|

|

市場調査レポート

商品コード

1810324

熱交換器の世界市場:タイプ別、材料別、最終用途産業別、地域別 - 2030年までの予測Heat Exchanger Market by Type (Shell & Tube, Plate & Frame, Air Cooled), Material (Metals, Alloys, Brazing Clad Materials), End-use Industry (Chemical, Energy, HVACR, Food & Beverage, Power, Pulp & Paper), and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 熱交換器の世界市場:タイプ別、材料別、最終用途産業別、地域別 - 2030年までの予測 |

|

出版日: 2025年09月06日

発行: MarketsandMarkets

ページ情報: 英文 313 Pages

納期: 即納可能

|

概要

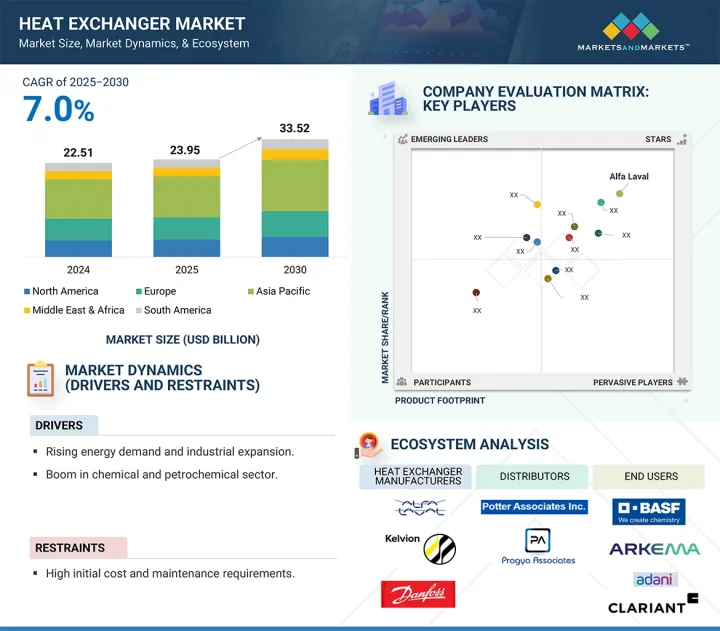

熱交換器の市場規模は、予測期間中に7.0%のCAGRで拡大し、2025年の239億5,000万米ドルから2030年には335億2,000万米ドルに達すると予測されています。

熱交換器市場は、急速な工業化、世界的なエネルギー需要の増加、発電、石油・ガス、化学、HVAC、食品加工、製薬などの産業におけるエネルギー効率の高いシステムに対するニーズの高まりが主な要因となっています。環境規制の強化や廃熱回収への関心の高まりは、産業界が熱管理の改善を通じて排出量と運用コストの削減を目指す中、採用をさらに加速させています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2022年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(100万米ドル)数量(台) |

| セグメント | タイプ別、材料別、最終用途産業別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、南米、中東・アフリカ |

さらに、アジア太平洋、ラテンアメリカ、中東の新興国は、インフラ、製造、エネルギー・プロジェクトに多額の投資を行っており、新規設置と交換ユニットの両方に大きな需要を生み出しています。しかし、市場の成長は、特に高度で特殊な熱交換器の初期投資コストの高さや、高汚染環境や腐食環境におけるメンテナンスの課題といった抑制要因に直面しています。

空冷式熱交換器(ACHE)は、プロセス流体から熱を放散させる冷却媒体として、水ではなく周囲の空気を使用する熱システムです。フィン付きチューブまたはコイルで構成され、その中を高温のプロセス流体が流れ、熱伝達を促進するためにファンが表面に大気を吹き付けます。シェル&チューブ式やプレート式熱交換器と異なり、ACHEは大量の冷却水を必要としないため、水不足に直面している地域や水処理コストが高い地域に特に適しています。ACHEは、石油・ガス、石油化学、発電、化学処理、および屋外環境で信頼性の高い連続冷却が必要なその他の産業で広く使用されています。モジュール式でフレキシブルな設計のため、さまざまな容量要件に対応する拡張性が高く、冷却水システムが不要なため、メンテナンスや運用の複雑さが軽減されます。空冷式熱交換器の採用が増加している背景には、環境への関心の高まり、水使用規制の強化、水冷システムの運用コストの増大があります。産業界が水への依存を減らす持続可能な冷却ソリューションを求める中、空冷式熱交換器は、特に乾燥地域やオフショア施設で脚光を浴びています。また、水の供給が制限されている遠隔地や危険な場所、あるいは冷却塔へのメンテナンスアクセスが現実的でない場所でも好まれています。

化学産業は、熱交換器にとって最も重要な最終用途分野の一つです。これらのシステムは、加熱、冷却、凝縮、蒸発などのプロセスにおいて、正確な温度調節、効率的な熱回収、腐食性流体や高粘度流体の安全な取り扱いに不可欠だからです。アジア太平洋では、中国の膨大な石油化学と特殊化学製品の生産量、急速に拡大するインドの2200億米ドル以上の化学部門、高品質で耐腐食性の設計を必要とする日本の高度な特殊製造業が需要の原動力となっています。北米は低コストのシェールガス原料の恩恵を受け、米国では生産能力の拡張と改修を推進し、欧州は特にドイツ、フランス、オランダで厳しいエネルギー効率と環境規制が先進的で持続可能な熱交換システムの採用に拍車をかけています。サウジアラビア、アラブ首長国連邦、カタールを中心とする中東・アフリカでは、大型で耐久性のあるユニットを必要とする石油化学メガプロジェクトからの需要が旺盛であり、ブラジルを中心とするラテンアメリカでは、ポリマー、農薬、精製プロジェクトに関連する化学製造が着実に成長しています。これらの地域では、エネルギーコストの上昇、二酸化炭素排出削減の推進、信頼性の高い高性能機器へのニーズが、世界の熱交換器市場の主要促進要因としての化学産業の役割を強化しています。

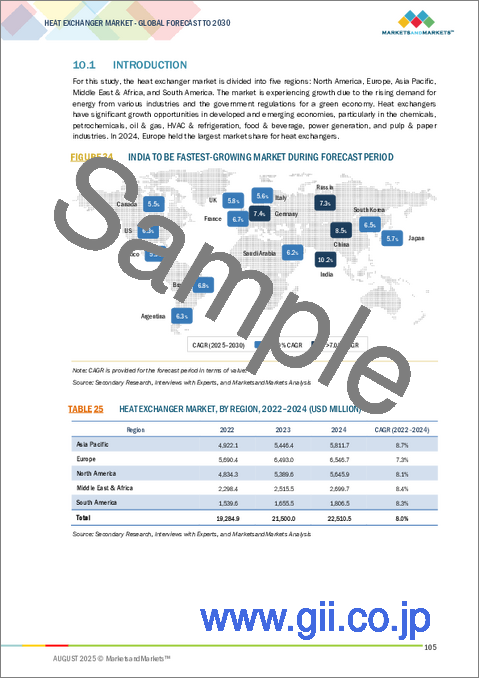

欧州は、成熟した産業基盤、厳格なエネルギー効率規制、持続可能な技術への強い注力によって、世界の熱交換器市場で最大のシェアを占めています。この地域には、化学、発電、石油・ガス、HVAC、食品・飲料、製薬など、確立された産業があり、高性能な熱交換システムに対する安定した需要を生み出しています。エネルギー効率、排出削減、廃熱回収に関するEU指令は、運転コストを削減しながら熱性能を最適化するため、プレート・アンド・フレーム式熱交換器や小型熱交換器などの先進設計の採用を加速しています。ドイツ、フランス、イタリアといった国々は、製造業と産業革新の分野でリードしており、ドイツは化学加工とエンジニアリングの専門技術のハブであり、フランスは原子力発電に優れ、イタリアは堅調な食品加工部門からの需要を牽引しています。英国の再生可能エネルギーへの取り組みは、冷暖房インフラの近代化と相まって、市場の成長をさらに後押ししています。さらに、欧州グリーンディールに支えられた欧州の脱炭素化推進は、地域冷暖房ネットワークや製造工場の廃熱回収への投資に拍車をかけています。

当レポートでは、世界の熱交換器市場について調査し、タイプ別、材料別、最終用途産業別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- マクロ経済指標

第6章 業界動向

- イントロダクション

- バリューチェーン分析

- 規制状況

- 貿易分析

- 価格分析

- 投資と資金調達のシナリオ

- エコシステム

- 顧客ビジネスに影響を与える動向/混乱

- 技術分析

- ケーススタディ分析

- 2025年~2026年の主な会議とイベント

- 特許分析

第7章 熱交換器市場(タイプ別)

- イントロダクション

- シェル&チューブ熱交換器

- プレート&フレーム熱交換器

- 空冷式熱交換器

- その他

第8章 熱交換器市場(材質別)

- イントロダクション

- 金属

- 合金

- ろう付けクラッド材

第9章 熱交換器市場(最終用途産業別)

- イントロダクション

- 化学薬品

- エネルギー

- HVACと冷凍

- 食品・飲料

- 電力

- パルプ・紙

- その他

第10章 熱交換器市場(地域別)

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- ロシア

- トルコ

- その他

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- その他

- 南米

- ブラジル

- アルゼンチン

- その他

- 中東・アフリカ

- GCC諸国

- その他

第11章 競合情勢

- 概要

- 主要参入企業の戦略

- 収益分析

- 市場シェア分析

- 企業評価と財務指標

- ブランド比較

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオと動向

第12章 企業プロファイル

- 主要参入企業

- ALFA LAVAL

- KELVION HOLDING GMBH

- DANFOSS

- EXCHANGER INDUSTRIES LIMITED

- MERSEN

- API HEAT TRANSFER

- BOYD

- JOHNSON CONTROLS

- XYLEM

- WABTEC CORPORATION

- SPX FLOW

- LU-VE GROUP

- LENNOX INTERNATIONAL INC.

- MODINE MANUFACTURING COMPANY

- WIELAND

- その他の企業

- AIR PRODUCTS AND CHEMICALS, INC.

- BARRIQUAND HEAT EXCHANGERS

- BRASK, INC.

- CATARACT STEEL

- CHART INDUSTRIES

- DOOSAN CORPORATION

- FUNKEWARMETAUSCHER APPARATEBAU GMBH

- HISAKA WORKS, LTD.

- HINDUSTAN DORR-OLIVER LTD.

- KOCH HEAT TRANSFER COMPANY

- RADIANT HEAT EXCHANGER PVT. LTD.

- SWEP INTERNATIONAL AB

- THERMAX LIMITED

- SIERRA S.P.A.

- VAHTERUS OY