|

|

市場調査レポート

商品コード

1327324

食品病原体安全性検査機器および消耗品の世界市場 (~2028年):タイプ (システム・検査キット・微生物培養培地)・サイト (インハウス・アウトソーシング施設・政府系ラボ)・検査対象食品・地域別Food Pathogen Safety Testing Equipment and Supplies Market by Type (Systems, Test Kits, and Microbial Culture Media), Site (In-House, Outsourcing Facility, and Government Labs), Food Tested and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 食品病原体安全性検査機器および消耗品の世界市場 (~2028年):タイプ (システム・検査キット・微生物培養培地)・サイト (インハウス・アウトソーシング施設・政府系ラボ)・検査対象食品・地域別 |

|

出版日: 2023年08月02日

発行: MarketsandMarkets

ページ情報: 英文 300 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の食品病原体安全性検査機器および消耗品の市場規模は、2023年の74億米ドルから、予測期間中は10.05%のCAGRで推移し、2028年には104億米ドルの規模に成長すると予測されています。

食中毒の発生は主に、マイコトキシン、病原体、酵母やカビの増殖を含む食品の摂取に起因します。サルモネラ菌、カンピロバクター、大腸菌、リステリア菌などの病原菌は、食品の微生物学的安全性を損ない、食中毒を引き起こす可能性があるため、特に懸念されています。

タイプ別で見ると、システムの部門が予測期間中に7.1%のCAGRで成長すると推計されています。食中毒の発生頻度の上昇に伴い、政府、消費者は食品の安全性をより重視するようになっており、その結果、信頼性の高い検査ソリューションに対するニーズが高まっています。また、規制当局による食品安全要件の厳格化により、食品会社は安全基準遵守を確実にするための高度な検査方法の導入を重要視しています。食品サプライチェーンのグローバル化により、製造過程や輸送過程における汚染の可能性が高まり、さまざまな段階での食品安全性確保のための検査が重要になっています。バイオテクノロジーと診断の分野での技術的進歩により、疾病検出の精度とスピードが向上し、食品事業者にとってより受け入れやすいシステムとなっています。

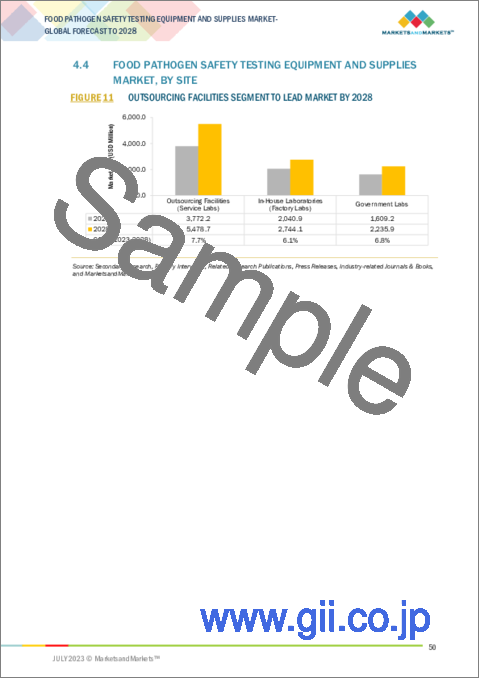

サイト別では、インハウスの部門が予測期間中に6.1%のCAGRを示す見通しです。インハウスでの食品病原体安全性検査は、その利点から業界全体で人気を集めています。これは食品製造施設内で病原体検査を実施するもので、外注の必要性を回避できます。このアプローチは、タイムリーな結果、費用対効果、品質管理、規制遵守、カスタマイズ性、機密性を提供し、さまざまな分野における食品の安全性を確保するための効果的なツールとなっています。

迅速に結果を得ることができるため、感染症が発見された場合、企業は迅速に対応することができ、汚染された商品の顧客への流通を止めることができます。さらに、検査頻度が高い企業や生産量が多い企業にとって、インハウス検査は経済的に有利であることが判明しています。検査手順を直接管理することで、厳格な品質管理基準、食品安全に関する法律の遵守、製品ラインや製造手順に合わせた検査手順の自由度を確保できます。また、非公開原料や独自の製剤を管理する会社にとって、インハウス検査はさらなる機密性を提供します。食品製造、レストラン、農業、小売、研究機関など、さまざまな産業において消費者保護を保証し、食品の完全性を維持するための重要なツールであるインハウス食品病原菌安全性検査は、食品業界が食品の安全性と品質保証を重視するようになるにつれて、ますます需要が高まっています。

地域別では、アジア太平洋地域が予測期間中に高いCAGRを示し、2028年には27億米ドルの規模に成長すると予測されています。食中毒の増加や食品安全に対する消費者の意識の高まりにより、信頼性の高い検査機器や消耗品に対する需要が高まっています。また、この地域の政府は公衆衛生を守るためにより厳しい規制を実施しており、厳格な検査ソリューションの必要性をさらに高めています。

当レポートでは、世界の食品病原体安全性検査機器および消耗品の市場を調査し、市場概要、市場影響因子および市場機会の分析、技術・特許の動向、ケーススタディ、関連法規制、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合環境、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- マクロ経済指標

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

第6章 産業動向

- 関税・法規制

- 特許分析

- 貿易分析

- 平均販売価格分析

- バリューチェーン分析

- サプライチェーン分析

- 顧客の事業に影響を与える動向/ディスラプション

- エコシステム分析

- ケーススタディ分析

- ポーターのファイブフォース分析

- 技術分析

- 主要ステークホルダーと購入基準

- 主要な会議とイベント

第7章 食品病原体安全性検査機器および消耗品市場:タイプ別

- システム

- ハイブリダイゼーションベース

- クロマトグラフィベース

- 分光分析ベース

- 免疫アッセイベース

- 検査キット

- 微生物培養培地

第8章 食品病原体安全性検査機器および消耗品市場:検査対象食品別

- 肉・鶏肉

- 魚介類

- 乳製品

- 加工食品

- 果物・野菜

- 穀物

- その他

第9章 食品病原体安全性検査機器および消耗品市場:サイト別

- インハウスラボ (ファクトリーラボ)

- アウトソーシング施設 (サービスラボ)

- 政府系ラボ

第10章 食品病原体安全性検査機器および消耗品市場:地域別

- 景気後退マクロ指標

- 北米

- 欧州

- アジア太平洋

- 南米

- その他の地域

第11章 競合情勢

- 概要

- 市場シェア分析

- 主要企業の収益分析

- 主要企業の年間収益・成長率

- 主要企業のEBITDA分析:地域別

- 主要企業の採用戦略

- 主要参入企業のスナップショット

- 主要企業の企業評価マトリックス

- スタートアップ/中小企業の企業評価マトリックス

- 競合シナリオ

第12章 企業プロファイル

- 主要企業

- THERMO FISHER SCIENTIFIC INC.

- BIO-RAD LABORATORIES, INC.

- MERCK KGAA

- NEOGEN CORPORATION

- SHIMADZU CORPORATION

- BIOMERIEUX

- AGILENT TECHNOLOGIES, INC.

- QIAGEN

- BRUKER

- PERKINELMER INC.

- HYGIENA, LLC

- SOLABIA GROUP(BIOKAR)

- ROKA BIO SCIENCE

- PROMEGA CORPORATION

- ROMER LABS DIVISION HOLDING

- スタートアップ/SME

- CHARM SCIENCES

- MICROBIOLOGICS, INC.

- R-BIOPHARM

- CONDALAB

- CHROMAGAR

- GOLD STANDARD DIAGNOSTICS

- CLEAR LABS, INC.

- RING BIOTECHNOLOGY CO LTD.

- NEMIS TECHNOLOGIES AG

- PATHOGENDX CORPORATION

第13章 隣接市場および関連市場

第14章 付録

The global market for food pathogen safety testing equipment and supplies is estimated to be valued at USD 7.4 Billion in 2023 and is projected to reach USD 10.4 Billion by 2028, at a CAGR of 7.1% during the forecast period. The occurrence of foodborne illnesses is mainly attributed to the consumption of food that contains mycotoxins, pathogens, or the proliferation of yeasts and molds. Pathogens like Salmonella, Campylobacter, E. coli, and Listeria are particularly concerning as they can compromise the microbiological safety of food, leading to foodborne illnesses. According to a recent report by the US Center for Disease Control and Prevention in 2020, there was an increase in cases of potentially dangerous foodborne illnesses in 2019 compared to the preceding three years, primarily caused by common bacteria present in the US food supply.

"The systems sub-segment in the by type segment is estimated to be growing at a CAGR of 7.1% for the food pathogen safety testing equipment and supplies market."

The demand for testing systems used in food pathogen testing equipment is increasing significantly due to a variety of compelling considerations. With the rising frequency of foodborne diseases, governments, and consumers are placing a greater focus on food safety, resulting in an increased need for dependable testing solutions. Stricter food safety requirements enforced by regulatory agencies have made it critical for food firms to implement sophisticated testing methods to ensure compliance with safety standards. The globalization of the food supply chain has raised the potential of contamination during manufacturing and transit, making testing methods critical for ensuring food safety at various stages. Technological advances in biotechnology and diagnostics have enhanced the accuracy and speed of disease detection, making the systems more acceptable to the food business.

Industry reputation and brand protection are becoming increasingly important, and testing methods provide a proactive way to avoid costly recalls and retain customer trust. The long-term cost-effectiveness of these systems, together with the emphasis on preventative actions, accords with food safety best practices. As the market for convenience and packaged foods grows, strong quality control procedures are required to avoid contamination, encouraging the use of testing technologies to verify product safety prior to distribution and consumption. Overall, the growing demand for these testing systems emphasizes their critical role in ensuring food safety and quality, propelling the food sector towards a more proactive and preventative strategy.

"The In-House sub-segment in the by-site segment is estimated to grow at a CAGR of 6.1% during the forecast period."

In-house food pathogen safety testing is gaining popularity across industries due to its advantages. It involves conducting pathogen testing within food production facilities, avoiding the need for outsourcing. This approach offers timely results, cost-effectiveness, quality control, regulatory compliance, customization, and confidentiality, making it an effective tool for ensuring food safety in various sectors.

The capacity to get results quickly allows businesses to respond quickly if infections are found, halting the distribution of tainted goods to customers. Additionally, for businesses with high testing frequency or high production quantities, in-house testing turns out to be financially advantageous over time. Direct control over the testing procedure ensures strict quality control standards, adherence to laws governing food safety, and the freedom to adapt testing procedures to product lines and manufacturing procedures. For companies managing private materials or proprietary formulations, in-house testing provides further secrecy. A crucial tool for guaranteeing consumer protection and maintaining the integrity of food products across various sectors, including food manufacturing, restaurants, agriculture, retail, and research institutions, in-house food pathogen safety testing is becoming more and more in demand as the food industry places an increased emphasis on food safety and quality assurance.

"Asia Pacific to grow at a significant CAGR during the forecast period, in food, pathogen safety testing equipment and supplies market to reach a value of USD 2.7 billion by 2028."

In the Asia Pacific region, food pathogen safety testing equipment and supplies have become essential tools to ensure the safety and quality of food products. The rising instances of foodborne illnesses and increased consumer awareness about food safety have created a higher demand for dependable testing equipment and supplies. Governments in the region are enforcing stricter regulations to protect public health, further fuelling the need for robust testing solutions. Advancements in technology have led to the development of more precise and efficient testing equipment, making it more accessible to businesses. As the food industry expands and globalizes in the region, the risk of contamination during production, processing, and distribution grows, necessitating regular and comprehensive pathogen testing. Businesses across various sectors, such as food manufacturing, agriculture, food service, and retail, are adopting these testing solutions to comply with regulations and prioritize consumer safety. With an increasing focus on food safety, the demand for advanced and reliable food pathogen safety testing equipment and supplies is projected to continue its upward trend in the Asia Pacific.

The break-up of the profile of primary participants in the food pathogen testing market:

- By Company: Tier 1 - 50%, Tier 2 - 40%, Tier 3 - 10%

- By Designation: Manager level - 60%, and C-Level- 40%

- By Region: North America -9%, Asia Pacific - 18%, Europe - 73%

Major key players operating in the food pathogen safety testing equipment and supplies market include Thermo Fisher Scientific Inc. (US), Bio-Rad Laboratories, Inc. (US), Merck KGaA (Germany), Neogen Corporation (US), BIOMERIEUX (France), Agilent Technologies, Inc. (US), QIAGEN (Germany), Shimadzu Corporation (Japan), Bruker (US), and PerkinElmer Inc. (US).

Research Coverage:

This research report categorizes the food pathogen safety testing equipment and supplies market by the site (In-House, Outsourcing Facility, Government Labs), by type (Systems, Test kits, Microbial culture media), by food tested (Meat & Poultry, Fish & Seafood, Dairy, Processed foods, Fruits & Vegetables, Cereals & Grains & other food tested) and by region (North America, Europe, Asia Pacific, South America, RoW). The scope of this report encompasses a comprehensive examination of major factors, including drivers, restraints, challenges, and opportunities, that significantly influence the growth of the food pathogen safety testing equipment and supplies market. Extensive research has been conducted to analyze key industry players, offering valuable insights into their business overview, product offerings, key strategies, contracts, partnerships, new product launches, as well as mergers and acquisitions associated with the food pathogen safety testing equipment and supplies market. Furthermore, the report includes a competitive analysis of emerging startups in the food pathogen safety testing equipment and supplies market ecosystem.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall food pathogen testing market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Cross-contamination of food products due to complex processes, Stringent food regulations, availability of advanced rapid technology, increase in demand for convenience and packaged food products, rising food recalls due to non-compliant food products, rise in consumer awareness about food safety), restraints (Lack of coordination between market stakeholders and improper enforcement of regulatory laws and supporting infrastructure, Complexity in testing techniques, Varying test results with test methods), opportunities (Technological advancements in testing industry, Spike in food safety concerns after COVID-19), and challenges (Lack of harmonization of food safety standards, High cost associated with procurement of food safety testing equipment) influencing the growth of the food pathogen safety testing equipment and supplies market.

- New Product launch/Innovation: Detailed insights on research & development activities and new product launches in the food pathogen safety testing equipment and supplies market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the food pathogen safety testing equipment and supplies market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the food pathogen safety testing equipment and supplies market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players like Thermo Fisher Scientific Inc. (US), Bio-Rad Laboratories, Inc. (US), Merck KGaA (Germany), Neogen Corporation (US), BIOMERIEUX (France), Agilent Technologies, Inc. (US) and others in the food pathogen safety testing equipment and supplies market strategies.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.1 INCLUSIONS AND EXCLUSIONS

- 1.3.2 REGIONS COVERED

- 1.4 YEARS CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.5.1 CURRENCY UNIT

- TABLE 1 USD EXCHANGE RATES, 2019-2022

- 1.5.2 VOLUME UNIT

- 1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primaries

- 2.1.2.3 Key primary insights

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 APPROACH ONE: BOTTOM-UP (BASED ON TYPES OF FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES, BY REGION)

- 2.2.2 APPROACH TWO: TOP-DOWN (BASED ON GLOBAL MARKET)

- 2.2.3 SUPPLY-SIDE ANALYSIS

- FIGURE 2 SUPPLY-SIDE ANALYSIS

- 2.2.4 DEMAND-SIDE ANALYSIS

- 2.3 DATA TRIANGULATION

- FIGURE 3 DATA TRIANGULATION METHODOLOGY

- 2.4 RECESSION IMPACT ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- TABLE 2 FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET SNAPSHOT, 2023 VS. 2028

- FIGURE 4 FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2023 VS. 2028 (USD MILLION)

- FIGURE 5 FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY SITE, 2023 VS. 2028 (USD MILLION)

- FIGURE 6 FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 7 FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY REGION, 2022

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET

- FIGURE 8 RISING HEALTH AWARENESS TO DRIVE FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET

- 4.2 EUROPE: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY SITE AND KEY COUNTRY

- FIGURE 9 OUTSOURCING FACILITIES SEGMENT AND GERMANY ACCOUNTED FOR SIGNIFICANT SHARE IN 2022

- 4.3 FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED

- FIGURE 10 MEAT & POULTRY SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.4 FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY SITE

- FIGURE 11 OUTSOURCING FACILITIES SEGMENT TO LEAD MARKET BY 2028

- 4.5 FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED AND REGION

- FIGURE 12 MEAT & POULTRY SEGMENT AND EUROPE TO ACCOUNT FOR SIGNIFICANT SHARE DURING FORECAST PERIOD

- 4.6 FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET: MAJOR REGIONAL SUBMARKETS

- FIGURE 13 US TO ACCOUNT FOR LARGEST SHARE IN 2023

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC INDICATORS

- 5.2.1 GLOBALIZATION OF FOOD TRADE

- FIGURE 14 CHANGE IN EXPORT VALUE, BY PRODUCT {AVERAGE BASE PERIOD (2000-2002) VS. AVERAGE CURRENT PERIOD (2019-2021)}

- 5.2.2 RISING HEALTH AWARENESS

- 5.3 MARKET DYNAMICS

- FIGURE 15 FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.3.1 DRIVERS

- 5.3.1.1 Growing emphasis on food quality and protecting brand reputation

- 5.3.1.2 Introduction of stringent food safety regulations and standards

- 5.3.1.3 Rise in foodborne illnesses

- TABLE 3 FOODBORNE OUTBREAKS IN US, 2021-2023

- 5.3.2 RESTRAINTS

- 5.3.2.1 High equipment cost

- 5.3.2.2 Risk of contamination during food testing procedures

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Growing demand for food testing in emerging markets

- 5.3.3.2 Integration of advanced technologies

- 5.3.3.3 Increasing focus on importance of food safety

- 5.3.4 CHALLENGES

- 5.3.4.1 Rapidly evolving pathogen strains

- 5.3.4.2 Complex testing methods

- 5.3.4.3 Standardization of testing protocols

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TARIFF AND REGULATORY LANDSCAPE

- 6.2.1 REGULATORY FRAMEWORK

- 6.2.1.1 Global Food Safety Initiative (GFSI)

- 6.2.1.2 North America

- 6.2.1.2.1 US

- 6.2.1.2.1.1 Federal Legislation

- 6.2.1.2.1.2 State Legislation

- 6.2.1.2.1.3 Food Safety in Retail Food

- 6.2.1.2.1.4 Food Safety in Trade

- 6.2.1.2.1.5 HACCP Regulation

- 6.2.1.2.1.6 US Regulation for Foodborne Pathogens in Poultry

- 6.2.1.2.1.7 Food Safety Regulation for Fruit and Vegetable Growers

- 6.2.1.2.2 Canada

- 6.2.1.2.3 Mexico

- 6.2.1.2.1 US

- 6.2.1.3 Europe

- 6.2.1.3.1 European Union

- FIGURE 16 LEGISLATION PROCESS IN EU

- 6.2.1.3.1.1 Microbiological Criteria Regulation

- 6.2.1.3.2 Germany

- 6.2.1.3.3 UK

- 6.2.1.3.4 France

- 6.2.1.3.5 Italy

- 6.2.1.3.6 Poland

- 6.2.1.4 Asia Pacific

- 6.2.1.4.1 China

- 6.2.1.4.2 Japan

- 6.2.1.4.3 India

- 6.2.1.4.3.1 Food Safety Standards Amendment Regulation, 2012

- 6.2.1.4.3.2 Food Safety Standards Amendment Regulation, 2011

- 6.2.1.4.3.3 Food Safety and Standards Act, 2006

- 6.2.1.4.4 Australia and New Zealand

- 6.2.1.4.4.1 Food Standards Australia and New Zealand

- 6.2.1.5 South America

- 6.2.1.5.1 Brazil

- 6.2.1.5.1.1 Ministry of Agriculture, Livestock, and Food Supply (MAPA)

- 6.2.1.5.1.2 Ministry of Health (MS)

- 6.2.1.5.2 Argentina

- 6.2.1.5.1 Brazil

- 6.2.1.6 Rest of the World

- 6.2.1.6.1 South Africa

- 6.2.1.6.1.1 International vs. Local Standards & Legislation

- 6.2.1.6.1.2 Private Standards in South Africa and Requirements for Product Testing

- 6.2.1.6.1 South Africa

- 6.2.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 4 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.2.1 REGULATORY FRAMEWORK

- 6.3 PATENT ANALYSIS

- TABLE 8 MAJOR PATENTS GRANTED, 2013-2022

- FIGURE 17 MAJOR PATENTS GRANTED, 2012-2021

- FIGURE 18 REGIONAL ANALYSIS OF MAJOR PATENTS GRANTED

- 6.4 TRADE ANALYSIS

- FIGURE 19 IMPORT VALUE OF PREPARED CULTURE MEDIA, 2019-2022 (USD THOUSAND)

- TABLE 9 IMPORT VALUE OF PREPARED CULTURE MEDIA, 2022 (USD THOUSAND)

- FIGURE 20 EXPORT VALUE OF PREPARED CULTURE MEDIA, 2019-2022 (USD THOUSAND)

- TABLE 10 EXPORT VALUE OF PREPARED CULTURE MEDIA, 2022 (USD THOUSAND)

- 6.5 AVERAGE SELLING PRICE ANALYSIS

- TABLE 11 INDICATIVE PRICE ANALYSIS, BY TYPE, 2022

- 6.6 VALUE CHAIN ANALYSIS

- FIGURE 21 VALUE CHAIN ANALYSIS

- 6.6.1 RESEARCH AND PRODUCT DEVELOPMENT

- 6.6.2 RAW MATERIAL SOURCING

- 6.6.3 MANUFACTURING AND ASSEMBLY

- 6.6.4 LOGISTICS AND DISTRIBUTION

- 6.6.5 MARKETING AND SALES

- 6.6.6 REGULATORY BODIES AND STANDARDS ORGANIZATIONS

- 6.6.7 END USERS

- 6.7 SUPPLY CHAIN ANALYSIS

- FIGURE 22 SUPPLY CHAIN ANALYSIS

- 6.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 23 REVENUE SHIFT FOR FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET

- 6.9 ECOSYSTEM ANALYSIS

- FIGURE 24 ECOSYSTEM MAP

- TABLE 12 ROLE OF PLAYERS IN MARKET ECOSYSTEM

- 6.10 CASE STUDY ANALYSIS

- 6.10.1 BCN RESEARCH LABORATORIES PARTNERED WITH BIOMERIEUX TO INTRODUCE GENE-UP SYSTEMS FOR FOOD SAFETY TESTING

- 6.10.2 EUROFINS COLLABORATED WITH RHEONIX TO INTRODUCE RHEONIX LISTERIA PATTERNALERT ASSAY

- 6.11 PORTER'S FIVE FORCES ANALYSIS

- TABLE 13 PORTER'S FIVE FORCES ANALYSIS

- 6.11.1 INTENSITY OF COMPETITIVE RIVALRY

- 6.11.2 BARGAINING POWER OF SUPPLIERS

- 6.11.3 BARGAINING POWER OF BUYERS

- 6.11.4 THREAT OF SUBSTITUTES

- 6.11.5 THREAT OF NEW ENTRANTS

- 6.12 TECHNOLOGY ANALYSIS

- 6.12.1 BIOSENSORS

- 6.12.2 NANOSENSORS

- 6.12.3 LANTHANIDE-BASED ASSAYS

- 6.12.4 LECTIN-BASED BIOSENSOR TECHNOLOGY

- 6.12.5 MICROARRAYS

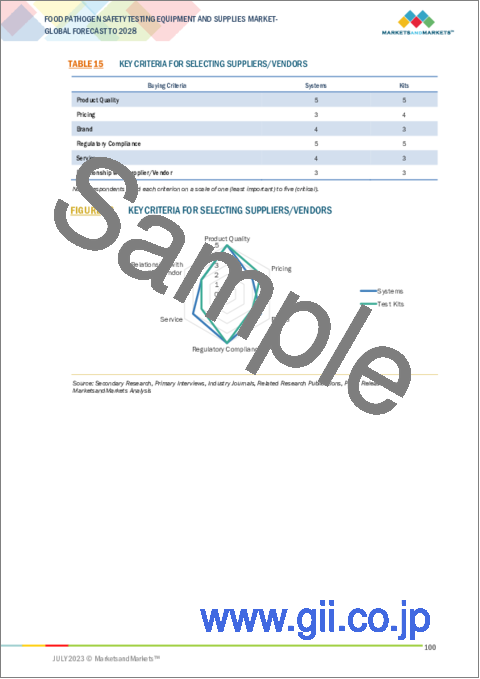

- 6.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 25 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY SAFETY TESTING EQUIPMENT TYPES

- TABLE 14 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY SAFETY TESTING EQUIPMENT TYPES

- 6.13.2 BUYING CRITERIA

- TABLE 15 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

- FIGURE 26 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

- 6.14 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 16 KEY CONFERENCES AND EVENTS, 2023-2024

7 FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY TYPE

- 7.1 INTRODUCTION

- FIGURE 27 FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- TABLE 17 FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 18 FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 7.2 SYSTEMS

- TABLE 19 SYSTEMS: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY SUBTYPE, 2018-2022 (USD MILLION)

- TABLE 20 SYSTEMS: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 21 SYSTEMS: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 22 SYSTEMS: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.2.1 HYBRIDIZATION-BASED

- 7.2.1.1 Need for high analytical precision in food testing to drive adoption of hybridization-based systems

- 7.2.1.2 Polymerase chain reaction (PCR)

- TABLE 23 GENE TARGETS USED FOR FOOD PATHOGENS IN DEVELOPED PCR TESTS

- 7.2.1.3 Gene amplifiers

- 7.2.2 CHROMATOGRAPHY-BASED

- 7.2.2.1 Focus on detecting chemical contaminants in food to encourage use of chromatography-based techniques

- 7.2.2.2 High-performance liquid chromatography (HPLC)

- 7.2.2.3 Liquid chromatography

- 7.2.2.4 Gas chromatography

- 7.2.2.5 Other chromatography-based systems

- 7.2.3 SPECTROMETRY-BASED

- 7.2.3.1 Growing demand to gain analytical approach to food pathogen testing to drive market

- 7.2.4 IMMUNOASSAY-BASED

- 7.2.4.1 Focus on building ability to test multiple samples to drive use of immunoassay-based systems

- 7.3 TEST KITS

- 7.3.1 NEED FOR USER-FRIENDLY AND EFFICIENT FOOD TESTING SOLUTIONS TO BOOST GROWTH

- TABLE 24 TEST KITS: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 25 TEST KITS: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.4 MICROBIAL CULTURE MEDIA

- 7.4.1 GROWING DEMAND FOR ADVANCED TECHNOLOGIES TO DRIVE ADOPTION OF FOOD SAFETY TESTING SOLUTIONS

- TABLE 26 MICROBIAL CULTURE MEDIA: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 27 MICROBIAL CULTURE MEDIA: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY REGION, 2023-2028 (USD MILLION)

8 FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED

- 8.1 INTRODUCTION

- TABLE 28 FOODBORNE PATHOGENS, BY FOOD SOURCE

- FIGURE 28 FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2023 VS. 2028 (USD MILLION)

- TABLE 29 FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2018-2022 (USD MILLION)

- TABLE 30 FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2023-2028 (USD MILLION)

- 8.2 MEAT & POULTRY

- 8.2.1 RISING GLOBAL MEAT AND POULTRY CONSUMPTION TO SPUR DEMAND

- TABLE 31 MEAT & POULTRY: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 32 MEAT & POULTRY: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3 FISH & SEAFOOD

- 8.3.1 GROWING RISK OF CONTAMINATION OF FISH AND SEAFOOD DUE TO SUPPLY CHAIN COMPLEXITIES TO DRIVE MARKET

- TABLE 33 FISH & SEAFOOD: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 34 FISH & SEAFOOD: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.4 DAIRY PRODUCTS

- 8.4.1 MOUNTING CASES OF LISTERIOSIS AND OTHER PATHOGEN-RELATED ILLNESSES IN DAIRY PRODUCTS TO STIMULATE MARKET DEMAND

- TABLE 35 DAIRY PRODUCTS: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 36 DAIRY PRODUCTS: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.5 PROCESSED FOOD

- 8.5.1 PROCESSED FOODS' SUSCEPTIBILITY TO PATHOGEN CONTAMINATION TO DRIVE DEMAND FOR SAFETY TESTING EQUIPMENT

- TABLE 37 PROCESSED FOOD: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 38 PROCESSED FOOD: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.6 FRUITS & VEGETABLES

- 8.6.1 MULTIPLE OUTBREAKS ASSOCIATED WITH PATHOGENS IN FRUITS AND VEGETABLES TO FUEL MARKET GROWTH

- TABLE 39 FRUITS & VEGETABLES: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 40 FRUITS & VEGETABLES: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.7 CEREALS & GRAINS

- 8.7.1 GROWING RISK OF CROSS-CONTAMINATION DUE TO WIDE APPLICATION OF CEREALS AND GRAINS IN FOOD INDUSTRY TO BOOST MARKET

- TABLE 41 CEREALS & GRAINS: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 42 CEREALS & GRAINS: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.8 OTHER FOOD PRODUCTS

- TABLE 43 OTHER FOOD PRODUCTS: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 44 OTHER FOOD PRODUCTS: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY REGION, 2023-2028 (USD MILLION)

9 FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY SITE

- 9.1 INTRODUCTION

- FIGURE 29 FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY SITE, 2023 VS. 2028 (USD MILLION)

- TABLE 45 FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY SITE, 2018-2022 (USD MILLION)

- TABLE 46 FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY SITE, 2023-2028 (USD MILLION)

- 9.2 IN-HOUSE LABORATORIES (FACTORY LABS)

- 9.2.1 NEED TO MAINTAIN BRAND REPUTATION AND CONSUMER TRUST TO DRIVE USE OF IN-HOUSE LABORATORIES

- TABLE 47 IN-HOUSE LABORATORIES: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 48 IN-HOUSE LABORATORIES: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.3 OUTSOURCING FACILITIES (SERVICE LABS)

- 9.3.1 NEED TO ACCESS SPECIALIZED EXPERTISE AND ADVANCED TECHNOLOGIES TO DRIVE DEMAND FOR OUTSOURCING LABORATORIES

- TABLE 49 OUTSOURCING FACILITIES: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 50 OUTSOURCING FACILITIES: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.4 GOVERNMENT LABS

- 9.4.1 INDEPENDENT AND IMPARTIAL TESTING PROVIDED BY GOVERNMENT LABS TO FUEL MARKET GROWTH

- TABLE 51 GOVERNMENT LABS: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 52 GOVERNMENT LABS: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY REGION, 2023-2028 (USD MILLION)

10 FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 30 FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET: GEOGRAPHIC SNAPSHOT

- TABLE 53 FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 54 FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.2 RECESSION MACROINDICATORS

- FIGURE 31 RECESSION MACROINDICATORS

- FIGURE 32 GLOBAL INFLATION RATE, 2011-2022

- FIGURE 33 GLOBAL GDP, 2011-2022 (USD TRILLION)

- FIGURE 34 RECESSION INDICATORS AND THEIR IMPACT ON FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET

- FIGURE 35 GLOBAL FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET: EARLIER FORECAST VS. RECESSION FORECAST

- 10.3 NORTH AMERICA

- 10.3.1 NORTH AMERICA: RECESSION IMPACT ANALYSIS

- FIGURE 36 NORTH AMERICA: INFLATION RATES, BY KEY COUNTRY, 2018-2022

- FIGURE 37 NORTH AMERICA: RECESSION IMPACT ANALYSIS, 2022 VS. 2023

- TABLE 55 NORTH AMERICA: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY SITE, 2018-2022 (USD MILLION)

- TABLE 56 NORTH AMERICA: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY SITE, 2023-2028 (USD MILLION)

- TABLE 57 NORTH AMERICA: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 58 NORTH AMERICA: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 59 NORTH AMERICA: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2018-2022 (USD MILLION)

- TABLE 60 NORTH AMERICA: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2023-2028 (USD MILLION)

- TABLE 61 NORTH AMERICA: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 62 NORTH AMERICA: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.3.2 US

- 10.3.2.1 Stringent food safety regulations to stimulate market

- TABLE 63 US: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2018-2022 (USD MILLION)

- TABLE 64 US: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2023-2028 (USD MILLION)

- 10.3.3 CANADA

- 10.3.3.1 Government initiatives aimed at reducing pathogens in meat and poultry to boost growth

- TABLE 65 CANADA: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2018-2022 (USD MILLION)

- TABLE 66 CANADA: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2023-2028 (USD MILLION)

- 10.3.4 MEXICO

- 10.3.4.1 Growing food exports to US and need for stringent safety measures to boost market

- TABLE 67 MEXICO: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2018-2022 (USD MILLION)

- TABLE 68 MEXICO: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2023-2028 (USD MILLION)

- 10.4 EUROPE

- FIGURE 38 EUROPEAN FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET SNAPSHOT

- 10.4.1 EUROPE: RECESSION IMPACT ANALYSIS

- FIGURE 39 EUROPE: INFLATION RATES, BY KEY COUNTRY, 2017-2022

- FIGURE 40 EUROPE: RECESSION IMPACT ANALYSIS, 2022 VS. 2023

- TABLE 69 EUROPE: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY SITE, 2018-2022 (USD MILLION)

- TABLE 70 EUROPE: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY SITE, 2023-2028 (USD MILLION)

- TABLE 71 EUROPE: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 72 EUROPE: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 73 EUROPE: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2018-2022 (USD MILLION)

- TABLE 74 EUROPE: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2023-2028 (USD MILLION)

- TABLE 75 EUROPE: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 76 EUROPE: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.4.2 GERMANY

- 10.4.2.1 Rising concerns over foodborne illnesses to drive market

- TABLE 77 GERMANY: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2018-2022 (USD MILLION)

- TABLE 78 GERMANY: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2023-2028 (USD MILLION)

- 10.4.3 FRANCE

- 10.4.3.1 Prevalence of multiple product recalls in country to stimulate growth

- TABLE 79 FRANCE: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2018-2022 (USD MILLION)

- TABLE 80 FRANCE: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2023-2028 (USD MILLION)

- 10.4.4 UK

- 10.4.4.1 Government funding and support initiatives for tracking foodborne pathogens to propel market

- TABLE 81 UK: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2018-2022 (USD MILLION)

- TABLE 82 UK: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2023-2028 (USD MILLION)

- 10.4.5 ITALY

- 10.4.5.1 Thriving tourism and hospitality industry to boost growth

- TABLE 83 ITALY: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2018-2022 (USD MILLION)

- TABLE 84 ITALY: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2023-2028 (USD MILLION)

- 10.4.6 SPAIN

- 10.4.6.1 Ongoing struggle with listeriosis and other foodborne illnesses to spur growth

- TABLE 85 SPAIN: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2018-2022 (USD MILLION)

- TABLE 86 SPAIN: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2023-2028 (USD MILLION)

- 10.4.7 POLAND

- 10.4.7.1 Growing dairy industry and exports to Ukraine to drive growth

- TABLE 87 POLAND: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2018-2022 (USD MILLION)

- TABLE 88 POLAND: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2023-2028 (USD MILLION)

- 10.4.8 REST OF EUROPE

- TABLE 89 REST OF EUROPE: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2018-2022 (USD MILLION)

- TABLE 90 REST OF EUROPE: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2023-2028 (USD MILLION)

- 10.5 ASIA PACIFIC

- FIGURE 41 ASIA PACIFIC FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET SNAPSHOT

- 10.5.1 ASIA PACIFIC: RECESSION IMPACT ANALYSIS

- FIGURE 42 ASIA PACIFIC: INFLATION RATES, BY KEY COUNTRY, 2017-2022

- FIGURE 43 ASIA PACIFIC: RECESSION IMPACT ANALYSIS, 2022 VS. 2023

- TABLE 91 ASIA PACIFIC: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY SITE, 2018-2022 (USD MILLION)

- TABLE 92 ASIA PACIFIC: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY SITE, 2023-2028 (USD MILLION)

- TABLE 93 ASIA PACIFIC: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 94 ASIA PACIFIC: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 95 ASIA PACIFIC: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2018-2022 (USD MILLION)

- TABLE 96 ASIA PACIFIC: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2023-2028 (USD MILLION)

- TABLE 97 ASIA PACIFIC: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 98 ASIA PACIFIC: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.5.2 CHINA

- 10.5.2.1 Government regulations and certifications for food safety to propel market

- TABLE 99 CHINA: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2018-2022 (USD MILLION)

- TABLE 100 CHINA: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2023-2028 (USD MILLION)

- 10.5.3 JAPAN

- 10.5.3.1 Rising incidences of food poisoning and increased food safety tests to drive market

- TABLE 101 JAPAN: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2018-2022 (USD MILLION)

- TABLE 102 JAPAN: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2023-2028 (USD MILLION)

- 10.5.4 INDIA

- 10.5.4.1 Growing food processing market to boost demand for food pathogen testing equipment

- TABLE 103 INDIA: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2018-2022 (USD MILLION)

- TABLE 104 INDIA: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2023-2028 (USD MILLION)

- 10.5.5 AUSTRALIA & NEW ZEALAND

- 10.5.5.1 Fear of outbreaks of Salmonella and E. coli to boost demand for food pathogen testing equipment

- TABLE 105 AUSTRALIA & NEW ZEALAND: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2018-2022 (USD MILLION)

- TABLE 106 AUSTRALIA & NEW ZEALAND: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2023-2028 (USD MILLION)

- 10.5.6 SOUTHEAST ASIA

- 10.5.6.1 Increasing awareness regarding safety and quality of food to encourage adoption of food pathogen testing equipment

- TABLE 107 SOUTHEAST ASIA: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2018-2022 (USD MILLION)

- TABLE 108 SOUTHEAST ASIA: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2023-2028 (USD MILLION)

- 10.5.7 REST OF ASIA PACIFIC

- TABLE 109 REST OF ASIA PACIFIC: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2018-2022 (USD MILLION)

- TABLE 110 REST OF ASIA PACIFIC: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2023-2028 (USD MILLION)

- 10.6 SOUTH AMERICA

- 10.6.1 SOUTH AMERICA: RECESSION IMPACT ANALYSIS

- FIGURE 44 SOUTH AMERICA: INFLATION RATES, BY KEY COUNTRY, 2017-2022

- FIGURE 45 SOUTH AMERICA: RECESSION IMPACT ANALYSIS, 2022 VS. 2023

- TABLE 111 SOUTH AMERICA: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY SITE, 2018-2022 (USD MILLION)

- TABLE 112 SOUTH AMERICA: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY SITE, 2023-2028 (USD MILLION)

- TABLE 113 SOUTH AMERICA: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 114 SOUTH AMERICA: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 115 SOUTH AMERICA: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2018-2022 (USD MILLION)

- TABLE 116 SOUTH AMERICA: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2023-2028 (USD MILLION)

- TABLE 117 SOUTH AMERICA: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 118 SOUTH AMERICA: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.6.2 BRAZIL

- 10.6.2.1 Booming food processing industry to spur market

- TABLE 119 BRAZIL: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2018-2022 (USD MILLION)

- TABLE 120 BRAZIL: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2023-2028 (USD MILLION)

- 10.6.3 ARGENTINA

- 10.6.3.1 Awareness among consumers regarding mounting cases of foodborne illnesses to contribute to market growth

- TABLE 121 ARGENTINA: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2018-2022 (USD MILLION)

- TABLE 122 ARGENTINA: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2023-2028 (USD MILLION)

- 10.6.4 REST OF SOUTH AMERICA

- TABLE 123 REST OF SOUTH AMERICA: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2018-2022 (USD MILLION)

- TABLE 124 REST OF SOUTH AMERICA: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2023-2028 (USD MILLION)

- 10.7 REST OF THE WORLD

- 10.7.1 ROW: RECESSION IMPACT ANALYSIS

- FIGURE 46 ROW: INFLATION RATES, BY KEY COUNTRY, 2017-2022

- FIGURE 47 ROW: RECESSION IMPACT ANALYSIS, 2022 VS. 2023

- TABLE 125 ROW: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY SITE, 2018-2022 (USD MILLION)

- TABLE 126 ROW: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY SITE, 2023-2028 (USD MILLION)

- TABLE 127 ROW: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 128 ROW: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 129 ROW: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2018-2022 (USD MILLION)

- TABLE 130 ROW: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2023-2028 (USD MILLION)

- TABLE 131 ROW: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 132 ROW: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.7.2 MIDDLE EAST

- 10.7.2.1 Heavy reliance on imported foods to drive demand for food pathogen safety testing equipment

- TABLE 133 MIDDLE EAST: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2018-2022 (USD MILLION)

- TABLE 134 MIDDLE EAST: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2023-2028 (USD MILLION)

- 10.7.3 AFRICA

- 10.7.3.1 Increasing international collaborations dedicated to elevating food safety standards to drive demand

- TABLE 135 AFRICA: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2018-2022 (USD MILLION)

- TABLE 136 AFRICA: FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY FOOD TESTED, 2023-2028 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 MARKET SHARE ANALYSIS, 2022

- TABLE 137 INTENSITY OF COMPETITIVE RIVALRY, 2022

- 11.3 REVENUE ANALYSIS FOR KEY PLAYERS

- FIGURE 48 REVENUE ANALYSIS FOR KEY PLAYERS, 2018-2022 (USD BILLION)

- 11.4 ANNUAL REVENUE VS. GROWTH (KEY PLAYERS)

- FIGURE 49 ANNUAL REVENUE, 2022 (USD BILLION) VS. REVENUE GROWTH, 2020-2022

- 11.5 EBITDA ANALYSIS FOR KEY PLAYERS, BY KEY REGION

- FIGURE 50 EBITDA ANALYSIS FOR KEY PLAYERS, BY KEY REGION, 2022 (USD BILLION)

- 11.6 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 138 STRATEGIES ADOPTED BY KEY PLAYERS

- 11.7 GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS

- FIGURE 51 GLOBAL SNAPSHOT OF KEY PARTICIPANTS, 2022

- 11.8 COMPANY EVALUATION MATRIX FOR KEY PLAYERS, 2022

- 11.8.1 STARS

- 11.8.2 EMERGING LEADERS

- 11.8.3 PERVASIVE PLAYERS

- 11.8.4 PARTICIPANTS

- FIGURE 52 COMPANY EVALUATION MATRIX FOR KEY PLAYERS, 2022

- 11.8.5 COMPANY FOOTPRINT, BY TYPE

- TABLE 139 COMPANY FOOTPRINT, BY TYPE

- TABLE 140 COMPANY FOOTPRINT, BY CERTIFICATION

- TABLE 141 COMPANY FOOTPRINT, BY REGION

- TABLE 142 OVERALL COMPANY FOOTPRINT

- 11.9 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES, 2022

- 11.9.1 PROGRESSIVE COMPANIES

- 11.9.2 STARTING BLOCKS

- 11.9.3 RESPONSIVE COMPANIES

- 11.9.4 DYNAMIC COMPANIES

- FIGURE 53 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES, 2022

- 11.9.5 COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 143 LIST OF KEY STARTUPS/SMES

- TABLE 144 COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- 11.10 COMPETITIVE SCENARIO

- 11.10.1 PRODUCT LAUNCHES

- TABLE 145 PRODUCT LAUNCHES, 2020-2022

- 11.10.2 DEALS

- TABLE 146 DEALS, 2019-2022

- 11.10.3 OTHERS

- TABLE 147 OTHERS, 2022

12 COMPANY PROFILES

(Business overview, Products/Solutions/Services offered, Recent Developments, MNM view)**

- 12.1 KEY PLAYERS

- 12.1.1 THERMO FISHER SCIENTIFIC INC.

- TABLE 148 THERMO FISHER SCIENTIFIC INC.: BUSINESS OVERVIEW

- FIGURE 54 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT

- TABLE 149 THERMO FISHER SCIENTIFIC INC.: DEALS

- TABLE 150 THERMO FISHER SCIENTIFIC INC.: OTHERS

- 12.1.2 BIO-RAD LABORATORIES, INC.

- TABLE 151 BIO-RAD LABORATORIES, INC.: BUSINESS OVERVIEW

- FIGURE 55 BIO-RAD LABORATORIES, INC.: COMPANY SNAPSHOT

- TABLE 152 BIO-RAD LABORATORIES, INC.: PRODUCT LAUNCHES

- 12.1.3 MERCK KGAA

- TABLE 153 MERCK KGAA: BUSINESS OVERVIEW

- FIGURE 56 MERCK KGAA: COMPANY SNAPSHOT

- 12.1.4 NEOGEN CORPORATION

- TABLE 154 NEOGEN CORPORATION: BUSINESS OVERVIEW

- FIGURE 57 NEOGEN CORPORATION: COMPANY SNAPSHOT

- TABLE 155 NEOGEN CORPORATION: DEALS

- 12.1.5 SHIMADZU CORPORATION

- TABLE 156 SHIMADZU CORPORATION: BUSINESS OVERVIEW

- FIGURE 58 SHIMADZU CORPORATION: COMPANY SNAPSHOT

- 12.1.6 BIOMERIEUX

- TABLE 157 BIOMERIEUX: BUSINESS OVERVIEW

- FIGURE 59 BIOMERIEUX: COMPANY SNAPSHOT

- TABLE 158 BIOMERIEUX: PRODUCT LAUNCHES

- TABLE 159 BIOMERIEUX: DEALS

- 12.1.7 AGILENT TECHNOLOGIES, INC.

- TABLE 160 AGILENT TECHNOLOGIES, INC.: BUSINESS OVERVIEW

- FIGURE 60 AGILENT TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- TABLE 161 AGILENT TECHNOLOGIES, INC.: OTHERS

- 12.1.8 QIAGEN

- TABLE 162 QIAGEN: BUSINESS OVERVIEW

- FIGURE 61 QIAGEN: COMPANY SNAPSHOT

- 12.1.9 BRUKER

- TABLE 163 BRUKER: BUSINESS OVERVIEW

- FIGURE 62 BRUKER: COMPANY SNAPSHOT

- 12.1.10 PERKINELMER INC.

- TABLE 164 PERKINELMER INC.: BUSINESS OVERVIEW

- 12.1.11 HYGIENA, LLC

- TABLE 165 HYGIENA, LLC: BUSINESS OVERVIEW

- 12.1.12 SOLABIA GROUP (BIOKAR)

- TABLE 166 SOLABIA GROUP: BUSINESS OVERVIEW

- TABLE 167 SOLABIA GROUP: DEALS

- 12.1.13 ROKA BIO SCIENCE

- TABLE 168 ROKA BIO SCIENCE: BUSINESS OVERVIEW

- 12.1.14 PROMEGA CORPORATION

- TABLE 169 PROMEGA CORPORATION: BUSINESS OVERVIEW

- 12.1.15 ROMER LABS DIVISION HOLDING

- TABLE 170 ROMER LABS DIVISION HOLDING: BUSINESS OVERVIEW

- 12.2 STARTUPS/SMES

- 12.2.1 CHARM SCIENCES

- TABLE 171 CHARM SCIENCES: BUSINESS OVERVIEW

- 12.2.2 MICROBIOLOGICS, INC.

- TABLE 172 MICROBIOLOGICS, INC.: BUSINESS OVERVIEW

- 12.2.3 R-BIOPHARM

- TABLE 173 R-BIOPHARM: BUSINESS OVERVIEW

- TABLE 174 R-BIOPHARM: DEALS

- 12.2.4 CONDALAB

- TABLE 175 CONDALAB: BUSINESS OVERVIEW

- 12.2.5 CHROMAGAR

- TABLE 176 CHROMAGAR: BUSINESS OVERVIEW

- 12.2.6 GOLD STANDARD DIAGNOSTICS

- TABLE 177 GOLD STANDARD DIAGNOSTICS: BUSINESS OVERVIEW

- 12.2.7 CLEAR LABS, INC.

- TABLE 178 CLEAR LABS, INC.: BUSINESS OVERVIEW

- 12.2.8 RING BIOTECHNOLOGY CO LTD.

- TABLE 179 RING BIOTECHNOLOGY CO LTD.: BUSINESS OVERVIEW

- 12.2.9 NEMIS TECHNOLOGIES AG

- TABLE 180 NEMIS TECHNOLOGIES AG: BUSINESS OVERVIEW

- 12.2.10 PATHOGENDX CORPORATION

- TABLE 181 PATHOGENDX CORPORATION: BUSINESS OVERVIEW

- *Details on Business overview, Products/Solutions/Services offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

13 ADJACENT AND RELATED MARKETS

- 13.1 INTRODUCTION

- TABLE 182 MARKETS ADJACENT TO FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET

- 13.2 LIMITATIONS

- 13.3 FOOD SAFETY TESTING MARKET

- 13.3.1 MARKET DEFINITION

- 13.3.2 MARKET OVERVIEW

- TABLE 183 FOOD SAFETY TESTING MARKET, BY TARGET TESTED, 2017-2021 (USD MILLION)

- TABLE 184 FOOD SAFETY TESTING MARKET, BY TARGET TESTED, 2022-2027 (USD MILLION)

- 13.4 FOOD DIAGNOSTICS MARKET

- 13.4.1 MARKET DEFINITION

- 13.4.2 MARKET OVERVIEW

- TABLE 185 FOOD DIAGNOSTICS MARKET, BY TYPE, 2018-2025 (USD MILLION)

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS