|

|

市場調査レポート

商品コード

1858529

農業用ドローンの世界市場 (~2030年):提供タイプ (ハードウェア・ソフトウェア・Drone-as-a-Service)・技術タイプ・ペイロード容量・コンポーネント・農産物・農場規模・飛行範囲・用途・農業環境・地域別Agriculture Drones Market by Offering Type (Hardware, Software, Drone-as-a-Service), Technology Type, Payload Capacity, Component, Farm Produce, Farm Size, Range, Application, Farming Environment, and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 農業用ドローンの世界市場 (~2030年):提供タイプ (ハードウェア・ソフトウェア・Drone-as-a-Service)・技術タイプ・ペイロード容量・コンポーネント・農産物・農場規模・飛行範囲・用途・農業環境・地域別 |

|

出版日: 2025年10月16日

発行: MarketsandMarkets

ページ情報: 英文 429 Pages

納期: 即納可能

|

概要

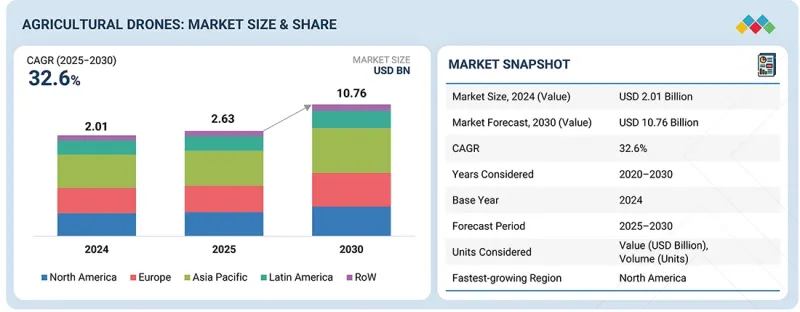

農業用ドローンの市場規模は、2025年の26億3,000万米ドルから、2025年から2030年までの予測期間中は32.6%のCAGRで推移し、2030年には107億6,000万米ドルに達すると予測されています。

FAAによる農業用途でのドローン使用承認により、導入が加速し、農業用ドローン市場には大きな成長機会が生まれています。規制上の障壁が減ったことで、関係者は最小限のコンプライアンス要件でドローン技術を導入できるようになり、市場の普及が広がっています。ドローンとデータ分析プラットフォームの活用により、意思決定の効率化、資源の最適化、生産性の向上が実現します。また、持続可能な農業への注目が高まる中、ドローンは環境に配慮した農業手法を可能にしています。FAAによる免除措置も、ドローン利用の容易化を後押ししています。さらに、規制緩和により、ドローン運用に関するトレーニングプログラムやコンサルティングサービスの需要も増加しています。これらは市場成長を支える新たな事業機会となっています。この免除措置は農業用ドローン市場の成長に有利な環境を生み出す重要な要因となっています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021-2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025-2030年 |

| 単位 | 金額 (米ドル) ・数量 (数量) |

| セグメント別 | 提供タイプ、技術、ペイロード容量、コンポーネント、農産物、農場規模、飛行範囲、用途、農業環境、地域 |

| 対象地域 | 北米、欧州、アジア太平洋、南米、その他の地域 |

ドローンの民間および商業的応用に伴うセキュリティと安全性の懸念:民間および商業用途でのドローン利用には、セキュリティおよび安全性の懸念が存在し、これが農業用ドローン市場の成長抑制要因となる可能性があります。第一の懸念はプライバシー侵害です。カメラやセンサーを搭載したドローンは私有地の画像やデータを無断で取得する恐れがあり、法的トラブルや社会的反発を招くリスクがあるため、プライバシー侵害を懸念する農家の導入意欲を下げる可能性があります。また、他の航空機との衝突・事故リスクも問題視されています。ドローンは農業空域を使用するため、事故が発生すれば人身事故や物損事故につながる可能性があり、規制強化や責任問題の増大が発生し、農家にとってドローン導入の負担となる懸念があります。

"用途別では、精密農業の部門が市場を独占"

この理由には、世界的な人口増加に伴う食料安全保障の必要性と、農業生産性の最適化の重要性が挙げられます。精密農業では、農家がデータに基づく意思決定を行うことで、作物収量を向上させ、資源利用を最適化できます。ドローンはこの過程で不可欠な役割を果たし、リアルタイムデータや詳細な分析情報を提供します。また、高解像度画像、マルチスペクトルセンサー、AI統合などの技術の進化により、作物や土壌の成長パターン、健康状態の高度な解析が可能になっています。これらは環境規制への適合や持続可能な製品への消費者志向とも一致しています。さらに、政府による先端農業技術への助成金や支援策が、農家にドローンや精密農業ソリューションへの投資を促進しており、この分野の成長を牽引しています。

"アジア太平洋地域が予測期間中に大きなCAGRを示す"

この地域では、精密農業の導入率が非常に高く、農家はドローンを作物モニタリング、土壌分析、精密散布などに積極的に活用しています。さらに、農業の近代化を目指す政府の取り組みも市場拡大を後押ししています。アジア諸国では、食料安全保障や持続可能性向上のために、資金援助・補助金・研修プログラムを通じて先端技術の導入を促進しており、これがドローン市場の成長をさらに加速させています。

当レポートでは、世界の農業用ドローンの市場を調査し、市場概要、市場成長への各種影響因子の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

よくあるご質問

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- マクロ経済見通し

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 農業用ドローンにおける生成AIの影響

第6章 業界動向

- バリューチェーン分析

- 貿易分析

- サプライチェーン分析

- 技術分析

- 価格分析

- エコシステム分析

- 顧客の事業に影響を与える動向/混乱

- 特許分析

- 2025-2026年の主な会議とイベント

- 規制状況

- ポーターのファイブフォース分析

- 主要なステークホルダーと購入基準

- ケーススタディ分析

- 投資と資金調達のシナリオ

- 2025年の米国関税が農業用ドローン市場に与える影響

第7章 農業用ドローン市場:用途別

- 精密農業

- フィールドマッピング

- 可変施用

- 作物スカウティング

- 作物散布

- その他

- 家畜モニタリング

- 精密養殖

- スマートグリーンハウス

- その他

第8章 農業用ドローン市場:コンポーネント別

- フレーム

- コントローラーシステム

- 推進システム

- センサー&カメラシステム

- レーダーセンサー

- LIDARセンサー

- マルチスペクトルシステム

- 赤外線カメラ

- サーマルカメラ

- その他

- ナビゲーションシステム

- GPS

- GIS

- バッテリー

- その他

第9章 農業用ドローン市場:農場規模別

- 小規模農場 (180エーカー未満)

- 中規模農場 (180~500エーカー)

- 大規模農場 (500~2,000エーカー)

- 超大規模農場 (2,000エーカー超)

第10章 農業用ドローン市場:農業環境別

- 屋外

- 屋内

第11章 農業用ドローン市場:提供タイプ別

- ハードウェア

- 固定翼ドローン

- 回転翼ドローン

- ハイブリッドドローン

- ソフトウェア

- データ管理ソフトウェア

- イメージングソフトウェア

- データ分析ソフトウェア

- その他のソフトウェア

- DaaS (Drone-as-a-Service)

- ドローンプラットフォームサービス

- 保守・修理・オーバーホール (MRO) サービス

- ドローントレーニング&シミュレーションサービス

第12章 農業用ドローン市場:ペイロード容量別

- 小型ペイロードドローン (最大2kg)

- 中型ペイロードドローン (2~20kg)

- 大型ペイロードドローン (20~50kg)

- 超大型ペイロードドローン (50kg以上)

第13章 農業用ドローン市場:飛行範囲別

- 目視内飛行 (VLOS)

- 目視外飛行 (BVLOS)

第14章 農業用ドローン市場:農産物別

- 穀物

- トウモロコシ

- 小麦

- 米

- その他

- 油糧種子・豆類

- 大豆

- ひまわり

- その他

- 果物・野菜

- 核果類

- 柑橘類

- ベリー

- 根菜類

- 葉野菜

- その他

- その他

第15章 農業用ドローン市場:技術別

- サーマルイメージング

- マルチスペクトルイメージング

- ハイパースペクトルイメージング

- 光検出・測距

- RGBイメージング

- 合成開口レーダー

- 近赤外線イメージング

- 全地球航法衛星システム

第16章 農業用ドローン市場:地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- スペイン

- イタリア

- フランス

- ドイツ

- 英国

- その他

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリアとニュージーランド

- その他

- 南米

- ブラジル

- アルゼンチン

- その他

- その他の地域

- アフリカ

- 中東

第17章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 収益分析

- 市場シェア分析

- 企業評価マトリックス:主要企業

- 企業評価マトリックス:新興企業/中小企業

- 企業評価と財務指標

- ブランド/製品比較

- 競合シナリオ・動向

第18章 企業プロファイル

- 主要企業

- DJI

- TRIMBLE INC.

- PARROT DRONE SAS

- YAMAHA MOTOR CO., LTD.

- AGEAGLE AERIAL SYSTEMS INC.

- DRONEDEPLOY

- SENTERA

- XAG CO., LTD.

- AUTEL ROBOTICS

- YUNEEC

- MICRODRONES

- DESTINUS

- GAMAYA

- HYLIO

- HIPHEN

- その他の企業

- JOUAV

- SHENZHEN GC ELECTRONICS CO., LTD.

- ARIES SOLUTIONS

- WINGTRA AG

- SKY-DRONES TECHNOLOGIES LTD

- DELAIR

- SHENZHEN GREPOW BATTERY CO., LTD.

- APPLIED AERONAUTICS

- VISION AERIAL, INC.

- QUANTUM-SYSTEMS GMBH