|

|

市場調査レポート

商品コード

1924864

無人搬送車(AGV)の世界市場:タイプ別、ナビゲーション技術別 - 予測(~2032年)Automated Guided Vehicle Market by Type, Navigation Technology - Global Forecast to 2032 |

||||||

カスタマイズ可能

|

|||||||

| 無人搬送車(AGV)の世界市場:タイプ別、ナビゲーション技術別 - 予測(~2032年) |

|

出版日: 2026年01月19日

発行: MarketsandMarkets

ページ情報: 英文 345 Pages

納期: 即納可能

|

概要

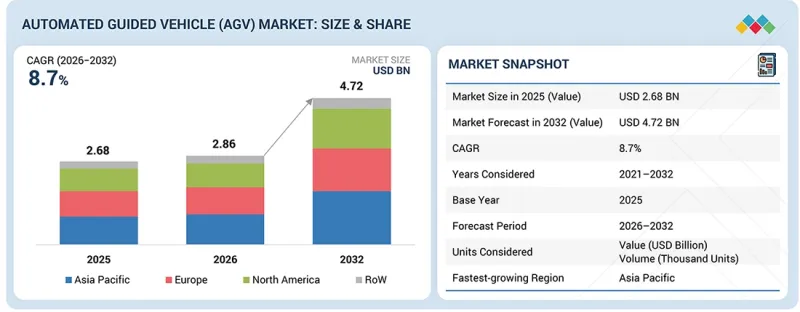

世界の無人搬送車(AGV)の市場規模は、2026年の28億6,000万米ドルから2032年までに47億2,000万米ドルに達すると予測され、予測期間にCAGRで8.7%の成長を記録する見込みです。

この成長は、組織が内部のマテリアルフローの改良、手作業の削減、一貫した業務成果の維持に注力する中で、工場、倉庫、流通施設におけるAGVの採用が増加していることに起因しています。

| 調査範囲 | |

|---|---|

| 調査対象期間 | 2021年~2032年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2032年 |

| 単位 | 10億米ドル |

| セグメント | タイプ、ナビゲーション技術、地域 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

企業は、信頼性と安全性が極めて重要な構造化された環境において、反復的な輸送作業、ライン供給、牽引、パレット移動を支援するため、AGVの展開を拡大しています。安定したナビゲーション、効率的な交通管理、連続運転下での信頼性の高い性能を提供するAGVシステムへの需要が高まっています。工場の近代化、ロジスティクスインフラの拡張、オートメーションアップグレードへの継続的な投資が、市場成長をさらに後押ししています。組織が効率性、コスト管理、拡張可能なオートメーション戦略を優先する中、AGVは世界市場における長期的なマテリアルハンドリングと業務最適化計画の不可欠な要素となりつつあります。

「軽負荷AGVが無人搬送車(AGV)市場において、大きなシェアを占める見込み」

軽負荷AGVセグメントが予測期間に無人搬送車(AGV)市場において大きなシェアを占める見込みです。これは、頻繁かつ短距離の材料移動を必要とする用途での強い採用に支えられています。軽負荷AGVは、工場、倉庫、流通施設において、トートハンドリング、小型パレット輸送、キッティング、ラインサイド補充などの業務に広く展開されています。取得コストが低く、コンパクトな形状、展開の容易さから、スペースに制約があり、適度な積載が必要な施設に適しています。企業は、反復的な内部輸送の自動化、職場の安全性の向上、手作業への依存度低減を目的として、軽負荷AGVを採用しています。これらのシステムは効率的な交通流と連続運転をサポートし、組織が一貫したスループットと運用管理を維持するのに寄与します。中小規模施設やレトロフィットプロジェクトにおけるオートメーションの拡大に伴い、軽負荷AGVの需要は引き続き増加しており、AGV市場全体でその重要性をさらに強めています。

「レーザー誘導が無人搬送車(AGV)市場において大幅なCAGRで成長します。」

レーザー誘導セグメントが予測期間に無人搬送車(AGV)市場において大幅なCAGRで成長する見込みです。これは、構造化された産業環境における高いナビゲーション精度と安定した性能への需要の増加に支えられています。レーザー誘導式AGVは、精密な位置決め、反復可能な経路設定、長時間の稼働サイクルにおける一貫した運用が求められる施設で広く採用されています。これらのシステムは、レイアウトの安定性と予測可能なマテリアルフローが重要な工場、倉庫、流通センターに最適です。企業は、スループットの向上、ナビゲーションエラーの低減、共有交通エリアにおける安全性の向上を目的として、レーザー誘導技術を採用しています。レーザー誘導式AGVは、頻繁な経路調整を必要とせず、迅速な作動と信頼性の高い運用を可能にするため、大規模な展開において魅力的です。精度、信頼性、制御されたワークフローが優先される環境において、組織がオートメーションを拡大するにつれて、レーザー誘導式AGVへの需要は引き続き増加し、このセグメントの力強い成長を支えます。

「アジア太平洋が無人搬送車(AGV)市場でもっとも急速に成長する地域として浮上します。」

アジア太平洋は、予測期間に無人搬送車(AGV)市場においてもっとも高い成長率を示す見込みです。これは、製造能力の急速な拡大、大規模な倉庫開発、生産・ロジスティクス施設におけるオートメーションの普及の拡大に支えられています。同地域の企業は、内部のマテリアルフローの改良、手作業の削減、大量処理業務における一貫した処理能力の維持を目的としてAGVを展開しています。ファクトリーオートメーション、流通インフラ、施設内輸送ニーズの力強い成長により、構造化された再現性のあるAGVベースのマテリアルハンドリングシステムへの需要が高まっています。

当レポートでは、世界の無人搬送車(AGV)市場について調査分析し、主な促進要因と抑制要因、製品開発とイノベーション、競合情勢に関する知見を提供しています。

よくあるご質問

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

第3章 重要な知見

- 無人搬送車(AGV)市場の企業にとって魅力的な機会

- 無人搬送車(AGV)市場:タイプ別

- 無人搬送車(AGV)市場:ナビゲーション技術別

- 無人搬送車(AGV)市場:業界別

- 無人搬送車(AGV)市場:積載量別

- 北米の無人搬送車(AGV)市場:業界別、国別

- 無人搬送車(AGV)市場:地域別

第4章 市場の概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 相互接続された市場と部門横断的な機会

- Tier 1/2/3企業の戦略的動き

第5章 業界動向

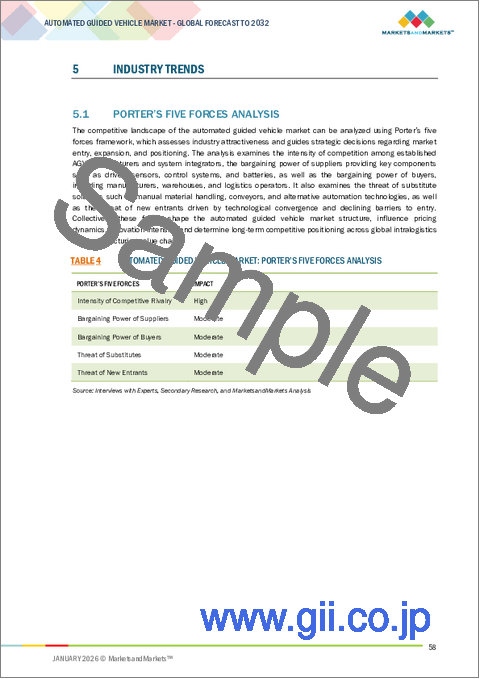

- ポーターのファイブフォース分析

- マクロ経済の見通し

- GDPの動向と予測

- 世界のeコマースと小売業界の動向

- 自動車業界の動向

- バリューチェーン分析

- エコシステム分析

- 価格設定の分析

- 無人搬送車(AGV)の価格帯:主要企業別(2025年)

- 無人搬送車(AGV)の平均販売価格の動向:タイプ別(2021年~2025年)

- 牽引車の平均販売価格の動向:地域別(2021年~2025年)

- 投資と資金調達のシナリオ

- 貿易分析

- 輸入シナリオ(842,710)

- 輸出シナリオ(842,710)

- カスタマービジネスに影響を与える動向/混乱

- 主な会議とイベント(2026年)

- ケーススタディ分析

- 2025年の米国関税の影響 - 無人搬送車(AGV)市場

- 主な関税率

- 価格の影響の分析

- 国/地域への影響

- 業界への影響

第6章 技術の進歩、AIによる影響、特許、イノベーション

- 主要技術

- AI

- 機械学習

- 隣接技術

- 産業用IoT

- 次世代無線技術

- 補完技術

- 協働ロボット

- デジタルツインテクノロジー

- 技術/製品ロードマップ

- 特許分析

- 無人搬送車(AGV)市場に対するAIの影響

- 主なユースケースと市場の将来性

- 無人搬送車(AGV)市場におけるOEMのベストプラクティス

- 無人搬送車(AGV)市場におけるAI導入に関するケーススタディ

- 相互接続された/隣接するエコシステムと市場企業への影響

- AI統合無人搬送車(AGV)の採用に対する顧客の準備状況

第7章 規制情勢

- 規制情勢とコンプライアンス

- 規制機関、政府機関、その他の組織

- 業界標準

- 規制

第8章 顧客情勢と購買行動

- 意思決定プロセス

- 購買プロセスに関与する主なステークホルダーとその評価基準

- 購買プロセスにおける主なステークホルダー

- 購入基準

- 採用障壁と内部課題

- さまざまな業界のアンメットニーズ

第9章 無人搬送車(AGV)の技術と潜在的な用途

- 無人搬送車(AGV)で使用される標準技術

- LiDARセンサー

- カメラビジョン

- 無人搬送車(AGV)の潜在的な用途

- 空港

- 建設、インフラ開発プロジェクト

第10章 無人搬送車(AGV)のバッテリーのタイプと充電方法

- 無人搬送車(AGV)で使用されるバッテリーのタイプ

- 鉛蓄電池

- リチウムイオンバッテリー

- ニッケル系電池

- 純鉛電池

- バッテリー充電の代替手段

- 自動充電と機会充電

- バッテリー交換

- プラグイン充電

第11章 無人搬送車(AGV)に提供されるコンポーネントとサービス

- ハードウェア

- ソフトウェア・サービス

第12章 無人搬送車(AGV)の近年の動向

- IoT接続性

- 協働AGVの採用

- スケーラビリティとモジュール設計

- 先進のナビゲーション技術

- エネルギー効率と持続可能性

- AIと機械学習の統合

- リアルタイムデータ処理向けエッジコンピューティング

第13章 無人搬送車(AGV)の用途

- ピックアンドプレース

- 包装・パレタイジング

- 組立・保管

第14章 無人搬送車(AGV)市場:タイプ別

- 牽引車

- ユニットロードキャリアー

- パレットトラック

- 組立ライン車両

- フォークリフト

- その他のタイプ

第15章 無人搬送車(AGV)市場:積載量別

- 軽負荷AGV

- 中負荷AGV

- 重負荷AGV

第16章 無人搬送車(AGV)市場:ナビゲーション技術別

- レーザー誘導

- 磁気誘導

- 電磁誘導

- 光テープ誘導

- 視覚誘導

- その他のナビゲーション技術

第17章 無人搬送車(AGV)市場:産業別

- 自動車

- 化学品

- 航空

- 半導体・電子

- eコマース・小売

- 食品・飲料

- 医薬品

- 医療機器

- 金属・重機

- ロジスティクス/3PL

- パルプ・紙

- その他の産業

第18章 無人搬送車(AGV)市場:地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- オランダ

- その他の欧州

- アジア太平洋

- 中国

- 日本

- オーストラリア

- 韓国

- インド

- マレーシア

- インドネシア

- シンガポール

- タイ

- その他のアジア太平洋

- その他の地域

- 中東

- 南米

- アフリカ

第19章 競合情勢

- 主要企業の競争戦略/強み(2021年~2025年)

- 収益分析(2020年~2024年)

- 市場シェア分析(2025年)

- 企業の評価と財務指標(2025年)

- ブランド/製品の比較

- DAIFUKU CO., LTD.(日本)

- JBT(米国)

- KION GROUP AG(ドイツ)

- KUKA SE & CO. KGAA(ドイツ)

- TOYOTA INDUSTRIES CORPORATION(日本)

- 企業の評価マトリクス:主要企業(2025年)

- 企業の評価マトリクス:スタートアップ/中小企業(2025年)

- 競合シナリオ

第20章 企業プロファイル

- 主要企業

- DAIFUKU CO., LTD.

- JBT

- KION GROUP AG

- TOYOTA INDUSTRIES CORPORATION

- KUKA SE & CO. KGAA

- SCOTT

- SSI SCHAEFER

- HYSTER-YALE, INC.

- JUNGHEINRICH AG

- MEIDENSHA CORPORATION

- MITSUBISHI LOGISNEXT CO., LTD.

- OCEANEERING INTERNATIONAL, INC.

- その他の企業

- NEURA MOBILE ROBOTS GMBH

- AMERICA IN MOTION, INC.

- ASSECO CEIT, A.S.

- SUZHOU CASUN INTELLIGENT ROBOT CO., LTD.

- JIANGXI DANBAHE ROBOT CO., LTD.

- E80 GROUP S.P.A.

- GLOBAL AGV

- GRENZEBACH GROUP

- IDC CORPORATION

- NANCHANG INDUSTRIAL CONTROL ROBOT CO., LTD.

- SAFELOG GMBH

- SIMPLEX ROBOTICS PVT. LTD.

- SYSTEM LOGISTICS S.P.A.

- BALYO