|

|

市場調査レポート

商品コード

1695349

保険プラットフォームの世界市場 (~2030年):提供サービス (中核保険・インシュアテック)・用途 (引受・CRM・データ分析)・技術 (AI・ブロックチェーン・クラウドコンピューティング・分析)・保険タイプ (健康・生命・損害保険・旅行)・エンドユーザー別Insurance Platform Market by Offering (Core Insurance, Insurtech), Application (Underwriting, CRM, Data Analytics), Technology (AI, Blockchain, Cloud Computing, Analytics), Insurance Type (Health, Life, P&C, Travel), & End User - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 保険プラットフォームの世界市場 (~2030年):提供サービス (中核保険・インシュアテック)・用途 (引受・CRM・データ分析)・技術 (AI・ブロックチェーン・クラウドコンピューティング・分析)・保険タイプ (健康・生命・損害保険・旅行)・エンドユーザー別 |

|

出版日: 2025年03月25日

発行: MarketsandMarkets

ページ情報: 英文 419 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

保険プラットフォーム市場は、2025年の1,161億6,000万米ドルから、予測期間中はCAGR 12.3%で推移し、2030年には2,075億2,000万米ドルの規模に成長すると予測されています。

保険プラットフォームの市場は、デジタルトランスフォーメーションの動向の高まり、パーソナライズされた保険契約に対する顧客ニーズの高まり、拡張性と効率性の向上を目的としたクラウドベースのソリューションの採用拡大が成長の原動力となっています。保険会社はAI、データアナリティクス、自動化を活用して、引受、保険金請求処理、顧客エンゲージメントを強化しています。一方で、市場はデータセキュリティの懸念、規制の複雑さ、レガシーシステムの統合、限られたデジタルリテラシー、高い導入コストなどの課題に直面しています。保険会社は、進化する顧客の期待や業界の需要に応えるため、堅牢でありながら柔軟性の高いプラットフォームを模索しており、イノベーションとコンプライアンスのバランスを取ることが依然として極めて重要です。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020-2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025-2030年 |

| 単位 | 米ドル |

| セグメント | 提供区分・用途・技術・保険タイプ・エンドユーザー・地域 |

| 対象地域 | 北米・欧州・アジア太平洋・中東&アフリカ・ラテンアメリカ |

”用途別では、保険契約管理・回収・出金の部門が予測期間中に最も高い成長率を記録する見込み"

保険契約管理・回収・出金の部門は、業務の合理化、顧客体験の向上、財務管理の強化に対する需要の高まりにより、保険プラットフォーム市場で最速の成長を遂げる見通しです。これらのソリューションにより、保険会社は保険証券の発行、保険料の徴収、保険金の支払いといった重要なプロセスを自動化し、手作業を減らし、ミスを最小限に抑えることができます。デジタル決済ソリューションの導入が進み、リアルタイムの取引追跡が求められるようになっていることも、成長をさらに加速させています。さらに保険会社は、保険契約管理と財務ワークフローを組み合わせた統合プラットフォームに投資し、シームレスなデータフローとコンプライアンスを確保することで、最終的により迅速で効率的なサービス提供を推進しています。

”技術別では、クラウドコンピューティング技術が予測期間中に最大のシェアを占める"

クラウドコンピューティング技術は、その拡張性、柔軟性、コスト効率の高さから、保険プラットフォーム市場において最大の市場シェアを占めると予想されています。保険会社は、データストレージの強化、アクセス性の向上、遠隔操作のサポートなどを目的に、クラウドソリューションの採用を増やしています。クラウドプラットフォームは、AI、ビッグデータアナリティクス、IoTなどの先進技術とのシームレスな統合を可能にし、保険会社は貴重な洞察を得て意思決定を改善し、顧客体験を向上させることができます。さらに、クラウドコンピューティングは新サービスの迅速な展開を可能にし、市場の需要に応える俊敏性を確保します。保険会社がデジタルトランスフォーメーションを優先し、革新的なソリューションを求める中、クラウドベースのプラットフォームは、進化するビジネスニーズに対応する安全で適応性の高いインフラを提供します。

”アジア太平洋地域はイノベーションと新技術に後押しされ急成長を示し、市場規模では北米がリード”

アジア太平洋地域は、急速なデジタルトランスフォーメーション、インターネット普及率の上昇、新興国での保険導入の増加により、もっとも高い成長率を記録すると予測されています。中間層人口の増加、スマートフォンの利用拡大、デジタル金融を推進する政府の取り組みが、先進的な保険プラットフォームへの需要をさらに押し上げています。一方、北米は、確立された保険プロバイダー、デジタルソリューションへの高額の投資、AI、クラウドコンピューティング、ブロックチェーンなどの最先端技術の早期導入に牽引され、最大の市場シェアを占めると予想されています。同地域の強力な規制フレームワークと、デジタルファーストの保険サービスを好む顧客の志向も同市場の優位性をさらに強固なものにしています。

当レポートでは、世界の保険プラットフォームの市場を調査し、市場概要、市場成長への各種影響因子の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と業界動向

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 保険プラットフォームの進化

- サプライチェーン分析

- エコシステム分析

- 投資情勢と資金調達シナリオ

- ケーススタディ分析

- 技術分析

- 規制状況

- 保険プラットフォーム市場における生成AIの影響

- 特許分析

- 価格分析

- 主要な会議とイベント

- ポーターのファイブフォース分析

- 保険プラットフォームのビジネスモデル

- 保険プラットフォームの市場の購入者に影響を与える動向/混乱

- 主なステークホルダーと購入基準

第6章 保険プラットフォーム市場:エンドユーザー別

- 保険会社

- 保険代理店およびブローカー

- 独立系機関

- 証券会社

- オンラインアグリゲーター

- サードパーティ管理者

- 請求処理会社

- 保険契約管理サービスプロバイダー

- その他

第7章 保険プラットフォーム市場:技術別

- AI・アナリティクス

- IoT

- ブロックチェーン

- クラウドコンピューティング

- その他

第8章 保険プラットフォーム市場:用途別

- 請求管理

- 仮想請求処理

- 請求処理

- 請求アナリティクス

- 請求ワークフローの自動化

- その他

- 引受およびリスク管理

- 団体保険引受

- リスク評価とモデリング

- リスク予測

- その他

- 保険ワークフロー自動化

- リード管理

- インテリジェントドキュメント処理

- ビデオKYC/EKYC

- 料金設定・見積管理

- その他

- 顧客関係管理

- 顧客データ管理

- 顧客との交流・エンゲージメント

- カスタマーサポート&サービス

- チャットボット・バーチャルアシスタント

- その他

- 請求・決済

- 保険料の請求・請求書発行

- オンライン決済処理

- 調整・会計

- その他

- データアナリティクス

- 代位弁済分析

- パフォーマンスの追跡&レポーティング

- 不正行為の検出と防止

- サイバーリスク分析

- 行動分析

- コンプライアンス・レポーティング

- 規制コンプライアンス管理

- レポートの自動化

- コンプライアンス監査

- リスクとガバナンス管理

- その他

- 保険契約管理・回収・出金

- 保険契約の作成と変更

- 保険契約管理

- 保険料の回収

- 出金および支出管理

- その他

- セールス&マーケティング

- 代理店およびブローカー管理

- 消費者への直接販売

- デジタルセールスの実現

- その他

- デジタルエンゲージメント&ポータル

- 顧客ポータル&セルフサービス

- モバイルアプリ&デジタルチャネル

- チャットボット&バーチャルアシスタント

- 予測モデリング/異常事態予測

- 請求損害規模モデリング

- 保険契約推奨エンジン

- 極限イベント分析

- 保険数理モデリング・予測

- 災害モデリング

- その他

第9章 保険プラットフォーム市場:保険タイプ別

- 健康保険

- 生命保険・年金保険

- 損害保険

- 住宅所有者保険

- 自動車保険

- 商業保険

- その他

- 専門保険

- 旅行保険

- ペット保険

- 海上・航空保険

- 資産保険

- その他

- その他

第10章 保険プラットフォーム市場:提供区分別

- ソフトウェア

- コア保険プラットフォーム

- 保険技術プラットフォーム

- 保険業務および管理プラットフォーム

- サービス

- プロフェッショナルサービス

- マネージドサービス

第11章 保険プラットフォーム市場:地域別

- 北米

- 市場促進要因

- マクロ経済見通し

- 米国

- カナダ

- 欧州

- 市場促進要因

- マクロ経済見通し

- 英国

- ドイツ

- フランス

- イタリア

- スペイン

- スイス

- その他

- アジア太平洋

- 市場促進要因

- マクロ経済見通し

- 中国

- 日本

- インド

- 韓国

- オーストラリア・ニュージーランド

- シンガポール

- その他

- 中東・アフリカ

- 市場促進要因

- マクロ経済見通し

- 中東

- アフリカ

- ラテンアメリカ

- 市場促進要因

- マクロ経済見通し

- ブラジル

- メキシコ

- アルゼンチン

- その他

第12章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 収益分析

- 市場シェア分析

- 製品比較分析

- 企業価値評価と財務指標

- 企業評価マトリックス:主要企業

- 企業評価マトリックス:スタートアップ/中小企業

- 競合シナリオと動向

第13章 企業プロファイル

- 主要企業

- SALESFORCE

- MICROSOFT

- SAP

- ORACLE

- IBM

- ACCENTURE

- ADOBE

- COGNIZANT

- VERISK

- その他の企業

- SERVICENOW

- DXC TECHNOLOGY

- GUIDEWIRE SOFTWARE

- PEGASYSTEMS

- VERTAFORE

- LEXISNEXIS

- SAPIENS INTERNATIONAL CORPORATION

- APPLIED SYSTEMS

- MAJESCO

- APPIAN

- DUCK CREEK TECHNOLOGIES

- INSURITY

- EIS GROUP

- BOLTTECH

- FINEOS

- SME/スタートアップ

- COALITION

- ONESHIELD

- SHIFT TECHNOLOGY

- ENSUREDIT

- SUREIFY

- SOCOTRA

- HYPEREXPONENTIAL

- PRIMA SOLUTIONS

- BRITECORE

- ZIPARI

- INSURESOFT

- SYMBO

- COGITATE TECHNOLOGY SOLUTIONS

- INSUREDMINE

- TRUSTLAYER

- QUANTEMPLATE

- AGENCYSMART

- JENESIS SOFTWARE

- PERFECTQUOTE

- INSUREDHQ

第14章 隣接市場と関連市場

第15章 付録

List of Tables

- TABLE 1 USD EXCHANGE RATE, 2020-2024

- TABLE 2 PRIMARY INTERVIEWS

- TABLE 3 FACTOR ANALYSIS

- TABLE 4 GLOBAL INSURANCE PLATFORM MARKET SIZE AND GROWTH RATE, 2020-2024 (USD MILLION, Y-O-Y %)

- TABLE 5 GLOBAL INSURANCE PLATFORM MARKET SIZE AND GROWTH RATE, 2025-2030 (USD MILLION, Y-O-Y %)

- TABLE 6 INSURANCE PLATFORM MARKET: ECOSYSTEM

- TABLE 7 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 MIDDLE EAST AND AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 PATENTS FILED, 2016-2025

- TABLE 13 INSURANCE PLATFORM MARKET: KEY PATENTS, 2024-2025

- TABLE 14 PRICING OF INSURANCE PLATFORMS, BY APPLICATION

- TABLE 15 PRICING DATA OF INSURANCE PLATFORMS, BY INSURANCE TYPE

- TABLE 16 INSURANCE PLATFORM MARKET: KEY CONFERENCES AND EVENTS

- TABLE 17 PORTER'S FIVE FORCES: IMPACT ON INSURANCE PLATFORM MARKET

- TABLE 18 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 19 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 20 INSURANCE PLATFORM MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 21 INSURANCE PLATFORM MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 22 INSURANCE COMPANIES: INSURANCE PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 23 INSURANCE COMPANIES: INSURANCE PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 24 INSURANCE AGENCIES & BROKERS: INSURANCE PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 25 INSURANCE AGENCIES & BROKERS: INSURANCE PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 26 THIRD-PARTY ADMINISTRATORS: INSURANCE PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 27 THIRD-PARTY ADMINISTRATORS: INSURANCE PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 28 OTHER END USERS: INSURANCE PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 29 OTHER END USERS: INSURANCE PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 30 INSURANCE PLATFORM MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 31 INSURANCE PLATFORM MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 32 AI & ANALYTICS: INSURANCE PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 33 AI & ANALYTICS: INSURANCE PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 34 IOT: INSURANCE PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 35 IOT: INSURANCE PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 36 BLOCKCHAIN: INSURANCE PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 37 BLOCKCHAIN: INSURANCE PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 38 CLOUD COMPUTING: INSURANCE PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 39 CLOUD COMPUTING: INSURANCE PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

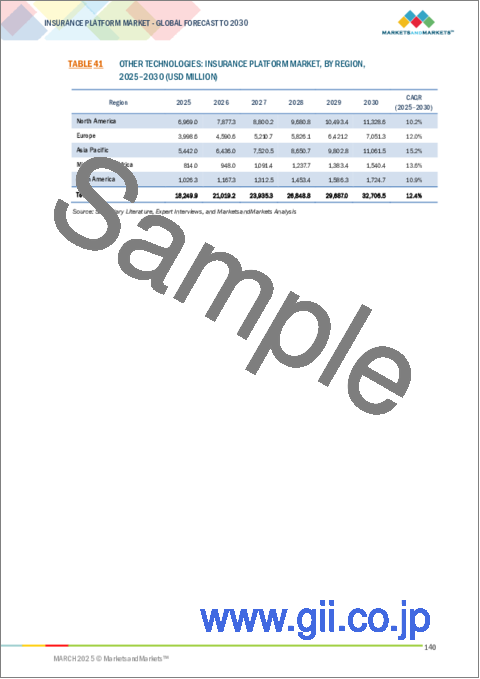

- TABLE 40 OTHER TECHNOLOGIES: INSURANCE PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 41 OTHER TECHNOLOGIES: INSURANCE PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 42 INSURANCE PLATFORM MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 43 INSURANCE PLATFORM MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 44 CLAIMS MANAGEMENT: INSURANCE PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 45 CLAIMS MANAGEMENT: INSURANCE PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 46 UNDERWRITING & RISK MANAGEMENT: INSURANCE PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 47 UNDERWRITING & RISK MANAGEMENT: INSURANCE PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 48 INSURANCE WORKFLOW AUTOMATION: INSURANCE PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 49 INSURANCE WORKFLOW AUTOMATION: INSURANCE PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 50 CUSTOMER RELATIONSHIP MANAGEMENT: INSURANCE PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 51 CUSTOMER RELATIONSHIP MANAGEMENT: INSURANCE PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 52 BILLING & PAYMENTS: INSURANCE PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 53 BILLING & PAYMENTS: INSURANCE PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 54 DATA ANALYTICS: INSURANCE PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 55 DATA ANALYTICS: INSURANCE PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 56 COMPLIANCE & REPORTING: INSURANCE PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 57 COMPLIANCE & REPORTING: INSURANCE PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 58 POLICY ADMINISTRATION, COLLECTION, AND DISBURSEMENT: INSURANCE PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 59 POLICY ADMINISTRATION, COLLECTION, AND DISBURSEMENT: INSURANCE PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 60 SALES & MARKETING: INSURANCE PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 61 SALES & MARKETING: INSURANCE PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 62 DIGITAL ENGAGEMENT & PORTALS: INSURANCE PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 63 DIGITAL ENGAGEMENT & PORTALS: INSURANCE PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 64 PREDICTIVE MODELING/EXTREME EVENT FORECASTING: INSURANCE PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 65 PREDICTIVE MODELING/EXTREME EVENT FORECASTING: INSURANCE PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 66 OTHER APPLICATIONS: INSURANCE PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 67 OTHER APPLICATIONS: INSURANCE PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 68 INSURANCE PLATFORM MARKET, BY INSURANCE TYPE, 2020-2024 (USD MILLION)

- TABLE 69 INSURANCE PLATFORM MARKET, BY INSURANCE TYPE, 2025-2030 (USD MILLION)

- TABLE 70 HEALTH INSURANCE: INSURANCE PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 71 HEALTH INSURANCE: INSURANCE PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 72 LIFE & ANNUITY INSURANCE: INSURANCE PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 73 LIFE & ANNUITY INSURANCE: INSURANCE PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 74 P&C INSURANCE: INSURANCE PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 75 P&C INSURANCE: INSURANCE PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 76 SPECIALTY INSURANCE: INSURANCE PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 77 SPECIALTY INSURANCE: INSURANCE PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 78 OTHER INSURANCE TYPES: INSURANCE PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 79 OTHER INSURANCE TYPES: INSURANCE PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 80 INSURANCE PLATFORM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 81 INSURANCE PLATFORM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 82 INSURANCE PLATFORM MARKET, BY SOFTWARE TYPE, 2020-2024 (USD MILLION)

- TABLE 83 INSURANCE PLATFORM MARKET, BY SOFTWARE TYPE, 2025-2030 (USD MILLION)

- TABLE 84 CORE INSURANCE PLATFORMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 85 CORE INSURANCE PLATFORMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 86 INSURANCE TECHNOLOGY PLATFORMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 87 INSURANCE TECHNOLOGY PLATFORMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 88 INSURANCE OPERATIONS & MANAGEMENT PLATFORMS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 89 INSURANCE OPERATIONS & MANAGEMENT PLATFORMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 90 INSURANCE PLATFORM MARKET, BY SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 91 INSURANCE PLATFORM MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 92 INSURANCE PLATFORM MARKET, BY PROFESSIONAL SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 93 INSURANCE PLATFORM MARKET, BY PROFESSIONAL SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 94 CONSULTING & ADVISORY SERVICES: INSURANCE PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 95 CONSULTING & ADVISORY SERVICES: INSURANCE PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 96 INTEGRATION & IMPLEMENTATION SERVICES: INSURANCE PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 97 INTEGRATION & IMPLEMENTATION SERVICES: INSURANCE PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 98 CUSTOM PLATFORM DESIGN & DEVELOPMENT SERVICES: INSURANCE PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 99 CUSTOM PLATFORM DESIGN & DEVELOPMENT SERVICES: INSURANCE PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 100 TRAINING & EDUCATION SERVICES: INSURANCE PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 101 TRAINING & EDUCATION SERVICES: INSURANCE PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 102 INSURANCE PLATFORM MARKET, BY MANAGED SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 103 INSURANCE PLATFORM MARKET, BY MANAGED SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 104 MANAGED SERVICES: INSURANCE PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 105 MANAGED SERVICES: INSURANCE PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 106 PLATFORM HOSTING & INFRASTRUCTURE MANAGEMENT SERVICES: INSURANCE PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 107 PLATFORM HOSTING & INFRASTRUCTURE MANAGEMENT SERVICES: INSURANCE PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 108 PLATFORM MAINTENANCE & SUPPORT SERVICES: INSURANCE PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 109 PLATFORM MAINTENANCE & SUPPORT SERVICES: INSURANCE PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 110 DATA MANAGEMENT & MIGRATION SERVICES: INSURANCE PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 111 DATA MANAGEMENT & MIGRATION SERVICES: INSURANCE PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 112 SECURITY & COMPLIANCE SERVICES: INSURANCE PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 113 SECURITY & COMPLIANCE SERVICES: INSURANCE PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 114 INSURANCE PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 115 INSURANCE PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 116 NORTH AMERICA: INSURANCE PLATFORM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 117 NORTH AMERICA: INSURANCE PLATFORM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 118 NORTH AMERICA: INSURANCE PLATFORM MARKET, BY SOFTWARE TYPE, 2020-2024 (USD MILLION)

- TABLE 119 NORTH AMERICA: INSURANCE PLATFORM MARKET, BY SOFTWARE TYPE, 2025-2030 (USD MILLION)

- TABLE 120 NORTH AMERICA: INSURANCE PLATFORM MARKET, BY SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 121 NORTH AMERICA: INSURANCE PLATFORM MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 122 NORTH AMERICA: INSURANCE PLATFORM MARKET, BY PROFESSIONAL SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 123 NORTH AMERICA: INSURANCE PLATFORM MARKET, BY PROFESSIONAL SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 124 NORTH AMERICA: INSURANCE PLATFORM MARKET, BY MANAGED SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 125 NORTH AMERICA: INSURANCE PLATFORM MARKET, BY MANAGED SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 126 NORTH AMERICA: INSURANCE PLATFORM MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 127 NORTH AMERICA: INSURANCE PLATFORM MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 128 NORTH AMERICA: INSURANCE PLATFORM MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 129 NORTH AMERICA: INSURANCE PLATFORM MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 130 NORTH AMERICA: INSURANCE PLATFORM MARKET, BY INSURANCE TYPE, 2020-2024 (USD MILLION)

- TABLE 131 NORTH AMERICA: INSURANCE PLATFORM MARKET, BY INSURANCE TYPE, 2025-2030 (USD MILLION)

- TABLE 132 NORTH AMERICA: INSURANCE PLATFORM MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 133 NORTH AMERICA: INSURANCE PLATFORM MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 134 NORTH AMERICA: INSURANCE PLATFORM MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 135 NORTH AMERICA: INSURANCE PLATFORM MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 136 US: INSURANCE PLATFORM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 137 US: INSURANCE PLATFORM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 138 US: INSURANCE PLATFORM MARKET, BY INSURANCE TYPE, 2020-2024 (USD MILLION)

- TABLE 139 US: INSURANCE PLATFORM MARKET, BY INSURANCE TYPE, 2025-2030 (USD MILLION)

- TABLE 140 CANADA: INSURANCE PLATFORM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 141 CANADA: INSURANCE PLATFORM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 142 CANADA: INSURANCE PLATFORM MARKET, BY INSURANCE TYPE, 2020-2024 (USD MILLION)

- TABLE 143 CANADA: INSURANCE PLATFORM MARKET, BY INSURANCE TYPE, 2025-2030 (USD MILLION)

- TABLE 144 EUROPE: INSURANCE PLATFORM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 145 EUROPE: INSURANCE PLATFORM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 146 EUROPE: INSURANCE PLATFORM MARKET, BY SOFTWARE TYPE, 2020-2024 (USD MILLION)

- TABLE 147 EUROPE: INSURANCE PLATFORM MARKET, BY SOFTWARE TYPE, 2025-2030 (USD MILLION)

- TABLE 148 EUROPE: INSURANCE PLATFORM MARKET, BY SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 149 EUROPE: INSURANCE PLATFORM MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 150 EUROPE: INSURANCE PLATFORM MARKET, BY PROFESSIONAL SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 151 EUROPE: INSURANCE PLATFORM MARKET, BY PROFESSIONAL SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 152 EUROPE: INSURANCE PLATFORM MARKET, BY MANAGED SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 153 EUROPE: INSURANCE PLATFORM MARKET, BY MANAGED SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 154 EUROPE: INSURANCE PLATFORM MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 155 EUROPE: INSURANCE PLATFORM MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 156 EUROPE: INSURANCE PLATFORM MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 157 EUROPE: INSURANCE PLATFORM MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 158 EUROPE: INSURANCE PLATFORM MARKET, BY INSURANCE TYPE, 2020-2024 (USD MILLION)

- TABLE 159 EUROPE: INSURANCE PLATFORM MARKET, BY INSURANCE TYPE, 2025-2030 (USD MILLION)

- TABLE 160 EUROPE: INSURANCE PLATFORM MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 161 EUROPE: INSURANCE PLATFORM MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 162 EUROPE: INSURANCE PLATFORM MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 163 EUROPE: INSURANCE PLATFORM MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 164 UK: INSURANCE PLATFORM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 165 UK: INSURANCE PLATFORM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 166 UK: INSURANCE PLATFORM MARKET, BY INSURANCE TYPE, 2020-2024 (USD MILLION)

- TABLE 167 UK: INSURANCE PLATFORM MARKET, BY INSURANCE TYPE, 2025-2030 (USD MILLION)

- TABLE 168 GERMANY: INSURANCE PLATFORM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 169 GERMANY: INSURANCE PLATFORM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 170 GERMANY: INSURANCE PLATFORM MARKET, BY INSURANCE TYPE, 2020-2024 (USD MILLION)

- TABLE 171 GERMANY: INSURANCE PLATFORM MARKET, BY INSURANCE TYPE, 2025-2030 (USD MILLION)

- TABLE 172 FRANCE: INSURANCE PLATFORM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 173 FRANCE: INSURANCE PLATFORM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 174 ITALY: INSURANCE PLATFORM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 175 ITALY: INSURANCE PLATFORM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 176 SPAIN: INSURANCE PLATFORM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 177 SPAIN: INSURANCE PLATFORM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 178 SWITZERLAND: INSURANCE PLATFORM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 179 SWITZERLAND: INSURANCE PLATFORM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 180 REST OF EUROPE: INSURANCE PLATFORM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 181 REST OF EUROPE: INSURANCE PLATFORM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 182 ASIA PACIFIC: INSURANCE PLATFORM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 183 ASIA PACIFIC: INSURANCE PLATFORM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 184 ASIA PACIFIC: INSURANCE PLATFORM MARKET, BY SOFTWARE TYPE, 2020-2024 (USD MILLION)

- TABLE 185 ASIA PACIFIC: INSURANCE PLATFORM MARKET, BY SOFTWARE TYPE, 2025-2030 (USD MILLION)

- TABLE 186 ASIA PACIFIC: INSURANCE PLATFORM MARKET, BY SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 187 ASIA PACIFIC: INSURANCE PLATFORM MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 188 ASIA PACIFIC: INSURANCE PLATFORM MARKET, BY PROFESSIONAL SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 189 ASIA PACIFIC: INSURANCE PLATFORM MARKET, BY PROFESSIONAL SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 190 ASIA PACIFIC: INSURANCE PLATFORM MARKET, BY MANAGED SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 191 ASIA PACIFIC: INSURANCE PLATFORM MARKET, BY MANAGED SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 192 ASIA PACIFIC: INSURANCE PLATFORM MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 193 ASIA PACIFIC: INSURANCE PLATFORM MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 194 ASIA PACIFIC: INSURANCE PLATFORM MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 195 ASIA PACIFIC: INSURANCE PLATFORM MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 196 ASIA PACIFIC: INSURANCE PLATFORM MARKET, BY INSURANCE TYPE, 2020-2024 (USD MILLION)

- TABLE 197 ASIA PACIFIC: INSURANCE PLATFORM MARKET, BY INSURANCE TYPE, 2025-2030 (USD MILLION)

- TABLE 198 ASIA PACIFIC: INSURANCE PLATFORM MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 199 ASIA PACIFIC: INSURANCE PLATFORM MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 200 ASIA PACIFIC: INSURANCE PLATFORM MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 201 ASIA PACIFIC: INSURANCE PLATFORM MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 202 CHINA: INSURANCE PLATFORM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 203 CHINA: INSURANCE PLATFORM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 204 CHINA: INSURANCE PLATFORM MARKET, BY INSURANCE TYPE, 2020-2024 (USD MILLION)

- TABLE 205 CHINA: INSURANCE PLATFORM MARKET, BY INSURANCE TYPE, 2025-2030 (USD MILLION)

- TABLE 206 JAPAN: INSURANCE PLATFORM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 207 JAPAN: INSURANCE PLATFORM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 208 INDIA: INSURANCE PLATFORM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 209 INDIA: INSURANCE PLATFORM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 210 INDIA: INSURANCE PLATFORM MARKET, BY INSURANCE TYPE, 2020-2024 (USD MILLION)

- TABLE 211 INDIA: INSURANCE PLATFORM MARKET, BY INSURANCE TYPE, 2025-2030 (USD MILLION)

- TABLE 212 SOUTH KOREA: INSURANCE PLATFORM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 213 SOUTH KOREA: INSURANCE PLATFORM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 214 AUSTRALIA & NEW ZEALAND: INSURANCE PLATFORM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 215 AUSTRALIA & NEW ZEALAND: INSURANCE PLATFORM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 216 SINGAPORE: INSURANCE PLATFORM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 217 SINGAPORE: INSURANCE PLATFORM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 218 REST OF ASIA PACIFIC: INSURANCE PLATFORM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 219 REST OF ASIA PACIFIC: INSURANCE PLATFORM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 220 MIDDLE EAST & AFRICA: INSURANCE PLATFORM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 221 MIDDLE EAST & AFRICA: INSURANCE PLATFORM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 222 MIDDLE EAST & AFRICA: INSURANCE PLATFORM MARKET, BY SOFTWARE TYPE, 2020-2024 (USD MILLION)

- TABLE 223 MIDDLE EAST & AFRICA: INSURANCE PLATFORM MARKET, BY SOFTWARE TYPE, 2025-2030 (USD MILLION)

- TABLE 224 MIDDLE EAST & AFRICA: INSURANCE PLATFORM MARKET, BY SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 225 MIDDLE EAST & AFRICA: INSURANCE PLATFORM MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 226 MIDDLE EAST & AFRICA: INSURANCE PLATFORM MARKET, BY PROFESSIONAL SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 227 MIDDLE EAST & AFRICA: INSURANCE PLATFORM MARKET, BY PROFESSIONAL SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 228 MIDDLE EAST & AFRICA: INSURANCE PLATFORM MARKET, BY MANAGED SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 229 MIDDLE EAST & AFRICA: INSURANCE PLATFORM MARKET, BY MANAGED SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 230 MIDDLE EAST & AFRICA: INSURANCE PLATFORM MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 231 MIDDLE EAST & AFRICA: INSURANCE PLATFORM MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 232 MIDDLE EAST & AFRICA: INSURANCE PLATFORM MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 233 MIDDLE EAST & AFRICA: INSURANCE PLATFORM MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 234 MIDDLE EAST & AFRICA: INSURANCE PLATFORM MARKET, BY INSURANCE TYPE, 2020-2024 (USD MILLION)

- TABLE 235 MIDDLE EAST & AFRICA: INSURANCE PLATFORM MARKET, BY INSURANCE TYPE, 2025-2030 (USD MILLION)

- TABLE 236 MIDDLE EAST & AFRICA: INSURANCE PLATFORM MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 237 MIDDLE EAST & AFRICA: INSURANCE PLATFORM MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 238 MIDDLE EAST & AFRICA: INSURANCE PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 239 MIDDLE EAST & AFRICA: INSURANCE PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 240 MIDDLE EAST: INSURANCE PLATFORM MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 241 MIDDLE EAST: INSURANCE PLATFORM MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 242 SAUDI ARABIA: INSURANCE PLATFORM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 243 SAUDI ARABIA: INSURANCE PLATFORM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 244 SAUDI ARABIA: INSURANCE PLATFORM MARKET, BY INSURANCE TYPE, 2020-2024 (USD MILLION)

- TABLE 245 SAUDI ARABIA: INSURANCE PLATFORM MARKET, BY INSURANCE TYPE, 2025-2030 (USD MILLION)

- TABLE 246 UAE: INSURANCE PLATFORM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 247 UAE: INSURANCE PLATFORM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 248 QATAR: INSURANCE PLATFORM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 249 QATAR: INSURANCE PLATFORM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 250 REST OF MIDDLE EAST: INSURANCE PLATFORM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 251 REST OF MIDDLE EAST: INSURANCE PLATFORM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 252 AFRICA: INSURANCE PLATFORM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 253 AFRICA: INSURANCE PLATFORM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 254 LATIN AMERICA: INSURANCE PLATFORM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 255 LATIN AMERICA: INSURANCE PLATFORM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 256 LATIN AMERICA: INSURANCE PLATFORM MARKET, BY SOFTWARE TYPE, 2020-2024 (USD MILLION)

- TABLE 257 LATIN AMERICA: INSURANCE PLATFORM MARKET, BY SOFTWARE TYPE, 2025-2030 (USD MILLION)

- TABLE 258 LATIN AMERICA: INSURANCE PLATFORM MARKET, BY SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 259 LATIN AMERICA: INSURANCE PLATFORM MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 260 LATIN AMERICA: INSURANCE PLATFORM MARKET, BY PROFESSIONAL SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 261 LATIN AMERICA: INSURANCE PLATFORM MARKET, BY PROFESSIONAL SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 262 LATIN AMERICA: INSURANCE PLATFORM MARKET, BY MANAGED SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 263 LATIN AMERICA: INSURANCE PLATFORM MARKET, BY MANAGED SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 264 LATIN AMERICA: INSURANCE PLATFORM MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 265 LATIN AMERICA: INSURANCE PLATFORM MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 266 LATIN AMERICA: INSURANCE PLATFORM MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 267 LATIN AMERICA: INSURANCE PLATFORM MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 268 LATIN AMERICA: INSURANCE PLATFORM MARKET, BY INSURANCE TYPE, 2020-2024 (USD MILLION)

- TABLE 269 LATIN AMERICA: INSURANCE PLATFORM MARKET, BY INSURANCE TYPE, 2025-2030 (USD MILLION)

- TABLE 270 LATIN AMERICA: INSURANCE PLATFORM MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 271 LATIN AMERICA: INSURANCE PLATFORM MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 272 LATIN AMERICA: INSURANCE PLATFORM MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 273 LATIN AMERICA: INSURANCE PLATFORM MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 274 BRAZIL: INSURANCE PLATFORM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 275 BRAZIL: INSURANCE PLATFORM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 276 BRAZIL: INSURANCE PLATFORM MARKET, BY INSURANCE TYPE, 2020-2024 (USD MILLION)

- TABLE 277 BRAZIL: INSURANCE PLATFORM MARKET, BY INSURANCE TYPE, 2025-2030 (USD MILLION)

- TABLE 278 MEXICO: INSURANCE PLATFORM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 279 MEXICO: INSURANCE PLATFORM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 280 ARGENTINA: INSURANCE PLATFORM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 281 ARGENTINA: INSURANCE PLATFORM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 282 REST OF LATIN AMERICA: INSURANCE PLATFORM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 283 REST OF LATIN AMERICA: INSURANCE PLATFORM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 284 OVERVIEW OF STRATEGIES ADOPTED BY KEY INSURANCE PLATFORM VENDORS, 2022-2025

- TABLE 285 INSURANCE PLATFORM MARKET: DEGREE OF COMPETITION

- TABLE 286 REGIONAL FOOTPRINT (25 COMPANIES), 2024

- TABLE 287 INSURANCE TYPE FOOTPRINT (25 COMPANIES), 2024

- TABLE 288 APPLICATION FOOTPRINT (25 COMPANIES), 2024

- TABLE 289 END USER FOOTPRINT (25 COMPANIES), 2024

- TABLE 290 INSURANCE PLATFORM MARKET: KEY STARTUPS/SMES, 2024

- TABLE 291 INSURANCE PLATFORM MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 292 INSURANCE PLATFORM MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS, 2022-2025

- TABLE 293 INSURANCE PLATFORM MARKET: DEALS, 2022-2025

- TABLE 294 SALESFORCE: BUSINESS OVERVIEW

- TABLE 295 SALESFORCE: PRODUCTS OFFERED

- TABLE 296 SALESFORCE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 297 SALESFORCE: DEALS

- TABLE 298 MICROSOFT: BUSINESS OVERVIEW

- TABLE 299 MICROSOFT: PRODUCTS OFFERED

- TABLE 300 MICROSOFT: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 301 MICROSOFT: DEALS

- TABLE 302 SAP: BUSINESS OVERVIEW

- TABLE 303 SAP: PRODUCTS OFFERED

- TABLE 304 SAP: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 305 SAP: DEALS

- TABLE 306 ORACLE: BUSINESS OVERVIEW

- TABLE 307 ORACLE: PRODUCTS OFFERED

- TABLE 308 ORACLE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 309 ORACLE: DEALS

- TABLE 310 GOOGLE: BUSINESS OVERVIEW

- TABLE 311 GOOGLE: PRODUCTS

- TABLE 312 GOOGLE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 313 GOOGLE: DEALS

- TABLE 314 IBM: BUSINESS OVERVIEW

- TABLE 315 IBM: PRODUCTS OFFERED

- TABLE 316 IBM: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 317 IBM: DEALS

- TABLE 318 ACCENTURE: BUSINESS OVERVIEW

- TABLE 319 ACCENTURE: PRODUCTS OFFERED

- TABLE 320 ACCENTURE: DEALS

- TABLE 321 ADOBE: BUSINESS OVERVIEW

- TABLE 322 ADOBE: PRODUCTS OFFERED

- TABLE 323 ADOBE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 324 ADOBE: DEALS

- TABLE 325 COGNIZANT: BUSINESS OVERVIEW

- TABLE 326 COGNIZANT: PRODUCTS OFFERED

- TABLE 327 COGNIZANT: DEALS

- TABLE 328 VERISK: BUSINESS OVERVIEW

- TABLE 329 VERISK: PRODUCTS OFFERED

- TABLE 330 VERISK: DEALS

- TABLE 331 FINTECH AS A SERVICE MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 332 FINTECH AS A SERVICE MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 333 FINTECH AS A SERVICE MARKET, BY TECHNOLOGY, 2018-2023 (USD MILLION)

- TABLE 334 FINTECH AS A SERVICE MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 335 FINTECH AS A SERVICE MARKET, BY APPLICATION, 2018-2023 (USD MILLION)

- TABLE 336 FINTECH AS A SERVICE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 337 FINTECH AS A SERVICE MARKET, BY END USER, 2018-2023 (USD MILLION)

- TABLE 338 FINTECH AS A SERVICE MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 339 FINTECH AS A SERVICE MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 340 FINTECH AS A SERVICE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 341 DIGITAL LENDING MARKET, BY OFFERING, 2017-2020 (USD MILLION)

- TABLE 342 DIGITAL LENDING MARKET, BY OFFERING, 2021-2026 (USD MILLION)

- TABLE 343 DIGITAL LENDING MARKET, BY DEPLOYMENT MODE, 2017-2020 (USD MILLION)

- TABLE 344 DIGITAL LENDING MARKET, BY DEPLOYMENT MODE, 2021-2026 (USD MILLION)

- TABLE 345 DIGITAL LENDING MARKET, BY END USER, 2017-2020 (USD MILLION)

- TABLE 346 DIGITAL LENDING MARKET, BY END USER, 2021-2026 (USD MILLION)

- TABLE 347 DIGITAL LENDING MARKET, BY REGION, 2017-2020 (USD MILLION)

- TABLE 348 DIGITAL LENDING MARKET, BY REGION 2021-2026 (USD MILLION)

List of Figures

- FIGURE 1 INSURANCE PLATFORM MARKET SEGMENTATION & REGIONS

- FIGURE 2 INSURANCE PLATFORM MARKET: RESEARCH DESIGN

- FIGURE 3 DATA TRIANGULATION

- FIGURE 4 INSURANCE PLATFORM MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 5 APPROACH 1, BOTTOM-UP (SUPPLY-SIDE) - REVENUE FROM SOLUTIONS/SERVICES OF INSURANCE PLATFORM MARKET

- FIGURE 6 APPROACH 2 - BOTTOM-UP (SUPPLY-SIDE) - COLLECTIVE REVENUE FROM KEY COMPANIES IN THE INSURANCE PLATFORM MARKET

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3, BOTTOM-UP (SUPPLY-SIDE) - COLLECTIVE REVENUE FROM ALL SOLUTIONS/ SERVICES OF INSURANCE PLATFORM MARKET

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 4, BOTTOM-UP (DEMAND-SIDE) - SHARE OF INSURANCE PLATFORM THROUGH OVERALL INSURANCE PLATFORM SPENDING

- FIGURE 9 SOFTWARE TO BE LARGEST OFFERING SEGMENT IN 2025

- FIGURE 10 INSURANCE TECHNOLOGY PLATFORMS SOFTWARE TO HOLD MAJOR SHARE IN 2025

- FIGURE 11 PROFESSIONAL SERVICES TO LEAD SEGMENT IN 2025

- FIGURE 12 CONSULTING & ADVISORY TO LEAD AMONG PROFESSIONAL SERVICES IN 2025

- FIGURE 13 PLATFORM HOSTING & INFRASTRUCTURE MANAGEMENT SERVICES TO DOMINATE IN 2025

- FIGURE 14 CLOUD COMPUTING TO LEAD AMONG TECHNOLOGIES IN 2025

- FIGURE 15 CLAIMS MANAGEMENT TO EMERGE AS LARGEST APPLICATION SEGMENT IN 2025

- FIGURE 16 P&C INSURANCE TO ACCOUNT FOR MAJORITY OF MARKET IN 2025

- FIGURE 17 THIRD-PARTY ADMINISTRATORS TO BE FASTEST-GROWING END USER OVER FORECAST PERIOD

- FIGURE 18 ASIA PACIFIC TO REGISTER FASTEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 19 DIGITAL TRANSFORMATION AND EVOLVING CONSUMER EXPECTATIONS DRIVE INSURANCE PLATFORM MARKET

- FIGURE 20 PREDICTIVE MODELING/EXTREME EVENT FORECASTING TO WITNESS HIGHEST GROWTH RATE

- FIGURE 21 INSURANCE TECHNOLOGY PLATFORMS AND P&C INSURANCE - LARGEST SHAREHOLDERS IN NORTH AMERICA IN 2025

- FIGURE 22 NORTH AMERICA TO HOLD LARGEST MARKET SHARE IN 2025

- FIGURE 23 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: INSURANCE PLATFORM MARKET

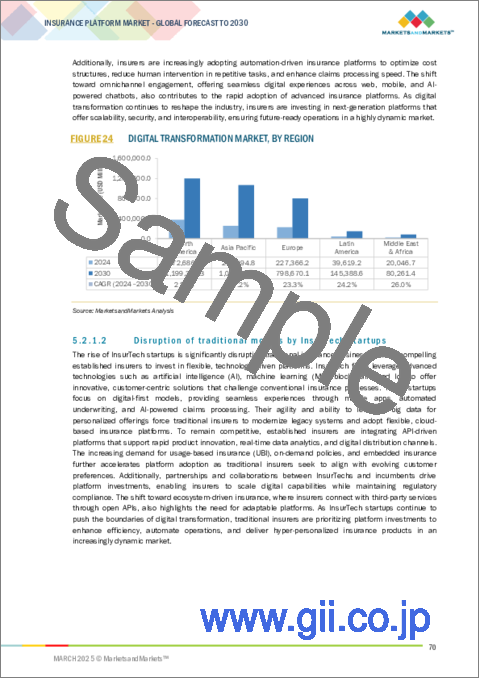

- FIGURE 24 DIGITAL TRANSFORMATION MARKET, BY REGION

- FIGURE 25 GLOBAL EARLY-STAGE INSURTECH DEAL SIZE (USD MILLION)

- FIGURE 26 INSURANCE PLATFORM MARKET EVOLUTION

- FIGURE 27 INSURANCE PLATFORM MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 28 KEY PLAYERS IN INSURANCE PLATFORM MARKET ECOSYSTEM

- FIGURE 29 INSURANCE PLATFORM MARKET: INVESTMENT LANDSCAPE AND FUNDING SCENARIO

- FIGURE 30 GLOBAL INSURANCE PLATFORM INVESTMENTS, 2020 TO 2024

- FIGURE 31 POTENTIAL OF GENERATIVE AI IN INSURANCE PLATFORM USE CASES

- FIGURE 32 NUMBER OF PATENTS GRANTED, 2016-2025

- FIGURE 33 REGIONAL ANALYSIS OF PATENTS GRANTED, 2016-2025

- FIGURE 34 INSURANCE PLATFORM MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 35 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 36 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 37 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 38 INSURANCE COMPANIES - LARGEST END USER SEGMENT DURING FORECAST PERIOD

- FIGURE 39 AI & ANALYTICS TECHNOLOGY SEGMENT TO DOMINATE BY 2030

- FIGURE 40 PREDICTIVE MODELING/EXTREME EVENT FORECASTING TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 41 HEALTH INSURANCE TO BE LARGEST SEGMENT IN 2030

- FIGURE 42 SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 43 INSURANCE TECHNOLOGY SOFTWARE TO GROW FASTEST DURING FORECAST PERIOD

- FIGURE 44 MANAGED SERVICES TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 45 NORTH AMERICA TO BE LARGEST REGIONAL MARKET DURING FORECAST PERIOD

- FIGURE 46 INDIA TO WITNESS FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 47 NORTH AMERICA: INSURANCE PLATFORM MARKET SNAPSHOT

- FIGURE 48 ASIA PACIFIC: INSURANCE PLATFORM MARKET SNAPSHOT

- FIGURE 49 TOP FIVE DOMINANT PLAYERS IN INSURANCE PLATFORM, 2020-2024 (USD MILLION)

- FIGURE 50 SHARE OF LEADING COMPANIES IN INSURANCE PLATFORM MARKET, 2024

- FIGURE 51 CRM SOLUTION COMPARATIVE ANALYSIS

- FIGURE 52 CLAIMS MANAGEMENT SOFTWARE COMPARATIVE ANALYSIS

- FIGURE 53 FINANCIAL METRICS OF KEY VENDORS

- FIGURE 54 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 55 INSURANCE PLATFORM MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 56 COMPANY FOOTPRINT (25 COMPANIES), 2024

- FIGURE 57 INSURANCE PLATFORM MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 58 SALESFORCE: COMPANY SNAPSHOT

- FIGURE 59 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 60 SAP: COMPANY SNAPSHOT

- FIGURE 61 ORACLE: COMPANY SNAPSHOT

- FIGURE 62 GOOGLE: COMPANY SNAPSHOT

- FIGURE 63 IBM: COMPANY SNAPSHOT

- FIGURE 64 ACCENTURE: COMPANY SNAPSHOT

- FIGURE 65 ADOBE: COMPANY SNAPSHOT

- FIGURE 66 COGNIZANT: COMPANY SNAPSHOT

- FIGURE 67 VERISK: COMPANY SNAPSHOT

The insurance platform market is projected to grow from USD 116.16 billion in 2025 to USD 207.52 billion by 2030 at a compound annual growth rate (CAGR) of 12.3% during the forecast period. The insurance platform market is driven by rising digital transformation trends, increasing customer demand for personalized policies, and the growing adoption of cloud-based solutions for improved scalability and efficiency. Insurers leverage AI, data analytics, and automation to enhance underwriting, claims processing, and customer engagement. However, market growth faces challenges such as data security concerns, regulatory complexities, legacy system integration, limited digital literacy, and high implementation costs. Balancing innovation with compliance remains crucial as insurers seek robust yet flexible platforms to meet evolving customer expectations and industry demands.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | USD (Billion) |

| Segments | Offering, Application, Technology, Insurance Type, End User, and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

"Policy Administration, Collection & Disbursement application is expected to register the fastest growth rate during the forecast period"

Policy administration, collection, and disbursement applications are poised to experience the fastest growth in the insurance platform market due to increasing demand for streamlined operations, improved customer experience, and enhanced financial management. These solutions enable insurers to automate critical processes such as policy issuance, premium collection, and claims disbursement, reducing manual efforts and minimizing errors. The rising adoption of digital payment solutions and the need for real-time transaction tracking further accelerate growth. Moreover, insurers invest in integrated platforms that combine policy management with financial workflows, ensuring seamless data flow and compliance, ultimately driving faster and more efficient service delivery.

"Cloud Computing technology will have the largest market share during the forecast period"

Cloud computing technology is expected to hold the largest market share in the insurance platform market due to its scalability, flexibility, and cost-efficiency. Insurers are increasingly adopting cloud solutions to enhance data storage, improve accessibility, and support remote operations. Cloud platforms enable seamless integration with advanced technologies like AI, big data analytics, and IoT, allowing insurers to gain valuable insights, improve decision-making, and enhance customer experiences. Additionally, cloud computing facilitates faster deployment of new services, ensuring agility in responding to market demands. As insurers prioritize digital transformation and seek innovative solutions, cloud-based platforms provide a secure, adaptable infrastructure that meets evolving business needs.

"Asia Pacific to witness rapid Insurance platform growth fueled by innovation and emerging technologies, while North America leads in market size"

The Asia Pacific region is projected to register the fastest growth rate in the insurance platform market due to rapid digital transformation, increasing internet penetration, and rising insurance adoption across emerging economies. Growing middle-class populations, expanding smartphone usage, and government initiatives promoting digital finance further boost demand for advanced insurance platforms. Meanwhile, North America is expected to hold the largest market share, driven by established insurance providers, high investment in digital solutions, and early adoption of cutting-edge technologies like AI, cloud computing, and blockchain. The region's strong regulatory framework and customer preference for digital-first insurance services further solidify its market dominance.

Breakdown of primaries

In-depth interviews were conducted with Chief Executive Officers (CEOs), innovation and technology directors, system integrators, and executives from various key organizations operating in the insurance platform market.

- By Company: Tier I - 33%, Tier II - 52%, and Tier III - 15%

- By Designation: C Level - 30%, Director Level - 48%, and others - 22%

- By Region: North America - 42%, Europe - 20%, Asia Pacific - 25%, Middle East & Africa - 8%, and Latin America - 5%

The report includes the study of key players offering insurance platform solutions and services. It profiles major vendors in the Insurance platform market. The major players in the Insurance platform market include Salesforce (US), IBM (US), Microsoft (US), Google (US), Adobe (US), Oracle (US), SAP (Germany), Pegasystems (US), Accenture (Ireland), DXC Technology (US), Guidewire Software (US), Duck Creek Technologies (US), Applied Systems (US), Fineos (Ireland), Cognizant (US), Appian (US), Verisk (US), Bolttech (US), ServiceNow (US), LexisNexis (US), Majesco (US), EIS Group (US), Insurity Inc (US), Vertafore (US), Sapiens International Corporation (Israel), Prima Solutions (France), Cogitate Technology Solutions (US), AgencySmart (US), InsureSoft (Canada), BriteCore (US), Shift Technology (France), Zipari (US), Quantemplate (UK), Jenesis Software (US), Sureify (US), OneShield (US), Ensuredit (India), Socotra (US), Coalition (US), Symbo (India), TrustLayer (US), PerfectQuote (US), Hyperexponential (UK), InsuredMine (US), and InsuredHQ (New Zealand).

Research coverage

This research report covers the insurance platform market, which has been segmented based on offering, application, technology, insurance type, and end user. The offering segment consists of software and services. The software segment contains core insurance platforms, insurance technology platforms, insurance operations & management platforms. The services segment consists of professional services (consulting & advisory services, integration & implementation services, custom platform design and development services, training & education services) and managed services (platform hosting & infrastructure management services, platform maintenance & support services, data management & migration services, security & compliance services). The application segment includes claims management (virtual claims handling, claims processing, claims analytics, claims workflow automation, and others (fraud detection & prevention, third-party claims management)), underwriting & risk management (group insurance underwriting, risk assessment & modeling, risk prediction, and others (underwriting decision support and portfolio management)), insurance workflow automation (lead management, intelligent document processing, video KYC/eKYC, pricing & quote management, and others (collaboration & self-service and customer queries & issue resolution)), customer relationship management (customer data management, customer interaction & engagement, customer support & service, chatbots & virtual assistants, others (retention & loyalty programs and customer onboarding)), billing & payments (premium billing & invoicing, online payment processing, reconciliation & accounting, others (payment fraud detection and multi-currency & cross-border payments)), digital engagement & portals (customer portals & self-service, mobile apps & digital channels, and chatbots & virtual assistants), data analytics (subrogation analytics, performance tracking & reporting, fraud detection & prevention, cyber risk analytics, and behavioral analytics), compliance & reporting (regulatory compliance management, reporting automation, compliance auditing, risk & governance management, others (anti-money laundering and compliance monitoring)), policy administration, collection & disbursement (policy creation & modification, policy management, premium collection, payout disbursement management, others (endorsements & renewals and collection management & reconciliation)), sales & marketing (agency & broker management, direct-to-consumer sales, digital sales enablement, others (lead management & conversion tracking and personalized product recommendations)), predictive modeling/extreme even forecasting (claims severity modeling, policy recommendation engines, extreme event analysis, actuarial modeling & predictions, catastrophe modeling), and others (reinsurance management, API & microservices, call center software, smart contracts integration)). The technology segment is bifurcated into cloud computing, AI & analytics, IoT, blockchain, and others (cybersecurity and edge computing). The insurance type segment consists of health insurance, life & annuities insurance, property & casualty insurance (homeowners' insurance, auto insurance, commercial insurance, and others (renters' general liability, worker compensation, disability, and umbrella insurance)), specialty insurance (cybersecurity insurance, travel insurance, pet insurance, marine & aviation insurance, asset insurance, and others (education, reinsurance, and agriculture)). The end user segment consists of insurance companies, insurance agencies & brokers (independent agencies, brokerage firms, online aggregators), third-party administrators (claims handling firms and policy management service providers), and others (actuaries and reinsurers). The regional analysis of the insurance platform market covers North America, Europe, Asia Pacific, the Middle East & Africa (MEA), and Latin America. The report also contains a detailed analysis of investment & funding scenarios, case studies, regulatory landscape, ecosystem analysis, supply chain analysis, pricing analysis, and technology analysis.

Key Benefits of Buying the Report

The report would provide the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall insurance platform market and its subsegments. It would help stakeholders understand the competitive landscape and gain more insights to position their business and plan suitable go-to-market strategies. It also helps stakeholders understand the market's pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (digital transformation across the insurance value chain is accelerating platform adoption, the emergence of insurtech startups disrupts traditional business models and compels established insurers to invest in flexible platforms, and the increasing complexity of regulatory compliance drives demand for platforms with built-in compliance features and automated reporting capabilities), restraints (legacy system integration barriers often delay implementation timelines and increase project complexity, high implementation costs associated with modernizing insurance platforms pose a barrier to adoption, and limited digital literacy among traditional insurers and agents hinders the smooth transition to automated and AI-driven insurance platforms), opportunities (embedded insurance models offer opportunities for platforms to integrate insurance into non-insurance applications via APIs and microservices, the increasing adoption of usage-based and parametric insurance products creates demand for platforms with robust IoT integration and real-time data processing, and the growing demand for digital-first insurance solutions creates opportunities for platforms to offer seamless customer experiences), and challenges (cybersecurity risks pose a major concern in the insurance platform market, market fragmentation makes it challenging for insurance platform providers to offer standardized solutions, and managing the increasing volume and variety of data sources while ensuring data quality and governance remains a persistent challenge).

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the insurance platform market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the insurance platform market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the insurance platform market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like Salesforce (US), IBM (US), Microsoft (US), Google (US), Adobe (US), Oracle (US), SAP (Germany), Pegasystems (US), Accenture (Ireland), DXC Technology (US), Guidewire Software (US), Duck Creek Technologies (US), Applied Systems (US), Fineos (Ireland), Cognizant (US), Appian (US), Verisk (US), Bolttech (US), ServiceNow (US), LexisNexis (US), Majesco (US), EIS Group (US), Insurity Inc (US), Vertafore (US), Sapiens International Corporation (Israel), Prima Solutions (France), Cogitate Technology Solutions (US), AgencySmart (US), InsureSoft (Canada), BriteCore (US), Shift Technology (France), Zipari (US), Quantemplate (UK), Jenesis Software (US), Sureify (US), OneShield (US), Ensuredit (India), Socotra (US), Coalition (US), Symbo (India), TrustLayer (US), PerfectQuote (US), Hyperexponential (UK), InsuredMine (US), and InsuredHQ (New Zealand), among others in the insurance platform market. The report also helps stakeholders understand the pulse of the insurance platform market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION & REGIONS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primary profiles

- 2.1.2.2 Key industry insights

- 2.2 MARKET BREAKUP AND DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- 2.4 MARKET FORECAST

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 STUDY LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN INSURANCE PLATFORM MARKET

- 4.2 INSURANCE PLATFORM MARKET: TOP THREE APPLICATIONS

- 4.3 NORTH AMERICA: INSURANCE PLATFORM MARKET, BY SOFTWARE AND INSURANCE TYPE

- 4.4 INSURANCE PLATFORM MARKET, BY REGION

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Digital transformation across insurance value chain

- 5.2.1.2 Disruption of traditional models by InsurTech startups

- 5.2.1.3 Complex regulations that drive demand for platforms with built-in compliance and automation

- 5.2.2 RESTRAINTS

- 5.2.2.1 Legacy system integration leading to implementation delays and added complexity

- 5.2.2.2 High modernization costs

- 5.2.2.3 Limited digital literacy among traditional insurers and agents

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Embedded insurance for seamless integration via APIs and microservices

- 5.2.3.2 Rising adoption of usage-based and parametric insurance leading to demand for IoT-enabled, real-time platforms

- 5.2.3.3 Growing demand for digital-first insurance solutions for seamless customer experience

- 5.2.4 CHALLENGES

- 5.2.4.1 Cybersecurity risks

- 5.2.4.2 Market fragmentation, leading to non-standardization

- 5.2.4.3 Managing diverse data sources while ensuring quality and governance

- 5.2.1 DRIVERS

- 5.3 EVOLUTION OF INSURANCE PLATFORMS

- 5.4 SUPPLY CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- 5.5.1 SOFTWARE TYPE

- 5.5.1.1 Core insurance platforms

- 5.5.1.2 Insurance technology platforms

- 5.5.1.3 Insurance operations & management platforms

- 5.5.2 INSURANCE TYPE

- 5.5.2.1 Health insurance

- 5.5.2.2 Life & annuity insurance

- 5.5.2.3 Property & casualty insurance

- 5.5.2.4 Specialty & other insurance

- 5.5.1 SOFTWARE TYPE

- 5.6 INVESTMENT LANDSCAPE AND FUNDING SCENARIO

- 5.7 CASE STUDY ANALYSIS

- 5.7.1 CASE STUDY 1: SALESFORCE ASSISTS AXA BUSINESS INSURANCE IN ENHANCING CUSTOMER SATISFACTION

- 5.7.2 CASE STUDY 2: AON ITALY TRANSFORMS INSURANCE AND RISK MANAGEMENT OPERATIONS USING IBM CLOUD PAKS

- 5.7.3 CASE STUDY 3: PACIFIC LIFE'S DIGITAL TRANSFORMATION WITH ACCENTURE AND SALESFORCE

- 5.7.4 CASE STUDY 4: SUN LIFE FINANCIAL ESTABLISHES DIGITAL TRANSFORMATION THROUGH MODERNIZATION

- 5.7.5 CASE STUDY 5: ARAG GROUP EXPEDITES INTERNATIONAL REPORTING THROUGH IMPLEMENTATION OF SAP

- 5.7.6 CASE STUDY 6: QBE IMPLEMENTS MODERN REINSURANCE MANAGEMENT SYSTEM WITH DUCK CREEK TECHNOLOGIES

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Artificial intelligence and machine learning

- 5.8.1.2 Blockchain

- 5.8.1.3 Cloud computing

- 5.8.1.4 IoT

- 5.8.1.5 Big data and analytics

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Robotic process automation

- 5.8.2.2 Application programming interface

- 5.8.2.3 Augmented reality/Virtual reality

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 Cybersecurity

- 5.8.3.2 Digital identity verification

- 5.8.3.3 Telematics and GPS

- 5.8.1 KEY TECHNOLOGIES

- 5.9 REGULATORY LANDSCAPE

- 5.9.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.9.2 REGULATORY FRAMEWORK/KEY REGULATIONS

- 5.9.2.1 North America

- 5.9.2.1.1 The Health Insurance Portability and Accountability Act (HIPAA)

- 5.9.2.1.2 The Gramm-Leach-Bliley Act (GLBA)

- 5.9.2.1.3 The Personal Information Protection and Electronic Documents Act (PIPEDA)

- 5.9.2.2 Europe

- 5.9.2.2.1 General Data Protection Regulation (GDPR)

- 5.9.2.2.2 Insurance Distribution Directive (IDD)

- 5.9.2.2.3 Solvency II Directive

- 5.9.2.3 Asia Pacific

- 5.9.2.3.1 Insurance Regulatory and Development Authority of India (IRDAI) Regulations (India)

- 5.9.2.3.2 Financial Services Agency (FSA) Regulations (Japan)

- 5.9.2.3.3 Insurance Authority (IA) Regulations (Hong Kong)

- 5.9.2.4 Middle East & Africa

- 5.9.2.4.1 Insurance Authority (IA) Regulations (United Arab Emirates)

- 5.9.2.4.2 Financial Sector Conduct Authority (FSCA) Regulations (South Africa)

- 5.9.2.4.3 Central Bank of Nigeria (CBN) Regulations (Nigeria)

- 5.9.2.5 Latin America

- 5.9.2.5.1 Superintendency of Securities and Insurance (SVS) Regulations

- 5.9.2.5.2 Superintendence of Private Insurance (SUSEP) Regulations

- 5.9.2.5.3 National Insurance and Bonding Commission (CNSF) Regulations

- 5.9.2.1 North America

- 5.10 IMPACT OF GENERATIVE AI ON INSURANCE PLATFORM MARKET

- 5.10.1 AUTOMATED CLAIMS PROCESSING

- 5.10.2 FRAUD DETECTION AND PREVENTION

- 5.10.3 UNDERWRITING

- 5.10.4 PERSONALIZED POLICY RECOMMENDATIONS

- 5.10.5 CHATBOTS & VIRTUAL ASSISTANTS

- 5.10.6 REGULATORY COMPLIANCE AUTOMATION

- 5.11 PATENT ANALYSIS

- 5.11.1 METHODOLOGY

- 5.11.2 PATENTS FILED, BY DOCUMENT TYPE

- 5.11.3 INNOVATION AND PATENT APPLICATIONS

- 5.12 PRICING ANALYSIS

- 5.12.1 AVERAGE SELLING PRICE TREND IN INSURANCE PLATFORM MARKET, BY APPLICATION, 2025

- 5.12.2 INDICATIVE PRICING ANALYSIS, BY INSURANCE TYPE, 2025

- 5.13 KEY CONFERENCES AND EVENTS (2025-2026)

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 THREAT OF NEW ENTRANTS

- 5.14.2 THREAT OF SUBSTITUTES

- 5.14.3 BARGAINING POWER OF SUPPLIERS

- 5.14.4 BARGAINING POWER OF BUYERS

- 5.14.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.15 INSURANCE PLATFORM BUSINESS MODELS

- 5.15.1 PLATFORM LICENSING

- 5.15.2 SOFTWARE AS A SERVICE

- 5.15.3 PAY-PER-USE AND ON-DEMAND

- 5.15.4 API INTEGRATION AND DEVELOPER SERVICES

- 5.15.5 WHITE-LABEL INSURANCE PLATFORMS

- 5.16 TRENDS/DISRUPTIONS IMPACTING BUYERS IN INSURANCE PLATFORM MARKET

- 5.17 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.17.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.17.2 BUYING CRITERIA

6 INSURANCE PLATFORM MARKET, BY END USER

- 6.1 INTRODUCTION

- 6.1.1 END USER: INSURANCE PLATFORM MARKET DRIVERS

- 6.2 INSURANCE COMPANIES

- 6.2.1 OPTIMIZE INSURANCE OPERATIONS WITH DIGITAL PLATFORMS FOR ENHANCED EFFICIENCY AND CUSTOMER ENGAGEMENT

- 6.3 INSURANCE AGENCIES & BROKERS

- 6.3.1 INDEPENDENT AGENCIES

- 6.3.1.1 Leverage digital solutions for efficiency and growth

- 6.3.2 BROKERAGE FIRMS

- 6.3.2.1 Enhanced insurance brokerage efficiency and client engagement -key focus areas

- 6.3.3 ONLINE AGGREGATORS

- 6.3.3.1 Enhance insurance accessibility through AI-driven online aggregators

- 6.3.1 INDEPENDENT AGENCIES

- 6.4 THIRD-PARTY ADMINISTRATORS

- 6.4.1 CLAIMS HANDLING FIRMS

- 6.4.1.1 Optimize claims handling with AI-driven and cloud-based solutions

- 6.4.2 POLICY MANAGEMENT SERVICE PROVIDERS

- 6.4.2.1 Use cutting-edge digital solutions for efficient, compliant policy administration

- 6.4.1 CLAIMS HANDLING FIRMS

- 6.5 OTHER END USERS

7 INSURANCE PLATFORM MARKET, BY TECHNOLOGY

- 7.1 INTRODUCTION

- 7.1.1 TECHNOLOGY: INSURANCE PLATFORM MARKET DRIVERS

- 7.2 AI & ANALYTICS

- 7.2.1 REFINE MARKETING STRATEGIES AND OPTIMIZE DISTRIBUTION CHANNELS

- 7.3 IOT

- 7.3.1 ENHANCES RISK MANAGEMENT, EFFICIENCY, AND CUSTOMER ENGAGEMENT

- 7.4 BLOCKCHAIN

- 7.4.1 REVOLUTIONIZES INSURANCE WITH TRANSPARENCY, SECURITY, AND EFFICIENCY

- 7.5 CLOUD COMPUTING

- 7.5.1 DISASTER RECOVERY AND BUSINESS CONTINUITY STRENGTHENED WITH DATA REDUNDANCY AND MINIMAL DOWNTIME

- 7.6 OTHER TECHNOLOGIES

8 INSURANCE PLATFORM MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.1.1 APPLICATION: INSURANCE PLATFORM MARKET DRIVERS

- 8.2 CLAIMS MANAGEMENT

- 8.2.1 VIRTUAL CLAIMS HANDLING

- 8.2.1.1 Accelerated automation and inspection to lead to improved customer satisfaction

- 8.2.2 CLAIMS PROCESSING

- 8.2.2.1 Enhanced processing with AI-powered platforms for faster digital workflows

- 8.2.3 CLAIMS ANALYTICS

- 8.2.3.1 Automating raw data into strategic intelligence to make smarter decisions

- 8.2.4 CLAIMS WORKFLOW AUTOMATION

- 8.2.4.1 AI, RPA, and intelligent document processing to optimize claims lifecycle

- 8.2.5 OTHERS

- 8.2.5.1 AI-driven fraud detection and third-party claims management to enhance efficiency accuracy

- 8.2.1 VIRTUAL CLAIMS HANDLING

- 8.3 UNDERWRITING & RISK MANAGEMENT

- 8.3.1 GROUP INSURANCE UNDERWRITING

- 8.3.1.1 Leverages statistical data to determine coverage terms and pricing

- 8.3.2 RISK ASSESSMENT & MODELING

- 8.3.2.1 Advanced AI and ML usage to ensure fair pricing and smarter decision-making

- 8.3.3 RISK PREDICTION

- 8.3.3.1 Advanced ML models refine risk prediction to improve accuracy and operational efficiency

- 8.3.4 OTHERS

- 8.3.4.1 Optimized underwriting decision support & portfolio management for effective risk management strategies

- 8.3.1 GROUP INSURANCE UNDERWRITING

- 8.4 INSURANCE WORKFLOW AUTOMATION

- 8.4.1 LEAD MANAGEMENT

- 8.4.1.1 Automated lead management to help enhance sales efficiency and customer satisfaction

- 8.4.2 INTELLIGENT DOCUMENT PROCESSING

- 8.4.2.1 Enhanced accuracy and faster decision-making for regulatory compliance and cost reduction

- 8.4.3 VIDEO KYC/EKYC

- 8.4.3.1 Reduced operational costs and seamless digital experience

- 8.4.4 PRICING & QUOTE MANAGEMENT

- 8.4.4.1 Automated pricing & quote management improves efficiency and offers data-driven premiums

- 8.4.5 OTHERS

- 8.4.5.1 Enhanced efficiency and decision-making with collaboration, self-service, and portfolio management

- 8.4.1 LEAD MANAGEMENT

- 8.5 CUSTOMER RELATIONSHIP MANAGEMENT

- 8.5.1 CUSTOMER DATA MANAGEMENT

- 8.5.1.1 Predictive analytics and seamless integration make data actionable and valuable for customer-centric strategies

- 8.5.2 CUSTOMER INTERACTION & ENGAGEMENT

- 8.5.2.1 Automated marketing campaigns and dynamic content recommendations to enhance customer journey experience

- 8.5.3 CUSTOMER SUPPORT & SERVICE

- 8.5.3.1 AI-driven ticketing systems streamline issue resolution

- 8.5.4 CHATBOTS & VIRTUAL ASSISTANTS

- 8.5.4.1 AI-powered chatbots and virtual assistants for seamless customer interactions

- 8.5.5 OTHERS

- 8.5.5.1 Enhanced customer retention and loyalty with data-driven CRM strategies and onboarding

- 8.5.1 CUSTOMER DATA MANAGEMENT

- 8.6 BILLING & PAYMENTS

- 8.6.1 PREMIUM BILLING & INVOICING

- 8.6.1.1 Automated premium billing & invoicing for accurate and efficient payment processing

- 8.6.2 ONLINE PAYMENT PROCESSING

- 8.6.2.1 Secure payment processing with multiple methods and fraud protection

- 8.6.3 RECONCILIATION & ACCOUNTING

- 8.6.3.1 Seamless reconciliation and accounting for transparent financial tracking and compliance

- 8.6.4 OTHERS

- 8.6.4.1 Payment fraud detection and seamless multi-currency & cross-border transactions

- 8.6.1 PREMIUM BILLING & INVOICING

- 8.7 DATA ANALYTICS

- 8.7.1 SUBROGATION ANALYTICS

- 8.7.1.1 AI-driven subrogation analytics to maximize recoveries and reduce claim expenses

- 8.7.2 PERFORMANCE TRACKING & REPORTING

- 8.7.2.1 Real-time tracking for optimized insurance operations and decision-making

- 8.7.3 FRAUD DETECTION & PREVENTION

- 8.7.3.1 Advanced fraud detection & prevention using AI, machine learning, and big data

- 8.7.4 CYBER RISK ANALYTICS

- 8.7.4.1 Comprehensive cyber risk analytics for accurate underwriting and proactive threat mitigation

- 8.7.5 BEHAVIORAL ANALYTICS

- 8.7.5.1 Personalized insurance, risk assessment, and fraud prevention strategies

- 8.7.1 SUBROGATION ANALYTICS

- 8.8 COMPLIANCE & REPORTING

- 8.8.1 REGULATORY COMPLIANCE MANAGEMENT

- 8.8.1.1 Key to evolving insurance industry standards and regulations

- 8.8.2 REPORTING AUTOMATION

- 8.8.2.1 Helps streamline compliance, financial, and operational data management in insurance

- 8.8.3 COMPLIANCE AUDITING

- 8.8.3.1 Ensures adherence to industry regulations and internal policy standards

- 8.8.4 RISK & GOVERNANCE MANAGEMENT

- 8.8.4.1 Strengthens regulatory compliance and operational resilience in insurance

- 8.8.5 OTHERS

- 8.8.5.1 Anti-money laundering and compliance monitoring to strengthen regulatory integrity in insurance

- 8.8.1 REGULATORY COMPLIANCE MANAGEMENT

- 8.9 POLICY ADMINISTRATION, COLLECTION, AND DISBURSEMENT

- 8.9.1 POLICY CREATION & MODIFICATION

- 8.9.1.1 Offer personalized insurance coverage and regulatory compliance

- 8.9.2 POLICY MANAGEMENT

- 8.9.2.1 Provides seamless administration, renewal, and customer engagement in insurance

- 8.9.3 PREMIUM COLLECTION

- 8.9.3.1 Secure, automated, and fraud-resistant payment processing

- 8.9.4 PAYOUT & DISBURSEMENT MANAGEMENT

- 8.9.4.1 Enables faster, transparent, and data-driven claims settlement

- 8.9.5 OTHERS

- 8.9.5.1 Automated endorsements, renewals, collection management, and reconciliation in modern platforms

- 8.9.1 POLICY CREATION & MODIFICATION

- 8.10 SALES & MARKETING

- 8.10.1 AGENCY & BROKER MANAGEMENT

- 8.10.1.1 Revolutionized agency & broker management with AI, digital tools, and automation

- 8.10.2 DIRECT-TO-CONSUMER SALES

- 8.10.2.1 Personalization, e-commerce, and data insights - key transformation factors

- 8.10.3 DIGITAL SALES ENABLEMENT

- 8.10.3.1 AI, automation, and smart analytics - key enablers

- 8.10.4 OTHERS

- 8.10.4.1 Optimized lead management and personalized recommendations in insurance platforms with AI

- 8.10.1 AGENCY & BROKER MANAGEMENT

- 8.11 DIGITAL ENGAGEMENT & PORTALS

- 8.11.1 CUSTOMER PORTALS & SELF-SERVICE

- 8.11.1.1 Enhanced customer experience with AI-powered portals and self-service

- 8.11.2 MOBILE APPS & DIGITAL CHANNELS

- 8.11.2.1 Lead to maximized customer engagement

- 8.11.3 CHATBOTS & VIRTUAL ASSISTANTS

- 8.11.3.1 Revolutionizing customer support with AI

- 8.11.1 CUSTOMER PORTALS & SELF-SERVICE

- 8.12 PREDICTIVE MODELING/EXTREME EVENT FORECASTING

- 8.12.1 CLAIMS SEVERITY MODELING

- 8.12.1.1 Enhanced cost estimation with AI, automation, and predictive analytics

- 8.12.2 POLICY RECOMMENDATION ENGINES

- 8.12.2.1 Optimized engines using AI and personalized data insights

- 8.12.3 EXTREME EVENT ANALYSIS

- 8.12.3.1 Applies predictive modeling and machine learning

- 8.12.4 ACTUARIAL MODELING & PREDICTIONS

- 8.12.4.1 AI-driven risk assessment for financial stability

- 8.12.5 CATASTROPHE MODELING

- 8.12.5.1 Improving catastrophe modeling through AI, big data, and simulation techniques

- 8.12.1 CLAIMS SEVERITY MODELING

- 8.13 OTHER APPLICATIONS

9 INSURANCE PLATFORM MARKET, BY INSURANCE TYPE

- 9.1 INTRODUCTION

- 9.1.1 INSURANCE TYPE: INSURANCE PLATFORM MARKET DRIVERS

- 9.2 HEALTH INSURANCE

- 9.2.1 AI AND AUTOMATION USED FOR EFFICIENCY AND GROWTH IN HEALTHCARE

- 9.3 LIFE & ANNUITY INSURANCE

- 9.3.1 AUTOMATION AND ANALYTICS TO TRANSFORM INSURANCE LANDSCAPE

- 9.4 PROPERTY & CASUALTY INSURANCE

- 9.4.1 HOMEOWNERS INSURANCE

- 9.4.1.1 Innovation and resilience - shaping the future of home insurance

- 9.4.2 AUTO INSURANCE

- 9.4.2.1 Digital transformation being leveraged for future mobility

- 9.4.3 COMMERCIAL INSURANCE

- 9.4.3.1 Automation & risk management - key focus areas

- 9.4.4 OTHERS

- 9.4.1 HOMEOWNERS INSURANCE

- 9.5 SPECIALTY INSURANCE

- 9.5.1 TRAVEL INSURANCE

- 9.5.1.1 Technology and customization to shape the future of travel

- 9.5.2 PET INSURANCE

- 9.5.2.1 Ensures affordable veterinary care

- 9.5.3 MARINE & AVIATION INSURANCE

- 9.5.3.1 Navigate evolving risks and innovations in marine and aviation insurance

- 9.5.4 ASSET INSURANCE

- 9.5.4.1 Protect valuable assets with adaptive and data-driven insurance

- 9.5.5 OTHERS

- 9.5.1 TRAVEL INSURANCE

- 9.6 OTHER INSURANCE TYPES

10 INSURANCE PLATFORM MARKET, BY OFFERING

- 10.1 INTRODUCTION

- 10.1.1 OFFERING: INSURANCE PLATFORM MARKET DRIVERS

- 10.2 SOFTWARE

- 10.2.1 CORE INSURANCE PLATFORMS

- 10.2.1.1 Fundamental to streamlining policy administration, underwriting, claims processing, and billing

- 10.2.2 INSURANCE TECHNOLOGY PLATFORMS

- 10.2.2.1 Integrate advanced digital tools that enhance decision-making, risk management, and customer engagement

- 10.2.3 INSURANCE OPERATIONS & MANAGEMENT PLATFORMS

- 10.2.3.1 Focus on reducing manual effort and improving efficiency

- 10.2.1 CORE INSURANCE PLATFORMS

- 10.3 SERVICES

- 10.3.1 PROFESSIONAL SERVICES

- 10.3.1.1 Leveraged by insurers to accelerate innovation, improve customer engagement, and drive sustainable growth

- 10.3.1.2 Consulting & advisory

- 10.3.1.2.1 Enable insurance companies to stay competitive, improve agility, and make informed investment decisions

- 10.3.1.3 Integration & implementation

- 10.3.1.3.1 Ensure seamless deployment of digital solutions for efficiency and enhanced customer experience

- 10.3.1.4 Custom platform design & development

- 10.3.1.4.1 Involve development of bespoke insurance platforms with specialized features

- 10.3.1.5 Training & education

- 10.3.1.5.1 Include structured training programs, workshops, and hands-on sessions

- 10.3.2 MANAGED SERVICES

- 10.3.2.1 Provide end-to-end operational support for scalability of digital platforms

- 10.3.2.2 Platform hosting & infrastructure management services

- 10.3.2.2.1 Ensure secure, scalable, high-performing digital ecosystem

- 10.3.2.3 Platform maintenance & support services

- 10.3.2.3.1 Include proactive monitoring, bug fixes, software updates, and real-time issue resolution

- 10.3.2.4 Data management & migration services

- 10.3.2.4.1 Enable insurers to handle vast volumes of critical data

- 10.3.2.5 Security & compliance services

- 10.3.2.5.1 Safeguard digital ecosystems against cyber threats, data breaches, and regulatory violations

- 10.3.1 PROFESSIONAL SERVICES

11 INSURANCE PLATFORM MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 NORTH AMERICA: INSURANCE PLATFORM MARKET DRIVERS

- 11.2.2 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 11.2.3 US

- 11.2.3.1 Increasing digital transformation and regulatory compliance to drive market

- 11.2.4 CANADA

- 11.2.4.1 Commitment to regulatory stability and advanced technological infrastructure create conducive market environment

- 11.3 EUROPE

- 11.3.1 EUROPE: INSURANCE PLATFORM MARKET DRIVERS

- 11.3.2 EUROPE: MACROECONOMIC OUTLOOK

- 11.3.3 UK

- 11.3.3.1 Seamless customer experiences and integration with broader financial services - key focus areas

- 11.3.4 GERMANY

- 11.3.4.1 Digitalization and integration of InsurTech solutions streamline insurance processes

- 11.3.5 FRANCE

- 11.3.5.1 Leverages AI and data analytics in insurance processes

- 11.3.6 ITALY

- 11.3.6.1 Increasing consumer demand for user-friendly digital experience to drive market

- 11.3.7 SPAIN

- 11.3.7.1 Adoption of emerging technologies enhance underwriting processes and claims management

- 11.3.8 SWITZERLAND

- 11.3.8.1 Regulatory flexibility encourages insurers to invest in insurance platforms

- 11.3.9 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 ASIA PACIFIC: INSURANCE PLATFORM MARKET DRIVERS

- 11.4.2 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 11.4.3 CHINA

- 11.4.3.1 Rise of InsurTech firms and tech giants in insurance space to reshape market

- 11.4.4 JAPAN

- 11.4.4.1 Government initiatives and regulatory changes to drive market

- 11.4.5 INDIA

- 11.4.5.1 Focus on hyper-personalization, automation, and deeper integration with digital economy

- 11.4.6 SOUTH KOREA

- 11.4.6.1 Partnerships between traditional insurers and technology firms to enhance customer experience

- 11.4.7 AUSTRALIA & NEW ZEALAND

- 11.4.7.1 Set to explore AI potential for insurance platforms

- 11.4.8 SINGAPORE

- 11.4.8.1 Progress observed in advancement of digital insurance platform solutions

- 11.4.9 REST OF ASIA PACIFIC

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 MIDDLE EAST & AFRICA: INSURANCE PLATFORM MARKET DRIVERS

- 11.5.2 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 11.5.3 MIDDLE EAST

- 11.5.3.1 Saudi Arabia

- 11.5.3.1.1 Market poised for sustained growth and adoption of digital-first insurance models

- 11.5.3.2 UAE

- 11.5.3.2.1 Adoption of advanced technologies and increased awareness of insurance products to boost market

- 11.5.3.3 Qatar

- 11.5.3.3.1 Economic diversification efforts and increasing digital transformation to drive growth

- 11.5.3.4 Rest of Middle East

- 11.5.3.1 Saudi Arabia

- 11.5.4 AFRICA

- 11.6 LATIN AMERICA

- 11.6.1 LATIN AMERICA: INSURANCE PLATFORM MARKET DRIVERS

- 11.6.2 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 11.6.3 BRAZIL