|

|

市場調査レポート

商品コード

1442281

レーシングシミュレーターの世界市場:タイプ・用途・提供区分・車両タイプ・販売チャネル・コンポーネント・地域別 - 予測(~2030年)Racing Simulator Market by Type, Application, Offering, Vehicle Type, Sales Channel, Component & Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| レーシングシミュレーターの世界市場:タイプ・用途・提供区分・車両タイプ・販売チャネル・コンポーネント・地域別 - 予測(~2030年) |

|

出版日: 2024年02月26日

発行: MarketsandMarkets

ページ情報: 英文 223 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

世界のレーシングシミュレーターの市場規模は、2024年の5億米ドルから、予測期間中に15.6%のCAGRで推移し、2030年には11億米ドルの規模に成長すると予測されています。

レーシングシミュレーターの需要は、世界のeスポーツイベントへの嗜好の高まり、仮想シミュレーションレーシングイベントの実施に対するモータースポーツ協会の関心の高まり、娯楽目的でのレーシングシミュレーターの人気の高まりによって促進されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2024-2030年 |

| 基準年 | 2023年 |

| 予測期間 | 2024-2030 |

| 検討単位 | 金額 (米ドル) |

| セグメント | タイプ・用途・提供区分・車両タイプ・販売チャネル・コンポーネント・地域 |

| 対象地域 | 北米・欧州・アジア太平洋・その他の地域 |

販売チャネル別では、オンライン販売の部門が2024年の市場を独占する見通しです。オンラインプラットフォームは世界で85%超のシェアを占めています。オンラインプラットフォームは一元化されたマーケットプレースを提供するため、消費者は好みや要件に応じてさまざまな選択肢を検討することができます。また、アクセスが容易であること、選択肢が豊富であること、競争力のある価格で複数の会社が存在することなどが利点として挙げられます。ユーザーは、レーシングシミュレーターのモデルの広い選択肢から選択し、機能を比較し、レビューを読んで、自宅で快適に決めることができます。さらに、オンライン小売業者は、多くの場合、お得な情報、割引、バンドルパッケージなどを提供し、オンライン購入をより費用対効果の高いものにしています。

タイプ別では、フルスケールの部門がもっとも急成長している部門と分析されています。フルスケールレーシングシミュレーターは、高度なモーションプラットフォーム、フォースフィードバックステアリング、高品質グラフィックなどの機能を備え、レーサーにリアルで臨場感あふれる体験を与えます。

当レポートでは、世界のレーシングシミュレーターの市場を調査し、市場概要、市場影響因子および市場機会の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- レーシングシミュレーター市場の収益の推移

- エコシステム分析

- サプライチェーン分析

- 貿易分析

- 価格分析

- 特許分析

- ケーススタディ

- レーシングシミュレーター市場:今後のカンファレンスとイベントの詳細リスト

- 購入基準

- 技術動向

- SIMレーサーに関する洞察

第6章 レーシングシミュレーター市場:タイプ別

- コンパクト/エントリーレベルシミュレーター

- ミドルレベルシミュレーター

- フルスケールシミュレーター

第7章 レーシングシミュレーター市場:提供区分別

- ハードウェア

- ソフトウェア

第8章 レーシングシミュレーター市場:車両タイプ別

- 乗用車

- 商用車

第9章 レーシングシミュレーター市場:用途別

- 家庭用/個人用

- 商用

第10章 レーシングシミュレーター市場:販売チャネル別

- オンライン販売

- オフライン販売

第11章 レーシングシミュレーター市場:コンポーネントタイプ別

- ハンドル

- ペダルセット

- ギアボックスシフター

- シート

- モニタースタンド

- コックピット

- その他

第12章 レーシングシミュレーター市場:地域別

- アジア太平洋

- 欧州

- 北米

- その他の地域

第13章 競合情勢

- 概要

- 主要企業の戦略

- 市場ランキング分析

- 収益分析

- 企業評価マトリックス

- 競合シナリオ

- 企業価値評価

- ブランド比較

第14章 企業プロファイル

- 主要企業

- CXC SIMULATIONS

- TRAK RACER

- NEXT LEVEL RACING

- VI-GRADE GMBH

- D-BOX TECHNOLOGIES INC.

- CRUDEN

- ANTHONY BEST DYNAMICS LIMITED

- CRANFIELD AEROSPACE SOLUTIONS

- SIMXPERIENCE

- SIMWORX PTY LTD.

- その他の企業

- RS SIMULATION

- VESARO

- VERTICAL REALITY SIMULATIONS, LLC

- JCL SIMULATOR

- FPZERO SIMULATORS

- DOF REALITY MOTION SIMULATORS

- ADVANCED SIMRACING

- ECA GROUP

- MOTUM SIMULATION PTY LTD.

- SIMCRAFT

- PROFISIM S.R.O.

- CKAS MECHATRONICS PTY LTD.

- PRS

- IMSIM

- SIMULATIONSTECHNIK LINGNAU GMBH

- COOL PERFORMANCE

- MOZA RACING

- PLAYSEAT

- TECKNOTROVE

- FAAC INCORPORATED

- AVSIMULATION

第15章 MARKETSANDMARKETSによる推奨事項

- 北米とアジア太平洋がレーシングシミュレーターの潜在市場に

- 高度なシミュレーション技術の統合に重点を置いたレーシングシミュレーター

- 総論

第16章 付録

The racing simulator market is estimated to grow from USD 0.5 billion in 2024 to USD 1.1 billion by 2030 at a CAGR of 15.6% during the forecast period. The demand for racing simulators is growing owing to the growing preference for esports events worldwide, the rising focus of the motorsport association on conducting virtual sim racing events, and the increasing popularity of racing simulators for entertainment purposes, which will further drive the demand.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2023 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD Billion) |

| Segments | Type, Application, Offering, Vehicle Type, Sales Channel, Component & Region |

| Regions covered | North America, Europe, Asia Pacific, and the Rest of the World |

People from countries like India, China, Brazil, Mexico, and Argentina are also attracted to racing simulators to use as training tools for professional racers. However, the high integration and switching costs can hinder market growth, especially in developing countries.

"Online sales channel to dominate the racing simulator market in 2024."

The online platform for purchasing racing simulators contributes more than the market share of 85% globally. Online platforms provide a centralized marketplace, enabling consumers to explore various options per their preferences and requirements. Other benefits are easy accessibility, a wide variety of options, and the presence of several competitors at competitive pricing. Users can choose through a wide range of racing simulator models, compare features, read reviews & decide from the comfort of their homes. Furthermore, online retailers often offer exclusive deals, discounts, and bundle packages, making online purchases more cost-effective. Currently, many racing simulator companies target potential customers through online sales channels to reach a wide range of audiences, which helps establish a direct connection with consumers and reduces distribution and inventory costs. This helps racing simulator suppliers reduce the overhead cost associated with rent, utilities, and staffing, among others, and enables them to offer competitive pricing and improved profit margins.

"The Full-scale simulator market is analyzed as the fastest growing segment by simulator type."

Full-scale racing simulators are fully advanced with features such as advanced motion platforms, force feedback steering, and high-quality graphics, giving racers a realistic and lifelike experience. The price range of full-scale simulators starts from USD 12,000, contributing to the smallest share at a global level. These simulators are provided for high-precision steering wheels with realistic feedback, HD multi-monitor setup, full-adjustable seats, electrically controlled pedal sets, motion platforms, advanced hydraulics, and so on. Full-scale racing simulators provide high-fidelity graphics, accurate vehicle dynamics, and realistic motion feedback that recreate the closest approximation to actual racing conditions. Further, Virtual reality (VR) headsets provide a captivating visual experience, allowing users to feel thoroughly fascinated within the racing environment. It is costlier than the other two categories, increasingly adopted by professional racing training centers for aspiring racing car drivers, and preferred by dedicated professional racers who want to experience different driving styles. These simulators replicate authentic driving conditions, offering a valuable tool for honing skills, practicing race strategies, and improving overall performance. CXC Simulation, Cool Performance, Trak Racer, and Vi-Grade GmbH are some key suppliers of full-scale racing simulators globally. For instance, CXC simulation offers a full-scale racing simulator called MOTION Pro II which comes with a VR set, motion platforms, and 4 Degree of Freedom costs around USD 75,000. Further, the rising use of these full-scale racing simulators in developing countries such as China, India, and Brazil by professional racing drivers for practice is expected to drive the demand for full-scale simulators. In addition to this, the growing demand for online gaming, and increasing playstations is expected to drive the demand for full-scale racing simulators. Thus, the rising number of professional racers and their demand for realistic and lifelike racing simulators is expected to drive full-scale racing simulators in the coming years.

"Europe accounted for the second largest racing simulator market during the forecast period."

Europe is estimated to be the second largest racing simulator market after North America, where the UK dominates the regional market, followed by Germany and France. This is owing to the increasing preference among professional drivers to invest in racing simulators, effectively reducing costs associated with training on actual cars. The growth of esports and the prevalence of motorsport racing events like Formula 1 (like the British Grand Prix and the Italian Grand Prix), Le Mans Virtual Series, and various touring car championships further expand the racing simulator market. The enthusiasm for motorsports in Europe extends to a demand for racing simulators as users seek to replicate the thrill of their favorite races at home. Additionally, the prevalence of professional racing teams and training centers for professional driver development programs contributes to the regional growth of racing simulators. Numerous European OEMs, such as the BMW Group, Mercedes-Benz, Ferrari, and Porsche, actively participate in motorsport racing events. These companies are focusing on providing virtual training to their racing teams. For instance, BMW Motorsport and BMW M presented the new BMW M2 CS Racing LIVE 2019 public debut during the BMW SIM. Thus, higher consumer demand for personalized entertainment solutions, growing esports events, rising professional car racers, and initiatives by major sports car manufacturers to support young racing enthusiasts are driving the European racing simulator market.

Breakdown of Primaries

In-depth interviews were conducted with CXOs, marketing directors, other innovation and technology directors, and executives from various key organizations operating in this market.

- By Company Type: Supply Side- 70%, Demand Side- 30%

- By Designation: C-Level Executives - 40%, Director/ Vice Presidents- 30%, and Others - 30%

- By Region: North America - 35%, Europe - 25%, Asia Pacific- 40%,

The racing simulator market is led by established players such as CXC Simulation (US), D-Box Technologies, Inc. (Canada), Trak Racer (Australia), Next Level Racing (Australia), SIMXPERIENCE (US), Vi-Grade GmbH (Germany), Cruden B.V. (Netherlands), and Simworx Pty Ltd (Australia). The study includes an in-depth competitive analysis of these key players in the racing simulator market with their company profiles, MnM view of the top five companies, recent developments, and key market strategies.

Research Coverage:

The racing simulator market is segmented by region (Asia Pacific, Europe, North America, and RoW), vehicle type (passenger car and commercial vehicle), Simulator type (Compact, Mid-level, and Full-scale simulator), application (Home/ Personal Use, Commercial), offerings (Hardware, and Software), Sales Channel (Online, Offline), Component type (Steering Wheels, Pedal Sets, Gearbox Shifters, Seats, Monitor Stand, Cockpits, and Others).

The study also includes an in-depth competitive analysis of the key players in the market along with their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report:

This report provides insights concerning the following points:

Country-level simulator type-wise market: The report offers in-depth market sizing and forecasts for 2030 by simulator types, such as compact, mid-level, and full-scale simulators. This study covers the market sizing for the racing simulator market at the country and regional levels.

By Vehicle type: The report offers in-depth market sizing and forecasts up to 2030 by vehicle type, such as passenger cars, and commercial vehicles at the regional level. In-depth analysis of different vehicle types at the regional level.

Component Type & By Offerings: The report offers in-depth market sizing and forecasts up to 2030 by component types, such as steering wheels, pedal sets, gearbox shifters, seats, monitor stands, cockpits, and others. The report provides market sizing and forecasting till 2030 by offerings, such as online and offline.

The report provides the "Market Share" of the leading racing simulator market players.

Market Development: The report provides comprehensive information about lucrative emerging markets for the racing simulator market across regions.

Product Development/Innovation: The report gives detailed insights into R&D activities, upcoming technologies, and new product launches in the racing simulator market.

Market Diversification: The report offers detailed information about untapped markets, investments, new products, and recent developments in the racing simulator market.

The report provides insights on the following pointers:

- Analysis of key drivers (The Growing Number of eDport Events and Development in Internet Connectivity, Growing Number of Motorsports Racing Events, and Growing Demand for Entertainment), Restraints (High Integration and Switching Cost), Opportunities (Advancement in Technology Such as Integration of AI, Virtual Reality, and Next Generation Motion Platforms, Increase in Demand for Customized Racing Simulators), Challenges (Lack of Standardization and Technical Complexity)

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the racing simulator market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the racing simulator market across different regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the racing simulator market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like CXC Simulation (US), Trak Racer (Australia), Next Level Racing (Australia), D-Box Technologies, Inc. (Canada), Vi-Grade GmbH (Germany), and SIMXPERIENCE (US) in the racing simulator market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- TABLE 1 RACING SIMULATOR MARKET DEFINITION, BY SIMULATOR TYPE

- TABLE 2 RACING SIMULATOR MARKET DEFINITION, BY COMPONENT

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- TABLE 3 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- FIGURE 1 MARKETS COVERED

- 1.3.1 REGIONS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- TABLE 4 CURRENCY EXCHANGE RATES

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 RACING SIMULATOR MARKET: RESEARCH DESIGN

- FIGURE 3 RESEARCH MODEL

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources used to estimate base numbers and market size

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

- 2.1.2.1 Sampling techniques & data collection methods

- 2.1.3 PRIMARY PARTICIPANTS

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 5 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- 2.2.1 TOP-DOWN APPROACH: RACING SIMULATOR MARKET

- FIGURE 6 TOP-DOWN APPROACH: RACING SIMULATOR MARKET, BY SIMULATOR TYPE

- 2.3 RECESSION IMPACT

- 2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 7 DATA TRIANGULATION: RACING SIMULATOR MARKET

- 2.4.1 GLOBAL ASSUMPTIONS

- 2.4.2 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

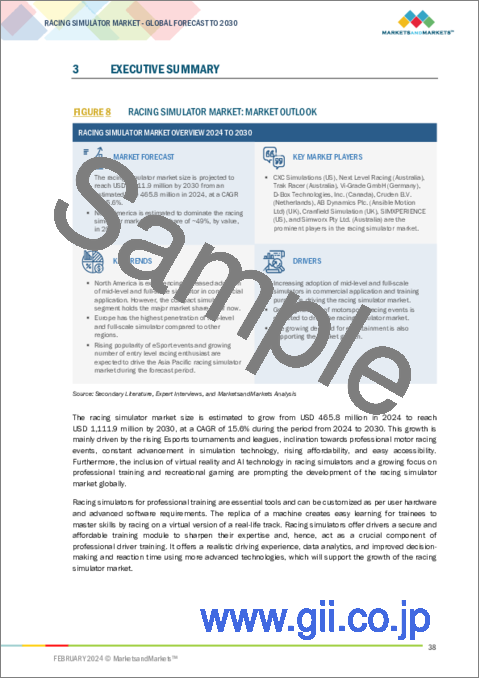

- FIGURE 8 RACING SIMULATOR MARKET: MARKET OUTLOOK

- FIGURE 9 RACING SIMULATOR MARKET, BY REGION, 2024 VS. 2030 (USD MILLION)

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN RACING SIMULATOR MARKET

- FIGURE 10 INCREASING VIRTUAL SIM RACING EVENTS AND GROWING POPULARITY TO DRIVE MARKET

- 4.2 RACING SIMULATOR MARKET, BY SIMULATOR TYPE

- FIGURE 11 COMPACT/ENTRY-LEVEL SIMULATORS TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- 4.3 RACING SIMULATOR MARKET, BY OFFERING

- FIGURE 12 HARDWARE SEGMENT TO DOMINATE RACING SIMULATOR MARKET DURING FORECAST PERIOD

- 4.4 RACING SIMULATOR MARKET, BY APPLICATION

- FIGURE 13 SIMULATORS FOR HOME/PERSONAL USE TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- 4.5 RACING SIMULATOR MARKET, BY SALES CHANNEL

- FIGURE 14 SIMULATOR SALES FROM ONLINE CHANNEL TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.6 RACING SIMULATOR MARKET, BY COMPONENT TYPE

- FIGURE 15 STEERING WHEEL SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- 4.7 RACING SIMULATOR MARKET, BY VEHICLE TYPE

- FIGURE 16 PASSENGER CAR SEGMENT TO LEAD RACING SIMULATOR MARKET

- 4.8 RACING SIMULATOR MARKET, BY REGION

- FIGURE 17 NORTH AMERICA TO BE LARGEST RACING SIMULATOR MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 18 MARKET DYNAMICS: RACING SIMULATOR MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Growing number of motorsports racing events

- TABLE 5 LIST OF PROMINENT SPORTCARS EVENTS, BY REGION

- 5.2.1.2 Growing number of Esport competitions with significant prize money

- TABLE 6 LIST OF ESPORT RACING EVENTS, 2023-2024

- 5.2.2 RESTRAINTS

- 5.2.2.1 High integration and switching cost

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Advancements in technologies such as AI, VR, and next-generation motion platforms

- TABLE 7 LIST OF RACING SIMULATORS WITH 4 DOF, 5 DOF, AND 6 DOF

- 5.2.3.2 Increased demand for customized racing simulators

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of standardization and technical complexity

- 5.3 REVENUE SHIFT IN RACING SIMULATOR MARKET

- FIGURE 19 REVENUE SHIFT AND NEW REVENUE POCKETS IN RACING SIMULATOR MARKET

- 5.4 ECOSYSTEM ANALYSIS

- FIGURE 20 RACING SIMULATOR MARKET: ECOSYSTEM MAPPING

- TABLE 8 RACING SIMULATOR MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- 5.5 SUPPLY CHAIN ANALYSIS

- FIGURE 21 SUPPLY CHAIN ANALYSIS: RACING SIMULATOR MARKET

- 5.6 TRADE ANALYSIS

- 5.6.1 IMPORT DATA

- 5.6.1.1 US

- TABLE 9 US IMPORT: DRIVING SIMULATORS, BY COUNTRY

- 5.6.1.2 Canada

- TABLE 10 CANADA IMPORT: DRIVING SIMULATORS, BY COUNTRY

- 5.6.1.3 China

- TABLE 11 CHINA IMPORT: DRIVING SIMULATORS, BY COUNTRY

- 5.6.1.4 Japan

- TABLE 12 JAPAN IMPORT: DRIVING SIMULATORS, BY COUNTRY

- 5.6.1.5 India

- TABLE 13 INDIA IMPORT: DRIVING SIMULATORS, BY COUNTRY

- 5.6.1.6 Germany

- TABLE 14 GERMANY IMPORT: DRIVING SIMULATORS, BY COUNTRY

- 5.6.1.7 France

- TABLE 15 FRANCE IMPORT: DRIVING SIMULATORS, BY COUNTRY

- 5.6.1.8 Spain

- TABLE 16 SPAIN IMPORT: DRIVING SIMULATORS, BY COUNTRY

- 5.6.1.9 UK

- TABLE 17 UK IMPORT: DRIVING SIMULATORS, BY COUNTRY

- 5.6.2 EXPORT DATA

- 5.6.2.1 US

- TABLE 18 US EXPORT: DRIVING SIMULATOR, BY COUNTRY

- 5.6.2.2 Canada

- TABLE 19 CANADA EXPORT: DRIVING SIMULATOR, BY COUNTRY

- 5.6.2.3 China

- TABLE 20 CHINA EXPORT: DRIVING SIMULATOR, BY COUNTRY

- 5.6.2.4 Japan

- TABLE 21 JAPAN EXPORT: DRIVING SIMULATOR, BY COUNTRY

- 5.6.2.5 India

- TABLE 22 INDIA EXPORT: DRIVING SIMULATOR, BY COUNTRY

- 5.6.2.6 Germany

- TABLE 23 GERMANY EXPORT: DRIVING SIMULATOR, BY COUNTRY

- 5.6.2.7 France

- TABLE 24 FRANCE EXPORT: DRIVING SIMULATOR, BY COUNTRY

- 5.6.2.8 Spain

- TABLE 25 SPAIN EXPORT: DRIVING SIMULATOR, BY COUNTRY

- 5.6.2.9 UK

- TABLE 26 UK EXPORT: DRIVING SIMULATOR, BY COUNTRY

- 5.6.1 IMPORT DATA

- 5.7 PRICING ANALYSIS

- TABLE 27 RACING SIMULATOR COMPONENT PRICE TREND, 2021 VS 2023P

- TABLE 28 BY SIMULATOR TYPE, 2021 VS 2023

- 5.8 PATENT ANALYSIS

- 5.9 CASE STUDY

- 5.9.1 USE CASE 1: LAURENS VANTHOOR TRAINING CASE STUDY

- 5.9.2 USE CASE 2: DEFENCE SCIENCE AND TECHNOLOGY ORGANISATION (DSTO), AUSTRALIA

- 5.9.3 USE CASE 3: MOOG AND BPS DEVELOPED SIMULATOR MOTION BASE THAT PROVIDES AUTHENTIC DRIVING EXPERIENCES

- 5.9.4 USE CASE 4: BASE PERFORMANCE SIMULATORS

- 5.9.5 USE CASE 5: MAHINDRA AND VI-GRADE GMBH JOINTLY DEVELOPED VI-CARREALTIME MODELS WITHIN SIMULATOR

- 5.10 RACING SIMULATOR MARKET: DETAILED LIST OF UPCOMING CONFERENCES & EVENTS

- 5.11 BUYING CRITERIA

- FIGURE 22 KEY BUYING CRITERIA FOR FULL-SCALE SIMULATOR VS COMPACT/ENTRY-LEVEL SIMULATOR

- TABLE 29 KEY BUYING CRITERIA FOR FULL-SCALE SIMULATOR VS COMPACT/ENTRY-LEVEL SIMULATOR

- 5.12 TECHNOLOGY TRENDS

- 5.12.1 ADVANCED PHYSICS ENGINES

- 5.12.2 NEXT-GENERATION MOTION PLATFORMS

- 5.12.3 VIRTUAL REALITY (VR)

- 5.13 INSIGHTS ON SIM RACERS IN TERMS OF AGE & PERSON

- 5.13.1 YOUNG ENTHUSIASTS (UNDER 18 YEARS)

- 5.13.2 YOUNG ADULTS (18-30 YEARS)

- 5.13.3 ADULTS (30-50 YEARS)

- 5.13.4 MATURE ENTHUSIASTS (ABOVE 50 YEARS)

6 RACING SIMULATOR MARKET, BY TYPE

- 6.1 INTRODUCTION

- FIGURE 23 RACING SIMULATOR MARKET, BY TYPE, 2024 VS. 2030 (USD MILLION)

- TABLE 30 RACING SIMULATOR MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 31 RACING SIMULATOR MARKET, BY TYPE, 2024-2030 (USD MILLION)

- 6.1.1 INDUSTRY INSIGHTS

- 6.2 COMPACT/ENTRY-LEVEL SIMULATOR

- 6.2.1 AFFORDABILITY AND SPACE EFFICIENCY TO DRIVE DEMAND IN HOME APPLICATION

- TABLE 32 COMPACT/ENTRY-LEVEL: RACING SIMULATOR MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 33 COMPACT/ENTRY-LEVEL: RACING SIMULATOR MARKET, BY REGION, 2024-2030 (USD MILLION)

- 6.3 MID-LEVEL SIMULATOR

- 6.3.1 OFFERS BALANCED MIX OF REALISTIC FEATURES AND COST

- TABLE 34 MID-LEVEL: RACING SIMULATOR MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 35 MID-LEVEL: RACING SIMULATOR MARKET, BY REGION, 2024-2030 (USD MILLION)

- 6.4 FULL-SCALE SIMULATOR

- 6.4.1 EUROPE TO BE LARGEST MARKET FOR FULL-SCALE SIMULATORS

- TABLE 36 FULL-SCALE: RACING SIMULATOR MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 37 FULL-SCALE: RACING SIMULATOR MARKET, BY REGION, 2024-2030 (USD MILLION)

7 RACING SIMULATOR MARKET, BY OFFERING

- 7.1 INTRODUCTION

- FIGURE 24 RACING SIMULATOR MARKET, BY OFFERING, 2024 VS. 2030 (USD MILLION)

- TABLE 38 RACING SIMULATOR MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 39 RACING SIMULATOR MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- 7.1.1 INDUSTRY INSIGHTS

- 7.2 HARDWARE

- 7.2.1 GROWING INCLINATION TOWARDS REALISM AND PRECISION FUELING DEMAND

- TABLE 40 HARDWARE: RACING SIMULATOR MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 41 HARDWARE: RACING SIMULATOR MARKET, BY REGION, 2024-2030 (USD MILLION)

- 7.3 SOFTWARE

- 7.3.1 ADVANCED CUSTOMIZATION OPTIONS AND ONGOING DEVELOPMENTS TO SUPPORT GROWTH

- TABLE 42 SOFTWARE: RACING SIMULATOR MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 43 SOFTWARE: RACING SIMULATOR MARKET, BY REGION, 2024-2030 (USD MILLION)

8 RACING SIMULATOR MARKET, BY VEHICLE TYPE

- 8.1 INTRODUCTION

- FIGURE 25 RACING SIMULATOR MARKET, BY VEHICLE TYPE, 2024 VS. 2030 (USD MILLION)

- TABLE 44 RACING SIMULATOR MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 45 RACING SIMULATOR MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- 8.1.1 INDUSTRY INSIGHTS

- 8.2 PASSENGER CAR

- 8.2.1 GROWING VIRTUAL CAR RACING EVENTS AND REALISTIC INTERPRETATION OF ACTUAL RACING CONDITIONS TO DRIVE DEMAND

- TABLE 46 PASSENGER CAR: RACING SIMULATOR MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 47 PASSENGER CAR: RACING SIMULATOR MARKET, BY REGION, 2024-2030 (USD MILLION)

- 8.3 COMMERCIAL VEHICLE

- 8.3.1 GROWING FANBASE FOR COMMERCIAL VEHICLE RACING AND RISING DEMAND AS REALISTIC TRAINING TOOL TO DRIVE GROWTH

- TABLE 48 COMMERCIAL VEHICLE: RACING SIMULATOR MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 49 COMMERCIAL VEHICLE: RACING SIMULATOR MARKET, BY REGION, 2024-2030 (USD MILLION)

9 RACING SIMULATOR MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- FIGURE 26 RACING SIMULATOR MARKET, BY APPLICATION, 2024 VS. 2030 (USD MILLION)

- TABLE 50 RACING SIMULATOR MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 51 RACING SIMULATOR MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- 9.1.1 INDUSTRY INSIGHTS

- 9.2 HOME/PERSONAL USE

- 9.2.1 COMPACT RACING SIMULATORS TO REMAIN PRIMARY CHOICE FOR HOME USE AND CASUAL RACING

- TABLE 52 HOME/PERSONAL USE: RACING SIMULATOR MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 53 HOME/PERSONAL USE: RACING SIMULATOR MARKET, BY REGION, 2024-2030 (USD MILLION)

- 9.3 COMMERCIAL

- 9.3.1 PROFESSIONAL-GRADE SETUP PREFERRED FOR COMMERCIAL APPLICATION

- TABLE 54 COMMERCIAL: RACING SIMULATOR MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 55 COMMERCIAL: RACING SIMULATOR MARKET, BY REGION, 2024-2030 (USD MILLION)

10 RACING SIMULATOR MARKET, BY SALES CHANNEL

- 10.1 INTRODUCTION

- FIGURE 27 RACING SIMULATORS MARKET, BY SALES CHANNEL, 2024 VS. 2030 (USD MILLION)

- TABLE 56 RACING SIMULATOR MARKET, BY SALES CHANNEL, 2019-2023 (USD MILLION)

- TABLE 57 RACING SIMULATOR MARKET, BY SALES CHANNEL, 2024-2030 (USD MILLION)

- 10.1.1 INDUSTRY INSIGHTS

- 10.2 ONLINE SALES

- 10.2.1 HIGHER FLEXIBILITY, EASY AVAILABILITY, AND WIDE VARIETY OF PRODUCTS TO DRIVE MARKET

- TABLE 58 ONLINE: RACING SIMULATOR MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 59 ONLINE: RACING SIMULATOR MARKET, BY REGION, 2024-2030 (USD MILLION)

- 10.3 OFFLINE SALES

- 10.3.1 NORTH AMERICA TO BE LARGEST MARKET IN OFFLINE SALES SEGMENT

- TABLE 60 OFFLINE: RACING SIMULATOR MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 61 OFFLINE: RACING SIMULATOR MARKET, BY REGION, 2024-2030 (USD MILLION)

11 RACING SIMULATOR MARKET, BY COMPONENT TYPE

- 11.1 INTRODUCTION

- FIGURE 28 RACING SIMULATOR MARKET, BY COMPONENT, 2024 VS. 2030 (USD MILLION)

- TABLE 62 RACING SIMULATOR MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 63 RACING SIMULATOR MARKET, BY COMPONENT, 2024-2030 (USD MILLION)

- 11.1.1 INDUSTRY INSIGHTS

- 11.2 STEERING WHEEL

- 11.2.1 INCORPORATION OF FORCE FEEDBACK SYSTEM AND FEATURE BUTTONS TO DRIVE DEMAND FOR STEERING WHEELS

- TABLE 64 STEERING WHEEL: RACING SIMULATOR MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 65 STEERING WHEEL: RACING SIMULATOR MARKET, BY REGION, 2024-2030 (USD MILLION)

- 11.3 PEDAL SETS

- 11.3.1 INCREASING DEMAND FOR RACING SIMULATORS WITH HYDRAULIC PEDALS FOR REALISTIC FEEL TO BOOST MARKET

- TABLE 66 PEDAL SETS: RACING SIMULATOR MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 67 PEDAL SETS: RACING SIMULATOR MARKET, BY REGION, 2024-2030 (USD MILLION)

- 11.4 GEARBOX SHIFTER

- 11.4.1 GROWING PREFERENCE FOR MORE REALISTIC AND IMMERSIVE EXPERIENCE TO DRIVE DEMAND

- TABLE 68 GEARBOX SHIFTER: RACING SIMULATOR MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 69 GEARBOX SHIFTER: RACING SIMULATOR MARKET, BY REGION, 2024-2030 (USD MILLION)

- 11.5 SEAT

- 11.5.1 INCREASING USE OF CUSTOMIZED SEATS TO BOOST DEMAND

- TABLE 70 SEAT: RACING SIMULATOR MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 71 SEAT: RACING SIMULATOR MARKET, BY REGION, 2024-2030 (USD MILLION)

- 11.6 MONITOR STAND

- 11.6.1 INCREASING USE OF THREE DISPLAY SETUPS TO DRIVE MARKET

- TABLE 72 MONITOR STAND: RACING SIMULATOR MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 73 MONITOR STAND: RACING SIMULATOR MARKET, BY REGION, 2024-2030 (USD MILLION)

- 11.7 COCKPIT

- 11.7.1 GROWING ADOPTION OF COCKPITS WITH SEAT MOUNTED TO DRIVE MARKET

- TABLE 74 COCKPIT: RACING SIMULATOR MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 75 COCKPIT: RACING SIMULATOR MARKET, BY REGION, 2024-2030 (USD MILLION)

- 11.8 OTHER COMPONENTS

- 11.8.1 GROWING ADOPTION OF MOTION PLATFORMS AND SIM DASHBOARD IN RACING SIMULATOR TO DRIVE MARKET

- TABLE 76 OTHER COMPONENTS: RACING SIMULATOR MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 77 OTHER COMPONENTS: RACING SIMULATOR MARKET, BY REGION, 2024-2030 (USD MILLION)

12 RACING SIMULATOR MARKET, BY REGION

- 12.1 INTRODUCTION

- FIGURE 29 RACING SIMULATOR MARKET, BY REGION, 2024 VS. 2030 (USD MILLION

- TABLE 78 RACING SIMULATOR MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 79 RACING SIMULATOR MARKET, BY REGION, 2024-2030 (USD MILLION)

- 12.1.1 INDUSTRY INSIGHTS

- 12.2 ASIA PACIFIC

- 12.2.1 ASIA PACIFIC: RECESSION IMPACT ANALYSIS

- FIGURE 30 ASIA PACIFIC: RACING SIMULATOR MARKET SNAPSHOT

- TABLE 80 ASIA PACIFIC: RACING SIMULATOR MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 81 ASIA PACIFIC: RACING SIMULATOR MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- 12.2.2 CHINA

- 12.2.2.1 Presence of major racing simulator manufacturers to drive market

- TABLE 82 CHINA: RACING SIMULATOR MARKET, BY SIMULATOR TYPE, 2019-2023(USD MILLION)

- TABLE 83 CHINA: RACING SIMULATOR MARKET, BY SIMULATOR TYPE, 2024-2030 (USD MILLION)

- 12.2.3 INDIA

- 12.2.3.1 Increasing accessibility to advanced gaming hardware and online gaming platforms to drive market

- TABLE 84 INDIA: RACING SIMULATOR MARKET, BY SIMULATOR TYPE, 2019-2023(USD MILLION)

- TABLE 85 INDIA: RACING SIMULATOR MARKET, BY SIMULATOR TYPE, 2024-2030 (USD MILLION)

- 12.2.4 JAPAN

- 12.2.4.1 Booming racing community to drive market

- TABLE 86 JAPAN: RACING SIMULATOR MARKET, BY SIMULATOR TYPE, 2019-2023(USD MILLION)

- TABLE 87 JAPAN: RACING SIMULATOR MARKET, BY SIMULATOR TYPE, 2024-2030 (USD MILLION)

- 12.2.5 SOUTH KOREA

- 12.2.5.1 Growing development of open racing simulator centers to drive market

- TABLE 88 SOUTH KOREA: RACING SIMULATOR MARKET, BY SIMULATOR TYPE, 2019-2023(USD MILLION)

- TABLE 89 SOUTH KOREA: RACING SIMULATOR MARKET, BY SIMULATOR TYPE, 2024-2030 (USD MILLION)

- 12.2.6 AUSTRALIA

- 12.2.6.1 Surge in virtual championships and collaborative events to drive market

- TABLE 90 AUSTRALIA: RACING SIMULATOR MARKET, BY SIMULATOR TYPE, 2019-2023(USD MILLION)

- TABLE 91 AUSTRALIA: RACING SIMULATOR MARKET, BY SIMULATOR TYPE, 2024-2030 (USD MILLION)

- 12.3 EUROPE

- 12.3.1 EUROPE: RECESSION IMPACT ANALYSIS

- FIGURE 31 EUROPE: RACING SIMULATOR MARKET, BY COUNTRY, 2024 VS. 2030

- TABLE 92 EUROPE: RACING SIMULATOR MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 93 EUROPE: RACING SIMULATOR MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- 12.3.2 GERMANY

- 12.3.2.1 Favorable government initiatives to drive market

- TABLE 94 GERMANY: RACING SIMULATOR MARKET, BY SIMULATOR TYPE, 2019-2023(USD MILLION)

- TABLE 95 GERMANY: RACING SIMULATOR MARKET, BY SIMULATOR TYPE, 2024-2030 (USD MILLION)

- 12.3.3 FRANCE

- 12.3.3.1 Growing interest in racing leagues and tournaments to drive market

- TABLE 96 FRANCE: RACING SIMULATOR MARKET, BY SIMULATOR TYPE, 2019-2023(USD MILLION)

- TABLE 97 FRANCE: RACING SIMULATOR MARKET, BY SIMULATOR TYPE, 2024-2030 (USD MILLION)

- 12.3.4 SPAIN

- 12.3.4.1 Thriving gaming culture and annual events to drive market

- TABLE 98 SPAIN: RACING SIMULATOR MARKET, BY SIMULATOR TYPE, 2019-2023(USD MILLION)

- TABLE 99 SPAIN: RACING SIMULATOR MARKET, BY SIMULATOR TYPE, 2024-2030 (USD MILLION)

- 12.3.5 ITALY

- 12.3.5.1 Growing focus on immersive virtual experiences to drive market

- TABLE 100 ITALY: RACING SIMULATOR MARKET, BY SIMULATOR TYPE, 2019-2023(USD MILLION)

- TABLE 101 ITALY: RACING SIMULATOR MARKET, BY SIMULATOR TYPE, 2024-2030 (USD MILLION)

- 12.3.6 UK

- 12.3.6.1 Rising partnerships among racing simulator manufacturers to drive market

- TABLE 102 UK: RACING SIMULATOR MARKET, BY SIMULATOR TYPE, 2019-2023(USD MILLION)

- TABLE 103 UK: RACING SIMULATOR MARKET, BY SIMULATOR TYPE, 2024-2030 (USD MILLION)

- 12.3.7 REST OF EUROPE

- TABLE 104 REST OF EUROPE: RACING SIMULATOR MARKET, BY SIMULATOR TYPE, 2019-2023(USD MILLION)

- TABLE 105 REST OF EUROPE: RACING SIMULATOR MARKET, BY SIMULATOR TYPE, 2024-2030 (USD MILLION)

- 12.4 NORTH AMERICA

- 12.4.1 NORTH AMERICA: RECESSION IMPACT ANALYSIS

- FIGURE 32 NORTH AMERICA: RACING SIMULATOR MARKET SNAPSHOT

- TABLE 106 NORTH AMERICA: RACING SIMULATOR MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 107 NORTH AMERICA: RACING SIMULATOR MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- 12.4.2 US

- 12.4.2.1 Growing sponsorships for virtual sim racing events from OEMs to drive market

- TABLE 108 US: RACING SIMULATOR MARKET, BY SIMULATOR TYPE, 2019-2023(USD MILLION)

- TABLE 109 US: RACING SIMULATOR MARKET, BY SIMULATOR TYPE, 2024-2030 (USD MILLION)

- 12.4.3 CANADA

- 12.4.3.1 Rising trend of virtual racing engagements to drive market

- TABLE 110 CANADA: RACING SIMULATOR MARKET, BY SIMULATOR TYPE, 2019-2023(USD MILLION)

- TABLE 111 CANADA: RACING SIMULATOR MARKET, BY SIMULATOR TYPE, 2024-2030 (USD MILLION)

- 12.4.4 MEXICO

- 12.4.4.1 Growing number of professional car racers to drive market

- TABLE 112 MEXICO: RACING SIMULATOR MARKET, BY SIMULATOR TYPE, 2019-2023(USD MILLION)

- TABLE 113 MEXICO: RACING SIMULATOR MARKET, BY SIMULATOR TYPE, 2024-2030 (USD MILLION)

- 12.5 REST OF THE WORLD

- 12.5.1 REST OF THE WORLD: RECESSION IMPACT ANALYSIS

- FIGURE 33 REST OF THE WORLD: RACING SIMULATOR MARKET, BY COUNTRY, 2024 VS. 2030 (USD MILLION)

- TABLE 114 REST OF THE WORLD: RACING SIMULATOR MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 115 REST OF THE WORLD: RACING SIMULATOR MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- 12.5.2 BRAZIL

- 12.5.2.1 Increasing accessibility of smartphones to drive market

- TABLE 116 BRAZIL: RACING SIMULATOR MARKET, BY SIMULATOR TYPE, 2019-2023(USD MILLION)

- TABLE 117 BRAZIL: RACING SIMULATOR MARKET, BY SIMULATOR TYPE, 2024-2030 (USD MILLION)

- 12.5.3 ARGENTINA

- 12.5.3.1 Surge in e-motorsports events to drive market

- TABLE 118 ARGENTINA: RACING SIMULATOR MARKET, BY SIMULATOR TYPE, 2019-2023(USD MILLION)

- TABLE 119 ARGENTINA: RACING SIMULATOR MARKET, BY SIMULATOR TYPE, 2024-2030 (USD MILLION)

- 12.5.4 UAE

- 12.5.4.1 Growing events hosted by Immersive Esports to drive market

- TABLE 120 UAE: RACING SIMULATOR MARKET, BY SIMULATOR TYPE, 2019-2023(USD MILLION)

- TABLE 121 UAE: RACING SIMULATOR MARKET, BY SIMULATOR TYPE, 2024-2030 (USD MILLION)

- 12.5.5 OTHER COUNTRIES

- TABLE 122 REST OF THE WORLD OTHERS: RACING SIMULATOR MARKET, BY SIMULATOR TYPE, 2019-2023(USD MILLION)

- TABLE 123 REST OF THE WORLD OTHERS: RACING SIMULATOR MARKET, BY SIMULATOR TYPE, 2024-2030 (USD MILLION)

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 KEY PLAYERS' STRATEGIES

- TABLE 124 KEY PLAYERS' STRATEGIES, 2018-2022

- 13.3 MARKET RANKING ANALYSIS

- FIGURE 34 MARKET RANKING ANALYSIS, 2022

- 13.4 REVENUE ANALYSIS

- FIGURE 35 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2020-2022

- 13.5 COMPANY EVALUATION MATRIX

- 13.5.1 STARS

- 13.5.2 EMERGING LEADERS

- 13.5.3 PERVASIVE PLAYERS

- 13.5.4 PARTICIPANTS

- FIGURE 36 COMPANY EVALUATION MATRIX, 2022

- 13.5.5 COMPANY FOOTPRINT

- TABLE 125 RACING SIMULATOR MARKET: COMPANY FOOTPRINT

- TABLE 126 RACING SIMULATOR MARKET: APPLICATION FOOTPRINT

- TABLE 127 RACING SIMULATOR MARKET: REGION FOOTPRINT

- 13.6 COMPETITIVE SCENARIO

- 13.6.1 PRODUCT LAUNCHES

- TABLE 128 RACING SIMULATION MARKET: PRODUCT LAUNCHES, AUGUST 2019-NOVEMBER 2023

- 13.6.2 DEALS

- TABLE 129 RACING SIMULATION MARKET: DEALS, MAY 2019-DECEMBER 2023

- 13.6.3 EXPANSIONS

- TABLE 130 RACING SIMULATION MARKET: EXPANSIONS, 2018-2022

- 13.7 COMPANY VALUATION

- FIGURE 37 COMPANY VALUATION, 2023 (USD MILLION)

- 13.8 BRAND COMPARISON

14 COMPANY PROFILES

- (Business overview, Products/Solutions/Services offered, Recent developments & MnM View)**

- 14.1 KEY PLAYERS

- 14.1.1 CXC SIMULATIONS

- TABLE 131 CXC SIMULATIONS: COMPANY OVERVIEW

- TABLE 132 CXC SIMULATIONS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 133 CXC SIMULATIONS: PRODUCT LAUNCHES

- 14.1.2 TRAK RACER

- TABLE 134 TRAK RACER: COMPANY OVERVIEW

- TABLE 135 TRAK RACER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 136 TRAK RACER: DEALS

- 14.1.3 NEXT LEVEL RACING

- TABLE 137 NEXT LEVEL RACING: COMPANY OVERVIEW

- TABLE 138 NEXT LEVEL RACING: PRODUCT LAUNCHES

- TABLE 139 NEXT LEVEL RACING: DEALS

- 14.1.4 VI-GRADE GMBH

- TABLE 140 VI-GRADE GMBH: COMPANY OVERVIEW

- TABLE 141 VI-GRADE GMBH: PRODUCT LAUNCHES

- TABLE 142 VI-GRADE GMBH: DEALS

- TABLE 143 VI-GRADE GMBH: EXPANSIONS

- TABLE 144 VI-GRADE GMBH: OTHER DEVELOPMENTS

- 14.1.5 D-BOX TECHNOLOGIES INC.

- TABLE 145 D-BOX TECHNOLOGIES INC.: COMPANY OVERVIEW

- FIGURE 38 D-BOX TECHNOLOGIES INC.: COMPANY SNAPSHOT

- TABLE 146 D-BOX TECHNOLOGIES INC.: PRODUCT LAUNCHES

- TABLE 147 D-BOX TECHNOLOGIES INC.: DEALS

- 14.1.6 CRUDEN

- TABLE 148 CRUDEN: COMPANY OVERVIEW

- TABLE 149 CRUDEN: DEALS

- TABLE 150 CRUDEN: EXPANSIONS

- TABLE 151 CRUDEN: OTHER DEVELOPMENTS

- 14.1.7 ANTHONY BEST DYNAMICS LIMITED

- TABLE 152 ANTHONY BEST DYNAMICS LIMITED: COMPANY OVERVIEW

- FIGURE 39 ANTHONY BEST DYNAMICS LIMITED: COMPANY SNAPSHOT

- TABLE 153 ANTHONY BEST DYNAMICS LIMITED: DEALS

- TABLE 154 ANTHONY BEST DYNAMICS LIMITED: EXPANSIONS

- TABLE 155 ANTHONY BEST DYNAMICS LIMITED: OTHER DEVELOPMENTS

- 14.1.8 CRANFIELD AEROSPACE SOLUTIONS

- TABLE 156 CRANFIELD AEROSPACE SOLUTIONS: COMPANY OVERVIEW

- TABLE 157 CRANFIELD AEROSPACE SOLUTIONS: DEALS

- 14.1.9 SIMXPERIENCE

- TABLE 158 SIMXPERIENCE: COMPANY OVERVIEW

- TABLE 159 SIMXPERIENCE: PRODUCT LAUNCHES

- 14.1.10 SIMWORX PTY LTD.

- TABLE 160 SIMWORX PTY LTD: COMPANY OVERVIEW

- *Details on Business overview, Products/Solutions/Services offered, Recent developments & MnM View might not be captured in case of unlisted companies.

- 14.2 ADDITIONAL PLAYERS

- 14.2.1 RS SIMULATION

- TABLE 161 RS SIMULATION: COMPANY OVERVIEW

- 14.2.2 VESARO

- TABLE 162 VESARO: COMPANY OVERVIEW

- 14.2.3 VERTICAL REALITY SIMULATIONS, LLC

- TABLE 163 VERTICAL REALITY SIMULATIONS, LLC: COMPANY OVERVIEW

- 14.2.4 JCL SIMULATOR

- TABLE 164 JCL SIMULATOR: COMPANY OVERVIEW

- 14.2.5 FPZERO SIMULATORS

- TABLE 165 FPZERO SIMULATORS: COMPANY OVERVIEW

- 14.2.6 DOF REALITY MOTION SIMULATORS

- TABLE 166 DOF REALITY MOTION SIMULATORS: COMPANY OVERVIEW

- 14.2.7 ADVANCED SIMRACING

- TABLE 167 ADVANCED SIMRACING: COMPANY OVERVIEW

- 14.2.8 ECA GROUP

- TABLE 168 ECA GROUP: COMPANY OVERVIEW

- 14.2.9 MOTUM SIMULATION PTY LTD.

- TABLE 169 MOTUM SIMULATION PTY LTD.: COMPANY OVERVIEW

- 14.2.10 SIMCRAFT

- TABLE 170 SIMCRAFT: COMPANY OVERVIEW

- 14.2.11 PROFISIM S.R.O.

- TABLE 171 PROFISIM S.R.O.: COMPANY OVERVIEW

- 14.2.12 CKAS MECHATRONICS PTY LTD.

- TABLE 172 CKAS MECHATRONICS PTY LTD.: COMPANY OVERVIEW

- 14.2.13 PRS

- TABLE 173 PRS: COMPANY OVERVIEW

- 14.2.14 IMSIM

- TABLE 174 IMSIM: COMPANY OVERVIEW

- 14.2.15 SIMULATIONSTECHNIK LINGNAU GMBH

- TABLE 175 SIMULATIONSTECHNIK LINGNAU GMBH: COMPANY OVERVIEW

- 14.2.16 COOL PERFORMANCE

- TABLE 176 COOL PERFORMANCE: COMPANY OVERVIEW

- 14.2.17 MOZA RACING

- TABLE 177 MOZA SIMRACING: COMPANY OVERVIEW

- 14.2.18 PLAYSEAT

- TABLE 178 PLAYSEAT: COMPANY OVERVIEW

- 14.2.19 TECKNOTROVE

- TABLE 179 TECKNOTROVE: COMPANY OVERVIEW

- 14.2.20 FAAC INCORPORATED

- TABLE 180 FAAC INCORPORATED: COMPANY OVERVIEW

- 14.2.21 AVSIMULATION

- TABLE 181 AVSIMULATION: COMPANY OVERVIEW

15 RECOMMENDATIONS BY MARKETSANDMARKETS

- 15.1 NORTH AMERICA AND ASIA PACIFIC TO BE POTENTIAL MARKETS FOR RACING SIMULATORS

- 15.2 RACING SIMULATORS TO FOCUS ON INTEGRATING ADVANCED SIMULATION TECHNOLOGIES

- 15.3 CONCLUSION

16 APPENDIX

- 16.1 INSIGHTS OF INDUSTRY EXPERTS

- 16.2 DISCUSSION GUIDE

- 16.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.4 CUSTOMIZATION OPTIONS

- 16.4.1 RACING SIMULATOR MARKET, BY OFFERINGS & COUNTRY

- 16.4.1.1 Hardware

- 16.4.1.2 Software

- 16.4.2 COMMERCIAL RACING SIMULATOR MARKET, BY APPLICATION

- 16.4.2.1 Training centers

- 16.4.2.2 Arcades

- 16.4.2.3 Malls & casinos

- 16.4.2.4 Others

- 16.4.1 RACING SIMULATOR MARKET, BY OFFERINGS & COUNTRY

- 16.5 RELATED REPORTS

- 16.6 AUTHOR DETAILS