|

|

市場調査レポート

商品コード

1507985

3Dデジタルアセットの世界市場 - 市場規模、シェア、成長分析:コンポーネント別、用途別、展開モード別 - 産業予測(~2029年)3D Digital Asset Market Size, Share, Growth Analysis, By Component (Hardware, Software (3D Modeling, 3D Scanning, 3D Animation), Services), Application (Visualization, Simulation, Live Experience), and Deployment Mode - Global Industry Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 3Dデジタルアセットの世界市場 - 市場規模、シェア、成長分析:コンポーネント別、用途別、展開モード別 - 産業予測(~2029年) |

|

出版日: 2024年07月02日

発行: MarketsandMarkets

ページ情報: 英文 298 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

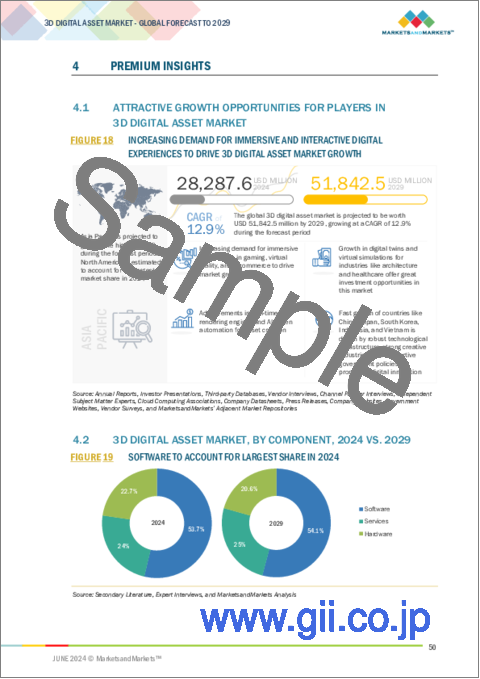

3Dデジタルアセットの市場規模は、2024年の283億米ドルから、予測期間中はCAGR 12.9%で推移し、2029年には518億米ドルの規模に成長すると予測されています。

3Dアセット管理プラットフォームへのAIと機械学習の組み込みが拡大しており、効率が大幅に向上し、プロセスが簡素化されています。AIを搭載したツールは、タグ付け、分類、検索の作業を効率化し、3Dアセットの膨大なコレクションを処理するのに必要な時間とエネルギーを最小限に抑えます。機械学習アルゴリズムは、アセット検索の精度と関連性を高め、ユーザーが簡単に適切なアセットを発見して利用できるようにします。この自動化により、プロジェクトはより効率的に、より高い品質で完了します。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2019-2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024-2029年 |

| 単位 | 米ドル(米ドル) |

| セグメント | コンポーネント・用途・展開モード・産業・地域別 |

| 対象地域 | 北米・欧州・アジア太平洋・中東&アフリカ・ラテンアメリカ |

サービス別では、マネージドサービスが予測期間中にもっとも高いCAGRで成長する見通し:

マネージドサービスでは、デジタルアセット管理プロセスやインフラ管理を専門のサービスプロバイダーにアウトソーシングします。これには、アセットの作成から配布までを監督し、最高のパフォーマンス、拡張性、セキュリティを保証することが含まれます。マネージドサービスプロバイダーは、クラウドストレージ、メタデータ管理、アセットライフサイクル管理など、業界の要件に合わせたソリューションを提供します。マネージドサービスを利用することで、企業は運用を簡素化し、ITコストを削減し、主要なビジネス目標に集中することができます。同時に、デジタルアセット管理ソリューションと技術に関する専門家のアドバイスと継続的な機能強化を受けることができます。

用途別では、ビジュアライゼーションの部門が予測期間中に最大のシェアを示す見通し:

ビジュアライゼーションツールは、さまざまな分野における3Dモデルのプレゼンテーションとエンゲージメントを向上させるために極めて重要です。このソフトウェアを使用することで、ユーザーは3Dアセットを非常に正確でリアルな品質で作成・管理できるようになり、バーチャルプロトタイピング、製品設計、没入型シミュレーションなどの活動が容易になります。ビジュアライゼーションツールは、詳細な建築モデルを作成する建築業界や、複雑なキャラクターやシーンに生命を吹き込むエンターテイメント業界などで不可欠です。ユーザーフレンドリーなインターフェースと確かなグラフィック機能を提供することで、これらのツールはプロセスを簡素化し、精度を高め、想像力豊かな進歩を促し、最終的には効率と意思決定手順を向上させます。

展開モード別では、クラウド展開が予測期間中にもっとも高いCAGRを示す見通し:

クラウド展開では、インターネット経由でアクセスできるリモートサーバーにソフトウェアをホスティングし、アセットを保存します。このモデルには、拡張性、柔軟性、場所を選ばないアクセス性といった大きな利点があるため、インフラの初期費用を最小限に抑え、迅速な拡張性を活用しようとする組織にとって特に魅力的です。クラウドベースのソリューションは、分散したチーム間でのシームレスなコラボレーションを促進し、更新とメンテナンスを合理化し、集中管理と堅牢な暗号化対策によってデータセキュリティを強化します。クラウド展開を採用することで、企業はリソース配分を最適化し、イノベーションサイクルを加速し、アーキテクチャやエンターテイメントから製造やヘルスケアに至るまで、さまざまな業界で3Dアセットを効果的に管理することができます。

当レポートでは、世界の3Dデジタルアセット市場を調査し、市場概要、市場影響因子の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と業界動向

- 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 業界動向

- 3Dデジタルアセット市場の実績の概要

- 購入者/顧客に影響を与える動向/ディスラプション

- 価格分析

- サプライチェーン分析

- エコシステム分析

- 技術分析

- 特許分析

- 貿易分析

- ケーススタディ

- 主な会議とイベント

- 現在のビジネスモデルと新たなビジネスモデル

- 3Dデジタルアセット市場におけるベストプラクティス

- ツール、フレームワーク、テクニック

- 3Dデジタルアセット市場の将来情勢

- 規制状況

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- 投資と資金調達のシナリオ

- 主要動向分析

第6章 3Dデジタルアセット市場:コンポーネント別

- ハードウェア

- 3Dスキャナー

- モーションキャプチャシステム

- ソフトウェア

- 3Dモデリングソフトウェア

- 3Dスキャンソフトウェア

- 3Dレンダリングおよび視覚化ソフトウェア

- 3Dアニメーションソフトウェア

- 画像再構成ソフトウェア

- サービス

- プロフェッショナルサービス

- マネージドサービス

第7章 3Dデジタルアセット市場:展開モード別

- オンプレミス

- クラウド

第8章 3Dデジタルアセット市場:用途別

- ビジュアライゼーション

- 建築レンダリング

- eコマース向け製品レンダリング

- データの視覚化

- その他

- シミュレーション

- 医療トレーニングシミュレーション

- フライトトレーニングシミュレーター

- 製造プロセスシミュレーション

- その他

- デジタルプロトタイピング

- ゲーム・アニメーション

- バーチャルエクスペリエンス

- バーチャルツアー

- バーチャルトレーニング環境

- バーチャルイベント・カンファレンス

- その他

- マーケティング・広告

- 製品マーケティング

- ブランドキャンペーン

- デジタルサイネージ

- その他

- その他

第9章 3Dデジタルアセット市場:産業別

- メディア&エンターテインメント

- 建築・建設

- ヘルスケア&ライフサイエンス

- 小売・eコマース

- 政府・防衛

- 製造

- 自動車

- その他

第10章 3Dデジタルアセット市場:地域別

- 北米

- 欧州

- アジア太平洋

- 中東・アフリカ

- ラテンアメリカ

第11章 競合情勢

- 主要企業の戦略

- 収益分析

- 市場シェア分析

- ベンダー製品/ブランド比較

- 企業評価マトリックス:主要企業

- 企業評価マトリックス:スタートアップ/中小企業

- 競合シナリオと動向

第12章 企業プロファイル

- 主要企業

- AUTODESK

- SIEMENS

- ADOBE

- UNITY

- NVIDIA

- MICROSOFT

- ANSYS

- EPIC GAMES

- PTC

- TRIMBLE

- SONY

- その他の企業

- APPLE

- META

- REPLY

- IKEA

- PIXAR

- HEXA

- THREEKIT

- SITECORE

- DAMINION

- CONSORTIQ

- MODELRY

- DESIGN CONNECTED

- SPATIAL SYSTEMS

- VNTANA

- CESIUM

- ECHO 3D

- KEYSHOT

- MOOVLY

第13章 隣接市場・関連市場

第14章 付録

The 3d digital asset market is expected to grow from USD 28.3 billion in 2024 to USD 51.8 billion by 2029 at a Compound Annual Growth Rate (CAGR) of 12.9% during the forecast period. The growing incorporation of AI and machine learning in 3D asset management platforms greatly boosts efficiency and simplifies processes. AI-powered tools streamline the tagging, categorizing, and retrieval tasks, minimizing the time and energy needed to handle extensive collections of 3D assets. Machine learning algorithms enhance accuracy and relevance in asset search, allowing users to easily discover and utilize the appropriate assets. This automation results in projects being completed more efficiently and with higher quality outcomes.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | USD (Billion) |

| Segments | Component, Application, Deployment Mode, Vertical and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

"As per services, the managed services will grow at the highest CAGR during the forecast period."

In the service division of the 3d digital asset market, managed services entail outsourcing digital asset management processes and infrastructure management to specialized service providers. This involves overseeing assets from creation to distribution, guaranteeing the best performance, scalability, and security. Managed service providers provide tailored solutions to meet industry requirements, including cloud storage, metadata management, and asset lifecycle management. By utilizing managed services, companies can simplify operations, cut IT costs, and concentrate on primary business goals while receiving expert advice and ongoing enhancements in digital asset management solutions and technologies.

"As per application type, visualization holds the largest share during the forecast period."

In the 3d digital asset sector, the visualization tool is crucial for improving the presentation and engagement with 3D models in different sectors. This software allows users to create and control 3D assets with great accuracy and lifelike quality, making activities like virtual prototyping, product design, and immersive simulations easier. Visualization tools are essential in industries such as architecture for creating detailed building models and entertainment for bringing complex characters and scenes to life. By offering user-friendly interfaces and solid graphic features, these tools simplify processes, boost precision, and spur imaginative advancements, ultimately heightening efficiency and decision-making procedures.

"As per deployment mode, the cloud deployment will grow with the highest CAGR during the forecast period."

Cloud deployment within the 3d digital asset market segment involves hosting software and storing assets on remote servers accessed via the Internet. This model offers significant benefits such as scalability, flexibility, and accessibility from any location, making it particularly appealing to organizations seeking to minimize upfront infrastructure costs and leverage rapid scalability. Cloud-based solutions facilitate seamless collaboration across distributed teams, streamline updates and maintenance, and enhance data security through centralized management and robust encryption measures. By adopting cloud deployment, businesses can optimize resource allocation, accelerate innovation cycles, and effectively manage 3D assets across industries ranging from architecture and entertainment to manufacturing and healthcare.

The breakup of the profiles of the primary participants is below:

- By Company: Tier I: 35%, Tier II: 45%, and Tier III: 20%

- By Designation: C-Level Executives: 35%, Director Level: 25%, and Others: 40%

- By Region: North America: 45%, Europe: 20%, Asia Pacific: 30%, Rest of World: 5%

Note: Others include sales managers, marketing managers, and product managers

Note: The rest of the World consists of the Middle East & Africa, and Latin America

Note: Tier 1 companies have revenues of more than USD 100 million; tier 2 companies' revenue ranges from USD 10 million to USD 100 million; and tier 3 companies' revenue is less than 10 million

Source: Secondary Literature, Expert Interviews, and MarketsandMarkets Analysis

Some of the significant vendors offering 3d digital asset solutions and services across the globe include Autodesk (US), Siemens (Germany), Adobe (US), Unity (US), NVIDIA (US), Microsoft (US), Ansys (US), Epic Games (US), PTC (US), Trimble (US), Sony (Tokyo), Apple (US), Meta (US), Reply (Italy), Google (US), IKEA (Netherlands), Hexa (Israel), Threekit (US), Sitecore (US), Daminion (US), Consortiq (UK), Modelry (US), Design Connected (Bulgaria), VNTANA (US), Cesium (US), Keyshot (US), and Moovly (Belgium).

Research coverage:

The study provides an in-depth analysis of the 3d digital asset market from 2019 based on market trends and its potential growth from 2024 to 2029. It provides detailed market trends, a competitive landscape, market size, forecasts, and analysis of the key players in the 3d digital asset market. This market study analyzes the growth rate and penetration of 3d digital asset across all the major regions.

Reasons to buy this report:

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the 3d digital asset market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of critical drivers (rapid technological advancement, advancements in AR & VR, educational and training application), restraints (technical standards and interpretability, security concerns), opportunities (e-commerce integration, growing interest in metaverse), and challenges (intellectual property and licensing issue, market fragmentation) influencing the growth of the 3d digital asset market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the 3d digital asset market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the 3d digital asset market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the 3d digital asset market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and Autodesk (US), Siemens (Germany), Adobe (US), Unity (US), NVIDIA (US), Microsoft (US), Ansys (US), Epic Games (US), PTC (US), Trimble (US), and Sony (Tokyo) among others in the 3d digital asset market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- FIGURE 1 3D DIGITAL ASSET MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- FIGURE 2 3D DIGITAL ASSET MARKET SEGMENTATION, BY REGION

- 1.3.3 YEARS CONSIDERED

- FIGURE 3 STUDY YEARS CONSIDERED

- 1.4 CURRENCY

- TABLE 2 USD EXCHANGE RATES, 2018-2023

- 1.5 STAKEHOLDERS

- 1.6 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 4 3D DIGITAL ASSET MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primary profiles

- FIGURE 5 BREAKUP OF PRIMARY INTERVIEWS, BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.1.2.2 Key industry insights

- FIGURE 6 KEY INSIGHTS FROM INDUSTRY EXPERTS

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 7 3D DIGITAL ASSET MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS AND CORRESPONDING STAGE-WISE SOURCES

- FIGURE 9 BOTTOM-UP APPROACH (SUPPLY SIDE): COLLECTIVE REVENUE OF 3D DIGITAL ASSET VENDORS

- FIGURE 10 SUPPLY-SIDE ANALYSIS: ILLUSTRATION OF VENDOR REVENUE ESTIMATION

- FIGURE 11 APPROACH 2 (DEMAND SIDE): REVENUE GENERATED FROM COMPONENTS

- FIGURE 12 APPROACH 2 (DEMAND SIDE): REVENUE FROM COUNTRY-WISE SPENDING

- 2.3 MARKET FORECAST

- TABLE 3 FACTOR ANALYSIS

- 2.4 DATA TRIANGULATION

- FIGURE 13 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 IMPACT OF RECESSION ON GLOBAL 3D DIGITAL ASSET MARKET

- TABLE 4 RECESSION IMPACT

- 2.7 LIMITATIONS

- FIGURE 14 LIMITATIONS

3 EXECUTIVE SUMMARY

- FIGURE 15 3D DIGITAL ASSET MARKET SNAPSHOT, 2019-2029

- FIGURE 16 TOP MARKET SEGMENTS IN TERMS OF GROWTH RATE

- FIGURE 17 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR PLAYERS IN 3D DIGITAL ASSET MARKET

- FIGURE 18 INCREASING DEMAND FOR IMMERSIVE AND INTERACTIVE DIGITAL EXPERIENCES TO DRIVE 3D DIGITAL ASSET MARKET GROWTH

- 4.2 3D DIGITAL ASSET MARKET, BY COMPONENT, 2024 VS. 2029

- FIGURE 19 SOFTWARE TO ACCOUNT FOR LARGEST SHARE IN 2024

- 4.3 3D DIGITAL ASSET MARKET, BY APPLICATION, 2024 VS. 2029

- FIGURE 20 VISUALIZATION TO ACCOUNT FOR LARGEST SHARE IN 2024

- 4.4 3D DIGITAL ASSET MARKET, BY DEPLOYMENT MODE, 2024 VS. 2029

- FIGURE 21 ON-PREMISES SEGMENT TO ACCOUNT FOR LARGER SHARE IN 2024

- 4.5 3D DIGITAL ASSET MARKET, BY VERTICAL, 2024 VS. 2029

- FIGURE 22 ARCHITECTURE & CONSTRUCTION TO ACCOUNT FOR LARGEST SHARE IN 2024

- 4.6 3D DIGITAL ASSET MARKET, BY REGION, 2024 VS. 2029

- FIGURE 23 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENTS IN NEXT FIVE YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 MARKET OVERVIEW

- 5.2 MARKET DYNAMICS

- FIGURE 24 3D DIGITAL ASSET MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Rapid technological advancements

- 5.2.1.2 Demand across industries for immersive technologies

- 5.2.1.3 Educational and training applications

- 5.2.2 RESTRAINTS

- 5.2.2.1 Technical standards and interoperability

- 5.2.2.2 Security concerns

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 E-commerce integration

- 5.2.3.2 Rise in interest in metaverse

- 5.2.4 CHALLENGES

- 5.2.4.1 Intellectual Property (IP) and licensing issues

- 5.2.4.2 Market fragmentation

- 5.3 INDUSTRY TRENDS

- 5.3.1 BRIEF HISTORY OF 3D DIGITAL ASSET MARKET

- FIGURE 25 BRIEF HISTORY OF 3D DIGITAL ASSET

- 5.3.1.1 1990-2000

- 5.3.1.2 2000-2010

- 5.3.1.3 2010-2020

- 5.3.1.4 2020-Present

- 5.3.2 TRENDS/DISRUPTIONS IMPACTING BUYERS/CUSTOMERS

- FIGURE 26 TRENDS/DISRUPTIONS IMPACTING BUYERS/CUSTOMERS IN 3D DIGITAL ASSET MARKET

- 5.3.3 PRICING ANALYSIS

- 5.3.3.1 Average selling price trend of key players, by offering

- FIGURE 27 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY OFFERING (USD)

- TABLE 5 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY OFFERING (USD)

- 5.3.3.2 Indicative pricing analysis of 3D digital assets

- TABLE 6 INDICATIVE PRICING ANALYSIS OF 3D DIGITAL ASSETS

- 5.3.4 SUPPLY CHAIN ANALYSIS

- FIGURE 28 3D DIGITAL ASSET MARKET: SUPPLY CHAIN ANALYSIS

- 5.3.4.1 Content Creation

- 5.3.4.2 Processing & Optimization

- 5.3.4.3 Distribution & Monetization

- 5.3.4.4 End User Applications

- 5.3.5 ECOSYSTEM ANALYSIS

- FIGURE 29 3D DIGITAL ASSET ECOSYSTEM

- TABLE 7 3D DIGITAL ASSET MARKET: ECOSYSTEM

- 5.3.6 TECHNOLOGY ANALYSIS

- 5.3.6.1 Key Technologies

- 5.3.6.1.1 Procedural generation

- 5.3.6.1.2 Subdivision surfaces

- 5.3.6.1.3 Ray tracing

- 5.3.6.1.4 LIDAR

- 5.3.6.1.5 Photogrammetry

- 5.3.6.1.6 Simultaneous Localization and Mapping (SLAM)

- 5.3.6.2 Adjacent Technologies

- 5.3.6.2.1 IoT

- 5.3.6.2.2 5G Technology

- 5.3.6.2.3 Digital Twins

- 5.3.6.2.4 Data Mining

- 5.3.6.2.5 Predictive Analytics

- 5.3.6.3 Complementary Technologies

- 5.3.6.3.1 Virtualization

- 5.3.6.3.2 Computer Vision

- 5.3.6.3.3 Additive Manufacturing

- 5.3.6.3.4 Material Extrusion

- 5.3.6.3.5 Shader Technology

- 5.3.6.3.6 Vector Graphics

- 5.3.6.1 Key Technologies

- 5.3.7 PATENT ANALYSIS

- 5.3.7.1 Methodology

- FIGURE 30 LIST OF MAJOR PATENTS ASSOCIATED WITH 3D DIGITAL ASSET

- TABLE 8 LIST OF MAJOR PATENTS

- 5.3.8 TRADE ANALYSIS

- 5.3.8.1 Export Scenario

- TABLE 9 EXPORT SCENARIO FOR HS CODE: 903149, BY COUNTRY, 2021-2023 (USD THOUSAND)

- FIGURE 31 EXPORT SCENARIO FOR HS CODE: 903149, BY COUNTRY, 2021-2023 (USD THOUSAND)

- 5.3.8.2 Import Scenario

- TABLE 10 IMPORT SCENARIO FOR HS CODE: 903149, BY COUNTRY, 2021-2023 (USD THOUSAND)

- FIGURE 32 IMPORT SCENARIO FOR HS CODE: 903149, BY COUNTRY, 2021-2023 (USD THOUSAND)

- 5.3.9 CASE STUDIES

- TABLE 11 SONY PICTURES ANIMATION TRANSFORMS PRE-PRODUCTION WITH NVIDIA OMNIVERSE AND FLIXIVERSE

- TABLE 12 TRANSFORMING RAPID PROTOTYPING WITH AUTODESK FUSION AT RIVIAN

- TABLE 13 UNITY EMPOWERED BOSCH REXROTH TO BOOST SALES AND CUSTOMER ENGAGEMENT WITH VIRTUAL SHOWROOM SOLUTION

- TABLE 14 ENHANCING IN-STORE DISPLAY EFFICIENCY AND DECISION-MAKING WITH ADOBE'S 3D SOLUTIONS AT HERSHEY

- TABLE 15 META'S VR SOLUTION ENHANCED COLLABORATION AND REDUCED COSTS FOR MORTENSON CONSTRUCTION PROJECTS

- 5.3.10 KEY CONFERENCES & EVENTS

- TABLE 16 3D DIGITAL ASSET MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2023-2024

- 5.3.11 CURRENT AND EMERGING BUSINESS MODELS

- 5.3.11.1 Current Business Models

- 5.3.11.1.1 Licensing Model

- 5.3.11.1.2 Subscription-based Services Model

- 5.3.11.1.3 3D Asset Marketplaces Model

- 5.3.11.2 Emerging Business Models

- 5.3.11.2.1 Subscription with Customization Model

- 5.3.11.2.2 3D Asset-as-a-Service (AaaS) Model

- 5.3.11.2.3 NFT-based Ownership Model

- 5.3.11.1 Current Business Models

- 5.3.12 BEST PRACTICES IN 3D DIGITAL ASSET MARKET

- 5.3.13 TOOLS, FRAMEWORKS, AND TECHNIQUES

- FIGURE 33 TOOLS, FRAMEWORKS, AND TECHNIQUES

- 5.3.14 FUTURE LANDSCAPE OF 3D DIGITAL ASSET MARKET

- 5.3.14.1 3D Digital Asset Technology Roadmap Till 2030

- 5.3.14.2 Short-term Roadmap (2024-2025)

- 5.3.14.3 Mid-Term Roadmap (2026-2028)

- 5.3.14.4 Long-Term Roadmap (2029-2030)

- 5.3.15 REGULATORY LANDSCAPE

- 5.3.15.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.3.15.2 Regulations, By Region

- 5.3.15.2.1 North America

- 5.3.15.2.1.1 US

- 5.3.15.2.1.2 Canada

- 5.3.15.2.2 Europe

- 5.3.15.2.2.1 UK

- 5.3.15.2.2.2 Germany

- 5.3.15.2.3 Asia Pacific

- 5.3.15.2.3.1 China

- 5.3.15.2.3.2 India

- 5.3.15.2.3.3 Japan

- 5.3.15.2.4 Middle East & Africa

- 5.3.15.2.4.1 UAE

- 5.3.15.2.4.2 South Africa

- 5.3.15.2.5 Latin America

- 5.3.15.2.5.1 Brazil

- 5.3.15.2.1 North America

- 5.3.15.2 Regulations, By Region

- 5.3.16 PORTER'S FIVE FORCES ANALYSIS

- TABLE 22 IMPACT OF PORTER'S FIVE FORCES ON 3D DIGITAL ASSET MARKET

- FIGURE 34 3D DIGITAL ASSET MARKET: PORTER'S FIVE FORCES MODEL

- 5.3.16.1 Threat of new entrants

- 5.3.16.2 Threat of substitutes

- 5.3.16.3 Bargaining power of buyers

- 5.3.16.4 Bargaining power of suppliers

- 5.3.16.5 Intensity of competitive rivalry

- 5.3.17 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.3.17.1 Key stakeholders in buying process

- FIGURE 35 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- TABLE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- 5.3.17.2 Buying criteria

- FIGURE 36 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 24 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- 5.3.18 INVESTMENT AND FUNDING SCENARIO

- FIGURE 37 INVESTMENT AND FUNDING SCENARIO, 2019-2023 (USD MILLION)

- 5.3.19 KEY TRENDS ANALYSIS

- 5.3.19.1 Universal Scene Description (USD)

- 5.3.19.2 OPENUSD

- 5.3.19.3 Physically Based Rendering (PBR)

- 5.3.19.4 OPENBR

- 5.3.19.5 OPENVDB

- 5.3.19.6 METAVERSE

- 5.3.19.7 Digital twins

6 3D DIGITAL ASSET MARKET, BY COMPONENT

- 6.1 INTRODUCTION

- 6.1.1 COMPONENT: 3D DIGITAL ASSET MARKET DRIVERS

- FIGURE 38 SOFTWARE SEGMENT TO ACCOUNT FOR LARGEST MARKET IN 2024

- TABLE 25 3D DIGITAL ASSET MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 26 3D DIGITAL ASSET MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- 6.2 HARDWARE

- 6.2.1 ADVANCED COMPUTING DEVICES TO ENSURE HIGH PERFORMANCE AND COMPATIBILITY FOR MANAGING 3D DATA ACROSS INDUSTRIES

- FIGURE 39 3D SCANNERS SEGMENT TO ACCOUNT FOR LARGER MARKET IN 2024

- TABLE 27 3D DIGITAL ASSET MARKET, BY HARDWARE, 2019-2023 (USD MILLION)

- TABLE 28 3D DIGITAL ASSET MARKET, BY HARDWARE, 2024-2029 (USD MILLION)

- TABLE 29 HARDWARE: 3D DIGITAL ASSET MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 30 HARDWARE: 3D DIGITAL ASSET MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.2.2 3D SCANNERS

- TABLE 31 3D SCANNERS: 3D DIGITAL ASSET MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 32 3D SCANNERS: 3D DIGITAL ASSET MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.2.3 MOTION CAPTURE SYSTEMS

- TABLE 33 MOTION CAPTURE SYSTEMS: 3D DIGITAL ASSET MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 34 MOTION CAPTURE SYSTEMS: 3D DIGITAL ASSET MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.3 SOFTWARE

- 6.3.1 EFFICIENT 3D SOFTWARE SOLUTIONS TO ENHANCE DIGITAL ASSETS WITH ADVANCED FUNCTIONALITY AND COLLABORATION CAPABILITIES

- FIGURE 40 3D MODELING SEGMENT TO ACCOUNT FOR LARGEST MARKET IN 2024

- TABLE 35 3D DIGITAL ASSET MARKET, BY SOFTWARE, 2019-2023 (USD MILLION)

- TABLE 36 3D DIGITAL ASSET MARKET, BY SOFTWARE, 2024-2029 (USD MILLION)

- TABLE 37 SOFTWARE: 3D DIGITAL ASSET MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 38 SOFTWARE: 3D DIGITAL ASSET MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.3.2 3D MODELING SOFTWARE

- TABLE 39 3D MODELING SOFTWARE: 3D DIGITAL ASSET MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 40 3D MODELING SOFTWARE: 3D DIGITAL ASSET MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.3.2.1 Solid modeling

- 6.3.2.2 Wireframe modeling

- 6.3.2.3 Surface modeling

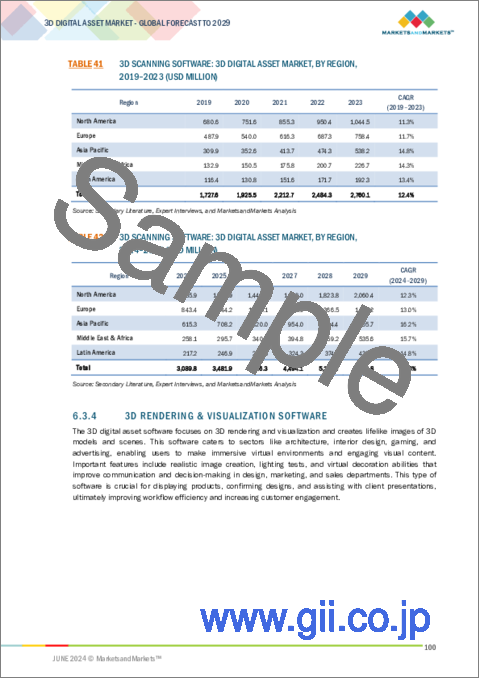

- 6.3.3 3D SCANNING SOFTWARE

- TABLE 41 3D SCANNING SOFTWARE: 3D DIGITAL ASSET MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 42 3D SCANNING SOFTWARE: 3D DIGITAL ASSET MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.3.4 3D RENDERING & VISUALIZATION SOFTWARE

- TABLE 43 3D RENDERING & VISUALIZATION SOFTWARE: 3D DIGITAL ASSET MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 44 3D RENDERING & VISUALIZATION SOFTWARE: 3D DIGITAL ASSET MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.3.5 3D ANIMATION SOFTWARE

- TABLE 45 3D ANIMATION SOFTWARE: 3D DIGITAL ASSET MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 46 3D ANIMATION SOFTWARE: 3D DIGITAL ASSET MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.3.6 IMAGE RECONSTRUCTION SOFTWARE

- TABLE 47 IMAGE RECONSTRUCTION SOFTWARE: 3D DIGITAL ASSET MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 48 IMAGE RECONSTRUCTION SOFTWARE: 3D DIGITAL ASSET MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.4 SERVICES

- 6.4.1 COMPREHENSIVE SERVICES TO SIMPLIFY CREATION, MANAGEMENT, AND MONETIZATION OF 3D DIGITAL ASSETS

- FIGURE 41 PROFESSIONAL SERVICES TO ACCOUNT FOR LARGER MARKET IN 2024

- TABLE 49 3D DIGITAL ASSET MARKET, BY SERVICE, 2019-2023 (USD MILLION)

- TABLE 50 3D DIGITAL ASSET MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 51 SERVICES: 3D DIGITAL ASSET MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 52 SERVICES: 3D DIGITAL ASSET MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.4.2 PROFESSIONAL SERVICES

- TABLE 53 PROFESSIONAL SERVICES: 3D DIGITAL ASSET MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 54 PROFESSIONAL SERVICES: 3D DIGITAL ASSET MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.4.2.1 Integration & implementation

- 6.4.2.2 Consulting & training

- 6.4.2.3 Support & maintenance

- 6.4.3 MANAGED SERVICES

- TABLE 55 MANAGED SERVICES: 3D DIGITAL ASSET MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 56 MANAGED SERVICES: 3D DIGITAL ASSET MARKET, BY REGION, 2024-2029 (USD MILLION)

7 3D DIGITAL ASSET MARKET, BY DEPLOYMENT MODE

- 7.1 INTRODUCTION

- FIGURE 42 ON-PREMISES TO ACCOUNT FOR LARGER MARKET IN 2029

- 7.1.1 DEPLOYMENT MODE: 3D DIGITAL ASSET MARKET DRIVERS

- TABLE 57 3D DIGITAL ASSET MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 58 3D DIGITAL ASSET MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- 7.2 ON-PREMISES

- 7.2.1 NEED FOR SECURE AND CUSTOMIZED 3D DIGITAL ASSETS FOR HIGH-SECURITY INDUSTRIES TO DRIVE DEMAND

- TABLE 59 ON-PREMISES: 3D DIGITAL ASSET MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 60 ON-PREMISES: 3D DIGITAL ASSET MARKET, BY REGION, 2024-2029 (USD MILLION)

- 7.3 CLOUD

- 7.3.1 CLOUD TO OFFER SECURE, CONTROLLED, AND COMPLIANT INFRASTRUCTURE FOR ENTERPRISES

- TABLE 61 CLOUD: 3D DIGITAL ASSET MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 62 CLOUD: 3D DIGITAL ASSET MARKET, BY REGION, 2024-2029 (USD MILLION)

8 3D DIGITAL ASSET MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.1.1 APPLICATION: 3D DIGITAL ASSET MARKET DRIVERS

- FIGURE 43 VISUALIZATION SEGMENT TO ACCOUNT FOR LARGEST MARKET IN 2024

- 8.2 VISUALIZATION

- TABLE 63 VISUALIZATION: 3D DIGITAL ASSET MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 64 VISUALIZATION: 3D DIGITAL ASSET MARKET, BY REGION, 2024-2029 (USD MILLION)

- 8.2.1 ARCHITECTURAL RENDERING

- 8.2.2 PRODUCT RENDERING FOR E-COMMERCE

- 8.2.3 DATA VISUALIZATION

- 8.2.4 OTHER VISUALIZATION APPLICATIONS

- 8.3 SIMULATION

- TABLE 65 SIMULATION: 3D DIGITAL ASSET MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 66 SIMULATION: 3D DIGITAL ASSET MARKET, BY REGION, 2024-2029 (USD MILLION)

- 8.3.1 MEDICAL TRAINING SIMULATIONS

- 8.3.2 FLIGHT TRAINING SIMULATORS

- 8.3.3 MANUFACTURING PROCESS SIMULATIONS

- 8.3.4 OTHER SIMULATION APPLICATIONS

- 8.4 DIGITAL PROTOTYPING

- TABLE 67 DIGITAL PROTOTYPING: 3D DIGITAL ASSET MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 68 DIGITAL PROTOTYPING: 3D DIGITAL ASSET MARKET, BY REGION, 2024-2029 (USD MILLION)

- 8.4.1 DIGITAL PROTOTYPING: APPLICATION AREAS

- 8.4.1.1 Automotive Concept Design

- 8.4.1.2 Consumer Product Prototyping

- 8.4.1.3 Interior Design Visualization

- 8.4.2 OTHER DIGITAL PROTOTYPING APPLICATIONS

- 8.5 GAMING & ANIMATION

- TABLE 69 GAMING & ANIMATION: 3D DIGITAL ASSET MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 70 GAMING & ANIMATION: 3D DIGITAL ASSET MARKET, BY REGION, 2024-2029 (USD MILLION)

- 8.5.1 GAMING & ANIMATION: APPLICATION AREAS

- 8.5.1.1 Character Modeling & Animation

- 8.5.1.2 Environment Design

- 8.5.1.3 Texturing & Shading

- 8.5.2 OTHER GAMING & ANIMATION APPLICATIONS

- 8.6 VIRTUAL EXPERIENCE

- TABLE 71 VIRTUAL EXPERIENCE: 3D DIGITAL ASSET MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 72 VIRTUAL EXPERIENCE: 3D DIGITAL ASSET MARKET, BY REGION, 2024-2029 (USD MILLION)

- 8.6.1 VIRTUAL TOURS

- 8.6.2 VIRTUAL TRAINING ENVIRONMENTS

- 8.6.3 VIRTUAL EVENTS & CONFERENCES

- 8.6.4 OTHER VIRTUAL EXPERIENCE APPLICATIONS

- 8.7 MARKETING & ADVERTISING

- TABLE 73 MARKETING & ADVERTISING: 3D DIGITAL ASSET MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 74 MARKETING & ADVERTISING: 3D DIGITAL ASSET MARKET, BY REGION, 2024-2029 (USD MILLION)

- 8.7.1 PRODUCT MARKETING

- 8.7.2 BRAND CAMPAIGNS

- 8.7.3 DIGITAL SIGNAGE

- 8.7.4 OTHER MARKETING & ADVERTISING APPLICATIONS

- 8.8 OTHER APPLICATIONS

- TABLE 75 OTHER APPLICATIONS: 3D DIGITAL ASSET MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 76 OTHER APPLICATIONS: 3D DIGITAL ASSET MARKET, BY REGION, 2024-2029 (USD MILLION)

9 3D DIGITAL ASSET MARKET, BY VERTICAL

- 9.1 INTRODUCTION

- FIGURE 44 ARCHITECTURE & CONSTRUCTION VERTICAL TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- 9.1.1 VERTICAL: 3D DIGITAL ASSET MARKET DRIVERS

- TABLE 77 3D DIGITAL ASSET MARKET, BY VERTICAL, 2019-2023 (USD MILLION)

- TABLE 78 3D DIGITAL ASSET MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- 9.2 MEDIA & ENTERTAINMENT

- TABLE 79 MEDIA & ENTERTAINMENT: 3D DIGITAL ASSET MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 80 MEDIA & ENTERTAINMENT: 3D DIGITAL ASSET MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 81 MEDIA & ENTERTAINMENT: 3D DIGITAL ASSET MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 82 MEDIA & ENTERTAINMENT: 3D DIGITAL ASSET MARKET, BY REGION, 2024-2029 (USD MILLION)

- 9.2.1 MEDIA & ENTERTAINMENT, BY TYPE

- 9.2.1.1 Film & broadcasting

- TABLE 83 FILM & BROADCASTING: 3D DIGITAL ASSET MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 84 FILM & BROADCASTING: 3D DIGITAL ASSET MARKET, BY REGION, 2024-2029 (USD MILLION)

- 9.2.1.2 Gaming

- TABLE 85 GAMING: 3D DIGITAL ASSET MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 86 GAMING: 3D DIGITAL ASSET MARKET, BY REGION, 2024-2029 (USD MILLION)

- 9.2.1.3 Other media & entertainment applications

- TABLE 87 OTHER MEDIA & ENTERTAINMENT APPLICATIONS: 3D DIGITAL ASSET MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 88 OTHER MEDIA & ENTERTAINMENT APPLICATIONS: 3D DIGITAL ASSET MARKET, BY REGION, 2024-2029 (USD MILLION)

- 9.2.2 MEDIA & ENTERTAINMENT: USE CASES

- 9.2.2.1 Gaming

- 9.2.2.2 Visual Effects (VFX)

- 9.2.2.3 Augmented Reality & Virtual Reality

- 9.2.2.4 Other Use Cases

- 9.3 ARCHITECTURE & CONSTRUCTION

- TABLE 89 ARCHITECTURE & CONSTRUCTION: 3D DIGITAL ASSET MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 90 ARCHITECTURE & CONSTRUCTION: 3D DIGITAL ASSET MARKET, BY REGION, 2024-2029 (USD MILLION)

- 9.3.1 ARCHITECTURE & CONSTRUCTION: USE CASES

- 9.3.1.1 Architectural Visualization & Walkthrough

- 9.3.1.2 Building Information Modeling (BIM)

- 9.3.1.3 Site Analysis & Surveying

- 9.3.1.4 Other Use Cases

- 9.4 HEALTHCARE & LIFE SCIENCES

- TABLE 91 HEALTHCARE & LIFE SCIENCES: 3D DIGITAL ASSET MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 92 HEALTHCARE & LIFE SCIENCES: 3D DIGITAL ASSET MARKET, BY REGION, 2024-2029 (USD MILLION)

- 9.4.1 HEALTHCARE & LIFE SCIENCES: USE CASES

- 9.4.1.1 Medical Imaging & Visualization

- 9.4.1.2 Surgical Planning & Simulation

- 9.4.1.3 Anatomical Education & Training

- 9.4.1.4 Other Use Cases

- 9.5 RETAIL & E-COMMERCE

- TABLE 93 RETAIL & E-COMMERCE: 3D DIGITAL ASSET MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 94 RETAIL & E-COMMERCE: 3D DIGITAL ASSET MARKET, BY REGION, 2024-2029 (USD MILLION)

- 9.5.1 RETAIL & E-COMMERCE: USE CASES

- 9.5.1.1 Visual Try-ons

- 9.5.1.2 Product Visualization

- 9.5.1.3 Customization & Personalization

- 9.5.1.4 Other Use Cases

- 9.6 GOVERNMENT & DEFENSE

- TABLE 95 GOVERNMENT & DEFENSE: 3D DIGITAL ASSET MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 96 GOVERNMENT & DEFENSE: 3D DIGITAL ASSET MARKET, BY REGION, 2024-2029 (USD MILLION)

- 9.6.1 GOVERNMENT & DEFENSE: USE CASES

- 9.6.1.1 Urban Planning & GIS

- 9.6.1.2 Emergency Response & Disaster Management

- 9.6.1.3 Cultural Heritage Preservation

- 9.6.1.4 Other Use Cases

- 9.7 MANUFACTURING

- TABLE 97 MANUFACTURING: 3D DIGITAL ASSET MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 98 MANUFACTURING: 3D DIGITAL ASSET MARKET, BY REGION, 2024-2029 (USD MILLION)

- 9.7.1 MANUFACTURING: USE CASES

- 9.7.1.1 Product Design & Prototyping

- 9.7.1.2 Factory Layout Planning

- 9.7.1.3 Maintenance & Repair Simulation

- 9.7.1.4 Other Use Cases

- 9.8 AUTOMOTIVE

- TABLE 99 AUTOMOTIVE: 3D DIGITAL ASSET MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 100 AUTOMOTIVE: 3D DIGITAL ASSET MARKET, BY REGION, 2024-2029 (USD MILLION)

- 9.8.1 AUTOMOTIVE: USE CASES

- 9.8.1.1 Automated Parking Systems

- 9.8.1.2 Collision Avoidance Systems

- 9.8.1.3 Driver Assistance Systems

- 9.8.1.4 Other Use Cases

- 9.9 OTHER VERTICALS

- TABLE 101 OTHER VERTICALS: 3D DIGITAL ASSET MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 102 OTHER VERTICALS: 3D DIGITAL ASSET MARKET, BY REGION, 2024-2029 (USD MILLION)

10 3D DIGITAL ASSET MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 45 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 103 3D DIGITAL ASSET MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 104 3D DIGITAL ASSET MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.2 NORTH AMERICA

- 10.2.1 NORTH AMERICA: 3D DIGITAL ASSET MARKET DRIVERS

- 10.2.2 NORTH AMERICA: RECESSION IMPACT

- FIGURE 46 NORTH AMERICA: MARKET SNAPSHOT

- TABLE 105 NORTH AMERICA: 3D DIGITAL ASSET MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 106 NORTH AMERICA: 3D DIGITAL ASSET MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 107 NORTH AMERICA: 3D DIGITAL ASSET MARKET, BY HARDWARE, 2019-2023 (USD MILLION)

- TABLE 108 NORTH AMERICA: 3D DIGITAL ASSET MARKET, BY HARDWARE, 2024-2029 (USD MILLION)

- TABLE 109 NORTH AMERICA: 3D DIGITAL ASSET MARKET, BY SOFTWARE, 2019-2023 (USD MILLION)

- TABLE 110 NORTH AMERICA: 3D DIGITAL ASSET MARKET, BY SOFTWARE, 2024-2029 (USD MILLION)

- TABLE 111 NORTH AMERICA: 3D DIGITAL ASSET MARKET, BY SERVICE, 2019-2023 (USD MILLION)

- TABLE 112 NORTH AMERICA: 3D DIGITAL ASSET MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 113 NORTH AMERICA: 3D DIGITAL ASSET MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 114 NORTH AMERICA: 3D DIGITAL ASSET MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 115 NORTH AMERICA: 3D DIGITAL ASSET MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 116 NORTH AMERICA: 3D DIGITAL ASSET MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 117 NORTH AMERICA: 3D DIGITAL ASSET MARKET, BY VERTICAL, 2019-2023 (USD MILLION)

- TABLE 118 NORTH AMERICA: 3D DIGITAL ASSET MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 119 NORTH AMERICA: 3D DIGITAL ASSET MARKET IN MEDIA & ENTERTAINMENT, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 120 NORTH AMERICA: 3D DIGITAL ASSET MARKET IN MEDIA & ENTERTAINMENT, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 121 NORTH AMERICA: 3D DIGITAL ASSET MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 122 NORTH AMERICA: 3D DIGITAL ASSET MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 10.2.3 US

- 10.2.3.1 North America's competitive edge in 3D digital asset market defined by technological infrastructure and sector services

- TABLE 123 US: 3D DIGITAL ASSET MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 124 US: 3D DIGITAL ASSET MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- 10.2.4 CANADA

- 10.2.4.1 Canada to drive 3D digital asset management with advanced technology and thriving creative industries

- TABLE 125 CANADA: 3D DIGITAL ASSET MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 126 CANADA: 3D DIGITAL ASSET MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- 10.3 EUROPE

- 10.3.1 EUROPE: 3D DIGITAL ASSET MARKET DRIVERS

- 10.3.2 EUROPE: RECESSION IMPACT

- TABLE 127 EUROPE: 3D DIGITAL ASSET MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 128 EUROPE: 3D DIGITAL ASSET MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 129 EUROPE: 3D DIGITAL ASSET MARKET, BY HARDWARE, 2019-2023 (USD MILLION)

- TABLE 130 EUROPE: 3D DIGITAL ASSET MARKET, BY HARDWARE, 2024-2029 (USD MILLION)

- TABLE 131 EUROPE: 3D DIGITAL ASSET MARKET, BY SOFTWARE, 2019-2023 (USD MILLION)

- TABLE 132 EUROPE: 3D DIGITAL ASSET MARKET, BY SOFTWARE, 2024-2029 (USD MILLION)

- TABLE 133 EUROPE: 3D DIGITAL ASSET MARKET, BY SERVICE, 2019-2023 (USD MILLION)

- TABLE 134 EUROPE: 3D DIGITAL ASSET MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 135 EUROPE: 3D DIGITAL ASSET MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 136 EUROPE: 3D DIGITAL ASSET MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 137 EUROPE: 3D DIGITAL ASSET MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 138 EUROPE: 3D DIGITAL ASSET MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 139 EUROPE: 3D DIGITAL ASSET MARKET, BY VERTICAL, 2019-2023 (USD MILLION)

- TABLE 140 EUROPE: 3D DIGITAL ASSET MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 141 EUROPE: 3D DIGITAL ASSET MARKET IN MEDIA & ENTERTAINMENT, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 142 EUROPE: 3D DIGITAL ASSET MARKET IN MEDIA & ENTERTAINMENT, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 143 EUROPE: 3D DIGITAL ASSET MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 144 EUROPE: 3D DIGITAL ASSET MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 10.3.3 UK

- 10.3.3.1 UK to advance 3D digital asset management, fostering innovation in media and technology sectors

- TABLE 145 UK: 3D DIGITAL ASSET MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 146 UK: 3D DIGITAL ASSET MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- 10.3.4 GERMANY

- 10.3.4.1 Germany to elevate 3D digital asset management with industrial innovation and strategic economic focus

- TABLE 147 GERMANY: 3D DIGITAL ASSET MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 148 GERMANY: 3D DIGITAL ASSET MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- 10.3.5 FRANCE

- 10.3.5.1 France to excel in European 3D digital asset market with strong industry focus and government-backed innovation initiatives

- TABLE 149 FRANCE: 3D DIGITAL ASSET MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 150 FRANCE: 3D DIGITAL ASSET MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- 10.3.6 ITALY

- 10.3.6.1 Italy to catalyze 3D digital innovation in creative and industrial sectors across Europe and globally

- TABLE 151 ITALY: 3D DIGITAL ASSET MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 152 ITALY: 3D DIGITAL ASSET MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- 10.3.7 REST OF EUROPE

- TABLE 153 REST OF EUROPE: 3D DIGITAL ASSET MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 154 REST OF EUROPE: 3D DIGITAL ASSET MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- 10.4 ASIA PACIFIC

- 10.4.1 ASIA PACIFIC: 3D DIGITAL ASSET MARKET DRIVERS

- 10.4.2 ASIA PACIFIC: RECESSION IMPACT

- FIGURE 47 ASIA PACIFIC: MARKET SNAPSHOT

- TABLE 155 ASIA PACIFIC: 3D DIGITAL ASSET MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 156 ASIA PACIFIC: 3D DIGITAL ASSET MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 157 ASIA PACIFIC: 3D DIGITAL ASSET MARKET, BY HARDWARE, 2019-2023 (USD MILLION)

- TABLE 158 ASIA PACIFIC: 3D DIGITAL ASSET MARKET, BY HARDWARE, 2024-2029 (USD MILLION)

- TABLE 159 ASIA PACIFIC: 3D DIGITAL ASSET MARKET, BY SOFTWARE, 2019-2023 (USD MILLION)

- TABLE 160 ASIA PACIFIC: 3D DIGITAL ASSET MARKET, BY SOFTWARE, 2024-2029 (USD MILLION)

- TABLE 161 ASIA PACIFIC: 3D DIGITAL ASSET MARKET, BY SERVICE, 2019-2023 (USD MILLION)

- TABLE 162 ASIA PACIFIC: 3D DIGITAL ASSET MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 163 ASIA PACIFIC: 3D DIGITAL ASSET MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 164 ASIA PACIFIC: 3D DIGITAL ASSET MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 165 ASIA PACIFIC: 3D DIGITAL ASSET MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 166 ASIA PACIFIC: 3D DIGITAL ASSET MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 167 ASIA PACIFIC: 3D DIGITAL ASSET MARKET, BY VERTICAL, 2019-2023 (USD MILLION)

- TABLE 168 ASIA PACIFIC: 3D DIGITAL ASSET MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 169 ASIA PACIFIC: 3D DIGITAL ASSET MARKET IN MEDIA & ENTERTAINMENT, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 170 ASIA PACIFIC: 3D DIGITAL ASSET MARKET IN MEDIA & ENTERTAINMENT, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 171 ASIA PACIFIC: 3D DIGITAL ASSET MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 172 ASIA PACIFIC: 3D DIGITAL ASSET MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 10.4.3 CHINA

- 10.4.3.1 China's strategic advancements in 3D digital asset management to fuel Asia Pacific market

- TABLE 173 CHINA: 3D DIGITAL ASSET MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 174 CHINA: 3D DIGITAL ASSET MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- 10.4.4 JAPAN

- 10.4.4.1 Japan to expand 3D digital asset market with technological integration and industry specialization

- TABLE 175 JAPAN: 3D DIGITAL ASSET MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 176 JAPAN: 3D DIGITAL ASSET MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- 10.4.5 AUSTRALIA & NEW ZEALAND

- 10.4.5.1 Australia and New Zealand to embrace advanced 3D digital asset solutions for creative industries

- TABLE 177 AUSTRALIA & NEW ZEALAND: 3D DIGITAL ASSET MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 178 AUSTRALIA & NEW ZEALAND: 3D DIGITAL ASSET MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- 10.4.6 REST OF ASIA PACIFIC

- TABLE 179 REST OF ASIA PACIFIC: 3D DIGITAL ASSET MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 180 REST OF ASIA PACIFIC: 3D DIGITAL ASSET MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 MIDDLE EAST & AFRICA: 3D DIGITAL ASSET MARKET DRIVERS

- 10.5.2 MIDDLE EAST & AFRICA: RECESSION IMPACT

- TABLE 181 MIDDLE EAST & AFRICA: 3D DIGITAL ASSET MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 182 MIDDLE EAST & AFRICA: 3D DIGITAL ASSET MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 183 MIDDLE EAST & AFRICA: 3D DIGITAL ASSET MARKET, BY HARDWARE, 2019-2023 (USD MILLION)

- TABLE 184 MIDDLE EAST & AFRICA: 3D DIGITAL ASSET MARKET, BY HARDWARE, 2024-2029 (USD MILLION)

- TABLE 185 MIDDLE EAST & AFRICA: 3D DIGITAL ASSET MARKET, BY SOFTWARE, 2019-2023 (USD MILLION)

- TABLE 186 MIDDLE EAST & AFRICA: 3D DIGITAL ASSET MARKET, BY SOFTWARE, 2024-2029 (USD MILLION)

- TABLE 187 MIDDLE EAST & AFRICA: 3D DIGITAL ASSET MARKET, BY SERVICE, 2019-2023 (USD MILLION)

- TABLE 188 MIDDLE EAST & AFRICA: 3D DIGITAL ASSET MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 189 MIDDLE EAST & AFRICA: 3D DIGITAL ASSET MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 190 MIDDLE EAST & AFRICA: 3D DIGITAL ASSET MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 191 MIDDLE EAST & AFRICA: 3D DIGITAL ASSET MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 192 MIDDLE EAST & AFRICA: 3D DIGITAL ASSET MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 193 MIDDLE EAST & AFRICA: 3D DIGITAL ASSET MARKET, BY VERTICAL, 2019-2023 (USD MILLION)

- TABLE 194 MIDDLE EAST & AFRICA: 3D DIGITAL ASSET MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 195 MIDDLE EAST & AFRICA: 3D DIGITAL ASSET MARKET IN MEDIA & ENTERTAINMENT, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 196 MIDDLE EAST & AFRICA: 3D DIGITAL ASSET MARKET IN MEDIA & ENTERTAINMENT, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 197 MIDDLE EAST & AFRICA: 3D DIGITAL ASSET MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 198 MIDDLE EAST & AFRICA: 3D DIGITAL ASSET MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 10.5.3 GCC COUNTRIES (GULF COOPERATION COUNCIL)

- 10.5.3.1 Saudi Arabia

- 10.5.3.1.1 Saudi Arabia to invest in 3D digital assets through Vision 2030 and expanding entertainment

- 10.5.3.1 Saudi Arabia

- TABLE 199 GCC COUNTRIES: 3D DIGITAL ASSET MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 200 GCC COUNTRIES: 3D DIGITAL ASSET MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 201 GCC COUNTRIES: 3D DIGITAL ASSET MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 202 GCC COUNTRIES: 3D DIGITAL ASSET MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 10.5.3.2 UAE

- 10.5.3.2.1 UAE's role as tech and cultural hub to drive 3D digital asset market growth

- 10.5.3.3 Rest of GCC Countries

- 10.5.3.2 UAE

- 10.5.4 SOUTH AFRICA

- 10.5.4.1 South Africa's emerging role in expanding 3D digital asset solutions in Sub-Saharan Africa to drive market

- TABLE 203 SOUTH AFRICA: 3D DIGITAL ASSET MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 204 SOUTH AFRICA: 3D DIGITAL ASSET MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- 10.5.5 REST OF MIDDLE EAST & AFRICA

- TABLE 205 REST OF MIDDLE EAST & AFRICA: 3D DIGITAL ASSET MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 206 REST OF MIDDLE EAST & AFRICA: 3D DIGITAL ASSET MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- 10.6 LATIN AMERICA

- 10.6.1 LATIN AMERICA: 3D DIGITAL ASSET MARKET DRIVERS

- 10.6.2 LATIN AMERICA: RECESSION IMPACT

- TABLE 207 LATIN AMERICA: 3D DIGITAL ASSET MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 208 LATIN AMERICA: 3D DIGITAL ASSET MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 209 LATIN AMERICA: 3D DIGITAL ASSET MARKET, BY HARDWARE, 2019-2023 (USD MILLION)

- TABLE 210 LATIN AMERICA: 3D DIGITAL ASSET MARKET, BY HARDWARE, 2024-2029 (USD MILLION)

- TABLE 211 LATIN AMERICA: 3D DIGITAL ASSET MARKET, BY SOFTWARE, 2019-2023 (USD MILLION)

- TABLE 212 LATIN AMERICA: 3D DIGITAL ASSET MARKET, BY SOFTWARE, 2024-2029 (USD MILLION)

- TABLE 213 LATIN AMERICA: 3D DIGITAL ASSET MARKET, BY SERVICE, 2019-2023 (USD MILLION)

- TABLE 214 LATIN AMERICA: 3D DIGITAL ASSET MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 215 LATIN AMERICA: 3D DIGITAL ASSET MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 216 LATIN AMERICA: 3D DIGITAL ASSET MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 217 LATIN AMERICA: 3D DIGITAL ASSET MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 218 LATIN AMERICA: 3D DIGITAL ASSET MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 219 LATIN AMERICA: 3D DIGITAL ASSET MARKET, BY VERTICAL, 2019-2023 (USD MILLION)

- TABLE 220 LATIN AMERICA: 3D DIGITAL ASSET MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 221 LATIN AMERICA: 3D DIGITAL ASSET MARKET IN MEDIA & ENTERTAINMENT, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 222 LATIN AMERICA: 3D DIGITAL ASSET MARKET IN MEDIA & ENTERTAINMENT, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 223 LATIN AMERICA: 3D DIGITAL ASSET MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 224 LATIN AMERICA: 3D DIGITAL ASSET MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 10.6.3 BRAZIL

- 10.6.3.1 Brazil to boost 3D digital asset management with tech innovation and strategic sector support

- TABLE 225 BRAZIL: 3D DIGITAL ASSET MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 226 BRAZIL: 3D DIGITAL ASSET MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- 10.6.4 MEXICO

- 10.6.4.1 Mexico's growing influence in 3D assets to be fueled by media expansion and digital transformation

- TABLE 227 MEXICO: 3D DIGITAL ASSET MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 228 MEXICO: 3D DIGITAL ASSET MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- 10.6.5 REST OF LATIN AMERICA

- TABLE 229 REST OF LATIN AMERICA: 3D DIGITAL ASSET MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 230 REST OF LATIN AMERICA: 3D DIGITAL ASSET MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES

- TABLE 231 STRATEGIES ADOPTED BY KEY PLAYERS

- 11.3 REVENUE ANALYSIS

- FIGURE 48 3D DIGITAL ASSET MARKET: HISTORICAL REVENUE ANALYSIS, 2019-2023 (USD MILLION)

- 11.4 MARKET SHARE ANALYSIS

- TABLE 232 MARKET SHARE OF KEY VENDORS, 2023

- FIGURE 49 3D DIGITAL ASSET MARKET SHARE ANALYSIS, 2023

- 11.5 3D DIGITAL ASSET MARKET: VENDOR PRODUCTS/BRANDS COMPARISON

- FIGURE 50 VENDOR PRODUCT/BRAND COMPARISON

- 11.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- FIGURE 51 COMPANY EVALUATION MATRIX (KEY PLAYERS): CRITERIA WEIGHTAGE

- 11.6.1 STARS

- 11.6.2 EMERGING LEADERS

- 11.6.3 PERVASIVE PLAYERS

- 11.6.4 PARTICIPANTS

- FIGURE 52 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 11.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- FIGURE 53 3D DIGITAL ASSET MARKET: COMPANY FOOTPRINT

- TABLE 233 3D DIGITAL ASSET MARKET: REGION FOOTPRINT

- TABLE 234 3D DIGITAL ASSET MARKET: COMPONENT FOOTPRINT

- TABLE 235 3D DIGITAL ASSET MARKET: VERTICAL FOOTPRINT

- 11.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- FIGURE 54 COMPANY EVALUATION MATRIX (STARTUPS/SMES): CRITERIA WEIGHTAGE

- 11.7.1 PROGRESSIVE COMPANIES

- 11.7.2 RESPONSIVE COMPANIES

- 11.7.3 DYNAMIC COMPANIES

- 11.7.4 STARTING BLOCKS

- FIGURE 55 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 11.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 11.7.5.1 Detailed list of key startups/SMEs

- TABLE 236 3D DIGITAL ASSET MARKET: COMPETITIVE BENCHMARKING FOR KEY STARTUPS/SMES

- 11.7.5.2 Competitive benchmarking of key startups/SMEs

- TABLE 237 3D DIGITAL ASSET MARKET: KEY STARTUPS/SMES

- 11.8 COMPANY VALUATION AND FINANCIAL METRICS OF KEY VENDORS

- 11.8.1 COMPANY VALUATION

- FIGURE 56 COMPANY VALUATION OF KEY VENDORS (USD BILLION)

- 11.8.2 EV/EBITDA

- FIGURE 57 FINANCIAL METRICS OF KEY VENDORS, 2024

- FIGURE 58 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS, 2024

- 11.9 COMPETITIVE SCENARIO AND TRENDS

- 11.9.1 PRODUCT LAUNCHES

- TABLE 238 3D DIGITAL ASSET MARKET: PRODUCT LAUNCHES, MARCH 2022-MAY 2024

- 11.9.2 DEALS

- TABLE 239 3D DIGITAL ASSET MARKET: DEALS, JANUARY 2022-MARCH 2024

12 COMPANY PROFILES

- 12.1 INTRODUCTION

- (Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)**

- 12.2 KEY PLAYERS

- 12.2.1 AUTODESK

- TABLE 240 AUTODESK: BUSINESS OVERVIEW

- FIGURE 59 AUTODESK: COMPANY SNAPSHOT

- TABLE 241 AUTODESK: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 242 AUTODESK: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 243 AUTODESK: DEALS

- 12.2.2 SIEMENS

- TABLE 244 SIEMENS: BUSINESS OVERVIEW

- FIGURE 60 SIEMENS: COMPANY SNAPSHOT

- TABLE 245 SIEMENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 246 SIEMENS: DEALS

- 12.2.3 ADOBE

- TABLE 247 ADOBE: BUSINESS OVERVIEW

- FIGURE 61 ADOBE: COMPANY SNAPSHOT

- TABLE 248 ADOBE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 249 ADOBE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 250 ADOBE: DEALS

- 12.2.4 UNITY

- TABLE 251 UNITY: BUSINESS OVERVIEW

- FIGURE 62 UNITY: COMPANY SNAPSHOT

- TABLE 252 UNITY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 253 UNITY: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 254 UNITY: DEALS

- 12.2.5 NVIDIA

- TABLE 255 NVIDIA: BUSINESS OVERVIEW

- FIGURE 63 NVIDIA: COMPANY SNAPSHOT

- TABLE 256 NVIDIA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 257 NVIDIA: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 258 NVIDIA: DEALS

- TABLE 259 NVIDIA: OTHER DEVELOPMENTS

- 12.2.6 MICROSOFT

- TABLE 260 MICROSOFT: BUSINESS OVERVIEW

- FIGURE 64 MICROSOFT: COMPANY SNAPSHOT

- TABLE 261 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 262 MICROSOFT: DEALS

- 12.2.7 ANSYS

- TABLE 263 ANSYS: BUSINESS OVERVIEW

- FIGURE 65 ANSYS: COMPANY SNAPSHOT

- TABLE 264 ANSYS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 265 ANSYS: DEALS

- 12.2.8 EPIC GAMES

- TABLE 266 EPIC GAMES: BUSINESS OVERVIEW

- TABLE 267 EPIC GAMES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 268 EPIC GAMES: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 269 EPIC GAMES: DEALS

- 12.2.9 PTC

- TABLE 270 PTC: BUSINESS OVERVIEW

- FIGURE 66 PTC: COMPANY SNAPSHOT

- TABLE 271 PTC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.2.10 TRIMBLE

- TABLE 272 TRIMBLE: BUSINESS OVERVIEW

- FIGURE 67 TRIMBLE: COMPANY SNAPSHOT

- TABLE 273 TRIMBLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 274 TRIMBLE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 275 TRIMBLE: DEALS

- 12.2.11 SONY

- TABLE 276 SONY: BUSINESS OVERVIEW

- FIGURE 68 SONY: COMPANY SNAPSHOT

- TABLE 277 SONY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 278 SONY: PRODUCT LAUNCHES AND ENHANCEMENTS

- 12.3 OTHER PLAYERS

- 12.3.1 APPLE

- 12.3.2 META

- 12.3.3 REPLY

- 12.3.4 GOOGLE

- 12.3.5 IKEA

- 12.3.6 PIXAR

- 12.3.7 HEXA

- 12.3.8 THREEKIT

- 12.3.9 SITECORE

- 12.3.10 DAMINION

- 12.3.11 CONSORTIQ

- 12.3.12 MODELRY

- 12.3.13 DESIGN CONNECTED

- 12.3.14 SPATIAL SYSTEMS

- 12.3.15 VNTANA

- 12.3.16 CESIUM

- 12.3.17 ECHO 3D

- 12.3.18 KEYSHOT

- 12.3.19 MOOVLY

- *Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)** might not be captured in case of unlisted companies.

13 ADJACENT AND RELATED MARKETS

- 13.1 INTRODUCTION

- 13.1.1 RELATED MARKETS

- 13.2 3D IMAGING MARKET

- TABLE 279 3D IMAGING MARKET, BY COMPONENT, 2018-2022 (USD MILLION)

- TABLE 280 3D IMAGING MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 281 3D IMAGING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 282 3D IMAGING MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 283 3D IMAGING MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 284 3D IMAGING MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 13.3 AR VR SOFTWARE MARKET

- TABLE 285 AR VR SOFTWARE MARKET, BY TECHNOLOGY TYPE, 2017-2022 (USD MILLION)

- TABLE 286 AR VR SOFTWARE MARKET, BY TECHNOLOGY TYPE, 2023-2028 (USD MILLION)

- TABLE 287 AR VR SOFTWARE MARKET, BY SOFTWARE TYPE, 2017-2022 (USD MILLION)

- TABLE 288 AR VR SOFTWARE MARKET, BY SOFTWARE TYPE, 2023-2028 (USD MILLION)

- TABLE 289 AR VR SOFTWARE MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 290 AR VR SOFTWARE MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 291 AR VR SOFTWARE MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 292 AR VR SOFTWARE MARKET, BY REGION, 2023-2028 (USD MILLION)

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS