|

|

市場調査レポート

商品コード

1747194

プレートおよびフレーム式熱交換器の世界市場:タイプ別、用途別、地域別 - 2030年までの予測Plate & Frame Heat Exchanger Market by Type (Gasketed, Welded, Brazed), Application (HVAC & Refrigeration, Chemical, Petrochemical, Oil & Gas, Food & Beverage, Power Generation, Pulp & Paper), Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| プレートおよびフレーム式熱交換器の世界市場:タイプ別、用途別、地域別 - 2030年までの予測 |

|

出版日: 2025年06月09日

発行: MarketsandMarkets

ページ情報: 英文 232 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

プレートおよびフレーム式熱交換器の市場規模は、7.8%のCAGRで拡大し、2025年の72億1,000万米ドルから2030年には105億米ドルに達すると予測されています。

プレートおよびフレーム式熱交換器は、その汎用性と高効率の熱制御により、HVACRシステムに不可欠な部品であり、ビルや産業メンテナンス市場と直接的な相関関係があります。HVACR機器に対する新たな需要は、商業・住宅部門における新築ストックや既存ストックの改修を通じたインフラ整備や都市化の新たな需要によって拡大しています。HVACR部門は金融のあらゆる部門にアピールしており、その成長は、世界の需要を満たすプレートおよびフレーム式熱交換器を必要とするさまざまな暖房、冷房、エネルギー処理を生み出し、プレートおよびフレーム式熱交換器部門の成長を牽引しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 対象台数 | 金額(100万米ドル)、数量(台) |

| セグメント別 | タイプ別、用途別、地域別 |

| 対象地域 | 欧州、北米、アジア太平洋、中東・アフリカ、南米 |

溶接プレートおよびフレーム式熱交換器は、プレートおよびフレーム式熱交換器の中で市場金額ベースで2番目に大きなタイプです。溶接プレート・フレーム式熱交換器は、高圧・高温に対応できるため、石油・ガス、化学処理、発電、HVACの各分野の課題産業用途に適しています。コンパクトで高性能なアーキテクチャは、限られた設置スペースで非常に生産性の高い熱伝達を実現します。溶接構造のため、ガスケットが破損して運転を停止したり、流体が漏れたりする心配がありません。これにより、熱交換器システムの信頼性と運転安全性が向上します。さらに、溶接プレート・フレーム式熱交換器は、文字通り、特定のプロセス・ニーズに合わせてサイズを調整することができ、効率的なメンテナンスと洗浄機能により、あらゆる産業で最大限の魅力を発揮するため、市場での競合地位を確保することができます。

化学分野は、信頼性が高く、効果的で、耐腐食性の熱交換ソリューションに対する業界の需要により、予測期間中、プレートおよびフレーム式熱交換器市場において、金額ベースで2番目に大きな応用分野となり、急成長を示すと予測されます。加えて、化学処理には本質的に極端な攻撃的流体、高温、厳格な熱制御と清浄度の直接的証拠が含まれるため、プレートおよびフレーム式熱交換器、特にチタン、ハステロイなどの専門材料で製造された熱交換器の使用が必要となります。プレートおよびフレーム式熱交換器は、小さなスペースに収まるように構成することができるため、メンテナンスが容易で、プロセス媒体を除去し、効率的な運転を促進するために分離・洗浄するのも比較的簡単です。複雑で腐食性の高い媒体を扱うため、ダウンタイムが少ないということは、組織の稼働率、効率、稼働時間を最大化することを意味します。化学製造の継続的な世界的拡大は、安全、効率的、効果的な管理、コストのかかるプロセス時間の最大化に貢献する高度で柔軟な熱交換器と同化付属機器から恩恵を受け続けています。そして、信頼性の高い操作と熱交換器市場でのシェアを最適化するための機能を特徴とします。

プレートおよびフレーム式熱交換器の最大かつ急成長地域は、アジア太平洋地域です。これは、中国やインドなど、この地域の主要国で起きている重工業化、都市化の進展、経済成長によるものです。その結果、化学、HVAC、石油化学、飲食品、石油・ガス市場などの重要な分野でプレート式熱交換器の需要が高まっています。最大の成長促進要因としては、エネルギー効率の重視、インフラストラクチャーや一般製造業への投資、先端技術の推進力の高まりなどが挙げられます。さらに、その他の重要な要因としては、成長を促進する政府の政策、豊富で低コストの労働力、アジア太平洋地域での足跡を拡大することを決定し、カテゴリーとして強力な市場シェアを持つ、この地域のこの市場における現在の支配的で急成長している地位を後押しする、主に大手メーカーを中心とした世界のメーカーなどが挙げられます。このような状況が続けば、アジア太平洋地域は予測期間中、プレートおよびフレーム式熱交換器市場の規模と成長の両面でトップシェアを維持すると予想されます。

当レポートでは、世界のプレートおよびフレーム式熱交換器市場について調査し、タイプ別、用途別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- バリューチェーン分析

- ポーターのファイブフォース分析

- マクロ経済指標

- 2025年~2026年の主な会議とイベント

- 購入決定に影響を与える主な要因

- 関税と規制

- 平均販売価格分析

- 技術分析

- エコシステム

- 特許分析

- 貿易分析

- ケーススタディ

- 2025年の米国関税がプレートおよびフレーム式熱交換器市場に与える影響

- 価格影響分析

- 最終用途産業への影響

第6章 プレートおよびフレーム式熱交換器市場(タイプ別)

- イントロダクション

- ガスケットプレートおよびフレーム式熱交換器

- 溶接プレート熱交換器(WPHE)

- ろう付けプレート熱交換器(BPHE)

- その他

第7章 プレートおよびフレーム式熱交換器市場(用途別)

- イントロダクション

- HVAC・冷凍

- 化学薬品

- 石油化学製品・石油・ガス

- 食品と飲料

- 発電

- パルプ・紙

- その他

第8章 プレートおよびフレーム式熱交換器市場(地域別)

- イントロダクション

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- その他

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- スウェーデン

- その他

- 中東・アフリカ

- GCC諸国

- その他

- 南米

- ブラジル

- アルゼンチン

- その他

第9章 競合情勢

- 概要

- 主要企業の収益分析(2022年~2024年)

- 2023年の市場シェア分析

- 市場評価マトリックス、2024年

- 企業評価マトリックス、主要参入企業、2024年

- スタートアップ企業と中小企業(SMES)評価マトリックス

- 競合シナリオ

第10章 企業プロファイル

- 主要参入企業

- ALFA LAVAL

- DANFOSS

- KELVION HOLDING GMBH

- SPX FLOW

- XYLEM

- API HEAT TRANSFER

- BOYD

- H. GUNTNER(UK)LIMITED

- JOHNSON CONTROLS

- WABTEC CORPORATION

- その他の企業

- BARRIQUAND TECHNOLOGIES THERMIQUES

- CHART INDUSTRIES

- FUNKE HEAT EXCHANGER APPARATEBAU

- HISAKA WORKS, LTD.

- RADIANT HEAT EXCHANGER PVT. LTD.

- SWEP INTERNATIONAL AB

- VAHTERUS OY

- KAORI

- DIVERSIFIED HEAT TRANSFER

- HRS HEAT EXCHANGERS

- ONDA

- SECESPOL

- HYDAC

- BAODE

- THERMOFIN

第11章 付録

List of Tables

- TABLE 1 PLATE & FRAME HEAT EXCHANGER MARKET: INCLUSIONS & EXCLUSIONS

- TABLE 2 PORTER'S FIVE FORCES ANALYSIS: PLATE & FRAME HEAT EXCHANGER MARKET

- TABLE 3 POWER GENERATION, BY COUNTRY, QUADRILLION BTU

- TABLE 4 DEMAND FOR AIR CONDITIONING, BY COUNTRY (2023)

- TABLE 5 CHEMICAL SALES - GLOBAL MARKET SHARE, 2023 (PERCENTAGE)

- TABLE 6 PLATE & FRAME HEAT EXCHANGER MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2025-2026

- TABLE 7 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 AVERAGE SELLING PRICE, BY APPLICATION, 2022-2030 (USD/UNIT)

- TABLE 9 PLATE & FRAME HEAT EXCHANGER MARKET: ECOSYSTEM

- TABLE 10 GRANTED PATENTS ACCOUNT FOR 36% OF ALL PATENTS IN LAST 10 YEARS

- TABLE 11 PATENTS BY LG ELECTRONICS INC.

- TABLE 12 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

- TABLE 13 IMPORT DATA FOR HS CODE 841950-COMPLIANT PRODUCTS, BY COUNTRY, 2022-2024

- TABLE 14 EXPORT DATA FOR HS CODE 841950-COMPLIANT PRODUCTS, BY COUNTRY, 2022-2024

- TABLE 15 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 16 KEY PRODUCT-RELATED TARIFF EFFECTIVE FOR PLATE & FRAME HEAT EXCHANGER

- TABLE 17 PLATE & FRAME HEAT EXCHANGER MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 18 PLATE & FRAME HEAT EXCHANGER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 19 PLATE & FRAME HEAT EXCHANGER MARKET, BY TYPE, 2022-2024 (UNIT)

- TABLE 20 PLATE & FRAME HEAT EXCHANGER MARKET, BY TYPE, 2025-2030 (UNIT)

- TABLE 21 PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 22 PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 23 PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2022-2024 (UNIT)

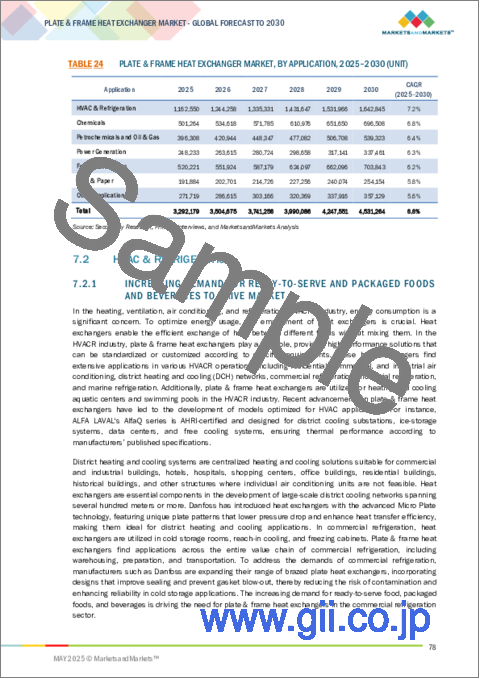

- TABLE 24 PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (UNIT)

- TABLE 25 PLATE & FRAME HEAT EXCHANGER MARKET, BY REGION, 2022-2024 (UNIT)

- TABLE 26 PLATE & FRAME HEAT EXCHANGER MARKET, BY REGION, 2025-2030 (UNIT)

- TABLE 27 PLATE & FRAME HEAT EXCHANGER MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 28 PLATE & FRAME HEAT EXCHANGER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 29 ASIA PACIFIC: PLATE & FRAME HEAT EXCHANGER MARKET, BY COUNTRY, 2022-2024 (UNIT)

- TABLE 30 ASIA PACIFIC: PLATE & FRAME HEAT EXCHANGER MARKET, BY COUNTRY, 2025-2030 (UNIT)

- TABLE 31 ASIA PACIFIC: PLATE & FRAME HEAT EXCHANGER MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 32 ASIA PACIFIC: PLATE & FRAME HEAT EXCHANGER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 33 ASIA PACIFIC: PLATE & FRAME HEAT EXCHANGER MARKET, BY TYPE, 2022-2024 (UNIT)

- TABLE 34 ASIA PACIFIC: PLATE & FRAME HEAT EXCHANGER MARKET, BY TYPE, 2025-2030 (UNIT)

- TABLE 35 ASIA PACIFIC: PLATE & FRAME HEAT EXCHANGER MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 36 ASIA PACIFIC: PLATE & FRAME HEAT EXCHANGER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 37 ASIA PACIFIC: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2022-2024 (UNIT)

- TABLE 38 ASIA PACIFIC: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (UNIT)

- TABLE 39 ASIA PACIFIC: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 40 ASIA PACIFIC: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 41 CHINA: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2022-2024 (UNIT)

- TABLE 42 CHINA: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (UNIT)

- TABLE 43 CHINA: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 44 CHINA: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 45 INDIA: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2022-2024 (UNIT)

- TABLE 46 INDIA: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (UNIT)

- TABLE 47 INDIA: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 48 INDIA: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 49 JAPAN: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2022-2024 (UNIT)

- TABLE 50 JAPAN: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (UNIT)

- TABLE 51 JAPAN: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 52 JAPAN: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 53 SOUTH KOREA: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2022-2024 (UNIT)

- TABLE 54 SOUTH KOREA: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (UNIT)

- TABLE 55 SOUTH KOREA: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 56 SOUTH KOREA: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 57 REST OF ASIA PACIFIC: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2022-2024 (UNIT)

- TABLE 58 REST OF ASIA PACIFIC: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (UNIT)

- TABLE 59 REST OF ASIA PACIFIC: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 60 REST OF ASIA PACIFIC: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 61 NORTH AMERICA: PLATE & FRAME HEAT EXCHANGER MARKET, BY COUNTRY, 2022-2024 (UNIT)

- TABLE 62 NORTH AMERICA: PLATE & FRAME HEAT EXCHANGER MARKET, BY COUNTRY, 2025-2030 (UNIT)

- TABLE 63 NORTH AMERICA: PLATE & FRAME HEAT EXCHANGER MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 64 NORTH AMERICA: PLATE & FRAME HEAT EXCHANGER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 65 NORTH AMERICA: PLATE & FRAME HEAT EXCHANGER MARKET, BY TYPE, 2022-2024 (UNIT)

- TABLE 66 NORTH AMERICA: PLATE & FRAME HEAT EXCHANGER MARKET, BY TYPE, 2025-2030 (UNIT)

- TABLE 67 NORTH AMERICA: PLATE & FRAME HEAT EXCHANGER MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 68 NORTH AMERICA: PLATE & FRAME HEAT EXCHANGER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 69 NORTH AMERICA: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2022-2024 (UNIT)

- TABLE 70 NORTH AMERICA: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (UNIT)

- TABLE 71 NORTH AMERICA: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 72 NORTH AMERICA: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 73 US: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2022-2024 (UNIT)

- TABLE 74 US: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (UNIT)

- TABLE 75 US: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 76 US: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 77 CANADA: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2022-2024 (UNIT)

- TABLE 78 CANADA: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (UNIT)

- TABLE 79 CANADA: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 80 CANADA: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 81 MEXICO: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2022-2024 (UNIT)

- TABLE 82 MEXICO: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (UNIT)

- TABLE 83 MEXICO: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 84 MEXICO: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 85 EUROPE: PLATE & FRAME HEAT EXCHANGER MARKET, BY COUNTRY, 2022-2024 (UNIT)

- TABLE 86 EUROPE: PLATE & FRAME HEAT EXCHANGER MARKET, BY COUNTRY, 2025-2030 (UNIT)

- TABLE 87 EUROPE: PLATE & FRAME HEAT EXCHANGER MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 88 EUROPE: PLATE & FRAME HEAT EXCHANGER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 89 EUROPE: PLATE & FRAME HEAT EXCHANGER MARKET, BY TYPE, 2022-2024 (UNIT)

- TABLE 90 EUROPE: PLATE & FRAME HEAT EXCHANGER MARKET, BY TYPE, 2025-2030 (UNIT)

- TABLE 91 EUROPE: PLATE & FRAME HEAT EXCHANGER MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 92 EUROPE: PLATE & FRAME HEAT EXCHANGER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 93 EUROPE: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2022-2024 (UNIT)

- TABLE 94 EUROPE: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (UNIT)

- TABLE 95 EUROPE: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 96 EUROPE: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 97 GERMANY: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2022-2024 (UNIT)

- TABLE 98 GERMANY: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (UNIT)

- TABLE 99 GERMANY: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 100 GERMANY: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 101 FRANCE: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2022-2024 (UNIT)

- TABLE 102 FRANCE: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (UNIT)

- TABLE 103 FRANCE: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 104 FRANCE: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 105 UK: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2022-2024 (UNIT)

- TABLE 106 UK: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (UNIT)

- TABLE 107 UK: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 108 UK: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 109 ITALY: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2022-2024 (UNIT)

- TABLE 110 ITALY: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (UNIT)

- TABLE 111 ITALY: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 112 ITALY: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 113 SWEDEN: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2022-2024 (UNIT)

- TABLE 114 SWEDEN: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (UNIT)

- TABLE 115 SWEDEN: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 116 SWEDEN: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 117 REST OF EUROPE: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2022-2024 (UNIT)

- TABLE 118 REST OF EUROPE: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (UNIT)

- TABLE 119 REST OF EUROPE: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 120 REST OF EUROPE: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 121 MIDDLE EAST & AFRICA: PLATE & FRAME HEAT EXCHANGER MARKET, BY COUNTRY, 2022-2024 (UNIT)

- TABLE 122 MIDDLE EAST & AFRICA: PLATE & FRAME HEAT EXCHANGER MARKET, BY COUNTRY, 2025-2030 (UNIT)

- TABLE 123 MIDDLE EAST & AFRICA: PLATE & FRAME HEAT EXCHANGER MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 124 MIDDLE EAST & AFRICA: PLATE & FRAME HEAT EXCHANGER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 125 MIDDLE EAST & AFRICA: PLATE & FRAME HEAT EXCHANGER MARKET, BY TYPE, 2022-2024 (UNIT)

- TABLE 126 MIDDLE EAST & AFRICA: PLATE & FRAME HEAT EXCHANGER MARKET, BY TYPE, 2025-2030 (UNIT)

- TABLE 127 MIDDLE EAST & AFRICA: PLATE & FRAME HEAT EXCHANGER MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 128 MIDDLE EAST & AFRICA: PLATE & FRAME HEAT EXCHANGER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 129 MIDDLE EAST & AFRICA: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2022-2024 (UNIT)

- TABLE 130 MIDDLE EAST & AFRICA: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (UNIT)

- TABLE 131 MIDDLE EAST & AFRICA: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 132 MIDDLE EAST & AFRICA: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 133 SAUDI ARABIA: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2022-2024 (UNIT)

- TABLE 134 SAUDI ARABIA: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (UNIT)

- TABLE 135 SAUDI ARABIA: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 136 SAUDI ARABIA: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 137 UAE: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2022-2024 (UNIT)

- TABLE 138 UAE: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (UNIT)

- TABLE 139 UAE: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 140 UAE: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 141 REST OF GCC COUNTRIES: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2022-2024 (UNIT)

- TABLE 142 REST OF GCC COUNTRIES: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (UNIT)

- TABLE 143 REST OF GCC COUNTRIES: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 144 REST OF GCC COUNTRIES: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 145 REST OF MIDDLE EAST & AFRICA: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2022-2024 (UNIT)

- TABLE 146 REST OF MIDDLE EAST & AFRICA: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (UNIT)

- TABLE 147 REST OF MIDDLE EAST & AFRICA: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 148 REST OF MIDDLE EAST & AFRICA: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 149 SOUTH AMERICA: PLATE & FRAME HEAT EXCHANGER MARKET, BY COUNTRY, 2022-2024 (UNIT)

- TABLE 150 SOUTH AMERICA: PLATE & FRAME HEAT EXCHANGER MARKET, BY COUNTRY, 2025-2030 (UNIT)

- TABLE 151 SOUTH AMERICA: PLATE & FRAME HEAT EXCHANGER MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 152 SOUTH AMERICA: PLATE & FRAME HEAT EXCHANGER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 153 SOUTH AMERICA: PLATE & FRAME HEAT EXCHANGER MARKET, BY TYPE, 2022-2024 (UNIT)

- TABLE 154 SOUTH AMERICA: PLATE & FRAME HEAT EXCHANGER MARKET, BY TYPE, 2025-2030 (UNIT)

- TABLE 155 SOUTH AMERICA: PLATE & FRAME HEAT EXCHANGER MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 156 SOUTH AMERICA: PLATE & FRAME HEAT EXCHANGER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 157 SOUTH AMERICA: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2022-2024 (UNIT)

- TABLE 158 SOUTH AMERICA: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (UNIT)

- TABLE 159 SOUTH AMERICA: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 160 SOUTH AMERICA: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 161 BRAZIL: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2022-2024 (UNIT)

- TABLE 162 BRAZIL: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (UNIT)

- TABLE 163 BRAZIL: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 164 BRAZIL: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 165 ARGENTINA: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2022-2024 (UNIT)

- TABLE 166 ARGENTINA: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (UNIT)

- TABLE 167 ARGENTINA: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 168 ARGENTINA: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 169 REST OF SOUTH AMERICA: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2022-2024 (UNIT)

- TABLE 170 REST OF SOUTH AMERICA: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (UNIT)

- TABLE 171 REST OF SOUTH AMERICA: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 172 REST OF SOUTH AMERICA: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 173 COMPANIES ADOPTED ACQUISITIONS AND EXPANSIONS AS KEY GROWTH STRATEGIES BETWEEN JANUARY 2019 AND APRIL 2025

- TABLE 174 PLATE & FRAME HEAT EXCHANGER MARKET: REVENUE ANALYSIS, 2022-2024 (USD BILLION)

- TABLE 175 PLATE & FRAME HEAT EXCHANGER MARKET: INTENSITY OF COMPETITIVE RIVALRY

- TABLE 176 MARKET EVALUATION MATRIX, 2024

- TABLE 177 PLATE & FRAME HEAT EXCHANGER MARKET: REGION FOOTPRINT

- TABLE 178 PLATE & FRAME HEAT EXCHANGER MARKET: TYPE FOOTPRINT

- TABLE 179 PLATE & FRAME HEAT EXCHANGER MARKET: APPLICATION FOOTPRINT

- TABLE 180 PLATE & FRAME HEAT EXCHANGER MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 181 PLATE & FRAME HEAT EXCHANGER MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 182 PLATE & FRAME HEAT EXCHANGER MARKET: PRODUCT LAUNCHES, JANUARY 2019-APRIL 2025

- TABLE 183 PLATE & FRAME HEAT EXCHANGER MARKET: DEALS, JANUARY 2019-MAY 2025

- TABLE 184 PLATE & FRAME HEAT EXCHANGER MARKET: EXPANSIONS, JANUARY 2019-APRIL 2025

- TABLE 185 PLATE & FRAME HEAT EXCHANGER MARKET: OTHERS, JANUARY 2019-APRIL 2025

- TABLE 186 ALFA LAVAL: COMPANY OVERVIEW

- TABLE 187 ALFA LAVAL: PRODUCT OFFERING

- TABLE 188 ALFA LAVAL: PRODUCT LAUNCHES, JANUARY 2019-APRIL 2025

- TABLE 189 ALFA LAVAL: DEALS, JANUARY 2019-APRIL 2025

- TABLE 190 ALFA LAVAL: EXPANSIONS, JANUARY 2019-APRIL 2025

- TABLE 191 DANFOSS: COMPANY OVERVIEW

- TABLE 192 DANFOSS: PRODUCT OFFERING

- TABLE 193 DANFOSS: PRODUCT LAUNCHES, JANUARY 2019-APRIL 2025

- TABLE 194 DANFOSS: DEALS, JANUARY 2019-APRIL 2025

- TABLE 195 KELVION HOLDING GMBH: COMPANY OVERVIEW

- TABLE 196 KELVION HOLDING GMBH: PRODUCT OFFERING

- TABLE 197 KELVION HOLDING GMBH: PRODUCT LAUNCHES, JANUARY 2019-APRIL 2025

- TABLE 198 KELVION HOLDING GMBH: OTHERS, JANUARY 2019-APRIL 2025

- TABLE 199 SPX FLOW: COMPANY OVERVIEW

- TABLE 200 SPX FLOW: PRODUCT OFFERING

- TABLE 201 SPX FLOW: PRODUCT LAUNCHES, JANUARY 2019-APRIL 2025

- TABLE 202 SPX FLOW: EXPANSIONS, JANUARY 2019-APRIL 2025

- TABLE 203 XYLEM: COMPANY OVERVIEW

- TABLE 204 XYLEM: PRODUCT OFFERING

- TABLE 205 XYLEM: DEALS, JANUARY 2019-APRIL 2025

- TABLE 206 API HEAT TRANSFER: COMPANY OVERVIEW

- TABLE 207 API HEAT TRANSFER: PRODUCT OFFERING

- TABLE 208 BOYD: COMPANY OVERVIEW

- TABLE 209 BOYD: PRODUCT OFFERING

- TABLE 210 BOYD: DEALS, JANUARY 2019-APRIL 2025

- TABLE 211 BOYD: EXPANSIONS, JANUARY 2019- APRIL 2025

- TABLE 212 H. GUNTNER (UK) LIMITED: COMPANY OVERVIEW

- TABLE 213 H. GUNTNER (UK) LIMITED: PRODUCT OFFERING

- TABLE 214 H. GUNTNER (UK) LIMITED: DEALS, JANUARY 2019-APRIL 2025

- TABLE 215 JOHNSON CONTROLS: COMPANY OVERVIEW

- TABLE 216 JOHNSON CONTROLS: PRODUCT OFFERING

- TABLE 217 JOHNSON CONTROLS: DEALS, JANUARY 2019 - APRIL 2025

- TABLE 218 WABTEC CORPORATION: COMPANY OVERVIEW

- TABLE 219 WABTEC CORPORATION: PRODUCT OFFERING

- TABLE 220 WABTEC CORPORATION: PRODUCT LAUNCHES, JANUARY 2019-APRIL 2025

- TABLE 221 WABTEC CORPORATION: DEALS, JANUARY 2019-APRIL 2025

- TABLE 222 BARRIQUAND TECHNOLOGIES THERMIQUES: COMPANY OVERVIEW

- TABLE 223 CHART INDUSTRIES: COMPANY OVERVIEW

- TABLE 224 FUNKE HEAT EXCHANGER APPARATEBAU: COMPANY OVERVIEW

- TABLE 225 HISAKA WORKS, LTD.: COMPANY OVERVIEW

- TABLE 226 RADIANT HEAT EXCHANGER PVT. LTD.: COMPANY OVERVIEW

- TABLE 227 SWEP INTERNATIONAL AB: COMPANY OVERVIEW

- TABLE 228 VAHTERUS OY: COMPANY OVERVIEW

- TABLE 229 KAORI: COMPANY OVERVIEW

- TABLE 230 DIVERSIFIED HEAT TRANSFER: COMPANY OVERVIEW

- TABLE 231 HRS HEAT EXCHANGERS: COMPANY OVERVIEW

- TABLE 232 ONDA: COMPANY OVERVIEW

- TABLE 233 SECESPOL: COMPANY OVERVIEW

- TABLE 234 HYDAC: COMPANY OVERVIEW

- TABLE 235 BAODE: COMPANY OVERVIEW

- TABLE 236 THERMOFIN: COMPANY OVERVIEW

List of Figures

- FIGURE 1 PLATE & FRAME HEAT EXCHANGER MARKET: SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 PLATE & FRAME HEAT EXCHANGER MARKET: RESEARCH DESIGN

- FIGURE 3 PLATE & FRAME HEAT EXCHANGER MARKET: BOTTOM-UP APPROACH

- FIGURE 4 PLATE & FRAME HEAT EXCHANGER MARKET: TOP-DOWN APPROACH

- FIGURE 5 PLATE & FRAME HEAT EXCHANGER MARKET: MARKET SIZE ESTIMATION (BASE NUMBER CALCULATION)

- FIGURE 6 DEMAND-SIDE FORECAST PROJECTIONS

- FIGURE 7 PLATE & FRAME HEAT EXCHANGER MARKET: DATA TRIANGULATION

- FIGURE 8 GASKETED PLATE & FRAME HEAT EXCHANGERS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 9 HVAC & REFRIGERATION APPLICATION TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 10 ASIA PACIFIC TO WITNESS HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 11 HIGH GROWTH POTENTIAL IN ASIA PACIFIC DURING FORECAST PERIOD

- FIGURE 12 HVAC & REFRIGERATION APPLICATION LED MARKET IN EUROPE

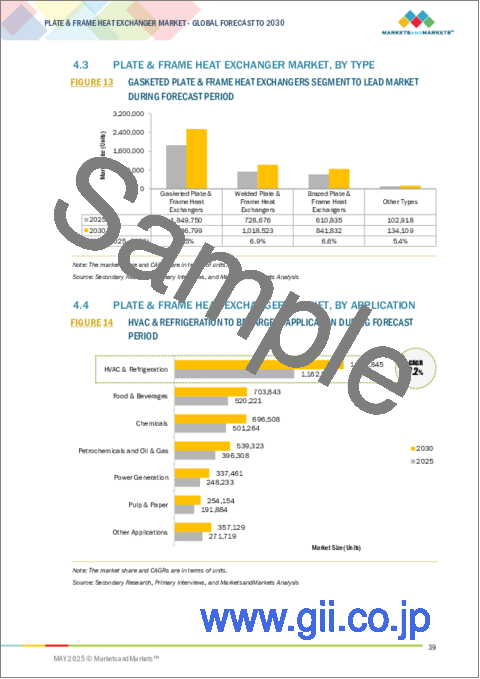

- FIGURE 13 GASKETED PLATE & FRAME HEAT EXCHANGERS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 14 HVAC & REFRIGERATION TO BE LARGEST APPLICATION DURING FORECAST PERIOD

- FIGURE 15 INDIA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 17 PLATE & FRAME HEAT EXCHANGER MARKET: VALUE CHAIN ANALYSIS

- FIGURE 18 PORTER'S FIVE FORCES ANALYSIS: PLATE & FRAME HEAT EXCHANGER MARKET

- FIGURE 19 KEY BUYING CRITERIA

- FIGURE 20 AVERAGE SELLING PRICE, BY REGION, 2022-2030 (USD/UNIT)

- FIGURE 21 AVERAGE SELLING PRICE, BY TOP THREE MARKET PLAYERS, 2024 (USD/UNIT)

- FIGURE 22 ECOSYSTEM OF PLATE & FRAME HEAT EXCHANGER MARKET

- FIGURE 23 PATENT PUBLICATION TRENDS FROM 2012 TO 2022

- FIGURE 24 LEGAL STATUS OF PATENTS

- FIGURE 25 TOP JURISDICTIONS, BY DOCUMENT

- FIGURE 26 TOP 10 COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS

- FIGURE 27 GASKETED PLATE & FRAME HEAT EXCHANGERS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 28 HVAC & REFRIGERATION APPLICATION TO WITNESS HIGHEST CAGR

- FIGURE 29 INDIA TO RECORD FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 30 ASIA PACIFIC: PLATE & FRAME HEAT EXCHANGER MARKET SNAPSHOT

- FIGURE 31 NORTH AMERICA: PLATE & FRAME HEAT EXCHANGER MARKET SNAPSHOT

- FIGURE 32 EUROPE: PLATE & FRAME HEAT EXCHANGER MARKET SNAPSHOT

- FIGURE 33 PLATE & FRAME HEAT EXCHANGER MARKET SHARE, BY COMPANY, 2023

- FIGURE 34 PLATE & FRAME HEAT EXCHANGER MARKET: COMPANY EVALUATION MATRIX, (KEY PLAYERS), 2024

- FIGURE 35 PLATE & FRAME HEAT EXCHANGER MARKET: COMPANY FOOTPRINT

- FIGURE 36 PLATE & FRAME HEAT EXCHANGER MARKET: STARTUP AND SME MATRIX, 2024

- FIGURE 37 ALFA LAVAL: COMPANY SNAPSHOT

- FIGURE 38 DANFOSS: COMPANY SNAPSHOT

- FIGURE 39 SPX FLOW: COMPANY SNAPSHOT

- FIGURE 40 XYLEM: COMPANY SNAPSHOT

- FIGURE 41 JOHNSON CONTROLS: COMPANY SNAPSHOT

- FIGURE 42 WABTEC CORPORATION: COMPANY SNAPSHOT

The plate & frame heat exchanger market is projected to reach USD 10.50 billion by 2030 from USD 7.21 billion in 2025, at a CAGR of 7.8%. Plate & frame heat exchangers, with their versatility and highly efficient thermal control, are essential components in HVACR systems, which have a direct correlation with the building and industrial maintenance markets. The renewed demand for HVACR equipment has been magnified due to new demand for infrastructure and urbanization through new building stock and refurbishment of existing stock in commercial and residential sectors. The HVACR sector appeals to all sectors of finance, and its growth is creating a range of heating, cooling, and energy-treatment applications requiring plate & frame heat exchangers to meet demands globally, driving the growth of the plate and frame heat exchanger sector.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million), Volume (Units) |

| Segments | By Type, By Application, and By Region |

| Regions covered | Europe, North America, Asia Pacific, Middle East & Africa, and South America |

"Based on type, welded plate & frame heat exchanger is the second-largest type in plate & frame heat exchanger market during the forecast period, in terms of value."

Welded plate and frame heat exchangers are the second most significant types of plate and frame heat exchangers in terms of market value. They can accommodate high pressures and high temperatures, making them suitable for challenging industrial applications in the oil & gas, chemical processing, power generation, and HVAC sectors. Their compact, high-performance architectural presence provides exceptionally productive heat transfer in limited installation spaces. Their welded construction means they do not have gaskets that may fail and shut down operations or allow fluid leakages. This improves the reliability and operational safety of the heat exchanger system. Additionally, welded plate and frame heat exchangers can be literally tailored and sized to specific process needs, while their efficient maintenance and cleaning features maximize appeal across all industries, thus securing their competitive position in the marketplace.

"Based on application, chemicals is the second-fastest-growing application in the plate & frame heat exchanger market during the forecast period, in terms of value."

The chemicals segment is projected to be the second-largest application segment, showing the fastest growth in the plate & frame heat exchanger market during the forecast period, in terms of value, due to the industry's demand for dependable, effective, and corrosion-resistant heat transfer solutions. In addition, chemical processing inherently involves extremes in aggressive fluids, high temperatures, and direct evidence of strict thermal control and cleanliness, requiring the use of plate & frame heat exchangers, especially those manufactured with expert materials like titanium, Hastelloy, etc. Plate & frame heat exchangers can be configured to fit within small spaces, making them easy to maintain and relatively simple to isolate & flush to remove process media and promote efficient operation. As they handle complex and corrosive media, less downtime means the organization maximizes utilization, efficiency, and uptime. The continued global expansion of chemical manufacturing continues to benefit from highly advanced and flexible heat exchangers and assimilated ancillary equipment that contribute to the maximization of safe, efficient, and effective management of their costly process time - and identify features to optimize reliable operation and share in the heat exchanger market.

"Based on region, Asia Pacific accounts for the largest share and is projected to be the fastest-growing region in the plate & frame heat exchanger market, in terms of value."

The largest and fastest-growing region for plate & frame heat exchangers is the Asia Pacific due to heavy industrialization, increased urbanization, and economic growth occurring in major countries in the region, such as China and India. This has resulted in the demand for plate heat exchangers in several important sectors, such as chemicals, HVAC, petrochemicals, food & beverage, and oil & gas markets. The largest growth drivers include a focus on energy efficiency, investment of infrastructure and general manufacturing, and a growing push for advanced technologies. Further, other important factors include government policies promoting growth, an abundance of low-cost labor, and global, mostly major manufacturers, deciding to expand their footprint in the Asia Pacific and, as a category, have a strong market share, thrusting the region's currently dominant and fast growing position in this market. If these conditions continue, the Asia Pacific is expected to retain the leading share in terms of both, size and growth in the plate & frame heat exchanger market over the forecast period.

In the process of determining and verifying the market size for several segments and subsegments identified through secondary research, extensive primary interviews were conducted. A breakdown of the profiles of the primary interviewees is as follows:

- By Company Type: Tier 1 - 40%, Tier 2 - 30%, and Tier 3 - 30%

- By Designation: Directors- 35%, Managers - 25%, and Others - 40%

- By Region: North America - 22%, Europe - 22%, Asia Pacific - 45%, RoW - 11%

The key players in this market are ALFA LAVAL (Sweden), Danfoss (Denmark), Kelvion Holding GmbH (Germany), SPX Flow (US), XYLEM (US), API Heat Transfer (US), H. Guntner (UK) LTD. (UK), Boyd Corporation (US), Johnson Controls (Ireland), Wabtec Corporation (US), Barriquand Technologies Thermiques (France), Chart Industries (US), Funke Heat Exchanger (Germany), Hisaka Works Ltd. (Japan), Radiant Heat Exchangers Pvt. Ltd. (India), SWEP International AB (Sweden), Vahterus OY (Finland), Kaori (Taiwan), Diversified Heat Transfer (US), HRS Heat Exchangers (UK), ONDA (Italy), SECESPOL (Poland), HYDAC (Germany), Baode (China), and Thermofin (Canada).

Research Coverage

This report segments the plate & frame heat exchanger market based on type, application, and region, and provides estimations for the overall value of the market across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, products and services, key strategies, product launches, expansions, and mergers and acquisitions associated with the plate & frame heat exchanger market.

Key benefits of buying this report

This research report focuses on various levels of analysis, including industry analysis (industry trends), market ranking analysis of top players, and company profiles, which together provide an overall view of the competitive landscape, emerging and high-growth segments of the plate & frame heat exchanger market, high-growth regions, and market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of key drivers (Stringent environmental regulations, Rising demand for HVACR equipment, Technological developments in brazed plate heat exchangers, Expansion of chemical and petrochemical industries), restraints (Volatility in raw material prices, Increasing demand for battery electric vehicles, Application limitations and alternative technologies), opportunities (Growth of plate & frame heat exchanger aftermarket, Rapid industrialization in emerging regions) and challenges (Clogging of heat exchangers, Limited serviceability of brazed plate & frame heat exchangers).

- Market Penetration: Comprehensive information on the plate & frame heat exchangers offered by top players in the global plate & frame heat exchanger market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the plate & frame heat exchanger market.

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the market for plate & frame heat exchangers across regions.

- Market Diversification: Exhaustive information about new products, untapped regions, and recent developments in the global plate & frame heat exchanger market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the plate & frame heat exchanger market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Primary interviews: Demand and supply sides

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of interviews with experts

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 MARKET SIZE PROJECTION

- 2.4 DATA TRIANGULATION

- 2.5 FACTOR ANALYSIS

- 2.6 ASSUMPTIONS

- 2.7 LIMITATIONS AND RISKS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 SIGNIFICANT OPPORTUNITIES FOR PLATE & FRAME HEAT EXCHANGER MARKET PLAYERS

- 4.2 EUROPE: PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION AND COUNTRY

- 4.3 PLATE & FRAME HEAT EXCHANGER MARKET, BY TYPE

- 4.4 PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION

- 4.5 PLATE & FRAME HEAT EXCHANGER MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Stringent environmental regulations

- 5.2.1.2 Rising demand for HVACR equipment

- 5.2.1.3 Technological developments in brazed plate heat exchangers

- 5.2.1.4 Expansion of chemical and petrochemical industries

- 5.2.2 RESTRAINTS

- 5.2.2.1 Volatility in raw material prices

- 5.2.2.2 Increasing demand for battery electric vehicles

- 5.2.2.3 Application limitations and alternative technologies

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growth of plate & frame heat exchanger aftermarket

- 5.2.3.2 Rapid industrialization in emerging regions

- 5.2.4 CHALLENGES

- 5.2.4.1 Clogging of heat exchangers

- 5.2.4.2 Limited serviceability of brazed plate & frame heat exchangers

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.3.1 RAW MATERIAL SUPPLIERS

- 5.3.2 MANUFACTURERS

- 5.3.3 DISTRIBUTORS

- 5.3.4 END USERS

- 5.4 PORTER'S FIVE FORCES ANALYSIS

- 5.4.1 THREAT OF NEW ENTRANTS

- 5.4.2 THREAT OF SUBSTITUTES

- 5.4.3 BARGAINING POWER OF SUPPLIERS

- 5.4.4 BARGAINING POWER OF BUYERS

- 5.4.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.5 MACROECONOMIC INDICATORS

- 5.5.1 POWER GENERATION

- 5.5.2 DEMAND FOR AIR CONDITIONING (AC)

- 5.5.3 CHEMICAL SALES

- 5.6 KEY CONFERENCES & EVENTS, 2025-2026

- 5.7 KEY FACTORS AFFECTING BUYING DECISIONS

- 5.7.1 QUALITY

- 5.7.2 SERVICE

- 5.8 TARIFFS AND REGULATIONS

- 5.8.1 ASIA PACIFIC

- 5.8.2 EUROPE

- 5.8.3 NORTH AMERICA

- 5.8.3.1 US

- 5.8.3.2 Canada

- 5.9 AVERAGE SELLING PRICE ANALYSIS

- 5.9.1 AVERAGE SELLING PRICE BASED ON REGION

- 5.9.2 AVERAGE SELLING PRICE BASED ON APPLICATION, 2022-2030

- 5.9.3 AVERAGE SELLING PRICE OF TOP THREE MARKET PLAYERS, 2024

- 5.10 TECHNOLOGY ANALYSIS

- 5.10.1 MICRO/NANOSTRUCTURED SURFACES

- 5.10.2 ADDITIVE MANUFACTURING

- 5.10.3 SURFACE COATINGS

- 5.10.4 COMPUTATIONAL FLUID DYNAMICS (CFD)

- 5.10.5 INTELLIGENT MONITORING AND CONTROL SYSTEMS

- 5.11 ECOSYSTEM

- 5.12 PATENT ANALYSIS

- 5.12.1 INTRODUCTION

- 5.12.2 METHODOLOGY

- 5.12.3 DOCUMENT TYPE

- 5.12.4 INSIGHTS

- 5.12.5 LEGAL STATUS OF PATENTS

- 5.12.6 JURISDICTION ANALYSIS

- 5.12.7 TOP COMPANIES/APPLICANTS

- 5.13 TRADE ANALYSIS

- 5.13.1 IMPORT-EXPORT SCENARIO OF PLATE & FRAME HEAT EXCHANGER MARKET (HS CODE 841950)

- 5.14 CASE STUDIES

- 5.14.1 REQUIREMENT IN DISTRICT HEATING SYSTEM

- 5.15 IMPACT OF 2025 US TARIFF ON PLATE & FRAME HEAT EXCHANGER MARKET

- 5.15.1 INTRODUCTION

- 5.15.2 KEY TARIFF RATES

- 5.16 PRICE IMPACT ANALYSIS

- 5.16.1 IMPACT ON COUNTRY/REGION

- 5.16.1.1 US

- 5.16.1.2 Europe

- 5.16.1.3 Asia Pacific

- 5.16.1 IMPACT ON COUNTRY/REGION

- 5.17 IMPACT ON END-USE INDUSTRIES

6 PLATE & FRAME HEAT EXCHANGER MARKET, BY TYPE

- 6.1 INTRODUCTION

- 6.2 GASKETED PLATE & FRAME HEAT EXCHANGER

- 6.2.1 COMPACT SIZE, HIGH HEAT TRANSFER EFFICIENCY, EASY MAINTENANCE, AND WIDE RANGE OF OPERATING CONDITIONS TO DRIVE MARKET

- 6.3 WELDED PLATE HEAT EXCHANGER (WPHE)

- 6.3.1 SUITABILITY FOR HANDLING AGGRESSIVE FLUIDS TO BOOST MARKET

- 6.4 BRAZED PLATE HEAT EXCHANGER (BPHE)

- 6.4.1 HIGH EFFICIENCY, COMPACT SIZE, RELIABILITY, AND EASE OF MAINTENANCE TO FUEL DEMAND

- 6.5 OTHER TYPES

7 PLATE & FRAME HEAT EXCHANGER MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.2 HVAC & REFRIGERATION

- 7.2.1 INCREASING DEMAND FOR READY-TO-SERVE AND PACKAGED FOODS AND BEVERAGES TO DRIVE MARKET

- 7.3 CHEMICALS

- 7.3.1 NEED FOR SAFE AND EFFICIENT HEAT TRANSFER IN CHEMICAL PROCESSES TO FUEL DEMAND

- 7.4 PETROCHEMICALS AND OIL & GAS

- 7.4.1 REQUIREMENT FOR EFFICIENT OIL COOLING, CONDENSATION, HEAT RECOVERY, AND GAS PROCESSING TO SUPPORT GROWTH

- 7.5 FOOD & BEVERAGES

- 7.5.1 COST-EFFECTIVE SOLUTIONS AS CONDENSERS, CHILLERS, AND EVAPORATORS TO PROPEL MARKET

- 7.6 POWER GENERATION

- 7.6.1 CONSISTENT COOLING OF LUBE OILS, BEARINGS, AND ROTOR BLADES IN DIESEL, STEAM, OR GAS TURBINES TO DRIVE MARKET

- 7.7 PULP & PAPER

- 7.7.1 ENHANCED PRODUCTION EFFICIENCY AND MAXIMIZED HEAT RECOVERY TO DRIVE MARKET

- 7.8 OTHER APPLICATIONS

8 PLATE & FRAME HEAT EXCHANGER MARKET, BY REGION

- 8.1 INTRODUCTION

- 8.2 ASIA PACIFIC

- 8.2.1 CHINA

- 8.2.1.1 Availability of low-cost labor and cheap raw materials to drive market

- 8.2.2 INDIA

- 8.2.2.1 Rapid urbanization and industrialization to propel market

- 8.2.3 JAPAN

- 8.2.3.1 Substantial demand from transportation and automotive sectors to boost market

- 8.2.4 SOUTH KOREA

- 8.2.4.1 Investments in energy sources to drive market

- 8.2.5 REST OF ASIA PACIFIC

- 8.2.1 CHINA

- 8.3 NORTH AMERICA

- 8.3.1 US

- 8.3.1.1 Increasing demand for natural gas and petroleum to drive market

- 8.3.2 CANADA

- 8.3.2.1 Availability of vast natural resources to contribute to market growth

- 8.3.3 MEXICO

- 8.3.3.1 Population growth to drive demand for power generation

- 8.3.1 US

- 8.4 EUROPE

- 8.4.1 GERMANY

- 8.4.1.1 Transition toward renewable energy sources to support market growth

- 8.4.2 FRANCE

- 8.4.2.1 Chemical exports to boost market growth

- 8.4.3 UK

- 8.4.3.1 R&D expenditure in chemical sector to boost market

- 8.4.4 ITALY

- 8.4.4.1 Growing numbers of chemical manufacturers to boost market

- 8.4.5 SWEDEN

- 8.4.5.1 Oil & gas sector to fuel market growth

- 8.4.6 REST OF EUROPE

- 8.4.1 GERMANY

- 8.5 MIDDLE EAST & AFRICA

- 8.5.1 GCC COUNTRIES

- 8.5.1.1 Saudi Arabia

- 8.5.1.1.1 Government implementation of new power projects to drive market growth

- 8.5.1.2 UAE

- 8.5.1.2.1 Expansion of natural gas production facilities to boost growth

- 8.5.1.3 Rest of GCC countries

- 8.5.1.1 Saudi Arabia

- 8.5.2 REST OF MIDDLE EAST & AFRICA

- 8.5.1 GCC COUNTRIES

- 8.6 SOUTH AMERICA

- 8.6.1 BRAZIL

- 8.6.1.1 Growing population to fuel market growth

- 8.6.2 ARGENTINA

- 8.6.2.1 Focus on non-hydro renewable sources to boost demand

- 8.6.3 REST OF SOUTH AMERICA

- 8.6.1 BRAZIL

9 COMPETITIVE LANDSCAPE

- 9.1 OVERVIEW

- 9.2 REVENUE ANALYSIS OF TOP PLAYERS, 2022-2024

- 9.3 MARKET SHARE ANALYSIS, 2023

- 9.4 MARKET EVALUATION MATRIX, 2024

- 9.5 COMPANY EVALUATION MATRIX, KEY PLAYERS, 2024

- 9.5.1 STARS

- 9.5.2 EMERGING LEADERS

- 9.5.3 PERVASIVE PLAYERS

- 9.5.4 PARTICIPANTS

- 9.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 9.5.5.1 Company footprint

- 9.5.5.2 Region footprint

- 9.5.5.3 Type footprint

- 9.5.5.4 Application footprint

- 9.6 STARTUPS AND SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX

- 9.6.1 RESPONSIVE COMPANIES

- 9.6.2 STARTING BLOCKS

- 9.6.3 PROGRESSIVE COMPANIES

- 9.6.4 DYNAMIC COMPANIES

- 9.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 9.6.5.1 Detailed list of key startups/SMEs

- 9.6.5.2 Competitive benchmarking of key startups/SMEs

- 9.7 COMPETITIVE SCENARIO

- 9.7.1 PRODUCT LAUNCHES

- 9.7.2 DEALS

- 9.7.3 EXPANSIONS

- 9.7.4 OTHERS

10 COMPANY PROFILES

- 10.1 KEY PLAYERS

- 10.1.1 ALFA LAVAL

- 10.1.1.1 Business overview

- 10.1.1.2 Products offered

- 10.1.1.3 Recent developments

- 10.1.1.3.1 Product launches

- 10.1.1.3.2 Deals

- 10.1.1.3.3 Expansions

- 10.1.1.4 MnM view

- 10.1.1.4.1 Key strengths

- 10.1.1.4.2 Strategic choices

- 10.1.1.4.3 Weaknesses and competitive threats

- 10.1.2 DANFOSS

- 10.1.2.1 Business overview

- 10.1.2.2 Products offered

- 10.1.2.3 Recent developments

- 10.1.2.3.1 Product launches

- 10.1.2.3.2 Deals

- 10.1.2.4 MnM view

- 10.1.2.4.1 Key strengths

- 10.1.2.4.2 Strategic choices

- 10.1.2.4.3 Weaknesses and competitive threats

- 10.1.3 KELVION HOLDING GMBH

- 10.1.3.1 Business overview

- 10.1.3.2 Products offered

- 10.1.3.3 Recent developments

- 10.1.3.3.1 Product launches

- 10.1.3.3.2 Others

- 10.1.3.4 MnM view

- 10.1.3.4.1 Key strengths

- 10.1.3.4.2 Strategic choices

- 10.1.3.4.3 Weaknesses and competitive threats

- 10.1.4 SPX FLOW

- 10.1.4.1 Business overview

- 10.1.4.2 Products offered

- 10.1.4.3 Recent developments

- 10.1.4.3.1 Product launches

- 10.1.4.3.2 Expansions

- 10.1.4.4 MnM view

- 10.1.4.4.1 Key strengths

- 10.1.4.4.2 Strategic choices

- 10.1.4.4.3 Weaknesses and competitive threats

- 10.1.5 XYLEM

- 10.1.5.1 Business overview

- 10.1.5.2 Products offered

- 10.1.5.3 Recent developments

- 10.1.5.3.1 Deals

- 10.1.5.4 MnM view

- 10.1.5.4.1 Key strengths

- 10.1.5.4.2 Strategic choices

- 10.1.5.4.3 Weaknesses and competitive threats

- 10.1.6 API HEAT TRANSFER

- 10.1.6.1 Business overview

- 10.1.6.2 Products offered

- 10.1.6.3 MnM view

- 10.1.7 BOYD

- 10.1.7.1 Business overview

- 10.1.7.2 Products offered

- 10.1.7.3 Recent developments

- 10.1.7.3.1 Deals

- 10.1.7.4 Expansions

- 10.1.7.5 MnM view

- 10.1.8 H. GUNTNER (UK) LIMITED

- 10.1.8.1 Business overview

- 10.1.8.2 Products offered

- 10.1.8.3 Recent developments

- 10.1.8.3.1 Deals

- 10.1.8.4 MnM view

- 10.1.9 JOHNSON CONTROLS

- 10.1.9.1 Business overview

- 10.1.9.2 Products offered

- 10.1.9.3 Recent developments

- 10.1.9.3.1 Deals

- 10.1.9.4 MnM view

- 10.1.10 WABTEC CORPORATION

- 10.1.10.1 Business overview

- 10.1.10.2 Products offered

- 10.1.10.3 Recent developments

- 10.1.10.3.1 Product launches

- 10.1.10.3.2 Deals

- 10.1.10.4 MnM view

- 10.1.1 ALFA LAVAL

- 10.2 OTHER PLAYERS

- 10.2.1 BARRIQUAND TECHNOLOGIES THERMIQUES

- 10.2.2 CHART INDUSTRIES

- 10.2.3 FUNKE HEAT EXCHANGER APPARATEBAU

- 10.2.4 HISAKA WORKS, LTD.

- 10.2.5 RADIANT HEAT EXCHANGER PVT. LTD.

- 10.2.6 SWEP INTERNATIONAL AB

- 10.2.7 VAHTERUS OY

- 10.2.8 KAORI

- 10.2.9 DIVERSIFIED HEAT TRANSFER

- 10.2.10 HRS HEAT EXCHANGERS

- 10.2.11 ONDA

- 10.2.12 SECESPOL

- 10.2.13 HYDAC

- 10.2.14 BAODE

- 10.2.15 THERMOFIN

11 APPENDIX

- 11.1 DISCUSSION GUIDE

- 11.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 11.3 CUSTOMIZATION OPTIONS

- 11.4 RELATED REPORTS

- 11.5 AUTHOR DETAILS