|

|

市場調査レポート

商品コード

1491991

ESGレポーティングソフトウェアの世界市場:オファリング別、展開タイプ別、組織規模別、業界別、地域別 - 2029年までの予測ESG Reporting Software Market by Offering (Software and Services), Deployment Type (On-premises and Cloud), Organization Size (Large Enterprises and SMEs), Vertical (BFSI and Government, Public Sector, and Non-profit), & Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| ESGレポーティングソフトウェアの世界市場:オファリング別、展開タイプ別、組織規模別、業界別、地域別 - 2029年までの予測 |

|

出版日: 2024年06月06日

発行: MarketsandMarkets

ページ情報: 英文 260 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

ESGレポーティングソフトウェアの市場規模は、2024年の9億米ドルから2029年には21億米ドルに成長すると予測され、予測期間中のCAGRは17.0%になるとみられています。

ESGレポーティングソフトウェア市場は、包括的な持続可能性指標、高度なデータ分析、リアルタイムのレポーティング機能を統合することで、BFSI、政府、公共部門・非営利団体、製造業、小売業、エネルギー、テクノロジーなど、さまざまな分野で徐々に普及しています。これらのソフトウェアソリューションは、データ収集、パフォーマンス追跡、コンプライアンス報告、利害関係者エンゲージメントなど、エンドツーエンドのESG管理を提供します。ESGレポーティングソフトウェアの採用は、業務効率の向上、規制要件への対応、サステナビリティイニシアチブの改善などを目的に、各組織で増加しています。ソリューション分野には主に、API、SDK、その他の接続技術によってサポートされるデータ統合、分析、レポーティングプラットフォームが含まれます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2019年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 検討単位 | 米ドル(10億米ドル) |

| セグメント | オファリング別、展開タイプ別、組織規模別、業界別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、中東・アフリカ、ラテンアメリカ |

サービスは、組織が持続可能性プロジェクトを管理し、報告要件を満たすための支援、ノウハウ、アドバイスを提供するため、ESG報告書作成サービスには不可欠です。

これには、サステナビリティ目標の設定、ESG戦略の策定、世界・レポーティングイニシアチブ(GRI)、カーボンディスクロージャープロジェクト(CDP)、サステナビリティ会計基準委員会(SASB)などの報告基準の導入支援が含まれます。また、サービスプロバイダーは、関連するESG指標の特定、データの収集・分析、組織のニーズや利害関係者の期待に合わせてカスタマイズしたESGレポートの作成においても組織を支援します。さらにサービスには、利害関係者の関与、重要性評価、ベンチマーキングが含まれ、同業他社やベストプラクティスと比較した組織のパフォーマンスを理解するのに役立ちます。

さらに、サービスには、組織がESGレポーティングソフトウェアを適切に活用してサステナビリティデータと報告プロセスを管理できるようにするための、ソフトウェアの導入、カスタマイズ、サポートが含まれます。これは、ソフトウェアのインストール、設定、既存システムとの統合、ユーザートレーニング、継続的な技術サポートで構成されます。サービス・プロバイダーは組織と緊密に連携し、ESGレポーティングソフトウェアを組織固有のニーズに合わせて微調整することで、持続可能性目標を達成しながら投資を最大限に活用できるようにします。サービスはESGレポーティングソフトウェアを補完するもので、組織が複雑なサステナビリティレポーティングを実施し、環境、社会、ガバナンスの責任を果たすために必要な知識、ツール、サポートを提供します。

小売・消費財分野では、ESGレポーティングソフトウェアは企業の持続可能性活動の管理と報告を支援するために不可欠です。ESGレポーティングソフトウェアは、小売・消費財企業が環境影響、社会的イニシアティブ、ガバナンス慣行などの非財務的ESGデータを収集、分析、報告するのを支援するもので、これにはエネルギー消費、廃棄物発生、サプライチェーン慣行、労働基準、多様性イニシアティブのモニタリングが含まれます。さらに、ESGレポーティングソフトウェアは、小売・消費財企業が透明性を促進し、消費者、投資家、その他の利害関係者に対する信頼を構築するのを支援します。ESGレポーティングソフトウェアは、持続可能性のモニタリングとレポーティングを行うための完全な手段を提供することで、企業が持続可能性と企業の社会的責任への献身を強調することを可能にします。これは、消費者が持続可能で責任ある行動の価値観に対応する製品やブランドにシフトすることで、ブランド・ロイヤルティ、良い評判、マーケットでの競争優位につながります。

当レポートでは、世界のESGレポーティングソフトウェア市場について調査し、オファリング別、展開タイプ別、組織規模別、業界別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と業界動向

- イントロダクション

- 市場力学

- ケーススタディ分析

- エコシステム分析

- バリューチェーン分析

- 価格分析

- 特許分析

- 技術分析

- 規制状況

- ポーターのファイブフォース分析

- 2024年~2025年の主な会議とイベント

- 顧客のビジネスに影響を与える動向/混乱

- 主な利害関係者と購入基準

- 購入基準

- ビジネスモデル分析

- 投資と資金調達のシナリオ

第6章 ESGレポーティングソフトウェア市場、オファリング別

- イントロダクション

- ソフトウェア

- サービス

第7章 ESGレポーティングソフトウェア市場、展開タイプ別

- イントロダクション

- クラウド

- オンプレミス

第8章 ESGレポーティングソフトウェア市場、組織規模別

- イントロダクション

- 中小企業

- 大企業

第9章 ESGレポーティングソフトウェア市場、業界別

- イントロダクション

- BFSI

- 政府、公共部門、非営利団体

- 製造

- 食品・飲料

- 小売・消費財

- エネルギー・ユーティリティ

- その他

第10章 ESGレポーティングソフトウェア市場、地域別

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- 中東・アフリカ

- ラテンアメリカ

第11章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 収益分析

- 市場シェア分析

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2023年

- 企業価値評価と財務指標

- 競合シナリオと動向

第12章 企業プロファイル

- 主要参入企業

- WOLTERS KLUWER

- NASDAQ

- PWC

- WORKIVA

- LSEG

- GREENSTONE

- DILIGENT

- SPHERA

- CORITY

- INTELEX

- その他の企業

- NOVISTO

- EMEX

- IBM

- ANTHESIS

- DIGINEX

- BAIN & COMPANY

- KERAMIDA INC. INC.

- ISOMETRIX

- VERVANTIS

- ACCUVIO

- スタートアップ/中小企業

- ESG FLO

- MEASURABL

- PLAN A

- SUSTAINLAB

- ESGGO

第13章 隣接/関連市場

第14章 付録

The ESG reporting software market is expected to grow from USD 0.9 billion in 2024 to USD 2.1 billion by 2029, at a CAGR of 17.0% during the forecast period. The ESG reporting software market has gradually gained traction across various sectors, including BFSI, government, public sector & non-profit, manufacturing, retail, energy, and technology, by integrating comprehensive sustainability metrics, advanced data analytics, and real-time reporting capabilities. These software solutions offer end-to-end ESG management, including data collection, performance tracking, compliance reporting, and stakeholder engagement. Organizations are increasingly adopting ESG reporting software to enhance operational efficiency, meet regulatory requirements, and improve sustainability initiatives. The solutions segment primarily includes data integration, analytics, and reporting platforms supported by APIs, SDKs, and other connected technologies.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | USD (Billion) |

| Segments | Offering, Deployment Type, Organization Size, and Vertical |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

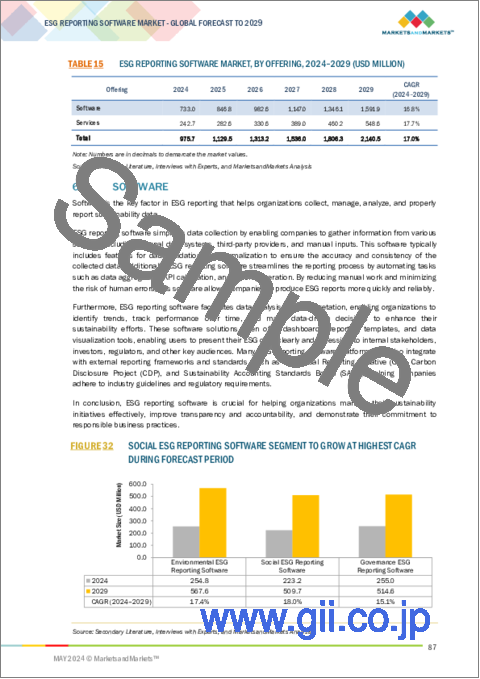

"As per the offering, services will grow at the highest CAGR during the forecast period. "

Services are indispensable in ESG reporting offerings, as they give organizations assistance, know-how, and advice to manage their sustainability projects and meet the reporting requirements.

On the one hand, services assist organizations in dealing with the complexities of ESG reporting through consulting, training, and advisory services; this includes support with the establishment of sustainability goals, creation of ESG strategies, and implementation of reporting standards such as the Global Reporting Initiative (GRI), Carbon Disclosure Project (CDP), and Sustainability Accounting Standards Board (SASB). Service providers also assist organizations in identifying relevant ESG metrics, collecting and analyzing the data, and preparing ESG reports customized to the organization's needs and stakeholder expectations. Furthermore, services could include stakeholder engagement, materiality assessments, and benchmarking that helps organizations understand their performance compared to the industry peers and best practices.

Additionally, services involve software implementation, customization, and support to ensure that organizations can adequately utilize ESG reporting software to control their sustainability data and reporting processes; this consists of software installation, configuration, and integration with existing systems, user training, and continuous technical support. Service providers collaborate closely with organizations to fine-tune the ESG reporting software to their specific needs, ensuring they get the best out of their investment while meeting their sustainability targets. The services complement ESG reporting software as they provide organizations with the knowledge, tools, and support they need to go through the complexities of sustainability reporting and show their dedication to environmental, social, and governance responsibility.

"As per verticals, the retail & consumer goods segment will grow at the highest CAGR during the forecast period. "

Within retail & consumer goods, the ESG reporting software is vital to help firms manage and report their sustainability activities. ESG reporting software helps retail & consumer goods companies collect, analyze, and report non-financial ESG data, including environmental impact, social initiatives, and governance practices; this involves monitoring energy consumption, waste generation, supply chain practices, labor standards, and diversity initiatives. In addition, ESG reporting software assists retail & consumer goods companies promote transparency and build trust toward consumers, investors, and other stakeholders. By providing a complete set of instruments to handle sustainability monitoring and reporting, ESG reporting software makes it possible for companies to highlight their devotion to sustainability and corporate social responsibility; this can result in brand loyalty, good reputation, and competitive advantage in the marketplace, as consumers shift to the products and brands that correspond with their sustainable and responsible behavior values.

Based on region, the European region will hold the second-largest market size during the forecast period.

The European market has very diverse business needs. Its achievements in science and technology have been significant. Moreover, R&D is an integral part of the European economy. Robust economic infrastructure and high internet penetration make Europe one of the top markets for cloud-based services. The major countries in the region's analysis are the UK, Italy, and Germany. The established internet and robust economic infrastructure with business demand for ESG solutions make Europe one of the top three markets and the second largest in the ESG reporting software market. The major countries considered in this report for analysis are the UK, Germany, Italy, and others. The UK and Germany have the highest potential for the ESG reporting software market among all other countries. Business demands in the European market are diverse and reasonably similar to those in North America. Enterprises in this region have strong technical expertise and bigger IT budgets. Major players, such as Microsoft, Oracle, IBM, and OVH, have established cloud partnerships with European vendors to cater to customers' growing demands and increase the customer base. The region is an early adopter of advanced technology due to the solid technical expertise and better IT budget of enterprises. Factors such as data security and data sovereignty compel enterprises in this region to adopt ESG reporting software solutions.

The breakup of the profiles of the primary participants is below:

- By Company: Tier I: 40%, Tier II: 30%, and Tier III: 30%

- By Designation: C-Level Executives: 25%, Director Level: 45%, and Others: 30%

- By Region: North America: 40%, Europe: 25%, Asia Pacific: 20%, Rest of World: 15%

Note: Tier 1 companies have more than USD 10 billion, tier 2 companies' revenue ranges between USD 1 and 10 billion, and tier 3 companies' revenue ranges between USD 500 million and 1 billion. Other designations include sales managers, marketing managers, and product managers.

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

Some of the significant vendors offering ESG reporting software solutions across the globe include.

Wolters Kluwer (Netherlands), Nasdaq(US), PWC(UK), Workiva(US), LSEG(UK), Greenstone(UK), Diligent(US), Sphera(US), Cority(Canada), and Intelex(Canada)

Research coverage:

The market study covers the ESG reporting software market across segments. It aims to estimate the market size and the growth potential of this market across different market segments, such as offering, deployment type, organization size, vertical, and region. It includes an in-depth competitive analysis of the key players in the market, their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Reasons to buy this report:

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall ESG reporting software market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (ESG reporting software facilitates proactive risk management strategies by allowing companies to set thresholds, benchmarks, and targets related to ESG performance metrics), opportunities (ESG reporting software could be integrated with various enterprise systems, such as ERP, CRM, and HCM platforms, to consolidate data and streamline reporting processes), and challenges (the rise in the broadened scope of corporate board responsibilities also requires sincere focus and timeline commitment from board members to meet their legal duties).

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the ESG reporting software market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the ESG reporting software market across varied regions.

- Market Diversification: Exhaustive information about new products and services, untapped geographies, recent developments, and investments in the ESG reporting software market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and business processes offered in the ESG reporting software market of leading players like Wolters Kluwer (Netherlands), Nasdaq(US), PWC(UK), Workiva(US), LSEG(UK), among others in the ESG reporting software market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES, 2019-2023

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

- 1.7.1 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 ESG REPORTING SOFTWARE MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primary interviews

- 2.1.2.2 Key insights from industry experts

- 2.2 DATA TRIANGULATION

- FIGURE 2 ESG REPORTING SOFTWARE MARKET: DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- FIGURE 3 ESG REPORTING SOFTWARE MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- 2.3.1 TOP-DOWN APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 6 ESG REPORTING SOFTWARE MARKET: RESEARCH FLOW

- 2.3.3 MARKET ESTIMATION APPROACHES

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH FROM SUPPLY SIDE - COLLECTIVE REVENUE OF VENDORS

- FIGURE 9 BOTTOM-UP APPROACH FROM SUPPLY SIDE: COLLECTIVE REVENUE OF VENDORS

- FIGURE 10 DEMAND-SIDE APPROACH: ESG REPORTING SOFTWARE MARKET

- 2.4 MARKET FORECAST

- TABLE 2 FACTOR ANALYSIS

- 2.5 RECESSION IMPACT ON ESG REPORTING SOFTWARE MARKET

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- FIGURE 11 ESG REPORTING SOFTWARE MANAGEMENT MARKET SNAPSHOT, 2021-2029

- FIGURE 12 TOP MARKET SEGMENTS IN TERMS OF GROWTH RATE

- FIGURE 13 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR PLAYERS IN ESG REPORTING SOFTWARE MARKET

- FIGURE 14 RISING REGULATORY PRESSURES ACROSS VERTICALS AND INVESTOR DEMAND TO PROPEL ESG REPORTING SOFTWARE MARKET GROWTH

- 4.2 ESG REPORTING SOFTWARE MARKET, BY OFFERING, 2024 VS. 2029

- FIGURE 15 SOFTWARE SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- 4.3 ESG REPORTING SOFTWARE MARKET, BY SOFTWARE TYPE, 2024 VS. 2029

- FIGURE 16 ENVIRONMENTAL ESG REPORTING SOFTWARE SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2029

- 4.4 ESG REPORTING SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2024 VS. 2029

- FIGURE 17 ON-PREMISES SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- 4.5 ESG REPORTING SOFTWARE MARKET, BY ORGANIZATION SIZE, 2024 VS. 2029

- FIGURE 18 LARGE ENTERPRISES SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- 4.6 ESG REPORTING SOFTWARE MARKET, BY VERTICAL, 2024 VS. 2029

- FIGURE 19 BFSI SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- 4.7 ESG REPORTING SOFTWARE MARKET, BY REGION, 2024 VS. 2029

- FIGURE 20 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENTS IN NEXT FIVE YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 21 ESG REPORTING SOFTWARE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Consistent growth in corporate data volume

- 5.2.1.2 Proliferation in growth of credible corporate disclosures

- 5.2.1.3 Emphasis on automated data collection, reporting, and reduced manual efforts

- 5.2.1.4 Growing demand for navigating and mitigating ESG risks

- 5.2.2 RESTRAINTS

- 5.2.2.1 Huge initial capital expenditure

- 5.2.2.2 Regulatory uncertainty hindering adoption and expansion of ESG reporting software

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Climate testing to gain traction among financial service organizations

- 5.2.3.2 Assessment of natural capital and biodiversity risks to grow significantly

- 5.2.3.3 Enhancing sustainability through integration with enterprise systems

- 5.2.4 CHALLENGES

- 5.2.4.1 Inadequate management practices and lack of skilled workforce

- 5.2.4.2 Rising pressure on corporate boards and government leaders to enhance ESG skills

- 5.3 CASE STUDY ANALYSIS

- 5.3.1 MOSAIC COMPANY REDUCED EMISSIONS AND ADAPTED TO CHANGING REGULATORY ENVIRONMENTS WITH PWC

- 5.3.2 SOUTHWEST AIRLINES STREAMLINED INTERNAL AND EXTERNAL REPORTING BY DEPLOYING WORKIVA'S SOLUTIONS

- 5.3.3 DAVINES GROUP IMPROVED DATA ACCURACY AND REPORTING WITH GREENSTONE'S ESG SOFTWARE

- 5.3.4 MELBOURNE WATER STREAMLINED SUSTAINABILITY REPORTING TO CREATE SINGLE SYSTEM OF RECORD FOR ENERGY USE AND ESG PERFORMANCE WITH IBM'S ENVIZI SUITE

- 5.3.5 NORTHROP GRUMMAN MAXIMIZED EFFICIENCY WITH IMPROVED DATA MANAGEMENT BY DEPLOYING SPHERA'S SOLUTION

- 5.4 ECOSYSTEM ANALYSIS

- TABLE 3 ESG REPORTING SOFTWARE MARKET: ECOSYSTEM

- FIGURE 22 KEY PLAYERS IN ESG REPORTING SOFTWARE MARKET ECOSYSTEM

- 5.5 VALUE CHAIN ANALYSIS

- FIGURE 23 ESG REPORTING SOFTWARE MARKET: VALUE CHAIN ANALYSIS

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY SOFTWARE

- TABLE 4 INDICATIVE PRICING ANALYSIS OF ESG REPORTING SOFTWARE MARKET, BY SOFTWARE

- 5.6.2 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY ORGANIZATION SIZE

- 5.7 PATENT ANALYSIS

- FIGURE 24 NUMBER OF PATENTS PUBLISHED, 2013-2023

- FIGURE 25 NUMBER OF PATENTS GRANTED FOR ESG REPORTING SOFTWARE MARKET (GLOBAL) IN 2023

- TABLE 5 TOP 10 PATENT OWNERS IN LAST 10 YEARS

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Cloud computing

- 5.8.1.2 Data analytics and business intelligence tools

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 IoT

- 5.8.2.2 Cybersecurity

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 AI/ML

- 5.8.3.2 Blockchain

- 5.8.1 KEY TECHNOLOGIES

- 5.9 REGULATORY LANDSCAPE

- 5.9.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.9.2 REGULATIONS, BY REGION

- 5.9.2.1 North America

- 5.9.2.2 Europe

- 5.9.2.3 Asia Pacific

- 5.9.2.4 Middle East & South Africa

- 5.9.2.5 Latin America

- 5.9.3 REGULATORY IMPLICATIONS AND INDUSTRY STANDARDS

- 5.9.3.1 General Data Protection Regulation (GDPR)

- 5.9.3.2 SEC Rule 17a-4

- 5.9.3.3 ISO/IEC 27001

- 5.9.3.4 System and Organization Controls (SOC) 2 type II compliance

- 5.9.3.5 Financial Industry Regulatory Authority (FINRA)

- 5.9.3.6 Freedom of Information Act (FOIA)

- 5.9.3.7 Health Insurance Portability and Accountability Act (HIPAA)

- 5.10 PORTER'S FIVE FORCES ANALYSIS

- TABLE 10 PORTER'S FIVE FORCES' IMPACT ON ESG REPORTING SOFTWARE MARKET

- FIGURE 26 PORTER'S FIVE FORCES ANALYSIS: ESG REPORTING SOFTWARE MARKET

- 5.10.1 THREAT OF NEW ENTRANTS

- 5.10.2 THREAT OF SUBSTITUTES

- 5.10.3 BARGAINING POWER OF SUPPLIERS

- 5.10.4 BARGAINING POWER OF BUYERS

- 5.10.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.11 KEY CONFERENCES AND EVENTS, 2024-2025

- TABLE 11 ESG REPORTING SOFTWARE MARKET: KEY CONFERENCES AND EVENTS, 2024-2025

- 5.12 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 27 ESG REPORTING SOFTWARE MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- TABLE 12 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- 5.14 BUYING CRITERIA

- FIGURE 29 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 13 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- 5.15 BUSINESS MODEL ANALYSIS

- 5.15.1 SUBSCRIPTION-BASED MODEL

- 5.15.2 PAY-PER-USE MODEL

- 5.15.3 ENTERPRISE LICENSING MODEL

- 5.15.4 FREEMIUM MODEL

- 5.15.5 ENTERPRISE LICENSING MODEL

- 5.16 INVESTMENT & FUNDING SCENARIO

- FIGURE 30 LEADING GLOBAL ESG REPORTING SOFTWARE MARKET VENDORS BY NUMBER OF INVESTORS AND FUNDING ROUNDS, 2023

6 ESG REPORTING SOFTWARE MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.1.1 OFFERINGS: ESG REPORTING SOFTWARE MARKET DRIVERS

- FIGURE 31 SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- TABLE 14 ESG REPORTING SOFTWARE MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 15 ESG REPORTING SOFTWARE MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- 6.2 SOFTWARE

- FIGURE 32 SOCIAL ESG REPORTING SOFTWARE SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 16 ESG REPORTING SOFTWARE MARKET, BY SOFTWARE, 2019-2023 (USD MILLION)

- TABLE 17 ESG REPORTING SOFTWARE MARKET, BY SOFTWARE, 2024-2029 (USD MILLION)

- TABLE 18 SOFTWARE: ESG REPORTING SOFTWARE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 19 SOFTWARE: ESG REPORTING SOFTWARE MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.2.1 SOFTWARE TYPES: ESG REPORTING SOFTWARE MARKET

- 6.2.2 ENVIRONMENTAL ESG REPORTING SOFTWARE

- 6.2.2.1 Environmental ESG reporting software to help organizations calculate KPIs and generate comprehensive reports

- TABLE 20 ENVIRONMENTAL ESG REPORTING SOFTWARE: ESG REPORTING SOFTWARE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 21 ENVIRONMENTAL ESG REPORTING SOFTWARE: ESG REPORTING SOFTWARE MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.2.2.2 Carbon emission tracking software

- 6.2.2.2.1 Emission inventory management

- 6.2.2.2.2 Carbon footprint calculation

- 6.2.2.2.3 Emission reduction goal tracking

- 6.2.2.3 Energy consumption monitoring software

- 6.2.2.3.1 Energy usage tracking

- 6.2.2.3.2 Demand-side management

- 6.2.2.3.3 Energy conservation measures tracking

- 6.2.2.4 Sustainability performance management software

- 6.2.2.4.1 Water usage tracking

- 6.2.2.4.2 Waste management and recycling

- 6.2.2.4.3 Biodiversity conservation efforts

- 6.2.2.5 Climate risk assessment software

- 6.2.2.5.1 Physical risk assessment

- 6.2.2.5.2 Transition risk analysis

- 6.2.2.5.3 Resilience planning and adaptation strategies

- 6.2.2.6 Environmental Impact Assessment (EIA) software

- 6.2.2.6.1 Project-specific impact assessment

- 6.2.2.6.2 Regulatory compliance evaluations

- 6.2.2.6.3 Mitigation measures planning and monitoring

- 6.2.2.2 Carbon emission tracking software

- 6.2.3 SOCIAL ESG REPORTING SOFTWARE

- 6.2.3.1 Social ESG reporting software to help organizations control their social impact, spot weak points, and contribute to CSR

- TABLE 22 SOCIAL ESG REPORTING SOFTWARE: ESG REPORTING SOFTWARE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 23 SOCIAL ESG REPORTING SOFTWARE: ESG REPORTING SOFTWARE MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.2.3.2 Diversity metrics tracking software

- 6.2.3.2.1 Gender diversity

- 6.2.3.2.2 Ethnic diversity

- 6.2.3.2.3 LGBTQ+ representation

- 6.2.3.2.4 Accessibility initiatives

- 6.2.3.3 Labor practices reporting software

- 6.2.3.3.1 Labor rights compliance monitoring

- 6.2.3.3.2 Workplace safety programs

- 6.2.3.3.3 Employee engagement surveys

- 6.2.3.4 Community engagement tracking software

- 6.2.3.4.1 Community investment tracking

- 6.2.3.4.2 Stakeholder consultation platforms

- 6.2.3.4.3 SLO management

- 6.2.3.5 Human rights assessment software

- 6.2.3.5.1 Supply chain human rights audits

- 6.2.3.5.2 Human Rights Impact Assessments (HRIAs)

- 6.2.3.5.3 Human trafficking and modern slavery risk assessment

- 6.2.3.6 Social Impact Assessment (SIA) software

- 6.2.3.6.1 Social Return on Investment (SRoI) analysis audits

- 6.2.3.6.2 Community development indicators tracking

- 6.2.3.6.3 Poverty alleviation program evaluation

- 6.2.3.2 Diversity metrics tracking software

- 6.2.4 GOVERNANCE ESG REPORTING SOFTWARE

- 6.2.4.1 Governance ESG reporting software organizations to simplify data collection by collecting information from various sources

- TABLE 24 GOVERNANCE ESG REPORTING SOFTWARE: ESG REPORTING SOFTWARE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 25 GOVERNANCE ESG REPORTING SOFTWARE: ESG REPORTING SOFTWARE MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.2.4.2 Corporate governance reporting software

- 6.2.4.2.1 Board of directors management

- 6.2.4.2.2 Governance structure documentation

- 6.2.4.2.3 Shareholder engagement tools

- 6.2.4.3 Ethics and compliance management software

- 6.2.4.3.1 Code of conduct enforcement

- 6.2.4.3.2 Whistleblower hotline management

- 6.2.4.3.3 Compliance training and certification tracking

- 6.2.4.4 Risk management software

- 6.2.4.4.1 Enterprise Risk Management (ERM)

- 6.2.4.4.2 Internal control assessments

- 6.2.4.4.3 Risk heat maps and dashboards

- 6.2.4.5 Regulatory compliance tracking software

- 6.2.4.5.1 Regulatory change management

- 6.2.4.5.2 Compliance calendar and deadline tracking

- 6.2.4.5.3 Audit trail documentation

- 6.2.4.6 Internal audit software

- 6.2.4.6.1 Audit planning and scheduling

- 6.2.4.6.2 Audit findings management

- 6.2.4.6.3 Audit report generation and distribution

- 6.2.4.2 Corporate governance reporting software

- 6.3 SERVICES

- TABLE 26 SERVICES: ESG REPORTING SOFTWARE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 27 SERVICES: ESG REPORTING SOFTWARE MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.3.1 CONSULTING

- 6.3.1.1 Consulting services to assess materiality of ESG issues, identify relevant reporting frameworks, and establish KPIs to measure performance

- 6.3.2 INTEGRATION & DEPLOYMENT

- 6.3.2.1 Integration & deployment services to help in seamless integration of ESG reporting software with organization's existing systems

- 6.3.3 SUPPORT & MAINTENANCE

- 6.3.3.1 Support & maintenance services to ensure smooth operation and effectiveness of ESG reporting software

7 ESG REPORTING SOFTWARE MARKET, BY DEPLOYMENT TYPE

- 7.1 INTRODUCTION

- FIGURE 33 CLOUD SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- 7.1.1 DEPLOYMENT TYPES: ESG REPORTING SOFTWARE MARKET DRIVERS

- TABLE 28 ESG REPORTING SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2019-2023 (USD MILLION)

- TABLE 29 ESG REPORTING SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2024-2029 (USD MILLION)

- 7.2 CLOUD

- 7.2.1 COST-EFFECTIVENESS, EASY ACCESS, AND SCALABILITY TO BOOST DEMAND FOR CLOUD-BASED ESG SOLUTIONS

- TABLE 30 CLOUD: ESG REPORTING SOFTWARE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 31 CLOUD: ESG REPORTING SOFTWARE MARKET, BY REGION, 2024-2029 (USD MILLION)

- 7.3 ON-PREMISES

- 7.3.1 RISING FOCUS ON SECURITY AND COMPLIANCE TO FUEL DEMAND FOR ON-PREMISES ESG REPORTING SOFTWARE

- TABLE 32 ON-PREMISES: ESG REPORTING SOFTWARE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 33 ON-PREMISES: ESG REPORTING SOFTWARE MARKET, BY REGION, 2024-2029 (USD MILLION)

8 ESG REPORTING SOFTWARE MARKET, BY ORGANIZATION SIZE

- 8.1 INTRODUCTION

- FIGURE 34 SMES SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- 8.1.1 ORGANIZATION SIZES: ESG REPORTING SOFTWARE MARKET DRIVERS

- TABLE 34 ESG REPORTING SOFTWARE MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 35 ESG REPORTING SOFTWARE MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- 8.2 SMALL AND MEDIUM-SIZED ENTERPRISES

- 8.2.1 ESG REPORTING SOFTWARE TO OFFER CENTRALIZED DATA COLLECTION, ANALYSIS, AND REPORTING PLATFORM FOR SUSTAINABILITY DATA

- TABLE 36 SMALL AND MEDIUM-SIZED ENTERPRISES: ESG REPORTING SOFTWARE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 37 SMALL AND MEDIUM-SIZED ENTERPRISES: ESG REPORTING SOFTWARE MARKET, BY REGION, 2024-2029 (USD MILLION)

- 8.3 LARGE ENTERPRISES

- 8.3.1 ESG REPORTING SOFTWARE TO HELP LARGE-SCALE COMPANIES ENHANCE REPUTATION, MINIMIZE RISKS, AND REINFORCE THEIR COMPETITIVE EDGE FOR MANAGING RISKS

- TABLE 38 LARGE ENTERPRISES: ESG REPORTING SOFTWARE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 39 LARGE ENTERPRISES: ESG REPORTING SOFTWARE MARKET, BY REGION, 2024-2029 (USD MILLION)

9 ESG REPORTING SOFTWARE MARKET, BY VERTICAL

- 9.1 INTRODUCTION

- FIGURE 35 BFSI SEGMENT TO ACCOUNT FOR LARGEST MARKET DURING FORECAST PERIOD

- 9.1.1 VERTICALS: ESG REPORTING SOFTWARE MARKET DRIVERS

- TABLE 40 ESG REPORTING SOFTWARE MARKET, BY VERTICAL, 2019-2023 (USD MILLION)

- TABLE 41 ESG REPORTING SOFTWARE MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- 9.2 BFSI

- 9.2.1 NEED FOR CAPITAL INVESTMENT AND FINANCIAL SUPPORT TO SPUR DEMAND FOR ESG REPORTING SOFTWARE IN BFSI

- 9.2.2 BFSI: APPLICATION AREAS

- 9.2.2.1 Risk management & compliance

- 9.2.2.2 Investment analysis & decision making

- 9.2.2.3 Stakeholder engagement & transparency

- 9.2.2.4 Credit risk management

- 9.2.2.5 Other BFSI application areas

- TABLE 42 BFSI: ESG REPORTING SOFTWARE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 43 BFSI: ESG REPORTING SOFTWARE MARKET, BY REGION, 2024-2029 (USD MILLION)

- 9.3 GOVERNMENT, PUBLIC SECTOR, AND NON-PROFIT

- 9.3.1 NEED FOR REGULATORY COMPLIANCE & REPORTING, POLICY DEVELOPMENT, AND IMPLEMENTATION TO PROPEL MARKET

- 9.3.2 GOVERNMENT, PUBLIC SECTOR, AND NON-PROFIT: APPLICATION AREAS

- 9.3.2.1 Policy development & implementation

- 9.3.2.2 Regulatory compliance & reporting

- 9.3.2.3 Public service delivery optimization

- 9.3.2.4 Other government, public sector, and non-profit application areas

- TABLE 44 GOVERNMENT, PUBLIC SECTOR, AND NON-PROFIT: ESG REPORTING SOFTWARE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 45 GOVERNMENT, PUBLIC SECTOR, AND NON-PROFIT: ESG REPORTING SOFTWARE MARKET, BY REGION, 2024-2029 (USD MILLION)

- 9.4 MANUFACTURING

- 9.4.1 NEED TO CONTROL HIGH CARBON EMISSIONS AND WATER SCARCITY TO ACCELERATE MARKET GROWTH

- 9.4.2 MANUFACTURING: APPLICATION AREAS

- 9.4.2.1 Environmental impact assessment & management

- 9.4.2.2 Supply chain sustainability

- 9.4.2.3 Energy efficiency & resource management

- 9.4.2.4 Compliance & regulatory reporting

- 9.4.2.5 Product lifecycle assessment

- 9.4.2.6 Risk identification & mitigation

- TABLE 46 MANUFACTURING: ESG REPORTING SOFTWARE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 47 MANUFACTURING: ESG REPORTING SOFTWARE MARKET, BY REGION, 2024-2029 (USD MILLION)

- 9.5 FOOD & BEVERAGES

- 9.5.1 ESG REPORTING SOFTWARE TO CREATE SUPPLY CHAIN TRANSPARENCY AND MANAGE WASTE AND CARBON EMISSION

- 9.5.2 FOOD & BEVERAGES: APPLICATION AREAS

- 9.5.2.1 Supply chain transparency & visibility

- 9.5.2.2 Carbon & energy management

- 9.5.2.3 Waste management & conservation

- 9.5.2.4 Social responsibility & labor practices

- TABLE 48 FOOD & BEVERAGES: ESG REPORTING SOFTWARE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 49 FOOD & BEVERAGES: ESG REPORTING SOFTWARE MARKET, BY REGION, 2024-2029 (USD MILLION)

- 9.6 RETAIL & CONSUMER GOODS

- 9.6.1 ESG REPORTING SOFTWARE TO MONITOR ENERGY CONSUMPTION, WASTE GENERATION, SUPPLY CHAIN PRACTICES, LABOR STANDARDS, AND DIVERSITY INITIATIVES

- 9.6.2 RETAIL & CONSUMER GOODS: APPLICATION AREAS

- 9.6.2.1 Supply chain transparency & sustainability

- 9.6.2.2 Energy & resource management

- 9.6.2.3 Corporate governance & ethics

- 9.6.2.4 Stakeholder communication & transparency

- TABLE 50 RETAIL & CONSUMER GOODS: ESG REPORTING SOFTWARE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 51 RETAIL & CONSUMER GOODS: ESG REPORTING SOFTWARE MARKET, BY REGION, 2024-2029 (USD MILLION)

- 9.7 ENERGY & UTILITIES

- 9.7.1 NEED FOR RENEWABLE ENERGY INTEGRATION & TRANSITION, CARBON FOOTPRINT MONITORING, AND RESOURCE CONSERVATION TO DRIVE MARKET

- 9.7.2 ENERGY & UTILITIES: APPLICATION AREAS

- 9.7.2.1 Carbon footprint monitoring & reduction

- 9.7.2.2 Renewable energy integration & transition

- 9.7.2.3 Resource efficiency & conservation

- 9.7.2.4 Other energy & utilities application areas

- TABLE 52 ENERGY & UTILITIES: ESG REPORTING SOFTWARE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 53 ENERGY & UTILITIES: ESG REPORTING SOFTWARE MARKET, BY REGION, 2024-2029 (USD MILLION)

- 9.8 OTHER VERTICALS

- TABLE 54 OTHER VERTICALS: ESG REPORTING SOFTWARE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 55 OTHER VERTICALS: ESG REPORTING SOFTWARE MARKET, BY REGION, 2024-2029 (USD MILLION)

10 ESG REPORTING SOFTWARE MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 36 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET BY 2029

- TABLE 56 ESG REPORTING SOFTWARE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 57 ESG REPORTING SOFTWARE MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.2 NORTH AMERICA

- 10.2.1 NORTH AMERICA: ESG REPORTING SOFTWARE MARKET DRIVERS

- 10.2.2 NORTH AMERICA: RECESSION IMPACT

- FIGURE 37 NORTH AMERICA: MARKET SNAPSHOT

- TABLE 58 NORTH AMERICA: ESG REPORTING SOFTWARE MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 59 NORTH AMERICA: ESG REPORTING SOFTWARE MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 60 NORTH AMERICA: ESG REPORTING SOFTWARE MARKET, BY SOFTWARE, 2019-2023 (USD MILLION)

- TABLE 61 NORTH AMERICA: ESG REPORTING SOFTWARE MARKET, BY SOFTWARE, 2024-2029 (USD MILLION)

- TABLE 62 NORTH AMERICA: ESG REPORTING SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2019-2023 (USD MILLION)

- TABLE 63 NORTH AMERICA: ESG REPORTING SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2024-2029 (USD MILLION)

- TABLE 64 NORTH AMERICA: ESG REPORTING SOFTWARE MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 65 NORTH AMERICA: ESG REPORTING SOFTWARE MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 66 NORTH AMERICA: ESG REPORTING SOFTWARE MARKET, BY VERTICAL, 2019-2023 (USD MILLION)

- TABLE 67 NORTH AMERICA: ESG REPORTING SOFTWARE MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 68 NORTH AMERICA: ESG REPORTING SOFTWARE MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 69 NORTH AMERICA: ESG REPORTING SOFTWARE MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 10.2.3 US

- 10.2.3.1 Need to monitor, manage, and report eco-friendly projects and sustainability outcome to fuel demand for ESG reporting software

- TABLE 70 US: ESG REPORTING SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2019-2023 (USD MILLION)

- TABLE 71 US: ESG REPORTING SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2024-2029 (USD MILLION)

- TABLE 72 US: ESG REPORTING SOFTWARE MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 73 US: ESG REPORTING SOFTWARE MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- 10.2.4 CANADA

- 10.2.4.1 Government initiatives for cloud adoption and stable economy and rising adoption of sustainability to drive market

- TABLE 74 CANADA: ESG REPORTING SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2019-2023 (USD MILLION)

- TABLE 75 CANADA: ESG REPORTING SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2024-2029 (USD MILLION)

- TABLE 76 CANADA: ESG REPORTING SOFTWARE MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 77 CANADA: ESG REPORTING SOFTWARE MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- 10.3 EUROPE

- 10.3.1 EUROPE: ESG REPORTING SOFTWARE MARKET DRIVERS

- 10.3.2 EUROPE: RECESSION IMPACT

- TABLE 78 EUROPE: ESG REPORTING SOFTWARE MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 79 EUROPE: ESG REPORTING SOFTWARE MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 80 EUROPE: ESG REPORTING SOFTWARE MARKET, BY SOFTWARE, 2019-2023 (USD MILLION)

- TABLE 81 EUROPE: ESG REPORTING SOFTWARE MARKET, BY SOFTWARE, 2024-2029 (USD MILLION)

- TABLE 82 EUROPE: ESG REPORTING SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2019-2023 (USD MILLION)

- TABLE 83 EUROPE: ESG REPORTING SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2024-2029 (USD MILLION)

- TABLE 84 EUROPE: ESG REPORTING SOFTWARE MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 85 EUROPE: ESG REPORTING SOFTWARE MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 86 EUROPE: ESG REPORTING SOFTWARE MARKET, BY VERTICAL, 2019-2023 (USD MILLION)

- TABLE 87 EUROPE: ESG REPORTING SOFTWARE MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 88 EUROPE: ESG REPORTING SOFTWARE MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 89 EUROPE: ESG REPORTING SOFTWARE MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 10.3.3 UK

- 10.3.3.1 Increased operational efficiency and rising focus on importance of sustainability to boost demand for ESG reporting software

- TABLE 90 UK: ESG REPORTING SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2019-2023 (USD MILLION)

- TABLE 91 UK: ESG REPORTING SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2024-2029 (USD MILLION)

- TABLE 92 UK: ESG REPORTING SOFTWARE MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 93 UK: ESG REPORTING SOFTWARE MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- 10.3.4 GERMANY

- 10.3.4.1 Rising Internet use, rapid implementation of new technologies, and increasing adoption of digitalization to propel market

- TABLE 94 GERMANY: ESG REPORTING SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2019-2023 (USD MILLION)

- TABLE 95 GERMANY: ESG REPORTING SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2024-2029 (USD MILLION)

- TABLE 96 GERMANY: ESG REPORTING SOFTWARE MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 97 GERMANY: ESG REPORTING SOFTWARE MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- 10.3.5 ITALY

- 10.3.5.1 Increasing reporting regulations and rising demand for ESG disclosures to spur market growth

- TABLE 98 ITALY: ESG REPORTING SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2019-2023 (USD MILLION)

- TABLE 99 ITALY: ESG REPORTING SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2024-2029 (USD MILLION)

- TABLE 100 ITALY: ESG REPORTING SOFTWARE MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 101 ITALY: ESG REPORTING SOFTWARE MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- 10.3.6 REST OF EUROPE

- TABLE 102 REST OF EUROPE: ESG REPORTING SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2019-2023 (USD MILLION)

- TABLE 103 REST OF EUROPE: ESG REPORTING SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2024-2029 (USD MILLION)

- TABLE 104 REST OF EUROPE: ESG REPORTING SOFTWARE MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 105 REST OF EUROPE: ESG REPORTING SOFTWARE MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- 10.4 ASIA PACIFIC

- 10.4.1 ASIA PACIFIC: ESG REPORTING SOFTWARE MARKET DRIVERS

- 10.4.2 ASIA PACIFIC: RECESSION IMPACT

- FIGURE 38 ASIA PACIFIC: MARKET SNAPSHOT

- TABLE 106 ASIA PACIFIC: ESG REPORTING SOFTWARE MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 107 ASIA PACIFIC: ESG REPORTING SOFTWARE MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 108 ASIA PACIFIC: ESG REPORTING SOFTWARE MARKET, BY SOFTWARE, 2019-2023 (USD MILLION)

- TABLE 109 ASIA PACIFIC: ESG REPORTING SOFTWARE MARKET, BY SOFTWARE, 2024-2029 (USD MILLION)

- TABLE 110 ASIA PACIFIC: ESG REPORTING SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2019-2023 (USD MILLION)

- TABLE 111 ASIA PACIFIC: ESG REPORTING SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2024-2029 (USD MILLION)

- TABLE 112 ASIA PACIFIC: ESG REPORTING SOFTWARE MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 113 ASIA PACIFIC: ESG REPORTING SOFTWARE MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 114 ASIA PACIFIC: ESG REPORTING SOFTWARE MARKET, BY VERTICAL, 2019-2023 (USD MILLION)

- TABLE 115 ASIA PACIFIC: ESG REPORTING SOFTWARE MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 116 ASIA PACIFIC: ESG REPORTING SOFTWARE MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 117 ASIA PACIFIC: ESG REPORTING SOFTWARE MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 10.4.3 CHINA

- 10.4.3.1 Focus on corporate social responsibility and sustainable business practices and increased adoption of new technologies to foster market

- TABLE 118 CHINA: ESG REPORTING SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2019-2023 (USD MILLION)

- TABLE 119 CHINA: ESG REPORTING SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2024-2029 (USD MILLION)

- TABLE 120 CHINA: ESG REPORTING SOFTWARE MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 121 CHINA: ESG REPORTING SOFTWARE MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- 10.4.4 JAPAN

- 10.4.4.1 Enterprises' shift toward digital transformation and focus on streamlining business process to drive market

- TABLE 122 JAPAN: ESG REPORTING SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2019-2023 (USD MILLION)

- TABLE 123 JAPAN: ESG REPORTING SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2024-2029 (USD MILLION)

- TABLE 124 JAPAN: ESG REPORTING SOFTWARE MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 125 JAPAN: ESG REPORTING SOFTWARE MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- 10.4.5 REST OF ASIA PACIFIC

- TABLE 126 REST OF ASIA PACIFIC: ESG REPORTING SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2019-2023 (USD MILLION)

- TABLE 127 REST OF ASIA PACIFIC: ESG REPORTING SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2024-2029 (USD MILLION)

- TABLE 128 REST OF ASIA PACIFIC: ESG REPORTING SOFTWARE MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 129 REST OF ASIA PACIFIC: ESG REPORTING SOFTWARE MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 MIDDLE EAST & AFRICA: ESG REPORTING SOFTWARE MARKET DRIVERS

- 10.5.2 MIDDLE EAST & AFRICA: RECESSION IMPACT

- TABLE 130 MIDDLE EAST & AFRICA: ESG REPORTING SOFTWARE MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 131 MIDDLE EAST & AFRICA: ESG REPORTING SOFTWARE MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 132 MIDDLE EAST & AFRICA: ESG REPORTING SOFTWARE MARKET, BY SOFTWARE, 2019-2023 (USD MILLION)

- TABLE 133 MIDDLE EAST & AFRICA: ESG REPORTING SOFTWARE MARKET, BY SOFTWARE, 2024-2029 (USD MILLION)

- TABLE 134 MIDDLE EAST & AFRICA: ESG REPORTING SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2019-2023 (USD MILLION)

- TABLE 135 MIDDLE EAST & AFRICA: ESG REPORTING SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2024-2029 (USD MILLION)

- TABLE 136 MIDDLE EAST & AFRICA: ESG REPORTING SOFTWARE MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 137 MIDDLE EAST & AFRICA: ESG REPORTING SOFTWARE MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 138 MIDDLE EAST & AFRICA: ESG REPORTING SOFTWARE MARKET, BY VERTICAL, 2019-2023 (USD MILLION)

- TABLE 139 MIDDLE EAST & AFRICA: ESG REPORTING SOFTWARE MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 140 MIDDLE EAST & AFRICA: ESG REPORTING SOFTWARE MARKET, BY SUBREGION, 2019-2023 (USD MILLION)

- TABLE 141 MIDDLE EAST & AFRICA: ESG REPORTING SOFTWARE MARKET, BY SUBREGION, 2024-2029 (USD MILLION)

- 10.5.3 GULF COOPERATION COUNCIL COUNTRIES

- 10.5.3.1 Increasing emphasis on corporate social responsibility, sustainable business practices, and rising digital transformation to drive market

- TABLE 142 GULF COOPERATION COUNCIL COUNTRIES: ESG REPORTING SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2019-2023 (USD MILLION)

- TABLE 143 GULF COOPERATION COUNCIL COUNTRIES: ESG REPORTING SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2024-2029 (USD MILLION)

- TABLE 144 GULF COOPERATION COUNCIL COUNTRIES: ESG REPORTING SOFTWARE MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 145 GULF COOPERATION COUNCIL COUNTRIES: ESG REPORTING SOFTWARE MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- 10.5.3.2 KSA

- 10.5.3.3 UAE

- 10.5.3.4 Rest of GCC Countries

- 10.5.4 SOUTH AFRICA

- 10.5.4.1 Inclusive Digital Transformation initiative and increasing emphasis on corporate social responsibility to foster market growth

- TABLE 146 SOUTH AFRICA: ESG REPORTING SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2019-2023 (USD MILLION)

- TABLE 147 SOUTH AFRICA: ESG REPORTING SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2024-2029 (USD MILLION)

- TABLE 148 SOUTH AFRICA: ESG REPORTING SOFTWARE MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 149 SOUTH AFRICA: ESG REPORTING SOFTWARE MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- 10.5.5 REST OF MIDDLE EAST & AFRICA

- TABLE 150 REST OF MIDDLE EAST & AFRICA: ESG REPORTING SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2019-2023 (USD MILLION)

- TABLE 151 REST OF MIDDLE EAST & AFRICA: ESG REPORTING SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2024-2029 (USD MILLION)

- TABLE 152 REST OF MIDDLE EAST & AFRICA: ESG REPORTING SOFTWARE MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 153 REST OF MIDDLE EAST & AFRICA: ESG REPORTING SOFTWARE MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- 10.6 LATIN AMERICA

- 10.6.1 LATIN AMERICA: ESG REPORTING SOFTWARE MARKET DRIVERS

- 10.6.2 LATIN AMERICA: RECESSION IMPACT

- TABLE 154 LATIN AMERICA: ESG REPORTING SOFTWARE MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 155 LATIN AMERICA: ESG REPORTING SOFTWARE MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 156 LATIN AMERICA: ESG REPORTING SOFTWARE MARKET, BY SOFTWARE, 2019-2023 (USD MILLION)

- TABLE 157 LATIN AMERICA: ESG REPORTING SOFTWARE MARKET, BY SOFTWARE, 2024-2029 (USD MILLION)

- TABLE 158 LATIN AMERICA: ESG REPORTING SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2019-2023 (USD MILLION)

- TABLE 159 LATIN AMERICA: ESG REPORTING SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2024-2029 (USD MILLION)

- TABLE 160 LATIN AMERICA: ESG REPORTING SOFTWARE MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 161 LATIN AMERICA: ESG REPORTING SOFTWARE MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 162 LATIN AMERICA: ESG REPORTING SOFTWARE MARKET, BY VERTICAL, 2019-2023 (USD MILLION)

- TABLE 163 LATIN AMERICA: ESG REPORTING SOFTWARE MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 164 LATIN AMERICA: ESG REPORTING SOFTWARE MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 165 LATIN AMERICA: ESG REPORTING SOFTWARE MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 10.6.3 BRAZIL

- 10.6.3.1 Rapid digital transformation initiatives and need to strengthen digital security to accelerate market growth

- TABLE 166 BRAZIL: ESG REPORTING SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2019-2023 (USD MILLION)

- TABLE 167 BRAZIL: ESG REPORTING SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2024-2029 (USD MILLION)

- TABLE 168 BRAZIL: ESG REPORTING SOFTWARE MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 169 BRAZIL: ESG REPORTING SOFTWARE MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- 10.6.4 REST OF LATIN AMERICA

- TABLE 170 REST OF LATIN AMERICA: ESG REPORTING SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2019-2023 (USD MILLION)

- TABLE 171 REST OF LATIN AMERICA: ESG REPORTING SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2024-2029 (USD MILLION)

- TABLE 172 REST OF LATIN AMERICA: ESG REPORTING SOFTWARE MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 173 REST OF LATIN AMERICA: ESG REPORTING SOFTWARE MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- TABLE 174 OVERVIEW OF STRATEGIES ADOPTED BY KEY ESG REPORTING SOFTWARE MARKET VENDORS

- 11.3 REVENUE ANALYSIS

- FIGURE 39 TOP FOUR PLAYERS DOMINATING MARKET IN LAST FIVE YEARS

- 11.4 MARKET SHARE ANALYSIS

- FIGURE 40 ESG REPORTING SOFTWARE MARKET SHARE ANALYSIS, 2023

- TABLE 175 ESG REPORTING SOFTWARE MARKET: DEGREE OF COMPETITION

- 11.5 BRAND/PRODUCT COMPARISON

- FIGURE 41 BRAND/PRODUCT COMPARISON

- 11.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 11.6.1 STARS

- 11.6.2 EMERGING LEADERS

- 11.6.3 PERVASIVE PLAYERS

- 11.6.4 PARTICIPANTS

- FIGURE 42 ESG REPORTING SOFTWARE MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- 11.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- FIGURE 43 ESG REPORTING SOFTWARE MARKET: OVERALL COMPANY FOOTPRINT

- TABLE 176 ESG REPORTING SOFTWARE MARKET: REGIONAL FOOTPRINT

- TABLE 177 ESG REPORTING SOFTWARE MARKET: OFFERING FOOTPRINT

- TABLE 178 ESG REPORTING SOFTWARE MARKET: ORGANIZATION SIZE FOOTPRINT

- TABLE 179 ESG REPORTING SOFTWARE MARKET: VERTICAL FOOTPRINT

- 11.7 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2023

- 11.7.1 PROGRESSIVE COMPANIES

- 11.7.2 RESPONSIVE COMPANIES

- 11.7.3 DYNAMIC COMPANIES

- 11.7.4 STARTING BLOCKS

- FIGURE 44 ESG REPORTING SOFTWARE MARKET: COMPANY EVALUATION MATRIX (START-UPS/SMES), 2023

- 11.7.5 COMPETITIVE BENCHMARKING: START-UPS/SMES, 2023

- TABLE 180 ESG REPORTING SOFTWARE MARKET: KEY START-UPS/SMES, 2023

- TABLE 181 ESG REPORTING SOFTWARE MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES, 2023

- 11.8 COMPANY VALUATION AND FINANCIAL METRICS

- FIGURE 45 COMPANY VALUATION AND FINANCIAL METRICS

- 11.9 COMPETITIVE SCENARIO AND TRENDS

- 11.9.1 PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 182 ESG REPORTING SOFTWARE MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS, MAY 2022-APRIL 2024

- 11.9.2 DEALS

- TABLE 183 ESG REPORTING SOFTWARE MARKET: DEALS, SEPTEMBER 2021-FEBRUARY 2024

12 COMPANY PROFILES

- (Business overview, Products/Services/Solutions offered, Recent Developments, MNM view)**

- 12.1 KEY PLAYERS

- 12.1.1 WOLTERS KLUWER

- TABLE 184 WOLTERS KLUWER: BUSINESS OVERVIEW

- FIGURE 46 WOLTERS KLUWER: COMPANY SNAPSHOT

- TABLE 185 WOLTERS KLUWER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 186 WOLTERS KLUWER: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 187 WOLTERS KLUWER: DEALS

- 12.1.2 NASDAQ

- TABLE 188 NASDAQ: BUSINESS OVERVIEW

- FIGURE 47 NASDAQ: COMPANY SNAPSHOT

- TABLE 189 NASDAQ: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 190 NASDAQ: PRODUCT LAUNCHES

- TABLE 191 NASDAQ: DEALS

- 12.1.3 PWC

- TABLE 192 PWC: BUSINESS OVERVIEW

- FIGURE 48 PWC: COMPANY SNAPSHOT

- TABLE 193 PWC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 194 PWC: DEALS

- 12.1.4 WORKIVA

- TABLE 195 WORKIVA: BUSINESS OVERVIEW

- FIGURE 49 WORKIVA: COMPANY SNAPSHOT

- TABLE 196 WORKIVA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 197 WORKIVA: PRODUCT ENHANCEMENTS

- TABLE 198 WORKIVA: DEALS

- 12.1.5 LSEG

- TABLE 199 LSEG: BUSINESS OVERVIEW

- FIGURE 50 LSEG: COMPANY SNAPSHOT

- TABLE 200 LSEG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 201 LSEG: PRODUCT LAUNCHES

- TABLE 202 LSEG: DEALS

- 12.1.6 GREENSTONE

- TABLE 203 GREENSTONE: BUSINESS OVERVIEW

- TABLE 204 GREENSTONE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 205 GREENSTONE: DEALS

- 12.1.7 DILIGENT

- TABLE 206 DILIGENT: BUSINESS OVERVIEW

- TABLE 207 DILIGENT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 208 DILIGENT: PRODUCT LAUNCHES

- TABLE 209 DILIGENT: DEALS

- 12.1.8 SPHERA

- TABLE 210 SPHERA: BUSINESS OVERVIEW

- TABLE 211 SPHERA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 212 SPHERA: PRODUCT LAUNCHES

- TABLE 213 SPHERA: DEALS

- 12.1.9 CORITY

- TABLE 214 CORITY: BUSINESS OVERVIEW

- TABLE 215 CORITY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 216 CORITY: DEALS

- 12.1.10 INTELEX

- TABLE 217 INTELEX: BUSINESS OVERVIEW

- TABLE 218 INTELEX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 219 INTELEX: PRODUCT LAUNCHES

- 12.2 OTHER PLAYERS

- 12.2.1 NOVISTO

- 12.2.2 EMEX

- 12.2.3 IBM

- 12.2.4 ANTHESIS

- 12.2.5 DIGINEX

- 12.2.6 BAIN & COMPANY

- 12.2.7 KERAMIDA INC. INC.

- 12.2.8 ISOMETRIX

- 12.2.9 VERVANTIS

- 12.2.10 ACCUVIO

- 12.3 START-UPS/SMES

- 12.3.1 ESG FLO

- 12.3.2 MEASURABL

- 12.3.3 PLAN A

- 12.3.4 SUSTAINLAB

- 12.3.5 ESGGO

- *Details on Business overview, Products/Services/Solutions offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

13 ADJACENT/RELATED MARKETS

- 13.1 INTRODUCTION

- 13.1.1 RELATED MARKETS

- 13.1.2 LIMITATIONS

- 13.2 ENVIRONMENT, HEALTH, AND SAFETY MARKET

- TABLE 220 ENVIRONMENT, HEALTH, AND SAFETY MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 221 ENVIRONMENT, HEALTH, AND SAFETY MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 222 ENVIRONMENT, HEALTH, AND SAFETY MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 223 ENVIRONMENT, HEALTH, AND SAFETY MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS