanization are expected to present lucrative opportunities for the players operating in the offshore support vessel.

- Product Development/ Innovation: The offshore support vessel market is witnessing significant product development and innovation, driven by the growing demand for environmentally friendly, safe and sustainable products. Companies are investing in developing advanced offshore support vessel technologies for various applications.

- Market Development: Edison Chouest Offshore has announced the acquisition of ROVOP, a prominent remotely operated vehicle (ROV) company. This acquisition, combined with Chouest's subsea service company, C-Innovation, significantly expands their capabilities, now boasting a fleet of over 100 ROVs and 6 autonomous underwater vehicles (AUVs). Integrating ROVOP into the Chouest family not only broadens Chouest's service portfolio but also provides ROVOP with access to greater resources. ROVOP will benefit from the support and expertise of other Chouest companies, including vessel-based operations, Caltex Oil Tools, Bram Offshore, and C-Innovation. This synergy will enable ROVOP to better serve its existing clients and attract new business with an expanded range of services. This acquisition is a strategic move to enhance Chouest's integrated subsea services, demonstrating its commitment to advancing its technological capabilities and service offerings globally. Chouest looks forward to this new chapter with ROVOP, strengthening its leadership position in the subsea services industry.

- Market Diversification: BOURBON announces a significant investment in renewing its fleet with the order of six new crewboats from Piriou shipyards. Aiming for a 20% reduction in fuel consumption, this new generation of crewboats demonstrates BOURBON and its teams' commitment to sustainable navigation practices while enhancing vessel energy efficiency and modernizing the fleet for customer benefit. These six new Surfer-type vessels will strengthen the fleet operating in West Africa, providing customers with an optimal balance of modularity, comfort, and energy efficiency. With a length of 27 meters and a top speed of 30 knots, these Surfers will accommodate between 50 and 70 passengers, depending on the configuration, and feature two cargo deck spaces (40m2 at the stern and 20m2 at the front), offering versatility highly valued by customers. Additionally, these connected vessels will enable real-time data analysis for continuous optimization of fuel consumption and engine operating parameters.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players, like include A.P. Moller - Maersk (Denmark), Tidewater Inc. (US), BOURBON (France), Edison Chouset Offshore (US), and Deltamarin Ltd (Europe), among others in the offshore support vessel market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 INCLUSIONS AND EXCLUSIONS

- 1.3.2 MARKETS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

- 1.9 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.2 SECONDARY AND PRIMARY RESEARCH

- 2.2.1 SECONDARY DATA

- 2.2.1.1 List of key secondary sources

- 2.2.1.2 Key data from secondary sources

- 2.2.2 PRIMARY DATA

- 2.2.2.1 List of primary interview participants

- 2.2.2.2 Key industry insights

- 2.2.2.3 Breakdown of primaries

- 2.2.2.4 Key data from primary sources

- 2.2.1 SECONDARY DATA

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 MARKET SIZE ESTIMATION METHODOLOGY

- 2.4.1 BOTTOM-UP APPROACH

- 2.4.2 TOP-DOWN APPROACH

- 2.4.3 DEMAND-SIDE ANALYSIS

- 2.4.3.1 Demand-side metrics

- 2.4.3.1.1 Demand-side assumptions

- 2.4.3.1.2 Demand-side calculations

- 2.4.3.1 Demand-side metrics

- 2.4.4 SUPPLY-SIDE ANALYSIS

- 2.4.4.1 Supply-side metrics

- 2.4.4.1.1 Supply-side assumptions

- 2.4.4.1.2 Supply-side calculations

- 2.4.4.1 Supply-side metrics

- 2.5 FORECAST

- 2.6 RISK ASSESSMENT

- 2.7 RECESSION IMPACT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN OFFSHORE SUPPORT VESSEL MARKET

- 4.2 OFFSHORE SUPPORT VESSEL MARKET, BY TYPE

- 4.3 OFFSHORE SUPPORT VESSEL MARKET, BY APPLICATION

- 4.4 OFFSHORE SUPPORT VESSEL MARKET, BY END-USER INDUSTRY

- 4.5 OFFSHORE SUPPORT VESSEL MARKET IN ASIA PACIFIC, BY END-USER INDUSTRY AND COUNTRY

- 4.6 OFFSHORE SUPPORT VESSEL MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rise in offshore drilling and renewable energy generation

- 5.2.1.2 Rapid advancement in vessel design and propulsion systems

- 5.2.2 RESTRAINTS

- 5.2.2.1 Fluctuating crude oil prices

- 5.2.2.2 Price pressures due to supply-demand gap

- 5.2.2.3 Stringent regulations related to oil and gas field developments

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Replacement of aging offshore oil and gas infrastructure

- 5.2.3.2 Increased ultra-deepwater exploration activities in Arctic

- 5.2.4 CHALLENGES

- 5.2.4.1 High operational risks

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE (AVERAGE DAY RATE) TREND OF OFFSHORE SUPPORT VESSELS

- 5.4.2 AVERAGE SELLING PRICE (AVERAGE DAY RATE) TREND OF OFFSHORE SUPPORT VESSELS, BY REGION

- 5.4.3 AVERAGE SELLING PRICE (AVERAGE DAY RATE) TREND OF OFFSHORE SUPPORT VESSELS, BY TYPE

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 REGULATORY LANDSCAPE

- 5.7.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.7.2 REGULATIONS

- 5.8 PATENT ANALYSIS

- 5.9 CASE STUDY ANALYSIS

- 5.9.1 ALIMAK LEVERAGES TECHNICAL SOLUTIONS TO STREAMLINE VARIABLE TOP LANDING OF ELEVATOR SYSTEMS FOR OFFSHORE VESSELS

- 5.9.2 ATZ MARINE TECHNOLOGIES SUPPLIES RETROFIT CLASS-TYPE-APPROVED SEAL TO REDUCE TAIL SHAFT WEAR OF VROON VESSELS

- 5.9.3 EIDESVIK OFFSHORE ASA INSTALLS NIDEC ASI'S BESS SYSTEMS TO IMPROVE ENERGY EFFICIENCY OF VESSELS

- 5.10 TECHNOLOGY ANALYSIS

- 5.10.1 KEY TECHNOLOGIES

- 5.10.1.1 Dynamic positioning systems

- 5.10.1.2 Advanced navigation systems

- 5.10.2 COMPLEMENTARY TECHNOLOGIES

- 5.10.2.1 Real-time data analytics

- 5.10.3 ADJACENT TECHNOLOGIES

- 5.10.3.1 Unmanned aerial vehicles

- 5.10.3.2 Augmented reality (AR) and virtual reality (VR)

- 5.10.1 KEY TECHNOLOGIES

- 5.11 KEY CONFERENCES AND EVENTS, 2024-2025

- 5.12 TRADE ANALYSIS

- 5.12.1 HS CODE 72

- 5.12.1.1 Export scenario

- 5.12.1.2 Import scenario

- 5.12.2 HS CODE 2606

- 5.12.2.1 Export scenario

- 5.12.2.2 Import scenario

- 5.12.3 HS CODE 7019

- 5.12.3.1 Export scenario

- 5.12.3.2 Import scenario

- 5.12.1 HS CODE 72

- 5.13 PORTER'S FIVE FORCES ANALYSIS

- 5.13.1 THREAT OF SUBSTITUTES

- 5.13.2 BARGAINING POWER OF SUPPLIERS

- 5.13.3 BARGAINING POWER OF BUYERS

- 5.13.4 THREAT OF NEW ENTRANTS

- 5.13.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.14.2 BUYING CRITERIA

- 5.15 INVESTMENT AND FUNDING SCENARIO

6 MATERIALS USED TO BUILD OFFSHORE SUPPORT VESSELS

- 6.1 INTRODUCTION

- 6.2 CONSTRUCTION MATERIALS

- 6.2.1 STEEL

- 6.2.2 ALUMINUM

- 6.2.3 FIBERGLASS

- 6.2.4 COMPOSITE MATERIAL

- 6.2.5 WOOD

- 6.3 CLADDING MATERIALS

- 6.3.1 STAINLESS STEEL

- 6.3.2 ALUMINUM

- 6.3.3 COPPER-NICKEL ALLOY

- 6.3.4 TITANIUM

- 6.3.5 INCONEL

7 FUELS USED IN OFFSHORE SUPPORT VESSELS

- 7.1 INTRODUCTION

- 7.2 FUEL OIL

- 7.3 LIQUEFIED NATURAL GAS (LNG)

8 OFFSHORE SUPPORT VESSEL MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 SHALLOW WATER

- 8.2.1 EXTENSIVE OIL AND GAS PRODUCTION EFFORTS TO FUEL SEGMENTAL GROWTH

- 8.3 DEEPWATER

- 8.3.1 DEPLETION OF SHALLOW WATER OIL RESERVES TO CONTRIBUTE TO SEGMENTAL GROWTH

9 OFFSHORE SUPPORT VESSEL MARKET, BY END-USER INDUSTRY

- 9.1 INTRODUCTION

- 9.2 OIL & GAS

- 9.2.1 INCREASING NEED TO SUPPORT DRILLING RIGS AND PRODUCTION PLATFORMS TO BOOST SEGMENTAL GROWTH

- 9.3 WIND ENERGY

- 9.3.1 RISING DEMAND FOR SUSTAINABLE POWER SOURCES TO FOSTER SEGMENTAL GROWTH

10 OFFSHORE SUPPORT VESSEL MARKET, BY TYPE

- 10.1 INTRODUCTION

- 10.2 ANCHOR-HANDLING TUG SUPPLY VESSELS

- 10.2.1 STABILITY AND SWIFT RESPONSE TO EMERGENCIES TO CONTRIBUTE TO SEGMENTAL GROWTH

- 10.3 PLATFORM SUPPLY VESSELS

- 10.3.1 INCREASED OFFSHORE OIL AND GAS DRILLING OPERATIONS TO FOSTER SEGMENTAL GROWTH

- 10.4 MULTI-PURPOSE SUPPORT VESSELS

- 10.4.1 RISE IN UNDERSEA EXPLORATION TO EXTRACT OIL AND GAS RESOURCES TO ACCELERATE SEGMENTAL GROWTH

- 10.5 STANDBY & RESCUE VESSELS

- 10.5.1 STRICT ADHERENCE TO HEALTH AND SAFETY REGULATIONS TO BOOST SEGMENTAL GROWTH

- 10.6 CREW VESSELS

- 10.6.1 HIGH COMFORT AND FUNCTIONALITY TO FUEL SEGMENTAL GROWTH

- 10.7 SEISMIC VESSELS

- 10.7.1 NEED TO IDENTIFY POTENTIAL OIL AND GAS EXPLORATION SITES TO AUGMENT SEGMENTAL GROWTH

- 10.8 CHASE VESSELS

- 10.8.1 ADOPTION TO REDUCE COLLISION RISKS AND SAFEGUARD SURVEY TOOLS TO DRIVE MARKET

- 10.9 OTHER VESSELS

11 OFFSHORE SUPPORT VESSEL MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 ASIA PACIFIC

- 11.2.1 RECESSION IMPACT ON OFFSHORE SUPPORT VESSEL MARKET IN ASIA PACIFIC

- 11.2.2 CHINA

- 11.2.2.1 Mounting investment in offshore oil and gas exploration and production projects to foster market growth

- 11.2.3 INDIA

- 11.2.3.1 Rising offshore infrastructure expansion to address oil and gas demand to accelerate market growth

- 11.2.4 MALAYSIA

- 11.2.4.1 Increasing deepwater exploration efforts to contribute to market growth

- 11.2.5 THAILAND

- 11.2.5.1 Rapid transition toward low-carbon economy to facilitate market growth

- 11.2.6 VIETNAM

- 11.2.6.1 Rising investment in deepwater oil and gas projects to augment market growth

- 11.2.7 REST OF ASIA PACIFIC

- 11.3 EUROPE

- 11.3.1 RECESSION IMPACT ON OFFSHORE SUPPORT VESSEL MARKET IN EUROPE

- 11.3.2 UK

- 11.3.2.1 Surging demand for offshore wind energy to contribute to market growth

- 11.3.3 NORWAY

- 11.3.3.1 Rising emphasis on boosting wind energy production capacity to drive market

- 11.3.4 NETHERLANDS

- 11.3.4.1 Mounting investment in offshore oil and gas projects to foster market growth

- 11.3.5 REST OF EUROPE

- 11.4 NORTH AMERICA

- 11.4.1 RECESSION IMPACT ON OFFSHORE SUPPORT VESSEL MARKET IN NORTH AMERICA

- 11.4.2 US

- 11.4.2.1 Increasing reliance on offshore wind energy to meet renewable energy targets to boost market growth

- 11.4.3 CANADA

- 11.4.3.1 Rising allocation of funds for renewable energy infrastructure development to fuel market growth

- 11.4.4 MEXICO

- 11.4.4.1 Increasing focus on enhancing offshore drilling to facilitate market growth

- 11.5 SOUTH AMERICA

- 11.5.1 RECESSION IMPACT ON OFFSHORE SUPPORT VESSEL MARKET IN SOUTH AMERICA

- 11.5.2 BRAZIL

- 11.5.2.1 Escalating oil production from deepwater and ultra-deepwater reservoirs to augment market growth

- 11.5.3 REST OF SOUTH AMERICA

- 11.6 MIDDLE EAST & AFRICA

- 11.6.1 RECESSION IMPACT ON OFFSHORE SUPPORT VESSEL MARKET IN MIDDLE EAST & AFRICA

- 11.6.2 GCC

- 11.6.2.1 Saudi Arabia

- 11.6.2.1.1 Increasing competition with shale oil producers in North America to foster market growth

- 11.6.2.2 UAE

- 11.6.2.2.1 Escalating oil production to meet global energy demand to drive market

- 11.6.2.3 Qatar

- 11.6.2.3.1 Rising export of liquefied natural gas to contribute to market growth

- 11.6.2.4 Oman

- 11.6.2.4.1 Increasing oil and gas exploration and production to accelerate market growth

- 11.6.2.1 Saudi Arabia

- 11.6.3 NIGERIA

- 11.6.3.1 Rising fiscal incentives for offshore oil operators to fuel market growth

- 11.6.4 ANGOLA

- 11.6.4.1 Increasing deepwater construction activities to boost market growth

- 11.6.5 REST OF MIDDLE EAST & AFRICA

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2019-2024

- 12.3 MARKET SHARE ANALYSIS, 2023

- 12.4 MARKET EVALUATION FRAMEWORK, 2019-2024

- 12.5 REVENUE ANALYSIS, 2019-2023

- 12.6 COMPANY VALUATION AND FINANCIAL METRICS

- 12.7 BRAND/PRODUCT COMPARISON

- 12.8 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 12.8.1 STARS

- 12.8.2 EMERGING LEADERS

- 12.8.3 PERVASIVE PLAYERS

- 12.8.4 PARTICIPANTS

- 12.8.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 12.8.5.1 Company footprint

- 12.8.5.2 Region footprint

- 12.8.5.3 End-user industry footprint

- 12.8.5.4 Application footprint

- 12.8.5.5 Type footprint

- 12.9 COMPETITIVE SCENARIO AND TRENDS

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

- 12.9.3 EXPANSIONS

- 12.9.4 OTHERS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 TIDEWATER INC.

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Deals

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths/Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses/Competitive threats

- 13.1.2 A.P. MOLLER - MAERSK

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Product launches

- 13.1.2.3.2 Deals

- 13.1.2.3.3 Others

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths/Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses/Competitive threats

- 13.1.3 BOURBON

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Product launches

- 13.1.3.3.2 Deals

- 13.1.3.3.3 Others

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths/Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses/Competitive threats

- 13.1.4 GALLIANO MARINE SERVICE

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Deals

- 13.1.4.3.2 Expansions

- 13.1.4.4 MnM view

- 13.1.4.4.1 Key strengths/Right to win

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses/Competitive threats

- 13.1.5 DELTAMARIN LTD

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Deals

- 13.1.5.3.2 Others

- 13.1.5.4 MnM view

- 13.1.5.4.1 Key strengths/Right to win

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses/Competitive threats

- 13.1.6 SEA1 OFFSHORE

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Product launches

- 13.1.6.3.2 Deals

- 13.1.6.3.3 Others

- 13.1.7 SOLSTAD OFFSHORE ASA

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Product launches

- 13.1.7.3.2 Deals

- 13.1.7.3.3 Others

- 13.1.8 DOF

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Deals

- 13.1.8.3.2 Others

- 13.1.9 VROON

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Deals

- 13.1.9.3.2 Others

- 13.1.10 SEACOR MARINE

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Deals

- 13.1.11 HAVILA SHIPPING ASA

- 13.1.11.1 Business overview

- 13.1.11.2 Products/Solutions/Services offered

- 13.1.11.3 Recent developments

- 13.1.11.3.1 Others

- 13.1.12 KAWASAKI KISEN KAISHA LTD.

- 13.1.12.1 Business overview

- 13.1.12.2 Products/Solutions/Services offered

- 13.1.12.3 Recent developments

- 13.1.12.3.1 Deals

- 13.1.12.3.2 Others

- 13.1.13 OSTENSJO REDERI

- 13.1.13.1 Business overview

- 13.1.13.2 Products/Solutions/Services offered

- 13.1.13.3 Recent developments

- 13.1.13.3.1 Deals

- 13.1.13.3.2 Others

- 13.1.14 NAM CHEONG LIMITED

- 13.1.14.1 Business overview

- 13.1.14.2 Products/Solutions/Services offered

- 13.1.15 MMA OFFSHORE LIMITED

- 13.1.15.1 Business overview

- 13.1.15.2 Products/Solutions/Services offered

- 13.1.15.3 Recent developments

- 13.1.15.3.1 Deals

- 13.1.15.3.2 Others

- 13.1.16 GRUPO CBO

- 13.1.16.1 Business overview

- 13.1.16.2 Products/Solutions/Services offered

- 13.1.16.3 Recent developments

- 13.1.16.3.1 Deals

- 13.1.17 POSH

- 13.1.17.1 Business overview

- 13.1.17.2 Products/Solutions/Services offered

- 13.1.18 VALLIANZ HOLDINGS LIMITED

- 13.1.18.1 Business overview

- 13.1.18.2 Products/Solutions/Services offered

- 13.1.19 PACIFIC RADIANCE LTD

- 13.1.19.1 Business overview

- 13.1.19.2 Products/Solutions/Services offered

- 13.1.1 TIDEWATER INC.

- 13.2 OTHER PLAYERS

- 13.2.1 ROYAL IHC

- 13.2.2 HARVEY GULF INTERNATIONAL MARINE

- 13.2.3 GC RIEBER

- 13.2.4 M3 MARINE GROUP

- 13.2.5 HORNBECK OFFSHORE

- 13.2.6 FEG

- 13.2.7 BUMI ARMADA BERHAD

14 APPENDIX

- 14.1 INSIGHTS FROM INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS