|

|

市場調査レポート

商品コード

1504308

CCUS吸収の世界市場:吸収タイプ別、最終用途産業別、地域別 - 予測(~2030年)CCUS Absorption Market by Absorption Type (Chemical Absorption, Physical Absorption), End-Use Industry (Oil & Gas, Power Generation, Chemical & Petrochemical, Cement, Iron & Steel), and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| CCUS吸収の世界市場:吸収タイプ別、最終用途産業別、地域別 - 予測(~2030年) |

|

出版日: 2024年06月28日

発行: MarketsandMarkets

ページ情報: 英文 255 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

世界のCCUS吸収の市場規模は、2024年の4億米ドルから2030年までに17億米ドルに達すると予測され、予測期間にCAGRで26.5%の成長が見込まれます。

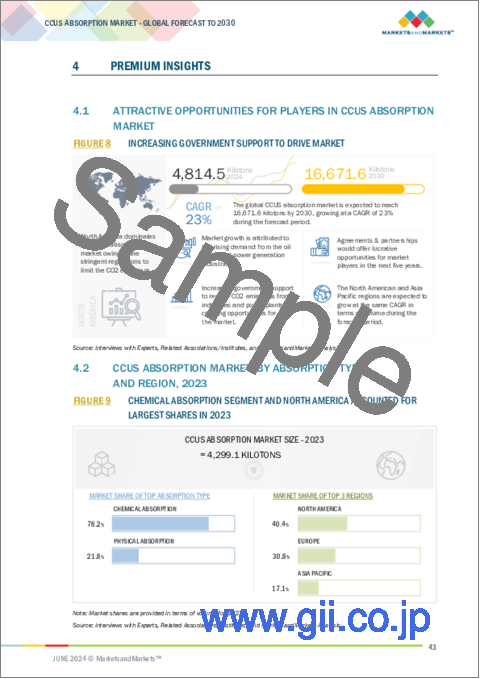

世界中の政府は、炭素回収・利用・貯留(CCUS)吸収の実施において重要な役割を果たしています。政府はCCUS技術の採用を奨励するため、政策支援、規制枠組み、財政的インセンティブを提供しています。例えばオーストラリア政府は、排出削減を確実にするため、CCUSへの民間投資を奨励する規制を実施しています。同様に、欧州連合(EU)はCCUSを主要な戦略的ネットゼロ技術と位置づけ、Innovation FundとConnecting Europe Facilityのもと、CCUSプロジェクトへの資金提供を行っています。各国政府もまた、カーボンプライシング制度の確立、資本助成や融資の提供、資本・経営コストに対応する税額控除の提供などにより、CCUSプロジェクトを可能にする環境を整えつつあります。さらに各国政府は、明確な許認可スケジュールを設定し、規制機関をすべての許認可活動のワンストップショップに指定することで、行政手続きや許認可手続きを迅速化しています。こうした取り組みは、CCUS技術の普及と温室効果ガス排出削減を実現する上で極めて重要です。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2019年~2030年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2030年 |

| 単位 | 金額(100万/10億米ドル)、数量(トン) |

| セグメント | 吸収タイプ、機能、最終用途産業、地域 |

| 対象地域 | 欧州、北米、アジア太平洋、南米、中東・アフリカ |

「化学吸収が市場を独占し続けます。」

化学吸収タイプは、その広範な採用と実証された有効性により、CCUS吸収市場で最大の市場シェアを維持し続けると予測されます。化学吸収は、溶媒を使用して排ガスからCO2を回収するもので、確立された成熟技術です。このプロセスは、発電、石油・ガス、化学処理を含むさまざまな産業で広く使用されています。また、化学吸収法は、膜分離や低温蒸留などの他の方法と比べ、費用対効果が高いです。さらに、この技術は長年にわたって継続的に改良および最適化されており、より効率的で信頼性の高いものとなっています。ExxonMobilやChevronなどの主要企業も、化学吸収技術の開発と商業化に多額の投資を行っており、市場での地位をさらに強固なものにしています。その結果、確立されたプレゼンス、費用対効果、継続的な技術の進歩により、化学吸収がCCUS吸収市場を独占し続ける見込みです。

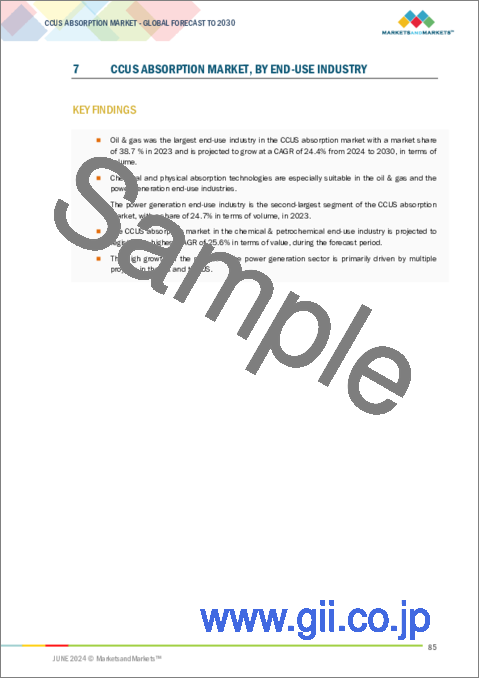

「発電が市場で2番目に大きな産業となります。」

発電の最終用途産業は、温室効果ガスの排出削減に重要な役割を果たしているため、CCUS吸収市場で2番目に大きな市場シェアを維持する見通しです。同産業はCO2の大きな排出源であり、CCUS技術の採用はネットゼロ排出の達成に不可欠です。世界各国の政府は発電による排出を削減する政策を実施しており、CCUSソリューションの需要を促進しています。さらに、再生可能エネルギー発電への注目の高まりと柔軟な発電オプションの必要性も、電力部門におけるCCUS技術の採用を後押ししています。ExxonMobilやExxonMobilといった産業の主要企業は、カーボンフットプリントを削減し規制要件を満たすため、CCUS技術を積極的に模索しています。低炭素社会の実現に重要な役割を果たす発電産業は、今後もCCUS市場で大きなシェアを占めると予測されます。

「北米が金額・数量ともに市場で支配的な地域となります。」

複数の要因により北米がCCUS吸収市場を独占し続けると予測されます。同地域では、二酸化炭素排出の抑制とよりクリーンなエネルギー源への転換が強く求められており、こうした目標を達成するためのCCUSソリューションの採用が進んでいます。ExxonMobil、Chevron、Lindeなど、CCUS技術を積極的に研究している主要企業のプレゼンスも、この地域の優位性に寄与しています。さらに、この地域の研究開発に向けた広範なプログラムや、税額控除という形の資金提供インセンティブが、CCUSプロジェクトの開発と展開を支えています。さらに、45Q税額控除のような政策を含むこの地域の規制枠組みは、CCUSプロジェクトが活性化するのに有利な環境を提供しています。これらの複合的な要因により、北米が今後数年間、世界のCCUS市場をリードし続けることは確実です。

当レポートでは、世界のCCUS吸収市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- CCUS吸収市場の企業にとって魅力的な機会

- CCUS吸収市場:吸収タイプ別、地域別(2023年)

- CCUS吸収市場:吸収タイプ別

- CCUS吸収市場:最終用途産業別

- CCUS吸収市場:主要国別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ポーターのファイブフォース分析

- サプライチェーン分析

- 原材料

- 製造プロセス

- 最終製品

- バリューチェーン分析

- 主なステークホルダーと購入基準

- 特許分析

- 規制情勢

- 規制機関、政府機関、その他の組織

- CCUS吸収市場の基準

- 主な会議とイベント

- エコシステム分析:CCUS吸収市場

- 価格分析

- 平均販売価格:最終用途産業別(主要企業)

- 平均販売価格:吸収タイプ別

- 平均販売価格:最終用途産業別

- 平均販売価格:地域別

- 貿易分析

- HSコード281121の輸出シナリオ

- HSコード281121の輸入シナリオ

- 技術分析

- 主要技術

- 補完技術

- ケーススタディ分析

- 顧客ビジネスに影響を与える動向と混乱

- CCUS吸収市場の投資情勢

第6章 CCUS吸収市場:吸収タイプ別

- イントロダクション

- 物理吸収

- 化学吸収

第7章 CCUS吸収市場:最終用途産業別

- イントロダクション

- 石油・ガス

- 発電

- 化学・石油化学

- セメント

- 鉄鋼

- その他の最終用途産業

第8章 CCUS吸収市場:地域別

- イントロダクション

- 北米

- アジア太平洋

- 不況の影響

- アジア太平洋のCCUS吸収市場:吸収タイプ別

- アジア太平洋のCCUS吸収市場:最終用途産業別

- アジア太平洋のCCUS吸収市場:国別

- 欧州

- 不況の影響

- CCUS吸収市場:吸収タイプ別

- CCUS吸収市場:最終用途産業別

- CCUS吸収市場:国別

- 中東・アフリカ

- 不況の影響

- 中東・アフリカのCCUS吸収市場:吸収タイプ別

- 中東・アフリカのCCUS吸収市場:最終用途産業別

- 中東・アフリカのCCUS吸収市場:国別

- 南米

- 不況の影響

- 南米のCCUS吸収市場:吸収タイプ別

- 南米のCCUS吸収市場:最終用途産業別

- 南米のCCUS吸収市場:国別

第9章 競合情勢

- 主要企業戦略/有力企業

- 収益分析

- 市場シェア分析

- ブランド/製品の比較分析

- 企業の評価マトリクス

- スタートアップ/中小企業の評価マトリクス

- 競合シナリオと動向

- CCUS吸収技術プロバイダーの評価と財務指標

第10章 企業プロファイル

- 主要企業

- FLUOR CORPORATION

- EXXONMOBIL CORPORATION

- ROYAL DUTCH SHELL PLC

- MITSUBISHI HEAVY INDUSTRIES

- JGC HOLDINGS CORPORATION

- SCHLUMBERGER LIMITED

- AKER SOLUTIONS

- EQUINOR

- HONEYWELL INTERNATIONAL

- TOTALENERGIES SE

- BASF

- HITACHI

- SIEMENS

- GENERAL ELECTRIC

- CHEVRON CORPORATION

- その他の企業

- CARBON CLEAN SOLUTIONS

- OCCIDENTAL

- BABCOCK & WILCOX

- BRITISH PETROLEUM

- GREEN POWER INTERNATIONAL

- WOLF MIDSTREAM

- SONATRACH

第11章 付録

The global CCUS Absorption market size is projected to grow from USD 0.4 Billion in 2024 to USD 1.7 Billion by 2030, at a CAGR of 26.5% during the forecast period. Governments across the globe are playing a crucial role in implementing Carbon Capture, Utilization, and Storage (CCUS) absorption. They are providing policy support, regulatory frameworks, and financial incentives to encourage the adoption of CCUS technology. For instance, the Australian government has implemented regulations to incentivize private sector investment in CCUS to ensure emission reductions. Similarly, the European Union has identified CCUS as a key strategic net zero technology and is providing funding for CCUS projects under the Innovation Fund and the Connecting Europe Facility. Governments are also creating enabling environments for CCUS projects by establishing carbon pricing systems, providing capital grants and loans, and offering tax credits to address capital and operating costs. Additionally, governments are accelerating administrative and permitting procedures by establishing clear permit approval timelines and designating regulatory agencies as one-stop-shops for all permitting activities. These efforts are crucial for achieving the widespread adoption of CCUS technology and reducing greenhouse gas emissions.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2030 |

| Base Year | 2023 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD Million/Billion), and Volume (Ton) |

| Segments | Absorption type, Function, End-use Industry, and Region |

| Regions covered | Europe, North America, Asia Pacific, South America, and Middle East & Africa |

"Chemical absorption to continue dominatin the CCUS Absorption market"

The chemical absorption type is expected to continue holding the largest market share in the CCUS absorption market due to its widespread adoption and proven effectiveness. Chemical absorption involves the use of a solvent to capture CO2 from flue gas, which is a well-established and mature technology. The process is widely used in various industries, including power generation, oil and gas, and chemical processing. The chemical absorption method is also relatively cost-effective compared to other methods, such as membrane separation and cryogenic distillation. Additionally, the technology has been continuously improved and optimized over the years, making it more efficient and reliable. Key players like ExxonMobil and Chevron have also invested heavily in developing and commercializing chemical absorption technology, further solidifying its position in the market. As a result, chemical absorption is likely to continue dominating the CCUS absorption market, driven by its established presence, cost-effectiveness, and ongoing technological advancements

"Power Generation to be the second largest industry in CCUS Absorption market"

The power generation end-use industry is poised to continue holding the second largest market share in the CCUS absorption market due to the significant role it plays in reducing greenhouse gas emissions. The industry is a major source of CO2 emissions, and the adoption of CCUS technology is crucial for achieving net-zero emissions. Governments worldwide are implementing policies to reduce emissions from power generation, driving the demand for CCUS solutions. Additionally, the increasing focus on renewable energy sources and the need for flexible power generation options are also driving the adoption of CCUS technology in the power sector. Key players in the industry, such as ExxonMobil and Chevron, are actively exploring CCUS technologies to reduce their carbon footprint and meet regulatory requirements. The power generation industry's significant market share in the CCUS market is expected to continue as it plays a vital role in achieving a low-carbon future.

"North America to be the dominating region in CCUS Absorption market in terms of both value and volume."

North America is expected to continue dominating the CCUS Absorption (CCUS) absorption market due to several factors. The region's strong emphasis on curbing carbon emissions and shifting towards cleaner energy sources drives the adoption of CCUS solutions to achieve these goals. The presence of key players like ExxonMobil, Chevron, and Linde, which are actively exploring CCUS technologies, also contributes to the region's dominance. Additionally, the region's extensive programs for research and development, as well as funding incentives in the form of tax credits, support the development and deployment of CCUS projects. Furthermore, the region's regulatory framework, which includes policies like the 45Q tax credit, provides a favorable environment for CCUS projects to thrive. These factors combined ensure that North America will continue to lead the global CCUS market in the coming years.

This study has been validated through primary interviews conducted with various industry experts globally. These primary sources have been divided into the following three categories:

By Company Type- Tier 1- 40%, Tier 2- 33%, and Tier 3- 27%

By Designation- C Level- 50%, Director Level- 30%, and Others- 20%

By Region- North America- 15%, Europe- 50%, Asia Pacific (APAC) - 20%, South America-10%, Middle East & Africa (MEA) -5%,

The report provides a comprehensive analysis of company profiles :

ExxonMobil Corporation (US), Equinor ASA (Norway), Honeywell International Inc. (US), Fluor Corporation (US), Mitsubishi Heavy Industries Ltd. (Japan), Royal Dutch Shell Plc (Britain), TotalEnergies SE (France), BASF SE (Germany), JGC Holdings Corporation (Japan), Schlumberger Ltd. (US), Aker Solutions (Norway), Siemens AG (Germany), Hitachi Ltd. (Japan), General Electric (US), Chevron Ion Clean Energy (US).

Research Coverage

This report covers the global CCUS Absorption market and forecasts the market size until 2030. It includes the following market segmentation - by Absorption type (Chemical Absorption, Physical Absorption), by End-Use Industry ( Oil & Gas, Power Generation, Chemicals & Petrochemicals, Cement, Iron & Steel, and Others), and Region (North America, Europe, Asia Pacific, Middle East & Africa, South America). Porter's Five Forces Analysis, along with the drivers, restraints, opportunities, and challenges, have been discussed in the report. It also provides company profiles and competitive strategies adopted by the major players in the global CCUS Absorption market.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall CCUS Absorption market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Growing environmental consciousness to lower carbon footprints, Changing emission standards and regulations across the globe), restraints (High cost of carbon capture and storage, increasing cost for solvents), opportunities (ongoing research and development to create more advanced capture methods, Expanding in the Asia-Pacific region), and challenges (Higher CO2 capture costs, High CAPEX for deployment of CCUS) are influencing the growth of the CCUS Absorption market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the CCUS Absorption market

- Market Development: Comprehensive information about lucrative markets - the report analyses the CCUS Absorption market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the CCUS Absorption market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like ExxonMobil Corporation (US), Equinor ASA (Norway), Honeywell International Inc. (US), Fluor Corporation (US), Mitsubishi Heavy Industries Ltd. (Japan), Royal Dutch Shell Plc (Britain), TotalEnergies SE (France), BASF SE (Germany), JGC Holdings Corporation (Japan), Schlumberger Ltd. (US), Aker Solutions (Norway), Siemens AG (Germany), Hitachi Ltd. (Japan), General Electric (US), Chevron Ion Clean Energy (US), among others in the CCUS Absorption market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 CCUS ABSORPTION MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 RESEARCH LIMITATIONS

- 1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 CCUS ABSORPTION MARKET: RESEARCH DESIGN

- 2.2 BASE NUMBER CALCULATION

- 2.2.1 MARKET SIZE ESTIMATION

- 2.2.2 MARKET SIZE CALCULATION, BY END-USE INDUSTRY

- 2.3 FORECAST NUMBER CALCULATION

- 2.3.1 SECONDARY DATA

- 2.3.1.1 Key data from secondary sources

- 2.3.2 PRIMARY DATA

- 2.3.2.1 Key data from primary sources

- 2.3.2.2 Interviews with experts - Top players in CCUS absorption market

- 2.3.2.3 Breakdown of interviews with experts

- 2.3.2.4 Key industry insights

- 2.3.1 SECONDARY DATA

- 2.4 MARKET SIZE ESTIMATION

- 2.4.1 BOTTOM-UP APPROACH

- FIGURE 2 CCUS ABSORPTION MARKET: BOTTOM-UP APPROACH

- 2.4.2 TOP-DOWN APPROACH

- FIGURE 3 CCUS ABSORPTION MARKET: TOP-DOWN APPROACH

- 2.5 DATA TRIANGULATION

- FIGURE 4 CCUS ABSORPTION MARKET: DATA TRIANGULATION

- 2.6 IMPACT OF RECESSION

- 2.7 FACTOR ANALYSIS

- 2.8 RESEARCH ASSUMPTIONS

- 2.9 MARKET GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

- 2.10 RESEARCH LIMITATIONS

- 2.11 RISKS ASSOCIATED WITH CCUS MARKET

3 EXECUTIVE SUMMARY

- FIGURE 5 CHEMICAL ABSORPTION SEGMENT DOMINATED MARKET IN 2023

- FIGURE 6 OIL & GAS INDUSTRY ACCOUNTED FOR LARGEST MARKET SHARE IN 2023

- FIGURE 7 NORTH AMERICA ACCOUNTED FOR LARGEST MARKET SHARE IN 2023

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN CCUS ABSORPTION MARKET

- FIGURE 8 INCREASING GOVERNMENT SUPPORT TO DRIVE MARKET

- 4.2 CCUS ABSORPTION MARKET, BY ABSORPTION TYPE AND REGION, 2023

- FIGURE 9 CHEMICAL ABSORPTION SEGMENT AND NORTH AMERICA ACCOUNTED FOR LARGEST SHARES IN 2023

- 4.3 CCUS ABSORPTION MARKET, BY ABSORPTION TYPE

- FIGURE 10 CHEMICAL ABSORPTION HELD LARGEST SHARE IN 2023

- 4.4 CCUS ABSORPTION MARKET, BY END-USE INDUSTRY

- FIGURE 11 OIL & GAS END-USE INDUSTRY ACCOUNTED FOR LARGEST SHARE IN 2023

- 4.5 CCUS ABSORPTION MARKET, BY KEY COUNTRY

- FIGURE 12 MARKET IN CHINA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 13 CCUS ABSORPTION MARKET: MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing number of carbon-intensive industries

- 5.2.1.2 Growing focus on reducing CO2 emissions

- TABLE 1 COUNTRY-WISE LIST OF ZERO-EMISSION TARGETS

- 5.2.1.3 Government initiatives in CCUS technologies

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost associated with carbon capture technology

- 5.2.2.2 Competition from alternative carbon capture technologies

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Continuous investments in developing innovative carbon absorption technologies

- 5.2.3.2 Announcements of large capacity hydrogen projects

- TABLE 2 ANNOUNCED HYDROGEN PROJECTS

- 5.2.3.3 Large number of upcoming projects in Asia Pacific

- 5.2.4 CHALLENGES

- 5.2.4.1 Reducing cost of CO2 capture

- 5.2.4.2 High initial investment cost

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 14 CCUS ABSORPTION MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- TABLE 3 CCUS ABSORPTION MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.4 SUPPLY CHAIN ANALYSIS

- TABLE 4 CCUS ABSORPTION MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- 5.4.1 RAW MATERIAL

- 5.4.2 MANUFACTURING PROCESS

- 5.4.3 FINAL PRODUCT

- 5.5 VALUE CHAIN ANALYSIS

- FIGURE 15 CCUS ABSORPTION MARKET: VALUE CHAIN ANALYSIS

- 5.6 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.6.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 16 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES

- TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES IN CCUS ABSORPTION MARKET

- 5.6.2 BUYING CRITERIA

- FIGURE 17 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- TABLE 6 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES IN CCUS ABSORPTION MARKET

- 5.7 PATENT ANALYSIS

- 5.7.1 INTRODUCTION

- 5.7.2 METHODOLOGY

- 5.7.3 DOCUMENT TYPE

- TABLE 7 TOTAL NUMBER OF PATENTS

- FIGURE 18 PATENT ANALYSIS, BY DOCUMENT TYPE

- FIGURE 19 PATENT PUBLICATION TREND, 2018-2023

- 5.7.4 INSIGHTS

- 5.7.5 LEGAL STATUS

- FIGURE 20 CCUS ABSORPTION MARKET: LEGAL STATUS OF PATENTS

- 5.7.6 JURISDICTION ANALYSIS

- FIGURE 21 CHINA JURISDICTION REGISTERED HIGHEST NUMBER OF PATENTS

- 5.7.7 TOP APPLICANTS

- FIGURE 22 KABUSHIKI KAISHA TOSHIBA REGISTERED HIGHEST NUMBER OF PATENTS

- 5.7.8 PATENTS BY KABUSHIKI KAISHA TOSHIBA

- 5.7.9 PATENTS BY GLOBAL THERMOSTAT OPERATIONS LLC

- 5.7.10 PATENTS BY GENERAL ELECTRIC TECHNOLOGY GMBH

- 5.7.11 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

- 5.8 REGULATORY LANDSCAPE

- 5.8.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 REST OF WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.8.2 STANDARDS IN CCUS ABSORPTION MARKET

- TABLE 12 CURRENT STANDARD CODES FOR CCUS ABSORPTION MARKET

- 5.9 KEY CONFERENCES AND EVENTS

- TABLE 13 KEY CONFERENCES AND EVENTS, 2024-2025

- 5.10 ECOSYSTEM ANALYSIS: CCUS ABSORPTION MARKET

- 5.10.1 ECOSYSTEM MAP

- FIGURE 23 KEY PLAYERS IN CCUS ABSORPTION MARKET ECOSYSTEM

- 5.11 PRICING ANALYSIS

- 5.11.1 AVERAGE SELLING PRICE, BY END-USE INDUSTRY (KEY PLAYER)

- FIGURE 24 AVERAGE SELLING PRICES OF CCUS ABSORPTION OFFERED BY KEY PLAYERS FOR TOP THREE END-USE INDUSTRIES (USD/KG)

- 5.11.2 AVERAGE SELLING PRICE, BY ABSORPTION TYPE

- FIGURE 25 AVERAGE SELLING PRICE BASED ON ABSORPTION TYPE (USD/KG)

- 5.11.3 AVERAGE SELLING PRICE, BY END-USE INDUSTRY

- FIGURE 26 AVERAGE SELLING PRICE BASED ON END-USE INDUSTRY (USD/KG)

- 5.11.4 AVERAGE SELLING PRICE, BY REGION

- TABLE 14 AVERAGE SELLING PRICE OF CCUS ABSORPTION, BY REGION

- 5.12 TRADE ANALYSIS

- 5.12.1 EXPORT SCENARIO FOR HS CODE 281121

- FIGURE 27 EXPORTS, BY KEY COUNTRIES, 2018-2023 (USD THOUSAND)

- TABLE 15 TOP 10 EXPORTING COUNTRIES IN 2023

- 5.12.2 IMPORT SCENARIO FOR HS CODE 281121

- FIGURE 28 IMPORTS, BY KEY COUNTRIES, 2018-2023 (USD THOUSAND)

- TABLE 16 TOP 10 IMPORTING COUNTRIES IN 2023

- 5.13 TECHNOLOGY ANALYSIS

- 5.13.1 KEY TECHNOLOGIES

- 5.13.2 COMPLEMENTARY TECHNOLOGIES

- 5.14 CASE STUDY ANALYSIS

- 5.15 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 29 REVENUE SHIFT OF CCUS ABSORPTION MARKET

- 5.16 CCUS ABSORPTION MARKET INVESTMENT LANDSCAPE

- FIGURE 30 INVESTOR DEALS AND FUNDING IN CCUS ABSORPTION MARKET SOARED IN 2023

6 CCUS ABSORPTION MARKET, BY ABSORPTION TYPE

- 6.1 INTRODUCTION

- FIGURE 31 CHEMICAL ABSORPTION SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- TABLE 17 CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2019-2023 (USD MILLION)

- TABLE 18 CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2019-2023 (KILOTON)

- TABLE 19 CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2024-2030 (USD MILLION)

- TABLE 20 CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2024-2030 (KILOTON)

- 6.2 PHYSICAL ABSORPTION

- 6.2.1 GROWING DEMAND FROM HIGH CO2 CONCENTRATION AND STREAM PRESSURE PLANTS TO DRIVE MARKET

- TABLE 21 PHYSICAL ABSORPTION: CCUS ABSORPTION MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 22 PHYSICAL ABSORPTION: CCUS ABSORPTION MARKET, BY REGION, 2019-2023 (KILOTON)

- TABLE 23 PHYSICAL ABSORPTION: CCUS ABSORPTION MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 24 PHYSICAL ABSORPTION: CCUS ABSORPTION MARKET, BY REGION, 2024-2030 (KILOTON)

- 6.3 CHEMICAL ABSORPTION

- 6.3.1 INCREASING DEMAND IN INDUSTRIES EMITTING LOW PRESSURE CO2 TO DRIVE MARKET

- TABLE 25 CHEMICAL ABSORPTION: CCUS ABSORPTION MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 26 CHEMICAL ABSORPTION: CCUS ABSORPTION MARKET, BY REGION, 2019-2023 (KILOTON)

- TABLE 27 CHEMICAL ABSORPTION: CCUS ABSORPTION MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 28 CHEMICAL ABSORPTION: CCUS ABSORPTION MARKET, BY REGION, 2024-2030 (KILOTON)

7 CCUS ABSORPTION MARKET, BY END-USE INDUSTRY

- 7.1 INTRODUCTION

- FIGURE 32 OIL & GAS END-USE INDUSTRY TO DOMINATE MARKET DURING FORECAST PERIOD

- TABLE 29 CCUS ABSORPTION MARKET, BY END-USE INDUSTRY, 2019-2023 (USD MILLION)

- TABLE 30 CCUS ABSORPTION MARKET, BY END-USE INDUSTRY, 2019-2023 (KILOTON)

- TABLE 31 CCUS ABSORPTION MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 32 CCUS ABSORPTION MARKET, BY END-USE INDUSTRY, 2024-2030 (KILOTON)

- 7.2 OIL & GAS

- 7.2.1 INCREASING ENERGY GENERATION WORLDWIDE TO DRIVE MARKET

- TABLE 33 OIL & GAS: CCUS ABSORPTION MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 34 OIL & GAS: CCUS ABSORPTION MARKET, BY REGION, 2019-2023 (KILOTON)

- TABLE 35 OIL & GAS: CCUS ABSORPTION MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 36 OIL & GAS: CCUS ABSORPTION MARKET, BY REGION, 2024-2030 (KILOTON)

- 7.3 POWER GENERATION

- 7.3.1 RISING DEMAND FOR ENERGY TO DRIVE MARKET

- TABLE 37 POWER GENERATION: CCUS ABSORPTION MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 38 POWER GENERATION: CCUS ABSORPTION MARKET, BY REGION, 2019-2023 (KILOTON)

- TABLE 39 POWER GENERATION: CCUS ABSORPTION MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 40 POWER GENERATION: CCUS ABSORPTION MARKET, BY REGION, 2024-2030 (KILOTON)

- 7.4 CHEMICAL & PETROCHEMICAL

- 7.4.1 AMMONIA PRODUCTION PLANTS CONTRIBUTE SIGNIFICANTLY TO MARKET GROWTH

- TABLE 41 CHEMICAL & PETROCHEMICAL: CCUS ABSORPTION MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 42 CHEMICAL & PETROCHEMICAL: CCUS ABSORPTION MARKET, BY REGION, 2019-2023 (KILOTON)

- TABLE 43 CHEMICAL & PETROCHEMICAL: CCUS ABSORPTION MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 44 CHEMICAL & PETROCHEMICAL: CCUS ABSORPTION MARKET, BY REGION, 2024-2030 (KILOTON)

- 7.5 CEMENT

- 7.5.1 GOVERNMENT REGULATIONS AND HIGH EMISSIONS TO DRIVE MARKET

- TABLE 45 CEMENT: CCUS ABSORPTION MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 46 CEMENT: CCUS ABSORPTION MARKET, BY REGION, 2019-2023 (KILOTON)

- TABLE 47 CEMENT: CCUS ABSORPTION MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 48 CEMENT: CCUS ABSORPTION MARKET, BY REGION, 2024-2030 (KILOTON)

- 7.6 IRON & STEEL

- 7.6.1 HIGH ANTHROPOGENIC CO2 EMISSIONS TO DRIVE MARKET

- TABLE 49 IRON & STEEL: CCUS ABSORPTION MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 50 IRON & STEEL: CCUS ABSORPTION MARKET, BY REGION, 2019-2023 (KILOTON)

- TABLE 51 IRON & STEEL: CCUS ABSORPTION MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 52 IRON & STEEL: CCUS ABSORPTION MARKET, BY REGION, 2024-2030 (KILOTON)

- 7.7 OTHER END-USE INDUSTRIES

- TABLE 53 OTHER END-USE INDUSTRIES: CCUS ABSORPTION MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 54 OTHER END-USE INDUSTRIES: CCUS ABSORPTION MARKET, BY REGION, 2019-2023 (KILOTON)

- TABLE 55 OTHER END-USE INDUSTRIES: CCUS ABSORPTION MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 56 OTHER END-USE INDUSTRIES: CCUS ABSORPTION MARKET, BY REGION, 2024-2030 (KILOTON)

8 CCUS ABSORPTION MARKET, BY REGION

- 8.1 INTRODUCTION

- FIGURE 33 CHINA TO BE FASTEST-GROWING CCUS ABSORPTION MARKET DURING FORECAST PERIOD

- TABLE 57 CCUS ABSORPTION MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 58 CCUS ABSORPTION MARKET, BY REGION, 2019-2023 (KILOTON)

- TABLE 59 CCUS ABSORPTION MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 60 CCUS ABSORPTION MARKET, BY REGION, 2024-2030 (KILOTON)

- 8.2 NORTH AMERICA

- 8.2.1 IMPACT OF RECESSION

- FIGURE 34 NORTH AMERICA: CCUS ABSORPTION MARKET SNAPSHOT

- TABLE 61 NORTH AMERICA: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2019-2023 (USD MILLION)

- TABLE 62 NORTH AMERICA: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2019-2023 (KILOTON)

- TABLE 63 NORTH AMERICA: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2024-2030 (USD MILLION)

- TABLE 64 NORTH AMERICA: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2024-2030 (KILOTON)

- TABLE 65 NORTH AMERICA: CCUS ABSORPTION MARKET, BY END-USE INDUSTRY, 2019-2023 (USD MILLION)

- TABLE 66 NORTH AMERICA: CCUS ABSORPTION MARKET, BY END-USE INDUSTRY, 2019-2023 (KILOTON)

- TABLE 67 NORTH AMERICA: CCUS ABSORPTION MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 68 NORTH AMERICA: CCUS ABSORPTION MARKET, BY END-USE INDUSTRY, 2024-2030 (KILOTON)

- TABLE 69 NORTH AMERICA: CCUS ABSORPTION MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 70 NORTH AMERICA: CCUS ABSORPTION MARKET, BY COUNTRY, 2019-2023 (KILOTON)

- TABLE 71 NORTH AMERICA: CCUS ABSORPTION MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 72 NORTH AMERICA: CCUS ABSORPTION MARKET, BY COUNTRY, 2024-2030 (KILOTON)

- 8.2.1.1 US

- 8.2.1.1.1 Government support for implementation of CCUS absorption to drive market

- 8.2.1.1 US

- TABLE 73 US: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2019-2023 (USD MILLION)

- TABLE 74 US: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2019-2023 (KILOTON)

- TABLE 75 US: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2024-2030 (USD MILLION)

- TABLE 76 US: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2024-2030 (KILOTON)

- 8.2.1.2 Canada

- 8.2.1.2.1 Increasing investments in CCUS projects to drive market

- 8.2.1.2 Canada

- TABLE 77 CANADA: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2019-2023 (USD MILLION)

- TABLE 78 CANADA: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2019-2023 (KILOTON)

- TABLE 79 CANADA: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2024-2030 (USD MILLION)

- TABLE 80 CANADA: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2024-2030 (KILOTON)

- 8.2.1.3 Mexico

- 8.2.1.3.1 Need to curb GHG emissions from electricity & heat generation industry to drive market

- 8.2.1.3 Mexico

- TABLE 81 MEXICO: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2019-2023 (USD MILLION)

- TABLE 82 MEXICO: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2019-2023 (KILOTON)

- TABLE 83 MEXICO: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2024-2030 (USD MILLION)

- TABLE 84 MEXICO: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2024-2030 (KILOTON)

- 8.3 ASIA PACIFIC

- 8.3.1 IMPACT OF RECESSION

- FIGURE 35 ASIA PACIFIC: CCUS ABSORPTION MARKET SNAPSHOT

- 8.3.2 ASIA PACIFIC: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE

- TABLE 85 ASIA PACIFIC: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2019-2023 (USD MILLION)

- TABLE 86 ASIA PACIFIC: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2019-2023 (KILOTON)

- TABLE 87 ASIA PACIFIC: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2024-2030 (USD MILLION)

- TABLE 88 ASIA PACIFIC: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2024-2030 (KILOTON)

- 8.3.3 ASIA PACIFIC: CCUS ABSORPTION MARKET, BY END-USE INDUSTRY

- TABLE 89 ASIA PACIFIC: CCUS ABSORPTION MARKET, BY END-USE INDUSTRY, 2019-2023 (USD MILLION)

- TABLE 90 ASIA PACIFIC: CCUS ABSORPTION MARKET, BY END-USE INDUSTRY, 2019-2023 (KILOTON)

- TABLE 91 ASIA PACIFIC: CCUS ABSORPTION MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 92 ASIA PACIFIC: CCUS ABSORPTION MARKET, BY END-USE INDUSTRY, 2024-2030 (KILOTON)

- 8.3.4 ASIA PACIFIC: CCUS ABSORPTION MARKET, BY COUNTRY

- TABLE 93 ASIA PACIFIC: CCUS ABSORPTION MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 94 ASIA PACIFIC: CCUS ABSORPTION MARKET, BY COUNTRY, 2019-2023 (KILOTON)

- TABLE 95 ASIA PACIFIC: CCUS ABSORPTION MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 96 ASIA PACIFIC: CCUS ABSORPTION MARKET, BY COUNTRY, 2024-2030 (KILOTON)

- 8.3.4.1 China

- 8.3.4.1.1 Collaborations with various countries and organizations to drive market

- 8.3.4.1 China

- TABLE 97 CHINA: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2019-2023 (USD MILLION)

- TABLE 98 CHINA: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2019-2023 (KILOTON)

- TABLE 99 CHINA: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2024-2030 (USD MILLION)

- TABLE 100 CHINA: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2024-2030 (KILOTON)

- 8.3.4.2 Japan

- 8.3.4.2.1 Major technology providers and strong industrial base to support market growth

- 8.3.4.2 Japan

- TABLE 101 JAPAN: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2019-2023 (USD MILLION)

- TABLE 102 JAPAN: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2019-2023 (KILOTON)

- TABLE 103 JAPAN: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2024-2030 (USD MILLION)

- TABLE 104 JAPAN: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2024-2030 (KILOTON)

- 8.3.4.3 India

- 8.3.4.3.1 Industrialization and emission regulations to drive market

- 8.3.4.3 India

- TABLE 105 INDIA: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2019-2023 (USD MILLION)

- TABLE 106 INDIA: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2019-2023 (KILOTON)

- TABLE 107 INDIA: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2024-2030 (USD MILLION)

- TABLE 108 INDIA: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2024-2030 (KILOTON)

- 8.3.4.4 Australia

- 8.3.4.4.1 Funding initiatives by government to boost market

- 8.3.4.4 Australia

- TABLE 109 AUSTRALIA: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2019-2023 (USD MILLION)

- TABLE 110 AUSTRALIA: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2019-2023 (KILOTON)

- TABLE 111 AUSTRALIA: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2024-2030 (USD MILLION)

- TABLE 112 AUSTRALIA: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2024-2030 (KILOTON)

- 8.3.4.5 Rest of Asia Pacific

- TABLE 113 REST OF ASIA PACIFIC: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2019-2023 (USD MILLION)

- TABLE 114 REST OF ASIA PACIFIC: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2019-2023 (KILOTON)

- TABLE 115 REST OF ASIA PACIFIC: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2024-2030 (USD MILLION)

- TABLE 116 REST OF ASIA PACIFIC: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2024-2030 (KILOTON)

- 8.4 EUROPE

- 8.4.1 IMPACT OF RECESSION

- FIGURE 36 EUROPE: CCUS ABSORPTION MARKET SNAPSHOT

- 8.4.2 CCUS ABSORPTION MARKET, BY ABSORPTION TYPE

- TABLE 117 EUROPE: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2019-2023 (USD MILLION)

- TABLE 118 EUROPE: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2019-2023 (KILOTON)

- TABLE 119 EUROPE: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2024-2030 (USD MILLION)

- TABLE 120 EUROPE: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2024-2030 (KILOTON)

- 8.4.3 CCUS ABSORPTION MARKET, BY END-USE INDUSTRY

- TABLE 121 EUROPE: CCUS ABSORPTION MARKET, BY END-USE INDUSTRY, 2019-2023 (USD MILLION)

- TABLE 122 EUROPE: CCUS ABSORPTION MARKET, BY END-USE INDUSTRY, 2019-2023 (KILOTON)

- TABLE 123 EUROPE: CCUS ABSORPTION MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 124 EUROPE: CCUS ABSORPTION MARKET, BY END-USE INDUSTRY, 2024-2030 (KILOTON)

- 8.4.4 CCUS ABSORPTION MARKET, BY COUNTRY

- TABLE 125 EUROPE: CCUS ABSORPTION MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 126 EUROPE: CCUS ABSORPTION MARKET, BY COUNTRY, 2019-2023 (KILOTON)

- TABLE 127 EUROPE: CCUS ABSORPTION MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 128 EUROPE: CCUS ABSORPTION MARKET, BY COUNTRY, 2024-2030 (KILOTON)

- 8.4.4.1 Norway

- 8.4.4.1.1 Increased need for electricity generation from natural gas to drive market

- 8.4.4.1 Norway

- TABLE 129 NORWAY: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2019-2023 (USD MILLION)

- TABLE 130 NORWAY: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2019-2023 (KILOTON)

- TABLE 131 NORWAY: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2024-2030 (USD MILLION)

- TABLE 132 NORWAY: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2024-2030 (KILOTON)

- 8.4.4.2 UK

- 8.4.4.2.1 Ambitious new strategy aimed at becoming global leader in CCUS to boost market

- 8.4.4.2 UK

- TABLE 133 UK: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2019-2023 (USD MILLION)

- TABLE 134 UK: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2019-2023 (KILOTON)

- TABLE 135 UK: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2024-2030 (USD MILLION)

- TABLE 136 UK: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2024-2030 (KILOTON)

- 8.4.4.3 France

- 8.4.4.3.1 Government initiatives toward reducing carbon emissions to boost market

- 8.4.4.3 France

- TABLE 137 FRANCE: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2019-2023 (USD MILLION)

- TABLE 138 FRANCE: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2019-2023 (KILOTON)

- TABLE 139 FRANCE: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2024-2030 (USD MILLION)

- TABLE 140 FRANCE: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2024-2030 (KILOTON)

- 8.4.4.4 Netherlands

- 8.4.4.4.1 Implementation of projects to boost market

- 8.4.4.4 Netherlands

- TABLE 141 NETHERLANDS: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2019-2023 (USD MILLION)

- TABLE 142 NETHERLANDS: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2019-2023 (KILOTON)

- TABLE 143 NETHERLANDS: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2024-2030 (USD MILLION)

- TABLE 144 NETHERLANDS: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2024-2030 (KILOTON)

- 8.4.4.5 Italy

- 8.4.4.5.1 Demand for CCUS systems to drive market

- 8.4.4.5 Italy

- TABLE 145 ITALY: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2019-2023 (USD MILLION)

- TABLE 146 ITALY: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2019-2023 (KILOTON)

- TABLE 147 ITALY: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2024-2030 (USD MILLION)

- TABLE 148 ITALY: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2024-2030 (KILOTON)

- 8.4.4.6 Rest of Europe

- TABLE 149 REST OF EUROPE: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2019-2023 (USD MILLION)

- TABLE 150 REST OF EUROPE: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2019-2023 (KILOTON)

- TABLE 151 REST OF EUROPE: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2024-2030 (USD MILLION)

- TABLE 152 REST OF EUROPE: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2024-2030 (KILOTON)

- 8.5 MIDDLE EAST & AFRICA

- 8.5.1 IMPACT OF RECESSION

- 8.5.2 MIDDLE EAST & AFRICA: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE

- TABLE 153 MIDDLE EAST & AFRICA: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2019-2023 (USD MILLION)

- TABLE 154 MIDDLE EAST & AFRICA: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2019-2023 (KILOTON)

- TABLE 155 MIDDLE EAST & AFRICA: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2024-2030 (USD MILLION)

- TABLE 156 MIDDLE EAST & AFRICA: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2024-2030 (KILOTON)

- 8.5.3 MIDDLE EAST & AFRICA: CCUS ABSORPTION MARKET, BY END-USE INDUSTRY

- TABLE 157 MIDDLE EAST & AFRICA: CCUS ABSORPTION MARKET, BY END-USE INDUSTRY, 2019-2023 (USD MILLION)

- TABLE 158 MIDDLE EAST & AFRICA: CCUS ABSORPTION MARKET, BY END-USE INDUSTRY, 2019-2023 (KILOTON)

- TABLE 159 MIDDLE EAST & AFRICA: CCUS ABSORPTION MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 160 MIDDLE EAST & AFRICA: CCUS ABSORPTION MARKET, BY END-USE INDUSTRY, 2024-2030 (KILOTON)

- 8.5.4 MIDDLE EAST & AFRICA: CCUS ABSORPTION MARKET, BY COUNTRY

- TABLE 161 MIDDLE EAST & AFRICA: CCUS ABSORPTION MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 162 MIDDLE EAST & AFRICA: CCUS ABSORPTION MARKET, BY COUNTRY, 2019-2023 (KILOTON)

- TABLE 163 MIDDLE EAST & AFRICA: CCUS ABSORPTION MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 164 MIDDLE EAST & AFRICA: CCUS ABSORPTION MARKET, BY COUNTRY, 2024-2030 (KILOTON)

- 8.5.4.1 GCC countries

- TABLE 165 GCC COUNTRIES: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2019-2023 (USD MILLION)

- TABLE 166 GCC COUNTRIES: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2019-2023 (KILOTON)

- TABLE 167 GCC COUNTRIES: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2024-2030 (USD MILLION)

- TABLE 168 GCC COUNTRIES: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2024-2030 (KILOTON)

- 8.5.4.2 UAE

- 8.5.4.2.1 Commitment to meet climate goals to drive market

- 8.5.4.2 UAE

- TABLE 169 UAE: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2019-2023 (USD MILLION)

- TABLE 170 UAE: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2019-2023 (KILOTON)

- TABLE 171 UAE: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2024-2030 (USD MILLION)

- TABLE 172 UAE: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2024-2030 (KILOTON)

- 8.5.4.3 Saudi Arabia

- 8.5.4.3.1 Government support and increasing investments in renewable energy to boost market

- 8.5.4.3 Saudi Arabia

- TABLE 173 SAUDI ARABIA: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2019-2023 (USD MILLION)

- TABLE 174 SAUDI ARABIA: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2019-2023 (KILOTON)

- TABLE 175 SAUDI ARABIA: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2024-2030 (USD MILLION)

- TABLE 176 SAUDI ARABIA: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2024-2030 (KILOTON)

- 8.5.4.4 Rest of GCC countries

- TABLE 177 REST OF GCC COUNTRIES: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2019-2023 (USD MILLION)

- TABLE 178 REST OF GCC COUNTRIES: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2019-2023 (KILOTON)

- TABLE 179 REST OF GCC COUNTRIES: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2024-2030 (USD MILLION)

- TABLE 180 REST OF GCC COUNTRIES: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2024-2030 (KILOTON)

- 8.5.4.5 Rest of Middle East & Africa

- TABLE 181 REST OF MIDDLE EAST & AFRICA: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2019-2023 (USD MILLION)

- TABLE 182 REST OF MIDDLE EAST & AFRICA: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2019-2023 (KILOTON)

- TABLE 183 REST OF MIDDLE EAST & AFRICA: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2024-2030 (USD MILLION)

- TABLE 184 REST OF MIDDLE EAST & AFRICA: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2024-2030 (KILOTON)

- 8.6 SOUTH AMERICA

- 8.6.1 IMPACT OF RECESSION

- 8.6.2 SOUTH AMERICA: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE

- TABLE 185 SOUTH AMERICA: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2019-2023 (USD MILLION)

- TABLE 186 SOUTH AMERICA: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2019-2023 (KILOTON)

- TABLE 187 SOUTH AMERICA: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2024-2030 (USD MILLION)

- TABLE 188 SOUTH AMERICA: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2024-2030 (KILOTON)

- 8.6.3 SOUTH AMERICA: CCUS ABSORPTION MARKET, BY END-USE INDUSTRY

- TABLE 189 SOUTH AMERICA: CCUS ABSORPTION MARKET, BY END-USE INDUSTRY, 2019-2023 (USD MILLION)

- TABLE 190 SOUTH AMERICA: CCUS ABSORPTION MARKET, BY END-USE INDUSTRY, 2019-2023 (KILOTON)

- TABLE 191 SOUTH AMERICA: CCUS ABSORPTION MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 192 SOUTH AMERICA: CCUS ABSORPTION MARKET, BY END-USE INDUSTRY, 2024-2030 (KILOTON)

- 8.6.4 SOUTH AMERICA: CCUS ABSORPTION MARKET, BY COUNTRY

- TABLE 193 SOUTH AMERICA: CCUS ABSORPTION MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 194 SOUTH AMERICA: CCUS ABSORPTION MARKET, BY COUNTRY, 2019-2023 (KILOTON)

- TABLE 195 SOUTH AMERICA: CCUS ABSORPTION MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 196 SOUTH AMERICA: CCUS ABSORPTION MARKET, BY COUNTRY, 2024-2030 (KILOTON)

- 8.6.4.1 Brazil

- 8.6.4.1.1 Demand from industrial plants to drive market

- 8.6.4.1 Brazil

- TABLE 197 BRAZIL: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2019-2023 (USD MILLION)

- TABLE 198 BRAZIL: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2019-2023 (KILOTON)

- TABLE 199 BRAZIL: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2024-2030 (USD MILLION)

- TABLE 200 BRAZIL: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2024-2030 (KILOTON)

- 8.6.4.2 Argentina

- 8.6.4.2.1 Imposition of carbon tax on liquids and other fluids to drive market

- 8.6.4.2 Argentina

- TABLE 201 ARGENTINA: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2019-2023 (USD MILLION)

- TABLE 202 ARGENTINA: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2019-2023 (KILOTON)

- TABLE 203 ARGENTINA: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2024-2030 (USD MILLION)

- TABLE 204 ARGENTINA: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2024-2030 (KILOTON)

- 8.6.4.3 Chile

- 8.6.4.3.1 Emphasis on forest carbon capture to achieve carbon neutrality to drive market

- 8.6.4.3 Chile

- TABLE 205 CHILE: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2019-2023 (USD MILLION)

- TABLE 206 CHILE: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2019-2023 (KILOTON)

- TABLE 207 CHILE: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2024-2030 (USD MILLION)

- TABLE 208 CHILE: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2024-2030 (KILOTON)

- 8.6.4.4 Rest of South America

- TABLE 209 REST OF SOUTH AMERICA: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2019-2023 (USD MILLION)

- TABLE 210 REST OF SOUTH AMERICA: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2019-2023 (KILOTON)

- TABLE 211 REST OF SOUTH AMERICA: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2024-2030 (USD MILLION)

- TABLE 212 REST OF SOUTH AMERICA: CCUS ABSORPTION MARKET, BY ABSORPTION TYPE, 2024-2030 (KILOTON)

9 COMPETITIVE LANDSCAPE

- 9.1 KEY PLAYER STRATEGIES/RIGHT TO WIN

- TABLE 213 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- 9.2 REVENUE ANALYSIS

- FIGURE 37 CCUS ABSORPTION MARKET: REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS

- 9.3 MARKET SHARE ANALYSIS

- FIGURE 38 SHARES OF TOP COMPANIES IN CCUS ABSORPTION MARKET

- TABLE 214 DEGREE OF COMPETITION

- 9.4 BRAND/PRODUCT COMPARATIVE ANALYSIS

- FIGURE 39 CCUS ABSORPTION MARKET: TOP TRENDING BRANDS/PRODUCTS

- 9.4.1 COMPARATIVE ANALYSIS OF CCUS ABSORPTION TECHNOLOGY BRANDS/PRODUCTS

- FIGURE 40 COMPARATIVE ANALYSIS OF CCUS ABSORPTION TECHNOLOGY BRANDS/PRODUCTS

- 9.4.1.1 Fluor Econamine FG Plus

- 9.4.1.2 ExxonMobil Corporation: CCUS

- 9.4.1.3 Equinor ASA: CCUS

- 9.4.1.4 Mitsubishi: KM-CDR

- 9.4.1.5 Aker Solutions: CCUS

- 9.5 COMPANY EVALUATION MATRIX

- 9.5.1 STARS

- 9.5.2 PERVASIVE PLAYERS

- 9.5.3 EMERGING LEADERS

- 9.5.4 PARTICIPANTS

- FIGURE 41 CCUS ABSORPTION MARKET: COMPETITIVE LEADERSHIP MAPPING, 2023

- 9.5.5 COMPANY FOOTPRINT

- TABLE 215 OVERALL COMPANY FOOTPRINT (15 COMPANIES)

- TABLE 216 END-USE INDUSTRY: COMPANY FOOTPRINT (15 COMPANIES)

- TABLE 217 REGION: COMPANY FOOTPRINT (15 COMPANIES)

- 9.6 STARTUP/SME EVALUATION MATRIX

- 9.6.1 PROGRESSIVE COMPANIES

- 9.6.2 RESPONSIVE COMPANIES

- 9.6.3 DYNAMIC COMPANIES

- 9.6.4 STARTING BLOCKS

- FIGURE 42 CCUS ABSORPTION MARKET: STARTUP/SME EVALUATION MATRIX, 2023

- 9.6.5 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 218 CCUS ABSORPTION MARKET: KEY STARTUPS/SMES

- TABLE 219 CCUS ABSORPTION MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 9.7 COMPETITIVE SCENARIO AND TRENDS

- TABLE 220 CCUS ABSORPTION MARKET: DEALS, JANUARY 2019-MAY 2024

- TABLE 221 CCUS ABSORPTION MARKET: EXPANSIONS, JANUARY 2019-MAY 2024

- TABLE 222 CCUS ABSORPTION MARKET: OTHER DEVELOPMENTS, JANUARY 2019-MAY 2024

- 9.8 VALUATION AND FINANCIAL METRICS OF CCUS ABSORPTION TECHNOLOGY PROVIDERS

- FIGURE 43 EV/EBITDA OF KEY VENDORS

- FIGURE 44 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

10 COMPANY PROFILES

- 10.1 KEY COMPANIES

(Business Overview, Products/Services/Solutions Offered, Recent Developments, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats)**

- 10.1.1 FLUOR CORPORATION

- TABLE 223 FLUOR CORPORATION: COMPANY OVERVIEW

- FIGURE 45 FLUOR CORPORATION: COMPANY SNAPSHOT

- TABLE 224 FLUOR CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 225 FLUOR CORPORATION: DEALS, JANUARY 2019-MAY 2024

- TABLE 226 FLUOR CORPORATION: OTHER DEVELOPMENTS, JANUARY 2019-MAY 2024

- 10.1.2 EXXONMOBIL CORPORATION

- TABLE 227 EXXONMOBIL CORPORATION: COMPANY OVERVIEW

- FIGURE 46 EXXONMOBIL CORPORATION: COMPANY SNAPSHOT

- TABLE 228 EXXONMOBIL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 229 EXXONMOBIL CORPORATION: DEALS, JANUARY 2019-MAY 2024

- TABLE 230 EXXONMOBIL CORPORATION: EXPANSIONS, JANUARY 2019-MAY 2024

- 10.1.3 ROYAL DUTCH SHELL PLC

- TABLE 231 ROYAL DUTCH SHELL PLC: COMPANY OVERVIEW

- FIGURE 47 ROYAL DUTCH SHELL PLC: COMPANY SNAPSHOT

- TABLE 232 ROYAL DUTCH SHELL PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 233 ROYAL DUTCH SHELL PLC: DEALS, JANUARY 2019-MAY 2024

- TABLE 234 ROYAL DUTCH SHELL PLC: EXPANSIONS, JANUARY 2019-MAY 2024

- 10.1.4 MITSUBISHI HEAVY INDUSTRIES

- TABLE 235 MITSUBISHI HEAVY INDUSTRIES: COMPANY OVERVIEW

- TABLE 237 MITSUBISHI HEAVY INDUSTRIES: DEALS, JANUARY 2019-MAY 2024

- TABLE 238 MITSUBISHI HEAVY INDUSTRIES: EXPANSIONS, JANUARY 2019-MAY 2024

- 10.1.5 JGC HOLDINGS CORPORATION

- TABLE 241 JGC HOLDINGS CORPORATION: DEALS, JANUARY 2019-MAY 2024

- 10.1.6 SCHLUMBERGER LIMITED

- TABLE 242 SCHLUMBERGER LIMITED: COMPANY OVERVIEW

- FIGURE 50 SCHLUMBERGER LIMITED: COMPANY SNAPSHOT

- TABLE 243 SCHLUMBERGER LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 244 SCHLUMBERGER LIMITED: DEALS, JANUARY 2019-MAY 2024

- TABLE 245 SCHLUMBERGER LIMITED: EXPANSIONS, JANUARY 2019-MAY 2024

- 10.1.7 AKER SOLUTIONS

- TABLE 246 AKER SOLUTIONS: COMPANY OVERVIEW

- FIGURE 51 AKER SOLUTIONS: COMPANY SNAPSHOT

- TABLE 247 AKER SOLUTIONS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 248 AKER SOLUTIONS: DEALS, JANUARY 2019-MAY 2024

- 10.1.8 EQUINOR

- TABLE 249 EQUINOR: COMPANY OVERVIEW

- FIGURE 52 EQUINOR: COMPANY SNAPSHOT

- TABLE 250 EQUINOR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 251 EQUINOR: DEALS, JANUARY 2019-MAY 2024

- TABLE 252 EQUINOR: EXPANSIONS, JANUARY 2019-MAY 2024

- 10.1.9 HONEYWELL INTERNATIONAL

- TABLE 253 HONEYWELL INTERNATIONAL: COMPANY OVERVIEW

- FIGURE 53 HONEYWELL INTERNATIONAL: COMPANY SNAPSHOT

- TABLE 254 HONEYWELL INTERNATIONAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 255 HONEYWELL INTERNATIONAL: DEALS, JANUARY 2019-MAY 2024

- 10.1.10 TOTALENERGIES SE

- TABLE 256 TOTALENERGIES SE: COMPANY OVERVIEW

- FIGURE 54 TOTALENERGIES SE: COMPANY SNAPSHOT

- TABLE 257 TOTALENERGIES SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 258 TOTALENERGIES SE: DEALS, JANUARY 2019-MAY 2024

- 10.1.11 BASF

- TABLE 259 BASF: COMPANY OVERVIEW

- FIGURE 55 BASF: COMPANY SNAPSHOT

- TABLE 260 BASF: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 261 BASF: DEALS, JANUARY 2019-MAY 2024

- 10.1.12 HITACHI

- TABLE 262 HITACHI: COMPANY OVERVIEW

- FIGURE 56 HITACHI: COMPANY SNAPSHOT

- TABLE 263 HITACHI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 10.1.13 SIEMENS

- TABLE 264 SIEMENS: COMPANY OVERVIEW

- FIGURE 57 SIEMENS: COMPANY SNAPSHOT

- TABLE 265 SIEMENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 10.1.14 GENERAL ELECTRIC

- TABLE 266 GENERAL ELECTRIC: COMPANY OVERVIEW

- FIGURE 58 GENERAL ELECTRIC: COMPANY SNAPSHOT

- TABLE 267 GENERAL ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 10.1.15 CHEVRON CORPORATION

- TABLE 268 CHEVRON CORPORATION: COMPANY OVERVIEW

- FIGURE 59 CHEVRON CORPORATION: COMPANY SNAPSHOT

- TABLE 269 CHEVRON CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- *Business Overview, Products/Services/Solutions Offered, Recent Developments, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats might not be captured in case of unlisted companies.

- 10.2 OTHER PLAYERS

- 10.2.1 CARBON CLEAN SOLUTIONS

- TABLE 270 CARBON CLEAN SOLUTIONS: COMPANY OVERVIEW

- 10.2.2 OCCIDENTAL

- TABLE 271 OCCIDENTAL: COMPANY OVERVIEW

- 10.2.3 BABCOCK & WILCOX

- TABLE 272 BABCOCK & WILCOX: COMPANY OVERVIEW

- 10.2.4 BRITISH PETROLEUM

- TABLE 273 BRITISH PETROLEUM: COMPANY OVERVIEW

- 10.2.5 GREEN POWER INTERNATIONAL

- TABLE 274 GREEN POWER INTERNATIONAL: COMPANY OVERVIEW

- 10.2.6 WOLF MIDSTREAM

- TABLE 275 WOLF MIDSTREAM: COMPANY OVERVIEW

- 10.2.7 SONATRACH

- TABLE 276 SONATRACH: COMPANY OVERVIEW

11 APPENDIX

- 11.1 DISCUSSION GUIDE

- 11.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 11.3 CUSTOMIZATION OPTIONS

- 11.4 RELATED REPORTS

- 11.5 AUTHOR DETAILS