|

|

市場調査レポート

商品コード

1442277

民間電動航空機の世界市場:プラットフォーム・航続距離・出力・地域別 (~2035年)Commercial Electric Aircraft Market by Platform, Range, Power and Region - Global Forecast to 2035 |

||||||

カスタマイズ可能

|

|||||||

| 民間電動航空機の世界市場:プラットフォーム・航続距離・出力・地域別 (~2035年) |

|

出版日: 2024年02月22日

発行: MarketsandMarkets

ページ情報: 英文 192 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

世界の民間電動航空機の市場規模は、2026年に9,700万米ドル、2031年の6億9,200万米ドルから、2031年から2035年までの予測期間中は20.7%のCAGRで推移し、2035年には14億6,700万米ドルの規模に成長すると予測されています。

民間電動航空機の市場は急速に進化しており、航空旅行に革命を起こす見通しです。持続可能性目標、技術の進歩、消費者の嗜好の進化に後押しされ、同市場は大きな成長の可能性を秘めています。完全な電動航空技術は、より静かで、クリーンで、潜在的にはよりコスト効率の高い空の旅を約束します。民間電動航空機の採用には、いくつかの顕著な要因が触媒として作用しています。政府や航空会社が定めた厳しい環境規制や排出削減目標が、電動化へのシフトを後押ししています。また、電池技術の進歩が、エネルギー密度の向上と航続距離の延長を実現し、長距離移動の新たな可能性を切り開く見通しでです。さらに、投資家の関心の高まりと、航空宇宙産業と技術系新興企業との提携も、技術革新と市場の勢いを加速させています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2026-2035年 |

| 基準年 | 2026年 |

| 予測期間 | 2026-2035年 |

| 検討単位 | 金額 (米ドル) |

| セグメント別 | プラットフォーム・航続距離・出力・地域別 |

| 対象地域 | 北米・欧州・アジア太平洋・その他の地域 |

プラットフォーム別で見ると、地域輸送機の部門が予測期間中のもっとも高いCAGRを示すと予測されています。同部門の成長軌道は、環境に対する関心の高まり、電気推進技術の進歩、持続可能な旅行オプションに対する消費者の嗜好の進化などの要因によってもたらされています。地域輸送機は、小規模な都市や町を結ぶ極めて重要な役割を担っており、この部門における電気推進への移行は、二酸化炭素排出量と運航コストの大幅な削減を約束するものです。さらに、電池技術が進化を続け、電動航空機の機能が成熟する中で、航空会社は、規制上の義務付けと環境に優しい旅行ソリューションを求める消費者の需要の両方を満たすため、地域輸送に電動航空機を採用する傾向が強まっています。

航続距離別では、200-500kmの部門が予測期間中に最大のCAGRで成長すると予測されています。この成長動向は、短・中距離路線における持続可能な輸送手段に対する需要の増加、性能と効率の向上を可能にする電気推進システムの技術的進歩、電動航空機の採用を支持する規制上の優遇措置など、いくつかの主要要因によってもたらされます。航空会社や運航会社は、200~500kmの航路でコスト効率が高く環境に優しいソリューションを提供する電動航空機の可能性をますます認識するようになっており、それによってこの部門への投資と技術革新が促進されています。

地域別では、アジア太平洋地域が予測期間中に最も高いCAGRを示すと推計されています。まず、アジア太平洋地域では急速な経済成長と都市化が進んでおり、航空輸送需要の増加に繋がっています。また、同地域の国々が環境問題への対処に努めるなか、民間電動航空機を含む持続可能航空ソリューションの採用が重視されるようになっています。さらに、クリーンエネルギーや交通インフラに対する政府の取り組みや投資も、同地域における電動航空機の開発・展開を後押ししています。さらに、中国、インド、東南アジア諸国などの主要新興市場の存在は、民間電動航空機メーカーや運航会社に大きな成長機会を提供しています。良好な市場環境、技術の進歩、政府の支援政策により、アジア太平洋地域は民間電動航空機市場の主要拠点として台頭しつつあり、今後数年間で成長を遂げることが予想されています。

当レポートでは、世界の民間電動航空機の市場を調査し、市場概要、市場影響因子および市場機会の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- 顧客のビジネスに影響を与える動向/ディスラプション

- エコシステム分析

- 運用データ

- 民間電動航空機の総所有コスト

- ビジネスモデル

- 投資と資金調達のシナリオ

- 平均販売価格分析

- 技術分析

- 規制状況

- 貿易データ分析

- 主なステークホルダーと購入基準

- 主な会議とイベント

- 使用事例の分析

第6章 業界の動向

- 技術動向

- 電池技術の進歩

- 電気推進およびパワートレインシステム

- 空力構造と空力設計

- 高度なアビオニクスと飛行制御システム

- メガトレンドの影響

- デジタル化と接続性

- AIと機械学習

- サプライチェーン分析

- 特許分析

- 技術ロードマップ

第7章 民間電動航空機市場:プラットフォーム別

- 民間電動航空機市場:プラットフォーム別 (台数)

- 民間電動航空機市場:プラットフォーム別 (金額)

- 地域輸送機

- 20~40席

- 40席超

- ビジネスジェット

- 5席未満

- 5~10席

- 10~20席

第8章 民間電動航空機市場:航続距離別

- 200キロ未満

- 200-500キロ

- 500キロ超

第9章 民間電動航空機市場:電力別

- 100-500KW

- 500KW超

第10章 民間電動航空機市場:地域別

- 北米

- 欧州

- アジア太平洋

- その他の地域

第11章 競合情勢

- 主要企業の戦略

- ランキング分析

- 企業評価マトリックス

- スタートアップ/中小企業の評価マトリックス

- 企業評価と財務指標

- 競合シナリオ

第12章 企業プロファイル

- 主要企業

- HEART AEROSPACE

- EVIATION

- LILIUM

- WRIGHT ELECTRIC INC.

- ARCHER AVIATION INC.

- EMBRAER

- VAERIDION GMBH

- SCYLAX GMBH

- JOBY AVIATION

- VERTICAL AEROSPACE

- WISK AERO LLC

- OVERAIR, INC.

- SUPERNAL, LLC

- ELECTRIC AVIATION GROUP

- COSTRUZIONI AERONAUTICHE TECNAM S.P.A.

- その他の企業

- MAGNIX

- SAFRAN

- HONEYWELL INTERNATIONAL INC.

- H55

- EVOLITO LTD.

- BAE SYSTEMS

- KITE MAGNETICS PTY LTD.

- NIDEC MOTOR CORPORATION

- THALES

- LEONARDO S.P.A.

第13章 付録

The commercial electric aircraft market is expected to be USD 97 million in 2026 to USD 692 million in 2031 and is projected to reach USD 1,467 million by 2035, at a CAGR of 20.7% from 2031 to 2035. The commercial electric aircraft (CEA) market represents a rapidly evolving landscape poised to revolutionize air travel. Driven by sustainability goals, technological advancements, and evolving consumer preferences, this market offers significant growth potential. The fully electric technology promises quieter, cleaner, and potentially more cost-effective air travel. Several prominent factors act as catalysts for CEA adoption. Stringent environmental regulations and emissions reduction targets set by governments and airlines propel the shift towards electrification. Advancements in battery technology, offering greater energy density and extended range, unlock new possibilities for longer journeys. Additionally, growing investor interest and partnerships between aerospace industries and technology startups accelerate innovation and market momentum

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2026-2035 |

| Base Year | 2026 |

| Forecast Period | 2026-2035 |

| Units Considered | Value (USD Million) |

| Segments | By Platform, Range, Power and Region |

| Regions covered | North America, Europe, APAC, RoW |

"Based on platform, the regional transport aircraft segment is estimated to to grow with the highest CAGR in the forecast period."

Based on Platform, commercial electric aircraft market has been segmented into regional transport aircraft and business jets. This growth trajectory is a convergence of factors, including escalating environmental concerns, advancements in electric propulsion technology, and evolving consumer preferences for sustainable travel options. Regional transport aircraft play a pivotal role in connecting smaller cities and towns, and the transition to electric propulsion within this segment promises significant reductions in carbon emissions and operational costs. Furthermore, as battery technology continues to evolve and electric aircraft capabilities mature, airlines are increasingly inclined to adopt electric regional transport aircraft to meet both regulatory mandates and consumer demand for eco-friendly travel solutions. Consequently, stakeholders across the aviation industry are strategically aligning their efforts to capitalize on the opportunities presented by the expanding market for electric regional transport jets.

"Based on range, 200-500 Km segment is estimated to grow with the highest CAGR in the forecast period."

The 200-500 km segment is projected to grow the most for the 2031 to 2035 period. This growth trend is driven by several key factors, including the increasing demand for sustainable transportation options for short to medium-haul routes, technological advancements in electric propulsion systems enabling enhanced performance and efficiency, and regulatory incentives favoring the adoption of electric aircraft. Airlines and operators are increasingly recognizing the potential of electric aircraft to offer cost-effective and environmentally friendly solutions for routes within the 200-500 km range, thereby driving investment and innovation in this segment. As battery technology continues to advance, extending flight ranges and reducing charging times, the market for electric aircraft in the 200-500 km segment is expected to experience significant expansion, attracting both established aerospace manufacturers and emerging startups seeking to capitalize on this growing market opportunity.

Based on Power, the >500 kW segment is estimated to have the highest CAGR in the forecast period.

The >500 kW segment, characterized by its higher power output, is forecasted to have the highest CAGR by power within the commercial electric aircraft market from 2031 to 2035. This growth trajectory is influenced by several key factors driving the adoption of electric propulsion systems in larger aircraft categories. Firstly, advancements in battery technology and electric motor efficiency are enablers, allowing the development of electric aircraft with greater power outputs exceeding 500 kW. These technological advancements are essential for enhancing the performance and range capabilities of electric aircraft, making them increasingly viable for larger commercial applications. Additionally, the growing emphasis on sustainability and environmental regulations is compelling airlines and operators to seek cleaner and more efficient alternatives to traditional fossil fuel-powered aircraft, thereby driving demand for electric propulsion solutions in the >500 kW segment.

Based on regions, the Asia Pacific region is estimated to have the highest CAGR in the forecast period.

The Asia Pacific region is expected to witness the highest CAGR in the commercial electric aircraft market from 2031 to 2035. Several factors contribute to this anticipated growth trajectory. Firstly, the Asia Pacific region is experiencing rapid economic growth and urbanization, leading to increased demand for air transportation. As countries in the region strive to address environmental challenges, there is a growing emphasis on adopting sustainable aviation solutions, including commercial electric aircraft. Additionally, government initiatives and investments in clean energy and transportation infrastructure are driving the development and deployment of electric aircraft in the region. Furthermore, the presence of key emerging markets such as China, India, and Southeast Asian countries offers significant growth opportunities for commercial electric aircraft manufacturers and operators. With favorable market conditions, technological advancements, and supportive government policies, the Asia Pacific region is emeriging as a leading hub for the commercial electric aircraft market, experiencing growth in the coming years.

The break-up of the profile of primary participants in the commercial electric aircraft market:

- By Company Type: Tier 1 - 35%, Tier 2 - 45%, and Tier 3 - 20%

- By Designation: C Level - 40%, Director Level - 25%, and Others - 35%

- By Region: North America - 45%, Europe - 25%, Asia Pacific - 25%, Rest of the World (RoW) - 10%

Major companies profiled in the report include Heart Aerospace (Sweden), Thales (France), Wright Electric Inc. (UK), Eviation (US), magniX (UK), Joby Aviation (US), Electric Aviation Group (France), Embraer (Brazil), Lilium (Germany), Vertical Aerospace (UK), Archer Aviation Inc.(US), among others.

Research Coverage:

This market study covers the commercial electric aircraft market across various segments and subsegments. It aims to estimate this market's size and growth potential across different parts based on platform, range, power and region. This study also includes an in-depth competitive analysis of the key players in the market, their company profiles, key observations related to their product and business offerings, recent developments, and key market strategies they adopted.

Reasons to buy this report:

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall the commercial electric aircraft market. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities. The commercial electric aircraft market is experiencing substantial growth, primarily driven by the exchange of real-time information. The increasing trend toward international cooperation and joint operations among nations is fostering demand for the commercial electric aircrafs, contributing to regional and global stability. The report provides insights on the following pointers:

- Market Drivers: Market Drivers such as the technological advancements, increasing passenger investments, growing environmental sustainability initiatives and other drivers covered in the report.

- Market Penetration: Comprehensive information on the commercial electric aircraft offered by the top players in the market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the the commercial electric aircraft market

- Market Development: Comprehensive information about lucrative markets - the report analyses the commercial electric aircraft market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the commercial electric aircraft market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, products, and manufacturing capabilities of leading players in the the commercial electric aircraft market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 COMMERCIAL ELECTRIC AIRCRAFT MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 INCLUSIONS AND EXCLUSIONS

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- 1.5 CURRENCY CONSIDERED

- TABLE 2 USD EXCHANGE RATES

- 1.6 KEY STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 REPORT PROCESS FLOW

- FIGURE 3 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.2 RECESSION IMPACT ANALYSIS

- 2.2.1 DEMAND-SIDE INDICATORS

- 2.2.2 SUPPLY-SIDE INDICATORS

- 2.3 FACTOR ANALYSIS

- 2.3.1 INTRODUCTION

- 2.3.2 DEMAND-SIDE INDICATORS

- 2.3.3 SUPPLY-SIDE ANALYSIS

- 2.4 MARKET SIZE ESTIMATION AND METHODOLOGY

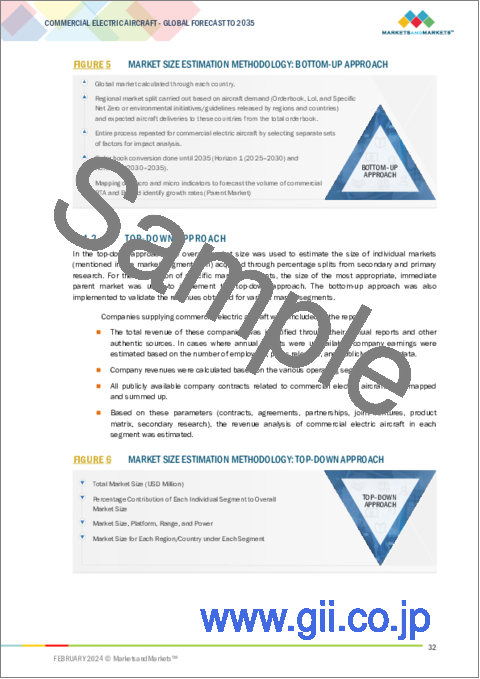

- 2.4.1 BOTTOM-UP APPROACH

- 2.4.1.1 Parent market analysis

- 2.4.1.2 Commercial electric aircraft market analysis

- 2.4.1.3 Regional market analysis

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.4.2 TOP-DOWN APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.4.1 BOTTOM-UP APPROACH

- 2.5 DATA TRIANGULATION

- FIGURE 7 DATA TRIANGULATION

- 2.6 RESEARCH ASSUMPTIONS

- 2.6.1 GROWTH RATE ASSUMPTIONS

- 2.6.2 PARAMETRIC ASSUMPTIONS FOR MARKET FORECAST

- 2.7 RESEARCH LIMITATIONS

- 2.8 RISK ANALYSIS

3 EXECUTIVE SUMMARY

- FIGURE 8 REGIONAL TRANSPORT AIRCRAFT SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 9 200-500 KM SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 10 >500 KW SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 11 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE IN 2031

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN COMMERCIAL ELECTRIC AIRCRAFT MARKET

- FIGURE 12 INCREASING DEMAND FOR SUSTAINABLE AIRCRAFT AND TECHNOLOGICAL ADVANCEMENTS TO DRIVE MARKET

- 4.2 COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY PLATFORM

- FIGURE 13 BUSINESS JETS SEGMENT TO HAVE LARGEST MARKET SHARE IN 2031

- 4.3 COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY RANGE

- FIGURE 14 200-500 KM SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- 4.4 COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY COUNTRY

- FIGURE 15 CANADA TO BE FASTEST-GROWING MARKET BETWEEN 2031 AND 2035

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 16 COMMERCIAL ELECTRIC AIRCRAFT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Growing environmental sustainability initiatives

- 5.2.1.2 Rising advancements in powertrains

- 5.2.1.3 Increasing regional routes and investments

- 5.2.2 RESTRAINTS

- 5.2.2.1 Cybersecurity and connectivity risks

- 5.2.2.2 Increasing airspace congestion

- 5.2.2.3 Competition from alternative fuels

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing adoption of commercial electric aircraft in emerging economies

- 5.2.3.2 Infrastructure development for electric aviation

- 5.2.4 CHALLENGES

- 5.2.4.1 High initial costs

- 5.2.4.2 Maintaining airline profitability and favorable public perception

- 5.2.4.3 Limited regulatory framework

- 5.3 VALUE CHAIN ANALYSIS

- FIGURE 17 VALUE CHAIN ANALYSIS

- 5.3.1 RAW MATERIALS

- 5.3.2 R&D

- 5.3.3 COMPONENT MANUFACTURING (OEMS)

- 5.3.4 ASSEMBLERS AND INTEGRATORS

- 5.3.5 END USERS

- 5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 18 REVENUE SHIFT AND NEW REVENUE POCKETS FOR COMMERCIAL ELECTRIC AIRCRAFT MARKET PLAYERS

- 5.5 ECOSYSTEM ANALYSIS

- 5.5.1 PROMINENT COMPANIES

- 5.5.2 PRIVATE AND SMALL ENTERPRISES

- 5.5.3 END USERS

- FIGURE 19 ECOSYSTEM MAPPING

- TABLE 3 ROLE OF COMPANIES IN ECOSYSTEM

- 5.6 OPERATIONAL DATA

- FIGURE 20 AIRCRAFT DELIVERIES, BY PLATFORM (UNITS)

- TABLE 4 TOTAL ORDER BOOK OF COMMERCIAL AIRCRAFT MANUFACTURERS, 2024

- TABLE 5 TOTAL ORDER BACKLOG OF TOP FIVE COMMERCIAL AIRCRAFT MANUFACTURERS, 2024

- 5.7 TOTAL COST OF OWNERSHIP OF COMMERCIAL ELECTRIC AIRCRAFT

- FIGURE 21 TOTAL COST OF OWNERSHIP, BY PLATFORM (USD MILLION)

- TABLE 6 TOTAL COST OF OWNERSHIP OF COMMERCIAL ELECTRIC AIRCRAFT (USD MILLION)

- FIGURE 22 COMPARISON OF TOTAL COST OF OWNERSHIP, BY PLATFORM (USD MILLION)

- 5.8 BUSINESS MODELS

- 5.9 INVESTMENT AND FUNDING SCENARIO

- 5.10 AVERAGE SELLING PRICE ANALYSIS

- 5.10.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY PLATFORM

- FIGURE 23 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY PLATFORM

- TABLE 7 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY PLATFORM (USD MILLION)

- 5.10.2 INDICATIVE PRICING ANALYSIS

- 5.11 TECHNOLOGY ANALYSIS

- 5.11.1 DATA ANALYTICS AND MANAGEMENT

- 5.11.2 SOLID-STATE BATTERIES

- 5.12 REGULATORY LANDSCAPE

- TABLE 8 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 MIDDLE EAST: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13 TRADE DATA ANALYSIS

- FIGURE 24 IMPORT VALUE OF (PRODUCT HARMONIZED SYSTEM CODE: 8803) PARTS OF AIRCRAFT AND SPACECRAFT OF HEADING 8801 OR 8802

- TABLE 13 COMMERCIAL ELECTRIC AIRCRAFT MARKET: COUNTRY-WISE IMPORTS, 2019-2022 (USD THOUSAND)

- FIGURE 25 EXPORT VALUE OF (PRODUCT HARMONIZED SYSTEM CODE: 8803) PARTS OF AIRCRAFT AND SPACECRAFT OF HEADING 8801 OR 8802

- TABLE 14 COMMERCIAL ELECTRIC AIRCRAFT MARKET: COUNTRY-WISE EXPORTS, 2019-2022 (USD THOUSAND)

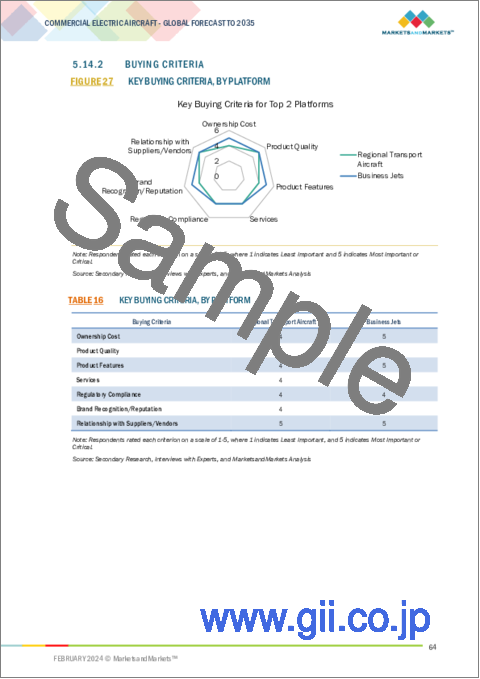

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY PLATFORM

- TABLE 15 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY PLATFORM (%)

- 5.14.2 BUYING CRITERIA

- FIGURE 27 KEY BUYING CRITERIA, BY PLATFORM

- TABLE 16 KEY BUYING CRITERIA, BY PLATFORM

- 5.15 KEY CONFERENCES AND EVENTS

- TABLE 17 KEY CONFERENCES AND EVENTS, 2024

- 5.16 USE CASE ANALYSIS

- 5.16.1 ELECTRIC PROPULSION SYSTEM FOR COMMERCIAL ELECTRIC AIRCRAFT

- 5.16.2 DEVELOPMENT OF REGIONAL ELECTRIC AIRCRAFT

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TECHNOLOGY TRENDS

- 6.2.1 ADVANCEMENTS IN BATTERY TECHNOLOGY

- 6.2.2 ELECTRIC PROPULSION AND POWERTRAIN SYSTEMS

- 6.2.3 AEROSTRUCTURE AND AERODYNAMICS DESIGN

- 6.2.4 ADVANCED AVIONICS AND FLIGHT CONTROL SYSTEMS

- 6.3 IMPACT OF MEGATRENDS

- 6.3.1 DIGITALIZATION AND CONNECTIVITY

- 6.3.2 ARTIFICIAL INTELLIGENCE AND MACHINE LEARNING

- 6.4 SUPPLY CHAIN ANALYSIS

- FIGURE 28 SUPPLY CHAIN ANALYSIS

- 6.5 PATENT ANALYSIS

- FIGURE 29 PATENT ANALYSIS

- TABLE 18 INNOVATIONS AND PATENT REGISTRATIONS, 2023-2024

- 6.6 TECHNOLOGY ROADMAP

- FIGURE 30 TECHNOLOGY ROADMAP

- FIGURE 31 EVOLUTION OF KEY TECHNOLOGIES

- FIGURE 32 EMERGING TRENDS RELATED TO COMMERCIAL ELECTRIC AIRCRAFT

7 COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY PLATFORM

- 7.1 INTRODUCTION

- FIGURE 33 COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY PLATFORM, 2026-2035 (USD MILLION)

- 7.2 COMMERCIAL ELECTRIC AIRCRAFT BY PLATFORM (UNITS)

- TABLE 19 COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY PLATFORM, 2026-2030 (UNITS)

- TABLE 20 COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY PLATFORM, 2031-2035 (UNITS)

- 7.3 COMMERCIAL ELECTRIC AIRCRAFT BY PLATFORM (USD MILLION)

- TABLE 21 COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY PLATFORM, 2026-2030 (USD MILLION)

- TABLE 22 COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY PLATFORM, 2031-2035 (USD MILLION)

- 7.4 REGIONAL TRANSPORT AIRCRAFT

- 7.4.1 20-40 SEATS

- 7.4.1.1 Increasing demand for sustainable regional transport to drive market

- 7.4.2 >40 SEATS

- 7.4.2.1 Growing shift toward short-haul flights to drive market

- 7.4.1 20-40 SEATS

- 7.5 BUSINESS JETS

- TABLE 23 COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY BUSINESS JETS, 2026-2030 (USD MILLION)

- TABLE 24 COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY BUSINESS JETS, 2031-2035 (USD MILLION)

- 7.5.1 <5 SEATS

- 7.5.1.1 Surge in adoption of electric propulsion systems to drive market

- 7.5.2 5-10 SEATS

- 7.5.2.1 Rising focus on hybrid-electric propulsion technologies to drive market

- 7.5.3 10-20 SEATS

- 7.5.3.1 Booming electric aviation initiatives to drive market

8 COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY RANGE

- 8.1 INTRODUCTION

- FIGURE 34 COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY RANGE, 2026-2035 (USD MILLION)

- TABLE 25 COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY RANGE, 2026-2030 (USD MILLION)

- TABLE 26 COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY RANGE, 2031-2035 (USD MILLION)

- 8.2 <200 KM

- 8.2.1 RISING NEED FOR ENVIRONMENT-FRIENDLY AND LOW-COST TRANSPORTATION TO DRIVE MARKET

- 8.3 200-500 KM

- 8.3.1 GROWING NUMBER OF GOVERNMENT INITIATIVES TO DRIVE MARKET

- 8.4 >500 KM

- 8.4.1 INCREASING ADVANCEMENTS IN ENERGY STORAGE TO DRIVE MARKET

9 COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY POWER

- 9.1 INTRODUCTION

- FIGURE 35 COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY POWER, 2026-2035 (USD MILLION)

- TABLE 27 COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY POWER, 2026-2030 (USD MILLION)

- TABLE 28 COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY POWER, 2031-2035 (USD MILLION)

- 9.2 100-500 KW

- 9.2.1 GROWING COLLABORATIONS BETWEEN ELECTRIC MOTOR MANUFACTURERS AND AIRCRAFT DEVELOPERS TO DRIVE MARKET

- 9.3 >500 KW

- 9.3.1 SURGE IN POWER ELECTRONICS AND ADVANCED MATERIALS INNOVATIONS TO DRIVE MARKET

10 COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 36 COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY REGION

- TABLE 29 COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY REGION, 2026-2030 (USD MILLION)

- TABLE 30 COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY REGION, 2031-2035 (USD MILLION)

- 10.1.1 REGIONAL RECESSION IMPACT ANALYSIS

- TABLE 31 REGIONAL RECESSION IMPACT ANALYSIS

- 10.2 NORTH AMERICA

- 10.2.1 NORTH AMERICA: RECESSION IMPACT ANALYSIS

- FIGURE 37 NORTH AMERICA: COMMERCIAL ELECTRIC AIRCRAFT MARKET SNAPSHOT

- 10.2.2 NORTH AMERICA: PESTLE ANALYSIS

- TABLE 32 NORTH AMERICA: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY COUNTRY, 2026-2030 (USD MILLION)

- TABLE 33 NORTH AMERICA: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY COUNTRY, 2031-2035 (USD MILLION)

- TABLE 34 NORTH AMERICA: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY PLATFORM, 2026-2030 (USD MILLION)

- TABLE 35 NORTH AMERICA: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY PLATFORM, 2031-2035 (USD MILLION)

- TABLE 36 NORTH AMERICA: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY RANGE, 2026-2030 (USD MILLION)

- TABLE 37 NORTH AMERICA: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY RANGE, 2031-2035 (USD MILLION)

- TABLE 38 NORTH AMERICA: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY POWER, 2026-2030 (USD MILLION)

- TABLE 39 NORTH AMERICA: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY POWER, 2031-2035 (USD MILLION)

- 10.2.3 US

- 10.2.3.1 Presence of leading OEMs to drive market

- TABLE 40 US: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY PLATFORM, 2026-2030 (USD MILLION)

- TABLE 41 US: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY PLATFORM, 2031-2035 (USD MILLION)

- TABLE 42 US: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY RANGE, 2026-2030 (USD MILLION)

- TABLE 43 US: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY RANGE, 2031-2035 (USD MILLION)

- TABLE 44 US: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY POWER, 2026-2030 (USD MILLION)

- TABLE 45 US: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY POWER, 2031-2035 (USD MILLION)

- 10.2.4 CANADA

- 10.2.4.1 Increasing R&D investments to drive market

- TABLE 46 CANADA: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY PLATFORM, 2026-2030 (USD MILLION)

- TABLE 47 CANADA: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY PLATFORM, 2031-2035 (USD MILLION)

- TABLE 48 CANADA: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY RANGE, 2026-2030 (USD MILLION)

- TABLE 49 CANADA: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY RANGE, 2031-2035 (USD MILLION)

- TABLE 50 CANADA: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY POWER, 2026-2030 (USD MILLION)

- TABLE 51 CANADA: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY POWER, 2031-2035 (USD MILLION)

- 10.3 EUROPE

- 10.3.1 EUROPE: RECESSION IMPACT ANALYSIS

- 10.3.2 EUROPE: PESTLE ANALYSIS

- FIGURE 38 EUROPE: COMMERCIAL ELECTRIC AIRCRAFT MARKET SNAPSHOT

- TABLE 52 EUROPE: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY COUNTRY, 2026-2030 (USD MILLION)

- TABLE 53 EUROPE: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY COUNTRY, 2031-2035 (USD MILLION)

- TABLE 54 EUROPE: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY PLATFORM, 2026-2030 (USD MILLION)

- TABLE 55 EUROPE: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY PLATFORM, 2031-2035 (USD MILLION)

- TABLE 56 EUROPE: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY RANGE, 2026-2030 (USD MILLION)

- TABLE 57 EUROPE: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY RANGE, 2031-2035 (USD MILLION)

- TABLE 58 EUROPE: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY POWER, 2026-2030 (USD MILLION)

- TABLE 59 EUROPE: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY POWER, 2031-2035 (USD MILLION)

- 10.3.3 UK

- 10.3.3.1 Technological advancements in aircraft solutions and infrastructure to drive market

- TABLE 60 UK: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY PLATFORM, 2026-2030 (USD MILLION)

- TABLE 61 UK: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY PLATFORM, 2031-2035 (USD MILLION)

- TABLE 62 UK: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY RANGE, 2026-2030 (USD MILLION)

- TABLE 63 UK: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY RANGE, 2031-2035 (USD MILLION)

- TABLE 64 UK: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY POWER, 2026-2030 (USD MILLION)

- TABLE 65 UK: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY POWER, 2031-2035 (USD MILLION)

- 10.3.4 FRANCE

- 10.3.4.1 France 2030 investment initiative to drive market

- TABLE 66 FRANCE: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY PLATFORM, 2026-2030 (USD MILLION)

- TABLE 67 FRANCE: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY PLATFORM, 2031-2035 (USD MILLION)

- TABLE 68 FRANCE: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY RANGE, 2026-2030 (USD MILLION)

- TABLE 69 FRANCE: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY RANGE, 2031-2035 (USD MILLION)

- TABLE 70 FRANCE: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY POWER, 2026-2030 (USD MILLION)

- TABLE 71 FRANCE: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY POWER, 2031-2035 (USD MILLION)

- 10.3.5 GERMANY

- 10.3.5.1 Net-zero emission goals by 2045 to drive market

- TABLE 72 GERMANY: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY PLATFORM, 2026-2030 (USD MILLION)

- TABLE 73 GERMANY: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY PLATFORM, 2031-2035 (USD MILLION)

- TABLE 74 GERMANY: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY RANGE, 2026-2030 (USD MILLION)

- TABLE 75 GERMANY: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY RANGE, 2031-2035 (USD MILLION)

- TABLE 76 GERMANY: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY POWER, 2026-2030 (USD MILLION)

- TABLE 77 GERMANY: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY POWER, 2031-2035 (USD MILLION)

- 10.3.6 REST OF EUROPE

- TABLE 78 REST OF EUROPE: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY PLATFORM, 2026-2030 (USD MILLION)

- TABLE 79 REST OF EUROPE: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY PLATFORM, 2031-2035 (USD MILLION)

- TABLE 80 REST OF EUROPE: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY RANGE, 2026-2030 (USD MILLION)

- TABLE 81 REST OF EUROPE: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY RANGE, 2031-2035 (USD MILLION)

- TABLE 82 REST OF EUROPE: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY POWER, 2026-2030 (USD MILLION)

- TABLE 83 REST OF EUROPE: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY POWER, 2031-2035 (USD MILLION)

- 10.4 ASIA PACIFIC

- 10.4.1 ASIA PACIFIC: RECESSION IMPACT ANALYSIS

- 10.4.2 ASIA PACIFIC: PESTLE ANALYSIS

- FIGURE 39 ASIA PACIFIC: COMMERCIAL ELECTRIC AIRCRAFT MARKET SNAPSHOT

- TABLE 84 ASIA PACIFIC: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY COUNTRY, 2031-2035 (USD MILLION)

- TABLE 85 ASIA PACIFIC: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY COUNTRY, 2031-2035 (USD MILLION)

- TABLE 86 ASIA PACIFIC: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY PLATFORM, 2026-2030 (USD MILLION)

- TABLE 87 ASIA PACIFIC: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY PLATFORM, 2031-2035 (USD MILLION)

- TABLE 88 ASIA PACIFIC: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY RANGE, 2026-2030 (USD MILLION)

- TABLE 89 ASIA PACIFIC: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY RANGE, 2031-2035 (USD MILLION)

- TABLE 90 ASIA PACIFIC: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY POWER, 2026-2030 (USD MILLION)

- TABLE 91 ASIA PACIFIC: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY POWER, 2031-2035 (USD MILLION)

- 10.4.3 CHINA

- 10.4.3.1 Made in China initiative to drive market

- TABLE 92 CHINA: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY PLATFORM, 2026-2030 (USD MILLION)

- TABLE 93 CHINA: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY PLATFORM, 2031-2035 (USD MILLION)

- TABLE 94 CHINA: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY RANGE, 2026-2030 (USD MILLION)

- TABLE 95 CHINA: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY RANGE, 2031-2035 (USD MILLION)

- TABLE 96 CHINA: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY POWER, 2026-2030 (USD MILLION)

- TABLE 97 CHINA: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY POWER, 2031-2035 (USD MILLION)

- 10.4.4 INDIA

- 10.4.4.1 Growing adoption of electric vehicle take-off and landing aircraft to drive market

- TABLE 98 INDIA: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY PLATFORM, 2031-2035 (USD MILLION)

- TABLE 99 INDIA: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY RANGE, 2031-2035 (USD MILLION)

- TABLE 100 INDIA: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY POWER, 2031-2035 (USD MILLION)

- 10.4.5 JAPAN

- 10.4.5.1 Increasing replacement of existing aircraft to drive market

- TABLE 101 JAPAN: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY PLATFORM, 2031-2035 (USD MILLION)

- TABLE 102 JAPAN: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY RANGE, 2031-2035 (USD MILLION)

- TABLE 103 JAPAN: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY POWER, 2031-2035 (USD MILLION)

- 10.4.6 SOUTH KOREA

- 10.4.6.1 Favorable advanced air mobility ecosystem to drive market

- TABLE 104 SOUTH KOREA: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY PLATFORM, 2031-2035 (USD MILLION)

- TABLE 105 SOUTH KOREA: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY RANGE, 2031-2035 (USD MILLION)

- TABLE 106 SOUTH KOREA: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY POWER, 2031-2035 (USD MILLION)

- 10.4.7 REST OF ASIA PACIFIC

- TABLE 107 REST OF ASIA PACIFIC: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY PLATFORM, 2031-2035 (USD MILLION)

- TABLE 108 REST OF ASIA PACIFIC: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY RANGE, 2031-2035 (USD MILLION)

- TABLE 109 REST OF ASIA PACIFIC: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY POWER, 2031-2035 (USD MILLION)

- 10.5 REST OF THE WORLD

- 10.5.1 REST OF THE WORLD: RECESSION IMPACT ANALYSIS

- 10.5.2 REST OF THE WORLD: PESTLE ANALYSIS

- FIGURE 40 REST OF THE WORLD: COMMERCIAL ELECTRIC AIRCRAFT MARKET SNAPSHOT

- TABLE 110 REST OF THE WORLD: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY REGION, 2026-2030 (USD MILLION)

- TABLE 111 REST OF THE WORLD: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY REGION, 2031-2035 (USD MILLION)

- TABLE 112 REST OF THE WORLD: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY PLATFORM, 2026-2030 (USD MILLION)

- TABLE 113 REST OF THE WORLD: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY PLATFORM, 2031-2035 (USD MILLION)

- TABLE 114 REST OF THE WORLD: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY RANGE, 2026-2030 (USD MILLION)

- TABLE 115 REST OF THE WORLD: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY RANGE, 2031-2035 (USD MILLION)

- TABLE 116 REST OF THE WORLD: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY POWER, 2026-2030 (USD MILLION)

- TABLE 117 REST OF THE WORLD: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY POWER, 2031-2035 (USD MILLION)

- 10.5.3 MIDDLE EAST

- 10.5.3.1 Rising demand for business jets to drive market

- TABLE 118 MIDDLE EAST: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY PLATFORM, 2026-2030 (USD MILLION)

- TABLE 119 MIDDLE EAST: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY PLATFORM, 2031-2035 (USD MILLION)

- TABLE 120 MIDDLE EAST: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY RANGE, 2026-2030 (USD MILLION)

- TABLE 121 MIDDLE EAST: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY RANGE, 2031-2035 (USD MILLION)

- TABLE 122 MIDDLE EAST: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY POWER, 2026-2030 (USD MILLION)

- TABLE 123 MIDDLE EAST: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY POWER, 2031-2035 (USD MILLION)

- 10.5.4 AFRICA

- 10.5.4.1 Global shift toward all-electric aircraft to drive market

- TABLE 124 AFRICA: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY PLATFORM, 2031-2035 (USD MILLION)

- TABLE 125 AFRICA: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY RANGE, 2031-2035 (USD MILLION)

- TABLE 126 AFRICA: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY POWER, 2031-2035 (USD MILLION)

- 10.5.5 LATIN AMERICA

- 10.5.5.1 Growing subsidies and investments in aerospace sector to drive market

- TABLE 127 LATIN AMERICA: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY PLATFORM, 2026-2030 (USD MILLION)

- TABLE 128 LATIN AMERICA: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY PLATFORM, 2031-2035 (USD MILLION)

- TABLE 129 LATIN AMERICA: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY RANGE, 2026-2030 (USD MILLION)

- TABLE 130 LATIN AMERICA: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY RANGE, 2031-2035 (USD MILLION)

- TABLE 131 LATIN AMERICA: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY POWER, 2026-2030 (USD MILLION)

- TABLE 132 LATIN AMERICA: COMMERCIAL ELECTRIC AIRCRAFT MARKET, BY POWER, 2031-2035 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 STRATEGIES OF KEY PLAYERS

- TABLE 133 STRATEGIES OF KEY PLAYERS

- 11.3 RANKING ANALYSIS

- FIGURE 41 MARKET RANKING OF KEY PLAYERS, 2022

- 11.4 COMPANY EVALUATION MATRIX

- 11.4.1 STARS

- 11.4.2 EMERGING LEADERS

- 11.4.3 PERVASIVE PLAYERS

- 11.4.4 PARTICIPANTS

- FIGURE 42 COMPANY EVALUATION MATRIX, 2022

- 11.4.5 COMPANY FOOTPRINT

- TABLE 134 COMMERCIAL ELECTRIC AIRCRAFT MARKET: COMPANY FOOTPRINT

- TABLE 135 COMMERCIAL ELECTRIC AIRCRAFT MARKET: RANGE FOOTPRINT

- TABLE 136 COMMERCIAL ELECTRIC AIRCRAFT MARKET: PLATFORM FOOTPRINT

- TABLE 137 COMMERCIAL ELECTRIC AIRCRAFT MARKET: REGION FOOTPRINT

- 11.5 STARTUP/SME EVALUATION MATRIX

- 11.5.1 PROGRESSIVE COMPANIES

- 11.5.2 RESPONSIVE COMPANIES

- 11.5.3 DYNAMIC COMPANIES

- 11.5.4 STARTING BLOCKS

- FIGURE 43 STARTUP/SME EVALUATION MATRIX, 2022

- 11.5.5 COMPETITIVE BENCHMARKING

- TABLE 138 COMMERCIAL ELECTRIC AIRCRAFT MARKET: KEY STARTUPS/SMES

- 11.6 COMPANY VALUATION AND FINANCIAL METRICS

- FIGURE 44 COMPANY VALUATION, 2022

- FIGURE 45 FINANCIAL METRICS, 2022

- FIGURE 46 PRODUCT COMPARISON OF KEY PLAYERS

- 11.7 COMPETITIVE SCENARIO

- 11.7.1 PRODUCT LAUNCHES

- TABLE 139 COMMERCIAL ELECTRIC AIRCRAFT MARKET: PRODUCT LAUNCHES, DECEMBER 2023

- 11.7.2 DEALS

- TABLE 140 COMMERCIAL ELECTRIC AIRCRAFT MARKET: DEALS, JANUARY 2020-JANUARY 2024

- 11.7.3 OTHER DEVELOPMENTS

- TABLE 141 COMMERCIAL ELECTRIC AIRCRAFT MARKET: OTHER DEVELOPMENTS, OCTOBER 2020-FEBRUARY 2024

12 COMPANY PROFILES

- (Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) **

- 12.1 INTRODUCTION

- 12.2 KEY PLAYERS

- 12.2.1 HEART AEROSPACE

- TABLE 142 HEART AEROSPACE: COMPANY OVERVIEW

- TABLE 143 HEART AEROSPACE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 144 HEART AEROSPACE: DEALS

- TABLE 145 HEART AEROSPACE: OTHER DEVELOPMENTS

- 12.2.2 EVIATION

- TABLE 146 EVIATION: COMPANY OVERVIEW

- TABLE 147 EVIATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 148 EVIATION: DEALS

- TABLE 149 EVIATION: OTHER DEVELOPMENTS

- 12.2.3 LILIUM

- TABLE 150 LILIUM: COMPANY OVERVIEW

- TABLE 151 LILIUM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 152 LILIUM: DEALS

- 12.2.4 WRIGHT ELECTRIC INC.

- TABLE 153 WRIGHT ELECTRIC INC.: COMPANY OVERVIEW

- TABLE 154 WRIGHT ELECTRIC INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 155 WRIGHT ELECTRIC INC.: DEALS

- TABLE 156 WRIGHT ELECTRIC INC.: OTHER DEVELOPMENTS

- 12.2.5 ARCHER AVIATION INC.

- TABLE 157 ARCHER AVIATION INC.: COMPANY OVERVIEW

- TABLE 158 ARCHER AVIATION INC.: PRODUCTS/ SOLUTIONS/SERVICES OFFERED

- TABLE 159 ARCHER AVIATION INC.: DEALS

- 12.2.6 EMBRAER

- TABLE 160 EMBRAER: COMPANY OVERVIEW

- FIGURE 47 EMBRAER: COMPANY SNAPSHOT

- TABLE 161 EMBRAER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 162 EMBRAER: DEALS

- 12.2.7 VAERIDION GMBH

- TABLE 163 VAERIDION GMBH: COMPANY OVERVIEW

- TABLE 164 VAERIDION GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 165 VAERIDION GMBH: DEALS

- TABLE 166 VAERIDION GMBH: OTHER DEVELOPMENTS

- 12.2.8 SCYLAX GMBH

- TABLE 167 SCYLAX GMBH: COMPANY OVERVIEW

- TABLE 168 SCYLAX GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.2.9 JOBY AVIATION

- TABLE 169 JOBY AVIATION: COMPANY OVERVIEW

- TABLE 170 JOBY AVIATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 171 JOBY AVIATION: DEALS

- 12.2.10 VERTICAL AEROSPACE

- TABLE 172 VERTICAL AEROSPACE: COMPANY OVERVIEW

- TABLE 173 VERTICAL AEROSPACE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 174 VERTICAL AEROSPACE: DEALS

- TABLE 175 VERTICAL AEROSPACE: OTHER DEVELOPMENTS

- 12.2.11 WISK AERO LLC

- TABLE 176 WISK AERO LLC: COMPANY OVERVIEW

- TABLE 177 WISK AERO LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 178 WISK AERO LLC: DEALS

- TABLE 179 WISK AERO LLC: OTHER DEVELOPMENTS

- 12.2.12 OVERAIR, INC.

- TABLE 180 OVERAIR, INC.: COMPANY OVERVIEW

- TABLE 181 OVERAIR, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 182 OVERAIR, INC.: PRODUCT LAUNCHES

- TABLE 183 OVERAIR, INC.: DEALS

- TABLE 184 OVERAIR, INC.: OTHER DEVELOPMENTS

- 12.2.13 SUPERNAL, LLC

- TABLE 185 SUPERNAL, LLC: COMPANY OVERVIEW

- TABLE 186 SUPERNAL, LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 187 SUPERNAL, LLC: DEALS

- 12.2.14 ELECTRIC AVIATION GROUP

- TABLE 188 ELECTRIC AVIATION GROUP: COMPANY OVERVIEW

- TABLE 189 ELECTRIC AVIATION GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 190 ELECTRIC AVIATION GROUP: DEALS

- 12.2.15 COSTRUZIONI AERONAUTICHE TECNAM S.P.A.

- TABLE 191 COSTRUZIONI AERONAUTICHE TECNAM S.P.A.: COMPANY OVERVIEW

- TABLE 192 COSTRUZIONI AERONAUTICHE TECNAM S.P.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.3 OTHER PLAYERS

- 12.3.1 MAGNIX

- TABLE 193 MAGNIX: COMPANY OVERVIEW

- 12.3.2 SAFRAN

- TABLE 194 SAFRAN: COMPANY OVERVIEW

- 12.3.3 HONEYWELL INTERNATIONAL INC.

- TABLE 195 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- 12.3.4 H55

- TABLE 196 H55: COMPANY OVERVIEW

- 12.3.5 EVOLITO LTD.

- TABLE 197 EVOLITO LTD.: COMPANY OVERVIEW

- 12.3.6 BAE SYSTEMS

- TABLE 198 BAE SYSTEMS: COMPANY OVERVIEW

- 12.3.7 KITE MAGNETICS PTY LTD.

- TABLE 199 KITE MAGNETICS PTY LTD.: COMPANY OVERVIEW

- 12.3.8 NIDEC MOTOR CORPORATION

- TABLE 200 NIDEC MOTOR CORPORATION: COMPANY OVERVIEW

- 12.3.9 THALES

- TABLE 201 THALES: COMPANY OVERVIEW

- 12.3.10 LEONARDO S.P.A.

- TABLE 202 LEONARDO S.P.A.: COMPANY OVERVIEW

- *Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS